|

|

市場調査レポート

商品コード

1754285

マイクロLEDディスプレイの世界市場 - 市場規模、シェア、動向、予測:製品別、アプリケーション別、業種別、地域別、2025年~2033年Micro-LED Display Market Size, Share, Trends and Forecast by Product, Application, Industry Vertical, and Region, 2025-2033 |

||||||

カスタマイズ可能

|

|||||||

| マイクロLEDディスプレイの世界市場 - 市場規模、シェア、動向、予測:製品別、アプリケーション別、業種別、地域別、2025年~2033年 |

|

出版日: 2025年06月02日

発行: IMARC

ページ情報: 英文 140 Pages

納期: 2~3営業日

|

全表示

- 概要

- 図表

- 目次

マイクロLEDディスプレイの世界市場規模は、2024年に7億3,451万米ドルとなりました。今後、IMARC Groupは、2033年には543億9,473万米ドルに達し、2025年から2033年にかけて58.27%のCAGRを示すと予測しています。現在、アジア太平洋地域が市場を独占しており、2024年の市場シェアは43.2%です。同地域の優位性は、高度なインフラ、強力な技術基盤、大規模生産能力によって支えられています。アジア太平洋地域は、ディスプレイ技術革新への集中投資、効率的な部品調達、高級視覚技術への需要の高まりから恩恵を受けています。製造技術の継続的な改善と高度に熟練した労働力により、この地域は競争力を維持しています。このリーダーシップは、同地域におけるマイクロLEDディスプレイ市場シェアの拡大に大きく貢献し続けています。

マイクロLED(発光ダイオード)技術は、従来のスクリーンと比較して、より高い輝度、より豊かな黒色、強化されたコントラスト比を提供します。また、応答速度が速いため、スムーズなモーションレンダリングが可能になり、ゲームやビデオ再生、リフレッシュレートの高い各種アプリケーションにおけるユーザーエクスペリエンスが向上します。色の正確さと視野角の広さは視覚の質を高め、マイクロLEDはハイエンドディスプレイの有力な選択肢となっています。さらに、大手ハイテク企業は、マイクロLED技術を強化するための研究開発(R&D)に多額の投資を行っています。技術に関する戦略的パートナーシップ、合併、ライセンシング契約は、市場への迅速な参入と生産能力の向上を促進しています。これらの協力関係はさらに、マイクロLEDをより多様な製品やプラットフォームに組み込むことを促進し、市場の商業的可能性を高めています。

米国は、マイクロLEDの進歩に積極的に投資している数多くのハイテク大手や新興企業の存在によって、市場で重要な役割を果たしています。各企業は特許を取得し、独自の製造プロセスを構築し、物質移動とチップ接合技術を強化することで、商業化を加速させています。さらに、メーカー各社は人工知能(AI)機能を組み込み、コンテンツエコシステムを拡大してユーザーとのインタラクションを向上させています。インテリジェント機能と高品質ディスプレイの組み合わせは、マイクロLED技術の革新を促し、エンターテインメント、ライフスタイル、スマートホーム分野での幅広い利用を促進しています。例えば、CES First Look 2025でSamsung Electronics Americaは、Neo QLED、OLED、QLED、The Frameを搭載した最も幅広いテレビで、AI主導のVision AIプラットフォームを発表しました。SamsungはさらにArt Storeを拡張し、マイクロLEDテレビでアート作品にアクセスできるマイクロLEDアドバンスメントや、スマートディスプレイ技術とパーソナルグルーミングを統合したマイクロLEDビューティーミラーを発表しました。これらの開発により、Samsungはパーソナライズされ、スマートで、相互接続されたスクリーン体験を追求していることが強調されました。

マイクロLEDディスプレイ市場動向:

高輝度とエネルギー効率

マイクロLEDスクリーンは、標準的な液晶ディスプレイ(LCD)や有機発光ダイオード(OLED)パネルに比べて輝度が高いです。これは、視認性が重要なスタジアムやビルボードなど、周囲光が強い屋外環境では特に有益です。欧州委員会の報告によると、欧州には常時約200万から800万枚のビルボードがあり、この数字は増え続けています。これとは別に、画質への影響を最小限に抑えながら明るさを維持できることから、マイクロLEDディスプレイは、さまざまな照明状況で信頼性の高い性能を必要とする個人にとって理想的であり、ユーザー体験を向上させる。マイクロLED技術は、特に明るい環境において、従来のディスプレイ技術よりも少ない電力しか消費しません。これは、マイクロLEDが直接発光するため、バックライトが不要なためです。消費電力の削減は、ポータブル機器のバッテリー寿命の延長や、大型スクリーンの運用コストの削減につながり、市場の成長に好影響を与えます。

優れた画質

マイクロLED技術は色域を拡大し、ディスプレイがより鮮やかで多様な色を作り出すことを可能にします。この機能は、特にゲーム、映画、写真など、色の正確さが要求される用途において、ユーザーの視覚体験を向上させる。例えば、ビデオゲームのプレイヤー数は2025年までに35億人を超えると予想されています。このほか、マイクロLEDはスクリーン全体に均一な色品質を提供し、色ずれを最小限に抑え、どの角度から見ても正確な色彩を維持するため、大手プレーヤーにチャンスをもたらします。これは、グラフィックデザインや映画制作のような専門的な用途にとって極めて重要です。マイクロLEDスクリーンは、個々のピクセルを活性化・非活性化することで、高いコントラスト比を実現します。この能力により、真の黒と鮮やかなハイライトが可能になり、画像全体の品質が向上します。この強化されたコントラストは、特にハイダイナミックレンジ(HDR)ビデオの視聴体験を向上させます。

高い拡張性

マイクロLEDスクリーンは拡張性が高いため、スマートウォッチのような小型のウェアラブルディスプレイから、大型の商業用スクリーンや公共用スクリーンまで、さまざまなサイズで製造することができます。2025年現在、スマートウォッチの世界ユーザー数は4億5,469万人で、2023年の3億2,399万人から41%増加しています。このような適応性により、生産者はコンシューマーエレクトロニクス、自動車、小売、エンターテインメントなど様々な市場分野に注力することができ、これが市場の成長を支えています。Micro-LED技術のモジュール特性は、性能や鮮明さを損なうことなくカスタムサイズのスクリーンを作成することを可能にし、美術品の展示や広大なデジタルサイネージなどのユニークなセットアップに適しています。従来のディスプレイ技術とは対照的に、マイクロLEDは高ピクセル密度を失うことなく拡大縮小できるため、大画面で超高解像度(UHD)や8K解像度を達成することができます。この能力は、ホームエンターテインメントシステム、専門的なデザインソフトウェア、正確な画像の鮮明さを必要とする高品質モニターなどの用途に不可欠です。

目次

第1章 序文

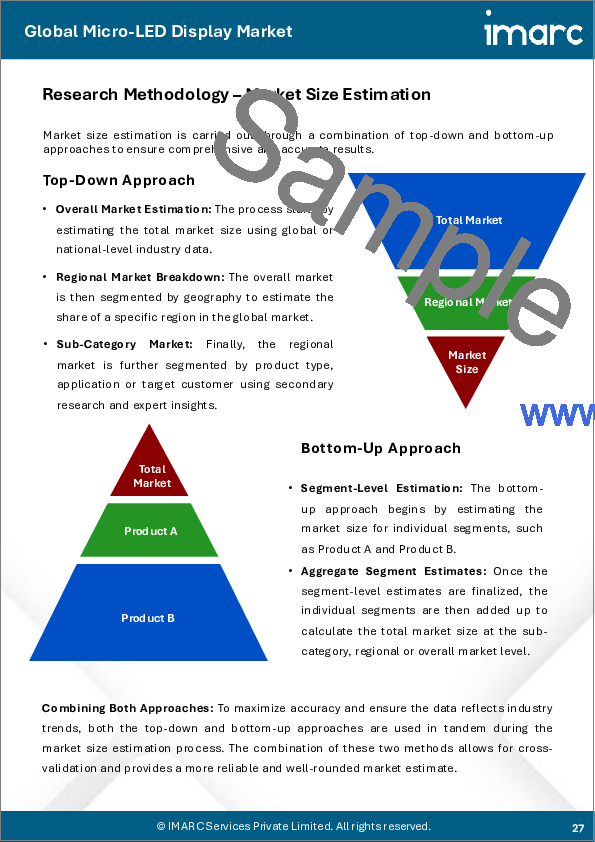

第2章 調査範囲と調査手法

- 調査の目的

- ステークホルダー

- データソース

- 一次情報

- 二次情報

- 市場推定

- ボトムアップアプローチ

- トップダウンアプローチ

- 調査手法

第3章 エグゼクティブサマリー

第4章 イントロダクション

- 概要

- 主要業界動向

第5章 世界のマイクロLEDディスプレイ市場

- 市場概要

- 市場実績

- COVID-19の影響

- 市場予測

第6章 市場内訳:製品別

- マイクロディスプレイ

- 大規模ディスプレイ

- 小型・中型ディスプレイ

第7章 市場内訳:アプリケーション別

- スマートフォン・タブレット

- PC・ラップトップ

- テレビ

- スマートウォッチ

- その他

第8章 市場内訳:業種別

- コンシューマーエレクトロニクス

- エンターテインメント・スポーツ

- 自動車

- 小売

- 政府・防衛

- その他

第9章 市場内訳:地域別

- 北米

- 米国

- カナダ

- アジア太平洋地域

- 中国

- 日本

- インド

- 韓国

- オーストラリア

- インドネシア

- その他

- 欧州

- ドイツ

- フランス

- 英国

- イタリア

- スペイン

- ロシア

- その他

- ラテンアメリカ

- ブラジル

- メキシコ

- その他

- 中東・アフリカ

- 市場内訳:国別

第10章 SWOT分析

- 概要

- 強み

- 弱み

- 機会

- 脅威

第11章 バリューチェーン分析

第12章 ポーターのファイブフォース分析

- 概要

- 買い手の交渉力

- 供給企業の交渉力

- 競合の程度

- 新規参入業者の脅威

- 代替品の脅威

第13章 価格分析

第14章 競合情勢

- 市場構造

- 主要企業

- 主要企業のプロファイル

- Aledia

- eLux Inc.

