|

|

市場調査レポート

商品コード

1800826

コンテナ型データセンター市場の分析:コンテナの種類別、組織規模別、用途別、最終用途産業別、地域別(2025~2033年)Containerized Data Center Market Report by Type of Container, Organization Size, Application, End Use Industry, and Region 2025-2033 |

||||||

カスタマイズ可能

|

|||||||

| コンテナ型データセンター市場の分析:コンテナの種類別、組織規模別、用途別、最終用途産業別、地域別(2025~2033年) |

|

出版日: 2025年08月01日

発行: IMARC

ページ情報: 英文 137 Pages

納期: 2~3営業日

|

全表示

- 概要

- 図表

- 目次

世界のコンテナ型データセンターの市場規模は、2024年に130億米ドルに達しました。今後、IMARC Groupは、同市場が2033年までに645億米ドルに達し、2025~2033年の成長率(CAGR)は19.49%に達すると予測しています。同市場は主に、迅速な展開と拡張性、新興市場での採用拡大、エネルギー効率、エッジコンピューティングの統合によって大きな成長を遂げています。さらに、ハイパフォーマンスコンピューティング(高性能計算)と人工知能の技術的進歩がその魅力を高めています。これらの柔軟でコスト効率に優れたソリューションは、多様なビジネスニーズに対応するため、現代のITインフラにとって不可欠なものとなり、市場拡大を牽引しています。

コンテナ型データセンター市場の動向:

技術進歩

ハイパフォーマンスコンピューティング(HPC)や人工知能(AI)といった技術の継続的な進歩が、コンテナ型データセンターに統合されつつあります。この統合により、処理能力と運用効率が向上し、より複雑でデータ量の多いアプリケーションの処理が可能になります。HPCとAIのテクノロジーは、データ分析の高速化、リアルタイム処理、ビッグデータ分析、機械学習、シミュレーションなどのタスクにおけるパフォーマンスの向上を可能にします。その結果、コンテナ型データセンターは、金融、医療、科学研究など、さまざまな業界の幅広いアプリケーションにますます適してきています。例えば、三菱重工業は2023年10月、ハイブリッド冷却を搭載した新しいコンテナ型データセンターを発表し、2023年末までに商用化を開始する予定です。40kVAクラスの12ftコンテナには、液浸冷却と空冷システムの両方が組み込まれており、40℃での液浸冷却のみではPUE1.05、ハイブリッド方式では1.14を目指しています。

新興市場での採用増加

東南アジア、ラテンアメリカ、アフリカなどの新興市場では、その費用対効果と柔軟性から、コンテナ型データセンターへの需要が高まっています。これらの地域では従来のデータセンターに必要なインフラが不足していることが多く、コンテナ型ソリューションが魅力的な選択肢となっています。コンテナ型データセンターは迅速に展開でき、輸送も容易で、特定のニーズに応じて拡張できるため、リソースが限られている地域に最適です。この柔軟性により、こうした地域の企業は、従来のデータセンターに必要な多額の投資をすることなく、IT能力を強化することができます。例えば、インドネシアのブロードバンド・プロバイダーであるリンク・ネットは2023年10月、中国の通信事業者である中興通訊(ZTE)と提携し、インドネシアのジャカルタとスラバヤに2つの新しいデータセンターを開設しました。このデータセンターは、リンク・ネットの住宅用ブロードバンド事業の信頼性を高め、顧客のスムーズな接続を確保するためのものです。それぞれ300ラックの容量を持つこれらの施設は、同国の通信インフラを強化し、デジタル成長をサポートすることを目的としています。

エッジコンピューティングの統合

データ発生源に近い場所でデータ処理を行う必要があるエッジコンピューティングの台頭が、コンテナ型データセンターの需要を促進しています。これらのモジュール式ユニットはエッジの場所に配置でき、低遅延のデータ処理能力を提供します。この近接性により、待ち時間が短縮され、リアルタイムのデータ処理が強化され、ネットワーク全体の効率が向上します。例えば、2023年12月、シーメンス・ガメサ社は、ハルにある英国の製造施設にセキュアi.T.エンバイロメンツのModCelコンテナ型データセンターを導入しました。このデータセンターは、風力タービンを含む再生可能エネルギー機器製造の生産システムと通信をサポートします。このデータセンターは、ハンバー河口沿いのドックベースの環境向けに特別に設計されており、奥行き1,200mmの48Uキャビネット2台、ラックマウント型UPS付きPDU、冷却用のダウンフロー型AirSys Unicool AHUユニットを外付けしています。コンテナ型データセンターは、柔軟性、拡張性、迅速な導入ソリューションを提供し、IoT、自律走行車、スマートシティなどの分野で高まる即時データ処理のニーズに応えるため、エッジコンピューティングに最適です。

