|

|

市場調査レポート

商品コード

1341051

HVACラインセットの世界市場 (~2028年):材料 (銅・低炭素)・エンドユーザー産業 (住宅・商業・産業)・実装区分 (新築・改修)・地域別HVAC Linset Market by Material (Copper, Low Carbon), End-Use Industry (Residential, Commercial, Industrial), Implementation (New Construction, Retrofit) & Region(NA, Asia Pacific, Europe, Middle East & Africa, South America) - Global Forecast to 2028 |

||||||

カスタマイズ可能

|

|||||||

| HVACラインセットの世界市場 (~2028年):材料 (銅・低炭素)・エンドユーザー産業 (住宅・商業・産業)・実装区分 (新築・改修)・地域別 |

|

出版日: 2023年08月24日

発行: MarketsandMarkets

ページ情報: 英文 201 Pages

納期: 即納可能

|

- 全表示

- 概要

- 目次

世界のHVACラインセットの市場規模は、2023年の92億米ドルから、予測期間中は7.9%のCAGRで推移し、2028年には134億米ドルの規模に成長すると予測されています。 都市化や住宅建設の増加、スマートホームのトレンドの高まり、エアコン需要の増加などの要因が同市場を牽引する要因です。

世界の気温上昇やヒートアイランド化、消費者の所得増加が製造業者に大きな成長機会を提供すると予想されています。

アジア太平洋地域は最大かつ最速成長の市場です。この地域は、大規模な建設とインフラ整備が行われているため、高い成長を示しています。市場成長は、主に中国、インド、東南アジア諸国からの需要に起因しています。一方、金額ベースでは、市場が成熟している北米が予測期間中にリードを示すと予想されています。

また、材料別では、その汎用性と適用性により、低炭素鋼が第2位のシェアを示すと予測されています。HVACや冷凍産業のシームレスチューブに使用される低炭素鋼は、極端な温度に耐えるため、冷媒輸送に最適です。商業用HVACシステムにおける極めて重要な役割、中東、東南アジア、米国などの地域における重要性、多数の中小鉄鋼メーカーによるサポートなどの要因が同部門が成長を後押ししています。

当レポートでは、世界のHVACラインセットの市場を調査し、市場概要、市場への影響因子および市場機会の分析、市場規模の推移・予測、各種区分・地域別の詳細分析、技術・特許の動向、ケーススタディ、法規制環境、競合情勢、主要企業のプロファイルなどをまとめています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

- ポーターのファイブフォース分析

- バリューチェーン分析

- 原材料の分析

- ケーススタディ分析

- マクロ経済指標

- 関税、基準、規制状況

- 貿易分析

- 技術分析

- エコシステム

- 特許分析

- 主な会議とイベント

- 価格分析

- 事業に影響を与える動向とディスラプション

第6章 HVACラインセット市場:材料別

- 銅

- 低炭素鋼

- その他

- 銅 vs 低炭素鋼

第7章 HVACラインセット市場:エンドユーザー産業別

- 住宅

- 商用

- 産業用

第8章 HVACラインセット市場:実装区分別

- 新築

- 改修

第9章 HVACラインセット市場:地域別

- アジア太平洋

- 北米

- 欧州

- 中東・アフリカ

- 南米

第10章 競合情勢

- 概要

- 主要企業のランキング分析

- 市場シェア分析

- 主要企業の収益分析

- 市場評価マトリックス

- 主要企業の企業評価マトリックス

- スタートアップ/中小企業向けの企業評価マトリクス

- 企業のエンドユーザー産業におけるフットプリント

- 企業の地域におけるフットプリント

- 製品ポートフォリオの強み

- 事業戦略の優秀性

- 競合シナリオ

第11章 企業プロファイル

- 主要企業

- HALCOR

- HYDRO

- KME SE

- MUELLER STREAMLINE CO.

- CERRO FLOW PRODUCTS LLC

- LINESETS INC.

- PDM US

- ZHEJIANG ICE LOONG ENVIRONMENTAL SCI-TECH CO., LTD.

- FEINROHREN S.P.A

- PTUBES, INC.

- DIVERSITECH CORPORATION

- FOSHAN SHUNDE LECONG HENGXIN COPPER TUBE FACTORY

- INABA DENKO AMERICA

- ZHEJIANG HAILIANG CO., LTD.

- JMF COMPANY

- GREAT LAKES COPPER LTD.

- HMAX

- ICOOL USA, INC.

- CAMBRIDGE-LEE INDUSTRIES LLC

- その他の企業

- MM KEMBLA

- MANDEV TUBES

- UNIFLOW COPPER TUBES

- KOBELCO & MATERIALS COPPER TUBE CO., LTD.

- MEHTA TUBES LIMITED

- KLIMA INDUSTRIES

第12章 付録

The global HVAC Linset market size is estimated to be USD 9.2 billion in 2023 and projected to reach USD 13.4 billion by 2028, at a CAGR of 7.9%. Urbanization and increase in residential construction, growing trends of smart homes, and increasing demand for air conditioners are the factors driving the market for HVAC Linset. However, local cooling solutions and rising environmental concerns are expected to restrain this market. Rising global temperatures and heat islands and growing incomes of people are expected to offer significant growth opportunities to manufacturers. Major challenges faced by the players in this market are the passive cooling and free cooling solutions and adoption of new refrigerants.

APAC is the largest and the fastest-growing market for HVAC Linset. The region is witnessing high growth in the HVAC Linset market due to large construction and infrastructure activities being carried out. The growth of the HVAC Linset market is mainly attributed to the demand from China, India, and Southeast Asian countries. These bustling economies have a lot of potential customers. In terms of value, North America is expected to lead the HVAC Linset market during the forecast period, owing to the matured market.

"Low carbon accounted for the second largest market share amongst other materials in the HVAC Linset market"

Low carbon or low carbon steel has the second-largest share in the HVAC Linset market due to its versatility and applicability. Used for seamless tubing in HVAC and refrigeration industries, low carbon steel withstands extreme temperatures, making it ideal for refrigerant transport. Its prominence is driven by its pivotal role in commercial HVAC systems, its significance in regions like the Middle East, Southeast Asia, and the US, and the support of numerous SME steel manufacturers.

"The new construction segment is estimated to be the second fastest growing segment in the HVAC Linset market during the forecast period."

The new construction segment is estimated to be the second fastest-growing market in the HVAC Linset industry, driven by its pivotal role in enhancing benefits, comfort, indoor air quality, and energy efficiency. As varied construction projects demand tailored heating and cooling systems, the need for efficient appliances becomes paramount. Rapid urbanization, economic growth, and technological advancements in emerging regions like APAC, the Middle East, and Africa propel the demand for new construction. Governments' infrastructural investments and green initiatives further bolster adoption, fostering a smarter and healthier environment through energy-efficient HVAC Linset, amplified by the integration of smart sensors and thermostats.

"Asia Pacific has the largest market share the HVAC Linset Market, in terms of value."

Asia Pacific has the largest share in the HVAC Linset market due to robust infrastructural growth, surging urbanization, and expanding manufacturing activities. China's industrialization and India's burgeoning middle class contribute to the region's dominance. The adoption of advanced VRF systems in countries like Japan, China, and South Korea further strengthens Asia Pacific's leadership. This region's market leadership is a result of its diverse growth drivers and strategic market adoption, positioning it at the forefront of the global HVAC Linset industry.

"Based on region, Europe is projected to be third fastest growing market in the HVAC Linset market during the forecast period."

Europe estimated to be the third fastest growing HVAC Linset market, fueled by heightened construction activities and the presence of renowned HVAC Linset manufacturers. Prominent European countries like Germany, France, and the UK exhibit consistent consumption trends. The region's efficient manufacturing facilities and strategic distribution channels aid in supplying HVAC Linset to key system manufacturers. With a focus on increased residential constructions and supportive government initiatives, Europe is poised for substantial growth in the HVAC Linset industry.

Breakdown of primaries

The study contains insights from various industry experts, ranging from component suppliers to Tier 1 companies and OEMs. The break-up of the primaries is as follows:

- By Company Type: Tier 1 - 40%, Tier 2 - 30%, and Tier 3 - 30%

- By Designation: C Level- 20%, D-level - 10%, And Other Level - 70%

- By Region: North America - 20%, Europe - 30%, APAC - 30%, Middle East & Africa - 10%, South America-10%.

The HVAC Linset market is dominated by a few globally established players such as Daikin (Japan), Haclor (Greece), Hydro (Norway), KME SE (Germany), and Mueller Streamline Co. (US).

Research Coverage:

The report covers the HVAC Linset market and forecasts its size, by volume and value, based on region (Asia Pacific, Europe, North America, South America, and Middle East & Africa), material (copper, low carbon), end-use industry (commercial, residential, industrial), implementation (new construction, retrofit).

The report also provides a comprehensive review of market drivers, restraints, opportunities, and challenges in the HVAC Linset market. The report also covers qualitative aspects in addition to the quantitative aspects of these markets.

Key Benefits of Buying the Report:

The report will help the leaders/new entrants in this market with information on the closest approximations of the revenue numbers for the overall market and the sub-segments. This report will help stakeholders understand the competitive landscape and gain more insights to better position their businesses and plan suitable go-to-market strategies. The report also helps stakeholders understand the pulse of the HVAC Linset market and provides them with information on key market drivers, restraints, challenges, and opportunities.

Key benefits of buying this report

This research report is focused on various levels of analysis - industry analysis (industry trends), market ranking analysis of top players, and company profiles, which together provide an overall view on the competitive landscape; emerging and high-growth segments of the HVAC Linset market; high-growth regions; and market drivers, restraints, opportunities, and challenges.

The report provides insights on the following pointers:

- Analysis of drivers (urbanization & increase in residential construction and growing trends of smart homes), restraints (local cooling solutions and rising environment concerns), opportunities (rising global temperatures and heat islands and growing income to propel the demand for HVAC systems) and challenges (passive cooling and free cooling solutions and adoption of new refrigerants) influencing the growth of HVAC Linset market.

- Market Penetration: Comprehensive information on HVAC Linset market offered by top players in the global market.

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and mergers & acquisitions in the HVAC Linset market.

- Market Development: Comprehensive information about lucrative emerging markets - the report analyzes the markets for HVAC Linset market across regions.

- Competitive Assessment: In-depth assessment of market shares, strategies, products, and manufacturing capabilities of leading players in the HVAC Linset

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 MARKET SCOPE

- 1.3.1 HVAC LINESET MARKET SEGMENTATION

- 1.3.2 REGIONS COVERED

- 1.3.3 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 UNITS CONSIDERED

- 1.6 STAKEHOLDERS

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- FIGURE 1 HVAC LINESET MARKET: RESEARCH DESIGN

- 2.1.1 SECONDARY DATA

- 2.1.1.1 List of major secondary sources

- 2.1.1.2 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key data from primary sources

- 2.1.2.2 Breakdown of primary interviews

- 2.1.3 PRIMARY INTERVIEWS

- 2.1.3.1 Primary interviews - demand & supply sides

- 2.1.3.2 Key industry insights

- 2.2 MARKET SIZE ESTIMATION

- FIGURE 2 HVAC LINESET MARKET SIZE ESTIMATION

- 2.2.1 TOP-DOWN APPROACH

- 2.2.1.1 Approach for arriving at market size using top-down analysis

- FIGURE 3 TOP-DOWN APPROACH

- 2.2.2 BOTTOM-UP APPROACH

- 2.2.2.1 Approach for arriving at market size using bottom-up analysis

- FIGURE 4 BOTTOM-UP APPROACH

- FIGURE 5 MARKET SIZE ESTIMATION: BOTTOM-UP APPROACH (DEMAND SIDE)

- 2.3 DATA TRIANGULATION

- FIGURE 6 HVAC LINESET MARKET: DATA TRIANGULATION

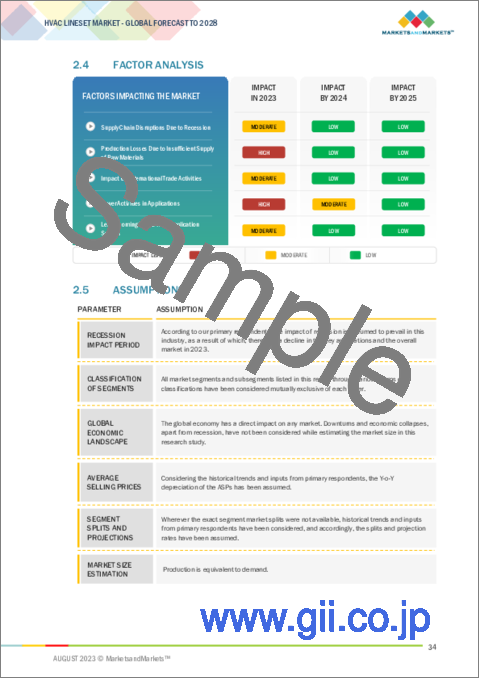

- 2.4 FACTOR ANALYSIS

- 2.5 ASSUMPTIONS

- 2.6 LIMITATIONS

3 EXECUTIVE SUMMARY

- FIGURE 7 COPPER SEGMENT TO DOMINATE MARKET BY 2028

- FIGURE 8 COMMERCIAL SEGMENT TO BE LARGEST END-USE INDUSTRY DURING FORECAST PERIOD

- FIGURE 9 RETROFIT TO REGISTER HIGHER CAGR DURING FORECAST PERIOD

- FIGURE 10 ASIA PACIFIC TO LEAD HVAC LINESET MARKET BETWEEN 2023 AND 2028

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN HVAC LINESET MARKET

- FIGURE 11 EMERGING ECONOMIES TO OFFER LUCRATIVE GROWTH OPPORTUNITIES FOR MARKET PLAYERS

- 4.2 HVAC LINESET MARKET, BY MATERIAL TYPE

- FIGURE 12 LOW CARBON TO BE FASTEST-GROWING SEGMENT DURING FORECAST PERIOD

- 4.3 HVAC LINESET MARKET, BY IMPLEMENTATION

- FIGURE 13 NEW CONSTRUCTION TO ACCOUNT FOR LARGER MARKET SHARE

- 4.4 HVAC LINESET MARKET, BY REGION

- FIGURE 14 HVAC LINESET MARKET IN EMERGING COUNTRIES TO GROW AT FASTER RATE

- 4.5 ASIA PACIFIC: HVAC LINESET MARKET

- FIGURE 15 CHINA TO LEAD HVAC LINESET MARKET DURING FORECAST PERIOD

- 4.6 HVAC LINESET MARKET: MAJOR COUNTRIES

- FIGURE 16 INDIA TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- FIGURE 17 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES IN HVAC LINESET MARKET

- 5.2.1 DRIVERS

- 5.2.1.1 Urbanization and increase in residential construction

- 5.2.1.2 Growing trend of smart homes

- 5.2.1.3 Rising demand for air conditioners

- FIGURE 18 DEMAND FOR AIR CONDITIONERS IN US FROM 2019 TO 2021

- 5.2.1.4 Increasing requirement for replacement and retrofitting HVAC systems

- 5.2.2 RESTRAINTS

- 5.2.2.1 Local cooling solutions

- 5.2.2.2 High installation and maintenance costs of HVAC systems

- 5.2.2.3 Rising environmental concerns

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Rising global temperatures and heat islands

- 5.2.3.2 Combination of climate and income dynamics

- 5.2.4 CHALLENGES

- 5.2.4.1 Passive cooling and free cooling solutions

- 5.2.4.2 Adoption of new refrigerants

- TABLE 1 GWP VALUES OF REFRIGERANTS USED IN AIR CONDITIONERS

- 5.3 PORTER'S FIVE FORCES ANALYSIS

- FIGURE 19 HVAC LINESET MARKET: PORTER'S FIVE FORCES ANALYSIS

- 5.3.1 THREAT OF NEW ENTRANTS

- 5.3.2 BARGAINING POWER OF BUYERS

- 5.3.3 BARGAINING POWER OF SUPPLIERS

- 5.3.4 THREAT OF SUBSTITUTES

- 5.3.5 INTENSITY OF COMPETITIVE RIVALRY

- TABLE 2 HVAC LINESET MARKET: PORTER'S FIVE FORCES ANALYSIS

- 5.4 VALUE CHAIN ANALYSIS

- FIGURE 20 OVERVIEW OF VALUE CHAIN OF HVAC LINESET MARKET

- 5.4.1 RAW MATERIAL SUPPLIERS

- 5.4.2 HVAC LINESET MANUFACTURERS

- 5.4.3 DISTRIBUTORS

- 5.4.4 HVAC SYSTEM MANUFACTURERS

- 5.4.5 HVAC LINESET END USERS

- 5.5 RAW MATERIAL ANALYSIS

- 5.5.1 COPPER

- 5.5.2 LOW CARBON STEEL

- 5.5.3 ALUMINUM

- 5.6 CASE STUDY ANALYSIS

- 5.6.1 OPTIMIZING HVAC&R EFFICIENCY WITH SMALLER DIAMETER COPPER TUBES USING MULTI-OBJECTIVE GENETIC ALGORITHMS

- 5.6.2 ADVANCING ENERGY EFFICIENCY IN RAC INDUSTRY WITH INNER GROOVED COPPER TUBES

- 5.7 MACROECONOMIC INDICATORS

- 5.7.1 GLOBAL GDP TRENDS

- TABLE 3 PROJECTED REAL GDP GROWTH (ANNUAL PERCENTAGE CHANGE) OF KEY COUNTRIES, 2018-2025

- 5.8 TARIFFS, STANDARDS, AND REGULATORY LANDSCAPE

- 5.8.1 REGULATIONS

- 5.8.1.1 EUROPE

- 5.8.1.2 US

- 5.8.1.3 Others

- 5.8.2 STANDARDS

- 5.8.2.1 Occupational Safety and Health Act of 1970 (OSHA Standards)

- 5.8.2.2 European Committee for Standardization (CEN)

- 5.8.2.3 American Society of Heating, Refrigerating, and Air Conditioning Engineers (ASHRAE)

- 5.8.3 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 4 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.8.1 REGULATIONS

- 5.9 TRADE ANALYSIS

- TABLE 5 MAJOR EXPORTING COUNTRIES - HVAC LINESET (USD MILLION)

- TABLE 6 MAJOR IMPORTING COUNTRIES- HVAC LINESET (USD MILLION)

- 5.10 TECHNOLOGY ANALYSIS

- 5.10.1 MINI-SPLIT SYSTEMS

- 5.10.2 PRE-INSULATED LINESETS

- 5.10.3 VARIABLE REFRIGERANT FLOW

- 5.10.4 SMART HVAC INTEGRATION

- 5.11 ECOSYSTEM

- FIGURE 21 HVAC LINESET ECOSYSTEM

- TABLE 7 HVAC LINESET MARKET: ECOSYSTEM

- 5.12 PATENT ANALYSIS

- 5.12.1 INTRODUCTION

- 5.12.2 METHODOLOGY

- 5.12.3 DOCUMENT TYPE

- TABLE 8 TOTAL NUMBER OF PATENTS

- FIGURE 22 TOTAL NUMBER OF PATENTS REGISTERED IN 10 YEARS (2012-2022)

- 5.12.4 PUBLICATION TRENDS IN LAST 10 YEARS

- FIGURE 23 NUMBER OF PATENTS YEAR-WISE FROM 2012 TO 2022

- 5.12.5 INSIGHTS

- 5.12.6 LEGAL STATUS OF PATENTS

- FIGURE 24 PATENT ANALYSIS, BY LEGAL STATUS

- 5.12.7 JURISDICTION ANALYSIS

- FIGURE 25 TOP JURISDICTION - BY DOCUMENT

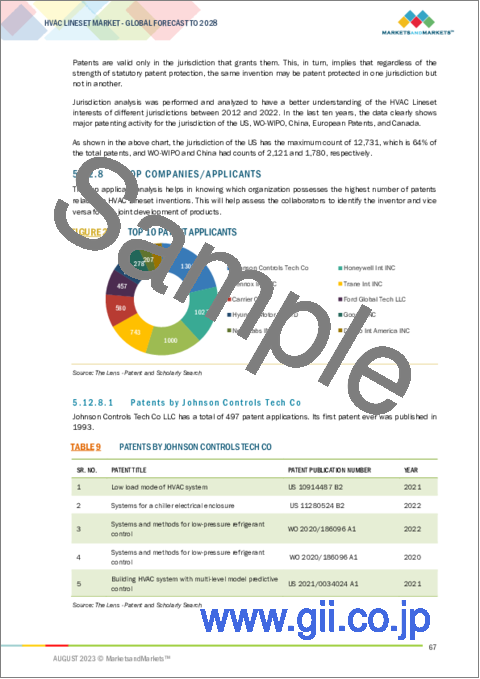

- 5.12.8 TOP COMPANIES/APPLICANTS

- FIGURE 26 TOP 10 PATENT APPLICANTS

- 5.12.8.1 Patents by Johnson Controls Tech Co

- TABLE 9 PATENTS BY JOHNSON CONTROLS TECH CO

- 5.12.8.2 Patents by Honeywell Int Inc

- TABLE 10 PATENTS BY HONEYWELL INT INC

- 5.12.8.3 Patents by Lennox Ind Inc

- TABLE 11 PATENTS BY LENNOX IND INC

- 5.12.9 TOP 10 PATENT OWNERS (US) IN LAST 10 YEARS

- TABLE 12 TOP 10 PATENT OWNERS

- 5.13 KEY CONFERENCES & EVENTS IN 2023-2024

- TABLE 13 HVAC LINESET MARKET: DETAILED LIST OF CONFERENCES & EVENTS

- 5.14 PRICING ANALYSIS

- 5.14.1 AVERAGE SELLING PRICE BASED ON REGION

- FIGURE 27 HVAC LINESET PRICES IN DIFFERENT REGIONS, 2021

- FIGURE 28 AVERAGE SELLING PRICE OF KEY PLAYERS FOR TOP THREE END-USE INDUSTRY SEGMENTS

- 5.14.2 AVERAGE SELLING PRICE, BY KEY PLAYERS

- TABLE 14 KEY PLAYERS: AVERAGE SELLING PRICE (USD/UNIT)

- 5.15 TRENDS AND DISRUPTIONS IMPACTING BUSINESSES

- FIGURE 29 TRENDS AND DISRUPTIONS IMPACTING BUSINESSES

6 HVAC LINESET MARKET, BY MATERIAL TYPE

- 6.1 INTRODUCTION

- FIGURE 30 LOW CARBON TO BE FASTEST-GROWING MATERIAL TYPE DURING FORECAST PERIOD

- TABLE 15 HVAC LINESET MARKET, BY MATERIAL TYPE, 2020-2022 (USD MILLION)

- TABLE 16 HVAC LINESET MARKET, BY MATERIAL TYPE, 2023-2028 (USD MILLION)

- TABLE 17 HVAC LINESET MARKET, BY MATERIAL TYPE, 2020-2022 (MILLION METER)

- TABLE 18 HVAC LINESET MARKET, BY MATERIAL TYPE, 2023-2028 (MILLION METER)

- 6.2 COPPER

- 6.2.1 RISING RESIDENTIAL CONSTRUCTION TO DRIVE MARKET

- 6.2.2 ADVANTAGES OF COPPER

- 6.2.2.1 Malleability

- 6.2.2.2 Easy to join

- 6.2.2.3 Durable

- 6.2.2.4 100% recyclable

- 6.2.3 APPLICATIONS

- 6.3 LOW CARBON

- 6.3.1 GROWTH IN COMMERCIAL SECTOR TO DRIVE DEMAND

- 6.4 OTHERS

- 6.5 COPPER VS. LOW CARBON

- TABLE 19 GWP VALUES OF REFRIGERANTS USED IN AIR CONDITIONERS

7 HVAC LINESET MARKET, BY END-USE INDUSTRY

- 7.1 INTRODUCTION

- FIGURE 31 COMMERCIAL SEGMENT TO ACCOUNT FOR LARGEST SHARE DURING FORECAST PERIOD

- TABLE 20 HVAC LINESET MARKET, BY END-USE INDUSTRY, 2020-2022 (USD MILLION)

- TABLE 21 HVAC LINESET MARKET, BY END-USE INDUSTRY, 2023-2028 (USD MILLION)

- TABLE 22 HVAC LINESET MARKET, BY END-USE INDUSTRY, 2020-2022 (MILLION METER)

- TABLE 23 HVAC LINESET MARKET, BY END-USE INDUSTRY, 2023-2028 (MILLION METER)

- 7.2 RESIDENTIAL

- 7.2.1 RISE IN DEMAND FOR AIR CONDITIONING SYSTEMS TO DRIVE MARKET

- 7.3 COMMERCIAL

- 7.3.1 HIGH ADOPTION OF ENERGY EFFICIENCY REGULATIONS TO DRIVE MARKET

- 7.4 INDUSTRIAL

- 7.4.1 GROWING USE IN OIL & GAS AND PHARMACEUTICAL SECTORS TO DRIVE MARKET

8 HVAC LINESET MARKET, BY IMPLEMENTATION

- 8.1 INTRODUCTION

- FIGURE 32 RETROFIT SEGMENT TO REGISTER HIGHER CAGR DURING FORECAST PERIOD

- TABLE 24 HVAC LINESET MARKET, BY IMPLEMENTATION, 2020-2022 (MILLION METER)

- TABLE 25 HVAC LINESET MARKET, BY IMPLEMENTATION, 2023-2028 (MILLION METER)

- TABLE 26 HVAC LINESET MARKET, BY IMPLEMENTATION, 2020-2022 (USD MILLION)

- TABLE 27 HVAC LINESET MARKET, BY IMPLEMENTATION, 2023-2028 (USD MILLION)

- 8.2 NEW CONSTRUCTION

- 8.2.1 RAPID URBANIZATION AND ROBUST ECONOMIC GROWTH TO DRIVE SEGMENT

- 8.3 RETROFIT

- 8.3.1 GROWING DEMAND FOR COST-EFFECTIVE SYSTEMSTO DRIVE MARKET

9 HVAC LINESET MARKET, BY REGION

- 9.1 INTRODUCTION

- FIGURE 33 INDIA TO REGISTER HIGHEST GROWTH BETWEEN 2023 AND 2028

- TABLE 28 HVAC LINESET MARKET, BY REGION, 2020-2022 (MILLION METER)

- TABLE 29 HVAC LINESET MARKET, BY REGION, 2023-2028 (MILLION METER)

- TABLE 30 HVAC LINESET MARKET, BY REGION, 2020-2022 (USD MILLION)

- TABLE 31 HVAC LINESET MARKET, BY REGION, 2023-2028 (USD MILLION)

- 9.2 ASIA PACIFIC

- FIGURE 34 ASIA PACIFIC: HVAC LINESET MARKET SNAPSHOT

- TABLE 32 ASIA PACIFIC: HVAC LINESET MARKET, BY COUNTRY, 2020-2022 (MILLION METER)

- TABLE 33 ASIA PACIFIC: HVAC LINESET MARKET, BY COUNTRY, 2023-2028 (MILLION METER)

- TABLE 34 ASIA PACIFIC: HVAC LINESET MARKET, BY COUNTRY, 2020-2022 (USD MILLION)

- TABLE 35 ASIA PACIFIC: HVAC LINESET MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 36 ASIA PACIFIC: HVAC LINESET MARKET, BY END-USE INDUSTRY, 2020-2022 (MILLION METER)

- TABLE 37 ASIA PACIFIC: HVAC LINESET MARKET, BY END-USE INDUSTRY, 2023-2028 (MILLION METER)

- TABLE 38 ASIA PACIFIC: HVAC LINESET MARKET, BY END-USE INDUSTRY, 2020-2022 (USD MILLION)

- TABLE 39 ASIA PACIFIC: HVAC LINESET MARKET, BY END-USE INDUSTRY, 2023-2028 (USD MILLION)

- 9.2.1 CHINA

- 9.2.1.1 Urbanization and economic development to drive market

- TABLE 40 CHINA: HVAC LINESET MARKET, BY END-USE INDUSTRY, 2020-2022 (MILLION METER)

- TABLE 41 CHINA: HVAC LINESET MARKET, BY END-USE INDUSTRY, 2023-2028 (MILLION METER)

- TABLE 42 CHINA: HVAC LINESET MARKET, BY END-USE INDUSTRY, 2020-2022 (USD MILLION)

- TABLE 43 CHINA: HVAC LINESET MARKET, BY END-USE INDUSTRY, 2023-2028 (USD MILLION)

- 9.2.2 INDIA

- 9.2.2.1 Government initiatives and climatic conditions to drive market

- TABLE 44 INDIA: HVAC LINESET MARKET, BY END-USE INDUSTRY, 2020-2022 (MILLION METER)

- TABLE 45 INDIA: HVAC LINESET MARKET, BY END-USE INDUSTRY, 2023-2028 (MILLION METER)

- TABLE 46 INDIA: HVAC LINESET MARKET, BY END-USE INDUSTRY, 2020-2022 (USD MILLION)

- TABLE 47 INDIA: HVAC LINESET MARKET, BY END-USE INDUSTRY, 2023-2028 (USD MILLION)

- 9.2.3 JAPAN

- 9.2.3.1 Presence of leading HVAC system manufacturers to fuel market

- TABLE 48 JAPAN: HVAC LINESET MARKET, BY END-USE INDUSTRY, 2020-2022 (MILLION METER)

- TABLE 49 JAPAN: HVAC LINESET MARKET, BY END-USE INDUSTRY, 2023-2028 (MILLION METER)

- TABLE 50 JAPAN: HVAC LINESET MARKET, BY END-USE INDUSTRY, 2020-2022 (USD MILLION)

- TABLE 51 JAPAN: HVAC LINESET MARKET, BY END-USE INDUSTRY, 2023-2028 (USD MILLION)

- 9.2.4 SOUTH KOREA

- 9.2.4.1 Rising demand for air conditioners to drive market

- TABLE 52 SOUTH KOREA: HVAC LINESET MARKET, BY END-USE INDUSTRY, 2020-2022 (MILLION METER)

- TABLE 53 SOUTH KOREA: HVAC LINESET MARKET, BY END-USE INDUSTRY, 2023-2028 (MILLION METER)

- TABLE 54 SOUTH KOREA: HVAC LINESET MARKET, BY END-USE INDUSTRY, 2020-2022 (USD MILLION)

- TABLE 55 SOUTH KOREA: HVAC LINESET MARKET, BY END-USE INDUSTRY, 2023-2028 (USD MILLION)

- 9.2.5 REST OF ASIA PACIFIC

- TABLE 56 REST OF ASIA PACIFIC: HVAC LINESET MARKET, BY END-USE INDUSTRY, 2020-2022 (MILLION METER)

- TABLE 57 REST OF ASIA PACIFIC: HVAC LINESET MARKET, BY END-USE INDUSTRY, 2023-2028 (MILLION METER)

- TABLE 58 REST OF ASIA PACIFIC: HVAC LINESET MARKET, BY END-USE INDUSTRY, 2020-2022 (USD MILLION)

- TABLE 59 REST OF ASIA PACIFIC: HVAC LINESET MARKET, BY END-USE INDUSTRY, 2023-2028 (USD MILLION)

- 9.3 NORTH AMERICA

- TABLE 60 NORTH AMERICA: HVAC LINESET MARKET, BY COUNTRY, 2020-2022 (MILLION METER)

- TABLE 61 NORTH AMERICA: HVAC LINESET MARKET, BY COUNTRY, 2023-2028 (MILLION METER)

- TABLE 62 NORTH AMERICA: HVAC LINESET MARKET, BY COUNTRY, 2020-2022 (USD MILLION)

- TABLE 63 NORTH AMERICA: HVAC LINESET MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 64 NORTH AMERICA: HVAC LINESET MARKET, BY END-USE INDUSTRY, 2020-2022 (MILLION METER)

- TABLE 65 NORTH AMERICA: HVAC LINESET MARKET, BY END-USE INDUSTRY, 2023-2028 (MILLION METER)

- TABLE 66 NORTH AMERICA: HVAC LINESET MARKET, BY END-USE INDUSTRY, 2020-2022 (USD MILLION)

- TABLE 67 NORTH AMERICA: HVAC LINESET MARKET, BY END-USE INDUSTRY, 2023-2028 (USD MILLION)

- 9.3.1 US

- 9.3.1.1 Surge in construction activities to drive demand for HVAC systems and linesets

- TABLE 68 US: HVAC LINESET MARKET, BY END-USE INDUSTRY, 2020-2022 (MILLION METER)

- TABLE 69 US: HVAC LINESET MARKET, BY END-USE INDUSTRY, 2023-2028 (MILLION METER)

- TABLE 70 US: HVAC LINESET MARKET, BY END-USE INDUSTRY, 2020-2022 (USD MILLION)

- TABLE 71 US: HVAC LINESET MARKET, BY END-USE INDUSTRY, 2023-2028 (USD MILLION)

- 9.3.2 CANADA

- 9.3.2.1 New housing projects to boost market

- TABLE 72 CANADA: HVAC LINESET MARKET, BY END-USE INDUSTRY, 2020-2022 (MILLION METER)

- TABLE 73 CANADA: HVAC LINESET MARKET, BY END-USE INDUSTRY, 2023-2028 (MILLION METER)

- TABLE 74 CANADA: HVAC LINESET MARKET, BY END-USE INDUSTRY, 2020-2022 (USD MILLION)

- TABLE 75 CANADA: HVAC LINESET MARKET, BY END-USE INDUSTRY, 2023-2028 (USD MILLION)

- 9.3.3 MEXICO

- 9.3.3.1 Government initiatives to boost adoption of HVAC systems and linesets

- TABLE 76 MEXICO: HVAC LINESET MARKET, BY END-USE INDUSTRY, 2020-2022 (MILLION METER)

- TABLE 77 MEXICO: HVAC LINESET MARKET, BY END-USE INDUSTRY, 2023-2028 (MILLION METER)

- TABLE 78 MEXICO: HVAC LINESET MARKET, BY END-USE INDUSTRY, 2020-2022 (USD MILLION)

- TABLE 79 MEXICO: HVAC LINESET MARKET, BY END-USE INDUSTRY, 2023-2028 (USD MILLION)

- 9.4 EUROPE

- FIGURE 35 EUROPE: HVAC LINESET MARKET SNAPSHOT

- TABLE 80 EUROPE: HVAC LINESET MARKET, BY COUNTRY, 2020-2022 (MILLION METER)

- TABLE 81 EUROPE: HVAC LINESET MARKET, BY COUNTRY, 2023-2028 (MILLION METER)

- TABLE 82 EUROPE: HVAC LINESET MARKET, BY COUNTRY, 2020-2022 (USD MILLION)

- TABLE 83 EUROPE: HVAC LINESET MARKET BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 84 EUROPE: HVAC LINESET MARKET, BY END-USE INDUSTRY, 2020-2022 (MILLION METER)

- TABLE 85 EUROPE: HVAC LINESET MARKET, BY END-USE INDUSTRY, 2023-2028 (MILLION METER)

- TABLE 86 EUROPE: HVAC LINESET MARKET, BY END-USE INDUSTRY, 2020-2022 (USD MILLION)

- TABLE 87 EUROPE: HVAC LINESET MARKET, BY END-USE INDUSTRY, 2023-2028 (USD MILLION)

- 9.4.1 GERMANY

- 9.4.1.1 Surge in construction of residential infrastructure to boost market

- TABLE 88 GERMANY: HVAC LINESET MARKET, BY END-USE INDUSTRY, 2020-2022 (MILLION METER)

- TABLE 89 GERMANY: HVAC LINESET MARKET, BY END-USE INDUSTRY, 2023-2028 (MILLION METER)

- TABLE 90 GERMANY: HVAC LINESET MARKET, BY END-USE INDUSTRY, 2020-2022 (USD MILLION)

- TABLE 91 GERMANY: HVAC LINESET MARKET, BY END-USE INDUSTRY, 2023-2028 (USD MILLION)

- 9.4.2 UK

- 9.4.2.1 Government subsidies and schemes for HVAC systems to fuel market

- TABLE 92 UK: HVAC LINESET MARKET, BY END-USE INDUSTRY, 2020-2022 (MILLION METER)

- TABLE 93 UK: HVAC LINESET MARKET, BY END-USE INDUSTRY, 2023-2028 (MILLION METER)

- TABLE 94 UK: HVAC LINESET MARKET, BY END-USE INDUSTRY, 2020-2022 (USD MILLION)

- TABLE 95 UK: HVAC LINESET MARKET, BY END-USE INDUSTRY, 2023-2028 (USD MILLION)

- 9.4.3 FRANCE

- 9.4.3.1 Population growth and low interest rates to boost demand for HVAC linesets

- TABLE 96 FRANCE: HVAC LINESET MARKET, BY END-USE INDUSTRY, 2020-2022 (MILLION METER)

- TABLE 97 FRANCE: HVAC LINESET MARKET, BY END-USE INDUSTRY, 2023-2028 (MILLION METER)

- TABLE 98 FRANCE: HVAC LINESET MARKET, BY END-USE INDUSTRY, 2020-2022 (USD MILLION)

- TABLE 99 FRANCE: HVAC LINESET MARKET, BY END-USE INDUSTRY, 2023-2028 (USD MILLION)

- 9.4.4 ITALY

- 9.4.4.1 Investments in residential buildings and construction projects to drive market

- TABLE 100 ITALY: HVAC LINESET MARKET, BY END-USE INDUSTRY, 2020-2022 (MILLION METER)

- TABLE 101 ITALY: HVAC LINESET MARKET, BY END-USE INDUSTRY, 2023-2028 (MILLION METER)

- TABLE 102 ITALY: HVAC LINESET MARKET, BY END-USE INDUSTRY, 2020-2022 (USD MILLION)

- TABLE 103 ITALY: HVAC LINESET MARKET, BY END-USE INDUSTRY, 2023-2028 (USD MILLION)

- 9.4.5 SPAIN

- 9.4.5.1 Demand for commercial air conditioning units to drive market

- TABLE 104 SPAIN: HVAC LINESET MARKET, BY END-USE INDUSTRY, 2020-2022 (MILLION METER)

- TABLE 105 SPAIN: HVAC LINESET MARKET, BY END-USE INDUSTRY, 2023-2028 (MILLION METER)

- TABLE 106 SPAIN: HVAC LINESET MARKET, BY END-USE INDUSTRY, 2020-2022 (USD MILLION)

- TABLE 107 SPAIN: HVAC LINESET MARKET, BY END-USE INDUSTRY, 2023-2028 (USD MILLION)

- 9.4.6 REST OF EUROPE

- TABLE 108 REST OF EUROPE: HVAC LINESET MARKET, BY END-USE INDUSTRY, 2020-2022 (MILLION METER)

- TABLE 109 REST OF EUROPE: HVAC LINESET MARKET, BY END-USE INDUSTRY, 2023-2028 (MILLION METER)

- TABLE 110 REST OF EUROPE: HVAC LINESET MARKET, BY END-USE INDUSTRY, 2020-2022 (USD MILLION)

- TABLE 111 REST OF EUROPE: HVAC LINESET MARKET, BY END-USE INDUSTRY, 2023-2028 (USD MILLION)

- 9.5 MIDDLE EAST & AFRICA

- TABLE 112 MIDDLE EAST & AFRICA: HVAC LINESET MARKET, BY COUNTRY, 2020-2022 (MILLION METER)

- TABLE 113 MIDDLE EAST & AFRICA: HVAC LINESET MARKET, BY COUNTRY, 2023-2028 (MILLION METER)

- TABLE 114 MIDDLE EAST & AFRICA: HVAC LINESET MARKET, BY COUNTRY, 2020-2022 (USD MILLION)

- TABLE 115 MIDDLE EAST & AFRICA: HVAC LINESET MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 116 MIDDLE EAST & AFRICA: HVAC LINESET MARKET, BY END-USE INDUSTRY, 2020-2022 (MILLION METER)

- TABLE 117 MIDDLE EAST & AFRICA: HVAC LINESET MARKET, BY END-USE INDUSTRY 2023-2028 (MILLION METER)

- TABLE 118 MIDDLE EAST & AFRICA: HVAC LINESET MARKET, BY END-USE INDUSTRY, 2020-2022 (USD MILLION)

- TABLE 119 MIDDLE EAST & AFRICA: HVAC LINESET MARKET, BY END-USE INDUSTRY, 2023-2028 (USD MILLION)

- 9.5.1 SAUDI ARABIA

- 9.5.1.1 Investments in non-oil-based economy to drive market

- TABLE 120 SAUDI ARABIA: HVAC LINESET MARKET, BY END-USE INDUSTRY, 2020-2022 (MILLION METER)

- TABLE 121 SAUDI ARABIA: HVAC LINESET MARKET, BY END-USE INDUSTRY, 2023-2028 (MILLION METER)

- TABLE 122 SAUDI ARABIA: HVAC LINESET MARKET, BY END-USE INDUSTRY, 2020-2022 (USD MILLION)

- TABLE 123 SAUDI ARABIA: HVAC LINESET MARKET, BY END-USE INDUSTRY, 2023-2028 (USD MILLION)

- 9.5.2 UAE

- 9.5.2.1 Rise in industrial and construction activities to drive market

- TABLE 124 UAE: HVAC LINESET MARKET, BY END-USE INDUSTRY, 2020-2022 (MILLION METER)

- TABLE 125 UAE: HVAC LINESET MARKET, BY END-USE INDUSTRY, 2023-2028 (MILLION METER)

- TABLE 126 UAE: HVAC LINESET MARKET, BY END-USE INDUSTRY, 2020-2022 (USD MILLION)

- TABLE 127 UAE: HVAC LINESET MARKET, BY END-USE INDUSTRY, 2023-2028 (USD MILLION)

- 9.5.3 SOUTH AFRICA

- 9.5.3.1 Increasing investments in tourism infrastructure to drive market

- TABLE 128 SOUTH AFRICA: HVAC LINESET MARKET, BY END-USE INDUSTRY, 2020-2022 (MILLION METER)

- TABLE 129 SOUTH AFRICA: HVAC LINESET MARKET, BY END-USE INDUSTRY, 2023-2028 (MILLION METER)

- TABLE 130 SOUTH AFRICA: HVAC LINESET MARKET, BY END-USE INDUSTRY, 2020-2022 (USD MILLION)

- TABLE 131 SOUTH AFRICA: HVAC LINESET MARKET, BY END-USE INDUSTRY, 2023-2028 (USD MILLION)

- 9.5.4 REST OF MIDDLE EAST & AFRICA

- TABLE 132 REST OF MIDDLE EAST & AFRICA: HVAC LINESET MARKET, BY END-USE INDUSTRY, 2020-2022 (MILLION METER)

- TABLE 133 REST OF MIDDLE EAST & AFRICA: HVAC LINESET MARKET, BY END-USE INDUSTRY, 2023-2028 (MILLION METER)

- TABLE 134 REST OF MIDDLE EAST & AFRICA: HVAC LINESET MARKET, BY END-USE INDUSTRY, 2020-2022 (USD MILLION)

- TABLE 135 REST OF MIDDLE EAST & AFRICA: HVAC LINESET MARKET, BY END-USE INDUSTRY, 2023-2028 (USD MILLION)

- 9.6 SOUTH AMERICA

- TABLE 136 SOUTH AMERICA: HVAC LINESET MARKET, BY COUNTRY, 2020-2022 (MILLION METER)

- TABLE 137 SOUTH AMERICA: HVAC LINESET MARKET, BY COUNTRY, 2023-2028 (MILLION METER)

- TABLE 138 SOUTH AMERICA: HVAC LINESET MARKET, BY COUNTRY, 2020-2022 (USD MILLION)

- TABLE 139 SOUTH AMERICA: HVAC LINESET MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 140 SOUTH AMERICA: HVAC LINESET MARKET, BY END-USE INDUSTRY, 2020-2022 (MILLION METER)

- TABLE 141 SOUTH AMERICA: HVAC LINESET MARKET, BY END-USE INDUSTRY, 2023-2028 (MILLION METER)

- TABLE 142 SOUTH AMERICA: HVAC LINESET MARKET, BY END-USE INDUSTRY, 2020-2022 (USD MILLION)

- TABLE 143 SOUTH AMERICA: HVAC LINESET MARKET, BY END-USE INDUSTRY, 2023-2028 (USD MILLION)

- 9.6.1 BRAZIL

- 9.6.1.1 Rapid industrial growth and presence of established manufacturers to drive market

- TABLE 144 BRAZIL: HVAC LINESET MARKET, BY END-USE INDUSTRY, 2020-2022 (MILLION METER)

- TABLE 145 BRAZIL: HVAC LINESET MARKET, BY END-USE INDUSTRY, 2023-2028 (MILLION METER)

- TABLE 146 BRAZIL: HVAC LINESET MARKET, BY END-USE INDUSTRY, 2020-2022 (USD MILLION)

- TABLE 147 BRAZIL: HVAC LINESET MARKET, BY END-USE INDUSTRY, 2023-2028 (USD MILLION)

- 9.6.2 ARGENTINA

- 9.6.2.1 Rise in housing projects to fuel demand for HVAC linesets

- TABLE 148 ARGENTINA: HVAC LINESET MARKET, BY END-USE INDUSTRY, 2020-2022 (MILLION METER)

- TABLE 149 ARGENTINA: HVAC LINESET MARKET, BY END-USE INDUSTRY, 2023-2028 (MILLION METER)

- TABLE 150 ARGENTINA: HVAC LINESET MARKET, BY END-USE INDUSTRY, 2020-2022 (USD MILLION)

- TABLE 151 ARGENTINA: HVAC LINESET MARKET, BY END-USE INDUSTRY, 2023-2028 (USD MILLION)

- 9.6.3 REST OF SOUTH AMERICA

- TABLE 152 REST OF SOUTH AMERICA: HVAC LINESET MARKET, BY END-USE INDUSTRY, 2020-2022 (MILLION METER)

- TABLE 153 REST OF SOUTH AMERICA: HVAC LINESET MARKET, BY END-USE INDUSTRY, 2023-2028 (MILLION METER)

- TABLE 154 REST OF SOUTH AMERICA: HVAC LINESET MARKET, BY END-USE INDUSTRY, 2020-2022 (USD MILLION)

- TABLE 155 REST OF SOUTH AMERICA: HVAC LINESET MARKET, BY END-USE INDUSTRY, 2023-2028 (USD MILLION)

10 COMPETITIVE LANDSCAPE

- 10.1 OVERVIEW

- FIGURE 36 COMPANIES ADOPTED ACQUISITION/ JOINT VENTURE/COLLABORATION AS KEY GROWTH STRATEGIES BETWEEN 2019 AND 2023

- 10.2 RANKING ANALYSIS OF KEY MARKET PLAYERS, 2022

- FIGURE 37 RANKING OF TOP FIVE PLAYERS IN HVAC LINESET MARKET, 2022

- 10.3 MARKET SHARE ANALYSIS

- FIGURE 38 HVAC LINESET MARKET SHARE, BY COMPANY (2022)

- TABLE 156 HVAC LINESET MARKET: DEGREE OF COMPETITION

- 10.4 REVENUE ANALYSIS OF TOP PLAYERS

- TABLE 157 HVAC LINESET MARKET: REVENUE ANALYSIS (USD BILLION)

- 10.5 MARKET EVALUATION MATRIX

- TABLE 158 MARKET EVALUATION MATRIX

- 10.6 COMPANY EVALUATION MATRIX FOR KEY PLAYERS

- 10.6.1 STAR PLAYERS

- 10.6.2 EMERGING LEADERS

- 10.6.3 PERVASIVE PLAYERS

- 10.6.4 PARTICIPANTS

- FIGURE 39 HVAC LINESET MARKET: COMPANY EVALUATION MATRIX FOR KEY PLAYERS, 2022

- 10.7 COMPANY EVALUATION MATRIX FOR STARTUPS/SMES

- 10.7.1 RESPONSIVE COMPANIES

- 10.7.2 STARTING BLOCKS

- 10.7.3 PROGRESSIVE COMPANIES

- 10.7.4 DYNAMIC COMPANIES

- FIGURE 40 HVAC LINESET MARKET: COMPANY EVALUATION MATRIX FOR STARTUPS AND SMES, 2022

- 10.8 COMPANY END-USE INDUSTRY FOOTPRINT

- 10.9 COMPANY REGION FOOTPRINT

- 10.10 STRENGTH OF PRODUCT PORTFOLIO

- 10.11 BUSINESS STRATEGY EXCELLENCE

- 10.12 COMPETITIVE SCENARIO

- 10.12.1 DEALS

- TABLE 159 DEALS, 2019 -2023

- 10.12.2 OTHER DEVELOPMENTS

- TABLE 160 OTHER DEVELOPMENTS, 2019-2023

11 COMPANY PROFILES

- 11.1 KEY PLAYERS

(Business Overview, Products/Solutions/Services offered, Recent Developments, MnM View)**

- 11.1.1 HALCOR

- TABLE 161 HALCOR: COMPANY OVERVIEW

- FIGURE 41 HALCOR: COMPANY SNAPSHOT

- TABLE 162 HALCOR: PRODUCT OFFERED

- 11.1.2 HYDRO

- TABLE 163 HYDRO: COMPANY OVERVIEW

- FIGURE 42 HYDRO: COMPANY SNAPSHOT

- TABLE 164 HYDRO: PRODUCTS OFFERED

- TABLE 165 HYDRO: DEALS

- TABLE 166 HYDRO: OTHER DEVELOPMENTS

- 11.1.3 KME SE

- TABLE 167 KME SE: COMPANY OVERVIEW

- TABLE 168 KME SE: PRODUCTS OFFERED

- TABLE 169 KME SE: DEALS

- 11.1.4 MUELLER STREAMLINE CO.

- TABLE 170 MUELLER STREAMLINE CO.: COMPANY OVERVIEW

- TABLE 171 MUELLER STREAMLINE CO.: PRODUCTS OFFERED

- TABLE 172 MUELLER STREAMLINE CO.: DEALS

- 11.1.5 CERRO FLOW PRODUCTS LLC

- TABLE 173 CERRO FLOW PRODUCTS LLC: COMPANY OVERVIEW

- TABLE 174 CERRO FLOW PRODUCTS LLC: PRODUCTS OFFERED

- 11.1.6 LINESETS INC.

- TABLE 175 LINESETS INC.: COMPANY OVERVIEW

- TABLE 176 LINESETS INC.: PRODUCT OFFERINGS

- TABLE 177 LINESETS INC.: PRODUCT LAUNCHES

- TABLE 178 LINESETS INC.: OTHER DEVELOPMENTS

- 11.1.7 PDM US

- TABLE 179 PDM US: COMPANY OVERVIEW

- TABLE 180 PDM US: PRODUCTS OFFERED

- TABLE 181 PDM US: OTHER DEVELOPMENTS

- 11.1.8 ZHEJIANG ICE LOONG ENVIRONMENTAL SCI-TECH CO., LTD.

- TABLE 182 ZHEJIANG ICE LOONG ENVIRONMENTAL SCI-TECH CO., LTD.: COMPANY OVERVIEW

- TABLE 183 ZHEJIANG ICE LOONG ENVIRONMENTAL SCI-TECH CO., LTD.: PRODUCTS OFFERED

- 11.1.9 FEINROHREN S.P.A

- TABLE 184 FEINROHREN S.P.A.: COMPANY OVERVIEW

- TABLE 185 FEINROHREN S.P.A.: PRODUCTS OFFERED

- TABLE 186 FEINROHREN S.P.A.: OTHER DEVELOPMENTS

- 11.1.10 PTUBES, INC.

- TABLE 187 PTUBES, INC.: COMPANY OVERVIEW

- TABLE 188 PTUBES, INC.: PRODUCTS OFFERED

- TABLE 189 PTUBES INC.: OTHER DEVELOPMENTS

- 11.1.11 DIVERSITECH CORPORATION

- TABLE 190 DIVERSITECH CORPORATION: COMPANY OVERVIEW

- TABLE 191 DIVERSITECH CORPORATION: PRODUCTS OFFERED

- TABLE 192 DIVERSITECH CORPORATION: DEALS

- 11.1.12 FOSHAN SHUNDE LECONG HENGXIN COPPER TUBE FACTORY

- TABLE 193 FOSHAN SHUNDE LECONG HENGXIN COPPER TUBE FACTORY: COMPANY OVERVIEW

- TABLE 194 FOSHAN SHUNDE LECONG HENGXIN COPPER TUBE FACTORY: PRODUCTS OFFERED

- 11.1.13 INABA DENKO AMERICA

- TABLE 195 INABA DENKO AMERICA: COMPANY OVERVIEW

- TABLE 196 INABA DENKO AMERICA: PRODUCTS OFFERED

- 11.1.14 ZHEJIANG HAILIANG CO., LTD.

- TABLE 197 ZHEJIANG HAILIANG CO., LTD.: COMPANY OVERVIEW

- TABLE 198 ZHEJIANG HAILIANG CO., LTD.: PRODUCTS OFFERED

- TABLE 199 ZHEJIANG HAILIANG CO., LTD.: DEALS

- TABLE 200 ZHEJIANG HAILIANG CO., LTD.: OTHER DEVELOPMENTS

- 11.1.15 JMF COMPANY

- TABLE 201 JMF COMPANY: COMPANY OVERVIEW

- TABLE 202 JMF COMPANY: PRODUCTS OFFERED

- 11.1.16 GREAT LAKES COPPER LTD.

- TABLE 203 GREAT LAKES COPPER LTD.: COMPANY OVERVIEW

- TABLE 204 GREAT LAKES COPPER LTD.: PRODUCTS OFFERED

- 11.1.17 HMAX

- TABLE 205 HMAX: COMPANY OVERVIEW

- TABLE 206 HMAX: PRODUCTS OFFERED

- 11.1.18 ICOOL USA, INC.

- TABLE 207 ICOOL USA, INC.: COMPANY OVERVIEW

- TABLE 208 ICOOL USA, INC.: PRODUCTS OFFERED

- TABLE 209 ICOOL USA: PRODUCT LAUNCHES

- 11.1.19 CAMBRIDGE-LEE INDUSTRIES LLC

- TABLE 210 CAMBRIDGE-LEE INDUSTRIES LLC: COMPANY OVERVIEW

- TABLE 211 CAMBRIDGE-LEE INDUSTRIES LLC: PRODUCTS OFFERED

- TABLE 212 CAMBRIDGE-LEE INDUSTRIES LLC: DEALS 189\ **Details on Business Overview, Products/Solutions/Services offered, Recent Developments, MnM View might not be captured in case of unlisted companies.

- 11.2 OTHER PLAYERS

- 11.2.1 MM KEMBLA

- 11.2.2 MANDEV TUBES

- 11.2.3 UNIFLOW COPPER TUBES

- 11.2.4 KOBELCO & MATERIALS COPPER TUBE CO., LTD.

- 11.2.5 MEHTA TUBES LIMITED

- 11.2.6 KLIMA INDUSTRIES

12 APPENDIX

- 12.1 DISCUSSION GUIDE

- 12.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 12.3 CUSTOMIZATION OPTIONS

- 12.4 RELATED REPORTS

- 12.5 AUTHOR DETAILS