|

|

市場調査レポート

商品コード

1768845

航空分野における5Gの世界市場規模、シェア、業界分析レポート(接続タイプ別、通信インフラ別、技術別、最終用途別、地域別展望・予測、2025年~2032年)Global 5G In Aviation Market Size, Share & Industry Analysis Report By Connectivity Type, By Communication Infrastructure, By Technology, By End Use, By Regional Outlook and Forecast, 2025 - 2032 |

||||||

|

|||||||

| 航空分野における5Gの世界市場規模、シェア、業界分析レポート(接続タイプ別、通信インフラ別、技術別、最終用途別、地域別展望・予測、2025年~2032年) |

|

出版日: 2025年06月30日

発行: KBV Research

ページ情報: 英文 377 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

航空分野における5G市場規模は、予測期間中に30.8%のCAGRで市場成長し、2032年までに215億1,000万米ドルに達すると予想されています。

COVID-19パンデミックの間、航空分野における5Gインフラの展開は大幅に遅れました。渡航制限、ロックダウン、そして人員不足により、空港や航空管制センターにおける5Gインフラの構築と設置は著しく阻害されました。政府や空港当局がデジタル技術のアップグレードではなく、公衆衛生危機への対応にリソースを振り向けたため、多くの計画されていた展開が延期されました。航空業界のサプライチェーンはパンデミック中に大きな影響を受けました。このように、COVID-19パンデミックは市場に悪影響を及ぼしました。

市場成長要因

航空業界は、精度、安全性、そして瞬時の意思決定能力によって繁栄しています。従来の通信ネットワーク、特に旧来の衛星通信システムや4Gシステムは、今日の高度にコネクテッドな航空機に求められる遅延と帯域幅の制限に苦労しています。超低遅延(最短1ミリ秒)と極めて高速なデータ伝送を実現する5Gの導入は、この重要な運用ニーズに直接対応します。さらに、航空交通管制システム、特に無人航空機システム(UAS)やドローンの台頭に伴い、より迅速な応答サイクルが求められており、5Gは既存のネットワークよりもはるかに効果的にこれを実現できます。

さらに、今日の航空機はもはや独立した機械的な乗り物ではなく、センサー、コネクテッドシステム、そしてソフトウェア定義インターフェースを搭載した空飛ぶデジタルプラットフォームへと変貌を遂げています。この「コネクテッド航空機」への移行は、航空業界のデジタルトランスフォーメーションの基盤となります。航空機全体に数百、あるいは数千ものセンサーが組み込まれているため、継続的なデータ収集、処理、そして通信が不可欠です。しかし、このデータ爆発的な増加に対応するには、5G特有の高スループット、超高信頼性、そして低遅延を実現する通信ネットワークが必要です。

市場抑制要因

しかし、統合車両健全性管理(IVHM)システムの導入を阻む最大の障壁の一つは、初期導入コストの高さと、既存の車両プラットフォームへの統合の複雑さです。民間航空、自動車、防衛のいずれの分野でも、IVHM導入には多額の初期投資が必要になる場合があります。これには、高度なセンサー、組み込みシステム、データ処理インフラ、クラウドおよびエッジコンピューティング機能、そしてカスタムアルゴリズムやソフトウェアプラットフォームの開発または取得に関連するコストが含まれます。結論として、IVHM導入にかかる初期コストの高さと多面的な複雑さは、特にコスト重視の分野やインフラに制約のある分野において、IVHMの広範な導入を阻む大きな障壁となっています。

バリューチェーン分析

航空分野における5Gのバリューチェーンは、航空会社や空港が通信事業者や機器ベンダーからアンテナ、ルーター、チップなどの5Gハードウェアを調達するインバウンド・ロジスティクスから始まります。運用段階では、これらのコンポーネントがシステムに統合され、スマートメンテナンス、地上の自律運用、リアルタイム監視が可能になります。アウトバウンド・ロジスティクスでは、強化された機内エンターテイメント、シームレスな乗客接続、貨物追跡など、5G対応サービスの提供が行われます。マーケティング&セールスは、5Gのような高速・低遅延通信のメリットを航空業界の利害関係者に訴求することに注力します。最後に、サービス段階では、導入後の継続的なサポート、システムの最適化、ネットワークの信頼性確保が図られます。

接続タイプ展望

接続タイプに基づいて、航空分野における5G市場は、空対地通信と地上対地通信に分類されます。地上対地通信セグメントは、2024年に航空分野における5G市場において48%の収益シェアを獲得しました。地上対地通信は、5Gネットワークを用いて、航空エコシステム内の様々な地上拠点間のデータ交換を促進するものです。これには、空港、航空管制塔、整備施設、航空会社のオペレーションセンター間の通信が含まれます。このセグメントにおける5Gの応用は、リアルタイム調整の強化、空港物流の改善、航空機の遠隔診断と予知保全の実現、自動化とAIを活用した運用のサポートなどをもたらします。

通信インフラ展望

通信インフラに基づいて、航空分野における5G市場は、スモールセル、分散アンテナシステム(DAS)、無線アクセスネットワーク(RAN)に分類されます。無線アクセスネットワーク(RAN)セグメントは、2024年の航空分野における5G市場において11%の収益シェアを占めました。無線アクセスネットワーク(RAN)とは、個々のデバイスを無線接続を介してコアネットワークに接続する通信システムの一部を指します。航空業界において、RANインフラは、航空機システム、乗客用デバイス、空港運営によって生成される膨大な量のデータを5Gネットワーククで処理するために不可欠です。

技術展望

航空分野における5G市場は、技術別に見ると、拡張モバイルブロードバンド(eMBB)、超信頼性低遅延通信(URLLC)、大規模マシン型通信(mMTC)に分類されます。大規模マシン型通信(mMTC)セグメントは、2024年に市場収益シェアの15%を占めました。大規模マシン型通信(mMTC)は、人間の介入を最小限に抑えながら、多数のデバイス、センサー、機械を接続することを可能にします。航空分野において、mMTCは空港や航空機におけるモノのインターネット(IoT)エコシステムを支える上で重要な役割を果たしています。

最終用途展望

航空分野における5G市場は、最終用途に基づいて航空機と空港の2つに分類されます。航空機分野は、2024年の航空分野における5G市場において52%の収益シェアを獲得しました。航空機分野では、5G技術を活用して機内サービスと運航効率の両方を向上させています。高速接続により、機内エンターテイメント、リアルタイム通信、そして乗客と乗務員のためのライブデータストリーミングが向上します。

地域展望

地域別に見ると、航空分野における5G市場は、北米、欧州、アジア太平洋、ラテンアメリカ・中東・アフリカにわたって分析されています。北米セグメントは、2024年の航空分野における5G市場の収益シェアの35%を記録しました。北米は、先進的なインフラへの多額の投資とイノベーションへの強い注力により、航空分野における5G技術の導入において先進的な地域となっています。大手航空会社、航空機メーカー、そして技術企業の存在により、航空機搭載および地上アプリケーションの両方において5Gの急速な導入が促進されています。

目次

第1章 市場範囲と調査手法

- 市場の定義

- 目的

- 市場範囲

- セグメンテーション

- 調査手法

第2章 市場要覧

- 主なハイライト

第3章 市場概要

- イントロダクション

- 概要

- 市場構成とシナリオ

- 概要

- 市場に影響を与える主な要因

- 市場促進要因

- 市場抑制要因

- 市場機会

- 市場の課題

第4章 競合分析 - 世界

- 市場シェア分析、2024年

- 航空分野における5Gの最新戦略

- ポーターファイブフォース分析

第5章 航空分野における5Gのバリューチェーン分析

- インバウンド物流

- オペレーション

- アウトバウンド物流

- マーケティングとセールス

- サービス

第6章 航空分野における5Gの主要顧客基準

第7章 世界市場:接続タイプ別

- 世界の空対地通信市場:地域別

- 世界の地上対地上通信市場:地域別

第8章 世界市場:通信インフラ別

- 世界のスモールセル市場:地域別

- 世界の分散アンテナシステム(DAS)市場:地域別

- 世界の無線アクセスネットワーク(RAN)市場:地域別

第9章 世界市場:技術別

- 世界の拡張モバイルブロードバンド(eMBB)市場:地域別

- 世界の超高信頼性低遅延通信(URLLC)市場:地域別

- 世界の大規模マシン型通信(mMTC)市場:地域別

第10章 世界市場:最終用途別

- 世界の航空機市場:地域別

- 世界の空港市場:地域別

第11章 世界市場:地域別

- 北米

- 北米の市場:国別

- 米国

- カナダ

- メキシコ

- その他北米地域

- 北米の市場:国別

- 欧州

- 欧州の市場:国別

- 英国

- ドイツ

- フランス

- ロシア

- スペイン

- イタリア

- その他欧州地域

- 欧州の市場:国別

- アジア太平洋地域

- アジア太平洋の市場:国別

- 中国

- 日本

- インド

- 韓国

- シンガポール

- マレーシア

- その他アジア太平洋地域

- アジア太平洋の市場:国別

- ラテンアメリカ・中東・アフリカ

- ラテンアメリカ・中東・アフリカの市場:国別

- アラブ首長国連邦

- カタール

- ブラジル

- サウジアラビア

- 南アフリカ

- エジプト

- その他ラテンアメリカ・中東・アフリカ地域

- ラテンアメリカ・中東・アフリカの市場:国別

第12章 企業プロファイル

- Huawei Technologies Co, Ltd.(Huawei Investment & Holding Co., Ltd.)

- Nokia Corporation

- Cisco Systems, Inc

- Honeywell International, Inc

- Thales Group SA

- Ericsson AB

- Panasonic Holdings Corporation

- NTT Data Corporation

- OneWeb Holdings Ltd

- Collins Aerospace(RTX Corporation)

第13章 航空分野における5Gの成功必須条件

LIST OF TABLES

- TABLE 1 Global 5G In Aviation Market, 2021 - 2024, USD Million

- TABLE 2 Global 5G In Aviation Market, 2025 - 2032, USD Million

- TABLE 3 Key Costumer Criteria of 5G In Aviation Market

- TABLE 4 Global 5G In Aviation Market by Connectivity Type, 2021 - 2024, USD Million

- TABLE 5 Global 5G In Aviation Market by Connectivity Type, 2025 - 2032, USD Million

- TABLE 6 Global Air-to-Ground Communication Market by Region, 2021 - 2024, USD Million

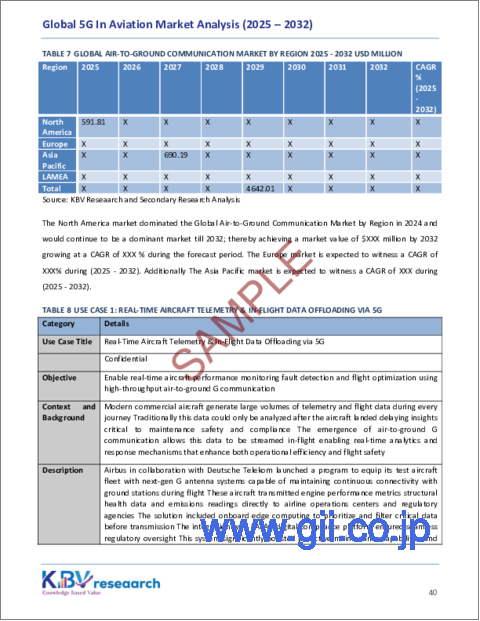

- TABLE 7 Global Air-to-Ground Communication Market by Region, 2025 - 2032, USD Million