目次

第1章 序文

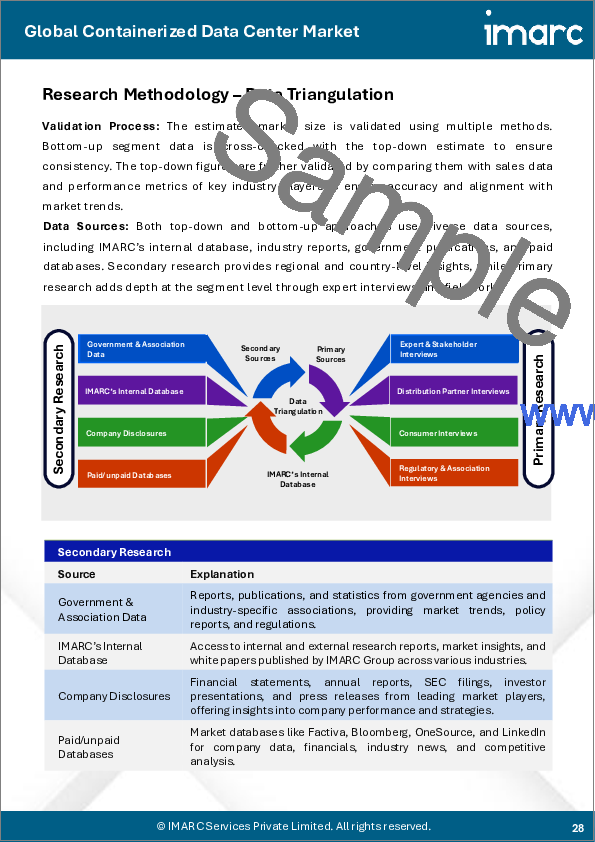

第2章 分析範囲・手法

- 分析目的

- ステークホルダー

- データソース

- 一次情報

- 二次情報

- 市場推定

- ボトムアップアプローチ

- トップダウンアプローチ

- 分析手法

第3章 エグゼクティブサマリー

第4章 イントロダクション

第5章 世界のコンテナ型データセンター市場

- 市場概要

- 市場実績

- COVID-19の影響

- 市場予測

第6章 市場区分:コンテナの種類別

- 20フィートコンテナ

- 40フィートコンテナ

- カスタム型コンテナ

第7章 市場区分:組織規模別

- 小規模組織

- 中規模組織

- 大規模組織

第8章 市場区分:用途別

- グリーンフィールド

- ブラウンフィールド

- 更新・統合

第9章 市場区分:最終用途産業別

- BFSI

- IT・通信

- 政府

- 教育

- 医療

- 防衛

- エンターテインメント・メディア

- その他

第10章 市場区分:地域別

- 北米

- 米国

- カナダ

- アジア太平洋

- 中国

- 日本

- インド

- 韓国

- オーストラリア

- インドネシア

- その他

- 欧州

- ドイツ

- フランス

- 英国

- イタリア

- スペイン

- ロシア

- その他

- ラテンアメリカ

- ブラジル

- メキシコ

- その他

- 中東・アフリカ

第11章 SWOT分析

第12章 バリューチェーン分析

第13章 ポーターのファイブフォース分析

第14章 価格分析

第15章 競合情勢

- 市場構造

- 主要企業

- 主要企業のプロファイル

- Cisco Systems Inc.

- Dell Technologies Inc.

- Eaton Corporation Plc

- Hewlett Packard Enterprise Comp

- Huawei Technologies Co. Ltd.

