|

|

市場調査レポート

商品コード

1496912

OSAT(半導体組立・検査アウトソーシング)市場:動向、機会、競合分析【2024-2030年】Outsourced Semiconductor Assembly and Testing (OSAT) Market: Trends, Opportunities and Competitive Analysis [2024-2030] |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| OSAT(半導体組立・検査アウトソーシング)市場:動向、機会、競合分析【2024-2030年】 |

|

出版日: 2024年04月22日

発行: Lucintel

ページ情報: 英文 150 Pages

納期: 3営業日

|

全表示

- 概要

- 目次

OSAT(半導体組立・検査アウトソーシング)市場動向と予測

世界のOSAT市場は、2024年から2030年までのCAGRが4.5%で、2030年までに推定514億米ドルに達すると予測されます。この市場の主な促進要因は、より高機能・高性能を提供するためのエレクトロニクス製品内の半導体含有量の増加、スマートフォンやインターネット接続機器の需要の伸び、安全性、ナビゲーション、燃費効率、排ガス削減、エンターテインメントシステムなどを目的とした自動車内の電子コンテンツの増加です。世界の半導体組立・検査(OSAT)アウトソーシング市場の将来は、自動車、通信、コンピューティング&ネットワーキング、コンシューマーエレクトロニクス、産業界における機会で有望視されています。

- Lucintelは、通信インフラや電子製品の需要が世界中で高まっていることから、アセンブリ&パッケージングが予測期間中最大のセグメントであり続けると予測しています。

- この市場の中では、5G技術の受け入れ拡大やスマートテレビ、タブレット、スマートフォンの消費拡大により、コンシューマーエレクトロニクス分野が最も高い成長を記録すると予測されています。

- アジア太平洋地域は、IoTの採用拡大、自動車1台当たりの電子コンテンツの増加、中国、台湾、インドなどの国々における産業オートメーションの拡大により、予測期間中に最も高い成長を記録すると予想されます。

アジア太平洋地域は最も高い成長が見込まれます。

1.米国:Amkor Technology, Inc.やASE Technology Holding Co., Ltd.などの企業が米国OSAT市場のイノベーションを牽引しています。半導体産業協会(SIA)などのイニシアチブは、半導体製造における協力と研究を促進します。米国政府は、国防総省(DoD)や全米科学財団(NSF)などの機関を通じて半導体の研究開発を支援しています。

2.台湾:Advanced Semiconductor Engineering, Inc.(ASE)やSiliconware Precision Industries Co., Ltd.(SPIL)をはじめとする台湾企業は、世界の半導体メーカーをリードしています。(SPIL)などの台湾企業が世界のOSAT市場をリードしています。産業開発局(IDB)のような政府のイニシアチブは、半導体産業の成長と競争力を支えています。台湾半導体研究所(TSRI)は半導体技術の研究開発を推進しています。

3.中国:Jiangsu Changjiang Electronics Technology Co., Ltd. (JCET)やTianshui Huatian Technology Co., Ltd.などの中国のOSAT企業は急速に拡大しています。「Made in China 2025」計画などの政府のイニシアチブは、半導体産業の能力強化を目指しています。工業情報化部(MIIT)は半導体製造に支援を提供しています。

4.韓国:Amkor Technology Korea Inc.やPowertech Technology Inc.(PTI)のような韓国企業は、OSAT市場の著名なプレーヤーです。韓国半導体産業協会(KSIA)のような政府のイニシアチブは、産業の成長とイノベーションを促進します。通商産業エネルギー省(MOTIE)は半導体開発イニシアチブを支援しています。

5.シンガポール:Global Foundries Singapore Pte.Ltd.やUTAC Holdings Ltd.など、シンガポールのOSAT企業が世界市場に大きく貢献しています。シンガポール経済開発庁(EDB)などの政府のイニシアチブは、半導体製造への投資と人材育成を支援しています。国立研究財団(NRF)は、半導体の研究開発プロジェクトに資金を提供しています。