- Innolux Corporation

- Jade Bird Display

- LG Display Co. Ltd.(LG Electronics Inc.)

- Lumens Co. Ltd.

- Nanosys Inc.

- PlayNitride Inc.

- Plessey Semiconductors Ltd.

- Samsung Electronics Co. Ltd.

- Sony Group Corporation

- VueReal

List of Figures

- Figure 1: Global: Micro-LED Display Market: Major Drivers and Challenges

- Figure 2: Global: Micro-LED Display Market: Sales Value (in Million USD), 2019-2024

- Figure 3: Global: Micro-LED Display Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 4: Global: Micro-LED Display Market: Breakup by Product (in %), 2024

- Figure 5: Global: Micro-LED Display Market: Breakup by Application (in %), 2024

- Figure 6: Global: Micro-LED Display Market: Breakup by Industry Vertical (in %), 2024

- Figure 7: Global: Micro-LED Display Market: Breakup by Region (in %), 2024

- Figure 8: Global: Micro-LED Display (Micro Display) Market: Sales Value (in Million USD), 2019 & 2024

- Figure 9: Global: Micro-LED Display (Micro Display) Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 10: Global: Micro-LED Display (Large Scale Display) Market: Sales Value (in Million USD), 2019 & 2024

- Figure 11: Global: Micro-LED Display (Large Scale Display) Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 12: Global: Micro-LED Display (Small and Medium-sized Display) Market: Sales Value (in Million USD), 2019 & 2024

- Figure 13: Global: Micro-LED Display (Small and Medium-sized Display) Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 14: Global: Micro-LED Display (Smartphone and Tablets) Market: Sales Value (in Million USD), 2019 & 2024

- Figure 15: Global: Micro-LED Display (Smartphone and Tablets) Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 16: Global: Micro-LED Display (PC and Laptop) Market: Sales Value (in Million USD), 2019 & 2024

- Figure 17: Global: Micro-LED Display (PC and Laptop) Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 18: Global: Micro-LED Display (TV) Market: Sales Value (in Million USD), 2019 & 2024

- Figure 19: Global: Micro-LED Display (TV) Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 20: Global: Micro-LED Display (Smartwatch) Market: Sales Value (in Million USD), 2019 & 2024

- Figure 21: Global: Micro-LED Display (Smartwatch) Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 22: Global: Micro-LED Display (Other Applications) Market: Sales Value (in Million USD), 2019 & 2024

- Figure 23: Global: Micro-LED Display (Other Applications) Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 24: Global: Micro-LED Display (Consumer Electronics) Market: Sales Value (in Million USD), 2019 & 2024

- Figure 25: Global: Micro-LED Display (Consumer Electronics) Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 26: Global: Micro-LED Display (Entertainment and Sports) Market: Sales Value (in Million USD), 2019 & 2024

- Figure 27: Global: Micro-LED Display (Entertainment and Sports) Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 28: Global: Micro-LED Display (Automotive) Market: Sales Value (in Million USD), 2019 & 2024

- Figure 29: Global: Micro-LED Display (Automotive) Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 30: Global: Micro-LED Display (Retail) Market: Sales Value (in Million USD), 2019 & 2024

- Figure 31: Global: Micro-LED Display (Retail) Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 32: Global: Micro-LED Display (Government and Defense) Market: Sales Value (in Million USD), 2019 & 2024

- Figure 33: Global: Micro-LED Display (Government and Defense) Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 34: Global: Micro-LED Display (Other Industry Verticals) Market: Sales Value (in Million USD), 2019 & 2024

- Figure 35: Global: Micro-LED Display (Other Industry Verticals) Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 36: North America: Micro-LED Display Market: Sales Value (in Million USD), 2019 & 2024

- Figure 37: North America: Micro-LED Display Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 38: United States: Micro-LED Display Market: Sales Value (in Million USD), 2019 & 2024

- Figure 39: United States: Micro-LED Display Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 40: Canada: Micro-LED Display Market: Sales Value (in Million USD), 2019 & 2024

- Figure 41: Canada: Micro-LED Display Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 42: Asia-Pacific: Micro-LED Display Market: Sales Value (in Million USD), 2019 & 2024

- Figure 43: Asia-Pacific: Micro-LED Display Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 44: China: Micro-LED Display Market: Sales Value (in Million USD), 2019 & 2024

- Figure 45: China: Micro-LED Display Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 46: Japan: Micro-LED Display Market: Sales Value (in Million USD), 2019 & 2024

- Figure 47: Japan: Micro-LED Display Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 48: India: Micro-LED Display Market: Sales Value (in Million USD), 2019 & 2024

- Figure 49: India: Micro-LED Display Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 50: South Korea: Micro-LED Display Market: Sales Value (in Million USD), 2019 & 2024

- Figure 51: South Korea: Micro-LED Display Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 52: Australia: Micro-LED Display Market: Sales Value (in Million USD), 2019 & 2024

