|

|

市場調査レポート

商品コード

1275430

小売クラウドの世界市場:コンポーネント別(ソリューション、サービス)、サービスモデル別(SaaS、PaaS、IaaS)、展開モデル別(パブリック、プライベート、ハイブリッドクラウド)、組織規模別(中小企業、大企業)、地域別 - 2028年までの予測Retail Cloud Market by Component (Solutions and Services), Service Model (SaaS, PaaS, and IaaS), Deployment Model (Public, Private, and Hybrid Cloud), Organization Size (SMEs and Large Enterprises) and Region - Global Forecast to 2028 |

||||||

カスタマイズ可能

|

|||||||

| 小売クラウドの世界市場:コンポーネント別(ソリューション、サービス)、サービスモデル別(SaaS、PaaS、IaaS)、展開モデル別(パブリック、プライベート、ハイブリッドクラウド)、組織規模別(中小企業、大企業)、地域別 - 2028年までの予測 |

|

出版日: 2023年05月11日

発行: MarketsandMarkets

ページ情報: 英文 266 Pages

納期: 即納可能

|

- 全表示

- 概要

- 目次

世界の小売クラウドの市場規模は、2023年の470億米ドルから、2028年までに1,149億米ドルまで拡大し、予測期間中にCAGRで19.6%の成長が予測されています。

小売向けIoTの登場と、小売経営を改善するための新しい小売技術の採用が、小売クラウド市場の成長に機会を提供しています。クラウドにおけるデータセキュリティへの懸念は、小売クラウド市場の成長にとって重要な課題となっています。

ソリューション別では、レポーティング・アナリティクスセグメントが予測期間中に最も高いCAGRを保持する

小売クラウドソリューションは、小売業にさまざまな革命をもたらしましたが、その1つが、レポーティング・アナリティクスソリューションの使用により、ビジネスオペレーションをより深く理解できるようになったことです。クラウドの力を活用することで、小売業者は膨大な量のデータを収集・分析し、顧客行動、販売動向、在庫管理などに関する貴重な知見を得ることができます。小売クラウドアナリティクスソリューションは、POSシステム、顧客ロイヤルティプログラム、ソーシャルメディアなど、さまざまなデータソースを使用して、顧客の行動や嗜好に関するデータを収集します。このデータを分析することで、パターンや動向を明らかにし、ビジネスの意思決定に役立つ洞察を得ることができます。クラウドベースのレポーティング・アナリティクスソリューションを使用する主な利点の1つは、インターネット接続があればどこからでもリアルタイムのデータにアクセスできることです。つまり、管理者やその他の関係者は、データや洞察に迅速かつ容易にアクセスし、最新の情報に基づいて意思決定を行うことができるのです。

サービス別では、プロフェッショナルサービスセグメントが予測期間中に最大の市場シェアを占める

小売クラウドプロフェッショナルサービスは、様々な形で企業を支援することができます。例えば、企業はクラウド専門家の専門知識を活用し、独自のニーズを満たすカスタマイズされたソリューションを設計・実装することができます。これには、サプライチェーン管理、在庫管理、顧客管理などのソリューションが含まれます。また、小売クラウドプロフェッショナルサービスは、企業が既存のアプリケーションやデータをクラウドに移行するのを支援することもできます。クラウドへの移行は複雑なプロセスであるため、スムーズな移行を実現するために専門家の助けが必要になることも少なくありません。クラウド専門家は、企業が現在のインフラを評価し、どのアプリケーションとデータをクラウドに移行すべきかを判断し、業務の中断を最小限に抑える移行計画を策定するのを支援します。クラウドプロフェッショナルサービスのもう1つの重要な側面は、継続的なサポートとメンテナンスです。クラウドベースのソリューションに依存している企業は、アプリケーションがスムーズに動作し、データが安全であることを保証するために、継続的なサポートを必要としています。クラウドプロフェッショナルは、継続的なサポートとメンテナンスを提供することで、企業がコア業務に集中できるようにし、技術的な詳細は専門家に任せることができます。

組織規模別では、中小企業セグメントが予測期間中に最も高いCAGRを示すと予測される

従業員数が1,000人未満の組織は、中小企業に分類されます。これらの企業は、大企業に比べてリソース不足に直面し、ビジネスプロセスのコスト最適化のために、複雑な問題を解決するための優れた方法を必要としています。クラウドサービスは、その使いやすさと柔軟性から、中小企業のビジネスプロセスの中心的な存在となっており、その採用は今後数年で拡大すると予想されます。急速に進化する小売業界において、業務の効率化を図り、競争力を維持するために、中小企業における小売クラウドソリューションとサービスの導入が加速しています。クラウドコンピューティングは、ハードウェア、ソフトウェア、ITインフラへの多額の先行投資を必要とせず、大企業と同じ技術や機能を中小企業に提供するものです。

地域別では、アジア太平洋地域が予測期間中に最も高いCAGRを示すと予測される

アジア太平洋地域の技術開発が、小売クラウド市場を牽引すると予想されます。アジア太平洋地域は、中国、日本、インドなどの国々でデジタルトランスフォーメーションの取り組みへの投資が見込まれています。State of The Edgeレポートによると、2020年にはアジア太平洋地域のエッジコンピューティング機器の設置面積は187MWとなり、地域の中で最も大きくなります。例えば、Alibaba Cloudはアジア太平洋地域最大のクラウドプロバイダーの1つであり、アジア太平洋地域の小売業者と協力して、eコマース、物流、サプライチェーン管理向けのクラウドベースソリューションを提供しています。これにより、同地域における小売クラウドソリューションの導入が促進される可能性があります。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要と業界動向

- イントロダクション

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

- ケーススタディ分析

- サプライチェーン分析

- エコシステム

- 技術分析

- 価格分析

- 特許分析

- ポーターのファイブフォース分析

- 主要な会議とイベント

- 関税と規制状況

- 購入者に影響を与える動向/混乱

- 主要な利害関係者と購入基準

第6章 小売クラウド市場:コンポーネント別

- イントロダクション

- ソリューション

- サプライチェーン管理

- 顧客管理

- マーチャンダイジング

- ワークフォース管理

- レポーティング・アナリティクス

- データセキュリティ

- オムニチャネル

- その他

- サービス

- プロフェッショナルサービス

- マネージドサービス

第7章 小売クラウド市場:サービスモデル別

- イントロダクション

- SaaS

- PaaS

- IaaS

第8章 小売クラウド市場:展開モデル別

- イントロダクション

- パブリッククラウド

- プライベートクラウド

- ハイブリッドクラウド

第9章 小売クラウド市場:組織規模別

- イントロダクション

- 中小企業

- 大企業

第10章 小売クラウド市場:地域別

- イントロダクション

- 北米

- 米国

- カナダ

- 欧州

- 英国

- ドイツ

- フランス

- その他の欧州

- アジア太平洋地域

- 中国

- 日本

- インド

- その他のアジア太平洋地域

- 中東・アフリカ

- サウジアラビア

- アラブ首長国連邦

- その他の中東・アフリカ

- ラテンアメリカ

- ブラジル

- メキシコ

- その他のラテンアメリカ

第11章 競合情勢

- 概要

- 市場評価の枠組み

- 主要企業戦略/有力企業

- 収益分析

- 企業の財務指標

- 主要な市場参入企業の世界スナップショット

- 市場シェア分析

- 企業の評価象限

- スタートアップ/中小企業の評価象限

- 主要な市場の発展

第12章 企業プロファイル

- 主要企業

- AWS

- MICROSOFT

- ORACLE

- SALESFORCE

- SAP

- ACCENTURE

- ALIBABA CLOUD

- IBM

- CISCO

- VMWARE

- FUJITSU

- BLUE YONDER

- COGNIZANT

- WORKDAY

- INFOR

- RACKSPACE

- SPS COMMERCE

- ATOS

- EPICOR

- NUTANIX

- LIGHTSPEED COMMERCE

- TEKION

- SYMPHONYAI RETAIL CPG

- 中小企業/スタートアップ

- CLOVER NETWORK

- RAPIDSCALE

- RETAILCLOUD

- RETAIL SOLUTIONS

- BRIGHTPEARL

- KLIGER-WEISS INFOSYSTEMS

- OPENBRAVO

- IVEND RETAIL BY CITIXSYS

- IQMETRIX

- ONE STEP RETAIL SOLUTIONS

- RETAILOPS

第13章 隣接市場

- イントロダクション

- 小売POS市場

- クラウドコンピューティング市場

第14章 付録

The retail cloud market size is expected to grow from USD 47.0 billion in 2023 to USD 114.9 billion by 2028 at a Compound Annual Growth Rate (CAGR) of 19.6% during the forecast period. The advent of IoT in retail and adoption of new retail technologies to improve retail management to offer opportunities for the growth of retail cloud market. The concerns over data security in cloud represents a significant challenge for the growth of the retail cloud market.