OSAT市場:セグメント別

この調査では、世界のOSAT市場について、サービスタイプ別、パッケージングタイプ別、用途別、地域別の予測を以下の通り掲載:

OSAT市場の最近の動向

- 先進パッケージングソリューションに対する需要の高まり:OSAT市場は、ファンアウトウエハーレベルパッケージング(FOWLP)や3Dパッケージング技術などの先進パッケージングソリューションに対する需要の高まりによって成長を遂げています。これらの技術は、半導体デバイスの高性能化、小型化、異種集積化を可能にします。

- 生産能力拡大への投資:OSATプロバイダーは、半導体パッケージングと検査サービスに対する需要の高まりに対応するため、能力拡張に投資しています。ASE Technology Holding Co.やAmkor Technologyのような企業は、業界のニーズをサポートするために生産設備を増強し、先進的な設備を取得しています。

- 検査装置の技術的進歩:OSAT各社は、半導体検査工程の効率、精度、信頼性を向上させるため、先進的な検査装置や手法を採用しています。自動検査ハンドリングシステムや高速検査ソリューションなどの革新がOSATプロバイダーの能力を高めています。

- ヘテロジニアスインテグレーションとシステムインテグレーションへの注力:OSATベンダーは、ヘテロジニアスインテグレーションとシステムレベルパッケージングへの関与を強めており、複数のチップ、センサー、受動部品を1つのパッケージに統合するサービスを提供しています。この動向は、自動車、IoT、人工知能などのアプリケーションで統合ソリューションに対する需要が高まっていることと一致しています。

- 先進材料とプロセスの採用:OSATプロバイダーは、5G、エッジコンピューティング、高性能コンピューティングなどの新興アプリケーションの要件に対応するため、先進的な材料と製造プロセスを採用しています。先進基板材料、ウエハーレベルチップスケールパッケージング(WLCSP)、システムインパッケージ(SiP)などの技術が市場で人気を集めています。

目次

第1章 エグゼクティブサマリー

第2章 世界のOSAT市場:市場力学

- イントロダクション、背景、分類

- サプライチェーン

- 業界の促進要因と課題

第3章 2018年から2030年までの市場動向と予測分析

- マクロ経済動向(2018~2023年)と予測(2024~2030年)

- 世界のOSAT市場の動向(2018~2023年)と予測(2024~2030年)

