|

|

市場調査レポート

商品コード

1742431

協働ロボットの世界市場:ペイロード別、コンポーネント別、用途別、業界別、地域別 - 2030年までの予測Collaborative Robot Market by Payload (Less than 5 kg, 5-10 kg, 11-25 kg, More than 25 kg), Component (Hardware, Software), Application (Handling, Assembling & Disassembling, Dispensing, Processing), Industry and Region - Global Forecast to 2030 |

||||||

カスタマイズ可能

|

|||||||

| 協働ロボットの世界市場:ペイロード別、コンポーネント別、用途別、業界別、地域別 - 2030年までの予測 |

|

出版日: 2025年05月30日

発行: MarketsandMarkets

ページ情報: 英文 347 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

世界の協働ロボットの市場規模は、2025年の14億2,000万米ドルから2030年には33億8,000万米ドルに成長し、2025年から2030年までのCAGRは18.9%と予測されています。

協働ロボットは、業務効率の向上、人件費の削減、職場の安全性の向上により、あらゆる規模の企業に大きな利益をもたらします。その柔軟性、統合の容易さ、大規模な安全インフラなしで人間と一緒に作業できる能力により、大企業でも中小企業でも利用しやすくなっています。協働ロボット(コボット)は投資回収が早く、異なるタスクに簡単に再配置できるため、ダイナミックな生産シナリオに最適です。この適応性が、さまざまな産業で市場浸透が進んでいる主な理由の1つです。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2020年~2030年 |

| 基準年 | 2024年 |

| 予測期間 | 2025年~2030年 |

| 検討単位 | 金額(100万米ドル) |

| セグメント別 | ペイロード別、コンポーネント別、用途別、業界別、地域別 |

| 対象地域 | 北米、欧州、アジア太平洋、その他の地域 |

センサー、アクチュエーター、コントローラー、ロボットアームなど、協働ロボット市場のハードウェアコンポーネントは、コボット機能の中核を形成しています。洗練された信頼性の高いロボットシステムに対する需要の高まりが、高性能ハードウェアコンポーネントへの投資を後押ししています。コボットの高度化と複雑なタスク処理能力の向上により、強固なハードウェア・ソリューションに対する需要はさらに拡大しています。また、軽量素材と小型化における継続的な技術革新は、ハードウェアの優位性を強化しています。この要素は、安全で正確かつ効果的な人間と協働ロボットの協働を促進するために引き続き重要です。

協働ロボット市場のハンドリング用途分野は、マテリアルハンドリング、ピッキングと配置、梱包、パレタイジング機能に対する高い需要により成長を遂げています。協働ロボット(コボット)は、精度、再現性、人間とともに安全に作業できる能力を提供するため、これらの用途に最適です。物流、エレクトロニクス、自動車業界では、ワークフローの効率を高めるためにコボットを採用するケースが増えています。その柔軟性と統合の容易さは、このセグメントの成長を促進する重要な要因となっています。

中国の協働ロボット市場は、その強力な製造基盤と産業自動化への積極的な推進力によって牽引されています。同国はエレクトロニクス、自動車、消費財などの分野で主導権を握っており、柔軟な自動化ソリューションに対する大きな需要を生み出しています。コボットは、配備の容易さ、コスト効率、人間と並んで安全に作業できる能力により、中国のダイナミックな生産環境に特に適しています。さらに、「メイド・イン・チャイナ2025」のような政府のイニシアチブは、スマート工場の開発とコボットの採用をさらに加速させる。さらに、「メイド・イン・チャイナ2025」のような政府のイニシアチブは、スマート工場の開発、ひいてはコボットの受け入れを加速し続けています。

当レポートでは、世界の協働ロボット市場について調査し、ペイロード別、コンポーネント別、用途別、業界別、地域別動向、および市場に参入する企業のプロファイルなどをまとめています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

第6章 市場概要

- 顧客ビジネスに影響を与える動向/混乱

- 価格分析

- バリューチェーン分析

- エコシステム分析

- 技術分析

- 特許分析

- 貿易分析

- 2025年~2026年の主な会議とイベント

- ケーススタディ分析

- 投資と資金調達のシナリオ

- 関税と規制状況

- ポーターのファイブフォース分析

- 主要な利害関係者と購入基準

- 2025年の米国関税が協働ロボット市場に与える影響

- 協働ロボット市場におけるAIの影響

第7章 協働ロボットとIoTの統合

- イントロダクション

- コネクティビティテクノロジー

- イーサネット

- WI-FI

- Bluetooth

- セルラー

- 相互運用性ソフトウェア

第8章 人間とロボットの協調作業環境

- イントロダクション

- 安全評価監視停止

- ハンドガイド

- 速度低下および車間距離監視

- パワーとフォースの制限

第9章 協働ロボット市場(ペイロード別)

- イントロダクション

- 5kg未満

- 5~10キロ

- 11~25キロ

- 25kg以上

第10章 協働ロボット市場(コンポーネント別)

- イントロダクション

- ハードウェア

- ソフトウェア

第11章 協働ロボット市場(用途別)

- イントロダクション

- ハンドリング

- 組立・分解

- 溶接・はんだ付け

- 分注

- 加工

- その他

第12章 協働ロボット市場(業界別)

- イントロダクション

- 自動車

- エレクトロニクス

- 金属・機械加工

- プラスチック・ポリマー

- 食品・飲料

- 家具・設備

- ヘルスケア

- ロジスティクス

- その他

第13章 協働ロボット市場(地域別)

- イントロダクション

- 北米

- 北米のマクロ経済見通し

- 米国

- カナダ

- メキシコ

- 欧州

- 欧州のマクロ経済見通し

- ドイツ

- イタリア

- スペイン

- フランス

- 英国

- その他

- アジア太平洋

- アジア太平洋のマクロ経済見通し

- 中国

- 韓国

- 日本

- 台湾

- タイ

- インド

- その他

- その他の地域

- マクロ経済見通しは連続

- 南米

- 中東

- アフリカ

第14章 競合情勢

- 概要

- 主要参入企業の戦略/強み、2021年~2025年

- 収益分析

- 市場シェア分析、2024年

- 企業評価と財務指標

- ブランド/製品比較

- 企業評価マトリックス:主要参入企業、2024年

- 企業評価マトリックス:スタートアップ/中小企業、2024年

- 競合シナリオ

第15章 企業プロファイル

- イントロダクション

- 主要参入企業

- UNIVERSAL ROBOTS A/S

- FANUC CORPORATION

- ABB

- TECHMAN ROBOT INC.

- AUBO(BEIJING)ROBOTICS TECHNOLOGY CO., LTD.

- KUKA AG

- DOOSAN ROBOTICS INC.

- DENSO CORPORATION

- YASKAWA ELECTRIC CORPORATION

- RETHINK ROBOTICS

- その他の企業

- SIASUN ROBOT & AUTOMATION CO., LTD.

- FRANKA ROBOTICS GMBH

- COMAU S.P.A.

- F&P ROBOTICS AG

- STAUBLI INTERNATIONAL AG

- BOSCH REXROTH AG

- PRODUCTIVE ROBOTICS LLC

- NEURA ROBOTICS GMBH

- ELEPHANTROBOTICS

- ELITE ROBOTS

- NIRYO

- HANWHA CORPORATION

- OMRON ADEPT TECHNOLOGY, INC.

- MIP ROBOTICS

- KAWASAKI ROBOTICS

- DOBOT

- JAKA ROBOTICS

- HUILING-TECH ROBOTIC CO., LTD.

