|

|

市場調査レポート

商品コード

1385097

マグロの世界市場規模、シェア、産業動向分析レポート:タイプ別、種別、地域別展望と予測、2023年~2030年Global Tuna Fish Market Size, Share & Industry Trends Analysis Report By Type (Canned, Fresh, and Frozen), By Species (Skipjack, Albacore, Yellowfin, Bigeye, Bluefin, and Others), By Regional Outlook and Forecast, 2023 - 2030 |

||||||

|

|||||||

| マグロの世界市場規模、シェア、産業動向分析レポート:タイプ別、種別、地域別展望と予測、2023年~2030年 |

|

出版日: 2023年10月31日

発行: KBV Research

ページ情報: 英文 301 Pages

納期: 即納可能

|

- 全表示

- 概要

- 図表

- 目次

マグロ市場規模は、予測期間中にCAGR 3.3%で成長し、2030年までに511億米ドルに達すると予測されます。2022年の市場規模は5221.4キロトンで成長率は3.7%(2019-2022年)です。

KBVカーディナルマトリックスに示された分析によると、伊藤忠商事株式会社が市場の先駆者であり、Century Pacific Foods Inc.、Dongwon Enterprises Co.Ltd.、Thai Union Group PLCなどの企業がこの市場における主要なイノベーターです。2021年5月、タイ・ユニオン・グループPLCは、魚の缶詰を製造・販売するルーゲン・フィッシュAGの残り49%の株式取得を完了しました。この戦略的な動きは、タイ・ユニオンにとって大きな付加価値となり、タイ・ユニオンのドイツ市場への献身を再確認するものとなっています。

市場成長要因

マグロのサプライチェーンにおける技術の進歩

ブロックチェーンや電子タグなどの先端技術の利用により、マグロのサプライチェーン全体のトレーサビリティが向上しました。これにより、漁業者から消費者に至る利害関係者が購入するマグロの原産地を追跡できるようになっています。マグロの漁獲から食卓に上るまでの行程を追跡できるようになったことで、透明性が確保され、違法・無報告・無規制(IUU)漁業の撲滅に役立ちます。漁具や漁法における技術革新は、漁業がより持続可能な漁法を採用することを可能にしました。これには混獲を減らし、非対象種への影響を最小限に抑える選択的漁法の開発も含まれます。まとめると、技術の進歩は市場に大きな好影響を与えています。

可処分所得の増加と都市化

可処分所得が増加するにつれて、消費者の消費力が顕著に高まり、個人の食生活の選択肢が多様化します。このような背景のもと、高級で高品質なまぐろ製品を入手しやすくなったことで、まぐろ製品に対する需要が大幅に増加します。人口の増加に伴う都市部の変貌は、多様な食の嗜好や食体験が受け入れられる環境づくりに貢献しています。マグロは多様な料理への応用が可能であるため、都市住民の間で人気の選択肢となっています。こうした要因が市場の成長を後押ししています。

市場抑制要因

混獲と持続不可能な漁法に関する規制

混獲とは、マグロ漁の際に非対象種が意図せず捕獲されることを指し、巻き網や延縄など特定の漁法が原因となることが多いです。この問題は漁業にいくつかの課題を突きつけています。混獲の多発は環境破壊につながります。サメ、ウミガメ、イルカなどの非対象種が漁具に絡まり、傷害や死亡に至ることがあります。これらの種は海洋のバランスにとって重要な生態学的役割を担っていることが多いため、これは海洋生態系と生物多様性に影響を及ぼします。今後数年間は、こうした要因が市場の成長を阻害すると予想されます。

タイプ別展望

タイプ別に見ると、市場は缶詰、生鮮、冷凍に区分されます。2022年の市場では生鮮部門が大きな売上シェアを占めています。生鮮マグロは缶詰マグロに比べ、よりしっかりとした風味と硬めの食感が特徴です。その味と食感は、魚の独特の特徴を好む人々に好まれます。生鮮マグロを選ぶ際、消費者は地元産や持続可能な方法で調達されたものを選ぶことができ、責任ある水産物消費に貢献します。生鮮まぐろは焼く、炙る、炙る、焼くなど、好みの焼き加減で調理できるため、幅広い料理への応用が可能です。

種の展望

種によって、市場はカツオ、ビンナガ、キハダ、メバチ、クロマグロ、その他に分けられます。カツオセグメントは2022年の市場で最も高い売上シェアを獲得しました。良質なタンパク質はカツオに豊富に含まれています。タンパク質は一般的な成長、筋肉増強、組織修復に必要です。アスリートやボディビルダーなど、たんぱく質の摂取量を増やしたいと考えている人には理想的な食品です。カツオは汎用性が高く、サラダ、サンドイッチ、寿司、パスタなど、さまざまな料理に使用できます。カツオの缶詰は、手早く簡単に食事の準備ができるパントリーの主食として便利です。

地域別展望

地域別では、北米、欧州、アジア太平洋地域、ラテンアメリカ・中東・アフリカ地域で市場を分析します。アジア太平洋地域は2022年の市場成長率が顕著です。マグロのような高タンパク食品に対する需要は、人口増加と一人当たり所得の上昇により、中国やインドのような国々で急増しています。European Market Observatory for Fisheries and Aquaculture Products Report 2022によると、世界の養殖生産国トップ4はすべてアジアにあります。さらに、この地域の住民は養殖業で高収入の仕事を見つけることができます。こうした発展は、養殖セクターの成長を加速させ、市場躍進を後押しすると思われます。

目次

第1章 市場範囲と調査手法

- 市場の定義

- 目的

- 市場範囲

- セグメンテーション

- 調査手法

第2章 市場の概要

- 主なハイライト

第3章 市場概要

- イントロダクション

- 概要

- 市場構成とシナリオ

- 概要

- 市場に影響を与える主な要因

- 市場促進要因

- 市場抑制要因

第4章 競合分析- 世界

- KBV Cardinal Matrix

- 最近の業界全体の戦略的展開

- パートナーシップ、コラボレーション、および契約

- 製品の発売と製品の拡大

- 買収と合併

- 主要成功戦略

- 主な戦略

- 主要な戦略的動き

- ポーターのファイブフォース分析

第5章 世界のマグロ市場:タイプ別

- 世界の缶詰市場:地域別

- 世界の生鮮市場:地域別

- 世界の冷凍市場:地域別

第6章 世界のマグロ市場:種別

- 世界のカツオ市場:地域別

- 世界のビンナガ市場:地域別

- 世界のキハダ市場:地域別

- 世界のメバチ市場:地域別

- 世界のクロマグロ市場:地域別

- 世界のその他の市場:地域別

第7章 世界のマグロ市場:地域別

- 北米

- 北米の市場:国別

- 米国

- カナダ

- メキシコ

- その他北米地域

- 北米の市場:国別

- 欧州

- 欧州の市場:国別

- ドイツ

- 英国

- フランス

- ロシア

- スペイン

- イタリア

- その他欧州地域

- 欧州の市場:国別

- アジア太平洋

- アジア太平洋の市場:国別

- 中国

- 日本

- インド

- 韓国

- シンガポール

- マレーシア

- その他アジア太平洋地域

- アジア太平洋の市場:国別

- ラテンアメリカ・中東・アフリカ

- ラテンアメリカ・中東・アフリカの市場:国別

- ブラジル

- アルゼンチン

- アラブ首長国連邦

- サウジアラビア

- 南アフリカ

- ナイジェリア

- その他ラテンアメリカ・中東・アフリカ地域

- ラテンアメリカ・中東・アフリカの市場:国別

第8章 企業プロファイル

- Bolton Group Sr.l

- Century Pacific Food Inc

- The Jealsa Rianxeira SA.U. Group

- ITOCHU Corporation

- Thai Union Group PLC

- Dongwon Enterprises Co Ltd.

