|

|

市場調査レポート

商品コード

1743546

コアバンキングソフトウェアの世界市場:市場規模・シェア・動向分析 (展開方式別、最終用途別、コンポーネント別、地域別)・展望・将来予測 (2025年~2032年)Global Core Banking Software Market Size, Share & Industry Analysis Report By Deployment (Cloud and On-premise), By End Use, By Component, By Regional Outlook and Forecast, 2025 - 2032 |

||||||

|

|||||||

| コアバンキングソフトウェアの世界市場:市場規模・シェア・動向分析 (展開方式別、最終用途別、コンポーネント別、地域別)・展望・将来予測 (2025年~2032年) |

|

出版日: 2025年05月20日

発行: KBV Research

ページ情報: 英文 355 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

世界のコアバンキングソフトウェアの市場規模は、予測期間中に10.0%のCAGRで市場成長し、2032年までに251億米ドルに達すると予想されています。

さらに、銀行業界におけるクラウドコンピューティングの導入は、金融機関の業務運営に革命をもたらしています。クラウドベースのCBSは、拡張性、柔軟性、そして費用対効果に優れており、銀行は市場の変化や顧客ニーズに迅速に対応できます。クラウドへの移行により、銀行はレガシーインフラへの依存を軽減し、運用コストを削減し、システムの信頼性を高めることができます。したがって、クラウドベースのCBSへの移行は、銀行業界における俊敏性、効率性、そしてイノベーションへのニーズによって推進されていると言えるでしょう。

しかし、最新のコアバンキングソフトウェア(CBS)システムの導入には多額の投資が必要であり、高額な導入コストと長期にわたる導入期間が市場における主な制約の一つとなっています。レガシーシステムから最新のCBSへの移行には、ソフトウェアの導入以外にも多くの費用がかかります。銀行は、新しいハードウェア、システム統合、データ移行、従業員研修、そして継続的な技術サポートに投資しなければなりません。結果として、多くの中規模・小規模銀行は、財務的な負担とオペレーショナルリスクを懸念し、CBSの近代化を先延ばしにしています。

展開方式別の展望

展開方式に基づいて、市場はクラウドとオンプレミスの2つに分類されます。オンプレミスCBSの導入は、レガシーインフラ、複雑なカスタムワークフロー、あるいはデータレジデンシーとシステム全体の管理を必要とする規制要件を抱える金融機関で依然として主流です。これらのソリューションは通常、銀行内部で管理され、銀行はハードウェア、ソフトウェア、そしてデータへの直接的な監視が可能です。オンプレミスシステムは、クラウド規制の進展が緩やかな地域、あるいは大量の機密データを扱うために厳格な内部管理が求められる地域では、依然として主流となっています。

最終用途別の展望

エンドユーザー別に見ると、市場は銀行、金融機関、その他のエンドユーザーに分類されます。銀行はCBS市場において最大のセグメントを占め、堅牢性、拡張性、安全性に優れたプラットフォームに対する需要を牽引しています。商業銀行、リテール銀行、協同組合銀行は、顧客口座の管理、取引処理、融資業務のサポート、デジタルバンキングサービスの統合においてCBSを活用しています。

コンポーネント別の展望

コンポーネントに基づいて、市場はソリューション(預金、ローン、企業顧客ソリューション、その他の種類のソリューション)とサービス(専門的サービス、マネージドサービス)に分類されます。サービスセグメントは、コアバンキングソリューションの導入とライフサイクル管理をサポートします。これには、コンサルティング、統合、カスタマイズ、移行、テスト、トレーニング、サポートサービスが含まれます。CBSプラットフォームがより複雑になり、多様な銀行環境への適応性が高まるにつれて、導入の成功と長期的なパフォーマンスを確保する上で、サービスの役割はますます重要になっています。

地域別の展望

地域別に見ると、市場は北米、欧州、アジア太平洋、ラテンアメリカ・中東・アフリカに分類されます。北米のコアバンキングソフトウェア市場では、金融機関がシームレスでリアルタイムなデジタルサービスを提供しつつ、運用のレジリエンスを維持するというプレッシャーの高まりを背景に、プラットフォームの近代化に向けた大きな転換が見られます。組み込み型ファイナンスの利用が増加する中、この地域の銀行は、小売プラットフォーム、フィンテックアプリ、エンタープライズソフトウェア環境などのサードパーティのエコシステムに直接統合できるよう、コアシステムを見直しています。

目次

第1章 市場の範囲と分析手法

- 市場の定義

- 目的

- 市場範囲

- セグメンテーション

- 分析手法

第2章 市場要覧

- 主なハイライト

第3章 市場概要

- イントロダクション

- 概要

- 市場構成とシナリオ

- 概要

- 市場に影響を与える主な要因

- 市場促進要因

- 市場抑制要因

- 市場機会

- 市場の課題

- ポーターのファイブフォース分析

第4章 競合分析:世界市場

- 市場シェア分析 (2024年)

- コアバンキングソフトウェア市場で展開される戦略

- ポーターのファイブフォース分析

第5章 主な顧客基準:世界のコアバンキングソフトウェア市場

- スケーラビリティとパフォーマンス

- モジュール性と柔軟性

- クラウド対応と導入の柔軟性

- APIエコシステムとオープンバンキングの統合

- セキュリティ、プライバシー、規制コンプライアンス

- 総所有コスト(TCO)

- 導入のスピードとアップグレードの容易さ

- スタッフと顧客のためのユーザーエクスペリエンス(UX)

- ベンダーの評判、業界の専門知識、および参照

- ローカリゼーション、サポート、アフターサービス

第6章 世界のコアバンキングソフトウェア市場:展開方式別

- 世界のクラウド市場:地域別

- 世界のオンプレミス市場:地域別

第7章 世界のコアバンキングソフトウェア市場:最終用途別

- 世界の銀行市場:地域別

- 世界の金融機関市場:地域別

- 世界のその他の最終用途市場:地域別

第8章 世界のコアバンキングソフトウェア市場:コンポーネント別

- 世界のソリューション市場:地域別

- 世界のコアバンキングソフトウェア市場:ソリューションの種類別

- 世界のサービス市場:地域別

- 世界のコアバンキングソフトウェア市場:サービスの種類別

第9章 世界のコアバンキングソフトウェア市場:地域別

- 北米

- 北米のコアバンキングソフトウェア市場:国別

- 米国

- カナダ

- メキシコ

- その他北米地域

- 北米のコアバンキングソフトウェア市場:国別

- 欧州

- 欧州のコアバンキングソフトウェア市場:国別

- 英国

- ドイツ

- フランス

- ロシア

- スペイン

- イタリア

- その他欧州地域

- 欧州のコアバンキングソフトウェア市場:国別

- アジア太平洋

- アジア太平洋のコアバンキングソフトウェア市場:国別

- 中国

- 日本

- インド

- 韓国

- シンガポール

- マレーシア

- その他アジア太平洋地域

- アジア太平洋のコアバンキングソフトウェア市場:国別

- ラテンアメリカ・中東・アフリカ

- ラテンアメリカ・中東・アフリカのコアバンキングソフトウェア市場:国別

- ブラジル

- アルゼンチン

- アラブ首長国連邦

- サウジアラビア

- 南アフリカ

- ナイジェリア

- その他ラテンアメリカ・中東・アフリカ地域

- ラテンアメリカ・中東・アフリカのコアバンキングソフトウェア市場:国別

第10章 企業プロファイル

- Capgemini SE

- Finastra Group Holdings Limited(Vista Equity Partners)

- Temenos AG

- HCL Technologies Ltd(HCL Enterprises)

- Oracle Corporation

- Fiserv, Inc

- Infosys Limited

- SAP SE

- Tata Consultancy Services Ltd

- Jack Henry & Associates, Inc

第11章 コアバンキングソフトウェア市場の成功必須条件

LIST OF TABLES

- TABLE 1 Global Core Banking Software Market, 2021 - 2024, USD Million

- TABLE 2 Global Core Banking Software Market, 2025 - 2032, USD Million

- TABLE 3 Key Customer Criteria - Global Core Banking Software Market

- TABLE 4 Global Core Banking Software Market by Deployment, 2021 - 2024, USD Million

- TABLE 5 Global Core Banking Software Market by Deployment, 2025 - 2032, USD Million

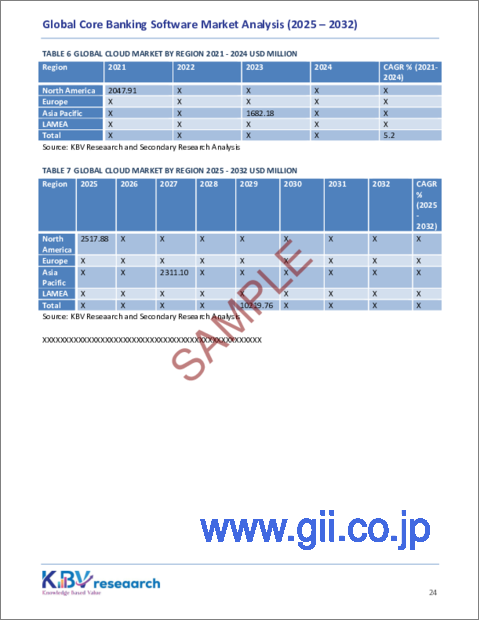

- TABLE 6 Global Cloud Market by Region, 2021 - 2024, USD Million

- TABLE 7 Global Cloud Market by Region, 2025 - 2032, USD Million

- TABLE 8 Global On-premise Market by Region, 2021 - 2024, USD Million

- TABLE 9 Global On-premise Market by Region, 2025 - 2032, USD Million

- TABLE 10 Global Core Banking Software Market by End Use, 2021 - 2024, USD Million

- TABLE 11 Global Core Banking Software Market by End Use, 2025 - 2032, USD Million

- TABLE 12 Global Banks Market by Region, 2021 - 2024, USD Million

- TABLE 13 Global Banks Market by Region, 2025 - 2032, USD Million

- TABLE 14 Global Financial Institutions Market by Region, 2021 - 2024, USD Million

- TABLE 15 Global Financial Institutions Market by Region, 2025 - 2032, USD Million

- TABLE 16 Global Other End Use Market by Region, 2021 - 2024, USD Million

- TABLE 17 Global Other End Use Market by Region, 2025 - 2032, USD Million

- TABLE 18 Global Core Banking Software Market by Component, 2021 - 2024, USD Million

- TABLE 19 Global Core Banking Software Market by Component, 2025 - 2032, USD Million

- TABLE 20 Global Solution Market by Region, 2021 - 2024, USD Million

- TABLE 21 Global Solution Market by Region, 2025 - 2032, USD Million

- TABLE 22 Global Core Banking Software Market by Solution Type, 2021 - 2024, USD Million

