|

|

市場調査レポート

商品コード

1832109

水耕栽培の市場規模、シェア、動向、予測:タイプ別、作物タイプ別、装置別、地域別、2025~2033年Hydroponics Market Size, Share, Trends and Forecast by Type, Crop Type, Equipment, and Region, 2025-2033 |

||||||

カスタマイズ可能

|

|||||||

| 水耕栽培の市場規模、シェア、動向、予測:タイプ別、作物タイプ別、装置別、地域別、2025~2033年 |

|

出版日: 2025年10月01日

発行: IMARC

ページ情報: 英文 136 Pages

納期: 2~3営業日

|

概要

水耕栽培の世界市場規模は2024年に147億3,000万米ドルとなりました。2033年には331億2,000万米ドルに達すると予測され、2025~2033年のCAGRは9.30%です。現在、北米が市場を独占しています。水耕栽培市場は、持続可能な農業慣行に関する関心の高まりとともに、地元で生産された新鮮な果物や野菜に対する顧客ニーズの高まりによって推進されています。水不足への懸念の高まりや従来の農業による環境悪化に対処する必要性が、採用をさらに増加させています。さらに、技術の進歩と効率的で資源を節約する農業の必要性が、水耕栽培市場シェアを大幅に拡大する主な要因となっています。

水耕栽培市場の主要促進要因の1つは、持続可能な農法に対する需要の高まりです。従来の農業が土地の劣化、水不足、気候変動などの課題に直面する中、水耕栽培はより効率的で資源を節約する代替手段を提供しています。水耕栽培システムは、少ない水と土を使用することで、都市部や耕作地の限られた地域での食糧生産を可能にします。このアプローチは資源を節約するだけでなく、地元産の新鮮な農産物に対するニーズの高まりもサポートします。

米国水耕栽培市場は、主に持続可能な農業と地元産農産物への需要の高まりによって大きな成長を遂げています。都市化、限られた耕地、水不足が、特に大都市圏での水耕栽培システムの採用を後押ししています。持続可能な農業に対する米国政府の助成金や補助金による支援は、市場拡大をさらに後押ししています。さらに、新鮮で無農薬の有機農産物に対する消費者の嗜好の高まりが、小売業者に水耕栽培の導入を促しています。自動化やAIを駆使したシステムなど、技術の進歩が効率性を高めており、水耕栽培は国内での大規模な通年農業にとって実行可能なソリューションとなっています。

水耕栽培の市場動向:

食糧不足の深刻化

世界的な食糧不足危機の激化が市場を活性化しています。国連によると、2050年までに世界人口は97億人に達し、食糧需要は70%増加すると予想されています。世界人口の増加に伴い、従来の土壌を利用した農業だけでは食糧需要の増加を満たすことができなくなります。気候変動による異常気象や水不足は、この問題をさらに悪化させています。都市化とそれに伴う耕地の荒廃が、さらに問題を大きくしています。これらのシステムは、非常に効率的で年間を通した作物生産を可能にするため、食糧供給を強化するための有力な選択肢となっています。水耕栽培は、管理された屋内条件で作物を栽培することで、従来の農法に比べ、土を使わずに高い収穫量を得ることができます。さらに、水耕栽培は都市部でも多用途に使用できるため、地域に根ざした食料生産を促進します。これにより、新鮮な農産物を供給するための遠方への依存が減り、二酸化炭素排出量が減少するだけでなく、食料安全保障も向上します。水の使用量を減らし、化学物質への依存を最小限に抑えるという固有の資源効率は、持続可能性の目標や枯渇した天然資源への圧力と完全に一致します。水耕栽培は、現代農業における革新的な力であり、食糧供給の回復力、持続可能性、豊かさを高めることに貢献しています。その結果、水耕栽培の市場成長と採用は、食糧不安が高まる現代において、世界中で急速に増加しています。

耕地面積の減少

耕作可能な土地の減少が市場の成長を後押ししています。世界中で、都市化、土地の劣化、競合する土地利用需要により、伝統的な土壌ベースの農業に適した土地の量が著しく制限されています。FAOによれば、毎年1,200万ヘクタールの土地が劣化しています。これは1分あたり23ヘクタールに相当します。この動向が続く中、限られたスペースを効率的に利用できる革新的な農法を見つけることがますます急務となり、その解決策として水耕栽培が浮上しました。広大な耕地を必要とせず、土がなくても作物を育てることができます。代わりに植物は、栄養豊富な水溶液の中で、垂直に積み重ねられたシステムや制御された室内環境で成長します。この垂直で土壌を必要としないアプローチは、垂直農園や屋上庭園といった都市環境での栽培を可能にし、スペースを最大限に活用します。さらに、耕作不可能な土地や汚染された土地を農業用に再生する手段にもなります。水耕栽培システムでは、肥沃な土壌を必要としないため、工場跡地や汚染が懸念される地域など、ほとんどどこにでも設置することができます。これは、土地資源が乏しく、人口が増え続ける世界において、持続可能で効率的な食糧生産への扉を開くものです。水耕栽培は、増加の一途をたどる耕地への圧力から、食糧安全保障を確実にします。また、重要な自然生息地の保全にも役立ち、現代農業の大幅な成長を支えています。

