|

|

市場調査レポート

商品コード

1136866

集団健康管理 (PHM) の世界市場:コンポーネント別 (ソフトウェア、サービス)・提供方式別 (オンプレミス、クラウドベース)・エンドユーザー別 (医療機関 (病院、ACO)、医療保険者、雇用者グループ、政府機関) の将来予測 (2027年まで)Population Health Management (PHM) Market by Component (Software, Services), Mode of Delivery (On-premise, Cloud-based), End User (Healthcare Providers (Hospitals, ACOs), Healthcare Payers, Employer Groups, Government Bodies) - Global Forecast to 2027 |

||||||

|

● お客様のご希望に応じて、既存データの加工や未掲載情報(例:国別セグメント)の追加などの対応が可能です。 詳細はお問い合わせください。 |

|||||||

| 集団健康管理 (PHM) の世界市場:コンポーネント別 (ソフトウェア、サービス)・提供方式別 (オンプレミス、クラウドベース)・エンドユーザー別 (医療機関 (病院、ACO)、医療保険者、雇用者グループ、政府機関) の将来予測 (2027年まで) |

|

出版日: 2022年10月10日

発行: MarketsandMarkets

ページ情報: 英文 201 Pages

納期: 即納可能

|

- 全表示

- 概要

- 目次

世界の集団健康管理市場は、2022年の278億米ドルから2027年には533億米ドルに達する見通しで、また予測期間中のCAGRは13.9%と見込まれています。

市場の主な促進要因として、地域社会の医療向上に向けた政府の取り組み強化、患者数の増加、高齢者人口の増加、医療費抑制のニーズの増大などが挙げられます。しかし、熟練したIT専門家の不足や高額なインフラ投資が、同市場の成長をある程度抑制するものと思われます。

コンポーネント別では、ソフトウェアセグメントが予測期間中に最大のセグメントとなり、最も高い成長を記録すると予測されています。同分野の成長要因は、業務効率の向上、ハードウェアへの先行投資が不要なこと、患者エンゲージメント強化に関連したソフトウェア採用の増加です。

エンドユーザー別では、2021年には医療提供者の分野が最も高い成長率で成長すると予測されています。医療費抑制ニーズの高まり、より良い財務結果へのニーズの高まり、ACAの義務化などが、今後の需要促進につながると考えられています。

地域別では、アジア太平洋が予測期間中に最も高いCAGRで成長すると予測されます。APAC地域の市場成長は主に、医療インフラの改善、メディカルツーリズムの拡大、HCIT導入に向けた政府の取り組み、医療費の増加、消費者の購買力向上などの要因が主な要因となっています。

当レポートでは、世界の集団健康管理 (PHM) の市場について分析し、市場の基本構造や最新情勢、主な市場促進・抑制要因、コンポーネント別・提供方式別・エンドユーザー別・地域別の市場動向の見通し、市場競争の状態、主要企業のプロファイルなどを調査しております。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- 市場力学

第6章 業界考察

- 産業動向

- イノベーション推進のための相互運用性と統合の必要性

- 支払者から提供者へのリスク負担のシフト

- 「患者中心の医療」に対する需要の高まり

- クラウドベースのITソリューション

- 医療提供者の統合

- エコシステム分析

- ACO (Accountable Care Organization) の進化:有望な支払い改革

- HCIT (医療用IT) の支出分析

- 北米

- 欧州

- アジア太平洋

- 規制分析

- ポーターのファイブフォース分析

- 特許分析

- 隣接市場の分析

- ケーススタディ

- 主な利害関係者と購入基準

- 主な会議とイベント (2022年~2023年)

- 顧客のビジネスに影響を与える動向/混乱

- 価格分析

- 初期費用

- 年間保守料

- 技術分析

- 人工知能 (AI) と機械学習 (ML) の統合

- データ分析

第7章 集団健康管理市場:コンポーネント別

- イントロダクション

- ソフトウェア

- サービス

第8章 集団健康管理市場:提供方式別

- イントロダクション

- オンプレミス提供モード

- クラウドベース提供モード

第9章 集団健康管理市場:エンドユーザー別

- イントロダクション

- 医療提供者

- 医療費支払者

- その他のエンドユーザー

第10章 集団健康管理市場:地域別

- イントロダクション

- 北米

- 米国

- カナダ

- 欧州

- ドイツ

- 英国

- フランス

- イタリア

- スペイン

- 他の欧州諸国

- アジア太平洋

- 日本

- 中国

- インド

- 他のアジア太平洋諸国

- ラテンアメリカ

- 中東・アフリカ

第11章 競合情勢

- イントロダクション

- 主要企業の戦略/有力企業

- 集団健康管理市場:研究開発費

- 主要企業の収益分析

- 主要企業の収益評価:地域別

- 企業評価クアドラント

- 競合リーダーシップのマッピング:新興企業/中小企業

- 主要企業の分析

- 競合状況・動向

- 製品の発売

- 資本取引

- その他の動向

第12章 企業プロファイル

- 主要企業

- CERNER CORPORATION

- ALLSCRIPTS HEALTHCARE SOLUTIONS

- IBM CORPORATION

- EPIC SYSTEMS CORPORATION

- KONINKLIJKE PHILIPS

- I2I POPULATION HEALTH

- HEALTH CATALYST

- OPTUM INC. (UNITEDHEALTH GROUPの子会社)

- ENLI HEALTH INTELLIGENCE (A CEDAR GROUP TECHNOLOGIES)

- ECLINICALWORKS

- HEALTHEC, LLC

- MEDECISION

- ARCADIA

- ATHENAHEALTH

- COTIVITI (VERSCEND TECHNOLOGIES)

- NEXTGEN HEALTHCARE, INC.

