|

|

市場調査レポート

商品コード

1860261

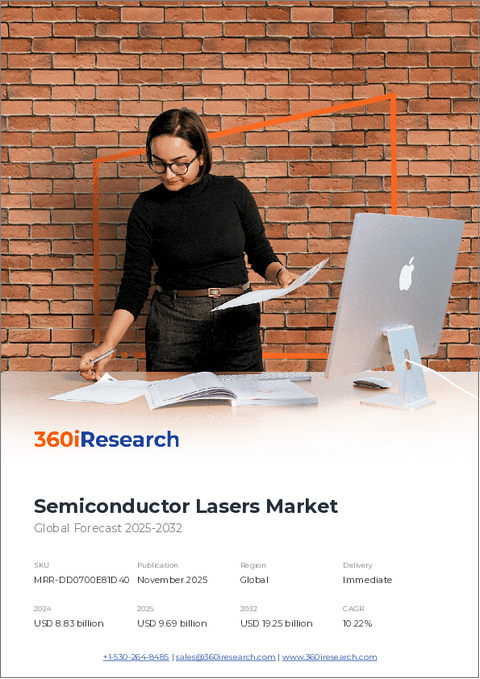

半導体レーザー市場:製品タイプ別、波長別、半導体材料別、用途別 - 2025年~2032年の世界予測Semiconductor Lasers Market by Product Type, Wavelength, Semiconductor Material, Application - Global Forecast 2025-2032 |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| 半導体レーザー市場:製品タイプ別、波長別、半導体材料別、用途別 - 2025年~2032年の世界予測 |

|

出版日: 2025年09月30日

発行: 360iResearch

ページ情報: 英文 196 Pages

納期: 即日から翌営業日

|

概要

半導体レーザー市場は、2032年までにCAGR10.27%で227億2,000万米ドル規模に成長すると予測されております。

| 主な市場の統計 | |

|---|---|

| 基準年2024 | 103億9,000万米ドル |

| 推定年2025 | 114億2,000万米ドル |

| 予測年2032 | 227億2,000万米ドル |

| CAGR(%) | 10.27% |

半導体レーザー業界の情勢に関する権威ある分析であり、融合する技術、アプリケーションの促進要因、そして賢明な投資のための戦略的優先事項を解説しております

半導体レーザー業界の情勢は現在、急速な技術改良と業界横断的な採用が進んでおり、幅広い商業・防衛用途における光学駆動システムの再定義が進んでいます。近年、ダイオード構造、材料工学、パッケージングにおける革新が、システムレベルの統合技術の進歩と融合し、レーザーは実験室での珍品から、自動車用センシング、民生機器、通信ネットワーク、医療機器における重要部品へと進化を遂げています。システム設計者や調達責任者が次世代の能力を評価する中で、半導体レーザーが単一の技術ではなく、性能範囲、コスト構造、サプライチェーン依存性が異なるプラットフォーム群であるという認識が高まっています。

材料技術、統合アーキテクチャ、そして変化するエンドマーケットの需要動向におけるブレークスルーが、半導体レーザー分野における戦略的優位性とサプライチェーン構造を再定義しています

半導体レーザー産業は、競争優位性とイノベーションの道筋を総合的に変えるいくつかの変革的な変化によって再構築されています。第一に、材料工学のブレークスルー(特にワイドバンドギャップ技術とヘテロジニアス集積技術)により、高出力・紫外線レーザーの性能限界が拡大し、より高いピーク出力と環境耐性を要求する新たな応用分野が実現しました。その結果、システムインテグレーターは部品選定基準を再評価し、ライフサイクル耐久性と熱管理をより重視するようになり、これはパッケージングや組立への投資にも影響を及ぼしています。

2025年の関税措置が半導体レーザーのバリューチェーン全体において、サプライチェーン、地域別製造インセンティブ、戦略的投資判断をいかに変容させたかを評価する

2025年に導入された米国関税の累積的影響は、半導体レーザー利害関係者のコスト構造、調達戦略、リスク計算を再構築しました。主要デバイスクラス及び上流基板に対する輸入関税の引き上げは、メーカーに対し既存のサプライヤー体制の見直しを迫り、ニアショアリング施策の加速や従来地域外における代替材料ベンダーの検討を促しました。これに対応し、多くの企業は調達チャネルの多様化、長期供給契約の確保、二次ベンダーの認定加速に取り組み、単一供給源への依存リスクを軽減しています。

