|

|

市場調査レポート

商品コード

1661269

ゼラチンの市場規模、シェア、動向、予測:原料別、最終用途別、地域別、2025年~2033年Gelatin Market Size, Share, Trends and Forecast by Raw Material, End Use, and Region, 2025-2033 |

||||||

カスタマイズ可能

|

|||||||

| ゼラチンの市場規模、シェア、動向、予測:原料別、最終用途別、地域別、2025年~2033年 |

|

出版日: 2025年02月10日

発行: IMARC

ページ情報: 英文 136 Pages

納期: 2~3営業日

|

全表示

- 概要

- 図表

- 目次

2024年のゼラチンの市場の世界市場規模は47万970トンでした。今後、IMARC Groupは、市場は2033年までに53万6,020トンに達し、2025~2033年のCAGRは1.3%になると予測しています。現在、欧州が市場を独占しており、2024年には39.5%を超える大きな市場シェアを占めています。同市場は、天然素材やクリーンラベル素材に対する消費者の需要の高まり、健康意識の高まりによる医薬品・栄養補助食品分野の拡大、製品製造プロセスにおける継続的な技術進歩などを背景に、着実な成長を遂げています。

ゼラチン消費に伴う健康効果に対する意識の高まりが市場成長を後押し

大衆の間での健康意識の高まりは、世界中でゼラチンの需要を促進している主な要因の一つです。ゼラチンはタンパク質の構成要素であるアミノ酸を豊富に含み、消化しやすいです。体内で最も豊富で重要なタンパク質であるコラーゲンを多く含んでいます。また、関節にもよく、関節の回復を助け、皮膚、髪、爪の健康を促進します。

本レポートでは、市場構造、主要企業の市場シェア、主要企業の市況分析、主要成功戦略、競合ダッシュボード、企業評価象限などの競合分析を行っています。また、主要企業の詳細プロファイルも掲載しています。市場構造は上位6社に集中しています。ゼラチン業界にはメーカーが6社しか存在しないため、新規参入の量は少ないです。

ゼラチンとは?

ゼラチンは、牛、豚、魚などの動物の結合組織に含まれる構造タンパク質であるコラーゲンに由来する、無色、無味、水溶性の動物性タンパク質です。皮膚、骨、腱などのコラーゲンを含む組織を、タンパク質が抽出されるまで水で煮沸し、冷やすとゲル状の物質になることで得られます。タンパク質、ビタミン、ミネラル、カルシウム、マグネシウム、カリウム、その他の必須栄養素を豊富に含みます。腸内環境を改善し、炎症を抑え、皮膚の健康を促進し、骨の健康を高め、シワを目立たなくします。結晶化制御、水結合、フィルム形成、増粘、乳化特性を提供します。

COVID-19の影響

COVID-19の大流行はゼラチン業界に大きな影響を与え、多くの国に前例のない課題を課しました。多くの国が施錠や渡航制限を行ったため、世界的にゼラチンのサプライチェーンが混乱しました。レストランやホテルの閉鎖によって、ゼラチンを使った製品の需要も減少しました。その結果、多くのゼラチンメーカーが減産や一時的な操業停止を余儀なくされました。さらに、パンデミックはゼラチン産業の原料供給にも影響を与えました。ゼラチンに使用されるコラーゲンは動物の製品別から得られるが、パンデミックは食肉加工業界の混乱により、これらの製品別の不足を招いた。これとは別に、パンデミックはゼラチン産業に新たな機会をもたらしました。パンデミックの間、免疫力を高めるサプリメントや機能性食品の需要が高まり、ゼラチンはこれらの製品に不可欠な成分です。さらに、さまざまな医薬品が必要とされたため、カプセルのようなゼラチンベースの医薬品の需要も増加しました。パンデミックがもたらした課題に対応するため、多くのゼラチンメーカーは新たな戦略を採用しました。従業員をウイルスから守るために施設の安全対策を実施し、消費者のニーズの変化に対応した新製品の開発に注力しました。

ゼラチンの市場動向:

ゼラチンはゲル化剤、安定剤、増粘剤として、プリン、ムース、サワークリーム、ヨーグルト、ソーセージ、ワイン、ビール、スープ、グレイビーソースなど、さまざまな食品や飲料の調製に利用されています。これは、調理済み(RTE)食品の消費増加、アルコール飲料の消費増加、飲食品(F&B)産業の繁栄と相まって、世界の市場成長を促進する主な要因のひとつとなっています。また、急速な都市化、多忙なスケジュール、消費者の購買力の拡大も要因のひとつと考えられます。さらに、栄養バーやプロテイン飲料の製造におけるゼラチンの使用量の増加や、大衆の間での健康意識の高まりが、市場にプラスの影響を与えています。さらに、カプセル、錠剤、グミを製造するための結合剤やコーティング剤として、製薬業界や栄養補助食品業界でゼラチンの利用が増加していることも、市場の成長を後押ししています。また、毎日の食生活で栄養補助食品の消費が増加していることも、この市場の成長を後押ししています。さらに、ヘアマスク、フェイスマスク、モイスチャライザー、マスカラ、アイライナー、シャンプー、コンディショナーなど、さまざまなパーソナルケア製品や化粧品の製造におけるゼラチンの使用も増加しています。また、シワ対策、新陳代謝の促進、爪や髪の強化にも役立ちます。これに加えて、ゼラチンをベースとしたパーソナルケア製品や化粧品がオフラインやオンラインの小売チャネルで簡単に入手できることも、市場の成長を後押ししています。これとは別に、製品メーカーや販売業者は、個人の菜食志向の変化やクリーンラベル製品への嗜好の高まりから、ビーガン用ゼラチンの発売に向けて幅広く投資しています。また、廃棄物、エネルギー消費、水使用、全体的な環境への影響を削減する技術やプロセスに資金を提供しています。

本レポートで扱う主な質問

- ゼラチンの市場の市場規模は?

- ゼラチンの市場の将来展望は?

- ゼラチンの市場を牽引する主な要因は何か?

- ゼラチンの市場のシェアが最も高い地域は?

- 世界のゼラチンの市場の主要企業は?

目次

第1章 序文

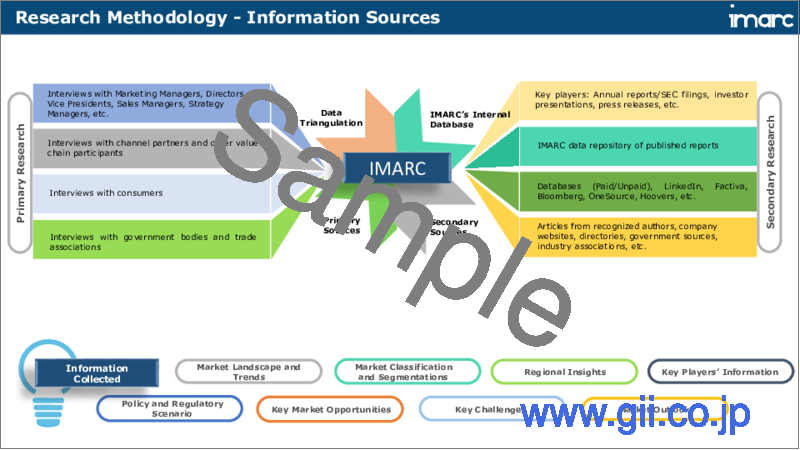

第2章 調査範囲と調査手法

- 調査の目的

- ステークホルダー

- データソース

- 一次情報

- 二次情報

- 市場推定

- ボトムアップアプローチ

- トップダウンアプローチ

- 調査手法

第3章 エグゼクティブサマリー

第4章 イントロダクション

- 概要

- プロパティ

- 主要業界動向

第5章 世界のゼラチン産業

- 市場概要

- 市場実績

- 数量動向

- 金額動向

- 価格分析

- 主要価格指標

- 価格構造

- 価格動向

- COVID-19の影響

- 市場内訳:地域別

- 市場内訳:原材料別

- 市場内訳:最終用途別

- 市場予測

- SWOT分析

- 概要

- 強み

- 弱み

- 機会

- 脅威

- バリューチェーン分析

- 原材料調達

- 製造

- マーケティング

- 流通

- 輸出

- 最終用途

- ポーターのファイブフォース分析

- 概要

- 買い手の交渉力

- 供給企業の交渉力

- 競合の程度

- 新規参入業者の脅威

- 代替品の脅威

- 貿易データ

- 輸入

- 輸出

- 市場促進要因と成功要因

第6章 主要地域の実績

- 欧州

- 北米

- アジア

- 南米

- その他

第7章 市場:原材料別

- 豚皮

- 市場動向

- 市場予測

- 牛皮

- 市場動向

- 市場予測

- 骨

- 市場動向

- 市場予測

- その他

- 市場動向

- 市場予測

第8章 マーケット:最終用途別

- 飲食品

- 市場動向

- 市場予測

- 栄養補助食品

- 市場動向

- 市場予測

- 医薬品

- 市場動向

- 市場予測

- 写真

- 市場動向

- 市場予測

- 化粧品

- 市場動向

- 市場予測

- その他

- 市場動向

- 市場予測

第9章 競合情勢

- 競争構造

- 主要企業の生産能力

第10章 ゼラチン製造工程

- 製品概要

- 製造工程

- 詳細なプロセスフロー

- 原材料要件

- 質量バランスと原料転換率

第11章 ゼラチン原料市場分析

- 牛と豚の骨

- 市場実績

- ボリュームトレンド

- 価値トレンド

- 価格動向

- 市場内訳:地域別

- 主要サプライヤー

- 市場実績

- 炭酸ナトリウム

- 市場実績

- ボリュームトレンド

- 価値トレンド

- 価格動向

- 市場内訳:地域別

- 主要サプライヤー

- 市場実績

- 塩酸

- 市場実績

- ボリュームトレンド

- 価値トレンド

- 価格動向

- 市場内訳:地域別

- 主要サプライヤー

- 市場実績

- 生石灰

- 市場実績

- ボリュームトレンド

- 価値トレンド

- 価格動向

- 市場内訳:地域別

- 主要サプライヤー

- 市場実績

第12章 主要企業のプロファイル

- Gelita AG(Formerly DGF Stoess)

- Rousselot SAS

- PB Gelatin(Tessenderlo Group)

- Sterling Biotech Ltd

- Weishardt Group

- Nitta Gelatin

List of Figures

- Figure 1: Global: Gelatin Market: Major Drivers and Challenges

- Figure 2: Global: Gelatin Market: Sales Volume Trends (in '000 Tons), 2019-2024

- Figure 3: Global: Gelatin Market: Sales Value Trends (in Billion USD), 2019-2024

- Figure 4: Global: Gelatin Market: Average Price Trends (in USD/Ton), 2019-2024

- Figure 5: Gelatin Market: Price Structure

- Figure 6: Global: Gelatin Market Forecast: Average Price Trends (in USD/Ton), 2025-2033

- Figure 7: Global: Gelatin Market: Breakup by Region (in %), 2024

- Figure 8: Global: Gelatin Market: Breakup by Raw Material (in %), 2024

- Figure 9: Global: Gelatin Market: Breakup by End-Use (in %), 2024

- Figure 10: Global: Gelatin Market Forecast: Sales Volume Trends (in '000 Tons), 2025-2033

- Figure 11: Global: Gelatin Market Forecast: Sales Value Trends (in Billion USD), 2025-2033

- Figure 12: Global: Gelatin Industry: SWOT Analysis

- Figure 13: Global: Gelatin Industry: Value Chain Analysis

- Figure 14: Global: Gelatin Industry: Porter's Five Forces Analysis

- Figure 15: Global: Gelatin Market: Import Volume Breakup by Country (in %), 2024

- Figure 16: USA: Gelatin Market: Import Volume Trend (in Tons), 2024

- Figure 17: Global: Gelatin Market: Export Volume Breakup by Country (in %), 2024

- Figure 18: Brazil: Gelatin Market: Export Volume Trend (in Tons), 2024

- Figure 19: Europe: Gelatin Market: Volume Trends (in '000 Tons), 2019 & 2024

- Figure 20: Europe: Gelatin Market Forecast: Volume Trends (in '000 Tons), 2025-2033

- Figure 21: North America: Gelatin Market: Volume Trends (in '000 Tons), 2019 & 2024

- Figure 22: North America: Gelatin Market Forecast: Volume Trends (in '000 Tons), 2025-2033

- Figure 23: Asia: Gelatin Market: Volume Trends (in '000 Tons), 2019 & 2024

- Figure 24: Asia: Gelatin Market Forecast: Volume Trends (in '000 Tons), 2025-2033

- Figure 25: South America: Gelatin Market: Volume Trends (in '000 Tons), 2019 & 2024

- Figure 26: South America: Gelatin Market Forecast: Volume Trends (in '000 Tons), 2025-2033

- Figure 27: Others: Gelatin Market: Volume Trends (in '000 Tons), 2019 & 2024

- Figure 28: Others: Gelatin Market Forecast: Volume Trends (in '000 Tons), 2025-2033

- Figure 29: Global: Gelatin Market (Pig Skin): Volume Trends (in '000 Tons), 2019 & 2024

- Figure 30: Global: Gelatin Market Forecast (Pig Skin): Volume Trends (in '000 Tons), 2025-2033

- Figure 31: Global: Gelatin Market (Bovine Hides): Volume Trends (in '000 Tons), 2019 & 2024

- Figure 32: Global: Gelatin Market Forecast (Bovine Hides): Volume Trends (in '000 Tons), 2025-2033

- Figure 33: Global: Gelatin Market (Bones): Volume Trends (in '000 Tons), 2019 & 2024

- Figure 34: Global: Gelatin Market Forecast (Bones): Volume Trends (in '000 Tons), 2025-2033

- Figure 35: Global: Gelatin Market (Other Raw Materials): Volume Trends (in '000 Tons), 2019 & 2024

- Figure 36: Global: Gelatin Market Forecast (Other Raw Materials): Volume Trends (in '000 Tons), 2025-2033

- Figure 37: Global: Gelatin Market (in Food and Beverages): Volume Trends (in '000 Tons), 2019 & 2024

- Figure 38: Global: Gelatin Market Forecast (in Food and Beverages): Volume Trends (in '000 Tons), 2025-2033

- Figure 39: Global: Gelatin Market (in Nutraceuticals): Volume Trends (in '000 Tons), 2019 & 2024

- Figure 40: Global: Gelatin Market Forecast (in Nutraceuticals): Volume Trends (in '000 Tons), 2025-2033

- Figure 41: Global: Gelatin Market (in Pharmaceuticals): Volume Trends (in '000 Tons), 2019 & 2024

- Figure 42: Global: Gelatin Market Forecast (in Pharmaceuticals): Volume Trends (in '000 Tons), 2025-2033

- Figure 43: Global: Gelatin Market (in Photography): Volume Trends (in '000 Tons), 2019 & 2024

- Figure 44: Global: Gelatin Market Forecast (in Photography): Volume Trends (in '000 Tons), 2025-2033

- Figure 45: Global: Gelatin Market (in Cosmetics): Volume Trends (in '000 Tons), 2019 & 2024

- Figure 46: Global: Gelatin Market Forecast (in Cosmetics): Volume Trends (in '000 Tons), 2025-2033

- Figure 47: Global: Gelatin Market (Other End Uses): Volume Trends (in '000 Tons), 2019 & 2024

- Figure 48: Global: Gelatin Market Forecast (Other End Uses): Volume Trends (in '000 Tons), 2025-2033

- Figure 49: Gelatin Manufacturing: Detailed Process Flow

- Figure 50: Gelatin Manufacturing: Conversion Rate of Feedstocks

- Figure 51: Global: Cow and Pig Bones Market: Production Volume Trend (in Million Tons), 2019-2024

- Figure 52: Global: Cow and Pig Bones Market: Production Value Trend (in Million USD), 2019-2024

- Figure 53: Global: Cow and Pig Bones Market: Price Trend (in USD/Ton), 2019-2024

- Figure 54: Global: Cow and Pig Bones Market: Breakup by Region (in %), 2024

- Figure 55: Global: Cow and Pig Bones Market Forecast: Production Volume Trends (in Million Tons), 2025-2033

- Figure 56: Global: Cow and Pig Bones Market Forecast: Production Value Trend (in Million USD), 2025-2033

- Figure 57: Global: Sodium Carbonate Market: Production Volume Trend (in Million Tons), 2019-2024

- Figure 58: Global: Sodium Carbonate Market: Production Value Trend (in Million USD), 2019-2024

- Figure 59: Global: Sodium Carbonate Market: Price Trend (in USD/Ton), 2019-2024

- Figure 60: Global: Sodium Carbonate Market: Breakup by Region (in %), 2024

- Figure 61: Global: Sodium Carbonate Market Forecast: Production Volume Trend (in Million Tons), 2025-2033

- Figure 62: Global: Sodium Carbonate Market Forecast: Production Value Trend (in Million USD), 2025-2033

- Figure 63: Global: Hydrochloric Acid Market: Production Volume Trend (in Million Tons), 2019-2024

- Figure 64: Global: Hydrochloric Acid Market: Production value Trend (in Million USD), 2019-2024

- Figure 65: Global: Hydrochloric Acid Market: Price Trend (in USD/Ton), 2019-2024

- Figure 66: Global: Hydrochloric Acid Market: Breakup by Region (in %), 2024

- Figure 67: Global: Hydrochloric Acid Market Forecast: Production Volume Trend (in Million Tons), 2025-2033

- Figure 68: Global: Hydrochloric Acid Market Forecast: Production Value Trend (in Million USD), 2025-2033

- Figure 69: Global: Quick Lime Market: Production Volume Trend (in Million Tons), 2019-2024

- Figure 70: Global: Quick Lime Market: Production Value Trend (in Million USD), 2019-2024

- Figure 71: Global: Quick Lime Market: Price Trend (in USD/Ton), 2019-2024

- Figure 72: Global: Quick Lime Market: Breakup by Region (in %), 2024

- Figure 73: Global: Quick Lime Market Forecast: Production Volume Trend (in Million Tons), 2025-2033

- Figure 74: Global: Quick Lime Market Forecast: Production Value Trend (in Million USD), 2025-2033

List of Tables

- Table 1: Gelatin: Physical Properties

- Table 2: Gelatin: Chemical Properties

- Table 3: Global: Gelatin Market: Key Industry Highlights, 2024 and 2033

- Table 4: Global: Gelatin Market Forecast: Breakup by Region (in '000 Tons), 2025-2033

- Table 5: Global: Gelatin Market Forecast: Breakup by Raw Material (in '000 Tons), 2025-2033

- Table 6: Global: Gelatin Market Forecast: Breakup by End-Use (in '000 Tons), 2025-2033

- Table 7: Global: Gelatin Market: Imports by Major Countries

- Table 8: Global: Gelatin Market: Exports by Major Countries

- Table 9: Global: Gelatin Market: Competitive Structure

- Table 10: Global: Gelatin Market: Capacity of Major Players (in '000 Tons)

- Table 11: Gelatin/Ossein Manufacturing Process: Raw Material Requirements

- Table 12: Global: List of Major Pork and Beef Producers

- Table 13: Global: Major Sodium Carbonate Producers

- Table 14: Global: Major Hydrochloric Acid Manufacturers

The global gelatin market size was valued at 4,70,970 Tons in 2024. Looking forward, IMARC Group estimates the market to reach 5,36,020 Tons by 2033, exhibiting a CAGR of 1.3% during 2025-2033. Europe currently dominates the market, holding a significant market share of over 39.5% in 2024. The market is experiencing steady growth driven by the growing consumer demand for natural and clean-label ingredients, the pharmaceutical and nutraceutical sectors' expansion due to increased health awareness, and continuous technological advancements in product manufacturing processes.

The Rising Awareness About the Health Benefits Associated with Gelatin Consumption Augmenting the Market Growth

The increasing health consciousness among the masses represents one of the major factors driving the demand for gelatin around the world. Gelatin is rich in amino acids, which are the building blocks of proteins and are easily digestible. It is a high source of collagen which is the most abundant and important protein in the body. It is also good for joints and can help joint recovery and promote skin, hair, and nail health.

Competitive analysis such as market structure, market share by key players, player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided. The market structure is concentrated with top six players. The volume of new entrants is low in the gelatin industry due to the presence of only six manufacturers in the industry.

What is Gelatin?

Gelatin is a colorless, flavorless, and water soluble animal protein derived from collagen, which is a structural protein found in the connective tissues of animals, including cows, pigs, and fish. It is obtained by boiling collagen-containing tissues, such as skin, bones, and tendons, in water until the protein is extracted and forms a gel-like substance when cooled. It is rich in protein, vitamins, minerals, calcium, magnesium, potassium, and other essential nutrients. It aids in improving gut health, reducing inflammation, promoting skin health, boosting bone health, and minimizing the appearance of wrinkles. It offers crystallization control, water binding, film-forming, thickening, and emulsifying properties.

COVID-19 Impact:

The COVID-19 pandemic outbreak has caused a significant impact on the gelatin industry and imposed unprecedented challenges on numerous countries. The lockdowns and travel restrictions imposed by many countries disrupted the global supply chain of gelatin. The closure of restaurants and hotels also reduced the demand for gelatin-based products. As a result, many gelatin manufacturers had to cut down their production or shut down their operations temporarily. Moreover, the pandemic affected the raw material supply for the gelatin industry. The collagen used for gelatin is obtained from animal by-products, and the pandemic led to a shortage of these by-products due to the disruption of the meat processing industry. Apart from this, the pandemic created new opportunities for the gelatin industry. The demand for immunity-boosting supplements and functional foods increased during the pandemic, and gelatin is an essential ingredient in these products. Additionally, the demand for gelatin-based pharmaceutical products, such as capsules, increased due to the considerable need for different medications. In response to the challenges posed by the pandemic, many gelatin manufacturers adopted new strategies. They implemented safety measures in their facilities to protect their employees from the virus and focused on developing new products that catered to the changing needs of consumers.

Gelatin Market Trends:

Gelatin is utilized as a gelling agent, stabilizer, and thickener in the preparation of several food products and beverages, such as puddings, mousses, sour cream, yogurt, sausages, wine, beer, soups, and gravies. This, coupled with the increasing consumption of ready to eat (RTE) food products, rising consumption of alcoholic beverages, and thriving food and beverage (F&B) industry, represent one of the key factors facilitating the market growth around the world. It can also be attributed to rapid urbanization, hectic schedules, and expanding purchasing power of consumers. Furthermore, the increasing usage of gelatin in the manufacturing of nutritional bars and protein drinks and the growing health consciousness among the masses is influencing the market positively. Moreover, the rising utilization of gelatin in the pharmaceutical and nutraceutical industries as a binding agent and coating for producing capsules, tablets, and gummies is propelling the growth of the market. It can also be attributed to the growing consumption of dietary supplements among individuals in their daily diets. In addition, there is an increase in the use of gelatin in the manufacturing of various personal care and cosmetic products, including hair masks, face masks, moisturizers, mascara, eyeliners, shampoo, and conditioners. It also aids in fighting wrinkles, boosting the metabolism, and strengthening nails and hair. This, along with the easy availability of gelatin based personal care and cosmetic products via offline and online retail channels, is favoring the growth of the market. Apart from this, product manufacturers and sellers are extensively investing in the launching of vegan gelatin variants due to the shifting inclination of individuals toward vegan diets and the growing preference for clean label products. They are also funding technologies and processes that reduce waste, energy consumption, water usage and the overall environmental impact.

Key Market Segmentation:

Raw Material Insights:

- Pig Skin

- Bovine Hides

- Bones

- Others

End Use Insights:

- Food and Beverages

- Nutraceuticals

- Pharmaceuticals

- Photography

- Cosmetics

- Others

Regional Insights:

- Europe

- North America

- Asia

- South America

- Others

- The report has also provided a comprehensive analysis of all the major regional markets, which include Europe, North America, Asia, South America, and others. According to the report, Europe was the largest market for gelatin. The increasing use of gelatin for combating rheumatoid arthritis, osteoarthritis and osteoporosis and significant growth in the medical sector represents one of the major factors bolstering the market growth in the region. Moreover, the rising utilization of gelatin in various food products and beverages, such as ice-creams, ice-lollies, jellybeans, and candies, is favoring the growth of the market in the region. Apart from this, the growing demand for plant-based and vegetarian gelatin alternatives is influencing the market positively. Furthermore, key players operating in the region are investing in research and development (R&D) to create new and innovative gelatin products.

Competitive Landscape:

The report has also provided a comprehensive analysis of the competitive landscape in the global gelatin market. Some of the companies covered in the report include:

- Gelita AG (Formerly DGF Stoess)

- Rousselot SAS

- PB Gelatin (Tessenderlo Group)

- Sterling Biotech Ltd

- Weishardt Group

- Nitta Gelatin

- Please note that this only represents a partial list of companies, and the complete list has been provided in the report.

Key Questions Answered in This Report

- 1.How big is the gelatin market?

- 2.What is the future outlook of the gelatin market?

- 3.What are the key factors driving the gelatin market?

- 4.Which region accounts for the largest gelatin market share?

- 5.Which are the leading companies in the global gelatin market?

Table of Contents

1 Preface

2 Scope and Methodology

- 2.1 Objectives of the Study

- 2.2 Stakeholders

- 2.3 Data Sources

- 2.3.1 Primary Sources

- 2.3.2 Secondary Sources

- 2.4 Market Estimation

- 2.4.1 Bottom-Up Approach

- 2.4.2 Top-Down Approach

- 2.5 Forecasting Methodology

3 Executive Summary

4 Introduction

- 4.1 Overview

- 4.2 Properties

- 4.3 Key Industry Trends

5 Global Gelatin Industry

- 5.1 Market Overview

- 5.2 Market Performance

- 5.2.1 Volume Trends

- 5.2.2 Value Trends

- 5.3 Price Analysis

- 5.3.1 Key Price Indicators

- 5.3.2 Price Structure

- 5.3.3 Price Trends

- 5.4 Impact of COVID-19

- 5.5 Market Breakup by Region

- 5.6 Market Breakup by Raw Material

- 5.7 Market Breakup by End-Use

- 5.8 Market Forecast

- 5.9 SWOT Analysis

- 5.9.1 Overview

- 5.9.2 Strengths

- 5.9.3 Weaknesses

- 5.9.4 Opportunities

- 5.9.5 Threats

- 5.10 Value Chain Analysis

- 5.10.1 Raw Material Procurement

- 5.10.2 Manufacturing

- 5.10.3 Marketing

- 5.10.4 Distribution

- 5.10.5 Exports

- 5.10.6 End-Use

- 5.11 Porter's Five Forces Analysis

- 5.11.1 Overview

- 5.11.2 Bargaining Power of Buyers

- 5.11.3 Bargaining Power of Suppliers

- 5.11.4 Degree of Competition

- 5.11.5 Threat of New Entrants

- 5.11.6 Threat of Substitutes

- 5.12 Trade Data

- 5.12.1 Imports

- 5.12.2 Exports

- 5.13 Key Market Drivers and Success Factors

6 Performance of Key Regions

- 6.1 Europe

- 6.1.1 Market Trends

- 6.1.2 Market Forecast

- 6.2 North America

- 6.2.1 Market Trends

- 6.2.2 Market Forecast

- 6.3 Asia

- 6.3.1 Market Trends

- 6.3.2 Market Forecast

- 6.4 South America

- 6.4.1 Market Trends

- 6.4.2 Market Forecast

- 6.5 Others

- 6.5.1 Market Trends

- 6.5.2 Market Forecast

7 Market by Raw Material

- 7.1 Pig Skin

- 7.1.1 Market Trends

- 7.1.2 Market Forecast

- 7.2 Bovine Hides

- 7.2.1 Market Trends

- 7.2.2 Market Forecast

- 7.3 Bones

- 7.3.1 Market Trends

- 7.3.2 Market Forecast

- 7.4 Others

- 7.4.1 Market Trends

- 7.4.2 Market Forecast

8 Market by End-Use

- 8.1 Food and Beverages

- 8.1.1 Market Trends

- 8.1.2 Market Forecast

- 8.2 Nutraceuticals

- 8.2.1 Market Trends

- 8.2.2 Market Forecast

- 8.3 Pharmaceuticals

- 8.3.1 Market Trends

- 8.3.2 Market Forecast

- 8.4 Photography

- 8.4.1 Market Trends

- 8.4.2 Market Forecast

- 8.5 Cosmetics

- 8.5.1 Market Trends

- 8.5.2 Market Forecast

- 8.6 Others

- 8.6.1 Market Trends

- 8.6.2 Market Forecast

9 Competitive Landscape

- 9.1 Competitive Structure

- 9.2 Production Capacities of Key Players

10 Gelatin Manufacturing Process

- 10.1 Product Overview

- 10.2 Manufacturing Process

- 10.3 Detailed Process Flow

- 10.4 Raw Material Requirement

- 10.5 Mass Balance and Feedstock Conversion Rate

11 Gelatin Feedstock Market Analysis

- 11.1 Cow and Pig Bones

- 11.1.1 Market Performance

- 11.1.1.1 Volume Trend

- 11.1.1.2 Value Trend

- 11.1.2 Price Trend

- 11.1.3 Market Breakup by Region

- 11.1.4 Key Suppliers

- 11.1.1 Market Performance

- 11.2 Sodium Carbonate

- 11.2.1 Market Performance

- 11.2.1.1 Volume Trend

- 11.2.1.2 Value Trend

- 11.2.2 Price Trend

- 11.2.3 Market Breakup by Region

- 11.2.4 Key Suppliers

- 11.2.1 Market Performance

- 11.3 Hydrochloric Acid

- 11.3.1 Market Performance

- 11.3.1.1 Volume Trend

- 11.3.1.2 Value Trend

- 11.3.2 Price Trend

- 11.3.3 Market Breakup by Region

- 11.3.4 Key Suppliers

- 11.3.1 Market Performance

- 11.4 Quick Lime

- 11.4.1 Market Performance

- 11.4.1.1 Volume Trend

- 11.4.1.2 Value Trend

- 11.4.2 Price Trend

- 11.4.3 Market Breakup by Region

- 11.4.4 Key Suppliers

- 11.4.1 Market Performance

12 Key Player Profiles

- 12.1 Gelita AG (Formerly DGF Stoess)

- 12.2 Rousselot SAS

- 12.3 PB Gelatin (Tessenderlo Group)

- 12.4 Sterling Biotech Ltd

- 12.5 Weishardt Group

- 12.6 Nitta Gelatin