- その他の企業

- CONIFER HEALTH SOLUTIONS

- SPH ANALYTICS

- LIGHTBEAM HEALTH SOLUTIONS

- INNOVACCER

- LUMERIS

- ZEOMEGA

- HGS HEALTHCARE, LLC

- PERSIVIA

- COLOR HEALTH, INC.

第13章 付録

The global population health management market is projected to reach USD 53.3 billion by 2027 from USD 27.8 billion in 2022, at a CAGR of 13.9% during the forecast period. Growth in this market is driven by the growing government initiatives to improve community health, increasing patient pool, rising geriatric population and the growing need to curtail healthcare costs. However, lack of skilled IT professionals & high infrastructural investments are expected to restrain the growth of this market to a certain extent.

"The software segment is projected to be the largest segment& register the highest growth in the population health management market, by component"

Based on the component, the software segment is projected to be the largest segment& register the highest growth during the forecast period. Factors responsible for the growth of this segment is the increased adoption of software pertaining to improved operational efficiency, no upfront capital investment for hardware, enhanced patient engagement.

"Healthcare Providers was the largest segment by the end user of population health management market in 2021"

Healthcare providers segment is projected to grow at the highest growth rate in the population health management market in 2021. Growing need to curtail healthcare costs, rising need for better financial outcomes, ACA mandates is expected to drive the demand for population health management services in the coming years.

"APAC to witness the highest growth rate during the forecast period."

The Asia Pacific market is projected to grow at the highest CAGR during the forecast period. Market growth in the APAC region is mainly driven by factors such as the improving healthcare infrastructure, growing medical tourism, government initiatives for the adoption of HCIT, increasing healthcare expenditure, and the rising purchasing power of consumers will also propel market growth.

The break-down of primary participants is as mentioned below:

- By Company Type - Tier 1:40%, Tier 2: 35%, and Tier 3: 25%

- By Designation - C-level: 25%, Director-level: 55%,and Others: 20%

- By Region - North America: 40%,Europe: 25%,AsiaPacific: 20%, Latin America: 10%,and Middle East & Africa: 5%.

Key players in the Population Health Management Market

The key players operating in the population health management market includeCerner Corporation (US), Epic Systems Corporation (US), Koninklijke Philips (Netherlands), i2i Population Health (US), Health Catalyst (US), Optum (US), Enli Health Intelligence (US), eClinicalWorks (US), Allscripts Healthcare Solutions (US), IBM Corporation (US), HealthEC LLC (US), Medecision (US), Arcadia (US), athenahealth (US), Cotiviti (US), NextGen Healthcare, Inc. (US), Conifer Health Solutions (US), SPH Analytics (US), Lightbeam Health Solutions (US), Innovaccer (US).

Research Coverage:

The report analyses the population health management market and aims to estimate the market size and future growth potential of various market segments, based on components, delivery mode, end user, and region. The report also provides a competitive analysis of the key players operating in this market, along with their company profiles, product offerings, recent developments, and key market strategies.

Reasons to Buy the Report

This report will enrich established firms as well as new entrants/smaller firms to gauge the pulse of the market, which, in turn, would help them garner a greater share of the market. The report will help the leaders/new entrants in this market with information on the closest approximations of the revenue numbers for the overall market and the sub-segments. This report will help stakeholders understand the competitive landscape and gain more insights to better position their businesses and plan suitable go-to-market.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.2.1 INCLUSIONS AND EXCLUSIONS

- 1.2.2 MARKETS COVERED

- FIGURE 1 POPULATION HEALTH MANAGEMENT MARKET

- FIGURE 2 REGIONAL SEGMENTS COVERED

- 1.2.3 YEARS CONSIDERED

- 1.3 CURRENCY CONSIDERED

- TABLE 1 EXCHANGE RATES UTILIZED FOR CONVERSION TO USD

- 1.4 STAKEHOLDERS

- 1.5 LIMITATIONS

- 1.6 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- FIGURE 3 RESEARCH DESIGN

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- FIGURE 4 PRIMARY SOURCES

- 2.1.2.1 Key data from primary sources

- 2.1.2.2 Insights from primary experts

- FIGURE 5 BREAKDOWN OF PRIMARY INTERVIEWS: SUPPLY SIDE AND DEMAND SIDE PARTICIPANTS

- FIGURE 6 BREAKDOWN OF PRIMARY INTERVIEWS (SUPPLY SIDE): BY COMPANY TYPE, DESIGNATION, AND REGION

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 APPROACH 1: BOTTOM-UP APPROACH (DEMAND SIDE ANALYSIS)

