|

|

市場調査レポート

商品コード

1235843

水産養殖製品の世界市場:飼育製品の種類別 (装置、化学品、医薬品、肥料)・養殖環境別 (淡水、海洋、汽水)・品種別 (水生動物、水生植物)・生産の種類別・地域別の将来予測 (2027年まで)Aquaculture Products Market by Rearing Product Type (Equipment, Chemicals, Pharmaceuticals, Fertilizers), Culture (Freshwater, Marine, Brackish Water), Species (Aquatic Animals, Aquatic Plants), Production Type and Region - Global Forecast to 2027 |

||||||

|

● お客様のご希望に応じて、既存データの加工や未掲載情報(例:国別セグメント)の追加などの対応が可能です。 詳細はお問い合わせください。 |

|||||||

| 水産養殖製品の世界市場:飼育製品の種類別 (装置、化学品、医薬品、肥料)・養殖環境別 (淡水、海洋、汽水)・品種別 (水生動物、水生植物)・生産の種類別・地域別の将来予測 (2027年まで) |

|

出版日: 2023年03月02日

発行: MarketsandMarkets

ページ情報: 英文 269 Pages

納期: 即納可能

|

- 全表示

- 概要

- 目次

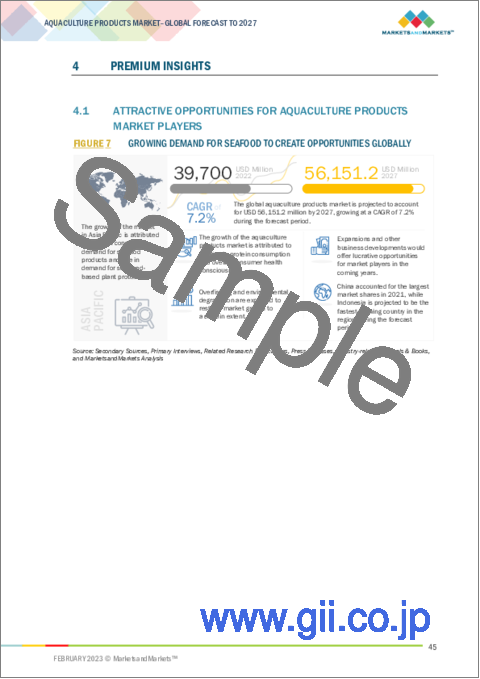

世界の水産養殖製品の市場規模は、2022年に397億米ドル、2027年には562億米ドルに達すると予測され、予測期間中に7.2%のCAGRで成長する見込みです。

世界の人口が増加し続ける中、魚介類の需要は増加しており、養殖は人間が消費するタンパク源としてますます重要性を増しています。

養殖環境別では、淡水養殖が市場を独占し、近年は大幅な成長を遂げています。人口増加、都市化、所得向上などを背景とした淡水魚の需要増が、この成長の主な要因となっています。また、養殖技術や生産方法の進歩により、淡水魚の養殖が容易かつ費用対効果の高いものとなっており、これが市場の成長をさらに後押ししています。商業目的で養殖される淡水魚の代表的な種には、ティラピア、ナマズ、マス、コイなどがあります。

地域別に見ると、アジア太平洋が急成長しており、予測期間中に7.5%のCAGRで成長する見通しです。同地域は、人口増加、世界有数の経済成長、魚介類への嗜好の高まりから、同地域の水産養殖製品市場の拡大が期待されています。さらに、大手企業は同地域で販売拠点や製造工場を拡大しており、域内の急成長する水産養殖製品市場のエコシステムを後押ししています。

当レポートでは、世界の水産養殖製品の市場について分析し、市場の基本構造や最新情勢、主な市場促進・抑制要因、品種別・養殖環境別・生産の種類別・飼育製品の種類別・地域別の市場動向の見通し、市場競争の状態、主要企業のプロファイルなどを調査しております。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- マクロ経済指標

- 共働き世帯の増加

- 世界人口の増加

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

第6章 業界動向

- イントロダクション

- バリューチェーン

- サプライチェーン分析

- 水産養殖市場のエコシステム

- 顧客のビジネスに影響を与える動向/混乱

- 技術分析

- 価格分析

- 特許分析

- 貿易分析

- 主な会議とイベント

- ケーススタディ

- 関税と規制の状況

- ポーターのファイブフォース分析

- 主な利害関係者と購入基準

第7章 水産養殖製品市場:品種別

- イントロダクション

- 水生動物

- 魚類

- 軟体動物

- 甲殻類

- その他の水生動物

- 水生植物

- 海藻類

- 微細藻類

第8章 水産養殖製品市場:養殖環境別

- イントロダクション

- 淡水

- 海洋

- 汽水

第9章 水産養殖製品市場:生産の種類別

- イントロダクション

- 小規模

- 中規模・大規模

第10章 水産養殖製品市場:飼育製品の種類別

- イントロダクション

- 装置

- 収容設備

- 水ポンプ・フィルター

- 水循環・通気設備

- 洗浄装置

- フィーダー

- その他の機器

- 化学品

- 肥料

- 医薬品

第11章 水産養殖製品市場:地域別

- イントロダクション

- 水産養殖製品市場に対する景気後退の影響

- 北米

- 米国

- カナダ

- メキシコ

- 欧州

- ノルウェー

- 英国

- スペイン

- イタリア

- フランス

- トルコ

- 他の欧州諸国

- アジア太平洋

- 中国

- インド

- 日本

- インドネシア

- タイ

- ベトナム

- 他のアジア太平洋諸国

- 南米

- ブラジル

- チリ

- エクアドル

- 他の南米諸国

- 他の国々 (RoW)

- アフリカ

- 中東

第12章 競合情勢

- 概要

- 市場シェア分析

- 主要企業の戦略

- 主要企業の収益分析:セグメント別

- 企業評価クアドラント (主要企業)

- 企業評価クアドラント (スタートアップ/中小企業)

- 競合ベンチマーキング

- 資本取引とその他の動向

第13章 企業プロファイル

- 主要企業

- PENTAIR PLC

- AKVA GROUP

- XYLEM INC

- AQUACULTURE EQUIPMENT LTD

- AQUACULTURE SYSTEM TECHNOLOGIES, LLC

- LUXSOL

- PIONEER GROUP

- CPI EQUIPMENT INC

- ASAKUA

- FREA AQUACULTURE SOLUTIONS

- LIFEGARD AQUATICS

- TAN INTERNATIONAL LTD

- REEF INDUSTRIES, INC

- AQUAFARM EQUIPMENT AS

- MAGIC VALLEY HELI-ARC, MFG, INC

- スタートアップ/中小企業

- ELIMAT SL

- EUSKAN

- SKAGINN 3X

- MILANESE

- SMIR AS

- KJAERGAARD MASKINFABRIK AS

- BOSMAN WATERMANAGEMENT BV

- RODELTA

- IRAS A/S

- HIDROSTAL

第14章 隣接・関連市場

- イントロダクション

- 制限事項

- フィッシュポンプ市場

- 水生除草剤市場

第15章 付録

The global aquaculture products market is estimated to be valued at USD 39.7 Billion in 2022. It is projected to reach USD 56.2 Billion by 2027, recording a CAGR of 7.2% during the forecast period. Aquaculture is the practice of cultivating aquatic organisms, including fish, shellfish, and plants, in controlled environments such as tanks, ponds, or cages. As the world's population continues to grow, demand for seafood is increasing, and aquaculture is becoming an increasingly important source of protein for human consumption. Aquaculture products include a wide range of seafood, such as salmon, shrimp, tilapia, oysters, and clams, as well as aquatic plants such as seaweed. These products can be sold fresh, frozen, or canned, and are a valuable source of income for many coastal communities around the world.

"Asia Pacific is projected to witness the growth of 7.5% during the forecast period making it the fastest-growing market."

The aquaculture products market in Asia Pacific is growing at a CAGR of 7.5%. The Asia Pacific region consists of a rising population, some of the world's fastest-growing economies, and a growing preference for seafoods, which is expected to thrive the aquaculture products market in the region. Moreover, major players are expanding their sales presence and manufacturing plants in the region, pumping the aquaculture products market's ecosystem in the fastest growing region.

