|

|

市場調査レポート

商品コード

1603240

栄養補助食品の世界市場:原料調達・品質別、技術別、タイプ別、適用方法別、ターゲット消費者別、機能別、流通チャネル別、地域別 - 2029年までの予測Dietary Supplements Market by Type (Botanicals, Vitamins, Minerals, Amino Acids, Enzymes, Probiotics), Mode of Application (Tablets, Capsules, Liquid, Powder, Gummies/Chewables), Target Consumer, Function, Region - Global Forecast to 2029 |

||||||

カスタマイズ可能

|

|||||||

| 栄養補助食品の世界市場:原料調達・品質別、技術別、タイプ別、適用方法別、ターゲット消費者別、機能別、流通チャネル別、地域別 - 2029年までの予測 |

|

出版日: 2024年11月26日

発行: MarketsandMarkets

ページ情報: 英文 472 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

世界の栄養補助食品の市場規模は、2024年に1,795億3,000万米ドルになるとみられ、予測期間中のCAGRは7.6%と見込まれており、2029年には2,587億5,000万米ドルに達すると予測されています。

アクティブなライフスタイルへのシフトや予防ヘルスケアへの注目といった要因が、この拡大に大きく寄与しています。さらに、スポーツ栄養、認知健康、消化器系の健康など、特定のニーズをターゲットにした斬新な製品が、オーダーメイドのソリューションを求める消費者の間で人気を集めています。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2024年~2029年 |

| 基準年 | 2023年 |

| 予測期間 | 2024年~2029年 |

| 検討単位 | 金額(米ドル) |

| セグメント別 | 原料調達・品質別、技術別、タイプ別、適用方法別、ターゲット消費者別、機能別、流通チャネル別、地域別 |

| 対象地域 | 北米、欧州、アジア太平洋、南米、その他の地域 |

1994年に制定された栄養補助食品健康教育法(DSHEA)の下、製造業者と販売業者は、製品を販売する前に製品の安全性と適切な表示を確保することが義務付けられています。FDAは、完成品の栄養補助食品と栄養成分の両方を、従来の食品や医薬品とは異なる枠組みで規制しています。粗悪品や不当表示された製品が製造元を離れて市場に出回ると、FDAは消費者の安全を確保し、製品の完全性を維持するために、製品回収、警告状、輸入警告、法的措置などの手段を講じます。これらの規制は、安全性、適切な表示、製品の完全性を確保することにより、栄養補助食品業界に対する消費者の信頼を維持する上で重要な役割を果たしており、液体やチュアブルタイプのサプリメントのような提供形態の革新を含め、業界の成長と進化する消費者ニーズへの対応能力を間接的に支えています。

消費者はカスタマイズされた栄養を求め、AI主導の推奨は革新的な製品と考えられています。FDAは、より安全で透明性の高い製品の製造を確保するため、規制を強化しています。そのため、メーカーは品質保証や表示への投資を大幅に増やす必要に迫られています。また、オンライン小売は、従来の小売チャネルを破壊し、ブランドは消費者へのダイレクト・マーケティングを通じて繁栄しています。また、持続可能性とクリーン・ラベルの動向は、持続可能性と倫理的に調達された原材料を重視する消費者のために、製品開発のトレンドを再構築しています。これは実際、業界の力学を再形成し、消費者の関与だけでなく、競争の新たな基準を引き上げています。

当レポートでは、世界の栄養補助食品市場について調査し、原料調達・品質別、技術別、タイプ別、適用方法別、ターゲット消費者別、機能別、流通チャネル別、地域別動向、および市場に参入する企業のプロファイルなどをまとめています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- マクロ経済的要因

- 市場力学

- 生成AIが食品・飲料の原料・添加物に与える影響

第6章 業界の動向

- イントロダクション

- 顧客ビジネスに影響を与える動向/混乱

- 価格分析

- サプライチェーン分析

- バリューチェーン分析

- エコシステム

- 技術分析

- 特許分析

- 貿易分析

- 2024年~2025年の主な会議とイベント

- 関税と規制状況

- 栄養補助食品の世界の規制

- ポーターのファイブフォース分析

- 主な利害関係者と購入基準

- 投資と資金調達のシナリオ

- ケーススタディ分析

第7章 栄養補助食品市場(原料調達・品質別)

- イントロダクション

- 原材料の調達

- 原材料の品質

- 試験と認証

- 原材料の不正防止

- 透明性とラベル付け

第8章 栄養補助食品市場(技術別)

- イントロダクション

- 酵素工学

- スマート製造と自動化

- 分子蒸留

- 多層埋め込み

- 食品のプロバイオティクス化のためのマイクロカプセル化粉末

第9章 栄養補助食品市場(タイプ別)

- イントロダクション

- 植物

- ビタミン

- ミネラル

- アミノ酸

- 酵素

- プロバイオティクス

- その他

第10章 栄養補助食品市場(適用方法別)

- イントロダクション

- タブレット

- カプセル

- 液体

- 粉末

- グミ/チュアブル

第11章 栄養補助食品市場(ターゲット消費者別)

- イントロダクション

- 乳児

- 子供

- 大人

- 妊娠中の女性

- 高齢者

第12章 栄養補助食品市場(機能別)

- イントロダクション

- 腸

- 免疫

- スポーツ栄養

- 皮膚

- 代謝

- 体重管理

- 骨・関節

- その他

第13章 栄養補助食品市場(流通チャネル別)

- イントロダクション

- 薬局

- スーパーマーケット/ハイパーマーケット

- ヘルス・ウェルネスストア

- オンライン

- その他

第14章 栄養補助食品市場(地域別)

- イントロダクション

- 北米

- 米国

- カナダ

- メキシコ

- 欧州

- ドイツ

- 英国

- フランス

- イタリア

- スペイン

- その他

- アジア太平洋

- 中国

- インド

- 日本

- オーストラリアとニュージーランド

- その他

- 南米

- ブラジル

- アルゼンチン

- その他

- その他の地域

- アフリカ

- 中東

第15章 競合情勢

- 概要

- 主要参入企業の戦略/強み

- 収益分析

- 市場シェア分析

- 企業評価マトリックス:主要参入企業、2023年

- 企業評価マトリックス:スタートアップ/中小企業、2023年

- 企業価値評価と財務指標

- ブランド/製品比較

- 競合シナリオと動向

第16章 企業プロファイル

- 主要参入企業

- NESTLE

- ABBOTT

- OTSUKA HOLDINGS CO., LTD.

- HALEON GROUP OF COMPANIES

- GLANBIA PLC

- BAYER AG

- H&H GROUP

- NATURE'S SUNSHINE PRODUCTS, INC.

- NU SKIN

- AMWAY CORP.

- HERBALIFE INTERNATIONAL OF AMERICA, INC.

- BIONOVA

- ARKOPHARMA

- AMERICAN HEALTH

- VITACO

- その他の企業/スタートアップ/中小企業

- POWER GUMMIES

- BIOMEDICAL RESEARCH LABORATORIES, LLC

- HEALTHKART.COM

- NORDIC NATURALS

- BIOGAIA

- ALFA LABORATORIES, INC.

- NUTRISCIENCE CORPORATION

- NATURE'S ESSENTIALS

- LIFE EXTENSION

- SOLGAR INC.

- 栄養補助食品原料メーカー

- ADM

- CARGILL, INCORPORATED

- INTERNATIONAL FLAVORS & FRAGRANCES INC

- BASF SE

- DSM-FIRMENICH

- ASSOCIATED BRITISH FOODS PLC

- KYOWA KIRIN CO., LTD

- FONTERRA CO-OPERATIVE GROUP LIMITED

- KERRY GROUP PLC

- DIVI'S NUTRACEUTICALS

第17章 隣接市場と関連市場

第18章 付録

List of Tables

- TABLE 1 USD EXCHANGE RATES CONSIDERED, 2019-2023

- TABLE 2 DIETARY SUPPLEMENTS MARKET SNAPSHOT, 2024 VS. 2029

- TABLE 3 FOODS BOOSTING IMMUNE SYSTEM

- TABLE 4 MICRONUTRIENT DEFICIENCY CONDITIONS AND WORLDWIDE PREVALENCE

- TABLE 5 WIDELY USED FORTIFIED FOODS

- TABLE 6 AVERAGE SELLING PRICE TREND AMONG KEY PLAYERS, 2023

- TABLE 7 AVERAGE SELLING PRICE, BY TYPE, 2020-2023 (USD/TON)

- TABLE 8 AVERAGE SELLING PRICE, BY REGION, 2020-2023 (USD/TON)

- TABLE 9 DIETARY SUPPLEMENTS MARKET: ECOSYSTEM

- TABLE 10 PATENTS PERTAINING TO DIETARY SUPPLEMENTS, 2020-2024

- TABLE 11 TOP FIVE EXPORTERS OF PROVITAMINS AND VITAMINS (HS CODE 2936), 2020-2023 (USD THOUSAND)

- TABLE 12 TOP FIVE IMPORTERS OF PROVITAMINS AND VITAMINS (HS CODE 2936), 2020-2023 (USD THOUSAND)

- TABLE 13 EXPORT SCENARIO FOR HS CODE 300290, BY COUNTRY, 2021-2023 (KG)

- TABLE 14 IMPORT SCENARIO FOR HS CODE 300290, BY COUNTRY, 2021-2023 (KG)

- TABLE 15 DIETARY SUPPLEMENTS MARKET: DETAILED LIST OF CONFERENCES AND EVENTS, 2024-2025

- TABLE 16 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 17 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 18 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 19 REST OF THE WORLD: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 20 RDI FOR VITAMINS AND MINERALS ESSENTIAL IN HUMAN NUTRITION

- TABLE 21 DIETARY REFERENCE INTAKES

- TABLE 22 RECOMMENDED VITAMIN LEVELS

- TABLE 23 QUANTITY OF MINERALS AND THEIR LIMITS

- TABLE 24 RECOMMENDED MAXIMUM LEVELS FOR ADDITION OF VITAMINS TO FOOD SUPPLEMENTS AND CONVENTIONAL FOODS

- TABLE 25 RECOMMENDED MAXIMUM LEVELS FOR ADDITION OF MINERALS AND TRACE ELEMENTS TO FOOD SUPPLEMENTS AND CONVENTIONAL FOODS

- TABLE 26 DAILY REFERENCE INTAKES FOR VITAMINS AND MINERALS

- TABLE 27 VITAMINS: MAXIMUM DAILY USE

- TABLE 28 MINERALS: MAXIMUM DAILY USE

- TABLE 29 CATEGORIES WITH REGARD TO FUNCTIONAL FOODS AND LEGISLATIVE CRITERIA OF HEALTH CLAIMS

- TABLE 30 DIFFERENT CATEGORIES OF PRODUCTS COVERED UNDER NUTRACEUTICAL REGULATIONS

- TABLE 31 VALUES FOR VITAMINS ALLOWED TO BE USED IN FOOD FOR SPECIAL DIETARY USE AND SPECIAL MEDICAL PURPOSE (OTHER THAN THOSE INTENDED FOR USE IN INFANT FORMULA)