第16章 付録

List of Tables

- TABLE 1 AVERAGE SELLING PRICE OF COLLABORATIVE ROBOTS

- TABLE 2 AVERAGE SELLING PRICE OF COLLABORATIVE ROBOTS OFFERED BY KEY PLAYERS, BY PAYLOAD (USD)

- TABLE 3 AVERAGE SELLING PRICE TREND OF COLLABORATIVE ROBOTS, BY REGION, 2021-2030 (USD)

- TABLE 4 COLLABORATIVE ROBOT MARKET: ROLE OF COMPANIES IN ECOSYSTEM

- TABLE 5 LIST OF PATENTS, 2021-2024

- TABLE 6 IMPORT DATA FOR HS CODE 847950-COMPLIANT PRODUCTS, BY COUNTRY, 2019-2023 (USD THOUSAND)

- TABLE 7 EXPORT DATA FOR HS CODE 847950-COMPLIANT PRODUCTS, BY COUNTRY, 2019-2023 (USD THOUSAND)

- TABLE 8 COLLABORATIVE ROBOT MARKET: LIST OF KEY CONFERENCES AND EVENTS, 2025-2026

- TABLE 9 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 10 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 11 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 12 REST OF THE WORLD: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 13 NORTH AMERICA: SAFETY STANDARDS FOR COLLABORATIVE ROBOTS

- TABLE 14 EUROPE: SAFETY STANDARDS FOR COLLABORATIVE ROBOTS

- TABLE 15 ASIA PACIFIC: SAFETY STANDARDS FOR COLLABORATIVE ROBOTS

- TABLE 16 REST OF THE WORLD: SAFETY STANDARDS FOR COLLABORATIVE ROBOTS

- TABLE 17 COLLABORATIVE ROBOT MARKET: IMPACT OF PORTER'S FIVE FORCES

- TABLE 18 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE INDUSTRIES (%)

- TABLE 19 KEY BUYING CRITERIA FOR TOP THREE INDUSTRIES

- TABLE 20 US-ADJUSTED RECIPROCAL TARIFF RATES

- TABLE 21 COLLABORATIVE ROBOT MARKET, BY PAYLOAD, 2021-2024 (USD MILLION)

- TABLE 22 COLLABORATIVE ROBOT MARKET, BY PAYLOAD, 2025-2030 (USD MILLION)

- TABLE 23 COLLABORATIVE ROBOT MARKET, BY PAYLOAD, 2021-2024 (UNITS)

- TABLE 24 COLLABORATIVE ROBOT MARKET, BY PAYLOAD, 2025-2030 (UNITS)

- TABLE 25 COMPANIES OFFERING COLLABORATIVE ROBOTS WITH PAYLOAD CAPACITY OF UP TO 5 KG

- TABLE 26 LESS THAN 5 KG: COLLABORATIVE ROBOT MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

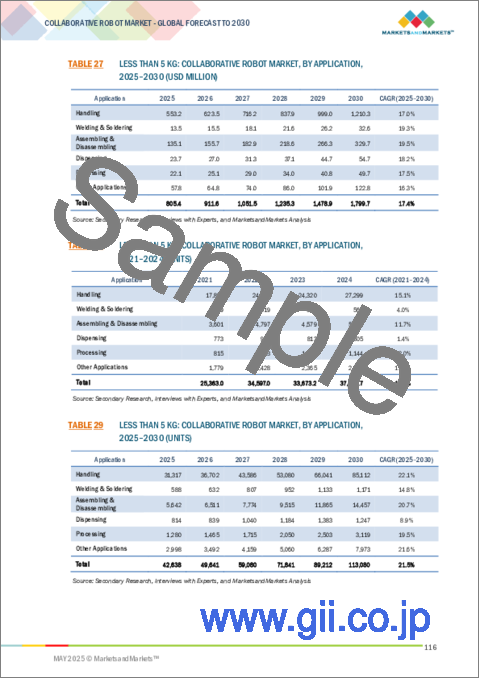

- TABLE 27 LESS THAN 5 KG: COLLABORATIVE ROBOT MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 28 LESS THAN 5 KG: COLLABORATIVE ROBOT MARKET, BY APPLICATION, 2021-2024 (UNITS)

- TABLE 29 LESS THAN 5 KG: COLLABORATIVE ROBOT MARKET, BY APPLICATION, 2025-2030 (UNITS)

- TABLE 30 LESS THAN 5 KG: COLLABORATIVE ROBOT MARKET, BY INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 31 LESS THAN 5 KG: COLLABORATIVE ROBOT MARKET, BY INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 32 LESS THAN 5 KG: COLLABORATIVE ROBOT MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 33 LESS THAN 5 KG: COLLABORATIVE ROBOT MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 34 COMPANIES OFFERING COLLABORATIVE ROBOTS WITH 5-10 KG PAYLOAD CAPACITY

- TABLE 35 5-10 KG: COLLABORATIVE ROBOT MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 36 5-10 KG: COLLABORATIVE ROBOT MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 37 5-10 KG: COLLABORATIVE ROBOT MARKET, BY APPLICATION, 2021-2024 (UNITS)

- TABLE 38 5-10 KG: COLLABORATIVE ROBOT MARKET, BY APPLICATION, 2025-2030 (UNITS)

- TABLE 39 5-10 KG: COLLABORATIVE ROBOT MARKET, BY INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 40 5-10 KG: COLLABORATIVE ROBOT MARKET, BY INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 41 5-10 KG: COLLABORATIVE ROBOT MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 42 5-10 KG: COLLABORATIVE ROBOT MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 43 COMPANIES OFFERING COLLABORATIVE ROBOTS WITH PAYLOAD CAPACITY OF 10-25 KG

- TABLE 44 11-25 KG: COLLABORATIVE ROBOT MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 45 11-25 KG: COLLABORATIVE ROBOT MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 46 11-25 KG: COLLABORATIVE ROBOT MARKET, BY APPLICATION, 2021-2024 (UNITS)

- TABLE 47 11-25 KG: COLLABORATIVE ROBOT MARKET, BY APPLICATION, 2025-2030 (UNITS)

- TABLE 48 11-25 KG: COLLABORATIVE ROBOT MARKET, BY INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 49 11-25 KG: COLLABORATIVE ROBOT MARKET, BY INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 50 11-25 KG: COLLABORATIVE ROBOT MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 51 11-25 KG: COLLABORATIVE ROBOT MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 52 COMPANIES OFFERING COLLABORATIVE ROBOTS WITH PAYLOAD CAPACITY OF MORE THAN 25 KG

- TABLE 53 MORE THAN 25 KG: COLLABORATIVE ROBOT MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 54 MORE THAN 25 KG: COLLABORATIVE ROBOT MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 55 MORE THAN 25 KG: COLLABORATIVE ROBOT MARKET, BY APPLICATION, 2021-2024 (UNITS)

- TABLE 56 MORE THAN 25 KG: COLLABORATIVE ROBOT MARKET, BY APPLICATION, 2025-2030 (UNITS)

- TABLE 57 MORE THAN 25 KG: COLLABORATIVE ROBOT MARKET, BY INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 58 MORE THAN 25 KG: COLLABORATIVE ROBOT MARKET, BY INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 59 MORE THAN 25 KG: COLLABORATIVE ROBOT MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 60 MORE THAN 25 KG: COLLABORATIVE ROBOT MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 61 COLLABORATIVE ROBOT MARKET, BY COMPONENT 2021-2024 (USD MILLION)

- TABLE 62 COLLABORATIVE ROBOT MARKET, BY COMPONENT, 2025-2030 (USD MILLION)

- TABLE 63 ROBOTIC WELDING GUN MANUFACTURERS

- TABLE 64 ELECTRIC GRIPPER MANUFACTURERS

- TABLE 65 MAGNETIC GRIPPER MANUFACTURERS

- TABLE 66 COLLABORATIVE ROBOT MARKET RANKING ANALYSIS, BY APPLICATION

- TABLE 67 COLLABORATIVE ROBOT MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 68 COLLABORATIVE ROBOT MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 69 COLLABORATIVE ROBOT MARKET, BY APPLICATION, 2021-2024 (UNITS)

- TABLE 70 COLLABORATIVE ROBOT MARKET, BY APPLICATION, 2025-2030 (UNITS)

- TABLE 71 COMPANIES OFFERING COLLABORATIVE ROBOTS FOR HANDLING APPLICATIONS

- TABLE 72 HANDLING: COLLABORATIVE ROBOT MARKET, BY PAYLOAD, 2021-2024 (USD MILLION)

- TABLE 73 HANDLING: COLLABORATIVE ROBOT MARKET, BY PAYLOAD, 2025-2030 (USD MILLION)

- TABLE 74 HANDLING: COLLABORATIVE ROBOT MARKET, BY PAYLOAD, 2021-2024 (UNITS)

- TABLE 75 HANDLING: COLLABORATIVE ROBOT MARKET, BY PAYLOAD, 2025-2030 (UNITS)

- TABLE 76 HANDLING: COLLABORATIVE ROBOT MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 77 HANDLING: COLLABORATIVE ROBOT MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 78 COMPANIES OFFERING COLLABORATIVE ROBOTS FOR ASSEMBLING & DISASSEMBLING APPLICATIONS

- TABLE 79 ASSEMBLING & DISASSEMBLING: COLLABORATIVE ROBOT MARKET, BY PAYLOAD, 2021-2024 (USD MILLION)

- TABLE 80 ASSEMBLING & DISASSEMBLING: COLLABORATIVE ROBOT MARKET, BY PAYLOAD, 2025-2030 (USD MILLION)

- TABLE 81 ASSEMBLING & DISASSEMBLING: COLLABORATIVE ROBOT MARKET, BY PAYLOAD, 2021-2024 (UNITS)

