|

|

市場調査レポート

商品コード

1781109

不正検知・防止(FDP)の世界市場:不正タイプ別、提供別、業界別、地域別 - 予測(~2030年)Fraud Detection and Prevention (FDP) Market by Fraud Type (Identity, Payment, Insider, Investment), Offering (Solutions (Fraud Analytics, Authentication, and GRC) and Services), Vertical (BFSI, Healthcare, Retail), and Region - Global forecast to 2030 |

||||||

カスタマイズ可能

|

|||||||

| 不正検知・防止(FDP)の世界市場:不正タイプ別、提供別、業界別、地域別 - 予測(~2030年) |

|

出版日: 2025年07月28日

発行: MarketsandMarkets

ページ情報: 英文 592 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

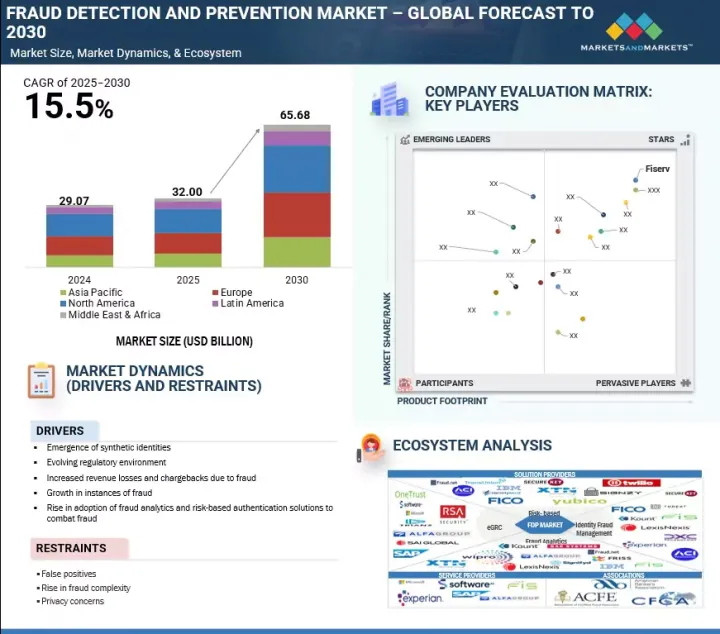

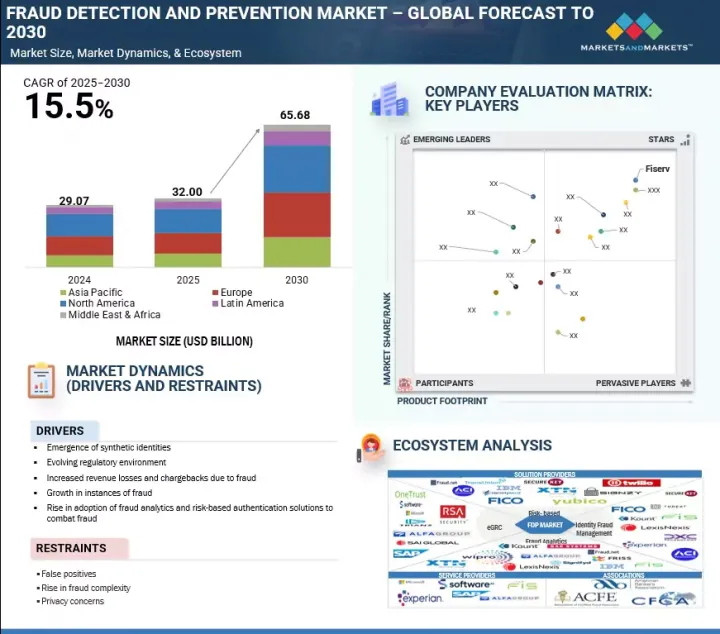

世界の不正検知・防止の市場規模は、2025年の320億米ドルから2030年までに656億8,000万米ドルに達すると予測され、予測期間にCAGRで15.5%の拡大が見込まれます。

取引詐欺のProtection-as-a-Serviceに対するニーズの高まりは、特にデジタル決済プロバイダーにとって、不正検知・防止市場の重要な促進要因として浮上しています。リアルタイム取引やカードを提示しない取引の増加に伴い、多くの企業が即時のリスク評価と柔軟な展開を提供するクラウドベースのソリューションを採用しています。このアプローチは、複雑なインフラ管理の負担を軽減しながら脅威への迅速な対応を可能にし、高速デジタル決済の安全確保に最適です。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2019年~2030年 |

| 基準年 | 2024年 |

| 予測期間 | 2025年~2030年 |

| 単位 | 100万米ドル/10億米ドル |

| セグメント | 不正タイプ、提供、展開方式、機能、組織規模、業界、地域 |

| 対象地域 | 北米、欧州、アジア太平洋、中東・アフリカ、ラテンアメリカ |

しかし、地域間で不正行為の分類、報告、対応に関する標準化されたフレームワークがないため、グローバル企業がFDPの運用を合理化し、国境を越えた脅威の緩和を調整することは困難であり、市場成長が抑制されています。

「オンプレミス展開セグメントが予測期間に最大の市場シェアを占めます。」

不正検知・防止市場では、主に銀行、保険、政府機関などの機密性の高いデータを扱う組織において、オンプレミス展開が依然として有力な選択肢となっています。これらの部門では、データセキュリティ、システムパフォーマンス、規制遵守を完全に管理することが最優先であり、オンプレミスセットアップの方がより高いパフォーマンスを実現できます。また、先進のカスタマイズや既存のインフラとの緊密な統合が可能なため、複雑なワークフローや厳格な内部政策を持つ機関にとっても理想的です。クラウドベースのソリューションは、その拡張性と柔軟性から人気が高まっていますが、多くの企業は依然としてオンプレミスのシステムに依存しています。このような動向は、特にデータプライバシー、遅延、オペレーショナルリスクが重要な懸念となる環境において、不正検知ツールを直接管理下に置く必要性から生じています。

「医療部門が予測期間にもっとも高いCAGRを占めます。」

医療部門は、デジタルカルテ量の増加、遠隔医療の採用、機密性の高い患者データを狙ったサイバー攻撃の増加により、FDP市場でもっとも速いペースで成長すると予測されています。医療システムがクラウドプラットフォームやコネクテッドデバイスに急速に移行する中、なりすまし、保険金詐欺、データ漏洩に関する脆弱性が急増しています。特に医療個人情報詐欺は大きな脅威となっており、盗まれた患者情報はしばしばダークウェブ上で財務データよりも高値で取引されています。さらに、虚偽の請求、処方箋詐欺、電子カルテへの不正アクセスにより、プロバイダーや保険企業はリアルタイムの不正検知ツールの採用を迫られています。HIPAAやGDPRのようなデータ保護規制を遵守しなければならないというプレッシャーも、行動分析、生体認証、AIによる異常検知への投資を加速させています。医療のデジタル化が進む中、患者の信頼を守り、財政的・風評的な損害を防ぐためには、安全で拡張性の高いインテリジェントなFDPソリューションへの需要が不可欠となっています。

「アジア太平洋が予測期間に最高のCAGRを記録します。」

アジア太平洋は、デジタル活動の急増と複雑な不正の脅威により、不正の検知と防止に向けた取り組みのホットスポットとして台頭しています。2023年後半には、同地域の企業の60%超が決済やデジタルバンキングの不正行為に毎月遭遇していると報告し、65%近くが前年比で不正行為が急増したことを指摘しています。モバイルファーストの経済が活況を呈し、リアルタイム決済システムが拡大する中、詐欺師はスピード、本人確認、トランザクションモニタリングのギャップを悪用しています。

当レポートでは、世界の不正検知・防止(FDP)市場について調査分析し、主な促進要因と抑制要因、競合情勢、将来の動向などの情報を提供しています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要な知見

- 不正検知・防止市場企業にとって魅力的な機会

- 不正検知・防止市場:不正タイプ別

- 不正検知・防止市場:提供別

- 不正検知・防止市場:ソリューション別

- 不正検知・防止市場:サービス別

- 不正検知・防止市場:展開方式別

- 不正検知・防止市場:組織規模別

- 不正検知・防止市場:機能別

- 不正検知・防止市場:業界別

- 不正検知・防止市場:BFSIタイプ別

- 市場投資シナリオ

第5章 市場の概要と業界動向

- イントロダクション

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

- ポーターのファイブフォース分析

- 主なステークホルダーと購入基準

- エコシステム分析/市場マップ

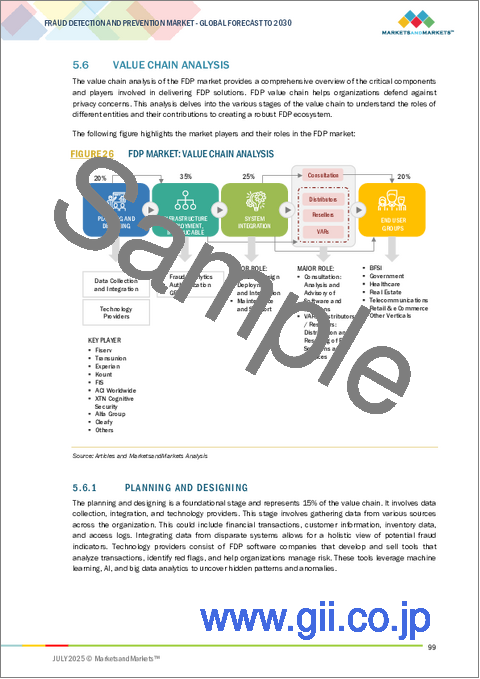

- バリューチェーン分析

- 計画と設計

- FDPソリューションプロバイダー

- システム統合

- 流通

- エンドユーザー

- 特許分析

- 規制情勢

- イントロダクション

- 規制機関、政府機関、その他の組織

- 主な規制

- 価格分析

- 主要企業の平均販売価格の動向:製品別(2025年)

- 参考価格分析:ソリューション別

- 技術分析

- 主要技術

- 補完技術

- 隣接技術

- ケーススタディ分析

- 主な会議とイベント(2025年~2026年)

- 投資情勢

- 不正検知・防止市場に対する生成AIの影響

- 主なユースケースと市場の将来性

- 相互接続された隣接エコシステムに対する生成AIの影響

- カスタマービジネスに影響を与える動向/混乱

- テクノロジーロードマップ

- 不正検知・防止市場の歴史

- 1990年代

- 2000年~2010年

- 2010年~2020年

- 2020年~現在

- 不正検知・防止市場におけるベストプラクティス

第6章 2025年の米国関税の影響 - 概要

- イントロダクション

- 主な関税率

- 価格の影響の分析

- 国/地域に対する影響

- 北米

- 欧州

- アジア太平洋

- 産業

第7章 不正検知・防止市場:不正タイプ別

- イントロダクション

- 小切手詐欺

- 個人情報詐欺

- インサイダー詐欺

- 投資詐欺

- 決済詐欺

- 保険詐欺

- フレンドリー詐欺

- その他の不正タイプ

第8章 不正検知・防止市場:提供別

- イントロダクション

- ソリューション

- サービス

第9章 不正検知・防止市場:展開方式別

- イントロダクション

- クラウド

- オンプレミス

第10章 不正検知・防止市場:機能別

- イントロダクション

- リアルタイム検知

- 法医学分析

第11章 不正検知・防止市場:組織規模別

- イントロダクション

- 大企業

- 中小企業

第12章 不正検知・防止市場:業界別

- イントロダクション

- BFSI

- 小売・eコマース

- 政府

- 医療

- 製造

- 旅行・輸送

- 不動産

- 通信

- その他の業界

第13章 不正検知・防止市場:地域別

- イントロダクション

- 北米

- 北米:不正検知・防止市場の促進要因

- 北米:マクロ経済の見通し

- 北米:MNMの戦略的知見

- 北米:規制情勢

- 米国

- カナダ

- 欧州

- 欧州:不正検知・防止市場の促進要因

- 欧州:マクロ経済の見通し

- 欧州:MNMの戦略的知見

- 欧州:規制情勢

- 英国

- ドイツ

- フランス

- スペイン

- イタリア

- ポーランド

- アイルランド

- チェコ共和国

- その他の欧州

- アジア太平洋

- アジア太平洋:不正検知・防止市場の促進要因

- アジア太平洋:マクロ経済の見通し

- アジア太平洋:MNMの戦略的知見

- アジア太平洋:規制情勢

- 中国

- 日本

- オーストラリア・ニュージーランド

- インド

- シンガポール

- その他のアジア太平洋

- 中東・アフリカ

- 中東・アフリカ:不正検知・防止市場の促進要因

- 中東・アフリカ:マクロ経済の見通し

- 中東・アフリカ:MNMの戦略的知見

- GCC

- 南アフリカ

- その他の中東・アフリカ

- ラテンアメリカ

- ラテンアメリカ:不正検知・防止市場の促進要因

- ラテンアメリカ:マクロ経済の見通し

- ラテンアメリカ:MNMの戦略的知見

- ブラジル

- メキシコ

- コロンビア

- その他のラテンアメリカ

第14章 競合情勢

- イントロダクション

- 主要参入企業の戦略/強み

- 収益分析(2019年~2024年)

- 市場シェア分析(2024年)

- 製品/ブランドの比較

- FISERV

- LEXISNEXIS

- TRANSUNION

- FIS GLOBAL

- NICE ACTIMIZE

- 企業の評価と財務指標

- 企業の評価(2025年)

- EV/EBIDTAを用いた財務指標

- 企業の評価マトリクス:主要企業(2024年)

- 企業の評価マトリクス:スタートアップ/中小企業(2024年)

- 競合シナリオと動向

第15章 企業プロファイル

- 主要企業

- FISERV

- LEXISNEXIS RISK SOLUTIONS

- TRANSUNION

- FIS GLOBAL

- NICE ACTIMIZE

- EXPERIAN

- IBM

- ACI WORLDWIDE

- SAS INSTITUTE

- RSA SECURITY

- SAP

- FICO

- MICROSOFT

- F5

- AWS

- BOTTOMLINE TECHNOLOGIES

- CLEARSALE

- GENPACT

- SECURONIX

- ACCERTIFY

- FEEDZAI

- CASEWARE

- ONESPAN

- SIGNIFYD

- BIOCATCH

- FRISS

- MAXMIND

- DATAVISOR

- CLEAFY

- GURUCUL

- RISKIFIED

- THOMSON REUTERS

- SIFT

- NOFRAUD

- FEATURESPACE

- XTN COGNITIVE SECURITY

- EQUIFAX

- ALFA GROUP

- PING IDENTITY

- GFT TECHNOLOGIES

- GBG

- KROLL

- その他の主要企業

- ALLOY

- CASTLE

- ENZOIC

- KUBIENT

- SPYCLOUD

- SEON

- DEDUCE

- INCOGNIA

- RESISTANT AI

- AMANI TECHNOLOGIES

- JUICYSCORE

- FUGU

- PIPL

第16章 隣接市場

- 隣接市場のイントロダクション

- マネーロンダリング対策(AML)市場

- EGRC市場

第17章 付録

List of Tables

- TABLE 1 USD EXCHANGE RATES, 2019-2024

- TABLE 2 FACTOR ANALYSIS

- TABLE 3 FRAUD DETECTION AND PREVENTION MARKET: ASSUMPTIONS

- TABLE 4 FRAUD DETECTION AND PREVENTION MARKET SIZE AND GROWTH RATE, 2019-2024 (USD MILLION, Y-O-Y %)