- Figure 53: Australia: Micro-LED Display Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 54: Indonesia: Micro-LED Display Market: Sales Value (in Million USD), 2019 & 2024

- Figure 55: Indonesia: Micro-LED Display Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 56: Others: Micro-LED Display Market: Sales Value (in Million USD), 2019 & 2024

- Figure 57: Others: Micro-LED Display Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 58: Europe: Micro-LED Display Market: Sales Value (in Million USD), 2019 & 2024

- Figure 59: Europe: Micro-LED Display Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 60: Germany: Micro-LED Display Market: Sales Value (in Million USD), 2019 & 2024

- Figure 61: Germany: Micro-LED Display Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 62: France: Micro-LED Display Market: Sales Value (in Million USD), 2019 & 2024

- Figure 63: France: Micro-LED Display Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 64: United Kingdom: Micro-LED Display Market: Sales Value (in Million USD), 2019 & 2024

- Figure 65: United Kingdom: Micro-LED Display Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 66: Italy: Micro-LED Display Market: Sales Value (in Million USD), 2019 & 2024

- Figure 67: Italy: Micro-LED Display Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 68: Spain: Micro-LED Display Market: Sales Value (in Million USD), 2019 & 2024

- Figure 69: Spain: Micro-LED Display Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 70: Russia: Micro-LED Display Market: Sales Value (in Million USD), 2019 & 2024

- Figure 71: Russia: Micro-LED Display Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 72: Others: Micro-LED Display Market: Sales Value (in Million USD), 2019 & 2024

- Figure 73: Others: Micro-LED Display Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 74: Latin America: Micro-LED Display Market: Sales Value (in Million USD), 2019 & 2024

- Figure 75: Latin America: Micro-LED Display Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 76: Brazil: Micro-LED Display Market: Sales Value (in Million USD), 2019 & 2024

- Figure 77: Brazil: Micro-LED Display Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 78: Mexico: Micro-LED Display Market: Sales Value (in Million USD), 2019 & 2024

- Figure 79: Mexico: Micro-LED Display Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 80: Others: Micro-LED Display Market: Sales Value (in Million USD), 2019 & 2024

- Figure 81: Others: Micro-LED Display Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 82: Middle East and Africa: Micro-LED Display Market: Sales Value (in Million USD), 2019 & 2024

- Figure 83: Middle East and Africa: Micro-LED Display Market: Breakup by Country (in %), 2024

- Figure 84: Middle East and Africa: Micro-LED Display Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 85: Global: Micro-LED Display Industry: SWOT Analysis

- Figure 86: Global: Micro-LED Display Industry: Value Chain Analysis

- Figure 87: Global: Micro-LED Display Industry: Porter's Five Forces Analysis

List of Tables

- Table 1: Global: Micro-LED Display Market: Key Industry Highlights, 2024 and 2033

- Table 2: Global: Micro-LED Display Market Forecast: Breakup by Product (in Million USD), 2025-2033

- Table 3: Global: Micro-LED Display Market Forecast: Breakup by Application (in Million USD), 2025-2033

- Table 4: Global: Micro-LED Display Market Forecast: Breakup by Industry Vertical (in Million USD), 2025-2033

- Table 5: Global: Micro-LED Display Market Forecast: Breakup by Region (in Million USD), 2025-2033

- Table 6: Global: Micro-LED Display Market: Competitive Structure

- Table 7: Global: Micro-LED Display Market: Key Players

The global Micro-LED display market size was valued at USD 734.51 Million in 2024. Looking forward, IMARC Group estimates the market to reach USD 54,394.73 Million by 2033, exhibiting a CAGR of 58.27% from 2025-2033. Asia Pacific currently dominates the market, holding a market share of 43.2% in 2024. The dominance of the regions is supported by its advanced infrastructure, strong technological base, and large-scale production capabilities. The Asia Pacific region benefits from concentrated investments in display innovation, efficient component sourcing, and the escalating demand for premium visual technologies. With continuous improvements in fabrication techniques and a highly skilled workforce, the region maintains a competitive edge. This leadership continues to significantly contribute to the expansion of the micro-LED display market share in the region.

Micro-light emitting diode (LED) technology offers greater brightness, richer blacks, and enhanced contrast ratios in comparison to conventional screens. The quick response time facilitates smoother motion rendering, improving user experience in gaming, video playback, and various high-refresh-rate applications. The precision of colors and broader viewing angles enhance visual quality, positioning micro-LEDs as a favored option for high-end displays. Furthermore, leading tech firms are significantly investing in research and development (R&D) to enhance micro-LED technology. Strategic partnerships, mergers, and licensing agreements for technology are facilitating quicker market entry and enhancing production capabilities. These collaborations additionally facilitate the incorporation of micro-LEDs into a wider variety of products and platforms, enhancing the market's commercial potential.

