|

|

市場調査レポート

商品コード

1830627

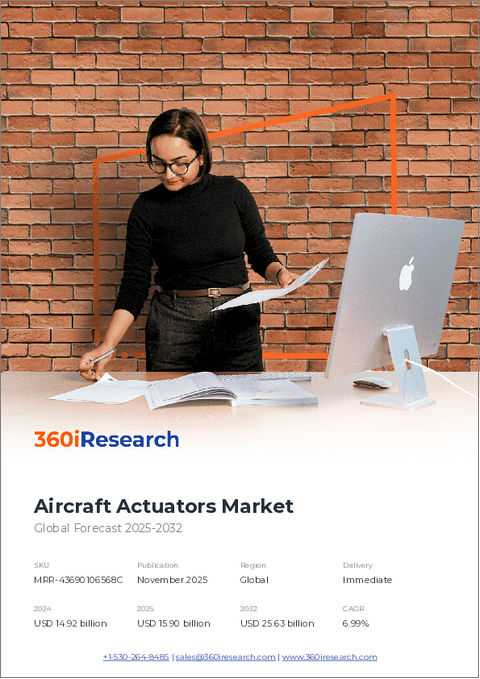

航空機用アクチュエータの市場:タイプ、最終用途産業、用途、提供、技術別-2025~2032年の世界予測Aircraft Actuators Market by Type, End Use Industry, Application, Offering, Technology - Global Forecast 2025-2032 |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| 航空機用アクチュエータの市場:タイプ、最終用途産業、用途、提供、技術別-2025~2032年の世界予測 |

|

出版日: 2025年09月30日

発行: 360iResearch

ページ情報: 英文 183 Pages

納期: 即日から翌営業日

|

概要

航空機用アクチュエータ市場は、2032年までにCAGR 6.38%で357億9,000万米ドルの成長が予測されています。

| 主な市場の統計 | |

|---|---|

| 基準年2024 | 218億1,000万米ドル |

| 推定年2025 | 232億1,000万米ドル |

| 予測年2032 | 357億9,000万米ドル |

| CAGR(%) | 6.38% |

このエグゼクティブサマリーでは、航空機用アクチュエータの最新事情を紹介し、航空機の性能、安全性、ライフサイクルの経済性を実現する基礎的な存在であることを位置づけています。アクチュエータは飛行に不可欠なシステムであり、電気的、油圧的、機械的、または空気圧的な信号を制御された動きに変換し、エンジン応答、飛行制御面、着陸装置、推力ベクトリングを制御します。その選択と統合は、冗長アーキテクチャ、認証経路、保守性、および全体的な運用信頼性に影響を与えます。航空会社や航空機メーカーが効率化を追求し、ライフサイクルコストの低減を追求する中で、アクチュエータの性能と相互運用性は、設計の中心的な基準となっています。

ここでは、技術の進歩、進化するサプライチェーン、規制の圧力、変化する最終用途の要求が、どのようにアクチュエータの仕様と調達方法を再構築しているかに焦点をあてて説明します。サプライヤーの技術革新、システムエンジニアリング、アフターマーケット・サービスなど、領域横断的な視点を重視することで、このイントロダクションは、変革的なシフト、2025年の米国の政策環境における関税関連の圧力、セグメンテーション主導の考察、地域ダイナミックス、競合のポジショニング、実践的な提言などをより深く検討するための舞台を提供します。その目的は、航空機アクチュエータのエコシステムにおける新たな現実にエンジニアリング、調達、コンプライアンス戦略を整合させるための簡潔かつ包括的なフレームワークを意思決定者に提供することです。

革新的な技術の進歩、サプライチェーンの進化、そして規制のシフトが、どのように航空部門全体でアクチュエータの設計、認証、運用性能を再構築しているのか

アクチュエータを取り巻く環境は、商業、軍事、無人の各プラットフォームにおいて、設計の優先順位、サプライヤーの足跡、認証のあり方を変化させるような、互いに交差する複数の変革の真っ只中にあります。電気アクチュエータの進歩、特にブラシレスやDCアーキテクチャとACアクチュエータは、設計者が軽量化、分散電源管理、ソフトウェア駆動制御ロジックを優先することを可能にしています。同時に、電気油圧ソリューションと純粋な油圧システムは、エネルギー密度とフェイルセーフ動作が依然として最重要である高負荷アプリケーション向けに最適化され続けています。機械的および空気圧的アプローチは、特に単純な信頼性、低コストのメンテナンス、または特定の力プロファイルが要求される場合に、重要なニッチな役割を維持します。このような技術シフトは、システム・インテグレーターに冗長性とヘルス・モニタリング戦略の再評価を促しています。