- TABLE 5 FRAUD DETECTION AND PREVENTION MARKET SIZE AND GROWTH RATE, 2025-2030 (USD MILLION, Y-O-Y %)

- TABLE 6 PORTER'S FIVE FORCES IMPACT ON FRAUD DETECTION AND PREVENTION MARKET

- TABLE 7 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE VERTICALS

- TABLE 8 KEY BUYING CRITERIA FOR TOP THREE VERTICALS

- TABLE 9 ROLE OF VENDORS IN FRAUD DETECTION AND PREVENTION ECOSYSTEM

- TABLE 10 LIST OF MAJOR PATENTS

- TABLE 11 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 12 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 13 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 14 ROW: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 15 AVERAGE SELLING PRICES FOR FDP SOLUTIONS OFFERED BY KEY PLAYERS, BY OFFERING, 2025

- TABLE 16 PRICING MODELS OF IBM

- TABLE 17 PRICING MODELS OF MAXMIND

- TABLE 18 PRICING MODELS OF AMAZON FRAUD DETECTOR

- TABLE 19 PRICING MODELS OF MICROSOFT DYNAMICS 365 FRAUD PROTECTION

- TABLE 20 PRICING MODELS OF FRAUDLABS PRO

- TABLE 21 FRAUD DETECTION AND PREVENTION MARKET: DETAILED LIST OF CONFERENCES & EVENTS, 2025-2026

- TABLE 22 US ADJUSTED RECIPROCAL TARIFF RATES

- TABLE 23 KEY PRODUCT-RELATED TARIFF EFFECTIVE FOR INDUSTRIAL CONTROL SYSTEM (ICS) SECURITY HARDWARE

- TABLE 24 EXPECTED CHANGE IN PRICES AND LIKELY IMPACT ON ENDUSE MARKET DUE TO TARIFF IMPACT

- TABLE 25 FRAUD DETECTION AND PREVENTION MARKET, BY FRAUD TYPE, 2019-2024 (USD MILLION)

- TABLE 26 FRAUD DETECTION AND PREVENTION MARKET, BY FRAUD TYPE, 2025-2030 (USD MILLION)

- TABLE 27 CHECK FRAUD: FRAUD DETECTION AND PREVENTION MARKET, BY REGION, 2019-2024 (USD MILLION)

- TABLE 28 CHECK FRAUD: FRAUD DETECTION AND PREVENTION MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 29 IDENTITY FRAUD: FRAUD DETECTION AND PREVENTION MARKET, BY REGION, 2019-2024 (USD MILLION)

- TABLE 30 IDENTITY FRAUD: FRAUD DETECTION AND PREVENTION MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 31 INSIDER FRAUD: FRAUD DETECTION AND PREVENTION MARKET, BY REGION, 2019-2024 (USD MILLION)

- TABLE 32 INSIDER FRAUD: FRAUD DETECTION AND PREVENTION MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 33 INVESTMENT FRAUD: FRAUD DETECTION AND PREVENTION MARKET, BY REGION, 2019-2024 (USD MILLION)

- TABLE 34 INVESTMENT FRAUD: FRAUD DETECTION AND PREVENTION MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 35 PAYMENT FRAUD: FRAUD DETECTION AND PREVENTION MARKET, BY REGION, 2019-2024 (USD MILLION)

- TABLE 36 PAYMENT FRAUD: FRAUD DETECTION AND PREVENTION MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 37 INSURANCE FRAUD: FRAUD DETECTION AND PREVENTION MARKET, BY REGION, 2019-2024 (USD MILLION)

- TABLE 38 INSURANCE FRAUD: FRAUD DETECTION AND PREVENTION MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 39 FRIENDLY FRAUD: FRAUD DETECTION AND PREVENTION MARKET, BY REGION, 2019-2024 (USD MILLION)

- TABLE 40 FRIENDLY FRAUD: FRAUD DETECTION AND PREVENTION MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 41 OTHER FRAUD: FRAUD DETECTION AND PREVENTION MARKET, BY REGION, 2019-2024 (USD MILLION)

- TABLE 42 OTHER FRAUD: FRAUD DETECTION AND PREVENTION MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 43 FRAUD DETECTION AND PREVENTION MARKET, BY OFFERING, 2019-2024 (USD MILLION)

- TABLE 44 FRAUD DETECTION AND PREVENTION MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 45 SOLUTIONS: FRAUD DETECTION AND PREVENTION MARKET, BY REGION, 2019-2024 (USD MILLION)

- TABLE 46 SOLUTIONS: FRAUD DETECTION AND PREVENTION MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 47 FRAUD DETECTION AND PREVENTION MARKET, BY SOLUTION, 2019-2024 (USD MILLION)

- TABLE 48 FRAUD DETECTION AND PREVENTION MARKET, BY SOLUTION, 2025-2030 (USD MILLION)

- TABLE 49 FRAUD ANALYTICS: FRAUD DETECTION AND PREVENTION MARKET, BY REGION, 2019-2024 (USD MILLION)

- TABLE 50 FRAUD ANALYTICS: FRAUD DETECTION AND PREVENTION MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 51 AUTHENTICATION: FRAUD DETECTION AND PREVENTION MARKET, BY REGION, 2019-2024 (USD MILLION)

- TABLE 52 AUTHENTICATION: FRAUD DETECTION AND PREVENTION MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 53 GOVERNANCE, RISK, AND COMPLIANCE: FRAUD DETECTION AND PREVENTION MARKET, BY REGION, 2019-2024 (USD MILLION)

- TABLE 54 GOVERNANCE, RISK, AND COMPLIANCE: FRAUD DETECTION AND PREVENTION MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 55 FRAUD DETECTION AND PREVENTION MARKET, BY SERVICE, 2019-2024 (USD MILLION)

- TABLE 56 FRAUD DETECTION AND PREVENTION MARKET, BY SERVICE, 2025-2030 (USD MILLION)

- TABLE 57 SERVICES: FRAUD DETECTION AND PREVENTION MARKET, BY REGION, 2019-2024 (USD MILLION)

- TABLE 58 SERVICES: FRAUD DETECTION AND PREVENTION MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 59 PROFESSIONAL SERVICES: FRAUD DETECTION AND PREVENTION MARKET, BY REGION, 2019-2024 (USD MILLION)

- TABLE 60 PROFESSIONAL SERVICES: FRAUD DETECTION AND PREVENTION MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 61 MANAGED SERVICES: FRAUD DETECTION AND PREVENTION MARKET, BY REGION, 2019-2024 (USD MILLION)

- TABLE 62 MANAGED SERVICES: FRAUD DETECTION AND PREVENTION MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 63 FRAUD DETECTION AND PREVENTION MARKET, BY DEPLOYMENT MODE, 2019-2024 (USD MILLION)

- TABLE 64 FRAUD DETECTION AND PREVENTION MARKET, BY DEPLOYMENT MODE, 2025-2030 (USD MILLION)

- TABLE 65 CLOUD: FRAUD DETECTION AND PREVENTION MARKET, BY REGION, 2019-2024 (USD MILLION)

- TABLE 66 CLOUD: FRAUD DETECTION AND PREVENTION MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 67 ON-PREMISES: FRAUD DETECTION AND PREVENTION MARKET, BY REGION, 2019-2024 (USD MILLION)

- TABLE 68 ON-PREMISES: FRAUD DETECTION AND PREVENTION MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 69 FRAUD DETECTION AND PREVENTION MARKET, BY FUNCTIONALITY, 2019-2024 (USD MILLION)

- TABLE 70 FRAUD DETECTION AND PREVENTION MARKET, BY FUNCTIONALITY, 2025-2030 (USD MILLION)

- TABLE 71 REAL-TIME DETECTION: FRAUD DETECTION AND PREVENTION MARKET, BY REGION, 2019-2024 (USD MILLION)

- TABLE 72 REAL-TIME DETECTION: FRAUD DETECTION AND PREVENTION MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 73 FORENSIC ANALYSIS: FRAUD DETECTION AND PREVENTION MARKET, BY REGION, 2019-2024 (USD MILLION)

- TABLE 74 FORENSIC ANALYSIS: FRAUD DETECTION AND PREVENTION MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 75 FRAUD DETECTION AND PREVENTION MARKET, BY ORGANIZATION SIZE, 2019-2024 (USD MILLION)

- TABLE 76 FRAUD DETECTION AND PREVENTION MARKET, BY ORGANIZATION SIZE, 2025-2030 (USD MILLION)

- TABLE 77 LARGE ENTERPRISES: FRAUD DETECTION AND PREVENTION MARKET, BY REGION, 2019-2024 (USD MILLION)

- TABLE 78 LARGE ENTERPRISES: FRAUD DETECTION AND PREVENTION MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 79 SMES: FRAUD DETECTION AND PREVENTION MARKET, BY REGION, 2019-2024 (USD MILLION)

- TABLE 80 SMES: FRAUD DETECTION AND PREVENTION MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 81 FRAUD DETECTION AND PREVENTION MARKET, BY VERTICAL, 2019-2024 (USD MILLION)

- TABLE 82 FRAUD DETECTION AND PREVENTION MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 83 BANKING, FINANCIAL SERVICES, AND INSURANCE: FRAUD DETECTION AND PREVENTION MARKET, BY REGION, 2019-2024 (USD MILLION)

- TABLE 84 BANKING, FINANCIAL SERVICES, AND INSURANCE: FRAUD DETECTION AND PREVENTION MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 85 FRAUD DETECTION AND PREVENTION MARKET, BY BFSI TYPE, 2019-2024 (USD MILLION)

- TABLE 86 FRAUD DETECTION AND PREVENTION MARKET, BY BFSI TYPE, 2025-2030 (USD MILLION)

- TABLE 87 BANKING: FRAUD DETECTION AND PREVENTION MARKET, BY REGION, 2019-2024 (USD MILLION)

- TABLE 88 BANKING: FRAUD DETECTION AND PREVENTION MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 89 FINANCIAL SERVICES: FRAUD DETECTION AND PREVENTION MARKET, BY REGION, 2019-2024 (USD MILLION)

- TABLE 90 FINANCIAL SERVICES: FRAUD DETECTION AND PREVENTION MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 91 INSURANCE: FRAUD DETECTION AND PREVENTION MARKET, BY REGION, 2019-2024 (USD MILLION)

- TABLE 92 INSURANCE: FRAUD DETECTION AND PREVENTION MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 93 RETAIL & ECOMMERCE: FRAUD DETECTION AND PREVENTION MARKET, BY REGION, 2019-2024 (USD MILLION)

- TABLE 94 RETAIL & ECOMMERCE: FRAUD DETECTION AND PREVENTION MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 95 GOVERNMENT: FRAUD DETECTION AND PREVENTION MARKET, BY REGION, 2019-2024 (USD MILLION)

- TABLE 96 GOVERNMENT: FRAUD DETECTION AND PREVENTION MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 97 HEALTHCARE: FRAUD DETECTION AND PREVENTION MARKET, BY REGION, 2019-2024 (USD MILLION)

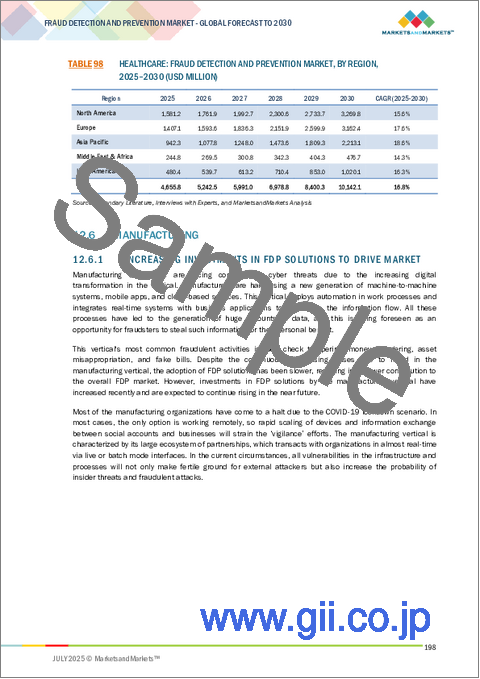

- TABLE 98 HEALTHCARE: FRAUD DETECTION AND PREVENTION MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 99 MANUFACTURING: FRAUD DETECTION AND PREVENTION MARKET, BY REGION, 2019-2024 (USD MILLION)

- TABLE 100 MANUFACTURING: FRAUD DETECTION AND PREVENTION MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 101 TRAVEL & TRANSPORTATION: FRAUD DETECTION AND PREVENTION MARKET, BY REGION, 2019-2024 (USD MILLION)

- TABLE 102 TRAVEL & TRANSPORTATION: FRAUD DETECTION AND PREVENTION MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 103 REAL ESTATE: FRAUD DETECTION AND PREVENTION MARKET, BY REGION, 2019-2024 (USD MILLION)

- TABLE 104 REAL ESTATE: FRAUD DETECTION AND PREVENTION MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 105 TELECOMMUNICATIONS: FRAUD DETECTION AND PREVENTION MARKET, BY REGION, 2019-2024 (USD MILLION)

- TABLE 106 TELECOMMUNICATIONS: FRAUD DETECTION AND PREVENTION MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 107 OTHER VERTICALS: FRAUD DETECTION AND PREVENTION MARKET, BY REGION, 2019-2024 (USD MILLION)

- TABLE 108 OTHER VERTICALS: FRAUD DETECTION AND PREVENTION MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 109 FRAUD DETECTION AND PREVENTION MARKET, BY REGION, 2019-2024 (USD MILLION)

- TABLE 110 FRAUD DETECTION AND PREVENTION MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 111 NORTH AMERICA: FRAUD DETECTION AND PREVENTION MARKET, BY OFFERING, 2019-2024 (USD MILLION)

- TABLE 112 NORTH AMERICA: FRAUD DETECTION AND PREVENTION MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 113 NORTH AMERICA: FRAUD DETECTION AND PREVENTION MARKET, BY SOLUTION, 2019-2024 (USD MILLION)

- TABLE 114 NORTH AMERICA: FRAUD DETECTION AND PREVENTION MARKET, BY SOLUTION, 2025-2030 (USD MILLION)

- TABLE 115 NORTH AMERICA: FRAUD DETECTION AND PREVENTION MARKET, BY SERVICE, 2019-2024 (USD MILLION)

- TABLE 116 NORTH AMERICA: FRAUD DETECTION AND PREVENTION MARKET, BY SERVICE, 2025-2030 (USD MILLION)

- TABLE 117 NORTH AMERICA: FRAUD DETECTION AND PREVENTION MARKET, BY DEPLOYMENT MODE, 2019-2024 (USD MILLION)

- TABLE 118 NORTH AMERICA: FRAUD DETECTION AND PREVENTION MARKET, BY DEPLOYMENT MODE, 2025-2030 (USD MILLION)

- TABLE 119 NORTH AMERICA: FRAUD DETECTION AND PREVENTION MARKET, BY ORGANIZATION SIZE, 2019-2024 (USD MILLION)

- TABLE 120 NORTH AMERICA: FRAUD DETECTION AND PREVENTION MARKET, BY ORGANIZATION SIZE, 2025-2030 (USD MILLION)

- TABLE 121 NORTH AMERICA: FRAUD DETECTION AND PREVENTION MARKET, BY VERTICAL, 2019-2024 (USD MILLION)

- TABLE 122 NORTH AMERICA: FRAUD DETECTION AND PREVENTION MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 123 NORTH AMERICA: FRAUD DETECTION AND PREVENTION MARKET, BY FRAUD TYPE, 2019-2024 (USD MILLION)

- TABLE 124 NORTH AMERICA: FRAUD DETECTION AND PREVENTION MARKET, BY FRAUD TYPE, 2025-2030 (USD MILLION)

- TABLE 125 NORTH AMERICA: FRAUD DETECTION AND PREVENTION MARKET, BY BFSI TYPE, 2019-2024 (USD MILLION)

- TABLE 126 NORTH AMERICA: FRAUD DETECTION AND PREVENTION MARKET, BY BFSI TYPE, 2025-2030 (USD MILLION)

- TABLE 127 NORTH AMERICA: FRAUD DETECTION AND PREVENTION MARKET, BY FUNCTIONALITY, 2019-2024 (USD MILLION)

- TABLE 128 NORTH AMERICA: FRAUD DETECTION AND PREVENTION MARKET, BY FUNCTIONALITY, 2025-2030 (USD MILLION)

- TABLE 129 NORTH AMERICA: FRAUD DETECTION AND PREVENTION MARKET, BY COUNTRY, 2019-2024 (USD MILLION)

- TABLE 130 NORTH AMERICA: FRAUD DETECTION AND PREVENTION MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 131 US: FRAUD DETECTION AND PREVENTION MARKET, BY OFFERING, 2019-2024 (USD MILLION)

- TABLE 132 US: FRAUD DETECTION AND PREVENTION MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 133 US: FRAUD DETECTION AND PREVENTION MARKET, BY SOLUTION, 2019-2024 (USD MILLION)

- TABLE 134 US: FRAUD DETECTION AND PREVENTION MARKET, BY SOLUTION, 2025-2030 (USD MILLION)

- TABLE 135 US: FRAUD DETECTION AND PREVENTION MARKET, BY SERVICE, 2019-2024 (USD MILLION)

- TABLE 136 US: FRAUD DETECTION AND PREVENTION MARKET, BY SERVICE, 2025-2030 (USD MILLION)

- TABLE 137 US: FRAUD DETECTION AND PREVENTION MARKET, BY DEPLOYMENT MODE, 2019-2024 (USD MILLION)

- TABLE 138 US: FRAUD DETECTION AND PREVENTION MARKET, BY DEPLOYMENT MODE, 2025-2030 (USD MILLION)

- TABLE 139 US: FRAUD DETECTION AND PREVENTION MARKET, BY ORGANIZATION SIZE, 2019-2024 (USD MILLION)

- TABLE 140 US: FRAUD DETECTION AND PREVENTION MARKET, BY ORGANIZATION SIZE, 2025-2030 (USD MILLION)

- TABLE 141 US: FRAUD DETECTION AND PREVENTION MARKET, BY VERTICAL, 2019-2024 (USD MILLION)

- TABLE 142 US: FRAUD DETECTION AND PREVENTION MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 143 US: FRAUD DETECTION AND PREVENTION MARKET, BY FRAUD TYPE, 2019-2024 (USD MILLION)

- TABLE 144 US: FRAUD DETECTION AND PREVENTION MARKET, BY FRAUD TYPE, 2025-2030 (USD MILLION)

- TABLE 145 US: FRAUD DETECTION AND PREVENTION MARKET, BY FUNCTIONALITY, 2019-2024 (USD MILLION)

- TABLE 146 US: FRAUD DETECTION AND PREVENTION MARKET, BY FUNCTIONALITY, 2025-2030 (USD MILLION)

- TABLE 147 US: FRAUD DETECTION AND PREVENTION MARKET, BY BFSI TYPE, 2019-2024 (USD MILLION)

- TABLE 148 US: FRAUD DETECTION AND PREVENTION MARKET, BY BFSI TYPE, 2025-2030 (USD MILLION)

- TABLE 149 CANADA: FRAUD DETECTION AND PREVENTION MARKET, BY OFFERING, 2019-2024 (USD MILLION)

- TABLE 150 CANADA: FRAUD DETECTION AND PREVENTION MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 151 CANADA: FRAUD DETECTION AND PREVENTION MARKET, BY SOLUTION, 2019-2024 (USD MILLION)

- TABLE 152 CANADA: FRAUD DETECTION AND PREVENTION MARKET, BY SOLUTION, 2025-2030 (USD MILLION)

- TABLE 153 CANADA: FRAUD DETECTION AND PREVENTION MARKET, BY SERVICE, 2019-2024 (USD MILLION)

- TABLE 154 CANADA: FRAUD DETECTION AND PREVENTION MARKET, BY SERVICE, 2025-2030 (USD MILLION)

- TABLE 155 CANADA: FRAUD DETECTION AND PREVENTION MARKET, BY DEPLOYMENT MODE, 2019-2024 (USD MILLION)

- TABLE 156 CANADA: FRAUD DETECTION AND PREVENTION MARKET, BY DEPLOYMENT MODE, 2025-2030 (USD MILLION)

- TABLE 157 CANADA: FRAUD DETECTION AND PREVENTION MARKET, BY ORGANIZATION SIZE, 2019-2024 (USD MILLION)

- TABLE 158 CANADA: FRAUD DETECTION AND PREVENTION MARKET, BY ORGANIZATION SIZE, 2025-2030 (USD MILLION)

- TABLE 159 CANADA: FRAUD DETECTION AND PREVENTION MARKET, BY VERTICAL, 2019-2024 (USD MILLION)

- TABLE 160 CANADA: FRAUD DETECTION AND PREVENTION MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 161 CANADA: FRAUD DETECTION AND PREVENTION MARKET, BY FRAUD TYPE, 2019-2024 (USD MILLION)

- TABLE 162 CANADA: FRAUD DETECTION AND PREVENTION MARKET, BY FRAUD TYPE, 2025-2030 (USD MILLION)

- TABLE 163 CANADA: FRAUD DETECTION AND PREVENTION MARKET, BY FUNCTIONALITY, 2019-2024 (USD MILLION)

- TABLE 164 CANADA: FRAUD DETECTION AND PREVENTION MARKET, BY FUNCTIONALITY, 2025-2030 (USD MILLION)

- TABLE 165 CANADA: FRAUD DETECTION AND PREVENTION MARKET, BY BFSI TYPE, 2019-2024 (USD MILLION)

- TABLE 166 CANADA: FRAUD DETECTION AND PREVENTION MARKET, BY BFSI TYPE, 2025-2030 (USD MILLION)

- TABLE 167 EUROPE: FRAUD DETECTION AND PREVENTION MARKET, BY OFFERING, 2019-2024 (USD MILLION)

- TABLE 168 EUROPE: FRAUD DETECTION AND PREVENTION MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 169 EUROPE: FRAUD DETECTION AND PREVENTION MARKET, BY SOLUTION, 2019-2024 (USD MILLION)

- TABLE 170 EUROPE: FRAUD DETECTION AND PREVENTION MARKET, BY SOLUTION, 2025-2030 (USD MILLION)

- TABLE 171 EUROPE: FRAUD DETECTION AND PREVENTION MARKET, BY SERVICE, 2019-2024 (USD MILLION)

- TABLE 172 EUROPE: FRAUD DETECTION AND PREVENTION MARKET, BY SERVICE, 2025-2030 (USD MILLION)

- TABLE 173 EUROPE: FRAUD DETECTION AND PREVENTION MARKET, BY DEPLOYMENT MODE, 2019-2024 (USD MILLION)

- TABLE 174 EUROPE: FRAUD DETECTION AND PREVENTION MARKET, BY DEPLOYMENT MODE, 2025-2030 (USD MILLION)

- TABLE 175 EUROPE: FRAUD DETECTION AND PREVENTION MARKET, BY ORGANIZATION SIZE, 2019-2024 (USD MILLION)

- TABLE 176 EUROPE: FRAUD DETECTION AND PREVENTION MARKET, BY ORGANIZATION SIZE, 2025-2030 (USD MILLION)

- TABLE 177 EUROPE: FRAUD DETECTION AND PREVENTION MARKET, BY VERTICAL, 2019-2024 (USD MILLION)

- TABLE 178 EUROPE: FRAUD DETECTION AND PREVENTION MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 179 EUROPE: FRAUD DETECTION AND PREVENTION MARKET, BY FRAUD TYPE, 2019-2024 (USD MILLION)

- TABLE 180 EUROPE: FRAUD DETECTION AND PREVENTION MARKET, BY FRAUD TYPE, 2025-2030 (USD MILLION)

- TABLE 181 EUROPE: FRAUD DETECTION AND PREVENTION MARKET, BY FUNCTIONALITY, 2019-2024 (USD MILLION)

- TABLE 182 EUROPE: FRAUD DETECTION AND PREVENTION MARKET, BY FUNCTIONALITY, 2025-2030 (USD MILLION)

- TABLE 183 EUROPE: FRAUD DETECTION AND PREVENTION MARKET, BY BFSI TYPE, 2019-2024 (USD MILLION)

- TABLE 184 EUROPE: FRAUD DETECTION AND PREVENTION MARKET, BY BFSI TYPE, 2025-2030 (USD MILLION)

- TABLE 185 EUROPE: FRAUD DETECTION AND PREVENTION MARKET, BY COUNTRY, 2019-2024 (USD MILLION)

- TABLE 186 EUROPE: FRAUD DETECTION AND PREVENTION MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 187 UK: FRAUD DETECTION AND PREVENTION MARKET, BY OFFERING, 2019-2024 (USD MILLION)

- TABLE 188 UK: FRAUD DETECTION AND PREVENTION MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 189 UK: FRAUD DETECTION AND PREVENTION MARKET, BY SOLUTION, 2019-2024 (USD MILLION)

- TABLE 190 UK: FRAUD DETECTION AND PREVENTION MARKET, BY SOLUTION, 2025-2030 (USD MILLION)

- TABLE 191 UK: FRAUD DETECTION AND PREVENTION MARKET, BY SERVICE, 2019-2024 (USD MILLION)

- TABLE 192 UK: FRAUD DETECTION AND PREVENTION MARKET, BY SERVICE, 2025-2030 (USD MILLION)

- TABLE 193 UK: FRAUD DETECTION AND PREVENTION MARKET, BY DEPLOYMENT MODE, 2019-2024 (USD MILLION)

- TABLE 194 UK: FRAUD DETECTION AND PREVENTION MARKET, BY DEPLOYMENT MODE, 2025-2030 (USD MILLION)

- TABLE 195 UK: FRAUD DETECTION AND PREVENTION MARKET, BY ORGANIZATION SIZE, 2019-2024 (USD MILLION)

- TABLE 196 UK: FRAUD DETECTION AND PREVENTION MARKET, BY ORGANIZATION SIZE, 2025-2030 (USD MILLION)

- TABLE 197 UK: FRAUD DETECTION AND PREVENTION MARKET, BY VERTICAL, 2019-2024 (USD MILLION)

- TABLE 198 UK: FRAUD DETECTION AND PREVENTION MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 199 UK: FRAUD DETECTION AND PREVENTION MARKET, BY FRAUD TYPE, 2019-2024 (USD MILLION)

- TABLE 200 UK: FRAUD DETECTION AND PREVENTION MARKET, BY FRAUD TYPE, 2025-2030 (USD MILLION)

- TABLE 201 UK: FRAUD DETECTION AND PREVENTION MARKET, BY FUNCTIONALITY, 2019-2024 (USD MILLION)

- TABLE 202 UK: FRAUD DETECTION AND PREVENTION MARKET, BY FUNCTIONALITY, 2025-2030 (USD MILLION)

- TABLE 203 UK: FRAUD DETECTION AND PREVENTION MARKET, BY BFSI TYPE, 2019-2024 (USD MILLION)

- TABLE 204 UK: FRAUD DETECTION AND PREVENTION MARKET, BY BFSI TYPE, 2025-2030 (USD MILLION)

- TABLE 205 GERMANY: FRAUD DETECTION AND PREVENTION MARKET, BY OFFERING, 2019-2024 (USD MILLION)

- TABLE 206 GERMANY: FRAUD DETECTION AND PREVENTION MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 207 GERMANY: FRAUD DETECTION AND PREVENTION MARKET, BY SOLUTION, 2019-2024 (USD MILLION)

- TABLE 208 GERMANY: FRAUD DETECTION AND PREVENTION MARKET, BY SOLUTION, 2025-2030 (USD MILLION)

- TABLE 209 GERMANY: FRAUD DETECTION AND PREVENTION MARKET, BY SERVICE, 2019-2024 (USD MILLION)

- TABLE 210 GERMANY: FRAUD DETECTION AND PREVENTION MARKET, BY SERVICE, 2025-2030 (USD MILLION)

- TABLE 211 GERMANY: FRAUD DETECTION AND PREVENTION MARKET, BY DEPLOYMENT MODE, 2019-2024 (USD MILLION)

- TABLE 212 GERMANY: FRAUD DETECTION AND PREVENTION MARKET, BY DEPLOYMENT MODE, 2025-2030 (USD MILLION)

- TABLE 213 GERMANY: FRAUD DETECTION AND PREVENTION MARKET, BY ORGANIZATION SIZE, 2019-2024 (USD MILLION)

- TABLE 214 GERMANY: FRAUD DETECTION AND PREVENTION MARKET, BY ORGANIZATION SIZE, 2025-2030 (USD MILLION)

- TABLE 215 GERMANY: FRAUD DETECTION AND PREVENTION MARKET, BY VERTICAL, 2019-2024 (USD MILLION)

- TABLE 216 GERMANY: FRAUD DETECTION AND PREVENTION MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 217 GERMANY: FRAUD DETECTION AND PREVENTION MARKET, BY FRAUD TYPE, 2019-2024 (USD MILLION)

- TABLE 218 GERMANY: FRAUD DETECTION AND PREVENTION MARKET, BY FRAUD TYPE, 2025-2030 (USD MILLION)

- TABLE 219 GERMANY: FRAUD DETECTION AND PREVENTION MARKET, BY FUNCTIONALITY, 2019-2024 (USD MILLION)

- TABLE 220 GERMANY: FRAUD DETECTION AND PREVENTION MARKET, BY FUNCTIONALITY, 2025-2030 (USD MILLION)

- TABLE 221 GERMANY: FRAUD DETECTION AND PREVENTION MARKET, BY BFSI TYPE, 2019-2024 (USD MILLION)

- TABLE 222 GERMANY: FRAUD DETECTION AND PREVENTION MARKET, BY BFSI TYPE, 2025-2030 (USD MILLION)

- TABLE 223 FRANCE: FRAUD DETECTION AND PREVENTION MARKET, BY OFFERING, 2019-2024 (USD MILLION)

- TABLE 224 FRANCE: FRAUD DETECTION AND PREVENTION MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 225 FRANCE: FRAUD DETECTION AND PREVENTION MARKET, BY SOLUTION, 2019-2024 (USD MILLION)

- TABLE 226 FRANCE: FRAUD DETECTION AND PREVENTION MARKET, BY SOLUTION, 2025-2030 (USD MILLION)

- TABLE 227 FRANCE: FRAUD DETECTION AND PREVENTION MARKET, BY SERVICE, 2019-2024 (USD MILLION)

- TABLE 228 FRANCE: FRAUD DETECTION AND PREVENTION MARKET, BY SERVICE, 2025-2030 (USD MILLION)

- TABLE 229 FRANCE: FRAUD DETECTION AND PREVENTION MARKET, BY DEPLOYMENT MODE, 2019-2024 (USD MILLION)

- TABLE 230 FRANCE: FRAUD DETECTION AND PREVENTION MARKET, BY DEPLOYMENT MODE, 2025-2030 (USD MILLION)

- TABLE 231 FRANCE: FRAUD DETECTION AND PREVENTION MARKET, BY ORGANIZATION SIZE, 2019-2024 (USD MILLION)

- TABLE 232 FRANCE: FRAUD DETECTION AND PREVENTION MARKET, BY ORGANIZATION SIZE, 2025-2030 (USD MILLION)

- TABLE 233 FRANCE: FRAUD DETECTION AND PREVENTION MARKET, BY VERTICAL, 2019-2024 (USD MILLION)

- TABLE 234 FRANCE: FRAUD DETECTION AND PREVENTION MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 235 FRANCE: FRAUD DETECTION AND PREVENTION MARKET, BY FRAUD TYPE, 2019-2024 (USD MILLION)

- TABLE 236 FRANCE: FRAUD DETECTION AND PREVENTION MARKET, BY FRAUD TYPE, 2025-2030 (USD MILLION)

- TABLE 237 FRANCE: FRAUD DETECTION AND PREVENTION MARKET, BY FUNCTIONALITY, 2019-2024 (USD MILLION)

- TABLE 238 FRANCE: FRAUD DETECTION AND PREVENTION MARKET, BY FUNCTIONALITY, 2025-2030 (USD MILLION)

- TABLE 239 FRANCE: FRAUD DETECTION AND PREVENTION MARKET, BY BFSI, 2019-2024 (USD MILLION)

- TABLE 240 FRANCE: FRAUD DETECTION AND PREVENTION MARKET, BY BFSI TYPE, 2025-2030 (USD MILLION)

- TABLE 241 SPAIN: FRAUD DETECTION AND PREVENTION MARKET, BY OFFERING, 2019-2024 (USD MILLION)

- TABLE 242 SPAIN: FRAUD DETECTION AND PREVENTION MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 243 SPAIN: FRAUD DETECTION AND PREVENTION MARKET, BY SOLUTION, 2019-2024 (USD MILLION)

- TABLE 244 SPAIN: FRAUD DETECTION AND PREVENTION MARKET, BY SOLUTION, 2025-2030 (USD MILLION)

- TABLE 245 SPAIN: FRAUD DETECTION AND PREVENTION MARKET, BY SERVICE, 2019-2024 (USD MILLION)

- TABLE 246 SPAIN: FRAUD DETECTION AND PREVENTION MARKET, BY SERVICE, 2025-2030 (USD MILLION)

- TABLE 247 SPAIN: FRAUD DETECTION AND PREVENTION MARKET, BY DEPLOYMENT MODE, 2019-2024 (USD MILLION)

- TABLE 248 SPAIN: FRAUD DETECTION AND PREVENTION MARKET, BY DEPLOYMENT MODE, 2025-2030 (USD MILLION)

- TABLE 249 SPAIN: FRAUD DETECTION AND PREVENTION MARKET, BY ORGANIZATION SIZE, 2019-2024 (USD MILLION)

- TABLE 250 SPAIN: FRAUD DETECTION AND PREVENTION MARKET, BY ORGANIZATION SIZE, 2025-2030 (USD MILLION)

- TABLE 251 SPAIN: FRAUD DETECTION AND PREVENTION MARKET, BY VERTICAL, 2019-2024 (USD MILLION)

- TABLE 252 SPAIN: FRAUD DETECTION AND PREVENTION MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 253 SPAIN: FRAUD DETECTION AND PREVENTION MARKET, BY FRAUD TYPE, 2019-2024 (USD MILLION)

- TABLE 254 SPAIN: FRAUD DETECTION AND PREVENTION MARKET, BY FRAUD TYPE, 2025-2030 (USD MILLION)

- TABLE 255 SPAIN: FRAUD DETECTION AND PREVENTION MARKET, BY FUNCTIONALITY, 2019-2024 (USD MILLION)

- TABLE 256 SPAIN: FRAUD DETECTION AND PREVENTION MARKET, BY FUNCTIONALITY, 2025-2030 (USD MILLION)

- TABLE 257 SPAIN: FRAUD DETECTION AND PREVENTION MARKET, BY BFSI TYPE, 2019-2024 (USD MILLION)

- TABLE 258 SPAIN: FRAUD DETECTION AND PREVENTION MARKET, BY BFSI TYPE, 2025-2030 (USD MILLION)

- TABLE 259 ITALY: FRAUD DETECTION AND PREVENTION MARKET, BY OFFERING, 2019-2024 (USD MILLION)

- TABLE 260 ITALY: FRAUD DETECTION AND PREVENTION MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 261 ITALY: FRAUD DETECTION AND PREVENTION MARKET, BY SOLUTION, 2019-2024 (USD MILLION)

- TABLE 262 ITALY: FRAUD DETECTION AND PREVENTION MARKET, BY SOLUTION, 2025-2030 (USD MILLION)

- TABLE 263 ITALY: FRAUD DETECTION AND PREVENTION MARKET, BY SERVICE, 2019-2024 (USD MILLION)

- TABLE 264 ITALY: FRAUD DETECTION AND PREVENTION MARKET, BY SERVICE, 2025-2030 (USD MILLION)

- TABLE 265 ITALY: FRAUD DETECTION AND PREVENTION MARKET, BY DEPLOYMENT MODE, 2019-2024 (USD MILLION)

- TABLE 266 ITALY: FRAUD DETECTION AND PREVENTION MARKET, BY DEPLOYMENT MODE, 2025-2030 (USD MILLION)

- TABLE 267 ITALY: FRAUD DETECTION AND PREVENTION MARKET, BY ORGANIZATION SIZE, 2019-2024 (USD MILLION)

- TABLE 268 ITALY: FRAUD DETECTION AND PREVENTION MARKET, BY ORGANIZATION SIZE, 2025-2030 (USD MILLION)

- TABLE 269 ITALY: FRAUD DETECTION AND PREVENTION MARKET, BY VERTICAL, 2019-2024 (USD MILLION)

- TABLE 270 ITALY: FRAUD DETECTION AND PREVENTION MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 271 ITALY: FRAUD DETECTION AND PREVENTION MARKET, BY FRAUD TYPE, 2019-2024 (USD MILLION)

- TABLE 272 ITALY: FRAUD DETECTION AND PREVENTION MARKET, BY FRAUD TYPE, 2025-2030 (USD MILLION)

- TABLE 273 ITALY: FRAUD DETECTION AND PREVENTION MARKET, BY FUNCTIONALITY, 2019-2024 (USD MILLION)

- TABLE 274 ITALY: FRAUD DETECTION AND PREVENTION MARKET, BY FUNCTIONALITY, 2025-2030 (USD MILLION)

- TABLE 275 ITALY: FRAUD DETECTION AND PREVENTION MARKET, BY BFSI TYPE, 2019-2024 (USD MILLION)

- TABLE 276 ITALY: FRAUD DETECTION AND PREVENTION MARKET, BY BFSI TYPE, 2025-2030 (USD MILLION)

- TABLE 277 POLAND: FRAUD DETECTION AND PREVENTION MARKET, BY OFFERING, 2019-2024 (USD MILLION)

- TABLE 278 POLAND: FRAUD DETECTION AND PREVENTION MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 279 POLAND: FRAUD DETECTION AND PREVENTION MARKET, BY SOLUTION, 2019-2024 (USD MILLION)

- TABLE 280 POLAND: FRAUD DETECTION AND PREVENTION MARKET, BY SOLUTION, 2025-2030 (USD MILLION)

- TABLE 281 POLAND: FRAUD DETECTION AND PREVENTION MARKET, BY SERVICE, 2019-2024 (USD MILLION)

- TABLE 282 POLAND: FRAUD DETECTION AND PREVENTION MARKET, BY SERVICE, 2025-2030 (USD MILLION)

- TABLE 283 POLAND: FRAUD DETECTION AND PREVENTION MARKET, BY DEPLOYMENT MODE, 2019-2024 (USD MILLION)

- TABLE 284 POLAND: FRAUD DETECTION AND PREVENTION MARKET, BY DEPLOYMENT MODE, 2025-2030 (USD MILLION)

- TABLE 285 POLAND: FRAUD DETECTION AND PREVENTION MARKET, BY ORGANIZATION SIZE, 2019-2024 (USD MILLION)

- TABLE 286 POLAND: FRAUD DETECTION AND PREVENTION MARKET, BY ORGANIZATION SIZE, 2025-2030 (USD MILLION)

- TABLE 287 POLAND: FRAUD DETECTION AND PREVENTION MARKET, BY VERTICAL, 2019-2024 (USD MILLION)

- TABLE 288 POLAND: FRAUD DETECTION AND PREVENTION MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 289 POLAND: FRAUD DETECTION AND PREVENTION MARKET, BY FRAUD TYPE, 2019-2024 (USD MILLION)

- TABLE 290 POLAND: FRAUD DETECTION AND PREVENTION MARKET, BY FRAUD TYPE, 2025-2030 (USD MILLION)

- TABLE 291 POLAND: FRAUD DETECTION AND PREVENTION MARKET, BY FUNCTIONALITY, 2019-2024 (USD MILLION)

- TABLE 292 POLAND: FRAUD DETECTION AND PREVENTION MARKET, BY FUNCTIONALITY, 2025-2030 (USD MILLION)

- TABLE 293 POLAND: FRAUD DETECTION AND PREVENTION MARKET, BY BFSI TYPE, 2019-2024 (USD MILLION)

- TABLE 294 POLAND: FRAUD DETECTION AND PREVENTION MARKET, BY BFSI TYPE, 2025-2030 (USD MILLION)

- TABLE 295 IRELAND: FRAUD DETECTION AND PREVENTION MARKET, BY OFFERING, 2019-2024 (USD MILLION)

- TABLE 296 IRELAND: FRAUD DETECTION AND PREVENTION MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 297 IRELAND: FRAUD DETECTION AND PREVENTION MARKET, BY SOLUTION, 2019-2024 (USD MILLION)

- TABLE 298 IRELAND: FRAUD DETECTION AND PREVENTION MARKET, BY SOLUTION, 2025-2030 (USD MILLION)

- TABLE 299 IRELAND: FRAUD DETECTION AND PREVENTION MARKET, BY SERVICE, 2019-2024 (USD MILLION)

- TABLE 300 IRELAND: FRAUD DETECTION AND PREVENTION MARKET, BY SERVICE, 2025-2030 (USD MILLION)

- TABLE 301 IRELAND: FRAUD DETECTION AND PREVENTION MARKET, BY DEPLOYMENT MODE, 2019-2024 (USD MILLION)

- TABLE 302 IRELAND: FRAUD DETECTION AND PREVENTION MARKET, BY DEPLOYMENT MODE, 2025-2030 (USD MILLION)

- TABLE 303 IRELAND: FRAUD DETECTION AND PREVENTION MARKET, BY ORGANIZATION SIZE, 2019-2024 (USD MILLION)

- TABLE 304 IRELAND: FRAUD DETECTION AND PREVENTION MARKET, BY ORGANIZATION SIZE, 2025-2030 (USD MILLION)

- TABLE 305 IRELAND: FRAUD DETECTION AND PREVENTION MARKET, BY VERTICAL, 2019-2024 (USD MILLION)

- TABLE 306 IRELAND: FRAUD DETECTION AND PREVENTION MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 307 IRELAND: FRAUD DETECTION AND PREVENTION MARKET, BY FRAUD TYPE, 2019-2024 (USD MILLION)

- TABLE 308 IRELAND: FRAUD DETECTION AND PREVENTION MARKET, BY FRAUD TYPE, 2025-2030 (USD MILLION)

- TABLE 309 IRELAND: FRAUD DETECTION AND PREVENTION MARKET, BY FUNCTIONALITY, 2019-2024 (USD MILLION)

- TABLE 310 IRELAND: FRAUD DETECTION AND PREVENTION MARKET, BY FUNCTIONALITY, 2025-2030 (USD MILLION)

- TABLE 311 IRELAND: FRAUD DETECTION AND PREVENTION MARKET, BY BFSI TYPE, 2019-2024 (USD MILLION)

- TABLE 312 IRELAND: FRAUD DETECTION AND PREVENTION MARKET, BY BFSI TYPE, 2025-2030 (USD MILLION)

- TABLE 313 CZECH REPUBLIC: FRAUD DETECTION AND PREVENTION MARKET, BY OFFERING, 2019-2024 (USD MILLION)

- TABLE 314 CZECH REPUBLIC: FRAUD DETECTION AND PREVENTION MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 315 CZECH REPUBLIC: FRAUD DETECTION AND PREVENTION MARKET, BY SOLUTION, 2019-2024 (USD MILLION)

- TABLE 316 CZECH REPUBLIC: FRAUD DETECTION AND PREVENTION MARKET, BY SOLUTION, 2025-2030 (USD MILLION)

- TABLE 317 CZECH REPUBLIC: FRAUD DETECTION AND PREVENTION MARKET, BY SERVICE, 2019-2024 (USD MILLION)

- TABLE 318 CZECH REPUBLIC: FRAUD DETECTION AND PREVENTION MARKET, BY SERVICE, 2025-2030 (USD MILLION)

- TABLE 319 CZECH REPUBLIC: FRAUD DETECTION AND PREVENTION MARKET, BY DEPLOYMENT MODE, 2019-2024 (USD MILLION)

- TABLE 320 CZECH REPUBLIC: FRAUD DETECTION AND PREVENTION MARKET, BY DEPLOYMENT MODE, 2025-2030 (USD MILLION)

- TABLE 321 CZECH REPUBLIC: FRAUD DETECTION AND PREVENTION MARKET, BY ORGANIZATION SIZE, 2019-2024 (USD MILLION)

- TABLE 322 CZECH REPUBLIC: FRAUD DETECTION AND PREVENTION MARKET, BY ORGANIZATION SIZE, 2025-2030 (USD MILLION)

- TABLE 323 CZECH REPUBLIC: FRAUD DETECTION AND PREVENTION MARKET, BY VERTICAL, 2019-2024 (USD MILLION)

- TABLE 324 CZECH REPUBLIC: FRAUD DETECTION AND PREVENTION MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 325 CZECH REPUBLIC: FRAUD DETECTION AND PREVENTION MARKET, BY FRAUD TYPE, 2019-2024 (USD MILLION)

- TABLE 326 CZECH REPUBLIC: FRAUD DETECTION AND PREVENTION MARKET, BY FRAUD TYPE, 2025-2030 (USD MILLION)

- TABLE 327 CZECH REPUBLIC: FRAUD DETECTION AND PREVENTION MARKET, BY FUNCTIONALITY, 2019-2024 (USD MILLION)

- TABLE 328 CZECH REPUBLIC: FRAUD DETECTION AND PREVENTION MARKET, BY FUNCTIONALITY, 2025-2030 (USD MILLION)

- TABLE 329 CZECH REPUBLIC: FRAUD DETECTION AND PREVENTION MARKET, BY BFSI TYPE, 2019-2024 (USD MILLION)

- TABLE 330 CZECH REPUBLIC: FRAUD DETECTION AND PREVENTION MARKET, BY BFSI TYPE, 2025-2030 (USD MILLION)

- TABLE 331 REST OF EUROPE: FRAUD DETECTION AND PREVENTION MARKET, BY OFFERING, 2019-2024 (USD MILLION)

- TABLE 332 REST OF EUROPE: FRAUD DETECTION AND PREVENTION MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 333 REST OF EUROPE: FRAUD DETECTION AND PREVENTION MARKET, BY SOLUTION, 2019-2024 (USD MILLION)

- TABLE 334 REST OF EUROPE: FRAUD DETECTION AND PREVENTION MARKET, BY SOLUTION, 2025-2030 (USD MILLION)

- TABLE 335 REST OF EUROPE: FRAUD DETECTION AND PREVENTION MARKET, BY SERVICE, 2019-2024 (USD MILLION)

- TABLE 336 REST OF EUROPE: FRAUD DETECTION AND PREVENTION MARKET, BY SERVICE, 2025-2030 (USD MILLION)

- TABLE 337 REST OF EUROPE: FRAUD DETECTION AND PREVENTION MARKET, BY DEPLOYMENT MODE, 2019-2024 (USD MILLION)

- TABLE 338 REST OF EUROPE: FRAUD DETECTION AND PREVENTION MARKET, BY DEPLOYMENT MODE, 2025-2030 (USD MILLION)

- TABLE 339 REST OF EUROPE: FRAUD DETECTION AND PREVENTION MARKET, BY ORGANIZATION SIZE, 2019-2024 (USD MILLION)

- TABLE 340 REST OF EUROPE: FRAUD DETECTION AND PREVENTION MARKET, BY ORGANIZATION SIZE, 2025-2030 (USD MILLION)

- TABLE 341 REST OF EUROPE: FRAUD DETECTION AND PREVENTION MARKET, BY VERTICAL, 2019-2024 (USD MILLION)

- TABLE 342 REST OF EUROPE: FRAUD DETECTION AND PREVENTION MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 343 REST OF EUROPE: FRAUD DETECTION AND PREVENTION MARKET, BY FRAUD TYPE, 2019-2024 (USD MILLION)

- TABLE 344 REST OF EUROPE: FRAUD DETECTION AND PREVENTION MARKET, BY FRAUD TYPE, 2025-2030 (USD MILLION)

- TABLE 345 REST OF EUROPE: FRAUD DETECTION AND PREVENTION MARKET, BY FUNCTIONALITY, 2019-2024 (USD MILLION)

- TABLE 346 REST OF EUROPE: FRAUD DETECTION AND PREVENTION MARKET, BY FUNCTIONALITY, 2025-2030 (USD MILLION)

- TABLE 347 REST OF EUROPE: FRAUD DETECTION AND PREVENTION MARKET, BY BFSI TYPE, 2019-2024 (USD MILLION)

- TABLE 348 REST OF EUROPE: FRAUD DETECTION AND PREVENTION MARKET, BY BFSI TYPE, 2025-2030 (USD MILLION)

- TABLE 349 ASIA PACIFIC: FRAUD DETECTION AND PREVENTION MARKET, BY OFFERING, 2019-2024 (USD MILLION)

- TABLE 350 ASIA PACIFIC: FRAUD DETECTION AND PREVENTION MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 351 ASIA PACIFIC: FRAUD DETECTION AND PREVENTION MARKET, BY SOLUTION, 2019-2024 (USD MILLION)

- TABLE 352 ASIA PACIFIC: FRAUD DETECTION AND PREVENTION MARKET, BY SOLUTION, 2025-2030 (USD MILLION)

- TABLE 353 ASIA PACIFIC: FRAUD DETECTION AND PREVENTION MARKET, BY SERVICE, 2019-2024 (USD MILLION)

- TABLE 354 ASIA PACIFIC: FRAUD DETECTION AND PREVENTION MARKET, BY SERVICE, 2025-2030 (USD MILLION)

- TABLE 355 ASIA PACIFIC: FRAUD DETECTION AND PREVENTION MARKET, BY DEPLOYMENT MODE, 2019-2024 (USD MILLION)

- TABLE 356 ASIA PACIFIC: FRAUD DETECTION AND PREVENTION MARKET, BY DEPLOYMENT MODE, 2025-2030 (USD MILLION)

- TABLE 357 ASIA PACIFIC: FRAUD DETECTION AND PREVENTION MARKET, BY ORGANIZATION SIZE, 2019-2024 (USD MILLION)

- TABLE 358 ASIA PACIFIC: FRAUD DETECTION AND PREVENTION MARKET, BY ORGANIZATION SIZE, 2025-2030 (USD MILLION)

- TABLE 359 ASIA PACIFIC: FRAUD DETECTION AND PREVENTION MARKET, BY VERTICAL, 2019-2024 (USD MILLION)

- TABLE 360 ASIA PACIFIC: FRAUD DETECTION AND PREVENTION MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 361 ASIA PACIFIC: FRAUD DETECTION AND PREVENTION MARKET, BY FRAUD TYPE, 2019-2024 (USD MILLION)

- TABLE 362 ASIA PACIFIC: FRAUD DETECTION AND PREVENTION MARKET, BY FRAUD TYPE, 2025-2030 (USD MILLION)

- TABLE 363 ASIA PACIFIC: FRAUD DETECTION AND PREVENTION MARKET, BY FUNCTIONALITY, 2019-2024 (USD MILLION)

- TABLE 364 ASIA PACIFIC: FRAUD DETECTION AND PREVENTION MARKET, FUNCTIONALITY, 2025-2030 (USD MILLION)

- TABLE 365 ASIA PACIFIC: FRAUD DETECTION AND PREVENTION MARKET, BY BFSI TYPE, 2019-2024 (USD MILLION)

- TABLE 366 ASIA PACIFIC: FRAUD DETECTION AND PREVENTION MARKET, BY BFSI TYPE, 2025-2030 (USD MILLION)

- TABLE 367 ASIA PACIFIC: FRAUD DETECTION AND PREVENTION MARKET, BY COUNTRY, 2019-2024 (USD MILLION)

- TABLE 368 ASIA PACIFIC: FRAUD DETECTION AND PREVENTION MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 369 CHINA: FRAUD DETECTION AND PREVENTION MARKET, BY OFFERING, 2019-2024 (USD MILLION)

- TABLE 370 CHINA: FRAUD DETECTION AND PREVENTION MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 371 CHINA: FRAUD DETECTION AND PREVENTION MARKET, BY SOLUTION, 2019-2024 (USD MILLION)

- TABLE 372 CHINA: FRAUD DETECTION AND PREVENTION MARKET, BY SOLUTION, 2025-2030 (USD MILLION)

- TABLE 373 CHINA: FRAUD DETECTION AND PREVENTION MARKET, BY SERVICE, 2019-2024 (USD MILLION)

- TABLE 374 CHINA: FRAUD DETECTION AND PREVENTION MARKET, BY SERVICE, 2025-2030 (USD MILLION)

- TABLE 375 CHINA: FRAUD DETECTION AND PREVENTION MARKET, BY DEPLOYMENT MODE, 2019-2024 (USD MILLION)

- TABLE 376 CHINA: FRAUD DETECTION AND PREVENTION MARKET, BY DEPLOYMENT MODE, 2025-2030 (USD MILLION)

- TABLE 377 CHINA: FRAUD DETECTION AND PREVENTION MARKET, BY ORGANIZATION SIZE, 2019-2024 (USD MILLION)

- TABLE 378 CHINA: FRAUD DETECTION AND PREVENTION MARKET, BY ORGANIZATION SIZE, 2025-2030 (USD MILLION)

- TABLE 379 CHINA: FRAUD DETECTION AND PREVENTION MARKET, BY VERTICAL, 2019-2024 (USD MILLION)

- TABLE 380 CHINA: FRAUD DETECTION AND PREVENTION MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 381 CHINA: FRAUD DETECTION AND PREVENTION MARKET, BY FRAUD TYPE, 2019-2024 (USD MILLION)

- TABLE 382 CHINA: FRAUD DETECTION AND PREVENTION MARKET, BY FRAUD TYPE, 2025-2030 (USD MILLION)

- TABLE 383 CHINA: FRAUD DETECTION AND PREVENTION MARKET, BY FUNCTIONALITY, 2019-2024 (USD MILLION)

- TABLE 384 CHINA: FRAUD DETECTION AND PREVENTION MARKET, BY FUNCTIONALITY, 2025-2030 (USD MILLION)

- TABLE 385 CHINA: FRAUD DETECTION AND PREVENTION MARKET, BY BFSI TYPE, 2019-2024 (USD MILLION)

- TABLE 386 CHINA: FRAUD DETECTION AND PREVENTION MARKET, BY BFSI TYPE, 2025-2030 (USD MILLION)

- TABLE 387 JAPAN: FRAUD DETECTION AND PREVENTION MARKET, BY OFFERING, 2019-2024 (USD MILLION)

- TABLE 388 JAPAN: FRAUD DETECTION AND PREVENTION MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 389 JAPAN: FRAUD DETECTION AND PREVENTION MARKET, BY SOLUTION, 2019-2024 (USD MILLION)

- TABLE 390 JAPAN: FRAUD DETECTION AND PREVENTION MARKET, BY SOLUTION, 2025-2030 (USD MILLION)

- TABLE 391 JAPAN: FRAUD DETECTION AND PREVENTION MARKET, BY SERVICE, 2019-2024 (USD MILLION)

- TABLE 392 JAPAN: FRAUD DETECTION AND PREVENTION MARKET, BY SERVICE, 2025-2030 (USD MILLION)

- TABLE 393 JAPAN: FRAUD DETECTION AND PREVENTION MARKET, BY DEPLOYMENT MODE, 2019-2024 (USD MILLION)

- TABLE 394 JAPAN: FRAUD DETECTION AND PREVENTION MARKET, BY DEPLOYMENT MODE, 2025-2030 (USD MILLION)

- TABLE 395 JAPAN: FRAUD DETECTION AND PREVENTION MARKET, BY ORGANIZATION SIZE, 2019-2024 (USD MILLION)

- TABLE 396 JAPAN: FRAUD DETECTION AND PREVENTION MARKET, BY ORGANIZATION SIZE, 2025-2030 (USD MILLION)

- TABLE 397 JAPAN: FRAUD DETECTION AND PREVENTION MARKET, BY VERTICAL, 2019-2024 (USD MILLION)

- TABLE 398 JAPAN: FRAUD DETECTION AND PREVENTION MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 399 JAPAN: FRAUD DETECTION AND PREVENTION MARKET, BY FRAUD TYPE, 2019-2024 (USD MILLION)

- TABLE 400 JAPAN: FRAUD DETECTION AND PREVENTION MARKET, BY FRAUD TYPE, 2025-2030 (USD MILLION)

- TABLE 401 JAPAN: FRAUD DETECTION AND PREVENTION MARKET, BY FUNCTIONALITY, 2019-2024 (USD MILLION)

- TABLE 402 JAPAN: FRAUD DETECTION AND PREVENTION MARKET, BY FUNCTIONALITY, 2025-2030 (USD MILLION)

- TABLE 403 JAPAN: FRAUD DETECTION AND PREVENTION MARKET, BY BFSI TYPE, 2019-2024 (USD MILLION)

- TABLE 404 JAPAN: FRAUD DETECTION AND PREVENTION MARKET, BY BFSI TYPE, 2025-2030 (USD MILLION)

- TABLE 405 AUSTRALIA AND NEW ZEALAND: FRAUD DETECTION AND PREVENTION MARKET, BY OFFERING, 2019-2024 (USD MILLION)

- TABLE 406 AUSTRALIA AND NEW ZEALAND: FRAUD DETECTION AND PREVENTION MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 407 AUSTRALIA AND NEW ZEALAND: FRAUD DETECTION AND PREVENTION MARKET, BY SOLUTION, 2019-2024 (USD MILLION)

- TABLE 408 AUSTRALIA AND NEW ZEALAND: FRAUD DETECTION AND PREVENTION MARKET, BY SOLUTION, 2025-2030 (USD MILLION)

- TABLE 409 AUSTRALIA AND NEW ZEALAND: FRAUD DETECTION AND PREVENTION MARKET, BY SERVICE, 2019-2024 (USD MILLION)

- TABLE 410 AUSTRALIA AND NEW ZEALAND: FRAUD DETECTION AND PREVENTION MARKET, BY SERVICE, 2025-2030 (USD MILLION)

- TABLE 411 AUSTRALIA AND NEW ZEALAND: FRAUD DETECTION AND PREVENTION MARKET, BY DEPLOYMENT MODE, 2019-2024 (USD MILLION)

- TABLE 412 AUSTRALIA AND NEW ZEALAND: FRAUD DETECTION AND PREVENTION MARKET, BY DEPLOYMENT MODE, 2025-2030 (USD MILLION)

- TABLE 413 AUSTRALIA AND NEW ZEALAND: FRAUD DETECTION AND PREVENTION MARKET, BY ORGANIZATION SIZE, 2019-2024 (USD MILLION)

- TABLE 414 AUSTRALIA AND NEW ZEALAND: FRAUD DETECTION AND PREVENTION MARKET, BY ORGANIZATION SIZE, 2025-2030 (USD MILLION)

- TABLE 415 AUSTRALIA AND NEW ZEALAND: FRAUD DETECTION AND PREVENTION MARKET, BY VERTICAL, 2019-2024 (USD MILLION)

- TABLE 416 AUSTRALIA AND NEW ZEALAND: FRAUD DETECTION AND PREVENTION MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 417 AUSTRALIA AND NEW ZEALAND: FRAUD DETECTION AND PREVENTION MARKET, BY FRAUD TYPE, 2019-2024 (USD MILLION)

- TABLE 418 AUSTRALIA AND NEW ZEALAND: FRAUD DETECTION AND PREVENTION MARKET, BY FRAUD TYPE, 2025-2030 (USD MILLION)

- TABLE 419 AUSTRALIA AND NEW ZEALAND: FRAUD DETECTION AND PREVENTION MARKET, BY FUNCTIONALITY, 2019-2024 (USD MILLION)

- TABLE 420 AUSTRALIA AND NEW ZEALAND: FRAUD DETECTION AND PREVENTION MARKET, BY FUNCTIONALITY, 2025-2030 (USD MILLION)

- TABLE 421 AUSTRALIA AND NEW ZEALAND: FRAUD DETECTION AND PREVENTION MARKET, BY BFSI TYPE, 2019-2024 (USD MILLION)

- TABLE 422 AUSTRALIA AND NEW ZEALAND: FRAUD DETECTION AND PREVENTION MARKET, BY BFSI TYPE, 2025-2030 (USD MILLION)

- TABLE 423 INDIA: FRAUD DETECTION AND PREVENTION MARKET, BY OFFERING, 2019-2024 (USD MILLION)

- TABLE 424 INDIA: FRAUD DETECTION AND PREVENTION MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 425 INDIA: FRAUD DETECTION AND PREVENTION MARKET, BY SOLUTION, 2019-2024 (USD MILLION)

- TABLE 426 INDIA: FRAUD DETECTION AND PREVENTION MARKET, BY SOLUTION, 2025-2030 (USD MILLION)

- TABLE 427 INDIA: FRAUD DETECTION AND PREVENTION MARKET, BY SERVICE, 2019-2024 (USD MILLION)

- TABLE 428 INDIA: FRAUD DETECTION AND PREVENTION MARKET, BY SERVICE, 2025-2030 (USD MILLION)

- TABLE 429 INDIA: FRAUD DETECTION AND PREVENTION MARKET, BY DEPLOYMENT MODE, 2019-2024 (USD MILLION)

- TABLE 430 INDIA: FRAUD DETECTION AND PREVENTION MARKET, BY DEPLOYMENT MODE, 2025-2030 (USD MILLION)

- TABLE 431 INDIA: FRAUD DETECTION AND PREVENTION MARKET, BY ORGANIZATION SIZE, 2019-2024 (USD MILLION)

- TABLE 432 INDIA: FRAUD DETECTION AND PREVENTION MARKET, BY ORGANIZATION SIZE, 2025-2030 (USD MILLION)

- TABLE 433 INDIA: FRAUD DETECTION AND PREVENTION MARKET, BY VERTICAL, 2019-2024 (USD MILLION)

- TABLE 434 INDIA: FRAUD DETECTION AND PREVENTION MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 435 INDIA: FRAUD DETECTION AND PREVENTION MARKET, BY FRAUD TYPE, 2019-2024 (USD MILLION)

- TABLE 436 INDIA: FRAUD DETECTION AND PREVENTION MARKET, BY FRAUD TYPE, 2025-2030 (USD MILLION)

- TABLE 437 INDIA: FRAUD DETECTION AND PREVENTION MARKET, BY FUNCTIONALITY, 2019-2024 (USD MILLION)

- TABLE 438 INDIA: FRAUD DETECTION AND PREVENTION MARKET, BY FUNCTIONALITY, 2025-2030 (USD MILLION)

- TABLE 439 INDIA: FRAUD DETECTION AND PREVENTION MARKET, BY BFSI TYPE, 2019-2024 (USD MILLION)

- TABLE 440 INDIA: FRAUD DETECTION AND PREVENTION MARKET, BY BFSI TYPE, 2025-2030 (USD MILLION)

- TABLE 441 SINGAPORE: FRAUD DETECTION AND PREVENTION MARKET, BY OFFERING, 2019-2024 (USD MILLION)

- TABLE 442 SINGAPORE: FRAUD DETECTION AND PREVENTION MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 443 SINGAPORE: FRAUD DETECTION AND PREVENTION MARKET, BY SOLUTION, 2019-2024 (USD MILLION)

- TABLE 444 SINGAPORE: FRAUD DETECTION AND PREVENTION MARKET, BY SOLUTION, 2025-2030 (USD MILLION)

- TABLE 445 SINGAPORE: FRAUD DETECTION AND PREVENTION MARKET, BY SERVICE, 2019-2024 (USD MILLION)

- TABLE 446 SINGAPORE: FRAUD DETECTION AND PREVENTION MARKET, BY SERVICE, 2025-2030 (USD MILLION)

- TABLE 447 SINGAPORE: FRAUD DETECTION AND PREVENTION MARKET, BY DEPLOYMENT MODE, 2019-2024 (USD MILLION)

- TABLE 448 SINGAPORE: FRAUD DETECTION AND PREVENTION MARKET, BY DEPLOYMENT MODE, 2025-2030 (USD MILLION)

- TABLE 449 SINGAPORE: FRAUD DETECTION AND PREVENTION MARKET, BY ORGANIZATION SIZE, 2019-2024 (USD MILLION)

- TABLE 450 SINGAPORE: FRAUD DETECTION AND PREVENTION MARKET, BY ORGANIZATION SIZE, 2025-2030 (USD MILLION)

- TABLE 451 SINGAPORE: FRAUD DETECTION AND PREVENTION MARKET, BY VERTICAL, 2019-2024 (USD MILLION)

- TABLE 452 SINGAPORE: FRAUD DETECTION AND PREVENTION MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 453 SINGAPORE: FRAUD DETECTION AND PREVENTION MARKET, BY FRAUD TYPE, 2019-2024 (USD MILLION)

- TABLE 454 SINGAPORE: FRAUD DETECTION AND PREVENTION MARKET, BY FRAUD TYPE, 2025-2030 (USD MILLION)

- TABLE 455 SINGAPORE: FRAUD DETECTION AND PREVENTION MARKET, BY FUNCTIONALITY, 2019-2024 (USD MILLION)

- TABLE 456 SINGAPORE: FRAUD DETECTION AND PREVENTION MARKET, BY FUNCTIONALITY, 2025-2030 (USD MILLION)

- TABLE 457 SINGAPORE: FRAUD DETECTION AND PREVENTION MARKET, BY BFSI TYPE, 2019-2024 (USD MILLION)

- TABLE 458 SINGAPORE: FRAUD DETECTION AND PREVENTION MARKET, BY BFSI TYPE, 2025-2030 (USD MILLION)

- TABLE 459 REST OF ASIA PACIFIC: FRAUD DETECTION AND PREVENTION MARKET, BY OFFERING, 2019-2024 (USD MILLION)

- TABLE 460 REST OF ASIA PACIFIC: FRAUD DETECTION AND PREVENTION MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 461 REST OF ASIA PACIFIC: FRAUD DETECTION AND PREVENTION MARKET, BY SOLUTION, 2019-2024 (USD MILLION)

- TABLE 462 REST OF ASIA PACIFIC: FRAUD DETECTION AND PREVENTION MARKET, BY SOLUTION, 2025-2030 (USD MILLION)

- TABLE 463 REST OF ASIA PACIFIC: FRAUD DETECTION AND PREVENTION MARKET, BY SERVICE, 2019-2024 (USD MILLION)

- TABLE 464 REST OF ASIA PACIFIC: FRAUD DETECTION AND PREVENTION MARKET, BY SERVICE, 2025-2030 (USD MILLION)

- TABLE 465 REST OF ASIA PACIFIC: FRAUD DETECTION AND PREVENTION MARKET, BY DEPLOYMENT MODE, 2019-2024 (USD MILLION)

- TABLE 466 REST OF ASIA PACIFIC: FRAUD DETECTION AND PREVENTION MARKET, BY DEPLOYMENT MODE, 2025-2030 (USD MILLION)

- TABLE 467 REST OF ASIA PACIFIC: FRAUD DETECTION AND PREVENTION MARKET, BY ORGANIZATION SIZE, 2019-2024 (USD MILLION)

- TABLE 468 REST OF ASIA PACIFIC: FRAUD DETECTION AND PREVENTION MARKET, BY ORGANIZATION SIZE, 2025-2030 (USD MILLION)

- TABLE 469 REST OF ASIA PACIFIC: FRAUD DETECTION AND PREVENTION MARKET, BY VERTICAL, 2019-2024 (USD MILLION)

- TABLE 470 REST OF ASIA PACIFIC: FRAUD DETECTION AND PREVENTION MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 471 REST OF ASIA PACIFIC: FRAUD DETECTION AND PREVENTION MARKET, BY FRAUD TYPE, 2019-2024 (USD MILLION)

- TABLE 472 REST OF ASIA PACIFIC: FRAUD DETECTION AND PREVENTION MARKET, BY FRAUD TYPE, 2025-2030 (USD MILLION)

- TABLE 473 REST OF ASIA PACIFIC: FRAUD DETECTION AND PREVENTION MARKET, BY FUNCTIONALITY, 2019-2024 (USD MILLION)

- TABLE 474 REST OF ASIA PACIFIC: FRAUD DETECTION AND PREVENTION MARKET, BY FUNCTIONALITY, 2025-2030 (USD MILLION)

- TABLE 475 REST OF ASIA PACIFIC: FRAUD DETECTION AND PREVENTION MARKET, BY BFSI, 2019-2024 (USD MILLION)

- TABLE 476 REST OF ASIA PACIFIC: FRAUD DETECTION AND PREVENTION MARKET, BY BFSI, 2025-2030 (USD MILLION)

- TABLE 477 MIDDLE EAST & AFRICA: REGULATORY LANDSCAPE

- TABLE 478 MIDDLE EAST & AFRICA: FRAUD DETECTION AND PREVENTION MARKET, BY OFFERING, 2019-2024 (USD MILLION)

- TABLE 479 MIDDLE EAST & AFRICA: FRAUD DETECTION AND PREVENTION MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 480 MIDDLE EAST & AFRICA: FRAUD DETECTION AND PREVENTION MARKET, BY SOLUTION, 2019-2024 (USD MILLION)

- TABLE 481 MIDDLE EAST & AFRICA: FRAUD DETECTION AND PREVENTION MARKET, BY SOLUTION, 2025-2030 (USD MILLION)

- TABLE 482 MIDDLE EAST & AFRICA: FRAUD DETECTION AND PREVENTION MARKET, BY SERVICE, 2019-2024 (USD MILLION)

- TABLE 483 MIDDLE EAST & AFRICA: FRAUD DETECTION AND PREVENTION MARKET, BY SERVICE, 2025-2030 (USD MILLION)

- TABLE 484 MIDDLE EAST & AFRICA: FRAUD DETECTION AND PREVENTION MARKET, BY DEPLOYMENT MODE, 2019-2024 (USD MILLION)

- TABLE 485 MIDDLE EAST & AFRICA: FRAUD DETECTION AND PREVENTION MARKET, BY DEPLOYMENT MODE, 2025-2030 (USD MILLION)

- TABLE 486 MIDDLE EAST & AFRICA: FRAUD DETECTION AND PREVENTION MARKET, BY ORGANIZATION SIZE, 2019-2024 (USD MILLION)

- TABLE 487 MIDDLE EAST & AFRICA: FRAUD DETECTION AND PREVENTION MARKET, BY ORGANIZATION SIZE, 2025-2030 (USD MILLION)

- TABLE 488 MIDDLE EAST & AFRICA: FRAUD DETECTION AND PREVENTION MARKET, BY VERTICAL, 2019-2024 (USD MILLION)

- TABLE 489 MIDDLE EAST & AFRICA: FRAUD DETECTION AND PREVENTION MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 490 MIDDLE EAST & AFRICA: FRAUD DETECTION AND PREVENTION MARKET, BY FRAUD TYPE, 2019-2024 (USD MILLION)

- TABLE 491 MIDDLE EAST & AFRICA: FRAUD DETECTION AND PREVENTION MARKET, BY FRAUD TYPE, 2025-2030 (USD MILLION)

- TABLE 492 MIDDLE EAST & AFRICA: FRAUD DETECTION AND PREVENTION MARKET, BY FUNCTIONALITY, 2019-2024 (USD MILLION)

- TABLE 493 MIDDLE EAST & AFRICA: FRAUD DETECTION AND PREVENTION MARKET, BY FUNCTIONALITY, 2025-2030 (USD MILLION)

- TABLE 494 MIDDLE EAST & AFRICA: FRAUD DETECTION AND PREVENTION MARKET, BY BFSI TYPE, 2019-2024 (USD MILLION)

- TABLE 495 MIDDLE EAST & AFRICA: FRAUD DETECTION AND PREVENTION MARKET, BY BFSI TYPE, 2025-2030 (USD MILLION)

- TABLE 496 MIDDLE EAST & AFRICA: FRAUD DETECTION AND PREVENTION MARKET, BY COUNTRY, 2019-2024 (USD MILLION)

- TABLE 497 MIDDLE EAST & AFRICA: FRAUD DETECTION AND PREVENTION MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 498 UAE: FRAUD DETECTION AND PREVENTION MARKET, BY OFFERING, 2019-2024 (USD MILLION)

- TABLE 499 UAE: FRAUD DETECTION AND PREVENTION MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 500 UAE: FRAUD DETECTION AND PREVENTION MARKET, BY SOLUTION, 2019-2024 (USD MILLION)

- TABLE 501 UAE: FRAUD DETECTION AND PREVENTION MARKET, BY SOLUTION, 2025-2030 (USD MILLION)

- TABLE 502 UAE: FRAUD DETECTION AND PREVENTION MARKET, BY SERVICE, 2019-2024 (USD MILLION)

- TABLE 503 UAE: FRAUD DETECTION AND PREVENTION MARKET, BY SERVICE, 2025-2030 (USD MILLION)

- TABLE 504 UAE: FRAUD DETECTION AND PREVENTION MARKET, BY DEPLOYMENT MODE, 2019-2024 (USD MILLION)

- TABLE 505 UAE: FRAUD DETECTION AND PREVENTION MARKET, BY DEPLOYMENT MODE, 2025-2030 (USD MILLION)

- TABLE 506 UAE: FRAUD DETECTION AND PREVENTION MARKET, BY ORGANIZATION SIZE, 2019-2024 (USD MILLION)

- TABLE 507 UAE: FRAUD DETECTION AND PREVENTION MARKET, BY ORGANIZATION SIZE, 2025-2030 (USD MILLION)

- TABLE 508 UAE: FRAUD DETECTION AND PREVENTION MARKET, BY VERTICAL, 2019-2024 (USD MILLION)

- TABLE 509 UAE: FRAUD DETECTION AND PREVENTION MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 510 UAE: FRAUD DETECTION AND PREVENTION MARKET, BY FRAUD TYPE, 2019-2024 (USD MILLION)

- TABLE 511 UAE: FRAUD DETECTION AND PREVENTION MARKET, BY FRAUD TYPE, 2025-2030 (USD MILLION)

- TABLE 512 UAE: FRAUD DETECTION AND PREVENTION MARKET, BY FUNCTIONALITY, 2019-2024 (USD MILLION)

- TABLE 513 UAE: FRAUD DETECTION AND PREVENTION MARKET, BY FUNCTIONALITY, 2025-2030 (USD MILLION)

- TABLE 514 UAE: FRAUD DETECTION AND PREVENTION MARKET, BY BFSI TYPE, 2019-2024 (USD MILLION)

- TABLE 515 UAE: FRAUD DETECTION AND PREVENTION MARKET, BY BFSI TYPE, 2025-2030 (USD MILLION)

- TABLE 516 SAUDI ARABIA: FRAUD DETECTION AND PREVENTION MARKET, BY OFFERING, 2019-2024 (USD MILLION)

- TABLE 517 SAUDI ARABIA: FRAUD DETECTION AND PREVENTION MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 518 SAUDI ARABIA: FRAUD DETECTION AND PREVENTION MARKET, BY SOLUTION, 2019-2024 (USD MILLION)

- TABLE 519 SAUDI ARABIA: FRAUD DETECTION AND PREVENTION MARKET, BY SOLUTION, 2025-2030 (USD MILLION)

- TABLE 520 SAUDI ARABIA: FRAUD DETECTION AND PREVENTION MARKET, BY SERVICE, 2019-2024 (USD MILLION)

- TABLE 521 SAUDI ARABIA: FRAUD DETECTION AND PREVENTION MARKET, BY SERVICE, 2025-2030 (USD MILLION)

- TABLE 522 SAUDI ARABIA: FRAUD DETECTION AND PREVENTION MARKET, BY DEPLOYMENT MODE, 2019-2024 (USD MILLION)

- TABLE 523 SAUDI ARABIA: FRAUD DETECTION AND PREVENTION MARKET, BY DEPLOYMENT MODE, 2025-2030 (USD MILLION)

- TABLE 524 SAUDI ARABIA: FRAUD DETECTION AND PREVENTION MARKET, BY ORGANIZATION SIZE, 2019-2024 (USD MILLION)

- TABLE 525 SAUDI ARABIA: FRAUD DETECTION AND PREVENTION MARKET, BY ORGANIZATION SIZE, 2025-2030 (USD MILLION)

- TABLE 526 SAUDI ARABIA: FRAUD DETECTION AND PREVENTION MARKET, BY VERTICAL, 2019-2024 (USD MILLION)

- TABLE 527 SAUDI ARABIA: FRAUD DETECTION AND PREVENTION MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 528 SAUDI ARABIA: FRAUD DETECTION AND PREVENTION MARKET, BY FRAUD TYPE, 2019-2024 (USD MILLION)

- TABLE 529 SAUDI ARABIA: FRAUD DETECTION AND PREVENTION MARKET, BY FRAUD TYPE, 2025-2030 (USD MILLION)

- TABLE 530 SAUDI ARABIA: FRAUD DETECTION AND PREVENTION MARKET, BY FUNCTIONALITY, 2019-2024 (USD MILLION)

- TABLE 531 SAUDI ARABIA: FRAUD DETECTION AND PREVENTION MARKET, BY FUNCTIONALITY, 2025-2030 (USD MILLION)

- TABLE 532 SAUDI ARABIA: FRAUD DETECTION AND PREVENTION MARKET, BY BFSI TYPE, 2019-2024 (USD MILLION)

- TABLE 533 SAUDI ARABIA: FRAUD DETECTION AND PREVENTION MARKET, BY BFSI TYPE, 2025-2030 (USD MILLION)

- TABLE 534 REST OF GCC COUNTRIES: FRAUD DETECTION AND PREVENTION MARKET, BY OFFERING, 2019-2024 (USD MILLION)

- TABLE 535 REST OF GCC COUNTRIES: FRAUD DETECTION AND PREVENTION MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 536 REST OF GCC COUNTRIES: FRAUD DETECTION AND PREVENTION MARKET, BY SOLUTION, 2019-2024 (USD MILLION)

- TABLE 537 REST OF GCC COUNTRIES: FRAUD DETECTION AND PREVENTION MARKET, BY SOLUTION, 2025-2030 (USD MILLION)

- TABLE 538 REST OF GCC COUNTRIES: FRAUD DETECTION AND PREVENTION MARKET, BY SERVICE, 2019-2024 (USD MILLION)

- TABLE 539 REST OF GCC COUNTRIES: FRAUD DETECTION AND PREVENTION MARKET, BY SERVICE, 2025-2030 (USD MILLION)

- TABLE 540 REST OF GCC COUNTRIES: FRAUD DETECTION AND PREVENTION MARKET, BY DEPLOYMENT MODE, 2019-2024 (USD MILLION)

- TABLE 541 REST OF GCC COUNTRIES: FRAUD DETECTION AND PREVENTION MARKET, BY DEPLOYMENT MODE, 2025-2030 (USD MILLION)

- TABLE 542 REST OF GCC COUNTRIES: FRAUD DETECTION AND PREVENTION MARKET, BY ORGANIZATION SIZE, 2019-2024 (USD MILLION)

- TABLE 543 REST OF GCC COUNTRIES: FRAUD DETECTION AND PREVENTION MARKET, BY ORGANIZATION SIZE, 2025-2030 (USD MILLION)

- TABLE 544 REST OF GCC COUNTRIES: FRAUD DETECTION AND PREVENTION MARKET, BY VERTICAL, 2019-2024 (USD MILLION)

- TABLE 545 REST OF GCC COUNTRIES: FRAUD DETECTION AND PREVENTION MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 546 REST OF GCC COUNTRIES: FRAUD DETECTION AND PREVENTION MARKET, BY FRAUD TYPE, 2019-2024 (USD MILLION)

- TABLE 547 REST OF GCC COUNTRIES: FRAUD DETECTION AND PREVENTION MARKET, BY FRAUD TYPE, 2025-2030 (USD MILLION)

- TABLE 548 REST OF GCC COUNTRIES: FRAUD DETECTION AND PREVENTION MARKET, BY FUNCTIONALITY, 2019-2024 (USD MILLION)

- TABLE 549 REST OF GCC COUNTRIES: FRAUD DETECTION AND PREVENTION MARKET, BY FUNCTIONALITY, 2025-2030 (USD MILLION)

- TABLE 550 REST OF GCC COUNTRIES: FRAUD DETECTION AND PREVENTION MARKET, BY BFSI TYPE, 2019-2024 (USD MILLION)

- TABLE 551 REST OF GCC COUNTRIES: FRAUD DETECTION AND PREVENTION MARKET, BY BFSI TYPE, 2025-2030 (USD MILLION)

- TABLE 552 SOUTH AFRICA: FRAUD DETECTION AND PREVENTION MARKET, BY OFFERING, 2019-2024 (USD MILLION)

- TABLE 553 SOUTH AFRICA: FRAUD DETECTION AND PREVENTION MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 554 SOUTH AFRICA: FRAUD DETECTION AND PREVENTION MARKET, BY SOLUTION, 2019-2024 (USD MILLION)

- TABLE 555 SOUTH AFRICA: FRAUD DETECTION AND PREVENTION MARKET, BY SOLUTION, 2025-2030 (USD MILLION)

- TABLE 556 SOUTH AFRICA: FRAUD DETECTION AND PREVENTION MARKET, BY SERVICE, 2019-2024 (USD MILLION)

- TABLE 557 SOUTH AFRICA: FRAUD DETECTION AND PREVENTION MARKET, BY SERVICE, 2025-2030 (USD MILLION)

- TABLE 558 SOUTH AFRICA: FRAUD DETECTION AND PREVENTION MARKET, BY DEPLOYMENT MODE, 2019-2024 (USD MILLION)

- TABLE 559 SOUTH AFRICA: FRAUD DETECTION AND PREVENTION MARKET, BY DEPLOYMENT MODE, 2025-2030 (USD MILLION)

- TABLE 560 SOUTH AFRICA: FRAUD DETECTION AND PREVENTION MARKET, BY ORGANIZATION SIZE, 2019-2024 (USD MILLION)

- TABLE 561 SOUTH AFRICA: FRAUD DETECTION AND PREVENTION MARKET, BY ORGANIZATION SIZE, 2025-2030 (USD MILLION)

- TABLE 562 SOUTH AFRICA: FRAUD DETECTION AND PREVENTION MARKET, BY VERTICAL, 2019-2024 (USD MILLION)

- TABLE 563 SOUTH AFRICA: FRAUD DETECTION AND PREVENTION MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 564 SOUTH AFRICA: FRAUD DETECTION AND PREVENTION MARKET, BY FRAUD TYPE, 2019-2024 (USD MILLION)

- TABLE 565 SOUTH AFRICA: FRAUD DETECTION AND PREVENTION MARKET, BY FRAUD TYPE, 2025-2030 (USD MILLION)

- TABLE 566 SOUTH AFRICA: FRAUD DETECTION AND PREVENTION MARKET, BY FUNCTIONALITY, 2019-2024 (USD MILLION)

- TABLE 567 SOUTH AFRICA: FRAUD DETECTION AND PREVENTION MARKET, BY FUNCTIONALITY, 2025-2030 (USD MILLION)

- TABLE 568 SOUTH AFRICA: FRAUD DETECTION AND PREVENTION MARKET, BY BFSI TYPE, 2019-2024 (USD MILLION)

- TABLE 569 SOUTH AFRICA: FRAUD DETECTION AND PREVENTION MARKET, BY BFSI TYPE, 2025-2030 (USD MILLION)

- TABLE 570 REST OF MIDDLE EAST & AFRICA: FRAUD DETECTION AND PREVENTION MARKET, BY OFFERING, 2019-2024 (USD MILLION)

- TABLE 571 REST OF MIDDLE EAST & AFRICA: FRAUD DETECTION AND PREVENTION MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 572 REST OF MIDDLE EAST & AFRICA: FRAUD DETECTION AND PREVENTION MARKET, BY SOLUTION, 2019-2024 (USD MILLION)

- TABLE 573 REST OF MIDDLE EAST & AFRICA: FRAUD DETECTION AND PREVENTION MARKET, BY SOLUTION, 2025-2030 (USD MILLION)

- TABLE 574 REST OF MIDDLE EAST & AFRICA: FRAUD DETECTION AND PREVENTION MARKET, BY SERVICE, 2019-2024 (USD MILLION)

- TABLE 575 REST OF MIDDLE EAST & AFRICA: FRAUD DETECTION AND PREVENTION MARKET, BY SERVICE, 2025-2030 (USD MILLION)

- TABLE 576 REST OF MIDDLE EAST & AFRICA: FRAUD DETECTION AND PREVENTION MARKET, BY DEPLOYMENT MODE, 2019-2024 (USD MILLION)

- TABLE 577 REST OF MIDDLE EAST & AFRICA: FRAUD DETECTION AND PREVENTION MARKET, BY DEPLOYMENT MODE, 2025-2030 (USD MILLION)

- TABLE 578 REST OF MIDDLE EAST & AFRICA: FRAUD DETECTION AND PREVENTION MARKET, BY ORGANIZATION SIZE, 2019-2024 (USD MILLION)

- TABLE 579 REST OF MIDDLE EAST & AFRICA: FRAUD DETECTION AND PREVENTION MARKET, BY ORGANIZATION SIZE, 2025-2030 (USD MILLION)

- TABLE 580 REST OF MIDDLE EAST & AFRICA: FRAUD DETECTION AND PREVENTION MARKET, BY VERTICAL, 2019-2024 (USD MILLION)

- TABLE 581 REST OF MIDDLE EAST & AFRICA: FRAUD DETECTION AND PREVENTION MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 582 REST OF MIDDLE EAST & AFRICA: FRAUD DETECTION AND PREVENTION MARKET, BY FRAUD TYPE, 2019-2024 (USD MILLION)

- TABLE 583 REST OF MIDDLE EAST & AFRICA: FRAUD DETECTION AND PREVENTION MARKET, BY FRAUD TYPE, 2025-2030 (USD MILLION)

- TABLE 584 REST OF MIDDLE EAST & AFRICA: FRAUD DETECTION AND PREVENTION MARKET, BY FUNCTIONALITY, 2019-2024 (USD MILLION)

- TABLE 585 REST OF MIDDLE EAST & AFRICA: FRAUD DETECTION AND PREVENTION MARKET, BY FUNCTIONALITY, 2025-2030 (USD MILLION)

- TABLE 586 REST OF MIDDLE EAST & AFRICA: FRAUD DETECTION AND PREVENTION MARKET, BY BFSI TYPE, 2019-2024 (USD MILLION)

- TABLE 587 REST OF MIDDLE EAST & AFRICA: FRAUD DETECTION AND PREVENTION MARKET, BY BFSI TYPE, 2025-2030 (USD MILLION)

- TABLE 588 REGULATORY LANDSCAPE

- TABLE 589 LATIN AMERICA: FRAUD DETECTION AND PREVENTION MARKET, BY OFFERING, 2019-2024 (USD MILLION)

- TABLE 590 LATIN AMERICA: FRAUD DETECTION AND PREVENTION MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 591 LATIN AMERICA: FRAUD DETECTION AND PREVENTION MARKET, BY SOLUTION, 2019-2024 (USD MILLION)

- TABLE 592 LATIN AMERICA: FRAUD DETECTION AND PREVENTION MARKET, BY SOLUTION, 2025-2030 (USD MILLION)

- TABLE 593 LATIN AMERICA: FRAUD DETECTION AND PREVENTION MARKET, BY SERVICE, 2019-2024 (USD MILLION)

- TABLE 594 LATIN AMERICA: FRAUD DETECTION AND PREVENTION MARKET, BY SERVICE, 2025-2030 (USD MILLION)

- TABLE 595 LATIN AMERICA: FRAUD DETECTION AND PREVENTION MARKET, BY DEPLOYMENT MODE, 2019-2024 (USD MILLION)

- TABLE 596 LATIN AMERICA: FRAUD DETECTION AND PREVENTION MARKET, BY DEPLOYMENT MODE, 2025-2030 (USD MILLION)

- TABLE 597 LATIN AMERICA: FRAUD DETECTION AND PREVENTION MARKET, BY ORGANIZATION SIZE, 2019-2024 (USD MILLION)

- TABLE 598 LATIN AMERICA: FRAUD DETECTION AND PREVENTION MARKET, BY ORGANIZATION SIZE, 2025-2030 (USD MILLION)

- TABLE 599 LATIN AMERICA: FRAUD DETECTION AND PREVENTION MARKET, BY VERTICAL, 2019-2024 (USD MILLION)

- TABLE 600 LATIN AMERICA: FRAUD DETECTION AND PREVENTION MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 601 LATIN AMERICA: FRAUD DETECTION AND PREVENTION MARKET, BY FRAUD TYPE, 2019-2024 (USD MILLION)

- TABLE 602 LATIN AMERICA: FRAUD DETECTION AND PREVENTION MARKET, BY FRAUD TYPE, 2025-2030 (USD MILLION)

- TABLE 603 LATIN AMERICA: FRAUD DETECTION AND PREVENTION MARKET, BY FUNCTIONALITY, 2019-2024 (USD MILLION)

- TABLE 604 LATIN AMERICA: FRAUD DETECTION AND PREVENTION MARKET, BY FUNCTIONALITY, 2025-2030 (USD MILLION)

- TABLE 605 LATIN AMERICA: FRAUD DETECTION AND PREVENTION MARKET, BY BFSI TYPE, 2019-2024 (USD MILLION)

- TABLE 606 LATIN AMERICA: FRAUD DETECTION AND PREVENTION MARKET, BY BFSI TYPE, 2025-2030 (USD MILLION)

- TABLE 607 LATIN AMERICA: FRAUD DETECTION AND PREVENTION MARKET, BY COUNTRY, 2019-2024 (USD MILLION)

- TABLE 608 LATIN AMERICA: FRAUD DETECTION AND PREVENTION MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 609 BRAZIL: FRAUD DETECTION AND PREVENTION MARKET, BY OFFERING, 2019-2024 (USD MILLION)

- TABLE 610 BRAZIL: FRAUD DETECTION AND PREVENTION MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 611 BRAZIL: FRAUD DETECTION AND PREVENTION MARKET, BY SOLUTION, 2019-2024 (USD MILLION)

- TABLE 612 BRAZIL: FRAUD DETECTION AND PREVENTION MARKET, BY SOLUTION, 2025-2030 (USD MILLION)

- TABLE 613 BRAZIL: FRAUD DETECTION AND PREVENTION MARKET, BY SERVICE, 2019-2024 (USD MILLION)

- TABLE 614 BRAZIL: FRAUD DETECTION AND PREVENTION MARKET, BY SERVICE, 2025-2030 (USD MILLION)

- TABLE 615 BRAZIL: FRAUD DETECTION AND PREVENTION MARKET, BY DEPLOYMENT MODE, 2019-2024 (USD MILLION)

- TABLE 616 BRAZIL: FRAUD DETECTION AND PREVENTION MARKET, BY DEPLOYMENT MODE, 2025-2030 (USD MILLION)

- TABLE 617 BRAZIL: FRAUD DETECTION AND PREVENTION MARKET, BY ORGANIZATION SIZE, 2019-2024 (USD MILLION)

- TABLE 618 BRAZIL: FRAUD DETECTION AND PREVENTION MARKET, BY ORGANIZATION SIZE, 2025-2030 (USD MILLION)

- TABLE 619 BRAZIL: FRAUD DETECTION AND PREVENTION MARKET, BY VERTICAL, 2019-2024 (USD MILLION)

- TABLE 620 BRAZIL: FRAUD DETECTION AND PREVENTION MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 621 BRAZIL: FRAUD DETECTION AND PREVENTION MARKET, BY FRAUD TYPE, 2019-2024 (USD MILLION)

- TABLE 622 BRAZIL: FRAUD DETECTION AND PREVENTION MARKET, BY FRAUD TYPE, 2025-2030 (USD MILLION)

- TABLE 623 BRAZIL: FRAUD DETECTION AND PREVENTION MARKET, BY FUNCTIONALITY, 2019-2024 (USD MILLION)

- TABLE 624 BRAZIL: FRAUD DETECTION AND PREVENTION MARKET, BY FUNCTIONALITY, 2025-2030 (USD MILLION)

- TABLE 625 BRAZIL: FRAUD DETECTION AND PREVENTION MARKET, BY BFSI TYPE, 2019-2024 (USD MILLION)

- TABLE 626 BRAZIL: FRAUD DETECTION AND PREVENTION MARKET, BY BFSI TYPE, 2025-2030 (USD MILLION)

- TABLE 627 MEXICO: FRAUD DETECTION AND PREVENTION MARKET, BY OFFERING, 2019-2024 (USD MILLION)

- TABLE 628 MEXICO: FRAUD DETECTION AND PREVENTION MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 629 MEXICO: FRAUD DETECTION AND PREVENTION MARKET, BY SOLUTION, 2019-2024 (USD MILLION)

- TABLE 630 MEXICO: FRAUD DETECTION AND PREVENTION MARKET, BY SOLUTION, 2025-2030 (USD MILLION)

- TABLE 631 MEXICO: FRAUD DETECTION AND PREVENTION MARKET, BY SERVICE, 2019-2024 (USD MILLION)

- TABLE 632 MEXICO: FRAUD DETECTION AND PREVENTION MARKET, BY SERVICE, 2025-2030 (USD MILLION)

- TABLE 633 MEXICO: FRAUD DETECTION AND PREVENTION MARKET, BY DEPLOYMENT MODE, 2019-2024 (USD MILLION)

- TABLE 634 MEXICO: FRAUD DETECTION AND PREVENTION MARKET, BY DEPLOYMENT MODE, 2025-2030 (USD MILLION)

- TABLE 635 MEXICO: FRAUD DETECTION AND PREVENTION MARKET, BY ORGANIZATION SIZE, 2019-2024 (USD MILLION)

- TABLE 636 MEXICO: FRAUD DETECTION AND PREVENTION MARKET, BY ORGANIZATION SIZE, 2025-2030 (USD MILLION)

- TABLE 637 MEXICO: FRAUD DETECTION AND PREVENTION MARKET, BY VERTICAL, 2019-2024 (USD MILLION)

- TABLE 638 MEXICO: FRAUD DETECTION AND PREVENTION MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 639 MEXICO: FRAUD DETECTION AND PREVENTION MARKET, BY FRAUD TYPE, 2019-2024 (USD MILLION)

- TABLE 640 MEXICO: FRAUD DETECTION AND PREVENTION MARKET, BY FRAUD TYPE, 2025-2030 (USD MILLION)

- TABLE 641 MEXICO: FRAUD DETECTION AND PREVENTION MARKET, BY BFSI TYPE, 2019-2024 (USD MILLION)

- TABLE 642 MEXICO: FRAUD DETECTION AND PREVENTION MARKET, BY FUNCTIONALITY, 2025-2030 (USD MILLION)

- TABLE 643 MEXICO: FRAUD DETECTION AND PREVENTION MARKET, BY FUNCTIONALITY, 2019-2024 (USD MILLION)

- TABLE 644 MEXICO: FRAUD DETECTION AND PREVENTION MARKET, BY BFSI TYPE, 2025-2030 (USD MILLION)

- TABLE 645 COLOMBIA: FRAUD DETECTION AND PREVENTION MARKET, BY OFFERING, 2019-2024 (USD MILLION)

- TABLE 646 COLOMBIA: FRAUD DETECTION AND PREVENTION MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 647 COLOMBIA: FRAUD DETECTION AND PREVENTION MARKET, BY SOLUTION, 2019-2024 (USD MILLION)

- TABLE 648 COLOMBIA: FRAUD DETECTION AND PREVENTION MARKET, BY SOLUTION, 2025-2030 (USD MILLION)

- TABLE 649 COLOMBIA: FRAUD DETECTION AND PREVENTION MARKET, BY SERVICE, 2019-2024 (USD MILLION)

- TABLE 650 COLOMBIA: FRAUD DETECTION AND PREVENTION MARKET, BY SERVICE, 2025-2030 (USD MILLION)

- TABLE 651 COLOMBIA: FRAUD DETECTION AND PREVENTION MARKET, BY DEPLOYMENT MODE, 2019-2024 (USD MILLION)

- TABLE 652 COLOMBIA: FRAUD DETECTION AND PREVENTION MARKET, BY DEPLOYMENT MODE, 2025-2030 (USD MILLION)

- TABLE 653 COLOMBIA: FRAUD DETECTION AND PREVENTION MARKET, BY ORGANIZATION SIZE, 2019-2024 (USD MILLION)

- TABLE 654 COLOMBIA: FRAUD DETECTION AND PREVENTION MARKET, BY ORGANIZATION SIZE, 2025-2030 (USD MILLION)

- TABLE 655 COLOMBIA: FRAUD DETECTION AND PREVENTION MARKET, BY VERTICAL, 2019-2024 (USD MILLION)

- TABLE 656 COLOMBIA: FRAUD DETECTION AND PREVENTION MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 657 COLOMBIA: FRAUD DETECTION AND PREVENTION MARKET, BY FRAUD TYPE, 2019-2024 (USD MILLION)

- TABLE 658 COLOMBIA: FRAUD DETECTION AND PREVENTION MARKET, BY FRAUD TYPE, 2025-2030 (USD MILLION)

- TABLE 659 COLOMBIA: FRAUD DETECTION AND PREVENTION MARKET, BY FUNCTIONALITY, 2019-2024 (USD MILLION)

- TABLE 660 COLOMBIA: FRAUD DETECTION AND PREVENTION MARKET, BY FUNCTIONALITY, 2025-2030 (USD MILLION)

- TABLE 661 COLOMBIA: FRAUD DETECTION AND PREVENTION MARKET, BY BFSI TYPE, 2019-2024 (USD MILLION)

- TABLE 662 COLOMBIA: FRAUD DETECTION AND PREVENTION MARKET, BY BFSI TYPE, 2025-2030 (USD MILLION)

- TABLE 663 REST OF LATIN AMERICA: FRAUD DETECTION AND PREVENTION MARKET, BY OFFERING, 2019-2024 (USD MILLION)

- TABLE 664 REST OF LATIN AMERICA: FRAUD DETECTION AND PREVENTION MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 665 REST OF LATIN AMERICA: FRAUD DETECTION AND PREVENTION MARKET, BY SOLUTION, 2019-2024 (USD MILLION)

- TABLE 666 REST OF LATIN AMERICA: FRAUD DETECTION AND PREVENTION MARKET, BY SOLUTION, 2025-2030 (USD MILLION)

- TABLE 667 REST OF LATIN AMERICA: FRAUD DETECTION AND PREVENTION MARKET, BY SERVICE, 2019-2024 (USD MILLION)

- TABLE 668 REST OF LATIN AMERICA: FRAUD DETECTION AND PREVENTION MARKET, BY SERVICE, 2025-2030 (USD MILLION)

- TABLE 669 REST OF LATIN AMERICA: FRAUD DETECTION AND PREVENTION MARKET, BY DEPLOYMENT MODE, 2019-2024 (USD MILLION)

- TABLE 670 REST OF LATIN AMERICA: FRAUD DETECTION AND PREVENTION MARKET, BY DEPLOYMENT MODE, 2025-2030 (USD MILLION)

- TABLE 671 REST OF LATIN AMERICA: FRAUD DETECTION AND PREVENTION MARKET, BY ORGANIZATION SIZE, 2019-2024 (USD MILLION)

- TABLE 672 REST OF LATIN AMERICA: FRAUD DETECTION AND PREVENTION MARKET, BY ORGANIZATION SIZE, 2025-2030 (USD MILLION)

- TABLE 673 REST OF LATIN AMERICA: FRAUD DETECTION AND PREVENTION MARKET, BY VERTICAL, 2019-2024 (USD MILLION)

- TABLE 674 REST OF LATIN AMERICA: FRAUD DETECTION AND PREVENTION MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 675 REST OF LATIN AMERICA: FRAUD DETECTION AND PREVENTION MARKET, BY FRAUD TYPE, 2019-2024 (USD MILLION)

- TABLE 676 REST OF LATIN AMERICA: FRAUD DETECTION AND PREVENTION MARKET, BY FRAUD TYPE, 2025-2030 (USD MILLION)

- TABLE 677 REST OF LATIN AMERICA: FRAUD DETECTION AND PREVENTION MARKET, BY FUNCTIONALITY, 2019-2024 (USD MILLION)

- TABLE 678 REST OF LATIN AMERICA: FRAUD DETECTION AND PREVENTION MARKET, BY FUNCTIONALITY, 2025-2030 (USD MILLION)

- TABLE 679 REST OF LATIN AMERICA: FRAUD DETECTION AND PREVENTION MARKET, BY BFSI TYPE, 2019-2024 (USD MILLION)

- TABLE 680 REST OF LATIN AMERICA: FRAUD DETECTION AND PREVENTION MARKET, BY BFSI TYPE, 2025-2030 (USD MILLION)

- TABLE 681 OVERVIEW OF STRATEGIES ADOPTED BY KEY FRAUD DETECTION AND PREVENTION VENDORS, 2023-2025

- TABLE 682 FRAUD DETECTION AND PREVENTION MARKET: DEGREE OF COMPETITION

- TABLE 683 FRAUD DETECTION AND PREVENTION MARKET: OFFERING FOOTPRINT

- TABLE 684 FRAUD DETECTION AND PREVENTION MARKET: FRAUD-TYPE FOOTPRINT