製品アーキテクチャ、波長特化性、材料工学、アプリケーション主導の採用パターンを統合した実践的なセグメンテーション知見により、戦略的ポジショニングを明確化します

製品、波長、材料、アプリケーションの次元で市場を細分化することで、導入と価値獲得に向けた微妙な経路が明らかになります。製品タイプの見地から、外部共振器ダイオードレーザーは、高精度センシングや分光法に魅力的な調整性と狭線幅の利点を提供します。一方、光ファイバーレーザーは、材料加工や長距離伝送に適した優れたビーム品質と電力処理能力を実現します。高出力ダイオードレーザーは、コンパクトで高効率な光源を必要とする産業・防衛用途の焦点となっており、量子カスケードレーザーはガス検知や特殊分光法に不可欠な中赤外領域の能力を提供します。低コストなウエハー規模製造の可能性を秘めた垂直共振器面発光レーザー(VCSEL)は、短距離センシングや光インターコネクト分野で急速に普及が進んでいます。

地域戦略の動向とインフラ整備の必要性は、製造規模、商業化の速度、政策支援が世界市場でどのように収束するかを決定づけています

地域的な力学は、半導体レーザー産業全体における投資優先順位と市場参入戦略に大きな影響を及ぼしています。アメリカ大陸では、国内製造能力の向上、戦略的サプライチェーンの確保、自動車・航空宇宙分野での応用拡大に重点が置かれており、利害関係者は強力なシステム統合能力を活用して下流の価値を捕捉しています。欧州・中東・アフリカ地域では、規制枠組みと国家産業政策がクラスター形成を主導しており、特に防衛調達や通信近代化が地域認定サプライヤーへの需要を創出しています。欧州の確立されたフォトニクス研究開発エコシステムは、産業政策介入や地域生産奨励策を補完するイノベーションのパイプラインを支えています。

半導体レーザー分野における業界リーダーシップを形作る、パートナーシップ・知的財産ポートフォリオ・製造投資戦略の競合と能力基盤

半導体レーザーエコシステム全体の競合構造は、垂直統合型既存企業、専門部品サプライヤー、そしてアプリケーション特化型イノベーションを推進する機敏な新興企業が混在する様相を示しています。エピタキシャル成長、デバイス製造、高度なパッケージングにまたがる能力を有する確立企業は、規模、プロセスの成熟度、顧客信頼において優位性を維持していますが、新規デバイス設計や統合手法を商業化する機敏な新規参入企業からの戦略的圧力に直面しています。システムインテグレーターと専門ファウンドリ間の提携がますます一般的になり、複雑なモジュールの市場投入期間を短縮すると同時に、資本リスクを分散させています。

経営陣がサプライチェーンを強化し、製造の成熟度を加速させ、製品戦略を高付加価値アプリケーション分野と整合させるための実践的かつ優先順位付けされた行動

業界リーダーは、短期的なレジリエンスと長期的なイノベーションリーダーシップのバランスを取る多角的戦略を採用すべきです。まず、重要な基板や部品について二次サプライヤーの認定を進め、関税や物流のショックへの曝露を低減する戦略的な在庫管理と契約構造を追求することで、サプライチェーンの多様化を優先します。同時に、歩留まり向上プログラムを加速し、テスト自動化への投資を推進することで、投入コストの変動下でも利益率を保護します。この業務上の重点化によりキャッシュフローを維持し、戦略的能力への選択的再投資を可能とします。

専門家インタビュー、技術文献の統合分析、サプライチェーンマッピング、シナリオストレステストを組み合わせた透明性の高い混合手法調査設計により、実践的な知見を確保

本分析は、定性的な専門家インタビュー、技術文献レビュー、対象を絞ったサプライチェーンマッピングを組み合わせた混合手法調査アプローチに基づき、深みと実践的関連性の両方を確保しております。主要な知見は、デバイス製造、システム統合、材料供給、エンドユーザー各セグメントの経営幹部との構造化インタビューから得られ、フォトニクスパッケージングおよび信頼性工学の専門家との協議によって補完されました。これらの対話により、技術導入サイクル、認証障壁、戦略的サプライヤー関係に関する文脈的理解が得られました。

