|

|

市場調査レポート

商品コード

1216963

クラウドデータセキュリティの世界市場:提供製品/サービス別・組織規模別 (大企業、中小企業)・提供方式別・業種別 (BFSI、小売業・eコマース、政府・防衛、医療・ライフサイエンス、IT・ITeS、通信)・地域別の将来予測 (2027年まで)Cloud Data Security Market by Offering, Organization Size (Large Enterprises and SMEs), Offering Type, Vertical (BFSI, Retail & eCommerce, Government and Defense, Healthcare and Life Sciences, IT and ITeS, Telecom) and Region - Global Forecast to 2027 |

||||||

|

● お客様のご希望に応じて、既存データの加工や未掲載情報(例:国別セグメント)の追加などの対応が可能です。 詳細はお問い合わせください。 |

|||||||

| クラウドデータセキュリティの世界市場:提供製品/サービス別・組織規模別 (大企業、中小企業)・提供方式別・業種別 (BFSI、小売業・eコマース、政府・防衛、医療・ライフサイエンス、IT・ITeS、通信)・地域別の将来予測 (2027年まで) |

|

出版日: 2023年02月07日

発行: MarketsandMarkets

ページ情報: 英文 273 Pages

納期: 即納可能

|

- 全表示

- 概要

- 目次

世界のクラウドデータセキュリティの市場規模は、2022年の44億米ドルから2027年には91億米ドルへと、予測期間中に15.5%のCAGRで成長すると予測されています。

この市場は、セキュリティ関連の侵害、サイバー攻撃の危険性の拡大、企業におけるクラウドサービスの採用拡大など、いくつかの要因によって有望な成長ポテンシャルを秘めています。しかし、クラウドデータセキュリティ・ソリューションの導入と管理は非常に複雑であり、また企業とクラウドセキュリティサービスプロバイダーとの間の協力関係の欠如や不信感が、市場拡大の妨げになると予測されます。

組織規模別では、中小企業向けが予測期間中に高いCAGRで成長すると予測されています。各種クラウドサービスの活用で場所を選ばずにビジネスを展開できることや、各種規制の強化、中小企業向けの全く新しい防御施術の開発・提供といった要因が、中小企業向け市場の成長を促しています。

業種別では、BFSI分野が予測期間中に最大の市場規模を占める見通しです。各国の金融当局によるセキュリティ規制の強化や、安全でコンプライアンスに準拠したクラウドへの要求から、BFSI向けクラウドセキュリティ市場は今後さらに拡大すると予想されます。

提供方式別では、フルマネージド型が予測期間中に高いCAGRで成長すると見込まれています。フルマネージドITサービスは、IT人材の確保が難しく、高度なスキルを持つ人材を社内で確保できない企業にとって最適な選択肢となっています。

当レポートでは、世界のクラウドデータセキュリティの市場について分析し、市場の基本構造や最新情勢、主な市場促進・抑制要因、提供製品/サービス別・組織規模別・提供方式別・業種別・地域別の市場動向の見通し、市場競争の状態、主要企業のプロファイルなどを調査しております。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要と業界の動向

- イントロダクション

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

- ケーススタディ分析

- バリューチェーン分析

- エコシステム分析

- ポーターのファイブフォース分析

- 価格分析

- 技術分析

- 特許分析

- バイヤーに影響を与える動向と混乱

- 関税と規制の状況

- 主な利害関係者と購入基準

- 主な会議とイベント (2023年)

第6章 クラウドデータセキュリティ市場:提供製品/サービス別

- イントロダクション

- ソリューション

- サービス

第7章 クラウドデータセキュリティ市場:組織規模別

- イントロダクション

- 大企業

- 中小企業 (SME)

第8章 クラウドデータセキュリティ市場:提供方式別

- イントロダクション

- フルマネージド

- コマネージド (共同管理)

第9章 クラウドデータセキュリティ市場:業種別

- イントロダクション

- 銀行・金融サービス・保険 (BFSI)

- 小売業・eコマース

- 政府・防衛

- 医療・ライフサイエンス

- IT・ITeS

- 通信

- その他の業種

第10章 クラウドデータセキュリティ市場:地域別

- イントロダクション

- 北米

- 米国

- カナダ

- 欧州

- 英国

- ドイツ

- 他の欧州諸国

- アジア太平洋

- 中国

- 日本

- インド

- 他のアジア太平洋諸国

- 中東・アフリカ

- 中東

- アフリカ

- ラテンアメリカ

- ブラジル

- メキシコ

- 他のラテンアメリカ諸国

第11章 競合情勢

- イントロダクション

- 主要企業の収益シェア分析 (2022年)

- 大手企業の市場シェア分析

- 過去の収益分析

- 主要企業のランキング

- 主要企業の評価マトリックス

- 競合ベンチマーキング

- スタートアップ/中小企業向け評価マトリックス

- 競合シナリオ

- 製品/ソリューションの発売

- 資本取引

第12章 企業プロファイル

- 主要企業

- CROWDSTRIKE

- CHECK POINT

- PALO ALTO NETWORKS

- ZSCALER

- IBM

- IMPERVA

- VERITAS

- DIGITAL GUARDIAN

- VMWARE

- THALES

- その他の企業

- SOPHOS

- POLAR

- NETWRIX

- INFORMATICA

- COMMVAULT

- ORCA SECURITY

- RADWARE

- RUBRIK

- VEEAM

- INFRASCALE

- DRUVA

- FACTION

- COHESITY

- NETSKOPE

- CLOUDIAN

第13章 隣接市場

- 隣接市場の概略

- 制限事項

- クラウドデータセキュリティ市場のエコシステムと隣接市場

- データ中心型セキュリティ市場

- CSPM (クラウドセキュリティ状態管理) 市場

- コンテナセキュリティ市場

第14章 付録

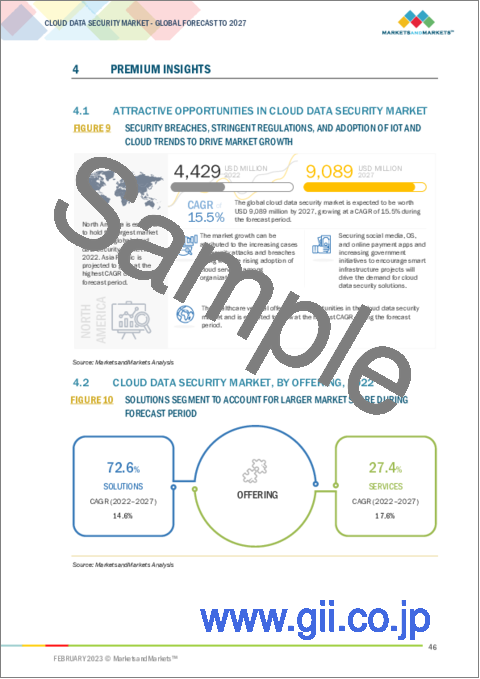

The global cloud data security market size is projected to grow from USD 4.4 billion in 2022 to USD 9.1 billion by 2027 at a Compound Annual Growth Rate (CAGR) of 15.5% during the forecast period.

The market has promising growth potential due to several factors, including security-related breaches, expanding dangers of cyberattacks, and increased adoption of cloud services among businesses. However, the greatest level of complexity in the deployment and management of cloud data security solutions, as well as a lack of cooperation and mistrust between enterprises and cloud security services providers, are projected to impede market expansion.

By organization size, the SMEs segment is to grow at a higher CAGR during the forecast period

Based on the organization's size, the cloud data security market is divided into large enterprises and SMEs. The public, private, and hybrid cloud usage gives SMEs the freedom to do business from any location. This anticipates the popularity of cloud security solutions among SMEs. Additionally, the expansion of this market sector would also be fueled by SMEs' increased attention to adhering to different regulatory compliances and data protection legislation, such as EU data protection rules. Moreover, organizations such as Check Point unveiled brand-new technologies for SMEs to provide defense against "fifth generation" widespread attacks on various IT infrastructure systems, such as the cloud, virtual machines, networks, and endpoints. Thus, it can be concluded that SMEs are anticipated to grow at the highest CAGR during the forecast period.

