|

|

市場調査レポート

商品コード

1252565

脱油レシチンの世界市場:原料別 (大豆、ヒマワリ、菜種・キャノーラ、卵)・特性別 (非GMO、GMO)・形状別 (粉末、顆粒)・用途別 (食品・飲料、飼料、工業用、ヘルスケア製品)・地域別の将来予測 (2028年まで)De-oiled Lecithin Market by Source (Soybean, Sunflower, Rapeseed & Canola, Eggs), Nature (Non-GMO and GMO), Form (Powder and Granules), Application (Food & Beverages, Feed, Industrial and Healthcare Products) and Region - Global Forecast to 2028 |

||||||

|

● お客様のご希望に応じて、既存データの加工や未掲載情報(例:国別セグメント)の追加などの対応が可能です。 詳細はお問い合わせください。 |

|||||||

| 脱油レシチンの世界市場:原料別 (大豆、ヒマワリ、菜種・キャノーラ、卵)・特性別 (非GMO、GMO)・形状別 (粉末、顆粒)・用途別 (食品・飲料、飼料、工業用、ヘルスケア製品)・地域別の将来予測 (2028年まで) |

|

出版日: 2023年03月28日

発行: MarketsandMarkets

ページ情報: 英文 311 Pages

納期: 即納可能

|

- 全表示

- 概要

- 目次

世界の脱油レシチンの市場規模は、2023年の2億2,000万米ドルから、2028年には3億2,100万米ドルに成長すると予測され、予測期間中のCAGRは7.8%に達する見通しです。

市場の主な促進要因として、食品・飲料における天然添加物利用の需要増加、低脂肪・低カロリーの健康的な食生活の消費拡大、自然な味と香りを持つヒマワリ製脱油レシチンに対する需要拡大などが挙げられます。このような背景から、脱油レシチンの新製品を開発・展開する必要性が高まっています。

"特性別では2023年に、非GMO分野が最大のシェアを占める"

特性別に見ると、非GMO (遺伝子組み換え生物) 分野が予測期間中、脱油レシチン市場をリードすると予測されます。その要因として、天然乳化剤として菓子類で、医薬品製剤で、エモリエント剤および抗酸化剤として化粧品で、非GMO脱油レシチンの使用が増加していることが挙げられます。

"用途別セグメントでは予測期間中、食品・飲料セグメントが市場シェアを独占する"

用途別に見ると、予測期間中は食品・飲料分野が市場シェアを独占すると予測されています。消費者の健康的な食生活に対する意識の高まり、ベーカリー・チューインガムやミルク・タンパク質飲料、インスタント飲料などでの脱油レシチンの利用が拡大し、それが脱油レシチンの採用につながっています。

"地域別では2023年に、アジア太平洋が最大の市場シェアを占める"

地域別に見ると、2023年にはアジア太平洋が最大のシェアを占めています。中国やインドなどのアジア太平洋諸国における大豆栽培の増加、アジア太平洋から欧州への脱油レシチンの輸出機会、日本や韓国などの国々における健康食品の消費パターンの増加、化粧品の使用の増加などにより、アジア太平洋市場は今後数年間でかなりの成長を遂げると考えられます。

当レポートでは、世界の脱油レシチンの市場について分析し、市場の基本構造や最新情勢、主な市場促進・抑制要因、抽出方法別・原料別・形状別・特性別・用途別・地域別の市場動向の見通し、市場競争の状態、主要企業のプロファイルなどを調査しております。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- マクロ経済指標

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

第6章 業界動向

- イントロダクション

- バリューチェーン分析

- サプライチェーン分析

- 市場マップとエコシステム分析

- 顧客のビジネスに影響を与える動向/混乱

- 技術分析

- 価格分析

- 特許分析

- 貿易分析

- ポーターのファイブフォース分析

- 主な利害関係者と購入基準

- 関税・規制状況

- ケーススタディ分析

- 主な会議とイベント (2023年~2024年)

第7章 脱油レシチン市場:抽出方法別

- イントロダクション

- アセトン抽出

- 二酸化炭素抽出

- 限外濾過プロセス

第8章 脱油レシチン市場:原料別

- イントロダクション

- 大豆

- ひまわり

- 菜種・キャノーラ

- 卵

- その他の原料

第9章 脱油レシチン市場:形状別

- イントロダクション

- 粉末

- 顆粒

第10章 脱油レシチン市場:特性別

- イントロダクション

- GMO (遺伝子組み換え生物)

- 非GMO

第11章 脱油レシチン市場:用途別

- イントロダクション

- 食品・飲料

- ベーカリー製品

- 菓子類

- インスタント食品

- 飲料

- 乳製品・非乳製品

- その他の食品用途

- 飼料

- 工業用

- ヘルスケア製品

第12章 脱油レシチン市場:地域別

- イントロダクション

- 北米

- 米国

- カナダ

- 欧州

- フランス

- イタリア

- 英国

- スペイン

- ドイツ

- 他の欧州諸国

- アジア太平洋

- 中国

- インド

- 日本

- オーストラリアとニュージーランド

- 他のアジア太平洋諸国

- ラテンアメリカ

- ブラジル

- アルゼンチン

- メキシコ

- チリ

- 他のラテンアメリカ諸国

- 他の国々 (RoW)

- 中東

- アフリカ

第13章 競合情勢

- 概要

- 市場シェア分析 (2021年)

- 主要企業の収益分析:セグメント別

- 主要企業が採用した戦略

- 企業評価クアドラント (主要企業)

- スタートアップ/中小企業向け企業評価クアドラント (2021年)

- 競合シナリオ

- 製品の発売

- 資本取引

- その他の動向

第14章 企業プロファイル

- 主要企業

- CARGILL, INCORPORATED

- ADM

- BUNGE LIMITED

- IMCD GROUP B.V.

- STERN-WYWIOL GRUPPE

- AMERICAN LECITHIN COMPANY

- SONIC BIOCHEM

- AVRIL GROUP

- FISMER LECITHIN

- CLARKSON GRAIN COMPANY, INC.

- AMITEX AGRO PRODUCT PRIVATE LIMITED

- LASENOR EMUL, S.L.

- LECITAL

- THE SCOULAR COMPANY

- GIIAVA

- SUN NUTRAFOODS

- VAV LIFE SCIENCES PVT LTD.

- AVI AGRI BUSINESS LIMITED

- LECILITE

- LECITEIN

第15章 隣接・関連市場

- イントロダクション

- 制限事項

- レシチン・リン脂質市場

- 食品乳化剤市場

第16章 付録

The de-oiled lecithin market is projected to grow from USD 220 Million in 2023 to USD 321 Million by 2028, at a CAGR of 7.8% during the forecast period. This market is anticipated to grow due to increasing demand for use of natural additives in food and beverage products, growing consumption of healthy diets with low-fat content and low calories, and rising surge in acceptance for sunflower de-oiled lecithin for its natural taste and smell. Such factors have driven the need to develop and deploy new products for de-oiled lecithin. De-oiled lecithin is a type of lecithin with almost no oil. It is basically known as an essentially ready nutraceutical with many nutritional benefits.

The non-GMO segment is expected to account for the largest share in 2023.

Based on nature, the non-GMO segment is projected to lead the de-oiled lecithin market during the forecast period. The growth of the segment can be attributed to the increasing use of non-GMO de-oiled lecithin in confectionery as a natural emulsifier, in pharmaceutical formulations and in cosmetics as emollient and antioxidant.

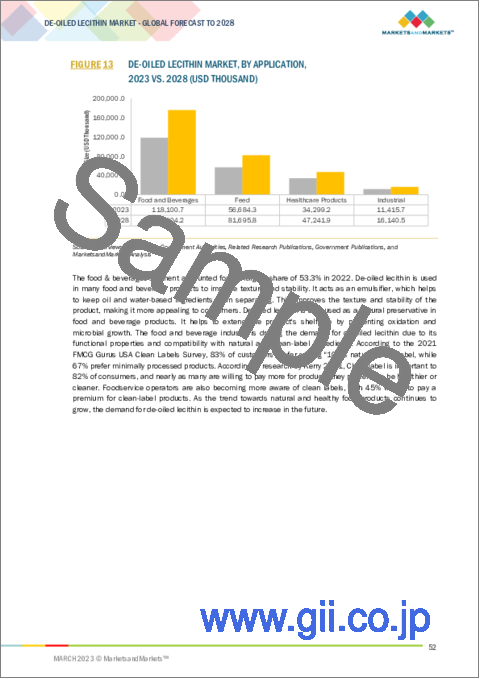

The food and beverage segment is projected to dominate the market share in the application segment during the forecast period.

Based on the application segment, the food and beverage segment is projected to dominate the market share during the forecast period. The rising awareness among consumers for healthy diets, the use of de-oiled lecithin in bakeries, chewing gum, milk and protein beverages, instant drinks, and many others have led to the adoption of de-oiled lecithin.

Asia Pacific is expected to account for the largest market share in 2023.

The de-oiled lecithin market industry has been studied in North America, Europe, Asia Pacific, Latin America, and the Rest of the World. Asia Pacific accounted for the largest market share in 2023. The Asia Pacific market will experience considerable growth in the next years because of rising soybean cultivation in the Asia Pacific countries such as China and India, export opportunities of de-oiled lecithin from Asia Pacific to Europe, growing healthy food consumption patterns and increasing use of cosmetic products in countries like Japan and South Korea.

The break-up of the profile of primary participants in the de-oiled lecithin market:

- By Company Type: Tier 1 - 30%, Tier 2 - 30%, and Tier 3 - 40%

- By Designation: C Level - 49%, Director Level - 21%, Others-30%

- By Region: Asia Pacific - 36%, Europe - 29%, North America - 24%, Latin America - 9%, and Rest of the World - 2%

Prominent companies include Cargill, Incorporated (US), ADM (US), Bunge Limited (US), IMCD Group B.V. (US), and Fismer Lecithin (Germany), among others.