- TABLE 32 VALUES FOR MINERALS AND TRACE ELEMENTS ALLOWED TO BE USED IN FOOD FOR SPECIAL DIETARY USE AND SPECIAL MEDICAL PURPOSE (OTHER THAN THOSE INTENDED FOR USE IN INFANT FORMULA)

- TABLE 33 VITAMINS

- TABLE 34 MINERALS

- TABLE 35 RECOMMENDED DAILY INTAKE VALUES OF NUTRIENTS (IDR) OF VOLUNTARY DECLARATION: VITAMINS AND MINERALS

- TABLE 36 DAILY REFERENCE VALUES AND TOLERABLE MAXIMUM INTAKE LEVEL OF VITAMINS, MINERALS, AND TRACE ELEMENTS FOR DIETARY SUPPLEMENTS

- TABLE 37 VITAMINS: RECOMMENDED DIETARY ALLOWANCE (RDA) AND ADEQUATE INTAKE (AI) (FOOD DOME DIETARY GUIDELINES OF ARAB COUNTRIES - ARAB CENTRE FOR NUTRITION - KINGDOM OF BAHRAIN)

- TABLE 38 MINERALS: RECOMMENDED DIETARY ALLOWANCE (RDA) AND ADEQUATE INTAKE (AI) (FOOD DOME DIETARY GUIDELINES OF ARAB COUNTRIES - ARAB CENTRE FOR NUTRITION - KINGDOM OF BAHRAIN)

- TABLE 39 IMPACT OF PORTER'S FIVE FORCES ON DIETARY SUPPLEMENTS MARKET

- TABLE 40 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TYPES OF DIETARY SUPPLEMENTS

- TABLE 41 KEY BUYING CRITERIA FOR KEY MODES OF APPLICATION OF DIETARY SUPPLEMENTS

- TABLE 42 SAFETY ASSESSMENT AND CERTIFICATION DEMAND BY INDUSTRY PLAYERS TO ENSURE TRANSPARENCY

- TABLE 43 COMPANIES FOCUSED ON DEVELOPING FLAVORED DIETARY SUPPLEMENT PRODUCTS

- TABLE 44 US-BASED FIRM STARTED OFFERING EASY-TO-USE AND EFFICIENT-TO-TAKE VITAMIN AND MINERAL PILLS THAT DISSOLVE INSTANTLY

- TABLE 45 DIETARY SUPPLEMENTS MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 46 DIETARY SUPPLEMENTS MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 47 DIETARY SUPPLEMENTS MARKET, BY TYPE, 2020-2023 (KT)

- TABLE 48 DIETARY SUPPLEMENTS MARKET, BY TYPE, 2024-2029 (KT)

- TABLE 49 BOTANICALS: DIETARY SUPPLEMENTS MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 50 BOTANICALS: DIETARY SUPPLEMENTS MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 51 BOTANICALS: DIETARY SUPPLEMENTS MARKET, BY REGION, 2020-2023 (KT)

- TABLE 52 BOTANICALS: DIETARY SUPPLEMENTS MARKET, BY REGION, 2024-2029 (KT)

- TABLE 53 VITAMINS: DIETARY SUPPLEMENTS MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 54 VITAMINS: DIETARY SUPPLEMENTS MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 55 VITAMINS: DIETARY SUPPLEMENTS MARKET, BY REGION, 2020-2023 (KT)

- TABLE 56 VITAMINS: DIETARY SUPPLEMENTS MARKET, BY REGION, 2024-2029 (KT)

- TABLE 57 VITAMINS: DIETARY SUPPLEMENTS MARKET, BY SUBTYPE, 2020-2023 (USD MILLION)

- TABLE 58 VITAMINS: DIETARY SUPPLEMENTS MARKET, BY SUBTYPE, 2024-2029 (USD MILLION)

- TABLE 59 MINERALS: USAGE AND SOURCES

- TABLE 60 TRACE ELEMENTS (MINERALS): USAGE AND SOURCES

- TABLE 61 MINERALS: DIETARY SUPPLEMENTS MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 62 MINERALS: DIETARY SUPPLEMENTS MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 63 MINERALS: DIETARY SUPPLEMENTS MARKET, BY REGION, 2020-2023 (KT)

- TABLE 64 MINERALS: DIETARY SUPPLEMENTS MARKET, BY REGION, 2024-2029 (KT)

- TABLE 65 MINERALS: DIETARY SUPPLEMENTS MARKET, BY SUBTYPE, 2020-2023 (USD MILLION)

- TABLE 66 MINERALS: DIETARY SUPPLEMENTS MARKET, BY SUBTYPE, 2024-2029 (USD MILLION)

- TABLE 67 AMINO ACIDS: DIETARY SUPPLEMENTS MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 68 AMINO ACIDS: DIETARY SUPPLEMENTS MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 69 AMINO ACIDS: DIETARY SUPPLEMENTS MARKET, BY REGION, 2020-2023 (KT)

- TABLE 70 AMINO ACIDS: DIETARY SUPPLEMENTS MARKET, BY REGION, 2024-2029 (KT)

- TABLE 71 AMINO ACIDS: DIETARY SUPPLEMENTS MARKET, BY SUBTYPE, 2020-2023 (USD MILLION)

- TABLE 72 AMINO ACIDS: DIETARY SUPPLEMENTS MARKET, BY SUBTYPE, 2024-2029 (USD MILLION)

- TABLE 73 ENZYMES: DIETARY SUPPLEMENTS MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 74 ENZYMES: DIETARY SUPPLEMENTS MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 75 ENZYMES: DIETARY SUPPLEMENTS MARKET, BY REGION, 2020-2023 (KT)

- TABLE 76 ENZYMES: DIETARY SUPPLEMENTS MARKET, BY REGION, 2024-2029 (KT)

- TABLE 77 PROBIOTICS: DIETARY SUPPLEMENTS MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 78 PROBIOTICS: DIETARY SUPPLEMENTS MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 79 PROBIOTICS: DIETARY SUPPLEMENTS MARKET, BY REGION, 2020-2023 (KT)

- TABLE 80 PROBIOTICS: DIETARY SUPPLEMENTS MARKET, BY REGION, 2024-2029 (KT)

- TABLE 81 OTHER TYPES: DIETARY SUPPLEMENTS MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 82 OTHER TYPES: DIETARY SUPPLEMENTS MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 83 OTHER TYPES: DIETARY SUPPLEMENTS MARKET, BY REGION, 2019-2023 (KT)

- TABLE 84 OTHER TYPES: DIETARY SUPPLEMENTS MARKET, BY REGION, 2024-2029 (KT)

- TABLE 85 DIETARY SUPPLEMENTS MARKET, BY MODE OF APPLICATION, 2020-2023 (USD MILLION)

- TABLE 86 DIETARY SUPPLEMENTS MARKET, BY MODE OF APPLICATION, 2024-2029 (USD MILLION)

- TABLE 87 TABLETS: DIETARY SUPPLEMENTS MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 88 TABLETS: DIETARY SUPPLEMENTS MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 89 CAPSULES: DIETARY SUPPLEMENTS MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 90 CAPSULES: DIETARY SUPPLEMENTS MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 91 LIQUID: DIETARY SUPPLEMENTS MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 92 LIQUID: DIETARY SUPPLEMENTS MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 93 POWDER: DIETARY SUPPLEMENTS MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 94 POWDER: DIETARY SUPPLEMENTS MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 95 GUMMIES/CHEWABLES: DIETARY SUPPLEMENTS MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 96 GUMMIES/CHEWABLES: DIETARY SUPPLEMENTS MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 97 DIETARY SUPPLEMENTS MARKET, BY TARGET CONSUMER, 2020-2023 (USD MILLION)

- TABLE 98 DIETARY SUPPLEMENTS MARKET, BY TARGET CONSUMER, 2024-2029 (USD MILLION)

- TABLE 99 INFANTS: DIETARY SUPPLEMENTS MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 100 INFANTS: DIETARY SUPPLEMENTS MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 101 CHILDREN: DIETARY SUPPLEMENTS MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 102 CHILDREN: DIETARY SUPPLEMENTS MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 103 ADULTS: DIETARY SUPPLEMENTS MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 104 ADULTS: DIETARY SUPPLEMENTS MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 105 PREGNANT WOMEN: DIETARY SUPPLEMENTS MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 106 PREGNANT WOMEN: DIETARY SUPPLEMENTS MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 107 ELDERLY: DIETARY SUPPLEMENTS MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 108 ELDERLY: DIETARY SUPPLEMENTS MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 109 DIETARY SUPPLEMENTS MARKET, BY FUNCTION, 2020-2023 (USD MILLION)

- TABLE 110 DIETARY SUPPLEMENTS MARKET, BY FUNCTION, 2024-2029 (USD MILLION)

- TABLE 111 GUT HEALTH: DIETARY SUPPLEMENTS MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 112 GUT HEALTH: DIETARY SUPPLEMENTS MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 113 IMMUNE HEALTH: DIETARY SUPPLEMENTS MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 114 IMMUNE HEALTH: DIETARY SUPPLEMENTS MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 115 SPORTS NUTRITION: DIETARY SUPPLEMENTS MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 116 SPORTS NUTRITION: DIETARY SUPPLEMENTS MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 117 SKIN HEALTH: DIETARY SUPPLEMENTS MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 118 SKIN HEALTH: DIETARY SUPPLEMENTS MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 119 METABOLIC HEALTH: DIETARY SUPPLEMENTS MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 120 METABOLIC HEALTH: DIETARY SUPPLEMENTS MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 121 WEIGHT MANAGEMENT: DIETARY SUPPLEMENTS MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 122 WEIGHT MANAGEMENT: DIETARY SUPPLEMENTS MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 123 BONE-BUILDING NUTRIENTS AND THEIR THERAPEUTIC RANGE

- TABLE 124 BONE & JOINT HEALTH: DIETARY SUPPLEMENTS MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 125 BONE & JOINT HEALTH: DIETARY SUPPLEMENTS MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 126 OTHER FUNCTIONS: DIETARY SUPPLEMENTS MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 127 OTHER FUNCTIONS: DIETARY SUPPLEMENTS MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 128 DIETARY SUPPLEMENTS MARKET, BY DISTRIBUTION CHANNEL, 2020-2023 (USD MILLION)

- TABLE 129 DIETARY SUPPLEMENTS MARKET, BY DISTRIBUTION CHANNEL, 2024-2029 (USD MILLION)

- TABLE 130 DIETARY SUPPLEMENTS MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 131 DIETARY SUPPLEMENTS MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 132 DIETARY SUPPLEMENTS MARKET, BY REGION, 2020-2023 (KT)

- TABLE 133 DIETARY SUPPLEMENTS MARKET, BY REGION, 2024-2029 (KT)

- TABLE 134 NORTH AMERICA: DIETARY SUPPLEMENTS MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 135 NORTH AMERICA: DIETARY SUPPLEMENTS MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 136 NORTH AMERICA: DIETARY SUPPLEMENTS MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 137 NORTH AMERICA: DIETARY SUPPLEMENTS MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 138 NORTH AMERICA: DIETARY SUPPLEMENTS MARKET, BY TYPE, 2020-2023 (KT)

