|

|

市場調査レポート

商品コード

1673492

二重特異性抗体の世界市場:市場の機会、用量、特許、薬価、売上、臨床試験動向(2030年)Global Bispecific Antibody Market Opportunity, Drug Dosage, Patent, Price, Sales & Clinical Trials Insight 2030 |

||||||

|

|||||||

| 二重特異性抗体の世界市場:市場の機会、用量、特許、薬価、売上、臨床試験動向(2030年) |

|

出版日: 2025年03月01日

発行: KuicK Research

ページ情報: 英文 1000 Pages

納期: 即日から翌営業日

|

全表示

- 概要

- 図表

- 目次

二重特異性抗体は、絶え間ない技術革新と患者受容の高まりにより、医薬品市場において最も有望かつ商業的に成功したターゲティングアプローチの一つとして台頭してきました。この驚異的な成長の主な要因は、二重特異性抗体の臨床試験数が飛躍的に増加していることであり、2015年には100件未満であったものが、2025年には650件を超えています。この進歩は、医薬品開発者、臨床研究機関、医師、患者といった複数の利害関係者に大きな利益をもたらしています。2025年3月現在、主要市場において17の二特異性抗体が承認されており、最初の二特異性抗体が承認された2015年には7,700万米ドルであったのに対し、累積売上高は350億米ドルを超えています。

二重特異性抗体の市場規模は、2024年に約120億米ドルに達し、2030年までに500億米ドルに急増すると予測されています。この成長軌道は、アンメット・メディカル・ニーズに対応できる革新的な生物製剤に対する需要の高まりを示しています。注目すべきは、HemlibraとVabysmoが世界の二重特異性抗体市場の主役として台頭し、合計で総売上高の75%以上を占めていることです。ロシュが開発した二重特異性抗体ヘムリブラは血友病Aの治療に用いられ、同じくロシュが開発したバビスモは黄斑変性と黄斑浮腫の治療薬です。両剤とも2024年には売上高が40億米ドルを突破し、それぞれの治療領域で主要な参入製品として頭角を現し、二重特異性抗体市場におけるRocheのリーダーシップを確固たるものにしています。

また、現在承認審査中の二重特異性抗体もいくつかあります。特に、治験中の二重特異性抗体であるリンボセルタマブは、多発性骨髄腫の治療薬として米国FDAと欧州医薬品庁(EMA)の審査を受けています。もう一つの有望な候補であるオドロネクスタマブは、様々な血液悪性腫瘍の治療薬として現在FDAの審査を受けています。これらの開発は、二重特異性抗体研究の進行と、がん治療に革命をもたらす可能性を強調するものです。

2025年3月現在、600以上の二特異性抗体が臨床試験中であり、この治療薬が複数の治療領域で計り知れない可能性を秘めていることを示しています。米国は、医薬品の技術革新とヘルスケア支出における主導権を反映し、研究開発(R&D)と売上の両面で二特異性抗体の最大市場であり続けています。

当レポートは、世界の二重特異性抗体市場について調査し、市場の概要とともに、薬剤動向、臨床試験動向、地域別動向、および市場に参入する企業の競合情勢などを提供しています。

目次

第1章 二重特異性抗体のイントロダクション

第2章 二重特異性抗体の組み合わせ戦略

- 化学療法

- 標的療法

- 免疫療法

- 放射線治療

第3章 上市済み二重特異性抗体の洞察

第4章 二重特異性抗体の独自プラットフォーム

第5章 世界および地域別の二重特異性抗体市場の見通し

- 年間および四半期の売上洞察(2020年~2024年)

