|

|

市場調査レポート

商品コード

1808043

コアバンキングソフトウェア市場:提供、サービス提供モデル、銀行タイプ、展開モデル、エンドユーザー別-2025~2030年の世界予測Core Banking Software Market by Offering, Service Delivery Model, Bank Type, Deployment Model, End User - Global Forecast 2025-2030 |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| コアバンキングソフトウェア市場:提供、サービス提供モデル、銀行タイプ、展開モデル、エンドユーザー別-2025~2030年の世界予測 |

|

出版日: 2025年08月28日

発行: 360iResearch

ページ情報: 英文 191 Pages

納期: 即日から翌営業日

|

概要

コアバンキングソフトウェア市場は、2024年には133億2,000万米ドルとなり、2025年には147億米ドル、CAGR 10.52%で成長し、2030年には242億8,000万米ドルに達すると予測されています。

| 主な市場の統計 | |

|---|---|

| 基準年2024 | 133億2,000万米ドル |

| 推定年2025 | 147億米ドル |

| 予測年2030 | 242億8,000万米ドル |

| CAGR(%) | 10.52% |

コアバンキングソフトウェアの領域を形成する戦略的基盤と新たな機会への洞察に満ちたオリエンテーション(利害関係者向け)

シームレスな取引処理、リアルタイムの口座管理、包括的なリスク監視を可能にするコアバンキングソフトウェアは、現代の金融機関の中核をなしています。銀行業務モデルがデジタル時代に進化するにつれ、統合ソフトウェアプラットフォームの役割は従来の台帳更新にとどまらず、顧客エンゲージメント、規制遵守、オープンバンキング構想にまで広がっています。俊敏性、コスト効率、セキュリティ強化への要求の高まりは、あらゆる規模の銀行がコアテクノロジーインフラへの戦略的投資を見直す動機となっています。

金融業界全体のコアバンキングソフトウェアアーキテクチャとサービス提供モデルを再定義する変革と技術的パラダイムシフト

コアバンキングソフトウェアの情勢は、デジタルトランスフォーメーションへの取り組みと進化する顧客の期待の融合によって、大きな変容を遂げています。クラウドベースのインフラとマイクロサービスアーキテクチャがモノリシックなレガシーシステムに取って代わり、銀行はより迅速かつ弾力的に新機能を展開できるようになりました。APIの普及により、フィンテックプラットフォームやサードパーティサービスとのシームレスな統合が促進され、長い開発サイクルではなく、オンデマンドでイノベーションを組織化できるモジュール環境が構築されています。

2025年の米国の新関税政策がコアバンキングソフトウェアのサプライチェーンとベンダーエコシステムに与える影響の包括的評価

2025年に米国で新たな関税措置が導入されたことで、コアバンキングソフトウェアのサプライチェーン全体に大きな波紋が広がっています。これらの貿易政策は、国内産業の保護と国際的なコスト構造の再調整を目的としており、特に輸入サーバー、ネットワーク機器、ストレージソリューションに依存するオンプレミスの展開では、ハードウェア調達費用の調整につながりました。その結果、銀行やテクノロジープロバイダーは、輸入関税の高騰による財務上の影響を軽減するために、調達戦略を再検討しています。

市場セグメンテーションの詳細な分析により、提供、サービス提供モデル、銀行タイプ、展開モデルなどに関する洞察を明らかにする

市場セグメンテーションの理解は、製品ポートフォリオを需要の変化に対応させようとするテクノロジープロバイダーや銀行幹部にとって重要な指針となります。提供、サービス提供モデル、銀行タイプ、展開モデルといった明確なレンズを通して情勢を評価することで、利害関係者は投資やカスタマイズの可能性が高い分野を特定することができます。この多次元的なアプローチにより、各セグメントがどのように相互作用し、より広範な業界のダイナミクスと顧客の期待を形成しているかが明らかになります。

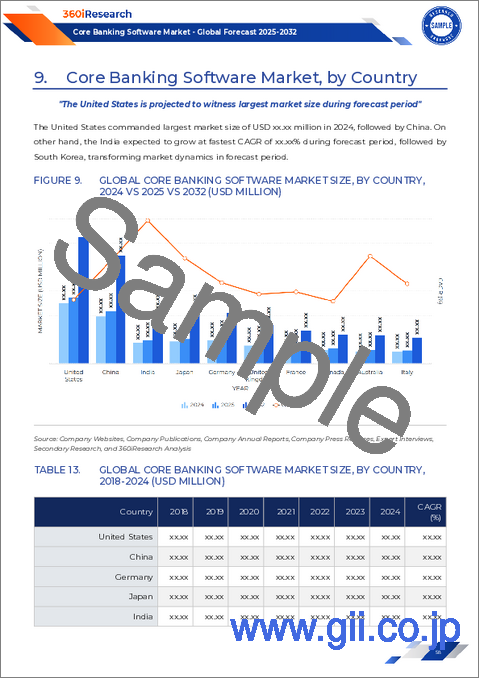

南北アメリカ、欧州、中東・アフリカ、アジア太平洋地域におけるコアバンキングソフトウェアのダイナミクスを明らかにする

各地域の市場力学は、コアバンキングソフトウェアの導入と進化に大きな影響を及ぼします。各市場はそれぞれ異なる規制環境、顧客の嗜好、技術エコシステムを示しているからです。このような微妙な違いを認識することで、経営幹部は導入戦略を調整し、最適な導入パートナーを選択し、各地域の需要に合った機能ロードマップに優先順位をつけることができます。南北アメリカ、欧州、中東・アフリカ、アジア太平洋地域を深堀りすることで、グローバルな展望を形成する多様な軌跡と共通の糸が見えてきます。

主要プロバイダーがコアバンキングソフトウェアエコシステム内でイノベーションの採用をどのように形作っているかを扱う戦略的企業プロファイルと競争動向

コアバンキングソフトウェア部門は、長年のグローバルテクノロジー企業とフィンテックに特化したイノベーターの組み合わせによるダイナミックな競合情勢を特徴としています。大手プロバイダーは、エンドツーエンドの機能を統合した包括的なプラットフォームを確立している一方、新興企業は、迅速なカスタマイズを可能にするモジュール型アーキテクチャやAPIファーストアーキテクチャを導入しています。このようなスケールと俊敏性の融合が、金融機関がベンダーの提供するサービスを評価し、戦略的ロードマップを構築する方法を形作っています。

コアバンキングソフトウェアの革新を効果的に進めるために、経営陣の指針となる実用的かつ将来を見据えた戦略的課題

金融サービス業界のリーダーは、柔軟性とコンプライアンスのバランスを取りながら、コアバンキングのワークロードをハイブリッドクラウド環境に移行することを優先すべきです。マイクロサービスとAPI中心のアーキテクチャを採用することで、金融機関は新商品のデリバリーを加速し、サードパーティとの統合を合理化し、レガシーインフラへの依存を減らすことができます。モジュール設計の原則を重視することで、迅速なスケーリングと的を絞ったイノベーションが可能になります。

実行可能な洞察を提供する分析フレームワークとともに、定量的・定性的データ収集を組み込んだ多段階調査手法

この分析では、コアバンキングソフトウェアの状況について包括的で信頼性の高い洞察を提供するために設計された多段階の調査手法を採用しています。まず、市場促進要因と技術動向の基本的な理解を深めるため、業界文献、ホワイトペーパー、規制ガイドライン、一般公開されている技術資料などを幅広く調査します。二次調査情報源としては、ベンダーのレポート、オープンバンキング標準、より広範なエコシステムの枠組みを構築する学術研究などがあります。

コアバンキングソフトウェアのトレンドと課題を戦略的必須事項と統合し、競争優位性を推進する集合的な洞察

このエグゼクティブサマリーで紹介する累積的な洞察は、コアバンキングソフトウェアの領域におけるかつてない変化のペースを強調するものです。クラウドネイティブアーキテクチャやマイクロサービスの広範な採用から、AI主導のアナリティクスの統合、柔軟な展開モデルの重要性の高まりに至るまで、銀行はレガシーな制約とデジタルイノベーションの要請の間の岐路に直面しています。規制の変化や関税の変動はさらに複雑さを増し、注意深いシナリオプランニングとサプライチェーンの俊敏性を要求しています。

目次

第1章 序文

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 市場の概要

第5章 市場力学

- 人工知能を活用したパーソナライゼーションモジュールをコアバンキングプラットフォームに統合

- スケーラブルなリアルタイムトランザクション処理を可能にするクラウドネイティブアーキテクチャの採用

- サードパーティのフィンテックエコシステムとの連携を促進するためのオープンバンキングAPIの実装

- デジタルバンキングチャネル保護に特化した高度なサイバーセキュリティフレームワークの導入

- 従来のオンプレミスシステムからコンテナ化されたマイクロサービスフレームワークへの移行戦略

- 取引の透明性を高めるブロックチェーン対応の越境決済ネットワークの活用

- 複数の管轄区域の銀行におけるAI駆動型規制報告ツールを使用したコンプライアンス自動化

- 決済チャネル全体でディープラーニングを活用したリアルタイム不正検出モデル

第6章 市場洞察

- ポーターのファイブフォース分析

- PESTEL分析

第7章 米国の関税の累積的な影響 2025年

第8章 コアバンキングソフトウェア市場:提供別

- サービス

- コンサルティング

- 実装・統合

- サポート・メンテナンス

- トレーニング・マネージドサービス

- ソフトウェア

- インターネットバンキングソリューション

- ローンおよび住宅ローン管理システム

- モバイルバンキングソリューション

- 決済処理モジュール

- リスクおよびコンプライアンス管理

- 富裕層および資産管理モジュール

第9章 コアバンキングソフトウェア市場:サービス提供モデル別

- ライセンスベース

- マネージド/ホストサービス

- サブスクリプション/SaaSベース

第10章 コアバンキングソフトウェア市場:銀行タイプ別

- ティア1銀行

- ティア2銀行

- ティア3銀行

第11章 コアバンキングソフトウェア市場:展開モデル別

- クラウド

- オンプレミス

第12章 コアバンキングソフトウェア市場:エンドユーザー別

- コーポレートバンキング

- 投資銀行

- プライベートバンキング

- リテールバンキング

- 農村・協同組合銀行

第13章 南北アメリカのコアバンキングソフトウェア市場

- 米国

- カナダ

- メキシコ

- ブラジル

- アルゼンチン

第14章 欧州、中東・アフリカのコアバンキングソフトウェア市場

- 英国

- ドイツ

- フランス

- ロシア

- イタリア

- スペイン

- アラブ首長国連邦

- サウジアラビア

- 南アフリカ

- デンマーク

- オランダ

- カタール

- フィンランド

- スウェーデン

- ナイジェリア

- エジプト

- トルコ

- イスラエル

- ノルウェー

- ポーランド

- スイス

第15章 アジア太平洋地域のコアバンキングソフトウェア市場

- 中国

- インド

- 日本

- オーストラリア

- 韓国

- インドネシア

- タイ

- フィリピン

- マレーシア

- シンガポール

- ベトナム

- 台湾

第16章 競合情勢

- 市場シェア分析, 2024

- FPNVポジショニングマトリックス, 2024

- 競合分析

- Temenos AG

- Intellect Design Arena Limited

- Accenture PLC

- Backbase B.V.

- Asseco Group

- Avaloq Group AG by NEC Corporation

- BML Istisharat SAL

- Capgemini SE

- Data Action Pty Ltd.

- Capital Banking Solutions

- Computer Services, Inc.

- Finastra

- Fidelity National Information Services, Inc.

- Fiserv, Inc.

- HCL Technologies Limited

- Infosys Limited

- Jack Henry & Associates, Inc.

- Mambu B.V.

- Oracle Corporation

- SAP SE

- Silverlake Axis Ltd.

- SoFi Technologies, Inc.

- Sopra Steria Group

- Tata Consultancy Services Limited

- Unisys Corporation

- Vilja Solutions AB

- VSoft Technologies Pvt. Ltd.

- 10x Banking Technology Limited