- FIGURE 7 BOTTOM-UP APPROACH (DEMAND SIDE ANALYSIS)

- FIGURE 8 CAGR PROJECTIONS: SUPPLY SIDE ANALYSIS

- 2.2.2 APPROACH 2: TOP-DOWN APPROACH (SUPPLY SIDE ANALYSIS)

- FIGURE 9 TOP-DOWN APPROACH

- 2.3 MARKET BREAKDOWN AND DATA TRIANGULATION

- FIGURE 10 DATA TRIANGULATION METHODOLOGY

- 2.4 RESEARCH ASSUMPTIONS

- 2.5 RISK ASSESSMENT

- TABLE 2 RISK ASSESSMENT: POPULATION HEALTH MANAGEMENT MARKET

3 EXECUTIVE SUMMARY

- FIGURE 11 POPULATION HEALTH MANAGEMENT MARKET, BY COMPONENT, 2022 VS. 2027 (USD MILLION)

- FIGURE 12 POPULATION HEALTH MANAGEMENT MARKET, BY MODE OF DELIVERY, 2022 VS. 2027 (USD MILLION)

- FIGURE 13 POPULATION HEALTH MANAGEMENT MARKET, BY END USER, 2022 VS. 2027 (USD MILLION)

- FIGURE 14 POPULATION HEALTH MANAGEMENT MARKET: GEOGRAPHICAL SNAPSHOT

4 PREMIUM INSIGHTS

- 4.1 POPULATION HEALTH MANAGEMENT MARKET OVERVIEW

- FIGURE 15 NEED TO CURTAIL ESCALATING HEALTHCARE COSTS TO DRIVE MARKET

- 4.2 ASIA PACIFIC: POPULATION HEALTH MANAGEMENT MARKET, BY END USER AND COUNTRY (2021)

- FIGURE 16 JAPAN DOMINATED ASIA PACIFIC MARKET IN 2021

- 4.3 POPULATION HEALTH MANAGEMENT MARKET: GEOGRAPHIC GROWTH OPPORTUNITIES

- FIGURE 17 CHINA TO REGISTER HIGHEST GROWTH RATE DURING FORECAST PERIOD

- 4.4 REGIONAL MIX: POPULATION HEALTH MANAGEMENT MARKET (2022-2027)

- FIGURE 18 NORTH AMERICA TO DOMINATE GLOBAL MARKET DURING FORECAST PERIOD

- 4.5 POPULATION HEALTH MANAGEMENT MARKET: DEVELOPED VS. DEVELOPING MARKETS

- FIGURE 19 DEVELOPING MARKETS TO REGISTER HIGHER GROWTH RATES DURING FORECAST PERIOD

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- TABLE 3 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES: IMPACT ANALYSIS

- FIGURE 20 POPULATION HEALTH MANAGEMENT MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- 5.2.1 DRIVERS

- 5.2.1.1 Government mandates and support for healthcare IT solutions

- 5.2.1.2 Need to curtail escalating healthcare costs

- FIGURE 21 US HEALTHCARE SPENDING, 2012-2020 (USD BILLION)

- 5.2.1.3 Rising geriatric population and subsequent growth in chronic disease burden

- 5.2.2 RESTRAINTS

- 5.2.2.1 High investments in infrastructure to set up robust PHM program

- 5.2.2.2 Rising data breach concerns

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Growing importance of emerging markets in healthcare sector

- 5.2.3.2 Rising focus on personalized medicine

- 5.2.3.3 Increasing focus on value-based medicine

- 5.2.4 CHALLENGES

- 5.2.4.1 Lack of data management capabilities and skilled analysts

- 5.2.4.2 Interoperability issues

6 INDUSTRY INSIGHTS

- 6.1 INDUSTRY TRENDS

- 6.1.1 NEED FOR INTEROPERABILITY AND INTEGRATION TO DRIVE INNOVATION

- 6.1.2 SHIFT OF RISK BURDEN FROM PAYERS TO PROVIDERS

- 6.1.3 GROWING DEMAND FOR PATIENT-CENTRIC HEALTHCARE

- FIGURE 22 VALUE-BASED CARE WORKFLOW

- 6.1.4 CLOUD-BASED IT SOLUTIONS

- 6.1.5 CONSOLIDATION OF HEALTHCARE PROVIDERS

- 6.2 ECOSYSTEM ANALYSIS

- FIGURE 23 POPULATION HEALTH MANAGEMENT MARKET: ECOSYSTEM ANALYSIS

- 6.3 EVOLUTION OF ACOS: A PROMISING PAYMENT REFORM

- 6.3.1 INTRODUCTION

- FIGURE 24 ACOS: REIMBURSEMENT MODEL

- 6.3.2 US: EVOLUTION OF ACOS

- FIGURE 25 EVOLUTION OF ACO MODELS

- 6.3.3 ROLE OF INFORMATION TECHNOLOGY IN ACCOUNTABLE CARE

- FIGURE 26 ACCOUNTABLE CARE SOLUTIONS AND THEIR USE

- 6.4 HCIT EXPENDITURE ANALYSIS

- 6.4.1 NORTH AMERICA

- TABLE 4 NORTH AMERICA: HEALTHCARE EXPENDITURE, BY COUNTRY

- 6.4.2 EUROPE

- 6.4.3 ASIA PACIFIC

- TABLE 5 JAPAN: HEALTHCARE IT INITIATIVES AND FUNDING

- TABLE 6 CHINA: HEALTHCARE IT INITIATIVES AND FUNDING

- 6.5 REGULATORY ANALYSIS

- 6.5.1 NORTH AMERICA

- 6.5.2 EUROPE

- 6.5.3 ASIA PACIFIC

- 6.6 PORTER'S FIVE FORCES ANALYSIS

- FIGURE 27 DEGREE OF COMPETITION TO BE HIGH IN POPULATION HEALTH MANAGEMENT MARKET

- TABLE 7 POPULATION HEALTH MANAGEMENT MARKET: PORTER'S FIVE FORCES ANALYSIS

- 6.7 PATENT ANALYSIS

- FIGURE 28 TOP PATENT OWNERS AND APPLICANTS FOR POPULATION HEALTH MANAGEMENT SOLUTIONS (JANUARY 2011-SEPTEMBER 2022)

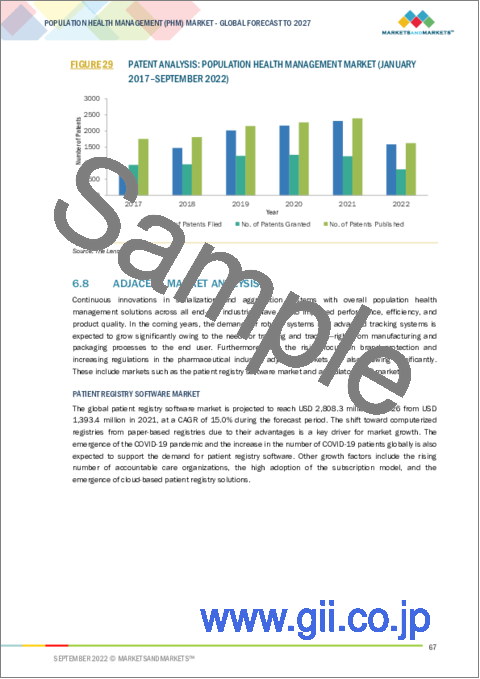

- FIGURE 29 PATENT ANALYSIS: POPULATION HEALTH MANAGEMENT MARKET (JANUARY 2017-SEPTEMBER 2022)

- 6.8 ADJACENT MARKET ANALYSIS

- FIGURE 30 PATIENT REGISTRY SOFTWARE MARKET: MARKET OVERVIEW

- FIGURE 31 AMBULATORY EHR MARKET: MARKET OVERVIEW

- 6.9 CASE STUDY

- 6.10 KEY STAKEHOLDERS AND BUYING CRITERIA

- 6.10.1 KEY STAKEHOLDERS IN BUYING PROCESS

- FIGURE 32 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS

- TABLE 8 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS FOR DEPLOYMENT MODES (%)

- 6.10.2 BUYING CRITERIA

- FIGURE 33 KEY BUYING CRITERIA FOR DEPLOYMENT MODES

- TABLE 9 KEY BUYING CRITERIA FOR DEPLOYMENT MODES

- 6.11 KEY CONFERENCES AND EVENTS (2022-2023)

- 6.12 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS' BUSINESSES

- FIGURE 34 REVENUE SHIFT IN POPULATION HEALTH MANAGEMENT MARKET

- 6.13 PRICING ANALYSIS

- 6.13.1 INITIAL FEES

- TABLE 10 PRE-ELEMENT FEE FOR PHM SOLUTIONS

- 6.13.2 ANNUAL MAINTENANCE FEES

- TABLE 11 ANNUAL MAINTENANCE FEE FOR PHM SOLUTIONS

- 6.14 TECHNOLOGY ANALYSIS

- 6.14.1 INTEGRATION OF AI AND ML

- 6.14.2 DATA ANALYTICS

7 POPULATION HEALTH MANAGEMENT MARKET, BY COMPONENT

- 7.1 INTRODUCTION

- TABLE 12 POPULATION HEALTH MANAGEMENT MARKET, BY COMPONENT, 2020-2027 (USD MILLION)

- 7.2 SOFTWARE

- 7.2.1 SOFTWARE TO DOMINATE COMPONENT SEGMENT

- TABLE 13 POPULATION HEALTH MANAGEMENT SOFTWARE OFFERED BY KEY PLAYERS

- TABLE 14 POPULATION HEALTH MANAGEMENT SOFTWARE MARKET, BY COUNTRY, 2020-2027 (USD MILLION)

- 7.3 SERVICES

- 7.3.1 INDISPENSABLE AND RECURRING NATURE OF SERVICES TO PROPEL MARKET

- TABLE 15 POPULATION HEALTH MANAGEMENT SERVICES OFFERED BY KEY PLAYERS

- TABLE 16 POPULATION HEALTH MANAGEMENT SERVICES MARKET, BY COUNTRY, 2020-2027 (USD MILLION)

8 POPULATION HEALTH MANAGEMENT MARKET, BY MODE OF DELIVERY

- 8.1 INTRODUCTION

- TABLE 17 POPULATION HEALTH MANAGEMENT MARKET, BY MODE OF DELIVERY, 2020-2027 (USD MILLION)

- 8.2 ON-PREMISE MODE OF DELIVERY

- 8.2.1 TRADITIONAL ON-PREMISE DEPLOYMENT TO ALLOW TIME TO TEST SOFTWARE UPGRADES BEFORE IMPLEMENTATION

- TABLE 18 ON-PREMISE MODE OF DELIVERY: PROS AND CONS

- TABLE 19 POPULATION HEALTH MANAGEMENT MARKET FOR ON-PREMISE SOLUTIONS, BY COUNTRY, 2020-2027 (USD MILLION)

- 8.3 CLOUD-BASED MODE OF DELIVERY

- 8.3.1 CLOUD-BASED DELIVERY TO REGISTER HIGHEST GROWTH DURING FORECAST PERIOD

- TABLE 20 CLOUD-BASED MODE OF DELIVERY: PROS AND CONS

- TABLE 21 POPULATION HEALTH MANAGEMENT MARKET FOR CLOUD-BASED SOLUTIONS, BY COUNTRY, 2020-2027 (USD MILLION)

9 POPULATION HEALTH MANAGEMENT MARKET, BY END USER

- 9.1 INTRODUCTION

- TABLE 22 POPULATION HEALTH MANAGEMENT MARKET, BY END USER, 2020-2027 (USD MILLION)

- 9.2 HEALTHCARE PROVIDERS

- 9.2.1 NEED TO IMPROVE PROFITABILITY OF HEALTHCARE OPERATIONS TO BOOST MARKET

- TABLE 23 POPULATION HEALTH MANAGEMENT MARKET FOR HEALTHCARE PROVIDERS, BY COUNTRY, 2020-2027 (USD MILLION)

- 9.3 HEALTHCARE PAYERS

- 9.3.1 INCREASED FOCUS ON OUTCOME-BASED PAYMENT MODELS TO STIMULATE DEMAND FOR PHM SOLUTIONS

- TABLE 24 POPULATION HEALTH MANAGEMENT MARKET FOR HEALTHCARE PAYERS, BY COUNTRY, 2020-2027 (USD MILLION)

- 9.4 OTHER END USERS

- TABLE 25 POPULATION HEALTH MANAGEMENT MARKET FOR OTHER END USERS, BY COUNTRY, 2020-2027 (USD MILLION)

10 POPULATION HEALTH MANAGEMENT MARKET, BY REGION

- 10.1 INTRODUCTION

- TABLE 26 POPULATION HEALTH MANAGEMENT MARKET, BY REGION, 2020-2027 (USD MILLION)

- 10.2 NORTH AMERICA

- FIGURE 35 NORTH AMERICA: POPULATION HEALTH MANAGEMENT MARKET SNAPSHOT

- TABLE 27 NORTH AMERICA: POPULATION HEALTH MANAGEMENT MARKET, BY COUNTRY, 2020-2027 (USD MILLION)

- TABLE 28 NORTH AMERICA: POPULATION HEALTH MANAGEMENT MARKET, BY COMPONENT, 2020-2027 (USD MILLION)

- TABLE 29 NORTH AMERICA: POPULATION HEALTH MANAGEMENT MARKET, BY MODE OF DELIVERY, 2020-2027 (USD MILLION)

- TABLE 30 NORTH AMERICA: POPULATION HEALTH MANAGEMENT MARKET, BY END USER, 2020-2027 (USD MILLION)

- 10.2.1 US

- 10.2.1.1 US to dominate North American market during forecast period

- TABLE 31 US: MACROECONOMIC INDICATORS

- TABLE 32 US: POPULATION HEALTH MANAGEMENT MARKET, BY COMPONENT, 2020-2027 (USD MILLION)

- TABLE 33 US: POPULATION HEALTH MANAGEMENT MARKET, BY MODE OF DELIVERY, 2020-2027 (USD MILLION)

- TABLE 34 US: POPULATION HEALTH MANAGEMENT MARKET, BY END USER, 2020-2027 (USD MILLION)

- 10.2.2 CANADA

- 10.2.2.1 Deployment of digital health initiatives to boost market

- TABLE 35 CANADA: MACROECONOMIC INDICATORS

- TABLE 36 CANADA: POPULATION HEALTH MANAGEMENT MARKET, BY COMPONENT, 2020-2027 (USD MILLION)

- TABLE 37 CANADA: POPULATION HEALTH MANAGEMENT MARKET, BY MODE OF DELIVERY, 2020-2027 (USD MILLION)

- TABLE 38 CANADA: POPULATION HEALTH MANAGEMENT MARKET, BY END USER, 2020-2027 (USD MILLION)

- 10.3 EUROPE

- TABLE 39 EUROPE: E-HEALTH PRIORITIES FOR HEALTHCARE PROVIDERS, BY COUNTRY, 2019

- TABLE 40 EUROPE: POPULATION HEALTH MANAGEMENT MARKET, BY COUNTRY, 2020-2027 (USD MILLION)