- TABLE 139 NORTH AMERICA: DIETARY SUPPLEMENTS MARKET, BY TYPE, 2024-2029 (KT)

- TABLE 140 NORTH AMERICA: DIETARY SUPPLEMENTS MARKET, BY FUNCTION, 2020-2023 (USD MILLION)

- TABLE 141 NORTH AMERICA: DIETARY SUPPLEMENTS MARKET, BY FUNCTION, 2024-2029 (USD MILLION)

- TABLE 142 NORTH AMERICA: DIETARY SUPPLEMENTS MARKET, BY MODE OF APPLICATION, 2020-2023 (USD MILLION)

- TABLE 143 NORTH AMERICA: DIETARY SUPPLEMENTS MARKET, BY MODE OF APPLICATION, 2024-2029 (USD MILLION)

- TABLE 144 NORTH AMERICA: DIETARY SUPPLEMENTS MARKET, BY TARGET CONSUMER, 2020-2023 (USD MILLION)

- TABLE 145 NORTH AMERICA: DIETARY SUPPLEMENTS MARKET, BY TARGET CONSUMER, 2024-2029 (USD MILLION)

- TABLE 146 US: DIETARY SUPPLEMENTS MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 147 US: DIETARY SUPPLEMENTS MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 148 CANADA: DIETARY SUPPLEMENTS MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 149 CANADA: DIETARY SUPPLEMENTS MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 150 MEXICO: DIETARY SUPPLEMENTS MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 151 MEXICO: DIETARY SUPPLEMENTS MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 152 EUROPE: DIETARY SUPPLEMENTS MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 153 EUROPE: DIETARY SUPPLEMENTS MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 154 EUROPE: DIETARY SUPPLEMENTS MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 155 EUROPE: DIETARY SUPPLEMENTS MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 156 EUROPE: DIETARY SUPPLEMENTS MARKET, BY TYPE, 2020-2023 (KT)

- TABLE 157 EUROPE: DIETARY SUPPLEMENTS MARKET, BY TYPE, 2024-2029 (KT)

- TABLE 158 EUROPE: DIETARY SUPPLEMENTS MARKET, BY FUNCTION, 2020-2023 (USD MILLION)

- TABLE 159 EUROPE: DIETARY SUPPLEMENTS MARKET, BY FUNCTION, 2024-2029 (USD MILLION)

- TABLE 160 EUROPE: DIETARY SUPPLEMENTS MARKET, BY MODE OF APPLICATION, 2020-2023 (USD MILLION)

- TABLE 161 EUROPE: DIETARY SUPPLEMENTS MARKET, BY MODE OF APPLICATION, 2024-2029 (USD MILLION)

- TABLE 162 EUROPE: DIETARY SUPPLEMENTS MARKET, BY TARGET CONSUMER, 2020-2023 (USD MILLION)

- TABLE 163 EUROPE: DIETARY SUPPLEMENTS MARKET, BY TARGET CONSUMER, 2024-2029 (USD MILLION)

- TABLE 164 GERMANY: DIETARY SUPPLEMENTS MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 165 GERMANY: DIETARY SUPPLEMENTS MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 166 UK: DIETARY SUPPLEMENTS MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 167 UK: DIETARY SUPPLEMENTS MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 168 FRANCE: DIETARY SUPPLEMENTS MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 169 FRANCE: DIETARY SUPPLEMENTS MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 170 ITALY: DIETARY SUPPLEMENTS MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 171 ITALY: DIETARY SUPPLEMENTS MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 172 SPAIN: DIETARY SUPPLEMENTS MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 173 SPAIN: DIETARY SUPPLEMENTS MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 174 REST OF EUROPE: DIETARY SUPPLEMENTS MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 175 REST OF EUROPE: DIETARY SUPPLEMENTS MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 176 ASIA PACIFIC: DIETARY SUPPLEMENTS MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 177 ASIA PACIFIC: DIETARY SUPPLEMENTS MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 178 ASIA PACIFIC: DIETARY SUPPLEMENTS MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 179 ASIA PACIFIC: DIETARY SUPPLEMENTS MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 180 ASIA PACIFIC: DIETARY SUPPLEMENTS MARKET, BY TYPE, 2020-2023 (KT)

- TABLE 181 ASIA PACIFIC: DIETARY SUPPLEMENTS MARKET, BY TYPE, 2024-2029 (KT)

- TABLE 182 ASIA PACIFIC: DIETARY SUPPLEMENTS MARKET, BY FUNCTION, 2020-2023 (USD MILLION)

- TABLE 183 ASIA PACIFIC: DIETARY SUPPLEMENTS MARKET, BY FUNCTION, 2024-2029 (USD MILLION)

- TABLE 184 ASIA PACIFIC: DIETARY SUPPLEMENTS MARKET, BY MODE OF APPLICATION, 2020-2023 (USD MILLION)

- TABLE 185 ASIA PACIFIC: DIETARY SUPPLEMENTS MARKET, BY MODE OF APPLICATION, 2024-2029 (USD MILLION)

- TABLE 186 ASIA PACIFIC: DIETARY SUPPLEMENTS MARKET, BY TARGET CONSUMER, 2020-2023 (USD MILLION)

- TABLE 187 ASIA PACIFIC: DIETARY SUPPLEMENTS MARKET, BY TARGET CONSUMER, 2024-2029 (USD MILLION)

- TABLE 188 CHINA: DIETARY SUPPLEMENTS MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 189 CHINA: DIETARY SUPPLEMENTS MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 190 INDIA: DIETARY SUPPLEMENTS MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 191 INDIA: DIETARY SUPPLEMENTS MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 192 JAPAN: DIETARY SUPPLEMENTS MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 193 JAPAN: DIETARY SUPPLEMENTS MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 194 AUSTRALIA & NEW ZEALAND: DIETARY SUPPLEMENTS MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 195 AUSTRALIA & NEW ZEALAND: DIETARY SUPPLEMENTS MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 196 REST OF ASIA PACIFIC: DIETARY SUPPLEMENTS MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 197 REST OF ASIA PACIFIC: DIETARY SUPPLEMENTS MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 198 SOUTH AMERICA: DIETARY SUPPLEMENTS MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 199 SOUTH AMERICA: DIETARY SUPPLEMENTS MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 200 SOUTH AMERICA: DIETARY SUPPLEMENTS MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 201 SOUTH AMERICA: DIETARY SUPPLEMENTS MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 202 SOUTH AMERICA: DIETARY SUPPLEMENTS MARKET, BY TYPE, 2020-2023 (KT)

- TABLE 203 SOUTH AMERICA: DIETARY SUPPLEMENTS MARKET, BY TYPE, 2024-2029 (KT)

- TABLE 204 SOUTH AMERICA: DIETARY SUPPLEMENTS MARKET, BY FUNCTION, 2020-2023 (USD MILLION)

- TABLE 205 SOUTH AMERICA: DIETARY SUPPLEMENTS MARKET, BY FUNCTION, 2024-2029 (USD MILLION)

- TABLE 206 SOUTH AMERICA: DIETARY SUPPLEMENTS MARKET, BY MODE OF APPLICATION, 2020-2023 (USD MILLION)

- TABLE 207 SOUTH AMERICA: DIETARY SUPPLEMENTS MARKET, BY MODE OF APPLICATION, 2024-2029 (USD MILLION)

- TABLE 208 SOUTH AMERICA: DIETARY SUPPLEMENTS MARKET, BY TARGET CONSUMER, 2020-2023 (USD MILLION)

- TABLE 209 SOUTH AMERICA: DIETARY SUPPLEMENTS MARKET, BY TARGET CONSUMER, 2024-2029 (USD MILLION)

- TABLE 210 BRAZIL: DIETARY SUPPLEMENTS MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 211 BRAZIL: DIETARY SUPPLEMENTS MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 212 ARGENTINA: DIETARY SUPPLEMENTS MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 213 ARGENTINA: DIETARY SUPPLEMENTS MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 214 REST OF SOUTH AMERICA: DIETARY SUPPLEMENTS MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 215 REST OF SOUTH AMERICA: DIETARY SUPPLEMENTS MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 216 ROW: DIETARY SUPPLEMENTS MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 217 ROW: DIETARY SUPPLEMENTS MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 218 ROW: DIETARY SUPPLEMENTS MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 219 ROW: DIETARY SUPPLEMENTS MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 220 ROW: DIETARY SUPPLEMENTS MARKET, BY TYPE, 2020-2023 (KT)

- TABLE 221 ROW: DIETARY SUPPLEMENTS MARKET, BY TYPE, 2024-2029 (KT)

- TABLE 222 ROW: DIETARY SUPPLEMENTS MARKET, BY FUNCTION, 2020-2023 (USD MILLION)

- TABLE 223 ROW: DIETARY SUPPLEMENTS MARKET, BY FUNCTION, 2024-2029 (USD MILLION)

- TABLE 224 ROW: DIETARY SUPPLEMENTS MARKET, BY MODE OF APPLICATION, 2020-2023 (USD MILLION)

- TABLE 225 ROW: DIETARY SUPPLEMENTS MARKET, BY MODE OF APPLICATION, 2024-2029 (USD MILLION)

- TABLE 226 ROW: DIETARY SUPPLEMENTS MARKET, BY TARGET CONSUMER, 2020-2023 (USD MILLION)

- TABLE 227 ROW: DIETARY SUPPLEMENTS MARKET, BY TARGET CONSUMER, 2024-2029 (USD MILLION)

- TABLE 228 AFRICA: DIETARY SUPPLEMENTS MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 229 AFRICA: DIETARY SUPPLEMENTS MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 230 MIDDLE EAST: DIETARY SUPPLEMENTS MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 231 MIDDLE EAST: DIETARY SUPPLEMENTS MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 232 OVERVIEW OF STRATEGIES DEPLOYED BY KEY MARKET PLAYERS

- TABLE 233 DIETARY SUPPLEMENTS MARKET: DEGREE OF COMPETITION, 2023

- TABLE 234 DIETARY SUPPLEMENTS MARKET: TYPE FOOTPRINT, 2023

- TABLE 235 DIETARY SUPPLEMENTS MARKET: MODE OF APPLICATION FOOTPRINT, 2023

- TABLE 236 DIETARY SUPPLEMENTS MARKET: FUNCTION FOOTPRINT, 2023

- TABLE 237 DIETARY SUPPLEMENTS MARKET: REGIONAL FOOTPRINT, 2023

- TABLE 238 DIETARY SUPPLEMENTS MARKET: DETAILED LIST OF KEY START-UPS/SMES

- TABLE 239 DIETARY SUPPLEMENTS MARKET: COMPETITIVE BENCHMARKING OF START-UPS/SMES

- TABLE 240 DIETARY SUPPLEMENTS MARKET: PRODUCT LAUNCHES, JANUARY 2019-NOVEMBER 2024

- TABLE 241 DIETARY SUPPLEMENTS MARKET: DEALS, JANUARY 2019-NOVEMBER 2024

- TABLE 242 DIETARY SUPPLEMENTS MARKET: EXPANSIONS, JANUARY 2019-NOVEMBER 2024

- TABLE 243 DIETARY SUPPLEMENTS MARKET: OTHER DEALS/DEVELOPMENTS, JANUARY 2019-NOVEMBER 2024

- TABLE 244 NESTLE: COMPANY OVERVIEW

- TABLE 245 NESTLE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 246 NESTLE: PRODUCT LAUNCHES

- TABLE 247 NESTLE: DEALS

- TABLE 248 NESTLE: EXPANSIONS

- TABLE 249 NESTLE: OTHER DEALS/DEVELOPMENTS

- TABLE 250 ABBOTT: COMPANY OVERVIEW

- TABLE 251 ABBOTT: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 252 ABBOTT: PRODUCT LAUNCHES

- TABLE 253 ABBOTT: DEALS

- TABLE 254 OTSUKA HOLDINGS CO., LTD.: COMPANY OVERVIEW

- TABLE 255 OTSUKA HOLDINGS CO., LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 256 OTSUKA HOLDINGS CO., LTD.: PRODUCT LAUNCHES

- TABLE 257 OTSUKA HOLDINGS CO., LTD.: DEALS

- TABLE 258 HALEON GROUP OF COMPANIES: COMPANY OVERVIEW

- TABLE 259 HALEON GROUP OF COMPANIES: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 260 HALEON GROUP OF COMPANIES: EXPANSIONS

- TABLE 261 GLANBIA PLC: COMPANY OVERVIEW

- TABLE 262 GLANBIA PLC: PRODUCTS OFFERED

- TABLE 263 GLANBIA PLC: DEALS

- TABLE 264 BAYER AG: COMPANY OVERVIEW

- TABLE 265 BAYER AG: PRODUCTS OFFERED

- TABLE 266 BAYER AG: DEALS

- TABLE 267 BAYER AG: EXPANSIONS

- TABLE 268 H&H GROUP: COMPANY OVERVIEW

- TABLE 269 H&H GROUP: PRODUCTS OFFERED

- TABLE 270 H&H GROUP: PRODUCT LAUNCHES

- TABLE 271 H&H GROUP: DEALS

- TABLE 272 H&H GROUP: EXPANSIONS

- TABLE 273 NATURE'S SUNSHINE PRODUCTS, INC.: COMPANY OVERVIEW

- TABLE 274 NATURE'S SUNSHINE PRODUCTS, INC.: PRODUCTS OFFERED

- TABLE 275 NATURE'S SUNSHINE PRODUCTS, INC.: PRODUCT LAUNCHES

- TABLE 276 NU SKIN: COMPANY OVERVIEW

- TABLE 277 NU SKIN: PRODUCTS OFFERED

- TABLE 278 AMWAY CORP.: COMPANY OVERVIEW

- TABLE 279 AMWAY CORP.: PRODUCTS OFFERED

- TABLE 280 AMWAY CORP.: PRODUCT LAUNCHES

- TABLE 281 AMWAY CORP.: DEALS

- TABLE 282 HERBALIFE INTERNATIONAL OF AMERICA, INC.: COMPANY OVERVIEW

- TABLE 283 HERBALIFE INTERNATIONAL OF AMERICA, INC.: PRODUCTS OFFERED

- TABLE 284 HERBALIFE INTERNATIONAL OF AMERICA, INC.: PRODUCT LAUNCHES

- TABLE 285 HERBALIFE INTERNATIONAL OF AMERICA, INC.: DEALS

- TABLE 286 BIONOVA: COMPANY OVERVIEW

- TABLE 287 BIONOVA: PRODUCTS OFFERED

- TABLE 288 ARKOPHARMA: COMPANY OVERVIEW

- TABLE 289 ARKOPHARMA: PRODUCTS OFFERED

- TABLE 290 AMERICAN HEALTH: COMPANY OVERVIEW

- TABLE 291 AMERICAN HEALTH: PRODUCTS OFFERED

- TABLE 292 VITACO: COMPANY OVERVIEW

- TABLE 293 VITACO: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 294 POWER GUMMIES: COMPANY OVERVIEW

- TABLE 295 POWER GUMMIES: PRODUCTS OFFERED

- TABLE 296 BIOMEDICAL RESEARCH LABORATORIES: COMPANY OVERVIEW

- TABLE 297 BIOMEDICAL RESEARCH LABORATORIES: PRODUCTS OFFERED

- TABLE 298 HEALTHKART: COMPANY OVERVIEW

- TABLE 299 HEALTHKART: PRODUCTS OFFERED

- TABLE 300 NORDIC NATURALS: COMPANY OVERVIEW

- TABLE 301 NORDIC NATURALS: PRODUCTS OFFERED

- TABLE 302 BIOGAIA: COMPANY OVERVIEW

- TABLE 303 BIOGAIA: PRODUCTS OFFERED

- TABLE 304 BIOGAIA: PRODUCT LAUNCHES

- TABLE 305 BIOGAIA: DEALS

- TABLE 306 BIOGAIA: EXPANSIONS

- TABLE 307 ALFA LABORATORIES, INC.: COMPANY OVERVIEW

- TABLE 308 NUTRISCIENCE CORPORATION: COMPANY OVERVIEW

- TABLE 309 NATURE'S ESSENTIALS: COMPANY OVERVIEW

- TABLE 310 LIFE EXTENSION: COMPANY OVERVIEW

- TABLE 311 SOLGAR INC.: COMPANY OVERVIEW

- TABLE 312 ADM: COMPANY OVERVIEW

- TABLE 313 CARGILL, INCORPORATED: COMPANY OVERVIEW

- TABLE 314 INTERNATIONAL FLAVORS & FRAGRANCES INC: COMPANY OVERVIEW

- TABLE 315 BASF SE: COMPANY OVERVIEW

- TABLE 316 DSM-FIRMENICH: COMPANY OVERVIEW

- TABLE 317 ASSOCIATED BRITISH FOODS PLC: COMPANY OVERVIEW

- TABLE 318 KYOWA KIRIN CO., LTD: COMPANY OVERVIEW

- TABLE 319 FONTERRA CO-OPERATIVE GROUP LIMITED: COMPANY OVERVIEW

- TABLE 320 KERRY GROUP PLC: COMPANY OVERVIEW

- TABLE 321 DIVI'S NUTRACEUTICALS: COMPANY OVERVIEW

- TABLE 322 ADJACENT MARKETS TO DIETARY SUPPLEMENTS MARKET

- TABLE 323 NUTRACEUTICAL INGREDIENTS MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 324 NUTRACEUTICAL INGREDIENTS MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 325 PROBIOTICS MARKET, BY REGION, 2020-2023 (USD BILLION)

- TABLE 326 PROBIOTICS MARKET, BY REGION, 2024-2029 (USD BILLION)

List of Figures

- FIGURE 1 DIETARY SUPPLEMENTS MARKET: RESEARCH DESIGN

- FIGURE 2 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

- FIGURE 3 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

- FIGURE 4 DIETARY SUPPLEMENTS MARKET SIZE CALCULATION: SUPPLY SIDE

- FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

- FIGURE 6 DATA TRIANGULATION

- FIGURE 7 DIETARY SUPPLEMENTS MARKET, BY TYPE, 2024 VS. 2029 (USD MILLION)

- FIGURE 8 DIETARY SUPPLEMENTS MARKET, BY TARGET CONSUMER, 2024 VS. 2029 (USD MILLION)

- FIGURE 9 DIETARY SUPPLEMENTS MARKET, BY MODE OF APPLICATION, 2024 VS. 2029 (USD MILLION)

- FIGURE 10 DIETARY SUPPLEMENTS MARKET, BY DISTRIBUTION CHANNEL, 2024 VS. 2029 (USD MILLION)

- FIGURE 11 DIETARY SUPPLEMENTS MARKET, BY FUNCTION, 2024 VS. 2029 (USD MILLION)

- FIGURE 12 DIETARY SUPPLEMENTS MARKET SHARE AND GROWTH RATE, BY REGION, 2024 (BY VALUE)

- FIGURE 13 EMERGING DEMAND FOR PERSONALIZED NUTRITION TO PRESENT OPPORTUNITIES FOR MARKET GROWTH

- FIGURE 14 CHINA AND VITAMINS SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARES IN 2024

- FIGURE 15 VITAMINS SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 16 ADULTS SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 17 CAPSULES SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 18 GUT HEALTH SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 19 VITAMINS SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 20 US TO ACCOUNT FOR LARGEST MARKET SHARE IN 2024

- FIGURE 21 CHRONIC DISEASES: TOP CAUSES OF DEATH WORLDWIDE AMONG ALL AGES IN 2021

- FIGURE 22 NUMBER OF DEATHS IN US DUE TO DIFFERENT DISEASES, 2022

- FIGURE 23 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES: MARKET DYNAMICS

- FIGURE 24 US: HEALTH EXPENDITURE, BY CATEGORY AND SOURCE OF FUNDS IN USD TRILLION, 2021

- FIGURE 25 AGING POPULATION IN JAPAN, 65 AND ABOVE (PERCENTAGE OF TOTAL POPULATION), 2018-2023

- FIGURE 26 NUMBER OF COUNTRIES WITH MANDATORY OR VOLUNTARY FOOD FORTIFICATION, 2021

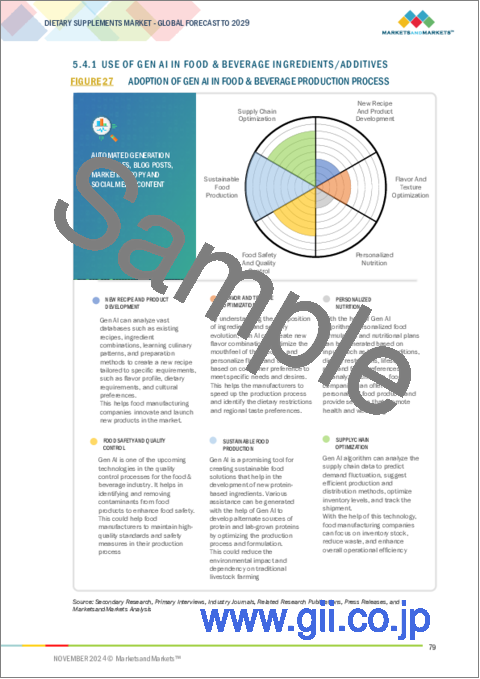

- FIGURE 27 ADOPTION OF GEN AI IN FOOD & BEVERAGE PRODUCTION PROCESS

- FIGURE 28 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- FIGURE 29 AVERAGE SELLING PRICE TREND AMONG KEY PLAYERS, 2023

- FIGURE 30 AVERAGE SELLING PRICE TREND, BY TYPE, 2020-2023 (USD/TON)

- FIGURE 1 AVERAGE SELLING PRICE TREND, BY REGION, 2020-2023 (USD/TON)