As per solutions, the reporting & analytics segment holds the highest CAGR during the forecast period.

Retail cloud solutions have revolutionized the retail industry in many ways, one of which is the ability to gain deeper insights into business operations through the use of reporting and analytics solutions. By leveraging the power of the cloud, retailers can collect and analyze vast amounts of data to gain valuable insights into customer behavior, sales trends, inventory management, and more. Retail cloud analytics solutions use a variety of data sources, such as point-of-sale systems, customer loyalty programs, and social media, to gather data on customer behavior and preferences. This data can then be analyzed to uncover patterns and trends and generate insights that can inform business decisions. One of the key benefits of using cloud-based reporting and analytics solutions is the ability to access real-time data from any location with an internet connection. This means that managers and other stakeholders can quickly and easily access data and insights, and make informed decisions based on the latest information.

As per services, professional services segment holds the largest market share during the forecast period.

Retail cloud professional services can help businesses in various ways. For instance, businesses can leverage the expertise of cloud professionals to design and implement customized solutions that meet their unique needs. This can include solutions for supply chain management, inventory management, customer management, and more. Retail cloud professional services can also help businesses migrate their existing applications and data to the cloud. Cloud migration can be a complex process, and businesses often require the help of experts to ensure a smooth transition. Cloud professionals can help businesses assess their current infrastructure, determine which applications and data should be migrated to the cloud, and develop a migration plan that minimizes disruption to operations. Another important aspect of retail cloud professional services is ongoing support and maintenance. Businesses that rely on cloud-based solutions require ongoing support to ensure that their applications are running smoothly and that their data is secure. Retail cloud professionals can provide ongoing support and maintenance to ensure that businesses can focus on their core operations and leave the technical details to the experts.

As per organization size, the SMEs segment is projected to witness the highest CAGR during the forecast period.

Organizations with employee size under 1,000 are categorized under SMEs. These enterprises face a greater resource crunch than large enterprises and require better methods to solve the complexities for better cost optimization on their business processes. Cloud services have become a central part of the business processes in SMEs, due to the ease of use and the flexibility they offer, and their adoption is expected to grow in the coming years. The adoption of retail cloud solutions and services among small and medium-sized enterprises (SMEs) is gaining momentum as they look to streamline their operations and remain competitive in the rapidly evolving retail industry. Cloud computing offers SMEs access to the same technologies and capabilities as larger enterprises, without the need for substantial upfront investments in hardware, software, and IT infrastructure.

As per region, the Asia Pacific is projected to witness the highest CAGR during the forecast period.

Technological development in the Asia Pacific region is expected to drive the retail cloud market. Asia Pacific region is expected to witness investment in digital transformation initiatives in countries such as China, Japan, and India. According to a State of The Edge report, in 2020, Asia Pacific had the largest edge computing equipment footprint 1 of 187MW-the highest among regions. Further, many cloud service providers are working with retailers to streamline operations, improve customer engagement, and drive innovation. for instance, Alibaba Cloud is one of the largest cloud providers in Asia Pacific and has been working with retailers in the region to provide cloud-based solutions for e-commerce, logistics, and supply chain management. This is likely to boost the adoption of retail cloud solutions in the region.

The breakup of the profiles of the primary participants is given below:

- By Company: Tier I: 20%, Tier II: 34%, and Tier III: 46%

- By Designation: C-Level Executives: 35%, Director Level: 25%, and Others: 40%

- By Region: Asia Pacific: 18%, Europe: 25%, North America: 42%, Rest of World: 15%

Note: Others include sales managers, marketing managers, and product managers

Note: Rest of the World includes the Middle East & Africa and Latin America

Note: Tier 1 companies have revenues more than USD 100 million; tier 2 companies' revenue ranges from USD 10 million to USD 100 million; and tier 3 companies' revenue is less than 10 million

Source: Secondary Literature, Expert Interviews, and MarketsandMarkets Analysis

Some of the major vendors offering retail cloud solutions and services across the globe include AWS (US), Microsoft (US), Google (US), Oracle (US), Salesforce (US), SAP (Germany), Accenture (Ireland), Alibaba Cloud (China), IBM (US), Cisco (US), VMware (US), Fujitsu (Japan), Blue Yonder (US), Cognizant (US), Workday (US), Infor (US), Rackspace (US), SPS Commerce (US), Atos (France), Epicor (US), Nutanix (US), Lightspeed Commerce (Canada), Tekion (US), and SymphonyAI Retail CPG.

Research coverage:

The market study covers the retail cloud market across segments. It aims at estimating the market size and the growth potential of this market across different segments, such as component, service model, deployment model, delivery, organization size, and region. It includes an in-depth competitive analysis of the key players in the market, along with their company profiles, key observations related to product and business offerings, recent developments, and key market strategies.

Reasons to buy this report:

The report will help the market leaders/new entrants in this market with information on the closest approximations of the revenue numbers for the overall retail cloud market and the subsegments. This report will help stakeholders understand the competitive landscape and gain more insights to position their businesses better and to plan suitable go-to-market strategies. The report also helps stakeholders understand the pulse of the market and provides them with information on key market drivers, restraints, challenges, and opportunities.

The report provides insights on the following pointers:

- Analysis of key drivers (need for enhancing online shopping experience, growing adoption of SaaS solutions to meet the changing customer demands and preferences, accelerated adoption of multi-cloud architecture), restraints (integration of cloud-based systems with the legacy systems), opportunities (advent of IoT in retail to improve retail management, growing adoption of New Retail technologies to integrate online and offline shopping experiences), and challenges (difficulty in switching IT workloads to other cloud vendor, concerns over data security in the cloud) influencing the growth of the retail cloud market.

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product & service launches in the retail cloud market.

- Market Development: Comprehensive information about lucrative markets - the report analyses the retail cloud market across varied regions.

- Market Diversification: Exhaustive information about new products & services, untapped geographies, recent developments, and investments in the retail cloud market.

- Competitive Assessment: In-depth assessment of market shares, growth strategies and service offerings of leading players like AWS (US), Microsoft (US), Google (US), Oracle (US), Salesforce (US), SAP (Germany), Accenture (Ireland), Alibaba Cloud (China), IBM (US), Cisco (US), among others in the retail cloud market.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.2.1 INCLUSIONS AND EXCLUSIONS

- 1.3 MARKET SCOPE

- 1.3.1 MARKET SEGMENTATION

- 1.3.2 REGIONS COVERED

- 1.3.3 YEARS CONSIDERED

- 1.4 CURRENCY

- TABLE 1 USD EXCHANGE RATES, 2015-2022

- 1.5 STAKEHOLDERS

- 1.6 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- FIGURE 1 RETAIL CLOUD MARKET: RESEARCH DESIGN

- 2.1.1 SECONDARY DATA

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Breakup of primary profiles

- FIGURE 2 BREAKUP OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

- 2.1.2.2 Key industry insights

- 2.2 DATA TRIANGULATION

- 2.3 MARKET SIZE ESTIMATION

- FIGURE 3 RETAIL CLOUD MARKET: TOP-DOWN AND BOTTOM-UP APPROACHES

- FIGURE 4 APPROACH 1 (SUPPLY SIDE): REVENUE OF SERVICES FROM RETAIL CLOUD VENDORS

- FIGURE 5 BOTTOM-UP APPROACH (SUPPLY SIDE): COLLECTIVE REVENUE OF RETAIL CLOUD VENDORS

- FIGURE 6 SUPPLY SIDE: CAGR PROJECTIONS

- FIGURE 7 APPROACH 2 (BOTTOM-UP): REVENUE GENERATED BY RETAIL CLOUD VENDORS FROM EACH SERVICE TYPE

- FIGURE 8 APPROACH 2 (DEMAND SIDE): REVENUE GENERATED FROM DIFFERENT APPLICATIONS

- 2.4 MARKET FORECAST

- TABLE 2 FACTOR ANALYSIS

- 2.5 RESEARCH ASSUMPTIONS

- 2.6 LIMITATIONS

3 EXECUTIVE SUMMARY

- FIGURE 9 FASTEST-GROWING SEGMENTS IN RETAIL CLOUD MARKET, 2023-2028

- FIGURE 10 SOLUTIONS TO ACCOUNT FOR LARGER MARKET THAN SERVICES DURING FORECAST PERIOD

- FIGURE 11 SAAS TO BE LARGEST SERVICE MODEL DURING FORECAST PERIOD

- FIGURE 12 PUBLIC CLOUD TO ACCOUNT FOR LARGEST DEPLOYMENT MODEL DURING FORECAST PERIOD

- FIGURE 13 LARGE ENTERPRISES TO BE LARGER ADOPTERS OF RETAIL CLOUD DURING FORECAST PERIOD

- FIGURE 14 RETAIL CLOUD MARKET: REGIONAL SNAPSHOT

4 PREMIUM INSIGHTS

- 4.1 OVERVIEW OF RETAIL CLOUD MARKET

- FIGURE 15 NEED TO ENHANCE CUSTOMER EXPERIENCES ACROSS ALL CHANNELS TO BOOST MARKET GROWTH

- 4.2 RETAIL CLOUD MARKET, BY COMPONENT

- FIGURE 16 SOLUTIONS TO ACCOUNT FOR LARGER MARKET SHARE

- 4.3 RETAIL CLOUD MARKET, BY SOLUTION

- FIGURE 17 SUPPLY CHAIN MANAGEMENT SOLUTION TO ACCOUNT FOR LARGEST MARKET SHARE

- 4.4 RETAIL CLOUD MARKET, BY SERVICE

- FIGURE 18 PROFESSIONAL SERVICES TO ACCOUNT FOR LARGER MARKET SHARE

- 4.5 RETAIL CLOUD MARKET, BY SERVICE MODEL

- FIGURE 19 SAAS SERVICE MODEL TO ACCOUNT FOR LARGEST MARKET SHARE

- 4.6 RETAIL CLOUD MARKET, BY DEPLOYMENT MODEL

- FIGURE 20 PUBLIC CLOUD TO ACCOUNT FOR LARGEST MARKET SHARE

- 4.7 RETAIL CLOUD MARKET, BY ORGANIZATION SIZE

- FIGURE 21 LARGE ENTERPRISES TO ACCOUNT FOR LARGEST MARKET SHARE

- 4.8 RETAIL CLOUD MARKET: REGIONAL SCENARIO

- FIGURE 22 ASIA PACIFIC TO EMERGE AS BEST MARKET FOR INVESTMENTS IN NEXT FIVE YEARS

5 MARKET OVERVIEW AND INDUSTRY TRENDS

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- FIGURE 23 MARKET DYNAMICS: RETAIL CLOUD MARKET

- 5.2.1 DRIVERS

- 5.2.1.1 Need to enhance online shopping experience

- 5.2.1.2 Growth in adoption of SaaS solutions to meet changing customer preferences

- 5.2.1.3 Accelerated adoption of multi-cloud architecture

- 5.2.2 RESTRAINTS

- 5.2.2.1 Integration of cloud-based systems with legacy systems

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Advent of IoT in retail to improve retail management

- 5.2.3.2 Adoption of new retail technologies to integrate online and offline shopping experiences

- 5.2.4 CHALLENGES

- 5.2.4.1 Difficulty in switching IT workloads to other cloud vendors

- 5.2.4.2 Concerns over data security in cloud

- 5.3 CASE STUDY ANALYSIS

- 5.3.1 GRUPO NAZAN CREATED SEAMLESS SHOPPING EXPERIENCE WITH ORACLE CLOUD SOLUTIONS

- 5.3.2 FLEXI MET GROWING DEMAND FOR ONLINE SHOPPING WITH SAP COMMERCE CLOUD SOLUTIONS

- 5.3.3 ALIANSCE SONAE SHOPPING CENTERS BUILT BETTER RETAIL EXPERIENCE WITH NUTANIX

- 5.3.4 GIBSON BRANDS STREAMLINED ITS BUSINESS AND CREATED IMMERSIVE CUSTOMER EXPERIENCE WITH MICROSOFT DYNAMICS 365

- 5.3.5 1-800-FLOWERS.COM, INC. MIGRATED TO IBM COMMERCE ON CLOUD PLATFORM ENVIRONMENT TO INTEGRATE ORDER MANAGEMENT SYSTEMS

- 5.4 SUPPLY CHAIN ANALYSIS

- FIGURE 24 RETAIL CLOUD MARKET: SUPPLY CHAIN

- 5.5 ECOSYSTEM

- FIGURE 25 RETAIL CLOUD MARKET: ECOSYSTEM

- 5.6 TECHNOLOGICAL ANALYSIS

- 5.6.1 MACHINE LEARNING

- 5.6.2 INTERNET OF THINGS

- 5.6.3 BLOCKCHAIN

- 5.6.4 ARTIFICIAL INTELLIGENCE

- 5.7 PRICING ANALYSIS

- TABLE 3 RETAILCOULD: PRICING ANALYSIS OF VENDORS IN RETAIL CLOUD MARKET

- TABLE 4 SHOPIFY: PRICING ANALYSIS OF VENDORS IN RETAIL CLOUD MARKET

- TABLE 5 VYAPAR: PRICING ANALYSIS OF VENDORS IN RETAIL CLOUD MARKET

- 5.8 PATENT ANALYSIS

- FIGURE 26 NUMBER OF PATENTS PUBLISHED, 2012-2022

- FIGURE 27 TOP FIVE PATENT OWNERS (GLOBAL), 2022

- TABLE 6 US: TOP TEN PATENT APPLICANTS, 2022

- TABLE 7 PATENTS IN RETAIL CLOUD MARKET

- 5.9 PORTER'S FIVE FORCES ANALYSIS

- FIGURE 28 PORTER'S FIVE FORCES ANALYSIS

- TABLE 8 PORTER'S FIVE FORCES ANALYSIS

- 5.9.1 THREAT OF NEW ENTRANTS

- 5.9.2 THREAT OF SUBSTITUTES

- 5.9.3 BARGAINING POWER OF SUPPLIERS

- 5.9.4 BARGAINING POWER OF BUYERS

- 5.9.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.10 KEY CONFERENCES AND EVENTS

- TABLE 9 KEY CONFERENCES AND EVENTS IN 2023 & 2024

- 5.11 TARIFF AND REGULATORY LANDSCAPE

- 5.11.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 10 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 11 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 12 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 13 REST OF THE WORLD: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.11.2 REGULATIONS

- 5.11.2.1 North America

- 5.11.2.2 Europe

- 5.11.2.3 Asia Pacific

- 5.11.2.4 Middle East & Africa

- 5.11.2.5 Latin America

- 5.12 TRENDS/DISRUPTIONS IMPACTING BUYERS

- FIGURE 29 RETAIL CLOUD MARKET: TRENDS/DISRUPTIONS IMPACTING BUYERS

- 5.13 KEY STAKEHOLDERS & BUYING CRITERIA

- 5.13.1 KEY STAKEHOLDERS IN BUYING PROCESS

- FIGURE 30 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR END USERS

- TABLE 14 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR END USERS

- 5.13.2 BUYING CRITERIA

- FIGURE 31 KEY BUYING CRITERIA FOR END USERS

- TABLE 15 KEY BUYING CRITERIA FOR END USERS

6 RETAIL CLOUD MARKET, BY COMPONENT

- 6.1 INTRODUCTION

- FIGURE 32 RETAIL CLOUD SOLUTIONS TO EDGE OVER SERVICES DURING FORECAST PERIOD

- 6.1.1 COMPONENT: RETAIL CLOUD MARKET DRIVERS

- TABLE 16 RETAIL CLOUD MARKET, BY COMPONENT, 2019-2022 (USD MILLION)

- TABLE 17 RETAIL CLOUD MARKET, BY COMPONENT, 2023-2028 (USD MILLION)

- 6.2 SOLUTIONS

- FIGURE 33 SUPPLY CHAIN MANAGEMENT TO BE LARGEST SOLUTION MARKET DURING FORECAST PERIOD

- TABLE 18 RETAIL CLOUD MARKET, BY SOLUTION, 2019-2022 (USD MILLION)

- TABLE 19 RETAIL CLOUD MARKET, BY SOLUTION, 2023-2028 (USD MILLION)

- TABLE 20 SOLUTIONS: RETAIL CLOUD MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 21 SOLUTIONS: RETAIL CLOUD MARKET, BY REGION, 2023-2028 (USD MILLION)