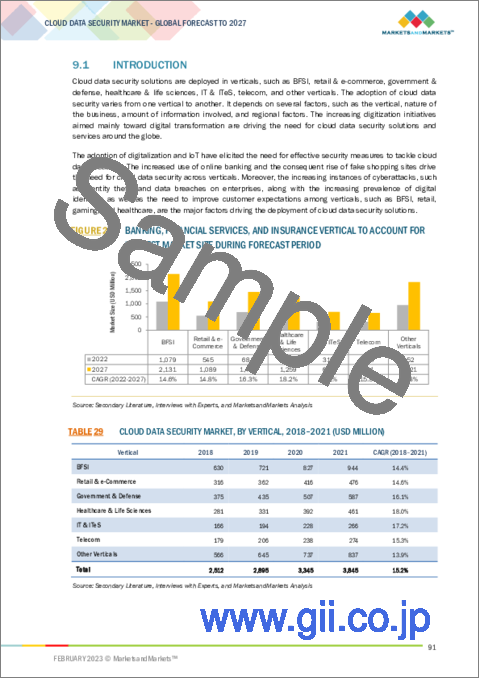

By vertical, BFSI segment to account for largest market size during forecast period

Regulators for the financial services industry anticipate that financial institutions will keep a high level of security. Therefore, the BFSI sector's cloud security market is anticipated to expand as a result of these heightened security regulations and demand for a safe and compliant cloud. Additionally, the rise in data breaches and cloud-native threats is pushing banks and insurance firms to switch to cloud security solutions, which is anticipated to propel market expansion. The PCI DSS regulatory standards are constantly being pressed onto financial organizations encouraging the BFSI sector to use cloud security platforms to ensure compliance with internal stakeholders and external authorities through efficient vulnerability and configuration management. Furthermore, governments worldwide are making strong efforts to ensure the cloud platform's security among financial institutions. Thus, it can be concluded that the BFSI vertical accounts for the largest market size during the forecast period.

By offering type, fully managed segment to grow at higher CAGR during the forecast period

The offering type for the cloud data security market includes fully managed and co-managed security. A fully managed IT service proves to be the best choice for businesses having trouble finding and keeping IT workers and lacking access to highly skilled IT personnel internally. It not only saves the hassle of recruiting but also have access to the talent required whenever needed. Additionally, with fully managed security, businesses eliminate the need to manage an on-site data center, maintain their gear, or keep an eye out for any network problems. Furthermore, businesses can get complete assistance by using a fully managed IT solution. Thus, fully managed security offerings are anticipated to have the highest CAGR during the forecast period.

Breakdown of primaries:

In-depth interviews were conducted with Chief Executive Officers (CEOs), marketing directors, other innovation and technology directors, and executives from various key organizations operating in the cloud data security market.

- By company type: Tier 1: 40%, Tier 2: 35%, and Tier 3: 25%

- By designation: C-level: 45%, Directors: 30%, and others: 25%

- By region: North America: 35%, APAC: 30%, Europe: 20%, Rest of the World (RoW): 15%

Major vendors in the global cloud data security market include CrowdStrike (US), Check Point (US), Palo Alto Networks (US), Zscaler (US), IBM (US), Imperva (US), Veritas (US), Digital Guardian (US), VMware (US), Thales (France), Sophos (UK), Polar (Israel), Netwrix (US), Informatica (US), Commvault (US), Orca Security (US), Radware (US), Rubrik (US), Veeam (US), Infrascale (US), Druva (US), Faction (US), Cohesity (US), Netskope (US), and Cloudian (US).

The study includes an in-depth competitive analysis of the key players in the cloud data security market, their company profiles, recent developments, and key market strategies.

Research coverage

The report segments the cloud data security market and forecasts its size by offering (solutions and services), organization size (large enterprises and SMEs), offering type (fully managed and co-managed), vertical (BFSI, retail and eCommerce, government and defense, healthcare and life sciences, IT and ITeS, telecom, and others), and region (North America, Europe, Middle East & Africa, Asia Pacific, and Latin America).

The study also includes an in-depth competitive analysis of the market's key players, their company profiles, key observations related to product and business offerings, recent developments, and key market strategies.

Key benefits of buying report

The report will help the market leaders/new entrants in this market with information on the closest approximations of the revenue numbers for the overall cloud data security market and the subsegments. This report will help stakeholders understand the competitive landscape and gain more insights to position their businesses better and plan suitable go-to-market strategies. The report also helps stakeholders understand the market pulse and provides information on key market drivers, restraints, challenges, and opportunities.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.2.1 INCLUSIONS AND EXCLUSIONS

- 1.3 STUDY SCOPE

- 1.3.1 CLOUD DATA SECURITY MARKET SEGMENTATION

- 1.3.2 REGIONS COVERED

- 1.3.3 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- TABLE 1 USD EXCHANGE RATES, 2018-2021

- 1.5 STAKEHOLDERS

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- FIGURE 1 CLOUD DATA SECURITY MARKET: RESEARCH DESIGN

- 2.1.1 SECONDARY DATA

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Breakup of primaries

- 2.1.2.2 Key industry insights

- 2.2 DATA TRIANGULATION

- FIGURE 2 CLOUD DATA SECURITY MARKET: RESEARCH FLOW

- 2.3 MARKET SIZE ESTIMATION

- FIGURE 3 MARKET SIZE ESTIMATION METHODOLOGY-APPROACH 1 (SUPPLY SIDE): REVENUE FROM SOLUTIONS/SERVICES OF CLOUD DATA SECURITY VENDORS

- FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY-APPROACH 3 (DEMAND SIDE), TOP-DOWN APPROACH

- 2.4 MARKET FORECAST

- TABLE 2 FACTOR ANALYSIS

- 2.5 RECESSION IMPACT AND RESEARCH ASSUMPTIONS

- 2.5.1 RECESSION IMPACT

- 2.5.2 RESEARCH ASSUMPTIONS

- 2.6 LIMITATIONS

- FIGURE 5 LIMITATIONS OF CLOUD DATA SECURITY MARKET

3 EXECUTIVE SUMMARY

- TABLE 3 CLOUD DATA SECURITY MARKET AND GROWTH RATE, 2018-2021 (USD MILLION, Y-O-Y %)

- TABLE 4 CLOUD DATA SECURITY MARKET AND GROWTH RATE, 2022-2027 (USD MILLION, Y-O-Y %)

- FIGURE 6 GLOBAL CLOUD DATA SECURITY MARKET SIZE AND Y-O-Y GROWTH RATE

- FIGURE 7 MARKET SHARE OF SEGMENTS WITH HIGH GROWTH RATES DURING FORECAST PERIOD

- FIGURE 8 NORTH AMERICA TO ACCOUNT FOR LARGEST SHARE IN 2022

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES IN CLOUD DATA SECURITY MARKET

- FIGURE 9 SECURITY BREACHES, STRINGENT REGULATIONS, AND ADOPTION OF IOT AND CLOUD TRENDS TO DRIVE MARKET GROWTH

- 4.2 CLOUD DATA SECURITY MARKET, BY OFFERING, 2022

- FIGURE 10 SOLUTIONS SEGMENT TO ACCOUNT FOR LARGER MARKET SHARE DURING FORECAST PERIOD

- 4.3 CLOUD DATA SECURITY MARKET, BY ORGANIZATION SIZE, 2022

- FIGURE 11 LARGE ENTERPRISES SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE

- 4.4 CLOUD DATA SECURITY MARKET, BY OFFERING TYPE, 2022

- FIGURE 12 CO-MANAGED SEGMENT TO ACCOUNT FOR LARGER MARKET SHARE

- 4.5 CLOUD DATA SECURITY MARKET SHARE OF TOP THREE VERTICALS AND REGIONS

- FIGURE 13 BFSI AND NORTH AMERICA TO ACCOUNT FOR LARGEST MARKET SHARES

- 4.6 CLOUD DATA SECURITY MARKET INVESTMENT SCENARIO, BY REGION

- FIGURE 14 ASIA PACIFIC TO EMERGE AS BEST MARKET FOR INVESTMENTS IN NEXT FIVE YEARS

5 MARKET OVERVIEW AND INDUSTRY TRENDS

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- FIGURE 15 CLOUD DATA SECURITY MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- 5.2.1 DRIVERS

- 5.2.1.1 Rising adoption of cloud services by enterprises

- 5.2.1.2 Increasing number of cyberattacks

- 5.2.2 RESTRAINTS

- 5.2.2.1 Lack of cooperation and distrust between businesses and cloud security service providers

- 5.2.2.2 Complexities associated with deployment and operations of cloud data security solutions

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Rising investments by social media companies in cloud security services