- International Business Machines Corporation

- Johnson Controls

- Rittal GmbH & Co. KG(Friedhelm Loh Group)

- Schneider Electric Se

- ZTE Corporation

List of Figures

- Figure 1: Global: Containerized Data Center Market: Major Drivers and Challenges

- Figure 2: Global: Containerized Data Center Market: Sales Value (in Billion USD), 2019-2024

- Figure 3: Global: Containerized Data Center Market: Breakup by Type of Container (in %), 2024

- Figure 4: Global: Containerized Data Center Market: Breakup by Organization Size (in %), 2024

- Figure 5: Global: Containerized Data Center Market: Breakup by Application (in %), 2024

- Figure 6: Global: Containerized Data Center Market: Breakup by End Use Industry (in %), 2024

- Figure 7: Global: Containerized Data Center Market: Breakup by Region (in %), 2024

- Figure 8: Global: Containerized Data Center Market Forecast: Sales Value (in Billion USD), 2025-2033

- Figure 9: Global: Containerized Data Center (20 FT Container) Market: Sales Value (in Million USD), 2019 & 2024

- Figure 10: Global: Containerized Data Center (20 FT Container) Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 11: Global: Containerized Data Center (40 FT Container) Market: Sales Value (in Million USD), 2019 & 2024

- Figure 12: Global: Containerized Data Center (40 FT Container) Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 13: Global: Containerized Data Center (Customized Container) Market: Sales Value (in Million USD), 2019 & 2024

- Figure 14: Global: Containerized Data Center (Customized Container) Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 15: Global: Containerized Data Center (Small Organization) Market: Sales Value (in Million USD), 2019 & 2024

- Figure 16: Global: Containerized Data Center (Small Organization) Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 17: Global: Containerized Data Center (Midsize Organization) Market: Sales Value (in Million USD), 2019 & 2024

- Figure 18: Global: Containerized Data Center (Midsize Organization) Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 19: Global: Containerized Data Center (Large Organization) Market: Sales Value (in Million USD), 2019 & 2024

- Figure 20: Global: Containerized Data Center (Large Organization) Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 21: Global: Containerized Data Center (Greenfield) Market: Sales Value (in Million USD), 2019 & 2024

- Figure 22: Global: Containerized Data Center (Greenfield) Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 23: Global: Containerized Data Center (Brownfield) Market: Sales Value (in Million USD), 2019 & 2024

- Figure 24: Global: Containerized Data Center (Brownfield) Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 25: Global: Containerized Data Center (Upgrade and Consolidation) Market: Sales Value (in Million USD), 2019 & 2024

- Figure 26: Global: Containerized Data Center (Upgrade and Consolidation) Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 27: Global: Containerized Data Center (BFSI) Market: Sales Value (in Million USD), 2019 & 2024

- Figure 28: Global: Containerized Data Center (BFSI) Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 29: Global: Containerized Data Center (IT and Telecommunications) Market: Sales Value (in Million USD), 2019 & 2024

- Figure 30: Global: Containerized Data Center (IT and Telecommunications) Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 31: Global: Containerized Data Center (Government) Market: Sales Value (in Million USD), 2019 & 2024

- Figure 32: Global: Containerized Data Center (Government) Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 33: Global: Containerized Data Center (Education) Market: Sales Value (in Million USD), 2019 & 2024

- Figure 34: Global: Containerized Data Center (Education) Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 35: Global: Containerized Data Center (Healthcare) Market: Sales Value (in Million USD), 2019 & 2024

- Figure 36: Global: Containerized Data Center (Healthcare) Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 37: Global: Containerized Data Center (Defense) Market: Sales Value (in Million USD), 2019 & 2024

- Figure 38: Global: Containerized Data Center (Defense) Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 39: Global: Containerized Data Center (Entertainment and Media) Market: Sales Value (in Million USD), 2019 & 2024

- Figure 40: Global: Containerized Data Center (Entertainment and Media) Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 41: Global: Containerized Data Center (Other Industries) Market: Sales Value (in Million USD), 2019 & 2024

- Figure 42: Global: Containerized Data Center (Other Industries) Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 43: North America: Containerized Data Center Market: Sales Value (in Million USD), 2019 & 2024

- Figure 44: North America: Containerized Data Center Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 45: United States: Containerized Data Center Market: Sales Value (in Million USD), 2019 & 2024

- Figure 46: United States: Containerized Data Center Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 47: Canada: Containerized Data Center Market: Sales Value (in Million USD), 2019 & 2024

- Figure 48: Canada: Containerized Data Center Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 49: Asia Pacific: Containerized Data Center Market: Sales Value (in Million USD), 2019 & 2024

- Figure 50: Asia Pacific: Containerized Data Center Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 51: China: Containerized Data Center Market: Sales Value (in Million USD), 2019 & 2024

- Figure 52: China: Containerized Data Center Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 53: Japan: Containerized Data Center Market: Sales Value (in Million USD), 2019 & 2024

- Figure 54: Japan: Containerized Data Center Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 55: India: Containerized Data Center Market: Sales Value (in Million USD), 2019 & 2024

- Figure 56: India: Containerized Data Center Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 57: South Korea: Containerized Data Center Market: Sales Value (in Million USD), 2019 & 2024

- Figure 58: South Korea: Containerized Data Center Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 59: Australia: Containerized Data Center Market: Sales Value (in Million USD), 2019 & 2024

- Figure 60: Australia: Containerized Data Center Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 61: Indonesia: Containerized Data Center Market: Sales Value (in Million USD), 2019 & 2024

- Figure 62: Indonesia: Containerized Data Center Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 63: Others: Containerized Data Center Market: Sales Value (in Million USD), 2019 & 2024

- Figure 64: Others: Containerized Data Center Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 65: Europe: Containerized Data Center Market: Sales Value (in Million USD), 2019 & 2024

- Figure 66: Europe: Containerized Data Center Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 67: Germany: Containerized Data Center Market: Sales Value (in Million USD), 2019 & 2024

- Figure 68: Germany: Containerized Data Center Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 69: France: Containerized Data Center Market: Sales Value (in Million USD), 2019 & 2024

- Figure 70: France: Containerized Data Center Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 71: United Kingdom: Containerized Data Center Market: Sales Value (in Million USD), 2019 & 2024

- Figure 72: United Kingdom: Containerized Data Center Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 73: Italy: Containerized Data Center Market: Sales Value (in Million USD), 2019 & 2024

- Figure 74: Italy: Containerized Data Center Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 75: Spain: Containerized Data Center Market: Sales Value (in Million USD), 2019 & 2024

- Figure 76: Spain: Containerized Data Center Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 77: Russia: Containerized Data Center Market: Sales Value (in Million USD), 2019 & 2024

- Figure 78: Russia: Containerized Data Center Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 79: Others: Containerized Data Center Market: Sales Value (in Million USD), 2019 & 2024

- Figure 80: Others: Containerized Data Center Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 81: Latin America: Containerized Data Center Market: Sales Value (in Million USD), 2019 & 2024

- Figure 82: Latin America: Containerized Data Center Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 83: Brazil: Containerized Data Center Market: Sales Value (in Million USD), 2019 & 2024

- Figure 84: Brazil: Containerized Data Center Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 85: Mexico: Containerized Data Center Market: Sales Value (in Million USD), 2019 & 2024

- Figure 86: Mexico: Containerized Data Center Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 87: Others: Containerized Data Center Market: Sales Value (in Million USD), 2019 & 2024

- Figure 88: Others: Containerized Data Center Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 89: Middle East and Africa: Containerized Data Center Market: Sales Value (in Million USD), 2019 & 2024

- Figure 90: Middle East and Africa: Containerized Data Center Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 91: Global: Containerized Data Center Industry: SWOT Analysis

- Figure 92: Global: Containerized Data Center Industry: Value Chain Analysis

- Figure 93: Global: Containerized Data Center Industry: Porter's Five Forces Analysis

List of Tables

- Table 1: Global: Containerized Data Center Market: Key Industry Highlights, 2024 and 2033

- Table 2: Global: Containerized Data Center Market Forecast: Breakup by Type of Container (in Million USD), 2025-2033

- Table 3: Global: Containerized Data Center Market Forecast: Breakup by Organization Size (in Million USD), 2025-2033

- Table 4: Global: Containerized Data Center Market Forecast: Breakup by Application (in Million USD), 2025-2033

- Table 5: Global: Containerized Data Center Market Forecast: Breakup by End Use Industry (in Million USD), 2025-2033

- Table 6: Global: Containerized Data Center Market Forecast: Breakup by Region (in Million USD), 2025-2033

- Table 7: Global: Containerized Data Center Market Structure

- Table 8: Global: Containerized Data Center Market: Key Players

The global containerized data center market size reached USD 13.0 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 64.5 Billion by 2033, exhibiting a growth rate (CAGR) of 19.49% during 2025-2033. The market is experiencing a significant growth mainly driven by the rapid deployment and scalability, increased adoption in emerging markets, energy efficiency, and the integration of edge computing. Additionally, technological advancements in high performance computing and artificial intelligence enhance their appeal. These flexible, cost-effective solutions meet diverse business needs, making them indispensable for modern IT infrastructure and driving market expansion.