- 6.2.1 SUPPLY CHAIN MANAGEMENT

- TABLE 22 SUPPLY CHAIN MANAGEMENT: RETAIL CLOUD MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 23 SUPPLY CHAIN MANAGEMENT: RETAIL CLOUD MARKET, BY REGION, 2023-2028 (USD MILLION)

- 6.2.2 CUSTOMER MANAGEMENT

- TABLE 24 CUSTOMER MANAGEMENT: RETAIL CLOUD MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 25 CUSTOMER MANAGEMENT: RETAIL CLOUD MARKET, BY REGION, 2023-2028 (USD MILLION)

- 6.2.3 MERCHANDISING

- TABLE 26 MERCHANDISING: RETAIL CLOUD MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 27 MERCHANDISING: RETAIL CLOUD MARKET, BY REGION, 2023-2028 (USD MILLION)

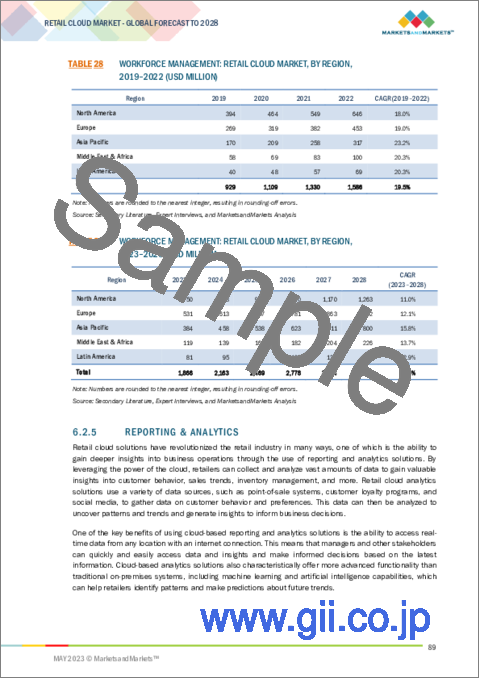

- 6.2.4 WORKFORCE MANAGEMENT

- TABLE 28 WORKFORCE MANAGEMENT: RETAIL CLOUD MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 29 WORKFORCE MANAGEMENT: RETAIL CLOUD MARKET, BY REGION, 2023-2028 (USD MILLION)

- 6.2.5 REPORTING & ANALYTICS

- TABLE 30 REPORTING & ANALYTICS: RETAIL CLOUD MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 31 REPORTING & ANALYTICS: RETAIL CLOUD MARKET, BY REGION, 2023-2028 (USD MILLION)

- 6.2.6 DATA SECURITY

- TABLE 32 DATA SECURITY: RETAIL CLOUD MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 33 DATA SECURITY: RETAIL CLOUD MARKET, BY REGION, 2023-2028 (USD MILLION)

- 6.2.7 OMNI-CHANNEL

- TABLE 34 OMNI-CHANNEL SOLUTIONS: RETAIL CLOUD MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 35 OMNI-CHANNEL SOLUTIONS: RETAIL CLOUD MARKET, BY REGION, 2023-2028 (USD MILLION)

- 6.2.8 OTHER SOLUTIONS

- TABLE 36 OTHER SOLUTIONS: RETAIL CLOUD MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 37 OTHER SOLUTIONS: RETAIL CLOUD MARKET, BY REGION, 2023-2028 (USD MILLION)

- 6.3 SERVICES

- TABLE 38 RETAIL CLOUD MARKET, BY SERVICE, 2019-2022 (USD MILLION)

- TABLE 39 RETAIL CLOUD MARKET, BY SERVICE, 2023-2028 (USD MILLION)

- TABLE 40 SERVICES: RETAIL CLOUD MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 41 SERVICES: RETAIL CLOUD MARKET, BY REGION, 2023-2028 (USD MILLION)

- 6.3.1 PROFESSIONAL SERVICES

- TABLE 42 PROFESSIONAL SERVICES: RETAIL CLOUD MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 43 PROFESSIONAL SERVICES: RETAIL CLOUD MARKET, BY REGION, 2023-2028 (USD MILLION)

- 6.3.2 MANAGED SERVICES

- TABLE 44 MANAGED SERVICES: RETAIL CLOUD MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 45 MANAGED SERVICES: RETAIL CLOUD MARKET, BY REGION, 2023-2028 (USD MILLION)

7 RETAIL CLOUD MARKET, BY SERVICE MODEL

- 7.1 INTRODUCTION

- FIGURE 34 SOFTWARE AS A SERVICE TO BE LARGEST SERVICE MODEL FOR RETAIL CLOUD DURING FORECAST PERIOD

- 7.1.1 SERVICE MODEL: RETAIL CLOUD MARKET DRIVERS

- TABLE 46 RETAIL CLOUD MARKET, BY SERVICE MODEL, 2019-2022 (USD MILLION)

- TABLE 47 RETAIL CLOUD MARKET, BY SERVICE MODEL, 2023-2028 (USD MILLION)

- 7.2 SOFTWARE AS A SERVICE

- TABLE 48 SOFTWARE AS A SERVICE: RETAIL CLOUD MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 49 SOFTWARE AS A SERVICE: RETAIL CLOUD MARKET, BY REGION, 2023-2028 (USD MILLION)

- 7.3 PLATFORM AS A SERVICE

- TABLE 50 PLATFORM AS A SERVICE: RETAIL CLOUD MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 51 PLATFORM AS A SERVICE: RETAIL CLOUD MARKET, BY REGION, 2023-2028 (USD MILLION)

- 7.4 INFRASTRUCTURE AS A SERVICE

- TABLE 52 INFRASTRUCTURE AS A SERVICE: RETAIL CLOUD MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 53 INFRASTRUCTURE AS A SERVICE: RETAIL CLOUD MARKET, BY REGION, 2023-2028 (USD MILLION)

8 RETAIL CLOUD MARKET, BY DEPLOYMENT MODEL

- 8.1 INTRODUCTION

- FIGURE 35 PUBLIC CLOUD TO BE DEPLOYED MORE THAN OTHER MODELS DURING FORECAST PERIOD

- 8.1.1 DEPLOYMENT MODEL: RETAIL CLOUD MARKET DRIVERS

- TABLE 54 RETAIL CLOUD MARKET, BY DEPLOYMENT MODEL, 2019-2022 (USD MILLION)

- TABLE 55 RETAIL CLOUD MARKET, BY DEPLOYMENT MODEL, 2023-2028 (USD MILLION)

- 8.2 PUBLIC CLOUD

- TABLE 56 PUBLIC CLOUD: RETAIL CLOUD MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 57 PUBLIC CLOUD: RETAIL CLOUD MARKET, BY REGION, 2023-2028 (USD MILLION)

- 8.3 PRIVATE CLOUD

- TABLE 58 PRIVATE CLOUD: RETAIL CLOUD MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 59 PRIVATE CLOUD: RETAIL CLOUD MARKET, BY REGION, 2023-2028 (USD MILLION)

- 8.4 HYBRID CLOUD

- TABLE 60 HYBRID CLOUD: RETAIL CLOUD MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 61 HYBRID CLOUD: RETAIL CLOUD MARKET, BY REGION, 2023-2028 (USD MILLION)

9 RETAIL CLOUD MARKET, BY ORGANIZATION SIZE

- 9.1 INTRODUCTION

- FIGURE 36 LARGE ENTERPRISES TO BE LARGER MARKET DURING FORECAST PERIOD

- 9.1.1 ORGANIZATION SIZE: RETAIL CLOUD MARKET DRIVERS

- TABLE 62 RETAIL CLOUD MARKET, BY ORGANIZATION SIZE, 2019-2022 (USD MILLION)

- TABLE 63 RETAIL CLOUD MARKET, BY ORGANIZATION SIZE, 2023-2028 (USD MILLION)

- 9.2 SMALL & MEDIUM ENTERPRISES

- TABLE 64 SMALL & MEDIUM ENTERPRISES: RETAIL CLOUD MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 65 SMALL & MEDIUM ENTERPRISES: RETAIL CLOUD MARKET, BY REGION, 2023-2028 (USD MILLION)

- 9.3 LARGE ENTERPRISES

- TABLE 66 LARGE ENTERPRISES: RETAIL CLOUD MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 67 LARGE ENTERPRISES: RETAIL CLOUD MARKET, BY REGION, 2023-2028 (USD MILLION)

