|

市場調査レポート

商品コード

1887256

倉庫自動化(2025年):倉庫自動化技術に対する需要分析(第7版)Warehouse Automation - 2025: An Analysis of Demand for Warehouse Automation Technology, 7th Edition |

||||||

|

|||||||

| 倉庫自動化(2025年):倉庫自動化技術に対する需要分析(第7版) |

|

出版日: 2025年12月12日

発行: Interact Analysis

ページ情報: 英文

納期: 即日から翌営業日

|

概要

本レポートはどのように役立つのでしょうか?

第7版となる当社の「倉庫自動化レポート」は、市場に関する最も包括的かつ詳細な分析を提供することをお約束いたします。本レポートの作成にあたり、数ヶ月にわたり100件以上の詳細な調査インタビューを実施し、120社以上の企業を分析いたしました。特に、各社が過去・現在・未来において倉庫自動化に投じる投資に焦点を当てております。

本レポートは、収益および受注データに基づき、倉庫自動化市場を包括的かつ詳細に評価しております。

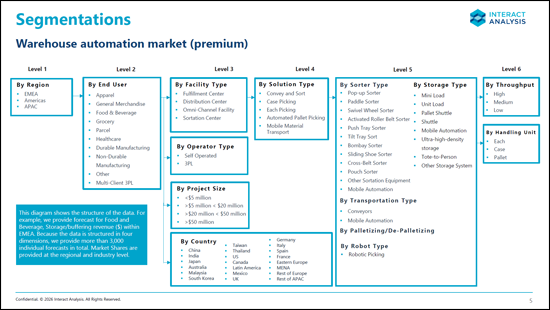

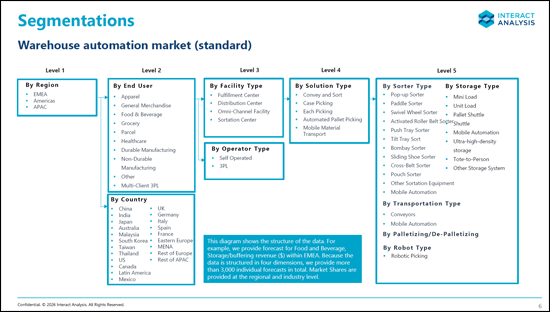

本レポートでは、倉庫自動化市場を多角的に分析し、国別、業種別、ソリューションタイプ別、製品タイプ別、機能別など、様々なセグメントに分類しております。さらに、自動倉庫システムの種類、自動仕分けシステムの種類、パレタイザー/デパレタイザーの種類といった個別技術タイプについても、より詳細なセグメンテーションを提供いたします。

本サービスで提供される膨大なデータに加え、本年版レポートでは2025年までの市場発展を深く掘り下げ、将来の成長セグメントを特定しております。ビジネスモデルや戦略の変化を分析し、競合情勢を検証します。これには約30社のベンダーに対する包括的なSWOT分析が含まれ、市場力学と競争上の位置付けを徹底的に理解する手助けとなります。

11の魅力的な使用事例- お客様は当社のレポートを以下の目的にご活用いただいております:

- 社内事業計画の策定および精緻化

- 新技術が市場に浸透する速度と範囲の把握

- 新たに台頭する製品動向とそのビジネスへの影響を把握するため

- 営業チームの業績をベンチマーク

- 投資家や株主への第三者データ提供

- 新規参入すべき市場を特定し、各市場に関連する機会・障壁・製品嗜好を把握する

- プレスリリースや外部向けプレゼンテーションを補強する引用文やデータを提供すること

- 競合他社との市場シェアを比較評価する

- 新たに台頭する競合他社を明確に把握する

- 主要トピックに関する業界のコンセンサスを把握し、内部仮定との整合性を検証する

- 需要に基づき市場における製品構成がどのように変化するかを理解する

倉庫自動化製品には、自動倉庫システム、コンベヤ、移動ロボット、ピッキングロボット、パレタイザ/デパレタイザ、仕分けシステム、ソフトウェアおよびサービスが含まれます。

製品の機能強化

本年は、レポートの範囲を大幅に拡大し、技術タイプ、取り扱い単位、処理能力範囲について、より詳細な情報を提供いたします。

仕分け設備の詳細度の向上

- 様々な用途で使用される異なる仕分け機タイプについて、より詳細な分析を行います。

処理能力別技術分析

- 仕分けシステムと保管システムを通過量別に分類いたします。

- 例えば、今年は、さまざまな高スループット仕分けシステムの市場規模と予測をご覧いただけます。

パレット自動化技術の詳細

- 技術タイプ別パレット保管自動化収益の内訳(クレーンベース技術とパレットシャトルの比較)。

プロジェクト規模別の市場分析の再紹介

- ドルベースでのプロジェクト規模別市場内訳

取扱単位別の市場内訳

- 取り扱い単位別市場分析(最も詳細なレベルでの分類)

本レポートで回答する3つの核心的な問い

本レポートでは、下記の3つの主要な質問と、各質問の構成要素について回答いたします。

現在の市場規模と将来の市場規模はどの程度でしょうか?

- 倉庫自動化分野のTAM(総市場規模)および浸透率分析

- エンドカスタマー投資に関するケーススタディ分析

- 倉庫自動化プロジェクトの現在および将来の導入実績

- 地域別・業界別・製品タイプ別の現在および将来の市場規模

競合情勢はどのような状況でしょうか?

- 市場シェア分析

- 合併・買収

- パートナーシップネットワーク

- ベンダープロファイル

- ベンダーのSWOT分析

- 資金調達

短期的に重要な動向は何でしょうか?

- 関税が倉庫自動化市場に与える影響

- 仕分け市場の詳細分析と仕分け機タイプ別の市場内訳

- 倉庫自動化市場のスループット別分析、およびスループット使用事例別収益の内訳

- パレット自動化市場をユニットロードとパレットシャトルに分類

- 業界構造が時間とともにどのように変化しているか