|

|

市場調査レポート

商品コード

1857673

AIoTプラットフォーム市場:オファリング別、プラットフォームタイプ別、展開別、用途別、産業分野別、エンドユーザー別-2025年~2032年の世界予測AIoT Platforms Market by Offering, Platform Type, Deployment, Application, Industry Vertical, End User - Global Forecast 2025-2032 |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| AIoTプラットフォーム市場:オファリング別、プラットフォームタイプ別、展開別、用途別、産業分野別、エンドユーザー別-2025年~2032年の世界予測 |

|

出版日: 2025年09月30日

発行: 360iResearch

ページ情報: 英文 190 Pages

納期: 即日から翌営業日

|

概要

AIoTプラットフォーム市場は、2032年までにCAGR 26.81%で515億5,000万米ドルの成長が予測されています。

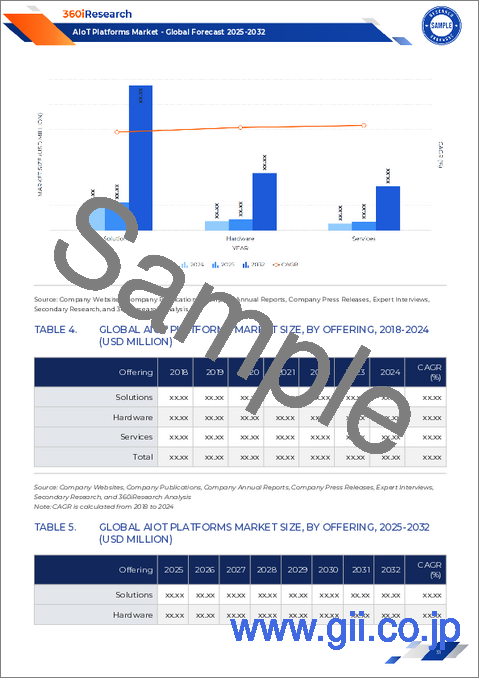

| 主な市場の統計 | |

|---|---|

| 基準年2024 | 77億米ドル |

| 推定年2025 | 95億米ドル |

| 予測年2032 | 515億5,000万米ドル |

| CAGR(%) | 26.81% |

AIoTプラットフォームの戦略的方向性とは、拡張可能な事業価値を引き出すために、融合技術と組織の優先順位をどのように整合させるべきかを明確にするものです

AIoTプラットフォームの情勢は、接続性、組込みインテリジェンス、産業プロセスの変革の交差点に位置し、企業が分散デバイスやシステムから価値を獲得する方法を再構築しています。このイントロダクションでは、組込みセンシング、エッジコンピューティング、相互運用可能なソフトウェアなどの技術的イネーブラを、資産集約型産業や消費者向けセグメントにおける企業の戦略的優先事項と関連付けることで、分析範囲をフレームワーク化します。そうすることで、プラットフォームを単体の製品としてではなく、ハードウェア、ソフトウェア、サービスをオーケストレーションして、オペレーションの回復力、安全性の向上、差別化された顧客体験などの測定可能な成果を提供するエコシステムとして位置づける。

導入が加速する中、プロダクトマネージャーから経営幹部までの利害関係者は、プラットフォームの能力と、導入モデル、調達サイクル、規制体制における制約との折り合いをつけなければならないです。この後の説明では、プラットフォームの種類と展開の選択肢を現実的に評価する必要性を強調する一方、統合の複雑さとデータガバナンスが依然として規模拡大の中心的な障壁であることを認識しています。このような基盤を構築することで、読者はベンダーの提案を評価し、社内の能力を調整し、AIoT投資から持続可能な価値を引き出すための短期的な取り組みに優先順位をつけるための明確なレンズを得ることができます。

エッジインテリジェンス、相互運用性、垂直化ソリューションの急速な進歩が、プラットフォームの選択基準と展開戦略をどのように再定義しているか

AIoTの展望は、エッジAI、コンバージド・コネクティビティ・スタック、Software-Defined Device Managementの進歩に牽引され、価値の創出・獲得方法を一挙に変える変革期を迎えています。エッジ推論とハイブリッド・コンピュート・アーキテクチャは、レイテンシーと帯域幅の依存性を低減し、予知保全からエネルギー最適化まで、幅広いアプリケーションのリアルタイム・クローズドループ制御を可能にしています。同時に、プラットフォーム・ベンダーは、ハードウェア・ゲートウェイ、接続管理、デバイス・オーケストレーションをアプリケーション・レベルのサービスとバンドルし、Time to Valueを加速させる統合型製品へと移行しています。

相互運用性標準とモジュール型APIは調達戦略を再構築し、マルチベンダーエコシステムをサポートするプラットフォームを好む企業を後押ししています。これと並行して、産業オートメーションにおけるIoT対応ロボティクスや、公共事業におけるスマートメーターのような、業種に特化したソリューションの普及が、プラットフォームプロバイダー間の専門知識の深化を促しています。こうしたシフトは、導入と統合、サポートとメンテナンス、トレーニングとコンサルティングを含むライフサイクルサービスの重要性を高めており、これらは今や中核的な機能能力と同じくらい採用に影響を与えています。その結果、意思決定者はベンダーの評価基準を見直し、機能のチェックリストではなく、拡張性、セキュリティ・バイ・デザイン、実証可能な成果を重視する必要があります。

米国の関税措置に対する政策主導のサプライチェーン調整と戦略的調達対応により、2025年のハードウェア調達と配備の選択が変わる

2025年における米国の関税導入は、AIoTプラットフォームのグローバル・サプライチェーンと調達戦略に新たな複雑性をもたらし、その影響は部品調達から総所有コストにまで及んでいます。関税に起因する投入コストの上昇により、企業はサプライヤーのポートフォリオを多様化し、製造拠点を地域化することで、その影響を軽減しようとしています。これに対応するため、一部のハードウェア・プラットフォーム開発企業は、代替部品ソースの認定を加速させ、コスト変動を管理しながら性能を維持するために、代替性を考慮した設計への投資を増やしています。

さらに、貿易障壁の上昇により、プラットフォーム・ベンダーとサービス・パートナーとの緊密な協力関係が促進され、エンド・ユーザーの調達リスクの一部を吸収するバンドル展開・統合モデルが提供されるようになりました。このシフトは、調達における差別化要因として、特にサポート&メンテナンスとトレーニング&コンサルティングといったサービスの役割を強化しています。複数の管轄区域にまたがって事業を展開する企業にとっては、関税によって展開戦略と契約条件の見直しが必須となり、多くの企業が、国境を越えたハードウェアの移動を減らすために、ハイブリッドまたは地域ごとにホストされるクラウドの取り決めを好んでいます。結局のところ、2025年の政策転換は、調達、法務、サプライチェーンの各チームが連携して、プラットフォーム展開の弾力性を確保する、シナリオベースの計画の必要性を浮き彫りにしています。

包括的なセグメンテーションフレームワークにより、製品タイプ、プラットフォームアーキテクチャ、展開モデル、業種別アプリケーションをバイヤーのニーズと技術的優先順位に合わせる

きめ細かなセグメンテーションビューにより、テクノロジーの選択がビジネスの成果や運用上の制約とどのように交差するかを明らかにし、製品戦略や商業計画のための実践的な指針を提供します。ハードウェアはゲートウェイ、ルーター、センサーに分類され、サービスは展開と統合、サポートとメンテナンス、トレーニングとコンサルティングに及び、ソリューションはアプリケーション管理、接続管理、デバイス管理に対応しています。プラットフォーム・タイプ別に見ると、ハードウェア・プラットフォームから統合プラットフォーム、ソフトウェア・プラットフォームまで、さまざまな製品が提供されています。デプロイメントに基づくと、クラウド、ハイブリッド、オンプレミスの各モデルがあり、それぞれレイテンシー、制御、運用オーバーヘッドにおけるトレードオフが存在します。アプリケーションに基づくと、プラットフォームは資産追跡、エネルギー管理、予知保全、安全・セキュリティなど多様な使用事例をサポートし、各使用事例には個別のデータモデルと統合パターンが要求されます。

よくあるご質問

目次

第1章 序文

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 市場の概要

第5章 市場洞察

- リアルタイムの故障検出と最適化を可能にする産業用エッジデバイス向けのAI駆動型予知保全フレームワーク

- AIoT展開におけるデータプライバシーとコンプライアンスを強化するための連携学習プロトコルの統合

- スマートシティにおける大規模AIoTセンサーネットワークのための低消費電力広域ネットワーク接続の展開

- サプライチェーン全体のAIoT対応製造プロセスのシミュレーションと最適化のためのデジタルツインモデルの実装

- 自律走行車のAI搭載IoTアプリケーションに超低遅延を実現する5Gネットワークスライシング機能の採用

- AIoT管理プラットフォーム内の異種エッジハードウェア上でコンテナ化されたAIワークロードのスケーラブルなオーケストレーション

- 多様なAIoTデバイスとクラウドエコシステムのシームレスな統合のための統一相互運用性標準の開発

- 組み込みAIoTモジュールへのリアルタイムコンピュータービジョン解析の統合による境界セキュリティ監視の強化

- 分散AIoTプラットフォームアーキテクチャにおける安全かつ透過的なデータ交換のためのブロックチェーン技術の利用

- プロアクティブなネットワーク・サイバーセキュリティ対策のための、マルチモーダルAIoTデータストリームに学習させた高度な異常検知アルゴリズム

第6章 米国の関税の累積的な影響, 2025

第7章 AIの累積的影響, 2025

第8章 AIoTプラットフォーム市場:提供別

- ハードウェア

- ゲートウェイ

- ルーター

- センサー

- サービス

- 展開と統合

- サポート&メンテナンス

- トレーニング&コンサルティング

- ソリューション

- アプリケーション管理

- コネクティビティ管理

- デバイス管理

第9章 AIoTプラットフォーム市場:プラットフォームタイプ別

- ハードウェアプラットフォーム

- 統合プラットフォーム

- ソフトウェアプラットフォーム

第10章 AIoTプラットフォーム市場:展開別

- クラウド

- ハイブリッド

- オンプレミス

第11章 AIoTプラットフォーム市場:用途別

- アセットトラッキング

- エネルギー管理

- 予知保全

- セーフティ&セキュリティ

第12章 AIoTプラットフォーム市場:業界別

- 自動車

- 自律走行車

- フリート管理ソリューション

- 車載インフォテインメント

- 銀行、金融サービス、保険

- 不正検知

- パーソナライズド・バンキング

- 建設

- 公共安全システム

- スマートインフラ

- 交通管理システム

- コンシューマー・エレクトロニクス

- コネクテッド・アプライアンス

- スマートホームアシスタント

- ウェアラブル・テクノロジー

- エネルギー・公益事業

- グリッド管理

- 再生可能エネルギー管理

- スマートメーター

- ヘルスケアとライフサイエンス

- 病院管理システム

- ラボ情報システム

- 産業オートメーション

- IoT対応ロボティクス

- 予測サポート

- スマートファクトリー

- 製造業

- ディスクリート製造

- プロセス製造

- 小売とeコマース

- 自動レジシステム

- スマート小売ソリューション

第13章 AIoTプラットフォーム市場:エンドユーザー別

- コンシューマ

- エンタープライズ

- 大企業

- 中小企業

第14章 AIoTプラットフォーム市場:地域別

- 南北アメリカ

- 北米

- ラテンアメリカ

- 欧州・中東・アフリカ

- 欧州

- 中東

- アフリカ

- アジア太平洋地域

第15章 AIoTプラットフォーム市場:グループ別

- ASEAN

- GCC

- EU

- BRICS

- G7

- NATO

第16章 AIoTプラットフォーム市場:国別

- 米国

- カナダ

- メキシコ

- ブラジル

- 英国

- ドイツ

- フランス

- ロシア

- イタリア

- スペイン

- 中国

- インド

- 日本

- オーストラリア

- 韓国

第17章 競合情勢

- 市場シェア分析, 2024

- FPNVポジショニングマトリックス, 2024

- 競合分析

- Allion Labs, Inc.

- Amazon Web Services, Inc.

- Arm Limited

- ASRock Industrial Computer Corp.

- Axiomtek Co., Ltd.

- Cisco Systems, Inc.

- Cloud Walk Technologies Co., Ltd.

- CMS Info Systems Limited

- Falkonry Inc.

- Google LLC by Alphabet Inc.

- Hewlett Packard Enterprise Development LP

- Hitachi, Ltd.

- Intel Corporation

- International Business Machines Corporation

- Microsoft Corporation

- Milesight

- NXP Semiconductors N.V.

- Open Text Corporation

- Oracle Corporation

- Qualcomm Incorporated

- Robert Bosch GmbH

- Samsung Electronics Co., Ltd.

- SAS Institute Inc.

- SEMIFIVE US, Inc.

- Sharp Corporation

- Sight Machine

- SMARTCOW AI TECHNOLOGIES PRIVATE LIMITED

- Terminus Group