10 RETAIL CLOUD MARKET, BY REGION

- 10.1 INTRODUCTION

- FIGURE 37 NORTH AMERICA TO BE LARGEST REGIONAL MARKET DURING FORECAST PERIOD

- TABLE 68 RETAIL CLOUD MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 69 RETAIL CLOUD MARKET, BY REGION, 2023-2028 (USD MILLION)

- 10.2 NORTH AMERICA

- TABLE 70 NORTH AMERICA: PESTLE ANALYSIS

- 10.2.1 NORTH AMERICA: RETAIL CLOUD MARKET DRIVERS

- 10.2.2 NORTH AMERICA: RECESSION IMPACT

- FIGURE 38 NORTH AMERICA: MARKET SNAPSHOT

- TABLE 71 NORTH AMERICA: RETAIL CLOUD MARKET, BY COMPONENT, 2019-2022 (USD MILLION)

- TABLE 72 NORTH AMERICA: RETAIL CLOUD MARKET, BY COMPONENT, 2023-2028 (USD MILLION)

- TABLE 73 NORTH AMERICA: RETAIL CLOUD MARKET, BY SOLUTION, 2019-2022 (USD MILLION)

- TABLE 74 NORTH AMERICA: RETAIL CLOUD MARKET, BY SOLUTION, 2023-2028 (USD MILLION)

- TABLE 75 NORTH AMERICA: RETAIL CLOUD MARKET, BY SERVICE, 2019-2022 (USD MILLION)

- TABLE 76 NORTH AMERICA: RETAIL CLOUD MARKET, BY SERVICE, 2023-2028 (USD MILLION)

- TABLE 77 NORTH AMERICA: RETAIL CLOUD MARKET, BY SERVICE MODEL, 2019-2022 (USD MILLION)

- TABLE 78 NORTH AMERICA: RETAIL CLOUD MARKET, BY SERVICE MODEL, 2023-2028 (USD MILLION)

- TABLE 79 NORTH AMERICA: RETAIL CLOUD MARKET, BY DEPLOYMENT MODEL, 2019-2022 (USD MILLION)

- TABLE 80 NORTH AMERICA: RETAIL CLOUD MARKET, BY DEPLOYMENT MODEL, 2023-2028 (USD MILLION)

- TABLE 81 NORTH AMERICA: RETAIL CLOUD MARKET, BY ORGANIZATION SIZE, 2019-2022 (USD MILLION)

- TABLE 82 NORTH AMERICA: RETAIL CLOUD MARKET, BY ORGANIZATION SIZE, 2023-2028 (USD MILLION)

- TABLE 83 NORTH AMERICA: RETAIL CLOUD MARKET, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 84 NORTH AMERICA: RETAIL CLOUD MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- 10.2.3 US

- 10.2.3.1 Rise in adoption rate of cloud services

- TABLE 85 US: RETAIL CLOUD MARKET, BY DEPLOYMENT MODEL, 2019-2022 (USD MILLION)

- TABLE 86 US: RETAIL CLOUD MARKET, BY DEPLOYMENT MODEL, 2023-2028 (USD MILLION)

- TABLE 87 US: RETAIL CLOUD MARKET, BY ORGANIZATION SIZE, 2019-2022 (USD MILLION)

- TABLE 88 US: RETAIL CLOUD MARKET, BY ORGANIZATION SIZE, 2023-2028 (USD MILLION)

- 10.2.4 CANADA

- 10.2.4.1 Technological developments and government initiatives

- TABLE 89 CANADA: RETAIL CLOUD MARKET, BY DEPLOYMENT MODEL, 2019-2022 (USD MILLION)

- TABLE 90 CANADA: RETAIL CLOUD MARKET, BY DEPLOYMENT MODEL, 2023-2028 (USD MILLION)

- TABLE 91 CANADA: RETAIL CLOUD MARKET, BY ORGANIZATION SIZE, 2019-2022 (USD MILLION)

- TABLE 92 CANADA: RETAIL CLOUD MARKET, BY ORGANIZATION SIZE, 2023-2028 (USD MILLION)

- 10.3 EUROPE

- TABLE 93 EUROPE: PESTLE ANALYSIS

- 10.3.1 EUROPE: RETAIL CLOUD MARKET DRIVERS

- 10.3.2 EUROPE: RECESSION IMPACT

- TABLE 94 EUROPE: RETAIL CLOUD MARKET, BY COMPONENT, 2019-2022 (USD MILLION)

- TABLE 95 EUROPE: RETAIL CLOUD MARKET, BY COMPONENT, 2023-2028 (USD MILLION)

- TABLE 96 EUROPE: RETAIL CLOUD MARKET, BY SOLUTION, 2019-2022 (USD MILLION)

- TABLE 97 EUROPE: RETAIL CLOUD MARKET, BY SOLUTION, 2023-2028 (USD MILLION)

- TABLE 98 EUROPE: RETAIL CLOUD MARKET, BY SERVICE, 2019-2022 (USD MILLION)

- TABLE 99 EUROPE: RETAIL CLOUD MARKET, BY SERVICE, 2023-2028 (USD MILLION)

- TABLE 100 EUROPE: RETAIL CLOUD MARKET, BY SERVICE MODEL, 2019-2022 (USD MILLION)

- TABLE 101 EUROPE: RETAIL CLOUD MARKET, BY SERVICE MODEL, 2023-2028 (USD MILLION)

- TABLE 102 EUROPE: RETAIL CLOUD MARKET, BY DEPLOYMENT MODEL, 2019-2022 (USD MILLION)

- TABLE 103 EUROPE: RETAIL CLOUD MARKET, BY DEPLOYMENT MODEL, 2023-2028 (USD MILLION)

- TABLE 104 EUROPE: RETAIL CLOUD MARKET, BY ORGANIZATION SIZE, 2019-2022 (USD MILLION)

- TABLE 105 EUROPE: RETAIL CLOUD MARKET, BY ORGANIZATION SIZE, 2023-2028 (USD MILLION)

- TABLE 106 EUROPE: RETAIL CLOUD MARKET, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 107 EUROPE: RETAIL CLOUD MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- 10.3.3 UK

- 10.3.3.1 Early adopter in European technology space

- TABLE 108 UK: RETAIL CLOUD MARKET, BY DEPLOYMENT MODEL, 2019-2022 (USD MILLION)

- TABLE 109 UK: RETAIL CLOUD MARKET, BY DEPLOYMENT MODEL, 2023-2028 (USD MILLION)

- TABLE 110 UK: RETAIL CLOUD MARKET, BY ORGANIZATION SIZE, 2019-2022 (USD MILLION)

- TABLE 111 UK: RETAIL CLOUD MARKET, BY ORGANIZATION SIZE, 2023-2028 (USD MILLION)

- 10.3.4 GERMANY

- 10.3.4.1 Increase in emphasis on data privacy and security

- TABLE 112 GERMANY: RETAIL CLOUD MARKET, BY DEPLOYMENT MODEL, 2019-2022 (USD MILLION)

- TABLE 113 GERMANY: RETAIL CLOUD MARKET, BY DEPLOYMENT MODEL, 2023-2028 (USD MILLION)

- TABLE 114 GERMANY: RETAIL CLOUD MARKET, BY ORGANIZATION SIZE, 2019-2022 (USD MILLION)

- TABLE 115 GERMANY: RETAIL CLOUD MARKET, BY ORGANIZATION SIZE, 2023-2028 (USD MILLION)

- 10.3.5 FRANCE

- 10.3.5.1 Accelerated digital transformation with COVID-19 outbreak

- TABLE 116 FRANCE: RETAIL CLOUD MARKET, BY DEPLOYMENT MODEL, 2019-2022 (USD MILLION)

- TABLE 117 FRANCE: RETAIL CLOUD MARKET, BY DEPLOYMENT MODEL, 2023-2028 (USD MILLION)

- TABLE 118 FRANCE: RETAIL CLOUD MARKET, BY ORGANIZATION SIZE, 2019-2022 (USD MILLION)

- TABLE 119 FRANCE: RETAIL CLOUD MARKET, BY ORGANIZATION SIZE, 2023-2028 (USD MILLION)

- 10.3.6 REST OF EUROPE

- TABLE 120 REST OF EUROPE: RETAIL CLOUD MARKET, BY DEPLOYMENT MODEL, 2019-2022 (USD MILLION)

- TABLE 121 REST OF EUROPE: RETAIL CLOUD MARKET, BY DEPLOYMENT MODEL, 2023-2028 (USD MILLION)

- TABLE 122 REST OF EUROPE: RETAIL CLOUD MARKET, BY ORGANIZATION SIZE, 2019-2022 (USD MILLION)

- TABLE 123 REST OF EUROPE: RETAIL CLOUD MARKET, BY ORGANIZATION SIZE, 2023-2028 (USD MILLION)

- 10.4 ASIA PACIFIC

- TABLE 124 ASIA PACIFIC: PESTLE ANALYSIS

- 10.4.1 ASIA PACIFIC: RETAIL CLOUD MARKET DRIVERS

- 10.4.2 ASIA PACIFIC: RECESSION IMPACT

- FIGURE 39 ASIA PACIFIC: MARKET SNAPSHOT

- TABLE 125 ASIA PACIFIC: RETAIL CLOUD MARKET, BY COMPONENT, 2019-2022 (USD MILLION)

- TABLE 126 ASIA PACIFIC: RETAIL CLOUD MARKET, BY COMPONENT, 2023-2028 (USD MILLION)

- TABLE 127 ASIA PACIFIC: RETAIL CLOUD MARKET, BY SOLUTION, 2019-2022 (USD MILLION)

- TABLE 128 ASIA PACIFIC: RETAIL CLOUD MARKET, BY SOLUTION, 2023-2028 (USD MILLION)

- TABLE 129 ASIA PACIFIC: RETAIL CLOUD MARKET, BY SERVICE, 2019-2022 (USD MILLION)

- TABLE 130 ASIA PACIFIC: RETAIL CLOUD MARKET, BY SERVICE, 2023-2028 (USD MILLION)

- TABLE 131 ASIA PACIFIC: RETAIL CLOUD MARKET, BY SERVICE MODEL, 2019-2022 (USD MILLION)

- TABLE 132 ASIA PACIFIC: RETAIL CLOUD MARKET, BY SERVICE MODEL, 2023-2028 (USD MILLION)

- TABLE 133 ASIA PACIFIC: RETAIL CLOUD MARKET, BY DEPLOYMENT MODEL, 2019-2022 (USD MILLION)

- TABLE 134 ASIA PACIFIC: RETAIL CLOUD MARKET, BY DEPLOYMENT MODEL, 2023-2028 (USD MILLION)

- TABLE 135 ASIA PACIFIC: RETAIL CLOUD MARKET, BY ORGANIZATION SIZE, 2019-2022 (USD MILLION)

- TABLE 136 ASIA PACIFIC: RETAIL CLOUD MARKET, BY ORGANIZATION SIZE, 2023-2028 (USD MILLION)

- TABLE 137 ASIA PACIFIC: RETAIL CLOUD MARKET, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 138 ASIA PACIFIC: RETAIL CLOUD MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- 10.4.3 CHINA

- 10.4.3.1 Rapid technological developments facilitate growth of eCommerce

- TABLE 139 CHINA: RETAIL CLOUD MARKET, BY DEPLOYMENT MODEL, 2019-2022 (USD MILLION)

- TABLE 140 CHINA: RETAIL CLOUD MARKET, BY DEPLOYMENT MODEL, 2023-2028 (USD MILLION)

- TABLE 141 CHINA: RETAIL CLOUD MARKET, BY ORGANIZATION SIZE, 2019-2022 (USD MILLION)

- TABLE 142 CHINA: RETAIL CLOUD MARKET, BY ORGANIZATION SIZE, 2023-2028 (USD MILLION)

- 10.4.4 JAPAN

- 10.4.4.1 Growth in eCommerce to drive adoption of cloud

- TABLE 143 JAPAN: RETAIL CLOUD MARKET, BY DEPLOYMENT MODEL, 2019-2022 (USD MILLION)

- TABLE 144 JAPAN: RETAIL CLOUD MARKET, BY DEPLOYMENT MODEL, 2023-2028 (USD MILLION)

- TABLE 145 JAPAN: RETAIL CLOUD MARKET, BY ORGANIZATION SIZE, 2019-2022 (USD MILLION)

- TABLE 146 JAPAN: RETAIL CLOUD MARKET, BY ORGANIZATION SIZE, 2023-2028 (USD MILLION)

- 10.4.5 INDIA

- 10.4.5.1 Rapid growth and digitalization of Indian retail sector

- TABLE 147 INDIA: RETAIL CLOUD MARKET, BY DEPLOYMENT MODEL, 2019-2022 (USD MILLION)

- TABLE 148 INDIA: RETAIL CLOUD MARKET, BY DEPLOYMENT MODEL, 2023-2028 (USD MILLION)

- TABLE 149 INDIA: RETAIL CLOUD MARKET, BY ORGANIZATION SIZE, 2019-2022 (USD MILLION)

- TABLE 150 INDIA: RETAIL CLOUD MARKET, BY ORGANIZATION SIZE, 2023-2028 (USD MILLION)

- 10.4.6 REST OF ASIA PACIFIC

- TABLE 151 REST OF ASIA PACIFIC: RETAIL CLOUD MARKET, BY DEPLOYMENT MODEL, 2019-2022 (USD MILLION)

- TABLE 152 REST OF ASIA PACIFIC: RETAIL CLOUD MARKET, BY DEPLOYMENT MODEL, 2023-2028 (USD MILLION)

- TABLE 153 REST OF ASIA PACIFIC: RETAIL CLOUD MARKET, BY ORGANIZATION SIZE, 2019-2022 (USD MILLION)

- TABLE 154 REST OF ASIA PACIFIC: RETAIL CLOUD MARKET, BY ORGANIZATION SIZE, 2023-2028 (USD MILLION)

- 10.5 MIDDLE EAST & AFRICA

- TABLE 155 MIDDLE EAST & AFRICA: PESTLE ANALYSIS

- 10.5.1 MIDDLE EAST & AFRICA: RETAIL CLOUD MARKET DRIVERS

- 10.5.2 MIDDLE EAST & AFRICA: RECESSION IMPACT

- TABLE 156 MIDDLE EAST & AFRICA: RETAIL CLOUD MARKET, BY COMPONENT, 2019-2022 (USD MILLION)

- TABLE 157 MIDDLE EAST & AFRICA: RETAIL CLOUD MARKET, BY COMPONENT, 2023-2028 (USD MILLION)

- TABLE 158 MIDDLE EAST & AFRICA: RETAIL CLOUD MARKET, BY SOLUTION, 2019-2022 (USD MILLION)

- TABLE 159 MIDDLE EAST & AFRICA: RETAIL CLOUD MARKET, BY SOLUTION, 2023-2028 (USD MILLION)

- TABLE 160 MIDDLE EAST & AFRICA: RETAIL CLOUD MARKET, BY SERVICE, 2019-2022 (USD MILLION)

- TABLE 161 MIDDLE EAST & AFRICA: RETAIL CLOUD MARKET, BY SERVICE, 2023-2028 (USD MILLION)

- TABLE 162 MIDDLE EAST & AFRICA: RETAIL CLOUD MARKET, BY SERVICE MODEL, 2019-2022 (USD MILLION)

- TABLE 163 MIDDLE EAST & AFRICA: RETAIL CLOUD MARKET, BY SERVICE MODEL, 2023-2028 (USD MILLION)

- TABLE 164 MIDDLE EAST & AFRICA: RETAIL CLOUD MARKET, BY DEPLOYMENT MODEL, 2019-2022 (USD MILLION)

- TABLE 165 MIDDLE EAST & AFRICA: RETAIL CLOUD MARKET, BY DEPLOYMENT MODEL, 2023-2028 (USD MILLION)

- TABLE 166 MIDDLE EAST & AFRICA: RETAIL CLOUD MARKET, BY ORGANIZATION SIZE, 2019-2022 (USD MILLION)

- TABLE 167 MIDDLE EAST & AFRICA: RETAIL CLOUD MARKET, BY ORGANIZATION SIZE, 2023-2028 (USD MILLION)

- TABLE 168 MIDDLE EAST & AFRICA: RETAIL CLOUD MARKET, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 169 MIDDLE EAST & AFRICA: RETAIL CLOUD MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- 10.5.3 SAUDI ARABIA

- 10.5.3.1 Growth in technological advancements with rise in eCommerce activity

- TABLE 170 SAUDI ARABIA: RETAIL CLOUD MARKET, BY DEPLOYMENT MODEL, 2019-2022 (USD MILLION)

- TABLE 171 SAUDI ARABIA: RETAIL CLOUD MARKET, BY DEPLOYMENT MODEL, 2023-2028 (USD MILLION)

- TABLE 172 SAUDI ARABIA: RETAIL CLOUD MARKET, BY ORGANIZATION SIZE, 2019-2022 (USD MILLION)

- TABLE 173 SAUDI ARABIA: RETAIL CLOUD MARKET, BY ORGANIZATION SIZE, 2023-2028 (USD MILLION)

- 10.5.4 UAE

- 10.5.4.1 Smart Dubai initiative and other government initiatives

- TABLE 174 UAE: RETAIL CLOUD MARKET, BY DEPLOYMENT MODEL, 2019-2022 (USD MILLION)

- TABLE 175 UAE: RETAIL CLOUD MARKET, BY DEPLOYMENT MODEL, 2023-2028 (USD MILLION)

- TABLE 176 UAE: RETAIL CLOUD MARKET, BY ORGANIZATION SIZE, 2019-2022 (USD MILLION)

- TABLE 177 UAE: RETAIL CLOUD MARKET, BY ORGANIZATION SIZE, 2023-2028 (USD MILLION)

- 10.5.5 REST OF MIDDLE EAST & AFRICA

- TABLE 178 REST OF THE MIDDLE EAST & AFRICA: RETAIL CLOUD MARKET, BY DEPLOYMENT MODEL, 2019-2022 (USD MILLION)

- TABLE 179 REST OF THE MIDDLE EAST & AFRICA: RETAIL CLOUD MARKET, BY DEPLOYMENT MODEL, 2023-2028 (USD MILLION)

- TABLE 180 REST OF THE MIDDLE EAST & AFRICA: RETAIL CLOUD MARKET, BY ORGANIZATION SIZE, 2019-2022 (USD MILLION)

- TABLE 181 REST OF THE MIDDLE EAST & AFRICA: RETAIL CLOUD MARKET, BY ORGANIZATION SIZE, 2023-2028 (USD MILLION)

- 10.6 LATIN AMERICA

- TABLE 182 LATIN AMERICA: PESTLE ANALYSIS

- 10.6.1 LATIN AMERICA: RETAIL CLOUD MARKET DRIVERS

- 10.6.2 LATIN AMERICA: RECESSION IMPACT

- TABLE 183 LATIN AMERICA: RETAIL CLOUD MARKET, BY COMPONENT, 2019-2022 (USD MILLION)

- TABLE 184 LATIN AMERICA: RETAIL CLOUD MARKET, BY COMPONENT, 2023-2028 (USD MILLION)

- TABLE 185 LATIN AMERICA: RETAIL CLOUD MARKET, BY SOLUTION, 2019-2022 (USD MILLION)

- TABLE 186 LATIN AMERICA: RETAIL CLOUD MARKET, BY SOLUTION, 2023-2028 (USD MILLION)

- TABLE 187 LATIN AMERICA: RETAIL CLOUD MARKET, BY SERVICE, 2019-2022 (USD MILLION)

- TABLE 188 LATIN AMERICA: RETAIL CLOUD MARKET, BY SERVICE, 2023-2028 (USD MILLION)

- TABLE 189 LATIN AMERICA: RETAIL CLOUD MARKET, BY SERVICE MODEL, 2019-2022 (USD MILLION)

- TABLE 190 LATIN AMERICA: RETAIL CLOUD MARKET, BY SERVICE MODEL, 2023-2028 (USD MILLION)

- TABLE 191 LATIN AMERICA: RETAIL CLOUD MARKET, BY DEPLOYMENT MODEL, 2019-2022 (USD MILLION)

- TABLE 192 LATIN AMERICA: RETAIL CLOUD MARKET, BY DEPLOYMENT MODEL, 2023-2028 (USD MILLION)

- TABLE 193 LATIN AMERICA: RETAIL CLOUD MARKET, BY ORGANIZATION SIZE, 2019-2022 (USD MILLION)

- TABLE 194 LATIN AMERICA: RETAIL CLOUD MARKET, BY ORGANIZATION SIZE, 2023-2028 (USD MILLION)

- TABLE 195 LATIN AMERICA: RETAIL CLOUD MARKET, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 196 LATIN AMERICA: RETAIL CLOUD MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- 10.6.3 BRAZIL

- 10.6.3.1 Retailers adopting SaaS solutions to manage CRM, eCommerce, and PoS systems

- TABLE 197 BRAZIL: RETAIL CLOUD MARKET, BY DEPLOYMENT MODEL, 2019-2022 (USD MILLION)

- TABLE 198 BRAZIL: RETAIL CLOUD MARKET, BY DEPLOYMENT MODEL, 2023-2028 (USD MILLION)

- TABLE 199 BRAZIL: RETAIL CLOUD MARKET, BY ORGANIZATION SIZE, 2019-2022 (USD MILLION)

- TABLE 200 BRAZIL: RETAIL CLOUD MARKET, BY ORGANIZATION SIZE, 2023-2028 (USD MILLION)

- 10.6.4 MEXICO

- 10.6.4.1 Adoption of cloud-based PoS systems in retail applications

- TABLE 201 MEXICO: RETAIL CLOUD MARKET, BY DEPLOYMENT MODEL, 2019-2022 (USD MILLION)

- TABLE 202 MEXICO: RETAIL CLOUD MARKET, BY DEPLOYMENT MODEL, 2023-2028 (USD MILLION)

- TABLE 203 MEXICO: RETAIL CLOUD MARKET, BY ORGANIZATION SIZE, 2019-2022 (USD MILLION)

- TABLE 204 MEXICO: RETAIL CLOUD MARKET, BY ORGANIZATION SIZE, 2023-2028 (USD MILLION)

- 10.6.5 REST OF LATIN AMERICA

- TABLE 205 REST OF LATIN AMERICA: RETAIL CLOUD MARKET, BY DEPLOYMENT MODEL, 2019-2022 (USD MILLION)

- TABLE 206 REST OF LATIN AMERICA: RETAIL CLOUD MARKET, BY DEPLOYMENT MODEL, 2023-2028 (USD MILLION)

- TABLE 207 REST OF LATIN AMERICA: RETAIL CLOUD MARKET, BY ORGANIZATION SIZE, 2019-2022 (USD MILLION)

- TABLE 208 REST OF LATIN AMERICA: RETAIL CLOUD MARKET, BY ORGANIZATION SIZE, 2023-2028 (USD MILLION)

11 COMPETITIVE LANDSCAPE

- 11.1 OVERVIEW

- 11.2 MARKET EVALUATION FRAMEWORK

- 11.3 KEY PLAYER STRATEGIES/RIGHT TO WIN

- TABLE 209 OVERVIEW OF STRATEGIES ADOPTED BY KEY RETAIL CLOUD VENDORS

- 11.4 REVENUE ANALYSIS

- FIGURE 40 HISTORICAL FOUR-YEAR REVENUE ANALYSIS OF LEADING PLAYERS, 2018-2022 (USD MILLION)

- 11.5 COMPANY FINANCIAL METRICS

- FIGURE 41 TRADING COMPARABLES, 2023 (EV/EBITDA)

- 11.6 GLOBAL SNAPSHOT OF KEY MARKET PARTICIPANTS

- FIGURE 42 GLOBAL SNAPSHOT OF KEY RETAIL CLOUD MARKET PARTICIPANTS, 2022

- 11.7 MARKET SHARE ANALYSIS

- FIGURE 43 RETAIL CLOUD MARKET: MARKET SHARE ANALYSIS, 2022

- TABLE 210 RETAIL CLOUD MARKET: DEGREE OF COMPETITION

- 11.8 COMPANY EVALUATION QUADRANT

- FIGURE 44 COMPANY EVALUATION QUADRANT: CRITERIA WEIGHTAGE

- 11.8.1 STARS

- 11.8.2 EMERGING LEADERS

- 11.8.3 PERVASIVE PLAYERS

- 11.8.4 PARTICIPANTS

- FIGURE 45 RETAIL CLOUD MARKET: KEY COMPANY EVALUATION QUADRANT, 2022

- 11.8.5 COMPANY PRODUCT FOOTPRINT ANALYSIS

- TABLE 211 KEY COMPANY PRODUCT FOOTPRINT

- FIGURE 46 RANKING OF KEY PLAYERS IN RETAIL CLOUD MARKET, 2022

- 11.9 STARTUP/SME EVALUATION QUADRANT

- FIGURE 47 STARTUP/SME EVALUATION QUADRANT: CRITERIA WEIGHTAGE

- 11.9.1 PROGRESSIVE COMPANIES

- 11.9.2 RESPONSIVE COMPANIES

- 11.9.3 DYNAMIC COMPANIES

- 11.9.4 STARTING BLOCKS

- FIGURE 48 RETAIL CLOUD MARKET: STARTUP/SME COMPANY EVALUATION QUADRANT, 2022

- 11.9.5 COMPETITIVE BENCHMARKING

- TABLE 212 RETAIL CLOUD MARKET: DETAILED LIST OF KEY STARTUPS/SMES

- TABLE 213 STARTUP/SME PRODUCT FOOTPRINT

- 11.10 KEY MARKET DEVELOPMENTS

- 11.10.1 PRODUCT LAUNCHES & ENHANCEMENTS

- TABLE 214 PRODUCT LAUNCHES & ENHANCEMENTS, 2021-2023

- 11.10.2 DEALS

- TABLE 215 DEALS, 2021-2023

12 COMPANY PROFILES

- 12.1 INTRODUCTION

- 12.2 KEY PLAYERS

- (Business Overview, Products/Solutions/Services Offered, Recent Developments, and MnM View)**

