|

|

市場調査レポート

商品コード

1808259

電流センサ市場:タイプ別、回路タイプ別、技術別、用途別、最終用途産業別-2025-2030年の世界予測Current Sensor Market by Type, Circuit Types, Technology, Application, End Use Industry - Global Forecast 2025-2030 |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| 電流センサ市場:タイプ別、回路タイプ別、技術別、用途別、最終用途産業別-2025-2030年の世界予測 |

|

出版日: 2025年08月28日

発行: 360iResearch

ページ情報: 英文 180 Pages

納期: 即日から翌営業日

|

概要

電流センサ市場は、2024年には47億5,000万米ドルとなり、2025年には51億7,000万米ドル、CAGR 9.15%で成長し、2030年には80億3,000万米ドルに達すると予測されています。

| 主な市場の統計 | |

|---|---|

| 基準年2024 | 47億5,000万米ドル |

| 推定年2025 | 51億7,000万米ドル |

| 予測年2030 | 80億3,000万米ドル |

| CAGR(%) | 9.15% |

デジタル時代の世界の主要産業における電流センサー技術の進化と戦略的重要性を促進する変革的ダイナミクスの解明

電流センサー技術は、現代の電気・電子システムの礎石として台頭し、多くの用途で効率、安全性、信頼性の向上に極めて重要な役割を果たしています。基本的な電流モニタリングのための初歩的なコンポーネントとして誕生した電流センサーは、材料科学、センサーアーキテクチャ、信号処理の進歩により、さまざまな環境条件や動作条件下で正確な測定が可能な高度に洗練された機器へと変貌を遂げました。産業界がリアルタイムのモニタリングと適応制御をますます求めるようになるにつれて、電流センサーは従来の境界を超え、デジタル制御システムやIoTフレームワークとシームレスに統合されるようになりました。

セクターを超えた電流センサ・ソリューションの前例のない成長と革新を触媒する主な技術的・市場的変化を特定する

過去10年の間に、現在のセンサーソリューションの情勢は、技術の進歩と進化する市場の要求の合流によって再形成されてきました。モノのインターネット(Internet of Things)アーキテクチャの登場により、デジタルネットワークとシームレスに統合できるセンサーが必要となり、メーカーは高度な通信プロトコルと低消費電力設計を組み込むようになりました。同時に、電気自動車の普及により、過酷な自動車環境下での高精度測定に対する厳しい要件が導入され、熱安定性と電磁両立性を強化したセンサーの開発が加速しています。

2025年米国関税政策がサプライチェーンに及ぼす包括的影響の評価現在のセンサーの生産戦略と価格構造

2025年初頭、電流センシング・デバイスを含む電子部品を対象とした米国の関税政策改正の導入は、世界のサプライチェーンと生産戦略に大きな影響を及ぼし始めました。製造業者や流通業者は調達決定を再評価せざるを得なくなり、その多くは関税の高い地域から部品調達を分散させることを選択しました。これにより、ニアショアリングや、関税優遇地域に代替組立拠点を設立する動きが加速しています。