- 承認済み二重特異性抗体の償還ポリシー

- 2030年の世界二重特異性抗体市場予測

第6章 世界の二重特異性抗体市場の動向、地域別

- 日本

- 韓国

- 米国

- 欧州

- 中国

- 英国

- オーストラリア

- カナダ

- ラテンアメリカ

第7章 世界の二重特異性抗体調査と市場動向、適応症別

- リンパ腫

- 多発性骨髄腫

- 白血病

- 肺がん

- 悪性黒色腫

- 消化器がん

- その他のがん

- 血液疾患

- 自己免疫疾患および炎症性疾患

- 微生物疾患

- 眼疾患

第8章 Blincyto-臨床、特許、価格設定、販売に関する洞察

第9章 Hemlibra- 臨床、特許、価格設定、販売に関する洞察

第10章 Rybrevant-臨床、特許、価格設定に関する洞察

第11章 Vabysmo-臨床、特許、価格設定、販売に関する洞察

第12章 Lunsumio-臨床、特許、価格設定、販売に関する洞察

第13章 Kaitani- 臨床と営業の洞察

第14章 Tecvayli-臨床、特許、価格設定に関する洞察

第15章 Columvi-臨床、特許、価格設定、販売に関する洞察

第16章 Epkinly-臨床、特許、価格設定、販売に関する洞察

第17章 Talvey-臨床、特許、価格設定に関する洞察

第18章 Elrexfio-臨床、特許、価格設定に関する洞察

第19章 Imdelltra-臨床、特許、価格設定、販売に関する洞察

第20章 Ivonescimab- 臨床的洞察

第21章 Ordspono-臨床および販売に関する洞察

第22章 Ziihera-臨床、価格設定、販売に関する洞察

第23章 Bizengri-臨床、特許、価格設定、販売に関する洞察

第24章 Korjuny- 臨床的洞察

第25章 企業、適応症、相別の世界の二重特異性抗体臨床試験

- 調査

- 前臨床

- 第I相

- 第I/II相

- 第II相

- 第II/III相

- 第III相

- 事前登録

- 登録済み

第26章 上市済み二重特異性抗体の企業別、国別、適応症別の臨床的洞察

第27章 競合情勢

- ABL Bio

- Abzyme Therapeutics

- Affimed Therapeutics

- Akeso Biopharma

- Alligator Bioscience

- Amgen

- Antibody Therapeutics

- APITBIO

- Aptevo Therapeutics

- Astellas Pharma

- AstraZeneca

- BioAtla

- Biosion

- Biotheus

- BJ Bioscience

- EpimAb Biotherapeutics

- FutureGen Biopharmaceutical

- Genentech

- Genmab

- Gensun Biopharma

- Harbour BioMed

- IGM Biosciences

- I-MAB Biopharma

- ImmuneOnco Biopharma

- Innovent Biologics

- Invenra

- Janssen Research & Development

- Kenjockety Biotechnology

- LaNova Medicines Limited

- Light Chain Bioscience

- Linton Pharm

- Lyvgen Biopharma

- MacroGenics

- Merus

- NovaRock Biotherapeutics

- Pfizer

- Phanes Therapeutics

- Prestige BioPharma

- Regeneron Pharmaceuticals

- Revitope

- Roche

- Virtuoso Therapeutics

- Xencor

- Y-Biologics

- Zhejiang Shimai Pharmaceutical

- Zymeworks

List of Figures

List of Figures

- Figure 1-1: Bispecific Antibodies - Advantages

- Figure 2-1: Antibody-Chemotherapy Combination - Advantages

- Figure 2-2: Antibody-Chemotherapy Combination - Impending Challenges

- Figure 3-1: Blincyto - Mechanism of Action

- Figure 3-2: Hemlibra - Mechanism of Action

- Figure 3-3: Rybrevant - Mechanism of Action

- Figure 3-4: Regulatory Designations - Benefits

- Figure 4-1: Multiclonics - Distinctive Characteristics

- Figure 4-2: Biclonics - Format

- Figure 4-3: ADAPTIR Bispecific Structure

- Figure 4-4: ADAPTIR-FLEX

- Figure 4-5: BEAT Platform - Multispecific Antibodies

- Figure 4-6: FIT-Ig - Proprietary Bispecific Platform

- Figure 4-7: BiClone format

- Figure 4-8: BioAtla CABs - Features

- Figure 4-9: BioAtla CABs - Benefits

- Figure 4-10: IMBiologic Bispecific Antibodies - Strategy

- Figure 4-11: IMBiologic Bispecific Antibodies - Mechanism of Action

- Figure 4-12: Novel HBICE

- Figure 4-13: HBICE - Mechanism of Action 1

- Figure 4-14: HBICE - Mechanism of Action 2

- Figure 4-15: Phanes Therapeutics - PACbody Platform

- Figure 4-16: Phanes Therapeutics - SPECpair Platform

- Figure 4-17: Phanes Therapeutics - ATACCbody

- Figure 4-18: Numab Therapeutics - Technology

- Figure 4-19: Grabody I Platform - Mechanism of Action

- Figure 4-20: Grabody I Platform - Mechanism of Action

- Figure 4-21: 3-Step DuoBody Production Process

- Figure 4-22: DuoHexaBody Molecules - Schematic

- Figure 4-23: iTAb - Patented Structure

- Figure 4-24: iTAb - Mechanism of Action

- Figure 4-25: Synimmune - Proprietary Bispecific Antibody Format

- Figure 4-26: BiTE - Structure

- Figure 4-27: BiTE Molecule

- Figure 4-28: Sanyou Super Trillion Common Light Chain Antibody Discovery Platform

- Figure 4-29: ALiCE - Characteristics

- Figure 4-30: ALiCE - Schematic Diagram & Mechanism of Action

- Figure 4-31: Abz2 Bispecific Platform

- Figure 4-32: Abz2 Bispecifics - Benefits

- Figure 4-33: Neo-X-Prime Bispecific Mechanism

- Figure 4-34: B-Body Bispecific Antibody - Structre

- Figure 4-35: xLinkBsAb - Structure

- Figure 4-36: PrecisionGATE Bispecific Antibody - Structure

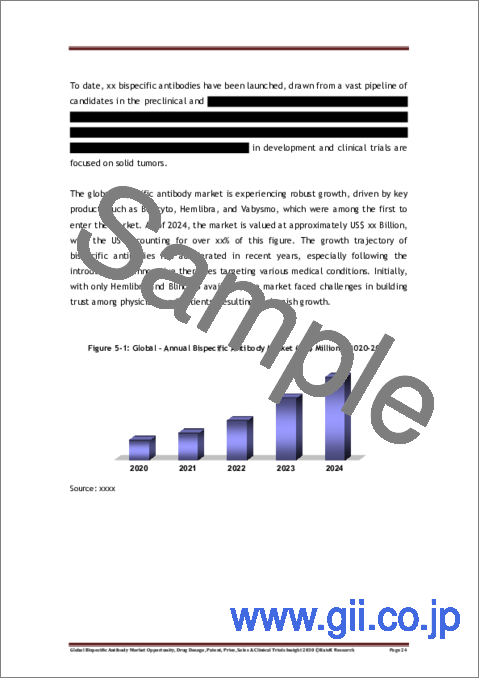

- Figure 5-1: Global - Annual Bispecific Antibody Market (US$ Million), 2020-2024

- Figure 5-2: Global - Annual Bispecific Antibodies Market By Drugs (US$ Million), 2024

- Figure 5-3: Global - Bispecific Antibodies Market Shares by Drugs (%), 2024

- Figure 5-4: Global - Quarterly Bispecific Antibody Market (US$ Million), 2024

- Figure 5-5: Global - Annual Bispecific Antibody Market By Region (US$ Million), 2024

- Figure 5-6: Global - Bispecific Antibody Market Shares By Region (%), 2024

- Figure 5-7: US -Bispecific Antibody Market (US$ Million), 2020-2024

- Figure 5-8: US - Quarterly Bispecific Antibodies Market (US$ Million), 2024

- Figure 5-9: US - Quarterly Bispecific Antibodies Market (US$ Million),2023

- Figure 5-10: ROW -Bispecific Antibody Market Value (US$ Million), 2020-2024

- Figure 5-11: ROW - Quarterly Bispecific Antibodies Market (US$ Million), 2024

- Figure 5-12: ROW - Quarterly Bispecific Antibodies Market (US$ Million), 2023

- Figure 5-13: Global - Bispecific Antibodies Market By Drug (US$ Million), 2023

- Figure 5-14: Global - Bispecific Antibodies Market Shares By Drugs (%), 2023

- Figure 5-15: Global - Quarterly Bispecific Antibody Market (US$ Million), 2023

- Figure 5-16: Global - Bispecific Antibody Market By Region (US$ Million), 2023

- Figure 5-17: Global - Bispecific Antibody Market Shares By Region (%), 2023

- Figure 5-18: Blincyto - Total Treatment Cost & Reimbursement Cost

- Figure 5-19: Blincyto - In Pocket & Out of Pocket Cost of Treatment

- Figure 5-20: Hemlibra - Total Treatment Cost & Reimbursement Cost

- Figure 5-21: Hemlibra - In Pocket & Out Of Pocket Cost Of Treatment

- Figure 5-22: Rybrevant - Maximum Coverage By Medicaid (US$), 2023

- Figure 5-23: Rybrevant - Maximum Coverage By Private Insurance Coverage (US$), 2021

- Figure 5-24: Vabysmo - Total Treatment Cost & Reimbursement Cost

- Figure 5-25: Vabysmo - In Pocket & Out Of Pocket Cost Of Treatment

- Figure 5-26: Global - Bispecific Antibody Market Opportunity Assessment (US$ Billion), 2025 - 2030

- Figure 6-1: US - Bispecific Antibodies Approval

- Figure 7-1: Bispecific Antibodies - Advantages

- Figure 7-2: HX009-II-02 Phase 1/2 Study - Initiation & Completion Year

- Figure 7-3: Bispecific Antibodies - Future Opportunities in Melanoma

- Figure 7-4: Mim8 Phase 3 (NCT05878938) Study - Initiation & Completion Year

- Figure 7-5: NXT007 Phase 1/2 (NCT05987449) Study - Initiation & Completion Year

- Figure 7-6: HMB-001 Phase 1/2 (NCT06211634) Study - Initiation & Completion Year

- Figure 8-1: Blincyto - Approval Year By Region

- Figure 8-2: Blincyto - Patent Filing & Expiration Year

- Figure 8-3: Blincyto - Treatment Regimen Cycles (Weeks)

- Figure 8-4: Blincyto - Duration Of Treatment Phase & Resting Phase In Induction & Consolidation Cycles For Treatment Of MRD-Positive B-Cell Precursor (Days)

- Figure 8-5: Blincyto - Recommended Number Of Induction & Consolidation Treatment Cycle For Relapsed B-Cell Precursor ALL

- Figure 8-6: Blincyto - Duration Of Single Induction, Consolidation, Continued Cycle & Full Treatment For Relapsed B-Cell Precursor ALL (Weeks)

- Figure 8-7: Global - Blincyto Sales (US$ Million), 2020-2024

- Figure 8-8: Global - Blincyto Sales Quaterly (US$ Million), 2024

- Figure 8-9: Global - Blincyto Sales Quaterly (US$ Million), 2023

- Figure 8-10: Blincyto - Sales By Region (US$ Million), 2024

- Figure 8-11: Blincyto - Sales By Region (%), 2024

- Figure 8-12: Blincyto - Sales By Region (US$ Million), 2023

- Figure 8-13: Global - Blincyto Sales By Region (%), 2023

- Figure 8-14: US - Blincyto Sales ((US$ Million), 2020-2024

- Figure 8-15: US - Blincyto Sales Quaterly (US$ Million), 2024

- Figure 8-16: US - Blincyto Sales Quaterly (US$ Million), 2023

- Figure 8-17: ROW - Blincyto Sales (US$ Million), 2020-2024

- Figure 8-18: ROW - Blincyto Sales Quaterly (US$ Million), 2024

- Figure 8-19: ROW - Blincyto Sales Quaterly (US$ Million), 2023

- Figure 9-1: Hemlibra - Approval Years By Region

- Figure 9-2: Hemlibra - Cost per Unit & Supply of 30 mg/mL Subcutaneous Injection Of Different Volumes (US$), March'2025

- Figure 9-3: Hemlibra - Cost per Unit & Supply of 150 mg/mL Subcutaneous Injection Of Different Volumes (US$), March'2025

- Figure 9-4: Hemlibra - Recommended Loading & Maintenance Dose For Treatment Of Hemophilia (mg/kg/Week)

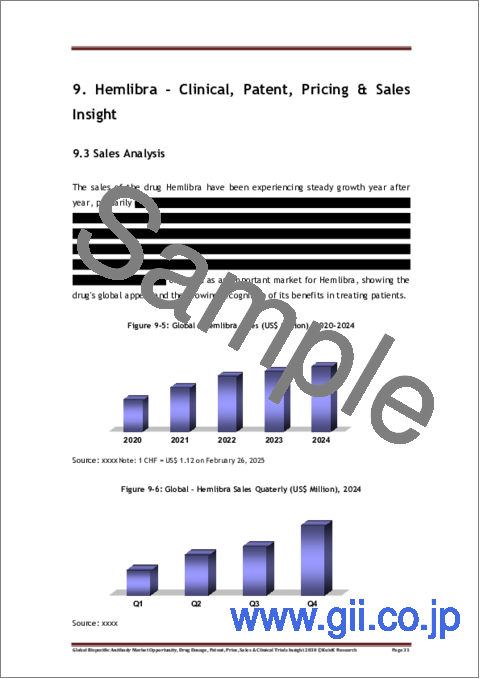

- Figure 9-5: Global - Hemlibra Sales (US$ Million), 2020-2024

- Figure 9-6: Global - Hemlibra Sales Quaterly (US$ Million), 2024

- Figure 9-7: Global - Hemlibra Sales Quaterly (US$ Million), 2023

- Figure 9-8: US - Hemlibra Sales (US$ Million), 2020-2024

- Figure 9-9: US - Hemlibra Sales Quaterly (US$ Million), 2024

- Figure 9-10: US - Hemlibra Sales Quaterly (US$ Million), 2023

- Figure 9-11: Europe - Hemlibra Sales (US$ Million), 2020-2024

- Figure 9-12: Europe - Hemlibra Sales Quaterly (US$ Million), 2024

- Figure 9-13: Europe - Hemlibra Sales Quaterly (US$ Million), 2023

- Figure 9-14: Japan - Hemlibra Sales (US$ Million), 2020-2024

- Figure 9-15: Japan - Hemlibra Sales Quaterly (US$ Million), 2024

- Figure 9-16: Japan - Hemlibra Sales Quaterly (US$ Million), 2023

- Figure 9-17: ROW - Hemlibra Sales (US$ Million), 2020-2024

- Figure 9-18: ROW - Hemlibra Sales Quaterly (US$ Million), 2024

- Figure 9-19: ROW - Hemlibra Sales Quaterly (US$ Million), 2023

- Figure 9-20: Global - US v/s ex-US Sales (US$ Million), 2024

- Figure 9-21: Global - Hemlibra Annual Sales By Region (US$ Million), 2024

- Figure 9-22: Global - Hemlibra Sales By Region (%), 2024

- Figure 9-23: Global - US v/s Ex-US Sales (US$ Million), 2023

- Figure 9-24: Global - Hemlibra Annual Sales By Region (US$ Million), 2023

- Figure 9-25: Global - Hemlibra Sales By Region (%), 2023

- Figure 10-1: Rybrevant - Patent Filing & Expiration Year

- Figure 10-2: Rybrevant - Price Per Unit & Supply Of Intravenous Solution (US$), March'2025

- Figure 10-3: Rybrevant - Recommended Dose Per Cycle By Body Weight (mg)

- Figure 10-4: Rybrevant - Dose Reduction In Patients With Weight Less Than 80 kg (mg)

- Figure 10-5: Rybrevant - Dose Reduction in Patients with Weight more than 80 Kg (mg)

- Figure 11-1: Vabysmo - Approval Year By Region

- Figure 11-2: Rybrevant - Patent Filing & Expiration Year

- Figure 11-3: Vabysmo - Price Per Unit & Supply Of Intravitreal Solution (US$), March'2025

- Figure 11-4: Global - Vabysmo Sales (US$ Million), 2022-2024

- Figure 11-5: Global - Vabysmo Sales Quaterly (US$ Million), 2024

- Figure 11-6: Global - Vabysmo Sales Quaterly (US$ Million), 2023

- Figure 11-7: US - Vabysmo Sales (US$ Million), 2022-2024

- Figure 11-8: US - Vabysmo Sales Quaterly (US$ Million), 2024

- Figure 11-9: US - Vabysmo Sales Quaterly (US$ Million), 2023

- Figure 11-10: Europe - Vabysmo Sales (US$ Million), 2022-2024

- Figure 11-11: Europe - Vabysmo Sales Quaterly (US$ Million), 2024

- Figure 11-12: Europe - Vabysmo Sales Quaterly (US$ Million), 2023

- Figure 11-13: Japan - Vabysmo Sales (US$ Million), 2022-2024

- Figure 11-14: Japan - Vabysmo Sales Quaterly (US$ Million), 2024

- Figure 11-15: Japan - Vabysmo Sales Quaterly (US$ Million), 2023

- Figure 11-16: ROW - Vabysmo Sales (US$ Million), 2022-2024

- Figure 11-17: ROW - Vabysmo Sales Quaterly (US$ Million), 2024

- Figure 11-18: ROW - Vabysmo Sales Quaterly (US$ Million), 2023

- Figure 11-19: Global - Vabysmo US v/s Ex-US Sales (US$ Million), 2024

- Figure 11-20: Global - Vabysmo Annual Sales by Region (US$ Million), 2024

- Figure 11-21: Global - Vabysmo Sales By Region (%), 2024

- Figure 11-22: Global - Vabysmo US v/s Ex-US Sales (US$ Million), 2023

- Figure 11-23: Global - Vabysmo Annual Sales By Region (US$ Million), 2023

- Figure 11-24: Global - Vabysmo Sales By Region (%), 2023

- Figure 12-1: Lunsumio - Approval Years By Region

- Figure 12-2: US - Price Per Unit & Supply of Lunsumio Intravenous Solution (US$), March'2025

- Figure 12-3: EU - Price Per Unit & Supply of Lunsumio Intravenous Solution (US$), March'2025

- Figure 12-4: Global - Lunsumio Sales (US$ Million), 2022-2024

- Figure 12-5: Global - Lunsumio Sales Quaterly (US$ Million), 2024

- Figure 12-6: Global - Lunsumio Sales Quaterly (US$ Million), 2023

- Figure 12-7: US - Lunsumio Sales (US$ Million), 2022-2024

- Figure 12-8: US - Lunsumio Sales Quaterly (US$ Million), 2024

- Figure 12-9: US - Lunsumio Sales Quaterly (US$ Million), 2023

- Figure 12-10: Europe - Lunsumio Sales (US$ Million), 2022-2024

- Figure 12-11: Europe - Lunsumio Sales Quaterly (US$ Million), 2024

- Figure 12-12: Europe - Lunsumio Sales Quaterly (US$ Million), 2023

- Figure 12-13: ROW - Lunsumio Sales (US$ Million), 2022-2024

- Figure 12-14: ROW - Lunsumio Sales Quaterly (US$ Million), 2024

- Figure 12-15: Lunsumio - US v/s Ex-US Sales (US$ Million), 2024

- Figure 12-16: Global - Lunsumio Annual Sales By Region (US$ Million), 2024

- Figure 12-17: Global - Lunsumio Sales By Region (%), 2024

- Figure 12-18: Global - US v/s Ex-US Sales (US$ Million), 2023

- Figure 12-19: Global - Lunsumio Annual Sales By Region (US$ Million), 2023

- Figure 12 20: Global - Lunsumio Sales By Region (%), 2023

- Figure 13-1: China - Kaitani Sales (US$ Million), 2022-2023

- Figure 13-2: China - Kaitani Sales (US$ Million), H1-H2'2023

- Figure 14-1: Tecvayli - Approval Years by Region

- Figure 14-2: Tecvayli - Patent Acceptance & Expiration Year

- Figure 14-3: US - Cost Per Unit & Supply Of Tecvayli Subcutaneous Solution (US$), March'2025

- Figure 14-4: EU - Cost of Supply Of Tecvayli Subcutaneous Solution (US$), March'2025

- Figure 14-5: Global - Tecvayli Sales (US$ Million), 2022-2024

- Figure 14-6: Global - Tecvayli Sales Quaterly (US$ Million), 2024

- Figure 14-7: Global - Tecvayli Sales Quaterly (US$ Million), 2023

- Figure 14-8: US - Tecvayli Sales (US$ Million), 2022-2024

- Figure 14-9: US - Tecvayli Sales Quaterly (US$ Million), 2024

- Figure 14-10: US - Tecvayli Sales Quaterly (US$ Million), 2023

- Figure 14-11: ROW - Tecvayli Sales (US$ Million), 2022-2024

- Figure 14-12: ROW - Tecvayli Sales Quaterly (US$ Million), 2024

- Figure 14-13: ROW - Tecvayli Sales Quaterly (US$ Million), 2023

- Figure 14-14: Tecvayli - US v/s Ex-US Sales (US$ Million), 2024

- Figure 14-15: Tecvayli - US v/s Ex-US Sales (%), 2024

- Figure 14-16: Tecvayli - US v/s Ex-US Sales (US$ Million), 2023

- Figure 14-17: Tecvayli - US v/s Ex-US Sales (%), 2023

- Figure 15-1: Columvi - Approval Year By Region

- Figure 15-2: US - Price Per Unit & Supply Of Columvi Intravenous Solution (US$), March'2025

- Figure 15-3: EU - Price Of Supply Of Columvi Intravenous Solution (US$), March'2025

- Figure 15-4: Global - Columvi Sales (US$ Million), 2023-2024

- Figure 15-5: Global - Columvi Sales Quaterly (US$ Million), 2024

- Figure 15-6: Global - Columvi Sales Quaterly (US$ Million), 2023

- Figure 15-7: US - Columvi Sales (US$ Million), 2023-2024

- Figure 15-8: US - Columvi Sales Quaterly (US$ Million), 2024

- Figure 15-9: US - Columvi Sales Quaterly (US$ Million), 2023

- Figure 15-10: Europe - Columvi Sales (US$ Million), 2023 & 2024

- Figure 15-11: Europe - Columvi Sales Quaterly (US$ Million), 2024

- Figure 15-12: Europe - Columvi Sales Quaterly (US$ Million), 2023

- Figure 15-13: ROW - Columvi Sales (US$ Million), 2023 & 2024

- Figure 15-14: ROW - Columvi Sales Quaterly (US$ Million), 2024

- Figure 15-15: ROW - Columvi Sales Quaterly (US$ Million), 2023

- Figure 15-16: Global - Columvi US v/s Ex-US Sales (US$ Million), 2024

- Figure 15-17: Global - Columvi Annual Sales By Region (US$ Million), 2024

- Figure 15-18: Global - Columvi Sales By Region (%), 2024

- Figure 15-19: Global - Columvi US v/s Ex-US Sales (US$ Million), 2023

- Figure 15-20: Global - Columvi Annual Sales By Region (US$ Million), 2023

- Figure 15-21: Global - Columvi Sales By Region (%), 2023

- Figure 16-1: Epkinly - Approval Year By Region

- Figure 16-2: US - Cost Per Unit & Supply Of Epkinly Subcutaneous Solution (US$), March'2025

- Figure 16-3: EU - Cost Of Supply Of Epkinly Subcutaneous Solution (US$), March'2025

- Figure 16-4: Global - Epkinly Sales (US$ Million), 2023 & 2024

- Figure 16-5: Global - Epkinly Sales Reported By Genmab (US$ Million), 2023 & 2024

- Figure 16-6: Global - Epkinly Sales Reported By AbbVie (US$ Million), 2023 & 2024

- Figure 16-7: Global - Epkinly Sales By Company (US$ Million), 2024

- Figure 16-8: Global - Epkinly Sales By Company (US$ Million), 2023

- Figure 17-1: Talvey - Approval Year By Region

- Figure 17-2: Talquetamab - FDA & EMA Designation Year

- Figure 17-3: Talvey - Patent Acceptance & Expiration Year

- Figure 17-4: US - Price Per Unit & Supply Of Talvey Intravenous Solution (US$), March'2025

- Figure 17-5: EU - Price Per Supply Of Talvey Intravenous Solution (US$), March'2025

- Figure 18-1: Elrexfio - Approval Year by Region

- Figure 18-2: Elranatamab - FDA & EMA Designation Year

- Figure 18-3: US - Price Per Unit & Supply Of Elrexfio Subcutaneous Solution (US$), March'2025

- Figure 18-4: Global - Elrexfio Sales (US$ Million), 2023 & 2024

- Figure 18-5: US - Elrexfio Sales (US$ Million), 2023 & 2024

- Figure 18-6: ROW - Elrexfio Sales (US$ Million), 2023 & 2024

- Figure 19-1: Imdelltra - Approval Year By Region

- Figure 19-2: US - Price Of Supply Of Imdelltra Intravenous Powder (US$), March'2025

- Figure 19-3: EU - Price Of Supply Of Imdelltra Intravenous Powder (US$), March'2025

- Figure 19-4: Global - Imdelltra Sales (US$ Million), 2024

- Figure 19-5: Global - Imdelltra Sales Quaterly (US$ Million), 2024

- Figure 21-1: Global - Ordspono Sales (US$ Million), 2022-2024

- Figure 21-2: Global - Ordspono Sales Quaterly (US$ Million), 2024

- Figure 22-1: US - Price Per Unit & Supply Of Ziihera (US$), March'2025

- Figure 22-2: Global - Ziihera Sales (US$ Million), 2024

- Figure 23-1: Zenocutuzumab - Active Patents

List of Tables

- Table 2-1: Bispecific Antibody & Chemotherapy Combinations in Clinical Trials

- Table 2-2: Bispecific Antibody & Targeted Therapy Combinations in Clinical Trials

- Table 2-3: Bispecific Antibody & Immunotherapy Combinations in Clinical Trials

- Table 2-4: Bispecific Antibody & Radiotherapy Combinations in Clinical Trials

- Table 3-1: Approved Bispecific Antibodies

- Table 3-2: US - Bispecific Antibodies with Regulatory Designations

- Table 3-3: EU - Bispecific Antibodies with Regulatory Designations

- Table 3-4: China - Bispecific Antibodies with Regulatory Designations

- Table 5-1: Epkinly - Billing Unit Application For Doses

- Table 5-2: Talvey - Coverage Summary

- Table 5-3: Talvey - Coding Summary

- Table 5-4: Elrexfio - HCPCS Codes

- Table 5-5: Elrexfio - HCPCS Modifiers

- Table 5-6: Imdelltra - Payer Coverage & Reimbursement Details

- Table 5-7: Ziihera - ICD-10-CM Codes

- Table 5-8: Ziihera - ICD-10-PCS Codes

- Table 6-1: US - Some FDA Designated Bispecific Antibodies

- Table 6-2: US - Bispecific Antibodies With Recent IND Clearances

- Table 6-3: EU - Bispecific Antibodies in Late Stage Clinical Trials

- Table 6-4: Latin America - Bispecific Antibodies in Clinical Trials

- Table 7-1: Lymphoma - Bispecific Antibodies in Clinical Trials

- Table 7-2: Multiple Myeloma - Bispecific Antibodies in Clinical Trials

- Table 7-3: Leukemia - Bispecific Antibodies in Clinical Trials

- Table 7-4: Lung Cancer - Bispecific Antibodies in Clinical Trials

- Table 7-5: Melanoma - Bispecific Antibodies in Clinical Trials

- Table 7-6: Gastrointestinal Cancers - Bispecific Antibodies in Clinical Trials

- Table 8-1: Blincyto - Active Patents

- Table 8-2: Blincyto - Recommended Dosage & Schedule For The Treatment of MRD-Positive B-Cell Precursor ALL

- Table 8-3: Blincyto - Recommended Dosage & Schedule for Treatment Of Relapsed Or Refractory B-Cell Precursor ALL

- Table 8-4: Blincyto - Recommended Dosage & Schedule For Treatment Of Relapsed Or Refractory B-Cell Precursor ALL

- Table 10-1: Rybrevant - Premedication

- Table 10-2: Rybrevant - Dose Reductions For Adverse Reactions

- Table 10-3: Rybrevant - Recommended Dosage Modifications For Adverse Reactions

- Table 12-1: Lunsumio - Recommended Treatment Cycles

- Table 12-2: Lunsumio - Recommended Premedications

- Table 12-3: Lunsumio - Recommendations For Management Of Cytokine Release Syndrome

- Table 14-1: Tecvayli - Dosing Schedule

- Table 14-2: Tecvayli - Recommended Dosage Modifications For Adverse Reactions

- Table 15-1: Columvi - Dosing Schedule (21-Day Treatment Cycles)

- Table 15-2: Columvi - Premedications To Be Administered

- Table 15-3: Columvi - Recommendations For Management Of Cytokine Release Syndrome

- Table 15-4: Columvi - Recommended Dosage Modification For Neurologic Toxicity (Including ICANS)

- Table 15-5: Columvi - Recommended Dosage Modifications For Other Adverse Reactions

- Table 16-1: Epkinly - Dosage Schedule

- Table 16-2: Epkinly - Recommendations For Management Of Cytokine Release Syndrome

- Table 16-3: Epkinly - Recommendations for Management of Immune Effector Cell-Associated Neurotoxicity Syndrome (ICANS)

- Table 16-4: Epkinly - Recommended Dosage Modifications For Other Adverse Reactions

- Table 17-1: Talvey - Weekly Dosing Schedule

- Table 17-2: Talvey - Biweekly Dosing Schedule

- Table 17-3: Talvey - Recommendations for Management of CRS

- Table 17-4: Talvey - Recommendations for Management of Immune Effector Cell-Associated Neurotoxicity Syndrome (ICANS)

- Table 17-5: Talvey - Recommendations For Management Of Neurologic Toxicity (excluding ICANS)

- Table 17-6: Talvey - Recommended Dosage Modifications For Other Adverse Reactions

- Table 18-1: Elrexfio - Dosing Schedule

- Table 18-2: Elrexfio - Recommendations For Management Of CRS

- Table 18-3: Elrexfio - Recommended Dosage Modifications For Other Adverse Reactions

- Table 22-1: Ziihera - Dosage Modifications For Adverse Reactions

- Table 23-1: Bizengri - Premedications Prior To Infusions

- Table 23-2: Bizengri - Recommended Dosage Modifications & Management For Adverse Reactions

Global Bispecific Antibody Market Opportunity, Drug Dosage, Patent, Price, Sales & Clinical Trials Insight 2030 Report findings & Highlights:

- Global & Regional Market Size, Clinical Trends Insight

- Global Bispecific Antibodies Sales Opportunity US$ 50 Billion By 2030

- Global Bispecific Antibodies Sales Surpassed US$ 11 Billion In 2024

- 17 Bispecific Antibodies Approved Across Key Markets

- Approved Antibodies Dosage, Patent, Pricing & Sales Insight

- Comprehensive Insight On More than 600 Bispecific Antibodies In Clinical Trials

- Global Bispecific Antibodies Clinical Trials By Company, Indication & Phase

Bispecific antibodies have emerged as one of the most promising and commercially successful targeting approaches in the pharmaceutical market, driven by continuous innovations and growing patient acceptance. A major factor contributing to this phenomenal growth is the exponential increase in the number of clinical trials for bispecific antibodies, which has surpassed 650 in 2025 from less than 100 in 2015. This progress has significantly benefited multiple stakeholders like drug developers, clinical research organizations, physicians, and patients. As of March 2025, 17 bispecific antibodies have been approved across key markets, with cumulative sales exceeding US$ 35 Billion as compared to US$ 77 Million in 2015 when the first bispecific antibody was approved.

The bispecific antibody market reached approximately US$ 12 billion in 2024, with projections by Kuick Research suggesting that this market will surge to US$ 50 billion by 2030. This growth trajectory highlights the increasing demand for innovative biologics that can address unmet medical needs. Notably, Hemlibra and Vabysmo have emerged as major contributors to the global bispecific antibodies market, collectively accounting for over 75% of the total sales. Hemlibra, a bispecific antibody developed by Roche, is used to treat hemophilia A, while Vabysmo, also developed by Roche, is a treatment for macular degeneration and macular edema. Both drugs saw sales surpassing US$ 4 Billion in 2024, emerging as key players in their respective therapeutic areas and solidifying Roche's leadership in the market for bispecific antibodies.

There are also several bispecific antibodies currently under regulatory review. Notably, Linvoseltamab, an investigational bispecific antibody, is undergoing review by the US FDA and the European Medicines Agency (EMA) for the treatment of multiple myeloma. Another promising candidate, Odronextamab, is currently under FDA review for the treatment of various hematologic malignancies. These developments underscore the ongoing progress in bispecific antibody research and their potential to revolutionize cancer treatment.

As of March 2025, more than 600 bispecific antibodies are currently undergoing clinical trials, demonstrating the immense potential of these therapeutics across multiple therapeutic areas. The US remains the largest market for bispecific antibodies in terms of both research and development (R&D) and sales, reflecting the country's leadership in pharmaceutical innovation and healthcare spending.

Leading players in the bispecific antibody market include Roche, Gilead, Amgen, Pfizer, Johnson & Johnson (Janssen), and others. These companies are at the forefront of developing innovative bispecific therapies, with a focus on oncology and other high-need areas. For example, Roche has leveraged its expertise in biologics to bring to market Hemlibra and Vabysmo, while Amgen is advancing bispecific T-cell engagers for cancer immunotherapy.

In addition to these leading companies, there have been significant regulatory designations granted to bispecific antibodies, enhancing the overall market landscape. Ivonescimab, a PD-1 x VEGF bispecific antibody developed by Akeso, received FDA Fast Track Designation in October 2024 for the treatment of non-small cell lung cancer (NSCLC) with EGFR mutations in the second-line or beyond setting. This designation accelerates the development process and highlights the growing interest in bispecific antibodies for treating cancer. Akeso is collaborating with Summit Therapeutics in the US and other countries to develop Ivonescimab.

Additionally, Invenra's Novel Antibody INV724 has received both Rare Pediatric Disease and Orphan Drug Designations from the US FDA for the treatment of neuroblastoma, a rare and aggressive cancer affecting children. INV724 targets the GD2 and B7-H3 antigens and has shown promise in early-stage clinical trials, offering hope for more effective treatments for pediatric cancers.

In conclusion, the bispecific antibody market is poised for substantial growth, driven by increasing approvals, ongoing clinical trials, and strong regulatory support. With major players like Roche, Gilead, Amgen, and Pfizer leading the charge, and promising candidates undergoing review, bispecific antibodies are set to transform the landscape of modern therapeutics. The market's rapid expansion from US$ 12 Billion in 2024 to an expected US$ 50 Billion by 2030, reflects the increasing recognition of bispecific antibodies as key solutions for treating complex and life-threatening diseases.