半導体レーザーにおける将来のリーダーシップの基盤として、製造可能性、供給のレジリエンス、アプリケーションとの整合性を強調する戦略的優先事項の簡潔な統合

半導体レーザーは転換期にあり、材料・集積化・応用需要パターンの進歩が収束し、差別化された機会と高度な戦略的複雑性を生み出しています。業界の未来は、技術的優位性を拡張可能な製造能力へと転換しつつ、変化する貿易政策や地域別インセンティブを乗り切れる組織によって形作られます。サプライチェーンのレジリエンス、的を絞った製造改善、応用分野に整合した製品ロードマップへの投資を行う企業が、長期的な価値獲得において優位な立場に立つでしょう。

よくあるご質問

目次

第1章 序文

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 市場の概要

第5章 市場洞察

- データセンター相互接続における高出力垂直共振器面発光レーザーの採用拡大

- 半導体レーザーとシリコンフォトニクスプラットフォームの統合による高速オンチップ光通信の実現

- 精密医療画像診断・診断技術のための量子ドットおよび量子井戸レーザー技術の進展

- 自動運転車向け精密センシングおよびLiDARアプリケーションにおける緑色・青色半導体レーザーダイオードの需要増加

- 環境モニタリングおよび産業試験における高度分光分析のための波長可変半導体レーザーの開発

第6章 米国の関税の累積的な影響, 2025

第7章 AIの累積的影響, 2025

第8章 半導体レーザー市場:製品タイプ別

- 外部共振器ダイオードレーザー

- ファイバー光レーザー(FOL)

- 高出力ダイオードレーザー(HPDL)

- 量子カスケードレーザー

- 垂直共振器面発光レーザー(VCSEL)

第9章 半導体レーザー市場:波長別

- 赤外レーザー

- 紫外線レーザー

- 可視レーザー

第10章 半導体レーザー市場:半導体材料別

- ガリウムヒ素アルミニウム

- ガリウムヒ素

- ガリウムインジウムリン

- ガリウム窒化物

- ガリウムリン

- インジウムガリウムヒ素

- インジウムガリウムヒ素窒化物

- インジウムガリウムリン

- インジウムリン

第11章 半導体レーザー市場:用途別

- 自動車

- ヘッドアップディスプレイ

- LiDARシステム

- 民生用電子機器

- ゲーム機

- バーチャルリアリティ機器

- 防衛・航空宇宙

- 通信システム

- レーザー照準システム

- ヘルスケア

- 皮膚科

- 眼科

- 外科用器具

- 通信

- 光ファイバー家庭内配線

- 長距離通信

第12章 半導体レーザー市場:地域別

- 南北アメリカ

- 北米

- ラテンアメリカ

- 欧州・中東・アフリカ

- 欧州

- 中東

- アフリカ

- アジア太平洋地域

第13章 半導体レーザー市場:グループ別

- ASEAN

- GCC

- EU

- BRICS

- G7

- NATO

第14章 半導体レーザー市場:国別

- 米国

- カナダ

- メキシコ

- ブラジル

- 英国

- ドイツ

- フランス

- ロシア

- イタリア

- スペイン

- 中国

- インド

- 日本

- オーストラリア

- 韓国

第15章 競合情勢

- 市場シェア分析, 2024

- FPNVポジショニングマトリックス, 2024

- 競合分析

- ALPHALAS GmbH

- ams-OSRAM AG

- Applied Manufacturing Technologies

- Arima Optoelectronics Corporation

- ASML Holding N.V.

- Beneq Oy

- Coherent Corp.

- Hamamatsu Photonics K.K.

- Han's Laser Technology Industry Group Co., Ltd.

- Innolume GmbH

- IPG Photonics Corporation

- Jenoptik AG

- Laserline GmbH

- Lumentum Holdings Inc.

- Mitsubishi Electric Corporation

- MKS Instruments, Inc.

- RMI Laser

- Rohm Co., Ltd.

- Sacher Lasertechnik, Inc.

- Sharp Corporation

- Sony Corporation

- Thorlabs, Inc.

- Toptica Photonics AG

- TRUMPF SE+Co. KG