- FIGURE 2 DIETARY SUPPLEMENTS MARKET: SUPPLY CHAIN ANALYSIS

- FIGURE 3 DIETARY SUPPLEMENTS MARKET: VALUE CHAIN ANALYSIS

- FIGURE 4 KEY PLAYERS IN DIETARY SUPPLEMENTS ECOSYSTEM

- FIGURE 5 NUMBER OF PATENTS GRANTED FOR DIETARY SUPPLEMENTS MARKET, 2013-2023

- FIGURE 6 REGIONAL ANALYSIS OF PATENTS GRANTED FOR DIETARY SUPPLEMENTS MARKET, 2013-2023

- FIGURE 7 EXPORT VALUE OF PROVITAMINS AND VITAMINS FOR KEY COUNTRIES, 2020-2023 (USD THOUSAND)

- FIGURE 8 IMPORT VALUE OF PROVITAMINS AND VITAMINS FOR KEY COUNTRIES, 2020-2023 (USD THOUSAND)

- FIGURE 9 PORTER'S FIVE FORCES MODEL: DIETARY SUPPLEMENTS MARKET

- FIGURE 10 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TYPES OF DIETARY SUPPLEMENTS

- FIGURE 11 KEY BUYING CRITERIA FOR KEY MODES OF APPLICATION

- FIGURE 12 INVESTMENT AND FUNDING SCENARIO, 2020-2024 (USD MILLION)

- FIGURE 13 DIETARY SUPPLEMENTS MARKET, BY TYPE, 2024 VS. 2029 (USD MILLION)

- FIGURE 14 DIETARY SUPPLEMENTS MARKET, BY MODE OF APPLICATION, 2024 VS. 2029 (USD MILLION)

- FIGURE 15 DIETARY SUPPLEMENTS MARKET, BY TARGET CONSUMER, 2024 VS. 2029 (USD MILLION)

- FIGURE 16 BENEFITS SOUGHT FROM FOOD/BEVERAGES/NUTRIENTS IN US

- FIGURE 17 DIETARY SUPPLEMENTS MARKET, BY FUNCTION, 2024 VS. 2029 (USD MILLION)

- FIGURE 18 TOP SPORTS NUTRITION INGREDIENTS SOUGHT BY CONSUMERS IN EUROPE

- FIGURE 19 DIETARY SUPPLEMENTS MARKET, BY DISTRIBUTION CHANNEL, 2024 VS. 2029 (USD MILLION)

- FIGURE 20 INDIA TO REGISTER HIGHEST CAGR IN GLOBAL DIETARY SUPPLEMENTS MARKET DURING FORECAST PERIOD

- FIGURE 21 NORTH AMERICA: MARKET SNAPSHOT

- FIGURE 22 US: MOST POPULAR SUPPLEMENTS AMONG ADULTS

- FIGURE 23 ASIA PACIFIC: MARKET SNAPSHOT

- FIGURE 24 REVENUE ANALYSIS FOR KEY COMPANIES, 2021-2023 (USD BILLION)

- FIGURE 25 SHARE OF LEADING PLAYERS IN DIETARY SUPPLEMENTS MARKET, 2023

- FIGURE 26 RANKING OF TOP FIVE PLAYERS IN DIETARY SUPPLEMENTS MARKET

- FIGURE 27 DIETARY SUPPLEMENTS MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2023

- FIGURE 28 DIETARY SUPPLEMENTS MARKET: COMPANY FOOTPRINT, 2023

- FIGURE 29 DIETARY SUPPLEMENTS MARKET: COMPANY EVALUATION MATRIX (START-UPS/SMES), 2023

- FIGURE 30 COMPANY VALUATION FOR NINE MAJOR PLAYERS IN DIETARY SUPPLEMENTS MARKET, 2023 (USD BILLION)

- FIGURE 31 EV/EBITDA OF MAJOR PLAYERS, 2023

- FIGURE 32 BRAND/PRODUCT COMPARISON

- FIGURE 33 NESTLE: COMPANY SNAPSHOT

- FIGURE 34 ABBOTT: COMPANY SNAPSHOT

- FIGURE 35 OTSUKA HOLDINGS CO., LTD.: COMPANY SNAPSHOT

- FIGURE 36 HALEON GROUP OF COMPANIES: COMPANY SNAPSHOT

- FIGURE 37 GLANBIA PLC: COMPANY SNAPSHOT

- FIGURE 38 BAYER AG: COMPANY SNAPSHOT

- FIGURE 39 H&H GROUP: COMPANY SNAPSHOT

- FIGURE 40 NATURE'S SUNSHINE PRODUCTS, INC.: COMPANY SNAPSHOT

- FIGURE 41 NU SKIN: COMPANY SNAPSHOT

- FIGURE 42 AMWAY CORP.: COMPANY SNAPSHOT

- FIGURE 43 HERBALIFE INTERNATIONAL OF AMERICA, INC.: COMPANY SNAPSHOT

- FIGURE 44 BIOGAIA: COMPANY SNAPSHOT

The global market for dietary supplements is estimated to be valued at USD 179.53 billion in 2024 and is projected to reach USD 258.75 billion by 2029, at a CAGR of 7.6% during the forecast period. Factors such as shifts toward active lifestyles and a focus on preventive healthcare are major contributors to this expansion. Additionally, novel products targeting specific needs, such as sports nutrition, cognitive health, and digestive health, are gaining popularity among consumers seeking tailored solutions.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2024-2029 |

| Base Year | 2023 |

| Forecast Period | 2024-2029 |

| Units Considered | Value (USD) |

| Segments | By Type, Mode of Application, Target Consumer, Function |

| Regions covered | North America, Europe, Asia Pacific, South America, and RoW |

Under the Dietary Supplement Health and Education Act of 1994 (DSHEA), manufacturers and distributors are mandated to ensure their products' safety and proper labeling before a product is marketed. The FDA regulates both finished dietary supplements and dietary ingredients under a distinct framework compared with conventional foods and drugs. Once adulterated or misbranded products leave the manufacturer and enter the marketplace, the FDA has several tools such as product recalls, warning letters, import alerts, and legal actions to ensure consumer safety and uphold product integrity. These regulations play a critical role in maintaining consumer trust in the dietary supplement industry by ensuring safety, proper labeling, and product integrity, which indirectly supports the industry's growth and ability to respond to evolving consumer needs, including innovation in delivery formats like liquid and chewable supplements.

Disruption in the dietary supplements market: Consumers demand customized nutritional, and AI-driven recommendations are considered innovative offerings. The FDA is regulating better to ensure the production of safer, more transparent products. Therefore, manufacturers face the need to make substantially greater investments in quality assurances and labeling. Online retail has also disrupted more traditional retail channels through which brands are thriving via direct-to-consumer marketing. Also, Sustainability and clean-label trends are reshaping the product development trend for sustainability and ethically sourced ingredient-conscious consumers. This is, in fact, reshaping industry dynamics, and raising new standards for competition as well as consumer engagement.

"Vitamins is the fastest growing dietary supplement type of dietary supplements market."

There is a growing demand for vitamins as immunity boosters, energy enhancers, and general health maintenance. Vitamin D supplements, for instance, are gaining acceptance because of their allied benefits of maintaining bone health. Conversely, vitamin C is a major usage product owing to its antioxidant properties and the potential to contribute towards making the skin healthier. Multivitamins have emerged as an extremely attractive product for busy people seeking easy ways of satisfying the everyday requirements of nutritional constituents. Moreover, as per the US Department of Health & Human Services, many adults and children in the United States take one or more vitamins or other dietary supplements, reflecting their growing popularity and diversity. Companies are leveraging this trend with new formats, including gummies, effervescent tablets, and fortified drinks, that satisfy consumer preference for diverse formats. Thus, growing popularity and diverse range highlight their integral role in supporting overall health and wellness, with consumers increasingly turning to these products for convenience and targeted health benefits.

"The tablets segment is dominant in the mode of application segment during the forecast period."

The tablets segment is likely to continue dominating the mode of application segment during the forecast period. This is because they are convenient, enable precise dosing, and are available everywhere. They are easy to store and have a longer shelf life, with high availability making it easier for consumers to have reliable and cost-effective nutrition that they can depend on. For instance, vitamin D and calcium come in widely available tablet forms, making them preferred choice for individuals seeking consistent and measurable doss. The convenience factor will make tablet form dominate the market, which will become an easy solution for health-conscious consumers.

North America is expected to dominate the dietary supplements market.

North America dominates the dietary supplement market, driven by high consumer demand and a growing trend of wellness-focused lifestyles. According to Glanbia plc's (Ireland) lookout on US supplements, in the United States, for example, over 38% of consumers reportedly take one or more supplements daily, compared to the global average of 26%. This enormous demand has been fueled by the advantages and personalization that supplements provide, enabling consumers to mix products that can be tailored for special health needs. Supplements are also chosen instead of food and beverages due to their ability to provide quicker and more immediate sources of essential nutrients.

Consumers in North America are increasingly turning to supplements to support both physical and mental well-being. According to Innova Health & Nutrition Survey 2022, while 27% of consumers in North America say they have used supplements to enhance their physical health, 34% have used supplements to enhance their mental or emotional well-being, which bodes well for mood support supplements - a space that continues to gain traction. This trend suggests consumer interest in holistic health, reflecting deeper remains of North America's importance in the global dietary supplements market.

In-depth interviews have been conducted with chief executive officers (CEOs), Directors, and other executives from various key organizations operating in the dietary supplements market:

- By Company Type: Tier 1 - 30%, Tier 2 - 45%, and Tier 3 - 25%

- By Designation: Directors - 25%, Managers - 50%, Others- 25%

- By Region: North America - 25%, Europe - 25%, Asia Pacific - 35%, South America - 9%, and Rest of the World -6%

Prominent companies in the market Nestle (Switzerland), Abbott (US), Amway Corp (US), Otsuka Holdings Co., Ltd (Japan), Glanbia PLC (Ireland), Bayer AG (Germany), Haleon Group of Companies (UK), Herbalife International of America, Inc. (US), Nature's Sunshine Products, Inc (US), Bionova (India), Arkopharma (France), American Health (US), H&H Group (Hong Kong), Nu Skin (US), and Vitaco (New Zealand).

Other players include Power Gummies (India), Biomedical Research Laboratories, LLC (US), HealthKart.com (India), Nordic Naturals (US), Alfa Laboratories, Inc. (US), NutriScience Corporation (US), Nature's Essentials (US), Life Extension (US), Solgar Inc (US), and BioGaia (Sweden).

Research Coverage:

This research report categorizes the Dietary Supplements Market by Type (Botanicals, Vitamins, Minerals, Amino Acids, Enzymes, Probiotics, Other Types), Mode of Application (Tablets, Capsules, Liquid, Powder, Softgels, Gummies/Chewables, Gel Caps), Target Consumer (Infants, Children, Adults, Pregnant Women, Elderly), Distribution Channel (Pharmacy, Supermarket/Hypermarket, Health & Wellness Stores, Online, Other Distribution Channels), Function (Gut Health, Immune Health, Sports Nutrition, Skin Health, Metabolic Health, Weight Management, Bone & Joint Health, Other Functions), Ingredient Sourcing & Quality (Ingredient Sourcing, Ingredient Quality, Testing & Certification, Ingredient Fraud Prevention, Transparency & Labeling), Technology (Big Data Analytics, 3D Printing, Smart Manufacturing & Automation, Probiotics & Microbiome Technology, Smart Packaging) and Region - Global Forecast to 2029. The scope of the report covers detailed information regarding the major factors, such as drivers, restraints, challenges, and opportunities, influencing the growth of dietary supplements. A detailed analysis of the key industry players has been done to provide insights into their business overview, services, key strategies, contracts, partnerships, agreements, new service launches, mergers and acquisitions, and recent developments associated with the dietary supplements market. Competitive analysis of upcoming startups in the dietary supplements market ecosystem is covered in this report. Furthermore, industry-specific trends such as technology analysis, ecosystem and market mapping, patent, regulatory landscape, among others, are also covered in the study.

Reasons to buy this report:

The report will help the market leaders/new entrants in this market with information on the closest approximations of the revenue numbers for the overall dietary supplements and the subsegments. This report will help stakeholders understand the competitive landscape and gain more insights to position their businesses better and plan suitable go-to-market strategies. The report also helps stakeholders understand the pulse of the market and provides them with information on key market drivers, restraints, challenges, and opportunities.

The report provides insights on the following pointers:

- Analysis of key drivers (Shift in consumer preferences due to increasing focus on health), restraints (High cost of dietary supplements), opportunities (Shift towards plant-based supplements), and challenges (Consumer skepticism and fake supplements associated with nutraceutical products) influencing the growth of the dietary supplements market.

- New product launch/Innovation: Detailed insights on research & development activities and new product launches in the dietary supplements market.

- Market Development: Comprehensive information about lucrative markets - the report analyzes the dietary supplements across varied regions.

- Market Diversification: Exhaustive information about new services, untapped geographies, recent developments, and investments in the dietary supplements market.

- Competitive Assessment: In-depth assessment of market shares, growth strategies, product offerings, brand/product comparison, and product food prints of leading players such as Nestle (Switzerland), Abbott (US), Amway Corp (US), Otsuka Holdings Co., Ltd (Japan), Glanbia PLC (Ireland), and other players in the dietary supplements market.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKET SEGMENTATION

- 1.3.2 INCLUSIONS & EXCLUSIONS

- 1.4 YEARS CONSIDERED

- 1.5 CURRENCY CONSIDERED

- 1.6 UNIT CONSIDERED

- 1.7 STAKEHOLDERS

- 1.8 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key data from primary sources

- 2.1.2.2 Breakdown of primary profiles

- 2.1.2.3 Key insights from industry experts

- 2.1.1 SECONDARY DATA

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 TOP-DOWN APPROACH

- 2.2.2 SUPPLY-SIDE ANALYSIS

- 2.2.3 BOTTOM-UP APPROACH (DEMAND SIDE)

- 2.3 DATA TRIANGULATION

- 2.4 RESEARCH ASSUMPTIONS

- 2.5 RESEARCH LIMITATIONS AND RISK ASSESSMENT

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR KEY PLAYERS IN DIETARY SUPPLEMENTS MARKET

- 4.2 ASIA PACIFIC: DIETARY SUPPLEMENTS MARKET, BY TYPE AND COUNTRY

- 4.3 DIETARY SUPPLEMENTS MARKET, BY TYPE

- 4.4 DIETARY SUPPLEMENTS MARKET, BY TARGET CONSUMER

- 4.5 DIETARY SUPPLEMENTS MARKET, BY MODE OF APPLICATION

- 4.6 DIETARY SUPPLEMENTS MARKET, BY FUNCTION

- 4.7 DIETARY SUPPLEMENTS MARKET, BY TYPE AND REGION

- 4.8 DIETARY SUPPLEMENTS MARKET: GEOGRAPHIC SNAPSHOT

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MACROECONOMIC FACTORS

- 5.2.1 RISING PREVALENCE OF CHRONIC DISEASES

- 5.3 MARKET DYNAMICS

- 5.3.1 DRIVERS

- 5.3.1.1 Shift in consumer preferences due to increasing focus on health

- 5.3.1.2 Rising healthcare burden due to chronic ailments

- 5.3.1.3 Rising geriatric population and their growing use of dietary supplements

- 5.3.1.4 Growing retail sales of functional foods

- 5.3.2 RESTRAINTS

- 5.3.2.1 High cost of dietary supplements

- 5.3.2.2 High R&D investments and cost of clinical trials

- 5.3.3 OPPORTUNITIES

- 5.3.3.1 Shift toward plant-based supplements

- 5.3.3.2 Consumer awareness about micronutrient deficiencies

- 5.3.3.3 Government mandates related to food fortification

- 5.3.4 CHALLENGES

- 5.3.4.1 Consumer skepticism and fake supplements associated with nutraceutical products

- 5.3.4.2 Challenging regulatory environment

- 5.3.1 DRIVERS

- 5.4 IMPACT OF GEN AI ON FOOD & BEVERAGE INGREDIENTS/ADDITIVES

- 5.4.1 USE OF GEN AI IN FOOD & BEVERAGE INGREDIENTS/ADDITIVES

- 5.4.2 CASE STUDIES FOR GENERATIVE AI IN FOOD & BEVERAGE INGREDIENTS/ADDITIVES

- 5.4.2.1 Kerry Trendspotter leveraged AI and ML to analyze consumer-generated social media content, identifying and predicting food trends

- 5.4.2.2 IFF partnered with Salus Optima to create personalized nutrition platform using AI to provide customized dietary recommendations based on individuals' metabolic health

- 5.4.2.3 Ingredion utilized cloud-based data analytics, AI, and cloud technology to address challenges in F&B industry

- 5.4.3 IMPACT OF GENERATIVE AI/AI ON DIETARY SUPPLEMENTS MARKET

- 5.4.4 ADJACENT ECOSYSTEM WORKING ON GENERATIVE AI

6 INDUSTRY TRENDS

- 6.1 INTRODUCTION

- 6.2 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 6.3 PRICING ANALYSIS

- 6.3.1 AVERAGE SELLING PRICE TREND OF DIETARY SUPPLEMENTS AMONG KEY PLAYERS

- 6.3.2 AVERAGE SELLING PRICE TREND, BY TYPE

- 6.3.3 AVERAGE SELLING PRICE TREND, BY REGION

- 6.4 SUPPLY CHAIN ANALYSIS

- 6.5 VALUE CHAIN ANALYSIS

- 6.5.1 RESEARCH AND DEVELOPMENT

- 6.5.2 SOURCING

- 6.5.3 MANUFACTURING

- 6.5.4 PACKAGING AND STORAGE

- 6.5.5 DISTRIBUTION

- 6.5.6 END USERS

- 6.6 ECOSYSTEM

- 6.6.1 SUPPLY SIDE

- 6.6.2 DEMAND SIDE

- 6.7 TECHNOLOGY ANALYSIS

- 6.7.1 KEY TECHNOLOGIES

- 6.7.1.1 CRISPR and gene editing

- 6.7.1.2 Food microencapsulation

- 6.7.1.2.1 Encapsulation of omega-3 to mask odor

- 6.7.2 COMPLEMENTARY TECHNOLOGIES

- 6.7.2.1 Robotics

- 6.7.2.2 3D printing

- 6.7.2.3 Hologram sciences

- 6.7.3 ADJACENT TECHNOLOGIES

- 6.7.3.1 Biotechnology

- 6.7.1 KEY TECHNOLOGIES

- 6.8 PATENT ANALYSIS

- 6.9 TRADE ANALYSIS

- 6.9.1 EXPORT SCENARIO OF PROVITAMINS AND VITAMINS

- 6.9.1.1 Export scenario of provitamins and vitamins

- 6.9.2 IMPORT SCENARIO OF PROVITAMINS AND VITAMINS

- 6.9.2.1 Import scenario of provitamins and vitamins

- 6.9.3 TRADE DATA ANALYSIS OF PROBIOTICS

- 6.9.1 EXPORT SCENARIO OF PROVITAMINS AND VITAMINS

- 6.10 KEY CONFERENCES AND EVENTS, 2024-2025

- 6.11 TARIFF AND REGULATORY LANDSCAPE

- 6.11.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 6.12 GLOBAL REGULATION OF DIETARY SUPPLEMENTS

- 6.12.1 US

- 6.12.1.1 Longevity of tablet form to drive market growth

- 6.12.1.1.1 Dietary supplements

- 6.12.1.1.2 Functional beverages

- 6.12.1.1.3 FDA Dietary Supplements - Specific Requirements and Guidance

- 6.12.1.1.4 New dietary ingredients

- 6.12.1.1.5 Current good manufacturing practices

- 6.12.1.1.6 Botanicals

- 6.12.1.1.7 Probiotics

- 6.12.1.1.8 Path for approval of herbal products by FDA

- 6.12.1.1.9 Manufacturing dietary supplements

- 6.12.1.1.10 Global standards for evaluation of probiotics

- 6.12.1.1.11 Regulation of probiotics as dietary supplements

- 6.12.1.1 Longevity of tablet form to drive market growth

- 6.12.2 CANADA

- 6.12.2.1 Dietary supplements

- 6.12.2.1.1 Regulatory compliance

- 6.12.2.1.2 Licensing requirement

- 6.12.2.1.3 Product licensing

- 6.12.2.1.4 Site licensing

- 6.12.2.1.5 Natural and Non-prescription Health Products Directorate (NNHPD)

- 6.12.2.1.6 Marketed Health Products Directorate (MHPD)

- 6.12.2.1.7 Health Products and Food Branch Inspectorate (HPFBI)

- 6.12.2.1.8 Content and composition of natural health products in Canada

- 6.12.2.1.8.1 Vitamin and minerals

- 6.12.2.1.9 Probiotics

- 6.12.2.1.10 Nutritional supplements

- 6.12.2.1 Dietary supplements

- 6.12.3 MEXICO

- 6.12.3.1 Dietary supplements & functional foods

- 6.12.4 GERMANY

- 6.12.4.1 Dietary supplements

- 6.12.5 UK

- 6.12.5.1 Dietary supplements

- 6.12.5.2 Herbal products

- 6.12.6 FRANCE

- 6.12.6.1 Dietary supplements

- 6.12.6.2 Botanicals

- 6.12.7 SPAIN

- 6.12.7.1 Dietary supplements

- 6.12.7.2 Botanicals

- 6.12.8 CHINA

- 6.12.8.1 Functional foods

- 6.12.8.2 Dietary supplements

- 6.12.8.3 Relevant regulation on health food

- 6.12.9 INDIA

- 6.12.9.1 Dietary supplements

- 6.12.10 JAPAN

- 6.12.10.1 Dietary supplements

- 6.12.11 AUSTRALIA & NEW ZEALAND

- 6.12.11.1 Dietary supplements

- 6.12.11.2 Vitamins and minerals

- 6.12.12 BRAZIL

- 6.12.12.1 Dietary supplements

- 6.12.12.2 Nutrients, bioactive substances, and enzymes

- 6.12.12.3 Probiotics

- 6.12.12.4 Herbal medicines

- 6.12.13 ARGENTINA

- 6.12.13.1 Functional foods

- 6.12.13.2 Dietary supplements

- 6.12.13.3 Vitamins and minerals

- 6.12.13.4 Herbal substances

- 6.12.14 COLOMBIA

- 6.12.14.1 Dietary supplements

- 6.12.14.2 Vitamins and minerals

- 6.12.14.3 Herbal substances

- 6.12.14.4 Other substances

- 6.12.15 AFRICA

- 6.12.15.1 Functional foods

- 6.12.15.2 Dietary supplements

- 6.12.15.3 Registrations in South Africa

- 6.12.15.4 Composition of supplements in South Africa

- 6.12.16 MIDDLE EAST

- 6.12.16.1 Dietary supplements

- 6.12.1 US

- 6.13 PORTER'S FIVE FORCES ANALYSIS

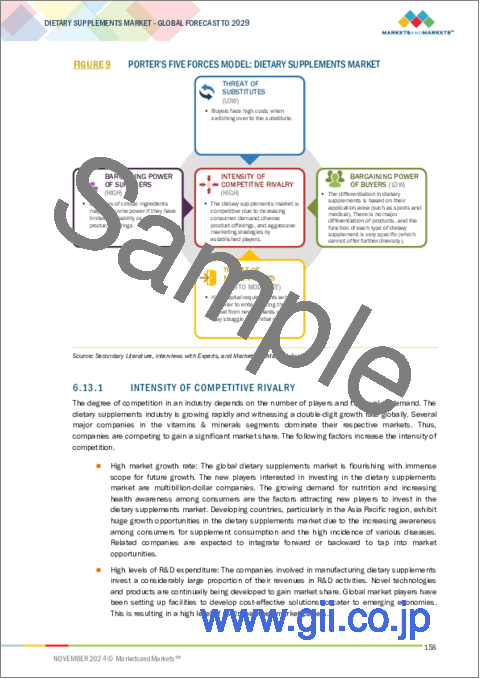

- 6.13.1 INTENSITY OF COMPETITIVE RIVALRY

- 6.13.2 BARGAINING POWER OF SUPPLIERS

- 6.13.3 BARGAINING POWER OF BUYERS

- 6.13.4 THREAT OF SUBSTITUTES

- 6.13.5 THREAT OF NEW ENTRANTS

- 6.14 KEY STAKEHOLDERS AND BUYING CRITERIA

- 6.14.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 6.14.2 BUYING CRITERIA

- 6.15 INVESTMENT AND FUNDING SCENARIO

- 6.16 CASE STUDY ANALYSIS

7 DIETARY SUPPLEMENTS MARKET, BY INGREDIENT SOURCING & QUALITY

- 7.1 INTRODUCTION

- 7.2 INGREDIENT SOURCING

- 7.3 INGREDIENT QUALITY

- 7.4 TESTING & CERTIFICATION

- 7.5 INGREDIENT FRAUD PREVENTION

- 7.6 TRANSPARENCY & LABELING

8 DIETARY SUPPLEMENTS MARKET, BY TECHNOLOGY

- 8.1 INTRODUCTION

- 8.2 ENZYME ENGINEERING

- 8.3 SMART MANUFACTURING & AUTOMATION

- 8.4 MOLECULAR DISTILLATION

- 8.5 MULTI-LAYER EMBEDDING

- 8.6 MICROENCAPSULATED POWDER FOR PROBIOTIFICATION IN FOOD PRODUCTS

9 DIETARY SUPPLEMENTS MARKET, BY TYPE

- 9.1 INTRODUCTION

- 9.2 BOTANICALS

- 9.2.1 RISING DEMAND FOR PLANT-BASED FOOD PRODUCTS TO PROPEL MARKET GROWTH

- 9.3 VITAMINS

- 9.3.1 DEFICIENCY OF VITAMINS TO BE KEY FACTOR FOR DRIVING THEIR USAGE

- 9.3.2 VITAMIN A

- 9.3.3 VITAMIN B

- 9.3.4 VITAMIN C

- 9.3.5 VITAMIN D

- 9.3.6 OTHER VITAMINS

- 9.4 MINERALS

- 9.4.1 RISING AWARENESS ABOUT IMPORTANCE OF MINERALS TO SUPPORT MARKET GROWTH

- 9.4.2 CALCIUM

- 9.4.3 IRON

- 9.4.4 OTHER MINERALS

- 9.5 AMINO ACIDS

- 9.5.1 NEED TO IMPROVE METABOLIC HEALTH TO TRIGGER DEMAND FOR AMINO ACIDS

- 9.5.2 BRANCHED-CHAIN AMINO ACIDS

- 9.5.3 L-ARGININE

- 9.5.4 GLUTAMINE

- 9.6 ENZYMES

- 9.6.1 IMPORTANCE OF ENZYMES IN ALL METABOLIC PROCESSES TO DRIVE DEMAND

- 9.7 PROBIOTICS

- 9.7.1 SURGE IN DEMAND FOR FORTIFIED FOOD PRODUCTS TO DRIVE GROWTH OF PROBIOTICS SEGMENT

- 9.8 OTHER TYPES

10 DIETARY SUPPLEMENTS MARKET, BY MODE OF APPLICATION

- 10.1 INTRODUCTION

- 10.2 TABLETS

- 10.2.1 LONGEVITY OF TABLET FORM TO DRIVE DEMAND

- 10.3 CAPSULES

- 10.3.1 EASE OF SWALLOWING AND VERSATILE FORMULATION TO BOOST DEMAND

- 10.4 LIQUID

- 10.4.1 ENHANCED ABSORPTION AND BIOAVAILABILITY TO BOLSTER DEMAND

- 10.5 POWDER

- 10.5.1 EASY RELEASE OF ACTIVE INGREDIENTS TO DRIVE USE OF POWDER FORM

- 10.6 GUMMIES/CHEWABLES

- 10.6.1 RISING CONSUMER DEMAND FOR CONVENIENT, FLAVORFUL, AND INNOVATIVE NUTRITIONAL SOLUTIONS TO DRIVE MARKET

11 DIETARY SUPPLEMENTS MARKET, BY TARGET CONSUMER

- 11.1 INTRODUCTION

- 11.2 INFANTS

- 11.2.1 ESSENTIAL NUTRIENTS REQUIRED FOR INFANT NUTRITION TO TRIGGER DEMAND FOR DIETARY SUPPLEMENTS

- 11.3 CHILDREN

- 11.3.1 ENHANCING COGNITIVE HEALTH AND IMMUNITY TO PROPEL DEMAND FOR DIETARY SUPPLEMENTS AMONG CHILDREN

- 11.4 ADULTS

- 11.4.1 ADDRESSING NUTRITIONAL DEFICIENCIES TO DRIVE DEMAND FOR DIETARY SUPPLEMENTS AMONG ADULTS

- 11.5 PREGNANT WOMEN

- 11.5.1 OPTIMIZING MATERNAL AND FETAL HEALTH TO LEAD TO RISING DEMAND FOR DIETARY SUPPLEMENTS DURING PREGNANCY

- 11.6 ELDERLY

- 11.6.1 CONSUMPTION OF DIETARY SUPPLEMENTS BY ELDERLY TO SUPPORT NUTRITIONAL NEEDS AND ENSURE OPTIMAL HEALTH OUTCOME

12 DIETARY SUPPLEMENTS MARKET, BY FUNCTION

- 12.1 INTRODUCTION

- 12.2 GUT HEALTH

- 12.2.1 GROWING CONSUMER AWARENESS OF GUT MICROBIOME TO BOOST DEMAND FOR GUT HEALTH SUPPLEMENTS

- 12.3 IMMUNE HEALTH

- 12.3.1 RISING CONSUMER FOCUS ON PREVENTIVE HEALTH AND NATURAL DEFENSE SUPPORT TO DRIVE DEMAND FOR IMMUNITY-BOOSTING SUPPLEMENTS

- 12.4 SPORTS NUTRITION

- 12.4.1 INCREASED NUTRIENT REQUIREMENTS DUE TO DEMANDING PHYSICAL ACTIVITIES TO DRIVE MARKET

- 12.5 SKIN HEALTH

- 12.5.1 INCREASING FOCUS ON PREVENTIVE CARE AND PURSUIT OF RADIANT, YOUTHFUL SKIN TO DRIVE MARKET FOR SKIN HEALTH SUPPLEMENTS

- 12.6 METABOLIC HEALTH

- 12.6.1 GROWING PREVALENCE OF LIFESTYLE-RELATED DISORDERS TO DRIVE MARKET

- 12.7 WEIGHT MANAGEMENT

- 12.7.1 SHIFTING CONSUMER PRIORITIES TOWARD HEALTHIER LIFESTYLES AND SUSTAINABLE WEIGHT CONTROL SOLUTIONS TO DRIVE MARKET

- 12.8 BONE & JOINT HEALTH

- 12.8.1 GROWING AGING POPULATION AND ESCALATING INCIDENCES OF OSTEOPOROSIS AND ARTHRITIS TO DRIVE MARKET

- 12.9 OTHER FUNCTIONS

13 DIETARY SUPPLEMENTS MARKET, BY DISTRIBUTION CHANNEL

- 13.1 INTRODUCTION

- 13.2 PHARMACIES

- 13.2.1 REQUIREMENT FOR TRUSTED ADVICE AND CONVENIENT ACCESS TO DRIVE MARKET

- 13.3 SUPERMARKETS/HYPERMARKETS

- 13.3.1 DEMAND FOR ACCESSIBILITY AND CONVENIENCE TO FUEL MARKET GROWTH

- 13.4 HEALTH & WELLNESS STORES

- 13.4.1 NEED FOR PERSONALIZED SOLUTIONS, EXPERT GUIDANCE, AND PREMIUM PRODUCT OFFERINGS TO DRIVE MARKET

- 13.5 ONLINE

- 13.5.1 COST-EFFECTIVE OPERATIONS AND EXPANDED REACH TO PROPEL MARKET

- 13.6 OTHER DISTRIBUTION CHANNELS

14 DIETARY SUPPLEMENTS MARKET, BY REGION

- 14.1 INTRODUCTION

- 14.2 NORTH AMERICA

- 14.2.1 US

- 14.2.1.1 Rise in number of health-conscious customers, surge in demand for functional food products, and growth in aging population to propel market

- 14.2.2 CANADA

- 14.2.2.1 Rise in prevalence of chronic diseases to fuel demand for dietary supplements in Canada

- 14.2.3 MEXICO

- 14.2.3.1 Malnutrition and obesity to trigger demand for dietary supplements

- 14.2.1 US

- 14.3 EUROPE

- 14.3.1 GERMANY

- 14.3.1.1 Surge in demand for plant-based food products to boost market growth

- 14.3.2 UK

- 14.3.2.1 Need to promote healthier lifestyles and proper nutrition and rising demand for herbal and probiotic supplements to foster market growth

- 14.3.3 FRANCE

- 14.3.3.1 Rising awareness about health benefits, government support for nutritional supplements, and rising demand for nutritional supplements to bolster market growth

- 14.3.4 ITALY

- 14.3.4.1 High prevalence of vitamin D deficiency to contribute to demand for dietary supplements

