|

|

市場調査レポート

商品コード

1398376

Mini LEDバックライトディスプレイの動向、OLED技術との競合の分析(2025年)2025 Mini LED Backlight Display Trend and OLED Technology Competition Analysis |

||||||

|

|||||||

| Mini LEDバックライトディスプレイの動向、OLED技術との競合の分析(2025年) |

|

出版日: 2024年08月28日

発行: TrendForce

ページ情報: 英文 194 Pages

納期: 即日から翌営業日

|

全表示

- 概要

- 目次

インフォグラフィックス

2024年~2028年のMini LEDバックライト用途の出荷台数の予測

第1章 産業動向:Mini LEDとOLEDのゼロサムゲーム、大型・中型・小型ディスプレイの熾烈な競合

各セグメントでMini LEDバックライトを搭載したLCDパネルの出荷台数が拡大しており、OLEDとの対決は避けられません。大型、中型、小型パネルのさまざまな用途において、Mini LEDバックライトの利益はOLEDの犠牲となり、その逆はゼロサムゲームとなっています。興味深いことに、これは技術開発の歴史によく見られる典型的な一方通行の置き換えモードではありません。むしろ、両技術はそれぞれ長所と短所を持ち、互いに密接に競合しています。

Mini LEDバックライトTV市場は2024年に大幅な伸びを見せますが、IT市場におけるOLED技術の好影響もあり、Mini LEDバックライト技術への投資に対する各ブランドの熱意は抑えられています。TrendForceの予測では、2024年の各用途の総出荷台数は1,270万個で、2023年比5%減となります。

TV、自動車、将来のMNT市場において、Mini LEDはOLEDよりも優位性があります。Mini LEDバックライトTVのコスト削減効果は大きいですが、OLED技術は大型TV市場で限定的な強さを示します。製品の差別化を強化し、ブランドの競争力を高めるために、Mini LEDバックライト技術は製品仕様のアップグレードに適したソリューションです。長期的には、この動向はMNT市場にも好影響を与え、MNTの普及率を高める促進要因となります。自動車市場では、Mini LEDバックライトが信頼性で優位に立ち、OLEDよりも高い出荷台数シェアを獲得しています。

しかし、NB、タブレット、VRの部門では、Mini LEDはOLEDほど競争力がありません。AppleがNBとタブレット製品にOLEDを採用することで、市場全体の状況が変わり、この2つの用途セグメントではMini LEDバックライト技術の普及率が継続的に低下することになります。

第2章 技術フォーカス:コストダウンを目指すMini LEDと性能向上を目指すOLED

2024年におけるMini LEDバックライトの最大の変化は、ソリューションが徐々に成熟し、上流からの下流までの各セグメントのメーカーがコスト削減方法についてコンセンサスを得たことです。業界全体のコンセンサスは、製品の標準化を加速させ、サプライヤーの果敢なスケールアップを促し、コスト競争力をさらに高めます。その結果、Mini LEDバックライト開発の最大の障害は取り除かれる見通しです。

第3章 TV市場:市場セグメンテーションの成功により、世界のMini LED TV売上は初めてOLED TVを上回ります。

2024年、Mini LEDバックライトTVの推定出荷台数は642万台です。中国ブランドメーカーが市場を席巻しています。Mini LEDバックライトのサプライチェーンが改善され、各企業がコスト削減戦略を徐々に実施していることから、世界の出荷台数は2023年比で59%増加し、大きな伸びを示しています。

OLEDは77インチや83インチの70~80インチディスプレイなどの製品を持っていますが、G8.5生産におけるコスト競争力が低く、超大型サイズのフレキシブルレイアウトでLCDに追いつくことができません。相対的に集中した供給、柔軟性のないパネルの価格、ブランド戦略の変化、経済的なカッティングサイズが55インチと65インチに集中していることを考えると、OLEDは多角的なカバー戦略を通じてMini LEDバックライトTVのような望ましい市場セグメンテーションを達成することができません。従って、2024年の総出荷台数では、史上初めてMini LEDバックライトTVがOLED TVを上回ると予測されます。