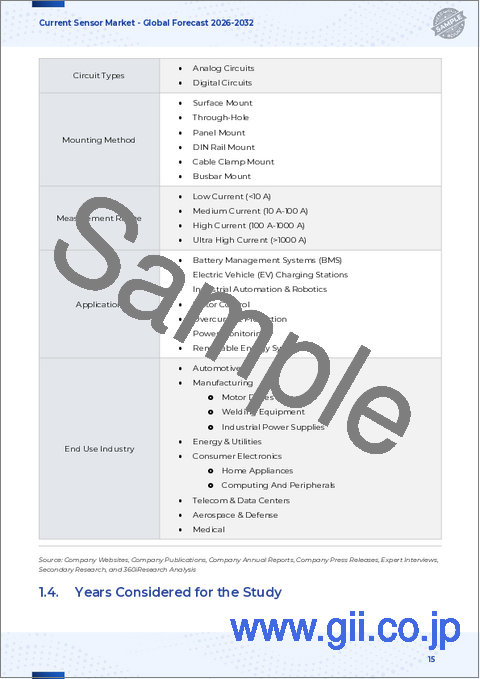

タイプ別回路アーキテクチャ技術用途別最終用途別電流センサー市場セグメンテーションの詳細分析から戦略的洞察を得る

現在のセンサー市場のセグメンテーションを検証すると、各コンポーネント・カテゴリーとアプリケーション・ドメインごとに異なる軌跡が明らかになります。センサーのタイプに注目すると、従来型の変流器は依然として高電圧電力監視の主力製品であり、ホール効果センサーは設置面積が小さく統合が容易なため、小型家電や自動車システムで脚光を浴びています。卓越した感度を持つ磁気抵抗センサーは、精密機器にニッチな用途を見出しており、ロゴスキーコイルセンサーは、産業環境で急速に変化する電流を測定するための柔軟なソリューションを提供しています。シャント抵抗センサーは、バッテリー管理および過電流保護シナリオにおいて、そのリニアな応答性と費用対効果が引き続き評価されています。

南北アメリカ、欧州、中東・アフリカ、アジア太平洋地域における電流センサの採用と開発動向に影響を与える地域ダイナミクスの探求

南北アメリカでは、再生可能エネルギー設備の急速な拡大と、送電網近代化のための厳しい規制が、高度な電流センシング・ソリューションの需要を促進しています。米国とカナダの自動車メーカーも電気自動車の生産を加速しており、バッテリー管理および充電インフラ・アプリケーションにおける高精度センサーの採用が増加しています。一方、中南米市場では重要インフラのアップグレードへの投資が始まっており、配電や産業オートメーションへのセンサー展開に新たな道が開かれています。

現在のセンサー技術の将来を形成する大手メーカーの競合差別化要因とイノベーション軌道を浮き彫りにする戦略

電流センサー分野の大手企業は、先進的な研究開発、戦略的パートナーシップ、的を絞った買収を組み合わせることで差別化を図っています。例えば、大手半導体企業は、信号処理の専門知識を活用して、センサ機能を電力管理集積回路に直接統合し、より小型で効率的な設計を可能にしています。システムオンチップ・ソリューションに向けたこの動向は、電気自動車や自律走行車のプラットフォームに合わせたモジュールの共同開発を目的とした、センサーの専門家と自動車OEMのコラボレーションによって補完されています。

実用的な戦略と戦術的なロードマップの策定により、現在のセンサー市場における価値の最大化と複雑性の克服において業界リーダーを強化します

競合情勢が激化し、急速に進化する現在のセンサー市場で成功を収めるためには、業界リーダーは技術革新と経営の俊敏性を両立させる多面的なアプローチを採用しなければならないです。まず、クローズドループ・センサ技術への投資を優先することで、電気自動車、再生可能エネルギーシステム、スマートグリッドにおける高精度アプリケーションへの需要の高まりに対応することができます。高度な制御アルゴリズムとフィードバック機構を活用することで、組織はエネルギー効率を最適化しながら、優れた測定忠実度を提供することができます。

現在のセンサー市場分析の妥当性信頼性と深さを確保するために採用された厳密な調査フレームワークと分析手法の詳細

この調査では、徹底的な2次調査と的を絞った1次調査を組み合わせた構造化手法を採用し、堅牢で包括的な市場分析を構築しています。業界出版物、技術雑誌、特許データベース、規制文書などの二次情報源から、技術動向、材料の進歩、進化する規格に関する基礎的な洞察が得られました。この机上調査は、システムインテグレーター、部品サプライヤー、最終用途の意思決定者などの主要利害関係者との詳細なインタビューによって補完され、市場促進要因と制約に関する多角的な視点を促進しました。

現在のセンサー・エコシステムにおける新たな機会を活用し課題に対処するための主要な発見と利害関係者にとっての戦略的重要事項のまとめ

この分析では、現在のセンサー技術が、デジタル変革、電化、規制の要請によって、重要な変曲点にあることが強調されています。材料と信号処理における技術革新がセンサーの能力を拡大し、AI対応プラットフォームとの統合が予知保全とシステム最適化の新たな道を開いています。同時に、地政学的なシフトと関税の調整により、サプライチェーンの弾力性と戦略的調達イニシアチブの必要性が浮き彫りになっています。