- IBL Ltd

- FC.F. Fishery Co., Ltd(Bumble Bee Foods, LLC)

- SEA DELIGHT, LLC

- High Liner Foods

第9章 市場の成功必須条件

LIST OF TABLES

- TABLE 1 Global Tuna Fish Market, 2019 - 2022, USD Million

- TABLE 2 Global Tuna Fish Market, 2023 - 2030, USD Million

- TABLE 3 Global Tuna Fish Market, 2019 - 2022, Kilo Tonnes

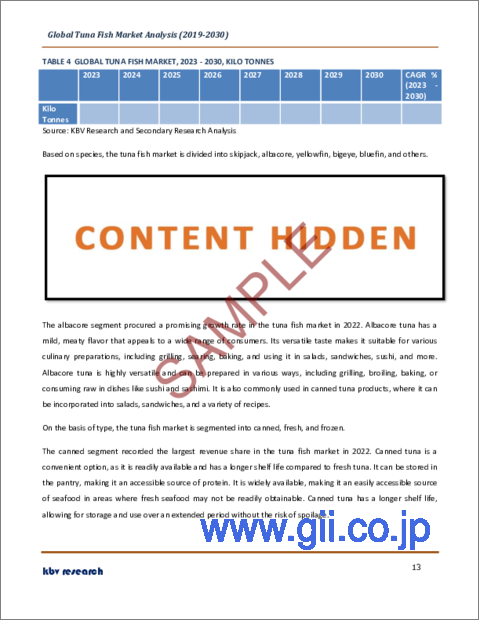

- TABLE 4 Global Tuna Fish Market, 2023 - 2030, Kilo Tonnes

- TABLE 5 Partnerships, Collaborations and Agreements- Tuna Fish Market

- TABLE 6 Product Launches And Product Expansions- Tuna Fish Market

- TABLE 7 Acquisition and Mergers- Tuna Fish Market

- TABLE 8 Global Tuna Fish Market by Type, 2019 - 2022, USD Million

- TABLE 9 Global Tuna Fish Market by Type, 2023 - 2030, USD Million

- TABLE 10 Global Tuna Fish Market by Type, 2019 - 2022, Kilo Tonnes

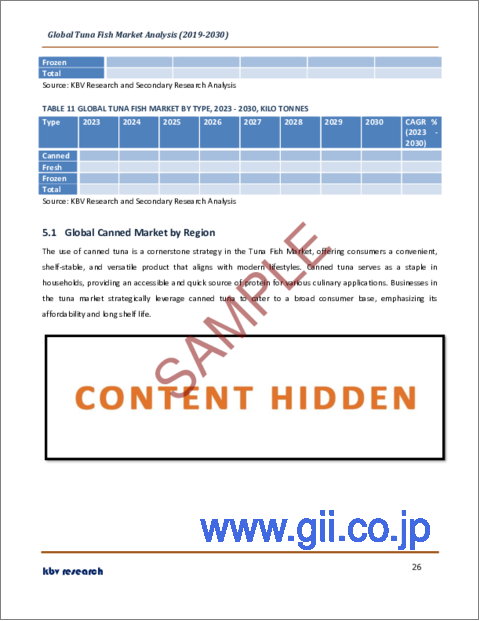

- TABLE 11 Global Tuna Fish Market by Type, 2023 - 2030, Kilo Tonnes

- TABLE 12 Global Canned Market by Region, 2019 - 2022, USD Million

- TABLE 13 Global Canned Market by Region, 2023 - 2030, USD Million

- TABLE 14 Global Canned Market by Region, 2019 - 2022, Kilo Tonnes

- TABLE 15 Global Canned Market by Region, 2023 - 2030, Kilo Tonnes

- TABLE 16 Global Fresh Market by Region, 2019 - 2022, USD Million

- TABLE 17 Global Fresh Market by Region, 2023 - 2030, USD Million

- TABLE 18 Global Fresh Market by Region, 2019 - 2022, Kilo Tonnes

- TABLE 19 Global Fresh Market by Region, 2023 - 2030, Kilo Tonnes

- TABLE 20 Global Frozen Market by Region, 2019 - 2022, USD Million

- TABLE 21 Global Frozen Market by Region, 2023 - 2030, USD Million

- TABLE 22 Global Frozen Market by Region, 2019 - 2022, Kilo Tonnes

- TABLE 23 Global Frozen Market by Region, 2023 - 2030, Kilo Tonnes

- TABLE 24 Global Tuna Fish Market by Species, 2019 - 2022, USD Million

- TABLE 25 Global Tuna Fish Market by Species, 2023 - 2030, USD Million

- TABLE 26 Global Tuna Fish Market by Species, 2019 - 2022, Kilo Tonnes

- TABLE 27 Global Tuna Fish Market by Species, 2023 - 2030, Kilo Tonnes

- TABLE 28 Global Skipjack Market by Region, 2019 - 2022, USD Million

- TABLE 29 Global Skipjack Market by Region, 2023 - 2030, USD Million

- TABLE 30 Global Skipjack Market by Region, 2019 - 2022, Kilo Tonnes

- TABLE 31 Global Skipjack Market by Region, 2023 - 2030, Kilo Tonnes

- TABLE 32 Global Albacore Market by Region, 2019 - 2022, USD Million

- TABLE 33 Global Albacore Market by Region, 2023 - 2030, USD Million

- TABLE 34 Global Albacore Market by Region, 2019 - 2022, Kilo Tonnes

- TABLE 35 Global Albacore Market by Region, 2023 - 2030, Kilo Tonnes

- TABLE 36 Global Yellowfin Market by Region, 2019 - 2022, USD Million

- TABLE 37 Global Yellowfin Market by Region, 2023 - 2030, USD Million

- TABLE 38 Global Yellowfin Market by Region, 2019 - 2022, Kilo Tonnes

- TABLE 39 Global Yellowfin Market by Region, 2023 - 2030, Kilo Tonnes

- TABLE 40 Global Bigeye Market by Region, 2019 - 2022, USD Million

- TABLE 41 Global Bigeye Market by Region, 2023 - 2030, USD Million

- TABLE 42 Global Bigeye Market by Region, 2019 - 2022, Kilo Tonnes

- TABLE 43 Global Bigeye Market by Region, 2023 - 2030, Kilo Tonnes

- TABLE 44 Global Bluefin Market by Region, 2019 - 2022, USD Million

- TABLE 45 Global Bluefin Market by Region, 2023 - 2030, USD Million

- TABLE 46 Global Bluefin Market by Region, 2019 - 2022, Kilo Tonnes

- TABLE 47 Global Bluefin Market by Region, 2023 - 2030, Kilo Tonnes

- TABLE 48 Global Others Market by Region, 2019 - 2022, USD Million

- TABLE 49 Global Others Market by Region, 2023 - 2030, USD Million

- TABLE 50 Global Others Market by Region, 2019 - 2022, Kilo Tonnes

- TABLE 51 Global Others Market by Region, 2023 - 2030, Kilo Tonnes

- TABLE 52 Global Tuna Fish Market by Region, 2019 - 2022, USD Million

- TABLE 53 Global Tuna Fish Market by Region, 2023 - 2030, USD Million

- TABLE 54 Global Tuna Fish Market by Region, 2019 - 2022, Kilo Tonnes

- TABLE 55 Global Tuna Fish Market by Region, 2023 - 2030, Kilo Tonnes

- TABLE 56 North America Tuna Fish Market, 2019 - 2022, USD Million

- TABLE 57 North America Tuna Fish Market, 2023 - 2030, USD Million

- TABLE 58 North America Tuna Fish Market, 2019 - 2022, Kilo Tonnes

- TABLE 59 North America Tuna Fish Market, 2023 - 2030, Kilo Tonnes

- TABLE 60 North America Tuna Fish Market by Type, 2019 - 2022, USD Million

- TABLE 61 North America Tuna Fish Market by Type, 2023 - 2030, USD Million

- TABLE 62 North America Tuna Fish Market by Type, 2019 - 2022, Kilo Tonnes

- TABLE 63 North America Tuna Fish Market by Type, 2023 - 2030, Kilo Tonnes

- TABLE 64 North America Canned Market by Country, 2019 - 2022, USD Million

- TABLE 65 North America Canned Market by Country, 2023 - 2030, USD Million

- TABLE 66 North America Canned Market by Country, 2019 - 2022, Kilo Tonnes

- TABLE 67 North America Canned Market by Country, 2023 - 2030, Kilo Tonnes

- TABLE 68 North America Fresh Market by Country, 2019 - 2022, USD Million

- TABLE 69 North America Fresh Market by Country, 2023 - 2030, USD Million

- TABLE 70 North America Fresh Market by Country, 2019 - 2022, Kilo Tonnes

- TABLE 71 North America Fresh Market by Country, 2023 - 2030, Kilo Tonnes

- TABLE 72 North America Frozen Market by Country, 2019 - 2022, USD Million

- TABLE 73 North America Frozen Market by Country, 2023 - 2030, USD Million

- TABLE 74 North America Frozen Market by Country, 2019 - 2022, Kilo Tonnes