- TABLE 23 Global Core Banking Software Market by Solution Type, 2025 - 2032, USD Million

- TABLE 24 Global Deposits Market by Region, 2021 - 2024, USD Million

- TABLE 25 Global Deposits Market by Region, 2025 - 2032, USD Million

- TABLE 26 Global Loans Market by Region, 2021 - 2024, USD Million

- TABLE 27 Global Loans Market by Region, 2025 - 2032, USD Million

- TABLE 28 Global Enterprise Customer Solutions Market by Region, 2021 - 2024, USD Million

- TABLE 29 Global Enterprise Customer Solutions Market by Region, 2025 - 2032, USD Million

- TABLE 30 Global Other Solution Type Market by Region, 2021 - 2024, USD Million

- TABLE 31 Global Other Solution Type Market by Region, 2025 - 2032, USD Million

- TABLE 32 Global Service Market by Region, 2021 - 2024, USD Million

- TABLE 33 Global Service Market by Region, 2025 - 2032, USD Million

- TABLE 34 Global Core Banking Software Market by Service Type, 2021 - 2024, USD Million

- TABLE 35 Global Core Banking Software Market by Service Type, 2025 - 2032, USD Million

- TABLE 36 Global Professional Service Market by Region, 2021 - 2024, USD Million

- TABLE 37 Global Professional Service Market by Region, 2025 - 2032, USD Million

- TABLE 38 Global Managed Service Market by Region, 2021 - 2024, USD Million

- TABLE 39 Global Managed Service Market by Region, 2025 - 2032, USD Million

- TABLE 40 Global Core Banking Software Market by Region, 2021 - 2024, USD Million

- TABLE 41 Global Core Banking Software Market by Region, 2025 - 2032, USD Million

- TABLE 42 North America Core Banking Software Market, 2021 - 2024, USD Million

- TABLE 43 North America Core Banking Software Market, 2025 - 2032, USD Million

- TABLE 44 North America Core Banking Software Market by Deployment, 2021 - 2024, USD Million

- TABLE 45 North America Core Banking Software Market by Deployment, 2025 - 2032, USD Million

- TABLE 46 North America Cloud Market by Region, 2021 - 2024, USD Million

- TABLE 47 North America Cloud Market by Region, 2025 - 2032, USD Million

- TABLE 48 North America On-premise Market by Region, 2021 - 2024, USD Million

- TABLE 49 North America On-premise Market by Region, 2025 - 2032, USD Million

- TABLE 50 North America Core Banking Software Market by End Use, 2021 - 2024, USD Million

- TABLE 51 North America Core Banking Software Market by End Use, 2025 - 2032, USD Million

- TABLE 52 North America Banks Market by Country, 2021 - 2024, USD Million

- TABLE 53 North America Banks Market by Country, 2025 - 2032, USD Million

- TABLE 54 North America Financial Institutions Market by Country, 2021 - 2024, USD Million

- TABLE 55 North America Financial Institutions Market by Country, 2025 - 2032, USD Million

- TABLE 56 North America Other End Use Market by Country, 2021 - 2024, USD Million

- TABLE 57 North America Other End Use Market by Country, 2025 - 2032, USD Million

- TABLE 58 North America Core Banking Software Market by Component, 2021 - 2024, USD Million

- TABLE 59 North America Core Banking Software Market by Component, 2025 - 2032, USD Million

- TABLE 60 North America Solution Market by Country, 2021 - 2024, USD Million

- TABLE 61 North America Solution Market by Country, 2025 - 2032, USD Million

- TABLE 62 North America Core Banking Software Market by Solution Type, 2021 - 2024, USD Million

- TABLE 63 North America Core Banking Software Market by Solution Type, 2025 - 2032, USD Million

- TABLE 64 North America Deposits Market by Country, 2021 - 2024, USD Million

- TABLE 65 North America Deposits Market by Country, 2025 - 2032, USD Million

- TABLE 66 North America Loans Market by Country, 2021 - 2024, USD Million

- TABLE 67 North America Loans Market by Country, 2025 - 2032, USD Million

- TABLE 68 North America Enterprise Customer Solutions Market by Country, 2021 - 2024, USD Million

- TABLE 69 North America Enterprise Customer Solutions Market by Country, 2025 - 2032, USD Million

- TABLE 70 North America Other Solution Type Market by Country, 2021 - 2024, USD Million

- TABLE 71 North America Other Solution Type Market by Country, 2025 - 2032, USD Million

- TABLE 72 North America Service Market by Country, 2021 - 2024, USD Million

- TABLE 73 North America Service Market by Country, 2025 - 2032, USD Million

- TABLE 74 North America Core Banking Software Market by Service Type, 2021 - 2024, USD Million

- TABLE 75 North America Core Banking Software Market by Service Type, 2025 - 2032, USD Million

- TABLE 76 North America Professional Service Market by Country, 2021 - 2024, USD Million

- TABLE 77 North America Professional Service Market by Country, 2025 - 2032, USD Million

- TABLE 78 North America Managed Service Market by Country, 2021 - 2024, USD Million

- TABLE 79 North America Managed Service Market by Country, 2025 - 2032, USD Million

- TABLE 80 North America Core Banking Software Market by Country, 2021 - 2024, USD Million

- TABLE 81 North America Core Banking Software Market by Country, 2025 - 2032, USD Million

- TABLE 82 US Core Banking Software Market, 2021 - 2024, USD Million

- TABLE 83 US Core Banking Software Market, 2025 - 2032, USD Million

- TABLE 84 US Core Banking Software Market by Deployment, 2021 - 2024, USD Million

- TABLE 85 US Core Banking Software Market by Deployment, 2025 - 2032, USD Million

- TABLE 86 US Core Banking Software Market by End Use, 2021 - 2024, USD Million

- TABLE 87 US Core Banking Software Market by End Use, 2025 - 2032, USD Million

- TABLE 88 US Core Banking Software Market by Component, 2021 - 2024, USD Million

- TABLE 89 US Core Banking Software Market by Component, 2025 - 2032, USD Million

- TABLE 90 US Core Banking Software Market by Solution Type, 2021 - 2024, USD Million

- TABLE 91 US Core Banking Software Market by Solution Type, 2025 - 2032, USD Million

- TABLE 92 US Core Banking Software Market by Service Type, 2021 - 2024, USD Million

- TABLE 93 US Core Banking Software Market by Service Type, 2025 - 2032, USD Million

- TABLE 94 Canada Core Banking Software Market, 2021 - 2024, USD Million

- TABLE 95 Canada Core Banking Software Market, 2025 - 2032, USD Million

- TABLE 96 Canada Core Banking Software Market by Deployment, 2021 - 2024, USD Million

- TABLE 97 Canada Core Banking Software Market by Deployment, 2025 - 2032, USD Million

- TABLE 98 Canada Core Banking Software Market by End Use, 2021 - 2024, USD Million

- TABLE 99 Canada Core Banking Software Market by End Use, 2025 - 2032, USD Million

- TABLE 100 Canada Core Banking Software Market by Component, 2021 - 2024, USD Million

- TABLE 101 Canada Core Banking Software Market by Component, 2025 - 2032, USD Million

- TABLE 102 Canada Core Banking Software Market by Solution Type, 2021 - 2024, USD Million

- TABLE 103 Canada Core Banking Software Market by Solution Type, 2025 - 2032, USD Million

- TABLE 104 Canada Core Banking Software Market by Service Type, 2021 - 2024, USD Million

- TABLE 105 Canada Core Banking Software Market by Service Type, 2025 - 2032, USD Million

- TABLE 106 Mexico Core Banking Software Market, 2021 - 2024, USD Million

- TABLE 107 Mexico Core Banking Software Market, 2025 - 2032, USD Million

- TABLE 108 Mexico Core Banking Software Market by Deployment, 2021 - 2024, USD Million

- TABLE 109 Mexico Core Banking Software Market by Deployment, 2025 - 2032, USD Million

- TABLE 110 Mexico Core Banking Software Market by End Use, 2021 - 2024, USD Million

- TABLE 111 Mexico Core Banking Software Market by End Use, 2025 - 2032, USD Million

- TABLE 112 Mexico Core Banking Software Market by Component, 2021 - 2024, USD Million

- TABLE 113 Mexico Core Banking Software Market by Component, 2025 - 2032, USD Million

- TABLE 114 Mexico Core Banking Software Market by Solution Type, 2021 - 2024, USD Million

- TABLE 115 Mexico Core Banking Software Market by Solution Type, 2025 - 2032, USD Million

- TABLE 116 Mexico Core Banking Software Market by Service Type, 2021 - 2024, USD Million

- TABLE 117 Mexico Core Banking Software Market by Service Type, 2025 - 2032, USD Million

- TABLE 118 Rest of North America Core Banking Software Market, 2021 - 2024, USD Million

- TABLE 119 Rest of North America Core Banking Software Market, 2025 - 2032, USD Million

- TABLE 120 Rest of North America Core Banking Software Market by Deployment, 2021 - 2024, USD Million

- TABLE 121 Rest of North America Core Banking Software Market by Deployment, 2025 - 2032, USD Million

- TABLE 122 Rest of North America Core Banking Software Market by End Use, 2021 - 2024, USD Million

- TABLE 123 Rest of North America Core Banking Software Market by End Use, 2025 - 2032, USD Million

- TABLE 124 Rest of North America Core Banking Software Market by Component, 2021 - 2024, USD Million

- TABLE 125 Rest of North America Core Banking Software Market by Component, 2025 - 2032, USD Million

- TABLE 126 Rest of North America Core Banking Software Market by Solution Type, 2021 - 2024, USD Million

- TABLE 127 Rest of North America Core Banking Software Market by Solution Type, 2025 - 2032, USD Million

- TABLE 128 Rest of North America Core Banking Software Market by Service Type, 2021 - 2024, USD Million

- TABLE 129 Rest of North America Core Banking Software Market by Service Type, 2025 - 2032, USD Million

- TABLE 130 Europe Core Banking Software Market, 2021 - 2024, USD Million

- TABLE 131 Europe Core Banking Software Market, 2025 - 2032, USD Million

- TABLE 132 Europe Core Banking Software Market by Deployment, 2021 - 2024, USD Million

- TABLE 133 Europe Core Banking Software Market by Deployment, 2025 - 2032, USD Million

- TABLE 134 Europe Cloud Market by Country, 2021 - 2024, USD Million

- TABLE 135 Europe Cloud Market by Country, 2025 - 2032, USD Million

- TABLE 136 Europe On-premise Market by Country, 2021 - 2024, USD Million

- TABLE 137 Europe On-premise Market by Country, 2025 - 2032, USD Million

- TABLE 138 Europe Core Banking Software Market by End Use, 2021 - 2024, USD Million

- TABLE 139 Europe Core Banking Software Market by End Use, 2025 - 2032, USD Million