Research Coverage:

This research report categorizes the de-oiled lecithin market by Source (Soybean, Sunflower, Rapeseed & Canola, Eggs, and Other Sources), Nature (Non-GMO and GMO), Form (Powder and Granules), Application (Food & Beverages, Feed, Industrial and Healthcare Products), and region (North America, Europe, Asia Pacific, Latin America and Rest of the World). The scope of the report covers detailed information regarding the major factors, such as drivers, restraints, challenges, and opportunities, influencing the growth of the de-oiled lecithin market. A detailed analysis of the key industry players has been done to provide insights into their business overview, solutions, and services; key strategies; Contracts, partnerships, and agreements. New product & service launches, mergers and acquisitions, and recent developments associated with the de-oiled lecithin market. Competitive analysis of upcoming startups in the de-oiled lecithin market ecosystem is covered in this report.

Reasons to buy this report:

The report will help the market leaders/new entrants in this market with information on the closest approximations of the revenue numbers for the overall de-oiled lecithin market and the subsegments. This report will help stakeholders understand the competitive landscape and gain more insights to position their businesses better and to plan suitable go-to-market strategies. The report also helps stakeholders understand the pulse of the market and provides them with information on key market drivers, restraints, challenges, and opportunities.

The report provides insights on the following pointers:

- Analysis of key drivers (Growing need for natural additives with increasing consumer awareness for consumer label products, increase in acceptance for sunflower de-oiled lecithin, Increase in demand for convenience food), restraints (Replicability of de-oiled lecithin by synthetic alternatives), opportunity (Emerging markets and changing consumer food habits), and challenges (Fluctuation in raw material prices, Concerns regarding the GMO de-oiled lecithin products and allergens) influencing the growth of the de-oiled lecithin market.

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product & service launches in the de-oiled lecithin market.

- Market Development: Comprehensive information about lucrative markets - the report analyses the de-oiled lecithin market across varied regions.

- Market Diversification: Exhaustive information about new products & services, untapped geographies, recent developments, and investments in the de-oiled lecithin market.

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and service offerings of leading players like Cargill, Incorporated (US), ADM (US), Bunge Limited (US), IMCD Group B.V. (US), Fismer Lecithin (Germany), Avril Group (France), The Scoular Company (US), GIIAVA (India) among others in the de-oiled lecithin market strategies. The report also helps stakeholders understand the lecithin and phospholipids market and provides them with information on key market drivers, restraints, challenges, and opportunities.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED

- FIGURE 1 DE-OILED LECITHIN MARKET: SEGMENTATION

- 1.3.2 REGIONAL SCOPE

- FIGURE 2 DE-OILED LECITHIN MARKET: REGIONAL SCOPE

- 1.4 INCLUSIONS AND EXCLUSIONS

- 1.5 YEARS CONSIDERED

- 1.6 CURRENCY CONSIDERED

- TABLE 1 USD EXCHANGE RATES CONSIDERED, 2018-2021

- 1.7 UNITS CONSIDERED

- 1.8 STAKEHOLDERS

- 1.9 SUMMARY OF CHANGES

- 1.9.1 RECESSION IMPACT

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- FIGURE 3 DE-OILED LECITHIN MARKET: RESEARCH DESIGN

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key data from primary sources

- 2.1.2.2 Key insights from industry experts

- 2.1.2.3 Breakdown of primary interviews

- FIGURE 4 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 MARKET SIZE ESTIMATION: BOTTOM-UP APPROACH

- FIGURE 5 DE-OILED LECITHIN MARKET SIZE ESTIMATION: BOTTOM-UP APPROACH

- 2.2.2 MARKET SIZE ESTIMATION: TOP-DOWN APPROACH

- FIGURE 6 DE-OILED LECITHIN MARKET SIZE ESTIMATION: TOP-DOWN APPROACH

- FIGURE 7 DE-OILED LECITHIN MARKET SIZE ESTIMATION (DEMAND SIDE)

- FIGURE 8 DE-OILED LECITHIN MARKET SIZE ESTIMATION, BY TYPE (SUPPLY SIDE)

- 2.3 DATA TRIANGULATION

- FIGURE 9 DATA TRIANGULATION

- 2.4 GROWTH FORECAST

- 2.5 RESEARCH ASSUMPTIONS

- 2.6 LIMITATIONS AND ASSOCIATED RISKS

- TABLE 2 LIMITATIONS AND ASSOCIATED RISKS

- 2.7 RECESSION IMPACT ANALYSIS

- 2.7.1 RECESSION IMPACT ON DE-OILED LECITHIN MARKET

- 2.7.1.1 Macro indicators of recession

- FIGURE 10 RECESSION INDICATORS AND THEIR IMPACT ON DE-OILED LECITHIN MARKET

- FIGURE 11 GLOBAL DE-OILED LECITHIN MARKET: EARLIER FORECAST VS. RECESSION FORECAST

- 2.7.1 RECESSION IMPACT ON DE-OILED LECITHIN MARKET

3 EXECUTIVE SUMMARY

- TABLE 3 DE-OILED LECITHIN MARKET SNAPSHOT, 2023 VS. 2028

- FIGURE 12 DE-OILED LECITHIN MARKET, BY SOURCE, 2023 VS. 2028 (USD THOUSAND)

- FIGURE 13 DE-OILED LECITHIN MARKET, BY APPLICATION, 2023 VS. 2028 (USD THOUSAND)

- FIGURE 14 DE-OILED LECITHIN MARKET, BY FORM, 2023 VS. 2028 (USD THOUSAND)

- FIGURE 15 DE-OILED LECITHIN MARKET, BY REGION, 2022

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN DE-OILED LECITHIN MARKET

- FIGURE 16 GROWING CONSUMER AWARENESS REGARDING CLEAN-LABEL PRODUCTS AND RISING DEMAND FOR NATURAL FOOD ADDITIVES

- 4.2 ASIA PACIFIC DE-OILED LECITHIN MARKET, BY KEY FOOD AND BEVERAGES AND COUNTRY

- FIGURE 17 CONFECTIONERIES SEGMENT AND CHINA DOMINATED ASIA PACIFIC DE-OILED LECITHIN MARKET IN 2022

- 4.3 DE-OILED LECITHIN MARKET, BY REGION

- FIGURE 18 INDIA DE-OILED LECITHIN MARKET TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- 4.4 DE-OILED LECITHIN MARKET, BY SOURCE AND REGION

- FIGURE 19 ASIA PACIFIC TO DOMINATE DE-OILED LECITHIN MARKET FOR ALL SOURCES, 2023 VS. 2028

- 4.5 DE-OILED LECITHIN MARKET, BY APPLICATION

- FIGURE 20 FOOD AND BEVERAGES SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE BY 2028

- 4.6 DE-OILED LECITHIN MARKET, BY NATURE

- FIGURE 21 NON-GMO SEGMENT TO ACCOUNT FOR LARGER MARKET SHARE BY 2028

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MACROECONOMIC INDICATORS

- 5.2.1 INCREASING OBESITY RATE

- FIGURE 22 OBESITY RATE AMONG ADULTS, BY COUNTRY, 2023 (%)

- 5.3 MARKET DYNAMICS

- FIGURE 23 DE-OILED LECITHIN MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- 5.3.1 DRIVERS

- 5.3.1.1 Increasing demand for natural food additives and growing consumer awareness regarding clean-label products

- 5.3.1.2 Increased demand for convenience food

- 5.3.1.3 Growing adoption of sunflower-based lecithin

- 5.3.1.4 Rising awareness regarding health benefits of functional foods

- 5.3.2 RESTRAINTS

- 5.3.2.1 Replicability of de-oiled lecithin with synthetic alternatives

- 5.3.2.2 Health concerns associated with soy and other allergen products

- 5.3.3 OPPORTUNITIES

- 5.3.3.1 Changing consumer lifestyles

- 5.3.3.2 Growing popularity of plant-based diet culture

- 5.3.4 CHALLENGES

- 5.3.4.1 Fluctuations in raw material prices

- FIGURE 24 FLUCTUATIONS IN RAW MATERIAL PRICES, 2011-2020 (USD/MT)

- 5.3.4.2 Concerns associated with genetically modified organism (GMO) de-oiled lecithin products

6 INDUSTRY TRENDS

- 6.1 INTRODUCTION

- 6.2 VALUE CHAIN ANALYSIS

- 6.2.1 RAW MATERIAL SOURCING

- 6.2.2 PRODUCTION AND PROCESSING

- 6.2.3 QUALITY AND SAFETY CONTROLLERS

- 6.2.4 DISTRIBUTION, MARKETING, AND SALES

- 6.2.5 END USERS

- FIGURE 25 DE-OILED LECITHIN MARKET: VALUE CHAIN ANALYSIS

- 6.3 SUPPLY CHAIN ANALYSIS

- FIGURE 26 DE-OILED LECITHIN MARKET: SUPPLY CHAIN ANALYSIS

- 6.4 MARKET MAP AND ECOSYSTEM ANALYSIS

- 6.4.1 DEMAND-SIDE ECOSYSTEM

- 6.4.2 SUPPLY-SIDE ECOSYSTEM

- FIGURE 27 DE-OILED LECITHIN MARKET MAP

- TABLE 4 DE-OILED LECITHIN MARKET: ECOSYSTEM ANALYSIS

- 6.5 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS' BUSINESSES

- 6.5.1 REVENUE SHIFT AND NEW REVENUE POCKETS FOR DE-OILED LECITHIN PROVIDERS

- FIGURE 28 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS' BUSINESSES

- 6.6 TECHNOLOGY ANALYSIS

- 6.7 PRICING ANALYSIS

- 6.7.1 AVERAGE SELLING PRICE OF DE-OILED LECITHIN

- 6.7.2 AVERAGE SELLING PRICE OF DE-OILED LECITHIN OFFERED BY KEY PLAYERS, BY SOURCE

- FIGURE 29 AVERAGE SELLING PRICE OF DE-OILED LECITHIN OFFERED BY KEY PLAYERS, BY SOURCE (USD/KG)

- TABLE 5 AVERAGE SELLING PRICE OF DE-OILED LECITHIN SOURCES, 2022 (USD/KG)