- TABLE 75 North America Frozen Market by Country, 2023 - 2030, Kilo Tonnes

- TABLE 76 North America Tuna Fish Market by Species, 2019 - 2022, USD Million

- TABLE 77 North America Tuna Fish Market by Species, 2023 - 2030, USD Million

- TABLE 78 North America Tuna Fish Market by Species, 2019 - 2022, Kilo Tonnes

- TABLE 79 North America Tuna Fish Market by Species, 2023 - 2030, Kilo Tonnes

- TABLE 80 North America Skipjack Market by Country, 2019 - 2022, USD Million

- TABLE 81 North America Skipjack Market by Country, 2023 - 2030, USD Million

- TABLE 82 North America Skipjack Market by Country, 2019 - 2022, Kilo Tonnes

- TABLE 83 North America Skipjack Market by Country, 2023 - 2030, Kilo Tonnes

- TABLE 84 North America Albacore Market by Country, 2019 - 2022, USD Million

- TABLE 85 North America Albacore Market by Country, 2023 - 2030, USD Million

- TABLE 86 North America Albacore Market by Country, 2019 - 2022, Kilo Tonnes

- TABLE 87 North America Albacore Market by Country, 2023 - 2030, Kilo Tonnes

- TABLE 88 North America Yellowfin Market by Country, 2019 - 2022, USD Million

- TABLE 89 North America Yellowfin Market by Country, 2023 - 2030, USD Million

- TABLE 90 North America Yellowfin Market by Country, 2019 - 2022, Kilo Tonnes

- TABLE 91 North America Yellowfin Market by Country, 2023 - 2030, Kilo Tonnes

- TABLE 92 North America Bigeye Market by Country, 2019 - 2022, USD Million

- TABLE 93 North America Bigeye Market by Country, 2023 - 2030, USD Million

- TABLE 94 North America Bigeye Market by Country, 2019 - 2022, Kilo Tonnes

- TABLE 95 North America Bigeye Market by Country, 2023 - 2030, Kilo Tonnes

- TABLE 96 North America Bluefin Market by Country, 2019 - 2022, USD Million

- TABLE 97 North America Bluefin Market by Country, 2023 - 2030, USD Million

- TABLE 98 North America Bluefin Market by Country, 2019 - 2022, Kilo Tonnes

- TABLE 99 North America Bluefin Market by Country, 2023 - 2030, Kilo Tonnes

- TABLE 100 North America Others Market by Country, 2019 - 2022, USD Million

- TABLE 101 North America Others Market by Country, 2023 - 2030, USD Million

- TABLE 102 North America Others Market by Country, 2019 - 2022, Kilo Tonnes

- TABLE 103 North America Others Market by Country, 2023 - 2030, Kilo Tonnes

- TABLE 104 North America Tuna Fish Market by Country, 2019 - 2022, USD Million

- TABLE 105 North America Tuna Fish Market by Country, 2023 - 2030, USD Million

- TABLE 106 North America Tuna Fish Market by Country, 2019 - 2022, Kilo Tonnes

- TABLE 107 North America Tuna Fish Market by Country, 2023 - 2030, Kilo Tonnes

- TABLE 108 US Tuna Fish Market, 2019 - 2022, USD Million

- TABLE 109 US Tuna Fish Market, 2023 - 2030, USD Million

- TABLE 110 US Tuna Fish Market, 2019 - 2022, Kilo Tonnes

- TABLE 111 US Tuna Fish Market, 2023 - 2030, Kilo Tonnes

- TABLE 112 US Tuna Fish Market by Type, 2019 - 2022, USD Million

- TABLE 113 US Tuna Fish Market by Type, 2023 - 2030, USD Million

- TABLE 114 US Tuna Fish Market by Type, 2019 - 2022, Kilo Tonnes

- TABLE 115 US Tuna Fish Market by Type, 2023 - 2030, Kilo Tonnes

- TABLE 116 US Tuna Fish Market by Species, 2019 - 2022, USD Million

- TABLE 117 US Tuna Fish Market by Species, 2023 - 2030, USD Million

- TABLE 118 US Tuna Fish Market by Species, 2019 - 2022, Kilo Tonnes

- TABLE 119 US Tuna Fish Market by Species, 2023 - 2030, Kilo Tonnes

- TABLE 120 Canada Tuna Fish Market, 2019 - 2022, USD Million

- TABLE 121 Canada Tuna Fish Market, 2023 - 2030, USD Million

- TABLE 122 Canada Tuna Fish Market, 2019 - 2022, Kilo Tonnes

- TABLE 123 Canada Tuna Fish Market, 2023 - 2030, Kilo Tonnes

- TABLE 124 Canada Tuna Fish Market by Type, 2019 - 2022, USD Million

- TABLE 125 Canada Tuna Fish Market by Type, 2023 - 2030, USD Million

- TABLE 126 Canada Tuna Fish Market by Type, 2019 - 2022, Kilo Tonnes

- TABLE 127 Canada Tuna Fish Market by Type, 2023 - 2030, Kilo Tonnes

- TABLE 128 Canada Tuna Fish Market by Species, 2019 - 2022, USD Million

- TABLE 129 Canada Tuna Fish Market by Species, 2023 - 2030, USD Million

- TABLE 130 Canada Tuna Fish Market by Species, 2019 - 2022, Kilo Tonnes

- TABLE 131 Canada Tuna Fish Market by Species, 2023 - 2030, Kilo Tonnes

- TABLE 132 Mexico Tuna Fish Market, 2019 - 2022, USD Million

- TABLE 133 Mexico Tuna Fish Market, 2023 - 2030, USD Million

- TABLE 134 Mexico Tuna Fish Market, 2019 - 2022, Kilo Tonnes

- TABLE 135 Mexico Tuna Fish Market, 2023 - 2030, Kilo Tonnes

- TABLE 136 Mexico Tuna Fish Market by Type, 2019 - 2022, USD Million

- TABLE 137 Mexico Tuna Fish Market by Type, 2023 - 2030, USD Million

- TABLE 138 Mexico Tuna Fish Market by Type, 2019 - 2022, Kilo Tonnes

- TABLE 139 Mexico Tuna Fish Market by Type, 2023 - 2030, Kilo Tonnes

- TABLE 140 Mexico Tuna Fish Market by Species, 2019 - 2022, USD Million

- TABLE 141 Mexico Tuna Fish Market by Species, 2023 - 2030, USD Million

- TABLE 142 Mexico Tuna Fish Market by Species, 2019 - 2022, Kilo Tonnes

- TABLE 143 Mexico Tuna Fish Market by Species, 2023 - 2030, Kilo Tonnes

- TABLE 144 Rest of North America Tuna Fish Market, 2019 - 2022, USD Million

- TABLE 145 Rest of North America Tuna Fish Market, 2023 - 2030, USD Million

- TABLE 146 Rest of North America Tuna Fish Market, 2019 - 2022, Kilo Tonnes

- TABLE 147 Rest of North America Tuna Fish Market, 2023 - 2030, Kilo Tonnes

- TABLE 148 Rest of North America Tuna Fish Market by Type, 2019 - 2022, USD Million

- TABLE 149 Rest of North America Tuna Fish Market by Type, 2023 - 2030, USD Million

- TABLE 150 Rest of North America Tuna Fish Market by Type, 2019 - 2022, Kilo Tonnes

- TABLE 151 Rest of North America Tuna Fish Market by Type, 2023 - 2030, Kilo Tonnes

- TABLE 152 Rest of North America Tuna Fish Market by Species, 2019 - 2022, USD Million

- TABLE 153 Rest of North America Tuna Fish Market by Species, 2023 - 2030, USD Million

- TABLE 154 Rest of North America Tuna Fish Market by Species, 2019 - 2022, Kilo Tonnes

- TABLE 155 Rest of North America Tuna Fish Market by Species, 2023 - 2030, Kilo Tonnes

- TABLE 156 Europe Tuna Fish Market, 2019 - 2022, USD Million

- TABLE 157 Europe Tuna Fish Market, 2023 - 2030, USD Million

- TABLE 158 Europe Tuna Fish Market, 2019 - 2022, Kilo Tonnes

- TABLE 159 Europe Tuna Fish Market, 2023 - 2030, Kilo Tonnes

- TABLE 160 Europe Tuna Fish Market by Type, 2019 - 2022, USD Million

- TABLE 161 Europe Tuna Fish Market by Type, 2023 - 2030, USD Million

- TABLE 162 Europe Tuna Fish Market by Type, 2019 - 2022, Kilo Tonnes

- TABLE 163 Europe Tuna Fish Market by Type, 2023 - 2030, Kilo Tonnes

- TABLE 164 Europe Canned Market by Country, 2019 - 2022, USD Million

- TABLE 165 Europe Canned Market by Country, 2023 - 2030, USD Million

- TABLE 166 Europe Canned Market by Country, 2019 - 2022, Kilo Tonnes

- TABLE 167 Europe Canned Market by Country, 2023 - 2030, Kilo Tonnes

- TABLE 168 Europe Fresh Market by Country, 2019 - 2022, USD Million

- TABLE 169 Europe Fresh Market by Country, 2023 - 2030, USD Million

- TABLE 170 Europe Fresh Market by Country, 2019 - 2022, Kilo Tonnes

- TABLE 171 Europe Fresh Market by Country, 2023 - 2030, Kilo Tonnes

- TABLE 172 Europe Frozen Market by Country, 2019 - 2022, USD Million

- TABLE 173 Europe Frozen Market by Country, 2023 - 2030, USD Million

- TABLE 174 Europe Frozen Market by Country, 2019 - 2022, Kilo Tonnes

- TABLE 175 Europe Frozen Market by Country, 2023 - 2030, Kilo Tonnes

- TABLE 176 Europe Tuna Fish Market by Species, 2019 - 2022, USD Million

- TABLE 177 Europe Tuna Fish Market by Species, 2023 - 2030, USD Million

- TABLE 178 Europe Tuna Fish Market by Species, 2019 - 2022, Kilo Tonnes

- TABLE 179 Europe Tuna Fish Market by Species, 2023 - 2030, Kilo Tonnes

- TABLE 180 Europe Skipjack Market by Country, 2019 - 2022, USD Million

- TABLE 181 Europe Skipjack Market by Country, 2023 - 2030, USD Million

- TABLE 182 Europe Skipjack Market by Country, 2019 - 2022, Kilo Tonnes

- TABLE 183 Europe Skipjack Market by Country, 2023 - 2030, Kilo Tonnes

- TABLE 184 Europe Albacore Market by Country, 2019 - 2022, USD Million

- TABLE 185 Europe Albacore Market by Country, 2023 - 2030, USD Million

- TABLE 186 Europe Albacore Market by Country, 2019 - 2022, Kilo Tonnes

- TABLE 187 Europe Albacore Market by Country, 2023 - 2030, Kilo Tonnes

- TABLE 188 Europe Yellowfin Market by Country, 2019 - 2022, USD Million

- TABLE 189 Europe Yellowfin Market by Country, 2023 - 2030, USD Million

- TABLE 190 Europe Yellowfin Market by Country, 2019 - 2022, Kilo Tonnes

- TABLE 191 Europe Yellowfin Market by Country, 2023 - 2030, Kilo Tonnes

- TABLE 192 Europe Bigeye Market by Country, 2019 - 2022, USD Million

- TABLE 193 Europe Bigeye Market by Country, 2023 - 2030, USD Million

- TABLE 194 Europe Bigeye Market by Country, 2019 - 2022, Kilo Tonnes

- TABLE 195 Europe Bigeye Market by Country, 2023 - 2030, Kilo Tonnes

- TABLE 196 Europe Bluefin Market by Country, 2019 - 2022, USD Million

- TABLE 197 Europe Bluefin Market by Country, 2023 - 2030, USD Million

- TABLE 198 Europe Bluefin Market by Country, 2019 - 2022, Kilo Tonnes

- TABLE 199 Europe Bluefin Market by Country, 2023 - 2030, Kilo Tonnes

- TABLE 200 Europe Others Market by Country, 2019 - 2022, USD Million

- TABLE 201 Europe Others Market by Country, 2023 - 2030, USD Million

- TABLE 202 Europe Others Market by Country, 2019 - 2022, Kilo Tonnes

- TABLE 203 Europe Others Market by Country, 2023 - 2030, Kilo Tonnes

- TABLE 204 Europe Tuna Fish Market by Country, 2019 - 2022, USD Million

- TABLE 205 Europe Tuna Fish Market by Country, 2023 - 2030, USD Million

- TABLE 206 Europe Tuna Fish Market by Country, 2019 - 2022, Kilo Tonnes

- TABLE 207 Europe Tuna Fish Market by Country, 2023 - 2030, Kilo Tonnes

- TABLE 208 Germany Tuna Fish Market, 2019 - 2022, USD Million

- TABLE 209 Germany Tuna Fish Market, 2023 - 2030, USD Million

- TABLE 210 Germany Tuna Fish Market, 2019 - 2022, Kilo Tonnes

- TABLE 211 Germany Tuna Fish Market, 2023 - 2030, Kilo Tonnes

- TABLE 212 Germany Tuna Fish Market by Type, 2019 - 2022, USD Million

- TABLE 213 Germany Tuna Fish Market by Type, 2023 - 2030, USD Million

- TABLE 214 Germany Tuna Fish Market by Type, 2019 - 2022, Kilo Tonnes

- TABLE 215 Germany Tuna Fish Market by Type, 2023 - 2030, Kilo Tonnes

- TABLE 216 Germany Tuna Fish Market by Species, 2019 - 2022, USD Million

- TABLE 217 Germany Tuna Fish Market by Species, 2023 - 2030, USD Million

- TABLE 218 Germany Tuna Fish Market by Species, 2019 - 2022, Kilo Tonnes

- TABLE 219 Germany Tuna Fish Market by Species, 2023 - 2030, Kilo Tonnes

- TABLE 220 UK Tuna Fish Market, 2019 - 2022, USD Million

- TABLE 221 UK Tuna Fish Market, 2023 - 2030, USD Million

- TABLE 222 UK Tuna Fish Market, 2019 - 2022, Kilo Tonnes

- TABLE 223 UK Tuna Fish Market, 2023 - 2030, Kilo Tonnes

- TABLE 224 UK Tuna Fish Market by Type, 2019 - 2022, USD Million

- TABLE 225 UK Tuna Fish Market by Type, 2023 - 2030, USD Million

- TABLE 226 UK Tuna Fish Market by Type, 2019 - 2022, Kilo Tonnes

- TABLE 227 UK Tuna Fish Market by Type, 2023 - 2030, Kilo Tonnes

- TABLE 228 UK Tuna Fish Market by Species, 2019 - 2022, USD Million

- TABLE 229 UK Tuna Fish Market by Species, 2023 - 2030, USD Million

- TABLE 230 UK Tuna Fish Market by Species, 2019 - 2022, Kilo Tonnes

- TABLE 231 UK Tuna Fish Market by Species, 2023 - 2030, Kilo Tonnes

- TABLE 232 France Tuna Fish Market, 2019 - 2022, USD Million

- TABLE 233 France Tuna Fish Market, 2023 - 2030, USD Million

- TABLE 234 France Tuna Fish Market, 2019 - 2022, Kilo Tonnes

- TABLE 235 France Tuna Fish Market, 2023 - 2030, Kilo Tonnes

- TABLE 236 France Tuna Fish Market by Type, 2019 - 2022, USD Million

- TABLE 237 France Tuna Fish Market by Type, 2023 - 2030, USD Million

- TABLE 238 France Tuna Fish Market by Type, 2019 - 2022, Kilo Tonnes

- TABLE 239 France Tuna Fish Market by Type, 2023 - 2030, Kilo Tonnes

- TABLE 240 France Tuna Fish Market by Species, 2019 - 2022, USD Million

- TABLE 241 France Tuna Fish Market by Species, 2023 - 2030, USD Million

- TABLE 242 France Tuna Fish Market by Species, 2019 - 2022, Kilo Tonnes

- TABLE 243 France Tuna Fish Market by Species, 2023 - 2030, Kilo Tonnes

- TABLE 244 Russia Tuna Fish Market, 2019 - 2022, USD Million

- TABLE 245 Russia Tuna Fish Market, 2023 - 2030, USD Million

- TABLE 246 Russia Tuna Fish Market, 2019 - 2022, Kilo Tonnes

- TABLE 247 Russia Tuna Fish Market, 2023 - 2030, Kilo Tonnes

- TABLE 248 Russia Tuna Fish Market by Type, 2019 - 2022, USD Million

- TABLE 249 Russia Tuna Fish Market by Type, 2023 - 2030, USD Million

- TABLE 250 Russia Tuna Fish Market by Type, 2019 - 2022, Kilo Tonnes

- TABLE 251 Russia Tuna Fish Market by Type, 2023 - 2030, Kilo Tonnes

- TABLE 252 Russia Tuna Fish Market by Species, 2019 - 2022, USD Million

- TABLE 253 Russia Tuna Fish Market by Species, 2023 - 2030, USD Million

- TABLE 254 Russia Tuna Fish Market by Species, 2019 - 2022, Kilo Tonnes

- TABLE 255 Russia Tuna Fish Market by Species, 2023 - 2030, Kilo Tonnes

- TABLE 256 Spain Tuna Fish Market, 2019 - 2022, USD Million

- TABLE 257 Spain Tuna Fish Market, 2023 - 2030, USD Million

- TABLE 258 Spain Tuna Fish Market, 2019 - 2022, Kilo Tonnes

- TABLE 259 Spain Tuna Fish Market, 2023 - 2030, Kilo Tonnes

- TABLE 260 Spain Tuna Fish Market by Type, 2019 - 2022, USD Million

- TABLE 261 Spain Tuna Fish Market by Type, 2023 - 2030, USD Million

- TABLE 262 Spain Tuna Fish Market by Type, 2019 - 2022, Kilo Tonnes

- TABLE 263 Spain Tuna Fish Market by Type, 2023 - 2030, Kilo Tonnes

- TABLE 264 Spain Tuna Fish Market by Species, 2019 - 2022, USD Million

- TABLE 265 Spain Tuna Fish Market by Species, 2023 - 2030, USD Million

- TABLE 266 Spain Tuna Fish Market by Species, 2019 - 2022, Kilo Tonnes

- TABLE 267 Spain Tuna Fish Market by Species, 2023 - 2030, Kilo Tonnes

- TABLE 268 Italy Tuna Fish Market, 2019 - 2022, USD Million

- TABLE 269 Italy Tuna Fish Market, 2023 - 2030, USD Million

- TABLE 270 Italy Tuna Fish Market, 2019 - 2022, Kilo Tonnes

- TABLE 271 Italy Tuna Fish Market, 2023 - 2030, Kilo Tonnes

- TABLE 272 Italy Tuna Fish Market by Type, 2019 - 2022, USD Million

- TABLE 273 Italy Tuna Fish Market by Type, 2023 - 2030, USD Million

- TABLE 274 Italy Tuna Fish Market by Type, 2019 - 2022, Kilo Tonnes

- TABLE 275 Italy Tuna Fish Market by Type, 2023 - 2030, Kilo Tonnes

- TABLE 276 Italy Tuna Fish Market by Species, 2019 - 2022, USD Million

- TABLE 277 Italy Tuna Fish Market by Species, 2023 - 2030, USD Million

- TABLE 278 Italy Tuna Fish Market by Species, 2019 - 2022, Kilo Tonnes

- TABLE 279 Italy Tuna Fish Market by Species, 2023 - 2030, Kilo Tonnes

- TABLE 280 Rest of Europe Tuna Fish Market, 2019 - 2022, USD Million

- TABLE 281 Rest of Europe Tuna Fish Market, 2023 - 2030, USD Million

- TABLE 282 Rest of Europe Tuna Fish Market, 2019 - 2022, Kilo Tonnes

- TABLE 283 Rest of Europe Tuna Fish Market, 2023 - 2030, Kilo Tonnes

- TABLE 284 Rest of Europe Tuna Fish Market by Type, 2019 - 2022, USD Million

- TABLE 285 Rest of Europe Tuna Fish Market by Type, 2023 - 2030, USD Million

- TABLE 286 Rest of Europe Tuna Fish Market by Type, 2019 - 2022, Kilo Tonnes

- TABLE 287 Rest of Europe Tuna Fish Market by Type, 2023 - 2030, Kilo Tonnes

- TABLE 288 Rest of Europe Tuna Fish Market by Species, 2019 - 2022, USD Million

- TABLE 289 Rest of Europe Tuna Fish Market by Species, 2023 - 2030, USD Million

- TABLE 290 Rest of Europe Tuna Fish Market by Species, 2019 - 2022, Kilo Tonnes

- TABLE 291 Rest of Europe Tuna Fish Market by Species, 2023 - 2030, Kilo Tonnes

The Global Tuna Fish Market size is expected to reach $51.1 billion by 2030, rising at a market growth of 3.3% CAGR during the forecast period. In the year 2022, the market attained a volume of 5221.4 Killo Tonnes experiencing a growth of 3.7% (2019-2022).

Albacore tuna has a mild, meaty flavor that appeals to a wide range of consumers. Its versatile taste makes it suitable for various culinary preparations, including grilling, searing, baking, and using it in salads, sandwiches, sushi, and more. Consequently, the Albacore segment would generate approximately 11.35% share of the market by 2030. Albacore tuna is highly versatile and can be prepared in various ways, including grilling, broiling, baking, or consuming raw in dishes like sushi and sashimi. It is also commonly used in canned tuna products, where it can be incorporated into salads, sandwiches, and a variety of recipes.

The major strategies followed by the market participants are Merger & Acquisition as the key developmental strategy to keep pace with the changing demands of end users. For instance, In September, 2023, Dongwon Enterprises Co. Ltd. took over StarKist Co., which provides healthy food products in the United States. Under this acquisition, the companies aimed to extend their businesses by selling family owners' holdings in other companies and luring investors in before becoming public. Additionally, In January, 2022, Century Pacific Food Inc. expanded its canned marine products portfolio by acquiring Ligo. This aligns with the company's mission to offer affordable nutrition, enabling regional production of Ligo products.

Based on the Analysis presented in the KBV Cardinal matrix; ITOCHU Corporation is the forerunner in the Market. and Companies such as Century Pacific Foods Inc., Dongwon Enterprises Co. Ltd., Thai Union Group PLC are some of the key innovators in the Market. In May, 2021, Thai Union Group PLC completed the acquisition of the remaining 49 percent of shares in Rugen Fisch AG, produces and sells canned fish. This strategic move underscored the significant value it added to the company and reaffirmed Thai Union's dedication to the German market.

Market Growth Factors

Technological advancements in the supply chain of tuna

The use of advanced technology, such as blockchain and electronic tagging, has improved traceability throughout the tuna supply chain. This has allowed stakeholders, from fishermen to consumers, to trace the origin of the tuna they purchase. The ability to track the journey of tuna from catch to plate ensures transparency and helps combat illegal, unreported, and unregulated (IUU) fishing, which is essential for maintaining the sustainability of tuna stocks. Technological innovations in fishing gear and methods have made it possible for the industry to adopt more sustainable practices. This includes the development of selective fishing methods that reduce bycatch and minimize the impact on non-target species. In summary, technological advancements have had a highly positive impact on the market.

Rising disposable income and urbanization

As disposable incomes increase, there is a notable surge in consumer spending power, allowing individuals to diversify their dietary choices. In this context, the demand for tuna products experiences a significant upswing, driven by the accessibility to premium and high-quality tuna offerings. The transformation of urban areas, marked by expanding populations, contributes to an environment where a variety of culinary preferences and dining experiences are embraced. Tuna, with its adaptability across diverse culinary applications, has become a popular choice among urban residents. These factors have propelled the growth of the market.

Market Restraining Factors

Regulations on bycatch and unsustainable fishing practices

Bycatch, which refers to the unintentional capture of non-target species during tuna fishing, often results from certain fishing methods, such as purse seine nets and longlines. This issue poses several challenges to the industry. The high incidence of bycatch contributes to environmental harm. Non-target species like sharks, turtles, and dolphins can become entangled in fishing gear, resulting in injury or death. This has consequences for marine ecosystems and biodiversity, as these species often have ecological roles that are important for the balance of the oceans. In the upcoming years, these factors are anticipated to impede market growth.

Type Outlook

On the basis of type, the market is segmented into canned, fresh, and frozen. The fresh segment witnessed a significant revenue share in the market in 2022. Fresh tuna offers a more robust flavor and firmer texture compared to canned tuna. Its taste and texture are preferred by those who appreciate the distinctive characteristics of the fish. When choosing fresh tuna, consumers can select local and sustainably sourced options, contributing to responsible seafood consumption. Fresh tuna can be grilled, seared, broiled, or baked to the preferred level of doneness, allowing for a wide range of culinary applications.

Species Outlook

Based on species, the market is divided into skipjack, albacore, yellowfin, bigeye, bluefin, and others. The skipjack segment garnered the highest revenue share in the market in 2022. High-quality protein can be found in abundance in skipjack tuna. Protein is necessary for general growth, muscular building, and tissue repair. It is an ideal food for individuals looking to increase their protein intake, such as athletes and bodybuilders. Skipjack tuna is highly versatile and can be used in various culinary preparations, including salads, sandwiches, sushi, and pasta dishes. Canned skipjack tuna is a convenient pantry staple for quick and easy meal preparation.

Regional Outlook

Region-wise, the market is analyzed across North America, Europe, Asia Pacific, and LAMEA. The Asia Pacific region procured a remarkable growth rate in the market in 2022. Demand for foods high in protein, like tuna, has surged in nations like China and India due to population growth and rising per capita income. The world's top four aquaculture-producing countries are all in Asia, according to the European Market Observatory for Fisheries and Aquaculture Products Report 2022. Additionally, residents in this region can find well-paying jobs in the aquaculture industry. These developments will boost the market's advancement by quickening the aquaculture sector's growth.

The market research report covers the analysis of key stakeholders of the market. Key companies profiled in the report include Bolton Group, Century Pacific Foods Inc., The Jealsa Rianxeira S.AU. Group, ITOCHU Corporation, Thai Union Group PLC, Dongwon Enterprises Co. Ltd., IBL Ltd., F.C.F. Fishery Co., Ltd., SEA DELIGHT, LLC, and High Liner Foods.

Strategies Deployed in Tuna Fish Market

Partnerships, Collaborations, and Agreements:

Mar-2022: Thai Union Group PLC partnered with Sustainable Fisheries Partnership (SFP) to enhance transparency in its supply chains and broaden considerations for biodiversity impact. This collaboration enables Thai Union to extend its involvement in the Ocean Disclosure Project (ODP), making supply chain and sustainability information accessible through the ODP platform.

Feb-2022: SEA DELIGHT, LLC, joined hands with Prime Seafood by the International Pole and Line Foundation (IPNsLF). Under this collaboration, the companies aimed to increase the visibility of this artisanal fishery in the main markets, which, in turn, has led to a more sustainable food system and protected the livelihoods of fishermen and their families.

Jan-2020: SEALECT Tuna, from Thai Union Group PLC, collaborated with the renowned local brand Pa Waen to introduce five new flavors of spicy tuna flakes. This innovative product, the first of its kind in the Thai market, blends nutritious tuna with authentic local chili paste. The SEALECT Tuna x Pa Waen Chili tuna flakes, launched at major supermarkets and online channels in Thailand, offer a unique fusion of flavors.

Product Launches and Product Expansions:

Mar-2023: Dongwon F&B, under Dongwon Enterprises, launched My Plant, a vegan line featuring plant-based tuna and vegetable dumplings. The My Plant series includes five tuna products (one canned, four pouches) and debuts with kimchi and regular dumplings. This expansion reflects Dongwon's response to the growing demand for plant-based alternatives.

Jul-2022: Century Pacific Food, Inc. expanded its "unMEAT" portfolio with the introduction of a plant-based, fish-free tuna. The latest addition, unMEAT Fish-free Tuna, replicates the taste, texture, and appearance of traditional tuna while being entirely plant-based. Crafted from ingredients such as non-GMO soy, natural oils, and flavors, this innovative product aligns with the growing demand for sustainable and plant-derived alternatives in the food industry.

Acquisition and Mergers:

Sep-2023: Dongwon Enterprises Co. Ltd. took over StarKist Co., which provides healthy food products in the United States. Under this acquisition, the companies aimed to extend their businesses by selling family owners' holdings in other companies and luring investors in before becoming public.

Jan-2022: Century Pacific Food Inc. expanded its canned marine products portfolio by acquiring Ligo, a legacy brand known for its range of high-quality sardines and other marine products. This aligns with the company's mission to offer affordable nutrition, enabling regional production of Ligo products.

Aug-2021: Bolton Group acquired Wild Planet Foods, a pioneer in the sustainable canned fish market in the US. This move reflects Bolton's commitment to international development goals and enhances its position in the world's largest tuna market.

