|

|

市場調査レポート

商品コード

1397668

ホームエンタテインメント機器の世界市場規模、シェア、産業動向分析レポート:流通チャネル別、接続形態別、タイプ別、地域別展望と予測、2023年~2030年Global Home Entertainment Devices Market Size, Share & Industry Trends Analysis Report By Distribution Channel (Offline, and Online), By Mode Of Connectivity (Wired, and Wireless) By Type, By Regional Outlook and Forecast, 2023 - 2030 |

||||||

|

|||||||

| ホームエンタテインメント機器の世界市場規模、シェア、産業動向分析レポート:流通チャネル別、接続形態別、タイプ別、地域別展望と予測、2023年~2030年 |

|

出版日: 2023年12月15日

発行: KBV Research

ページ情報: 英文 587 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

ホームエンタテインメント機器市場規模は、予測期間中にCAGR 5.8%で成長し、2030年には4,289億米ドルに達すると予測されます。2022年の市場規模は5億3,654万500台となり、6.1%の成長を遂げています(2019-2022年)。

KBV Cardinalのマトリックスに示された分析によると、Apple, Inc.とMicrosoft Corporationがこの市場の先駆者です。2023年6月、アップル社は、デジタルコンテンツを物理的世界とスムーズに統合する空間コンピュータ、アップル・ビジョン・プロの発売を発表しました。ビジョン・プロは、目、手、音声で操作できる3次元のユーザー・インターフェースを実現します。サムスン電子、LG、ソニーなどの企業が、この市場における主要なイノベーターです。

市場成長要因

世界のストリーミングサービスの台頭

ストリーミングサービスはオンデマンドコンテンツの膨大なライブラリを提供し、消費者が映画、テレビ番組、ドキュメンタリー、オリジナル番組を便利に視聴できるようにします。ストリーミング・アプリをスマートTVに直接インストールすることが標準機能となっています。スマートTVはシームレスな体験を提供し、ユーザーは追加のデバイスなしで人気のストリーミング・サービスにアクセスできます。こうしたアプリがテレビに内蔵されているという利便性が、スマートテレビの普及に貢献しています。さらに、より良い画質への要求から、4KウルトラHDやハイダイナミックレンジ(HDR)技術の採用が増加しています。これらの機能を備えたスマートTVやストリーミング・デバイスは、より鮮明な画像、鮮やかな色彩、改善されたコントラストを提供し、全体的な視聴体験を向上させる。こうした側面が、今後数年間、こうした機器の需要を押し上げると思われます。

高品質のオーディオ・ビジュアル体験に対する需要の増加

消費者は4Kや8Kといった高解像度ディスプレイを強く好むようになっています。こうしたディスプレイ技術の進歩は、優れた画質、よりシャープなディテール、より鮮やかな色彩を提供することで、視覚体験を一変させました。高解像度の大画面に対する需要は、テレビ、モニター、ディスプレイ・スクリーンの需要を促進する重要な要因となっています。さらに、大画面テレビや高精細モニターの需要も着実に高まっています。大型スクリーンは、特に高解像度で、より没入感のある視聴体験を提供し、市場の成長に寄与しています。これらの側面は、今後数年間、これらの機器の需要を促進すると思われます。

市場抑制要因

高い市場飽和度と競合

大規模で定評のあるブランドは、消費者の信頼と認知の恩恵を受けて大きな市場シェアを占めることが多いです。そのため、新興ブランドや知名度の低いブランドが効果的に競争するのは難しいです。多くの消費者は、信頼するブランドに固執する傾向があるため、新規参入企業が、すでに確立されたブランドに忠実な顧客を引き付け、維持することは困難です。さらに、小売チャネルや流通ネットワークへのアクセスも、新規参入企業の課題となります。既存ブランドは小売業者と強固な関係を築いていることが多く、新規参入企業が一等地の棚スペースやオンラインでの知名度を確保するのは難しいです。そのため、こうした要因が市場の需要を減退させる可能性があります。

流通チャネルの展望

流通チャネル別に見ると、市場はオフラインとオンラインに区分されます。2022年には、オンライン・セグメントが市場で大きな収益シェアを占めています。消費者は、いつでもどこでもオンラインでコンテンツにアクセスできる利便性をますます好むようになっており、オンライン・ホーム・エンターテインメント分野の拡大に寄与しています。この動向は、高速インターネット接続の普及、スマート・デバイスの利用可能性、スマートTVの人気の高まりによってさらに加速しています。これらの要因がこの分野の需要を押し上げると思われます。

接続方式の展望

接続形態によって、市場は無線と有線に分けられます。2022年には、ワイヤレス・セグメントが市場で大きな収益シェアを占める。ワイヤレス技術は比類のない利便性を提供し、ユーザーはケーブルの制約を受けずにデバイスを接続できます。このため、ワイヤレススピーカー、ヘッドフォン、サウンドシステムの採用が増加し、ホームエンタテインメントのセットアップに柔軟性を与え、物理的な接続の制約を受けずに高品質のオーディオを楽しむことができるようになっています。このような側面から、この分野は将来的に需要が増加することが予想されます。

タイプ別展望

市場はタイプ別に、ビデオ機器、オーディオ機器、ゲーム機に区分されます。2022年には、オーディオ機器分野が市場で大きな収益シェアを獲得しました。Dolby Atmos、DTS:X、その他のイマーシブ・オーディオ・フォーマットなどの高度なサウンド技術の開発により、サウンド再生の品質が大幅に向上しました。これらのシステムは、高音質のサウンドを提供することでユーザーに臨場感あふれる映画体験を提供し、ホーム・エンターテインメントのセットアップに加えられる人気商品となっています。これらの側面は、このセグメントに有利な成長見通しをもたらすと思われます。

地域別展望

地域別に見ると、市場は北米、欧州、アジア太平洋、LAMEAに区分されます。2022年には、アジア太平洋地域が市場で最も高い収益シェアを獲得しました。同地域は技術の進歩を迅速に受け入れています。アジア太平洋諸国の消費者は、ホームエンタテインメント分野で最新のイノベーションを積極的に取り入れています。アジア太平洋地域では、ゲームが大きな人気を博しています。日本、中国、韓国のような国々はゲーム文化が強く、ゲーム機やアクセサリーの需要が急増しています。これらの要因は、このセグメントに有利な成長見通しをもたらすと思われます。

目次

第1章 市場範囲と調査手法

- 市場の定義

- 目的

- 市場範囲

- セグメンテーション

- 調査手法

第2章 市場要覧

- 主なハイライト

第3章 市場概要

- イントロダクション

- 概要

- 市場構成とシナリオ

- 概要

- 市場に影響を与える主な要因

- 市場促進要因

- 市場抑制要因

第4章 競合分析- 世界

- KBV Cardinal Matrix

- 最近の業界全体の戦略的展開

- パートナーシップ、コラボレーション、および契約

- 製品の発売と製品の拡大

- 買収と合併

- 地理的拡大

- 主要成功戦略

- 主な戦略

- 主要な戦略的動き

- ポーターファイブフォース分析

第5章 世界のホームエンタテインメント機器市場:流通チャネル別

- 世界のオフライン市場:地域別

- 世界のオンライン市場:地域別

第6章 世界のホームエンタテインメント機器市場:接続モード別

- 世界の有線市場:地域別

- 世界のワイヤレス市場:地域別

第7章 世界のホームエンタテインメント機器市場:タイプ別

- 世界のビデオデバイス市場:地域別

- 世界のホームエンタテインメント機器市場:ビデオデバイスタイプ別

- 世界のテレビ市場:地域別

- 世界のプロジェクター市場:地域別

- 世界のBlu-rayおよびDVDプレーヤー市場:地域別

- 世界のデジタルビデオレコーダー市場:地域別

- 世界のその他の市場:地域別

- 世界のオーディオデバイス市場:地域別

- 世界のホームエンタテインメント機器市場:オーディオデバイスタイプ別

- 世界のホームシアターインボックス市場:地域別

- 世界のサウンドバー市場:地域別

- 世界のオーディオプレーヤー市場:地域別

- 世界のヘッドフォン市場:地域別

- 世界の家庭用ラジオ市場:地域別

- 世界のその他の市場:地域別

- 世界のゲーム機市場:地域別

第8章 世界のホームエンタテインメント機器市場:地域別

- 北米

- 北米の市場:国別

- 米国

- カナダ

- メキシコ

- その他北米地域

- 北米の市場:国別

- 欧州

- 欧州の市場:国別

- ドイツ

- 英国

- フランス

- ロシア

- スペイン

- イタリア

- その他欧州地域

- 欧州の市場:国別

- アジア太平洋

- アジア太平洋の市場:国別

- 中国

- 日本

- インド

- 韓国

- シンガポール

- マレーシア

- その他アジア太平洋地域

- アジア太平洋の市場:国別

- ラテンアメリカ・中東・アフリカ

- ラテンアメリカ・中東・アフリカの市場:国別

- ブラジル

- アルゼンチン

- アラブ首長国連邦

- サウジアラビア

- 南アフリカ

- ナイジェリア

- その他ラテンアメリカ・中東・アフリカ地域

- ラテンアメリカ・中東・アフリカの市場:国別

第9章 企業プロファイル

- Samsung Electronics Co, Ltd.(Samsung Group)

- LG Corporation

- Sony Corporation

- Toshiba Corporation

- Apple, Inc

- Panasonic Holdings Corporation

- Microsoft Corporation

- Koninklijke Philips NV

- Bose Corporation

- Mitsubishi Electric Corporation

第10章 市場の成功必須条件

LIST OF TABLES

- TABLE 1 Global Home Entertainment Devices Market, 2019 - 2022, USD Million

- TABLE 2 Global Home Entertainment Devices Market, 2023 - 2030, USD Million

- TABLE 3 Global Home Entertainment Devices Market, 2019 - 2022, Thousand Units

- TABLE 4 Global Home Entertainment Devices Market, 2023 - 2030, Thousand Units

- TABLE 5 Partnerships, Collaborations and Agreements- Home Entertainment Devices Market

- TABLE 6 Product Launches And Product Expansions- Home Entertainment Devices Market

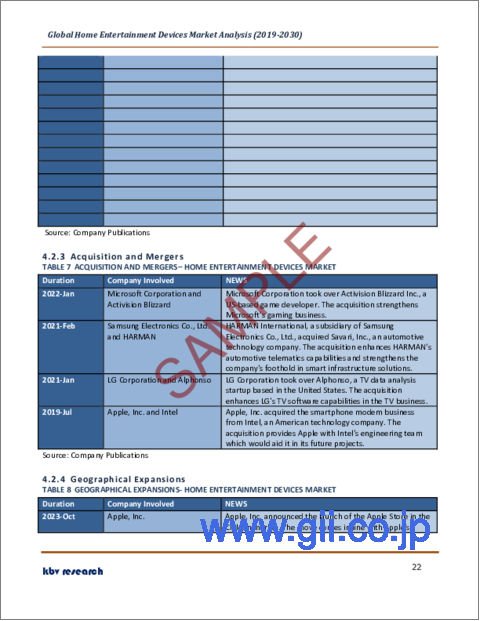

- TABLE 7 Acquisition and Mergers- Home Entertainment Devices Market

- TABLE 8 Geographical Expansions- Home Entertainment Devices Market

- TABLE 9 Global Home Entertainment Devices Market by Distribution Channel, 2019 - 2022, USD Million

- TABLE 10 Global Home Entertainment Devices Market by Distribution Channel, 2023 - 2030, USD Million

- TABLE 11 Global Home Entertainment Devices Market by Distribution Channel, 2019 - 2022, Thousand Units

- TABLE 12 Global Home Entertainment Devices Market by Distribution Channel, 2023 - 2030, Thousand Units

- TABLE 13 Global Offline Market by Region, 2019 - 2022, USD Million

- TABLE 14 Global Offline Market by Region, 2023 - 2030, USD Million

- TABLE 15 Global Offline Market by Region, 2019 - 2022, Thousand Units

- TABLE 16 Global Offline Market by Region, 2023 - 2030, Thousand Units

- TABLE 17 Global Online Market by Region, 2019 - 2022, USD Million

- TABLE 18 Global Online Market by Region, 2023 - 2030, USD Million

- TABLE 19 Global Online Market by Region, 2019 - 2022, Thousand Units

- TABLE 20 Global Online Market by Region, 2023 - 2030, Thousand Units

- TABLE 21 Global Home Entertainment Devices Market by Mode Of Connectivity, 2019 - 2022, USD Million

- TABLE 22 Global Home Entertainment Devices Market by Mode Of Connectivity, 2023 - 2030, USD Million

- TABLE 23 Global Home Entertainment Devices Market by Mode Of Connectivity, 2019 - 2022, Thousand Units

- TABLE 24 Global Home Entertainment Devices Market by Mode Of Connectivity, 2023 - 2030, Thousand Units

- TABLE 25 Global Wired Market by Region, 2019 - 2022, USD Million

- TABLE 26 Global Wired Market by Region, 2023 - 2030, USD Million

- TABLE 27 Global Wired Market by Region, 2019 - 2022, Thousand Units

- TABLE 28 Global Wired Market by Region, 2023 - 2030, Thousand Units

- TABLE 29 Global Wireless Market by Region, 2019 - 2022, USD Million

- TABLE 30 Global Wireless Market by Region, 2023 - 2030, USD Million

- TABLE 31 Global Wireless Market by Region, 2019 - 2022, Thousand Units

- TABLE 32 Global Wireless Market by Region, 2023 - 2030, Thousand Units

- TABLE 33 Global Home Entertainment Devices Market by Type, 2019 - 2022, USD Million

- TABLE 34 Global Home Entertainment Devices Market by Type, 2023 - 2030, USD Million

- TABLE 35 Global Home Entertainment Devices Market by Type, 2019 - 2022, Thousand Units

- TABLE 36 Global Home Entertainment Devices Market by Type, 2023 - 2030, Thousand Units

- TABLE 37 Global Video Devices Market by Region, 2019 - 2022, USD Million

- TABLE 38 Global Video Devices Market by Region, 2023 - 2030, USD Million

- TABLE 39 Global Video Devices Market by Region, 2019 - 2022, Thousand Units

- TABLE 40 Global Video Devices Market by Region, 2023 - 2030, Thousand Units

- TABLE 41 Global Home Entertainment Devices Market by Video Devices Type, 2019 - 2022, USD Million

- TABLE 42 Global Home Entertainment Devices Market by Video Devices Type, 2023 - 2030, USD Million

- TABLE 43 Global Home Entertainment Devices Market by Video Devices Type, 2019 - 2022, Thousand Units

- TABLE 44 Global Home Entertainment Devices Market by Video Devices Type, 2023 - 2030, Thousand Units

- TABLE 45 Global Televisions Market by Region, 2019 - 2022, USD Million

- TABLE 46 Global Televisions Market by Region, 2023 - 2030, USD Million

- TABLE 47 Global Televisions Market by Region, 2019 - 2022, Thousand Units

- TABLE 48 Global Televisions Market by Region, 2023 - 2030, Thousand Units

- TABLE 49 Global Projectors Market by Region, 2019 - 2022, USD Million

- TABLE 50 Global Projectors Market by Region, 2023 - 2030, USD Million

- TABLE 51 Global Projectors Market by Region, 2019 - 2022, Thousand Units

- TABLE 52 Global Projectors Market by Region, 2023 - 2030, Thousand Units

- TABLE 53 Global Blue-ray & DVD Players Market by Region, 2019 - 2022, USD Million

- TABLE 54 Global Blue-ray & DVD Players Market by Region, 2023 - 2030, USD Million

- TABLE 55 Global Blue-ray & DVD Players Market by Region, 2019 - 2022, Thousand Units

- TABLE 56 Global Blue-ray & DVD Players Market by Region, 2023 - 2030, Thousand Units

- TABLE 57 Global Digital Video Recorders Market by Region, 2019 - 2022, USD Million

- TABLE 58 Global Digital Video Recorders Market by Region, 2023 - 2030, USD Million

- TABLE 59 Global Digital Video Recorders Market by Region, 2019 - 2022, Thousand Units

- TABLE 60 Global Digital Video Recorders Market by Region, 2023 - 2030, Thousand Units

- TABLE 61 Global Others Market by Region, 2019 - 2022, USD Million

- TABLE 62 Global Others Market by Region, 2023 - 2030, USD Million

- TABLE 63 Global Others Market by Region, 2019 - 2022, Thousand Units

- TABLE 64 Global Others Market by Region, 2023 - 2030, Thousand Units

- TABLE 65 Global Audio Devices Market by Region, 2019 - 2022, USD Million

- TABLE 66 Global Audio Devices Market by Region, 2023 - 2030, USD Million

- TABLE 67 Global Audio Devices Market by Region, 2019 - 2022, Thousand Units

- TABLE 68 Global Audio Devices Market by Region, 2023 - 2030, Thousand Units

- TABLE 69 Global Home Entertainment Devices Market by Audio Devices Type, 2019 - 2022, USD Million

- TABLE 70 Global Home Entertainment Devices Market by Audio Devices Type, 2023 - 2030, USD Million

- TABLE 71 Global Home Entertainment Devices Market by Audio Devices Type, 2019 - 2022, Thousand Units

- TABLE 72 Global Home Entertainment Devices Market by Audio Devices Type, 2023 - 2030, Thousand Units

- TABLE 73 Global Home Theatre in box Market by Region, 2019 - 2022, USD Million

- TABLE 74 Global Home Theatre in box Market by Region, 2023 - 2030, USD Million

- TABLE 75 Global Home Theatre in box Market by Region, 2019 - 2022, Thousand Units

- TABLE 76 Global Home Theatre in box Market by Region, 2023 - 2030, Thousand Units

- TABLE 77 Global Sound Bars Market by Region, 2019 - 2022, USD Million

- TABLE 78 Global Sound Bars Market by Region, 2023 - 2030, USD Million

- TABLE 79 Global Sound Bars Market by Region, 2019 - 2022, Thousand Units

- TABLE 80 Global Sound Bars Market by Region, 2023 - 2030, Thousand Units

- TABLE 81 Global Audio Players Market by Region, 2019 - 2022, USD Million

- TABLE 82 Global Audio Players Market by Region, 2023 - 2030, USD Million

- TABLE 83 Global Audio Players Market by Region, 2019 - 2022, Thousand Units

- TABLE 84 Global Audio Players Market by Region, 2023 - 2030, Thousand Units

- TABLE 85 Global Headphones Market by Region, 2019 - 2022, USD Million

- TABLE 86 Global Headphones Market by Region, 2023 - 2030, USD Million

- TABLE 87 Global Headphones Market by Region, 2019 - 2022, Thousand Units

- TABLE 88 Global Headphones Market by Region, 2023 - 2030, Thousand Units

- TABLE 89 Global Home Radios Market by Region, 2019 - 2022, USD Million

- TABLE 90 Global Home Radios Market by Region, 2023 - 2030, USD Million

- TABLE 91 Global Home Radios Market by Region, 2019 - 2022, Thousand Units

- TABLE 92 Global Home Radios Market by Region, 2023 - 2030, Thousand Units

- TABLE 93 Global Others Market by Region, 2019 - 2022, USD Million

- TABLE 94 Global Others Market by Region, 2023 - 2030, USD Million

- TABLE 95 Global Others Market by Region, 2019 - 2022, Thousand Units

- TABLE 96 Global Others Market by Region, 2023 - 2030, Thousand Units

- TABLE 97 Global Gaming Consoles Market by Region, 2019 - 2022, USD Million

- TABLE 98 Global Gaming Consoles Market by Region, 2023 - 2030, USD Million

- TABLE 99 Global Gaming Consoles Market by Region, 2019 - 2022, Thousand Units

- TABLE 100 Global Gaming Consoles Market by Region, 2023 - 2030, Thousand Units

- TABLE 101 Global Home Entertainment Devices Market by Region, 2019 - 2022, USD Million

- TABLE 102 Global Home Entertainment Devices Market by Region, 2023 - 2030, USD Million

- TABLE 103 Global Home Entertainment Devices Market by Region, 2019 - 2022, Thousand Units

- TABLE 104 Global Home Entertainment Devices Market by Region, 2023 - 2030, Thousand Units

- TABLE 105 North America Home Entertainment Devices Market, 2019 - 2022, USD Million

- TABLE 106 North America Home Entertainment Devices Market, 2023 - 2030, USD Million

- TABLE 107 North America Home Entertainment Devices Market, 2019 - 2022, Thousand Units

- TABLE 108 North America Home Entertainment Devices Market, 2023 - 2030, Thousand Units

- TABLE 109 North America Home Entertainment Devices Market by Distribution Channel, 2019 - 2022, USD Million

- TABLE 110 North America Home Entertainment Devices Market by Distribution Channel, 2023 - 2030, USD Million

- TABLE 111 North America Home Entertainment Devices Market by Distribution Channel, 2019 - 2022, Thousand Units

- TABLE 112 North America Home Entertainment Devices Market by Distribution Channel, 2023 - 2030, Thousand Units

- TABLE 113 North America Offline Market by Region, 2019 - 2022, USD Million

- TABLE 114 North America Offline Market by Region, 2023 - 2030, USD Million

- TABLE 115 North America Offline Market by Region, 2019 - 2022, Thousand Units

- TABLE 116 North America Offline Market by Region, 2023 - 2030, Thousand Units

- TABLE 117 North America Online Market by Region, 2019 - 2022, USD Million

- TABLE 118 North America Online Market by Region, 2023 - 2030, USD Million

- TABLE 119 North America Online Market by Region, 2019 - 2022, Thousand Units

- TABLE 120 North America Online Market by Region, 2023 - 2030, Thousand Units

- TABLE 121 North America Home Entertainment Devices Market by Mode Of Connectivity, 2019 - 2022, USD Million

- TABLE 122 North America Home Entertainment Devices Market by Mode Of Connectivity, 2023 - 2030, USD Million

- TABLE 123 North America Home Entertainment Devices Market by Mode Of Connectivity, 2019 - 2022, Thousand Units

- TABLE 124 North America Home Entertainment Devices Market by Mode Of Connectivity, 2023 - 2030, Thousand Units

- TABLE 125 North America Wired Market by Region, 2019 - 2022, USD Million

- TABLE 126 North America Wired Market by Region, 2023 - 2030, USD Million

- TABLE 127 North America Wired Market by Region, 2019 - 2022, Thousand Units

- TABLE 128 North America Wired Market by Region, 2023 - 2030, Thousand Units

- TABLE 129 North America Wireless Market by Region, 2019 - 2022, USD Million

- TABLE 130 North America Wireless Market by Region, 2023 - 2030, USD Million

- TABLE 131 North America Wireless Market by Region, 2019 - 2022, Thousand Units

- TABLE 132 North America Wireless Market by Region, 2023 - 2030, Thousand Units

- TABLE 133 North America Home Entertainment Devices Market by Type, 2019 - 2022, USD Million

- TABLE 134 North America Home Entertainment Devices Market by Type, 2023 - 2030, USD Million

- TABLE 135 North America Home Entertainment Devices Market by Type, 2019 - 2022, Thousand Units

- TABLE 136 North America Home Entertainment Devices Market by Type, 2023 - 2030, Thousand Units

- TABLE 137 North America Video Devices Market by Country, 2019 - 2022, USD Million

- TABLE 138 North America Video Devices Market by Country, 2023 - 2030, USD Million

- TABLE 139 North America Video Devices Market by Country, 2019 - 2022, Thousand Units

- TABLE 140 North America Video Devices Market by Country, 2023 - 2030, Thousand Units

- TABLE 141 North America Home Entertainment Devices Market by Video Devices Type, 2019 - 2022, USD Million

- TABLE 142 North America Home Entertainment Devices Market by Video Devices Type, 2023 - 2030, USD Million

- TABLE 143 North America Home Entertainment Devices Market by Video Devices Type, 2019 - 2022, Thousand Units

- TABLE 144 North America Home Entertainment Devices Market by Video Devices Type, 2023 - 2030, Thousand Units

- TABLE 145 North America Televisions Market by Country, 2019 - 2022, USD Million

- TABLE 146 North America Televisions Market by Country, 2023 - 2030, USD Million

- TABLE 147 North America Televisions Market by Country, 2019 - 2022, Thousand Units

- TABLE 148 North America Televisions Market by Country, 2023 - 2030, Thousand Units

- TABLE 149 North America Projectors Market by Country, 2019 - 2022, USD Million

- TABLE 150 North America Projectors Market by Country, 2023 - 2030, USD Million

- TABLE 151 North America Projectors Market by Country, 2019 - 2022, Thousand Units

- TABLE 152 North America Projectors Market by Country, 2023 - 2030, Thousand Units

- TABLE 153 North America Blue-ray & DVD Players Market by Country, 2019 - 2022, USD Million

- TABLE 154 North America Blue-ray & DVD Players Market by Country, 2023 - 2030, USD Million

- TABLE 155 North America Blue-ray & DVD Players Market by Country, 2019 - 2022, Thousand Units

- TABLE 156 North America Blue-ray & DVD Players Market by Country, 2023 - 2030, Thousand Units

- TABLE 157 North America Digital Video Recorders Market by Country, 2019 - 2022, USD Million

- TABLE 158 North America Digital Video Recorders Market by Country, 2023 - 2030, USD Million

- TABLE 159 North America Digital Video Recorders Market by Country, 2019 - 2022, Thousand Units

- TABLE 160 North America Digital Video Recorders Market by Country, 2023 - 2030, Thousand Units

- TABLE 161 North America Others Market by Country, 2019 - 2022, USD Million

- TABLE 162 North America Others Market by Country, 2023 - 2030, USD Million

- TABLE 163 North America Others Market by Country, 2019 - 2022, Thousand Units

- TABLE 164 North America Others Market by Country, 2023 - 2030, Thousand Units

- TABLE 165 North America Audio Devices Market by Country, 2019 - 2022, USD Million

- TABLE 166 North America Audio Devices Market by Country, 2023 - 2030, USD Million

- TABLE 167 North America Audio Devices Market by Country, 2019 - 2022, Thousand Units

- TABLE 168 North America Audio Devices Market by Country, 2023 - 2030, Thousand Units

- TABLE 169 North America Home Entertainment Devices Market by Audio Devices Type, 2019 - 2022, USD Million

- TABLE 170 North America Home Entertainment Devices Market by Audio Devices Type, 2023 - 2030, USD Million

- TABLE 171 North America Home Entertainment Devices Market by Audio Devices Type, 2019 - 2022, Thousand Units

- TABLE 172 North America Home Entertainment Devices Market by Audio Devices Type, 2023 - 2030, Thousand Units

- TABLE 173 North America Home Theatre in box Market by Country, 2019 - 2022, USD Million

- TABLE 174 North America Home Theatre in box Market by Country, 2023 - 2030, USD Million

- TABLE 175 North America Home Theatre in box Market by Country, 2019 - 2022, Thousand Units

- TABLE 176 North America Home Theatre in box Market by Country, 2023 - 2030, Thousand Units

- TABLE 177 North America Sound Bars Market by Country, 2019 - 2022, USD Million

- TABLE 178 North America Sound Bars Market by Country, 2023 - 2030, USD Million

- TABLE 179 North America Sound Bars Market by Country, 2019 - 2022, Thousand Units

- TABLE 180 North America Sound Bars Market by Country, 2023 - 2030, Thousand Units

- TABLE 181 North America Audio Players Market by Country, 2019 - 2022, USD Million

- TABLE 182 North America Audio Players Market by Country, 2023 - 2030, USD Million

- TABLE 183 North America Audio Players Market by Country, 2019 - 2022, Thousand Units

- TABLE 184 North America Audio Players Market by Country, 2023 - 2030, Thousand Units

- TABLE 185 North America Headphones Market by Country, 2019 - 2022, USD Million

- TABLE 186 North America Headphones Market by Country, 2023 - 2030, USD Million

- TABLE 187 North America Headphones Market by Country, 2019 - 2022, Thousand Units

- TABLE 188 North America Headphones Market by Country, 2023 - 2030, Thousand Units

- TABLE 189 North America Home Radios Market by Country, 2019 - 2022, USD Million

- TABLE 190 North America Home Radios Market by Country, 2023 - 2030, USD Million

- TABLE 191 North America Home Radios Market by Country, 2019 - 2022, Thousand Units

- TABLE 192 North America Home Radios Market by Country, 2023 - 2030, Thousand Units

- TABLE 193 North America Others Market by Country, 2019 - 2022, USD Million

- TABLE 194 North America Others Market by Country, 2023 - 2030, USD Million

- TABLE 195 North America Others Market by Country, 2019 - 2022, Thousand Units

- TABLE 196 North America Others Market by Country, 2023 - 2030, Thousand Units

- TABLE 197 North America Gaming Consoles Market by Country, 2019 - 2022, USD Million

- TABLE 198 North America Gaming Consoles Market by Country, 2023 - 2030, USD Million

- TABLE 199 North America Gaming Consoles Market by Country, 2019 - 2022, Thousand Units

- TABLE 200 North America Gaming Consoles Market by Country, 2023 - 2030, Thousand Units

- TABLE 201 North America Home Entertainment Devices Market by Country, 2019 - 2022, USD Million

- TABLE 202 North America Home Entertainment Devices Market by Country, 2023 - 2030, USD Million

- TABLE 203 North America Home Entertainment Devices Market by Country, 2019 - 2022, Thousand Units

- TABLE 204 North America Home Entertainment Devices Market by Country, 2023 - 2030, Thousand Units

- TABLE 205 US Home Entertainment Devices Market, 2019 - 2022, USD Million

- TABLE 206 US Home Entertainment Devices Market, 2023 - 2030, USD Million

- TABLE 207 US Home Entertainment Devices Market, 2019 - 2022, Thousand Units

- TABLE 208 US Home Entertainment Devices Market, 2023 - 2030, Thousand Units

- TABLE 209 US Home Entertainment Devices Market by Distribution Channel, 2019 - 2022, USD Million

- TABLE 210 US Home Entertainment Devices Market by Distribution Channel, 2023 - 2030, USD Million

- TABLE 211 US Home Entertainment Devices Market by Distribution Channel, 2019 - 2022, Thousand Units

- TABLE 212 US Home Entertainment Devices Market by Distribution Channel, 2023 - 2030, Thousand Units

- TABLE 213 US Home Entertainment Devices Market by Mode Of Connectivity, 2019 - 2022, USD Million

- TABLE 214 US Home Entertainment Devices Market by Mode Of Connectivity, 2023 - 2030, USD Million

- TABLE 215 US Home Entertainment Devices Market by Mode Of Connectivity, 2019 - 2022, Thousand Units

- TABLE 216 US Home Entertainment Devices Market by Mode Of Connectivity, 2023 - 2030, Thousand Units

- TABLE 217 US Home Entertainment Devices Market by Type, 2019 - 2022, USD Million

- TABLE 218 US Home Entertainment Devices Market by Type, 2023 - 2030, USD Million

- TABLE 219 US Home Entertainment Devices Market by Type, 2019 - 2022, Thousand Units

- TABLE 220 US Home Entertainment Devices Market by Type, 2023 - 2030, Thousand Units

- TABLE 221 US Home Entertainment Devices Market by Video Devices Type, 2019 - 2022, USD Million

- TABLE 222 US Home Entertainment Devices Market by Video Devices Type, 2023 - 2030, USD Million

- TABLE 223 US Home Entertainment Devices Market by Video Devices Type, 2019 - 2022, Thousand Units

- TABLE 224 US Home Entertainment Devices Market by Video Devices Type, 2023 - 2030, Thousand Units

- TABLE 225 US Home Entertainment Devices Market by Audio Devices Type, 2019 - 2022, USD Million

- TABLE 226 US Home Entertainment Devices Market by Audio Devices Type, 2023 - 2030, USD Million

- TABLE 227 US Home Entertainment Devices Market by Audio Devices Type, 2019 - 2022, Thousand Units

- TABLE 228 US Home Entertainment Devices Market by Audio Devices Type, 2023 - 2030, Thousand Units

- TABLE 229 Canada Home Entertainment Devices Market, 2019 - 2022, USD Million

- TABLE 230 Canada Home Entertainment Devices Market, 2023 - 2030, USD Million

- TABLE 231 Canada Home Entertainment Devices Market, 2019 - 2022, Thousand Units

- TABLE 232 Canada Home Entertainment Devices Market, 2023 - 2030, Thousand Units

- TABLE 233 Canada Home Entertainment Devices Market by Distribution Channel, 2019 - 2022, USD Million

- TABLE 234 Canada Home Entertainment Devices Market by Distribution Channel, 2023 - 2030, USD Million

- TABLE 235 Canada Home Entertainment Devices Market by Distribution Channel, 2019 - 2022, Thousand Units

- TABLE 236 Canada Home Entertainment Devices Market by Distribution Channel, 2023 - 2030, Thousand Units

- TABLE 237 Canada Home Entertainment Devices Market by Mode Of Connectivity, 2019 - 2022, USD Million

- TABLE 238 Canada Home Entertainment Devices Market by Mode Of Connectivity, 2023 - 2030, USD Million

- TABLE 239 Canada Home Entertainment Devices Market by Mode Of Connectivity, 2019 - 2022, Thousand Units

- TABLE 240 Canada Home Entertainment Devices Market by Mode Of Connectivity, 2023 - 2030, Thousand Units

- TABLE 241 Canada Home Entertainment Devices Market by Type, 2019 - 2022, USD Million

- TABLE 242 Canada Home Entertainment Devices Market by Type, 2023 - 2030, USD Million

- TABLE 243 Canada Home Entertainment Devices Market by Type, 2019 - 2022, Thousand Units

- TABLE 244 Canada Home Entertainment Devices Market by Type, 2023 - 2030, Thousand Units

- TABLE 245 Canada Home Entertainment Devices Market by Video Devices Type, 2019 - 2022, USD Million

- TABLE 246 Canada Home Entertainment Devices Market by Video Devices Type, 2023 - 2030, USD Million

- TABLE 247 Canada Home Entertainment Devices Market by Video Devices Type, 2019 - 2022, Thousand Units

- TABLE 248 Canada Home Entertainment Devices Market by Video Devices Type, 2023 - 2030, Thousand Units

- TABLE 249 Canada Home Entertainment Devices Market by Audio Devices Type, 2019 - 2022, USD Million

- TABLE 250 Canada Home Entertainment Devices Market by Audio Devices Type, 2023 - 2030, USD Million

- TABLE 251 Canada Home Entertainment Devices Market by Audio Devices Type, 2019 - 2022, Thousand Units

- TABLE 252 Canada Home Entertainment Devices Market by Audio Devices Type, 2023 - 2030, Thousand Units

- TABLE 253 Mexico Home Entertainment Devices Market, 2019 - 2022, USD Million

- TABLE 254 Mexico Home Entertainment Devices Market, 2023 - 2030, USD Million

- TABLE 255 Mexico Home Entertainment Devices Market, 2019 - 2022, Thousand Units

- TABLE 256 Mexico Home Entertainment Devices Market, 2023 - 2030, Thousand Units

- TABLE 257 Mexico Home Entertainment Devices Market by Distribution Channel, 2019 - 2022, USD Million

- TABLE 258 Mexico Home Entertainment Devices Market by Distribution Channel, 2023 - 2030, USD Million

- TABLE 259 Mexico Home Entertainment Devices Market by Distribution Channel, 2019 - 2022, Thousand Units

- TABLE 260 Mexico Home Entertainment Devices Market by Distribution Channel, 2023 - 2030, Thousand Units

- TABLE 261 Mexico Home Entertainment Devices Market by Mode Of Connectivity, 2019 - 2022, USD Million

- TABLE 262 Mexico Home Entertainment Devices Market by Mode Of Connectivity, 2023 - 2030, USD Million

- TABLE 263 Mexico Home Entertainment Devices Market by Mode Of Connectivity, 2019 - 2022, Thousand Units

- TABLE 264 Mexico Home Entertainment Devices Market by Mode Of Connectivity, 2023 - 2030, Thousand Units

- TABLE 265 Mexico Home Entertainment Devices Market by Type, 2019 - 2022, USD Million

- TABLE 266 Mexico Home Entertainment Devices Market by Type, 2023 - 2030, USD Million

- TABLE 267 Mexico Home Entertainment Devices Market by Type, 2019 - 2022, Thousand Units

- TABLE 268 Mexico Home Entertainment Devices Market by Type, 2023 - 2030, Thousand Units

- TABLE 269 Mexico Home Entertainment Devices Market by Video Devices Type, 2019 - 2022, USD Million

- TABLE 270 Mexico Home Entertainment Devices Market by Video Devices Type, 2023 - 2030, USD Million

- TABLE 271 Mexico Home Entertainment Devices Market by Video Devices Type, 2019 - 2022, Thousand Units

- TABLE 272 Mexico Home Entertainment Devices Market by Video Devices Type, 2023 - 2030, Thousand Units

- TABLE 273 Mexico Home Entertainment Devices Market by Audio Devices Type, 2019 - 2022, USD Million

- TABLE 274 Mexico Home Entertainment Devices Market by Audio Devices Type, 2023 - 2030, USD Million

- TABLE 275 Mexico Home Entertainment Devices Market by Audio Devices Type, 2019 - 2022, Thousand Units

- TABLE 276 Mexico Home Entertainment Devices Market by Audio Devices Type, 2023 - 2030, Thousand Units

- TABLE 277 Rest of North America Home Entertainment Devices Market, 2019 - 2022, USD Million

- TABLE 278 Rest of North America Home Entertainment Devices Market, 2023 - 2030, USD Million

- TABLE 279 Rest of North America Home Entertainment Devices Market, 2019 - 2022, Thousand Units

- TABLE 280 Rest of North America Home Entertainment Devices Market, 2023 - 2030, Thousand Units

- TABLE 281 Rest of North America Home Entertainment Devices Market by Distribution Channel, 2019 - 2022, USD Million

- TABLE 282 Rest of North America Home Entertainment Devices Market by Distribution Channel, 2023 - 2030, USD Million

- TABLE 283 Rest of North America Home Entertainment Devices Market by Distribution Channel, 2019 - 2022, Thousand Units

- TABLE 284 Rest of North America Home Entertainment Devices Market by Distribution Channel, 2023 - 2030, Thousand Units

- TABLE 285 Rest of North America Home Entertainment Devices Market by Mode Of Connectivity, 2019 - 2022, USD Million

- TABLE 286 Rest of North America Home Entertainment Devices Market by Mode Of Connectivity, 2023 - 2030, USD Million

- TABLE 287 Rest of North America Home Entertainment Devices Market by Mode Of Connectivity, 2019 - 2022, Thousand Units

- TABLE 288 Rest of North America Home Entertainment Devices Market by Mode Of Connectivity, 2023 - 2030, Thousand Units

- TABLE 289 Rest of North America Home Entertainment Devices Market by Type, 2019 - 2022, USD Million

- TABLE 290 Rest of North America Home Entertainment Devices Market by Type, 2023 - 2030, USD Million

- TABLE 291 Rest of North America Home Entertainment Devices Market by Type, 2019 - 2022, Thousand Units

- TABLE 292 Rest of North America Home Entertainment Devices Market by Type, 2023 - 2030, Thousand Units

- TABLE 293 Rest of North America Home Entertainment Devices Market by Video Devices Type, 2019 - 2022, USD Million

- TABLE 294 Rest of North America Home Entertainment Devices Market by Video Devices Type, 2023 - 2030, USD Million

- TABLE 295 Rest of North America Home Entertainment Devices Market by Video Devices Type, 2019 - 2022, Thousand Units

- TABLE 296 Rest of North America Home Entertainment Devices Market by Video Devices Type, 2023 - 2030, Thousand Units

- TABLE 297 Rest of North America Home Entertainment Devices Market by Audio Devices Type, 2019 - 2022, USD Million

- TABLE 298 Rest of North America Home Entertainment Devices Market by Audio Devices Type, 2023 - 2030, USD Million

- TABLE 299 Rest of North America Home Entertainment Devices Market by Audio Devices Type, 2019 - 2022, Thousand Units

- TABLE 300 Rest of North America Home Entertainment Devices Market by Audio Devices Type, 2023 - 2030, Thousand Units

The Global Home Entertainment Devices Market size is expected to reach $428.9 billion by 2030, rising at a market growth of 5.8% CAGR during the forecast period. In the year 2022, the market attained a volume of 5,36,540.5 thousand units experiencing a growth of 6.1% (2019-2022).

The popularity of gaming consoles, including systems like PlayStation, Xbox, and Nintendo Switch, has been a significant driver for the market. Consequently, the gaming consoles segment would account for nearly 12% of the total market share by 2030. These Gaming consoles offer immersive gaming experiences, combining high-quality graphics, advanced gameplay, and innovative features. Consumers seeking diverse and high-performance gaming have driven the sales and adoption of these consoles.

The major strategies followed by the market participants are Product Launches as the key developmental strategy to keep pace with the changing demands of end users. For instance, in October, 2023, Sony Corporation introduced Pulse Explorer wireless earbuds. The earbuds have lossless PlayStation link technology and ultra-low latency mode along with AI-powered noise cancellation. Moreover, in September,2023, LG Corporation unveiled LG MAGNIT, a Micro LED residential display. The display comes in a 118-inch size and has a 0.6 mm 4K resolution.

Based on the Analysis presented in the KBV Cardinal matrix; Apple, Inc. and Microsoft Corporation are the forerunners in the Market. In June, 2023, Apple, Inc. announced the launch of Apple Vision Pro, a spatial computer that smoothly integrates digital content with the physical world. The Vision Pro makes a three-dimensional user interface that can be controlled by eyes, hands, and voice. Companies such as Samsung Electronics Co., Ltd., LG Corporation and Sony Corporation are some of the key innovators in Market.

Market Growth Factors

Rise of streaming services worldwide

Streaming services offer a vast library of on-demand content, allowing consumers to conveniently watch movies, TV shows, documentaries, and original programming. Installing streaming apps directly into smart TVs has become a standard feature. Smart TVs provide a seamless experience, allowing users to access popular streaming services without additional devices. The convenience of having these apps built into the TV contributes to the popularity of smart TVs. Furthermore, the demand for better picture quality has led to increased adoption of 4K Ultra HD and High Dynamic Range (HDR) technologies. Smart TVs and streaming devices with these capabilities offer sharper images, vibrant colors, and improved contrast, enhancing the overall viewing experience. These aspects will boost the demand for these devices in the coming years.

Increasing demand for high-quality audio-visual experiences

Consumers are showing a strong preference for high-resolution displays, such as 4K and 8K technologies. These advancements in display technology have transformed the visual experience by offering superior image quality, sharper details, and more vibrant colors. The demand for larger screens with higher resolutions has been a significant factor propelling the demand for televisions, monitors, and display screens. Moreover, the demand for big-screen televisions and high-definition monitors has steadily risen. Bigger screens offer a more immersive viewing experience, especially with higher resolutions, contributing to market growth. These aspects will propel the demand for these devices in the coming years.

Market Restraining Factors

High market saturation and competition

Larger, established brands often hold a significant market share, benefiting from consumer trust and recognition. This can make it difficult for newer or lesser-known brands to compete effectively. Many consumers tend to stick with brands they trust, making it challenging for new entrants to attract and retain customers who are already loyal to established brands. Additionally, access to retail channels and distribution networks can challenge newer companies. Established brands often have strong relationships with retailers, making it difficult for new entrants to secure prime shelf space or online visibility. Hence, these factors can reduce the demand in the market.

Distribution Channel Outlook

On the basis of distribution channel, the market is segmented into offline and online. In 2022, the online segment witnessed a substantial revenue share in the market. Consumers increasingly prefer the convenience of accessing content online, anytime and anywhere, contributing to the expansion of the online home entertainment sector. This trend is further fueled by the proliferation of high-speed internet connectivity, the availability of smart devices, and the growing popularity of smart TVs. These factors will boost the demand in the segment.

Mode of Connectivity Outlook

On the basis of mode of connectivity, the market is divided into wireless and wired. In 2022, the wireless segment witnessed a substantial revenue share in the market. Wireless technology offers unparalleled convenience, allowing users to connect devices without the constraints of cables. This has led to the increased adoption of wireless speakers, headphones, and sound systems, providing users with flexibility in their home entertainment setup and enabling them to enjoy high-quality audio without the limitations of physical connections. Owing to these aspects, the segment will witness increased demand in the future.

Type Outlook

Based on type, the market is segmented into video devices, audio devices, and gaming consoles. In 2022, the audio devices segment garnered a significant revenue share in the market. The development of advanced sound technologies, such as Dolby Atmos, DTS:X, and other immersive audio formats, has significantly enhanced the quality of sound reproduction. These systems provide users with an immersive cinematic experience by delivering high-quality sound, making them a sought-after addition to home entertainment setups. These aspects will pose lucrative growth prospects for the segment.

Regional Outlook

By region, the market is segmented into North America, Europe, Asia Pacific, and LAMEA. In 2022, the Asia Pacific segment acquired the highest revenue share in the market. The region has embraced technological advancements swiftly. Consumers in Asia Pacific countries are willing to adopt the latest innovations in the home entertainment segment. Gaming has gained substantial popularity in the Asia Pacific region. Countries like Japan, China, and South Korea have a strong gaming culture, and the demand for gaming consoles and accessories has surged. These factors will pose lucrative growth prospects for the segment.

The market research report covers the analysis of key stake holders of the market. Key companies profiled in the report include Samsung Electronics Co., Ltd. (Samsung Group), LG Corporation, Sony Corporation, Toshiba Corporation, Apple, Inc., Panasonic Holdings Corporation, Microsoft Corporation, Koninklijke Philips N.V., Bose Corporation and Mitsubishi Electric Corporation

Recent Strategies Deployed in Home Entertainment Devices Market

Product Launches and Product Expansions:

Oct-2023: Sony Corporation introduced Pulse Explorer wireless earbuds. The earbuds have lossless PlayStation link technology and ultra-low latency mode along with AI-powered noise cancellation.

Oct-2023: Microsoft Corporation released Surface Laptop Go 3, a portable surface laptop. The laptop comes with an Intel Core i5 processor, 16GB RAM, and 256GB of storage space.

Sep-2023: LG Corporation unveiled LG MAGNIT, a Micro LED residential display. The display comes in a 118-inch size and has a 0.6 mm 4K resolution.

Sep-2023: Toshiba Corporation introduced the Toshiba Z870 TV. The TV features a 144Hz Mini LED 4K display and REGZA Engine ZRi for providing an enhanced display output. Additionally, the TV has REGZA Bass Woofer Pro and ZR 2.1.2 Surround Sound System for delivering an unmatched audio experience.

Aug-2023: Koninklijke Philips N.V. announced the launch of the Philips TAB7007 soundbar. The soundbar comes with a 2.1-channel wireless subwoofer for a multidimensional audio experience and two front-firing speakers for providing a surround sound effect.

Jul-2023: LG Corporation announced the launch of and LG TONE Fit TF7 earbuds. The earbuds are IP67 rated and as such, are resistant to dust, sweat, and rain which facilitates the users to use them in any condition. Additionally, the earbuds have Active Noise Cancellation (ANC) technology for quality sound isolation.

Jul-2023: Toshiba Corporation released the M650 TV. The TV features Mini LED technology powered by REGZA Engine ZR used for delivering an enhanced viewing experience. Additionally, it has a Dolby Atmos-powered dedicated subwoofer for delivering a three-dimensional sound experience.

Jun-2023: Apple, Inc. announced the launch of Apple Vision Pro, a spatial computer that smoothly integrates digital content with the physical world. The Vision Pro makes a three-dimensional user interface that can be controlled by eyes, hands, and voice. It features a vision spatial operating system to deliver a seamless interaction experience.

May-2023: Samsung Electronics Co., Ltd. released M8 and M7 customizable smart monitors. The monitors feature an 11.39mm back thickness and height-adjustable stand to allow users to orient the view according to their preference.

May-2023: Panasonic Holdings Corporation released Panasonic Google TV. The TVs come in screen sizes of 32-inch, 43-inch, 55-inch, 65-inch, and 75-inch and are powered by 4K Colour Engine, Hexa Chrome, and Accuview Display for enhanced viewing experience.

Mar-2023: Sony Corporation unveiled the BRAVIA XR TV Lineup. The TVs in the lineup include X90L Full Array LED, X95L and X93L Mini LED, A80L OLED, and A95L QD-OLED. All the TVs in the lineup feature a Cognitive Processor XR, which provides unmatched display quality, and an Acoustic Center Sync that syncs the TV audio with the center channel of a compatible Sony soundbar creating an immersive homelike experience for the users.

Jan-2023: Apple, Inc. introduced HomePod portable smart speaker. The speaker comes with recent Apple innovations and Siri intelligence for an unmatched listening experience.

Oct-2022: Apple, Inc. introduced Apple TV 4K. The TV is powered by Apple's A15 Bionic chip for delivering a better gameplay experience. Additionally, the TV comes in two configurations Apple TV 4K (Wi-Fi) and Apple TV 4K (Wi-Fi + Ethernet).

Jan-2022: Samsung Electronics Co., Ltd. released The Freestyle, a portable projector, ambient lighting, and smart speaker device. The device features 180-degree rotational capabilities that allow users to view videos anywhere.

Oct-2021: Bose Corporation released SoundLink Flex portable speakers. The speaker features an ultra-rugged that makes it ideal for hiking applications and has Bose PositionIQ technology for detecting the speaker position. Additionally, it has a 12-hour long playtime.

Jul-2021: Sony Corporation announced the launch of the Alpha ZV-E10 camera. The camera features a 24.2-megapixel APS-C Exmor CMOS sensor along with a BIONZ X image processing engine for producing high-quality imagery. The camera is specifically designed for creators.

Jul-2021: Panasonic Holdings Corporation announced the launch of the JX and JS series of Android TVs. The sizes within the series range from 32 to 65 inches. Some features of the TVs include a bezel-less design, Accuview Display, and Hexa Chroma Drive.

Mergers & Acquisition:

Jan-2022: Microsoft Corporation took over Activision Blizzard Inc., a US-based game developer. The acquisition strengthens Microsoft's gaming business.

Feb-2021: HARMAN International, a subsidiary of Samsung Electronics Co., Ltd., acquired Savari, Inc., an automotive technology company. The acquisition enhances HARMAN's automotive telematics capabilities and strengthens the company's foothold in smart infrastructure solutions.

Jan-2021: LG Corporation took over Alphonso, a TV data analysis startup based in the United States. The acquisition enhances LG's TV software capabilities in the TV business.

Partnerships, Collaborations & Agreements:

Jun-2023: Sony Corporation signed a partnership with Zoom Video Communications Inc., to integrate Zoom meetings into its BRAVIA TV brand. As a result of the partnership, the customers would be able to experience more realistic video communications on a large TV screen.

Oct-2022: Samsung Electronics Co., Ltd. came into partnership with Google, an American technology company, to develop multi-system connection solutions for smart home devices. The partnership would facilitate smart home device owners to use their devices across different ecosystems.

Geographical Expansions:

Oct-2023: Apple, Inc. announced the launch of the Apple Store in the Chilean market. The move comes in line with Apple's growth strategy.

Scope of the Study

Market Segments covered in the Report:

By Distribution Channel (Volume, Thousand Units, Revenue, USD Billion/Million, 2019-30)

- Offline

- Online

By Mode Of Connectivity (Volume, Thousand Units, Revenue, USD Billion/Million, 2019-30)

- Wired

- Wireless

By Type (Volume, Thousand Units, Revenue, USD Billion/Million, 2019-30)

- Video Devices

- Televisions

- Projectors

- Blue-ray & DVD Players

- Digital Video Recorders

- Others

- Audio Devices

- Home Theatre in box

- Sound Bars

- Audio Players

- Headphones

- Home Radios

- Others

- Gaming Consoles

By Geography (Volume, Thousand Units, Revenue, USD Billion/Million, 2019-30)

- North America

- US

- Canada

- Mexico

- Rest of North America

- Europe

- Germany

- UK

- France

- Russia

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Singapore

- Malaysia

- Rest of Asia Pacific

- LAMEA

- Brazil

- Argentina

- UAE

- Saudi Arabia

- South Africa

- Nigeria

- Rest of LAMEA

Companies Profiled

- Samsung Electronics Co., Ltd. (Samsung Group)

- LG Corporation

- Sony Corporation

- Toshiba Corporation

- Apple, Inc.

- Panasonic Holdings Corporation

- Microsoft Corporation

- Koninklijke Philips N.V.

- Bose Corporation

- Mitsubishi Electric Corporation

Unique Offerings from KBV Research

- Exhaustive coverage

- Highest number of market tables and figures

- Subscription based model available

- Guaranteed best price

- Assured post sales research support with 10% customization free

Table of Contents

Chapter 1. Market Scope & Methodology

- 1.1 Market Definition

- 1.2 Objectives

- 1.3 Market Scope

- 1.4 Segmentation

- 1.4.1 Global Home Entertainment Devices Market, by Distribution Channel

- 1.4.2 Global Home Entertainment Devices Market, by Mode Of Connectivity

- 1.4.3 Global Home Entertainment Devices Market, by Type

- 1.4.4 Global Home Entertainment Devices Market, by Geography

- 1.5 Methodology for the research

Chapter 2. Market at a Glance

- 2.1 Key Highlights

Chapter 3. Market Overview

- 3.1 Introduction

- 3.1.1 Overview

- 3.1.1.1 Market Composition and Scenario

- 3.1.1 Overview

- 3.2 Key Factors Impacting the Market

- 3.2.1 Market Drivers

- 3.2.2 Market Restraints

Chapter 4. Competition Analysis - Global

- 4.1 KBV Cardinal Matrix

- 4.2 Recent Industry Wide Strategic Developments

- 4.2.1 Partnerships, Collaborations and Agreements

- 4.2.2 Product Launches and Product Expansions

- 4.2.3 Acquisition and Mergers

- 4.2.4 Geographical Expansions

- 4.3 Top Winning Strategies

- 4.3.1 Key Leading Strategies: Percentage Distribution (2019-2023)

- 4.3.2 Key Strategic Move: (Product Launches and Product Expansions: 2021, Jul - 2023, Oct) Leading Players

- 4.4 Porter Five Forces Analysis

Chapter 5. Global Home Entertainment Devices Market by Distribution Channel

- 5.1 Global Offline Market by Region

- 5.2 Global Online Market by Region

Chapter 6. Global Home Entertainment Devices Market by Mode Of Connectivity

- 6.1 Global Wired Market by Region

- 6.2 Global Wireless Market by Region

Chapter 7. Global Home Entertainment Devices Market by Type

- 7.1 Global Video Devices Market by Region

- 7.2 Global Home Entertainment Devices Market by Video Devices Type

- 7.2.1 Global Televisions Market by Region

- 7.2.2 Global Projectors Market by Region

- 7.2.3 Global Blue-ray & DVD Players Market by Region

- 7.2.4 Global Digital Video Recorders Market by Region

- 7.2.5 Global Others Market by Region

- 7.3 Global Audio Devices Market by Region

- 7.4 Global Home Entertainment Devices Market by Audio Devices Type

- 7.4.1 Global Home Theatre in box Market by Region

- 7.4.2 Global Sound Bars Market by Region

- 7.4.3 Global Audio Players Market by Region

- 7.4.4 Global Headphones Market by Region

- 7.4.5 Global Home Radios Market by Region

- 7.4.6 Global Others Market by Region

- 7.5 Global Gaming Consoles Market by Region

Chapter 8. Global Home Entertainment Devices Market by Region

- 8.1 North America Home Entertainment Devices Market

- 8.1.1 North America Home Entertainment Devices Market by Distribution Channel

- 8.1.1.1 North America Offline Market by Region

- 8.1.1.2 North America Online Market by Region

- 8.1.2 North America Home Entertainment Devices Market by Mode Of Connectivity

- 8.1.2.1 North America Wired Market by Region

- 8.1.2.2 North America Wireless Market by Region

- 8.1.3 North America Home Entertainment Devices Market by Type

- 8.1.3.1 North America Video Devices Market by Country

- 8.1.3.2 North America Home Entertainment Devices Market by Video Devices Type

- 8.1.3.2.1 North America Televisions Market by Country

- 8.1.3.2.2 North America Projectors Market by Country

- 8.1.3.2.3 North America Blue-ray & DVD Players Market by Country

- 8.1.3.2.4 North America Digital Video Recorders Market by Country

- 8.1.3.2.5 North America Others Market by Country

- 8.1.3.3 North America Audio Devices Market by Country

- 8.1.3.4 North America Home Entertainment Devices Market by Audio Devices Type

- 8.1.3.4.1 North America Home Theatre in box Market by Country

- 8.1.3.4.2 North America Sound Bars Market by Country

- 8.1.3.4.3 North America Audio Players Market by Country

- 8.1.3.4.4 North America Headphones Market by Country

- 8.1.3.4.5 North America Home Radios Market by Country

- 8.1.3.4.6 North America Others Market by Country

- 8.1.3.5 North America Gaming Consoles Market by Country

- 8.1.4 North America Home Entertainment Devices Market by Country

- 8.1.4.1 US Home Entertainment Devices Market

- 8.1.4.1.1 US Home Entertainment Devices Market by Distribution Channel

- 8.1.4.1.2 US Home Entertainment Devices Market by Mode Of Connectivity

- 8.1.4.1.3 US Home Entertainment Devices Market by Type

- 8.1.4.2 Canada Home Entertainment Devices Market

- 8.1.4.2.1 Canada Home Entertainment Devices Market by Distribution Channel

- 8.1.4.2.2 Canada Home Entertainment Devices Market by Mode Of Connectivity

- 8.1.4.2.3 Canada Home Entertainment Devices Market by Type

- 8.1.4.3 Mexico Home Entertainment Devices Market

- 8.1.4.3.1 Mexico Home Entertainment Devices Market by Distribution Channel

- 8.1.4.3.2 Mexico Home Entertainment Devices Market by Mode Of Connectivity

- 8.1.4.3.3 Mexico Home Entertainment Devices Market by Type

- 8.1.4.4 Rest of North America Home Entertainment Devices Market

- 8.1.4.4.1 Rest of North America Home Entertainment Devices Market by Distribution Channel

- 8.1.4.4.2 Rest of North America Home Entertainment Devices Market by Mode Of Connectivity

- 8.1.4.4.3 Rest of North America Home Entertainment Devices Market by Type

- 8.1.4.1 US Home Entertainment Devices Market

- 8.1.1 North America Home Entertainment Devices Market by Distribution Channel

- 8.2 Europe Home Entertainment Devices Market

- 8.2.1 Europe Home Entertainment Devices Market by Distribution Channel

- 8.2.1.1 Europe Offline Market by Country

- 8.2.1.2 Europe Online Market by Country

- 8.2.2 Europe Home Entertainment Devices Market by Mode Of Connectivity

- 8.2.2.1 Europe Wired Market by Country

- 8.2.2.2 Europe Wireless Market by Country

- 8.2.3 Europe Home Entertainment Devices Market by Type

- 8.2.3.1 Europe Video Devices Market by Country

- 8.2.3.2 Europe Home Entertainment Devices Market by Video Devices Type

- 8.2.3.2.1 Europe Televisions Market by Country

- 8.2.3.2.2 Europe Projectors Market by Country

- 8.2.3.2.3 Europe Blue-ray & DVD Players Market by Country

- 8.2.3.2.4 Europe Digital Video Recorders Market by Country

- 8.2.3.2.5 Europe Others Market by Country

- 8.2.3.3 Europe Audio Devices Market by Country

- 8.2.3.4 Europe Home Entertainment Devices Market by Audio Devices Type

- 8.2.3.4.1 Europe Home Theatre in box Market by Country

- 8.2.3.4.2 Europe Sound Bars Market by Country

- 8.2.3.4.3 Europe Audio Players Market by Country

- 8.2.3.4.4 Europe Headphones Market by Country

- 8.2.3.4.5 Europe Home Radios Market by Country

- 8.2.3.4.6 Europe Others Market by Country

- 8.2.3.5 Europe Gaming Consoles Market by Country

- 8.2.4 Europe Home Entertainment Devices Market by Country

- 8.2.4.1 Germany Home Entertainment Devices Market

- 8.2.4.1.1 Germany Home Entertainment Devices Market by Distribution Channel

- 8.2.4.1.2 Germany Home Entertainment Devices Market by Mode Of Connectivity

- 8.2.4.1.3 Germany Home Entertainment Devices Market by Type

- 8.2.4.2 UK Home Entertainment Devices Market

- 8.2.4.2.1 UK Home Entertainment Devices Market by Distribution Channel

- 8.2.4.2.2 UK Home Entertainment Devices Market by Mode Of Connectivity

- 8.2.4.2.3 UK Home Entertainment Devices Market by Type

- 8.2.4.3 France Home Entertainment Devices Market

- 8.2.4.3.1 France Home Entertainment Devices Market by Distribution Channel

- 8.2.4.3.2 France Home Entertainment Devices Market by Mode Of Connectivity

- 8.2.4.3.3 France Home Entertainment Devices Market by Type

- 8.2.4.4 Russia Home Entertainment Devices Market

- 8.2.4.4.1 Russia Home Entertainment Devices Market by Distribution Channel

- 8.2.4.4.2 Russia Home Entertainment Devices Market by Mode Of Connectivity

- 8.2.4.4.3 Russia Home Entertainment Devices Market by Type

- 8.2.4.5 Spain Home Entertainment Devices Market

- 8.2.4.5.1 Spain Home Entertainment Devices Market by Distribution Channel

- 8.2.4.5.2 Spain Home Entertainment Devices Market by Mode Of Connectivity

- 8.2.4.5.3 Spain Home Entertainment Devices Market by Type

- 8.2.4.6 Italy Home Entertainment Devices Market

- 8.2.4.6.1 Italy Home Entertainment Devices Market by Distribution Channel

- 8.2.4.6.2 Italy Home Entertainment Devices Market by Mode Of Connectivity

- 8.2.4.6.3 Italy Home Entertainment Devices Market by Type

- 8.2.4.7 Rest of Europe Home Entertainment Devices Market

- 8.2.4.7.1 Rest of Europe Home Entertainment Devices Market by Distribution Channel

- 8.2.4.7.2 Rest of Europe Home Entertainment Devices Market by Mode Of Connectivity

- 8.2.4.7.3 Rest of Europe Home Entertainment Devices Market by Type

- 8.2.4.1 Germany Home Entertainment Devices Market

- 8.2.1 Europe Home Entertainment Devices Market by Distribution Channel

- 8.3 Asia Pacific Home Entertainment Devices Market

- 8.3.1 Asia Pacific Home Entertainment Devices Market by Distribution Channel

- 8.3.1.1 Asia Pacific Offline Market by Country

- 8.3.1.2 Asia Pacific Online Market by Country

- 8.3.2 Asia Pacific Home Entertainment Devices Market by Mode Of Connectivity

- 8.3.2.1 Asia Pacific Wired Market by Country

- 8.3.2.2 Asia Pacific Wireless Market by Country

- 8.3.3 Asia Pacific Home Entertainment Devices Market by Type

- 8.3.3.1 Asia Pacific Video Devices Market by Country

- 8.3.3.2 Asia Pacific Home Entertainment Devices Market by Video Devices Type

- 8.3.3.2.1 Asia Pacific Televisions Market by Country

- 8.3.3.2.2 Asia Pacific Projectors Market by Country

- 8.3.3.2.3 Asia Pacific Blue-ray & DVD Players Market by Country

- 8.3.3.2.4 Asia Pacific Digital Video Recorders Market by Country

- 8.3.3.2.5 Asia Pacific Others Market by Country

- 8.3.3.3 Asia Pacific Audio Devices Market by Country

- 8.3.3.4 Asia Pacific Home Entertainment Devices Market by Audio Devices Type

- 8.3.3.4.1 Asia Pacific Home Theatre in box Market by Country

- 8.3.3.4.2 Asia Pacific Sound Bars Market by Country

- 8.3.3.4.3 Asia Pacific Audio Players Market by Country

- 8.3.3.4.4 Asia Pacific Headphones Market by Country

- 8.3.3.4.5 Asia Pacific Home Radios Market by Country

- 8.3.3.4.6 Asia Pacific Others Market by Country

- 8.3.3.5 Asia Pacific Gaming Consoles Market by Country

- 8.3.4 Asia Pacific Home Entertainment Devices Market by Country

- 8.3.4.1 China Home Entertainment Devices Market

- 8.3.4.1.1 China Home Entertainment Devices Market by Distribution Channel

- 8.3.4.1.2 China Home Entertainment Devices Market by Mode Of Connectivity

- 8.3.4.1.3 China Home Entertainment Devices Market by Type

- 8.3.4.2 Japan Home Entertainment Devices Market

- 8.3.4.2.1 Japan Home Entertainment Devices Market by Distribution Channel

- 8.3.4.2.2 Japan Home Entertainment Devices Market by Mode Of Connectivity

- 8.3.4.2.3 Japan Home Entertainment Devices Market by Type

- 8.3.4.3 India Home Entertainment Devices Market

- 8.3.4.3.1 India Home Entertainment Devices Market by Distribution Channel

- 8.3.4.3.2 India Home Entertainment Devices Market by Mode Of Connectivity

- 8.3.4.3.3 India Home Entertainment Devices Market by Type

- 8.3.4.4 South Korea Home Entertainment Devices Market

- 8.3.4.4.1 South Korea Home Entertainment Devices Market by Distribution Channel

- 8.3.4.4.2 South Korea Home Entertainment Devices Market by Mode Of Connectivity

- 8.3.4.4.3 South Korea Home Entertainment Devices Market by Type

- 8.3.4.5 Singapore Home Entertainment Devices Market

- 8.3.4.5.1 Singapore Home Entertainment Devices Market by Distribution Channel

- 8.3.4.5.2 Singapore Home Entertainment Devices Market by Mode Of Connectivity

- 8.3.4.5.3 Singapore Home Entertainment Devices Market by Type

- 8.3.4.6 Malaysia Home Entertainment Devices Market

- 8.3.4.6.1 Malaysia Home Entertainment Devices Market by Distribution Channel

- 8.3.4.6.2 Malaysia Home Entertainment Devices Market by Mode Of Connectivity

- 8.3.4.6.3 Malaysia Home Entertainment Devices Market by Type

- 8.3.4.7 Rest of Asia Pacific Home Entertainment Devices Market

- 8.3.4.7.1 Rest of Asia Pacific Home Entertainment Devices Market by Distribution Channel

- 8.3.4.7.2 Rest of Asia Pacific Home Entertainment Devices Market by Mode Of Connectivity

- 8.3.4.7.3 Rest of Asia Pacific Home Entertainment Devices Market by Type

- 8.3.4.1 China Home Entertainment Devices Market

- 8.3.1 Asia Pacific Home Entertainment Devices Market by Distribution Channel

- 8.4 LAMEA Home Entertainment Devices Market

- 8.4.1 LAMEA Home Entertainment Devices Market by Distribution Channel

- 8.4.1.1 LAMEA Offline Market by Country

- 8.4.1.2 LAMEA Online Market by Country

- 8.4.2 LAMEA Home Entertainment Devices Market by Mode Of Connectivity

- 8.4.2.1 LAMEA Wired Market by Country

- 8.4.2.2 LAMEA Wireless Market by Country

- 8.4.3 LAMEA Home Entertainment Devices Market by Type

- 8.4.3.1 LAMEA Video Devices Market by Country

- 8.4.3.2 LAMEA Home Entertainment Devices Market by Video Devices Type

- 8.4.3.2.1 LAMEA Televisions Market by Country

- 8.4.3.2.2 LAMEA Projectors Market by Country

- 8.4.3.2.3 LAMEA Blue-ray & DVD Players Market by Country

- 8.4.3.2.4 LAMEA Digital Video Recorders Market by Country

- 8.4.3.2.5 LAMEA Others Market by Country

- 8.4.3.3 LAMEA Audio Devices Market by Country

- 8.4.3.4 LAMEA Home Entertainment Devices Market by Audio Devices Type

- 8.4.3.4.1 LAMEA Home Theatre in box Market by Country

- 8.4.3.4.2 LAMEA Sound Bars Market by Country

- 8.4.3.4.3 LAMEA Audio Players Market by Country

- 8.4.3.4.4 LAMEA Headphones Market by Country

- 8.4.3.4.5 LAMEA Home Radios Market by Country

- 8.4.3.4.6 LAMEA Others Market by Country

- 8.4.3.5 LAMEA Gaming Consoles Market by Country

- 8.4.4 LAMEA Home Entertainment Devices Market by Country

- 8.4.4.1 Brazil Home Entertainment Devices Market

- 8.4.4.1.1 Brazil Home Entertainment Devices Market by Distribution Channel

- 8.4.4.1.2 Brazil Home Entertainment Devices Market by Mode Of Connectivity

- 8.4.4.1.3 Brazil Home Entertainment Devices Market by Type

- 8.4.4.2 Argentina Home Entertainment Devices Market

- 8.4.4.2.1 Argentina Home Entertainment Devices Market by Distribution Channel

- 8.4.4.2.2 Argentina Home Entertainment Devices Market by Mode Of Connectivity

- 8.4.4.2.3 Argentina Home Entertainment Devices Market by Type

- 8.4.4.3 UAE Home Entertainment Devices Market

- 8.4.4.3.1 UAE Home Entertainment Devices Market by Distribution Channel

- 8.4.4.3.2 UAE Home Entertainment Devices Market by Mode Of Connectivity

- 8.4.4.3.3 UAE Home Entertainment Devices Market by Type

- 8.4.4.4 Saudi Arabia Home Entertainment Devices Market

- 8.4.4.4.1 Saudi Arabia Home Entertainment Devices Market by Distribution Channel

- 8.4.4.4.2 Saudi Arabia Home Entertainment Devices Market by Mode Of Connectivity

- 8.4.4.4.3 Saudi Arabia Home Entertainment Devices Market by Type

- 8.4.4.5 South Africa Home Entertainment Devices Market

- 8.4.4.5.1 South Africa Home Entertainment Devices Market by Distribution Channel

- 8.4.4.5.2 South Africa Home Entertainment Devices Market by Mode Of Connectivity

- 8.4.4.5.3 South Africa Home Entertainment Devices Market by Type

- 8.4.4.6 Nigeria Home Entertainment Devices Market

- 8.4.4.6.1 Nigeria Home Entertainment Devices Market by Distribution Channel

- 8.4.4.6.2 Nigeria Home Entertainment Devices Market by Mode Of Connectivity

- 8.4.4.6.3 Nigeria Home Entertainment Devices Market by Type

- 8.4.4.7 Rest of LAMEA Home Entertainment Devices Market

- 8.4.4.7.1 Rest of LAMEA Home Entertainment Devices Market by Distribution Channel

- 8.4.4.7.2 Rest of LAMEA Home Entertainment Devices Market by Mode Of Connectivity

- 8.4.4.7.3 Rest of LAMEA Home Entertainment Devices Market by Type

- 8.4.4.1 Brazil Home Entertainment Devices Market

- 8.4.1 LAMEA Home Entertainment Devices Market by Distribution Channel

Chapter 9. Company Profiles

- 9.1 Samsung Electronics Co., Ltd. (Samsung Group)

- 9.1.1 Company Overview

- 9.1.2 Financial Analysis

- 9.1.3 Segmental and Regional Analysis

- 9.1.4 Recent strategies and developments:

- 9.1.4.1 Partnerships, Collaborations, and Agreements:

- 9.1.4.2 Product Launches and Product Expansions:

- 9.1.4.3 Acquisition and Mergers:

- 9.1.5 SWOT Analysis

- 9.2 LG Corporation

- 9.2.1 Company Overview

- 9.2.2 Financial Analysis

- 9.2.3 Segmental and Regional Analysis

- 9.2.4 Research & Development Expenses

- 9.2.5 Recent strategies and developments:

- 9.2.5.1 Product Launches and Product Expansions:

- 9.2.5.2 Acquisition and Mergers:

- 9.2.6 SWOT Analysis

- 9.3 Sony Corporation

- 9.3.1 Company Overview

- 9.3.2 Financial Analysis

- 9.3.3 Segmental and Regional Analysis

- 9.3.4 Research & Development Expenses

- 9.3.5 Recent strategies and developments:

- 9.3.5.1 Partnerships, Collaborations, and Agreements:

- 9.3.5.2 Product Launches and Product Expansions:

- 9.3.6 SWOT Analysis

- 9.4 Toshiba Corporation

- 9.4.1 Company Overview

- 9.4.2 Financial Analysis

- 9.4.3 Segmental and Regional Analysis

- 9.4.4 Research and Development Expense

- 9.4.5 Recent strategies and developments:

- 9.4.5.1 Product Launches and Product Expansions:

- 9.4.6 SWOT Analysis

- 9.5 Apple, Inc.

- 9.5.1 Company Overview

- 9.5.2 Financial Analysis

- 9.5.3 Regional Analysis

- 9.5.4 Research & Development Expense

- 9.5.5 Recent strategies and developments:

- 9.5.5.1 Product Launches and Product Expansions:

- 9.5.5.2 Acquisition and Mergers:

- 9.5.5.3 Geographical Expansions:

- 9.5.6 SWOT Analysis

- 9.6 Panasonic Holdings Corporation

- 9.6.1 Company Overview

- 9.6.2 Financial Analysis

- 9.6.3 Segmental and Regional Analysis

- 9.6.4 Research & Development Expenses

- 9.6.5 Recent strategies and developments:

- 9.6.5.1 Product Launches and Product Expansions:

- 9.6.6 SWOT Analysis

- 9.7 Microsoft Corporation

- 9.7.1 Company Overview

- 9.7.2 Financial Analysis

- 9.7.3 Segmental and Regional Analysis

- 9.7.4 Research & Development Expenses

- 9.7.5 Recent strategies and developments:

- 9.7.5.1 Product Launches and Product Expansions:

- 9.7.5.2 Acquisition and Mergers:

- 9.7.6 SWOT Analysis

- 9.8 Koninklijke Philips N.V.

- 9.8.1 Company Overview

- 9.8.2 Financial Analysis

- 9.8.3 Segmental and Regional Analysis

- 9.8.4 Research & Development Expense

- 9.8.5 Recent strategies and developments:

- 9.8.5.1 Product Launches and Product Expansions:

- 9.8.6 SWOT Analysis

- 9.9 Bose Corporation

- 9.9.1 Company Overview

- 9.9.2 Recent strategies and developments:

- 9.9.2.1 Product Launches and Product Expansions:

- 9.9.3 SWOT Analysis

- 9.10. Mitsubishi Electric Corporation

- 9.10.1 Company Overview

- 9.10.2 Financial Analysis

- 9.10.3 Segmental and Regional Analysis

- 9.10.4 Research & Development Expense

- 9.10.5 SWOT Analysis