- サービスタイプ別

- 組立・パッケージング

- 検査

- パッケージングタイプ別

- ワイヤーボンド

- フリップチップ

- ウエハーレベル

- その他

- 用途別

- 自動車

- 通信

- コンピューティング・ネットワーキング

- コンシューマーエレクトロニクス

- 産業

第4章 2017年から2028年までの市場動向と予測分析:地域別

- 世界のOSAT市場:地域別

- 北米のOSAT市場

- サービスタイプ別

- 用途別

- 欧州のOSAT市場

- サービスタイプ別

- 用途別

- アジア太平洋のOSAT市場

- サービスタイプ別

- 用途別

- その他の地域のOSAT市場

- サービスタイプ別

- 用途別

第5章 競合分析

- 製品ポートフォリオ分析

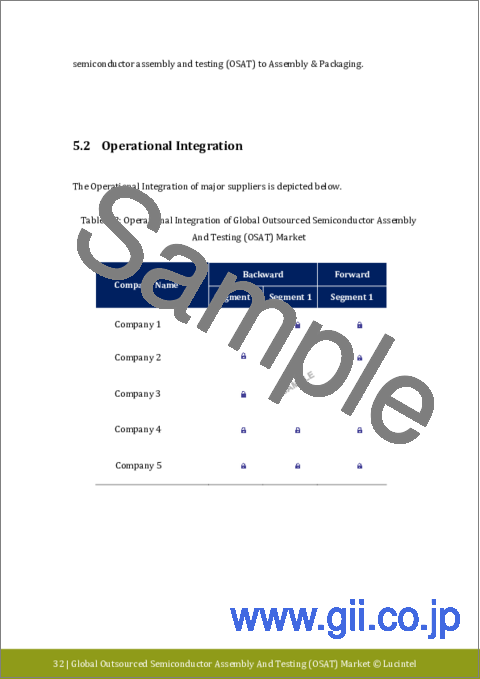

- 業務統合

- ポーターのファイブフォース分析

第6章 成長機会と戦略分析

- 成長機会分析

- サービスタイプ別

- パッケージングタイプ別

- 用途別

- 地域別

- 世界のOSAT市場の新たな動向

- 戦略分析

- 新製品の開発

- 世界のOSAT市場の能力拡大

- 世界のOSAT市場における合併、買収、合弁事業

- 認証とライセンシング

第7章 主要企業の企業プロファイル

- Advanced Semiconductor

- Amkor

- Jiangsu Changjiang Electronics Technology

- Siliconware Precision Industries

- PTI(Powertech Technology Inc.)

- United test and assembly center

- King Yuan Electronics

- ChipMOS .

Outsourced Semiconductor Assembly and Testing Market Trends and Forecast

The future of the global outsourced semiconductor assembly and testing (OSAT) market looks promising with opportunities in the automotive, telecommunication, computing & networking, consumer electronic, and industrial industries. The global outsourced semiconductor assembly and testing market is expected to reach an estimated $51.4 billion by 2030 with a CAGR of 4.5% from 2024 to 2030. The major drivers for this market are increasing semiconductor content within electronics products to provide greater functionality and higher levels of performance, growth in demand for smartphones and internet connected devices, and increasing electronic content in automotive for safety, navigation, fuel efficiency, emission reduction, and entertainment system.

- Lucintel forecast that assembly & packaging will remain the largest segment over the forecast period due to growing demand for telecom infrastructure and electronic products across the globe.

- Within this market, consumer electronics segment is projected to record the highest growth due to growing acceptance of 5G technologies and increasing consumption of smart televisions, tablets, and smartphones.

- Asia Pacific is expected to witness the highest growth during the forecast period due to growing adoption of IoT (internet of things), increasing electronic content per vehicle, and growing industrial automation in countries, such as China, Taiwan, and India.

Asia Pacific is expected to witness the highest growth

1. United States: Companies like Amkor Technology, Inc. and ASE Technology Holding Co., Ltd. drive innovation in the US OSAT market. Initiatives such as the Semiconductor Industry Association (SIA) promote collaboration and research in semiconductor manufacturing. The US government supports semiconductor R&D through agencies like the Department of Defense (DoD) and the National Science Foundation (NSF).

2. Taiwan: Taiwanese companies, including Advanced Semiconductor Engineering, Inc. (ASE) and Siliconware Precision Industries Co., Ltd. (SPIL), lead the global OSAT market. Government initiatives like the Industrial Development Bureau (IDB) support the semiconductor industry's growth and competitiveness. Taiwan Semiconductor Research Institute (TSRI) promotes R&D in semiconductor technologies.

3. China: Chinese OSAT companies like Jiangsu Changjiang Electronics Technology Co., Ltd. (JCET) and Tianshui Huatian Technology Co., Ltd. are expanding rapidly. Government initiatives such as the "Made in China 2025" plan aim to strengthen the semiconductor industry's capabilities. The Ministry of Industry and Information Technology (MIIT) provides support for semiconductor manufacturing.

4. South Korea: South Korean companies like Amkor Technology Korea Inc. and Powertech Technology Inc. (PTI) are prominent players in the OSAT market. Government initiatives like the Korea Semiconductor Industry Association (KSIA) promote industry growth and innovation. The Ministry of Trade, Industry and Energy (MOTIE) supports semiconductor development initiatives.