May-2021: Thai Union Group PLC completed the acquisition of the remaining 49 percent of shares in Rugen Fisch AG, produces and sells canned fish. This strategic move underscored the significant value it added to the company and reaffirmed Thai Union's dedication to the German market.

Mar-2021: Century Pacific Food Inc. has acquired Pacific Meat Company, a provider of processed meat to food service establishments, supermarkets, and butcher shops, expanding into a growing food segment with synergies to its shelf-stable portfolio. This strategic move enhanced capabilities and positions the company for opportunities in the evolving food industry.

Jan-2020: F.C.F. Fishery Co., Ltd. acquired Bumble Bee Foods, a 120-year-old beloved marketer of seafood and specialty protein products. Through this acquisition, FCF has bolstered its sustainability efforts and positioned itself for sustained leadership in the tuna and seafood industries.

Scope of the Study

Market Segments covered in the Report:

By Type (Volume, Killo Tonnes, USD Million, 2019-2030)

- Canned

- Fresh

- Frozen

By Species (Volume, Killo Tonnes, USD Million, 2019-2030)

- Skipjack

- Albacore

- Yellowfin

- Bigeye

- Bluefin

- Others

By Geography (Volume, Killo Tonnes, USD Million, 2019-2030)

- North America

- US

- Canada

- Mexico

- Rest of North America

- Europe

- Germany

- UK

- France

- Russia

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Singapore

- Malaysia

- Rest of Asia Pacific

- LAMEA

- Brazil

- Argentina

- UAE

- Saudi Arabia

- South Africa

- Nigeria

- Rest of LAMEA

Companies Profiled

- Bolton Group

- Century Pacific Foods Inc.

- The Jealsa Rianxeira S.AU. Group

- ITOCHU Corporation

- Thai Union Group PLC

- Dongwon Enterprises Co. Ltd.

- IBL Ltd.

- F.C.F. Fishery Co., Ltd.

- SEA DELIGHT, LLC

- High Liner Foods

Unique Offerings from KBV Research

- Exhaustive coverage

- Highest number of market tables and figures

- Subscription based model available

- Guaranteed best price

- Assured post sales research support with 10% customization free

Table of Contents

Chapter 1. Market Scope & Methodology

- 1.1 Market Definition

- 1.2 Objectives

- 1.3 Market Scope

- 1.4 Segmentation

- 1.4.1 Global Tuna Fish Market, by Type

- 1.4.2 Global Tuna Fish Market, by Species

- 1.4.3 Global Tuna Fish Market, by Geography

- 1.5 Methodology for the research

Chapter 2. Market At a Glance

- 2.1 Key Highlights

Chapter 3. Market Overview

- 3.1 Introduction

- 3.1.1 Overview

- 3.1.1.1 Market Composition and Scenario

- 3.1.1 Overview

- 3.2 Key Factors Impacting the Market

- 3.2.1 Market Drivers

- 3.2.2 Market Restraints

Chapter 4. Competition Analysis - Global

- 4.1 KBV Cardinal Matrix

- 4.2 Recent Industry Wide Strategic Developments

- 4.2.1 Partnerships, Collaborations and Agreements

- 4.2.2 Product Launches and Product Expansions

- 4.2.3 Acquisition and Mergers

- 4.3 Top Winning Strategies

- 4.3.1 Key Leading Strategies: Percentage Distribution (2019-2023)

- 4.3.2 Key Strategic Move: (Mergers & Acquisition : 2019, May - 2023, Sep) Leading Players

- 4.4 Porter's Five Forces Analysis

Chapter 5. Global Tuna Fish Market by Type

- 5.1 Global Canned Market by Region

- 5.2 Global Fresh Market by Region

- 5.3 Global Frozen Market by Region

Chapter 6. Global Tuna Fish Market by Species

- 6.1 Global Skipjack Market by Region

- 6.2 Global Albacore Market by Region

- 6.3 Global Yellowfin Market by Region

- 6.4 Global Bigeye Market by Region

- 6.5 Global Bluefin Market by Region

- 6.6 Global Others Market by Region

Chapter 7. Global Tuna Fish Market by Region

- 7.1 North America Tuna Fish Market

- 7.1.1 North America Tuna Fish Market by Type

- 7.1.1.1 North America Canned Market by Country

- 7.1.1.2 North America Fresh Market by Country

- 7.1.1.3 North America Frozen Market by Country

- 7.1.2 North America Tuna Fish Market by Species

- 7.1.2.1 North America Skipjack Market by Country

- 7.1.2.2 North America Albacore Market by Country

- 7.1.2.3 North America Yellowfin Market by Country

- 7.1.2.4 North America Bigeye Market by Country

- 7.1.2.5 North America Bluefin Market by Country

- 7.1.2.6 North America Others Market by Country

- 7.1.3 North America Tuna Fish Market by Country

- 7.1.3.1 US Tuna Fish Market

- 7.1.3.1.1 US Tuna Fish Market by Type

- 7.1.3.1.2 US Tuna Fish Market by Species

- 7.1.3.2 Canada Tuna Fish Market

- 7.1.3.2.1 Canada Tuna Fish Market by Type

- 7.1.3.2.2 Canada Tuna Fish Market by Species

- 7.1.3.3 Mexico Tuna Fish Market

- 7.1.3.3.1 Mexico Tuna Fish Market by Type

- 7.1.3.3.2 Mexico Tuna Fish Market by Species

- 7.1.3.4 Rest of North America Tuna Fish Market

- 7.1.3.4.1 Rest of North America Tuna Fish Market by Type

- 7.1.3.4.2 Rest of North America Tuna Fish Market by Species

- 7.1.3.1 US Tuna Fish Market

- 7.1.1 North America Tuna Fish Market by Type

- 7.2 Europe Tuna Fish Market

- 7.2.1 Europe Tuna Fish Market by Type

- 7.2.1.1 Europe Canned Market by Country

- 7.2.1.2 Europe Fresh Market by Country

- 7.2.1.3 Europe Frozen Market by Country

- 7.2.2 Europe Tuna Fish Market by Species

- 7.2.2.1 Europe Skipjack Market by Country

- 7.2.2.2 Europe Albacore Market by Country

- 7.2.2.3 Europe Yellowfin Market by Country

- 7.2.2.4 Europe Bigeye Market by Country

- 7.2.2.5 Europe Bluefin Market by Country

- 7.2.2.6 Europe Others Market by Country

- 7.2.3 Europe Tuna Fish Market by Country

- 7.2.3.1 Germany Tuna Fish Market

- 7.2.3.1.1 Germany Tuna Fish Market by Type

- 7.2.3.1.2 Germany Tuna Fish Market by Species

- 7.2.3.2 UK Tuna Fish Market

- 7.2.3.2.1 UK Tuna Fish Market by Type

- 7.2.3.2.2 UK Tuna Fish Market by Species

- 7.2.3.3 France Tuna Fish Market

- 7.2.3.3.1 France Tuna Fish Market by Type

- 7.2.3.3.2 France Tuna Fish Market by Species

- 7.2.3.4 Russia Tuna Fish Market

- 7.2.3.4.1 Russia Tuna Fish Market by Type

- 7.2.3.4.2 Russia Tuna Fish Market by Species

- 7.2.3.5 Spain Tuna Fish Market

- 7.2.3.5.1 Spain Tuna Fish Market by Type

- 7.2.3.5.2 Spain Tuna Fish Market by Species

- 7.2.3.6 Italy Tuna Fish Market

- 7.2.3.6.1 Italy Tuna Fish Market by Type

- 7.2.3.6.2 Italy Tuna Fish Market by Species

- 7.2.3.7 Rest of Europe Tuna Fish Market

- 7.2.3.7.1 Rest of Europe Tuna Fish Market by Type

- 7.2.3.7.2 Rest of Europe Tuna Fish Market by Species

- 7.2.3.1 Germany Tuna Fish Market

- 7.2.1 Europe Tuna Fish Market by Type

- 7.3 Asia Pacific Tuna Fish Market

- 7.3.1 Asia Pacific Tuna Fish Market by Type

- 7.3.1.1 Asia Pacific Canned Market by Country

- 7.3.1.2 Asia Pacific Fresh Market by Country

- 7.3.1.3 Asia Pacific Frozen Market by Country

- 7.3.2 Asia Pacific Tuna Fish Market by Species

- 7.3.2.1 Asia Pacific Skipjack Market by Country

- 7.3.2.2 Asia Pacific Albacore Market by Country

- 7.3.2.3 Asia Pacific Yellowfin Market by Country

- 7.3.2.4 Asia Pacific Bigeye Market by Country

- 7.3.2.5 Asia Pacific Bluefin Market by Country

- 7.3.2.6 Asia Pacific Others Market by Country

- 7.3.3 Asia Pacific Tuna Fish Market by Country

- 7.3.3.1 China Tuna Fish Market

- 7.3.3.1.1 China Tuna Fish Market by Type

- 7.3.3.1.2 China Tuna Fish Market by Species

- 7.3.3.2 Japan Tuna Fish Market

- 7.3.3.2.1 Japan Tuna Fish Market by Type

- 7.3.3.2.2 Japan Tuna Fish Market by Species

- 7.3.3.3 India Tuna Fish Market

- 7.3.3.3.1 India Tuna Fish Market by Type

- 7.3.3.3.2 India Tuna Fish Market by Species

- 7.3.3.4 South Korea Tuna Fish Market

- 7.3.3.4.1 South Korea Tuna Fish Market by Type

- 7.3.3.4.2 South Korea Tuna Fish Market by Species

- 7.3.3.5 Singapore Tuna Fish Market

- 7.3.3.5.1 Singapore Tuna Fish Market by Type

- 7.3.3.5.2 Singapore Tuna Fish Market by Species

- 7.3.3.6 Malaysia Tuna Fish Market

- 7.3.3.6.1 Malaysia Tuna Fish Market by Type

- 7.3.3.6.2 Malaysia Tuna Fish Market by Species

- 7.3.3.7 Rest of Asia Pacific Tuna Fish Market

- 7.3.3.7.1 Rest of Asia Pacific Tuna Fish Market by Type

- 7.3.3.7.2 Rest of Asia Pacific Tuna Fish Market by Species

- 7.3.3.1 China Tuna Fish Market

- 7.3.1 Asia Pacific Tuna Fish Market by Type

- 7.4 LAMEA Tuna Fish Market

- 7.4.1 LAMEA Tuna Fish Market by Type

- 7.4.1.1 LAMEA Canned Market by Country

- 7.4.1.2 LAMEA Fresh Market by Country

- 7.4.1.3 LAMEA Frozen Market by Country

- 7.4.2 LAMEA Tuna Fish Market by Species

- 7.4.2.1 LAMEA Skipjack Market by Country

- 7.4.2.2 LAMEA Albacore Market by Country

- 7.4.2.3 LAMEA Yellowfin Market by Country

- 7.4.2.4 LAMEA Bigeye Market by Country

- 7.4.2.5 LAMEA Bluefin Market by Country

- 7.4.2.6 LAMEA Others Market by Country

- 7.4.3 LAMEA Tuna Fish Market by Country

- 7.4.3.1 Brazil Tuna Fish Market

- 7.4.3.1.1 Brazil Tuna Fish Market by Type

- 7.4.3.1.2 Brazil Tuna Fish Market by Species

- 7.4.3.2 Argentina Tuna Fish Market

- 7.4.3.2.1 Argentina Tuna Fish Market by Type

- 7.4.3.2.2 Argentina Tuna Fish Market by Species

- 7.4.3.3 UAE Tuna Fish Market

- 7.4.3.3.1 UAE Tuna Fish Market by Type

- 7.4.3.3.2 UAE Tuna Fish Market by Species

- 7.4.3.4 Saudi Arabia Tuna Fish Market

- 7.4.3.4.1 Saudi Arabia Tuna Fish Market by Type

- 7.4.3.4.2 Saudi Arabia Tuna Fish Market by Species

- 7.4.3.5 South Africa Tuna Fish Market

- 7.4.3.5.1 South Africa Tuna Fish Market by Type

- 7.4.3.5.2 South Africa Tuna Fish Market by Species

- 7.4.3.6 Nigeria Tuna Fish Market

- 7.4.3.6.1 Nigeria Tuna Fish Market by Type

- 7.4.3.6.2 Nigeria Tuna Fish Market by Species

- 7.4.3.7 Rest of LAMEA Tuna Fish Market

- 7.4.3.7.1 Rest of LAMEA Tuna Fish Market by Type

- 7.4.3.7.2 Rest of LAMEA Tuna Fish Market by Species

- 7.4.3.1 Brazil Tuna Fish Market

- 7.4.1 LAMEA Tuna Fish Market by Type

Chapter 8. Company Profiles

- 8.1 Bolton Group S.r.l

- 8.1.1 Company Overview

- 8.1.2 Recent strategies and developments:

- 8.1.2.1 Acquisition and Mergers:

- 8.1.3 SWOT Analysis

- 8.2 Century Pacific Food Inc.

- 8.2.1 Company Overview

- 8.2.2 Financial Analysis

- 8.2.3 Segmental Analysis

- 8.2.4 Recent strategies and developments:

- 8.2.4.1 Product Launches and Product Expansions:

- 8.2.4.2 Acquisition and Mergers:

- 8.2.5 SWOT Analysis

- 8.3 The Jealsa Rianxeira S.A.U. Group

- 8.3.1 Company Overview

- 8.3.2 Recent strategies and developments:

- 8.3.2.1 Product Launches and Product Expansions:

- 8.3.3 SWOT Analysis

- 8.4 ITOCHU Corporation

- 8.4.1 Company Overview

- 8.4.2 Financial Analysis

- 8.4.3 Segmental and Regional Analysis

- 8.4.4 SWOT Analysis

- 8.5 Thai Union Group PLC

- 8.5.1 Company Overview

- 8.5.2 Financial Analysis

- 8.5.3 Segmental and Regional Analysis

- 8.5.4 Research & Development Expense

- 8.5.5 Recent strategies and developments:

- 8.5.5.1 Partnerships, Collaborations, and Agreements:

- 8.5.5.2 Acquisition and Mergers:

- 8.5.6 SWOT Analysis

- 8.6 Dongwon Enterprises Co. Ltd.

- 8.6.1 Company Overview

- 8.6.2 Recent strategies and developments:

- 8.6.2.1 Product Launches and Product Expansions:

- 8.6.2.2 Acquisition and Mergers:

- 8.6.3 SWOT Analysis

- 8.7 IBL Ltd.

- 8.7.1 Company Overview

- 8.7.2 Financial Analysis

- 8.7.3 Segmental and Regional Analysis

- 8.7.4 SWOT Analysis

- 8.8 F.C.F. Fishery Co., Ltd (Bumble Bee Foods, LLC)

- 8.8.1 Company Overview

- 8.8.2 Recent strategies and developments:

- 8.8.2.1 Acquisition and Mergers:

- 8.8.3 SWOT Analysis

- 8.9 SEA DELIGHT, LLC

- 8.9.1 Company Overview

- 8.9.2 Recent strategies and developments:

- 8.9.2.1 Partnerships, Collaborations, and Agreements:

- 8.9.2.2 Acquisition and Mergers:

- 8.9.3 SWOT Analysis

- 8.10. High Liner Foods

- 8.10.1 Company Overview

- 8.10.2 Financial Analysis

- 8.10.3 SWOT Analysis