目次

第1章 序文

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 市場の概要

第5章 市場力学

- 電気自動車のパワートレイン管理用電流センサーへのAI駆動型キャリブレーションアルゴリズムの統合

- 産業用IoTネットワークの予知保全を可能にする小型MEMS電流センサーの成長

- 分散型再生可能エネルギーシステムを最適化するためのワイヤレス電流センシングモジュールの採用

- 次世代通信インフラ向け高周波広帯域電流センサーの進歩

- スマートグリッドにおけるグリッドスケールのエネルギー貯蔵をサポートする双方向電流センサの開発

- 超小型デバイスの感度向上のためのグラフェンベース材料の実装

- 重要インフラにおけるデジタルデータストリームのためのサイバーセキュリティプロトコルの出現

- 自己発電型ウェアラブル健康モニター向けエネルギーハーベスティング回路と電流センサーの統合

- リアルタイムのリモート資産監視と診断のためのIoTプラットフォームと電流センサーの統合

- 高度な磁性電流センサ材料により、過酷な環境でも感度が向上し、熱ドリフトが低減されます

第6章 市場洞察

- ポーターのファイブフォース分析

- PESTEL分析

第7章 米国の関税の累積的な影響2025

第8章 電流センサ市場:タイプ別

- 変流器(CT)

- ホール効果センサー

- 磁気抵抗センサー

- ロゴウスキーコイルセンサー

- シャント抵抗センサ

第9章 電流センサ市場回路タイプ別

- アナログ回路

- デジタル回路

第10章 電流センサ市場:技術別

- クローズドループ

- 双方向

- 一方向

- オープンループ

第11章 電流センサ市場:用途別

- バッテリー管理システム(BMS)

- 電気自動車(EV)充電ステーション

- 産業オートメーションとロボット工学

- モーター制御

- 過電流保護

- 電力監視

- 再生可能エネルギーシステム

第12章 電流センサ市場:最終用途産業別

- 自動車

- 家電

- エネルギーと電力

- ヘルスケア

- 産業オートメーション

- 通信

第13章 南北アメリカの電流センサ市場

- 米国

- カナダ

- メキシコ

- ブラジル

- アルゼンチン

第14章 欧州・中東・アフリカの電流センサ市場

- 英国

- ドイツ

- フランス

- ロシア

- イタリア

- スペイン

- アラブ首長国連邦

- サウジアラビア

- 南アフリカ

- デンマーク

- オランダ

- カタール

- フィンランド

- スウェーデン

- ナイジェリア

- エジプト

- トルコ

- イスラエル

- ノルウェー

- ポーランド

- スイス

第15章 アジア太平洋地域の電流センサ市場

- 中国

- インド

- 日本

- オーストラリア

- 韓国

- インドネシア

- タイ

- フィリピン

- マレーシア

- シンガポール

- ベトナム

- 台湾

第16章 競合情勢

- 市場シェア分析, 2024

- FPNVポジショニングマトリックス, 2024

- 競合分析

- ABB Ltd.

- Aceinna Inc.

- Allegro Microsystems, Inc.

- AMBO Technology

- Asahi Kasei Corporation

- Broadcom Inc.

- Cheemi Technology Co., Ltd.

- Coto Technology, Inc.

- CR Magnetics, Inc.

- CTS Corporation

- DER EE Electrical Instrument CO., Ltd.

- Electrohms Private Limited

- Emerson Electric Co.

- Hitachi, Ltd.

- Honeywell International Inc.

- ICE Components, Inc.

- Infineon Technologies AG

- Kohshin Electric Corporation

- LEM Holding SA

- Littelfuse, Inc

- Luksens Technologie GmbH

- Melexis NV

- Mitsubishi Electric Corporation

- Monnit Corporation

- Murata Manufacturing Co., Ltd.

- NXP Semiconductors N.V.

- Olimex Ltd.

- OMRON Corporation

- Panasonic Holdings Corporation

- Robert Bosch GmbH

- Rockwell Automation Inc.

- Schneider Electric SE

- Sensitec GmbH

- Siemens AG

- Silicon Laboratories Inc.

- Skyworks Solutions, Inc.

- STMicroelectronics International N.V.

- Suncall Corporation

- Suzhou Novosense Microelectronics Co., Ltd.

- Tamura Corporation

- TDK Corporation

- TE Connectivity Ltd.

- Texas Instruments Incorporated

- Vacuumschmelze GmbH & Co. KG

- Yageo Corporation

- Yokogawa Electric Corporation