5. Singapore: Singaporean OSAT companies, including GlobalFoundries Singapore Pte. Ltd. and UTAC Holdings Ltd., contribute significantly to the global market. Government initiatives such as the Singapore Economic Development Board (EDB) support semiconductor manufacturing investments and talent development. The National Research Foundation (NRF) funds semiconductor research and development projects.

A more than 150-page report is developed to help in your business decisions. Sample figures with some insights are shown below.

Outsourced Semiconductor Assembly and Testing Market (OSAT) by Segment

The study includes a forecast for the global outsourced semiconductor assembly and testing market by service type, packaging type, application, and region, as follows:

OSAT Market by Service Type [Value ($B) Shipment Analysis from 2018 to 2030]:

- Assembly & Packaging

- Testing

OSAT Market by Packaging Type [Value ($B) Shipment Analysis from 2018 to 2030]:

- Wire Bond

- Flip Chip

- Wafer Level

- Others

OSAT Market by Application [Value ($B) Shipment Analysis from 2018 to 2030]:

- Automotive

- Telecommunications

- Computing & Networking

- Consumer Electronics

- Industrial

OSAT Market by Region [Value ($B) Shipment Analysis from 2018 to 2030]:

- North America

- Europe

- Asia Pacific

- The Rest of the World

List of Outsourced Semiconductor Assembly and Testing (OSAT) Companies

Companies in the market compete on the basis of product quality offered. Major players in this market focus on expanding their manufacturing facilities, R&D investments, infrastructural development, and leverage integration opportunities across the value chain. With these strategies outsourced semiconductor assembly and testing companies cater increasing demand, ensure competitive effectiveness, develop innovative products & technologies, reduce production costs, and expand their customer base. Some of the outsourced semiconductor assembly and testing companies profiled in this report includes.

- Advanced Semiconductor

- Amkor

- Jiangsu Changjiang Electronics Technology

- Siliconware Precision Industries

- PTI (Powertech Technology Inc.)

- United test and assembly center

- King Yuan Electronics

- ChipMOS

Recent Developments in OSAT Market

- Rising Demand for Advanced Packaging Solutions: The OSAT market is experiencing growth driven by increasing demand for advanced packaging solutions such as fan-out wafer-level packaging (FOWLP) and 3D packaging technologies. These technologies enable higher performance, miniaturization, and heterogeneous integration in semiconductor devices.

- Investments in Capacity Expansion: OSAT providers are investing in capacity expansion to meet the growing demand for semiconductor packaging and testing services. Companies like ASE Technology Holding Co. and Amkor Technology are ramping up production facilities and acquiring advanced equipment to support the industry's needs.

- Technological Advancements in Test Equipment: OSAT companies are adopting advanced test equipment and methodologies to improve efficiency, accuracy, and reliability in semiconductor testing processes. Innovations such as automated test handling systems and high-speed test solutions are enhancing the capabilities of OSAT providers.

- Focus on Heterogeneous Integration and System Integration: OSAT vendors are increasingly involved in heterogeneous integration and system-level packaging, offering services that combine multiple chips, sensors, and passive components into a single package. This trend aligns with the growing demand for integrated solutions in applications such as automotive, IoT, and artificial intelligence.

- Adoption of Advanced Materials and Processes: OSAT providers are adopting advanced materials and manufacturing processes to address the requirements of emerging applications such as 5G, edge computing, and high-performance computing. Technologies like advanced substrate materials, wafer-level chip-scale packaging (WLCSP), and system-in-package (SiP) are gaining traction in the market.

Features of the OSAT Market

- Market Size Estimates:Outsourced semiconductor assembly and testing market size estimation in terms of value ($B)

- Trend And Forecast Analysis:Market trends (2018-2023) and forecast (2024-2030) by various segments and regions.

- Segmentation Analysis:Outsourced semiconductor assembly and testing market size by various segments, such as by service type, packaging type, application, and region

- Regional Analysis:Outsourced semiconductor assembly and testing market breakdown by North America, Europe, Asia Pacific, and the Rest of the World.

- Growth Opportunities:Analysis on growth opportunities in different by service type, packaging type, application, and regions for the outsourced semiconductor assembly and testing market.

- Strategic Analysis:This includes M&A, new product development, and competitive landscape for the outsourced semiconductor assembly and testing market.

- Analysis of competitive intensity of the industry based on Porter's Five Forces model.

FAQ

Q1. What is the outsourced semiconductor assembly and testing (OSAT) market size?

Answer: The global outsourced semiconductor assembly and testing (OSAT) market is expected to reach an estimated $51.4 billion by 2030.

Q2. What is the growth forecast for the OSAT market?

Answer: The global outsourced semiconductor assembly and testing market is expected to grow with a CAGR of 4.5% from 2024 to 2030.

Q3. What are the major drivers influencing the growth of the OSAT market?

Answer: The major drivers for this market are increasing semiconductor content within electronics products to provide greater functionality and higher levels of performance, growth in demand for smartphones and internet connected devices, and increasing electronic content in automotive for safety, navigation, fuel efficiency, emission reduction, and entertainment system.

Q4. What are the major segments for OSAT market?

Answer: The future of the outsourced semiconductor assembly and testing market looks promising with opportunities in the automotive, telecommunication, computing & networking, consumer electronic, and industrial application industries.

Q5. Who are the key outsourced semiconductor assembly and testing companies?

Answer: Some of the key outsourced semiconductor assembly and testing companies are as follows:

- Advanced Semiconductor

- Amkor

- Jiangsu Changjiang Electronics Technology

- Siliconware Precision Industries

- PTI (Powertech Technology Inc.)

- United test and assembly center

- King Yuan Electronics

- ChipMOS

Q6. Which OSAT segment will be the largest in future?

Answer:Lucintel forecast that assembly & packaging will remain the largest segment over the forecast period due to growing demand for telecom infrastructure and electronic products across the globe.

Q7. In outsourced semiconductor assembly and testing market, which region is expected to be the largest in next 5 years?

Answer: Asia Pacific is expected to witness the highest growth during the forecast period due to growing adoption of IoT (internet of things), increasing electronic content per vehicle, and growing industrial automation in countries, such as China, Taiwan, and India.

Q8. Do we receive customization in this report?

Answer: Yes, Lucintel provides 10% Customization Without any Additional Cost.

This report answers following 11 key questions

- Q.1. What are some of the most promising, high-growth opportunities for the global outsourced semiconductor assembly and testing market by service type (assembly & packaging and testing), packaging type (wire bond, flip chip, wafer level, and others), application (automotive, telecommunications, computing & networking, consumer electronics, and industrial), and region (North America, Europe, Asia Pacific, and the Rest of the World)?

- Q.2. Which segments will grow at a faster pace and why?

- Q.3. Which region will grow at a faster pace and why?

- Q.4. What are the key factors affecting market dynamics? What are the key challenges and business risks in this market?

- Q.5. What are the business risks and competitive threats in this market?

- Q.6. What are the emerging trends in this market and the reasons behind them?

- Q.7. What are some of the changing demands of customers in the market?

- Q.8. What are the new developments in the market? Which companies are leading these developments?

- Q.9. Who are the major players in this market? What strategic initiatives are key players pursuing for business growth?

- Q.10. What are some of the competing products in this market and how big of a threat do they pose for loss of market share by material or product substitution?

- Q.11. What M&A activity has occurred in the last 5 years and what has its impact been on the industry?