- TABLE 140 Europe Banks Market by Country, 2021 - 2024, USD Million

- TABLE 141 Europe Banks Market by Country, 2025 - 2032, USD Million

- TABLE 142 Europe Financial Institutions Market by Country, 2021 - 2024, USD Million

- TABLE 143 Europe Financial Institutions Market by Country, 2025 - 2032, USD Million

- TABLE 144 Europe Other End Use Market by Country, 2021 - 2024, USD Million

- TABLE 145 Europe Other End Use Market by Country, 2025 - 2032, USD Million

- TABLE 146 Europe Core Banking Software Market by Component, 2021 - 2024, USD Million

- TABLE 147 Europe Core Banking Software Market by Component, 2025 - 2032, USD Million

- TABLE 148 Europe Solution Market by Country, 2021 - 2024, USD Million

- TABLE 149 Europe Solution Market by Country, 2025 - 2032, USD Million

- TABLE 150 Europe Core Banking Software Market by Solution Type, 2021 - 2024, USD Million

- TABLE 151 Europe Core Banking Software Market by Solution Type, 2025 - 2032, USD Million

- TABLE 152 Europe Deposits Market by Country, 2021 - 2024, USD Million

- TABLE 153 Europe Deposits Market by Country, 2025 - 2032, USD Million

- TABLE 154 Europe Loans Market by Country, 2021 - 2024, USD Million

- TABLE 155 Europe Loans Market by Country, 2025 - 2032, USD Million

- TABLE 156 Europe Enterprise Customer Solutions Market by Country, 2021 - 2024, USD Million

- TABLE 157 Europe Enterprise Customer Solutions Market by Country, 2025 - 2032, USD Million

- TABLE 158 Europe Other Solution Type Market by Country, 2021 - 2024, USD Million

- TABLE 159 Europe Other Solution Type Market by Country, 2025 - 2032, USD Million

- TABLE 160 Europe Service Market by Country, 2021 - 2024, USD Million

- TABLE 161 Europe Service Market by Country, 2025 - 2032, USD Million

- TABLE 162 Europe Core Banking Software Market by Service Type, 2021 - 2024, USD Million

- TABLE 163 Europe Core Banking Software Market by Service Type, 2025 - 2032, USD Million

- TABLE 164 Europe Professional Service Market by Country, 2021 - 2024, USD Million

- TABLE 165 Europe Professional Service Market by Country, 2025 - 2032, USD Million

- TABLE 166 Europe Managed Service Market by Country, 2021 - 2024, USD Million

- TABLE 167 Europe Managed Service Market by Country, 2025 - 2032, USD Million

- TABLE 168 Europe Core Banking Software Market by Country, 2021 - 2024, USD Million

- TABLE 169 Europe Core Banking Software Market by Country, 2025 - 2032, USD Million

- TABLE 170 UK Core Banking Software Market, 2021 - 2024, USD Million

- TABLE 171 UK Core Banking Software Market, 2025 - 2032, USD Million

- TABLE 172 UK Core Banking Software Market by Deployment, 2021 - 2024, USD Million

- TABLE 173 UK Core Banking Software Market by Deployment, 2025 - 2032, USD Million

- TABLE 174 UK Core Banking Software Market by End Use, 2021 - 2024, USD Million

- TABLE 175 UK Core Banking Software Market by End Use, 2025 - 2032, USD Million

- TABLE 176 UK Core Banking Software Market by Component, 2021 - 2024, USD Million

- TABLE 177 UK Core Banking Software Market by Component, 2025 - 2032, USD Million

- TABLE 178 UK Core Banking Software Market by Solution Type, 2021 - 2024, USD Million

- TABLE 179 UK Core Banking Software Market by Solution Type, 2025 - 2032, USD Million

- TABLE 180 UK Core Banking Software Market by Service Type, 2021 - 2024, USD Million

- TABLE 181 UK Core Banking Software Market by Service Type, 2025 - 2032, USD Million

- TABLE 182 Germany Core Banking Software Market, 2021 - 2024, USD Million

- TABLE 183 Germany Core Banking Software Market, 2025 - 2032, USD Million

- TABLE 184 Germany Core Banking Software Market by Deployment, 2021 - 2024, USD Million

- TABLE 185 Germany Core Banking Software Market by Deployment, 2025 - 2032, USD Million

- TABLE 186 Germany Core Banking Software Market by End Use, 2021 - 2024, USD Million

- TABLE 187 Germany Core Banking Software Market by End Use, 2025 - 2032, USD Million

- TABLE 188 Germany Core Banking Software Market by Component, 2021 - 2024, USD Million

- TABLE 189 Germany Core Banking Software Market by Component, 2025 - 2032, USD Million

- TABLE 190 Germany Core Banking Software Market by Solution Type, 2021 - 2024, USD Million

- TABLE 191 Germany Core Banking Software Market by Solution Type, 2025 - 2032, USD Million

- TABLE 192 Germany Core Banking Software Market by Service Type, 2021 - 2024, USD Million

- TABLE 193 Germany Core Banking Software Market by Service Type, 2025 - 2032, USD Million

- TABLE 194 France Core Banking Software Market, 2021 - 2024, USD Million

- TABLE 195 France Core Banking Software Market, 2025 - 2032, USD Million

- TABLE 196 France Core Banking Software Market by Deployment, 2021 - 2024, USD Million

- TABLE 197 France Core Banking Software Market by Deployment, 2025 - 2032, USD Million

- TABLE 198 France Core Banking Software Market by End Use, 2021 - 2024, USD Million

- TABLE 199 France Core Banking Software Market by End Use, 2025 - 2032, USD Million

- TABLE 200 France Core Banking Software Market by Component, 2021 - 2024, USD Million

- TABLE 201 France Core Banking Software Market by Component, 2025 - 2032, USD Million

- TABLE 202 France Core Banking Software Market by Solution Type, 2021 - 2024, USD Million

- TABLE 203 France Core Banking Software Market by Solution Type, 2025 - 2032, USD Million

- TABLE 204 France Core Banking Software Market by Service Type, 2021 - 2024, USD Million

- TABLE 205 France Core Banking Software Market by Service Type, 2025 - 2032, USD Million

- TABLE 206 Russia Core Banking Software Market, 2021 - 2024, USD Million

- TABLE 207 Russia Core Banking Software Market, 2025 - 2032, USD Million

- TABLE 208 Russia Core Banking Software Market by Deployment, 2021 - 2024, USD Million

- TABLE 209 Russia Core Banking Software Market by Deployment, 2025 - 2032, USD Million

- TABLE 210 Russia Core Banking Software Market by End Use, 2021 - 2024, USD Million

- TABLE 211 Russia Core Banking Software Market by End Use, 2025 - 2032, USD Million

- TABLE 212 Russia Core Banking Software Market by Component, 2021 - 2024, USD Million

- TABLE 213 Russia Core Banking Software Market by Component, 2025 - 2032, USD Million

- TABLE 214 Russia Core Banking Software Market by Solution Type, 2021 - 2024, USD Million

- TABLE 215 Russia Core Banking Software Market by Solution Type, 2025 - 2032, USD Million

- TABLE 216 Russia Core Banking Software Market by Service Type, 2021 - 2024, USD Million

- TABLE 217 Russia Core Banking Software Market by Service Type, 2025 - 2032, USD Million

- TABLE 218 Spain Core Banking Software Market, 2021 - 2024, USD Million

- TABLE 219 Spain Core Banking Software Market, 2025 - 2032, USD Million

- TABLE 220 Spain Core Banking Software Market by Deployment, 2021 - 2024, USD Million

- TABLE 221 Spain Core Banking Software Market by Deployment, 2025 - 2032, USD Million

- TABLE 222 Spain Core Banking Software Market by End Use, 2021 - 2024, USD Million

- TABLE 223 Spain Core Banking Software Market by End Use, 2025 - 2032, USD Million

- TABLE 224 Spain Core Banking Software Market by Component, 2021 - 2024, USD Million

- TABLE 225 Spain Core Banking Software Market by Component, 2025 - 2032, USD Million

- TABLE 226 Spain Core Banking Software Market by Solution Type, 2021 - 2024, USD Million

- TABLE 227 Spain Core Banking Software Market by Solution Type, 2025 - 2032, USD Million

- TABLE 228 Spain Core Banking Software Market by Service Type, 2021 - 2024, USD Million

- TABLE 229 Spain Core Banking Software Market by Service Type, 2025 - 2032, USD Million

- TABLE 230 Italy Core Banking Software Market, 2021 - 2024, USD Million

- TABLE 231 Italy Core Banking Software Market, 2025 - 2032, USD Million

- TABLE 232 Italy Core Banking Software Market by Deployment, 2021 - 2024, USD Million

- TABLE 233 Italy Core Banking Software Market by Deployment, 2025 - 2032, USD Million

- TABLE 234 Italy Core Banking Software Market by End Use, 2021 - 2024, USD Million

- TABLE 235 Italy Core Banking Software Market by End Use, 2025 - 2032, USD Million

- TABLE 236 Italy Core Banking Software Market by Component, 2021 - 2024, USD Million

- TABLE 237 Italy Core Banking Software Market by Component, 2025 - 2032, USD Million

- TABLE 238 Italy Core Banking Software Market by Solution Type, 2021 - 2024, USD Million

- TABLE 239 Italy Core Banking Software Market by Solution Type, 2025 - 2032, USD Million

- TABLE 240 Italy Core Banking Software Market by Service Type, 2021 - 2024, USD Million

- TABLE 241 Italy Core Banking Software Market by Service Type, 2025 - 2032, USD Million

- TABLE 242 Rest of Europe Core Banking Software Market, 2021 - 2024, USD Million

- TABLE 243 Rest of Europe Core Banking Software Market, 2025 - 2032, USD Million

- TABLE 244 Rest of Europe Core Banking Software Market by Deployment, 2021 - 2024, USD Million

- TABLE 245 Rest of Europe Core Banking Software Market by Deployment, 2025 - 2032, USD Million

- TABLE 246 Rest of Europe Core Banking Software Market by End Use, 2021 - 2024, USD Million

- TABLE 247 Rest of Europe Core Banking Software Market by End Use, 2025 - 2032, USD Million

- TABLE 248 Rest of Europe Core Banking Software Market by Component, 2021 - 2024, USD Million

- TABLE 249 Rest of Europe Core Banking Software Market by Component, 2025 - 2032, USD Million

- TABLE 250 Rest of Europe Core Banking Software Market by Solution Type, 2021 - 2024, USD Million

- TABLE 251 Rest of Europe Core Banking Software Market by Solution Type, 2025 - 2032, USD Million

- TABLE 252 Rest of Europe Core Banking Software Market by Service Type, 2021 - 2024, USD Million