- 14.3.5 SPAIN

- 14.3.5.1 Consumer preference for clean-label ingredients to accelerate market growth

- 14.3.6 REST OF EUROPE

- 14.3.1 GERMANY

- 14.4 ASIA PACIFIC

- 14.4.1 CHINA

- 14.4.1.1 Rapid growth of elderly & millennial populations and eCommerce platforms to accelerate market growth

- 14.4.2 INDIA

- 14.4.2.1 Health consciousness, changing lifestyles, increasing consumer affluence, and increased life expectancy to drive demand for dietary supplements

- 14.4.3 JAPAN

- 14.4.3.1 Rapidly aging population and increasing health consciousness to drive demand for dietary supplements

- 14.4.4 AUSTRALIA & NEW ZEALAND

- 14.4.4.1 Prevalence of chronic diseases and obesity among consumers to support demand

- 14.4.5 REST OF ASIA PACIFIC

- 14.4.1 CHINA

- 14.5 SOUTH AMERICA

- 14.5.1 BRAZIL

- 14.5.1.1 Increasing preference for functional food products to drive demand

- 14.5.2 ARGENTINA

- 14.5.2.1 Rising number of health-conscious consumers and increasing adoption of vegan diets to drive market

- 14.5.3 REST OF SOUTH AMERICA

- 14.5.1 BRAZIL

- 14.6 REST OF THE WORLD (ROW)

- 14.6.1 AFRICA

- 14.6.1.1 Rise in vitamin deficiency among women and children to fuel market growth

- 14.6.2 MIDDLE EAST

- 14.6.2.1 Use of dietary supplements for pharmaceuticals and sports nutrition to boost market growth

- 14.6.1 AFRICA

15 COMPETITIVE LANDSCAPE

- 15.1 OVERVIEW

- 15.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

- 15.3 REVENUE ANALYSIS

- 15.4 MARKET SHARE ANALYSIS

- 15.4.1 MARKET RANKING ANALYSIS

- 15.5 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2023

- 15.5.1 STARS

- 15.5.2 EMERGING LEADERS

- 15.5.3 PERVASIVE PLAYERS

- 15.5.4 PARTICIPANTS

- 15.5.5 COMPANY FOOTPRINT: KEY PLAYERS, 2023

- 15.5.5.1 Company footprint

- 15.5.5.2 Type footprint

- 15.5.5.3 Mode of application footprint

- 15.5.5.4 Function footprint

- 15.5.5.5 Regional footprint

- 15.6 COMPANY EVALUATION MATRIX: START-UPS/SMES, 2023

- 15.6.1 PROGRESSIVE COMPANIES

- 15.6.2 RESPONSIVE COMPANIES

- 15.6.3 DYNAMIC COMPANIES

- 15.6.4 STARTING BLOCKS

- 15.6.5 COMPETITIVE BENCHMARKING, START-UPS/SMES, 2023

- 15.6.5.1 Detailed list of key start-ups/SMEs

- 15.6.5.2 Competitive benchmarking of start-ups/SMEs

- 15.7 COMPANY VALUATION AND FINANCIAL METRICS

- 15.7.1 COMPANY VALUATION

- 15.7.2 FINANCIAL METRICS

- 15.8 BRAND/PRODUCT COMPARISON

- 15.9 COMPETITIVE SCENARIO AND TRENDS

- 15.9.1 PRODUCT LAUNCHES

- 15.9.2 DEALS

- 15.9.3 EXPANSIONS

- 15.9.4 OTHER DEALS/DEVELOPMENTS

16 COMPANY PROFILES

- 16.1 KEY PLAYERS

- 16.1.1 NESTLE

- 16.1.1.1 Business overview

- 16.1.1.2 Products/Solutions/Services offered

- 16.1.1.3 Recent developments

- 16.1.1.3.1 Product launches

- 16.1.1.3.2 Deals

- 16.1.1.3.3 Expansions

- 16.1.1.3.4 Other deals/developments

- 16.1.1.4 MnM view

- 16.1.1.4.1 Key strengths

- 16.1.1.4.2 Strategic choices

- 16.1.1.4.3 Weaknesses and competitive threats

- 16.1.2 ABBOTT

- 16.1.2.1 Business overview

- 16.1.2.2 Products/Solutions/Services offered

- 16.1.2.3 Recent developments

- 16.1.2.3.1 Product launches

- 16.1.2.3.2 Deals

- 16.1.2.4 MnM view

- 16.1.2.4.1 Right to win

- 16.1.2.4.2 Strategic choices

- 16.1.2.4.3 Weaknesses and competitive threats

- 16.1.3 OTSUKA HOLDINGS CO., LTD.

- 16.1.3.1 Business overview

- 16.1.3.2 Products/Solutions/Services offered

- 16.1.3.3 Recent developments

- 16.1.3.3.1 Product launches

- 16.1.3.3.2 Deals

- 16.1.3.4 MnM view

- 16.1.3.4.1 Key strengths

- 16.1.3.4.2 Strategic choices

- 16.1.3.4.3 Weaknesses and competitive threats

- 16.1.4 HALEON GROUP OF COMPANIES

- 16.1.4.1 Business overview

- 16.1.4.2 Products/Solutions/Services offered

- 16.1.4.3 Recent developments

- 16.1.4.3.1 Expansions

- 16.1.4.4 MnM view

- 16.1.4.4.1 Key strengths

- 16.1.4.4.2 Strategic choices

- 16.1.4.4.3 Weaknesses and competitive threats

- 16.1.5 GLANBIA PLC

- 16.1.5.1 Business overview

- 16.1.5.2 Products/Services/Solutions offered

- 16.1.5.3 Recent developments

- 16.1.5.3.1 Deals

- 16.1.5.4 MnM view

- 16.1.5.4.1 Key strengths

- 16.1.5.4.2 Strategic choices

- 16.1.5.4.3 Weaknesses and competitive threats

- 16.1.6 BAYER AG

- 16.1.6.1 Business overview

- 16.1.6.2 Products/Services/Solutions offered

- 16.1.6.3 Recent developments

- 16.1.6.3.1 Deals

- 16.1.6.3.2 Expansions

- 16.1.6.4 MnM view

- 16.1.7 H&H GROUP

- 16.1.7.1 Business overview

- 16.1.7.2 Products/Services/Solutions offered

- 16.1.7.3 Recent developments

- 16.1.7.3.1 Product launches

- 16.1.7.3.2 Deals

- 16.1.7.3.3 Expansions

- 16.1.7.4 MnM view

- 16.1.8 NATURE'S SUNSHINE PRODUCTS, INC.

- 16.1.8.1 Business overview

- 16.1.8.2 Products/Services/Solutions offered

- 16.1.8.3 Recent developments

- 16.1.8.3.1 Product launches

- 16.1.8.4 MnM view

- 16.1.9 NU SKIN

- 16.1.9.1 Business overview

- 16.1.9.2 Products/Services/Solutions offered

- 16.1.9.3 MnM view

- 16.1.10 AMWAY CORP.

- 16.1.10.1 Business overview

- 16.1.10.2 Products/Services/Solutions offered

- 16.1.10.3 Recent developments

- 16.1.10.3.1 Product launches

- 16.1.10.3.2 Deals

- 16.1.10.4 MnM view

- 16.1.11 HERBALIFE INTERNATIONAL OF AMERICA, INC.

- 16.1.11.1 Business overview

- 16.1.11.2 Products/Services/Solutions offered

- 16.1.11.3 Recent developments

- 16.1.11.3.1 Product launches

- 16.1.11.3.2 Deals

- 16.1.11.4 MnM view

- 16.1.12 BIONOVA

- 16.1.12.1 Business overview

- 16.1.12.2 Products/Services/Solutions offered

- 16.1.12.3 MnM view

- 16.1.13 ARKOPHARMA

- 16.1.13.1 Business overview

- 16.1.13.2 Products/Services/Solutions offered

- 16.1.13.3 MnM view

- 16.1.14 AMERICAN HEALTH

- 16.1.14.1 Business overview

- 16.1.14.2 Products/Services/Solutions offered

- 16.1.14.3 MnM view

- 16.1.15 VITACO

- 16.1.15.1 Business overview

- 16.1.15.2 Products/Services/Solutions offered

- 16.1.15.3 Recent developments

- 16.1.15.4 MnM view

- 16.1.1 NESTLE

- 16.2 OTHER PLAYERS/START-UPS/SMES

- 16.2.1 POWER GUMMIES

- 16.2.1.1 Business overview

- 16.2.1.2 Products/Services/Solutions offered

- 16.2.1.3 MnM view

- 16.2.2 BIOMEDICAL RESEARCH LABORATORIES, LLC

- 16.2.2.1 Business overview

- 16.2.2.2 Products/Services/Solutions offered

- 16.2.2.3 MnM view

- 16.2.3 HEALTHKART.COM

- 16.2.3.1 Business overview

- 16.2.3.2 Products/Services/Solutions offered

- 16.2.3.3 MnM view

- 16.2.4 NORDIC NATURALS

- 16.2.4.1 Business overview

- 16.2.4.2 Products/Services/Solutions offered

- 16.2.4.3 MnM view

- 16.2.5 BIOGAIA

- 16.2.5.1 Business overview

- 16.2.5.2 Products/Services/Solutions offered

- 16.2.5.3 Recent developments

- 16.2.5.3.1 Product launches

- 16.2.5.3.2 Deals

- 16.2.5.3.3 Expansions

- 16.2.5.4 MnM view

- 16.2.6 ALFA LABORATORIES, INC.

- 16.2.7 NUTRISCIENCE CORPORATION

- 16.2.8 NATURE'S ESSENTIALS

- 16.2.9 LIFE EXTENSION

- 16.2.10 SOLGAR INC.

- 16.2.1 POWER GUMMIES

- 16.3 DIETARY SUPPLEMENTS INGREDIENT MANUFACTURERS

- 16.3.1 ADM

- 16.3.2 CARGILL, INCORPORATED

- 16.3.3 INTERNATIONAL FLAVORS & FRAGRANCES INC

- 16.3.4 BASF SE

- 16.3.5 DSM-FIRMENICH

- 16.3.6 ASSOCIATED BRITISH FOODS PLC

- 16.3.7 KYOWA KIRIN CO., LTD

- 16.3.8 FONTERRA CO-OPERATIVE GROUP LIMITED

- 16.3.9 KERRY GROUP PLC

- 16.3.10 DIVI'S NUTRACEUTICALS

17 ADJACENT & RELATED MARKETS

- 17.1 INTRODUCTION

- 17.2 LIMITATIONS

- 17.3 NUTRACEUTICAL INGREDIENTS MARKET

- 17.3.1 MARKET DEFINITION

- 17.3.2 MARKET OVERVIEW

- 17.4 PROBIOTICS MARKET

- 17.4.1 MARKET DEFINITION

- 17.4.2 MARKET OVERVIEW

18 APPENDIX

- 18.1 DISCUSSION GUIDE

- 18.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 18.3 CUSTOMIZATION OPTIONS

- 18.4 RELATED REPORTS

- 18.5 AUTHOR DETAILS