|

|

市場調査レポート

商品コード

1827934

デジタルツイン市場:提供、タイプ、企業規模、用途、エンドユーザー別 - 2025年~2032年の世界予測Digital Twin Market by Offering, Type, Enterprise Size, Application, End-User - Global Forecast 2025-2032 |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| デジタルツイン市場:提供、タイプ、企業規模、用途、エンドユーザー別 - 2025年~2032年の世界予測 |

|

出版日: 2025年09月30日

発行: 360iResearch

ページ情報: 英文 184 Pages

納期: 即日から翌営業日

|

概要

デジタルツイン市場は、2032年までにCAGR 16.93%で806億5,000万米ドルの成長が予測されています。

| 主な市場の統計 | |

|---|---|

| 基準年2024 | 230億7,000万米ドル |

| 推定年2025 | 264億4,000万米ドル |

| 予測年2032 | 806億5,000万米ドル |

| CAGR(%) | 16.93% |

コネクティビティとシミュレーションの進歩が促進する、業界を超えたデジタルツインの統合別オペレーショナルエクセレンスとイノベーションの再構築

デジタルツインテクノロジーは、製造業、エネルギー、ヘルスケア、スマートシティなど、デジタル変革を実現する重要な手段として台頭してきました。物理的な資産、プロセス、システムの正確な仮想表現を作成することで、組織はオペレーションをリアルタイムで可視化し、製品開発を加速し、リソース利用を最適化することができます。この入門的研究では、デジタルレプリカを支える基本原則を掘り下げ、接続性、センサーネットワーク、シミュレーションエンジンの進歩により、デジタルツインの実装が、さまざまな産業や商業環境で、概念実証からミッションクリティカルな展開へとどのように昇華したかを探ります。

この分析では、業界との関わりや技術評価を通じて収集された洞察に基づき、進化するベストプラクティスと技術的推進力の統合的な見解を提供します。データモデリング手法とエッジ・ツー・クラウドアーキテクチャの融合により、予知保全、性能管理、設計改良のための新たな道が開かれました。さらに、持続可能性と規制遵守が重視されるようになったことで、二酸化炭素排出量、安全プロトコル、運用回復力を検証できる統合デジタル表現への需要が加速しています。

以下のセクションでは、情勢を再定義する変革的なシフトを検証し、政策変更の影響を分析し、セグメンテーションのニュアンスを明らかにし、地域とベンダーのダイナミクスを強調します。最後に、持続的なオペレーショナル・エクセレンスと競合差別化のためにデジタルツイン・キャパシティを活用するための戦略的提言を示します。

デジタルツインテクノロジーが物理環境と仮想環境を橋渡しし、プロセス、製品、サービスをグローバルに再定義する変革の波を捉える

モノのインターネット(Internet of Things)センサー、高性能コンピューティング、人工知能の融合により、デジタルツイン・イニシアチブは産業革新の最前線に押し上げられました。当初は孤立したデジタルモックアップであったものが、生産ライン全体、サプライチェーン、都市インフラを映し出す複雑なエンドツーエンドのソリューションへと急速に進化しています。この新世代のデジタルツインは、エッジコンピューティングを活用して重要なデータを資産に近いところで処理し、クラウドネイティブなフレームワークによって組織横断的なコラボレーションと継続的な改善サイクルを実現しています。

企業がこの技術シフトに対応する中で、設計、エンジニアリング、製造、サービスの各段階を統一された仮想-物理の連続体の中でつなぐデジタルスレッドという概念が登場しました。これらのスレッドは、高度な性能モニタリングと最適化を促進し、意思決定者が摩耗パターンからエネルギー消費までのシナリオをシミュレーションできるようにします。さらに、持続可能性の目標との統合により、企業はデジタルツインを使用して、排出量のマッピング、資源効率の追跡、循環経済プロセスのモデル化を行うようになりました。

今後、デジタルツインプラットフォームと、拡張現実やブロックチェーンなどの新興テクノロジーとの相互作用により、従来のビジネスモデルが再定義されつつあります。プロバイダーは、データ分析サブスクリプション、マネージドシミュレーションワークフロー、仮想試運転サービスなど、サービスポートフォリオを拡大しています。このような変革の収束は、利害関係者がアジャイル開発アプローチを採用し、分野横断的なパートナーシップを構築することで、デジタルツインエコシステムの可能性を最大限に引き出すことが不可欠であることを強調しています。