Containerized Data Center Market Trends:

Technological Advancements

Continuous advancements in technology, such as high-performance computing (HPC) and artificial intelligence (AI), are being integrated into containerized data centers. This integration enhances their processing power and operational efficiency, enabling them to handle more complex and data-intensive applications. HPC and AI technologies allow for faster data analysis, real-time processing, and improved performance in tasks such as big data analytics, machine learning, and simulations. As a result, containerized data centers are becoming increasingly suitable for a wider range of applications across various industries, including finance, healthcare, and scientific research. For instance, in October 2023, Mitsubishi Heavy Industries introduced a new containerized data center with hybrid cooling, set to launch commercially by the end of 2023. The 40kVA-class 12ft container incorporates both immersion and air-cooling systems, aiming for a PUE of 1.05 with immersion cooling alone at 40°C, and 1.14 with a hybrid approach.

Rising Adoption in Emerging Markets

There is a growing demand for containerized data centers in emerging markets like Southeast Asia, Latin America, and Africa due to their cost-effectiveness and flexibility. These regions often lack the infrastructure needed for traditional data centers, making containerized solutions an attractive alternative. Containerized data centers can be rapidly deployed, easily transported, and scaled according to specific needs, which is ideal for areas with limited resources. This flexibility allows businesses in these regions to enhance their IT capabilities without the substantial investments required for conventional data centers. For instance, in October 2023, Indonesian broadband provider Link Net partnered with Chinese telco ZTE to launch two new data centers in Jakarta and Surabaya, Indonesia. The data centers are designed to enhance the reliability of Link Net's residential broadband business and ensure smooth connectivity for customers. With a total capacity of 300 racks each, these facilities aim to strengthen the country's telecommunications infrastructure and support digital growth.

Integration of Edge Computing

The rise of edge computing, which requires data processing closer to the source of data generation, is driving the demand for containerized data centers. These modular units can be deployed at edge locations, providing low-latency data processing capabilities. This proximity reduces latency, enhances real-time data processing, and improves overall network efficiency. For instance, in December 2023, Siemens Gamesa deployed a Secure I.T. Environments ModCel containerized data center at its UK manufacturing facility in Hull. The data center will support production systems and communications for renewable energy equipment manufacturing including wind turbines. It is specifically designed for the dock-based environment along the Humber estuary, featuring two 48U 1,200mm deep cabinets, PDUs with rackmount UPS and externally mounted downflow AirSys Unicool AHU units for cooling. Containerized data centers are ideal for edge computing as they offer flexible, scalable, and rapid deployment solutions, meeting the growing need for immediate data processing in sectors like IoT, autonomous vehicles, and smart cities.

Containerized Data Center Market Segmentation:

Breakup by Type of Container:

- 20 FT Container

- 40 FT Container

- Customized Container

20 FT container accounts for the majority of the market share

The 20-foot container dominates the containerized data center market due to its optimal balance of portability and capacity. This standard size offers a versatile solution, fitting easily into existing logistics frameworks while providing sufficient space for critical IT infrastructure. Its compact dimensions make it ideal for deployments in urban areas with limited space, as well as for remote or temporary installations. The 20-foot container's popularity is also driven by its cost-effectiveness and efficiency in cooling and power distribution, meeting the needs of a wide range of industries seeking scalable, flexible, and rapid deployment of data center solutions.

Breakup by Organization Size:

- Small Organization

- Midsize Organization

- Large Organization

Large organization holds the largest share of the industry

Large organizations hold the largest share of the containerized data center market due to their extensive IT infrastructure needs and significant capital resources. These organizations, including multinational corporations, financial institutions, and tech giants, require scalable and flexible data center solutions to manage vast amounts of data and support global operations. Containerized data centers offer these large entities the ability to quickly deploy high-density computing environments, ensuring business continuity and disaster recovery. Additionally, their robust security features and energy-efficient designs align with corporate sustainability goals, making them an attractive option for large-scale enterprises aiming to optimize their data management strategies.