- TABLE 253 Rest of Europe Core Banking Software Market by Service Type, 2025 - 2032, USD Million

- TABLE 254 Asia Pacific Core Banking Software Market, 2021 - 2024, USD Million

- TABLE 255 Asia Pacific Core Banking Software Market, 2025 - 2032, USD Million

- TABLE 256 Asia Pacific Core Banking Software Market by Deployment, 2021 - 2024, USD Million

- TABLE 257 Asia Pacific Core Banking Software Market by Deployment, 2025 - 2032, USD Million

- TABLE 258 Asia Pacific Cloud Market by Country, 2021 - 2024, USD Million

- TABLE 259 Asia Pacific Cloud Market by Country, 2025 - 2032, USD Million

- TABLE 260 Asia Pacific On-premise Market by Country, 2021 - 2024, USD Million

- TABLE 261 Asia Pacific On-premise Market by Country, 2025 - 2032, USD Million

- TABLE 262 Asia Pacific Core Banking Software Market by End Use, 2021 - 2024, USD Million

- TABLE 263 Asia Pacific Core Banking Software Market by End Use, 2025 - 2032, USD Million

- TABLE 264 Asia Pacific Banks Market by Country, 2021 - 2024, USD Million

- TABLE 265 Asia Pacific Banks Market by Country, 2025 - 2032, USD Million

- TABLE 266 Asia Pacific Financial Institutions Market by Country, 2021 - 2024, USD Million

- TABLE 267 Asia Pacific Financial Institutions Market by Country, 2025 - 2032, USD Million

- TABLE 268 Asia Pacific Other End Use Market by Country, 2021 - 2024, USD Million

- TABLE 269 Asia Pacific Other End Use Market by Country, 2025 - 2032, USD Million

- TABLE 270 Asia Pacific Core Banking Software Market by Component, 2021 - 2024, USD Million

- TABLE 271 Asia Pacific Core Banking Software Market by Component, 2025 - 2032, USD Million

- TABLE 272 Asia Pacific Solution Market by Country, 2021 - 2024, USD Million

- TABLE 273 Asia Pacific Solution Market by Country, 2025 - 2032, USD Million

- TABLE 274 Asia Pacific Core Banking Software Market by Solution Type, 2021 - 2024, USD Million

- TABLE 275 Asia Pacific Core Banking Software Market by Solution Type, 2025 - 2032, USD Million

- TABLE 276 Asia Pacific Deposits Market by Country, 2021 - 2024, USD Million

- TABLE 277 Asia Pacific Deposits Market by Country, 2025 - 2032, USD Million

- TABLE 278 Asia Pacific Loans Market by Country, 2021 - 2024, USD Million

- TABLE 279 Asia Pacific Loans Market by Country, 2025 - 2032, USD Million

- TABLE 280 Asia Pacific Enterprise Customer Solutions Market by Country, 2021 - 2024, USD Million

- TABLE 281 Asia Pacific Enterprise Customer Solutions Market by Country, 2025 - 2032, USD Million

- TABLE 282 Asia Pacific Other Solution Type Market by Country, 2021 - 2024, USD Million

- TABLE 283 Asia Pacific Other Solution Type Market by Country, 2025 - 2032, USD Million

- TABLE 284 Asia Pacific Service Market by Country, 2021 - 2024, USD Million

- TABLE 285 Asia Pacific Service Market by Country, 2025 - 2032, USD Million

- TABLE 286 Asia Pacific Core Banking Software Market by Service Type, 2021 - 2024, USD Million

- TABLE 287 Asia Pacific Core Banking Software Market by Service Type, 2025 - 2032, USD Million

- TABLE 288 Asia Pacific Professional Service Market by Country, 2021 - 2024, USD Million

- TABLE 289 Asia Pacific Professional Service Market by Country, 2025 - 2032, USD Million

- TABLE 290 Asia Pacific Managed Service Market by Country, 2021 - 2024, USD Million

- TABLE 291 Asia Pacific Managed Service Market by Country, 2025 - 2032, USD Million

- TABLE 292 Asia Pacific Core Banking Software Market by Country, 2021 - 2024, USD Million

- TABLE 293 Asia Pacific Core Banking Software Market by Country, 2025 - 2032, USD Million

- TABLE 294 China Core Banking Software Market, 2021 - 2024, USD Million

- TABLE 295 China Core Banking Software Market, 2025 - 2032, USD Million

- TABLE 296 China Core Banking Software Market by Deployment, 2021 - 2024, USD Million

- TABLE 297 China Core Banking Software Market by Deployment, 2025 - 2032, USD Million

- TABLE 298 China Core Banking Software Market by End Use, 2021 - 2024, USD Million

- TABLE 299 China Core Banking Software Market by End Use, 2025 - 2032, USD Million

- TABLE 300 China Core Banking Software Market by Component, 2021 - 2024, USD Million

- TABLE 301 China Core Banking Software Market by Component, 2025 - 2032, USD Million

- TABLE 302 China Core Banking Software Market by Solution Type, 2021 - 2024, USD Million

- TABLE 303 China Core Banking Software Market by Solution Type, 2025 - 2032, USD Million

- TABLE 304 China Core Banking Software Market by Service Type, 2021 - 2024, USD Million

- TABLE 305 China Core Banking Software Market by Service Type, 2025 - 2032, USD Million

- TABLE 306 Japan Core Banking Software Market, 2021 - 2024, USD Million

- TABLE 307 Japan Core Banking Software Market, 2025 - 2032, USD Million

- TABLE 308 Japan Core Banking Software Market by Deployment, 2021 - 2024, USD Million

- TABLE 309 Japan Core Banking Software Market by Deployment, 2025 - 2032, USD Million

- TABLE 310 Japan Core Banking Software Market by End Use, 2021 - 2024, USD Million

- TABLE 311 Japan Core Banking Software Market by End Use, 2025 - 2032, USD Million

- TABLE 312 Japan Core Banking Software Market by Component, 2021 - 2024, USD Million

- TABLE 313 Japan Core Banking Software Market by Component, 2025 - 2032, USD Million

- TABLE 314 Japan Core Banking Software Market by Solution Type, 2021 - 2024, USD Million

- TABLE 315 Japan Core Banking Software Market by Solution Type, 2025 - 2032, USD Million

- TABLE 316 Japan Core Banking Software Market by Service Type, 2021 - 2024, USD Million

- TABLE 317 Japan Core Banking Software Market by Service Type, 2025 - 2032, USD Million

- TABLE 318 India Core Banking Software Market, 2021 - 2024, USD Million

- TABLE 319 India Core Banking Software Market, 2025 - 2032, USD Million

- TABLE 320 India Core Banking Software Market by Deployment, 2021 - 2024, USD Million

- TABLE 321 India Core Banking Software Market by Deployment, 2025 - 2032, USD Million

- TABLE 322 India Core Banking Software Market by End Use, 2021 - 2024, USD Million

- TABLE 323 India Core Banking Software Market by End Use, 2025 - 2032, USD Million

- TABLE 324 India Core Banking Software Market by Component, 2021 - 2024, USD Million

- TABLE 325 India Core Banking Software Market by Component, 2025 - 2032, USD Million

- TABLE 326 India Core Banking Software Market by Solution Type, 2021 - 2024, USD Million

- TABLE 327 India Core Banking Software Market by Solution Type, 2025 - 2032, USD Million

- TABLE 328 India Core Banking Software Market by Service Type, 2021 - 2024, USD Million

- TABLE 329 India Core Banking Software Market by Service Type, 2025 - 2032, USD Million

- TABLE 330 South Korea Core Banking Software Market, 2021 - 2024, USD Million

- TABLE 331 South Korea Core Banking Software Market, 2025 - 2032, USD Million

- TABLE 332 South Korea Core Banking Software Market by Deployment, 2021 - 2024, USD Million

- TABLE 333 South Korea Core Banking Software Market by Deployment, 2025 - 2032, USD Million

- TABLE 334 South Korea Core Banking Software Market by End Use, 2021 - 2024, USD Million

- TABLE 335 South Korea Core Banking Software Market by End Use, 2025 - 2032, USD Million

- TABLE 336 South Korea Core Banking Software Market by Component, 2021 - 2024, USD Million

- TABLE 337 South Korea Core Banking Software Market by Component, 2025 - 2032, USD Million

- TABLE 338 South Korea Core Banking Software Market by Solution Type, 2021 - 2024, USD Million

- TABLE 339 South Korea Core Banking Software Market by Solution Type, 2025 - 2032, USD Million

- TABLE 340 South Korea Core Banking Software Market by Service Type, 2021 - 2024, USD Million

- TABLE 341 South Korea Core Banking Software Market by Service Type, 2025 - 2032, USD Million

- TABLE 342 Singapore Core Banking Software Market, 2021 - 2024, USD Million

- TABLE 343 Singapore Core Banking Software Market, 2025 - 2032, USD Million

- TABLE 344 Singapore Core Banking Software Market by Deployment, 2021 - 2024, USD Million

- TABLE 345 Singapore Core Banking Software Market by Deployment, 2025 - 2032, USD Million

- TABLE 346 Singapore Core Banking Software Market by End Use, 2021 - 2024, USD Million

- TABLE 347 Singapore Core Banking Software Market by End Use, 2025 - 2032, USD Million

- TABLE 348 Singapore Core Banking Software Market by Component, 2021 - 2024, USD Million

- TABLE 349 Singapore Core Banking Software Market by Component, 2025 - 2032, USD Million

- TABLE 350 Singapore Core Banking Software Market by Solution Type, 2021 - 2024, USD Million

- TABLE 351 Singapore Core Banking Software Market by Solution Type, 2025 - 2032, USD Million

- TABLE 352 Singapore Core Banking Software Market by Service Type, 2021 - 2024, USD Million

- TABLE 353 Singapore Core Banking Software Market by Service Type, 2025 - 2032, USD Million

- TABLE 354 Malaysia Core Banking Software Market, 2021 - 2024, USD Million

- TABLE 355 Malaysia Core Banking Software Market, 2025 - 2032, USD Million

- TABLE 356 Malaysia Core Banking Software Market by Deployment, 2021 - 2024, USD Million

- TABLE 357 Malaysia Core Banking Software Market by Deployment, 2025 - 2032, USD Million

- TABLE 358 Malaysia Core Banking Software Market by End Use, 2021 - 2024, USD Million

- TABLE 359 Malaysia Core Banking Software Market by End Use, 2025 - 2032, USD Million

- TABLE 360 Malaysia Core Banking Software Market by Component, 2021 - 2024, USD Million

- TABLE 361 Malaysia Core Banking Software Market by Component, 2025 - 2032, USD Million

- TABLE 362 Malaysia Core Banking Software Market by Solution Type, 2021 - 2024, USD Million