- TABLE 82 ASSEMBLING & DISASSEMBLING: COLLABORATIVE ROBOT MARKET, BY PAYLOAD, 2025-2030 (UNITS)

- TABLE 83 COMPANIES OFFERING COLLABORATIVE ROBOTS FOR WELDING & SOLDERING APPLICATIONS

- TABLE 84 WELDING & SOLDERING: COLLABORATIVE ROBOT MARKET, BY PAYLOAD, 2021-2024 (USD MILLION)

- TABLE 85 WELDING & SOLDERING: COLLABORATIVE ROBOT MARKET, BY PAYLOAD, 2025-2030 (USD MILLION)

- TABLE 86 WELDING & SOLDERING: COLLABORATIVE ROBOT MARKET, BY PAYLOAD, 2021-2024 (UNITS)

- TABLE 87 WELDING & SOLDERING: COLLABORATIVE ROBOT MARKET, BY PAYLOAD, 2025-2030 (UNITS)

- TABLE 88 COMPANIES OFFERING COLLABORATIVE ROBOTS FOR DISPENSING APPLICATIONS

- TABLE 89 DISPENSING: COLLABORATIVE ROBOT MARKET, BY PAYLOAD, 2021-2024 (USD MILLION)

- TABLE 90 DISPENSING: COLLABORATIVE ROBOT MARKET, BY PAYLOAD, 2025-2030 (USD MILLION)

- TABLE 91 DISPENSING: COLLABORATIVE ROBOT MARKET, BY PAYLOAD, 2021-2024 (UNITS)

- TABLE 92 DISPENSING: COLLABORATIVE ROBOT MARKET, BY PAYLOAD, 2025-2030 (UNITS)

- TABLE 93 COMPANIES OFFERING COLLABORATIVE ROBOTS FOR PROCESSING APPLICATIONS

- TABLE 94 PROCESSING: COLLABORATIVE ROBOT MARKET, BY PAYLOAD, 2021-2024 (USD MILLION)

- TABLE 95 PROCESSING: COLLABORATIVE ROBOT MARKET, BY PAYLOAD, 2025-2030 (USD MILLION)

- TABLE 96 PROCESSING: COLLABORATIVE ROBOT MARKET, BY PAYLOAD, 2021-2024 (UNITS)

- TABLE 97 PROCESSING: COLLABORATIVE ROBOT MARKET, BY PAYLOAD, 2025-2030 (UNITS)

- TABLE 98 PROCESSING: COLLABORATIVE ROBOT MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 99 PROCESSING: COLLABORATIVE ROBOT MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 100 COMPANIES OFFERING COLLABORATIVE ROBOTS FOR OTHER APPLICATIONS

- TABLE 101 OTHER APPLICATIONS: COLLABORATIVE ROBOT MARKET, BY PAYLOAD, 2021-2024 (USD MILLION)

- TABLE 102 OTHER APPLICATIONS: COLLABORATIVE ROBOT MARKET, BY PAYLOAD, 2025-2030 (USD MILLION)

- TABLE 103 OTHER APPLICATIONS: COLLABORATIVE ROBOT MARKET, BY PAYLOAD, 2021-2024 (UNITS)

- TABLE 104 OTHER APPLICATIONS: COLLABORATIVE ROBOT MARKET, BY PAYLOAD, 2025-2030 (UNITS)

- TABLE 105 COLLABORATIVE ROBOT MARKET, BY INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 106 COLLABORATIVE ROBOT MARKET, BY INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 107 COLLABORATIVE ROBOT MARKET, BY INDUSTRY, 2021-2024 (UNITS)

- TABLE 108 COLLABORATIVE ROBOT MARKET, BY INDUSTRY, 2025-2030 (UNITS)

- TABLE 109 AUTOMOTIVE: COLLABORATIVE ROBOT MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 110 AUTOMOTIVE: COLLABORATIVE ROBOT MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 111 AUTOMOTIVE: COLLABORATIVE ROBOT MARKET, BY PAYLOAD, 2021-2024 (USD MILLION)

- TABLE 112 AUTOMOTIVE: COLLABORATIVE ROBOT MARKET, BY PAYLOAD, 2025-2030 (USD MILLION)

- TABLE 113 ELECTRONICS: COLLABORATIVE ROBOT MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 114 ELECTRONICS: COLLABORATIVE ROBOT MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 115 ELECTRONICS: COLLABORATIVE ROBOT MARKET, BY PAYLOAD, 2021-2024 (USD MILLION)

- TABLE 116 ELECTRONICS: COLLABORATIVE ROBOT MARKET, BY PAYLOAD, 2025-2030 (USD MILLION)

- TABLE 117 METALS & MACHINING: COLLABORATIVE ROBOT MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 118 METALS & MACHINING: COLLABORATIVE ROBOT MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 119 METALS & MACHINING: COLLABORATIVE ROBOT MARKET, BY PAYLOAD, 2021-2024 (USD MILLION)

- TABLE 120 METALS & MACHINING: COLLABORATIVE ROBOT MARKET, BY PAYLOAD, 2025-2030 (USD MILLION)

- TABLE 121 PLASTICS & POLYMERS: COLLABORATIVE ROBOT MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 122 PLASTICS & POLYMERS: COLLABORATIVE ROBOT MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 123 PLASTICS & POLYMERS: COLLABORATIVE ROBOT MARKET, BY PAYLOAD, 2021-2024 (USD MILLION)

- TABLE 124 PLASTICS & POLYMERS: COLLABORATIVE ROBOT MARKET, BY PAYLOAD, 2025-2030 (USD MILLION)

- TABLE 125 FOOD & BEVERAGES: COLLABORATIVE ROBOT MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 126 FOOD & BEVERAGES: COLLABORATIVE ROBOT MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 127 FOOD & BEVERAGES: COLLABORATIVE ROBOT MARKET, BY PAYLOAD, 2021-2024 (USD MILLION)

- TABLE 128 FOOD & BEVERAGES: COLLABORATIVE ROBOT MARKET, BY PAYLOAD, 2025-2030 (USD MILLION)

- TABLE 129 FURNITURE & EQUIPMENT: COLLABORATIVE ROBOT MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 130 FURNITURE & EQUIPMENT: COLLABORATIVE ROBOT MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 131 FURNITURE & EQUIPMENT: COLLABORATIVE ROBOT MARKET, BY PAYLOAD, 2021-2024 (USD MILLION)

- TABLE 132 FURNITURE & EQUIPMENT: COLLABORATIVE ROBOT MARKET, BY PAYLOAD, 2025-2030 (USD MILLION)

- TABLE 133 HEALTHCARE: COLLABORATIVE ROBOT MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 134 HEALTHCARE: COLLABORATIVE ROBOT MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 135 HEALTHCARE: COLLABORATIVE ROBOT MARKET, BY PAYLOAD, 2021-2024 (USD MILLION)

- TABLE 136 HEALTHCARE: COLLABORATIVE ROBOT MARKET, BY PAYLOAD, 2025-2030 (USD MILLION)

- TABLE 137 LOGISTICS: COLLABORATIVE ROBOT MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 138 LOGISTICS: COLLABORATIVE ROBOT MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 139 LOGISTICS: COLLABORATIVE ROBOT MARKET, BY PAYLOAD, 2021-2024 (USD MILLION)

- TABLE 140 LOGISTICS: COLLABORATIVE ROBOT MARKET, BY PAYLOAD, 2025-2030 (USD MILLION)

- TABLE 141 OTHER INDUSTRIES: COLLABORATIVE ROBOT MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 142 OTHER INDUSTRIES: COLLABORATIVE ROBOT MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 143 OTHER INDUSTRIES: COLLABORATIVE ROBOT MARKET, BY PAYLOAD, 2021-2024 (USD MILLION)

- TABLE 144 OTHER INDUSTRIES: COLLABORATIVE ROBOT MARKET, BY PAYLOAD, 2025-2030 (USD MILLION)

- TABLE 145 COLLABORATIVE ROBOT MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 146 COLLABORATIVE ROBOT MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 147 COLLABORATIVE ROBOT MARKET, BY REGION, 2021-2024 (UNITS)

- TABLE 148 COLLABORATIVE ROBOT MARKET, BY REGION, 2025-2030 (UNITS)

- TABLE 149 NORTH AMERICA: COLLABORATIVE ROBOT MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 150 NORTH AMERICA: COLLABORATIVE ROBOT MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 151 NORTH AMERICA: COLLABORATIVE ROBOT MARKET, BY COUNTRY, 2021-2024 (UNITS)