Breakup by Application:

- Greenfield

- Brownfield

- Upgrade and Consolidation

Greenfield represents the leading market segment

Greenfield projects represent the leading segment in the containerized data center market, driven by the increasing demand for scalable and efficient data infrastructure. These projects involve the construction of entirely new data centers on undeveloped land, allowing for customized and optimized design to meet specific requirements. Greenfield deployments offer the advantage of incorporating the latest technologies and innovations from the ground up, enhancing energy efficiency and operational performance. This segment's growth is fueled by the rising need for flexible and rapid deployment of data centers in emerging markets and remote locations, where traditional data center setups may be impractical or too costly.

Breakup by End Use Industry:

- BFSI

- IT and Telecommunications

- Government

- Education

- Healthcare

- Defense

- Entertainment and Media

- Others

IT and telecommunications exhibits a clear dominance in the market

The IT and telecommunications sector exhibits clear dominance in the containerized data center market due to its significant need for scalable, flexible, and rapid deployment of data infrastructure. This industry relies heavily on robust and efficient data centers to manage massive volumes of data, ensure low latency, and maintain high-speed connectivity. Containerized data centers offer an ideal solution by providing modular, portable, and energy-efficient facilities that can be deployed quickly in response to fluctuating demands. Additionally, the ability to easily scale operations and integrate with existing networks makes containerized data centers particularly appealing to IT and telecommunications companies, driving their market leadership.

Breakup by Region:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

North America leads the market, accounting for the largest containerized data center market share

The report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Europe (Germany, France, the United Kingdom, Italy, Spain, Russia, and others); Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, North America represents the largest regional market for containerized data center.

North America leads the containerized data center market, accounting for the largest share due to several key factors. The region's dominance is driven by its advanced IT infrastructure, high adoption rates of cloud computing, and significant investments in data center technologies by major corporations. Additionally, the presence of tech giants like Google, Microsoft, and Amazon Web Services enhances market growth through continuous innovation and expansion. For instance, major cloud service providers like Google, Meta, Amazon, Microsoft, and Oracle are investing heavily in data centers to support the growing demand for artificial intelligence. Their spending on cloud computing capabilities reached nearly $160 billion in 2022, with a 30% increase over the past five years. The surge in AI usage is driving this demand, causing a need for more power and infrastructure. North America's focus on energy efficiency and sustainability further boosts the adoption of containerized data centers, which offer scalable, portable, and efficient solutions. Government initiatives and supportive regulations also contribute to the region's leading position in this market.

Competitive Landscape:

- The market research report has also provided a comprehensive analysis of the competitive landscape in the market. Detailed profiles of all major companies have also been provided. Some of the major market players in the containerized data center industry include Cisco Systems Inc., Dell Technologies Inc., Eaton Corporation plc, Hewlett Packard Enterprise Comp, Huawei Technologies Co. Ltd., International Business Machines Corporation, Johnson Controls, Rittal GmbH & Co. KG (Friedhelm Loh Group), Schneider Electric SE, and ZTE Corporation.

(Please note that this is only a partial list of the key players, and the complete list is provided in the report.)

- The containerized data center market is highly competitive, characterized by a mix of established players and emerging innovators. Key players like IBM, Hewlett Packard Enterprise, and Dell leverage their robust technological capabilities and extensive service networks to dominate, often integrating advanced cooling systems and energy-efficient solutions to appeal to eco-conscious consumers. For instance, in May 2024, IBM expanded its server portfolio with the introduction of IBM Power S1012, offering up to 3X more performance per core than its predecessor. This 1-socket, half-wide Power10 processor-based system is optimized for edge-level computing and AI inferencing workloads. It enables real-time insights across industries and offers enhanced remote management capabilities. The Power S1012 also reduces IT footprint and increases core performance for IBM clients. The competition is further intensified by the growing demand for modular data solutions that can scale quickly, driven by the increasing data traffic and the shift towards cloud computing. As companies vie for market share, strategic partnerships and innovations in energy efficiency and sustainability have become crucial competitive factors. This dynamic market landscape pushes companies to continuously evolve and adapt, offering tailored solutions that meet diverse customer needs while focusing on reducing carbon footprints and operational costs.

Key Questions Answered in This Report

- 1.What was the size of the global containerized data center market in 2024?

- 2.What is the expected growth rate of the global containerized data center market during 2025-2033?

- 3.What has been the impact of COVID-19 on the global containerized data center market?

- 4.What are the key factors driving the global containerized data center market?

- 5.What is the breakup of the global containerized data center market based on the type of container?

- 6.What is the breakup of the global containerized data center market based on the organization size?

- 7.What is the breakup of the global containerized data center market based on the application?

- 8.What is the breakup of the global containerized data center market based on the end use industry?

- 9.What are the key regions in the global containerized data center market?

- 10.Who are the key players/companies in the global containerized data center market

Table of Contents

1 Preface

2 Scope and Methodology

- 2.1 Objectives of the Study

- 2.2 Stakeholders

- 2.3 Data Sources

- 2.3.1 Primary Sources

- 2.3.2 Secondary Sources

- 2.4 Market Estimation

- 2.4.1 Bottom-Up Approach

- 2.4.2 Top-Down Approach

- 2.5 Forecasting Methodology

3 Executive Summary

4 Introduction

- 4.1 Overview

- 4.2 Key Industry Trends

5 Global Containerized Data Center Market

- 5.1 Market Overview

- 5.2 Market Performance

- 5.3 Impact of COVID-19

- 5.4 Market Forecast

6 Market Breakup by Type of Container

- 6.1 20 FT Container

- 6.1.1 Market Trends

- 6.1.2 Market Forecast

- 6.2 40 FT Container

- 6.2.1 Market Trends

- 6.2.2 Market Forecast

- 6.3 Customized Container

- 6.3.1 Market Trends

- 6.3.2 Market Forecast

7 Market Breakup by Organization Size

- 7.1 Small Organization

- 7.1.1 Market Trends

- 7.1.2 Market Forecast

- 7.2 Midsize Organization

- 7.2.1 Market Trends

- 7.2.2 Market Forecast

- 7.3 Large Organization

- 7.3.1 Market Trends

- 7.3.2 Market Forecast

8 Market Breakup by Application

- 8.1 Greenfield

- 8.1.1 Market Trends

- 8.1.2 Market Forecast

- 8.2 Brownfield

- 8.2.1 Market Trends

- 8.2.2 Market Forecast

- 8.3 Upgrade and Consolidation

- 8.3.1 Market Trends

- 8.3.2 Market Forecast

9 Market Breakup by End Use Industry

- 9.1 BFSI

- 9.1.1 Market Trends

- 9.1.2 Market Forecast

- 9.2 IT and Telecommunications

- 9.2.1 Market Trends

- 9.2.2 Market Forecast

- 9.3 Government

- 9.3.1 Market Trends

- 9.3.2 Market Forecast

- 9.4 Education

- 9.4.1 Market Trends

- 9.4.2 Market Forecast

- 9.5 Healthcare

- 9.5.1 Market Trends

- 9.5.2 Market Forecast

- 9.6 Defense

- 9.6.1 Market Trends

- 9.6.2 Market Forecast

- 9.7 Entertainment and Media

- 9.7.1 Market Trends

- 9.7.2 Market Forecast

- 9.8 Others

- 9.8.1 Market Trends

- 9.8.2 Market Forecast

10 Market Breakup by Region

- 10.1 North America

- 10.1.1 United States

- 10.1.1.1 Market Trends

- 10.1.1.2 Market Forecast

- 10.1.2 Canada

- 10.1.2.1 Market Trends

- 10.1.2.2 Market Forecast

- 10.1.1 United States

- 10.2 Asia Pacific

- 10.2.1 China

- 10.2.1.1 Market Trends

- 10.2.1.2 Market Forecast

- 10.2.2 Japan

- 10.2.2.1 Market Trends