- TABLE 363 Malaysia Core Banking Software Market by Solution Type, 2025 - 2032, USD Million

- TABLE 364 Malaysia Core Banking Software Market by Service Type, 2021 - 2024, USD Million

- TABLE 365 Malaysia Core Banking Software Market by Service Type, 2025 - 2032, USD Million

- TABLE 366 Rest of Asia Pacific Core Banking Software Market, 2021 - 2024, USD Million

- TABLE 367 Rest of Asia Pacific Core Banking Software Market, 2025 - 2032, USD Million

- TABLE 368 Rest of Asia Pacific Core Banking Software Market by Deployment, 2021 - 2024, USD Million

- TABLE 369 Rest of Asia Pacific Core Banking Software Market by Deployment, 2025 - 2032, USD Million

- TABLE 370 Rest of Asia Pacific Core Banking Software Market by End Use, 2021 - 2024, USD Million

- TABLE 371 Rest of Asia Pacific Core Banking Software Market by End Use, 2025 - 2032, USD Million

- TABLE 372 Rest of Asia Pacific Core Banking Software Market by Component, 2021 - 2024, USD Million

- TABLE 373 Rest of Asia Pacific Core Banking Software Market by Component, 2025 - 2032, USD Million

- TABLE 374 Rest of Asia Pacific Core Banking Software Market by Solution Type, 2021 - 2024, USD Million

- TABLE 375 Rest of Asia Pacific Core Banking Software Market by Solution Type, 2025 - 2032, USD Million

- TABLE 376 Rest of Asia Pacific Core Banking Software Market by Service Type, 2021 - 2024, USD Million

- TABLE 377 Rest of Asia Pacific Core Banking Software Market by Service Type, 2025 - 2032, USD Million

- TABLE 378 LAMEA Core Banking Software Market, 2021 - 2024, USD Million

- TABLE 379 LAMEA Core Banking Software Market, 2025 - 2032, USD Million

- TABLE 380 LAMEA Core Banking Software Market by Deployment, 2021 - 2024, USD Million

- TABLE 381 LAMEA Core Banking Software Market by Deployment, 2025 - 2032, USD Million

- TABLE 382 LAMEA Cloud Market by Country, 2021 - 2024, USD Million

- TABLE 383 LAMEA Cloud Market by Country, 2025 - 2032, USD Million

- TABLE 384 LAMEA On-premise Market by Country, 2021 - 2024, USD Million

- TABLE 385 LAMEA On-premise Market by Country, 2025 - 2032, USD Million

- TABLE 386 LAMEA Core Banking Software Market by End Use, 2021 - 2024, USD Million

- TABLE 387 LAMEA Core Banking Software Market by End Use, 2025 - 2032, USD Million

- TABLE 388 LAMEA Banks Market by Country, 2021 - 2024, USD Million

- TABLE 389 LAMEA Banks Market by Country, 2025 - 2032, USD Million

- TABLE 390 LAMEA Financial Institutions Market by Country, 2021 - 2024, USD Million

- TABLE 391 LAMEA Financial Institutions Market by Country, 2025 - 2032, USD Million

- TABLE 392 LAMEA Other End Use Market by Country, 2021 - 2024, USD Million

- TABLE 393 LAMEA Other End Use Market by Country, 2025 - 2032, USD Million

- TABLE 394 LAMEA Core Banking Software Market by Component, 2021 - 2024, USD Million

- TABLE 395 LAMEA Core Banking Software Market by Component, 2025 - 2032, USD Million

- TABLE 396 LAMEA Solution Market by Country, 2021 - 2024, USD Million

- TABLE 397 LAMEA Solution Market by Country, 2025 - 2032, USD Million

- TABLE 398 LAMEA Core Banking Software Market by Solution Type, 2021 - 2024, USD Million

- TABLE 399 LAMEA Core Banking Software Market by Solution Type, 2025 - 2032, USD Million

- TABLE 400 LAMEA Deposits Market by Country, 2021 - 2024, USD Million

- TABLE 401 LAMEA Deposits Market by Country, 2025 - 2032, USD Million

- TABLE 402 LAMEA Loans Market by Country, 2021 - 2024, USD Million

- TABLE 403 LAMEA Loans Market by Country, 2025 - 2032, USD Million

- TABLE 404 LAMEA Enterprise Customer Solutions Market by Country, 2021 - 2024, USD Million

- TABLE 405 LAMEA Enterprise Customer Solutions Market by Country, 2025 - 2032, USD Million

- TABLE 406 LAMEA Other Solution Type Market by Country, 2021 - 2024, USD Million

- TABLE 407 LAMEA Other Solution Type Market by Country, 2025 - 2032, USD Million

- TABLE 408 LAMEA Service Market by Country, 2021 - 2024, USD Million

- TABLE 409 LAMEA Service Market by Country, 2025 - 2032, USD Million

- TABLE 410 LAMEA Core Banking Software Market by Service Type, 2021 - 2024, USD Million

- TABLE 411 LAMEA Core Banking Software Market by Service Type, 2025 - 2032, USD Million

- TABLE 412 LAMEA Professional Service Market by Country, 2021 - 2024, USD Million

- TABLE 413 LAMEA Professional Service Market by Country, 2025 - 2032, USD Million

- TABLE 414 LAMEA Managed Service Market by Country, 2021 - 2024, USD Million

- TABLE 415 LAMEA Managed Service Market by Country, 2025 - 2032, USD Million

- TABLE 416 LAMEA Core Banking Software Market by Country, 2021 - 2024, USD Million

- TABLE 417 LAMEA Core Banking Software Market by Country, 2025 - 2032, USD Million

- TABLE 418 Brazil Core Banking Software Market, 2021 - 2024, USD Million

- TABLE 419 Brazil Core Banking Software Market, 2025 - 2032, USD Million

- TABLE 420 Brazil Core Banking Software Market by Deployment, 2021 - 2024, USD Million

- TABLE 421 Brazil Core Banking Software Market by Deployment, 2025 - 2032, USD Million

- TABLE 422 Brazil Core Banking Software Market by End Use, 2021 - 2024, USD Million

- TABLE 423 Brazil Core Banking Software Market by End Use, 2025 - 2032, USD Million

- TABLE 424 Brazil Core Banking Software Market by Component, 2021 - 2024, USD Million

- TABLE 425 Brazil Core Banking Software Market by Component, 2025 - 2032, USD Million

- TABLE 426 Brazil Core Banking Software Market by Solution Type, 2021 - 2024, USD Million

- TABLE 427 Brazil Core Banking Software Market by Solution Type, 2025 - 2032, USD Million

- TABLE 428 Brazil Core Banking Software Market by Service Type, 2021 - 2024, USD Million

- TABLE 429 Brazil Core Banking Software Market by Service Type, 2025 - 2032, USD Million

- TABLE 430 Argentina Core Banking Software Market, 2021 - 2024, USD Million

- TABLE 431 Argentina Core Banking Software Market, 2025 - 2032, USD Million

- TABLE 432 Argentina Core Banking Software Market by Deployment, 2021 - 2024, USD Million

- TABLE 433 Argentina Core Banking Software Market by Deployment, 2025 - 2032, USD Million

- TABLE 434 Argentina Core Banking Software Market by End Use, 2021 - 2024, USD Million

- TABLE 435 Argentina Core Banking Software Market by End Use, 2025 - 2032, USD Million

- TABLE 436 Argentina Core Banking Software Market by Component, 2021 - 2024, USD Million

- TABLE 437 Argentina Core Banking Software Market by Component, 2025 - 2032, USD Million

- TABLE 438 Argentina Core Banking Software Market by Solution Type, 2021 - 2024, USD Million

- TABLE 439 Argentina Core Banking Software Market by Solution Type, 2025 - 2032, USD Million

- TABLE 440 Argentina Core Banking Software Market by Service Type, 2021 - 2024, USD Million

- TABLE 441 Argentina Core Banking Software Market by Service Type, 2025 - 2032, USD Million

- TABLE 442 UAE Core Banking Software Market, 2021 - 2024, USD Million

- TABLE 443 UAE Core Banking Software Market, 2025 - 2032, USD Million

- TABLE 444 UAE Core Banking Software Market by Deployment, 2021 - 2024, USD Million

- TABLE 445 UAE Core Banking Software Market by Deployment, 2025 - 2032, USD Million

- TABLE 446 UAE Core Banking Software Market by End Use, 2021 - 2024, USD Million

- TABLE 447 UAE Core Banking Software Market by End Use, 2025 - 2032, USD Million

- TABLE 448 UAE Core Banking Software Market by Component, 2021 - 2024, USD Million

- TABLE 449 UAE Core Banking Software Market by Component, 2025 - 2032, USD Million

- TABLE 450 UAE Core Banking Software Market by Solution Type, 2021 - 2024, USD Million

- TABLE 451 UAE Core Banking Software Market by Solution Type, 2025 - 2032, USD Million

- TABLE 452 UAE Core Banking Software Market by Service Type, 2021 - 2024, USD Million

- TABLE 453 UAE Core Banking Software Market by Service Type, 2025 - 2032, USD Million

- TABLE 454 Saudi Arabia Core Banking Software Market, 2021 - 2024, USD Million

- TABLE 455 Saudi Arabia Core Banking Software Market, 2025 - 2032, USD Million

- TABLE 456 Saudi Arabia Core Banking Software Market by Deployment, 2021 - 2024, USD Million

- TABLE 457 Saudi Arabia Core Banking Software Market by Deployment, 2025 - 2032, USD Million

- TABLE 458 Saudi Arabia Core Banking Software Market by End Use, 2021 - 2024, USD Million

- TABLE 459 Saudi Arabia Core Banking Software Market by End Use, 2025 - 2032, USD Million

- TABLE 460 Saudi Arabia Core Banking Software Market by Component, 2021 - 2024, USD Million

- TABLE 461 Saudi Arabia Core Banking Software Market by Component, 2025 - 2032, USD Million

- TABLE 462 Saudi Arabia Core Banking Software Market by Solution Type, 2021 - 2024, USD Million

- TABLE 463 Saudi Arabia Core Banking Software Market by Solution Type, 2025 - 2032, USD Million

- TABLE 464 Saudi Arabia Core Banking Software Market by Service Type, 2021 - 2024, USD Million

- TABLE 465 Saudi Arabia Core Banking Software Market by Service Type, 2025 - 2032, USD Million

- TABLE 466 South Africa Core Banking Software Market, 2021 - 2024, USD Million

- TABLE 467 South Africa Core Banking Software Market, 2025 - 2032, USD Million

- TABLE 468 South Africa Core Banking Software Market by Deployment, 2021 - 2024, USD Million

- TABLE 469 South Africa Core Banking Software Market by Deployment, 2025 - 2032, USD Million

- TABLE 470 South Africa Core Banking Software Market by End Use, 2021 - 2024, USD Million