Table of Contents

Table of Contents

1. Introduction To Bispecific Antibody

- 1.1 Overview

- 1.2 Clinical Advancement of Bispecific Antibodies

2. Bispecific Antibodies Combination Strategies

- 2.1 Chemotherapy

- 2.2 Targeted Therapy

- 2.3 Immunotherapies

- 2.4 Radiotherapy

3. Commercially Approved Bispecific Antibodies Insight

- 3.1 Company, Indication, Location & MOA

- 3.2 Bispecific Antibodies Granted FDA & EMA Designations

4. Bispecific Antibodies Proprietary Platforms

5. Global & Regional Bispecific Antibody Market Outlook

- 5.1 Yearly & Quarterly Sales Insight (2020 to 2024)

- 5.2 Approved Bispecific Antibodies Reimbursement Policy

- 5.3 Global Bispecific Antibody Market Forecast 2030

6. Global Bispecific Antibody Market Trends By Region

- 6.1 Japan

- 6.2 South Korea

- 6.3 US

- 6.4 Europe

- 6.5 China

- 6.6 UK

- 6.7 Australia

- 6.8 Canada

- 6.9 Latin America

7. Global Bispecific Antibodies Research & Market Trends By Indications

- 7.1 Lymphoma

- 7.2 Multiple Myeloma

- 7.3 Leukemia

- 7.4 Lung Cancer

- 7.5 Melanoma

- 7.6 Gastrointestinal Cancers

- 7.7 Other Cancers

- 7.8 Blood Disorders

- 7.9 Autoimmune & Inflammatory Diseases

- 7.10 Microbial Diseases

- 7.11 Ocular Diseases

8. Blincyto - Clinical, Patent, Pricing & Sales Insight

- 8.1 Overview & Patent Insight

- 8.2 Pricing & Dosage Analysis

- 8.3 Sales Analysis

9. Hemlibra - Clinical, Patent, Pricing & Sales Insight

- 9.1 Overview

- 9.2 Pricing & Dosage Insight

- 9.3 Sales Analysis

10. Rybrevant - Clinical, Patent & Pricing Insight

- 10.1 Overview

- 10.2 Pricing & Dosage Insight

11. Vabysmo - Clinical, Patent, Pricing & Sales Insight

- 11.1 Overview

- 11.2 Pricing & Dosage Insight

- 11.3 Sales Analysis

12. Lunsumio - Clinical, Patent, Pricing & Sales Insight

- 12.1 Overview & Patent Insight

- 12.2 Pricing & Dosage Insight

- 12.3 Sales Analysis

13. Kaitani - Clinical & Sales Insight

14. Tecvayli - Clinical, Patent & Pricing Insight

- 14.1 Overview & Patent Insight

- 14.2 Pricing & Dosage Insight

- 14.3 Sales Analysis

15. Columvi - Clinical, Patent, Pricing & Sales Insight

- 15.1 Overview & Patent Insight

- 15.2 Pricing & Dosage Insight

- 15.3 Sales Analysis

16. Epkinly - Clinical, Patent, Pricing & Sales Insight

- 16.1 Overview

- 16.2 Pricing & Dosage Insight

- 16.3 Sales Analysis

17. Talvey - Clinical, Patent & Pricing Insight

- 17.1 Overview & Patent Insight

- 17.2 Pricing & Dosage Insight

18. Elrexfio - Clinical, Patent & Pricing Insight

- 18.1 Overview

- 18.2 Pricing & Dosage Insight

- 18.3 Sales Analysis

19. Imdelltra - Clinical, Patent, Pricing & Sales Insight

- 19.1 Overview & Patent Insight

- 19.2 Pricing & Dosage Insight

- 19.3 Sales Analysis

20. Ivonescimab - Clinical Insight

21. Ordspono - Clinical & Sales Insight

- 21.1 Overview

- 21.2 Sales Analysis

22. Ziihera - Clinical, Pricing & Sales Insight

- 22.1 Overview

- 22.2 Pricing & Dosage

- 22.3 Sales Insight

23. Bizengri - Clinical, Patent, Pricing & Sales Insight

- 23.1 Overview

- 23.2 Dosing & Pricing

24. Korjuny - Clinical Insight

25. Global Bispecific Antibodies Clinical Trials By Company, Indication & Phase

- 25.1 Research

- 25.2 Preclinical

- 25.3 Phase-I

- 25.4 Phase-I/II

- 25.5 Phase-II

- 25.6 Phase-II/III

- 25.7 Phase-III

- 25.8 Preregistration

- 25.9 Registered

26. Marketed Bispecific Antibodies Clinical Insight By Company, Country & Indication

27. Competitive Landscape

- 27.1 ABL Bio

- 27.2 Abzyme Therapeutics

- 27.3 Affimed Therapeutics

- 27.4 Akeso Biopharma

- 27.5 Alligator Bioscience

- 27.6 Amgen

- 27.7 Antibody Therapeutics

- 27.8 APITBIO

- 27.9 Aptevo Therapeutics

- 27.10 Astellas Pharma

- 27.11 AstraZeneca

- 27.12 BioAtla

- 27.13 Biosion

- 27.14 Biotheus

- 27.15 BJ Bioscience

- 27.16 EpimAb Biotherapeutics

- 27.17 FutureGen Biopharmaceutical

- 27.18 Genentech

- 27.19 Genmab

- 27.20 Gensun Biopharma

- 27.21 Harbour BioMed

- 27.22 IGM Biosciences

- 27.23 I-MAB Biopharma

- 27.24 ImmuneOnco Biopharma

- 27.25 Innovent Biologics

- 27.26 Invenra

- 27.27 Janssen Research & Development

- 27.28 Kenjockety Biotechnology

- 27.29 LaNova Medicines Limited

- 27.30 Light Chain Bioscience

- 27.31 Linton Pharm

- 27.32 Lyvgen Biopharma

- 27.33 MacroGenics

- 27.34 Merus

- 27.35 NovaRock Biotherapeutics

- 27.36 Pfizer

- 27.37 Phanes Therapeutics

- 27.38 Prestige BioPharma

- 27.39 Regeneron Pharmaceuticals

- 27.40 Revitope

- 27.41 Roche

- 27.42 Virtuoso Therapeutics

- 27.43 Xencor

- 27.44 Y-Biologics

- 27.45 Zhejiang Shimai Pharmaceutical

- 27.46 Zymeworks