Table of Contents

1. Executive Summary

2. Global Outsourced Semiconductor Assembly and Testing Market: Market Dynamics

- 2.1: Introduction, Background, and Classifications

- 2.2: Supply Chain

- 2.3: Industry Drivers and Challenges

3. Market Trends and Forecast Analysis from 2018 to 2030

- 3.1: Macroeconomic Trends (2018-2023) and Forecast (2024-2030)

- 3.2: Global Outsourced Semiconductor Assembly and Testing Market Trends (2018-2023) and Forecast (2024-2030)

- 3.3: Global Outsourced Semiconductor Assembly and Testing Market by Service Type

- 3.3.1: Assembly & Packaging

- 3.3.2: Testing

- 3.4: Global Outsourced Semiconductor Assembly and Testing Market by Packaging Type

- 3.4.1: Wire Bond

- 3.4.2: Flip Chip

- 3.4.3: Wafer Level

- 3.4.4: Others

- 3.5: Global Outsourced Semiconductor Assembly and Testing Market by Application

- 3.5.1: Automotive

- 3.5.2: Telecommunications

- 3.5.3: Computing & Networking

- 3.5.4: Consumer Electronics

- 3.5.5: Industrial

4. Market Trends and Forecast Analysis by Region from 2017-2028

- 4.1: Global Outsourced Semiconductor Assembly and Testing Market by Region

- 4.2: North American Outsourced Semiconductor Assembly and Testing Market

- 4.2.1: North American Outsourced Semiconductor Assembly and Testing Market by Service Type: Assembly & Packaging and Testing

- 4.2.2: North American Outsourced Semiconductor Assembly and Testing Market by Application: Automotive, Telecommunications, Computing & Networking, Consumer Electronics, and Industrial

- 4.3: European Outsourced Semiconductor Assembly and Testing Market

- 4.3.1: European Outsourced Semiconductor Assembly and Testing Market by Service Type: Assembly & Packaging and Testing

- 4.3.2: European Outsourced Semiconductor Assembly and Testing Market by Application: Automotive, Telecommunications, Computing & Networking, Consumer Electronics, and Industrial

- 4.4: APAC Outsourced Semiconductor Assembly and Testing Market

- 4.4.1: APAC Outsourced Semiconductor Assembly and Testing Market by Service Type: Assembly & Packaging and Testing

- 4.4.2: APAC Outsourced Semiconductor Assembly and Testing Market by Application: Automotive, Telecommunications, Computing & Networking, Consumer Electronics, and Industrial

- 4.5: ROW Outsourced Semiconductor Assembly and Testing Market

- 4.5.1: ROW Outsourced Semiconductor Assembly and Testing Market by Service Type: Assembly & Packaging and Testing

- 4.5.2: ROW Outsourced Semiconductor Assembly and Testing Market by Application: Automotive, Telecommunications, Computing & Networking, Consumer Electronics, and Industrial

5. Competitor Analysis

- 5.1: Product Portfolio Analysis

- 5.2: Operational Integration

- 5.3: Porter's Five Forces Analysis

6. Growth Opportunities and Strategic Analysis

- 6.1: Growth Opportunity Analysis

- 6.1.1: Growth Opportunities for the Outsourced Semiconductor Assembly and Testing Market by Service Type

- 6.1.2: Growth Opportunities for the Outsourced Semiconductor Assembly and Testing Market by Packaging Type

- 6.1.3: Growth Opportunities for the Outsourced Semiconductor Assembly and Testing Market by Application

- 6.1.5: Growth Opportunities for the Outsourced Semiconductor Assembly and Testing Market by Region

- 6.2: Emerging Trends in the Global Outsourced Semiconductor Assembly and Testing Market

- 6.3: Strategic Analysis

- 6.3.1: New Product Development

- 6.3.2: Capacity Expansion of the Global Outsourced Semiconductor Assembly and Testing Market

- 6.3.3: Mergers, Acquisitions, and Joint Ventures in the Global Outsourced Semiconductor Assembly and Testing Market

- 6.3.4: Certification and Licensing

7. Company Profiles of Leading Players

- 7.1: Advanced Semiconductor

- 7.2: Amkor

- 7.3: Jiangsu Changjiang Electronics Technology

- 7.4: Siliconware Precision Industries

- 7.5: PTI (Powertech Technology Inc.)

- 7.6: United test and assembly center

- 7.7: King Yuan Electronics

- 7.8: ChipMOS .