- TABLE 471 South Africa Core Banking Software Market by End Use, 2025 - 2032, USD Million

- TABLE 472 South Africa Core Banking Software Market by Component, 2021 - 2024, USD Million

- TABLE 473 South Africa Core Banking Software Market by Component, 2025 - 2032, USD Million

- TABLE 474 South Africa Core Banking Software Market by Solution Type, 2021 - 2024, USD Million

- TABLE 475 South Africa Core Banking Software Market by Solution Type, 2025 - 2032, USD Million

- TABLE 476 South Africa Core Banking Software Market by Service Type, 2021 - 2024, USD Million

- TABLE 477 South Africa Core Banking Software Market by Service Type, 2025 - 2032, USD Million

- TABLE 478 Nigeria Core Banking Software Market, 2021 - 2024, USD Million

- TABLE 479 Nigeria Core Banking Software Market, 2025 - 2032, USD Million

- TABLE 480 Nigeria Core Banking Software Market by Deployment, 2021 - 2024, USD Million

- TABLE 481 Nigeria Core Banking Software Market by Deployment, 2025 - 2032, USD Million

- TABLE 482 Nigeria Core Banking Software Market by End Use, 2021 - 2024, USD Million

- TABLE 483 Nigeria Core Banking Software Market by End Use, 2025 - 2032, USD Million

- TABLE 484 Nigeria Core Banking Software Market by Component, 2021 - 2024, USD Million

- TABLE 485 Nigeria Core Banking Software Market by Component, 2025 - 2032, USD Million

- TABLE 486 Nigeria Core Banking Software Market by Solution Type, 2021 - 2024, USD Million

- TABLE 487 Nigeria Core Banking Software Market by Solution Type, 2025 - 2032, USD Million

- TABLE 488 Nigeria Core Banking Software Market by Service Type, 2021 - 2024, USD Million

- TABLE 489 Nigeria Core Banking Software Market by Service Type, 2025 - 2032, USD Million

- TABLE 490 Rest of LAMEA Core Banking Software Market, 2021 - 2024, USD Million

- TABLE 491 Rest of LAMEA Core Banking Software Market, 2025 - 2032, USD Million

- TABLE 492 Rest of LAMEA Core Banking Software Market by Deployment, 2021 - 2024, USD Million

- TABLE 493 Rest of LAMEA Core Banking Software Market by Deployment, 2025 - 2032, USD Million

- TABLE 494 Rest of LAMEA Core Banking Software Market by End Use, 2021 - 2024, USD Million

- TABLE 495 Rest of LAMEA Core Banking Software Market by End Use, 2025 - 2032, USD Million

- TABLE 496 Rest of LAMEA Core Banking Software Market by Component, 2021 - 2024, USD Million

- TABLE 497 Rest of LAMEA Core Banking Software Market by Component, 2025 - 2032, USD Million

- TABLE 498 Rest of LAMEA Core Banking Software Market by Solution Type, 2021 - 2024, USD Million

- TABLE 499 Rest of LAMEA Core Banking Software Market by Solution Type, 2025 - 2032, USD Million

- TABLE 500 Rest of LAMEA Core Banking Software Market by Service Type, 2021 - 2024, USD Million

- TABLE 501 Rest of LAMEA Core Banking Software Market by Service Type, 2025 - 2032, USD Million

- TABLE 502 Key Information - Capgemini SE

- TABLE 503 Key Information - Finastra Group Holdings Limited

- TABLE 504 Key Information - Temenos AG

- TABLE 505 Key Information - HCL Technologies Ltd.

- TABLE 506 Key Information - Oracle Corporation

- TABLE 507 Key Information - Fiserv, Inc.

- TABLE 508 Key Information - Infosys Limited

- TABLE 509 Key Information - SAP SE

- TABLE 510 Key Information - Tata Consultancy Services Ltd.

- TABLE 511 Key Information - Jack Henry & Associates, Inc.

LIST OF FIGURES

- FIG 1 Methodology for the research

- FIG 2 Global Core Banking Software Market, 2021 - 2032, USD Million

- FIG 3 Key Factors Impacting Core Banking Software Market

- FIG 4 Market Share Analysis, 2024

- FIG 5 Porter's Five Forces Analysis - Core Banking Software Market

- FIG 6 Key Customer Criteria - Global Core Banking Software Market

- FIG 7 Global Core Banking Software Market share by Deployment, 2024

- FIG 8 Global Core Banking Software Market share by Deployment, 2032

- FIG 9 Global Core Banking Software Market by Deployment, 2021 - 2032, USD Million

- FIG 10 Global Core Banking Software Market share by End Use, 2024

- FIG 11 Global Core Banking Software Market share by End Use, 2032

- FIG 12 Global Core Banking Software Market by End Use, 2021 - 2032, USD Million

- FIG 13 Global Core Banking Software Market share by Component, 2024

- FIG 14 Global Core Banking Software Market share by Component, 2032

- FIG 15 Global Core Banking Software Market by Component, 2021 - 2032, USD Million

- FIG 16 Global Core Banking Software Market share by Region, 2024

- FIG 17 Global Core Banking Software Market share by Region, 2032

- FIG 18 Global Core Banking Software Market by Region, 2021 - 2032, USD Million

- FIG 19 North America Core Banking Software Market, 2021 - 2032, USD Million

- FIG 20 North America Core Banking Software Market share by Deployment, 2024

- FIG 21 North America Core Banking Software Market share by Deployment, 2032

- FIG 22 North America Core Banking Software Market by Deployment, 2021 - 2032, USD Million

- FIG 23 North America Core Banking Software Market share by End Use, 2024

- FIG 24 North America Core Banking Software Market share by End Use, 2032

- FIG 25 North America Core Banking Software Market by End Use, 2021 - 2032, USD Million

- FIG 26 North America Core Banking Software Market share by Component, 2024

- FIG 27 North America Core Banking Software Market share by Component, 2032

- FIG 28 North America Core Banking Software Market by Component, 2021 - 2032, USD Million

- FIG 29 North America Core Banking Software Market share by Country, 2024

- FIG 30 North America Core Banking Software Market share by Country, 2032

- FIG 31 North America Core Banking Software Market by Country, 2021 - 2032, USD Million

- FIG 32 Europe Core Banking Software Market, 2021 - 2032, USD Million

- FIG 33 Europe Core Banking Software Market share by Deployment, 2024

- FIG 34 Europe Core Banking Software Market share by Deployment, 2032

- FIG 35 Europe Core Banking Software Market by Deployment, 2021 - 2032, USD Million

- FIG 36 Europe Core Banking Software Market share by End Use, 2024

- FIG 37 Europe Core Banking Software Market share by End Use, 2032

- FIG 38 Europe Core Banking Software Market by End Use, 2021 - 2032, USD Million

- FIG 39 Europe Core Banking Software Market share by Component, 2024

- FIG 40 Europe Core Banking Software Market share by Component, 2032

- FIG 41 Europe Core Banking Software Market by Component, 2021 - 2032, USD Million

- FIG 42 Europe Core Banking Software Market share by Country, 2024

- FIG 43 Europe Core Banking Software Market share by Country, 2032

- FIG 44 Europe Core Banking Software Market by Country, 2021 - 2032, USD Million

- FIG 45 Asia Pacific Core Banking Software Market, 2021 - 2032, USD Million

- FIG 46 Asia Pacific Core Banking Software Market share by Deployment, 2024

- FIG 47 Asia Pacific Core Banking Software Market share by Deployment, 2032

- FIG 48 Asia Pacific Core Banking Software Market by Deployment, 2021 - 2032, USD Million

- FIG 49 Asia Pacific Core Banking Software Market share by End Use, 2024

- FIG 50 Asia Pacific Core Banking Software Market share by End Use, 2032

- FIG 51 Asia Pacific Core Banking Software Market by End Use, 2021 - 2032, USD Million

- FIG 52 Asia Pacific Core Banking Software Market share by Component, 2024

- FIG 53 Asia Pacific Core Banking Software Market share by Component, 2032

- FIG 54 Asia Pacific Core Banking Software Market by Component, 2021 - 2032, USD Million

- FIG 55 Asia Pacific Core Banking Software Market share by Country, 2024

- FIG 56 Asia Pacific Core Banking Software Market share by Country, 2032

- FIG 57 Asia Pacific Core Banking Software Market by Country, 2021 - 2032, USD Million

- FIG 58 LAMEA Core Banking Software Market, 2021 - 2032, USD Million

- FIG 59 LAMEA Core Banking Software Market share by Deployment, 2024

- FIG 60 LAMEA Core Banking Software Market share by Deployment, 2032

- FIG 61 LAMEA Core Banking Software Market by Deployment, 2021 - 2032, USD Million

- FIG 62 LAMEA Core Banking Software Market share by End Use, 2024

- FIG 63 LAMEA Core Banking Software Market share by End Use, 2032

- FIG 64 LAMEA Core Banking Software Market by End Use, 2021 - 2032, USD Million

- FIG 65 LAMEA Core Banking Software Market share by Component, 2024

- FIG 66 LAMEA Core Banking Software Market share by Component, 2032

- FIG 67 LAMEA Core Banking Software Market by Component, 2021 - 2032, USD Million

- FIG 68 LAMEA Core Banking Software Market share by Country, 2024

- FIG 69 LAMEA Core Banking Software Market share by Country, 2032

- FIG 70 LAMEA Core Banking Software Market by Country, 2021 - 2032, USD Million

- FIG 71 SWOT Analysis: Capgemini SE

- FIG 72 Swot Analysis: Temenos AG

- FIG 73 Recent strategies and developments: HCL Technologies Ltd.

- FIG 74 SWOT Analysis: HCL Technologies Ltd.

- FIG 75 SWOT Analysis: Oracle Corporation

- FIG 76 SWOT Analysis: Infosys Limited

- FIG 77 SWOT Analysis: SAP SE

- FIG 78 SWOT Analysis: Tata Consultancy Services Ltd.

The Global Core Banking Software Market size is expected to reach $25.10 billion by 2032, rising at a market growth of 10.0% CAGR during the forecast period.

The COVID-19 pandemic further accelerated cloud migration, compelling financial institutions to support remote operations and digital-first strategies. Cloud-native platforms also benefit from modern architectural frameworks such as containerization and microservices, which improve system reliability and security. Vendors like Temenos, nCino, Finxact (a Fiserv company), and Mambu have become leading players in the cloud CBS space, often in collaboration with major cloud providers such as Amazon Web Services and Microsoft Azure.

The banking industry is undergoing a significant digital transformation, driven by evolving customer expectations and technological advancements. Modern customers demand seamless, personalized, and accessible banking experiences across multiple channels. To meet these expectations, banks are investing in CBS that offers real-time processing, omnichannel support, and integrated customer relationship management. Thus, digital transformation and the focus on customer-centric banking are compelling banks to adopt advanced CBS solutions.