- 5.2.3.2 Government initiatives encouraging smart infrastructure projects

- 5.2.4 CHALLENGES

- 5.2.4.1 Timely delivery of products and security-related issues with DevOps, DevSecOps, and automation

- 5.2.4.2 Cloud compliance and governance

- 5.2.4.3 Complex environments and constantly changing workloads

- 5.3 CASE STUDY ANALYSIS

- 5.3.1 CASE STUDY 1: LOOKOUT'S SOLUTION TO IMPROVE SECURITY AND COMPLIANCE FOR LEADING FINANCIAL TECHNOLOGY

- 5.3.2 CASE STUDY 2: 360LEARNING TO IMPROVE ITS CLOUD SECURITY POSTURE WITH ORCA CLOUD SECURITY PLATFORM

- 5.3.3 CASE STUDY 3: VARONIS EDGE TO FORTIFY CLOUD DATA SECURITY

- 5.4 VALUE CHAIN ANALYSIS

- FIGURE 16 VALUE CHAIN ANALYSIS: CLOUD DATA SECURITY MARKET

- 5.5 ECOSYSTEM ANALYSIS

- FIGURE 17 CLOUD DATA SECURITY MARKET: ECOSYSTEM

- 5.6 PORTER'S FIVE FORCES ANALYSIS

- FIGURE 18 PORTER'S FIVE FORCES ANALYSIS

- TABLE 5 PORTER'S FIVE FORCES ANALYSIS

- 5.6.1 THREAT OF NEW ENTRANTS

- 5.6.2 THREAT OF SUBSTITUTES

- 5.6.3 BARGAINING POWER OF SUPPLIERS

- 5.6.4 BARGAINING POWER OF BUYERS

- 5.6.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.7 PRICING ANALYSIS

- TABLE 6 CLOUD DATA SECURITY MARKET: PRICING LEVELS

- 5.8 TECHNOLOGY ANALYSIS

- 5.8.1 INCREASED USAGE OF AI AND ML

- 5.8.2 CLOUD SECURITY POSTURE MANAGEMENT

- 5.8.3 ENCRYPTION

- 5.8.4 IDENTITY AND ACCESS MANAGEMENT

- 5.8.5 BLOCKCHAIN IN CLOUD COMPUTING

- 5.8.6 VIRTUAL PRIVATE CLOUD AND SECURITY GROUPS

- 5.9 PATENT ANALYSIS

- TABLE 7 CLOUD DATA SECURITY MARKET: PATENTS

- FIGURE 19 TOP 10 COMPANIES WITH HIGHEST NUMBER OF PATENTS

- FIGURE 20 PATENTS PUBLISHED, YEAR-WISE

- FIGURE 21 TOP PATENTS BY JURISDICTION

- 5.10 TRENDS AND DISRUPTIONS IMPACTING BUYERS

- FIGURE 22 CHANGES AND TRENDS AFFECTING BUYERS

- 5.11 TARIFF AND REGULATORY LANDSCAPE

- 5.11.1 INTRODUCTION

- 5.11.2 PAYMENT CARD INDUSTRY DATA SECURITY STANDARD

- 5.11.3 CALIFORNIA CONSUMER PRIVACY ACT

- 5.11.4 PAYMENT SERVICES DIRECTIVE 2

- 5.11.5 PERSONAL INFORMATION PROTECTION AND ELECTRONIC DOCUMENTS ACT

- 5.11.6 ELECTRONIC IDENTIFICATION, AUTHENTICATION, AND TRUST SERVICES

- 5.11.7 INTERNATIONAL ORGANIZATION FOR STANDARDIZATION STANDARD 27001

- 5.11.8 FEDERAL INFORMATION PROCESSING STANDARDS

- 5.11.9 GRAMM-LEACH-BLILEY ACT OF 1999

- 5.11.10 EUROPEAN UNION GENERAL DATA PROTECTION REGULATION

- 5.11.11 SERVICE ORGANIZATION CONTROL 2 COMPLIANCE

- 5.11.12 HIPAA COMPLIANCE

- TABLE 8 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.12 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.12.1 KEY STAKEHOLDERS IN BUYING PROCESS

- FIGURE 23 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS (%)

- TABLE 9 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS (%)

- 5.13 KEY CONFERENCES AND EVENTS, 2023

- TABLE 10 CONFERENCES AND EVENTS, 2023

6 CLOUD DATA SECURITY MARKET, BY OFFERING

- 6.1 INTRODUCTION

- FIGURE 24 SOLUTIONS SEGMENT PROJECTED TO HAVE LARGER MARKET SHARE DURING FORECAST PERIOD

- TABLE 11 CLOUD DATA SECURITY MARKET, BY OFFERING, 2018-2021 (USD MILLION)

- TABLE 12 CLOUD DATA SECURITY MARKET, BY OFFERING, 2022-2027 (USD MILLION)

- 6.1.1 OFFERING: CLOUD DATA SECURITY MARKET DRIVERS

- 6.2 SOLUTIONS

- 6.2.1 ADVANCED CLOUD DATA SECURITY SOLUTIONS TO BOOST MARKET

- TABLE 13 SOLUTIONS: CLOUD DATA SECURITY MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 14 SOLUTIONS: CLOUD DATA SECURITY MARKET, BY REGION, 2022-2027 (USD MILLION)

- 6.3 SERVICES

- 6.3.1 SIGNIFICANT GROWTH IN CLOUD DATA MONITORING TO GENERATE DEMAND FOR SECURITY SERVICES

- TABLE 15 SERVICES: CLOUD DATA SECURITY MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 16 SERVICES: CLOUD DATA SECURITY MARKET, BY REGION, 2022-2027 (USD MILLION)

7 CLOUD DATA SECURITY MARKET, BY ORGANIZATION SIZE

- 7.1 INTRODUCTION

- FIGURE 25 LARGE ENTERPRISES TO HAVE LARGER MARKET SIZE DURING FORECAST PERIOD

- TABLE 17 CLOUD DATA SECURITY MARKET, BY ORGANIZATION SIZE, 2018-2021 (USD MILLION)

- TABLE 18 CLOUD DATA SECURITY MARKET, BY ORGANIZATION SIZE, 2022-2027 (USD MILLION)

- 7.1.1 ORGANIZATION SIZE: CLOUD DATA SECURITY MARKET DRIVERS

- 7.2 LARGE ENTERPRISES

- 7.2.1 RISING CONCERNS ABOUT REGULATORY COMPLIANCE TO FUEL ADOPTION OF CLOUD DATA SECURITY

- TABLE 19 LARGE ENTERPRISES: CLOUD DATA SECURITY MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 20 LARGE ENTERPRISES: CLOUD DATA SECURITY MARKET, BY REGION, 2022-2027 (USD MILLION)

- 7.3 SMALL AND MEDIUM-SIZED ENTERPRISES (SMES)

- 7.3.1 FLEXIBILITY AND AFFORDABILITY TO BOOST SALES OF SECURITY SOLUTIONS

- TABLE 21 SMALL AND MEDIUM-SIZED ENTERPRISES: CLOUD DATA SECURITY MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 22 SMALL AND MEDIUM-SIZED ENTERPRISES: CLOUD DATA SECURITY MARKET, BY REGION, 2022-2027 (USD MILLION)

8 CLOUD DATA SECURITY MARKET, BY OFFERING TYPE

- 8.1 INTRODUCTION

- FIGURE 26 CO-MANAGED SEGMENT TO DOMINATE DURING FORECAST PERIOD

- TABLE 23 CLOUD DATA SECURITY MARKET, BY OFFERING TYPE, 2018-2021 (USD MILLION)

- TABLE 24 CLOUD DATA SECURITY MARKET, BY OFFERING TYPE, 2022-2027 (USD MILLION)

- 8.1.1 OFFERING TYPE: CLOUD DATA SECURITY MARKET DRIVERS

- 8.2 FULLY MANAGED

- 8.2.1 CUSTOMIZATION OF FULLY MANAGED OFFERING TYPE TO FUEL DEMAND FOR SECURITY OPERATIONS

- TABLE 25 FULLY MANAGED: CLOUD DATA SECURITY MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 26 FULLY MANAGED: CLOUD DATA SECURITY MARKET, BY REGION, 2022-2027 (USD MILLION)

- 8.3 CO-MANAGED

- 8.3.1 COST OPTIMIZATION, SCALABILITY, AND FLEXIBILITY TO DRIVE DEMAND FOR INTERNAL SECURITY

- TABLE 27 CO-MANAGED: CLOUD DATA SECURITY MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 28 CO-MANAGED: CLOUD DATA SECURITY MARKET, BY REGION, 2022-2027 (USD MILLION)

9 CLOUD DATA SECURITY MARKET, BY VERTICAL

- 9.1 INTRODUCTION

- FIGURE 27 BANKING, FINANCIAL SERVICES, AND INSURANCE VERTICAL TO ACCOUNT FOR LARGEST MARKET SIZE DURING FORECAST PERIOD

- TABLE 29 CLOUD DATA SECURITY MARKET, BY VERTICAL, 2018-2021 (USD MILLION)

- TABLE 30 CLOUD DATA SECURITY MARKET, BY VERTICAL, 2022-2027 (USD MILLION)

- 9.1.1 VERTICAL: CLOUD DATA SECURITY MARKET DRIVERS

- 9.2 BANKING, FINANCIAL SERVICES, AND INSURANCE

- 9.2.1 RISING DEMAND FOR DATA PROTECTION SERVICES IN BANKING COMPANIES TO DRIVE MARKET

- TABLE 31 BANKING, FINANCIAL SERVICES, AND INSURANCE: CLOUD DATA SECURITY MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 32 BANKING, FINANCIAL SERVICES, AND INSURANCE: CLOUD DATA SECURITY MARKET, BY REGION, 2022-2027 (USD MILLION)

- 9.3 RETAIL & E-COMMERCE

- 9.3.1 AUTOMATION ACROSS RETAIL CHANNELS FOR CURBING DATA THEFT TO PROPEL MARKET

- TABLE 33 RETAIL & E-COMMERCE: CLOUD DATA SECURITY MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 34 RETAIL & E-COMMERCE: CLOUD DATA SECURITY MARKET, BY REGION, 2022-2027 (USD MILLION)

- 9.4 GOVERNMENT & DEFENSE

- 9.4.1 RISING CONCERNS ABOUT IDENTITY THEFT AND BUSINESS FRAUD TO FUEL MARKET GROWTH

- TABLE 35 GOVERNMENT & DEFENSE: CLOUD DATA SECURITY MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 36 GOVERNMENT & DEFENSE: CLOUD DATA SECURITY MARKET, BY REGION, 2022-2027 (USD MILLION)

- 9.5 HEALTHCARE & LIFE SCIENCES

- 9.5.1 NEED TO SECURE CRITICAL PATIENT DATA ACROSS CLOUD ENVIRONMENT TO BOOST SEGMENT GROWTH

- TABLE 37 HEALTHCARE & LIFE SCIENCES: CLOUD DATA SECURITY MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 38 HEALTHCARE & LIFE SCIENCES: CLOUD DATA SECURITY MARKET, BY REGION, 2022-2027 (USD MILLION)

- 9.6 INFORMATION TECHNOLOGY & INFORMATION TECHNOLOGY-ENABLED SERVICES

- 9.6.1 GROWING CONCERNS OF FRAUD AND COMPLIANCE TO PROPEL MARKET

- TABLE 39 INFORMATION TECHNOLOGY & INFORMATION TECHNOLOGY-ENABLED SERVICES: CLOUD DATA SECURITY MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 40 INFORMATION TECHNOLOGY & INFORMATION TECHNOLOGY-ENABLED SERVICES: CLOUD DATA SECURITY MARKET, BY REGION, 2022-2027 (USD MILLION)

- 9.7 TELECOM

- 9.7.1 NEED TO SECURE CLOUD TELECOM INFRASTRUCTURE TO FUEL SEGMENT GROWTH

- TABLE 41 TELECOM: CLOUD DATA SECURITY MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 42 TELECOM: CLOUD DATA SECURITY MARKET, BY REGION, 2022-2027 (USD MILLION)

- 9.8 OTHER VERTICALS

- TABLE 43 OTHER VERTICALS: CLOUD DATA SECURITY MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 44 OTHER VERTICALS: CLOUD DATA SECURITY MARKET, BY REGION, 2022-2027 (USD MILLION)

10 CLOUD DATA SECURITY MARKET, BY REGION

- 10.1 INTRODUCTION

- FIGURE 28 ASIA PACIFIC TO GROW AT HIGHEST CAGR BY 2027

- TABLE 45 CLOUD DATA SECURITY MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 46 CLOUD DATA SECURITY MARKET, BY REGION, 2022-2027 (USD MILLION)

- 10.2 NORTH AMERICA

- 10.2.1 NORTH AMERICA: CLOUD DATA SECURITY MARKET DRIVERS

- 10.2.2 NORTH AMERICA: RECESSION IMPACT

- 10.2.3 NORTH AMERICA: REGULATORY LANDSCAPE

- FIGURE 29 NORTH AMERICA: MARKET SNAPSHOT

- TABLE 47 NORTH AMERICA: CLOUD DATA SECURITY MARKET, BY OFFERING, 2018-2021 (USD MILLION)

- TABLE 48 NORTH AMERICA: CLOUD DATA SECURITY MARKET, BY OFFERING, 2022-2027 (USD MILLION)

- TABLE 49 NORTH AMERICA: CLOUD DATA SECURITY MARKET, BY ORGANIZATION SIZE, 2018-2021 (USD MILLION)

- TABLE 50 NORTH AMERICA: CLOUD DATA SECURITY MARKET, BY ORGANIZATION SIZE, 2022-2027 (USD MILLION)

- TABLE 51 NORTH AMERICA: CLOUD DATA SECURITY MARKET, BY OFFERING TYPE, 2018-2021 (USD MILLION)

- TABLE 52 NORTH AMERICA: CLOUD DATA SECURITY MARKET, BY OFFERING TYPE, 2022-2027 (USD MILLION)

- TABLE 53 NORTH AMERICA: CLOUD DATA SECURITY MARKET, BY VERTICAL, 2018-2021 (USD MILLION)

- TABLE 54 NORTH AMERICA: CLOUD DATA SECURITY MARKET, BY VERTICAL, 2022-2027 (USD MILLION)

- TABLE 55 NORTH AMERICA: CLOUD DATA SECURITY MARKET, BY COUNTRY, 2018-2021 (USD MILLION)

- TABLE 56 NORTH AMERICA: CLOUD DATA SECURITY MARKET, BY COUNTRY, 2022-2027 (USD MILLION)

- 10.2.4 US

- 10.2.4.1 Stringent regulations and technological advancements

- TABLE 57 US: CLOUD DATA SECURITY MARKET, BY OFFERING, 2018-2021 (USD MILLION)

- TABLE 58 US: CLOUD DATA SECURITY MARKET, BY OFFERING, 2022-2027 (USD MILLION)

- TABLE 59 US: CLOUD DATA SECURITY MARKET, BY ORGANIZATION SIZE, 2018-2021 (USD MILLION)

- TABLE 60 US: CLOUD DATA SECURITY MARKET, BY ORGANIZATION SIZE, 2022-2027 (USD MILLION)

- TABLE 61 US: CLOUD DATA SECURITY MARKET, BY OFFERING TYPE, 2018-2021 (USD MILLION)

- TABLE 62 US: CLOUD DATA SECURITY MARKET, BY OFFERING TYPE, 2022-2027 (USD MILLION)

- TABLE 63 US: CLOUD DATA SECURITY MARKET, BY VERTICAL, 2018-2021 (USD MILLION)

- TABLE 64 US: CLOUD DATA SECURITY MARKET, BY VERTICAL, 2022-2027 (USD MILLION)

- 10.2.5 CANADA

- 10.2.5.1 Increased data breaches and government efforts

- TABLE 65 CANADA: CLOUD DATA SECURITY MARKET, BY OFFERING, 2018-2021 (USD MILLION)

- TABLE 66 CANADA: CLOUD DATA SECURITY MARKET, BY OFFERING, 2022-2027 (USD MILLION)

- TABLE 67 CANADA: CLOUD DATA SECURITY MARKET, BY ORGANIZATION SIZE, 2018-2021 (USD MILLION)

- TABLE 68 CANADA: CLOUD DATA SECURITY MARKET, BY ORGANIZATION SIZE, 2022-2027 (USD MILLION)

- TABLE 69 CANADA: CLOUD DATA SECURITY MARKET, BY OFFERING TYPE, 2018-2021 (USD MILLION)

- TABLE 70 CANADA: CLOUD DATA SECURITY MARKET, BY OFFERING TYPE, 2022-2027 (USD MILLION)

- TABLE 71 CANADA: CLOUD DATA SECURITY MARKET, BY VERTICAL, 2018-2021 (USD MILLION)

- TABLE 72 CANADA: CLOUD DATA SECURITY MARKET, BY VERTICAL, 2022-2027 (USD MILLION)

- 10.3 EUROPE

- 10.3.1 EUROPE: CLOUD SECURITY MARKET DRIVERS

- 10.3.2 EUROPE: RECESSION IMPACT

- 10.3.3 EUROPE: REGULATORY LANDSCAPE

- TABLE 73 EUROPE: CLOUD DATA SECURITY MARKET, BY OFFERING, 2018-2021 (USD MILLION)

- TABLE 74 EUROPE: CLOUD DATA SECURITY MARKET, BY OFFERING, 2022-2027 (USD MILLION)

- TABLE 75 EUROPE: CLOUD DATA SECURITY MARKET, BY ORGANIZATION SIZE, 2018-2021 (USD MILLION)

- TABLE 76 EUROPE: CLOUD DATA SECURITY MARKET, BY ORGANIZATION SIZE, 2022-2027 (USD MILLION)

- TABLE 77 EUROPE: CLOUD DATA SECURITY MARKET, BY OFFERING TYPE, 2018-2021 (USD MILLION)

- TABLE 78 EUROPE: CLOUD DATA SECURITY MARKET, BY OFFERING TYPE, 2022-2027 (USD MILLION)

- TABLE 79 EUROPE: CLOUD DATA SECURITY MARKET, BY VERTICAL, 2018-2021 (USD MILLION)

- TABLE 80 EUROPE: CLOUD DATA SECURITY MARKET, BY VERTICAL, 2022-2027 (USD MILLION)

- TABLE 81 EUROPE: CLOUD DATA SECURITY MARKET, BY COUNTRY, 2018-2021 (USD MILLION)

- TABLE 82 EUROPE: CLOUD DATA SECURITY MARKET, BY COUNTRY, 2022-2027 (USD MILLION)

- 10.3.4 UK

- 10.3.4.1 Increasing adoption of cloud services and strict regulations

- TABLE 83 UK: CLOUD DATA SECURITY MARKET, BY OFFERING, 2018-2021 (USD MILLION)

- TABLE 84 UK: CLOUD DATA SECURITY MARKET, BY OFFERING, 2022-2027 (USD MILLION)

- TABLE 85 UK: CLOUD DATA SECURITY MARKET SIZE, BY ORGANIZATION SIZE, 2018-2021 (USD MILLION)

- TABLE 86 UK: CLOUD DATA SECURITY MARKET, BY ORGANIZATION SIZE, 2022-2027 (USD MILLION)

- TABLE 87 UK: CLOUD DATA SECURITY MARKET, BY OFFERING TYPE, 2018-2021 (USD MILLION)

- TABLE 88 UK: CLOUD DATA SECURITY MARKET, BY OFFERING TYPE, 2022-2027 (USD MILLION)

- TABLE 89 UK: CLOUD DATA SECURITY MARKET, BY VERTICAL, 2018-2021 (USD MILLION)

- TABLE 90 UK: CLOUD DATA SECURITY MARKET, BY VERTICAL, 2022-2027 (USD MILLION)

- 10.3.5 GERMANY

- 10.3.5.1 Robust economy and increased demand for compliance solutions

- TABLE 91 GERMANY: CLOUD DATA SECURITY MARKET, BY OFFERING, 2018-2021 (USD MILLION)

- TABLE 92 GERMANY: CLOUD DATA SECURITY MARKET, BY OFFERING, 2022-2027 (USD MILLION)

- TABLE 93 GERMANY: CLOUD DATA SECURITY MARKET, BY ORGANIZATION SIZE, 2018-2021 (USD MILLION)

- TABLE 94 GERMANY: CLOUD DATA SECURITY MARKET, BY ORGANIZATION SIZE, 2022-2027 (USD MILLION)

- TABLE 95 GERMANY: CLOUD DATA SECURITY MARKET, BY OFFERING TYPE, 2018-2021 (USD MILLION)

- TABLE 96 GERMANY: CLOUD DATA SECURITY MARKET, BY OFFERING TYPE, 2022-2027 (USD MILLION)

- TABLE 97 GERMANY: CLOUD DATA SECURITY MARKET, BY VERTICAL, 2018-2021 (USD MILLION)

- TABLE 98 GERMANY: CLOUD DATA SECURITY MARKET, BY VERTICAL, 2022-2027 (USD MILLION)

- 10.3.6 REST OF EUROPE

- TABLE 99 REST OF EUROPE: CLOUD DATA SECURITY MARKET, BY OFFERING, 2018-2021 (USD MILLION)

- TABLE 100 REST OF EUROPE: CLOUD DATA SECURITY MARKET, BY OFFERING, 2022-2027 (USD MILLION)

- TABLE 101 REST OF EUROPE: CLOUD DATA SECURITY MARKET, BY ORGANIZATION SIZE, 2018-2021 (USD MILLION)

- TABLE 102 REST OF EUROPE: CLOUD DATA SECURITY MARKET, BY ORGANIZATION SIZE, 2022-2027 (USD MILLION)

- TABLE 103 REST OF EUROPE: CLOUD DATA SECURITY MARKET, BY OFFERING TYPE, 2018-2021 (USD MILLION)

- TABLE 104 REST OF EUROPE: CLOUD DATA SECURITY MARKET, BY OFFERING TYPE, 2022-2027 (USD MILLION)

- TABLE 105 REST OF EUROPE: CLOUD DATA SECURITY MARKET, BY VERTICAL, 2018-2021 (USD MILLION)

- TABLE 106 REST OF EUROPE: CLOUD DATA SECURITY MARKET, BY VERTICAL, 2022-2027 (USD MILLION)

- 10.4 ASIA PACIFIC

- 10.4.1 ASIA PACIFIC: CLOUD DATA SECURITY MARKET DRIVERS

- 10.4.2 ASIA PACIFIC: RECESSION IMPACT

- 10.4.3 ASIA PACIFIC: REGULATORY LANDSCAPE

- FIGURE 30 ASIA PACIFIC: MARKET SNAPSHOT

- TABLE 107 ASIA PACIFIC: CLOUD DATA SECURITY MARKET, BY OFFERING, 2018-2021 (USD MILLION)

- TABLE 108 ASIA PACIFIC: CLOUD DATA SECURITY MARKET, BY OFFERING, 2022-2027 (USD MILLION)

- TABLE 109 ASIA PACIFIC: CLOUD DATA SECURITY MARKET, BY ORGANIZATION SIZE, 2018-2021 (USD MILLION)

- TABLE 110 ASIA PACIFIC: CLOUD DATA SECURITY MARKET, BY ORGANIZATION SIZE, 2022-2027 (USD MILLION)

- TABLE 111 ASIA PACIFIC: CLOUD DATA SECURITY MARKET, BY OFFERING TYPE, 2018-2021 (USD MILLION)

- TABLE 112 ASIA PACIFIC: CLOUD DATA SECURITY MARKET, BY OFFERING TYPE, 2022-2027 (USD MILLION)

- TABLE 113 ASIA PACIFIC: CLOUD DATA SECURITY MARKET, BY VERTICAL, 2018-2021 (USD MILLION)

- TABLE 114 ASIA PACIFIC: CLOUD DATA SECURITY MARKET, BY VERTICAL, 2022-2027 (USD MILLION)

- TABLE 115 ASIA PACIFIC: CLOUD DATA SECURITY MARKET, BY COUNTRY, 2018-2021 (USD MILLION)

- TABLE 116 ASIA PACIFIC: CLOUD DATA SECURITY MARKET, BY COUNTRY, 2022-2027 (USD MILLION)

- 10.4.4 CHINA

- 10.4.4.1 Growing cloud computing market and increasing use of smart technology

- TABLE 117 CHINA: CLOUD DATA SECURITY MARKET, BY OFFERING, 2018-2021 (USD MILLION)

- TABLE 118 CHINA: CLOUD DATA SECURITY MARKET, BY OFFERING, 2022-2027 (USD MILLION)

- TABLE 119 CHINA: CLOUD DATA SECURITY MARKET, BY ORGANIZATION SIZE, 2018-2021 (USD MILLION)

- TABLE 120 CHINA: CLOUD DATA SECURITY MARKET, BY ORGANIZATION SIZE, 2022-2027 (USD MILLION)

- TABLE 121 CHINA: CLOUD DATA SECURITY MARKET, BY OFFERING TYPE, 2018-2021 (USD MILLION)

- TABLE 122 CHINA: CLOUD DATA SECURITY MARKET, BY OFFERING TYPE, 2022-2027 (USD MILLION)

- TABLE 123 CHINA: CLOUD DATA SECURITY MARKET, BY VERTICAL, 2018-2021 (USD MILLION)

- TABLE 124 CHINA: CLOUD DATA SECURITY MARKET, BY VERTICAL, 2022-2027 (USD MILLION)

- 10.4.5 JAPAN

- 10.4.5.1 High internet penetration and digitally connected country

- TABLE 125 JAPAN: CLOUD DATA SECURITY MARKET, BY OFFERING, 2018-2021 (USD MILLION)

- TABLE 126 JAPAN: CLOUD DATA SECURITY MARKET, BY OFFERING, 2022-2027 (USD MILLION)

- TABLE 127 JAPAN: CLOUD DATA SECURITY MARKET, BY ORGANIZATION SIZE, 2018-2021 (USD MILLION)

- TABLE 128 JAPAN: CLOUD DATA SECURITY MARKET, BY ORGANIZATION SIZE, 2022-2027 (USD MILLION)

- TABLE 130 JAPAN: CLOUD DATA SECURITY MARKET, BY OFFERING TYPE, 2018-2021 (USD MILLION)

- TABLE 131 JAPAN: CLOUD DATA SECURITY MARKET, BY OFFERING TYPE, 2022-2027 (USD MILLION)

- TABLE 132 JAPAN: CLOUD DATA SECURITY MARKET, BY VERTICAL, 2018-2021 (USD MILLION)

- TABLE 133 JAPAN: CLOUD DATA SECURITY MARKET, BY VERTICAL, 2022-2027 (USD MILLION)

- 10.4.6 INDIA

- 10.4.6.1 Fastest developing country and highly prone to security attacks

- TABLE 134 INDIA: CLOUD DATA SECURITY MARKET, BY OFFERING, 2018-2021 (USD MILLION)

- TABLE 135 INDIA: CLOUD DATA SECURITY MARKET, BY OFFERING, 2022-2027 (USD MILLION)

- TABLE 136 INDIA: CLOUD DATA SECURITY MARKET, BY ORGANIZATION SIZE, 2018-2021 (USD MILLION)

- TABLE 137 INDIA: CLOUD DATA SECURITY MARKET, BY ORGANIZATION SIZE, 2022-2027 (USD MILLION)

- TABLE 138 INDIA: CLOUD DATA SECURITY MARKET, BY OFFERING TYPE, 2018-2021 (USD MILLION)

- TABLE 139 INDIA: CLOUD DATA SECURITY MARKET, BY OFFERING TYPE, 2022-2027 (USD MILLION)

- TABLE 140 INDIA: CLOUD DATA SECURITY MARKET, BY VERTICAL, 2018-2021 (USD MILLION)

- TABLE 141 INDIA: CLOUD DATA SECURITY MARKET, BY VERTICAL, 2022-2027 (USD MILLION)

- 10.4.7 REST OF ASIA PACIFIC

- TABLE 142 REST OF ASIA PACIFIC: CLOUD DATA SECURITY MARKET, BY OFFERING, 2018-2021 (USD MILLION)

- TABLE 143 REST OF ASIA PACIFIC: CLOUD DATA SECURITY MARKET, BY OFFERING, 2022-2027 (USD MILLION)

- TABLE 144 REST OF ASIA PACIFIC: CLOUD DATA SECURITY MARKET, BY ORGANIZATION SIZE, 2018-2021 (USD MILLION)

- TABLE 145 REST OF ASIA PACIFIC: CLOUD DATA SECURITY MARKET, BY ORGANIZATION SIZE, 2022-2027 (USD MILLION)

- TABLE 146 REST OF ASIA PACIFIC: CLOUD DATA SECURITY MARKET, BY OFFERING TYPE, 2018-2021 (USD MILLION)

- TABLE 147 REST OF ASIA PACIFIC: CLOUD DATA SECURITY MARKET, BY OFFERING TYPE, 2022-2027 (USD MILLION)

- TABLE 148 REST OF ASIA PACIFIC: CLOUD DATA SECURITY MARKET, BY VERTICAL, 2018-2021 (USD MILLION)

- TABLE 149 REST OF ASIA PACIFIC: CLOUD DATA SECURITY MARKET, BY VERTICAL, 2022-2027 (USD MILLION)

- 10.5 MIDDLE EAST & AFRICA

- 10.5.1 MIDDLE EAST & AFRICA: CLOUD DATA SECURITY DRIVERS

- 10.5.2 MIDDLE EAST & AFRICA: RECESSION IMPACT

- 10.5.3 MIDDLE EAST & AFRICA: REGULATORY LANDSCAPE

- TABLE 150 MIDDLE EAST & AFRICA: CLOUD DATA SECURITY MARKET, BY OFFERING, 2018-2021 (USD MILLION)

- TABLE 151 MIDDLE EAST & AFRICA: CLOUD DATA SECURITY MARKET, BY OFFERING, 2022-2027 (USD MILLION)

- TABLE 152 MIDDLE EAST & AFRICA: CLOUD DATA SECURITY MARKET, BY ORGANIZATION SIZE, 2018-2021 (USD MILLION)

- TABLE 153 MIDDLE EAST & AFRICA: CLOUD DATA SECURITY MARKET, BY ORGANIZATION SIZE, 2022-2027 (USD MILLION)

- TABLE 154 MIDDLE EAST & AFRICA: CLOUD DATA SECURITY MARKET, BY OFFERING TYPE, 2018-2021 (USD MILLION)

- TABLE 155 MIDDLE EAST & AFRICA: CLOUD DATA SECURITY MARKET, BY OFFERING TYPE, 2022-2027 (USD MILLION)

- TABLE 156 MIDDLE EAST & AFRICA: CLOUD DATA SECURITY MARKET, BY VERTICAL, 2018-2021 (USD MILLION)

- TABLE 157 MIDDLE EAST & AFRICA: CLOUD DATA SECURITY MARKET, BY VERTICAL, 2022-2027 (USD MILLION)

- TABLE 158 MIDDLE EAST & AFRICA: CLOUD DATA SECURITY MARKET, BY COUNTRY, 2018-2021 (USD MILLION)

- TABLE 159 MIDDLE EAST & AFRICA: CLOUD DATA SECURITY MARKET, BY COUNTRY, 2022-2027 (USD MILLION)

- 10.5.4 MIDDLE EAST

- 10.5.4.1 Growing adoption of cloud-based security and digital transformation

- TABLE 160 MIDDLE EAST: CLOUD DATA SECURITY MARKET, BY OFFERING, 2018-2021 (USD MILLION)

- TABLE 161 MIDDLE EAST: CLOUD DATA SECURITY MARKET, BY OFFERING, 2022-2027 (USD MILLION)

- TABLE 162 MIDDLE EAST: CLOUD DATA SECURITY MARKET, BY ORGANIZATION SIZE, 2018-2021 (USD MILLION)

- TABLE 163 MIDDLE EAST: CLOUD DATA SECURITY MARKET, BY ORGANIZATION SIZE, 2022-2027 (USD MILLION)

- TABLE 164 MIDDLE EAST: CLOUD DATA SECURITY MARKET, BY OFFERING TYPE, 2018-2021 (USD MILLION)

- TABLE 165 MIDDLE EAST: CLOUD DATA SECURITY MARKET, BY OFFERING TYPE, 2022-2027 (USD MILLION)

- TABLE 166 MIDDLE EAST: CLOUD DATA SECURITY MARKET, BY VERTICAL, 2018-2021 (USD MILLION)

- TABLE 167 MIDDLE EAST: CLOUD DATA SECURITY MARKET, BY VERTICAL, 2022-2027 (USD MILLION)

- 10.5.5 AFRICA

- 10.5.5.1 Adoption of cloud technology to tackle rising cases of cybercrimes

- TABLE 168 AFRICA: CLOUD DATA SECURITY MARKET, BY OFFERING, 2018-2021 (USD MILLION)

- TABLE 169 AFRICA: CLOUD DATA SECURITY MARKET, BY OFFERING, 2022-2027 (USD MILLION)

- TABLE 170 AFRICA: CLOUD DATA SECURITY MARKET, BY ORGANIZATION SIZE, 2018-2021 (USD MILLION)

- TABLE 171 AFRICA: CLOUD DATA SECURITY MARKET, BY ORGANIZATION SIZE, 2022-2027 (USD MILLION)

- TABLE 172 AFRICA: CLOUD DATA SECURITY MARKET, BY OFFERING TYPE, 2018-2021 (USD MILLION)

- TABLE 173 AFRICA: CLOUD DATA SECURITY MARKET, BY OFFERING TYPE, 2022-2027 (USD MILLION)

- TABLE 174 AFRICA: CLOUD DATA SECURITY MARKET, BY VERTICAL, 2018-2021 (USD MILLION)

- TABLE 175 AFRICA: CLOUD DATA SECURITY MARKET, BY VERTICAL, 2022-2027 (USD MILLION)

- 10.6 LATIN AMERICA

- 10.6.1 LATIN AMERICA: CLOUD DATA SECURITY MARKET DRIVERS

- 10.6.2 LATIN AMERICA: RECESSION IMPACT

- 10.6.3 LATIN AMERICA: REGULATORY LANDSCAPE

- TABLE 176 LATIN AMERICA: CLOUD DATA SECURITY MARKET, BY OFFERING, 2018-2021 (USD MILLION)

- TABLE 177 LATIN AMERICA: CLOUD DATA SECURITY MARKET, BY OFFERING, 2022-2027 (USD MILLION)

- TABLE 178 LATIN AMERICA: CLOUD DATA SECURITY MARKET, BY ORGANIZATION SIZE, 2018-2021 (USD MILLION)

- TABLE 179 LATIN AMERICA: CLOUD DATA SECURITY MARKET, BY ORGANIZATION SIZE, 2022-2027 (USD MILLION)

- TABLE 180 LATIN AMERICA: CLOUD DATA SECURITY MARKET, BY OFFERING TYPE, 2018-2021 (USD MILLION)

- TABLE 181 LATIN AMERICA: CLOUD DATA SECURITY MARKET, BY OFFERING TYPE, 2022-2027 (USD MILLION)

- TABLE 182 LATIN AMERICA: CLOUD DATA SECURITY MARKET, BY VERTICAL, 2018-2021 (USD MILLION)

- TABLE 183 LATIN AMERICA: CLOUD DATA SECURITY MARKET, BY VERTICAL, 2022-2027 (USD MILLION)

- TABLE 184 LATIN AMERICA: CLOUD DATA SECURITY MARKET, BY COUNTRY, 2018-2021 (USD MILLION)

- TABLE 185 LATIN AMERICA: CLOUD DATA SECURITY MARKET, BY COUNTRY, 2022-2027 (USD MILLION)

- 10.6.4 BRAZIL

- 10.6.4.1 Deployment of private and hybrid cloud and investment by cloud service vendors

- TABLE 186 BRAZIL: CLOUD DATA SECURITY MARKET, BY OFFERING, 2018-2021 (USD MILLION)

- TABLE 187 BRAZIL: CLOUD DATA SECURITY MARKET, BY OFFERING, 2022-2027 (USD MILLION)

- TABLE 188 BRAZIL: CLOUD DATA SECURITY MARKET, BY ORGANIZATION SIZE, 2018-2021 (USD MILLION)

- TABLE 189 BRAZIL: CLOUD DATA SECURITY MARKET, BY ORGANIZATION SIZE, 2022-2027 (USD MILLION)

- TABLE 190 BRAZIL: CLOUD DATA SECURITY MARKET, BY OFFERING TYPE, 2018-2021 (USD MILLION)

- TABLE 191 BRAZIL: CLOUD DATA SECURITY MARKET, BY OFFERING TYPE, 2022-2027 (USD MILLION)

- TABLE 192 BRAZIL: CLOUD DATA SECURITY MARKET, BY VERTICAL, 2018-2021 (USD MILLION)

- TABLE 193 BRAZIL: CLOUD DATA SECURITY MARKET, BY VERTICAL, 2022-2027 (USD MILLION)

- 10.6.5 MEXICO

- 10.6.5.1 Rise in digitization and investments by key organizations

- TABLE 194 MEXICO: CLOUD DATA SECURITY MARKET, BY OFFERING, 2018-2021 (USD MILLION)

- TABLE 195 MEXICO: CLOUD DATA SECURITY MARKET, BY OFFERING, 2022-2027 (USD MILLION)

- TABLE 196 MEXICO: CLOUD DATA SECURITY MARKET, BY ORGANIZATION SIZE, 2018-2021 (USD MILLION)

- TABLE 197 MEXICO: CLOUD DATA SECURITY MARKET, BY ORGANIZATION SIZE, 2022-2027 (USD MILLION)

- TABLE 198 MEXICO: CLOUD DATA SECURITY MARKET, BY OFFERING TYPE, 2018-2021 (USD MILLION)

- TABLE 199 MEXICO: CLOUD DATA SECURITY MARKET, BY OFFERING TYPE, 2022-2027 (USD MILLION)

- TABLE 200 MEXICO: CLOUD DATA SECURITY MARKET, BY VERTICAL, 2018-2021 (USD MILLION)

- TABLE 201 MEXICO: CLOUD DATA SECURITY MARKET, BY VERTICAL, 2022-2027 (USD MILLION)

- 10.6.6 REST OF LATIN AMERICA

- TABLE 202 REST OF LATIN AMERICA: CLOUD DATA SECURITY MARKET, BY OFFERING, 2018-2021 (USD MILLION)

- TABLE 203 REST OF LATIN AMERICA: CLOUD DATA SECURITY MARKET, BY OFFERING, 2022-2027 (USD MILLION)

- TABLE 204 REST OF LATIN AMERICA: CLOUD DATA SECURITY MARKET, BY ORGANIZATION SIZE, 2018-2021 (USD MILLION)

- TABLE 205 REST OF LATIN AMERICA: CLOUD DATA SECURITY MARKET, BY ORGANIZATION SIZE, 2022-2027 (USD MILLION)

- TABLE 206 REST OF LATIN AMERICA: CLOUD DATA SECURITY MARKET, BY OFFERING TYPE, 2018-2021 (USD MILLION)

- TABLE 207 REST OF LATIN AMERICA: CLOUD DATA SECURITY MARKET, BY OFFERING TYPE, 2022-2027 (USD MILLION)

- TABLE 208 REST OF LATIN AMERICA: CLOUD DATA SECURITY MARKET, BY VERTICAL, 2018-2021 (USD MILLION)

- TABLE 209 REST OF LATIN AMERICA: CLOUD DATA SECURITY MARKET, BY VERTICAL, 2022-2027 (USD MILLION)

11 COMPETITIVE LANDSCAPE

- 11.1 INTRODUCTION

- 11.2 REVENUE SHARE ANALYSIS OF LEADING PLAYERS, 2022

- FIGURE 31 REVENUE SHARE ANALYSIS OF CLOUD DATA SECURITY MARKET, 2022

- 11.3 MARKET SHARE ANALYSIS OF TOP MARKET PLAYERS

- TABLE 210 CLOUD DATA SECURITY MARKET: DEGREE OF COMPETITION

- 11.4 HISTORICAL REVENUE ANALYSIS

- FIGURE 32 SEGMENTAL REVENUE ANALYSIS OF TOP FIVE MARKET PLAYERS (USD MILLION)

- 11.5 RANKING OF KEY PLAYERS

- FIGURE 33 RANKING OF TOP FIVE CLOUD DATA SECURITY PLAYERS, 2022

- 11.6 EVALUATION MATRIX FOR KEY PLAYERS

- 11.6.1 DEFINITIONS AND METHODOLOGY

- FIGURE 34 EVALUATION QUADRANT FOR KEY PLAYERS: CRITERIA WEIGHTAGE

- FIGURE 35 EVALUATION MATRIX FOR KEY PLAYERS, 2022

- 11.6.2 STARS

- 11.6.3 EMERGING LEADERS

- 11.6.4 PERVASIVE PLAYERS

- 11.6.5 PARTICIPANTS

- 11.7 COMPETITIVE BENCHMARKING

- 11.7.1 EVALUATION CRITERIA FOR KEY COMPANIES

- TABLE 211 COMPANY VERTICAL FOOTPRINT

- 11.7.2 EVALUATION CRITERIA FOR STARTUPS/SMES

- TABLE 212 KEY STARTUPS

- 11.8 EVALUATION MATRIX FOR STARTUPS/SMES

- 11.8.1 DEFINITIONS AND METHODOLOGY

- FIGURE 36 EVALUATION QUADRANT FOR STARTUPS/SMES: CRITERIA WEIGHTAGE

- FIGURE 37 EVALUATION MATRIX FOR STARTUPS/SMES, 2022

- 11.8.2 PROGRESSIVE COMPANIES

- 11.8.3 RESPONSIVE COMPANIES

- 11.8.4 DYNAMIC COMPANIES

- 11.8.5 STARTING BLOCKS

- 11.9 COMPETITIVE SCENARIO

- 11.9.1 PRODUCT/SOLUTION LAUNCHES

- TABLE 213 CLOUD DATA SECURITY MARKET: PRODUCT/SOLUTION LAUNCHES, 2020-2022

- 11.9.2 DEALS

- TABLE 214 CLOUD DATA SECURITY MARKET: DEALS, 2020-2022

12 COMPANY PROFILES

(Business Overview, Products/Solutions/Services Offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats))**