- TABLE 41 EUROPE: POPULATION HEALTH MANAGEMENT MARKET, BY COMPONENT, 2020-2027 (USD MILLION)

- TABLE 42 EUROPE: POPULATION HEALTH MANAGEMENT MARKET, BY MODE OF DELIVERY, 2020-2027 (USD MILLION)

- TABLE 43 EUROPE: POPULATION HEALTH MANAGEMENT MARKET, BY END USER, 2020-2027 (USD MILLION)

- 10.3.1 GERMANY

- 10.3.1.1 Germany to dominate European population health management market

- TABLE 44 GERMANY: MACROECONOMIC INDICATORS

- TABLE 45 GERMANY: POPULATION HEALTH MANAGEMENT MARKET, BY COMPONENT, 2020-2027 (USD MILLION)

- TABLE 46 GERMANY: POPULATION HEALTH MANAGEMENT MARKET, BY MODE OF DELIVERY, 2020-2027 (USD MILLION)

- TABLE 47 GERMANY: POPULATION HEALTH MANAGEMENT MARKET, BY END USER, 2020-2027 (USD MILLION)

- 10.3.2 UK

- 10.3.2.1 Increasing public-private initiatives to support adoption of PHM solutions

- TABLE 48 UK: MACROECONOMIC INDICATORS

- TABLE 49 UK: POPULATION HEALTH MANAGEMENT MARKET, BY COMPONENT, 2020-2027 (USD MILLION)

- TABLE 50 UK: POPULATION HEALTH MANAGEMENT MARKET, BY MODE OF DELIVERY, 2020-2027 (USD MILLION)

- TABLE 51 UK: POPULATION HEALTH MANAGEMENT MARKET, BY END USER, 2020-2027 (USD MILLION)

- 10.3.3 FRANCE

- 10.3.3.1 Increasing patient volume for chronic and age-related conditions to fuel market

- TABLE 52 FRANCE: MACROECONOMIC INDICATORS

- TABLE 53 FRANCE: POPULATION HEALTH MANAGEMENT MARKET, BY COMPONENT, 2020-2027 (USD MILLION)

- TABLE 54 FRANCE: POPULATION HEALTH MANAGEMENT MARKET, BY MODE OF DELIVERY, 2020-2027 (USD MILLION)

- TABLE 55 FRANCE: POPULATION HEALTH MANAGEMENT MARKET, BY END USER, 2020-2027 (USD MILLION)

- 10.3.4 ITALY

- 10.3.4.1 Government initiatives to support market

- TABLE 56 ITALY: MACROECONOMIC INDICATORS

- TABLE 57 ITALY: POPULATION HEALTH MANAGEMENT MARKET, BY COMPONENT, 2020-2027 (USD MILLION)

- TABLE 58 ITALY: POPULATION HEALTH MANAGEMENT MARKET, BY MODE OF DELIVERY, 2020-2027 (USD MILLION)

- TABLE 59 ITALY: POPULATION HEALTH MANAGEMENT MARKET, BY END USER, 2020-2027 (USD MILLION)

- 10.3.5 SPAIN

- 10.3.5.1 Demand for e-prescriptions and better patient record management to drive adoption of PHM solutions

- TABLE 60 SPAIN: MACROECONOMIC INDICATORS

- TABLE 61 SPAIN: POPULATION HEALTH MANAGEMENT MARKET, BY COMPONENT, 2020-2027 (USD MILLION)

- TABLE 62 SPAIN: POPULATION HEALTH MANAGEMENT MARKET, BY MODE OF DELIVERY, 2020-2027 (USD MILLION)

- TABLE 63 SPAIN: POPULATION HEALTH MANAGEMENT MARKET, BY END USER, 2020-2027 (USD MILLION)

- 10.3.6 REST OF EUROPE

- TABLE 64 REST OF EUROPE: POPULATION HEALTH MANAGEMENT MARKET, BY COMPONENT, 2020-2027 (USD MILLION)

- TABLE 65 REST OF EUROPE: POPULATION HEALTH MANAGEMENT MARKET, BY MODE OF DELIVERY, 2020-2027 (USD MILLION)

- TABLE 66 REST OF EUROPE: POPULATION HEALTH MANAGEMENT MARKET, BY END USER, 2020-2027 (USD MILLION)

- 10.4 ASIA PACIFIC

- FIGURE 36 ASIA PACIFIC: POPULATION HEALTH MANAGEMENT MARKET SNAPSHOT

- TABLE 67 ASIA PACIFIC: POPULATION HEALTH MANAGEMENT MARKET, BY COUNTRY, 2020-2027 (USD MILLION)

- TABLE 68 ASIA PACIFIC: POPULATION HEALTH MANAGEMENT MARKET, BY COMPONENT, 2020-2027 (USD MILLION)

- TABLE 69 ASIA PACIFIC: POPULATION HEALTH MANAGEMENT MARKET, BY MODE OF DELIVERY, 2020-2027 (USD MILLION)