- 6.7.3 AVERAGE SELLING PRICE, BY SOURCE

- FIGURE 30 AVERAGE SELLING PRICE, BY SOURCE, 2018-2022 (USD/KG)

- TABLE 6 SOYBEAN DE-OILED LECITHIN: AVERAGE SELLING PRICE, BY REGION, 2018-2022 (USD/KG)

- TABLE 7 SUNFLOWER DE-OILED LECITHIN: AVERAGE SELLING PRICE, BY REGION, 2018-2022 (USD/KG)

- TABLE 8 RAPESEED & CANOLA DE-OILED LECITHIN: AVERAGE SELLING PRICE, BY REGION, 2018-2022 (USD/ KG)

- 6.8 PATENT ANALYSIS

- FIGURE 31 DE-OILED LECITHIN MARKET: PATENTS GRANTED, 2012-2022

- FIGURE 32 REGIONAL ANALYSIS OF PATENTS GRANTED FOR DE-OILED LECITHIN, 2011-2021

- TABLE 9 KEY PATENTS PERTAINING TO DE-OILED LECITHIN, 2021

- 6.9 TRADE ANALYSIS

- 6.9.1 IMPORT SCENARIO

- FIGURE 33 IMPORT DATA FOR DE-OILED LECITHIN, BY KEY COUNTRY, 2018-2022

- TABLE 10 TOP 10 IMPORTERS OF DE-OILED LECITHIN, 2021 (USD THOUSAND)

- 6.9.2 EXPORT SCENARIO

- FIGURE 34 EXPORT DATA FOR DE-OILED LECITHIN, BY KEY COUNTRY, 2017-2021

- TABLE 11 TOP 10 EXPORTERS OF DE-OILED LECITHIN, 2021 (USD THOUSAND)

- 6.10 PORTER'S FIVE FORCES ANALYSIS

- TABLE 12 DE-OILED LECITHIN MARKET: PORTER'S FIVE FORCES ANALYSIS

- 6.10.1 THREAT OF NEW ENTRANTS

- 6.10.2 THREAT OF SUBSTITUTES

- 6.10.3 BARGAINING POWER OF SUPPLIERS

- 6.10.4 BARGAINING POWER OF BUYERS

- 6.10.5 INTENSITY OF COMPETITIVE RIVALRY

- 6.11 KEY STAKEHOLDERS AND BUYING CRITERIA

- 6.11.1 KEY STAKEHOLDERS IN BUYING PROCESS

- FIGURE 35 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP APPLICATIONS

- TABLE 13 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP APPLICATIONS

- 6.11.2 BUYING CRITERIA

- FIGURE 36 KEY BUYING CRITERIA FOR TOP APPLICATIONS

- TABLE 14 KEY BUYING CRITERIA FOR TOP APPLICATIONS

- 6.12 TARIFF AND REGULATORY LANDSCAPE

- 6.12.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 15 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 16 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 17 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 18 LATIN AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 19 ROW: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 6.12.2 REGULATORY FRAMEWORK

- 6.12.2.1 US

- 6.12.2.1.1 Direct food substances generally recognized as safe

- 6.12.2.1.2 Multipurpose additives

- 6.12.2.1.3 Types of lecithin allowed in organic processed products

- 6.12.2.2 Canada

- 6.12.2.1 US

- 6.12.3 EUROPE

- 6.12.3.1 Commission Regulation (EU) No. 231/2012 of March 9, 2012, laying down specifications for food additives

- 6.12.3.2 Regulatory framework by EU

- 6.12.4 INDIA

- 6.12.4.1 Food Safety and Standards Authority of India (FSSAI)

- 6.13 CASE STUDY ANALYSIS

- TABLE 20 REGULATORY POLICIES FOR LECITHIN

- TABLE 21 GROWING DEMAND FOR NON-GMO PRODUCTS

- 6.14 KEY CONFERENCES AND EVENTS, 2023-2024

- TABLE 22 DE-OILED LECITHIN MARKET: DETAILED LIST OF CONFERENCES AND EVENTS, 2023-2024

7 DE-OILED LECITHIN MARKET, BY METHOD OF EXTRACTION

- 7.1 INTRODUCTION

- 7.2 ACETONE EXTRACTION

- 7.3 CARBON DIOXIDE EXTRACTION

- 7.4 ULTRAFILTRATION PROCESS

8 DE-OILED LECITHIN MARKET, BY SOURCE

- 8.1 INTRODUCTION

- TABLE 23 PHOSPHOLIPID COMPOSITION OF FLUID AND DE-OILED CANOLA LECITHIN

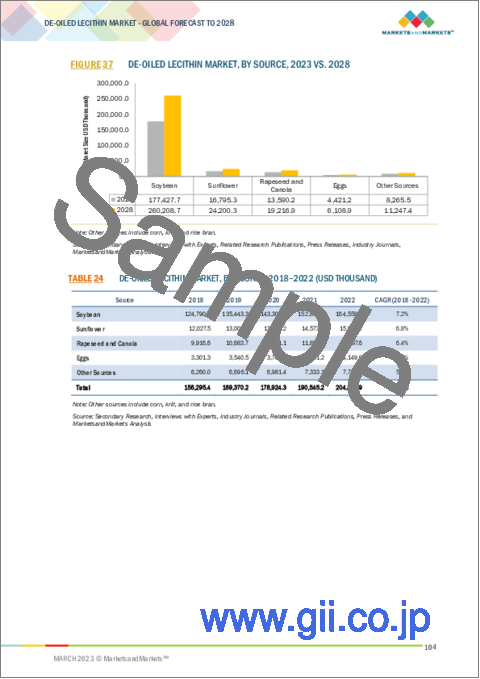

- FIGURE 37 DE-OILED LECITHIN MARKET, BY SOURCE, 2023 VS. 2028

- TABLE 24 DE-OILED LECITHIN MARKET, BY SOURCE, 2018-2022 (USD THOUSAND)

- TABLE 25 DE-OILED LECITHIN MARKET, BY SOURCE, 2023-2028 (USD THOUSAND)

- TABLE 26 DE-OILED LECITHIN MARKET, BY SOURCE, 2018-2022 (TONS)

- TABLE 27 DE-OILED LECITHIN MARKET, BY SOURCE, 2023-2028 (TONS)

- 8.2 SOYBEAN

- 8.2.1 HIGH HEALTH BENEFITS OF SOY IS INCREASING USAGE IN LECITHIN PRODUCTION

- FIGURE 38 TOP 10 SOYBEAN EXPORTING COUNTRIES, 2017-2022 (USD BILLION)

- TABLE 28 SOYBEAN: DE-OILED LECITHIN MARKET, BY REGION, 2018-2022 (USD THOUSAND)

- TABLE 29 SOYBEAN: DE-OILED LECITHIN MARKET, BY REGION, 2023-2028 (USD THOUSAND)

- TABLE 30 SOYBEAN: DE-OILED LECITHIN MARKET, BY REGION, 2018-2022 (TONS)

- TABLE 31 SOYBEAN: DE-OILED LECITHIN MARKET, BY REGION, 2023-2028 (TONS)

- 8.3 SUNFLOWER

- 8.3.1 INCREASING DEMAND FOR NATURAL AND ALLERGEN-FREE LECITHIN

- TABLE 32 SUNFLOWER: DE-OILED LECITHIN MARKET, BY REGION, 2018-2022 (USD THOUSAND)

- TABLE 33 SUNFLOWER: DE-OILED LECITHIN MARKET, BY REGION, 2023-2028 (USD THOUSAND)

- TABLE 34 SUNFLOWER: DE-OILED LECITHIN MARKET, BY REGION, 2018-2022 (TONS)

- TABLE 35 SUNFLOWER: DE-OILED LECITHIN MARKET, BY REGION, 2023-2028 (TONS)

- 8.4 RAPESEED & CANOLA

- 8.4.1 INCREASING DEMAND FOR PLANT-BASED DE-OILED LECITHIN

- TABLE 36 RAPESEED & CANOLA: DE-OILED LECITHIN MARKET, BY REGION, 2018-2022 (USD THOUSAND)

- TABLE 37 RAPESEED & CANOLA: DE-OILED LECITHIN MARKET, BY REGION, 2023-2028 (USD THOUSAND)

- TABLE 38 RAPESEED & CANOLA: DE-OILED LECITHIN MARKET, BY REGION, 2018-2022 (TONS)

- TABLE 39 RAPESEED & CANOLA: DE-OILED LECITHIN MARKET, BY REGION, 2023-2028 (TONS)

- 8.5 EGGS

- 8.5.1 RISING APPLICATIONS OF EGG LECITHIN IN PHARMACEUTICAL INDUSTRY

- TABLE 40 EGGS: DE-OILED LECITHIN MARKET, BY REGION, 2018-2022 (USD THOUSAND)

- TABLE 41 EGGS: DE-OILED LECITHIN MARKET, BY REGION, 2023-2028 (USD THOUSAND)

- TABLE 42 EGGS: DE-OILED LECITHIN MARKET, BY REGION, 2018-2022 (TONS)

- TABLE 43 EGGS: DE-OILED LECITHIN MARKET, BY REGION, 2023-2028 (TONS)

- 8.6 OTHER SOURCES

- TABLE 44 OTHER SOURCES: DE-OILED LECITHIN MARKET, BY REGION, 2018-2022 (USD THOUSAND)

- TABLE 45 OTHER SOURCES: DE-OILED LECITHIN MARKET, BY REGION, 2023-2028 (USD THOUSAND)

- TABLE 46 OTHER SOURCES: DE-OILED LECITHIN MARKET, BY REGION, 2018-2022 (TONS)

- TABLE 47 OTHER SOURCES: DE-OILED LECITHIN MARKET, BY REGION, 2023-2028 (TONS)

9 DE-OILED LECITHIN MARKET, BY FORM

- 9.1 INTRODUCTION

- FIGURE 39 DE-OILED LECITHIN MARKET, BY FORM, 2023 VS. 2028 (USD THOUSAND)

- TABLE 48 DE-OILED LECITHIN MARKET, BY FORM, 2018-2022 (USD THOUSAND)

- TABLE 49 DE-OILED LECITHIN MARKET, BY FORM, 2023-2028 (USD THOUSAND)

- 9.2 POWDER

- 9.2.1 POWDER FORM IS EASIER TO HANDLE, STORE, AND TRANSPORT AND HAS LONGER SHELF LIFE

- TABLE 50 POWDER: DE-OILED LECITHIN MARKET, BY REGION, 2018-2022 (USD THOUSAND)

- TABLE 51 POWDER: DE-OILED LECITHIN MARKET, BY REGION, 2023-2028 (USD THOUSAND)

- 9.3 GRANULES

- 9.3.1 GRANULE FORM FEATURES BETTER DISPERSIBILITY AND SOLUBILITY IN WATER THAT CAN IMPROVE TEXTURE AND STABILITY OF FOOD PRODUCTS

- TABLE 52 GRANULES: DE-OILED LECITHIN MARKET, BY REGION, 2018-2022 (USD THOUSAND)

- TABLE 53 GRANULES: DE-OILED LECITHIN MARKET, BY REGION, 2023-2028 (USD THOUSAND)

10 DE-OILED LECITHIN MARKET, BY NATURE

- 10.1 INTRODUCTION

- 10.2 GENETICALLY MODIFIED ORGANISMS (GMO)

- 10.2.1 HIGH RESISTANCE TO VARIOUS DISEASES

- 10.3 NON-GENETICALLY MODIFIED ORGANISMS (GMO)

- 10.3.1 RISING AWARENESS REGARDING HARMFUL CONSEQUENCES OF EATING GENETICALLY MODIFIED ORGANISMS (GMO) FOOD

11 DE-OILED LECITHIN MARKET, BY APPLICATION

- 11.1 INTRODUCTION

- FIGURE 40 DE-OILED LECITHIN MARKET, BY APPLICATION, 2023 VS. 2028 (USD THOUSAND)

- TABLE 54 DE-OILED LECITHIN MARKET, BY APPLICATION, 2018-2022 (USD THOUSAND)

- TABLE 55 DE-OILED LECITHIN MARKET, BY APPLICATION, 2023-2028 (USD THOUSAND)

- TABLE 56 FOOD AND BEVERAGES: DE-OILED LECITHIN MARKET, BY APPLICATION, 2018-2022 (USD THOUSAND)

- TABLE 57 FOOD AND BEVERAGES: DE-OILED LECITHIN MARKET, BY APPLICATION, 2023-2028 (USD THOUSAND)

- 11.2 FOOD AND BEVERAGES

- 11.2.1 INCREASING DEMAND FOR NATURAL AND ORGANIC INGREDIENTS

- TABLE 58 FOOD AND BEVERAGES: DE-OILED LECITHIN MARKET, BY REGION, 2018-2022 (USD THOUSAND)

- TABLE 59 FOOD AND BEVERAGES: DE-OILED LECITHIN MARKET, BY REGION, 2023-2028 (USD THOUSAND)

- 11.2.2 BAKERY

- TABLE 60 BAKERY: DE-OILED LECITHIN MARKET, BY REGION, 2018-2022 (USD THOUSAND)

- TABLE 61 BAKERY: DE-OILED LECITHIN MARKET, BY REGION, 2023-2028 (USD THOUSAND)

- 11.2.3 CONFECTIONERIES

- TABLE 62 CONFECTIONERIES: DE-OILED LECITHIN MARKET, BY REGION, 2018-2022 (USD THOUSAND)

- TABLE 63 CONFECTIONERIES: DE-OILED LECITHIN MARKET, BY REGION, 2023-2028 (USD THOUSAND)

- 11.2.4 CONVENIENCE FOODS

- TABLE 64 CONVENIENCE FOODS: DE-OILED LECITHIN MARKET, BY REGION, 2018-2022 (USD THOUSAND)

- TABLE 65 CONVENIENCE FOODS: DE-OILED LECITHIN MARKET, BY REGION, 2023-2028 (USD THOUSAND)

- 11.2.5 BEVERAGES

- TABLE 66 BEVERAGES: DE-OILED LECITHIN MARKET, BY REGION, 2018-2022 (USD THOUSAND)

- TABLE 67 BEVERAGES: DE-OILED LECITHIN MARKET, BY REGION, 2023-2028 (USD THOUSAND)

- 11.2.6 DAIRY & NON-DAIRY PRODUCTS

- TABLE 68 DAIRY & NON-DAIRY PRODUCTS: DE-OILED LECITHIN MARKET, BY REGION, 2018-2022 (USD THOUSAND)

- TABLE 69 DAIRY & NON-DAIRY PRODUCTS: DE-OILED LECITHIN MARKET, BY REGION, 2023-2028 (USD THOUSAND)

- 11.2.7 OTHER FOOD APPLICATIONS

- TABLE 70 OTHER FOOD APPLICATIONS: DE-OILED LECITHIN MARKET, BY REGION, 2018-2022 (USD THOUSAND)

- TABLE 71 OTHER FOOD APPLICATIONS: DE-OILED LECITHIN MARKET, BY REGION, 2023-2028 (USD THOUSAND)

- 11.3 FEED

- 11.3.1 GROWING DEMAND FOR ANIMAL-BASED PRODUCTS

- TABLE 72 FEED: DE-OILED LECITHIN MARKET, BY REGION, 2018-2022 (USD THOUSAND)

- TABLE 73 FEED: DE-OILED LECITHIN MARKET, BY REGION, 2023-2028 (USD THOUSAND)

- 11.4 INDUSTRIAL

- 11.4.1 RISING USE OF DE-OILED LECITHIN IN PAPER COATING, CANDLE, AND PRINTING INK INDUSTRIES

- TABLE 74 INDUSTRIAL: DE-OILED LECITHIN MARKET, BY REGION, 2018-2022 (USD THOUSAND)

- TABLE 75 INDUSTRIAL: DE-OILED LECITHIN MARKET, BY REGION, 2023-2028 (USD THOUSAND)

- 11.5 HEALTHCARE PRODUCTS

- 11.5.1 INCREASING USE OF DE-OILED LECITHIN IN TABLET AND PILL FORMULATIONS TO IMPROVE BIOAVAILABILITY AND STABILITY OF ACTIVE PHARMACEUTICAL INGREDIENTS

- TABLE 76 HEALTHCARE PRODUCTS: DE-OILED LECITHIN MARKET, BY REGION, 2018-2022 (USD THOUSAND)

- TABLE 77 HEALTHCARE PRODUCTS: DE-OILED LECITHIN MARKET, BY REGION, 2023-2028 (USD THOUSAND)

12 DE-OILED LECITHIN MARKET, BY REGION

- 12.1 INTRODUCTION

- FIGURE 41 US HELD LARGEST SHARE OF DE-OILED LECITHIN MARKET IN 2022

- TABLE 78 DE-OILED LECITHIN MARKET, BY REGION, 2018-2022 (USD THOUSAND)

- TABLE 79 DE-OILED LECITHIN MARKET, BY REGION, 2023-2028 (USD THOUSAND)

- TABLE 80 DE-OILED LECITHIN MARKET, BY REGION, 2018-2022 (TONS)

- TABLE 81 DE-OILED LECITHIN MARKET, BY REGION, 2023-2028 (TONS)

- TABLE 82 DE-OILED LECITHIN MARKET, BY SOURCE, 2018-2022 (USD THOUSAND)

- TABLE 83 DE-OILED LECITHIN MARKET, BY SOURCE, 2023-2028 (USD THOUSAND)

- TABLE 84 DE-OILED LECITHIN MARKET, BY SOURCE, 2018-2022 (TONS)

- TABLE 85 DE-OILED LECITHIN MARKET, BY SOURCE, 2023-2028 (TONS)

- TABLE 86 DE-OILED LECITHIN MARKET, BY APPLICATION, 2018-2022 (USD THOUSAND)

- TABLE 87 DE-OILED LECITHIN MARKET, BY APPLICATION, 2023-2028 (USD THOUSAND)

- TABLE 88 FOOD AND BEVERAGES: DE-OILED LECITHIN MARKET, BY APPLICATION, 2018-2022 (USD THOUSAND)

- TABLE 89 FOOD AND BEVERAGES: DE-OILED LECITHIN MARKET, BY APPLICATION, 2023-2028 (USD THOUSAND)

- TABLE 90 DE-OILED LECITHIN MARKET, BY NATURE, 2018-2022 (USD THOUSAND)

- TABLE 91 DE-OILED LECITHIN MARKET, BY NATURE, 2023-2028 (USD THOUSAND)

- TABLE 92 DE-OILED LECITHIN MARKET, BY FORM, 2018-2022 (USD THOUSAND)

- TABLE 93 DE-OILED LECITHIN MARKET, BY FORM, 2023-2028 (USD THOUSAND)

- 12.2 NORTH AMERICA

- 12.2.1 NORTH AMERICA: RECESSION IMPACT ANALYSIS

- FIGURE 42 NORTH AMERICA DE-OILED LECITHIN MARKET: RECESSION IMPACT ANALYSIS

- TABLE 94 NORTH AMERICA: DE-OILED LECITHIN MARKET, BY COUNTRY, 2018-2022 (USD THOUSAND)

- TABLE 95 NORTH AMERICA: DE-OILED LECITHIN MARKET, BY COUNTRY, 2023-2028 (USD THOUSAND)

- TABLE 96 NORTH AMERICA: DE-OILED LECITHIN MARKET, BY COUNTRY, 2018-2022 (TONS)

- TABLE 97 NORTH AMERICA: DE-OILED LECITHIN MARKET, BY COUNTRY, 2023-2028 (TONS)

- TABLE 98 NORTH AMERICA: DE-OILED LECITHIN MARKET, BY SOURCE, 2018-2022 (USD THOUSAND)

- TABLE 99 NORTH AMERICA: DE-OILED LECITHIN MARKET, BY SOURCE, 2023-2028 (USD THOUSAND)

- TABLE 100 NORTH AMERICA: DE-OILED LECITHIN MARKET, BY SOURCE, 2018-2022 (TONS)

- TABLE 101 NORTH AMERICA: DE-OILED LECITHIN MARKET, BY SOURCE, 2023-2028 (TONS)

- TABLE 102 NORTH AMERICA: DE-OILED LECITHIN MARKET, BY APPLICATION, 2018-2022 (USD THOUSAND)

- TABLE 103 NORTH AMERICA: DE-OILED LECITHIN MARKET, BY APPLICATION, 2023-2028 (USD THOUSAND)

- TABLE 104 NORTH AMERICA: DE-OILED LECITHIN MARKET FOR FOOD & BEVERAGES, BY APPLICATION, 2018-2022 (USD THOUSAND)

- TABLE 105 NORTH AMERICA: DE-OILED LECITHIN MARKET FOR FOOD & BEVERAGES, BY APPLICATION, 2023-2028 (USD THOUSAND)

- TABLE 106 NORTH AMERICA: DE-OILED LECITHIN MARKET, BY FORM, 2018-2022 (USD THOUSAND)

- TABLE 107 NORTH AMERICA: DE-OILED LECITHIN MARKET, BY FORM, 2023-2028 (USD THOUSAND)

- 12.2.2 US

- 12.2.2.1 Increasing demand for high-protein food products

- TABLE 108 US: DE-OILED LECITHIN MARKET, BY SOURCE, 2018-2022 (USD THOUSAND)

- TABLE 109 US: DE-OILED LECITHIN MARKET, BY SOURCE, 2023-2028 (USD THOUSAND)

- TABLE 110 US: DE-OILED LECITHIN MARKET, BY APPLICATION, 2018-2022 (USD THOUSAND)

- TABLE 111 US: DE-OILED LECITHIN MARKET, BY APPLICATION, 2023-2028 (USD THOUSAND)

- TABLE 112 US: DE-OILED LECITHIN MARKET, BY FORM, 2018-2022 (USD THOUSAND)

- TABLE 113 US: DE-OILED LECITHIN MARKET, BY FORM, 2023-2028 (USD THOUSAND)

- 12.2.3 CANADA

- 12.2.3.1 Booming food industry

- TABLE 114 CANADA: DE-OILED LECITHIN MARKET, BY SOURCE, 2018-2022 (USD THOUSAND)

- TABLE 115 CANADA: DE-OILED LECITHIN MARKET, BY SOURCE, 2023-2028 (USD THOUSAND)

- TABLE 116 CANADA: DE-OILED LECITHIN MARKET, BY APPLICATION, 2018-2022 (USD THOUSAND)

- TABLE 117 CANADA: DE-OILED LECITHIN MARKET, BY APPLICATION, 2023-2028 (USD THOUSAND)

- TABLE 118 CANADA: DE-OILED LECITHIN MARKET, BY FORM, 2018-2022 (USD THOUSAND)

- TABLE 119 CANADA: DE-OILED LECITHIN MARKET, BY FORM, 2023-2028 (USD THOUSAND)

- 12.3 EUROPE

- 12.3.1 EUROPE: RECESSION IMPACT ANALYSIS

- FIGURE 43 EUROPE DE-OILED LECITHIN MARKET: RECESSION IMPACT ANALYSIS

- TABLE 120 EUROPE: DE-OILED LECITHIN MARKET, BY COUNTRY, 2018-2022 (USD THOUSAND)

- TABLE 121 EUROPE: DE-OILED LECITHIN MARKET, BY COUNTRY, 2023-2028 (USD THOUSAND)

- TABLE 122 EUROPE: DE-OILED LECITHIN MARKET, BY COUNTRY, 2018-2022 (TONS)

- TABLE 123 EUROPE: DE-OILED LECITHIN MARKET, BY COUNTRY, 2023-2028 (TONS)

- TABLE 124 EUROPE: DE-OILED LECITHIN MARKET, BY SOURCE, 2018-2022 (USD THOUSAND)

- TABLE 125 EUROPE: DE-OILED LECITHIN MARKET, BY SOURCE, 2023-2028 (USD THOUSAND)

- TABLE 126 EUROPE: DE-OILED LECITHIN MARKET, BY SOURCE, 2018-2022 (TONS)

- TABLE 127 EUROPE: DE-OILED LECITHIN MARKET, BY SOURCE, 2023-2028 (TONS)

- TABLE 128 EUROPE: DE-OILED LECITHIN MARKET, BY APPLICATION, 2018-2022 (USD THOUSAND)

- TABLE 129 EUROPE: DE-OILED LECITHIN MARKET, BY APPLICATION, 2023-2028 (USD THOUSAND)

- TABLE 130 EUROPE: DE-OILED LECITHIN MARKET FOR FOOD AND BEVERAGES, BY APPLICATION, 2018-2022 (USD THOUSAND)

- TABLE 131 EUROPE: DE-OILED LECITHIN MARKET FOR FOOD AND BEVERAGES, BY APPLICATION, 2023-2028 (USD THOUSAND)

- TABLE 132 EUROPE: DE-OILED LECITHIN MARKET, BY FORM, 2018-2022 (USD THOUSAND)

- TABLE 133 EUROPE: DE-OILED LECITHIN MARKET, BY FORM, 2023-2028 (USD THOUSAND)

- 12.3.2 FRANCE

- 12.3.2.1 Growing concerns regarding food quality and health

- TABLE 134 FRANCE: DE-OILED LECITHIN MARKET, BY SOURCE, 2018-2022 (USD THOUSAND)

- TABLE 135 FRANCE: DE-OILED LECITHIN MARKET, BY SOURCE, 2023-2028 (USD THOUSAND)

- TABLE 136 FRANCE: DE-OILED LECITHIN MARKET, BY APPLICATION, 2018-2022 (USD THOUSAND)

- TABLE 137 FRANCE: DE-OILED LECITHIN MARKET, BY APPLICATION, 2023-2028 (USD THOUSAND)

- TABLE 138 FRANCE: DE-OILED LECITHIN MARKET, BY FORM, 2018-2022 (USD THOUSAND)

- TABLE 139 FRANCE: DE-OILED LECITHIN MARKET, BY FORM, 2023-2028 (USD THOUSAND)

- 12.3.3 ITALY

- 12.3.3.1 Rising demand for artisanal products

- TABLE 140 ITALY: DE-OILED LECITHIN MARKET, BY SOURCE, 2018-2022 (USD THOUSAND)

- TABLE 141 ITALY: DE-OILED LECITHIN MARKET, BY SOURCE, 2023-2028 (USD THOUSAND)

- TABLE 142 ITALY: DE-OILED LECITHIN MARKET, BY APPLICATION, 2018-2022 (USD THOUSAND)

- TABLE 143 ITALY: DE-OILED LECITHIN MARKET, BY APPLICATION, 2023-2028 (USD THOUSAND)

- TABLE 144 ITALY: DE-OILED LECITHIN MARKET, BY FORM, 2018-2022 (USD THOUSAND)

- TABLE 145 ITALY: DE-OILED LECITHIN MARKET, BY FORM, 2023-2028 (USD THOUSAND)

- 12.3.4 UK

- 12.3.4.1 Increasing concerns about food safety and demand for natural food products

- TABLE 146 UK: DE-OILED LECITHIN MARKET, BY SOURCE, 2018-2022 (USD THOUSAND)

- TABLE 147 UK: DE-OILED LECITHIN MARKET, BY SOURCE, 2023-2028 (USD THOUSAND)

- TABLE 148 UK: DE-OILED LECITHIN MARKET, BY APPLICATION, 2018-2022 (USD THOUSAND)

- TABLE 149 UK: DE-OILED LECITHIN MARKET, BY APPLICATION, 2023-2028 (USD THOUSAND)

- TABLE 150 UK: DE-OILED LECITHIN MARKET, BY FORM, 2018-2022 (USD THOUSAND)

- TABLE 151 UK: DE-OILED LECITHIN MARKET, BY FORM, 2023-2028 (USD THOUSAND)

- 12.3.5 SPAIN

- 12.3.5.1 Expanding food & beverage industry and changing lifestyles

- TABLE 152 SPAIN: DE-OILED LECITHIN MARKET, BY SOURCE, 2018-2022 (USD THOUSAND)

- TABLE 153 SPAIN: DE-OILED LECITHIN MARKET, BY SOURCE, 2023-2028 (USD THOUSAND)

- TABLE 154 SPAIN: DE-OILED LECITHIN MARKET, BY APPLICATION, 2018-2022 (USD THOUSAND)

- TABLE 155 SPAIN: DE-OILED LECITHIN MARKET, BY APPLICATION, 2023-2028 (USD THOUSAND)

- TABLE 156 SPAIN: DE-OILED LECITHIN MARKET, BY FORM, 2018-2022 (USD THOUSAND)

- TABLE 157 SPAIN: DE-OILED LECITHIN MARKET, BY FORM, 2023-2028 (USD THOUSAND)

- 12.3.6 GERMANY

- 12.3.6.1 Increasing demand for processed food products

- TABLE 158 GERMANY: DE-OILED LECITHIN MARKET, BY SOURCE, 2018-2022 (USD THOUSAND)

- TABLE 159 GERMANY: DE-OILED LECITHIN MARKET, BY SOURCE, 2023-2028 (USD THOUSAND)

- TABLE 160 GERMANY: DE-OILED LECITHIN MARKET, BY APPLICATION, 2018-2022 (USD THOUSAND)

- TABLE 161 GERMANY: DE-OILED LECITHIN MARKET, BY APPLICATION, 2023-2028 (USD THOUSAND)

- TABLE 162 GERMANY: DE-OILED LECITHIN MARKET, BY FORM, 2018-2022 (USD THOUSAND)

- TABLE 163 GERMANY: DE-OILED LECITHIN MARKET, BY FORM, 2023-2028 (USD THOUSAND)

- 12.3.7 REST OF EUROPE

- TABLE 164 REST OF EUROPE: DE-OILED LECITHIN MARKET, BY SOURCE, 2018-2022 (USD THOUSAND)

- TABLE 165 REST OF EUROPE: DE-OILED LECITHIN MARKET, BY SOURCE, 2023-2028 (USD THOUSAND)

- TABLE 166 REST OF EUROPE: DE-OILED LECITHIN MARKET, BY APPLICATION, 2018-2022 (USD THOUSAND)

- TABLE 167 REST OF EUROPE: DE-OILED LECITHIN MARKET, BY APPLICATION, 2023-2028 (USD THOUSAND)

- TABLE 168 REST OF EUROPE: DE-OILED LECITHIN MARKET, BY FORM, 2018-2022 (USD THOUSAND)

- TABLE 169 REST OF EUROPE: DE-OILED LECITHIN MARKET, BY FORM, 2023-2028 (USD THOUSAND)

- 12.4 ASIA PACIFIC

- 12.4.1 ASIA PACIFIC: RECESSION IMPACT ANALYSIS

- FIGURE 44 ASIA PACIFIC DE-OILED LECITHIN MARKET: RECESSION IMPACT ANALYSIS

- TABLE 170 ASIA PACIFIC: DE-OILED LECITHIN MARKET, BY COUNTRY, 2018-2022 (USD THOUSAND)

- TABLE 171 ASIA PACIFIC: DE-OILED LECITHIN MARKET, BY COUNTRY, 2023-2028 (USD THOUSAND)

- TABLE 172 ASIA PACIFIC: DE-OILED LECITHIN MARKET, BY COUNTRY, 2018-2022 (TONS)

- TABLE 173 ASIA PACIFIC: DE-OILED LECITHIN MARKET, BY COUNTRY, 2023-2028 (TONS)

- TABLE 174 ASIA PACIFIC: DE-OILED LECITHIN MARKET, BY SOURCE, 2018-2022 (USD THOUSAND)

- TABLE 175 ASIA PACIFIC: DE-OILED LECITHIN MARKET, BY SOURCE, 2023-2028 (USD THOUSAND)

- TABLE 176 ASIA PACIFIC: DE-OILED LECITHIN MARKET, BY SOURCE, 2018-2022 (TONS)

- TABLE 177 ASIA PACIFIC: DE-OILED LECITHIN MARKET, BY SOURCE, 2023-2028 (TONS)

- TABLE 178 ASIA PACIFIC: DE-OILED LECITHIN MARKET, BY FORM, 2018-2022 (USD THOUSAND)

- TABLE 179 ASIA PACIFIC: DE-OILED LECITHIN MARKET, BY FORM, 2023-2028 (USD THOUSAND)

- TABLE 180 ASIA PACIFIC: DE-OILED LECITHIN MARKET, BY APPLICATION, 2018-2022 (USD THOUSAND)

- TABLE 181 ASIA PACIFIC: DE-OILED LECITHIN MARKET, BY APPLICATION, 2023-2028 (USD THOUSAND)

- TABLE 182 ASIA PACIFIC: DE-OILED LECITHIN MARKET FOR FOOD AND BEVERAGES, BY APPLICATION, 2018-2022 (USD THOUSAND)

- TABLE 183 ASIA PACIFIC: DE-OILED LECITHIN MARKET FOR FOOD AND BEVERAGES, BY APPLICATION, 2023-2028 (USD THOUSAND)

- 12.4.2 CHINA

- 12.4.2.1 Rising demand for bakery products

- TABLE 184 CHINA: DE-OILED LECITHIN MARKET, BY SOURCE, 2018-2022 (USD THOUSAND)

- TABLE 185 CHINA: DE-OILED LECITHIN MARKET, BY SOURCE, 2023-2028 (USD THOUSAND)

- TABLE 186 CHINA: DE-OILED LECITHIN MARKET, BY FORM, 2018-2022 (USD THOUSAND)

- TABLE 187 CHINA: DE-OILED LECITHIN MARKET, BY FORM, 2023-2028 (USD THOUSAND)

- TABLE 188 CHINA: DE-OILED LECITHIN MARKET, BY APPLICATION, 2018-2022 (USD THOUSAND)

- TABLE 189 CHINA: DE-OILED LECITHIN MARKET, BY APPLICATION, 2023-2028 (USD THOUSAND)

- 12.4.3 INDIA

- 12.4.3.1 Shift toward healthy and high-quality products

- TABLE 190 INDIA: DE-OILED LECITHIN MARKET, BY SOURCE, 2018-2022 (USD THOUSAND)

- TABLE 191 INDIA: DE-OILED LECITHIN MARKET, BY SOURCE, 2023-2028 (USD THOUSAND)

- TABLE 192 INDIA: DE-OILED LECITHIN MARKET, BY FORM, 2018-2022 (USD THOUSAND)

- TABLE 193 INDIA: DE-OILED LECITHIN MARKET, BY FORM, 2023-2028 (USD THOUSAND)

- TABLE 194 INDIA: DE-OILED LECITHIN MARKET, BY APPLICATION, 2018-2022 (USD THOUSAND)

- TABLE 195 INDIA: DE-OILED LECITHIN MARKET, BY APPLICATION, 2023-2028 (USD THOUSAND)

- 12.4.4 JAPAN

- 12.4.4.1 Rapid expansion of convenience store chains over last decade

- TABLE 196 JAPAN: DE-OILED LECITHIN MARKET, BY SOURCE, 2018-2022 (USD THOUSAND)

- TABLE 197 JAPAN: DE-OILED LECITHIN MARKET, BY SOURCE, 2023-2028 (USD THOUSAND)

- TABLE 198 JAPAN: DE-OILED LECITHIN MARKET, BY FORM, 2018-2022 (USD THOUSAND)

- TABLE 199 JAPAN: DE-OILED LECITHIN MARKET, BY FORM, 2023-2028 (USD THOUSAND)

- TABLE 200 JAPAN: DE-OILED LECITHIN MARKET, BY APPLICATION, 2018-2022 (USD THOUSAND)

- TABLE 201 JAPAN: DE-OILED LECITHIN MARKET, BY APPLICATION, 2023-2028 (USD THOUSAND)

- 12.4.5 AUSTRALIA & NEW ZEALAND

- 12.4.5.1 Increasing use of lecithin as fat replacer

- TABLE 202 AUSTRALIA & NEW ZEALAND: DE-OILED LECITHIN MARKET, BY SOURCE, 2018-2022 (USD THOUSAND)

- TABLE 203 AUSTRALIA & NEW ZEALAND: DE-OILED LECITHIN MARKET, BY SOURCE, 2023-2028 (USD THOUSAND)

- TABLE 204 AUSTRALIA & NEW ZEALAND: DE-OILED LECITHIN MARKET, BY FORM, 2018-2022 (USD THOUSAND)

- TABLE 205 AUSTRALIA & NEW ZEALAND: DE-OILED LECITHIN MARKET, BY FORM, 2023-2028 (USD THOUSAND)

- TABLE 206 AUSTRALIA & NEW ZEALAND: DE-OILED LECITHIN MARKET, BY APPLICATION, 2018-2022 (USD THOUSAND)

- TABLE 207 AUSTRALIA & NEW ZEALAND: DE-OILED LECITHIN MARKET, BY APPLICATION, 2023-2028 (USD THOUSAND)

- 12.4.6 REST OF ASIA PACIFIC

- TABLE 208 REST OF ASIA PACIFIC: DE-OILED LECITHIN MARKET, BY SOURCE, 2018-2022 (USD THOUSAND)

- TABLE 209 REST OF ASIA PACIFIC: DE-OILED LECITHIN MARKET, BY SOURCE, 2023-2028 (USD THOUSAND)

- TABLE 210 REST OF ASIA PACIFIC: DE-OILED LECITHIN MARKET, BY FORM, 2018-2022 (USD THOUSAND)

- TABLE 211 REST OF ASIA PACIFIC: DE-OILED LECITHIN MARKET, BY FORM, 2023-2028 (USD THOUSAND)

- TABLE 212 REST OF ASIA PACIFIC: DE-OILED LECITHIN MARKET, BY APPLICATION, 2018-2022 (USD THOUSAND)

- TABLE 213 REST OF ASIA PACIFIC: DE-OILED LECITHIN MARKET, BY APPLICATION, 2023-2028 (USD THOUSAND)

- 12.5 LATIN AMERICA

- 12.5.1 LATIN AMERICA: RECESSION IMPACT ANALYSIS

- FIGURE 45 LATIN AMERICA DE-OILED LECITHIN MARKET: RECESSION IMPACT ANALYSIS

- TABLE 214 LATIN AMERICA: DE-OILED LECITHIN MARKET, BY COUNTRY, 2018-2022 (USD THOUSAND)

- TABLE 215 LATIN AMERICA: DE-OILED LECITHIN MARKET, BY COUNTRY, 2023-2028 (USD THOUSAND)

- TABLE 216 LATIN AMERICA: DE-OILED LECITHIN MARKET, BY COUNTRY, 2018-2022 (TONS)

- TABLE 217 LATIN AMERICA: DE-OILED LECITHIN MARKET, BY COUNTRY, 2023-2028 (TONS)

- TABLE 218 LATIN AMERICA: DE-OILED LECITHIN MARKET, BY SOURCE, 2018-2022 (USD THOUSAND)

- TABLE 219 LATIN AMERICA: DE-OILED LECITHIN MARKET, BY SOURCE, 2023-2028 (USD THOUSAND)

- TABLE 220 LATIN AMERICA: DE-OILED LECITHIN MARKET, BY SOURCE, 2018-2022 (TONS)

- TABLE 221 LATIN AMERICA: DE-OILED LECITHIN MARKET, BY SOURCE, 2023-2028 (TONS)

- TABLE 222 LATIN AMERICA: DE-OILED LECITHIN MARKET, BY FORM, 2018-2022 (USD THOUSAND)

- TABLE 223 LATIN AMERICA: DE-OILED LECITHIN MARKET, BY FORM, 2023-2028 (USD THOUSAND)

- TABLE 224 LATIN AMERICA: DE-OILED LECITHIN MARKET, BY APPLICATION, 2018-2022 (USD THOUSAND)

- TABLE 225 LATIN AMERICA: DE-OILED LECITHIN MARKET, BY APPLICATION, 2023-2028 (USD THOUSAND)

- TABLE 226 LATIN AMERICA: DE-OILED LECITHIN MARKET FOR FOOD AND BEVERAGES, BY APPLICATION, 2018-2022 (USD THOUSAND)

- TABLE 227 LATIN AMERICA: DE-OILED LECITHIN MARKET FOR FOOD AND BEVERAGES, BY APPLICATION, 2023-2028 (USD THOUSAND)

- 12.5.2 BRAZIL

- 12.5.2.1 High consumption of bakery products

- TABLE 228 BRAZIL: DE-OILED LECITHIN MARKET, BY SOURCE, 2018-2022 (USD THOUSAND)

- TABLE 229 BRAZIL: DE-OILED LECITHIN MARKET, BY SOURCE, 2023-2028 (USD THOUSAND)

- TABLE 230 BRAZIL: DE-OILED LECITHIN MARKET, BY FORM, 2018-2022 (USD THOUSAND)

- TABLE 231 BRAZIL: DE-OILED LECITHIN MARKET, BY FORM, 2023-2028 (USD THOUSAND)

- TABLE 232 BRAZIL: DE-OILED LECITHIN MARKET, BY APPLICATION, 2018-2022 (USD THOUSAND)

- TABLE 233 BRAZIL: DE-OILED LECITHIN MARKET, BY APPLICATION, 2023-2028 (USD THOUSAND)

- 12.5.3 ARGENTINA

- 12.5.3.1 Expanding lecithin industry

- TABLE 234 ARGENTINA: DE-OILED LECITHIN MARKET, BY SOURCE, 2018-2022 (USD THOUSAND)

- TABLE 235 ARGENTINA: DE-OILED LECITHIN MARKET, BY SOURCE, 2023-2028 (USD THOUSAND)

- TABLE 236 ARGENTINA: DE-OILED LECITHIN MARKET, BY FORM, 2018-2022 (USD THOUSAND)

- TABLE 237 ARGENTINA: DE-OILED LECITHIN MARKET, BY FORM, 2023-2028 (USD THOUSAND)

- TABLE 238 ARGENTINA: DE-OILED LECITHIN MARKET, BY APPLICATION, 2018-2022 (USD THOUSAND)

- TABLE 239 ARGENTINA: DE-OILED LECITHIN MARKET, BY APPLICATION, 2023-2028 (USD THOUSAND)

- 12.5.4 MEXICO

- 12.5.4.1 Increasing consumption of poultry products

- TABLE 240 MEXICO: DE-OILED LECITHIN MARKET, BY SOURCE, 2018-2022 (USD THOUSAND)

- TABLE 241 MEXICO: DE-OILED LECITHIN MARKET, BY SOURCE, 2023-2028 (USD THOUSAND)

- TABLE 242 MEXICO: DE-OILED LECITHIN MARKET, BY FORM, 2018-2022 (USD THOUSAND)

- TABLE 243 MEXICO: DE-OILED LECITHIN MARKET, BY FORM, 2023-2028 (USD THOUSAND)

- TABLE 244 MEXICO: DE-OILED LECITHIN MARKET, BY APPLICATION, 2018-2022 (USD THOUSAND)

- TABLE 245 MEXICO: DE-OILED LECITHIN MARKET, BY APPLICATION, 2023-2028 (USD THOUSAND)

- 12.5.5 CHILE

- 12.5.5.1 Growing food processing industry

- TABLE 246 CHILE: DE-OILED LECITHIN MARKET, BY SOURCE, 2018-2022 (USD THOUSAND)

- TABLE 247 CHILE: DE-OILED LECITHIN MARKET, BY SOURCE, 2023-2028 (USD THOUSAND)

- TABLE 248 CHILE: DE-OILED LECITHIN MARKET, BY FORM, 2018-2022 (USD THOUSAND)

- TABLE 249 CHILE: DE-OILED LECITHIN MARKET, BY FORM, 2023-2028 (USD THOUSAND)

- TABLE 250 CHILE: DE-OILED LECITHIN MARKET, BY APPLICATION, 2018-2022 (USD THOUSAND)

- TABLE 251 CHILE: DE-OILED LECITHIN MARKET, BY APPLICATION, 2023-2028 (USD THOUSAND)

- 12.5.6 REST OF LATIN AMERICA

- TABLE 252 REST OF LATIN AMERICA: DE-OILED LECITHIN MARKET, BY SOURCE, 2018-2022 (USD THOUSAND)

- TABLE 253 REST OF LATIN AMERICA: DE-OILED LECITHIN MARKET, BY SOURCE, 2023-2028 (USD THOUSAND)

- TABLE 254 REST OF LATIN AMERICA: DE-OILED LECITHIN MARKET, BY FORM, 2018-2022 (USD THOUSAND)

- TABLE 255 REST OF LATIN AMERICA: DE-OILED LECITHIN MARKET, BY FORM, 2023-2028 (USD THOUSAND)

- TABLE 256 REST OF LATIN AMERICA: DE-OILED LECITHIN MARKET, BY APPLICATION, 2018-2022 (USD THOUSAND)

- TABLE 257 REST OF LATIN AMERICA: DE-OILED LECITHIN MARKET, BY APPLICATION, 2023-2028 (USD THOUSAND)

- 12.6 ROW

- 12.6.1 ROW: RECESSION IMPACT ANALYSIS

- FIGURE 46 ROW DE-OILED LECITHIN MARKET: RECESSION IMPACT ANALYSIS

- TABLE 258 ROW: DE-OILED LECITHIN MARKET, BY COUNTRY, 2018-2022 (USD THOUSAND)

- TABLE 259 ROW: DE-OILED LECITHIN MARKET, BY COUNTRY, 2023-2028 (USD THOUSAND)

- TABLE 260 ROW: DE-OILED LECITHIN MARKET, BY COUNTRY, 2018-2022 (TONS)

- TABLE 261 ROW: DE-OILED LECITHIN MARKET, BY COUNTRY, 2023-2028 (TONS)

- TABLE 262 ROW: DE-OILED LECITHIN MARKET, BY SOURCE, 2018-2022 (USD THOUSAND)

- TABLE 263 ROW: DE-OILED LECITHIN MARKET, BY SOURCE, 2023-2028 (USD THOUSAND)

- TABLE 264 ROW: DE-OILED LECITHIN MARKET, BY SOURCE, 2018-2022 (TONS)

- TABLE 265 ROW: DE-OILED LECITHIN MARKET, BY SOURCE, 2023-2028 (TONS)

- TABLE 266 ROW: DE-OILED LECITHIN MARKET, BY APPLICATION, 2018-2022 (USD THOUSAND)

- TABLE 267 ROW: DE-OILED LECITHIN MARKET, BY APPLICATION, 2023-2028 (USD THOUSAND)

- TABLE 268 ROW: DE-OILED LECITHIN MARKET FOR FOOD & BEVERAGES, BY APPLICATION, 2018-2022 (USD THOUSAND)

- TABLE 269 ROW: DE-OILED LECITHIN MARKET FOR FOOD & BEVERAGES, BY APPLICATION, 2023-2028 (USD THOUSAND)

- TABLE 270 ROW: DE-OILED LECITHIN MARKET, BY FORM, 2018-2022 (USD THOUSAND)

- TABLE 271 ROW: DE-OILED LECITHIN MARKET, BY FORM, 2023-2028 (USD THOUSAND)

- 12.6.2 MIDDLE EAST

- 12.6.2.1 Significant increase in demand for premium food products

- TABLE 272 MIDDLE EAST: DE-OILED LECITHIN MARKET, BY SOURCE, 2018-2022 (USD THOUSAND)

- TABLE 273 MIDDLE EAST: DE-OILED LECITHIN MARKET, BY SOURCE, 2023-2028 (USD THOUSAND)

- TABLE 274 MIDDLE EAST: DE-OILED LECITHIN MARKET, BY APPLICATION, 2018-2022 (USD THOUSAND)

- TABLE 275 MIDDLE EAST: DE-OILED LECITHIN MARKET, BY APPLICATION, 2023-2028 (USD THOUSAND)

- TABLE 276 MIDDLE EAST: DE-OILED LECITHIN MARKET, BY FORM, 2018-2022 (USD THOUSAND)

- TABLE 277 MIDDLE EAST: DE-OILED LECITHIN MARKET, BY FORM, 2023-2028 (USD THOUSAND)

- 12.6.3 AFRICA

- 12.6.3.1 Increasing demand for processed food

- TABLE 278 AFRICA: DE-OILED LECITHIN MARKET, BY SOURCE, 2018-2022 (USD THOUSAND)

- TABLE 279 AFRICA: DE-OILED LECITHIN MARKET, BY SOURCE, 2023-2028 (USD THOUSAND)

- TABLE 280 AFRICA: DE-OILED LECITHIN MARKET, BY APPLICATION, 2018-2022 (USD THOUSAND)

- TABLE 281 AFRICA: DE-OILED LECITHIN MARKET, BY APPLICATION, 2023-2028 (USD THOUSAND)

- TABLE 282 AFRICA: DE-OILED LECITHIN MARKET, BY FORM, 2018-2022 (USD THOUSAND)

- TABLE 283 AFRICA: DE-OILED LECITHIN MARKET, BY FORM, 2023-2028 (USD THOUSAND)

13 COMPETITIVE LANDSCAPE

- 13.1 OVERVIEW

- 13.2 MARKET SHARE ANALYSIS, 2021

- TABLE 284 DE-OILED LECITHIN MARKET: DEGREE OF COMPETITION

- 13.3 SEGMENTAL REVENUE ANALYSIS OF KEY PLAYERS

- FIGURE 47 SEGMENTAL REVENUE ANALYSIS OF KEY PLAYERS, 2017-2021 (USD BILLION)

- 13.4 STRATEGIES ADOPTED BY KEY PLAYERS

- TABLE 285 STRATEGIES ADOPTED BY KEY DE-OILED LECITHIN MANUFACTURERS

- 13.5 COMPANY EVALUATION QUADRANT (KEY PLAYERS)

- 13.5.1 STARS

- 13.5.2 EMERGING LEADERS

- 13.5.3 PERVASIVE PLAYERS

- 13.5.4 PARTICIPANTS

- FIGURE 48 DE-OILED LECITHIN MARKET: COMPANY EVALUATION QUADRANT, 2022 (KEY PLAYERS)

- 13.5.5 PRODUCT FOOTPRINT

- TABLE 286 SOURCE: COMPANY FOOTPRINT

- TABLE 287 APPLICATION: COMPANY FOOTPRINT

- TABLE 288 REGION: COMPANY FOOTPRINT

- TABLE 289 OVERALL COMPANY FOOTPRINT

- 13.6 COMPANY EVALUATION QUADRANT FOR STARTUPS/SMES, 2021

- 13.6.1 PROGRESSIVE COMPANIES

- 13.6.2 STARTING BLOCKS

- 13.6.3 RESPONSIVE COMPANIES

- 13.6.4 DYNAMIC COMPANIES

- FIGURE 49 DE-OILED LECITHIN MARKET: COMPANY EVALUATION QUADRANT, 2022 (START-UP/SME)

- 13.6.5 COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- TABLE 290 DE-OILED LECITHIN MARKET: DETAILED LIST OF KEY STARTUPS/SMES

- TABLE 291 DE-OILED LECITHIN MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- 13.7 COMPETITIVE SCENARIO

- 13.7.1 PRODUCT LAUNCHES

- TABLE 292 DE-OILED LECITHIN MARKET: PRODUCT LAUNCHES, 2021

- 13.7.2 DEALS

- TABLE 293 DE-OILED LECITHIN MARKET: DEALS, 2019-2021

- 13.7.3 OTHER DEVELOPMENTS

- TABLE 294 DE-OILED LECITHIN MARKET: OTHER DEVELOPMENTS, 2019

14 COMPANY PROFILES

(Business overview, Products/Solutions/Services offered, Recent Developments, MNM view)*

- 14.1 KEY PLAYERS

- 14.1.1 CARGILL, INCORPORATED

- TABLE 295 CARGILL, INCORPORATED: COMPANY OVERVIEW

- FIGURE 50 CARGILL, INCORPORATED: COMPANY SNAPSHOT

- TABLE 296 CARGILL, INCORPORATED: PRODUCTS OFFERED

- 14.1.2 ADM

- TABLE 297 ADM: COMPANY OVERVIEW

- FIGURE 51 ADM: COMPANY SNAPSHOT

- TABLE 298 ADM: PRODUCTS OFFERED

- 14.1.3 BUNGE LIMITED

- TABLE 299 BUNGE LIMITED: COMPANY OVERVIEW

- FIGURE 52 BUNGE LIMITED: COMPANY SNAPSHOT

- TABLE 300 BUNGE LIMITED: PRODUCTS OFFERED

- TABLE 301 BUNGE LIMITED: DEALS

- 14.1.4 IMCD GROUP B.V.

- TABLE 302 IMCD GROUP B.V.: COMPANY OVERVIEW

- FIGURE 53 IMCD GROUP B.V.: COMPANY SNAPSHOT

- TABLE 303 IMCD GROUP B.V.: PRODUCTS OFFERED

- TABLE 304 IMCD GROUP B.V.: DEALS

- 14.1.5 STERN-WYWIOL GRUPPE

- TABLE 305 STERN-WYWIOL GRUPPE: COMPANY OVERVIEW

- TABLE 306 STERN-WYWIOL GRUPPE: PRODUCTS OFFERED

- TABLE 307 STERN-WYWIOL GRUPPE: PRODUCT LAUNCHES

- 14.1.6 AMERICAN LECITHIN COMPANY

- TABLE 308 AMERICAN LECITHIN COMPANY: COMPANY OVERVIEW

- TABLE 309 AMERICAN LECITHIN COMPANY: PRODUCTS OFFERED

- 14.1.7 SONIC BIOCHEM

- TABLE 310 SONIC BIOCHEM: COMPANY OVERVIEW

- TABLE 311 SONIC BIOCHEM: PRODUCTS OFFERED

- 14.1.8 AVRIL GROUP

- TABLE 312 AVRIL GROUP: COMPANY OVERVIEW

- TABLE 313 AVRIL GROUP: PRODUCTS OFFERED

- TABLE 314 AVRIL GROUP: DEALS

- 14.1.9 FISMER LECITHIN

- TABLE 315 FISMER LECITHIN: COMPANY OVERVIEW

- TABLE 316 FISMER LECITHIN: PRODUCTS OFFERED

- TABLE 317 FISMER LECITHIN: DEALS

- 14.1.10 CLARKSON GRAIN COMPANY, INC.

- TABLE 318 CLARKSON GRAIN COMPANY, INC.: COMPANY OVERVIEW

- TABLE 319 CLARKSON GRAIN COMPANY, INC.: PRODUCTS OFFERED

- 14.1.11 AMITEX AGRO PRODUCT PRIVATE LIMITED

- TABLE 320 AMITEX AGRO PRODUCT PRIVATE LIMITED: COMPANY OVERVIEW

- TABLE 321 AMITEX AGRO PRODUCT PRIVATE LIMITED.: PRODUCTS OFFERED

- 14.1.12 LASENOR EMUL, S.L.

- TABLE 322 LASENOR EMUL, S.L.: COMPANY OVERVIEW

- TABLE 323 LASENOR EMUL, S.L.: PRODUCTS OFFERED

- 14.1.13 LECITAL

- TABLE 324 LECITAL: COMPANY OVERVIEW

- TABLE 325 LECITAL: PRODUCTS OFFERED

- 14.1.14 THE SCOULAR COMPANY

- TABLE 326 THE SCOULAR COMPANY: COMPANY OVERVIEW

- TABLE 327 THE SCOULAR COMPANY: PRODUCTS OFFERED

- TABLE 328 THE SCOULAR COMPANY: OTHERS

- 14.1.15 GIIAVA

- TABLE 329 GIIAVA: COMPANY OVERVIEW

- TABLE 330 GIIAVA: PRODUCTS OFFERED

- 14.1.16 SUN NUTRAFOODS

- TABLE 331 SUN NUTRAFOODS: COMPANY OVERVIEW

- TABLE 332 SUN NUTRAFOODS: PRODUCTS OFFERED

- 14.1.17 VAV LIFE SCIENCES PVT LTD.

- TABLE 333 VAV LIFE SCIENCES PVT LTD.: COMPANY OVERVIEW

- TABLE 334 VAV LIFE SCIENCES PVT LTD.: PRODUCTS OFFERED

- 14.1.18 AVI AGRI BUSINESS LIMITED

- TABLE 335 AVI AGRI BUSINESS LIMITED: COMPANY OVERVIEW

- TABLE 336 AVI AGRI BUSINESS LIMITED: PRODUCTS OFFERED

- 14.1.19 LECILITE

- TABLE 337 LECILITE: COMPANY OVERVIEW

- TABLE 338 LECILITE: PRODUCTS OFFERED

- 14.1.20 LECITEIN

- TABLE 339 LECITEIN: COMPANY OVERVIEW

- TABLE 340 LECITEIN: PRODUCTS OFFERED

- Details on Business overview, Products/Solutions/Services offered, Recent Developments, MNM view might not be captured in case of unlisted companies.

15 ADJACENT AND RELATED MARKETS

- 15.1 INTRODUCTION

- 15.2 LIMITATIONS

- 15.3 LECITHIN & PHOSPHOLIPIDS MARKET

- 15.3.1 MARKET DEFINITION

- 15.3.2 MARKET OVERVIEW

- 15.3.3 LECITHIN & PHOSPHOLIPIDS MARKET, BY SOURCE

- 15.3.3.1 Introduction

- TABLE 341 LECITHIN MARKET, BY SOURCE, 2018-2021 (USD MILLION)

- TABLE 342 LECITHIN MARKET, BY SOURCE, 2022-2027 (USD MILLION)

- TABLE 343 LECITHIN MARKET, BY SOURCE, 2018-2021 (TON)

- TABLE 344 LECITHIN MARKET, BY SOURCE, 2022-2027 (TON)

- 15.3.4 LECITHIN & PHOSPHOLIPIDS MARKET, BY REGION

- 15.3.4.1 Introduction

- TABLE 345 LECITHIN MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 346 LECITHIN MARKET, BY REGION, 2022-2027 (USD MILLION)

- TABLE 347 LECITHIN MARKET, BY REGION, 2018-2021 (TON)

- TABLE 348 LECITHIN MARKET, BY REGION, 2022-2027 (TON)

- 15.4 FOOD EMULSIFIERS MARKET

- 15.4.1 MARKET DEFINITION

- 15.4.2 MARKET OVERVIEW

- 15.4.3 FOOD EMULSIFIERS MARKET, BY TYPE

- 15.4.3.1 Introduction

- TABLE 349 FOOD EMULSIFIERS MARKET, BY TYPE, 2016-2019 (USD MILLION)

- TABLE 350 FOOD EMULSIFIERS MARKET, BY TYPE, 2020-2025 (USD MILLION)

- TABLE 351 FOOD EMULSIFIERS MARKET, BY TYPE, 2016-2019 (KT)

- TABLE 352 FOOD EMULSIFIERS MARKET, BY TYPE, 2020-2025 (KT)

- 15.4.4 FOOD EMULSIFIERS MARKET, BY REGION

- 15.4.4.1 Introduction

- TABLE 353 FOOD EMULSIFIERS MARKET, BY REGION, 2016-2019 (USD MILLION)

- TABLE 354 FOOD EMULSIFIERS MARKET, BY REGION, 2020-2025 (USD MILLION)

16 APPENDIX

- 16.1 DISCUSSION GUIDE

- 16.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 16.3 CUSTOMIZATION OPTIONS

- 16.4 RELATED REPORTS

- 16.5 AUTHOR DETAILS