- TABLE 152 NORTH AMERICA: COLLABORATIVE ROBOT MARKET, BY COUNTRY, 2025-2030 (UNITS)

- TABLE 153 NORTH AMERICA: COLLABORATIVE ROBOT MARKET, BY PAYLOAD, 2021-2024 (USD MILLION)

- TABLE 154 NORTH AMERICA: COLLABORATIVE ROBOT MARKET, BY PAYLOAD, 2025-2030 (USD MILLION)

- TABLE 155 NORTH AMERICA: COLLABORATIVE ROBOT MARKET, BY INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 156 NORTH AMERICA: COLLABORATIVE ROBOT MARKET, BY INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 157 EUROPE: COLLABORATIVE ROBOT MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 158 EUROPE: COLLABORATIVE ROBOT MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 159 EUROPE: COLLABORATIVE ROBOT MARKET, BY COUNTRY, 2021-2024 (UNITS)

- TABLE 160 EUROPE: COLLABORATIVE ROBOT MARKET, BY COUNTRY, 2025-2030 (UNITS)

- TABLE 161 EUROPE: COLLABORATIVE ROBOT MARKET, BY PAYLOAD, 2021-2024 (USD MILLION)

- TABLE 162 EUROPE: COLLABORATIVE ROBOT MARKET, BY PAYLOAD, 2025-2030 (USD MILLION)

- TABLE 163 EUROPE: COLLABORATIVE ROBOT MARKET, BY INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 164 EUROPE: COLLABORATIVE ROBOT MARKET, BY INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 165 ASIA PACIFIC: COLLABORATIVE ROBOT MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 166 ASIA PACIFIC: COLLABORATIVE ROBOT MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 167 ASIA PACIFIC: COLLABORATIVE ROBOT MARKET, BY COUNTRY, 2021-2024 (UNITS)

- TABLE 168 ASIA PACIFIC: COLLABORATIVE ROBOT MARKET, BY COUNTRY, 2025-2030 (UNITS)

- TABLE 169 ASIA PACIFIC: COLLABORATIVE ROBOT MARKET, BY PAYLOAD, 2021-2024 (USD MILLION)

- TABLE 170 ASIA PACIFIC: COLLABORATIVE ROBOT MARKET, BY PAYLOAD, 2025-2030 (USD MILLION)

- TABLE 171 ASIA PACIFIC: COLLABORATIVE ROBOT MARKET, BY INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 172 ASIA PACIFIC: COLLABORATIVE ROBOT MARKET, BY INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 173 REST OF THE WORLD: COLLABORATIVE ROBOT MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 174 REST OF THE WORLD: COLLABORATIVE ROBOT MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 175 REST OF THE WORLD: COLLABORATIVE ROBOT MARKET, BY REGION, 2021-2024 (UNITS)

- TABLE 176 REST OF THE WORLD: COLLABORATIVE ROBOT MARKET, BY REGION, 2025-2030 (UNITS)

- TABLE 177 REST OF THE WORLD: COLLABORATIVE ROBOT MARKET, BY PAYLOAD, 2021-2024 (USD MILLION)

- TABLE 178 REST OF THE WORLD: COLLABORATIVE ROBOT MARKET, BY PAYLOAD, 2025-2030 (USD MILLION)

- TABLE 179 REST OF THE WORLD: COLLABORATIVE ROBOT MARKET, BY INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 180 REST OF THE WORLD: COLLABORATIVE ROBOT MARKET, BY INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 181 MIDDLE EAST: COLLABORATIVE ROBOT MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 182 MIDDLE EAST: COLLABORATIVE ROBOT MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 183 MIDDLE EAST: COLLABORATIVE ROBOT MARKET, BY REGION, 2021-2024 (UNITS)

- TABLE 184 MIDDLE EAST: COLLABORATIVE ROBOT MARKET, BY REGION, 2025-2030 (UNITS)

- TABLE 185 GCC: COLLABORATIVE ROBOT MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 186 GCC: COLLABORATIVE ROBOT MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 187 COLLABORATIVE ROBOT MARKET: OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS, JANUARY 2021-MAY 2025

- TABLE 188 COLLABORATIVE ROBOT MARKET: DEGREE OF COMPETITION

- TABLE 189 COLLABORATIVE ROBOT MARKET: REGION FOOTPRINT

- TABLE 190 COLLABORATIVE ROBOT MARKET: PAYLOAD FOOTPRINT

- TABLE 191 COLLABORATIVE ROBOT MARKET: APPLICATION FOOTPRINT

- TABLE 192 COLLABORATIVE ROBOT MARKET: INDUSTRY FOOTPRINT

- TABLE 193 COLLABORATIVE ROBOT MARKET: DETAILED LIST OF KEY STARTUPS/SMES

- TABLE 194 COLLABORATIVE ROBOT MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- TABLE 195 COLLABORATIVE ROBOT MARKET: PRODUCT LAUNCHES, JANUARY 2021-MAY 2025

- TABLE 196 COLLABORATIVE ROBOT MARKET: DEALS, JANUARY 2021-MAY 2025

- TABLE 197 COLLABORATIVE ROBOT MARKET: EXPANSIONS, JANUARY 2021-MAY 2025

- TABLE 198 UNIVERSAL ROBOTS A/S: COMPANY OVERVIEW

- TABLE 199 UNIVERSAL ROBOTS A/S: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 200 UNIVERSAL ROBOTS A/S: PRODUCT LAUNCHES

- TABLE 201 UNIVERSAL ROBOTS A/S: DEALS

- TABLE 202 UNIVERSAL ROBOTS A/S: EXPANSIONS

- TABLE 203 FANUC CORPORATION: COMPANY OVERVIEW

- TABLE 204 FANUC CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 205 FANUC CORPORATION: PRODUCT LAUNCHES

- TABLE 206 FANUC CORPORATION: EXPANSIONS

- TABLE 207 ABB: COMPANY OVERVIEW

- TABLE 208 ABB: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 209 ABB: PRODUCT LAUNCHES

- TABLE 210 ABB: DEALS

- TABLE 211 ABB: EXPANSIONS

- TABLE 212 TECHMAN ROBOT INC.: COMPANY OVERVIEW

- TABLE 213 TECHMAN ROBOT INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 214 TECHMAN ROBOT INC.: PRODUCT LAUNCHES

- TABLE 215 TECHMAN ROBOT INC.: DEALS

- TABLE 216 AUBO (BEIJING) ROBOTICS TECHNOLOGY CO., LTD.: COMPANY OVERVIEW

- TABLE 217 AUBO (BEIJING) ROBOTICS TECHNOLOGY CO., LTD.: PRODUCTS/SOLUTIONS/ SERVICES OFFERED

- TABLE 218 AUBO (BEIJING) ROBOTICS TECHNOLOGY CO., LTD.: PRODUCT LAUNCHES

- TABLE 219 AUBO (BEIJING) ROBOTICS TECHNOLOGY CO., LTD.: DEALS

- TABLE 220 AUBO (BEIJING) ROBOTICS TECHNOLOGY CO., LTD.: EXPANSIONS

- TABLE 221 KUKA AG: COMPANY OVERVIEW

- TABLE 222 KUKA AG: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 223 KUKA AG: PRODUCT LAUNCHES

- TABLE 224 KUKA AG: DEALS

- TABLE 225 DOOSAN ROBOTICS INC.: COMPANY OVERVIEW

- TABLE 226 DOOSAN ROBOTICS INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 227 DOOSAN ROBOTICS INC.: PRODUCT LAUNCHES

- TABLE 228 DOOSAN ROBOTICS INC.: DEALS

- TABLE 229 DOOSAN ROBOTICS INC.: EXPANSIONS

- TABLE 230 DENSO CORPORATION: COMPANY OVERVIEW

- TABLE 231 DENSO CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 232 DENSO CORPORATION: DEALS

- TABLE 233 YASKAWA ELECTRIC CORPORATION: COMPANY OVERVIEW

- TABLE 234 YASKAWA ELECTRIC CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 235 YASKAWA ELECTRIC CORPORATION: DEALS

- TABLE 236 YASKAWA ELECTRIC CORPORATION: EXPANSIONS

- TABLE 237 RETHINK ROBOTICS: COMPANY OVERVIEW

- TABLE 238 RETHINK ROBOTICS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

List of Figures

- FIGURE 1 COLLABORATIVE ROBOT MARKET SEGMENTATION AND REGIONAL SCOPE

- FIGURE 2 COLLABORATIVE ROBOT MARKET: RESEARCH DESIGN

- FIGURE 3 RESEARCH FLOW: COLLABORATIVE ROBOT MARKET SIZE ESTIMATION

- FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

- FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

- FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY (SUPPLY SIDE): REVENUE GENERATED BY MANUFACTURERS OF COLLABORATIVE ROBOTS