コンポーネントレベルの技術革新にとどまらず、サプライチェーンと製造の動向は、アクチュエータが航空機プラットフォームに到達する方法を再構築しています。アディティブ・マニュファクチャリングとモジュラー・サブアセンブリーの実践は開発サイクルを短縮し、デジタル・ツインとクローズドループ制御の進歩はインサービス性能分析の重要性を高めています。規制当局は、ソフトウェアで定義された動作や適応制御システムを考慮するために認証の枠組みを適応させつつあり、ベンダーやオペレータにチャンスとコンプライアンスの複雑さの両方を生み出しています。その結果、戦略的パートナーシップ、デジタルツールへの投資、エンジニアリングチーム全体のスキルアップが、急速に進化する情勢の中で競争力を維持するための重要な対応策として浮上しています。

2025年における米国の関税措置がアクチュエーターメーカーの部品調達、サプライヤー戦略、グローバルバリューチェーンに与える累積的影響の評価

米国が2025年に導入した政策措置は、部品調達戦略、サプライヤーとの交渉、アクチュエーターメーカーとその顧客のリスク管理実務に波及効果をもたらしました。関税の調整と関連する管理上の要件は、現地組立、サプライヤーの多様化、在庫の位置づけに関する選択に影響を与えました。多くの企業は、関税に関連するコスト変動の影響を軽減し、重要部品のリードタイムを短縮するために、ニアショアリングの取り組みを加速させたり、二重調達の取り決めを拡大させたりしました。このような戦略的対応は、長期的なサプライヤーとの関係を維持しつつ、突然の政策転換に備えるための契約条件の見直しとセットで行われることが多くなりました。

オペレーションチームは、関税の影響を受けやすいサブアセンブリーを特定するために、部品表の透明性を高め、トレーサビリティを強化しました。調達部門とエンジニアリング部門は、より緊密に連携し、認証基準を損なうことなく、国内調達の電気部品、機械的連結部、または地域内のハイドロメカニカルアセンブリを活用できる代替設計を特定しました。サプライヤーにとって、2025年の関税環境は、地域に根ざした能力を示し、地域のサービスセンターに投資し、柔軟なフルフィルメント・モデルを提供することの重要性を増大させました。全体として、これらの力学は、コンプライアンス文書と将来の政策の不確実性を管理するためのシナリオ・プランニングに焦点を当てた、より弾力的で地理的に多様化したサプライ・チェーンへと業界を押し上げました。

アクチュエータの種類、最終用途産業、用途、製品、および制御技術が、仕様、調達、およびライフサイクル戦略にどのような影響を及ぼすかを明らかにする、主要なセグメンテーションの洞察

セグメントレベルのダイナミクスは、調達仕様、メンテナンスアプローチ、技術革新の優先順位を左右する、明確な技術と最終用途の特性を明らかにします。タイプ別では、電気式アクチュエータはACアーキテクチャ、ブラシレスモータ、およびDCアクチュエータにまたがり、精密な制御とデジタル制御システムとの統合のために支持されている一方、油圧式アクチュエータは、電気油圧ハイブリッドと純粋な油圧設計の両方を通じて、高負荷、高エネルギー密度の要件に展開されています。レバー機構やスクリュージャッキ構成に代表される機械式アクチュエータは、シンプルさと決定論的な故障モードが優先される用途で関連性を保っています。空気圧式アクチュエータは、ダイヤフラム式であれピストン式であれ、迅速な作動と最小限の電気的依存性が望まれる特定のシステム・ニッチに対応し続けています。

最終用途産業全体では、民間航空機のプラットフォームはナローボディとワイドボディで要件が異なり、アクチュエータのサイズ、冗長性、保守性に影響を与えます。一般航空機は、単発機と多発機に分かれ、軽量でコスト効率に優れたソリューションが好まれます。ヘリコプターのアーキテクチャは、軽量クラスから重量クラスまであり、ローターと飛行制御システムには、コンパクトでパワー密度の高いアクチュエータが必要です。無人航空機は、固定翼と回転翼の設計を問わず、多くの場合、高度なソフトウェア制御と組み合わされた低質量で高効率のアクチュエータを重視しています。