- 10.2.2.2 Market Forecast

- 10.2.3 India

- 10.2.3.1 Market Trends

- 10.2.3.2 Market Forecast

- 10.2.4 South Korea

- 10.2.4.1 Market Trends

- 10.2.4.2 Market Forecast

- 10.2.5 Australia

- 10.2.5.1 Market Trends

- 10.2.5.2 Market Forecast

- 10.2.6 Indonesia

- 10.2.6.1 Market Trends

- 10.2.6.2 Market Forecast

- 10.2.7 Others

- 10.2.7.1 Market Trends

- 10.2.7.2 Market Forecast

- 10.2.1 China

- 10.3 Europe

- 10.3.1 Germany

- 10.3.1.1 Market Trends

- 10.3.1.2 Market Forecast

- 10.3.2 France

- 10.3.2.1 Market Trends

- 10.3.2.2 Market Forecast

- 10.3.3 United Kingdom

- 10.3.3.1 Market Trends

- 10.3.3.2 Market Forecast

- 10.3.4 Italy

- 10.3.4.1 Market Trends

- 10.3.4.2 Market Forecast

- 10.3.5 Spain

- 10.3.5.1 Market Trends

- 10.3.5.2 Market Forecast

- 10.3.6 Russia

- 10.3.6.1 Market Trends

- 10.3.6.2 Market Forecast

- 10.3.7 Others

- 10.3.7.1 Market Trends

- 10.3.7.2 Market Forecast

- 10.3.1 Germany

- 10.4 Latin America

- 10.4.1 Brazil

- 10.4.1.1 Market Trends

- 10.4.1.2 Market Forecast

- 10.4.2 Mexico

- 10.4.2.1 Market Trends

- 10.4.2.2 Market Forecast

- 10.4.3 Others

- 10.4.3.1 Market Trends

- 10.4.3.2 Market Forecast

- 10.4.1 Brazil

- 10.5 Middle East and Africa

- 10.5.1 Market Trends

- 10.5.2 Market Breakup by Country

- 10.5.3 Market Forecast

11 SWOT Analysis

- 11.1 Overview

- 11.2 Strengths

- 11.3 Weaknesses

- 11.4 Opportunities

- 11.5 Threats

12 Value Chain Analysis

13 Porters Five Forces Analysis

- 13.1 Overview

- 13.2 Bargaining Power of Buyers

- 13.3 Bargaining Power of Suppliers

- 13.4 Degree of Competition

- 13.5 Threat of New Entrants

- 13.6 Threat of Substitutes

14 Price Analysis

15 Competitive Landscape

- 15.1 Market Structure

- 15.2 Key Players

- 15.3 Profiles of Key Players

- 15.3.1 Cisco Systems Inc.

- 15.3.1.1 Company Overview

- 15.3.1.2 Product Portfolio

- 15.3.1.3 Financials

- 15.3.1.4 SWOT Analysis

- 15.3.2 Dell Technologies Inc.

- 15.3.2.1 Company Overview

- 15.3.2.2 Product Portfolio

- 15.3.2.3 Financials

- 15.3.2.4 SWOT Analysis

- 15.3.3 Eaton Corporation Plc

- 15.3.3.1 Company Overview

- 15.3.3.2 Product Portfolio

- 15.3.3.3 Financials

- 15.3.3.4 SWOT Analysis

- 15.3.4 Hewlett Packard Enterprise Comp

- 15.3.4.1 Company Overview

- 15.3.4.2 Product Portfolio

- 15.3.4.3 Financials

- 15.3.4.4 SWOT Analysis

- 15.3.5 Huawei Technologies Co. Ltd.

- 15.3.5.1 Company Overview

- 15.3.5.2 Product Portfolio

- 15.3.5.3 SWOT Analysis

- 15.3.6 International Business Machines Corporation

- 15.3.6.1 Company Overview

- 15.3.6.2 Product Portfolio

- 15.3.6.3 Financials

- 15.3.6.4 SWOT Analysis

- 15.3.7 Johnson Controls

- 15.3.7.1 Company Overview

- 15.3.7.2 Product Portfolio

- 15.3.7.3 Financials

- 15.3.7.4 SWOT Analysis

- 15.3.8 Rittal GmbH & Co. KG (Friedhelm Loh Group)

- 15.3.8.1 Company Overview

- 15.3.8.2 Product Portfolio

- 15.3.9 Schneider Electric Se

- 15.3.9.1 Company Overview

- 15.3.9.2 Product Portfolio

- 15.3.9.3 Financials

- 15.3.9.4 SWOT Analysis

- 15.3.10 ZTE Corporation

- 15.3.10.1 Company Overview

- 15.3.10.2 Product Portfolio

- 15.3.10.3 Financials

- 15.3.1 Cisco Systems Inc.