- TABLE 70 ASIA PACIFIC: POPULATION HEALTH MANAGEMENT MARKET, BY END USER, 2020-2027 (USD MILLION)

- 10.4.1 JAPAN

- 10.4.1.1 Japan accounted for largest share of Asia Pacific market in 2021

- TABLE 71 JAPAN: MACROECONOMIC INDICATORS

- TABLE 72 JAPAN: POPULATION HEALTH MANAGEMENT MARKET, BY COMPONENT, 2020-2027 (USD MILLION)

- TABLE 73 JAPAN: POPULATION HEALTH MANAGEMENT MARKET, BY MODE OF DELIVERY, 2020-2027 (USD MILLION)

- TABLE 74 JAPAN: POPULATION HEALTH MANAGEMENT MARKET, BY END USER, 2020-2027 (USD MILLION)

- 10.4.2 CHINA

- 10.4.2.1 Strong government support to propel market

- TABLE 75 CHINA: MACROECONOMIC INDICATORS

- TABLE 76 CHINA: POPULATION HEALTH MANAGEMENT MARKET, BY COMPONENT, 2020-2027 (USD MILLION)

- TABLE 77 CHINA: POPULATION HEALTH MANAGEMENT MARKET, BY MODE OF DELIVERY, 2020-2027 (USD MILLION)

- TABLE 78 CHINA: POPULATION HEALTH MANAGEMENT MARKET, BY END USER, 2020-2027 (USD MILLION)

- 10.4.3 INDIA

- 10.4.3.1 Growing volume of patient data generated within healthcare systems to drive market

- TABLE 79 INDIA: MACROECONOMIC INDICATORS

- TABLE 80 INDIA: POPULATION HEALTH MANAGEMENT MARKET, BY COMPONENT, 2020-2027 (USD MILLION)

- TABLE 81 INDIA: POPULATION HEALTH MANAGEMENT MARKET, BY MODE OF DELIVERY, 2020-2027 (USD MILLION)

- TABLE 82 INDIA: POPULATION HEALTH MANAGEMENT MARKET, BY END USER, 2020-2027 (USD MILLION)

- 10.4.4 REST OF ASIA PACIFIC

- TABLE 83 REST OF ASIA PACIFIC: POPULATION HEALTH MANAGEMENT MARKET, BY COMPONENT, 2020-2027 (USD MILLION)

- TABLE 84 REST OF ASIA PACIFIC: POPULATION HEALTH MANAGEMENT MARKET, BY MODE OF DELIVERY, 2020-2027 (USD MILLION)

- TABLE 85 REST OF ASIA PACIFIC: POPULATION HEALTH MANAGEMENT MARKET, BY END USER, 2020-2027 (USD MILLION)

- 10.5 LATIN AMERICA

- 10.5.1 BRAZIL, ARGENTINA, AND MEXICO TO EMERGE AS POTENTIAL HEALTHCARE MARKETS

- TABLE 86 LATIN AMERICA: POPULATION HEALTH MANAGEMENT MARKET, BY COMPONENT, 2020-2027 (USD MILLION)

- TABLE 87 LATIN AMERICA: POPULATION HEALTH MANAGEMENT MARKET, BY MODE OF DELIVERY, 2020-2027 (USD MILLION)

- TABLE 88 LATIN AMERICA: POPULATION HEALTH MANAGEMENT MARKET, BY END USER, 2020-2027 (USD MILLION)

- 10.6 MIDDLE EAST & AFRICA

- 10.6.1 INCREASING INVESTMENTS IN MODERNIZING HEALTHCARE TO PROPEL MARKET

- TABLE 89 MIDDLE EAST & AFRICA: POPULATION HEALTH MANAGEMENT MARKET, BY COMPONENT, 2020-2027 (USD MILLION)

- TABLE 90 MIDDLE EAST & AFRICA: POPULATION HEALTH MANAGEMENT MARKET, BY MODE OF DELIVERY, 2020-2027 (USD MILLION)

- TABLE 91 MIDDLE EAST & AFRICA: POPULATION HEALTH MANAGEMENT MARKET, BY END USER, 2020-2027 (USD MILLION)

11 COMPETITIVE LANDSCAPE

- 11.1 INTRODUCTION

- 11.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

- FIGURE 37 KEY DEVELOPMENTS OF MAJOR PLAYERS BETWEEN JANUARY 2019 AND AUGUST 2022

- 11.3 POPULATION HEALTH MANAGEMENT MARKET: R&D EXPENDITURE

- FIGURE 38 R&D EXPENDITURE OF KEY PLAYERS (2020 VS. 2021)

- 11.4 REVENUE ANALYSIS OF KEY PLAYERS

- FIGURE 39 REVENUE ANALYSIS OF KEY PLAYERS (2021)