アプリケーション主導のセグメンテーションは、さらに状況を微妙に変化させる。エンジン制御システムは、FADECと非FADECの実装によって区別され、それぞれインターフェイスと認証への影響が異なります。飛行制御の要件は、エルロン、エレベータ、ラダーなどのプライマリサーフェスと、フラップ、スラット、スポイラーなどのセカンダリエレメントに分かれており、信頼性とコマンド権限の考慮事項が階層化されています。ランディングギアシステムでは、メインギアとノーズギアのダイナミクスが異なり、衝撃や格納のプロファイルも異なります。スラストベクタリングは、3次元であれ2次元であれ、複雑な多軸アクチュエーションと熱管理に関する懸念をもたらします。ハードウェアとサービスの提供ベースの区別は、製品ライフサイクルを延長するメンテナンス、オーバーホール、修理の経路を含むサービスによって、市場投入モデルに影響を与えます。最後に、クローズドループシステム(適応制御とPIDコントローラーを含む)と、オープンループアレンジメント(自動または手動)の間の制御技術の二項対立は、診断、回復力、および認証戦略を形成します。これらのセグメンテーションレンズは、共に、目標とするエンジニアリングのトレードオフ、アフターマーケットサポートの設計、および調達の評価基準に役立ちます。

アクチュエータの採用、認証、アフターマーケットエコシステムを形成する、南北アメリカ、欧州、中東・アフリカ、アジア太平洋の地域ダイナミクスと競合ドライバー

地域力学は、認証の優先順位、サプライチェーン設計、アフターマーケットサポートモデルを異なる方法で形成します。アメリカ大陸では、フリートは一般的に後付けプログラムとアフターマーケットの対応力を優先しており、特に密集したフライトスケジュールをサポートするための整備性と迅速なターンアラウンドに重点を置いています。また、この地域では、近代化の取り組みにおいて、レガシー・プラットフォーム用のアクチュエータ性能を調整するために、OEMとオペレーターの間で強力な協力体制が築かれています。欧州、中東・アフリカでは、規制の調和が厳しく、高度な航空宇宙製造業が集中しているため、コンプライアンス文書化、サプライベースの適格性確認、次世代制御システムの共同研究が重視されます。この地域の認証タイムラインは、しばしば早期の適合設計投資を促進します。

アジア太平洋は、急速に拡大する民間航空機、成長する国産製造能力、現地化された整備能力への需要の高まりが混在しています。この地域のオペレーターは、コストへの敏感さと、運航効率を向上させる新技術の採用意欲のバランスをとることが多いです。どの地域でも、競争力は異なります。あるハブはコンポーネントのイノベーションと高価値のエンジニアリングを重視し、他のハブはスケーラブルな製造とコスト効率の良い供給を重視します。このような地理的特性を組み合わせることで、ベンダーの市場戦略やサービスセンターの立地に影響を与え、研修や規制への関与への投資が最大の戦略的利益をもたらす場所を決定することができます。

競合情勢の概要:アクチュエータの技術革新、アフターマーケットサービス、戦略的パートナーシップを推進する、主要な相手先商標製品メーカー、ティアサプライヤー、サービスプロバイダーを紹介

アクチュエータのエコシステムにおける主要企業は、深いエンジニアリングの伝統、統合されたシステム能力、拡大するアフターマーケット・サービス・ポートフォリオを兼ね備えています。市場リーダーは、コンディションベースのメンテナンス・プラットフォームや、予定外のダウンタイムを削減する診断対応アクチュエータなど、デジタル化への投資を通じて差別化を図っています。OEMと専門ティアサプライヤーとの戦略的パートナーシップは、開発スケジュールを延長することなく、ブラシレス電動アクチュエーション、小型油圧ハイブリッド、高度な制御ソフトウェアの導入を加速するための一般的な経路となっています。このような協力関係により、複雑なサブシステムのリスク共有と、より効率的な認証取得ルートも可能になります。

メンテナンス、オーバーホール、修理を専門とするサービス・プロバイダーは、より迅速なターンアラウンド、スペア・プーリング、現場での技術サポートを提供することで、資産の耐用年数を延ばし、派遣の信頼性を向上させることで、その存在感を高めています。モジュール式でライン交換可能なユニットを求める動向が、こうしたアフターマーケットでの提案を支えています。垂直統合や地域製造のフットプリントを追求する企業は、関税に起因する混乱や出荷の制約に対する回復力を獲得し、より予測可能なリードタイムや地域に密着したコンプライアンスサポートを提供できるようになりました。全体として、競争上の優位性の中心は、堅牢なハードウェアと、予知保全サービスや柔軟なフルフィルメント・モデルを組み合わせ、最新のフリート運用のテンポに対応する能力になってきています。

アクチュエーター調達の最適化、技術導入の加速化、法規制の緩和、弾力的なサプライチェーンの強化のために、業界リーダーが取るべき戦略的提言

業界のリーダーは、エンジニアリングの革新とサプライチェーンの強靭性、規制への対応とを整合させる多方面にわたる戦略を採用すべきです。第一に、モジュール設計アプローチとデジタルツイン機能を優先させ、統合テストを加速し、迅速な設計反復をサポートします。これにより、再確認のタイムラインを短縮し、ソフトウェア対応の作動機能の認証を迅速に行うことができます。第二に、関税の影響を受けやすい部品の二国間調達やニアショア調達に重点を置いてサプライヤー・ネットワークを多様化し、共有ロードマップや実績に基づくインセンティブを含む長期的な協力協定を確立します。このアプローチは、専門技術へのアクセスを維持しつつ、政策の変動を緩和します。

第三に、コンディション・ベース・メンテナンスと組込型ヘルス・モニタリングに投資し、アフターマーケットでのサービスを事後対応型の修理から事前対応型のサービス・モデルへと移行させる。この移行は、航空機の可用性を向上させるだけでなく、分析および遠隔診断に結びついた経常収益の機会を創出します。第四に、認証当局と積極的に連携し、適応制御システムとクローズドループアーキテクチャの受け入れ基準を共同開発し、型式証明や追加型式証明の際の曖昧さを減らします。最後に、修理ステーションと技術訓練センターを、運航会社が最大のダウンタイムリスクに直面する場所に配置することで、商業的提案を地域のニーズに合わせる。これらの行動を組み合わせることで、競争力を高めると同時に、アクチュエータシステムのライフサイクル全体で価値を獲得できるようにします。

データ収集、一次情報と二次情報、専門家別検証、航空機用アクチュエータとシステムに関する洞察を支える分析手法など、詳細な調査手法を紹介

本レポートは、エンジニアリング、ソーシング、認証の各リーダーの一次情報と、二次情報による厳密な検証を組み合わせた構造化調査プロセスから得られた知見を統合したものです。データ収集では、バリューチェーン全体でバランスの取れた視点を確保するため、相手先商標製品メーカー、ティアサプライヤー、メンテナンスプロバイダー、航空会社の視点を優先しました。質的なインプットは、技術的なホワイトペーパー、規格文書、および一般に公開されている認証ガイダンスと照合し、エンジニアリングの動向とコンプライアンスへの影響を検証しました。

分析手法には、重量、電力、故障モードの影響を評価するシステムレベルのトレードオフ分析、地域リスクと集中リスクを評価するサプライヤ・リスク・マッピング、政策主導のサプライチェーンの結果を探るシナリオ・プランニングなどが含まれました。専門家による検証セッションは、仮定をストレステストし、セグメンテーション基準を改良し、調達とエンジニアリングの利害関係者にとって実用的な妥当性を確保するために実施されました。調査手法全体を通じて、仮定の透明性、分析ステップの再現性、証拠と結論の間の明確なトレーサビリティに重点が置かれました。このアプローチは、調査結果の信頼性を支え、実行可能なビジネス上の意思決定への転換を支援するものです。

結論:アクチュエータ関係者にとっての技術的収束、サプライチェーンの強靭性、法規制の影響、商業化の道筋に関する戦略的収穫を総合します

結論として、航空機業界が効率性、回復力、デジタル変革を追求する中で、アクチュエータシステムは航空機システムアーキテクチャの中でますます戦略的な位置を占めるようになっています。電気アクチュエーションの進歩、洗練された油圧ソリューション、よりスマートな制御アルゴリズムが融合することで、より高性能、軽量、診断透過性の高いサブシステムが実現しつつあります。同時に、進化する政策の枠組みや地域的な力学は、運用の継続性と認証コンプライアンスを維持するために、強固なサプライヤー戦略と地域化されたサポート構造を必要とします。エンジニアリングの卓越性と、柔軟なサプライチェーン・アレンジメントやサービス中心のビジネスモデルをうまく組み合わせる利害関係者は、長期的な価値を獲得する上で最も有利な立場になると思われます。