長期的な観点からは、Mini LEDバックライトTVの価格設定はOLED TVよりも低いままであり、一部の製品はハイエンドLCDと価格設定が重なり、Mini LED製品の普及率がさらに高まると予測されます。

当レポートでは、Mini LEDバックライトディスプレイ産業について調査分析し、の出荷台数との普及率の予測、技術開発の動向、TV、IT、自動車の3大市場の開発動向などを提供しています。

目次

第1章 Mini LEDバックライト/OLED用途の出荷台数との普及率の予測

- コンシューマーエレクトロニクス向けMini LEDバックライトの出荷台数(2024年~2028年)

- Mini LEDバックライトのコンシューマーエレクトロニクスへの普及(2024年~2028年)

- Mini LEDバックライト/OLED TVの出荷台数(2024年~2028年)

- Mini LEDバックライト/OLED TVの普及率(2024年~2028年)

- Mini LEDバックライト/OLED MNTの出荷台数(2024年~2028年)

- Mini LEDバックライト/OLED MNTの普及率(2024年~2028年)

- Mini LEDバックライト/OLED NBの出荷台数(2024年~2028年)

- Mini LEDバックライト/OLED NBの普及率(2024年~2028年)

- Mini LEDバックライト/OLEDタブレットの出荷台数(2024年~2028年)

- Mini LEDバックライト/OLEDタブレットの普及率(2024年~2028年)

- Mini LEDバックライトVRの出荷台数と普及率(2024年~2028年)

- Mini LEDバックライトTVの種類とLEDの需要(2024年~2028年)

- Mini LEDバックライトMNTの種類とLEDの需要(2024年~2028年)

- Mini LEDバックライトNBの種類とLEDの需要(2024年~2028年)

- Mini LEDバックライトタブレットの種類とLEDの需要(2024年~2028年)

- Mini LEDバックライトVRの種類とLEDの需要(2024年~2028年)

- Mini LEDバックライト用途に求められるLED(COB)

- Mini LEDバックライト用途に求められるLED(POB)

- Mini LEDバックライト用途向けLED(COB)の収益

- Mini LEDバックライト用途向けLED(POB)の収益

- Mini LEDバックライト用途向けLED(COB/POB)の収益

第2章 Mini LEDバックライトの技術開発の動向

- COB技術のコストダウン分析

- PCBのコストダウン分析

- LEDチップのコストダウン分析

- Mini LEDバックライト駆動アーキテクチャの分析

- ドライバーICのコストダウン分析

- AMドライバーIC市場の分析

- 主流の8チャネルAMドライバーICの比較

- プロセスと材料のコストダウン分析

- 第8.x世代OLEDパネル工場投資計画

- AppleのOLED技術を自社製品に統合する計画

- OLED技術ロードマップ

- OLED効率の向上 - CSOTインクジェット VS. UDCドライプリント

- OLED効率改善 - JDI eLEAP VS. Visionox ViP

第3章 Mini LEDバックライト/OLED TV市場

- Mini LEDバックライト/OLED TVの入手可能な数量:地域別

- Mini LEDバックライト/OLED TVの価格差:地域別

- 超大型TVの需要 - 75インチと80インチ(2022年~2024年)

- 超大型TVの需要 - 98インチと100インチ(2023年~2024年)

- Mini LEDバックライトTVの価格の変化:地域別

- 中国のMini LEDバックライトTVの仕様と価格の変化

- 中国の低価格Mini LEDバックライトTVの仕様と価格の変化

- ローゾーンTVバックライトのコスト分析

- ミッドゾーンのTVバックライトのコスト分析

- ハイゾーンTVバックライトのコスト分析

- ブランド:Mini LEDバックライトモデルの概要(2023年・2024年)

- Mini LEDバックライトTVの出荷台数:ブランド別(2023年~2024年)

- Mini LEDバックライトTVサプライチェーンの分析

- 主流Mini LEDバックライトTVの販売価格の比較

- OLED TVの出荷台数と普及率(2023年~2024年)

- TVパネルの価格の比較:55インチOLED vs. LCDオープンセル

第4章 Mini LEDバックライト/OLED IT市場

1. MNT市場

- Mini LEDバックライト/OLED MNTの入手可能な数量:地域別

- 中国のMini LEDバックライトMNTの数量の変化

- Mini LEDバックライト/OLED MNTの価格差:地域別

- Mini LEDバックライトMNTの価格の変化:地域別

- 中国のMini LEDバックライトMNTの仕様と価格の変化

- 米国のMini LEDバックライトMNTの仕様と価格の変化

- 英国のMini LEDバックライトMNTの仕様と価格の変化

- 中国のガラスベースMini LEDバックライトMNTの仕様と価格の変化

- Mini LEDバックライトMNTの出荷台数:ブランド別(2023年~2024年)

- 主流OLED MNTの販売価格の比較(2024年)

- OLED MNTパネル供給状況(2023年~2025年)

- OLED MNTシェア:ブランド別(2023年~2024年)

2. NB市場

- Mini LEDバックライト/OLED NBの入手可能な数量:地域別

- Mini LEDバックライト/OLED NBの価格差:地域別

- Mini LEDバックライトNBの価格の変化:地域別

- NB LTPS LCDパネルの出荷台数(2023年~2025年)

- NB OLEDパネルの出荷台数の予測(2022年~2027年)

- OLED NBセットの出荷台数の予測(2022年~2027年)

3. タブレット市場

- Mini LEDバックライト/OLEDタブレットの入手可能な数量:地域別

- Mini LEDバックライト/OLEDタブレットの価格差:地域別

4. その他の地域での応用

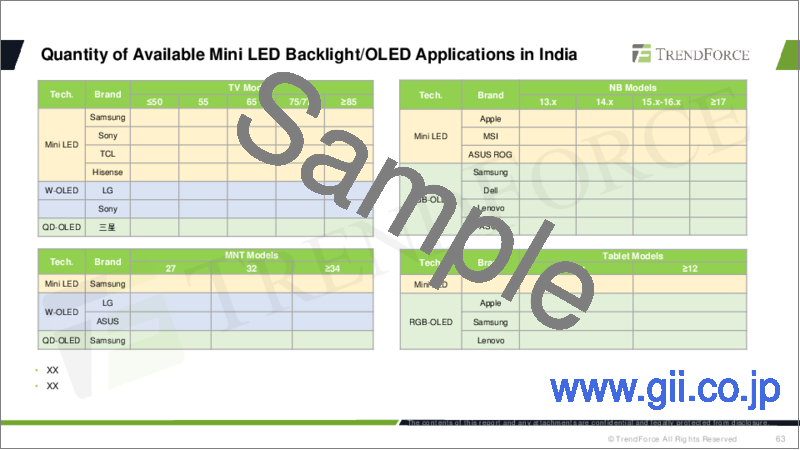

- インドのMini LEDバックライト/OLED用途の利用可能な数量

- インドのMini LEDバックライト/OLED用途の価格差

- ブラジルのMini LEDバックライト/OLED用途の利用可能な数量

- ブラジルのMini LEDバックライト/OLED用途の価格差

第5章 Mini LED自動車用ディスプレイ市場

- スマートコックピットの動向

- 自動車用ディスプレイ技術の概要

- 自動車用ディスプレイパネルの出荷台数と普及率(2024年~2028年)

- 自動車用バックライトLEDの市場金額の分析(2024年~2028年)

- Mini LED/HDR自動車用ディスプレイの動向 - パネルサイズ(2022年~2023年)

- Mini LED/HDR自動車用ディスプレイの動向 - 調光ゾーン(2022年~2023年)

- Mini LED/HDR自動車用ディスプレイ - 仕様 vs. サプライチェーン(2022年)

- Mini LED/HDR自動車用ディスプレイ - 仕様 vs. サプライチェーン(2023年)

- COB/COG/POG技術分析

- Mini LED/HDR自動車用ディスプレイのスケジュールと仕様(2022年~2028年)

- NIO ET7/ET5/ES7自動車用ディスプレイ - 仕様とコスト分析

- Roewe RX5自動車用ディスプレイ - 仕様とコスト分析

- キャデラックLYRIQ自動車ディスプレイ - 仕様とコスト分析

- ビュイックエレクトラE5自動車用ディスプレイ - 仕様とコスト分析

- リンカーンノーチラスオートモーティブディスプレイ - 仕様とコスト分析

- キャデラックセレスティクオートモーティブディスプレイ - 仕様とコスト分析

- LCD(エッジ型/直下型)とOLED自動車用ディスプレイ仕様の比較

- 自動車用ディスプレイコスト分析 - エッジ/ダイレクトタイプ(2024年)

- 自動車用バックライトLED製品の仕様と価格の分析(2024年)

- Mini LED自動車用ディスプレイ - ドライバーICの仕様の分析

- Mini LED自動車用ディスプレイ - ダイレクト/スキャンドライバーICの長所と短所の分析

- OLED自動車用ディスプレイのスケジュールと仕様(2022年~2024年)

- 自動車用バックライトディスプレイの市場情勢の分析

- HUD市場出荷台数 - 製品と地域市場の分析(2024年~2028年)

- HUD製品の仕様の分析(2024年)

- AR-HUD技術の分析

- HUD製品の価格分析(2023年~2024年)

- パノラマヘッドアップディスプレイ(P-HUD)と透明ディスプレイ

- AR-HUD OEMのサプライチェーンと製品の仕様の分析

- HUDの市場情勢の分析

第6章 Mini LEDバックライト産業の力学、Mini LEDバックライト市場のサプライチェーン

- LEDチップメーカー:HC Semitek

- LEDチップメーカー:Aucksun

- ドライバーICメーカー:HYASiC

- ドライバーICメーカー:X-Signal Integrated

- 装置企業:Kulicke & Soffa

- 装置プロバイダー:HOSON

- LEDパッケージプロバイダー:Everlight

- LEDパッケージプロバイダー:Lextar

- LEDパッケージプロバイダー:Jufei

- LEDパッケージプロバイダー:APT Electronics

- LEDパッケージプロバイダー:Hongli Display

- LEDパッケージプロバイダー:Nationstar

- LEDモジュールメーカー:Core Photoelectric Technology

- LEDパッケージプロバイダー:HGC

- LEDパッケージプロバイダー:ESPACE

- LEDパッケージプロバイダー:COREACH

- LEDガラス基材メーカー:WG Tech

- 用途企業:BOE

- 用途企業:Tianma

- 用途企業:TCL

- 用途企業:Hisense

- 用途企業:Xiaomi

INFOGRAPHICS

2024-2028 Mini LED Backlight Applications Shipments Forecast

Chapter 1 Industry Trends: Mini LED and OLED in Zero-sum Game, with Fierce Competition between Large-, Mid-, and Small-size Displays

With expanded shipments of LCD panels engineered with Mini LED backlight for various segments, the confrontation with OLED is inevitable. In various application across large, medium, and small panels, it has become a zero-sum game: gains for Mini LED backlight come at the expense of OLED, and vice versa. Interestingly, this is not the typical one-way replacement mode usually seen in the history of technological development. Instead, both technologies have their own strengths and weaknesses, competing closely with each other.

Although the Mini LED backlight TV market makes a significant increase in 2024, the positive impact of OLED technology in the IT market has also suppressed the enthusiasm of brands in investing in Mini LED backlight technology. TrendForce estimates that the total shipment of each application will be 12.7Mpcs in 2024, a decrease of 5% compared to 2023.

In the TV, automotive, and future MNT markets, Mini LED holds more advantages over OLED. The cost reduction effect of Mini LED backlight TV is significant, while OLED technology shows limited strength in the large-sized TV market. To enhance product differentiation and increase brand competitiveness, Mini LED backlight technology is the preferred solution for upgrading product specifications. In the long term, this trend will also have a positive impact on the MNT market, driving an increase in its penetration rate. In the automotive market, Mini LED backlight have won the reliability advantage, resulting in a higher share of shipments than OLED.

However, in the NB , Tablet, and VR sectors, Mini LED is not as competitive as OLED.Apple's embrace of OLED for NB and Tablet products will change the entire market landscape, leading to a continuous reduction in the penetration rate of Mini LED backlight technology in these two application areas.

Chapter 2 Technical Focus: Mini LED Strives for Cost Down, while OLED Aims at Better Performance

The biggest change in Mini LED backlight in 2024 is that the solutions are gradually becoming more mature, and manufacturers throughout the upstream and downstream segments have reached a consensus on ways to reduce costs. This chapter explores the cost reduction strategies that the industry is focusing on, including various strategies related to PCB, LED chips, driver IC, and process materials. The industry-wide consensus helps accelerate the standardization of products, which encourages suppliers to boldly scale up and further enhance cost competitiveness. As a result, the biggest obstacle to the development of Mini LED backlight is expected to be removed. According to TrendForce's analysis, cost reduction strategies for Mini LED that have achieved high consensus are as follows:

1. PCB Cost Down Analysis

- The form of PCB has transitioned from FR4 to single-sided aluminum substrates, comb boards, and light bars, which are applied to products with high, medium, and low dimming zone count, respectively.

- The harpoon board design enhances PCB material utilization, reducing the cost by more than 30%.

- Reduced material usage, increased single-board utilization, and decreased precision requirements have lowered PCB manufacturing costs but introduced reliability challenges.

- The key opportunity for cost reduction lies in whether the size of individual light boards can be standardized.

2. LED Chip Cost Down Analysis

- Increasing the pitch or optimizing the light emission angle through optical design to reduce the number of LEDs can achieve cost reduction.

- Using high-voltage chips(18V/24V/36V) not only reduces the number of LED per zone but also offers higher luminous efficiency, lower driving current, and simpler routing overall.

3. Driver IC Cost Down Analysis

- Among the two driving modes, Passive Matrix (PM) and Active Matrix (AM), the AM scheme is widely adopted due to its simple wiring and the ability to drive each zone separately.

- The AM driver IC is paired with a single-layer aluminum substrate and high-voltage LED chips to reduce the number of LED series connections, maximize driving efficiency, and lower PCB wiring complexity.

- As the number of dimming zones increases, more driver IC are needed.

- The material costs of using an AM driver IC are significantly reduced by over 70% compared to a PM driver IC, and increasing the number of channels further expands the cost reduction advantage.

4. Process and Materials Cost Down Analysis

- Currently, mainstream COB products are engineered with dispensing technology, which reduces material and manufacturing process costs while improving light uniformity.

- some manufacturers have replaced QD diffusion films with QD diffusion plates, reducing the cost by 20% in a single-channel process. However, high-temperature reliability challenges may still be encountered.

This chapter also discusses how, under the significant cost reduction pressure from Mini LED players, OLED manufacturers are advancing their technology to make their solutions increasingly refined, thereby defending against the threat posed by Mini LED.

Chapter 3 TV Market: Successful Market Segmentation Allows Mini LED TVs to Surpass OLED TVs in Global Sales for the First Time

From this chapter to Chapter 5, we will analyze the development trends of Mini LED backlight in the three major markets: TV, IT, and automotive.

In 2024, the estimated shipment of Mini LED backlight TV is 6,420K units. Chinese brand manufacturers have gained dominance in the market. With the improvement of the Mini LED backlight supply chain and the gradual implementation of cost reduction strategies by various companies, there has been significant growth, with global shipments increasing by 59% compared to 2023.

Although OLED has products such as 77-inch and 83-inch displays for the 70-80 inch range, its cost competitiveness in G8.5 production is poor, leading to OLED's inability to keep up with LCD in flexible layouts for extra-large sizes.Given the relatively concentrated supply, inflexible panel prices, changes in branding strategy, and the concentration of economic cutting size at 55 and 65 inches, OLED cannot achieve desirable market segmentation like Mini LED backlight TV through a diversified coverage strategy. Therefore, for the first time in history, Mini LED backlight TV will surpass OLED TV in total shipments for 2024.

From a long-term perspective, the pricing of Mini LED backlight TVs is expected to remain lower than that of OLED TVs, with some products even overlapping in pricing with high-end LCD, further increasing the penetration rate of Mini LED products.

Chapter 4 IT Market: As OLED Solidifies Its High-End Status, Mini LED is Likely to Become a "Wall Breaker"

Shipment of Mini LED backlight MNT in 2024 is estimated to be 347K units, which is only a 48% growth rate compared to 2023, lower than initially expected. This is mainly because of the positive response to OLED technology in the high-end market, leading brands to invest more actively in OLED product lines, resulting in Samsung's market share shrinking to 46%. However, Chinese brands continue to enter the mid-to-low-end market, but due their limited recognition and promotion efforts, benefits are limited.

Chinese brands such as Taidu and Titan Army continue to advance the specifications of

OLED MNT are currently in high demand and are almost a standard configuration product for all brands targeting the high-end market.In 2024, the supply capacity of OLED MNT will double compared to 2023. SDC's QD OLED, accounting for 75%, remains mainstream, while LGD's WOLED supply scale is also gradually increasing.Due to the strong demand, the supply of OLED MNT panels is expected to climb to 2.4 million pieces in 2025, with CSOT also joining the supply ranks.With the increasing availability of OLED MNT panels, the willingness of brands to adopt Mini LED backlight will also be correspondingly weakened.Brands almost universally allocate their high-end MNT resources to the promotion of OLED, causing a significant crowding-out effect on similarly positioned Mini LED backlight products.

In the long run, we still have faith in the development of Mini LED applications in the IT sector. As the shipments of Mini LED backlight TV increase, the cost reduction benefits are expected to extend to MNT applications, once again demonstrating the strategic advantage of diversified coverage for Mini LED products. Mini LED could overcome the current situation where high-end MNT products are primarily confined to the gaming market.

The rest of this chapter includes analyses of the price differences between Mini LED backlight and OLED products in the NB market, as well as shipment analysis. In addition to analyzing product specifications in the major markets, namely the US, Europe, and China, this report also offers insights into India and Brazil by analyzing the models available and the local price trends of new Mini LED backlight and OLED displays.

Chapter 5 Automotive Market: Smart Cockpit Transitions from Concept to Mass Production, Allowing Mini LED to Benefit from Increased Display Number and Size

With the trend towards digitalization in smart cockpit, automotive displays have become a crucial interface for connecting vehicles and driver interaction. Automotive displays include instrument clusters, central displays, rear view mirrors, HUD, rear-seat entertainment applications, and more. With an increasing number of vehicles incorporating a variety of automotive display products, larger sizes, wider aspect ratios, more displays, and freer placement methods are becoming the development direction for in-car displays. Additionally, the continuous improvement of performance parameters such as High Dynamic Range (HDR), Local Dimming, Wide Color Gamut, etc., coupled with the increasing demand for automotive displays, indicates a sustained rapid growth trend in the automotive display market.According to TrendForce analysis, the shipment of automotive display panels is expected to reach 257 million units in 2028. Mini LED displays will reap the benefits, with a penetration rate of 5.9%, surpassing OLED's 4.1%.

Chapter 6 Industry Dynamics: From a Competitive Landscape of Numerous Businesses to Major Manufacturers, Elite Mini LED Players Have Emerged

As Mini LED backlight products gradually enter the mass production stage, there have been significant changes in the list of highly active manufacturers. Different players have bet on various technologies and product solutions. By 2024, mainstream technologies and solutions become clear throughout the market. Manufacturers who have made the right bets are now enjoying the winners' dividends and returns, while those who missed out are gearing up for another round of intense investments.

This chapter outlines the main supply chain for the Mini LED backlight market, focusing on the dynamics of leading manufacturers in chips, driver IC, transfer equipment, packaging and modules, and applications regarding their products, technologies, revenues, and supply chain activities in the Mini LED sector.

Compared to the conventional backlight, Mini LED backlight represents a major technological innovation, bringing significant changes to the industry landscape. Conventional backlight supply chain companies have strong first-mover advantages and incumbent benefits. However, new players are also fully benefiting from these changes, breaking the previous monopoly and rising to prominence. By 2024, powerful players have begun to take center stage in the industry arena.

In this report, we have added the analyses of niche businesses benefiting from Mini LED backlight, such as Aucksun, HYASiC, X-Signal Integrated, APT Electronics, Core Photoelectric Technology, HGC, COREACH, and ESPACE. We have also added an analysis focusing on the current development of WG Tech, a company with a comprehensive presence in LED glass substrates manufacturing.

Table of Contents

Chapter I. Mini LED Backlight/OLED Application Shipment and Penetration Rates Forecast

- 2024-2028 Mini LED Backlight Shipment for Consumer Electronics Applications

- 2024-2028 Mini LED Backlight Penetration for Consumer Electronics Applications

- 2024-2028 Mini LED Backlight/OLED TV Shipment

- 2024-2028 Mini LED Backlight/OLED TV Penetration Rate

- 2024-2028 Mini LED Backlight/OLED MNT Shipment

- 2024-2028 Mini LED Backlight /OLED MNT Penetration Rate

- 2024-2028 Mini LED Backlight/OLED NB Shipment

- 2024-2028 Mini LED Backlight /OLED NB Penetration Rate

- 2024-2028 Mini LED Backlight/OLED Tablet Shipment

- 2024-2028 Mini LED Backlight /OLED Tablet Penetration Rate

- 2024-2028 Mini LED Backlight VR Shipment and Penetration Rate

- 2024-2028 Mini LED Backlight TV Types and LED Demand

- 2024-2028 Mini LED Backlight MNT Types and LED Demand

- 2024-2028 Mini LED Backlight NB Types and LED Demand

- 2024-2028 Mini LED Backlight Tablet Types and LED Demand

- 2024-2028 Mini LED Backlight VR Types and LED Demand

- LED (COB) Demanded for Mini LED Backlight Applications

- LED (POB) Demanded for Mini LED Backlight Applications

- LED (COB) Revenue for Mini LED Backlight Applications

- LED (POB) Revenue for Mini LED Backlight Applications

- LED (COB/POB) Revenue for Mini LED Backlight Applications

Chapter II. Mini LED Backlight Technology Development Trend

- COB Technology Cost Down Analysis

- PCB Cost Down Analysis

- LED Chip Cost Down Analysis

- Mini LED Backlight Driving Architecture Analysis

- Driver IC Cost Down Analysis

- AM Driver IC Market Analysis

- Mainstream 8-Channel AM Driver IC Comparison

- Process and Materials Cost Down Analysis

- 8.x Generation OLED Panel Factory Investment Plan

- Apple's Plan for Integrating OLED Technology into Its Products

- OLED Technology Roadmap

- OLED Efficacy Improvement - CSOT Ink-jet VS. UDC Dry Printed

- OLED Efficacy Improvement - JDI eLEAP VS. Visionox ViP

Chapter III. Mini LED Backlight/OLED TV Market

- Quantity of Available Mini LED Backlight/OLED TV in Different Regions

- Mini LED Backlight/OLED TV Price Differences in Different Regions

- 2022-2024(E) Demand for Super-Large Sized TV - 75" and 80"

- 2023-2024(E) Demand for Ultra-Large Sizes TV - 98" and 100"

- Mini LED Backlight TV Price Changes in Different Regions

- Mini LED Backlight TV Specifications and Price Changes in China

- Low-Priced Mini LED Backlight TV Specifications and Price Changes in China

- Low-Zones TV Backlight Cost Analysis

- Mid-Zones TV Backlight Cost Analysis

- High-Zones TV Backlight Cost Analysis

- Brands: 2023 and 2024 Mini LED Backlight Models Overview

- 2023-2024 Mini LED Backlight TV Shipments by Brand

- Mini LED Backlight TV Supply Chain Analysis

- Mainstream Mini LED Backlight TV Selling Price Comparison

- 2023-2024(E) OLED TV Shipment and Penetration Rate

- TV Panel Price Comparison: 55" OLED vs. LCD Open Cell

Chapter IV. Mini LED Backlight/OLED IT Market

4.1. MNT Market

- Quantity of Available Mini LED Backlight/OLED MNT in Different Regions

- Quantity Changes of Mini LED Backlight MNT in China

- Mini LED Backlight/OLED MNT Price Differences in Different Regions

- Mini LED Backlight MNT Price Changes in Different Regions

- Mini LED Backlight MNT Specifications and Price Changes in China

- Mini LED Backlight MNT Specifications and Price Changes in the US

- Mini LED Backlight MNT Specifications and Price Changes in the UK

- Glass-based Mini LED Backlight MNT Specifications and Price Changes in China

- 2023-2024 Mini LED Backlight MNT Shipments by Brand

- 1H24 Mainstream OLED MNT Selling Price Comparison

- 2023-2025(F) OLED MNT Panel Supply Status

- 2023-2024(E) OLED MNT Share by Brands

4.2. NB Market

- Quantity of Available Mini LED Backlight/OLED NB in Different Regions

- Mini LED Backlight/OLED NB Price Differences in Different Regions

- Mini LED Backlight NB Price Changes in Different Regions

- 2023-2025(F) NB LTPS LCD Panel Shipment

- 2022-2027(F) NB OLED Panel Shipment Forecast

- 2022-2027(F) OLED NB Set Shipment Forecast

4.3. Tablet Market

- Quantity of Available Mini LED Backlight/OLED Tablet in Different Regions

- Mini LED Backlight/OLED Tablet Price Differences in Different Regions

4.4. Applications in Other Regions

- Quantity of Available Mini LED Backlight/OLED Applications in India

- Mini LED Backlight/OLED Applications Price Differences in India

- Quantity of Available Mini LED Backlight/OLED Applications in Brazil

- Mini LED Backlight/OLED Applications Price Differences in Brazil

Chapter V. Mini LED Automotive Display Market

- Smart Cockpit Trend

- Automotive Display Technology Overview

- 2024-2028 Automotive Display Panel Shipment and Penetration Rate

- 2024-2028 Automotive Backlight LED Market Value Analysis

- 2022-2023 Mini LED / HDR Automotive Display Trend- Panel Size

- 2022-2023 Mini LED / HDR Automotive Display Trend- Dimming Zones

- 2022 Mini LED / HDR Automotive Display- Specification vs. Supply Chain

- 2023 Mini LED / HDR Automotive Display- Specification vs. Supply Chain

- COB / COG / POG Technology Analysis

- 2022-2028 Mini LED / HDR Automotive Display Schedule and Specification

- NIO ET7 / ET5 / ES7 Automotive Display- Specification and Cost Analysis

- Roewe RX5 Automotive Display- Specification and Cost Analysis

- Cadillac LYRIQ Automotive Display- Specification and Cost Analysis

- Buick Electra E5 Automotive Display- Specification and Cost Analysis

- Lincoln Nautilus Automotive Display- Specification and Cost Analysis

- Cadillac Celestiq Automotive Display- Specification and Cost Analysis

- LCD (Edge / Direct-Type) vs. OLED Automotive Display Specification

- 2024 Automotive Display Cost Analysis- Edge / Direct-Type

- 2024 Automotive Backlight LED Product Specification and Price Analysis

- Mini LED Automotive Display- Driver IC Specification Analysis

- Mini LED Automotive Display- Direct / Scan Driver IC Pros-Cons Analysis

- 2022-2024 OLED Automotive Display Schedule and Specification

- Automotive Backlight Display Market Landscape Analysis

- 2024-2028 HUD Market Shipment- Product vs. Regional Market Analysis

- 2024 HUD Product Specification Analysis

- AR-HUD Technology Analysis

- 2023-2024 HUD Product Price Analysis

- Panoramic Head-up Display (P-HUD) vs. Transparent Display

- AR-HUD OEM Supply Chain and Product Specification Analysis

- HUD Market Landscape Analysis

Chapter VI. Mini LED Backlight Industry DynamicsMini LED Backlight Market Supply Chain

- LED Chip Manufacturer: HC Semitek

- LED Chip Manufacturer: Aucksun

- Driver IC Manufacturer: HYASiC

- Driver IC Manufacturer: X-Signal Integrated

- Equipment Player: Kulicke & Soffa

- Equipment Provider: HOSON

- LED Package Provider: Everlight

- LED Package Provider: Lextar

- LED Package Provider: Jufei

- LED Package Provider: APT Electronics

- LED Package Provider: Hongli Display

- LED Package Provider: Nationstar

- LED Module Manufacturer: Core Photoelectric Technology

- LED Package Provider: HGC

- LED Package Provider: ESPACE

- LED Package Provider: COREACH

- LED Glass Substrate Manufacturer: WG Tech

- Application Player: BOE

- Application Player: Tianma

- Application Player: TCL

- Application Player: Hisense

- Application Player: Xiaomi