Additionally, the adoption of cloud computing in the banking sector is revolutionizing the way financial institutions operate. Cloud-based CBS offers scalability, flexibility, and cost-effectiveness, enabling banks to respond swiftly to market changes and customer needs. By migrating to the cloud, banks can reduce their reliance on legacy infrastructure, lower operational costs, and enhance system reliability. Therefore, the shift towards cloud-based CBS is driven by the need for agility, efficiency, and innovation in the banking sector.

However, implementing a modern Core Banking Software (CBS) system requires significant investment, making high implementation costs and extended timelines one of the primary restraints in the market. The transition from legacy systems to modern CBS involves expenses that go beyond software acquisition. Banks must invest in new hardware, system integration, data migration, employee training, and ongoing technical support. In conclusion, many mid-sized and smaller banks delay CBS modernization, fearing financial strain and operational risk.

Deployment Outlook

Based on Deployment, the market is segmented into Cloud and On-premise. on-premise CBS deployment remains prevalent among institutions with legacy infrastructure, complex custom workflows, or regulatory mandates requiring data residency and full system control. These solutions are typically managed internally, offering banks direct oversight of hardware, software, and data. On-premise systems continue to dominate in regions where cloud regulation is evolving slowly, or where large volumes of sensitive data demand tight internal control.

End Use Outlook

Based on End Use, the market is segmented into Banks, Financial Institutions, and Other End Use. Banks represent the largest segment in the CBS market and are the primary drivers of demand for robust, scalable, and secure platforms. Commercial, retail, and cooperative banks depend on CBS to manage customer accounts, process transactions, support lending operations, and integrate digital banking services.

Component Outlook

Based on Component, the market is segmented into Solution (Deposits, Loans, Enterprise Customer Solutions, and Other Solution Type) and Service (Professional Service and Managed Service). The Service segment supports the deployment and lifecycle management of core banking solutions. It includes consulting, integration, customization, migration, testing, training, and support services. As CBS platforms become more complex and adaptable to varied banking environments, the role of services in ensuring successful implementation and long-term performance has become increasingly important.

Regional Outlook

Region-wise, the market is analyzed across North America, Europe, Asia Pacific, and LAMEA. The Core Banking Software Market in North America is witnessing a significant shift toward platform modernization, driven by the growing pressure on financial institutions to deliver seamless, real-time digital services while maintaining operational resilience. With the increasing use of embedded finance, banks in the region are rethinking their core systems to integrate directly into third-party ecosystems such as retail platforms, fintech apps, and enterprise software environments.

Recent Strategies Deployed in the Market

- Mar-2025: Fiserv, Inc. partnered with Republic Bank & Trust Company to implement its DNA core banking platform, enhancing digital transformation, operational efficiency, and real-time transaction processing. The partnership aims to streamline banking processes, reduce manual workloads, and support future growth.

- Feb-2025: Fiserv, Inc. partnered with Third Federal Savings and Loan to implement its DNA core banking system, enhancing real-time transaction processing, operational efficiency, and digital transformation. The platform supports product development and customization, positioning the bank for future growth and improved customer experience.

- Jun-2024: HCLTech expands its partnership with apoBank to provide scalable, secure, and compliant digital foundation services. Leveraging its expertise in Avaloq's core banking system, HCLTech will enhance apoBank's IT infrastructure and cloud services, supporting its digital banking transformation and operational efficiency.

- Jan-2024: Finastra Group Holdings Limited partnered with Newgen Software to enhance loan origination by integrating Newgen's lending solutions with Finastra's LaserPro platform. This API-driven integration streamlines loan documentation, improves compliance, reduces manual effort, and accelerates financial processes for a seamless digital-first banking experience.

- Jun-2023: Temenos AG and Huawei expand their partnership to modernize core banking systems with cloud technology. Leveraging Huawei Cloud, they enhance scalability, cost efficiency, and security for banks, driving digital transformation and financial inclusion, especially in the Asia-Pacific region.

List of Key Companies Profiled

- Capgemini SE

- Finastra Group Holdings Limited (Vista Equity Partners)

- Temenos AG

- HCL Technologies Ltd.

- Oracle Corporation

- Fiserv, Inc.

- Infosys Limited

- SAP SE

- Tata Consultancy Services Ltd.

- Jack Henry & Associates, Inc.

Global Core Banking Software Market Report Segmentation

By Deployment

- Cloud

- On-premise

By End Use

- Banks

- Financial Institutions

- Other End Use

By Component

- Solution

- Deposits

- Loans

- Enterprise Customer Solutions

- Other Solution Type

- Service

- Professional Service

- Managed Service

By Geography

- North America

- US

- Canada

- Mexico

- Rest of North America

- Europe

- Germany

- UK

- France

- Russia

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Singapore

- Malaysia

- Rest of Asia Pacific

- LAMEA

- Brazil

- Argentina

- UAE

- Saudi Arabia

- South Africa

- Nigeria

- Rest of LAMEA

Table of Contents

Chapter 1. Market Scope & Methodology

- 1.1 Market Definition

- 1.2 Objectives

- 1.3 Market Scope

- 1.4 Segmentation

- 1.4.1 Global Core Banking Software Market, by Deployment

- 1.4.2 Global Core Banking Software Market, by End Use

- 1.4.3 Global Core Banking Software Market, by Component

- 1.4.4 Global Core Banking Software Market, by Geography

- 1.5 Methodology for the research

Chapter 2. Market at a Glance

- 2.1 Key Highlights

Chapter 3. Market Overview

- 3.1 Introduction

- 3.1.1 Overview

- 3.1.1.1 Market Scenario and Composition

- 3.1.1 Overview

- 3.2 Key Factors Impacting the Market

- 3.2.1 Market Drivers

- 3.2.2 Market Restraints

- 3.2.3 Market Opportunities

- 3.2.4 Market Challenges

Chapter 4. Competition Analysis - Global

- 4.1 Market Share Analysis, 2024

- 4.2 Strategies Deployed in Core Banking Software Market

- 4.3 Porter Five Forces Analysis

Chapter 5. Key Customer Criteria - Global Core Banking Software Market

- 5.1 Scalability and Performance

- 5.2 Modularity and Flexibility

- 5.3 Cloud-Readiness and Deployment Flexibility

- 5.4 API Ecosystem and Open Banking Integration

- 5.5 Security, Privacy, and Regulatory Compliance

- 5.6 Total Cost of Ownership (TCO)

- 5.7 Speed of Implementation and Ease of Upgrades

- 5.8 User Experience (UX) for Staff and Customers

- 5.9 Vendor Reputation, Industry Expertise, and References

- 5.10. Localization, Support, and Post-Sales Service

Chapter 6. Global Core Banking Software Market by Deployment

- 6.1 Global Cloud Market by Region

- 6.2 Global On-premise Market by Region

Chapter 7. Global Core Banking Software Market by End Use

- 7.1 Global Banks Market by Region

- 7.2 Global Financial Institutions Market by Region

- 7.3 Global Other End Use Market by Region

Chapter 8. Global Core Banking Software Market by Component

- 8.1 Global Solution Market by Region

- 8.2 Global Core Banking Software Market by Solution Type

- 8.2.1 Global Deposits Market by Region

- 8.2.2 Global Loans Market by Region

- 8.2.3 Global Enterprise Customer Solutions Market by Region

- 8.2.4 Global Other Solution Type Market by Region

- 8.3 Global Service Market by Region

- 8.4 Global Core Banking Software Market by Service Type

- 8.4.1 Global Professional Service Market by Region

- 8.4.2 Global Managed Service Market by Region

Chapter 9. Global Core Banking Software Market by Region

- 9.1 North America Core Banking Software Market

- 9.1.1 North America Core Banking Software Market by Deployment

- 9.1.1.1 North America Cloud Market by Region

- 9.1.1.2 North America On-premise Market by Region

- 9.1.2 North America Core Banking Software Market by End Use

- 9.1.2.1 North America Banks Market by Country

- 9.1.2.2 North America Financial Institutions Market by Country

- 9.1.2.3 North America Other End Use Market by Country

- 9.1.3 North America Core Banking Software Market by Component

- 9.1.3.1 North America Solution Market by Country

- 9.1.3.2 North America Core Banking Software Market by Solution Type

- 9.1.3.2.1 North America Deposits Market by Country

- 9.1.3.2.2 North America Loans Market by Country

- 9.1.3.2.3 North America Enterprise Customer Solutions Market by Country

- 9.1.3.2.4 North America Other Solution Type Market by Country

- 9.1.3.3 North America Service Market by Country

- 9.1.3.4 North America Core Banking Software Market by Service Type

- 9.1.3.4.1 North America Professional Service Market by Country

- 9.1.3.4.2 North America Managed Service Market by Country

- 9.1.4 North America Core Banking Software Market by Country

- 9.1.4.1 US Core Banking Software Market

- 9.1.4.1.1 US Core Banking Software Market by Deployment

- 9.1.4.1.2 US Core Banking Software Market by End Use

- 9.1.4.1.3 US Core Banking Software Market by Component

- 9.1.4.2 Canada Core Banking Software Market

- 9.1.4.2.1 Canada Core Banking Software Market by Deployment

- 9.1.4.2.2 Canada Core Banking Software Market by End Use

- 9.1.4.2.3 Canada Core Banking Software Market by Component

- 9.1.4.3 Mexico Core Banking Software Market

- 9.1.4.3.1 Mexico Core Banking Software Market by Deployment

- 9.1.4.3.2 Mexico Core Banking Software Market by End Use

- 9.1.4.3.3 Mexico Core Banking Software Market by Component

- 9.1.4.4 Rest of North America Core Banking Software Market

- 9.1.4.4.1 Rest of North America Core Banking Software Market by Deployment

- 9.1.4.4.2 Rest of North America Core Banking Software Market by End Use

- 9.1.4.4.3 Rest of North America Core Banking Software Market by Component

- 9.1.4.1 US Core Banking Software Market

- 9.1.1 North America Core Banking Software Market by Deployment

- 9.2 Europe Core Banking Software Market

- 9.2.1 Europe Core Banking Software Market by Deployment

- 9.2.1.1 Europe Cloud Market by Country

- 9.2.1.2 Europe On-premise Market by Country

- 9.2.2 Europe Core Banking Software Market by End Use

- 9.2.2.1 Europe Banks Market by Country

- 9.2.2.2 Europe Financial Institutions Market by Country

- 9.2.2.3 Europe Other End Use Market by Country

- 9.2.3 Europe Core Banking Software Market by Component

- 9.2.3.1 Europe Solution Market by Country

- 9.2.3.2 Europe Core Banking Software Market by Solution Type

- 9.2.3.2.1 Europe Deposits Market by Country

- 9.2.3.2.2 Europe Loans Market by Country

- 9.2.3.2.3 Europe Enterprise Customer Solutions Market by Country

- 9.2.3.2.4 Europe Other Solution Type Market by Country

- 9.2.3.3 Europe Service Market by Country

- 9.2.3.4 Europe Core Banking Software Market by Service Type

- 9.2.3.4.1 Europe Professional Service Market by Country

- 9.2.3.4.2 Europe Managed Service Market by Country

- 9.2.4 Europe Core Banking Software Market by Country

- 9.2.4.1 UK Core Banking Software Market

- 9.2.4.1.1 UK Core Banking Software Market by Deployment

- 9.2.4.1.2 UK Core Banking Software Market by End Use

- 9.2.4.1.3 UK Core Banking Software Market by Component

- 9.2.4.2 Germany Core Banking Software Market

- 9.2.4.2.1 Germany Core Banking Software Market by Deployment

- 9.2.4.2.2 Germany Core Banking Software Market by End Use

- 9.2.4.2.3 Germany Core Banking Software Market by Component

- 9.2.4.3 France Core Banking Software Market

- 9.2.4.3.1 France Core Banking Software Market by Deployment

- 9.2.4.3.2 France Core Banking Software Market by End Use

- 9.2.4.3.3 France Core Banking Software Market by Component

- 9.2.4.4 Russia Core Banking Software Market

- 9.2.4.4.1 Russia Core Banking Software Market by Deployment

- 9.2.4.4.2 Russia Core Banking Software Market by End Use

- 9.2.4.4.3 Russia Core Banking Software Market by Component

- 9.2.4.5 Spain Core Banking Software Market

- 9.2.4.5.1 Spain Core Banking Software Market by Deployment

- 9.2.4.5.2 Spain Core Banking Software Market by End Use

- 9.2.4.5.3 Spain Core Banking Software Market by Component

- 9.2.4.6 Italy Core Banking Software Market

- 9.2.4.6.1 Italy Core Banking Software Market by Deployment

- 9.2.4.6.2 Italy Core Banking Software Market by End Use

- 9.2.4.6.3 Italy Core Banking Software Market by Component

- 9.2.4.7 Rest of Europe Core Banking Software Market

- 9.2.4.7.1 Rest of Europe Core Banking Software Market by Deployment

- 9.2.4.7.2 Rest of Europe Core Banking Software Market by End Use

- 9.2.4.7.3 Rest of Europe Core Banking Software Market by Component

- 9.2.4.1 UK Core Banking Software Market

- 9.2.1 Europe Core Banking Software Market by Deployment

- 9.3 Asia Pacific Core Banking Software Market

- 9.3.1 Asia Pacific Core Banking Software Market by Deployment

- 9.3.1.1 Asia Pacific Cloud Market by Country

- 9.3.1.2 Asia Pacific On-premise Market by Country

- 9.3.2 Asia Pacific Core Banking Software Market by End Use

- 9.3.2.1 Asia Pacific Banks Market by Country

- 9.3.2.2 Asia Pacific Financial Institutions Market by Country

- 9.3.2.3 Asia Pacific Other End Use Market by Country

- 9.3.3 Asia Pacific Core Banking Software Market by Component

- 9.3.3.1 Asia Pacific Solution Market by Country

- 9.3.3.2 Asia Pacific Core Banking Software Market by Solution Type

- 9.3.3.2.1 Asia Pacific Deposits Market by Country

- 9.3.3.2.2 Asia Pacific Loans Market by Country

- 9.3.3.2.3 Asia Pacific Enterprise Customer Solutions Market by Country

- 9.3.3.2.4 Asia Pacific Other Solution Type Market by Country

- 9.3.3.3 Asia Pacific Service Market by Country

- 9.3.3.4 Asia Pacific Core Banking Software Market by Service Type

- 9.3.3.4.1 Asia Pacific Professional Service Market by Country

- 9.3.3.4.2 Asia Pacific Managed Service Market by Country

- 9.3.4 Asia Pacific Core Banking Software Market by Country

- 9.3.4.1 China Core Banking Software Market

- 9.3.4.1.1 China Core Banking Software Market by Deployment

- 9.3.4.1.2 China Core Banking Software Market by End Use

- 9.3.4.1.3 China Core Banking Software Market by Component

- 9.3.4.2 Japan Core Banking Software Market

- 9.3.4.2.1 Japan Core Banking Software Market by Deployment

- 9.3.4.2.2 Japan Core Banking Software Market by End Use

- 9.3.4.2.3 Japan Core Banking Software Market by Component

- 9.3.4.3 India Core Banking Software Market

- 9.3.4.3.1 India Core Banking Software Market by Deployment

- 9.3.4.3.2 India Core Banking Software Market by End Use

- 9.3.4.3.3 India Core Banking Software Market by Component

- 9.3.4.4 South Korea Core Banking Software Market

- 9.3.4.4.1 South Korea Core Banking Software Market by Deployment

- 9.3.4.4.2 South Korea Core Banking Software Market by End Use

- 9.3.4.4.3 South Korea Core Banking Software Market by Component

- 9.3.4.5 Singapore Core Banking Software Market

- 9.3.4.5.1 Singapore Core Banking Software Market by Deployment

- 9.3.4.5.2 Singapore Core Banking Software Market by End Use

- 9.3.4.5.3 Singapore Core Banking Software Market by Component

- 9.3.4.6 Malaysia Core Banking Software Market

- 9.3.4.6.1 Malaysia Core Banking Software Market by Deployment

- 9.3.4.6.2 Malaysia Core Banking Software Market by End Use

- 9.3.4.6.3 Malaysia Core Banking Software Market by Component

- 9.3.4.7 Rest of Asia Pacific Core Banking Software Market

- 9.3.4.7.1 Rest of Asia Pacific Core Banking Software Market by Deployment

- 9.3.4.7.2 Rest of Asia Pacific Core Banking Software Market by End Use

- 9.3.4.7.3 Rest of Asia Pacific Core Banking Software Market by Component

- 9.3.4.1 China Core Banking Software Market

- 9.3.1 Asia Pacific Core Banking Software Market by Deployment

- 9.4 LAMEA Core Banking Software Market

- 9.4.1 LAMEA Core Banking Software Market by Deployment

- 9.4.1.1 LAMEA Cloud Market by Country

- 9.4.1.2 LAMEA On-premise Market by Country

- 9.4.2 LAMEA Core Banking Software Market by End Use

- 9.4.2.1 LAMEA Banks Market by Country

- 9.4.2.2 LAMEA Financial Institutions Market by Country

- 9.4.2.3 LAMEA Other End Use Market by Country

- 9.4.3 LAMEA Core Banking Software Market by Component

- 9.4.3.1 LAMEA Solution Market by Country

- 9.4.3.2 LAMEA Core Banking Software Market by Solution Type

- 9.4.3.2.1 LAMEA Deposits Market by Country

- 9.4.3.2.2 LAMEA Loans Market by Country

- 9.4.3.2.3 LAMEA Enterprise Customer Solutions Market by Country

- 9.4.3.2.4 LAMEA Other Solution Type Market by Country

- 9.4.3.3 LAMEA Service Market by Country

- 9.4.3.4 LAMEA Core Banking Software Market by Service Type

- 9.4.3.4.1 LAMEA Professional Service Market by Country

- 9.4.3.4.2 LAMEA Managed Service Market by Country

- 9.4.4 LAMEA Core Banking Software Market by Country

- 9.4.4.1 Brazil Core Banking Software Market

- 9.4.4.1.1 Brazil Core Banking Software Market by Deployment

- 9.4.4.1.2 Brazil Core Banking Software Market by End Use

- 9.4.4.1.3 Brazil Core Banking Software Market by Component

- 9.4.4.2 Argentina Core Banking Software Market

- 9.4.4.2.1 Argentina Core Banking Software Market by Deployment

- 9.4.4.2.2 Argentina Core Banking Software Market by End Use

- 9.4.4.2.3 Argentina Core Banking Software Market by Component

- 9.4.4.3 UAE Core Banking Software Market

- 9.4.4.3.1 UAE Core Banking Software Market by Deployment

- 9.4.4.3.2 UAE Core Banking Software Market by End Use

- 9.4.4.3.3 UAE Core Banking Software Market by Component

- 9.4.4.4 Saudi Arabia Core Banking Software Market

- 9.4.4.4.1 Saudi Arabia Core Banking Software Market by Deployment

- 9.4.4.4.2 Saudi Arabia Core Banking Software Market by End Use

- 9.4.4.4.3 Saudi Arabia Core Banking Software Market by Component

- 9.4.4.5 South Africa Core Banking Software Market

- 9.4.4.5.1 South Africa Core Banking Software Market by Deployment

- 9.4.4.5.2 South Africa Core Banking Software Market by End Use

- 9.4.4.5.3 South Africa Core Banking Software Market by Component

- 9.4.4.6 Nigeria Core Banking Software Market

- 9.4.4.6.1 Nigeria Core Banking Software Market by Deployment

- 9.4.4.6.2 Nigeria Core Banking Software Market by End Use

- 9.4.4.6.3 Nigeria Core Banking Software Market by Component

- 9.4.4.7 Rest of LAMEA Core Banking Software Market

- 9.4.4.7.1 Rest of LAMEA Core Banking Software Market by Deployment

- 9.4.4.7.2 Rest of LAMEA Core Banking Software Market by End Use

- 9.4.4.7.3 Rest of LAMEA Core Banking Software Market by Component

- 9.4.4.1 Brazil Core Banking Software Market

- 9.4.1 LAMEA Core Banking Software Market by Deployment

Chapter 10. Company Profiles

- 10.1 Capgemini SE

- 10.1.1 Company Overview

- 10.1.2 Financial Analysis

- 10.1.3 Regional Analysis

- 10.1.4 SWOT Analysis

- 10.2 Finastra Group Holdings Limited (Vista Equity Partners)

- 10.2.1 Company Overview

- 10.2.2 Recent strategies and developments:

- 10.2.2.1 Partnerships, Collaborations, and Agreements:

- 10.3 Temenos AG

- 10.3.1 Company Overview

- 10.3.2 Financial Analysis

- 10.3.3 Segmental and Regional Analysis

- 10.3.4 Recent strategies and developments:

- 10.3.4.1 Partnerships, Collaborations, and Agreements:

- 10.3.5 SWOT Analysis

- 10.4 HCL Technologies Ltd. (HCL Enterprises)

- 10.4.1 Company Overview

- 10.4.2 Financial Analysis

- 10.4.3 Segmental and Regional Analysis

- 10.4.4 Research & Development Expenses

- 10.4.5 Recent strategies and developments:

- 10.4.5.1 Partnerships, Collaborations, and Agreements: