|

|

市場調査レポート

商品コード

1269631

金融向けデジタルツインの世界市場:提供別、最終用途産業別(BFSI、製造、輸送・物流、医療)、アプリケーション別、地域別 - 2028年までの予測Digital Twin in Finance Market by Offering, End-use Industry (BFSI, Manufacturing, Transportation & Logistics, Healthcare), Application and Region - Global Forecast to 2028 |

||||||

|

● お客様のご希望に応じて、既存データの加工や未掲載情報(例:国別セグメント)の追加などの対応が可能です。 詳細はお問い合わせください。 |

|||||||

| 金融向けデジタルツインの世界市場:提供別、最終用途産業別(BFSI、製造、輸送・物流、医療)、アプリケーション別、地域別 - 2028年までの予測 |

|

出版日: 2023年04月27日

発行: MarketsandMarkets

ページ情報: 英文 163 Pages

納期: 即納可能

|

- 全表示

- 概要

- 目次

世界の金融向けデジタルツインの市場規模は、2023年の1億米ドルから、2028年までに5億米ドルまで拡大し、予測期間中にCAGRで34.8%の成長が予測されています。

金融向けデジタルツイン市場の成長を促す主な要因は、安全なインフラを整備する必要性が高まっていることです。デジタルバンキングの利用拡大により、組織の間では顧客データや財務データを安全に管理することへの懸念が高まっています。IoTの普及に伴い、組織は侵害を防ぐために、より強固なセキュリティとプライバシーを必要としています。

"BFSI別では、金融サービスセグメントが予測期間中に最も高いCAGRで成長すると予想される"

消費者は金融サービスにおいてデジタルチャネルの利用を好むため、オンラインでの顧客体験を向上させる必要性が高まっています。これに対処するため、金融機関はサードパーティ企業と協力し、オンライン上の消費者行動に関するデータを収集しています。このデータは、デジタルツインがサードパーティのデータを活用してバーチャルアシスタントを作成し、人間のサポートアシスタントの必要性を代替し、シミュレーションされた対話を通じて消費者の問題を解決する方法に関する洞察を提供します。したがって、金融機関は、コストを最小限に抑え、作業効率を高めたいのであれば、この体験を強化する方法を見つける必要があります。あらゆる経験から学習できる自動化されたバーチャルアシスタントを実現するための現実的なアプローチの1つが、デジタルツインです。

"サービス別では、マネージドサービスセグメントが予測期間中に最も高いCAGRで成長すると予想される"

マネージドサービスは、特に顧客体験に関連するため重要です。技術的な領域では、十分に提供されたマネージドサービスが必要です。提供されるサービスは、クライアントの環境に完全に適合していなければなりません。技術的な専門知識、サービスの一貫性、柔軟性は、顧客の所在地に関係なく、ベンダーが提供しなければなりません。企業は、中核となるビジネスプロセスに注力しながら、同時に他のさまざまな機能をサポートすることは非常に困難です。そのため、保険などのBFSI分野では、マネージドサービスの重要性がさらに高まっています。

"予測期間中、アジア太平洋地域が最も高い成長率を示す"

アジア太平洋地域の企業は、柔軟な経済状況、工業化、各国政府のグローバリゼーションを動機とする政策、同地域で拡大するデジタル化から利益を得ることができます。金融向けデジタルツイン市場の成長は、同地域の都市化の進展によって促進されると予想されます。都市化の進展と可処分所得の増加に伴い、個人は物理的に銀行を訪れる代わりに、デジタルサービスを選択することができるようになりました。このことが、市場成長の可能性を広げています。アジア太平洋地域は、新技術の導入が先進的かつダイナミックに行われており、予測期間中に最も高いCAGRを記録すると予想されます。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要と業界動向

- 市場概要

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

- デジタルツイン技術の進化

- エコシステム分析

- バリューチェーン分析

- 価格分析

- 技術分析

- 業界でのユースケース

- 特許分析

- バイヤー/クライアントに影響を与える動向/混乱

- ポーターのファイブフォース分析

- 規制状況

- 主要な利害関係者と購入基準

- 主要な会議とイベント(2023年~2024年)

- 金融向けデジタルツイン市場のベストプラクティス

- 金融向けデジタルツイン市場の将来展望

第6章 金融向けデジタルツイン市場:提供別

- イントロダクション

- プラットフォーム・ソリューション

- サービス

- プロフェッショナルサービス

- マネージドサービス

第7章 金融向けデジタルツイン市場:アプリケーション別

- イントロダクション

- リスク評価・コンプライアンス

- プロセス最適化

- 保険金請求管理

- テスト・シミュレーション

- その他

第8章 金融向けデジタルツイン市場:最終用途産業別

- イントロダクション

- BFSI

- 銀行

- 金融サービス

- 保険

- 製造

- 医療

- 輸送・物流

- その他

第9章 金融向けデジタルツイン市場:地域別

- イントロダクション

- 北米

- 米国

- カナダ

- 欧州

- 英国

- ドイツ

- その他の欧州

- アジア太平洋地域

- 中国

- シンガポール

- その他のアジア太平洋地域

- その他の地域

第10章 競合情勢

- 概要

- 主要企業が採用した戦略

- 競合シナリオ

- 上位企業の市場シェア分析

- 競合ベンチマーキング

- 金融向けデジタルツイン市場の主要企業の市場ランキング(2023年)

- 企業評価クアドラント

- スタートアップ/中小企業の評価マトリックス手法と定義

- 競合シナリオ

第11章 企業プロファイル

- 主要企業

- IBM

- MICROSOFT

- CAPGEMINI

- SAP

- ANSYS

- ORACLE CORPORATION

- ALTAIR ENGINEERING INC.

- DELOITTE

- NVIDIA CORPORATION

- NTT DATA

- VERISK

- 中小企業/スタートアップ

- COSMO TECH

- NAYAONE

- VSOPTIMA

- MERLYNN INTELLIGENCE TECHNOLOGIES

- PIPRATE

- TADA

第12章 隣接/関連市場

- リスクアナリティクス市場

- 保険アナリティクス市場

第13章 付録

The digital twin in finance market size is projected to grow from USD 0.1 billion in 2023 to USD 0.5 billion by 2028, at a CAGR of 34.8% during the forecast period. The primary factor driving the growth of digital twin in finance market is the growing need to develop secure infrastructure. The growing use of digital banking has raised concerns among organizations about managing customer and financial data securely. As IoT has become more extensive, organizations require more robust security and privacy to prevent breaches

"By BFSI, the financial services segment is expected to grow with the highest CAGR during the forecast period"

Since consumers prefer using digital channels for financial services, there is a growing need to improve online customer experiences. To address this, financial institutions are collaborating with third-party companies to collect data on consumer behavior online. This data offers insights on how digital twins can leverage third-party data to create virtual assistants, which can replace the need for human support assistants and solve consumer problems through simulated interactions. Therefore, financial institutions must find ways to enhance this experience if they want to minimize costs and increase work efficiency. One practical approach to achieving an automated virtual assistant that can learn from every experience is through a digital twin.

"By service, the managed services segment is expected to grow with the highest CAGR during the forecast period"

Managed services are important as they are specifically related to client experiences. A technological domain requires well-delivered managed services. The services offered must fit perfectly into the client's environment. Technical expertise, service consistency, and flexibility must be provided by vendors regardless of the client's location. Companies find it extremely challenging to focus on core business processes and at the same time support various other functions. This makes managed services even more important in the BFSI sector such as insurance.

"Asia Pacific to register the highest growth rate during the forecast period"

Companies in the Asia Pacific could benefit from the flexible economic conditions, industrialization, the globalization-motivated policies of their governments, and the expanding digitalization in the region. The growth of the digital twin in finance market is anticipated to be fueled by the surge in urbanization in the region. With rising urbanization and increasing disposable incomes, individuals can conveniently opt for digital services instead of physically visiting banks. This broadens the potential for growth in the market. The Asia Pacific has witnessed an advanced and dynamic adoption of new technologies and is expected to record the highest CAGR during the forecast period.

Breakdown of primaries

The study contains insights from various industry experts, ranging from solution vendors to Tier 1 companies. The break-up of the primaries is as follows:

- By Company Type: Tier 1 - 35%, Tier 2 - 39%, and Tier 3 - 26%

- By Designation: C-level -55%, D-level - 40%, and Others - 5%

- By Region: North America - 38%, Europe - 40%, Asia Pacific - 21%, RoW- 1%

The major players in the digital twin in finance market are IBM (US), Microsoft (US), Capgemini (France), SAP (Germany), Ansys (US), Altair (US), NVIDIA (US), NTT Data (Japan), Oracle (US), Deloitte (UK), Verisk (US), Cosmo Tech (France), NayaOne (UK), VSOptima (US), Merlynn (US), Piprate (Ireland), and TADA (US). These players have adopted various growth strategies, such as partnerships, agreements and collaborations, new product launches and product enhancements, and acquisitions to expand their footprint in the digital twin in finance market.

Research Coverage

The market study covers the digital twin in finance market size across different segments. It aims at estimating the market size and the growth potential across different segments, including offering, end-use industry, and region. The study further includes an in-depth competitive analysis of the leading market players, along with their company profiles, key observations related to product and business offerings, recent developments, and market strategies.

Key Benefits of Buying the Report

The report will help the market leaders/new entrants with information on the closest approximations of the revenue numbers for the digital twin in finance market and its subsegments. This report will help stakeholders understand the competitive landscape and gain more insights to better position their businesses and to plan suitable go-to-market strategies. Moreover, the report will provide insights for stakeholders to understand the pulse of the market and provide them with information on key market drivers, restraints, challenges, and opportunities.

The report provides insights on the following pointers:

Analysis of key drivers (Growing adoption of industry 4.0, Growing need to test new market scenarios in real time to reduce risks, Increasing demand for secure infrastructure, Growing need to meet compliance requirements), restraints (High cost of digital twin deployment), opportunities (Increasing adoption of real-time data analytical tools, Growing demand for open banking, Risign emphasis on financial crime risk alert mangement), and challenges (Lack of skilled workforce, Growing threat of cyberattacks) influencing the growth of the digital twin in finance market.

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product & service launches in the digital twin in finance market.

- Market Development: Comprehensive information about lucrative markets - the report analyses the digital twin in finance market across varied regions

- Market Diversification: Exhaustive information about new products & services, untapped geographies, recent developments, and investments in the digital twin in finance market.

Competitive Assessment: In-depth assessment of market shares, growth strategies and service offerings of leading players like IBM (US), Microsoft (US), Capgemini (France), SAP (Germany), Ansys (US), Altair (US), NVIDIA (US), NTT Data (Japan), Oracle (US), Deloitte (UK), Verisk (US), Cosmo Tech (France), NayaOne (UK), VSOptima (US), Merlynn (US), Piprate (Ireland), and TADA (US).

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.2.1 INCLUSIONS & EXCLUSIONS

- 1.3 MARKET SCOPE

- 1.3.1 MARKET SEGMENTATION

- 1.3.2 REGIONS COVERED

- 1.3.3 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 STAKEHOLDERS

- 1.6 RECESSION IMPACT

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- FIGURE 1 GLOBAL DIGITAL TWIN IN FINANCE MARKET: RESEARCH DESIGN

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Primary interviews with experts

- 2.1.2.2 List of key primary interview participants

- 2.1.2.3 Breakup of primary interviews

- FIGURE 2 BREAKUP OF PRIMARY INTERVIEWS: BY COMPANY, DESIGNATION, AND REGION

- 2.1.2.4 Key industry insights

- 2.2 DATA TRIANGULATION

- 2.3 MARKET SIZE ESTIMATION

- FIGURE 3 MARKET SIZE ESTIMATION METHODOLOGY - APPROACH 1 (SUPPLY SIDE): REVENUE OF PLATFORMS/SOLUTIONS AND SERVICES

- 2.3.1 BOTTOM-UP APPROACH

- FIGURE 4 BOTTOM-UP APPROACH

- FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY - APPROACH 2: TOP-DOWN APPROACH (DEMAND SIDE)

- 2.3.2 TOP-DOWN APPROACH

- FIGURE 6 TOP-DOWN APPROACH

- 2.4 MARKET FORECAST

- TABLE 1 FACTOR ANALYSIS

- 2.5 STUDY ASSUMPTIONS

- 2.6 STUDY LIMITATIONS

3 EXECUTIVE SUMMARY

- FIGURE 7 DIGITAL TWIN IN FINANCE MARKET, 2023-2028 (USD MILLION)

- FIGURE 8 DIGITAL TWIN IN FINANCE MARKET, BY OFFERING, 2023 VS. 2028 (USD MILLION)

- FIGURE 9 DIGITAL TWIN IN FINANCE MARKET, BY END-USE INDUSTRY, 2023 VS. 2028 (USD MILLION)

- FIGURE 10 DIGITAL TWIN IN FINANCE MARKET, BY REGION, 2023 VS. 2028 (USD MILLION)

4 PREMIUM INSIGHTS

- 4.1 DIGITAL TWIN IN FINANCE MARKET OVERVIEW

- FIGURE 11 INCREASING USE OF DIGITALIZED PLATFORMS TO DRIVE MARKET GROWTH

- 4.2 NORTH AMERICA: DIGITAL TWIN IN FINANCE MARKET, BY OFFERING AND END-USE INDUSTRY (2023)

- FIGURE 12 BFSI SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE IN 2023

- 4.3 ASIA PACIFIC: DIGITAL TWIN IN FINANCE MARKET, BY OFFERING AND END-USE INDUSTRY (2023)

- FIGURE 13 PLATFORMS & SOLUTIONS TO DOMINATE MARKET IN ASIA PACIFIC IN 2023

- 4.4 EUROPE: DIGITAL TWIN IN FINANCE MARKET, BY OFFERING AND END-USE INDUSTRY (2023)

- FIGURE 14 BFSI SEGMENT TO HOLD LARGEST MARKET SHARE IN 2023

- 4.5 GEOGRAPHICAL SNAPSHOT OF DIGITAL TWIN IN FINANCE MARKET

- FIGURE 15 ASIA PACIFIC TO REGISTER HIGHEST GROWTH RATE DURING FORECAST PERIOD

5 MARKET OVERVIEW AND INDUSTRY TRENDS

- 5.1 MARKET OVERVIEW

- 5.2 MARKET DYNAMICS

- FIGURE 16 DIGITAL TWIN IN FINANCE MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- 5.2.1 DRIVERS

- 5.2.1.1 Growing adoption of Industry 4.0

- 5.2.1.2 Growing need to test new market scenarios in real-time to reduce risks

- 5.2.1.3 Increasing demand for secure infrastructure

- 5.2.1.4 Growing need to meet compliance requirements

- 5.2.2 RESTRAINTS

- 5.2.2.1 High cost of digital twin deployment

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Increasing adoption of real-time data analytical tools

- 5.2.3.2 Growing demand for open banking

- 5.2.3.3 Rising emphasis on financial crime risk alert management

- 5.2.4 CHALLENGES

- 5.2.4.1 Lack of skilled workforce

- 5.2.4.2 Growing threat of cyberattacks

- 5.3 EVOLUTION OF DIGITAL TWIN TECHNOLOGY

- 5.4 ECOSYSTEM ANALYSIS

- 5.4.1 RESEARCH & DEVELOPMENT

- 5.4.2 PLANNING & DESIGN

- 5.4.3 DIGITAL TWIN ENABLERS

- 5.4.4 SOLUTION/PLATFORM/SERVICE PROVIDERS

- 5.4.5 END USERS

- TABLE 2 DIGITAL TWIN IN FINANCE MARKET: ECOSYSTEM

- 5.5 VALUE CHAIN ANALYSIS

- FIGURE 17 DIGITAL TWIN IN FINANCE MARKET: VALUE CHAIN ANALYSIS

- 5.6 PRICING ANALYSIS

- 5.6.1 AVERAGE SELLING PRICE OF KEY PLAYERS, BY OFFERING

- TABLE 3 PRICING MODELS AND INDICATIVE PRICE POINTS, 2022-2023

- 5.6.2 AVERAGE SELLING PRICE TREND

- 5.7 TECHNOLOGY ANALYSIS

- 5.7.1 RELATED TECHNOLOGIES

- 5.7.1.1 Artificial intelligence and machine learning

- 5.7.1.2 Big data and analytics

- 5.7.1.3 IoT & IIoT

- 5.7.1.4 Augmented reality and virtual reality

- 5.7.1.5 Blockchain

- 5.7.1.6 5G

- 5.7.2 IMPACT OF DIGITAL TWINS ON ADJACENT TECHNOLOGIES

- 5.7.1 RELATED TECHNOLOGIES

- 5.8 INDUSTRY USE CASES

- 5.8.1 USE CASE 1: INSURANCE COMPANIES ARE ADOPTING DIGITAL TWINS TO MANAGE RISK

- 5.8.2 USE CASE 2: COMPANIES ADOPT DIGITAL TWINS TO ADDRESS LEGAL AND COMPLIANCE RISKS IN FINANCIAL DATA

- 5.9 PATENT ANALYSIS

- 5.9.1 DOCUMENT TYPES

- TABLE 4 PATENTS FILED, 2020-2023

- 5.9.2 INNOVATION AND PATENT APPLICATIONS

- FIGURE 18 TOTAL NUMBER OF PATENTS GRANTED IN A YEAR, 2020-2023

- FIGURE 19 TOP 10 COMPANIES WITH HIGHEST NUMBER OF PATENT APPLICATIONS

- TABLE 5 TOP TEN PATENT OWNERS IN DIGITAL TWIN IN FINANCE MARKET, 2020-2023

- TABLE 6 LIST OF PATENTS IN DIGITAL TWIN IN FINANCE MARKET, 2020-2022

- 5.10 TRENDS/DISRUPTIONS IMPACTING BUYERS/CLIENTS

- FIGURE 20 TRENDS/DISRUPTIONS IMPACTING BUYERS/CLIENTS IN DIGITAL TWIN IN FINANCE MARKET

- 5.11 PORTER'S FIVE FORCES ANALYSIS

- TABLE 7 DIGITAL TWIN IN FINANCE MARKET: PORTER'S FIVE FORCES MODEL

- 5.11.1 THREAT FROM NEW ENTRANTS

- 5.11.2 THREAT FROM SUBSTITUTES

- 5.11.3 BARGAINING POWER OF BUYERS

- 5.11.4 BARGAINING POWER OF SUPPLIERS

- 5.11.5 DEGREE OF COMPETITION

- 5.12 REGULATORY LANDSCAPE

- TABLE 8 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 9 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

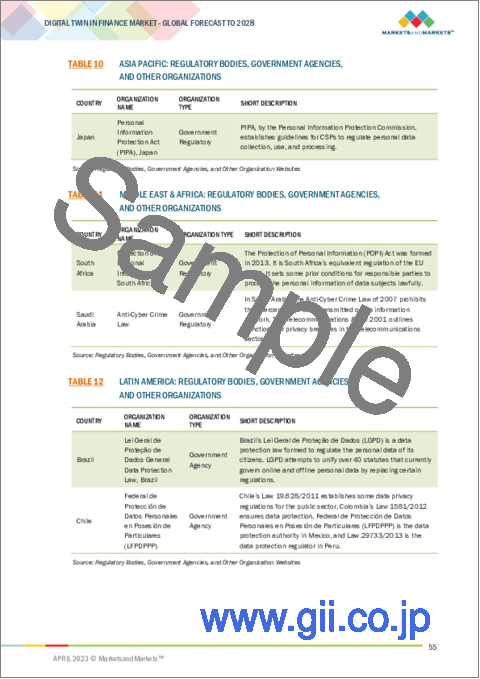

- TABLE 10 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 11 MIDDLE EAST & AFRICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 12 LATIN AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.12.1 ISO/TC 184/SC 4

- 5.12.2 ISO/TC 184

- 5.12.3 GENERAL PERSONAL DATA PROTECTION LAW (GPDP)

- 5.12.4 AUSTRALIAN DIGITAL CURRENCY COMMERCE ASSOCIATION (ADCCA)

- 5.12.5 DIGITAL SIGNATURE ACT

- 5.12.6 GDPR

- 5.12.7 FINANCIAL SERVICES MODERNIZATION ACT

- 5.12.8 SOX ACT

- 5.12.9 PAYMENT CARD INDUSTRY-DATA SECURITY STANDARD

- 5.12.10 HEALTH INSURANCE PORTABILITY AND ACCOUNTABILITY ACT

- 5.12.11 FEDERAL INFORMATION SECURITY MANAGEMENT ACT

- 5.13 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.13.1 KEY STAKEHOLDERS IN BUYING PROCESS

- FIGURE 21 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS

- TABLE 13 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS

- 5.13.2 BUYING CRITERIA

- FIGURE 22 KEY BUYING CRITERIA

- TABLE 14 KEY BUYING CRITERIA

- 5.14 KEY CONFERENCES AND EVENTS, 2023-2024

- TABLE 15 DIGITAL TWIN IN FINANCE MARKET: DETAILED LIST OF CONFERENCES AND EVENTS

- 5.15 BEST PRACTICES IN DIGITAL TWIN IN FINANCE MARKET

- 5.16 FUTURE OUTLOOK OF DIGITAL TWIN IN FINANCE MARKET

- 5.16.1 DIGITAL TWIN TECHNOLOGY ROADMAP TILL 2030

- 5.16.1.1 Short-term roadmap (2023-2025)

- 5.16.1.2 Mid-term roadmap (2026-2028)

- 5.16.1.3 Long-term roadmap (2029-2030)

- 5.16.1 DIGITAL TWIN TECHNOLOGY ROADMAP TILL 2030

6 DIGITAL TWIN IN FINANCE MARKET, BY OFFERING

- 6.1 INTRODUCTION

- 6.1.1 DIGITAL TWIN IN FINANCE MARKET, BY OFFERING: MARKET DRIVERS

- FIGURE 23 SERVICES SEGMENT TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- TABLE 16 DIGITAL TWIN IN FINANCE MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- 6.2 PLATFORMS & SOLUTIONS

- 6.2.1 BENEFITS SUCH AS REAL-TIME MONITORING AND PREDICTIVE MAINTENANCE TO DRIVE DEMAND FOR DIGITAL TWIN PLATFORMS & SOLUTIONS

- 6.3 SERVICES

- TABLE 17 DIGITAL TWIN IN FINANCE MARKET, BY TYPE, 2023-2028 (USD MILLION)

- 6.3.1 PROFESSIONAL SERVICES

- 6.3.1.1 Growing need for ongoing technical support to boost demand for professional services

- TABLE 18 PROFESSIONAL SERVICES: DIGITAL TWIN IN FINANCE MARKET, BY REGION, 2023-2028 (USD MILLION)

- 6.3.2 MANAGED SERVICES

- 6.3.2.1 Ability of managed services to improve client experiences to drive growth

- TABLE 19 MANAGED SERVICES: DIGITAL TWIN IN FINANCE MARKET, BY REGION, 2023-2028 (USD MILLION)

7 DIGITAL TWIN IN FINANCE MARKET, BY APPLICATION

- 7.1 INTRODUCTION

- 7.1.1 DIGITAL TWIN IN FINANCE MARKET, BY APPLICATION: MARKET DRIVERS

- 7.2 RISK ASSESSMENT & COMPLIANCE

- 7.2.1 GROWING NEED FOR REAL-TIME ASSET MONITORING FOR RISK ESTIMATION TO DRIVE MARKET GROWTH

- 7.3 PROCESS OPTIMIZATION

- 7.3.1 ABILITY OF DIGITAL TWINS TO CHECK AND REDUCE BOTTLENECKS TO BOOST ADOPTION

- 7.4 INSURANCE CLAIMS MANAGEMENT

- 7.4.1 GROWING USE OF DIGITAL TWINS TO PREVENT DELAYS IN CLAIMS MANAGEMENT PROCESSES TO FAVOR GROWTH

- 7.5 TESTING & SIMULATION

- 7.5.1 NEED FOR DIGITAL TWINS TO TEST AND ANALYZE SYSTEM BEHAVIOR IN COMPLEX SITUATIONS TO BOOST MARKET

- 7.6 OTHER APPLICATIONS

8 DIGITAL TWIN IN FINANCE MARKET, BY END-USE INDUSTRY

- 8.1 INTRODUCTION

- 8.1.1 DIGITAL TWIN IN FINANCE MARKET, BY END-USE INDUSTRY: MARKET DRIVERS

- FIGURE 24 HEALTHCARE INDUSTRY TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- TABLE 20 DIGITAL TWIN IN FINANCE MARKET, BY END-USE INDUSTRY, 2023-2028 (USD MILLION)

- 8.2 BFSI

- FIGURE 25 FINANCIAL SERVICES SEGMENT TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- TABLE 21 BFSI: DIGITAL TWIN IN FINANCE MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 22 BFSI: DIGITAL TWIN IN FINANCE MARKET, BY REGION, 2023-2028 (USD MILLION)

- 8.2.1 BANKING

- 8.2.1.1 Growing need to improve customer experiences to drive use of digital twins in banking sector

- TABLE 23 BANKING: DIGITAL TWIN IN FINANCE MARKET, BY REGION, 2023-2028 (USD MILLION)

- 8.2.1.1.1 Use cases

- 8.2.1.1.1.1 To check and enhance performance of ATMs in real-time

- 8.2.1.1.1.2 To manage and monitor customer buying preferences in banks

- 8.2.1.1.1 Use cases

- 8.2.2 FINANCIAL SERVICES

- 8.2.2.1 Need for virtual assistants to solve consumer problems through simulated interactions to drive demand for digital twins

- TABLE 24 FINANCIAL SERVICES: DIGITAL TWIN IN FINANCE MARKET, BY REGION, 2023-2028 (USD MILLION)

- 8.2.2.1.1 Use cases

- 8.2.2.1.1.1 To check performance of portfolio in various conditions before investing

- 8.2.2.1.1 Use cases

- 8.2.3 INSURANCE

- 8.2.3.1 Growing need for risk assessment in insurance sector to boost demand for digital twins

- TABLE 25 INSURANCE: DIGITAL TWIN IN FINANCE MARKET, BY REGION, 2023-2028 (USD MILLION)

- 8.2.3.1.1 Use cases

- 8.2.3.1.1.1 To estimate and settle claims quickly

- 8.2.3.1.1.2 To detect fraudulent claims

- 8.2.3.1.1.3 To address legal and compliance risks

- 8.2.3.1.1 Use cases

- 8.3 MANUFACTURING

- 8.3.1 NEED TO CUT TIME AND COST IN MANUFACTURING SECTOR TO DRIVE GROWTH

- TABLE 26 MANUFACTURING: DIGITAL TWIN IN FINANCE MARKET, BY REGION, 2023-2028 (USD MILLION)

- 8.3.1.1 Use cases

- 8.3.1.1.1 To reduce costs involved in manufacturing operations

- 8.3.1.1.2 To improve cost savings and product quality

- 8.3.1.1 Use cases

- 8.4 HEALTHCARE

- 8.4.1 GROWING TREND OF DIGITALIZATION IN HEALTHCARE TO BOOST ADOPTION OF DIGITAL TWINS

- TABLE 27 HEALTHCARE: DIGITAL TWIN IN FINANCE MARKET, BY REGION, 2023-2028 (USD MILLION)

- 8.4.1.1 Use cases

- 8.4.1.1.1 To reduce costs and improve efficiency with Oracle Health Insurance

- 8.4.1.1.2 To simulate and enhance clinical workflows

- 8.4.1.1 Use cases

- 8.5 TRANSPORTATION & LOGISTICS

- 8.5.1 NEED FOR TRANSPORTATION COMPANIES TO IMPROVE PERFORMANCE OF ASSETS AND PROCESSES TO FUEL MARKET GROWTH

- TABLE 28 TRANSPORTATION & LOGISTICS: DIGITAL TWIN IN FINANCE MARKET, BY REGION, 2023-2028 (USD MILLION)

- 8.5.1.1 Use cases

- 8.5.1.1.1 To make calculative investment decisions for Cross River Rail project

- 8.5.1.1.2 To prevent costly downtime and repairs

- 8.5.1.1 Use cases

- 8.6 OTHER END-USE INDUSTRIES

- TABLE 29 OTHER END-USE INDUSTRIES: DIGITAL TWIN IN FINANCE MARKET, BY REGION, 2023-2028 (USD MILLION)

- 8.6.1 USE CASES

- 8.6.1.1 To improve energy operations and help companies enhance revenue models

- 8.6.1.2 To better understand risk

9 DIGITAL TWIN IN FINANCE MARKET, BY REGION

- 9.1 INTRODUCTION

- FIGURE 26 DIGITAL TWIN IN FINANCE MARKET: REGIONAL SNAPSHOT (2023)

- FIGURE 27 ASIA PACIFIC TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- TABLE 30 DIGITAL TWIN IN FINANCE MARKET, BY REGION, 2023-2028 (USD MILLION)

- 9.2 NORTH AMERICA

- FIGURE 28 NORTH AMERICA: MARKET SNAPSHOT

- 9.2.1 NORTH AMERICA: DIGITAL TWIN IN FINANCE MARKET DRIVERS

- 9.2.2 NORTH AMERICA: RECESSION IMPACT

- TABLE 31 NORTH AMERICA: DIGITAL TWIN IN FINANCE MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 32 NORTH AMERICA: DIGITAL TWIN IN FINANCE SERVICES MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 33 NORTH AMERICA: DIGITAL TWIN IN FINANCE MARKET, BY END-USE INDUSTRY, 2023-2028 (USD MILLION)

- TABLE 34 NORTH AMERICA: DIGITAL TWIN IN FINANCE MARKET FOR BFSI SECTOR, BY TYPE, 2023-2028 (USD MILLION)

- 9.2.3 US

- 9.2.3.1 Rapid adoption of technology in financial sector to drive market growth

- 9.2.4 CANADA

- 9.2.4.1 Increasing cyberattacks to drive demand for digital twins

- 9.3 EUROPE

- FIGURE 29 EUROPE: MARKET SNAPSHOT

- 9.3.1 EUROPE: DIGITAL TWIN IN FINANCE MARKET DRIVERS

- 9.3.2 EUROPE: RECESSION IMPACT

- TABLE 35 EUROPE: DIGITAL TWIN IN FINANCE MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 36 EUROPE: DIGITAL TWIN IN FINANCE SERVICES MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 37 EUROPE: DIGITAL TWIN IN FINANCE MARKET, BY END-USE INDUSTRY, 2023-2028 (USD MILLION)

- TABLE 38 EUROPE: DIGITAL TWIN IN FINANCE MARKET FOR BFSI SECTOR, BY TYPE, 2023-2028 (USD MILLION)

- 9.3.3 UK

- 9.3.3.1 Need to improve efficiency of digital infrastructure to boost market growth

- 9.3.4 GERMANY

- 9.3.4.1 Significant adoption of IoT technologies and analytics in financial sector to propel market

- 9.3.5 REST OF EUROPE

- 9.4 ASIA PACIFIC

- FIGURE 30 ASIA PACIFIC: MARKET SNAPSHOT

- 9.4.1 ASIA PACIFIC: DIGITAL TWIN IN FINANCE MARKET DRIVERS

- 9.4.2 RECESSION IMPACT: ASIA PACIFIC

- TABLE 39 ASIA PACIFIC: DIGITAL TWIN IN FINANCE MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 40 ASIA PACIFIC: DIGITAL TWIN IN FINANCE SERVICES MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 41 ASIA PACIFIC: DIGITAL TWIN IN FINANCE MARKET, BY END-USE INDUSTRY, 2023-2028 (USD MILLION)

- TABLE 42 ASIA PACIFIC: DIGITAL TWIN IN FINANCE MARKET FOR BFSI SECTOR, BY TYPE, 2023-2028 (USD MILLION)

- 9.4.3 CHINA

- 9.4.3.1 Increasing government investments to enhance security of digital platforms to contribute to growth

- 9.4.4 SINGAPORE

- 9.4.4.1 Rapid adoption of innovative digital technologies across banking sector to fuel growth

- 9.4.5 REST OF ASIA PACIFIC

- 9.5 REST OF THE WORLD

- 9.5.1 REST OF THE WORLD: DIGITAL TWIN IN FINANCE MARKET DRIVERS

- 9.5.2 RECESSION IMPACT: REST OF THE WORLD

- TABLE 43 REST OF THE WORLD: DIGITAL TWIN IN FINANCE MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 44 REST OF THE WORLD: DIGITAL TWIN IN FINANCE SERVICES MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 45 REST OF THE WORLD: DIGITAL TWIN IN FINANCE MARKET, BY END-USE INDUSTRY, 2023-2028 (USD MILLION)

- TABLE 46 REST ON THE WORLD: DIGITAL TWIN IN FINANCE MARKET FOR BFSI SECTOR, BY TYPE, 2023-2028 (USD MILLION)

10 COMPETITIVE LANDSCAPE

- 10.1 OVERVIEW

- 10.2 STRATEGIES ADOPTED BY KEY PLAYERS

- TABLE 47 OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS IN DIGITAL TWIN IN FINANCE MARKET

- 10.3 COMPETITIVE SCENARIO

- 10.4 MARKET SHARE ANALYSIS OF TOP PLAYERS

- TABLE 48 DIGITAL TWIN IN FINANCE MARKET: DEGREE OF COMPETITION

- 10.5 COMPETITIVE BENCHMARKING

- TABLE 49 PRODUCT FOOTPRINT WEIGHTAGE

- TABLE 50 DIGITAL TWIN IN FINANCE MARKET: COMPETITIVE BENCHMARKING OF PLAYERS, BY OFFERING, END-USE INDUSTRY, AND REGION

- TABLE 51 DIGITAL TWIN IN FINANCE MARKET: DETAILED LIST OF KEY START-UPS/SMES

- 10.6 MARKET RANKING OF KEY PLAYERS IN DIGITAL TWIN IN FINANCE MARKET, 2023

- FIGURE 31 MARKET RANKING OF KEY PLAYERS, 2023

- 10.7 COMPANY EVALUATION QUADRANT

- FIGURE 32 COMPANY EVALUATION MATRIX: CRITERIA WEIGHTAGE

- 10.7.1 STARS

- 10.7.2 EMERGING LEADERS

- 10.7.3 PERVASIVE PLAYERS

- 10.7.4 PARTICIPANTS

- FIGURE 33 DIGITAL TWIN IN FINANCE MARKET: COMPANY EVALUATION MATRIX, 2023

- 10.8 START-UP/SME EVALUATION MATRIX METHODOLOGY AND DEFINITIONS

- FIGURE 34 START-UP/SME EVALUATION MATRIX: CRITERIA WEIGHTAGE

- 10.8.1 PROGRESSIVE COMPANIES

- 10.8.2 RESPONSIVE COMPANIES

- 10.8.3 DYNAMIC COMPANIES

- 10.8.4 STARTING BLOCKS

- FIGURE 35 DIGITAL TWIN IN FINANCE MARKET: START-UP/SME EVALUATION MATRIX, 2023

- 10.9 COMPETITIVE SCENARIO

- 10.9.1 PRODUCT LAUNCHES

- TABLE 52 PRODUCT LAUNCHES, JANUARY 2019-MARCH 2023

- 10.9.2 DEALS

- TABLE 53 DEALS, JANUARY 2019-MARCH 2023

11 COMPANY PROFILES

- 11.1 MAJOR PLAYERS

- (Business Overview, Products/Solutions/Services offered, Recent Developments, MnM View)**

- 11.1.1 IBM

- TABLE 54 IBM: BUSINESS OVERVIEW

- FIGURE 36 IBM: COMPANY SNAPSHOT

- TABLE 55 IBM: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 56 IBM: DEALS

- 11.1.2 MICROSOFT

- TABLE 57 MICROSOFT: BUSINESS OVERVIEW

- FIGURE 37 MICROSOFT: COMPANY SNAPSHOT

- TABLE 58 MICROSOFT: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 59 MICROSOFT: DEALS

- 11.1.3 CAPGEMINI

- TABLE 60 CAPGEMINI: BUSINESS OVERVIEW

- FIGURE 38 CAPGEMINI: COMPANY SNAPSHOT

- TABLE 61 CAPGEMINI: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 11.1.4 SAP

- TABLE 62 SAP: BUSINESS OVERVIEW

- FIGURE 39 SAP: COMPANY SNAPSHOT

- TABLE 63 SAP: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 11.1.5 ANSYS

- TABLE 64 ANSYS: BUSINESS OVERVIEW

- FIGURE 40 ANSYS: COMPANY SNAPSHOT

- TABLE 65 ANSYS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 66 ANSYS: PRODUCT LAUNCHES

- TABLE 67 ANSYS: DEALS

- 11.1.6 ORACLE CORPORATION

- TABLE 68 ORACLE CORPORATION: BUSINESS OVERVIEW

- FIGURE 41 ORACLE CORPORATION: COMPANY SNAPSHOT

- TABLE 69 ORACLE CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 70 ORACLE CORPORATION: DEALS

- 11.1.7 ALTAIR ENGINEERING INC.

- TABLE 71 ALTAIR ENGINEERING INC.: BUSINESS OVERVIEW

- FIGURE 42 ALTAIR ENGINEERING INC.: COMPANY SNAPSHOT

- TABLE 72 ALTAIR ENGINEERING INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 73 ALTAIR ENGINEERING INC.: DEALS

- 11.1.8 DELOITTE

- TABLE 74 DELOITTE: BUSINESS OVERVIEW

- FIGURE 43 DELOITTE: COMPANY SNAPSHOT

- TABLE 75 DELOITTE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 76 DELOITTE: DEALS

- 11.1.9 NVIDIA CORPORATION

- TABLE 77 NVIDIA CORPORATION: BUSINESS OVERVIEW

- FIGURE 44 NVIDIA CORPORATION: COMPANY SNAPSHOT

- TABLE 78 NVIDIA CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 11.1.10 NTT DATA

- 11.1.11 VERISK

- *Details on Business Overview, Products/Solutions/Services offered, Recent Developments, MnM View might not be captured in case of unlisted companies.

- 11.2 SMES/START-UPS

- 11.2.1 COSMO TECH

- 11.2.2 NAYAONE

- 11.2.3 VSOPTIMA

- 11.2.4 MERLYNN INTELLIGENCE TECHNOLOGIES

- 11.2.5 PIPRATE

- 11.2.6 TADA

12 ADJACENT/RELATED MARKETS

- 12.1 RISK ANALYTICS MARKET

- 12.1.1 MARKET DEFINITION

- 12.1.2 MARKET OVERVIEW

- 12.1.3 RISK ANALYTICS MARKET, BY COMPONENT

- TABLE 79 RISK ANALYTICS MARKET, BY COMPONENT, 2016-2021 (USD MILLION)

- TABLE 80 RISK ANALYTICS MARKET, BY COMPONENT, 2022-2027 (USD MILLION)

- 12.1.3.1 Software

- TABLE 81 RISK ANALYTICS SOFTWARE MARKET, BY REGION, 2016-2021 (USD MILLION)

- TABLE 82 RISK ANALYTICS SOFTWARE MARKET, BY REGION, 2022-2027 (USD MILLION)

- TABLE 83 RISK ANALYTICS SOFTWARE MARKET, BY TYPE, 2016-2021 (USD MILLION)

- TABLE 84 RISK ANALYTICS SOFTWARE MARKET, BY TYPE, 2022-2027 (USD MILLION)

- 12.1.3.2 Services

- TABLE 85 RISK ANALYTICS SERVICES MARKET, BY REGION, 2016-2021 (USD MILLION)

- TABLE 86 RISK ANALYTICS SERVICES MARKET, BY REGION, 2022-2027 (USD MILLION)

- TABLE 87 RISK ANALYTICS SERVICES MARKET, BY TYPE, 2016-2021 (USD MILLION)

- TABLE 88 RISK ANALYTICS SERVICES MARKET, BY TYPE, 2022-2027 (USD MILLION)

- 12.2 INSURANCE ANALYTICS MARKET

- 12.2.1 MARKET DEFINITION

- 12.2.2 MARKET OVERVIEW

- 12.2.3 INSURANCE ANALYTICS MARKET, BY COMPONENT

- TABLE 89 INSURANCE ANALYTICS MARKET, BY COMPONENT, 2016-2019 (USD MILLION)

- TABLE 90 INSURANCE ANALYTICS MARKET, BY COMPONENT, 2020-2026 (USD MILLION)

- TABLE 91 INSURANCE ANALYTICS SERVICES MARKET, BY TYPE, 2016-2019 (USD MILLION)

- TABLE 92 INSURANCE ANALYTICS SERVICES MARKET, BY TYPE, 2020-2026 (USD MILLION)

- 12.2.4 INSURANCE ANALYTICS MARKET, BY APPLICATION

- TABLE 93 INSURANCE ANALYTICS MARKET, BY APPLICATION, 2016-2019 (USD MILLION)

- TABLE 94 INSURANCE ANALYTICS MARKET, BY APPLICATION, 2020-2026 (USD MILLION)

- 12.2.5 INSURANCE ANALYTICS MARKET, BY DEPLOYMENT MODE

- TABLE 95 INSURANCE ANALYTICS MARKET, BY DEPLOYMENT MODE, 2016-2019 (USD MILLION)

- TABLE 96 INSURANCE ANALYTICS MARKET, BY DEPLOYMENT MODE, 2020-2026 (USD MILLION)

- 12.2.6 INSURANCE ANALYTICS MARKET, BY ORGANIZATION SIZE

- TABLE 97 INSURANCE ANALYTICS MARKET, BY ORGANIZATION SIZE, 2016-2019 (USD MILLION)

- TABLE 98 INSURANCE ANALYTICS MARKET, BY ORGANIZATION SIZE, 2020-2026 (USD MILLION)

- 12.2.7 INSURANCE ANALYTICS MARKET, BY END USER

- TABLE 99 INSURANCE ANALYTICS MARKET, BY END USER, 2016-2019 (USD MILLION)

- TABLE 100 INSURANCE ANALYTICS MARKET, BY END USER, 2020-2026 (USD MILLION)

- 12.2.8 INSURANCE ANALYTICS MARKET, BY REGION

- TABLE 101 INSURANCE ANALYTICS MARKET, BY REGION, 2016-2019 (USD MILLION)

- TABLE 102 INSURANCE ANALYTICS MARKET, BY REGION, 2020-2026 (USD MILLION)

13 APPENDIX

- 13.1 DISCUSSION GUIDE

- 13.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 13.3 CUSTOMIZATION OPTIONS

- 13.4 RELATED REPORTS

- 13.5 AUTHOR DETAILS