- 11.5 GEOGRAPHIC REVENUE ASSESSMENT OF KEY PLAYERS

- FIGURE 40 POPULATION HEALTH MANAGEMENT MARKET: GEOGRAPHIC REVENUE MIX

- 11.6 COMPANY EVALUATION QUADRANT

- 11.6.1 STARS

- 11.6.2 EMERGING LEADERS

- 11.6.3 PERVASIVE PLAYERS

- 11.6.4 PARTICIPANTS

- FIGURE 41 COMPETITIVE LEADERSHIP MAPPING, 2020

- 11.7 COMPETITIVE LEADERSHIP MAPPING - START-UPS/SMES

- 11.7.1 PROGRESSIVE COMPANIES

- 11.7.2 RESPONSIVE COMPANIES

- 11.7.3 DYNAMIC COMPANIES

- 11.7.4 STARTING BLOCKS

- FIGURE 42 COMPETITIVE LEADERSHIP MAPPING FOR START-UPS/SMES

- 11.8 KEY PLAYERS ANALYSIS

- TABLE 92 POPULATION HEALTH MANAGEMENT MARKET ANALYSIS, BY VENDOR TYPE

- 11.9 COMPETITIVE SITUATIONS AND TRENDS

- 11.9.1 PRODUCT LAUNCHES

- 11.9.2 DEALS

- 11.9.3 OTHER DEVELOPMENTS

12 COMPANY PROFILES

- 12.1 KEY PLAYERS

- (Business Overview, Products Offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats))**

- 12.1.1 CERNER CORPORATION

- TABLE 93 CERNER CORPORATION: COMPANY OVERVIEW

- FIGURE 43 CERNER CORPORATION: COMPANY SNAPSHOT (2021)

- 12.1.2 ALLSCRIPTS HEALTHCARE SOLUTIONS

- TABLE 94 ALLSCRIPTS HEALTHCARE SOLUTIONS, INC.: COMPANY OVERVIEW

- FIGURE 44 ALLSCRIPTS HEALTHCARE SOLUTIONS, INC.: COMPANY SNAPSHOT (2021)

- 12.1.3 IBM CORPORATION

- TABLE 95 IBM CORPORATION: COMPANY OVERVIEW

- FIGURE 45 IBM CORPORATION: COMPANY SNAPSHOT (2021)

- 12.1.4 EPIC SYSTEMS CORPORATION

- TABLE 96 EPIC SYSTEMS CORPORATION: COMPANY OVERVIEW

- 12.1.5 KONINKLIJKE PHILIPS

- TABLE 97 KONINKLIJKE PHILIPS N.V.: COMPANY OVERVIEW

- FIGURE 46 PHILLIPS HEALTHCARE: COMPANY SNAPSHOT (2021)

- 12.1.6 I2I POPULATION HEALTH

- TABLE 98 I2I POPULATION HEALTH: COMPANY OVERVIEW

- 12.1.7 HEALTH CATALYST

- TABLE 99 HEALTH CATALYST: COMPANY OVERVIEW

- FIGURE 47 HEALTH CATALYST: COMPANY SNAPSHOT (2021)

- 12.1.8 OPTUM INC. (A SUBSIDIARY OF UNITEDHEALTH GROUP)

- TABLE 100 OPTUM, INC: COMPANY OVERVIEW

- FIGURE 48 OPTUM: COMPANY SNAPSHOT (2021)

- 12.1.9 ENLI HEALTH INTELLIGENCE (A CEDAR GROUP TECHNOLOGIES)

- TABLE 101 ENLI HEALTH INTELLIGENCE: COMPANY OVERVIEW

- 12.1.10 ECLINICALWORKS

- TABLE 102 ECLINICALWORKS: COMPANY OVERVIEW

- 12.1.11 HEALTHEC, LLC

- TABLE 103 HEALTHEC LLC: COMPANY OVERVIEW

- 12.1.12 MEDECISION

- TABLE 104 MEDECISION: COMPANY OVERVIEW

- 12.1.13 ARCADIA

- TABLE 105 ARCADIA: COMPANY OVERVIEW

- 12.1.14 ATHENAHEALTH

- TABLE 106 ATHENAHEALTH, INC: COMPANY OVERVIEW

- 12.1.15 COTIVITI (VERSCEND TECHNOLOGIES)

- TABLE 107 COTIVITI: COMPANY OVERVIEW

- 12.1.16 NEXTGEN HEALTHCARE, INC.

- TABLE 108 NEXTGEN HEALTHCARE, INC.: COMPANY OVERVIEW

- FIGURE 49 NEXTGEN HEALTHCARE: COMPANY SNAPSHOT (2021)

- 12.2 OTHER PLAYERS

- 12.2.1 CONIFER HEALTH SOLUTIONS

- 12.2.2 SPH ANALYTICS

- 12.2.3 LIGHTBEAM HEALTH SOLUTIONS

- 12.2.4 INNOVACCER

- 12.2.5 LUMERIS

- 12.2.6 ZEOMEGA

- 12.2.7 HGS HEALTHCARE, LLC

- 12.2.8 PERSIVIA

- 12.2.9 COLOR HEALTH, INC.

- *Details on Business Overview, Products Offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats) might not be captured in case of unlisted companies.

13 APPENDIX

- 13.1 DISCUSSION GUIDE

- 13.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 13.3 AVAILABLE CUSTOMIZATIONS

- 13.4 RELATED REPORTS

- 13.5 AUTHOR DETAILS