The United States plays a vital role in the market, fueled by the presence of numerous tech giants and start-ups that are actively investing in micro-LED advancements. Firms are obtaining patents, creating exclusive manufacturing processes, and enhancing mass transfer and chip bonding techniques, which is speeding up commercialization. Moreover, producers are incorporating artificial intelligence (AI) features and broadening content ecosystems to improve user interaction. The combination of intelligent features with high-quality displays is driving innovation in micro-LED technology, fostering wider use in entertainment, lifestyle, and smart home sectors. For example, at CES First Look 2025, Samsung Electronics America launched its AI-driven Vision AI platform across its widest range of TVs, featuring Neo QLED, OLED, QLED, and The Frame. Samsung further extended its Art Store and unveiled micro-LED advancements, featuring access to artwork on micro-LED TVs and the micro-LED Beauty Mirror, integrating smart display technology with personal grooming. These developments emphasize Samsung's drive for personalized, smart, and interconnected screen experiences.

Micro-LED Display Market Trends:

High brightness and energy efficiency

Micro-LED screens offer greater brightness compared to standard liquid-crystal display (LCD) and organic light-emitting diode (OLED) panels. This proves particularly beneficial for outdoor settings with elevated ambient light, including stadiums and billboards, where visibility is crucial. The European Commission reports that there are approximately 2 to 8 million billboards in Europe at any moment, and this figure continues to rise. Apart from this, the capability to maintain brightness while minimally impacting image quality renders micro-LED displays ideal for individuals that require reliable performance in different lighting situations, thus enhancing the user experience. Micro-LED technology uses less power than conventional display technologies, particularly in bright settings. This is achieved as micro-LEDs emit light directly, eliminating the need for backlighting. Reduced power usage leads to extended battery life in portable gadgets and decreased operational costs in large screens, thus favorably influencing the market growth.

Superior picture quality

Micro-LED technology expands the color range, enabling displays to produce more vibrant and varied colors. This feature enhances the visual experiences of users, particularly in applications that demand color accuracy, such as gaming, films, and photography. For example, it is anticipated that the number of video game players will exceed 3.5 billion active users by 2025. Besides this, micro-LEDs provide uniform color quality across the screen, minimizing color shift and ensuring colors remain accurate from any viewing angle, presenting opportunities for major players. This is crucial for professional uses like graphic design and movie making. Micro-LED screens achieve elevated contrast ratios by activating and deactivating individual pixels. This ability allows for true blacks and vivid highlights, enhancing the overall quality of the image. This enhanced contrast improves the viewing experience, particularly for high dynamic range (HDR) video.

High Scalability

Micro-LED screens are highly scalable, allowing them to be produced in various sizes, ranging from compact wearable displays like smartwatches to large commercial and public screens. As of 2025, there are 454.69 million users of smartwatches globally, representing a 41% rise from the 323.99 million users recorded in 2023. This adaptability allows producers to focus on various market sectors, such as consumer electronics, automotive, retail, and entertainment, which is supporting the market growth. The modular characteristic of Micro-LED technology enables the creation of custom-sized screens without compromising on performance or clarity, making it suitable for unique setups, including art exhibits or expansive digital signage. In contrast to conventional display technologies, micro-LEDs can be scaled without losing high pixel density, enabling large screens to attain ultra-high definition (UHD) or 8K resolution. This ability is essential for uses like home entertainment systems, professional design software, and high-quality monitors that need exact image sharpness.

Micro-LED Display Industry Segmentation:

Analysis by Product:

- Micro Display

- Large Scale Display

- Small and Medium-sized Display

Large scale display holds the biggest share because it is ideal for providing high brightness, seamless scalability, and exceptional image quality across vast viewing areas. This display is perfect for environments that require captivating visual performance, including control centers, public exhibits, commercial promotions, and professional settings. Micro-LED technology facilitates the development of bezel-less modular displays, permitting manufacturers to create tailored screen dimensions without sacrificing resolution or consistency. Its durability against burn-in, extended lifespan, and reduced maintenance needs render it ideal for applications requiring continuous use. Furthermore, the capability to operate consistently in bright ambient light situations enhances its use in both indoor and outdoor settings. Firms are putting resources into perfecting large-panel production and decreasing pixel pitch to improve visual quality and efficiency. These operational and technical advantages are establishing large-scale display as the leading segment in the market.

Analysis by Application:

- Smartphone and Tablets

- PC and Laptop

- TV

- Smartwatch

- Others

Smartphone and tablets dominate the market with 34.2%, owing to their extensive usage, demand for high refresh rates, and increasing focus on superior display quality. Individuals value clarity, brightness, and energy efficiency in portable devices, which makes micro-LED technology extremely appealing. Its capability to produce clear images, rich contrast, and minimal power usage greatly improves the user experience in high-performance mobile devices. Device makers are striving to set their products apart by employing cutting-edge display technologies that enhance visibility in different lighting conditions, extend battery life, and create slimmer designs. The compact nature of smartphones and tablets also makes them suitable platforms for early Micro-LED adoption, allowing companies to refine fabrication and integration techniques. Additionally, the quick product upgrade cycles in the mobile device market generate ongoing demand for technological progress. These factors collectively support the leading role of smartphones and tablets in propelling the micro-LED display market growth.