- FIGURE 7 DATA TRIANGULATION: COLLABORATIVE ROBOT MARKET

- FIGURE 8 LESS THAN 5 KG SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 9 HANDLING SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 10 COLLABORATIVE ROBOT MARKET IN ELECTRONICS SEGMENT TO WITNESS FASTEST GROWTH DURING FORECAST PERIOD

- FIGURE 11 ASIA PACIFIC ACCOUNTED FOR LARGEST SHARE OF COLLABORATIVE ROBOT MARKET IN 2024

- FIGURE 12 INCREASED DEMAND FOR COBOTS IN AUTOMOTIVE AND ELECTRONICS INDUSTRIES TO DRIVE MARKET

- FIGURE 13 MORE THAN 25 KG SEGMENT TO RECORD HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 14 HANDLING SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 15 AUTOMOTIVE INDUSTRY TO BE LARGEST END USER DURING FORECAST PERIOD

- FIGURE 16 INDIA TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 17 COLLABORATIVE ROBOT MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 18 COLLABORATIVE ROBOT MARKET: IMPACT ANALYSIS OF DRIVERS

- FIGURE 19 E-COMMERCE MARKET STATISTICS (2017-2026)

- FIGURE 20 COLLABORATIVE ROBOT MARKET: IMPACT ANALYSIS OF RESTRAINTS

- FIGURE 21 COLLABORATIVE ROBOT MARKET: IMPACT ANALYSIS OF OPPORTUNITIES

- FIGURE 22 COLLABORATIVE ROBOT MARKET: IMPACT ANALYSIS OF CHALLENGES

- FIGURE 23 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- FIGURE 24 AVERAGE SELLING PRICE OF COLLABORATIVE ROBOTS OFFERED BY KEY PLAYERS, BY PAYLOAD

- FIGURE 25 AVERAGE SELLING PRICE TREND FOR COLLABORATIVE ROBOTS, BY REGION (2021-2030)

- FIGURE 26 VALUE CHAIN ANALYSIS: MAJOR VALUE ADDED DURING MANUFACTURING AND RESEARCH & DEVELOPMENT STAGES

- FIGURE 27 COLLABORATIVE ROBOT MARKET: ECOSYSTEM ANALYSIS

- FIGURE 28 PATENTS APPLIED AND GRANTED, 2014-2024

- FIGURE 29 IMPORT DATA FOR HS CODE 847950-COMPLIANT PRODUCTS FOR TOP FIVE COUNTRIES, 2019-2023

- FIGURE 30 EXPORT DATA FOR HS CODE 847950 -COMPLIANT PRODUCTS FOR TOP FIVE COUNTRIES, 2019-2023

- FIGURE 31 FUNDS RAISED BY COLLABORATIVE ROBOT MANUFACTURERS, 2021-2024

- FIGURE 32 COLLABORATIVE ROBOT MARKET: PORTER'S FIVE FORCES ANALYSIS

- FIGURE 33 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE INDUSTRIES

- FIGURE 34 KEY BUYING CRITERIA FOR TOP THREE INDUSTRIES

- FIGURE 35 IMPACT OF AI ON COLLABORATIVE ROBOT MARKET

- FIGURE 36 LESS THAN 5 KG SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 37 COLLABORATIVE ROBOT MARKET, BY COMPONENT

- FIGURE 38 HARDWARE SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 39 COLLABORATIVE ROBOT MARKET, BY APPLICATION

- FIGURE 40 HANDLING SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 41 COLLABORATIVE ROBOT MARKET: BY INDUSTRY

- FIGURE 42 ELECTRONICS SEGMENT TO RECORD HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 43 ASIA PACIFIC COLLABORATIVE ROBOT MARKET TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 44 NORTH AMERICA: COLLABORATIVE ROBOT MARKET SNAPSHOT

- FIGURE 45 EUROPE: COLLABORATIVE ROBOT MARKET SNAPSHOT

- FIGURE 46 ASIA PACIFIC: COLLABORATIVE ROBOT MARKET SNAPSHOT

- FIGURE 47 REVENUE ANALYSIS OF TOP THREE PLAYERS, 2020-2024

- FIGURE 48 MARKET SHARE ANALYSIS, 2024

- FIGURE 49 COMPANY VALUATION

- FIGURE 50 EV/EBITDA OF KEY VENDORS

- FIGURE 51 BRAND/PRODUCT COMPARISON

- FIGURE 52 COLLABORATIVE ROBOT MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2024

- FIGURE 53 COLLABORATIVE ROBOT MARKET: COMPANY FOOTPRINT

- FIGURE 54 COLLABORATIVE ROBOT MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2024

- FIGURE 55 FANUC CORPORATION: COMPANY SNAPSHOT

- FIGURE 56 ABB: COMPANY SNAPSHOT

- FIGURE 57 KUKA AG: COMPANY SNAPSHOT

- FIGURE 58 DENSO CORPORATION: COMPANY SNAPSHOT

- FIGURE 59 YASKAWA ELECTRIC CORPORATION: COMPANY SNAPSHOT

The global collaborative robot market is projected to grow from USD 1.42 billion in 2025 to USD 3.38 billion by 2030 at a CAGR of 18.9% from 2025 to 2030. Collaborative robots significantly benefit businesses of all sizes by enhancing operational efficiency, reducing labor costs, and improving workplace safety. Their flexibility, ease of integration, and ability to work alongside humans without extensive safety infrastructure make them accessible to both large enterprises and small and medium-sized businesses. Cobots facilitate a fast return on investment and can be easily redeployed for different tasks, making them perfect for a dynamic production scenario. This adaptability is one of the primary reasons for their increasing market penetration in various industries.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2020-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Million) |

| Segments | By Payload, Component, Application, Industry, and Region |

| Regions covered | North America, Europe, APAC, RoW |

"Hardware components to account for larger market share in 2030"

Hardware components in the collaborative robot market, including sensors, actuators, controllers, and robotic arms, form the core of cobot functionality. The growing demand for sophisticated and reliable robotic systems fuels investments in high-performance hardware components. With cobots' increased sophistication and complex-task handling capabilities, demand for solid hardware solutions is expanding even further. Also, continued innovation in lightweight materials and miniaturization reinforces hardware dominance. This element continues to be critical to facilitating safe, accurate, and effective human-robot collaboration.

"Handling applications to capture largest share of collaborative robot market throughout forecast period"

The handling application segment of the collaborative robot market is experiencing growth due to the high demand for material handling, picking and placing, packing, and palletizing functions. Collaborative robots, or cobots, are ideal for these applications because they offer precision, repeatability, and the ability to work safely alongside humans. Logistics, electronics, and automotive industries increasingly adopt cobots to enhance workflow efficiency. Their flexibility and ease of integration are key factors driving the growth of this segment.

"China to hold largest share of Asia Pacific collaborative robot market in 2030"

The collaborative robot market in China is driven by its strong manufacturing base and aggressive push toward industrial automation. The country's leadership in sectors such as electronics, automotive, and consumer goods creates substantial demand for flexible automation solutions. Cobots are particularly well-suited for China's dynamic production environments due to their ease of deployment, cost efficiency, and ability to work safely alongside humans. Moreover, government initiatives such as "Made in China 2025" further accelerate smart factory development and cobot adoption. Additionally, government initiatives such as "Made in China 2025" continue to accelerate smart factory development, and therefore the acceptance of cobots.

Extensive primary interviews were conducted with key industry experts in the collaborative robot market space to determine and verify the market size for various segments and subsegments gathered through secondary research. The breakup of primary participants for the report is shown below: The study contains insights from various industry experts, from component suppliers to Tier 1 companies and OEMs. The breakup of the primaries is as follows:

- By Company Type: Tier 1 - 40%, Tier 2 - 35%, and Tier 3 - 25%

- By Designation: C-level Executives - 45%, Directors - 35%, and Others - 20%

- By Region: North America - 30%, Europe - 22%, Asia Pacific - 40%, and RoW - 8%

Note: Three tiers of companies are defined based on their total revenue as of 2024; tier 1: revenue more than or equal to USD 500 million, tier 2: revenue between USD 100 million and USD 500 million, and tier 3: revenue less than or equal to USD 100 million. Other designations include sales and marketing executives, researchers, and members of various collaborative robot organizations.