2025年の米国関税がデジタルツインサプライチェーン、部品コスト、世界の産業競争力に及ぼす累積的影響の分析

米国が2025年に新たな関税を課すことで、デジタルツインコンポーネントのサプライチェーン経済と調達戦略に大きな変化がもたらされます。コンピューティングデバイスやネットワーキング機器のメーカーは、輸入関税の引き上げに直面し、調達モデルや総所有コストの再評価を促しています。特殊な半導体のインプットに依存することが多いセンサーメーカーも同様に、貿易条件の変化を踏まえて生産フットプリントを再評価しています。こうした変化は、統合サービスやシミュレーションツールプロバイダーにも波及し、プロジェクト計画、納期、パートナーエコシステムに影響を与えています。

このような政策展開を受けて、企業はサプライヤーネットワークの多様化を追求し、関税の影響を軽減するためにニアショアリングの選択肢を模索しています。企業が機敏性を維持し、重要な業務を地政学的な変動から守ろうとする中で、技術ベンダーと現地組立ハブとの間の協力協定が支持を集めています。部品表設計を最適化し、モジュラーアーキテクチャーを採用するための並行した努力は、部品の代替を迅速に調整できるようにし、弾力性をさらに高めています。最終的には、関税の影響を明確に把握し、貿易アドバイザーと積極的に連携することが、より複雑化したグローバルな環境でデジタルツインの勢いを持続させることを意図する企業にとって不可欠な実践方法となっています。

デジタルツイン市場の多面的なセグメンテーションにより、製品、展開、エンドユーザー、タイプ、企業規模、アプリケーションに関する洞察が明らかになります

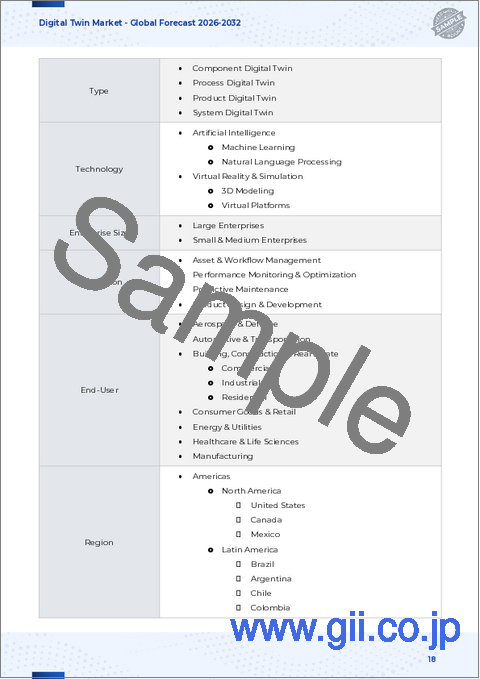

デジタルツインオファリングは、ハードウェア、サービス、ソフトウェアから構成されており、それぞれが包括的なデジタルレプリカを提供する上で明確な役割を担っています。ハードウェア面では、コンピューティングデバイスがシミュレーションのワークロードを処理し、ネットワーキングと通信モジュールがシームレスなデータ交換を促進し、センサーとアクチュエーターがバーチャルな相手にリアルタイムの操作信号を送ります。このインフラを補完するために、コンサルティングとアドバイザリー業務が組織の目的とガバナンスモデルの定義を支援し、統合サービスがセンサー、エッジゲートウェイ、クラウドプラットフォームをつなぎ合わせました。並行して、高度なデータモデリングツールが忠実度の高い数学的表現の作成を可能にし、シミュレーションエンジンがシステムの挙動を予測する複雑なシナリオ分析を実行します。

デジタルツインは、基本的な機能だけでなく、特定のビジネスニーズに対応するためにタイプ別に分類されています。コンポーネントツインは個々の資産に焦点を当て、プロセスツインはワークフローを精査し、プロダクトツインは設計の反復をガイドし、システムツインは相互接続されたオペレーションを全体的に監視します。導入の選択肢はさらに多様化し、制御とセキュリティを優先する企業にはオンプレミスが、拡張性と迅速なプロビジョニングを重視する企業にはオンクラウドソリューションが適しています。

企業規模は、導入の範囲とリソースの割り当ての両方を形成し、大企業は全社的な展開を追求することが多いが、中小企業は価値を検証するための的を絞った試験運用に集中します。使用事例は、運用を合理化するための資産とワークフローの管理、機器の寿命を延ばすための性能監視と最適化、リスク低減のための予知保全、洞察までの時間を短縮するための製品設計と開発など多岐にわたります。最後に、エンドユーザーのダイナミクスは、航空宇宙・防衛、自動車・輸送、商業・工業・住宅サブセグメントにまたがる建築・建設・不動産、消費財・小売、エネルギー・公益事業、ヘルスケア・ライフサイエンス、製造などのセクターを横断しており、それぞれが独自の課題を解決するためにデジタルツインを適用しています。

南北アメリカ、EMEA、アジア太平洋市場の動向、投資、エコシステムの成熟度を調査し、デジタルツインの導入を形成する地域力学を解明

南北アメリカ地域は、旺盛な民間投資、活発な新興企業エコシステム、デジタルトランスフォーメーションを促進する先進的な規制フレームワークによって、デジタルツインイノベーションをリードし続けています。北米と南米の各組織は、サプライチェーンの最適化、製品ライフサイクル管理の強化、持続可能性の義務付けをサポートするために、高度なシミュレーション機能を活用しています。スマートインフラプロジェクト、特に交通回廊やエネルギー配給ネットワークへの投資により、この地域はデジタルツインモデルをいち早く採用した地域としての評価が高まっています。

欧州、中東・アフリカでは、安全性、排出ガス、データプライバシーに関する厳しい規制指令が相まって、製造業、公益事業、都市開発におけるデジタルツインの導入が加速しています。ドイツの産業工学の伝統、米国のソフトウェア能力、湾岸諸国のインフラ近代化によって、スマートグリッドの導入から工場フロアのデジタル化まで、さまざまな取り組みがモザイクのように広がっています。共同研究コンソーシアムや官民パートナーシップは、イノベーションのギャップを埋め、スケーラブルな試験運用のための資金を動員するのに役立っていることが証明されています。

アジア太平洋地域は、急速なデジタル・インフラの展開、政府主導のインダストリー4.0プログラム、現地製造の回復力重視の高まりで際立っています。東アジアの先端エレクトロニクス・ハブから、東南アジアの製造クラスター、インドのテクノロジー・コリドーに至るまで、企業はクラウドネイティブなデジタルツイン・プラットフォームを、新興の5Gや産業エッジ・ソリューションと統合しつつあります。この地域の規模と導入のスピードは、グローバルベンダーの戦略を再構築し続け、プラットフォームプロバイダーは、多様な経済情勢の中で、提供サービスのローカライズとサポートネットワークの強化を促しています。

戦略的パートナーシップ、技術的ブレークスルー、コラボレーションを通じてデジタルツイン業界を前進させる有力プレーヤーと革新的ディスラプターを紹介します

大手テクノロジープロバイダーは、豊富なシミュレーション機能と既存の企業システムへのシームレスな統合を組み合わせたデジタルツインプラットフォームを確立しています。シーメンスはXceleratorポートフォリオにデジタルツインの機能を組み込んでおり、ゼネラル・エレクトリックのデジタル部門はクラウドネイティブソリューションによる資産パフォーマンス管理を重視しています。PTCはThingWorxプラットフォームを通じてモジュラー・ツイン・アーキテクチャーを支持し、ダッソー・システムズは3DEXPERIENCE環境でバーチャル・プロトタイピングと製品ライフサイクル管理を統合しています。ANSYSは物理ベースの特殊なシミュレーション・エンジンを提供し、IBMの企業としての伝統は、デジタル・レプリケーションに堅牢なアナリティクスとコグニティブ・コンピューティングをもたらします。一方、Microsoft Azureデジタルツインは、スケーラブルで拡張可能なIoT中心のデプロイメントのベンチマークを設定し、SAPはインテリジェントエンタープライズスイート内でツインワークフローを拡張しています。

これらの既存プレイヤーの他にも、専門ベンダーや新興のディスラプターのエコシステムが情勢を豊かにしています。エネルギー・ネットワークやビルディング・オートメーションなど、ドメインに特化したツインの実装に注力する企業もあれば、複数のツインを複合システム・モデルに統合する高度な調整レイヤーを開発する企業もあります。ソフトウェアインテグレーター、センサーメーカー、通信プロバイダー間の戦略的パートナーシップは、ソリューションの幅を広げ続け、現場のセンサーから経営陣のダッシュボードまで、エンドツーエンドの可視化を可能にしています。