- TABLE 8 Global Ground-to-Ground Communication Market by Region, 2021 - 2024, USD Million

- TABLE 9 Global Ground-to-Ground Communication Market by Region, 2025 - 2032, USD Million

- TABLE 10 Use Case 1: Real-Time Aircraft Telemetry & In-Flight Data Offloading via 5G

- TABLE 11 Use Case 2: Smart Ground Operations & 5G-Powered Ramp Management

- TABLE 12 Global 5G In Aviation Market by Communication Infrastructure, 2021 - 2024, USD Million

- TABLE 13 Global 5G In Aviation Market by Communication Infrastructure, 2025 - 2032, USD Million

- TABLE 14 Global Small Cells Market by Region, 2021 - 2024, USD Million

- TABLE 15 Global Small Cells Market by Region, 2025 - 2032, USD Million

- TABLE 16 Global Distributed Antenna Systems (DAS) Market by Region, 2021 - 2024, USD Million

- TABLE 17 Global Distributed Antenna Systems (DAS) Market by Region, 2025 - 2032, USD Million

- TABLE 18 Global Radio Access Network (RAN) Market by Region, 2021 - 2024, USD Million

- TABLE 19 Global Radio Access Network (RAN) Market by Region, 2025 - 2032, USD Million

- TABLE 20 Use Case 1: Gate-Side 5G Enablement Using Small Cells for High-Density Data Offload

- TABLE 21 Use Case 2: Seamless Terminal-Wide Connectivity with Distributed Antenna Systems (DAS)

- TABLE 22 Use Case 3: Integrated 5G Radio Access Network (RAN) for Airport-Wide Airside & Landside Operations

- TABLE 23 Global 5G In Aviation Market by Technology, 2021 - 2024, USD Million

- TABLE 24 Global 5G In Aviation Market by Technology, 2025 - 2032, USD Million

- TABLE 25 Global Enhanced Mobile Broadband (eMBB) Market by Region, 2021 - 2024, USD Million

- TABLE 26 Global Enhanced Mobile Broadband (eMBB) Market by Region, 2025 - 2032, USD Million

- TABLE 27 Global Ultra-Reliable Low-Latency Communication (URLLC) Market by Region, 2021 - 2024, USD Million

- TABLE 28 Global Ultra-Reliable Low-Latency Communication (URLLC) Market by Region, 2025 - 2032, USD Million

- TABLE 29 Global Massive Machine-Type Communication (mMTC) Market by Region, 2021 - 2024, USD Million

- TABLE 30 Global Massive Machine-Type Communication (mMTC) Market by Region, 2025 - 2032, USD Million

- TABLE 31 Use Case 1: High-Speed Passenger Connectivity with Enhanced Mobile Broadband (eMBB)

- TABLE 32 Use Case 2: Autonomous Aircraft Taxiing and Collision Avoidance via URLLC

- TABLE 33 Use Case 3: Scalable Asset Tracking & Predictive Maintenance via Massive Machine-Type Communication (mMTC)

- TABLE 34 Global 5G In Aviation Market by End Use, 2021 - 2024, USD Million

- TABLE 35 Global 5G In Aviation Market by End Use, 2025 - 2032, USD Million

- TABLE 36 Global Aircraft Market by Region, 2021 - 2024, USD Million

- TABLE 37 Global Aircraft Market by Region, 2025 - 2032, USD Million

- TABLE 38 Global Airport Market by Region, 2021 - 2024, USD Million

- TABLE 39 Global Airport Market by Region, 2025 - 2032, USD Million

- TABLE 40 Global 5G In Aviation Market by Region, 2021 - 2024, USD Million

- TABLE 41 Global 5G In Aviation Market by Region, 2025 - 2032, USD Million

- TABLE 42 North America 5G In Aviation Market, 2021 - 2024, USD Million

- TABLE 43 North America 5G In Aviation Market, 2025 - 2032, USD Million

- TABLE 44 North America 5G In Aviation Market by Connectivity Type, 2021 - 2024, USD Million

- TABLE 45 North America 5G In Aviation Market by Connectivity Type, 2025 - 2032, USD Million

- TABLE 46 North America Air-to-Ground Communication Market by Country, 2021 - 2024, USD Million

- TABLE 47 North America Air-to-Ground Communication Market by Country, 2025 - 2032, USD Million

- TABLE 48 North America Ground-to-Ground Communication Market by Country, 2021 - 2024, USD Million

- TABLE 49 North America Ground-to-Ground Communication Market by Country, 2025 - 2032, USD Million

- TABLE 50 North America 5G In Aviation Market by Communication Infrastructure, 2021 - 2024, USD Million

- TABLE 51 North America 5G In Aviation Market by Communication Infrastructure, 2025 - 2032, USD Million

- TABLE 52 North America Small Cells Market by Country, 2021 - 2024, USD Million

- TABLE 53 North America Small Cells Market by Country, 2025 - 2032, USD Million

- TABLE 54 North America Distributed Antenna Systems (DAS) Market by Country, 2021 - 2024, USD Million

- TABLE 55 North America Distributed Antenna Systems (DAS) Market by Country, 2025 - 2032, USD Million

- TABLE 56 North America Radio Access Network (RAN) Market by Country, 2021 - 2024, USD Million

- TABLE 57 North America Radio Access Network (RAN) Market by Country, 2025 - 2032, USD Million

- TABLE 58 North America 5G In Aviation Market by Technology, 2021 - 2024, USD Million

- TABLE 59 North America 5G In Aviation Market by Technology, 2025 - 2032, USD Million

- TABLE 60 North America Enhanced Mobile Broadband (eMBB) Market by Country, 2021 - 2024, USD Million

- TABLE 61 North America Enhanced Mobile Broadband (eMBB) Market by Country, 2025 - 2032, USD Million

- TABLE 62 North America Ultra-Reliable Low-Latency Communication (URLLC) Market by Country, 2021 - 2024, USD Million

- TABLE 63 North America Ultra-Reliable Low-Latency Communication (URLLC) Market by Country, 2025 - 2032, USD Million

- TABLE 64 North America Massive Machine-Type Communication (mMTC) Market by Country, 2021 - 2024, USD Million

- TABLE 65 North America Massive Machine-Type Communication (mMTC) Market by Country, 2025 - 2032, USD Million

- TABLE 66 North America 5G In Aviation Market by End Use, 2021 - 2024, USD Million

- TABLE 67 North America 5G In Aviation Market by End Use, 2025 - 2032, USD Million

- TABLE 68 North America Aircraft Market by Country, 2021 - 2024, USD Million

- TABLE 69 North America Aircraft Market by Country, 2025 - 2032, USD Million

- TABLE 70 North America Airport Market by Country, 2021 - 2024, USD Million

- TABLE 71 North America Airport Market by Country, 2025 - 2032, USD Million

- TABLE 72 North America 5G In Aviation Market by Country, 2021 - 2024, USD Million

- TABLE 73 North America 5G In Aviation Market by Country, 2025 - 2032, USD Million

- TABLE 74 US 5G In Aviation Market, 2021 - 2024, USD Million

- TABLE 75 US 5G In Aviation Market, 2025 - 2032, USD Million

- TABLE 76 US 5G In Aviation Market by Connectivity Type, 2021 - 2024, USD Million

- TABLE 77 US 5G In Aviation Market by Connectivity Type, 2025 - 2032, USD Million

- TABLE 78 US 5G In Aviation Market by Communication Infrastructure, 2021 - 2024, USD Million

- TABLE 79 US 5G In Aviation Market by Communication Infrastructure, 2025 - 2032, USD Million

- TABLE 80 US 5G In Aviation Market by Technology, 2021 - 2024, USD Million

- TABLE 81 US 5G In Aviation Market by Technology, 2025 - 2032, USD Million

- TABLE 82 US 5G In Aviation Market by End Use, 2021 - 2024, USD Million

- TABLE 83 US 5G In Aviation Market by End Use, 2025 - 2032, USD Million

- TABLE 84 Canada 5G In Aviation Market, 2021 - 2024, USD Million

- TABLE 85 Canada 5G In Aviation Market, 2025 - 2032, USD Million

- TABLE 86 Canada 5G In Aviation Market by Connectivity Type, 2021 - 2024, USD Million

- TABLE 87 Canada 5G In Aviation Market by Connectivity Type, 2025 - 2032, USD Million

- TABLE 88 Canada 5G In Aviation Market by Communication Infrastructure, 2021 - 2024, USD Million

- TABLE 89 Canada 5G In Aviation Market by Communication Infrastructure, 2025 - 2032, USD Million

- TABLE 90 Canada 5G In Aviation Market by Technology, 2021 - 2024, USD Million

- TABLE 91 Canada 5G In Aviation Market by Technology, 2025 - 2032, USD Million

- TABLE 92 Canada 5G In Aviation Market by End Use, 2021 - 2024, USD Million

- TABLE 93 Canada 5G In Aviation Market by End Use, 2025 - 2032, USD Million

- TABLE 94 Mexico 5G In Aviation Market, 2021 - 2024, USD Million

- TABLE 95 Mexico 5G In Aviation Market, 2025 - 2032, USD Million

- TABLE 96 Mexico 5G In Aviation Market by Connectivity Type, 2021 - 2024, USD Million

- TABLE 97 Mexico 5G In Aviation Market by Connectivity Type, 2025 - 2032, USD Million

- TABLE 98 Mexico 5G In Aviation Market by Communication Infrastructure, 2021 - 2024, USD Million

- TABLE 99 Mexico 5G In Aviation Market by Communication Infrastructure, 2025 - 2032, USD Million

- TABLE 100 Mexico 5G In Aviation Market by Technology, 2021 - 2024, USD Million

- TABLE 101 Mexico 5G In Aviation Market by Technology, 2025 - 2032, USD Million

- TABLE 102 Mexico 5G In Aviation Market by End Use, 2021 - 2024, USD Million

- TABLE 103 Mexico 5G In Aviation Market by End Use, 2025 - 2032, USD Million

- TABLE 104 Rest of North America 5G In Aviation Market, 2021 - 2024, USD Million

- TABLE 105 Rest of North America 5G In Aviation Market, 2025 - 2032, USD Million

- TABLE 106 Rest of North America 5G In Aviation Market by Connectivity Type, 2021 - 2024, USD Million

- TABLE 107 Rest of North America 5G In Aviation Market by Connectivity Type, 2025 - 2032, USD Million

- TABLE 108 Rest of North America 5G In Aviation Market by Communication Infrastructure, 2021 - 2024, USD Million

- TABLE 109 Rest of North America 5G In Aviation Market by Communication Infrastructure, 2025 - 2032, USD Million

- TABLE 110 Rest of North America 5G In Aviation Market by Technology, 2021 - 2024, USD Million

- TABLE 111 Rest of North America 5G In Aviation Market by Technology, 2025 - 2032, USD Million

- TABLE 112 Rest of North America 5G In Aviation Market by End Use, 2021 - 2024, USD Million

- TABLE 113 Rest of North America 5G In Aviation Market by End Use, 2025 - 2032, USD Million

- TABLE 114 Europe 5G In Aviation Market, 2021 - 2024, USD Million

- TABLE 115 Europe 5G In Aviation Market, 2025 - 2032, USD Million

- TABLE 116 Europe 5G In Aviation Market by Connectivity Type, 2021 - 2024, USD Million

- TABLE 117 Europe 5G In Aviation Market by Connectivity Type, 2025 - 2032, USD Million

- TABLE 118 Europe Air-to-Ground Communication Market by Country, 2021 - 2024, USD Million

- TABLE 119 Europe Air-to-Ground Communication Market by Country, 2025 - 2032, USD Million

- TABLE 120 Europe Ground-to-Ground Communication Market by Country, 2021 - 2024, USD Million

- TABLE 121 Europe Ground-to-Ground Communication Market by Country, 2025 - 2032, USD Million

- TABLE 122 Europe 5G In Aviation Market by Communication Infrastructure, 2021 - 2024, USD Million

- TABLE 123 Europe 5G In Aviation Market by Communication Infrastructure, 2025 - 2032, USD Million

- TABLE 124 Europe Small Cells Market by Country, 2021 - 2024, USD Million

- TABLE 125 Europe Small Cells Market by Country, 2025 - 2032, USD Million

- TABLE 126 Europe Distributed Antenna Systems (DAS) Market by Country, 2021 - 2024, USD Million

- TABLE 127 Europe Distributed Antenna Systems (DAS) Market by Country, 2025 - 2032, USD Million

- TABLE 128 Europe Radio Access Network (RAN) Market by Country, 2021 - 2024, USD Million

- TABLE 129 Europe Radio Access Network (RAN) Market by Country, 2025 - 2032, USD Million

- TABLE 130 Europe 5G In Aviation Market by Technology, 2021 - 2024, USD Million

- TABLE 131 Europe 5G In Aviation Market by Technology, 2025 - 2032, USD Million

- TABLE 132 Europe Enhanced Mobile Broadband (eMBB) Market by Country, 2021 - 2024, USD Million

- TABLE 133 Europe Enhanced Mobile Broadband (eMBB) Market by Country, 2025 - 2032, USD Million

- TABLE 134 Europe Ultra-Reliable Low-Latency Communication (URLLC) Market by Country, 2021 - 2024, USD Million

- TABLE 135 Europe Ultra-Reliable Low-Latency Communication (URLLC) Market by Country, 2025 - 2032, USD Million

- TABLE 136 Europe Massive Machine-Type Communication (mMTC) Market by Country, 2021 - 2024, USD Million

- TABLE 137 Europe Massive Machine-Type Communication (mMTC) Market by Country, 2025 - 2032, USD Million

- TABLE 138 Europe 5G In Aviation Market by End Use, 2021 - 2024, USD Million

- TABLE 139 Europe 5G In Aviation Market by End Use, 2025 - 2032, USD Million

- TABLE 140 Europe Aircraft Market by Country, 2021 - 2024, USD Million

- TABLE 141 Europe Aircraft Market by Country, 2025 - 2032, USD Million

- TABLE 142 Europe Airport Market by Country, 2021 - 2024, USD Million

- TABLE 143 Europe Airport Market by Country, 2025 - 2032, USD Million

- TABLE 144 Europe 5G In Aviation Market by Country, 2021 - 2024, USD Million

- TABLE 145 Europe 5G In Aviation Market by Country, 2025 - 2032, USD Million

- TABLE 146 UK 5G In Aviation Market, 2021 - 2024, USD Million

- TABLE 147 UK 5G In Aviation Market, 2025 - 2032, USD Million

- TABLE 148 UK 5G In Aviation Market by Connectivity Type, 2021 - 2024, USD Million

- TABLE 149 UK 5G In Aviation Market by Connectivity Type, 2025 - 2032, USD Million

- TABLE 150 UK 5G In Aviation Market by Communication Infrastructure, 2021 - 2024, USD Million

- TABLE 151 UK 5G In Aviation Market by Communication Infrastructure, 2025 - 2032, USD Million

- TABLE 152 UK 5G In Aviation Market by Technology, 2021 - 2024, USD Million

- TABLE 153 UK 5G In Aviation Market by Technology, 2025 - 2032, USD Million

- TABLE 154 UK 5G In Aviation Market by End Use, 2021 - 2024, USD Million

- TABLE 155 UK 5G In Aviation Market by End Use, 2025 - 2032, USD Million

- TABLE 156 Germany 5G In Aviation Market, 2021 - 2024, USD Million

- TABLE 157 Germany 5G In Aviation Market, 2025 - 2032, USD Million

- TABLE 158 Germany 5G In Aviation Market by Connectivity Type, 2021 - 2024, USD Million

- TABLE 159 Germany 5G In Aviation Market by Connectivity Type, 2025 - 2032, USD Million

- TABLE 160 Germany 5G In Aviation Market by Communication Infrastructure, 2021 - 2024, USD Million

- TABLE 161 Germany 5G In Aviation Market by Communication Infrastructure, 2025 - 2032, USD Million

- TABLE 162 Germany 5G In Aviation Market by Technology, 2021 - 2024, USD Million

- TABLE 163 Germany 5G In Aviation Market by Technology, 2025 - 2032, USD Million

- TABLE 164 Germany 5G In Aviation Market by End Use, 2021 - 2024, USD Million

- TABLE 165 Germany 5G In Aviation Market by End Use, 2025 - 2032, USD Million

- TABLE 166 France 5G In Aviation Market, 2021 - 2024, USD Million

- TABLE 167 France 5G In Aviation Market, 2025 - 2032, USD Million

- TABLE 168 France 5G In Aviation Market by Connectivity Type, 2021 - 2024, USD Million

- TABLE 169 France 5G In Aviation Market by Connectivity Type, 2025 - 2032, USD Million

- TABLE 170 France 5G In Aviation Market by Communication Infrastructure, 2021 - 2024, USD Million

- TABLE 171 France 5G In Aviation Market by Communication Infrastructure, 2025 - 2032, USD Million

- TABLE 172 France 5G In Aviation Market by Technology, 2021 - 2024, USD Million

- TABLE 173 France 5G In Aviation Market by Technology, 2025 - 2032, USD Million

- TABLE 174 France 5G In Aviation Market by End Use, 2021 - 2024, USD Million

- TABLE 175 France 5G In Aviation Market by End Use, 2025 - 2032, USD Million

- TABLE 176 Russia 5G In Aviation Market, 2021 - 2024, USD Million

- TABLE 177 Russia 5G In Aviation Market, 2025 - 2032, USD Million

- TABLE 178 Russia 5G In Aviation Market by Connectivity Type, 2021 - 2024, USD Million

- TABLE 179 Russia 5G In Aviation Market by Connectivity Type, 2025 - 2032, USD Million

- TABLE 180 Russia 5G In Aviation Market by Communication Infrastructure, 2021 - 2024, USD Million

- TABLE 181 Russia 5G In Aviation Market by Communication Infrastructure, 2025 - 2032, USD Million

- TABLE 182 Russia 5G In Aviation Market by Technology, 2021 - 2024, USD Million

- TABLE 183 Russia 5G In Aviation Market by Technology, 2025 - 2032, USD Million

- TABLE 184 Russia 5G In Aviation Market by End Use, 2021 - 2024, USD Million

- TABLE 185 Russia 5G In Aviation Market by End Use, 2025 - 2032, USD Million

- TABLE 186 Spain 5G In Aviation Market, 2021 - 2024, USD Million

- TABLE 187 Spain 5G In Aviation Market, 2025 - 2032, USD Million

- TABLE 188 Spain 5G In Aviation Market by Connectivity Type, 2021 - 2024, USD Million

- TABLE 189 Spain 5G In Aviation Market by Connectivity Type, 2025 - 2032, USD Million

- TABLE 190 Spain 5G In Aviation Market by Communication Infrastructure, 2021 - 2024, USD Million

- TABLE 191 Spain 5G In Aviation Market by Communication Infrastructure, 2025 - 2032, USD Million

- TABLE 192 Spain 5G In Aviation Market by Technology, 2021 - 2024, USD Million

- TABLE 193 Spain 5G In Aviation Market by Technology, 2025 - 2032, USD Million

- TABLE 194 Spain 5G In Aviation Market by End Use, 2021 - 2024, USD Million

- TABLE 195 Spain 5G In Aviation Market by End Use, 2025 - 2032, USD Million

- TABLE 196 Italy 5G In Aviation Market, 2021 - 2024, USD Million

- TABLE 197 Italy 5G In Aviation Market, 2025 - 2032, USD Million

- TABLE 198 Italy 5G In Aviation Market by Connectivity Type, 2021 - 2024, USD Million

- TABLE 199 Italy 5G In Aviation Market by Connectivity Type, 2025 - 2032, USD Million

- TABLE 200 Italy 5G In Aviation Market by Communication Infrastructure, 2021 - 2024, USD Million

- TABLE 201 Italy 5G In Aviation Market by Communication Infrastructure, 2025 - 2032, USD Million

- TABLE 202 Italy 5G In Aviation Market by Technology, 2021 - 2024, USD Million

- TABLE 203 Italy 5G In Aviation Market by Technology, 2025 - 2032, USD Million

- TABLE 204 Italy 5G In Aviation Market by End Use, 2021 - 2024, USD Million

- TABLE 205 Italy 5G In Aviation Market by End Use, 2025 - 2032, USD Million

- TABLE 206 Rest of Europe 5G In Aviation Market, 2021 - 2024, USD Million

- TABLE 207 Rest of Europe 5G In Aviation Market, 2025 - 2032, USD Million

- TABLE 208 Rest of Europe 5G In Aviation Market by Connectivity Type, 2021 - 2024, USD Million

- TABLE 209 Rest of Europe 5G In Aviation Market by Connectivity Type, 2025 - 2032, USD Million

- TABLE 210 Rest of Europe 5G In Aviation Market by Communication Infrastructure, 2021 - 2024, USD Million

- TABLE 211 Rest of Europe 5G In Aviation Market by Communication Infrastructure, 2025 - 2032, USD Million

- TABLE 212 Rest of Europe 5G In Aviation Market by Technology, 2021 - 2024, USD Million

- TABLE 213 Rest of Europe 5G In Aviation Market by Technology, 2025 - 2032, USD Million

- TABLE 214 Rest of Europe 5G In Aviation Market by End Use, 2021 - 2024, USD Million

- TABLE 215 Rest of Europe 5G In Aviation Market by End Use, 2025 - 2032, USD Million

- TABLE 216 Asia Pacific 5G In Aviation Market, 2021 - 2024, USD Million

- TABLE 217 Asia Pacific 5G In Aviation Market, 2025 - 2032, USD Million

- TABLE 218 Asia Pacific 5G In Aviation Market by Connectivity Type, 2021 - 2024, USD Million

- TABLE 219 Asia Pacific 5G In Aviation Market by Connectivity Type, 2025 - 2032, USD Million

- TABLE 220 Asia Pacific Air-to-Ground Communication Market by Country, 2021 - 2024, USD Million

- TABLE 221 Asia Pacific Air-to-Ground Communication Market by Country, 2025 - 2032, USD Million

- TABLE 222 Asia Pacific Ground-to-Ground Communication Market by Country, 2021 - 2024, USD Million

- TABLE 223 Asia Pacific Ground-to-Ground Communication Market by Country, 2025 - 2032, USD Million

- TABLE 224 Asia Pacific 5G In Aviation Market by Communication Infrastructure, 2021 - 2024, USD Million

- TABLE 225 Asia Pacific 5G In Aviation Market by Communication Infrastructure, 2025 - 2032, USD Million

- TABLE 226 Asia Pacific Small Cells Market by Country, 2021 - 2024, USD Million

- TABLE 227 Asia Pacific Small Cells Market by Country, 2025 - 2032, USD Million

- TABLE 228 Asia Pacific Distributed Antenna Systems (DAS) Market by Country, 2021 - 2024, USD Million

- TABLE 229 Asia Pacific Distributed Antenna Systems (DAS) Market by Country, 2025 - 2032, USD Million

- TABLE 230 Asia Pacific Radio Access Network (RAN) Market by Country, 2021 - 2024, USD Million

- TABLE 231 Asia Pacific Radio Access Network (RAN) Market by Country, 2025 - 2032, USD Million

- TABLE 232 Asia Pacific 5G In Aviation Market by Technology, 2021 - 2024, USD Million

- TABLE 233 Asia Pacific 5G In Aviation Market by Technology, 2025 - 2032, USD Million

- TABLE 234 Asia Pacific Enhanced Mobile Broadband (eMBB) Market by Country, 2021 - 2024, USD Million

- TABLE 235 Asia Pacific Enhanced Mobile Broadband (eMBB) Market by Country, 2025 - 2032, USD Million

- TABLE 236 Asia Pacific Ultra-Reliable Low-Latency Communication (URLLC) Market by Country, 2021 - 2024, USD Million

- TABLE 237 Asia Pacific Ultra-Reliable Low-Latency Communication (URLLC) Market by Country, 2025 - 2032, USD Million

- TABLE 238 Asia Pacific Massive Machine-Type Communication (mMTC) Market by Country, 2021 - 2024, USD Million

- TABLE 239 Asia Pacific Massive Machine-Type Communication (mMTC) Market by Country, 2025 - 2032, USD Million

- TABLE 240 Asia Pacific 5G In Aviation Market by End Use, 2021 - 2024, USD Million

- TABLE 241 Asia Pacific 5G In Aviation Market by End Use, 2025 - 2032, USD Million

- TABLE 242 Asia Pacific Aircraft Market by Country, 2021 - 2024, USD Million

- TABLE 243 Asia Pacific Aircraft Market by Country, 2025 - 2032, USD Million

- TABLE 244 Asia Pacific Airport Market by Country, 2021 - 2024, USD Million

- TABLE 245 Asia Pacific Airport Market by Country, 2025 - 2032, USD Million

- TABLE 246 Asia Pacific 5G In Aviation Market by Country, 2021 - 2024, USD Million

- TABLE 247 Asia Pacific 5G In Aviation Market by Country, 2025 - 2032, USD Million

- TABLE 248 China 5G In Aviation Market, 2021 - 2024, USD Million

- TABLE 249 China 5G In Aviation Market, 2025 - 2032, USD Million

- TABLE 250 China 5G In Aviation Market by Connectivity Type, 2021 - 2024, USD Million

- TABLE 251 China 5G In Aviation Market by Connectivity Type, 2025 - 2032, USD Million

- TABLE 252 China 5G In Aviation Market by Communication Infrastructure, 2021 - 2024, USD Million

- TABLE 253 China 5G In Aviation Market by Communication Infrastructure, 2025 - 2032, USD Million

- TABLE 254 China 5G In Aviation Market by Technology, 2021 - 2024, USD Million

- TABLE 255 China 5G In Aviation Market by Technology, 2025 - 2032, USD Million

- TABLE 256 China 5G In Aviation Market by End Use, 2021 - 2024, USD Million

- TABLE 257 China 5G In Aviation Market by End Use, 2025 - 2032, USD Million

- TABLE 258 Japan 5G In Aviation Market, 2021 - 2024, USD Million

- TABLE 259 Japan 5G In Aviation Market, 2025 - 2032, USD Million

- TABLE 260 Japan 5G In Aviation Market by Connectivity Type, 2021 - 2024, USD Million

- TABLE 261 Japan 5G In Aviation Market by Connectivity Type, 2025 - 2032, USD Million

- TABLE 262 Japan 5G In Aviation Market by Communication Infrastructure, 2021 - 2024, USD Million

- TABLE 263 Japan 5G In Aviation Market by Communication Infrastructure, 2025 - 2032, USD Million

- TABLE 264 Japan 5G In Aviation Market by Technology, 2021 - 2024, USD Million

- TABLE 265 Japan 5G In Aviation Market by Technology, 2025 - 2032, USD Million

- TABLE 266 Japan 5G In Aviation Market by End Use, 2021 - 2024, USD Million

- TABLE 267 Japan 5G In Aviation Market by End Use, 2025 - 2032, USD Million

- TABLE 268 India 5G In Aviation Market, 2021 - 2024, USD Million

- TABLE 269 India 5G In Aviation Market, 2025 - 2032, USD Million

- TABLE 270 India 5G In Aviation Market by Connectivity Type, 2021 - 2024, USD Million

- TABLE 271 India 5G In Aviation Market by Connectivity Type, 2025 - 2032, USD Million

- TABLE 272 India 5G In Aviation Market by Communication Infrastructure, 2021 - 2024, USD Million

- TABLE 273 India 5G In Aviation Market by Communication Infrastructure, 2025 - 2032, USD Million

- TABLE 274 India 5G In Aviation Market by Technology, 2021 - 2024, USD Million

- TABLE 275 India 5G In Aviation Market by Technology, 2025 - 2032, USD Million

- TABLE 276 India 5G In Aviation Market by End Use, 2021 - 2024, USD Million

- TABLE 277 India 5G In Aviation Market by End Use, 2025 - 2032, USD Million

- TABLE 278 South Korea 5G In Aviation Market, 2021 - 2024, USD Million

- TABLE 279 South Korea 5G In Aviation Market, 2025 - 2032, USD Million

- TABLE 280 South Korea 5G In Aviation Market by Connectivity Type, 2021 - 2024, USD Million

- TABLE 281 South Korea 5G In Aviation Market by Connectivity Type, 2025 - 2032, USD Million

- TABLE 282 South Korea 5G In Aviation Market by Communication Infrastructure, 2021 - 2024, USD Million

- TABLE 283 South Korea 5G In Aviation Market by Communication Infrastructure, 2025 - 2032, USD Million

- TABLE 284 South Korea 5G In Aviation Market by Technology, 2021 - 2024, USD Million

- TABLE 285 South Korea 5G In Aviation Market by Technology, 2025 - 2032, USD Million

- TABLE 286 South Korea 5G In Aviation Market by End Use, 2021 - 2024, USD Million

- TABLE 287 South Korea 5G In Aviation Market by End Use, 2025 - 2032, USD Million

- TABLE 288 Singapore 5G In Aviation Market, 2021 - 2024, USD Million

- TABLE 289 Singapore 5G In Aviation Market, 2025 - 2032, USD Million

- TABLE 290 Singapore 5G In Aviation Market by Connectivity Type, 2021 - 2024, USD Million

- TABLE 291 Singapore 5G In Aviation Market by Connectivity Type, 2025 - 2032, USD Million

- TABLE 292 Singapore 5G In Aviation Market by Communication Infrastructure, 2021 - 2024, USD Million

- TABLE 293 Singapore 5G In Aviation Market by Communication Infrastructure, 2025 - 2032, USD Million

- TABLE 294 Singapore 5G In Aviation Market by Technology, 2021 - 2024, USD Million

- TABLE 295 Singapore 5G In Aviation Market by Technology, 2025 - 2032, USD Million

- TABLE 296 Singapore 5G In Aviation Market by End Use, 2021 - 2024, USD Million

- TABLE 297 Singapore 5G In Aviation Market by End Use, 2025 - 2032, USD Million

- TABLE 298 Malaysia 5G In Aviation Market, 2021 - 2024, USD Million

- TABLE 299 Malaysia 5G In Aviation Market, 2025 - 2032, USD Million

- TABLE 300 Malaysia 5G In Aviation Market by Connectivity Type, 2021 - 2024, USD Million

- TABLE 301 Malaysia 5G In Aviation Market by Connectivity Type, 2025 - 2032, USD Million

- TABLE 302 Malaysia 5G In Aviation Market by Communication Infrastructure, 2021 - 2024, USD Million

- TABLE 303 Malaysia 5G In Aviation Market by Communication Infrastructure, 2025 - 2032, USD Million

- TABLE 304 Malaysia 5G In Aviation Market by Technology, 2021 - 2024, USD Million

- TABLE 305 Malaysia 5G In Aviation Market by Technology, 2025 - 2032, USD Million

- TABLE 306 Malaysia 5G In Aviation Market by End Use, 2021 - 2024, USD Million

- TABLE 307 Malaysia 5G In Aviation Market by End Use, 2025 - 2032, USD Million

- TABLE 308 Rest of Asia Pacific 5G In Aviation Market, 2021 - 2024, USD Million

- TABLE 309 Rest of Asia Pacific 5G In Aviation Market, 2025 - 2032, USD Million

- TABLE 310 Rest of Asia Pacific 5G In Aviation Market by Connectivity Type, 2021 - 2024, USD Million

- TABLE 311 Rest of Asia Pacific 5G In Aviation Market by Connectivity Type, 2025 - 2032, USD Million

- TABLE 312 Rest of Asia Pacific 5G In Aviation Market by Communication Infrastructure, 2021 - 2024, USD Million

- TABLE 313 Rest of Asia Pacific 5G In Aviation Market by Communication Infrastructure, 2025 - 2032, USD Million

- TABLE 314 Rest of Asia Pacific 5G In Aviation Market by Technology, 2021 - 2024, USD Million

- TABLE 315 Rest of Asia Pacific 5G In Aviation Market by Technology, 2025 - 2032, USD Million

- TABLE 316 Rest of Asia Pacific 5G In Aviation Market by End Use, 2021 - 2024, USD Million

- TABLE 317 Rest of Asia Pacific 5G In Aviation Market by End Use, 2025 - 2032, USD Million

- TABLE 318 LAMEA 5G In Aviation Market, 2021 - 2024, USD Million

- TABLE 319 LAMEA 5G In Aviation Market, 2025 - 2032, USD Million

- TABLE 320 LAMEA 5G In Aviation Market by Connectivity Type, 2021 - 2024, USD Million

- TABLE 321 LAMEA 5G In Aviation Market by Connectivity Type, 2025 - 2032, USD Million

- TABLE 322 LAMEA Air-to-Ground Communication Market by Country, 2021 - 2024, USD Million

- TABLE 323 LAMEA Air-to-Ground Communication Market by Country, 2025 - 2032, USD Million

- TABLE 324 LAMEA Ground-to-Ground Communication Market by Country, 2021 - 2024, USD Million

- TABLE 325 LAMEA Ground-to-Ground Communication Market by Country, 2025 - 2032, USD Million

- TABLE 326 LAMEA 5G In Aviation Market by Communication Infrastructure, 2021 - 2024, USD Million

- TABLE 327 LAMEA 5G In Aviation Market by Communication Infrastructure, 2025 - 2032, USD Million

- TABLE 328 LAMEA Small Cells Market by Country, 2021 - 2024, USD Million

- TABLE 329 LAMEA Small Cells Market by Country, 2025 - 2032, USD Million

- TABLE 330 LAMEA Distributed Antenna Systems (DAS) Market by Country, 2021 - 2024, USD Million

- TABLE 331 LAMEA Distributed Antenna Systems (DAS) Market by Country, 2025 - 2032, USD Million

- TABLE 332 LAMEA Radio Access Network (RAN) Market by Country, 2021 - 2024, USD Million

- TABLE 333 LAMEA Radio Access Network (RAN) Market by Country, 2025 - 2032, USD Million

- TABLE 334 LAMEA 5G In Aviation Market by Technology, 2021 - 2024, USD Million

- TABLE 335 LAMEA 5G In Aviation Market by Technology, 2025 - 2032, USD Million

- TABLE 336 LAMEA Enhanced Mobile Broadband (eMBB) Market by Country, 2021 - 2024, USD Million

- TABLE 337 LAMEA Enhanced Mobile Broadband (eMBB) Market by Country, 2025 - 2032, USD Million

- TABLE 338 LAMEA Ultra-Reliable Low-Latency Communication (URLLC) Market by Country, 2021 - 2024, USD Million

- TABLE 339 LAMEA Ultra-Reliable Low-Latency Communication (URLLC) Market by Country, 2025 - 2032, USD Million

- TABLE 340 LAMEA Massive Machine-Type Communication (mMTC) Market by Country, 2021 - 2024, USD Million

- TABLE 341 LAMEA Massive Machine-Type Communication (mMTC) Market by Country, 2025 - 2032, USD Million

- TABLE 342 LAMEA 5G In Aviation Market by End Use, 2021 - 2024, USD Million

- TABLE 343 LAMEA 5G In Aviation Market by End Use, 2025 - 2032, USD Million

- TABLE 344 LAMEA Aircraft Market by Country, 2021 - 2024, USD Million

- TABLE 345 LAMEA Aircraft Market by Country, 2025 - 2032, USD Million

- TABLE 346 LAMEA Airport Market by Country, 2021 - 2024, USD Million

- TABLE 347 LAMEA Airport Market by Country, 2025 - 2032, USD Million

- TABLE 348 LAMEA 5G In Aviation Market by Country, 2021 - 2024, USD Million

- TABLE 349 LAMEA 5G In Aviation Market by Country, 2025 - 2032, USD Million

- TABLE 350 UAE 5G In Aviation Market, 2021 - 2024, USD Million

- TABLE 351 UAE 5G In Aviation Market, 2025 - 2032, USD Million

- TABLE 352 UAE 5G In Aviation Market by Connectivity Type, 2021 - 2024, USD Million

- TABLE 353 UAE 5G In Aviation Market by Connectivity Type, 2025 - 2032, USD Million

- TABLE 354 UAE 5G In Aviation Market by Communication Infrastructure, 2021 - 2024, USD Million

- TABLE 355 UAE 5G In Aviation Market by Communication Infrastructure, 2025 - 2032, USD Million

- TABLE 356 UAE 5G In Aviation Market by Technology, 2021 - 2024, USD Million

- TABLE 357 UAE 5G In Aviation Market by Technology, 2025 - 2032, USD Million

- TABLE 358 UAE 5G In Aviation Market by End Use, 2021 - 2024, USD Million

- TABLE 359 UAE 5G In Aviation Market by End Use, 2025 - 2032, USD Million

- TABLE 360 Qatar 5G In Aviation Market, 2021 - 2024, USD Million

- TABLE 361 Qatar 5G In Aviation Market, 2025 - 2032, USD Million

- TABLE 362 Qatar 5G In Aviation Market by Connectivity Type, 2021 - 2024, USD Million

- TABLE 363 Qatar 5G In Aviation Market by Connectivity Type, 2025 - 2032, USD Million

- TABLE 364 Qatar 5G In Aviation Market by Communication Infrastructure, 2021 - 2024, USD Million

- TABLE 365 Qatar 5G In Aviation Market by Communication Infrastructure, 2025 - 2032, USD Million

- TABLE 366 Qatar 5G In Aviation Market by Technology, 2021 - 2024, USD Million

- TABLE 367 Qatar 5G In Aviation Market by Technology, 2025 - 2032, USD Million

- TABLE 368 Qatar 5G In Aviation Market by End Use, 2021 - 2024, USD Million

- TABLE 369 Qatar 5G In Aviation Market by End Use, 2025 - 2032, USD Million

- TABLE 370 Brazil 5G In Aviation Market, 2021 - 2024, USD Million

- TABLE 371 Brazil 5G In Aviation Market, 2025 - 2032, USD Million

- TABLE 372 Brazil 5G In Aviation Market by Connectivity Type, 2021 - 2024, USD Million

- TABLE 373 Brazil 5G In Aviation Market by Connectivity Type, 2025 - 2032, USD Million

- TABLE 374 Brazil 5G In Aviation Market by Communication Infrastructure, 2021 - 2024, USD Million

- TABLE 375 Brazil 5G In Aviation Market by Communication Infrastructure, 2025 - 2032, USD Million

- TABLE 376 Brazil 5G In Aviation Market by Technology, 2021 - 2024, USD Million

- TABLE 377 Brazil 5G In Aviation Market by Technology, 2025 - 2032, USD Million

- TABLE 378 Brazil 5G In Aviation Market by End Use, 2021 - 2024, USD Million

- TABLE 379 Brazil 5G In Aviation Market by End Use, 2025 - 2032, USD Million

- TABLE 380 Saudi Arabia 5G In Aviation Market, 2021 - 2024, USD Million

- TABLE 381 Saudi Arabia 5G In Aviation Market, 2025 - 2032, USD Million

- TABLE 382 Saudi Arabia 5G In Aviation Market by Connectivity Type, 2021 - 2024, USD Million

- TABLE 383 Saudi Arabia 5G In Aviation Market by Connectivity Type, 2025 - 2032, USD Million

- TABLE 384 Saudi Arabia 5G In Aviation Market by Communication Infrastructure, 2021 - 2024, USD Million

- TABLE 385 Saudi Arabia 5G In Aviation Market by Communication Infrastructure, 2025 - 2032, USD Million

- TABLE 386 Saudi Arabia 5G In Aviation Market by Technology, 2021 - 2024, USD Million

- TABLE 387 Saudi Arabia 5G In Aviation Market by Technology, 2025 - 2032, USD Million

- TABLE 388 Saudi Arabia 5G In Aviation Market by End Use, 2021 - 2024, USD Million

- TABLE 389 Saudi Arabia 5G In Aviation Market by End Use, 2025 - 2032, USD Million

- TABLE 390 South Africa 5G In Aviation Market, 2021 - 2024, USD Million

- TABLE 391 South Africa 5G In Aviation Market, 2025 - 2032, USD Million

- TABLE 392 South Africa 5G In Aviation Market by Connectivity Type, 2021 - 2024, USD Million

- TABLE 393 South Africa 5G In Aviation Market by Connectivity Type, 2025 - 2032, USD Million

- TABLE 394 South Africa 5G In Aviation Market by Communication Infrastructure, 2021 - 2024, USD Million

- TABLE 395 South Africa 5G In Aviation Market by Communication Infrastructure, 2025 - 2032, USD Million

- TABLE 396 South Africa 5G In Aviation Market by Technology, 2021 - 2024, USD Million

- TABLE 397 South Africa 5G In Aviation Market by Technology, 2025 - 2032, USD Million

- TABLE 398 South Africa 5G In Aviation Market by End Use, 2021 - 2024, USD Million

- TABLE 399 South Africa 5G In Aviation Market by End Use, 2025 - 2032, USD Million

- TABLE 400 Egypt 5G In Aviation Market, 2021 - 2024, USD Million

- TABLE 401 Egypt 5G In Aviation Market, 2025 - 2032, USD Million

- TABLE 402 Egypt 5G In Aviation Market by Connectivity Type, 2021 - 2024, USD Million

- TABLE 403 Egypt 5G In Aviation Market by Connectivity Type, 2025 - 2032, USD Million

- TABLE 404 Egypt 5G In Aviation Market by Communication Infrastructure, 2021 - 2024, USD Million

- TABLE 405 Egypt 5G In Aviation Market by Communication Infrastructure, 2025 - 2032, USD Million

- TABLE 406 Egypt 5G In Aviation Market by Technology, 2021 - 2024, USD Million

- TABLE 407 Egypt 5G In Aviation Market by Technology, 2025 - 2032, USD Million

- TABLE 408 Egypt 5G In Aviation Market by End Use, 2021 - 2024, USD Million

- TABLE 409 Egypt 5G In Aviation Market by End Use, 2025 - 2032, USD Million

- TABLE 410 Rest of LAMEA 5G In Aviation Market, 2021 - 2024, USD Million

- TABLE 411 Rest of LAMEA 5G In Aviation Market, 2025 - 2032, USD Million

- TABLE 412 Rest of LAMEA 5G In Aviation Market by Connectivity Type, 2021 - 2024, USD Million

- TABLE 413 Rest of LAMEA 5G In Aviation Market by Connectivity Type, 2025 - 2032, USD Million

- TABLE 414 Rest of LAMEA 5G In Aviation Market by Communication Infrastructure, 2021 - 2024, USD Million

- TABLE 415 Rest of LAMEA 5G In Aviation Market by Communication Infrastructure, 2025 - 2032, USD Million

- TABLE 416 Rest of LAMEA 5G In Aviation Market by Technology, 2021 - 2024, USD Million

- TABLE 417 Rest of LAMEA 5G In Aviation Market by Technology, 2025 - 2032, USD Million

- TABLE 418 Rest of LAMEA 5G In Aviation Market by End Use, 2021 - 2024, USD Million

- TABLE 419 Rest of LAMEA 5G In Aviation Market by End Use, 2025 - 2032, USD Million

- TABLE 420 Key Information - Huawei Technologies Co., Ltd.

- TABLE 421 Key Information - Nokia Corporation

- TABLE 422 Key Information - Cisco Systems, Inc.

- TABLE 423 Key Information - Honeywell International, Inc.

- TABLE 424 Key Information - Thales Group S.A.

- TABLE 425 key information - Ericsson AB

- TABLE 426 Key Information - Panasonic Holdings Corporation

- TABLE 427 Key Information - NTT Data Corporation

- TABLE 428 Key Information - OneWeb Holdings Ltd

- TABLE 429 Key Information - Collins Aerospace

LIST OF FIGURES

- FIG 1 Methodology for the research

- FIG 2 Global 5G In Aviation Market, 2021 - 2032, USD Million

- FIG 3 Key Factors Impacting 5G In Aviation Market

- FIG 4 Market Share Analysis, 2024

- FIG 5 Porter's Five Forces Analysis - 5G In Aviation Market

- FIG 6 Value Chain Analysis of 5G In Aviation Market

- FIG 7 Key Costumer Criteria of 5G In Aviation Market

- FIG 8 Global 5G In Aviation Market share by Connectivity Type, 2024

- FIG 9 Global 5G In Aviation Market share by Connectivity Type, 2032

- FIG 10 Global 5G In Aviation Market by Connectivity Type, 2021 - 2032, USD Million

- FIG 11 Global 5G In Aviation Market share by Communication Infrastructure, 2024

- FIG 12 Global 5G In Aviation Market share by Communication Infrastructure, 2032

- FIG 13 Global 5G In Aviation Market by Communication Infrastructure, 2021 - 2032, USD Million

- FIG 14 Global 5G In Aviation Market share by Technology, 2024

- FIG 15 Global 5G In Aviation Market share by Technology, 2032

- FIG 16 Global 5G In Aviation Market by Technology, 2021 - 2032, USD Million

- FIG 17 Global 5G In Aviation Market share by End Use, 2024

- FIG 18 Global 5G In Aviation Market share by End Use, 2032

- FIG 19 Global 5G In Aviation Market by End Use, 2021 - 2032, USD Million

- FIG 20 Global 5G In Aviation Market share by Region, 2024

- FIG 21 Global 5G In Aviation Market share by Region, 2032

- FIG 22 Global 5G In Aviation Market by Region, 2021 - 2032, USD Million

- FIG 23 North America 5G In Aviation Market, 2021 - 2032, USD Million

- FIG 24 North America 5G In Aviation Market share by Connectivity Type, 2024

- FIG 25 North America 5G In Aviation Market share by Connectivity Type, 2032

- FIG 26 North America 5G In Aviation Market by Connectivity Type, 2021 - 2032, USD Million

- FIG 27 North America 5G In Aviation Market share by Communication Infrastructure, 2024

- FIG 28 North America 5G In Aviation Market share by Communication Infrastructure, 2032

- FIG 29 North America 5G In Aviation Market by Communication Infrastructure, 2021 - 2032, USD Million

- FIG 30 North America 5G In Aviation Market share by Technology, 2024

- FIG 31 North America 5G In Aviation Market share by Technology, 2032

- FIG 32 North America 5G In Aviation Market by Technology, 2021 - 2032, USD Million

- FIG 33 North America 5G In Aviation Market share by End Use, 2024

- FIG 34 North America 5G In Aviation Market share by End Use, 2032

- FIG 35 North America 5G In Aviation Market by End Use, 2021 - 2032, USD Million

- FIG 36 North America 5G In Aviation Market share by Countryy, 2024

- FIG 37 North America 5G In Aviation Market share by Country, 2032

- FIG 38 North America 5G In Aviation Market by Country, 2021 - 2032, USD Million

- FIG 39 Europe 5G In Aviation Market, 2021 - 2032, USD Million

- FIG 40 Europe 5G In Aviation Market share by Connectivity Type, 2024

- FIG 41 Europe 5G In Aviation Market share by Connectivity Type, 2032

- FIG 42 Europe 5G In Aviation Market by Connectivity Type, 2021 - 2032, USD Million

- FIG 43 Europe 5G In Aviation Market share by Communication Infrastructure, 2024

- FIG 44 Europe 5G In Aviation Market share by Communication Infrastructure, 2032

- FIG 45 Europe 5G In Aviation Market by Communication Infrastructure, 2021 - 2032, USD Million

- FIG 46 Europe 5G In Aviation Market share by Technology, 2024

- FIG 47 Europe 5G In Aviation Market share by Technology, 2032

- FIG 48 Europe 5G In Aviation Market by Technology, 2021 - 2032, USD Million

- FIG 49 Europe 5G In Aviation Market share by End Use, 2024

- FIG 50 Europe 5G In Aviation Market share by End Use, 2032

- FIG 51 Europe 5G In Aviation Market by End Use, 2021 - 2032, USD Million

- FIG 52 Europe 5G In Aviation Market share by Country, 2024

- FIG 53 Europe 5G In Aviation Market share by Country, 2032

- FIG 54 Europe 5G In Aviation Market by Country, 2021 - 2032, USD Million

- FIG 55 Asia Pacific 5G In Aviation Market, 2021 - 2024, USD Million

- FIG 56 Asia Pacific 5G In Aviation Market share by Connectivity Type, 2024

- FIG 57 Asia Pacific 5G In Aviation Market share by Connectivity Type, 2032

- FIG 58 Asia Pacific 5G In Aviation Market by Connectivity Type, 2021 - 2032, USD Million

- FIG 59 Asia Pacific 5G In Aviation Market share by Communication Infrastructure, 2024

- FIG 60 Asia Pacific 5G In Aviation Market share by Communication Infrastructure, 2032

- FIG 61 Asia Pacific 5G In Aviation Market by Communication Infrastructure, 2021 - 2032, USD Million

- FIG 62 Asia Pacific 5G In Aviation Market share by Technology, 2024

- FIG 63 Asia Pacific 5G In Aviation Market share by Technology, 2032

- FIG 64 Asia Pacific 5G In Aviation Market by Technology, 2021 - 2032, USD Million

- FIG 65 Asia Pacific 5G In Aviation Market share by End Use, 2024

- FIG 66 Asia Pacific 5G In Aviation Market share by End Use, 2032

- FIG 67 Asia Pacific 5G In Aviation Market by End Use, 2021 - 2032, USD Million

- FIG 68 Asia Pacific 5G In Aviation Market share by Country, 2024

- FIG 69 Asia Pacific 5G In Aviation Market share by Country, 2032

- FIG 70 Asia Pacific 5G In Aviation Market by Country, 2021 - 2032, USD Million

- FIG 71 LAMEA 5G In Aviation Market, 2021 - 2032, USD Million

- FIG 72 LAMEA 5G In Aviation Market share by Connectivity Type, 2024

- FIG 73 LAMEA 5G In Aviation Market share by Connectivity Type, 2032

- FIG 74 LAMEA 5G In Aviation Market by Connectivity Type, 2021 - 2032, USD Million

- FIG 75 LAMEA 5G In Aviation Market share by Communication Infrastructure, 2024

- FIG 76 LAMEA 5G In Aviation Market share by Communication Infrastructure, 2032

- FIG 77 LAMEA 5G In Aviation Market by Communication Infrastructure, 2021 - 2032, USD Million

- FIG 78 LAMEA 5G In Aviation Market share by Technology, 2024

- FIG 79 LAMEA 5G In Aviation Market share by Technology, 2032

- FIG 80 LAMEA 5G In Aviation Market by Technology, 2021 - 2032, USD Million

- FIG 81 LAMEA 5G In Aviation Market share by End Use, 2024

- FIG 82 LAMEA 5G In Aviation Market share by End Use, 2032

- FIG 83 LAMEA 5G In Aviation Market by End Use, 2021 - 2032, USD Million

- FIG 84 LAMEA 5G In Aviation Market share by Country, 2024

- FIG 85 LAMEA 5G In Aviation Market share by Country, 2032

- FIG 86 LAMEA 5G In Aviation Market by Country, 2021 - 2032, USD Million

- FIG 87 SWOT Analysis: Huawei Technologies Co., Ltd.

- FIG 88 SWOT Analysis: Nokia Corporation

- FIG 89 SWOT Analysis: Cisco Systems, Inc.

- FIG 90 SWOT Analysis: Honeywell international, inc.

- FIG 91 SWOT Analysis: Thales Group S.A.

- FIG 92 SWOT Analysis: Ericsson AB

- FIG 93 SWOT Analysis: Panasonic Holdings Corporation

- FIG 94 Swot Analysis: Collins Aerospace

The Global 5G In Aviation Market size is expected to reach $21.51 billion by 2032, rising at a market growth of 30.8% CAGR during the forecast period.

Ultra-Reliable Low-Latency Communication (URLLC) is designed for mission-critical applications that require extremely low latency and near-instantaneous communication. In aviation, URLLC supports applications such as real-time flight control, automated aircraft landing systems, air traffic control coordination, and safety-critical operations. Its ability to provide consistent, delay-free connectivity is vital for improving operational safety and enabling advanced automation in both aircraft systems and airport infrastructure. Thus, the ultra-reliable low-latency communication (URLLC) segment garnered 26% revenue share in the market in 2024.

COVID 19 Impact Analysis

During the COVID-19 pandemic, the 5G in aviation market experienced considerable delays in infrastructure deployment. Travel restrictions, lockdowns, and workforce shortages significantly hindered the construction and installation of 5G infrastructure at airports and air traffic control centers. Many planned rollouts were postponed as governments and airport authorities redirected resources to manage the public health crisis rather than digital upgrades. The aviation industry's supply chain was heavily impacted during the pandemic. Thus, the COVID-19 pandemic had negative impact on the market.

Market Growth Factors

The aviation industry thrives on precision, safety, and the ability to make split-second decisions. Traditional communication networks, especially legacy satellite and 4G systems, struggle with the latency and bandwidth limitations required for today's highly connected aircraft. The introduction of 5G, with its ultra-low latency (as low as 1 millisecond) and exceptionally high-speed data transmission, directly addresses this critical operational need. Additionally, air traffic management systems, especially with the rise of unmanned aircraft systems (UAS) and drones, demand quicker response cycles, which 5G can deliver far more effectively than existing networks.

Additionally, aircraft today are no longer standalone mechanical vehicles; they have transformed into flying digital platforms loaded with sensors, connected systems, and software-defined interfaces. This shift to "connected aircraft" is foundational to the aviation industry's digital transformation. With hundreds or even thousands of sensors embedded throughout an aircraft, continuous data collection, processing, and communication are crucial. However, managing this data explosion requires a communication network capable of high throughput, ultra-reliability, and minimal latency-qualities intrinsic to 5G.

Market Restraining Factors

However, one of the most significant restraints impacting the adoption of Integrated Vehicle Health Management (IVHM) systems is the high initial cost of deployment, coupled with the complexity of integration into existing vehicle platforms. Whether in commercial aviation, automotive, or defense sectors, the upfront investment required for IVHM implementation can be substantial. This includes costs associated with advanced sensors, embedded systems, data processing infrastructure, cloud and edge computing capabilities, and the development or acquisition of custom algorithms and software platforms. In conclusion, the high initial cost and multifaceted complexity of IVHM implementation remain key barriers to its widespread adoption, particularly in cost-sensitive or infrastructure-constrained sectors.

Value Chain Analysis

The value chain of the 5G in Aviation Market begins with Inbound Logistics, where airlines and airports procure 5G hardware like antennas, routers, and chips from telecom and equipment vendors. In the Operations phase, these components are integrated into systems to enable smart maintenance, autonomous ground operations, and real-time monitoring. Outbound Logistics involves delivering 5G-enabled services such as enhanced in-flight entertainment, seamless passenger connectivity, and cargo tracking. Marketing & Sales focuses on promoting the benefits of 5G-like high-speed, low-latency communication-to aviation stakeholders. Finally, the Service stage ensures ongoing support, system optimization, and network reliability post-deployment.

Connectivity Type Outlook

Based on connectivity type, the 5G in aviation market is characterized into air-to-ground communication and ground-to-ground communication. The ground-to-ground communication segment procured 48% revenue share in the 5G in aviation market in 2024. Ground-to-ground communication involves the use of 5G networks to facilitate data exchange between various ground-based entities within the aviation ecosystem. This includes communication between airports, air traffic control towers, maintenance facilities, and airline operations centers. The application of 5G in this segment enhances real-time coordination, improves airport logistics, enables remote diagnostics and predictive maintenance of aircraft, and supports automation and AI-driven operations.

Communication Infrastructure Outlook

On the basis of communication infrastructure, the 5G in aviation market is classified into small cells, distributed antenna systems (DAS), and radio access network (RAN). The radio access network (RAN) segment held 11% revenue share in the 5G in aviation market in 2024. Radio Access Network (RAN) refers to the part of the telecommunications system that connects individual devices to the core network via radio connections. In the aviation industry, RAN infrastructure is essential for enabling the 5G network to handle vast amounts of data generated by aircraft systems, passenger devices, and airport operations.

Technology Outlook

By technology, the 5G in aviation market is divided into enhanced mobile broadband (eMBB), ultra-reliable low-latency communication (URLLC), and massive machine-type communication (mMTC). Massive machine-type communication (mMTC) segment held 15% revenue share in the market in 2024. Massive Machine-Type Communication (mMTC) facilitates the connection of many devices, sensors, and machines with minimal human intervention. In the aviation context, mMTC is instrumental in supporting the Internet of Things (IoT) ecosystem across airports and aircraft.

End Use Outlook

Based on end use, the 5G in aviation market is segmented into aircraft and airport. The aircraft segment procured 52% revenue share in the 5G in aviation market in 2024. The aircraft segment leverages 5G technology to enhance both onboard services and operational efficiency. High-speed connectivity enables improved in-flight entertainment, real-time communication, and live data streaming for passengers and crew.

Regional Outlook

Region-wise, the 5G in aviation market is analyzed across North America, Europe, Asia Pacific, and LAMEA. The North America segment recorded 35% revenue share in the 5G in aviation market in 2024. North America represents a leading region in the adoption of 5G technology within the aviation sector, driven by significant investments in advanced infrastructure and a strong focus on innovation. The presence of major airlines, aircraft manufacturers, and technology companies has facilitated the rapid deployment of 5G for both airborne and ground-based applications.

Recent Strategies Deployed in the Market

- Jun-2025: Nokia Corporation teamed up with Leonardo, an aerospace company to integrate Leonardo's MC_linX mission-critical services into Nokia's Core Enterprise Solutions. This collaboration delivers reliable private wireless networks (LTE/5G) for public safety, energy, and rail sectors worldwide, enhancing real-time voice, video, and data communication.

- Feb-2025: Huawei Technologies Co., Ltd. announced a partnership with KSIADC to transform King Salman International Airport into a smart aviation hub. Leveraging 5G-A, AI, and IoT, the partnership aims to enhance operations, passenger experience, and sustainability, aligning with Saudi Arabia's Vision 2030. Huawei will provide innovative ICT solutions to support this transformation.

- Oct-2024: NTT Data Corporation teamed up with Nokia, a Finnish multinational telecommunication, information technology, and consumer electronics corporation to deploy Private 5G networks at Cologne Bonn Airport and Fraport AG, enhancing real-time decision-making, efficiency, and smart airport operations. Their collaboration also established a 5G network in Brownsville, Texas, enabling advanced wireless capabilities through AI, IoT, edge computing, and data-driven innovations for mission-critical applications.

- Jul-2023: Thales Group S.A. acquired Cobham Aerospace Communications, an aerospace and defense company in a move that enhances its avionics portfolio with advanced cockpit communication systems-including L-band satcom, digital audio/radios, and smart antennas. The deal strengthens Thales's position in secure, real-time cockpit connectivity, driving fuel efficiency, reduced emissions, and retrofit opportunities.

- May-2023: Honeywell International Inc. unveiled VersaWave, a compact 5G-enabled satcom system tailored for Advanced Air Mobility (AAM) and UAVs. Weighing just 2.2lb, it seamlessly switches between satellite and cellular (5G/4G) networks-including GNSS-for BVLOS command, control, data transfer, and live video streaming.

List of Key Companies Profiled

- Huawei Technologies Co., Ltd. (Huawei Investment & Holding Co., Ltd.)

- Nokia Corporation

- Cisco Systems, Inc.

- Honeywell International Inc.

- Thales Group S.A.

- Ericsson AB

- Panasonic Holdings Corporation

- NTT Data Corporation

- OneWeb Holdings Ltd

- Collins Aerospace (RTX Corporation)

Global 5G In Aviation Market Report Segmentation

By Connectivity Type

- Air-to-Ground Communication

- Ground-to-Ground Communication

By Communication Infrastructure

- Small Cells

- Distributed Antenna Systems (DAS)

- Radio Access Network (RAN)

By Technology

- Enhanced Mobile Broadband (eMBB)

- Ultra-Reliable Low-Latency Communication (URLLC)

- Massive Machine-Type Communication (mMTC)

By End Use

- Aircraft

- Airport

By Geography

- North America

- US

- Canada

- Mexico

- Rest of North America

- Europe

- Germany

- UK

- France

- Russia

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Singapore

- Malaysia

- Rest of Asia Pacific

- LAMEA

- Brazil

- Argentina

- UAE

- Saudi Arabia

- South Africa

- Nigeria

- Rest of LAMEA

Table of Contents

Chapter 1. Market Scope & Methodology

- 1.1 Market Definition

- 1.2 Objectives

- 1.3 Market Scope

- 1.4 Segmentation

- 1.4.1 Global 5G In Aviation Market, by Connectivity Type

- 1.4.2 Global 5G In Aviation Market, by Communication Infrastructure

- 1.4.3 Global 5G In Aviation Market, by Technology

- 1.4.4 Global 5G In Aviation Market, by End Use

- 1.4.5 Global 5G In Aviation Market, by Geography

- 1.5 Methodology for the research

Chapter 2. Market at a Glance

- 2.1 Key Highlights

Chapter 3. Market Overview

- 3.1 Introduction

- 3.1.1 Overview

- 3.1.1.1 Market Composition and Scenario

- 3.1.1 Overview

- 3.2 Key Factors Impacting the Market

- 3.2.1 Market Drivers

- 3.2.2 Market Restraints

- 3.2.3 Market Opportunities

- 3.2.4 Market Challenges

Chapter 4. Competition Analysis - Global

- 4.1 Market Share Analysis, 2024

- 4.2 Recent Strategies Deployed in 5G In Aviation Market

- 4.3 Porter Five Forces Analysis

Chapter 5. Value Chain Analysis of 5G In Aviation Market

- 5.1 Inbound Logistics

- 5.2 Operations

- 5.3 Outbound Logistics

- 5.4 Marketing and Sales

- 5.5 Services

Chapter 6. Key Costumer Criteria of 5G In Aviation Market

Chapter 7. Global 5G In Aviation Market by Connectivity Type

- 7.1 Global Air-to-Ground Communication Market by Region

- 7.2 Global Ground-to-Ground Communication Market by Region

Chapter 8. Global 5G In Aviation Market by Communication Infrastructure

- 8.1 Global Small Cells Market by Region

- 8.2 Global Distributed Antenna Systems (DAS) Market by Region

- 8.3 Global Radio Access Network (RAN) Market by Region

Chapter 9. Global 5G In Aviation Market by Technology

- 9.1 Global Enhanced Mobile Broadband (eMBB) Market by Region

- 9.2 Global Ultra-Reliable Low-Latency Communication (URLLC) Market by Region

- 9.3 Global Massive Machine-Type Communication (mMTC) Market by Region

Chapter 10. Global 5G In Aviation Market by End Use

- 10.1 Global Aircraft Market by Region

- 10.2 Global Airport Market by Region

Chapter 11. Global 5G In Aviation Market by Region

- 11.1 North America 5G In Aviation Market

- 11.1.1 North America 5G In Aviation Market by Connectivity Type

- 11.1.1.1 North America Air-to-Ground Communication Market by Country

- 11.1.1.2 North America Ground-to-Ground Communication Market by Country

- 11.1.2 North America 5G In Aviation Market by Communication Infrastructure

- 11.1.2.1 North America Small Cells Market by Country

- 11.1.2.2 North America Distributed Antenna Systems (DAS) Market by Country

- 11.1.2.3 North America Radio Access Network (RAN) Market by Country

- 11.1.3 North America 5G In Aviation Market by Technology

- 11.1.3.1 North America Enhanced Mobile Broadband (eMBB) Market by Country

- 11.1.3.2 North America Ultra-Reliable Low-Latency Communication (URLLC) Market by Country

- 11.1.3.3 North America Massive Machine-Type Communication (mMTC) Market by Country

- 11.1.4 North America 5G In Aviation Market by End Use

- 11.1.4.1 North America Aircraft Market by Country

- 11.1.4.2 North America Airport Market by Country

- 11.1.5 North America 5G In Aviation Market by Country

- 11.1.5.1 US 5G In Aviation Market

- 11.1.5.1.1 US 5G In Aviation Market by Connectivity Type

- 11.1.5.1.2 US 5G In Aviation Market by Communication Infrastructure

- 11.1.5.1.3 US 5G In Aviation Market by Technology

- 11.1.5.1.4 US 5G In Aviation Market by End Use

- 11.1.5.2 Canada 5G In Aviation Market

- 11.1.5.2.1 Canada 5G In Aviation Market by Connectivity Type

- 11.1.5.2.2 Canada 5G In Aviation Market by Communication Infrastructure

- 11.1.5.2.3 Canada 5G In Aviation Market by Technology

- 11.1.5.2.4 Canada 5G In Aviation Market by End Use

- 11.1.5.3 Mexico 5G In Aviation Market

- 11.1.5.3.1 Mexico 5G In Aviation Market by Connectivity Type

- 11.1.5.3.2 Mexico 5G In Aviation Market by Communication Infrastructure

- 11.1.5.3.3 Mexico 5G In Aviation Market by Technology

- 11.1.5.3.4 Mexico 5G In Aviation Market by End Use

- 11.1.5.4 Rest of North America 5G In Aviation Market

- 11.1.5.4.1 Rest of North America 5G In Aviation Market by Connectivity Type

- 11.1.5.4.2 Rest of North America 5G In Aviation Market by Communication Infrastructure

- 11.1.5.4.3 Rest of North America 5G In Aviation Market by Technology

- 11.1.5.4.4 Rest of North America 5G In Aviation Market by End Use

- 11.1.5.1 US 5G In Aviation Market

- 11.1.1 North America 5G In Aviation Market by Connectivity Type

- 11.2 Europe 5G In Aviation Market

- 11.2.1 Europe 5G In Aviation Market by Connectivity Type

- 11.2.1.1 Europe Air-to-Ground Communication Market by Country

- 11.2.1.2 Europe Ground-to-Ground Communication Market by Country

- 11.2.2 Europe 5G In Aviation Market by Communication Infrastructure

- 11.2.2.1 Europe Small Cells Market by Country

- 11.2.2.2 Europe Distributed Antenna Systems (DAS) Market by Country

- 11.2.2.3 Europe Radio Access Network (RAN) Market by Country

- 11.2.3 Europe 5G In Aviation Market by Technology

- 11.2.3.1 Europe Enhanced Mobile Broadband (eMBB) Market by Country

- 11.2.3.2 Europe Ultra-Reliable Low-Latency Communication (URLLC) Market by Country

- 11.2.3.3 Europe Massive Machine-Type Communication (mMTC) Market by Country

- 11.2.4 Europe 5G In Aviation Market by End Use

- 11.2.4.1 Europe Aircraft Market by Country

- 11.2.4.2 Europe Airport Market by Country

- 11.2.5 Europe 5G In Aviation Market by Country

- 11.2.5.1 UK 5G In Aviation Market

- 11.2.5.1.1 UK 5G In Aviation Market by Connectivity Type

- 11.2.5.1.2 UK 5G In Aviation Market by Communication Infrastructure

- 11.2.5.1.3 UK 5G In Aviation Market by Technology

- 11.2.5.1.4 UK 5G In Aviation Market by End Use

- 11.2.5.2 Germany 5G In Aviation Market

- 11.2.5.2.1 Germany 5G In Aviation Market by Connectivity Type

- 11.2.5.2.2 Germany 5G In Aviation Market by Communication Infrastructure

- 11.2.5.2.3 Germany 5G In Aviation Market by Technology

- 11.2.5.2.4 Germany 5G In Aviation Market by End Use

- 11.2.5.3 France 5G In Aviation Market

- 11.2.5.3.1 France 5G In Aviation Market by Connectivity Type

- 11.2.5.3.2 France 5G In Aviation Market by Communication Infrastructure

- 11.2.5.3.3 France 5G In Aviation Market by Technology

- 11.2.5.3.4 France 5G In Aviation Market by End Use

- 11.2.5.4 Russia 5G In Aviation Market

- 11.2.5.4.1 Russia 5G In Aviation Market by Connectivity Type

- 11.2.5.4.2 Russia 5G In Aviation Market by Communication Infrastructure

- 11.2.5.4.3 Russia 5G In Aviation Market by Technology

- 11.2.5.4.4 Russia 5G In Aviation Market by End Use

- 11.2.5.5 Spain 5G In Aviation Market

- 11.2.5.5.1 Spain 5G In Aviation Market by Connectivity Type

- 11.2.5.5.2 Spain 5G In Aviation Market by Communication Infrastructure

- 11.2.5.5.3 Spain 5G In Aviation Market by Technology

- 11.2.5.5.4 Spain 5G In Aviation Market by End Use

- 11.2.5.6 Italy 5G In Aviation Market

- 11.2.5.6.1 Italy 5G In Aviation Market by Connectivity Type

- 11.2.5.6.2 Italy 5G In Aviation Market by Communication Infrastructure

- 11.2.5.6.3 Italy 5G In Aviation Market by Technology

- 11.2.5.6.4 Italy 5G In Aviation Market by End Use

- 11.2.5.7 Rest of Europe 5G In Aviation Market

- 11.2.5.7.1 Rest of Europe 5G In Aviation Market by Connectivity Type

- 11.2.5.7.2 Rest of Europe 5G In Aviation Market by Communication Infrastructure

- 11.2.5.7.3 Rest of Europe 5G In Aviation Market by Technology

- 11.2.5.7.4 Rest of Europe 5G In Aviation Market by End Use

- 11.2.5.1 UK 5G In Aviation Market

- 11.2.1 Europe 5G In Aviation Market by Connectivity Type

- 11.3 Asia Pacific 5G In Aviation Market

- 11.3.1 Asia Pacific 5G In Aviation Market by Connectivity Type

- 11.3.1.1 Asia Pacific Air-to-Ground Communication Market by Country

- 11.3.1.2 Asia Pacific Ground-to-Ground Communication Market by Country

- 11.3.2 Asia Pacific 5G In Aviation Market by Communication Infrastructure

- 11.3.2.1 Asia Pacific Small Cells Market by Country

- 11.3.2.2 Asia Pacific Distributed Antenna Systems (DAS) Market by Country

- 11.3.2.3 Asia Pacific Radio Access Network (RAN) Market by Country

- 11.3.3 Asia Pacific 5G In Aviation Market by Technology

- 11.3.3.1 Asia Pacific Enhanced Mobile Broadband (eMBB) Market by Country

- 11.3.3.2 Asia Pacific Ultra-Reliable Low-Latency Communication (URLLC) Market by Country

- 11.3.3.3 Asia Pacific Massive Machine-Type Communication (mMTC) Market by Country

- 11.3.4 Asia Pacific 5G In Aviation Market by End Use

- 11.3.4.1 Asia Pacific Aircraft Market by Country

- 11.3.4.2 Asia Pacific Airport Market by Country

- 11.3.5 Asia Pacific 5G In Aviation Market by Country

- 11.3.5.1 China 5G In Aviation Market

- 11.3.5.1.1 China 5G In Aviation Market by Connectivity Type

- 11.3.5.1.2 China 5G In Aviation Market by Communication Infrastructure

- 11.3.5.1.3 China 5G In Aviation Market by Technology

- 11.3.5.1.4 China 5G In Aviation Market by End Use

- 11.3.5.2 Japan 5G In Aviation Market

- 11.3.5.2.1 Japan 5G In Aviation Market by Connectivity Type

- 11.3.5.2.2 Japan 5G In Aviation Market by Communication Infrastructure

- 11.3.5.2.3 Japan 5G In Aviation Market by Technology

- 11.3.5.2.4 Japan 5G In Aviation Market by End Use

- 11.3.5.3 India 5G In Aviation Market

- 11.3.5.3.1 India 5G In Aviation Market by Connectivity Type

- 11.3.5.3.2 India 5G In Aviation Market by Communication Infrastructure

- 11.3.5.3.3 India 5G In Aviation Market by Technology

- 11.3.5.3.4 India 5G In Aviation Market by End Use

- 11.3.5.4 South Korea 5G In Aviation Market

- 11.3.5.4.1 South Korea 5G In Aviation Market by Connectivity Type

- 11.3.5.4.2 South Korea 5G In Aviation Market by Communication Infrastructure

- 11.3.5.4.3 South Korea 5G In Aviation Market by Technology

- 11.3.5.4.4 South Korea 5G In Aviation Market by End Use

- 11.3.5.5 Singapore 5G In Aviation Market

- 11.3.5.5.1 Singapore 5G In Aviation Market by Connectivity Type

- 11.3.5.5.2 Singapore 5G In Aviation Market by Communication Infrastructure

- 11.3.5.5.3 Singapore 5G In Aviation Market by Technology

- 11.3.5.5.4 Singapore 5G In Aviation Market by End Use

- 11.3.5.6 Malaysia 5G In Aviation Market

- 11.3.5.6.1 Malaysia 5G In Aviation Market by Connectivity Type

- 11.3.5.6.2 Malaysia 5G In Aviation Market by Communication Infrastructure

- 11.3.5.6.3 Malaysia 5G In Aviation Market by Technology

- 11.3.5.6.4 Malaysia 5G In Aviation Market by End Use

- 11.3.5.7 Rest of Asia Pacific 5G In Aviation Market

- 11.3.5.7.1 Rest of Asia Pacific 5G In Aviation Market by Connectivity Type

- 11.3.5.7.2 Rest of Asia Pacific 5G In Aviation Market by Communication Infrastructure

- 11.3.5.7.3 Rest of Asia Pacific 5G In Aviation Market by Technology

- 11.3.5.7.4 Rest of Asia Pacific 5G In Aviation Market by End Use

- 11.3.5.1 China 5G In Aviation Market

- 11.3.1 Asia Pacific 5G In Aviation Market by Connectivity Type

- 11.4 LAMEA 5G In Aviation Market

- 11.4.1 LAMEA 5G In Aviation Market by Connectivity Type

- 11.4.1.1 LAMEA Air-to-Ground Communication Market by Country

- 11.4.1.2 LAMEA Ground-to-Ground Communication Market by Country

- 11.4.2 LAMEA 5G In Aviation Market by Communication Infrastructure

- 11.4.2.1 LAMEA Small Cells Market by Country

- 11.4.2.2 LAMEA Distributed Antenna Systems (DAS) Market by Country

- 11.4.2.3 LAMEA Radio Access Network (RAN) Market by Country

- 11.4.3 LAMEA 5G In Aviation Market by Technology

- 11.4.3.1 LAMEA Enhanced Mobile Broadband (eMBB) Market by Country

- 11.4.3.2 LAMEA Ultra-Reliable Low-Latency Communication (URLLC) Market by Country

- 11.4.3.3 LAMEA Massive Machine-Type Communication (mMTC) Market by Country

- 11.4.4 LAMEA 5G In Aviation Market by End Use

- 11.4.4.1 LAMEA Aircraft Market by Country

- 11.4.4.2 LAMEA Airport Market by Country

- 11.4.5 LAMEA 5G In Aviation Market by Country

- 11.4.5.1 UAE 5G In Aviation Market

- 11.4.5.1.1 UAE 5G In Aviation Market by Connectivity Type

- 11.4.5.1.2 UAE 5G In Aviation Market by Communication Infrastructure

- 11.4.5.1.3 UAE 5G In Aviation Market by Technology

- 11.4.5.1.4 UAE 5G In Aviation Market by End Use

- 11.4.5.2 Qatar 5G In Aviation Market

- 11.4.5.2.1 Qatar 5G In Aviation Market by Connectivity Type

- 11.4.5.2.2 Qatar 5G In Aviation Market by Communication Infrastructure

- 11.4.5.2.3 Qatar 5G In Aviation Market by Technology

- 11.4.5.2.4 Qatar 5G In Aviation Market by End Use

- 11.4.5.3 Brazil 5G In Aviation Market

- 11.4.5.3.1 Brazil 5G In Aviation Market by Connectivity Type

- 11.4.5.3.2 Brazil 5G In Aviation Market by Communication Infrastructure

- 11.4.5.3.3 Brazil 5G In Aviation Market by Technology

- 11.4.5.3.4 Brazil 5G In Aviation Market by End Use

- 11.4.5.4 Saudi Arabia 5G In Aviation Market

- 11.4.5.4.1 Saudi Arabia 5G In Aviation Market by Connectivity Type

- 11.4.5.4.2 Saudi Arabia 5G In Aviation Market by Communication Infrastructure

- 11.4.5.4.3 Saudi Arabia 5G In Aviation Market by Technology

- 11.4.5.4.4 Saudi Arabia 5G In Aviation Market by End Use

- 11.4.5.5 South Africa 5G In Aviation Market

- 11.4.5.5.1 South Africa 5G In Aviation Market by Connectivity Type

- 11.4.5.5.2 South Africa 5G In Aviation Market by Communication Infrastructure

- 11.4.5.5.3 South Africa 5G In Aviation Market by Technology

- 11.4.5.5.4 South Africa 5G In Aviation Market by End Use

- 11.4.5.6 Egypt 5G In Aviation Market

- 11.4.5.6.1 Egypt 5G In Aviation Market by Connectivity Type

- 11.4.5.6.2 Egypt 5G In Aviation Market by Communication Infrastructure

- 11.4.5.6.3 Egypt 5G In Aviation Market by Technology

- 11.4.5.6.4 Egypt 5G In Aviation Market by End Use

- 11.4.5.7 Rest of LAMEA 5G In Aviation Market

- 11.4.5.7.1 Rest of LAMEA 5G In Aviation Market by Connectivity Type

- 11.4.5.7.2 Rest of LAMEA 5G In Aviation Market by Communication Infrastructure

- 11.4.5.7.3 Rest of LAMEA 5G In Aviation Market by Technology

- 11.4.5.7.4 Rest of LAMEA 5G In Aviation Market by End Use

- 11.4.5.1 UAE 5G In Aviation Market

- 11.4.1 LAMEA 5G In Aviation Market by Connectivity Type

Chapter 12. Company Profiles

- 12.1 Huawei Technologies Co., Ltd. (Huawei Investment & Holding Co., Ltd.)

- 12.1.1 Company Overview

- 12.1.2 Financial Analysis

- 12.1.3 Segmental and Regional Analysis

- 12.1.4 Research & Development Expenses

- 12.1.5 Recent strategies and developments:

- 12.1.5.1 Partnerships, Collaborations, and Agreements:

- 12.1.6 SWOT Analysis

- 12.2 Nokia Corporation

- 12.2.1 Company Overview

- 12.2.2 Financial Analysis

- 12.2.3 Segmental and Regional Analysis

- 12.2.4 Research & Development Expense

- 12.2.5 Recent strategies and developments:

- 12.2.5.1 Partnerships, Collaborations, and Agreements:

- 12.2.6 SWOT Analysis

- 12.3 Cisco Systems, Inc.

- 12.3.1 Company Overview

- 12.3.2 Financial Analysis

- 12.3.3 Regional Analysis

- 12.3.4 Research & Development Expense

- 12.3.5 SWOT Analysis

- 12.4 Honeywell International, Inc.

- 12.4.1 Company Overview

- 12.4.2 Financial Analysis

- 12.4.3 Segmental and Regional Analysis

- 12.4.4 Research & Development Expenses

- 12.4.5 Recent strategies and developments:

- 12.4.5.1 Product Launches and Product Expansions:

- 12.4.6 SWOT Analysis

- 12.5 Thales Group S.A.

- 12.5.1 Company Overview

- 12.5.2 Financial Analysis

- 12.5.3 Segmental Analysis

- 12.5.4 Research & Development Expenses

- 12.5.5 Recent strategies and developments:

- 12.5.5.1 Acquisition and Mergers:

- 12.5.6 SWOT Analysis

- 12.6 Ericsson AB

- 12.6.1 Company Overview

- 12.6.2 Financial Analysis

- 12.6.3 Segmental and Regional Analysis

- 12.6.4 Research & Development Expense

- 12.6.5 Recent strategies and developments: