|

|

市場調査レポート

商品コード

1702280

スヌースの市場規模、シェア、動向、予測:製品タイプ、フレーバー、流通チャネル、地域別、2025年~2033年Snus Market Size, Share, Trends and Forecast by Product Type, Flavors, Distribution Channel, and Region, 2025-2033 |

||||||

カスタマイズ可能

|

|||||||

| スヌースの市場規模、シェア、動向、予測:製品タイプ、フレーバー、流通チャネル、地域別、2025年~2033年 |

|

出版日: 2025年04月01日

発行: IMARC

ページ情報: 英文 142 Pages

納期: 2~3営業日

|

全表示

- 概要

- 図表

- 目次

スヌースの世界市場規模は、2024年に33億2,000万米ドルとなりました。今後、IMARC Groupは、市場は2033年までに62億米ドルに達し、2025~2033年のCAGRは6.82%になると予測しています。現在、欧州が市場を独占しており、2024年には62.0%を超える大きな市場シェアを占めています。健康リスクの少ないタバコ製品を好む健康志向の消費者の増加、環境問題への関心の高まりと持続可能性の推進、ニコチン供給システムの絶え間ない革新、主要企業間の提携と買収の増加が、市場を推進している主な要因の一部です。

スヌースは湿った粉末状の無煙たばこ製品で、小さなパウチに入っており、上唇の下に目立たないように置くように設計されています。従来の噛みタバコとは異なり、スヌスは唾を吐く必要がないため、タバコ・ユーザーにとってより便利で社会的に受け入れられる選択肢となっています。スヌースは、その独特な特徴と特性で知られており、他のタバコ製品とは異なるユニークな体験をユーザーに提供します。スヌースには、ミントやフルーツから伝統的なタバコまで様々なフレーバーがあり、多様な消費者の嗜好に対応しています。スヌースの作動メカニズムは、袋の膜を通してニコチンとその他のフレーバー化合物をゆっくりと放出することで、ユーザーにニコチンを長時間にわたってコントロールしながら供給することを可能にしています。

世界市場は主に、健康リスクの少ないタバコ製品を好む健康志向の消費者の増加によって牽引されています。これは、大衆の間でVAPEや電子タバコの人気が高まっていることに起因しています。これに伴い、従来の喫煙に対するスヌースの利点を強調する効果的なマーケティング・キャンペーンが消費者の共感を呼び、製品の普及率が高まっています。また、メーカーは製品ポートフォリオを拡大し、より幅広い顧客層を獲得するため、新しいフレーバーを継続的に投入しており、市場の活性化につながっています。これに加えて、タバコへの課税強化など厳しいタバコ規制政策が、代替タバコ製品の採用率上昇につながっており、市場の見通しは明るいです。さらに、オンラインやオフラインの小売チャネルで簡単に製品を入手できることも、市場の重要な成長要因となっています。

スヌース市場動向/促進要因:

環境問題の高まりと持続可能性の推進

近年、環境保全と持続可能性に対する関心の高まりが、無煙タバコ市場を含む様々な産業に影響を与える重要な促進要因として浮上しています。消費者のエコロジカル・フットプリントに対する意識が高まり、環境に優しい価値観に沿った製品を積極的に求めるようになっています。このような環境意識が高まり続ける中、タバコ会社は、このような進化する需要に対応するために、自社の慣行と製品を適合させる必要性を認識しています。この動向を受けて、スヌース市場では環境に優しい対策を実施する方向に大きくシフトしています。メーカー各社は現在、生分解性や堆肥化可能な素材をパウチに採用し、汚染や環境悪化の原因となる従来のプラスチック包装への依存を減らしています。この戦略的な動きは、環境意識の高い消費者層にアピールするだけでなく、環境への影響を軽減するという業界のコミットメントを示すものでもあります。さらに、各社はスヌスの製造に使用するタバコの持続可能な調達方法にも注力しています。

ニコチン供給システムの絶え間ない革新

技術の進歩に伴い、タバコ業界ではニコチン供給システムの革新が相次いでいます。この動向はスヌスを含む無煙タバコ市場の開拓にも大きな影響を与えています。メーカーは研究開発に多額の投資を行い、改良され洗練されたユーザー体験を提供する最先端のニコチンデリバリー・ソリューションを生み出しています。その目的は、代替品を求める既存のタバコ・ユーザーと、無煙タバコの選択肢を模索する潜在的な新規消費者の両方の嗜好に応えることです。さらに、メーカーは多様な消費者の嗜好に応えるため、多様なフレーバーを試しています。このようなフレーバーの革新は、ニコチン送達技術の進歩と相まって、より楽しくカスタマイズ可能な体験を求めるたばこユーザーの間でスヌース製品への関心を高めています。

主要企業間の提携と買収の増加

世界な接続性とeコマースの優位性の時代において、各業界の企業は流通チャネルの拡大と世界市場への浸透によってもたらされる機会を活用しています。スヌースを含む無煙たばこ市場もこの動向の例外ではないです。メーカー各社は、オンライン小売プラットフォームとeコマースの力を活用して世界中の消費者にリーチし、地理的障壁を取り払い、自社製品へのアクセスを容易にしています。各国の流通業者や小売業者との戦略的パートナーシップを通じて、スヌース業界はこれまで未開拓だった市場への参入に成功しています。このアプローチは、多様な層や文化に製品を紹介し、潜在的な消費者層を広げる上で効果的であることが証明されています。また、オンライン・ショッピングの利便性により、好奇心旺盛な消費者が場所を問わずスヌース製品を簡単に探せるようになり、市場の成長をさらに後押ししています。

目次

第1章 序文

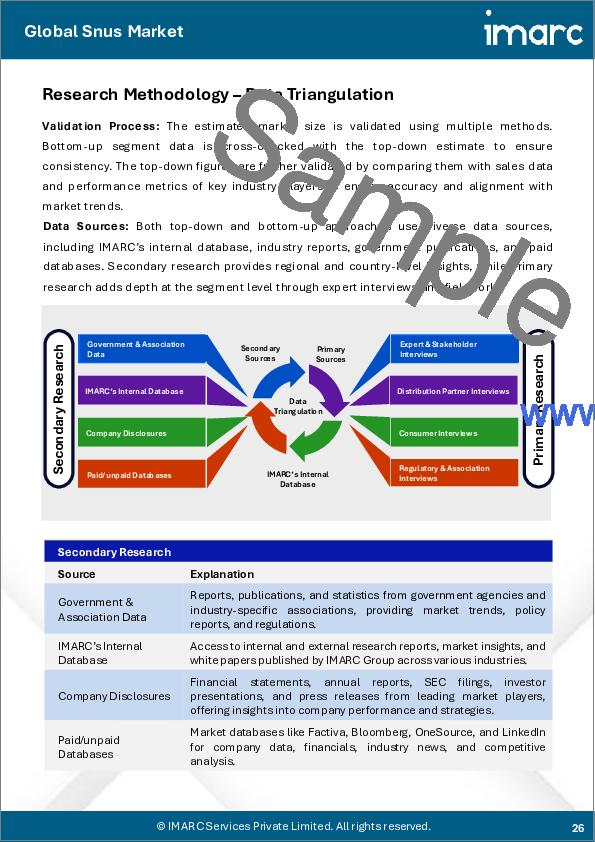

第2章 調査範囲と調査手法

- 調査の目的

- ステークホルダー

- データソース

- 一次情報

- 二次情報

- 市場推定

- ボトムアップアプローチ

- トップダウンアプローチ

- 調査手法

第3章 エグゼクティブサマリー

第4章 イントロダクション

- 概要

- 主要業界動向

第5章 世界のスヌース市場

- 市場概要

- 市場実績

- COVID-19の影響

- 市場予測

第6章 市場内訳:製品タイプ別

- ルーズスヌース

- ポーションスヌース

第7章 市場内訳:フレーバー別

- ミント

- ベリー

- ドライフルーツ

- その他

第8章 市場内訳:流通チャネル別

- タバコ店

- コンビニエンスストア

- オンライン小売店

- その他

第9章 市場内訳:地域別

- 北米

- 米国

- カナダ

- アジア太平洋地域

- 中国

- 日本

- インド

- 韓国

- オーストラリア

- インドネシア

- その他

- 欧州

- ドイツ

- フランス

- 英国

- イタリア

- スペイン

- ロシア

- その他

- ラテンアメリカ

- ブラジル

- メキシコ

- その他

- 中東・アフリカ

- 市場内訳:国別

第10章 SWOT分析

- 概要

- 強み

- 弱み

- 機会

- 脅威

第11章 バリューチェーン分析

第12章 ポーターのファイブフォース分析

- 概要

- 買い手の交渉力

- 供給企業の交渉力

- 競合の程度

- 新規参入業者の脅威

- 代替品の脅威

第13章 価格分析

第14章 競合情勢

- 市場構造

- 主要企業

- 主要企業のプロファイル

- Altria Group Inc.

- GN Tobacco Sweden AB

- Kurbits Snus AB

- Mac Baren Tobacco Company(Halberg A/S)

- Nordic Snus AB

- Philip Morris Products S.A.

- Skruf Snus AB

- Swedish Match AB

List of Figures

- Figure 1: Global: Snus Market: Major Drivers and Challenges

- Figure 2: Global: Snus Market: Sales Value (in Billion USD), 2019-2024

- Figure 3: Global: Snus Market Forecast: Sales Value (in Billion USD), 2025-2033

- Figure 4: Global: Snus Market: Breakup by Product Type (in %), 2024

- Figure 5: Global: Snus Market: Breakup by Flavors (in %), 2024

- Figure 6: Global: Snus Market: Breakup by Distribution Channel (in %), 2024

- Figure 7: Global: Snus Market: Breakup by Region (in %), 2024

- Figure 8: Global: Snus (Loose Snus) Market: Sales Value (in Million USD), 2019 & 2024

- Figure 9: Global: Snus (Loose Snus) Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 10: Global: Snus (Portion Snus) Market: Sales Value (in Million USD), 2019 & 2024

- Figure 11: Global: Snus (Portion Snus) Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 12: Global: Snus (Mint) Market: Sales Value (in Million USD), 2019 & 2024

- Figure 13: Global: Snus (Mint) Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 14: Global: Snus (Berries) Market: Sales Value (in Million USD), 2019 & 2024

- Figure 15: Global: Snus (Berries) Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 16: Global: Snus (Dry Fruit) Market: Sales Value (in Million USD), 2019 & 2024

- Figure 17: Global: Snus (Dry Fruit) Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 18: Global: Snus (Other Flavors) Market: Sales Value (in Million USD), 2019 & 2024

- Figure 19: Global: Snus (Other Flavors) Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 20: Global: Snus (Tobacco Stores) Market: Sales Value (in Million USD), 2019 & 2024

- Figure 21: Global: Snus (Tobacco Stores) Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 22: Global: Snus (Convenience Stores) Market: Sales Value (in Million USD), 2019 & 2024

- Figure 23: Global: Snus (Convenience Stores) Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 24: Global: Snus (Online Retail Stores) Market: Sales Value (in Million USD), 2019 & 2024

- Figure 25: Global: Snus (Online Retail Stores) Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 26: Global: Snus (Other Distribution Channels) Market: Sales Value (in Million USD), 2019 & 2024

- Figure 27: Global: Snus (Other Distribution Channels) Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 28: North America: Snus Market: Sales Value (in Million USD), 2019 & 2024

- Figure 29: North America: Snus Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 30: United States: Snus Market: Sales Value (in Million USD), 2019 & 2024

- Figure 31: United States: Snus Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 32: Canada: Snus Market: Sales Value (in Million USD), 2019 & 2024

- Figure 33: Canada: Snus Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 34: Asia-Pacific: Snus Market: Sales Value (in Million USD), 2019 & 2024

- Figure 35: Asia-Pacific: Snus Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 36: China: Snus Market: Sales Value (in Million USD), 2019 & 2024

- Figure 37: China: Snus Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 38: Japan: Snus Market: Sales Value (in Million USD), 2019 & 2024

- Figure 39: Japan: Snus Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 40: India: Snus Market: Sales Value (in Million USD), 2019 & 2024

- Figure 41: India: Snus Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 42: South Korea: Snus Market: Sales Value (in Million USD), 2019 & 2024

- Figure 43: South Korea: Snus Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 44: Australia: Snus Market: Sales Value (in Million USD), 2019 & 2024

- Figure 45: Australia: Snus Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 46: Indonesia: Snus Market: Sales Value (in Million USD), 2019 & 2024

- Figure 47: Indonesia: Snus Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 48: Others: Snus Market: Sales Value (in Million USD), 2019 & 2024

- Figure 49: Others: Snus Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 50: Europe: Snus Market: Sales Value (in Million USD), 2019 & 2024

- Figure 51: Europe: Snus Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 52: Germany: Snus Market: Sales Value (in Million USD), 2019 & 2024

- Figure 53: Germany: Snus Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 54: France: Snus Market: Sales Value (in Million USD), 2019 & 2024

- Figure 55: France: Snus Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 56: United Kingdom: Snus Market: Sales Value (in Million USD), 2019 & 2024

- Figure 57: United Kingdom: Snus Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 58: Italy: Snus Market: Sales Value (in Million USD), 2019 & 2024

- Figure 59: Italy: Snus Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 60: Spain: Snus Market: Sales Value (in Million USD), 2019 & 2024

- Figure 61: Spain: Snus Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 62: Russia: Snus Market: Sales Value (in Million USD), 2019 & 2024

- Figure 63: Russia: Snus Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 64: Others: Snus Market: Sales Value (in Million USD), 2019 & 2024

- Figure 65: Others: Snus Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 66: Latin America: Snus Market: Sales Value (in Million USD), 2019 & 2024

- Figure 67: Latin America: Snus Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 68: Brazil: Snus Market: Sales Value (in Million USD), 2019 & 2024

- Figure 69: Brazil: Snus Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 70: Mexico: Snus Market: Sales Value (in Million USD), 2019 & 2024

- Figure 71: Mexico: Snus Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 72: Others: Snus Market: Sales Value (in Million USD), 2019 & 2024

- Figure 73: Others: Snus Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 74: Middle East and Africa: Snus Market: Sales Value (in Million USD), 2019 & 2024

- Figure 75: Middle East and Africa: Snus Market: Breakup by Country (in %), 2024

- Figure 76: Middle East and Africa: Snus Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 77: Global: Snus Industry: SWOT Analysis

- Figure 78: Global: Snus Industry: Value Chain Analysis

- Figure 79: Global: Snus Industry: Porter's Five Forces Analysis

List of Tables

- Table 1: Global: Snus Market: Key Industry Highlights, 2024 and 2033

- Table 2: Global: Snus Market Forecast: Breakup by Product Type (in Million USD), 2025-2033

- Table 3: Global: Snus Market Forecast: Breakup by Flavors (in Million USD), 2025-2033

- Table 4: Global: Snus Market Forecast: Breakup by Distribution Channel (in Million USD), 2025-2033

- Table 5: Global: Snus Market Forecast: Breakup by Region (in Million USD), 2025-2033

- Table 6: Global: Snus Market: Competitive Structure

- Table 7: Global: Snus Market: Key Players

The global snus market size was valued at USD 3.32 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 6.20 Billion by 2033, exhibiting a CAGR of 6.82% during 2025-2033. Europe currently dominates the market, holding a significant market share of over 62.0% in 2024. The growing number of health-conscious consumers with a preference for tobacco products with reduced health risks, rising environmental concerns and sustainability drive, continual innovations in nicotine delivery systems, and increasing partnerships and acquisitions amongst key players are some of the key factors propelling the market.

Snus is a moist, powdered, smokeless tobacco product that comes in small pouches, designed to be placed discreetly under the upper lip. Unlike traditional chewing tobacco, snus does not require spitting, making it a more convenient and socially acceptable option for tobacco users. The product is known for its distinct characteristics and properties, offering users a unique experience compared to other tobacco products. Snus is available in various flavors, ranging from mint and fruit to traditional tobacco, catering to diverse consumer preferences. The working mechanism of snus involves the slow release of nicotine and other flavor compounds through the pouch's membrane, allowing for a long-lasting and controlled nicotine delivery to the user.

The global market is primarily driven by the growing number of health-conscious consumers with a preference for tobacco products with reduced health risks. This can be attributed to the increasing popularity of vaping and e-cigarettes among the masses. In line with this, effective marketing campaigns highlighting the benefits of snus over traditional smoking have resonated with consumers, which is resulting in a higher product uptake. Also, manufacturers are continuously introducing new flavors to expand their product portfolios and attract a broader customer base, thereby fueling the market. In addition to this, stringent tobacco control policies, such as higher taxes on cigarettes, are leading to the higher adoption of alternative tobacco products, which is creating a positive market outlook. Furthermore, the easy product availability across online and offline retail channels is also acting as a significant growth inducing factor for the market.

Snus Market Trends/Drivers:

Rising environmental concerns and sustainability drive

In recent years, the escalating concern for environmental preservation and sustainability has emerged as a critical driver impacting various industries, including the smokeless tobacco market. Consumers are becoming increasingly conscious of their ecological footprint and are actively seeking products that align with their eco-friendly values. As this environmental consciousness continues to grow, tobacco companies have recognized the need to adapt their practices and products to meet these evolving demands. In response to this trend, the snus market has seen a significant shift towards implementing environmentally friendly measures. Manufacturers are now exploring biodegradable and compostable materials for their pouches, reducing the reliance on conventional plastic packaging that contributes to pollution and environmental degradation. This strategic move not only appeals to the eco-conscious consumer base but also demonstrates the industry's commitment to mitigating its environmental impact. Moreover, companies are also focusing on sustainable sourcing practices for the tobacco used in snus production.

Continual innovations in nicotine delivery systems

As technology continues to advance, the tobacco industry has witnessed an influx of innovations in nicotine delivery systems. This trend has also significantly influenced the development of the smokeless tobacco market, including snus. Manufacturers are investing heavily in research and development to create cutting-edge nicotine delivery solutions that offer an improved and refined user experience. The goal is to cater to the preferences of both existing tobacco users seeking alternatives and potential new consumers exploring smokeless options. Additionally, manufacturers are experimenting with a diverse range of flavors to cater to varying consumer tastes. This flavor innovation, coupled with the advancements in nicotine delivery technology, is driving increased interest in snus products among tobacco users looking for a more enjoyable and customizable experience.

Rising partnerships and acquisitions amongst key players

In an era of global connectivity and e-commerce dominance, businesses across industries are capitalizing on the opportunities presented by expanding distribution channels and global market penetration. The smokeless tobacco market, including snus, is no exception to this trend. Manufacturers are leveraging the power of online retail platforms and e-commerce to reach consumers worldwide, breaking down geographical barriers and facilitating access to their products. Through strategic partnerships with local distributors and retailers in various countries, the snus industry has successfully entered previously untapped markets. This approach has proven effective in introducing the product to diverse demographics and cultures, thereby broadening the potential consumer base. The convenience of online shopping has also made it easier for curious consumers to explore snus products, regardless of their location, further fueling market growth.

Snus Industry Segmentation:

Breakup by Product Type:

- Loose Snus

- Portion Snus

Loose snus represents the largest market segment

The primary reason for the popularity of the loose snus segment is the experience it offers to seasoned snus users. These users often appreciate the hands-on approach and the ability to adjust the strength of the portion according to their nicotine tolerance. The tactile nature of preparing loose snus adds a level of ritual and enjoyment to the snus experience. Moreover, the loose snus segment attracts users who prefer a more traditional and authentic snus experience, as it closely aligns with the historical origins of snus.

On the other hand, portion snus offers a pre-portioned format that eliminates the need for users to mold the snus themselves, making it more convenient and user-friendly. Manufacturers continuously invest in innovative packaging and pouch designs for portion snus. Advanced technology ensures optimal nicotine release and improved flavor delivery, enhancing the overall user experience and attracting loyal customers. In addition to this, the availability of portion snus across online and offline retail channels allows companies to target a wide range of consumer segments effectively.

Breakup by Flavors:

- Mint

- Berries

- Dry Fruit

- Others

The availability of a wide array of flavors caters to diverse consumer tastes and preferences. By offering options beyond traditional tobacco, these flavored segments attract a broader customer base, including non-smokers exploring smokeless alternatives. Flavored snus is often perceived as a potentially healthier alternative to smoking and chewing tobacco due to its smokeless nature and appealing taste. This health-conscious perception contributes to the popularity of these flavored segments. In addition to this, manufacturers of flavored snus employ innovative marketing strategies and unique branding to differentiate their products in the market. Creative campaigns emphasizing the distinct flavor profiles enhance product visibility and drive consumer interest, thereby providing a boost to the sales.

Breakup by Distribution Channel:

- Tobacco Stores

- Convenience Stores

- Online Retail Stores

- Others

Convenience stores account for the majority of the market share

Convenience stores enjoy a strategic advantage due to their widespread presence in urban and rural areas. Their convenient accessibility ensures that customers can easily purchase tobacco products on-the-go, driving regular sales and attracting impulse buyers. Also, the major manufacturers invest in eye-catching point-of-sale displays and merchandising materials for convenience stores, leading to increased product visibility and potential sales.

On the other hand, tobacco stores offer a wide range of snus products, including exclusive and premium varieties that are not easily found in other retail outlets. This diverse selection attracts customers seeking unique flavors and nicotine strengths, contributing to the segment's growth. Leading manufacturers collaborate with tobacco stores to implement targeted marketing campaigns and in-store promotions. These initiatives create brand awareness, educate customers about new product launches, and incentivize purchases, driving footfall and sales at tobacco stores.

Additionally, online retail stores have the advantage of reaching customers worldwide, providing access to tobacco products even in regions where traditional retail distribution might be limited. This global reach opens up new market opportunities, driving the segment's expansion. Online retailers can also offer personalized product recommendations based on customer preferences and purchase history. This tailored shopping experience enhances customer satisfaction, leading to increased customer loyalty and repeat purchases.

Breakup by Region:

- North America

- United States

- Canada

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

Europe exhibits a clear dominance, accounting for the largest snus market share

The report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Europe (Germany, France, the United Kingdom, Italy, Spain, Russia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, Europe accounted for the largest market share.

With a long-standing tradition of smokeless tobacco use, certain countries in Europe, such as Sweden and Norway, have embraced snus as a part of their cultural heritage. The centuries-old tradition, coupled with the perception of snus as a potentially less harmful alternative to smoking, has driven widespread acceptance of snus products in the region.

In some European countries, it is considered a harm-reduction alternative to smoking, leading to regulatory support and acceptance. As public awareness of harm reduction strategies grows, along with changing perceptions of tobacco consumption, the snus market in Europe is poised for further expansion. The prevalence of tobacco use in various European countries influences the demand for smokeless alternatives like snus. As smoking rates decline, consumers are increasingly turning to snus as a less intrusive and odor-free way of consuming nicotine.

Competitive Landscape:

The top players in the snus market are implementing various strategies to ensure sustained market growth and maintain their competitive edge. To capture and retain consumer interest, top players in the snus market are heavily investing in product innovation. They are focusing on research and development (R&D) to create new flavors, pouch designs, and packaging options to cater to diverse consumer preferences. Top players are leveraging targeted marketing campaigns to highlight the benefits of their snus products, emphasizing factors such as reduced health risks compared to smoking, convenience, and eco-friendly initiatives. Also, the leading companies are expanding their product portfolios to offer a wider range of options to consumers. By introducing various nicotine strengths, flavors, and pouch sizes, they cater to different user preferences.

The report has provided a comprehensive analysis of the competitive landscape in the market. Detailed profiles of all major companies have also been provided. Some of the key players in the market include:

- Altria Group Inc.

- GN Tobacco Sweden AB

- Kurbits Snus AB

- Mac Baren Tobacco Company (Halberg A/S)

- Nordic Snus AB

- Philip Morris Products S.A.

- Skruf Snus AB

- Swedish Match AB

Key Questions Answered in This Report

- 1.What is snus?

- 2.How big is the global snus market?

- 3.What is the expected growth rate of the global snus market during 2025-2033?

- 4.What are the key factors driving the global snus market?

- 5.What is the leading segment of the global snus market based on product type?

- 6.What is the leading segment of the global snus market based on distribution channel?

- 7.What are the key regions in the global snus market?

- 8.Who are the key players/companies in the global snus market?

Table of Contents

1 Preface

2 Scope and Methodology

- 2.1 Objectives of the Study

- 2.2 Stakeholders

- 2.3 Data Sources

- 2.3.1 Primary Sources

- 2.3.2 Secondary Sources

- 2.4 Market Estimation

- 2.4.1 Bottom-Up Approach

- 2.4.2 Top-Down Approach

- 2.5 Forecasting Methodology

3 Executive Summary

4 Introduction

- 4.1 Overview

- 4.2 Key Industry Trends

5 Global Snus Market

- 5.1 Market Overview

- 5.2 Market Performance

- 5.3 Impact of COVID-19

- 5.4 Market Forecast

6 Market Breakup by Product Type

- 6.1 Loose Snus

- 6.1.1 Market Trends

- 6.1.2 Market Forecast

- 6.2 Portion Snus

- 6.2.1 Market Trends

- 6.2.2 Market Forecast

7 Market Breakup by Flavors

- 7.1 Mint

- 7.1.1 Market Trends

- 7.1.2 Market Forecast

- 7.2 Berries

- 7.2.1 Market Trends

- 7.2.2 Market Forecast

- 7.3 Dry Fruit

- 7.3.1 Market Trends

- 7.3.2 Market Forecast

- 7.4 Others

- 7.4.1 Market Trends

- 7.4.2 Market Forecast

8 Market Breakup by Distribution Channel

- 8.1 Tobacco Stores

- 8.1.1 Market Trends

- 8.1.2 Market Forecast

- 8.2 Convenience Stores

- 8.2.1 Market Trends

- 8.2.2 Market Forecast

- 8.3 Online Retail Stores

- 8.3.1 Market Trends

- 8.3.2 Market Forecast

- 8.4 Others

- 8.4.1 Market Trends

- 8.4.2 Market Forecast

9 Market Breakup by Region

- 9.1 North America

- 9.1.1 United States

- 9.1.1.1 Market Trends

- 9.1.1.2 Market Forecast

- 9.1.2 Canada

- 9.1.2.1 Market Trends

- 9.1.2.2 Market Forecast

- 9.1.1 United States

- 9.2 Asia-Pacific

- 9.2.1 China

- 9.2.1.1 Market Trends

- 9.2.1.2 Market Forecast

- 9.2.2 Japan

- 9.2.2.1 Market Trends

- 9.2.2.2 Market Forecast

- 9.2.3 India

- 9.2.3.1 Market Trends

- 9.2.3.2 Market Forecast

- 9.2.4 South Korea

- 9.2.4.1 Market Trends

- 9.2.4.2 Market Forecast

- 9.2.5 Australia

- 9.2.5.1 Market Trends

- 9.2.5.2 Market Forecast

- 9.2.6 Indonesia

- 9.2.6.1 Market Trends

- 9.2.6.2 Market Forecast

- 9.2.7 Others

- 9.2.7.1 Market Trends

- 9.2.7.2 Market Forecast

- 9.2.1 China

- 9.3 Europe

- 9.3.1 Germany

- 9.3.1.1 Market Trends

- 9.3.1.2 Market Forecast

- 9.3.2 France

- 9.3.2.1 Market Trends

- 9.3.2.2 Market Forecast

- 9.3.3 United Kingdom

- 9.3.3.1 Market Trends

- 9.3.3.2 Market Forecast

- 9.3.4 Italy

- 9.3.4.1 Market Trends

- 9.3.4.2 Market Forecast

- 9.3.5 Spain

- 9.3.5.1 Market Trends

- 9.3.5.2 Market Forecast

- 9.3.6 Russia

- 9.3.6.1 Market Trends

- 9.3.6.2 Market Forecast

- 9.3.7 Others

- 9.3.7.1 Market Trends

- 9.3.7.2 Market Forecast

- 9.3.1 Germany

- 9.4 Latin America

- 9.4.1 Brazil

- 9.4.1.1 Market Trends

- 9.4.1.2 Market Forecast

- 9.4.2 Mexico

- 9.4.2.1 Market Trends

- 9.4.2.2 Market Forecast

- 9.4.3 Others

- 9.4.3.1 Market Trends

- 9.4.3.2 Market Forecast

- 9.4.1 Brazil

- 9.5 Middle East and Africa

- 9.5.1 Market Trends

- 9.5.2 Market Breakup by Country

- 9.5.3 Market Forecast

10 SWOT Analysis

- 10.1 Overview

- 10.2 Strengths

- 10.3 Weaknesses

- 10.4 Opportunities

- 10.5 Threats

11 Value Chain Analysis

12 Porters Five Forces Analysis

- 12.1 Overview

- 12.2 Bargaining Power of Buyers

- 12.3 Bargaining Power of Suppliers

- 12.4 Degree of Competition

- 12.5 Threat of New Entrants

- 12.6 Threat of Substitutes

13 Price Analysis

14 Competitive Landscape

- 14.1 Market Structure

- 14.2 Key Players

- 14.3 Profiles of Key Players

- 14.3.1 Altria Group Inc.

- 14.3.1.1 Company Overview

- 14.3.1.2 Product Portfolio

- 14.3.1.3 Financials

- 14.3.1.4 SWOT Analysis

- 14.3.2 GN Tobacco Sweden AB

- 14.3.2.1 Company Overview

- 14.3.2.2 Product Portfolio

- 14.3.3 Kurbits Snus AB

- 14.3.3.1 Company Overview

- 14.3.3.2 Product Portfolio

- 14.3.4 Mac Baren Tobacco Company (Halberg A/S)

- 14.3.4.1 Company Overview

- 14.3.4.2 Product Portfolio

- 14.3.5 Nordic Snus AB

- 14.3.5.1 Company Overview

- 14.3.5.2 Product Portfolio

- 14.3.6 Philip Morris Products S.A.

- 14.3.6.1 Company Overview

- 14.3.6.2 Product Portfolio

- 14.3.7 Skruf Snus AB

- 14.3.7.1 Company Overview

- 14.3.7.2 Product Portfolio

- 14.3.8 Swedish Match AB

- 14.3.8.1 Company Overview

- 14.3.8.2 Product Portfolio

- 14.3.8.3 Financials

- 14.3.1 Altria Group Inc.