- 12.2.1 AWS

- TABLE 216 AWS: BUSINESS OVERVIEW

- FIGURE 49 AWS: COMPANY SNAPSHOT

- TABLE 217 AWS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 218 AWS: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 219 AWS: DEALS

- 12.2.2 MICROSOFT

- TABLE 220 MICROSOFT: BUSINESS OVERVIEW

- FIGURE 50 MICROSOFT: COMPANY SNAPSHOT

- TABLE 221 MICROSOFT: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 222 MICROSOFT: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 223 MICROSOFT: DEALS

- 12.2.3 GOOGLE

- TABLE 224 GOOGLE: BUSINESS OVERVIEW

- FIGURE 51 GOOGLE: COMPANY SNAPSHOT

- TABLE 225 GOOGLE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 226 GOOGLE: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 227 GOOGLE: DEALS

- 12.2.4 ORACLE

- TABLE 228 ORACLE: BUSINESS OVERVIEW

- FIGURE 52 ORACLE: COMPANY SNAPSHOT

- TABLE 229 ORACLE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 230 ORACLE: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 231 ORACLE: DEALS

- 12.2.5 SALESFORCE

- TABLE 232 SALESFORCE: BUSINESS OVERVIEW

- FIGURE 53 SALESFORCE: COMPANY SNAPSHOT

- TABLE 233 SALESFORCE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 234 SALESFORCE: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 235 SALESFORCE: DEALS

- 12.2.6 SAP

- TABLE 236 SAP: BUSINESS OVERVIEW

- FIGURE 54 SAP: COMPANY SNAPSHOT

- TABLE 237 SAP: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 238 SAP: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 239 SAP: DEALS

- 12.2.7 ACCENTURE

- TABLE 240 ACCENTURE: BUSINESS OVERVIEW

- FIGURE 55 ACCENTURE: COMPANY SNAPSHOT

- TABLE 241 ACCENTURE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 242 ACCENTURE: DEALS

- 12.2.8 ALIBABA CLOUD

- TABLE 243 ALIBABA CLOUD: BUSINESS OVERVIEW

- FIGURE 56 ALIBABA CLOUD: COMPANY SNAPSHOT

- TABLE 244 ALIBABA CLOUD: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 245 ALIBABA CLOUD: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 246 ALIBABA CLOUD: DEALS

- 12.2.9 IBM

- TABLE 247 IBM: BUSINESS OVERVIEW

- FIGURE 57 IBM: COMPANY SNAPSHOT

- TABLE 248 IBM: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 249 IBM: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 250 IBM: DEALS

- 12.2.10 CISCO

- TABLE 251 CISCO: BUSINESS OVERVIEW

- FIGURE 58 CISCO: COMPANY SNAPSHOT

- TABLE 252 CISCO: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 253 CISCO: DEALS

- 12.2.11 VMWARE

- 12.2.12 FUJITSU

- 12.2.13 BLUE YONDER

- 12.2.14 COGNIZANT

- 12.2.15 WORKDAY

- 12.2.16 INFOR

- 12.2.17 RACKSPACE

- 12.2.18 SPS COMMERCE

- 12.2.19 ATOS

- 12.2.20 EPICOR

- 12.2.21 NUTANIX

- 12.2.22 LIGHTSPEED COMMERCE

- 12.2.23 TEKION

- 12.2.24 SYMPHONYAI RETAIL CPG

- 12.3 SMES/STARTUPS

- 12.3.1 CLOVER NETWORK

- 12.3.2 RAPIDSCALE

- 12.3.3 RETAILCLOUD

- 12.3.4 RETAIL SOLUTIONS

- 12.3.5 BRIGHTPEARL

- 12.3.6 KLIGER-WEISS INFOSYSTEMS

- 12.3.7 OPENBRAVO

- 12.3.8 IVEND RETAIL BY CITIXSYS

- 12.3.9 IQMETRIX

- 12.3.10 ONE STEP RETAIL SOLUTIONS

- 12.3.11 RETAILOPS

- * Business Overview, Products/Solutions/Services Offered, Recent Developments, and MnM View might not be captured in case of unlisted companies.

13 ADJACENT MARKETS

- 13.1 INTRODUCTION

- TABLE 254 RELATED MARKETS

- 13.2 RETAIL POINT OF SALE MARKET

- TABLE 255 RETAIL POS MARKET, BY PRODUCT, 2014-2019 (USD MILLION)

- TABLE 256 RETAIL POS MARKET, BY PRODUCT, 2019-2026 (USD MILLION)

- TABLE 257 RETAIL POS MARKET, BY COMPONENT, 2014-2019 (USD MILLION)

- TABLE 258 RETAIL POS MARKET, BY COMPONENT, 2019-2026 (USD MILLION)

- TABLE 259 RETAIL POS MARKET, BY END USER, 2014-2019 (USD MILLION)

- TABLE 260 RETAIL POS MARKET, BY END USER, 2019-2026 (USD MILLION)

- TABLE 261 RETAIL POS MARKET, BY REGION, 2014-2019 (USD MILLION)

- TABLE 262 RETAIL POS MARKET, BY REGION, 2020-2026 (USD MILLION)

- 13.3 CLOUD COMPUTING MARKET

- TABLE 263 CLOUD COMPUTING MARKET, BY SERVICE MODEL, 2017-2021 (USD BILLION)

- TABLE 264 CLOUD COMPUTING MARKET, BY SERVICE MODEL, 2022-2027 (USD BILLION)

- TABLE 265 CLOUD COMPUTING MARKET, BY IAAS, 2017-2021 (USD BILLION)

- TABLE 266 CLOUD COMPUTING MARKET, BY IAAS, 2022-2027 (USD BILLION)

- TABLE 267 CLOUD COMPUTING MARKET, BY PAAS, 2017-2021 (USD BILLION)

- TABLE 268 CLOUD COMPUTING MARKET, BY PAAS, 2022-2027 (USD BILLION)

- TABLE 269 CLOUD COMPUTING MARKET, BY SAAS, 2017-2021 (USD BILLION)

- TABLE 270 CLOUD COMPUTING MARKET, BY SAAS, 2022-2027 (USD BILLION)

- TABLE 271 CLOUD COMPUTING MARKET, BY VERTICAL, 2017-2021 (USD BILLION)

- TABLE 272 CLOUD COMPUTING MARKET, BY VERTICAL, 2022-2027 (USD BILLION)

- TABLE 273 CLOUD COMPUTING MARKET, BY REGION, 2017-2021 (USD BILLION)

- TABLE 274 CLOUD COMPUTING MARKET, BY REGION, 2022-2027 (USD BILLION)

- TABLE 275 CLOUD COMPUTING MARKET, BY DEPLOYMENT MODEL, 2017-2021 (USD BILLION)

- TABLE 276 CLOUD COMPUTING MARKET, BY DEPLOYMENT MODEL, 2022-2027 (USD BILLION)

- TABLE 277 CLOUD COMPUTING MARKET, BY ORGANIZATION SIZE, 2017-2021 (USD BILLION)

- TABLE 278 CLOUD COMPUTING MARKET, BY ORGANIZATION SIZE, 2022-2027 (USD BILLION)

14 APPENDIX

- 14.1 DISCUSSION GUIDE

- 14.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 14.3 CUSTOMIZATION OPTIONS

- 14.4 RELATED REPORTS

- 14.5 AUTHOR DETAILS