- 12.1 KEY PLAYERS

- 12.1.1 CROWDSTRIKE

- TABLE 215 CROWDSTRIKE: BUSINESS OVERVIEW

- FIGURE 38 CROWDSTRIKE: COMPANY SNAPSHOT

- TABLE 216 CROWDSTRIKE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 217 CROWDSTRIKE: PRODUCT LAUNCHES

- TABLE 218 CROWDSTRIKE: DEALS

- 12.1.2 CHECK POINT

- TABLE 219 CHECK POINT: BUSINESS OVERVIEW

- FIGURE 39 CHECK POINT: COMPANY SNAPSHOT

- TABLE 220 CHECK POINT: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 221 CHECK POINT: PRODUCT LAUNCHES

- TABLE 222 CHECK POINT: DEALS

- 12.1.3 PALO ALTO NETWORKS

- TABLE 223 PALO ALTO NETWORKS: BUSINESS OVERVIEW

- FIGURE 40 PALO ALTO NETWORKS: COMPANY SNAPSHOT

- TABLE 224 PALO ALTO NETWORKS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 225 PALO ALTO NETWORKS: PRODUCT LAUNCHES

- TABLE 226 PALO ALTO NETWORKS: DEALS

- 12.1.4 ZSCALER

- TABLE 227 ZSCALER: BUSINESS OVERVIEW

- FIGURE 41 ZSCALER: COMPANY SNAPSHOT

- TABLE 228 ZSCALER: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 229 ZSCALER: PRODUCT LAUNCHES

- TABLE 230 ZSCALER: DEALS

- 12.1.5 IBM

- TABLE 231 IBM: BUSINESS OVERVIEW

- FIGURE 42 IBM: COMPANY SNAPSHOT

- TABLE 232 IBM: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 233 IBM: PRODUCT LAUNCHES

- TABLE 234 IBM: DEALS

- 12.1.6 IMPERVA

- TABLE 235 IMPERVA: BUSINESS OVERVIEW

- TABLE 236 IMPERVA: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 237 IMPERVA: PRODUCT LAUNCHES

- TABLE 238 IMPERVA: DEALS

- 12.1.7 VERITAS

- TABLE 239 VERITAS: BUSINESS OVERVIEW

- TABLE 240 VERITAS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 241 VERITAS: PRODUCT LAUNCHES

- TABLE 242 VERITAS: DEALS

- 12.1.8 DIGITAL GUARDIAN

- TABLE 243 DIGITAL GUARDIAN: BUSINESS OVERVIEW

- TABLE 244 DIGITAL GUARDIAN: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 245 DIGITAL GUARDIAN: DEALS

- 12.1.9 VMWARE

- TABLE 246 VMWARE: BUSINESS OVERVIEW

- FIGURE 43 VMWARE: COMPANY SNAPSHOT

- TABLE 247 VMWARE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 248 VMWARE: PRODUCT LAUNCHES

- TABLE 249 VMWARE: DEALS

- 12.1.10 THALES

- TABLE 250 THALES: BUSINESS OVERVIEW

- FIGURE 44 THALES: COMPANY SNAPSHOT

- TABLE 251 THALES: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 252 THALES: PRODUCT LAUNCHES

- TABLE 253 THALES: DEALS

- 12.2 OTHER PLAYERS

- 12.2.1 SOPHOS

- 12.2.2 POLAR

- 12.2.3 NETWRIX

- 12.2.4 INFORMATICA

- 12.2.5 COMMVAULT

- 12.2.6 ORCA SECURITY

- 12.2.7 RADWARE

- 12.2.8 RUBRIK

- 12.2.9 VEEAM

- 12.2.10 INFRASCALE

- 12.2.11 DRUVA

- 12.2.12 FACTION

- 12.2.13 COHESITY

- 12.2.14 NETSKOPE

- 12.2.15 CLOUDIAN

- *Details on Business Overview, Products/Solutions/Services Offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats) might not be captured in case of unlisted companies.

13 ADJACENT MARKETS

- 13.1 INTRODUCTION TO ADJACENT MARKETS

- TABLE 254 ADJACENT MARKETS AND FORECASTS

- 13.2 LIMITATIONS

- 13.3 CLOUD DATA SECURITY MARKET ECOSYSTEM AND ADJACENT MARKETS

- 13.3.1 DATA-CENTRIC SECURITY MARKET

- TABLE 255 DATA-CENTRIC SECURITY MARKET, BY DEPLOYMENT MODE, 2016-2021 (USD MILLION)

- TABLE 256 DATA-CENTRIC SECURITY MARKET, BY DEPLOYMENT MODE, 2022-2027 (USD MILLION)

- TABLE 257 ON-PREMISES: DATA-CENTRIC SECURITY MARKET, BY REGION, 2016-2021 (USD MILLION)

- TABLE 258 ON-PREMISES: DATA-CENTRIC SECURITY MARKET, BY REGION, 2022-2027 (USD MILLION)

- TABLE 259 CLOUD: DATA-CENTRIC SECURITY MARKET, BY REGION, 2016-2021 (USD MILLION)

- TABLE 260 CLOUD: DATA-CENTRIC SECURITY MARKET, BY REGION, 2022-2027 (USD MILLION)

- 13.3.2 CLOUD SECURITY POSTURE MANAGEMENT MARKET

- TABLE 261 CLOUD SECURITY POSTURE MANAGEMENT MARKET, BY ORGANIZATION SIZE, 2016-2021 (USD MILLION)

- TABLE 262 CLOUD SECURITY POSTURE MANAGEMENT MARKET, BY ORGANIZATION SIZE, 2022-2027 (USD MILLION)

- TABLE 263 CLOUD SECURITY POSTURE MANAGEMENT MARKET IN SMALL & MEDIUM ENTERPRISES, BY REGION, 2016-2021 (USD MILLION)

- TABLE 264 CLOUD SECURITY POSTURE MANAGEMENT MARKET IN SMALL & MEDIUM ENTERPRISES, BY REGION, 2022-2027 (USD MILLION)

- TABLE 265 CLOUD SECURITY POSTURE MANAGEMENT MARKET IN LARGE ENTERPRISES, BY REGION, 2016-2021 (USD MILLION)

- TABLE 266 CLOUD SECURITY POSTURE MANAGEMENT MARKET IN LARGE ENTERPRISES, BY REGION, 2022-2027 (USD MILLION)

- 13.3.3 CONTAINER SECURITY MARKET

- TABLE 267 CONTAINER SECURITY MARKET, BY DEPLOYMENT MODE, 2015-2020 (USD MILLION)

- TABLE 268 CONTAINER SECURITY MARKET, BY DEPLOYMENT MODE, 2021-2026 (USD MILLION)

- TABLE 269 CLOUD: CONTAINER SECURITY MARKET, BY REGION, 2015-2020 (USD MILLION)

- TABLE 270 CLOUD: CONTAINER SECURITY MARKET, BY REGION, 2021-2026 (USD MILLION)

- TABLE 271 ON-PREMISES: CONTAINER SECURITY MARKET, BY REGION, 2015-2020 (USD MILLION)

- TABLE 272 ON-PREMISES: CONTAINER SECURITY MARKET, BY REGION, 2021-2026 (USD MILLION)

14 APPENDIX

- 14.1 DISCUSSION GUIDE

- 14.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 14.3 CUSTOMIZATION OPTIONS

- 14.4 RELATED REPORTS

- 14.5 AUTHOR DETAILS