Universal Robots A/S (Denmark), FANUC CORPORATION (Japan), ABB (Switzerland), TECHMAN ROBOT INC. (Taiwan), AUBO (BEIJING) ROBOTICS TECHNOLOGY CO., LTD (China), KUKA AG (Germany), Doosan Robotics Inc. (South Korea), DENSO CORPORATION (Japan), YASKAWA ELECTRIC CORPORATION (Japan), Rethink Robotics (US), SIASUN Robot & Automation CO., Ltd (China), Franka Robotics GmbH (Germany), Comau S.p.A. (Italy), F&P Robotics AG (Switzerland), Staubli International AG. (Switzerland), Bosch Rexroth AG (Germany), Productive Robotics LLC (US), NEURA Robotics GmbH (Germany), ElephantRobotics (China), Elite Robots (China), Niryo (France), Hanwha Group (South Korea), Omron Corporation (US), and MIP robotics (France) are some key players in the collaborative robot market.

The study includes an in-depth competitive analysis of these key players in the collaborative robot market, with their company profiles, recent developments, and key market strategies.

Study Coverage: This research report categorizes the collaborative robot market based on payload (less than 5 kg, 5-10 kg, 11-25 kg, more than 25 kg), component (hardware, software), application (handling, welding & soldering, assembling & disassembling, dispensing, processing, other applications), industry (automotive, electronics, metals & machining, plastics & polymers, food & beverages, furniture & equipment, healthcare, logistics, other industries), and region (North America, Europe, Asia Pacific and RoW). The report describes the major drivers, restraints, challenges, and opportunities pertaining to the collaborative robot market and forecasts the same till 2030. The report also consists of leadership mapping and analysis of all the companies included in the collaborative robot ecosystem.

Key Benefits of Buying the Report The report will help the market leaders/new entrants in this market by providing information on the closest approximations of the revenue numbers for the overall collaborative robot market and the subsegments. This report will help stakeholders understand the competitive landscape and gain more insights to position their businesses better and plan suitable go-to-market strategies. The report also helps stakeholders understand the market pulse and provides information on key market drivers, restraints, challenges, and opportunities.

The report provides insights on the following pointers:

- Analysis of key drivers (higher return on investment than traditional industrial robotic systems, increased demand in e-commerce and logistics sectors, significant benefits in businesses of all sizes, and easy programming of cobots) restraints (higher preference for low-payload-capacity robots in heavy-duty industrial applications), opportunities (increasing focus of automation experts on pairing robotic arms with mobile platforms, growing number of subscriptions for Robotics-as-a-Service model, rising demand for automation in healthcare industry), and challenges (payload and speed limitations due to inherently designed cobots, difficulties in adapting to new standards and cybersecurity challenges related to connected robots) influencing the growth of the collaborative robot market

- Product Development/Innovation: Detailed insights into upcoming technologies, research and development activities, and the latest product and service launches in the collaborative robot market

- Market Development: Comprehensive information about lucrative markets - the report analyzes the collaborative robot market across varied regions

- Market Diversification: Exhaustive information about new products and services, untapped geographies, recent developments, and investments in the collaborative robot market

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and service offerings of leading players, such as Universal Robots A/S (Denmark), FANUC CORPORATION (Japan), ABB (Switzerland), TECHMAN ROBOT INC. (Taiwan), AUBO (BEIJING) ROBOTICS TECHNOLOGY CO., LTD (China) in the collaborative robot market

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED AND REGIONAL SCOPE

- 1.3.2 INCLUSIONS AND EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 UNITS CONSIDERED

- 1.6 LIMITATIONS

- 1.7 STAKEHOLDERS

- 1.8 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 List of key secondary sources

- 2.1.1.2 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 List of primary interview participants

- 2.1.2.2 Key data from primary sources

- 2.1.2.3 Key industry insights

- 2.1.2.4 Breakdown of primary interviews

- 2.1.3 SECONDARY AND PRIMARY RESEARCH

- 2.1.1 SECONDARY DATA

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 BOTTOM-UP APPROACH

- 2.2.1.1 Approach to capture market size using bottom-up analysis (demand side)

- 2.2.2 TOP-DOWN APPROACH

- 2.2.2.1 Approach to capture market size using top-down analysis (supply side)

- 2.2.1 BOTTOM-UP APPROACH

- 2.3 DATA TRIANGULATION

- 2.4 RESEARCH ASSUMPTIONS

- 2.4.1 ASSUMPTIONS

- 2.5 RESEARCH LIMITATIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN COLLABORATIVE ROBOT MARKET

- 4.2 COLLABORATIVE ROBOT MARKET, BY PAYLOAD

- 4.3 COLLABORATIVE ROBOT MARKET, BY APPLICATION

- 4.4 COLLABORATIVE ROBOT MARKET, BY INDUSTRY

- 4.5 COLLABORATIVE ROBOT MARKET, BY COUNTRY

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Higher return on investment than traditional industrial robotic systems

- 5.2.1.2 Increased demand in e-commerce and logistics sectors

- 5.2.1.3 Significant benefits for businesses of all sizes

- 5.2.1.4 Easy programming of cobots

- 5.2.2 RESTRAINTS

- 5.2.2.1 Higher preference for low-payload-capacity robots in heavy-duty industrial applications

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Increasing focus of automation experts on pairing robotic arms with mobile platforms

- 5.2.3.2 Growing number of subscriptions for Robotics-as-a-Service model

- 5.2.3.3 Rising demand for automation in healthcare industry

- 5.2.4 CHALLENGES

- 5.2.4.1 Inherent payload and speed limitations

- 5.2.4.2 Difficulties in adapting to new standards and cybersecurity challenges related to connected robots

- 5.2.1 DRIVERS

6 MARKET OVERVIEW

- 6.1 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 6.2 PRICING ANALYSIS

- 6.2.1 AVERAGE SELLING PRICE OF COLLABORATIVE ROBOTS OFFERED BY KEY PLAYERS, BY PAYLOAD

- 6.2.2 AVERAGE SELLING PRICE TREND, BY REGION

- 6.3 VALUE CHAIN ANALYSIS

- 6.4 ECOSYSTEM ANALYSIS

- 6.5 TECHNOLOGY ANALYSIS

- 6.5.1 KEY TECHNOLOGIES

- 6.5.1.1 Integration of embedded vision with collaborative robots

- 6.5.1.2 Pairing of collaborative robots with mobile platforms

- 6.5.2 COMPLEMENTARY TECHNOLOGIES

- 6.5.2.1 Penetration of IIoT and AI in industrial manufacturing

- 6.5.2.2 Adoption of innovative grippers in robotics manipulation

- 6.5.3 ADJACENT TECHNOLOGIES

- 6.5.3.1 Penetration of 5G in industrial manufacturing

- 6.5.1 KEY TECHNOLOGIES

- 6.6 PATENT ANALYSIS

- 6.7 TRADE ANALYSIS

- 6.7.1 IMPORT SCENARIO (HS CODE 847950)

- 6.7.2 EXPORT SCENARIO (HS CODE 847950)

- 6.8 KEY CONFERENCES AND EVENTS, 2025-2026

- 6.9 CASE STUDY ANALYSIS

- 6.9.1 SEAT COMPONENTS - STREAMLINING GEARBOX MANUFACTURING WITH COLLABORATIVE ROBOTS

- 6.9.2 FINNISH MANUFACTURER OVERCOMING WELDING CAPACITY CHALLENGES WITH ABB GOFA COBOTS

- 6.9.3 ACTION PLASTICS - TRANSFORMING PRODUCTION WITH OB7 COLLABORATIVE ROBOTS

- 6.9.4 ABB GOFA COBOT BOOSTS PRODUCTION CAPACITY FOR METEC

- 6.9.5 NAPCO BRANDS - REVOLUTIONIZING COFFEE BEAN PACKAGING WITH COLLABORATIVE ROBOTS

- 6.10 INVESTMENT AND FUNDING SCENARIO

- 6.11 TARIFF AND REGULATORY LANDSCAPE

- 6.11.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 6.11.2 STANDARDS AND REGULATIONS RELATED TO COLLABORATIVE ROBOTS

- 6.12 PORTER'S FIVE FORCES ANALYSIS

- 6.12.1 THREAT OF NEW ENTRANTS

- 6.12.2 THREAT OF SUBSTITUTES

- 6.12.3 BARGAINING POWER OF SUPPLIERS

- 6.12.4 BARGAINING POWER OF BUYERS

- 6.12.5 INTENSITY OF COMPETITIVE RIVALRY

- 6.13 KEY STAKEHOLDERS AND BUYING CRITERIA

- 6.13.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 6.13.2 BUYING CRITERIA

- 6.14 2025 US TARIFF IMPACT ON COLLABORATIVE ROBOT MARKET

- 6.14.1 INTRODUCTION

- 6.14.2 KEY TARIFF RATES

- 6.14.3 PRICE IMPACT ANALYSIS

- 6.14.4 KEY IMPACTS ON COUNTRIES/REGIONS

- 6.14.4.1 US

- 6.14.4.2 Europe

- 6.14.4.3 Asia Pacific

- 6.14.5 IMPACT ON END-USE INDUSTRIES

- 6.15 IMPACT OF AI ON COLLABORATIVE ROBOT MARKET

- 6.15.1 INTRODUCTION

7 INTEGRATION OF COBOTS AND IOT

- 7.1 INTRODUCTION

- 7.2 CONNECTIVITY TECHNOLOGY

- 7.2.1 ETHERNET

- 7.2.2 WI-FI

- 7.2.3 BLUETOOTH

- 7.2.4 CELLULAR

- 7.2.4.1 4G connectivity

- 7.2.4.2 5G connectivity

- 7.3 INTEROPERABILITY SOFTWARE

8 HUMAN-ROBOT COLLABORATIVE OPERATIONAL ENVIRONMENT

- 8.1 INTRODUCTION

- 8.2 SAFETY-RATED MONITORED STOP

- 8.3 HAND GUIDING

- 8.4 SPEED REDUCTION AND SEPARATION MONITORING

- 8.5 POWER AND FORCE LIMITING

9 COLLABORATIVE ROBOT MARKET, BY PAYLOAD

- 9.1 INTRODUCTION

- 9.2 LESS THAN 5 KG

- 9.2.1 INHERENT SAFETY FEATURES AND APPLICATIONS ACROSS INDUSTRIES TO DRIVE MARKET

- 9.3 5-10 KG

- 9.3.1 GROWING DEMAND IN FACTORY AUTOMATION TASKS TO DRIVE MARKET

- 9.4 11-25 KG

- 9.4.1 INCREASING DEPLOYMENT IN VARIOUS APPLICATIONS TO DRIVE MARKET

- 9.5 MORE THAN 25 KG

- 9.5.1 INCREASING DEMAND IN MANUFACTURING AND LOGISTICS TO DRIVE MARKET

10 COLLABORATIVE ROBOT MARKET, BY COMPONENT

- 10.1 INTRODUCTION

- 10.2 HARDWARE

- 10.2.1 ROBOTIC ARMS

- 10.2.1.1 Use of robotic arms with joints increasing to enable linear and circular motion

- 10.2.2 END EFFECTORS

- 10.2.2.1 Need for enhanced manufacturing efficiency to increase adoption

- 10.2.2.2 Welding guns

- 10.2.2.3 Grippers

- 10.2.2.3.1 Pneumatic grippers

- 10.2.2.3.2 Electric grippers

- 10.2.2.3.3 Dexterous robotic hands

- 10.2.2.3.3.1 4-finger robotic hands

- 10.2.2.3.3.2 5-finger robotic hands

- 10.2.2.3.4 Vacuum grippers

- 10.2.2.3.5 Magnetic grippers

- 10.2.2.4 Robotic screwdrivers

- 10.2.2.5 Sanding and deburring tools

- 10.2.2.6 Other EOATS

- 10.2.3 DRIVES

- 10.2.3.1 Reliance on drives to convert electrical energy into mechanical energy to drive demand

- 10.2.4 CONTROLLERS

- 10.2.4.1 Importance of enabling safe and effective human-robot collaboration to drive demand

- 10.2.5 SENSORS

- 10.2.5.1 Employment of sensors increasing to convert information into meaningful data

- 10.2.6 POWER SUPPLIES

- 10.2.6.1 Need for suitable power supplies for safe and efficient operation to drive demand

- 10.2.7 MOTORS

- 10.2.7.1 Need for rotational or linear force for precise movement and operation to drive demand

- 10.2.8 OTHER HARDWARE

- 10.2.1 ROBOTIC ARMS

- 10.3 SOFTWARE

- 10.3.1 RISING FOCUS ON DEVELOPING INTUITIVE PROGRAMMING SOFTWARE TO DRIVE MARKET

11 COLLABORATIVE ROBOT MARKET, BY APPLICATION

- 11.1 INTRODUCTION

- 11.2 HANDLING

- 11.2.1 PICK & PLACE

- 11.2.1.1 Offers easy-to-program solutions for first-time users

- 11.2.2 MATERIAL HANDLING

- 11.2.2.1 Technological advancements to increase capabilities of material-handling collaborative robots to drive market

- 11.2.3 PACKAGING & PALLETIZING

- 11.2.3.1 Requirement for medium payload collaborative robots to drive demand

- 11.2.4 MACHINE TENDING

- 11.2.4.1 Deployment of collaborative robots in CNC, injection, and blow molding operations to fuel demand

- 11.2.1 PICK & PLACE

- 11.3 ASSEMBLING & DISASSEMBLING

- 11.3.1 NUT FASTENING

- 11.3.1.1 Increasing adoption in nut-fastening processes on medium and large workpieces to drive market

- 11.3.2 SCREWDRIVING

- 11.3.2.1 Need for efficiency and consistency to drive market growth

- 11.3.1 NUT FASTENING

- 11.4 WELDING & SOLDERING

- 11.4.1 COLLABORATIVE ROBOTS SUITED FOR WELDING APPLICATIONS IN LOW-VOLUME, HIGH-MIX OPERATIONS

- 11.5 DISPENSING

- 11.5.1 GLUING

- 11.5.1.1 Robotic gluing ensures quality and consistency of application

- 11.5.2 PAINTING

- 11.5.2.1 Collaborative robot painting suitable for low-volume production

- 11.5.1 GLUING

- 11.6 PROCESSING

- 11.6.1 GRINDING

- 11.6.1.1 Use of force/torque sensors with end effectors ensuring consistency in grinding tasks

- 11.6.2 MILLING

- 11.6.2.1 Demand for automation in deburring, chamfering, and scraping requirements in milling tasks to boost market growth

- 11.6.3 CUTTING

- 11.6.3.1 Increasing demand in small-scale cutting applications to drive market

- 11.6.1 GRINDING

- 11.7 OTHER APPLICATIONS

- 11.7.1 INSPECTION & QUALITY TESTING

- 11.7.2 DIE-CASTING & MOLDING

12 COLLABORATIVE ROBOT MARKET, BY INDUSTRY

- 12.1 INTRODUCTION

- 12.2 AUTOMOTIVE

- 12.2.1 REQUIREMENT FOR PERFORMANCE OF LIGHT AND REPETITIVE TASKS TO DRIVE DEMAND

- 12.3 ELECTRONICS

- 12.3.1 NEED TO MANAGE SMALL AND FRAGILE COMPONENTS TO DRIVE DEMAND

- 12.4 METALS & MACHINING

- 12.4.1 INCREASING USE OF COLLABORATIVE ROBOTS ALONGSIDE CNC AND OTHER HEAVY MACHINERY TO DRIVE MARKET

- 12.5 PLASTICS & POLYMERS

- 12.5.1 ADOPTION OF LOW PAYLOAD CAPACITY COLLABORATIVE ROBOTS TO DRIVE DEMAND

- 12.6 FOOD & BEVERAGES

- 12.6.1 DEMAND IN PRIMARY AND SECONDARY HANDLING APPLICATIONS TO DRIVE MARKET

- 12.7 FURNITURE & EQUIPMENT

- 12.7.1 REQUIREMENT FOR VARIOUS PICK-AND-PLACE AND MACHINE-TENDING TASKS TO DRIVE DEMAND

- 12.8 HEALTHCARE

- 12.8.1 INCREASING DEMAND IN NON-SURGICAL APPLICATIONS TO DRIVE MARKET

- 12.9 LOGISTICS

- 12.9.1 INCREASING USE IN PICK & PLACE APPLICATIONS TO DRIVE DEMAND

- 12.10 OTHER INDUSTRIES

13 COLLABORATIVE ROBOT MARKET, BY REGION

- 13.1 INTRODUCTION

- 13.2 NORTH AMERICA

- 13.2.1 MACROECONOMIC OUTLOOK FOR NORTH AMERICA

- 13.2.2 US

- 13.2.2.1 Increased demand in various industries to drive market

- 13.2.3 CANADA

- 13.2.3.1 Foreign investments in automotive sector and government support for healthcare sector to drive market

- 13.2.4 MEXICO

- 13.2.4.1 Government measures to augment manufacturing activities to drive market

- 13.3 EUROPE

- 13.3.1 MACROECONOMIC OUTLOOK FOR EUROPE

- 13.3.2 GERMANY

- 13.3.2.1 Prominent presence of automotive and electronics industries to drive market

- 13.3.3 ITALY

- 13.3.3.1 Changing consumer needs in automotive sector to drive market

- 13.3.4 SPAIN

- 13.3.4.1 Adoption of automation in manufacturing industries to fuel demand

- 13.3.5 FRANCE

- 13.3.5.1 Government funding to boost automation and deployment of collaborative robots to drive market

- 13.3.6 UK

- 13.3.6.1 Investments in R&D to revive automotive industry to support market growth

- 13.3.7 REST OF EUROPE

- 13.4 ASIA PACIFIC

- 13.4.1 MACROECONOMIC OUTLOOK FOR ASIA PACIFIC

- 13.4.2 CHINA

- 13.4.2.1 Increasing investments in automation to drive market

- 13.4.3 SOUTH KOREA

- 13.4.3.1 Rising deployment in automotive and electronics industries to drive market

- 13.4.4 JAPAN

- 13.4.4.1 Increasing use of electric and hybrid vehicles to drive market

- 13.4.5 TAIWAN

- 13.4.5.1 Growth of electrical & electronics industry to drive market

- 13.4.6 THAILAND

- 13.4.6.1 Thailand 4.0 initiative to support market growth

- 13.4.7 INDIA

- 13.4.7.1 Increasing demand from manufacturing sector to drive market

- 13.4.8 REST OF ASIA PACIFIC

- 13.5 ROW

- 13.5.1 MACROECONOMIC OUTLOOK IN ROW

- 13.5.2 SOUTH AMERICA

- 13.5.2.1 Increasing adoption in healthcare sector to drive market

- 13.5.3 MIDDLE EAST

- 13.5.3.1 Increasing automation across various industries to fuel demand

- 13.5.3.2 GCC

- 13.5.3.2.1 Saudi Arabia

- 13.5.3.2.2 UAE

- 13.5.3.2.3 Rest of GCC

- 13.5.3.3 Rest of Middle East

- 13.5.4 AFRICA

- 13.5.4.1 Rising adoption in security and healthcare sectors to drive market

14 COMPETITIVE LANDSCAPE

- 14.1 OVERVIEW

- 14.2 KEY PLAYERS' STRATEGIES/RIGHT TO WIN, 2021-2025

- 14.3 REVENUE ANALYSIS

- 14.4 MARKET SHARE ANALYSIS, 2024

- 14.5 COMPANY VALUATION AND FINANCIAL METRICS

- 14.6 BRAND/PRODUCT COMPARISON

- 14.7 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 14.7.1 STARS

- 14.7.2 EMERGING LEADERS

- 14.7.3 PERVASIVE PLAYERS

- 14.7.4 PARTICIPANTS

- 14.7.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 14.7.5.1 Company footprint

- 14.7.5.2 Region footprint

- 14.7.5.3 Payload footprint

- 14.7.5.4 Application footprint

- 14.7.5.5 Industry footprint

- 14.8 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 14.8.1 PROGRESSIVE COMPANIES

- 14.8.2 RESPONSIVE COMPANIES

- 14.8.3 DYNAMIC COMPANIES

- 14.8.4 STARTING BLOCKS

- 14.8.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024

- 14.8.5.1 Detailed list of key startups/SMEs

- 14.8.5.2 Competitive benchmarking of key startups/SMEs

- 14.9 COMPETITIVE SCENARIO

- 14.9.1 PRODUCT LAUNCHES

- 14.9.2 DEALS

- 14.9.3 EXPANSIONS

15 COMPANY PROFILES

- 15.1 INTRODUCTION

- 15.2 KEY PLAYERS

- 15.2.1 UNIVERSAL ROBOTS A/S

- 15.2.1.1 Business overview

- 15.2.1.2 Products/Solutions/Services offered

- 15.2.1.3 Recent developments

- 15.2.1.3.1 Product launches

- 15.2.1.3.2 Deals

- 15.2.1.3.3 Expansions

- 15.2.1.4 MnM view

- 15.2.1.4.1 Key strengths

- 15.2.1.4.2 Strategic choices

- 15.2.1.4.3 Weaknesses and competitive threats

- 15.2.2 FANUC CORPORATION

- 15.2.2.1 Business overview

- 15.2.2.2 Products/Solutions/Services offered

- 15.2.2.3 Recent developments

- 15.2.2.3.1 Product launches

- 15.2.2.3.2 Expansions

- 15.2.2.4 MnM view

- 15.2.2.4.1 Key strengths

- 15.2.2.4.2 Strategic choices

- 15.2.2.4.3 Weaknesses and competitive threats

- 15.2.3 ABB

- 15.2.3.1 Business overview

- 15.2.3.2 Products/Solutions/Services offered

- 15.2.3.3 Recent developments

- 15.2.3.3.1 Product launches

- 15.2.3.3.2 Deals

- 15.2.3.3.3 Expansions

- 15.2.3.4 MnM view

- 15.2.3.4.1 Key strengths

- 15.2.3.4.2 Strategic choices

- 15.2.3.4.3 Weaknesses and competitive threats

- 15.2.4 TECHMAN ROBOT INC.

- 15.2.4.1 Business overview

- 15.2.4.2 Products/Solutions/Services offered

- 15.2.4.3 Recent developments

- 15.2.4.3.1 Product launches

- 15.2.4.3.2 Deals

- 15.2.4.4 MnM view

- 15.2.4.4.1 Key strengths

- 15.2.4.4.2 Strategic choices

- 15.2.4.4.3 Weaknesses and competitive threats

- 15.2.5 AUBO (BEIJING) ROBOTICS TECHNOLOGY CO., LTD.

- 15.2.5.1 Business overview

- 15.2.5.2 Products/Solutions/Services offered

- 15.2.5.3 Recent developments

- 15.2.5.3.1 Product launches

- 15.2.5.3.2 Deals

- 15.2.5.3.3 Expansions

- 15.2.5.4 MnM view

- 15.2.5.4.1 Key strengths

- 15.2.5.4.2 Strategic choices

- 15.2.5.4.3 Weaknesses and competitive threats

- 15.2.6 KUKA AG

- 15.2.6.1 Business overview

- 15.2.6.2 Products/Solutions/Services offered

- 15.2.6.3 Recent developments

- 15.2.6.3.1 Product launches

- 15.2.6.3.2 Deals

- 15.2.7 DOOSAN ROBOTICS INC.

- 15.2.7.1 Business overview

- 15.2.7.2 Products/Solutions/Services offered

- 15.2.7.3 Recent developments

- 15.2.7.3.1 Product launches

- 15.2.7.3.2 Deals

- 15.2.7.3.3 Expansions

- 15.2.8 DENSO CORPORATION

- 15.2.8.1 Business overview

- 15.2.8.2 Products/Solutions/Services offered

- 15.2.8.3 Recent developments

- 15.2.8.3.1 Deals

- 15.2.9 YASKAWA ELECTRIC CORPORATION

- 15.2.9.1 Business overview

- 15.2.9.2 Products/Solutions/Services offered

- 15.2.9.3 Recent developments

- 15.2.9.3.1 Deals

- 15.2.9.3.2 Expansions

- 15.2.10 RETHINK ROBOTICS

- 15.2.10.1 Business overview

- 15.2.10.2 Products/Solutions/Services offered

- 15.2.1 UNIVERSAL ROBOTS A/S

- 15.3 OTHER PLAYERS

- 15.3.1 SIASUN ROBOT & AUTOMATION CO., LTD.

- 15.3.2 FRANKA ROBOTICS GMBH

- 15.3.3 COMAU S.P.A.

- 15.3.4 F&P ROBOTICS AG

- 15.3.5 STAUBLI INTERNATIONAL AG

- 15.3.6 BOSCH REXROTH AG

- 15.3.7 PRODUCTIVE ROBOTICS LLC

- 15.3.8 NEURA ROBOTICS GMBH

- 15.3.9 ELEPHANTROBOTICS

- 15.3.10 ELITE ROBOTS

- 15.3.11 NIRYO

- 15.3.12 HANWHA CORPORATION

- 15.3.13 OMRON ADEPT TECHNOLOGY, INC.

- 15.3.14 MIP ROBOTICS

- 15.3.15 KAWASAKI ROBOTICS

- 15.3.16 DOBOT

- 15.3.17 JAKA ROBOTICS

- 15.3.18 HUILING-TECH ROBOTIC CO., LTD.

16 APPENDIX

- 16.1 DISCUSSION GUIDE

- 16.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 16.3 CUSTOMIZATION OPTIONS

- 16.4 RELATED REPORTS

- 16.5 AUTHOR DETAILS