"The freshwater segment by culture dominates the aquaculture products market."

The freshwater aquaculture market has experienced significant growth in recent years, and this trend is expected to continue in the coming years. The increasing demand for freshwater fish, driven by population growth, urbanization, and rising incomes, is a major driver of this growth. In addition, advances in aquaculture technology and production methods have made it easier and more cost-effective to cultivate freshwater fish, which has further fueled the growth of the market. Some of the most popular species of freshwater fish cultivated for commercial purposes include tilapia, catfish, trout, and carp. The market for these species has grown rapidly in recent years, especially in Asia and North America. Despite the challenges that freshwater aquaculture faces, such as environmental concerns and disease outbreaks, the market is expected to continue its growth trajectory, driven by increasing demand for sustainable sources of protein.

Product pricing is a crucial factor in capturing and targeting consumers. To target consumers in developing markets, where per capita income is still rising, and overall awareness and regulatory stringency are low, inorganic aquaculture products-based food and feed items can be sold easily. Thus, price is an important factor that is considered an advantage to the sales of aquaculture products, driving the market.

"Rise in trend of smart fish farming is creating opportunities in the aquaculture products market."

Smart fish farming is an emerging concept in aquaculture that involves the use of technology to optimize the production of fish and improve the efficiency of farming operations. This includes the use of sensors and data analytics to monitor water quality, feed consumption, and fish behavior, as well as the use of automated systems for feeding, harvesting, and processing fish. Smart fish farming can help farmers to reduce costs, improve productivity, and enhance the sustainability of their operations by reducing the environmental impact of aquaculture. For example, by monitoring water quality in real-time, farmers can adjust feeding rates and water circulation to maintain optimal conditions for fish growth and health, which can reduce the risk of disease outbreaks and improve the efficiency of feed utilization. As technology continues to evolve, the potential benefits of smart fish farming are likely to grow, and it is expected to play an increasingly important role in meeting the growing demand for seafood in a sustainable way.

Break-up of Primaries:

- By Company Type: Tier 1 - 30.0%, Tier 2- 45.0%, Tier 3 - 25.0%

- By Designation: Managers - 50.0%, CXOs - 25.0%, and Executives- 25.0%

- By Region: Asia Pacific - 30%, Europe - 35%, North America - 25%, RoW - 10%

Leading players profiled in this report:

- Pentair PLC (US)

- AKVA Group (Norway)

- Xylem Inc. (US)

- Aquaculture Equiment Ltd (UK)

- Aquaculture System Technologies LLC (US)

- LUXSOL (Russia)

- Pioneer Group (Taiwan)

- CPI Equipment Inc. (Canada)

- ASAKUA (Turkey)

- Frea Aquaculture Solutions (Denmark)

- Lifegard Aquatics (US)

- Tan International Ltd (UK)

- Reef Industries Inc. (US)

- Aquafarm Equipment AS (Norway)

- Magic Valley Hel Arc, Mfg, Inc (US)

- Elimat SL (Spain)

- Esukan (Spain)

- SKAGINN 3X (Iceland)

- Milanese (Italy)

- SMIR AS (Norway)

- Kjaergaard Maskinfabrik (Denmark)

- Bosman Water Management BV (Netherlands)

- Rodelta (Netherlands)

- IRA A/S (Denmark)

- Hirdostal (Switzerland)

Research Coverage:

The report segments the aquaculture products market on the basis of rearing product type, culture, production type, species, and region. In terms of insights, this report has focused on various levels of analyses-the competitive landscape, end-use analysis, and company profiles, which together comprise and discuss views on the emerging & high-growth segments, high-growth regions, countries, government initiatives, drivers, restraints, opportunities, and challenges of the global aquaculture products market.

Reasons to buy this report:

- To get a comprehensive overview of the aquaculture products market

- To gain wide-ranging information about the top players in this industry, their product portfolios, and key strategies adopted by them

- To gain insights about the major countries/regions in which the aquaculture products market is flourishing

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKET SEGMENTATION

- 1.3.2 REGIONS COVERED

- 1.4 YEARS CONSIDERED

- 1.5 UNITS CONSIDERED

- 1.5.1 CURRENCY/VALUE UNIT

- TABLE 1 USD EXCHANGE RATES CONSIDERED, 2018-2021

- 1.5.2 VOLUME UNIT

- 1.6 STAKEHOLDERS

- 1.7 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- FIGURE 1 AQUACULTURE PRODUCTS MARKET: RESEARCH DESIGN

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key data from primary sources

- 2.1.2.2 Breakdown of primaries

- 2.1.2.3 Key primary insights

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 APPROACH ONE: BOTTOM-UP (BASED ON REARING PRODUCT TYPE, BY REGION)

- 2.2.2 APPROACH TWO: TOP-DOWN (BASED ON GLOBAL MARKET)

- 2.3 DATA TRIANGULATION

- FIGURE 2 DATA TRIANGULATION METHODOLOGY

- 2.4 RECESSION IMPACT ANALYSIS

- 2.5 STUDY ASSUMPTIONS

- 2.6 STUDY LIMITATIONS AND RISK ASSESSMENT

3 EXECUTIVE SUMMARY

- TABLE 2 AQUACULTURE PRODUCTS MARKET SHARE SNAPSHOT, 2022 VS. 2027 (USD MILLION)

- FIGURE 3 AQUACULTURE PRODUCTS MARKET, BY REARING PRODUCT TYPE, 2022 VS. 2027 (USD MILLION)

- FIGURE 4 AQUACULTURE PRODUCTS MARKET, BY PRODUCTION TYPE, 2022 VS. 2027 (USD MILLION)

- FIGURE 5 AQUACULTURE PRODUCTS MARKET, BY SPECIES, 2022 VS. 2027 (USD MILLION)

- FIGURE 6 AQUACULTURE PRODUCTS MARKET SHARE AND GROWTH RATE (VALUE), BY REGION, 2021

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR AQUACULTURE PRODUCTS MARKET PLAYERS

- FIGURE 7 GROWING DEMAND FOR SEAFOOD TO CREATE OPPORTUNITIES GLOBALLY

- 4.2 ASIA PACIFIC: AQUACULTURE PRODUCTS, BY CULTURE & COUNTRY

- FIGURE 8 CHINA ACCOUNTED FOR LARGEST SHARE OF ASIA PACIFIC MARKET IN 2021

- 4.3 AQUACULTURE PRODUCTS MARKET, BY CULTURE

- FIGURE 9 FRESHWATER SEGMENT TO LEAD DURING FORECAST PERIOD

- 4.4 AQUACULTURE PRODUCTS MARKET, BY SPECIES

- FIGURE 10 AQUATIC ANIMALS TO DOMINATE DURING FORECAST PERIOD

- 4.5 AQUACULTURE PRODUCTS MARKET, BY PRODUCTION

- FIGURE 11 SMALL-SCALE PRODUCTION TO CLAIM LION SHARE DURING FORECAST PERIOD

- 4.6 AQUACULTURE PRODUCTS MARKET, REARING PRODUCT TYPE

- FIGURE 12 ASIA PACIFIC REGION TO DOMINATE MARKET DURING FORECAST PERIOD

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MACROECONOMIC INDICATORS

- 5.2.1 RISE IN NUMBER OF DUAL-INCOME HOUSEHOLDS

- FIGURE 13 US: EMPLOYMENT STATUS OF PARENTS WITH OWN CHILDREN UNDER 18 YEARS, 2018 VS. 2019 (USD BILLION)

- 5.2.2 GROWTH IN WORLD POPULATION

- FIGURE 14 GLOBAL POPULATION, 2005-2025 (BILLION)

- 5.3 MARKET DYNAMICS

- FIGURE 15 AQUACULTURE PRODUCTS MARKET DYNAMICS

- 5.3.1 DRIVERS

- 5.3.1.1 Growth of aquaculture industry

- FIGURE 16 GLOBAL AQUACULTURE PRODUCTION, 2015-2026 (TONNE)

- 5.3.1.2 Increase in health consciousness and environmental awareness

- FIGURE 17 CARBON FOOTPRINT (KG/100G), 2018

- 5.3.1.3 Rise in trend of smart fish farming

- 5.3.2 RESTRAINTS

- 5.3.2.1 Resource exploitation due to overfishing

- FIGURE 18 SHARE OF OVEREXPLOITED FISH STOCK, 1974-2017

- 5.3.3 OPPORTUNITIES

- 5.3.3.1 Increase in government initiatives to support aquaculture

- 5.3.3.2 Growth in demand for convenience food products

- 5.3.3.3 Increase in awareness and incorporation of fishmeal in animal diets

- 5.3.4 CHALLENGES

- 5.3.4.1 Increase in consumer appetite for vegan diets

- FIGURE 19 US PLANT-BASED FOOD SALES, 2018-2021 (USD BILLION)

6 INDUSTRY TRENDS

- 6.1 INTRODUCTION

- 6.2 VALUE CHAIN

- 6.2.1 RESEARCH & DEVELOPMENT

- 6.2.2 RAW MATERIAL SOURCING

- 6.2.3 MANUFACTURING

- 6.2.4 DISTRIBUTION

- 6.2.5 END USERS

- 6.2.6 POST-SALES SERVICES

- FIGURE 20 AQUACULTURE PRODUCTS MARKET: VALUE CHAIN

- 6.3 SUPPLY CHAIN ANALYSIS

- FIGURE 21 AQUACULTURE PRODUCTS MARKET: SUPPLY CHAIN

- 6.4 ECOSYSTEM OF AQUACULTURE PRODUCTS MARKET

- 6.4.1 DEMAND SIDE

- 6.4.2 SUPPLY SIDE

- FIGURE 22 AQUACULTURE PRODUCTS MARKET: ECOSYSTEM MAP

- 6.4.3 ECOSYSTEM MAPPING

- TABLE 3 AQUACULTURE PRODUCTS MARKET: ECOSYSTEM MAPPING

- 6.5 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS' BUSINESSES

- 6.5.1 REVENUE SHIFT AND NEW REVENUE POCKETS IN AQUACULTURE PRODUCTS MARKET

- FIGURE 23 REVENUE SHIFT IMPACTING AQUACULTURE PRODUCTS MARKET

- 6.6 TECHNOLOGY ANALYSIS

- 6.6.1 SMART PUMPS

- 6.6.2 ORAL VACCINE DELIVERY SYSTEM

- 6.7 PRICING ANALYSIS

- 6.7.1 GLOBAL AVERAGE SELLING PRICE, BY REARING PRODUCT TYPE

- FIGURE 24 AVERAGE SELLING PRICE OF AQUACULTURE PRODUCTS, 2021-2023 (USD/TON)

- TABLE 4 AVERAGE SELLING PRICE OF CHEMICALS IN AQUACULTURE PRODUCTS MARKET, BY REGION (USD/TON)

- TABLE 5 AVERAGE SELLING PRICE OF PHARMACEUTICALS IN AQUACULTURE PRODUCTS MARKET, BY REGION (USD/TON)

- 6.8 PATENT ANALYSIS

- FIGURE 25 NUMBER OF PATENTS GRANTED FOR AQUACULTURE PRODUCTS, 2011-2021

- FIGURE 26 REGIONAL ANALYSIS OF PATENTS GRANTED FOR AQUACULTURE PRODUCTS, 2019-2022

- 6.8.1 MAJOR PATENTS

- TABLE 6 LIST OF KEY PATENTS IN AQUACULTURE PRODUCTS, 2019-2022

- 6.9 TRADE ANALYSIS

- 6.9.1 EXPORT SCENARIO: FISH, CRUSTACEANS, MOLLUSKS, AND OTHER AQUATIC INVERTEBRATES

- FIGURE 27 FISH, CRUSTACEAN, MOLLUSK, AND OTHER AQUATIC INVERTEBRATE EXPORT VALUE, BY COUNTRY, 2017-2021 (USD MILLION)

- TABLE 7 EXPORT DATA OF FISH, CRUSTACEANS, MOLLUSKS, AND OTHER AQUATIC INVERTEBRATES FOR COUNTRIES, 2021 (USD THOUSAND)

- 6.9.2 FISH, CRUSTACEANS, MOLLUSKS, AND OTHER AQUATIC INVERTEBRATES

- FIGURE 28 FISH, CRUSTACEAN, MOLLUSK, AND OTHER AQUATIC INVERTEBRATE IMPORT VALUE, BY COUNTRY, 2017-2021 (USD MILLION)

- TABLE 8 IMPORT DATA OF FISH, CRUSTACEANS, MOLLUSKS, AND OTHER AQUATIC INVERTEBRATES FOR KEY COUNTRIES, 2021 (USD THOUSAND)

- 6.10 KEY CONFERENCES AND EVENTS

- TABLE 9 KEY CONFERENCES AND EVENTS IN AQUACULTURE PRODUCTS, 2022-2023

- 6.11 CASE STUDIES

- 6.11.1 SKAGINN 3X: VALUE PUMP SYSTEM

- 6.11.2 MAGIC VALLEY HELI-ARC & MFG. (MVHA): RADIO REMOTE CONTROL

- 6.12 TARIFF AND REGULATORY LANDSCAPE

- 6.12.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 10 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 11 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 12 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 13 SOUTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 14 ROW: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 6.12.2 REGULATORY FRAMEWORK

- 6.12.2.1 International Organization for Standardization (ISO)

- 6.12.2.2 North America

- 6.12.2.3 Europe

- 6.12.2.4 Asia Pacific

- 6.12.2.4.1 India

- 6.12.2.5 Rest of the World

- 6.12.2.5.1 South Africa

- 6.13 PORTER'S FIVE FORCES ANALYSIS

- TABLE 15 AQUACULTURE PRODUCTS MARKET: PORTER'S FIVE FORCES ANALYSIS

- 6.13.1 INTENSITY OF COMPETITIVE RIVALRY

- 6.13.2 BARGAINING POWER OF SUPPLIERS

- 6.13.3 BARGAINING POWER OF BUYERS

- 6.13.4 THREAT OF SUBSTITUTES

- 6.13.5 THREAT OF NEW ENTRANTS

- 6.14 KEY STAKEHOLDERS AND BUYING CRITERIA

- 6.14.1 KEY STAKEHOLDERS IN BUYING PROCESS

- FIGURE 29 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS FOR END USERS

- TABLE 16 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS FOR END USERS

- 6.14.2 BUYING CRITERIA

- FIGURE 30 KEY CRITERIA FOR SELECTING SUPPLIER/VENDOR

- TABLE 17 KEY CRITERIA FOR SELECTING SUPPLIERS/VENDORS

7 AQUACULTURE PRODUCTS MARKET, BY SPECIES

- 7.1 INTRODUCTION

- FIGURE 31 AQUACULTURE PRODUCTS MARKET, BY SPECIES, 2022 VS. 2027 (USD MILLION)

- TABLE 18 AQUACULTURE PRODUCTS MARKET, BY SPECIES, 2019-2021 (USD MILLION)

- TABLE 19 AQUACULTURE PRODUCTS MARKET, BY SPECIES, 2022-2027 (USD MILLION)

- 7.2 AQUATIC ANIMALS

- TABLE 20 ANIMAL AQUACULTURE PRODUCTS MARKET, BY TYPE, 2019-2021 (USD MILLION)

- TABLE 21 ANIMAL AQUACULTURE PRODUCTS MARKET, BY TYPE, 2022-2027 (USD MILLION)

- TABLE 22 ANIMAL AQUACULTURE PRODUCTS MARKET, BY REGION, 2019-2021 (USD MILLION)

- TABLE 23 ANIMAL AQUACULTURE PRODUCTS MARKET, BY REGION, 2022-2027 (USD MILLION)

- 7.2.1 FINFISH

- TABLE 24 FINFISH AQUACULTURE PRODUCTS MARKET, BY REGION, 2019-2021 (USD MILLION)

- TABLE 25 FINFISH AQUACULTURE PRODUCTS MARKET, BY REGION, 2022-2027 (USD MILLION)

- 7.2.2 MOLLUSKS

- TABLE 26 MOLLUSK AQUACULTURE PRODUCTS MARKET, BY REGION, 2019-2021 (USD MILLION)

- TABLE 27 MOLLUSK AQUACULTURE PRODUCTS MARKET, BY REGION, 2022-2027 (USD MILLION)

- 7.2.3 CRUSTACEANS

- TABLE 28 CRUSTACEAN AQUACULTURE PRODUCTS MARKET, BY REGION, 2019-2021 (USD MILLION)

- TABLE 29 CRUSTACEAN AQUACULTURE PRODUCTS MARKET, BY REGION, 2022-2027 (USD MILLION)

- 7.2.4 OTHER AQUATIC ANIMALS

- TABLE 30 OTHER ANIMAL AQUACULTURE PRODUCTS MARKET, BY REGION, 2019-2021 (USD MILLION)

- TABLE 31 OTHER ANIMAL AQUACULTURE PRODUCTS MARKET, BY REGION, 2022-2027 (USD MILLION)

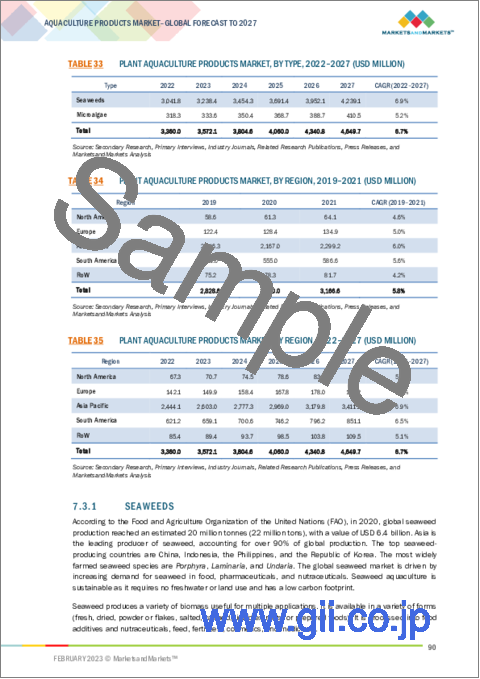

- 7.3 AQUATIC PLANTS

- TABLE 32 PLANT AQUACULTURE PRODUCTS MARKET, BY TYPE, 2019-2021 (USD MILLION)

- TABLE 33 PLANT AQUACULTURE PRODUCTS MARKET, BY TYPE, 2022-2027 (USD MILLION)

- TABLE 34 PLANT AQUACULTURE PRODUCTS MARKET, BY REGION, 2019-2021 (USD MILLION)

- TABLE 35 PLANT AQUACULTURE PRODUCTS MARKET, BY REGION, 2022-2027 (USD MILLION)

- 7.3.1 SEAWEEDS

- TABLE 36 SEAWEED AQUACULTURE PRODUCTS MARKET, BY REGION, 2019-2021 (USD MILLION)

- TABLE 37 SEAWEED AQUACULTURE PRODUCTS MARKET, BY REGION, 2022-2027 (USD MILLION)

- 7.3.2 MICROALGAE

- TABLE 38 MICROALGAE AQUACULTURE MARKET, BY REGION, 2019-2021 (USD MILLION)

- TABLE 39 MICROALGAE AQUACULTURE MARKET, BY REGION, 2022-2027 (USD MILLION)

8 AQUACULTURE PRODUCTS MARKET, BY CULTURE

- 8.1 INTRODUCTION

- FIGURE 32 AQUACULTURE PRODUCTS MARKET, BY CULTURE, 2022 VS. 2027 (USD MILLION)

- TABLE 40 AQUACULTURE PRODUCTS MARKET, BY CULTURE, 2019-2021 (USD MILLION)

- TABLE 41 AQUACULTURE PRODUCTS MARKET, BY CULTURE, 2022-2027 (USD MILLION)

- 8.2 FRESHWATER

- TABLE 42 FRESHWATER AQUACULTURE PRODUCTS MARKET, BY REGION, 2019-2021 (USD MILLION)

- TABLE 43 FRESHWATER AQUACULTURE PRODUCTS MARKET, BY REGION, 2022-2027 (USD MILLION)

- 8.3 MARINE

- TABLE 44 MARINE AQUACULTURE PRODUCTS MARKET, BY REGION, 2019-2021 (USD MILLION)

- TABLE 45 MARINE AQUACULTURE PRODUCTS MARKET, BY REGION, 2022-2027 (USD MILLION)

- 8.4 BRACKISH WATER

- TABLE 46 BRACKISH WATER AQUACULTURE PRODUCTS MARKET, BY REGION, 2019-2021 (USD MILLION)

- TABLE 47 BRACKISH WATER AQUACULTURE PRODUCTS MARKET, BY REGION, 2022-2027 (USD MILLION)

9 AQUACULTURE PRODUCTS MARKET, BY PRODUCTION TYPE

- 9.1 INTRODUCTION

- FIGURE 33 AQUACULTURE PRODUCTS MARKET, BY PRODUCTION TYPE, 2022 VS. 2027 (USD MILLION)

- TABLE 48 AQUACULTURE PRODUCTS MARKET, BY PRODUCTION TYPE, 2019-2021 (USD MILLION)

- TABLE 49 AQUACULTURE PRODUCTS MARKET, BY PRODUCTION TYPE, 2022-2027 (USD MILLION)

- 9.2 SMALL-SCALE

- TABLE 50 SMALL-SCALE AQUACULTURE PRODUCTS MARKET, BY REGION, 2019-2021 (USD MILLION)

- TABLE 51 SMALL-SCALE AQUACULTURE PRODUCTS MARKET, BY REGION, 2022-2027 (USD MILLION)

- 9.3 MEDIUM- & LARGE-SCALE

- TABLE 52 MEDIUM- &-LARGE-SCALE AQUACULTURE PRODUCTS MARKET, BY REGION, 2019-2021 (USD MILLION)

- TABLE 53 MEDIUM- &-LARGE-SCALE AQUACULTURE PRODUCTS MARKET, BY REGION, 2022-2027 (USD MILLION)

10 AQUACULTURE PRODUCTS MARKET, BY REARING PRODUCT TYPE

- 10.1 INTRODUCTION

- FIGURE 34 AQUACULTURE PRODUCTS MARKET, BY REARING PRODUCT TYPE, 2022 VS. 2027 (USD MILLION)

- TABLE 54 AQUACULTURE PRODUCTS MARKET, BY REARING PRODUCT TYPE, 2019-2021 (USD MILLION)

- TABLE 55 AQUACULTURE PRODUCTS MARKET, BY REARING PRODUCT TYPE, 2022-2027 (USD MILLION)

- 10.2 EQUIPMENT

- TABLE 56 AQUACULTURE EQUIPMENT MARKET, BY TYPE, 2019-2021 (USD MILLION)

- TABLE 57 AQUACULTURE EQUIPMENT MARKET, BY TYPE, 2022-2027 (USD MILLION)

- TABLE 58 AQUACULTURE EQUIPMENT MARKET, BY REGION, 2019-2021 (USD MILLION)

- TABLE 59 AQUACULTURE EQUIPMENT MARKET, BY REGION, 2022-2027 (USD MILLION)

- 10.2.1 CONTAINMENT EQUIPMENT

- TABLE 60 AQUACULTURE CONTAINMENT EQUIPMENT MARKET, BY REGION, 2019-2021 (USD MILLION)

- TABLE 61 AQUACULTURE CONTAINMENT EQUIPMENT MARKET, BY REGION, 2022-2027 (USD MILLION)

- 10.2.2 WATER PUMPS & FILTERS

- TABLE 62 AQUACULTURE WATER PUMPS & FILTERS MARKET, BY REGION, 2019-2021 (USD MILLION)

- TABLE 63 AQUACULTURE WATER PUMPS & FILTERS MARKET, BY REGION, 2022-2027 (USD MILLION)

- 10.2.3 WATER CIRCULATING & AERATING EQUIPMENT

- TABLE 64 AQUACULTURE WATER CIRCULATING & AERATING EQUIPMENT MARKET, BY REGION, 2019-2021 (USD MILLION)

- TABLE 65 AQUACULTURE WATER CIRCULATING & AERATING EQUIPMENT MARKET, BY REGION, 2022-2027 (USD MILLION)

- 10.2.4 CLEANING EQUIPMENT

- TABLE 66 AQUACULTURE CLEANING EQUIPMENT MARKET, BY REGION, 2019-2021 (USD MILLION)

- TABLE 67 AQUACULTURE CLEANING EQUIPMENT MARKET, BY REGION, 2022-2027 (USD MILLION)

- 10.2.5 FEEDERS

- TABLE 68 AQUACULTURE FEEDERS MARKET, BY REGION, 2019-2021 (USD MILLION)

- TABLE 69 AQUACULTURE FEEDERS MARKET, BY REGION, 2022-2027 (USD MILLION)

- 10.2.6 OTHER EQUIPMENT

- TABLE 70 OTHER AQUACULTURE EQUIPMENT MARKET, BY REGION, 2019-2021 (USD MILLION)

- TABLE 71 OTHER AQUACULTURE EQUIPMENT MARKET, BY REGION, 2022-2027 (USD MILLION)

- 10.3 CHEMICALS

- TABLE 72 AQUACULTURE CHEMICALS MARKET, BY REGION, 2019-2021 (USD MILLION)

- TABLE 73 AQUACULTURE CHEMICALS MARKET, BY REGION, 2022-2027 (USD MILLION)

- TABLE 74 AQUACULTURE CHEMICALS MARKET, BY REGION, 2019-2021 (KT)

- TABLE 75 AQUACULTURE CHEMICALS MARKET, BY REGION, 2022-2027 (KT)

- 10.4 FERTILIZERS

- TABLE 76 AQUACULTURE FERTILIZERS MARKET, BY REGION, 2019-2021 (USD MILLION)

- TABLE 77 AQUACULTURE FERTILIZERS MARKET, BY REGION, 2022-2027 (USD MILLION)

- 10.5 PHARMACEUTICALS

- TABLE 78 AQUACULTURE PHARMACEUTICALS MARKET, BY REGION, 2019-2021 (USD MILLION)

- TABLE 79 AQUACULTURE PHARMACEUTICALS MARKET, BY REGION, 2022-2027 (USD MILLION)

- TABLE 80 AQUACULTURE PHARMACEUTICALS MARKET, BY REGION, 2019-2021 (KT)

- TABLE 81 AQUACULTURE PHARMACEUTICALS MARKET, BY REGION, 2022-2027 (KT)

11 AQUACULTURE PRODUCTS MARKET, BY REGION

- 11.1 INTRODUCTION

- FIGURE 35 GEOGRAPHIC SNAPSHOT (2022-2027): INDONESIA TO GROW AT HIGHEST RATE AND IS EMERGING AS NEW HOTSPOT

- TABLE 82 AQUACULTURE PRODUCTS MARKET, BY REGION, 2019-2021 (USD MILLION)

- TABLE 83 AQUACULTURE PRODUCTS MARKET, BY REGION, 2022-2027 (USD MILLION)

- 11.2 RECESSION IMPACT ON AQUACULTURE PRODUCTS MARKET

- 11.2.1 MACRO INDICATORS OF RECESSION

- FIGURE 36 INDICATORS OF RECESSION

- FIGURE 37 GLOBAL INFLATION RATE, 2011-2021

- FIGURE 38 GLOBAL GDP, 2011-2021 (USD TRILLION)

- TABLE 84 RECESSION INDICATORS AND THEIR IMPACT ON AQUACULTURE PRODUCTS MARKET

- FIGURE 39 GLOBAL AQUACULTURE PRODUCTS MARKET: PREVIOUS FORECAST VS. RECESSION FORECAST

- 11.3 NORTH AMERICA

- 11.3.1 NORTH AMERICA: RECESSION IMPACT ANALYSIS

- FIGURE 40 NORTH AMERICA: AQUACULTURE PRODUCTS MARKET: RECESSION IMPACT ANALYSIS

- TABLE 85 NORTH AMERICA: AQUACULTURE PRODUCTS MARKET, BY COUNTRY, 2019-2021 (USD MILLION)

- TABLE 86 NORTH AMERICA: AQUACULTURE PRODUCTS MARKET, BY COUNTRY, 2022-2027 (USD MILLION)

- TABLE 87 NORTH AMERICA: AQUACULTURE PRODUCTS MARKET, BY SPECIES, 2019-2021 (USD MILLION)

- TABLE 88 NORTH AMERICA: AQUACULTURE PRODUCTS MARKET, BY SPECIES, 2022-2027 (USD MILLION)

- TABLE 89 NORTH AMERICA: ANIMAL AQUACULTURE PRODUCTS MARKET, BY TYPE, 2019-2021 (USD MILLION)

- TABLE 90 NORTH AMERICA: ANIMAL AQUACULTURE PRODUCTS MARKET, BY TYPE, 2022-2027 (USD MILLION)

- TABLE 91 NORTH AMERICA: PLANT AQUACULTURE PRODUCTS MARKET, BY TYPE, 2019-2021 (USD MILLION)

- TABLE 92 NORTH AMERICA: PLANT AQUACULTURE PRODUCTS MARKET, BY TYPE, 2022-2027 (USD MILLION)

- TABLE 93 NORTH AMERICA: AQUACULTURE PRODUCTS MARKET, BY PRODUCTION TYPE, 2019-2021 (USD MILLION)

- TABLE 94 NORTH AMERICA: AQUACULTURE PRODUCTS MARKET, BY PRODUCTION TYPE, 2022-2027 (USD MILLION)

- TABLE 95 NORTH AMERICA: AQUACULTURE PRODUCTS MARKET, BY CULTURE, 2019-2021 (USD MILLION)

- TABLE 96 NORTH AMERICA: AQUACULTURE PRODUCTS MARKET, BY CULTURE, 2022-2027 (USD MILLION)

- TABLE 97 NORTH AMERICA: AQUACULTURE PRODUCTS MARKET, BY REARING PRODUCT TYPE, 2019-2021 (USD MILLION)

- TABLE 98 NORTH AMERICA: AQUACULTURE PRODUCTS MARKET, BY REARING PRODUCT TYPE, 2022-2027 (USD MILLION)

- TABLE 99 NORTH AMERICA: AQUACULTURE PRODUCTS MARKET, BY EQUIPMENT TYPE, 2019-2021 (USD MILLION)

- TABLE 100 NORTH AMERICA: AQUACULTURE PRODUCTS MARKET, BY EQUIPMENT TYPE, 2022-2027 (USD MILLION)

- 11.3.2 US

- 11.3.2.1 Focus on increasing domestic fish production demand

- TABLE 101 US: AQUACULTURE PRODUCTS MARKET, BY REARING PRODUCT TYPE, 2019-2021 (USD MILLION)

- TABLE 102 US: AQUACULTURE PRODUCTS MARKET, BY REARING PRODUCT TYPE, 2022-2027 (USD MILLION)

- 11.3.3 CANADA

- 11.3.3.1 Government support for technological advancements

- TABLE 103 CANADA: AQUACULTURE PRODUCTS MARKET, BY REARING PRODUCT TYPE, 2019-2021 (USD MILLION)

- TABLE 104 CANADA: AQUACULTURE PRODUCTS MARKET, BY REARING PRODUCT TYPE, 2022-2027 (USD MILLION)

- 11.3.4 MEXICO

- 11.3.4.1 Domestic consumption of seafood and meeting export demand

- TABLE 105 MEXICO: AQUACULTURE PRODUCTS MARKET, BY REARING PRODUCT TYPE, 2019-2021 (USD MILLION)

- TABLE 106 MEXICO: AQUACULTURE PRODUCTS MARKET, BY REARING PRODUCT TYPE, 2022-2027 (USD MILLION)

- 11.4 EUROPE

- 11.4.1 EUROPE: RECESSION IMPACT ANALYSIS

- TABLE 107 EUROPE: AQUACULTURE PRODUCTS MARKET, BY COUNTRY, 2019-2021 (USD MILLION)

- TABLE 108 EUROPE: AQUACULTURE PRODUCTS MARKET, BY COUNTRY, 2022-2027 (USD MILLION)

- TABLE 109 EUROPE: AQUACULTURE PRODUCTS MARKET, BY SPECIES, 2019-2021 (USD MILLION)

- TABLE 110 EUROPE: AQUACULTURE PRODUCTS MARKET, BY SPECIES, 2022-2027 (USD MILLION)

- TABLE 111 EUROPE: ANIMAL AQUACULTURE PRODUCTS MARKET, BY TYPE, 2019-2021 (USD MILLION)

- TABLE 112 EUROPE: ANIMAL AQUACULTURE PRODUCTS MARKET, BY TYPE, 2022-2027 (USD MILLION)

- TABLE 113 EUROPE: PLANT AQUACULTURE PRODUCTS MARKET, BY TYPE, 2019-2021 (USD MILLION)

- TABLE 114 EUROPE: PLANT AQUACULTURE PRODUCTS MARKET, BY TYPE, 2022-2027 (USD MILLION)

- TABLE 115 EUROPE: AQUACULTURE PRODUCTS MARKET, BY PRODUCTION TYPE, 2019-2021 (USD MILLION)

- TABLE 116 EUROPE: AQUACULTURE PRODUCTS MARKET, BY PRODUCTION TYPE, 2022-2027 (USD MILLION)

- TABLE 117 EUROPE: AQUACULTURE PRODUCTS MARKET, BY CULTURE, 2019-2021 (USD MILLION)

- TABLE 118 EUROPE: AQUACULTURE PRODUCTS MARKET, BY CULTURE, 2022-2027 (USD MILLION)

- TABLE 119 EUROPE: AQUACULTURE PRODUCTS MARKET, BY REARING PRODUCT TYPE, 2019-2021 (USD MILLION)

- TABLE 120 EUROPE: AQUACULTURE PRODUCTS MARKET, BY REARING PRODUCT TYPE, 2022-2027 (USD MILLION)

- TABLE 121 EUROPE: AQUACULTURE PRODUCTS MARKET, BY EQUIPMENT TYPE, 2019-2021 (USD MILLION)

- TABLE 122 EUROPE: AQUACULTURE PRODUCTS MARKET, BY EQUIPMENT TYPE, 2022-2027 (USD MILLION)

- 11.4.2 NORWAY

- 11.4.2.1 Greater focus on advancing aquaculture products infrastructure

- TABLE 123 NORWAY: AQUACULTURE PRODUCTS MARKET, BY REARING PRODUCT TYPE, 2019-2021 (USD MILLION)

- TABLE 124 NORWAY: AQUACULTURE PRODUCTS MARKET, BY REARING PRODUCT TYPE, 2022-2027 (USD MILLION)

- 11.4.3 UK

- 11.4.3.1 Increase in investment in aquaculture products

- TABLE 125 UK: AQUACULTURE PRODUCTS MARKET, BY REARING PRODUCT TYPE, 2019-2021 (USD MILLION)

- TABLE 126 UK: AQUACULTURE PRODUCTS MARKET, BY REARING PRODUCT TYPE, 2022-2027 (USD MILLION)

- 11.4.4 SPAIN

- 11.4.4.1 Largest aquaculture sector in EU and investments by European Commission

- TABLE 127 SPAIN: AQUACULTURE PRODUCTS MARKET, BY REARING PRODUCT TYPE, 2019-2021 (USD MILLION)

- TABLE 128 SPAIN: AQUACULTURE PRODUCTS MARKET, BY REARING PRODUCT TYPE, 2022-2027 (USD MILLION)

- 11.4.5 ITALY

- 11.4.5.1 High fish consumption to drive demand for aquaculture products in region

- TABLE 129 ITALY: AQUACULTURE PRODUCTS MARKET, BY REARING PRODUCT TYPE, 2019-2021 (USD MILLION)

- TABLE 130 ITALY: AQUACULTURE PRODUCTS MARKET, BY REARING PRODUCT TYPE, 2022-2027 (USD MILLION)

- 11.4.6 FRANCE

- 11.4.6.1 Growth in development of advanced aquaculture facilities

- TABLE 131 FRANCE: AQUACULTURE PRODUCTS MARKET, BY REARING PRODUCT TYPE, 2019-2021 (USD MILLION)

- TABLE 132 FRANCE: AQUACULTURE PRODUCTS MARKET, BY REARING PRODUCT TYPE, 2022-2027 (USD MILLION)

- 11.4.7 TURKEY

- 11.4.7.1 Sustainable development of aquaculture products to fuel demand for RAS equipment

- TABLE 133 TURKEY: AQUACULTURE PRODUCTS MARKET, BY REARING PRODUCT TYPE, 2019-2021 (USD MILLION)

- TABLE 134 TURKEY: AQUACULTURE PRODUCTS MARKET, BY REARING PRODUCT TYPE, 2022-2027 (USD MILLION)

- 11.4.8 REST OF EUROPE

- TABLE 135 REST OF EUROPE: AQUACULTURE PRODUCTS MARKET, BY REARING PRODUCT TYPE, 2019-2021 (USD MILLION)

- TABLE 136 REST OF EUROPE: AQUACULTURE PRODUCTS MARKET, BY REARING PRODUCT TYPE, 2022-2027 (USD MILLION)

- 11.5 ASIA PACIFIC

- 11.5.1 ASIA PACIFIC: RECESSION IMPACT ANALYSIS

- FIGURE 41 ASIA PACIFIC: MARKET SNAPSHOT

- TABLE 137 ASIA PACIFIC: AQUACULTURE PRODUCTS MARKET, BY COUNTRY, 2019-2021 (USD MILLION)

- TABLE 138 ASIA PACIFIC: AQUACULTURE PRODUCTS MARKET, BY COUNTRY, 2022-2027 (USD MILLION)

- TABLE 139 ASIA PACIFIC: AQUACULTURE PRODUCTS MARKET, BY SPECIES, 2019-2021 (USD MILLION)

- TABLE 140 ASIA PACIFIC: AQUACULTURE PRODUCTS MARKET, BY SPECIES, 2022-2027 (USD MILLION)

- TABLE 141 ASIA PACIFIC: ANIMAL AQUACULTURE PRODUCTS MARKET, BY TYPE, 2019-2021 (USD MILLION)

- TABLE 142 ASIA PACIFIC: ANIMAL AQUACULTURE PRODUCTS MARKET, BY TYPE, 2022-2027 (USD MILLION)

- TABLE 143 ASIA PACIFIC: PLANT AQUACULTURE PRODUCTS MARKET, BY TYPE, 2019-2021 (USD MILLION)

- TABLE 144 ASIA PACIFIC: PLANT AQUACULTURE PRODUCTS MARKET, BY TYPE, 2022-2027 (USD MILLION)

- TABLE 145 ASIA PACIFIC: AQUACULTURE PRODUCTS MARKET, BY PRODUCTION TYPE, 2019-2021 (USD MILLION)

- TABLE 146 ASIA PACIFIC: AQUACULTURE PRODUCTS MARKET, BY PRODUCTION TYPE, 2022-2027 (USD MILLION)

- TABLE 147 ASIA PACIFIC: AQUACULTURE PRODUCTS MARKET, BY CULTURE, 2019-2021 (USD MILLION)

- TABLE 148 ASIA PACIFIC: AQUACULTURE PRODUCTS MARKET, BY CULTURE, 2022-2027 (USD MILLION)

- TABLE 149 ASIA PACIFIC: AQUACULTURE PRODUCTS MARKET, BY REARING PRODUCT TYPE, 2019-2021 (USD MILLION)

- TABLE 150 ASIA PACIFIC: AQUACULTURE PRODUCTS MARKET, BY REARING PRODUCT TYPE, 2022-2027 (USD MILLION)

- TABLE 151 ASIA PACIFIC: AQUACULTURE PRODUCTS MARKET, BY EQUIPMENT TYPE, 2019-2021 (USD MILLION)

- TABLE 152 ASIA PACIFIC: AQUACULTURE PRODUCTS MARKET, BY EQUIPMENT TYPE, 2022-2027 (USD MILLION)

- 11.5.2 CHINA

- 11.5.2.1 Expansion of aquaculture sector with processing, distribution, and cold chain systems to drive domestic demand

- TABLE 153 CHINA: AQUACULTURE PRODUCTS MARKET, BY REARING PRODUCT TYPE, 2019-2021 (USD MILLION)

- TABLE 154 CHINA: AQUACULTURE PRODUCTS MARKET, BY REARING PRODUCT TYPE, 2022-2027 (USD MILLION)

- 11.5.3 INDIA

- 11.5.3.1 Government monetary support toward fisheries and farmer welfare

- TABLE 155 INDIA: AQUACULTURE PRODUCTS MARKET, BY REARING PRODUCT TYPE, 2019-2021 (USD MILLION)

- TABLE 156 INDIA: AQUACULTURE PRODUCTS MARKET, BY REARING PRODUCT TYPE, 2022-2027 (USD MILLION)

- 11.5.4 JAPAN

- 11.5.4.1 Focus on technology to boost smart aquaculture equipment demand

- TABLE 157 JAPAN: AQUACULTURE PRODUCTS MARKET, BY REARING PRODUCT TYPE, 2019-2021 (USD MILLION)

- TABLE 158 JAPAN: AQUACULTURE PRODUCTS MARKET, BY REARING PRODUCT TYPE, 2022-2027 (USD MILLION)

- 11.5.5 INDONESIA

- 11.5.5.1 Infrastructural improvement for shrimp production

- TABLE 159 INDONESIA: AQUACULTURE PRODUCTS MARKET, BY REARING PRODUCT TYPE, 2019-2021 (USD MILLION)

- TABLE 160 INDONESIA: AQUACULTURE PRODUCTS MARKET, BY REARING PRODUCT TYPE, 2022-2027 (USD MILLION)

- 11.5.6 THAILAND

- 11.5.6.1 Environmentally friendly seafood production to drive sustainable aquaculture

- TABLE 161 THAILAND: AQUACULTURE PRODUCTS MARKET, BY REARING PRODUCT TYPE, 2019-2021 (USD MILLION)

- TABLE 162 THAILAND: AQUACULTURE PRODUCTS MARKET, BY REARING PRODUCT TYPE, 2022-2027 (USD MILLION)

- 11.5.7 VIETNAM

- 11.5.7.1 Rise in seafood exports from country

- TABLE 163 VIETNAM: AQUACULTURE PRODUCTS MARKET, BY REARING PRODUCT TYPE, 2019-2021 (USD MILLION)

- TABLE 164 VIETNAM: AQUACULTURE PRODUCTS MARKET, BY REARING PRODUCT TYPE, 2022-2027 (USD MILLION)

- 11.5.8 REST OF ASIA PACIFIC

- TABLE 165 REST OF ASIA PACIFIC: AQUACULTURE PRODUCTS MARKET, BY REARING PRODUCT TYPE, 2019-2021 (USD MILLION)

- TABLE 166 REST OF ASIA PACIFIC: AQUACULTURE PRODUCTS MARKET, BY REARING PRODUCT TYPE, 2022-2027 (USD MILLION)

- 11.6 SOUTH AMERICA

- 11.6.1 SOUTH AMERICA: RECESSION IMPACT ANALYSIS

- FIGURE 42 SOUTH AMERICA: MARKET SNAPSHOT

- TABLE 167 SOUTH AMERICA: AQUACULTURE PRODUCTS MARKET, BY COUNTRY, 2019-2021 (USD MILLION)

- TABLE 168 SOUTH AMERICA: AQUACULTURE PRODUCTS MARKET, BY COUNTRY, 2022-2027 (USD MILLION)

- TABLE 169 SOUTH AMERICA: AQUACULTURE PRODUCTS MARKET, BY SPECIES, 2019-2021 (USD MILLION)

- TABLE 170 SOUTH AMERICA: AQUACULTURE PRODUCTS MARKET, BY SPECIES, 2022-2027 (USD MILLION)

- TABLE 171 SOUTH AMERICA: ANIMAL AQUACULTURE PRODUCTS MARKET, BY TYPE, 2019-2021 (USD MILLION)

- TABLE 172 SOUTH AMERICA: ANIMAL AQUACULTURE PRODUCTS MARKET, BY TYPE, 2022-2027 (USD MILLION)

- TABLE 173 SOUTH AMERICA: PLANT AQUACULTURE PRODUCTS MARKET, BY TYPE, 2019-2021 (USD MILLION)

- TABLE 174 SOUTH AMERICA: PLANT AQUACULTURE PRODUCTS MARKET, BY TYPE, 2022-2027 (USD MILLION)

- TABLE 175 SOUTH AMERICA: AQUACULTURE PRODUCTS MARKET, BY PRODUCTION TYPE, 2019-2021 (USD MILLION)

- TABLE 176 SOUTH AMERICA: AQUACULTURE PRODUCTS MARKET, BY PRODUCTION TYPE, 2022-2027 (USD MILLION)

- TABLE 177 SOUTH AMERICA: AQUACULTURE PRODUCTS MARKET, BY CULTURE, 2019-2021 (USD MILLION)

- TABLE 178 SOUTH AMERICA: AQUACULTURE PRODUCTS MARKET, BY CULTURE, 2022-2027 (USD MILLION)

- TABLE 179 SOUTH AMERICA: AQUACULTURE PRODUCTS MARKET, BY REARING PRODUCT TYPE, 2019-2021 (USD MILLION)

- TABLE 180 SOUTH AMERICA: AQUACULTURE PRODUCTS MARKET, BY REARING PRODUCT TYPE, 2022-2027 (USD MILLION)

- TABLE 181 SOUTH AMERICA: AQUACULTURE PRODUCTS MARKET, BY EQUIPMENT TYPE, 2019-2021 (USD MILLION)

- TABLE 182 SOUTH AMERICA: AQUACULTURE PRODUCTS MARKET, BY EQUIPMENT TYPE, 2022-2027 (USD MILLION)

- 11.6.2 BRAZIL

- 11.6.2.1 Seafood consumption to boost aquaculture products market

- TABLE 183 BRAZIL: AQUACULTURE PRODUCTS MARKET, BY REARING PRODUCT TYPE, 2019-2021 (USD MILLION)

- TABLE 184 BRAZIL: AQUACULTURE PRODUCTS MARKET, BY REARING PRODUCT TYPE, 2022-2027 (USD MILLION)

- 11.6.3 CHILE

- 11.6.3.1 Favorable government policies to boost market

- TABLE 185 CHILE: AQUACULTURE PRODUCTS MARKET, BY REARING PRODUCT TYPE, 2019-2021 (USD MILLION)

- TABLE 186 CHILE: AQUACULTURE PRODUCTS MARKET, BY REARING PRODUCT TYPE, 2022-2027 (USD MILLION)

- 11.6.4 ECUADOR

- 11.6.4.1 New legal framework to boost aquaculture industry

- TABLE 187 ECUADOR: AQUACULTURE PRODUCTS MARKET, BY REARING PRODUCT TYPE, 2019-2021 (USD MILLION)

- TABLE 188 ECUADOR: AQUACULTURE PRODUCTS MARKET, BY REARING PRODUCT TYPE, 2022-2027 (USD MILLION)

- 11.6.5 REST OF SOUTH AMERICA

- TABLE 189 REST OF SOUTH AMERICA: AQUACULTURE PRODUCTS MARKET, BY REARING PRODUCT TYPE, 2019-2021 (USD MILLION)

- TABLE 190 REST OF SOUTH AMERICA: AQUACULTURE PRODUCTS MARKET, BY REARING PRODUCT TYPE, 2022-2027 (USD MILLION)

- 11.7 REST OF THE WORLD (ROW)

- 11.7.1 ROW: RECESSION IMPACT ANALYSIS

- TABLE 191 ROW: AQUACULTURE PRODUCTS MARKET, BY REGION, 2019-2021 (USD MILLION)

- TABLE 192 ROW: AQUACULTURE PRODUCTS MARKET, BY REGION, 2022-2027 (USD MILLION)

- TABLE 193 ROW: AQUACULTURE PRODUCTS MARKET, BY SPECIES, 2019-2021 (USD MILLION)

- TABLE 194 ROW: AQUACULTURE PRODUCTS MARKET, BY SPECIES, 2022-2027 (USD MILLION)

- TABLE 195 ROW: ANIMAL AQUACULTURE PRODUCTS MARKET, BY TYPE, 2019-2021 (USD MILLION)

- TABLE 196 ROW: ANIMAL AQUACULTURE PRODUCTS MARKET, BY TYPE, 2022-2027 (USD MILLION)

- TABLE 197 ROW: PLANT AQUACULTURE PRODUCTS MARKET, BY TYPE, 2019-2021 (USD MILLION)

- TABLE 198 ROW: PLANT AQUACULTURE PRODUCTS MARKET, BY TYPE, 2022-2027 (USD MILLION)

- TABLE 199 ROW: AQUACULTURE PRODUCTS MARKET, BY PRODUCTION TYPE, 2019-2021 (USD MILLION)

- TABLE 200 ROW: AQUACULTURE PRODUCTS MARKET, BY PRODUCTION TYPE, 2022-2027 (USD MILLION)

- TABLE 201 ROW: AQUACULTURE PRODUCTS MARKET, BY CULTURE, 2019-2021 (USD MILLION)

- TABLE 202 ROW: AQUACULTURE PRODUCTS MARKET, BY CULTURE, 2022-2027 (USD MILLION)

- TABLE 203 ROW: AQUACULTURE PRODUCTS MARKET, BY REARING PRODUCT TYPE, 2019-2021 (USD MILLION)

- TABLE 204 ROW: AQUACULTURE PRODUCTS MARKET, BY REARING PRODUCT TYPE, 2022-2027 (USD MILLION)

- TABLE 205 ROW: AQUACULTURE PRODUCTS MARKET, BY EQUIPMENT TYPE, 2019-2021 (USD MILLION)

- TABLE 206 ROW: AQUACULTURE PRODUCTS MARKET, BY EQUIPMENT TYPE, 2022-2027 (USD MILLION)

- 11.7.2 AFRICA

- 11.7.2.1 EU-funded projects in Africa

- TABLE 207 AFRICA: AQUACULTURE PRODUCTS MARKET, BY REARING PRODUCT TYPE, 2019-2021 (USD MILLION)

- TABLE 208 AFRICA: AQUACULTURE PRODUCTS MARKET, BY REARING PRODUCT TYPE, 2022-2027 (USD MILLION)

- 11.7.3 MIDDLE EAST

- 11.7.3.1 Government strategic initiatives and collaborations

- TABLE 209 MIDDLE EAST: AQUACULTURE PRODUCTS MARKET, BY REARING PRODUCT TYPE, 2019-2021 (USD MILLION)

- TABLE 210 MIDDLE EAST: AQUACULTURE PRODUCTS MARKET, BY REARING PRODUCT TYPE, 2022-2027 (USD MILLION)

12 COMPETITIVE LANDSCAPE

- 12.1 OVERVIEW

- 12.2 MARKET SHARE ANALYSIS

- TABLE 211 AQUACULTURE PRODUCTS MARKET SHARE (CONSOLIDATED)

- 12.3 KEY PLAYER STRATEGIES

- 12.4 SEGMENTAL REVENUE ANALYSIS OF KEY PLAYERS

- FIGURE 43 SEGMENTAL REVENUE ANALYSIS OF KEY MARKET PLAYERS, 2017-2021 (USD MILLION)

- 12.5 COMPANY EVALUATION QUADRANT (KEY PLAYERS)

- 12.5.1 STARS

- 12.5.2 PERVASIVE PLAYERS

- 12.5.3 EMERGING LEADERS

- 12.5.4 PARTICIPANTS

- FIGURE 44 AQUACULTURE PRODUCTS MARKET, COMPANY EVALUATION QUADRANT, 2022 (OVERALL MARKET)

- 12.5.5 PRODUCT FOOTPRINT

- TABLE 212 COMPANY PRODUCT FOOTPRINT, BY SPECIES TYPE

- TABLE 213 COMPANY PRODUCT FOOTPRINT, BY REARING PRODUCT TYPE

- TABLE 214 COMPANY PRODUCT FOOTPRINT, BY REGION

- TABLE 215 OVERALL COMPANY FOOTPRINT

- 12.6 COMPANY EVALUATION QUADRANT (STARTUPS/SMES)

- 12.6.1 PROGRESSIVE COMPANIES

- 12.6.2 STARTING BLOCKS

- 12.6.3 RESPONSIVE COMPANIES

- 12.6.4 DYNAMIC COMPANIES

- FIGURE 45 AQUACULTURE PRODUCTS MARKET, COMPANY EVALUATION QUADRANT, 2022 (STARTUPS/SMES)

- 12.7 COMPETITIVE BENCHMARKING

- TABLE 216 AQUACULTURE PRODUCTS MARKET: DETAILED LIST OF KEY STARTUPS/SMES

- TABLE 217 AQUACULTURE PRODUCTS MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUP/SMES

- 12.8 DEALS AND OTHER DEVELOPMENTS

- 12.8.1 DEALS

- TABLE 218 AQUACULTURE PRODUCTS MARKET: DEALS, FEBRUARY 2019-AUGUST 2022

- 12.8.2 OTHER DEVELOPMENTS

- TABLE 219 AQUACULTURE PRODUCTS MARKET: OTHERS, AUGUST 2022-NOVEMBER 2022

13 COMPANY PROFILES

- 13.1 KEY PLAYERS

- 13.1.1 PENTAIR PLC

- 13.1.2 AKVA GROUP

- 13.1.3 XYLEM INC

- 13.1.4 AQUACULTURE EQUIPMENT LTD

- 13.1.5 AQUACULTURE SYSTEM TECHNOLOGIES, LLC

- 13.1.6 LUXSOL

- 13.1.7 PIONEER GROUP

- 13.1.8 CPI EQUIPMENT INC

- 13.1.9 ASAKUA

- 13.1.10 FREA AQUACULTURE SOLUTIONS

- 13.1.11 LIFEGARD AQUATICS

- 13.1.12 TAN INTERNATIONAL LTD

- 13.1.13 REEF INDUSTRIES, INC

- 13.1.14 AQUAFARM EQUIPMENT AS

- 13.1.15 MAGIC VALLEY HELI-ARC, MFG, INC

- 13.2 STARTUPS/SMES

- 13.2.1 ELIMAT SL

- 13.2.2 EUSKAN

- 13.2.3 SKAGINN 3X

- 13.2.4 MILANESE

- 13.2.5 SMIR AS

- 13.2.6 KJAERGAARD MASKINFABRIK AS

- 13.2.7 BOSMAN WATERMANAGEMENT BV

- 13.2.8 RODELTA

- 13.2.9 IRAS A/S

- 13.2.10 HIDROSTAL

14 ADJACENT & RELATED MARKETS

- 14.1 INTRODUCTION

- 14.2 LIMITATIONS

- 14.3 FISH PUMPS MARKET

- 14.3.1 MARKET DEFINITION

- 14.3.2 MARKET OVERVIEW

- 14.3.3 FISH PUMPS MARKET, BY SIZE

- 14.3.4 FISH PUMPS MARKET, BY REGION

- 14.4 AQUATIC HERBICIDES MARKET

- 14.4.1 MARKET DEFINITION

- 14.4.2 MARKET OVERVIEW

- 14.4.3 AQUATIC HERBICIDES MARKET, BY TYPE

- 14.4.4 AQUATIC HERBICIDES MARKET, BY REGION

15 APPENDIX

- 15.1 DISCUSSION GUIDE

- 15.2 KNOWLEDGESTORE: MARKETSANDMARKETS SUBSCRIPTION PORTAL

- 15.3 AVAILABLE CUSTOMIZATIONS

- 15.4 RELATED REPORTS

- 15.5 AUTHOR DETAILS