設計チームは開発プロセスの早い段階で保守性とデジタル診断を統合する必要があり、調達はサプライチェーンの可視性と契約の柔軟性を優先する必要があり、サービス組織は予知保全と結果ベースの保全モデルへの移行を加速させる必要があります。アクチュエータの利害関係者は、技術的、規制的、地域的な配慮を統合的な戦略にまとめることで、航空機の可用性とライフサイクルの経済性を直接改善する性能と信頼性の向上を引き出しながら、複雑さを乗り越えることができます。

よくあるご質問

目次

第1章 序文

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 市場の概要

第5章 市場洞察

- 電気機械式飛行制御アクチュエータの統合により、重量とメンテナンス要件が軽減されます。

- 予知保全のための組み込みセンサーとIoT接続を備えたスマートアクチュエータの採用

- 航空宇宙における複雑な形状の軽量アクチュエータ部品への積層造形の使用

- 極度の熱環境に耐えられる高温油圧アクチュエータの開発

- 民間航空機の安全性を高める冗長フライバイワイヤアクチュエータアーキテクチャの進歩

- 回転翼航空機の燃料効率と排出量削減を向上させるために、油圧アクチュエータから電気油圧アクチュエータへの移行

- 動的条件下での適応飛行制御のためのサーボアクチュエータへのAI駆動制御ユニットの統合

第6章 米国の関税の累積的な影響, 2025

第7章 AIの累積的影響, 2025

第8章 航空機用アクチュエータの市場:タイプ別

- 電気

- 交流

- ブラシレス

- 直流

- 油圧式

- 電気油圧式

- ピュア油圧

- 機械

- レバー

- スクリュージャック

- 空気圧

- ダイヤフラム

- ピストン

第9章 航空機用アクチュエータの市場:最終用途産業別

- 民間航空機

- ナローボディ

- ワイドボディ

- 一般航空

- マルチエンジン

- 単発エンジン

- ヘリコプター

- 大型ヘリコプター

- 小型ヘリコプター

- 中型ヘリコプター

- 軍用機

- ファイター

- 輸送

- 無人航空機

- 固定翼

- 回転翼

第10章 航空機用アクチュエータの市場:用途別

- エンジン制御

- ファデック

- 非ファデック

- 飛行管制

- 一次飛行制御

- エルロン

- エレベーター

- ラダー

- 二次飛行制御

- フラップ

- スラット

- スポイラー

- 一次飛行制御

- 着陸装置

- メインギア

- ノーズギア

- 推力偏向

- 3次元

- 2次元

第11章 航空機用アクチュエータの市場:提供別

- ハードウェア

- サービス

- メンテナンス

- オーバーホール

- 修理

第12章 航空機用アクチュエータの市場:技術別

- クローズドループ

- 適応制御

- PIDコントローラ

- オープンループ

- 自動

- 手動

第13章 航空機用アクチュエータの市場:地域別

- 南北アメリカ

- 北米

- ラテンアメリカ

- 欧州・中東・アフリカ

- 欧州

- 中東

- アフリカ

- アジア太平洋地域

第14章 航空機用アクチュエータの市場:グループ別

- ASEAN

- GCC

- EU

- BRICS

- G7

- NATO

第15章 航空機用アクチュエータの市場:国別

- 米国

- カナダ

- メキシコ

- ブラジル

- 英国

- ドイツ

- フランス

- ロシア

- イタリア

- スペイン

- 中国

- インド

- 日本

- オーストラリア

- 韓国

第16章 競合情勢

- 市場シェア分析, 2024

- FPNVポジショニングマトリックス, 2024

- 競合分析

- Honeywell International Inc.

- Raytheon Technologies Corporation

- Moog Inc.

- Parker-Hannifin Corporation

- Safran SA

- Eaton Corporation plc

- Liebherr-International AG

- Curtiss-Wright Corporation

- Meggitt PLC

- Fokker Elmo B.V.