デジタルツイン・キャパビリティを活用し、オペレーションの回復力、持続可能な成長、競合優位性を高めるための実行可能な戦略で業界リーダーを支援

業界のリーダーは、試験的な目標を計画外のダウンタイムの削減や設計の反復の迅速化などの明確なビジネス成果に合わせることで、実験的プロジェクトから企業規模のデジタルツインプログラムに移行することができます。この取り組みの中心は、ITとOTアーキテクチャの近代化であり、データ取り込みパイプラインの安全性と拡張性を確保することです。データモデルにオープンスタンダードを導入し、センサーベンダー間の相互運用性を促進することで、統合の複雑さを緩和し、デジタル投資の将来性を確保することができます。

さらに、組織は、運用の現実を反映したツイン環境を共同作成するために、ドメインの専門家、データサイエンティスト、ソフトウェアエンジニアを融合させた部門横断的なチームを育成する必要があります。専門のサービスプロバイダーと提携することで、特に高度なアナリティクスやAIを活用したシミュレーションを統合する際に、知識の移転を迅速化し、価値実現までの時間を短縮することができます。長期的な導入をサポートするために、経営幹部は、役割、責任、パフォーマンス指標を定義するガバナンスの枠組みを確立し、デジタルツインテクノロジーに関する従業員のスキルアップのためのトレーニングプログラムを確立する必要があります。

最後に、持続可能性と規制遵守の基準をツインシナリオに組み込むことは、環境スチュワードシップを推進するだけでなく、進化する政策義務に対するレジリエンスを培うことにもなります。重要な領域で小規模な実装を試験的に行い、より広範な展開に向けて反復することで、企業は効率性を体系的に解き放ち、意思決定を強化し、業務全体で卓越したデジタルツインの再現可能な青写真を構築することができます。

デジタルツインダイナミクスを明らかにするために、1次調査、2次データ分析、専門家の検証を用いた厳密な調査手法を概説します

本調査では、デジタルツインの定量的側面と定性的側面の両方を捉えることを目的とした、混合法のアプローチを採用しています。一次的な洞察は、大手企業、ソリューションプロバイダー、業界団体を代表するシニアエグゼクティブ、テクノロジーアーキテクト、サブジェクトマターエキスパートとの詳細なインタビューを通じて収集しました。これらの会話から、さまざまなセクターにおける現実の導入課題、テクノロジー統合パターン、新たなベストプラクティスが浮かび上がりました。

二次情報源としては、技術ジャーナル、ホワイトペーパー、企業プレゼンテーション、規制当局への提出資料などを用い、一次調査結果を検証し、文脈を整理しました。標準化団体や業界コンソーシアムから公開されているデータセットを分析し、実現技術の進化を追跡するとともに、特許文献レビューによりイノベーションの軌跡を可視化しました。データの三角測量技術により、多様な情報の流れに一貫性を持たせ、独立コンサルタントや学術研究者からなる専門家検証パネルを通じて主要な仮説を検証しました。

プロセス全体を通じて、分析フレームワークのピアレビューや、選ばれたインタビュー参加者との反復フィードバックループなど、厳格な品質管理プロトコルが維持されました。この調査手法は、信頼できる洞察のための包括的な基盤を提供し、デジタルツイン・ダイナミクスの多面的な性質を確実に反映させ、意思決定者にとって実行可能な成果を支援するものです。

デジタルツインの進化に関する主要な知見と戦略的な視点を統合し、意思決定の指針とするとともに、事業環境全体にわたるイノベーションを促進します

デジタルツインテクノロジーが主流になるにつれ、業務プロセス、製品イノベーション、戦略的プランニングを変革する能力がますます明らかになっています。仮想レプリカを活用してライフサイクル全体をモデル化する組織は、俊敏性の向上、リスクの低減、優れたリソース管理を実現できます。リアルタイムのセンサーデータ、高度なシミュレーションエンジン、AI主導のアナリティクスの融合は、処方的であると同時に予測的な意思決定の新しいパラダイムを支えます。

資産の信頼性、パフォーマンスの最適化、持続可能なオペレーションなど、デジタルツイン・イニシアチブと企業の目標との戦略的な整合性が最も重要です。結束力のあるガバナンス構造と機能横断的なコラボレーションが重要なイネーブラーとして機能し、柔軟な展開アーキテクチャがデジタルツインを組織の優先事項に合わせて進化させることを保証します。地域ダイナミックスや政策シフトが採用の軌道に影響を与え続ける中、適応可能なテクノロジー・ロードマップは、新たな動向に対応して企業がピボットできるようにします。

結論として、デジタルツイン機能の統合は、技術的なマイルストーンであると同時に戦略的な必須事項でもあります。この分析から得られた知見を統合することで、意思決定者は自信を持って複雑性を乗り越え、卓越したオペレーションを推進し、業界全体のイノベーションのための新たな道を切り開くことができます。

目次

第1章 序文

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 市場の概要

第5章 市場洞察

- 先進製造業におけるマルチスケールデジタルツインによるAI駆動型予知保全の実装

- グローバルサプライチェーンの透明性向上のためのブロックチェーンによるデジタルツインデータ共有の進化

- スマートファクトリー運用における動的デジタルツインモデリングのためのリアルタイムIoTデータストリームの統合

- 産業オートメーションにおける低遅延シミュレーションのためのエッジコンピューティングアーキテクチャの採用

- IoTエコシステム全体でシームレスなデジタルツインコラボレーションを可能にする相互運用性プロトコルの標準化

- 5Gネットワークスライシングを活用し、都市デジタルツインの高帯域幅リアルタイム同期をサポート

- 複雑な資産のデジタルツインの自動作成と継続的な更新のための生成AI機能の統合

- スケーラブルなエンタープライズデジタルツイン展開を実現するためのハイブリッドクラウドエッジフレームワークの開発

- デジタルツイン環境内での深層強化学習の使用による自動運転車のトレーニングと検証の最適化

- 仮想患者モデリングと予測シミュレーションを通じて、デジタルツインアプリケーションをパーソナライズされたヘルスケアに拡張します。

第6章 米国の関税の累積的な影響, 2025

第7章 AIの累積的影響, 2025

第8章 デジタルツイン市場:提供別

- ハードウェア

- コンピューティングデバイス

- ネットワーキングとコミュニケーション

- センサーとアクチュエータ

- サービス

- コンサルティング&アドバイザリー

- 統合サービス

- ソフトウェア

- データモデリングツール

- シミュレーションエンジン

第9章 デジタルツイン市場:タイプ別

- コンポーネントデジタルツイン

- プロセスデジタルツイン

- 製品デジタルツイン

- システムデジタルツイン

第10章 デジタルツイン市場:企業規模別

- 大企業

- 中小企業

第11章 デジタルツイン市場:用途別

- 資産とワークフロー管理

- パフォーマンス監視と最適化

- 予知保全

- 製品設計・開発

第12章 デジタルツイン市場:エンドユーザー別

- 航空宇宙および防衛

- 自動車・輸送

- 建築・建設・不動産

- 商業用

- 産業用

- 住宅用

- 消費財・小売

- エネルギー・公益事業

- ヘルスケアとライフサイエンス

- 製造業

第13章 デジタルツイン市場:地域別

- 南北アメリカ

- 北米

- ラテンアメリカ

- 欧州・中東・アフリカ

- 欧州

- 中東

- アフリカ

- アジア太平洋地域

第14章 デジタルツイン市場:グループ別

- ASEAN

- GCC

- EU

- BRICS

- G7

- NATO

第15章 デジタルツイン市場:国別

- 米国

- カナダ

- メキシコ

- ブラジル

- 英国

- ドイツ

- フランス

- ロシア

- イタリア

- スペイン

- 中国

- インド

- 日本

- オーストラリア

- 韓国

第16章 競合情勢

- 市場シェア分析, 2024

- FPNVポジショニングマトリックス, 2024

- 競合分析

- ABB Ltd.

- Altair Engineering Inc.

- Amazon Web Services, Inc.

- ANSYS, Inc.

- Bentley Systems, Inc.

- Cisco Systems, Inc.

- Dassault Systemes SE

- dSPACE GmbH

- Emerson Electric Co.

- General Electric Company

- Hewlett Packard Enterprise Development LP

- Honeywell International Inc.

- Huawei Technologies Co., Ltd.

- Intel Corporation

- International Business Machines Corporation(IBM)

- Lenovo Group Limited

- Matterport, Inc. by CoStar Group

- Microsoft Corporation

- NTT DATA GROUP Corporation

- NVIDIA Corporation

- Oracle Corporation

- PTC Inc.

- QiO Technologies Ltd

- Robert Bosch GmbH

- Salesforce, Inc.

- SAP SE