Analysis by Industry Vertical:

- Consumer Electronics

- Entertainment and Sports

- Automotive

- Retail

- Government and Defense

- Others

Consumer electronics represent the largest segment, holding 65.9% of the market share, due to the ongoing need for compact, energy-efficient, and high-resolution display technologies. Users are progressively looking for devices that provide better brightness, contrast, and responsiveness, which micro-LEDs achieve more efficiently than conventional OLED or LCD options. The competition within the consumer electronics industry encourages brands to incorporate cutting-edge display technologies to set their products apart and improve user experiences. Ongoing advancements in product design and form factor, featuring thinner, lighter, and more resilient displays, enhance the adoption of micro-LED technology. The growing emphasis on improving battery longevity and display quality in portable devices corresponds closely with the natural benefits of micro-LEDs. Furthermore, the rising fascination with new technologies like wearable gadgets and immersive screens is driving the need for more sophisticated and tailored display options. As consumer electronics continue to drive the demand for advanced visual technologies, the micro-LED display market forecast reflects strong growth prospects led by innovation in device design, energy efficiency, and display performance.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

Asia Pacific leads the market, holding 43.2% market share, because of its robust display technology development ecosystem, established manufacturing infrastructure, and availability of skilled technical talent. For instance, in 2024, South Korea's LG Display unveiled the world's first 50% stretchable Micro LED display, demonstrated on November 8 in Seoul. The 12-inch RGB screen, made with 40-micron LEDs, stretches to 18 inches with 100 PPI resolution and high durability. The area has transformed into a center for innovation, supported by substantial public and private funding aimed at developing next-generation display technologies. Robust regional interest in high-performance visual technology is propelling the adoption of micro-LED displays in various applications. Moreover, businesses throughout the Asia Pacific region are diligently seeking advancements in miniaturization, energy efficiency, and large-scale production methods, which contribute to lowering the overall cost of micro-LED displays. The area's vertically integrated supply chain, which includes materials, components, and equipment, facilitates quicker turnaround and enhanced quality management.

Key Regional Takeaways:

United States Micro-LED Display Market Analysis

In North America, the market portion held by the United States was 87.50% of the overall total. The United States is experiencing a rise in micro-LED display usage, driven by the growing number of smartwatch users coinciding with the swift expansion of the sports and fitness sector. As per a nationwide health survey carried out in 2024, more than 50 million individuals in America indicated that they frequently use technology to track their health. As users progressively incorporate wearable devices into everyday health tracking and sports performance monitoring, the need for high-quality and efficient displays is rising. Micro-LED display technology provides enhanced brightness, energy efficiency, and durability, meeting user expectations in the sports and fitness sector. This trend is encouraging smartwatch makers to incorporate micro-LED screens into their products to satisfy user demands. The ongoing innovation in the sports and fitness sector and the rising focus on personal wellness are offering positive micro-LED display market outlook. With the rapid increase in smartwatch use among different demographic groups, display manufacturers are leveraging this trend to enhance their market presence.

Europe Micro-LED Display Market Analysis

The micro-LED display market in Europe is experiencing growth attributed to the rising use of personal computing devices, particularly laptops and PCs. For example, in 2024, Germany topped Europe in laptop production sales, totaling 216.85 million euros, with Portugal coming next at 123.74 million euros, and the United Kingdom at 102.11 million euros. With the rise of remote work, digital education, and creative careers requiring excellent screen clarity and effectiveness, micro-LED screens are becoming the ideal display options. Their superior resolution, energy efficiency, and extended lifespan offer significant benefits for prolonged use in professional and educational settings. As manufacturers aim to decrease eye fatigue and improve visual sharpness, micro-LED displays fulfill the changing demands of users in PC and laptop usage. The move toward hybrid work environments is encouraging device makers to focus on advanced display technologies. Moreover, eco-conscious individuals in Europe are leaning towards sustainable and energy-efficient electronics, driving the need for micro-LED solutions. The area's robust technological framework also promotes the quicker integration of these displays into popular devices.

Asia Pacific Micro-LED Display Market Analysis

The Asia-Pacific region is witnessing robust growth in micro-LED display integration fueled by the swift growth of the consumer electronics industry. Reports indicate that the size of the consumer electronics market in India hit USD 83.70 Billion in 2024. IMARC Group anticipates the market to attain USD 152.59 Billion by 2033, showing a growth rate (CAGR) of 6.90% from 2025 to 2033. Rising demand for next-generation display solutions in devices like televisions, gaming consoles, and digital cameras is prompting manufacturers to invest in micro-LED technology. As users in the region demand better image quality, lower power usage, and increased durability, micro-LED displays are emerging as a favored option. The consumer electronics sector is very competitive, leading brands to implement cutting-edge technologies to set their products apart. The capability of Micro-LED to provide ultra-slim, bezel-free designs and exceptional brightness without burn-in problems enhances its growing adoption. Increasing income levels and urban digital lifestyles are further enhancing sales in consumer electronics, establishing micro-LED displays as a crucial facilitator of sophisticated user experiences across diverse product categories in Asia-Pacific.

Latin America Micro-LED Display Market Analysis

Latin America is experiencing a growing adoption of micro-LED display technology, fueled by the increasing number of smartphone and tablet users. For example, Brazil boasts 143.43 million smartphone users, achieving a 66.6% penetration rate among its 215.31 million residents. The increase in mobile device usage is encouraging manufacturers to improve display attributes to meet user expectations for brighter, sharper, and more resilient screens. As smartphones and tablets emerge as key tools for communication, media, and business uses, the uptake of micro-LED displays in this area is speeding up. Micro-LED's capability to provide energy efficiency and vivid visuals aligns perfectly with the growing digital usage trends in Latin America.

Middle East and Africa Micro-LED Display Market Analysis

The demand for micro-LED displays is increasing in the Middle East and Africa due to the expansion of entertainment and sports, as well as advertising billboards, in urban areas. For example, at the start of 2024, there were 294 advertising boards in total, distributed throughout Dubai, including Sheikh Rashid Al Maktoum Road, Al Khail Road, Umm Suqeim Road, and Al Khawaneej Road. Of these, 85 were digital billboards and 209 were static billboards of various kinds and sizes, with the option to convert static into digital formats. Digital billboards are progressively utilizing micro-LED screens for vivid and weatherproof imagery. In sports arenas and entertainment centers, high-definition screens are essential for engaging experiences.

Competitive Landscape:

Major participants in the market are concentrating on improving display resolution, boosting brightness and energy efficiency, and lowering production costs by optimizing processes. They are making significant investments in research operations to tackle issues concerning mass transfer, yield enhancement, and scalability for commercial manufacturing. Strategic alliances, mergers, and acquisitions are being sought to gain access to proprietary technologies, enhance manufacturing capacities, and speed up product development timelines. Initiatives are being implemented to broaden applications in different sectors, such as consumer electronics, automotive screens, and AR and VR interfaces, as companies strive to seize new opportunities and strengthen their standings in the market. In 2025, Plessey Semiconductors and Meta announced the development of the world's brightest red microLED display for AR glasses with ultra-low power use. This innovation supports Meta's Orion AR glasses, combining high brightness, resolution, and compact form. The collaboration marks a major step toward mainstream AR adoption.

The report provides a comprehensive analysis of the competitive landscape in the Micro-LED display market with detailed profiles of all major companies, including:

- Aledia

- eLux Inc.

- Innolux Corporation

- Jade Bird Display

- LG Display Co. Ltd. (LG Electronics Inc.)

- Lumens Co. Ltd.

- Nanosys Inc.

- PlayNitride Inc.

- Plessey Semiconductors Ltd.

- Samsung Electronics Co. Ltd.

- Sony Group Corporation

- VueReal

Key Questions Answered in This Report

- 1.How big is the Micro-LED display market?

- 2.What is the future outlook of Micro-LED display market?

- 3.What are the key factors driving the Micro-LED display market?

- 4.Which region accounts for the largest Micro-LED display market share?

- 5.Which are the leading companies in the global Micro-LED display market?

Table of Contents

1 Preface

2 Scope and Methodology

- 2.1 Objectives of the Study

- 2.2 Stakeholders

- 2.3 Data Sources

- 2.3.1 Primary Sources

- 2.3.2 Secondary Sources

- 2.4 Market Estimation

- 2.4.1 Bottom-Up Approach

- 2.4.2 Top-Down Approach

- 2.5 Forecasting Methodology

3 Executive Summary

4 Introduction

- 4.1 Overview

- 4.2 Key Industry Trends

5 Global Micro-LED Display Market

- 5.1 Market Overview

- 5.2 Market Performance

- 5.3 Impact of COVID-19

- 5.4 Market Forecast

6 Market Breakup by Product

- 6.1 Micro Display

- 6.1.1 Market Trends

- 6.1.2 Market Forecast

- 6.2 Large Scale Display

- 6.2.1 Market Trends

- 6.2.2 Market Forecast

- 6.3 Small and Medium-sized Display

- 6.3.1 Market Trends

- 6.3.2 Market Forecast

7 Market Breakup by Application

- 7.1 Smartphone and Tablets

- 7.1.1 Market Trends

- 7.1.2 Market Forecast

- 7.2 PC and Laptop

- 7.2.1 Market Trends

- 7.2.2 Market Forecast

- 7.3 TV

- 7.3.1 Market Trends

- 7.3.2 Market Forecast

- 7.4 Smartwatch

- 7.4.1 Market Trends

- 7.4.2 Market Forecast

- 7.5 Others

- 7.5.1 Market Trends

- 7.5.2 Market Forecast

8 Market Breakup by Industry Vertical

- 8.1 Consumer Electronics

- 8.1.1 Market Trends

- 8.1.2 Market Forecast

- 8.2 Entertainment and Sports

- 8.2.1 Market Trends

- 8.2.2 Market Forecast

- 8.3 Automotive

- 8.3.1 Market Trends

- 8.3.2 Market Forecast

- 8.4 Retail

- 8.4.1 Market Trends

- 8.4.2 Market Forecast

- 8.5 Government and Defense

- 8.5.1 Market Trends

- 8.5.2 Market Forecast

- 8.6 Others

- 8.6.1 Market Trends

- 8.6.2 Market Forecast

9 Market Breakup by Region

- 9.1 North America

- 9.1.1 United States

- 9.1.1.1 Market Trends

- 9.1.1.2 Market Forecast

- 9.1.2 Canada

- 9.1.2.1 Market Trends

- 9.1.2.2 Market Forecast

- 9.1.1 United States

- 9.2 Asia-Pacific

- 9.2.1 China

- 9.2.1.1 Market Trends

- 9.2.1.2 Market Forecast

- 9.2.2 Japan

- 9.2.2.1 Market Trends

- 9.2.2.2 Market Forecast

- 9.2.3 India

- 9.2.3.1 Market Trends

- 9.2.3.2 Market Forecast

- 9.2.4 South Korea

- 9.2.4.1 Market Trends

- 9.2.4.2 Market Forecast

- 9.2.5 Australia

- 9.2.5.1 Market Trends

- 9.2.5.2 Market Forecast

- 9.2.6 Indonesia

- 9.2.6.1 Market Trends

- 9.2.6.2 Market Forecast

- 9.2.7 Others

- 9.2.7.1 Market Trends

- 9.2.7.2 Market Forecast

- 9.2.1 China

- 9.3 Europe

- 9.3.1 Germany

- 9.3.1.1 Market Trends

- 9.3.1.2 Market Forecast

- 9.3.2 France

- 9.3.2.1 Market Trends

- 9.3.2.2 Market Forecast

- 9.3.3 United Kingdom

- 9.3.3.1 Market Trends

- 9.3.3.2 Market Forecast

- 9.3.4 Italy

- 9.3.4.1 Market Trends

- 9.3.4.2 Market Forecast

- 9.3.5 Spain

- 9.3.5.1 Market Trends

- 9.3.5.2 Market Forecast

- 9.3.6 Russia

- 9.3.6.1 Market Trends

- 9.3.6.2 Market Forecast

- 9.3.7 Others

- 9.3.7.1 Market Trends

- 9.3.7.2 Market Forecast

- 9.3.1 Germany

- 9.4 Latin America

- 9.4.1 Brazil

- 9.4.1.1 Market Trends

- 9.4.1.2 Market Forecast

- 9.4.2 Mexico

- 9.4.2.1 Market Trends

- 9.4.2.2 Market Forecast

- 9.4.3 Others

- 9.4.3.1 Market Trends

- 9.4.3.2 Market Forecast

- 9.4.1 Brazil

- 9.5 Middle East and Africa

- 9.5.1 Market Trends

- 9.5.2 Market Breakup by Country

- 9.5.3 Market Forecast

10 SWOT Analysis

- 10.1 Overview

- 10.2 Strengths

- 10.3 Weaknesses

- 10.4 Opportunities

- 10.5 Threats

11 Value Chain Analysis

12 Porters Five Forces Analysis

- 12.1 Overview

- 12.2 Bargaining Power of Buyers

- 12.3 Bargaining Power of Suppliers

- 12.4 Degree of Competition

- 12.5 Threat of New Entrants

- 12.6 Threat of Substitutes

13 Price Analysis

14 Competitive Landscape

- 14.1 Market Structure

- 14.2 Key Players

- 14.3 Profiles of Key Players

- 14.3.1 Aledia

- 14.3.1.1 Company Overview

- 14.3.1.2 Product Portfolio

- 14.3.2 eLux Inc.

- 14.3.2.1 Company Overview

- 14.3.2.2 Product Portfolio

- 14.3.3 Innolux Corporation

- 14.3.3.1 Company Overview

- 14.3.3.2 Product Portfolio

- 14.3.3.3 Financials

- 14.3.4 Jade Bird Display

- 14.3.4.1 Company Overview

- 14.3.4.2 Product Portfolio

- 14.3.5 LG Display Co. Ltd. (LG Electronics Inc.)

- 14.3.5.1 Company Overview

- 14.3.5.2 Product Portfolio

- 14.3.5.3 Financials

- 14.3.6 Lumens Co. Ltd.

- 14.3.6.1 Company Overview

- 14.3.6.2 Product Portfolio

- 14.3.6.3 Financials

- 14.3.7 Nanosys Inc.

- 14.3.7.1 Company Overview

- 14.3.7.2 Product Portfolio

- 14.3.8 PlayNitride Inc.

- 14.3.8.1 Company Overview

- 14.3.8.2 Product Portfolio

- 14.3.9 Plessey Semiconductors Ltd.

- 14.3.9.1 Company Overview

- 14.3.9.2 Product Portfolio

- 14.3.10 Samsung Electronics Co. Ltd.

- 14.3.10.1 Company Overview

- 14.3.10.2 Product Portfolio

- 14.3.10.3 Financials

- 14.3.10.4 SWOT Analysis

- 14.3.11 Sony Group Corporation

- 14.3.11.1 Company Overview

- 14.3.11.2 Product Portfolio

- 14.3.11.3 Financials

- 14.3.11.4 SWOT Analysis

- 14.3.12 VueReal

- 14.3.12.1 Company Overview

- 14.3.12.2 Product Portfolio

- 14.3.1 Aledia