効率的な屋内外水耕栽培法の開発

効率的な屋内外水耕栽培法の開発は、市場に多くの機会を提供すると期待されています。これらの革新的な栽培技術は水耕栽培の潜在能力を解き放ち、都市部の愛好家から大規模な商業経営まで、多様な栽培者にとって魅力的で実現可能な選択肢となっています。効率的な屋内水耕栽培システムは、作物の栽培方法に革命をもたらしました。水耕栽培システムは、従来の栽培に比べ、水の使用量を最大90%削減することができます。先進的なセットアップでは、LED栽培ライト、自動栄養供給、精密な環境制御などの技術を採用し、植物の成長に最適な条件を作り出しています。これにより、年間を通じた栽培が可能になり、温度、湿度、光強度などの環境パラメーターを特定の作物の要求に合わせて調整することができます。その結果、屋内型水耕栽培は都市型農業の定番となり、新鮮な農産物を地元で持続的に栽培し、フード・マイレージとそれに伴う二酸化炭素排出量を削減することを可能にしています。垂直農法や温室栽培といったこれらの方法は、水耕栽培の活躍の場を広げています。これらのシステムは、悪天候から守りながら土地を最大限に利用します。耕作地が乏しい地域や、課題が多い気候の地域では特に価値があります。屋外の水耕栽培は、従来の農業への負担を軽減しながら、資源利用と作物収量を最適化することで、食糧安全保障への懸念に対応しています。

需要の高まりと資源制約の中で水耕栽培の採用が増加

同市場は、世界的な主要動向の総合によって著しい成長を遂げています。まず、新鮮で無農薬、地元産の農産物を求める顧客の需要が明らかに増加しているため、生産者は制御された環境内で年間を通して栽培できる水耕栽培システムに移行しています。水耕栽培は、土壌を必要とせず、植物の素早い成長と収穫量の増加を可能にし、都市部における持続可能な食料への需要の高まりを解決します。これに加えて、特に乾燥・半乾燥地域で深刻化する水不足が、水耕栽培へのシフトを促しています。2024年9月に発表された最近の研究では、園芸作物の水耕栽培と慣行農法の資源効率が分析されています。この研究によると、水耕栽培システムは土地と水の利用効率で従来の農法を上回り、水の消費量が最大90%少なく、単位面積当たりの作物生産量が増加しています。従来の農業では水が限られた資源となりつつあるため、このような水効率に優れた方法が普及しつつあります。さらに、先進国や新興諸国の政府の中には、食料安全保障を確保するための効果的なソリューションとして水耕栽培を奨励するため、補助金や技術支援、政策的インセンティブを提供しているところもあります。こうしたプログラムは技術革新を促し、投資を促進することで、水耕栽培市場の成長を支えています。

課題と機会:

市場は、その有望な成長にもかかわらず、いくつかの課題に直面しています。特に小規模農家や新興企業にとっては、高い初期投資と運用コストが大きな参入障壁となっています。さらに、養分バランス、照明、環境制御を管理するための技術的専門知識が必要とされることも、普及を妨げる要因となっています。新興諸国における認知度の低さも、市場拡大の妨げとなっています。しかし、こうした課題は、大きな機会によって相殺されています。急速な都市化と耕地の縮小が、土壌を使わない農法への需要を加速させています。加えて、無農薬で地元で栽培された作物に対する消費者の需要が、市場導入を後押ししています。さらに、持続可能な農業と食糧安全保障に向けた政府の取り組みが、市場成長の機会をさらにもたらしています。これとは別に、戦略的パートナーシップ、研究開発(R&D)投資、教育イニシアティブもまた、ギャップを埋め、水耕栽培の世界的なプレゼンスを拡大する可能性を秘めています。

目次

第1章 序文

第2章 調査範囲と調査手法

- 調査の目的

- ステークホルダー

- データソース

- 一次情報

- 二次情報

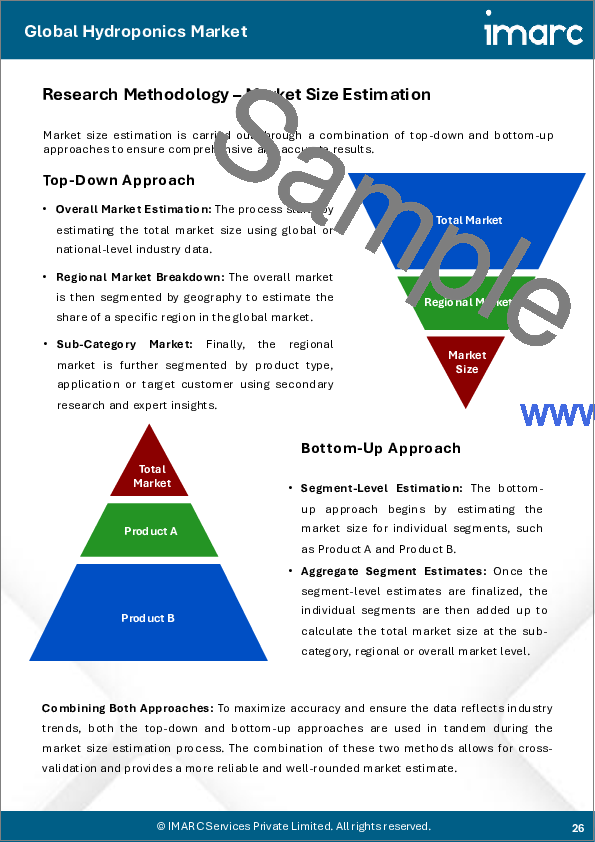

- 市場推定

- ボトムアップアプローチ

- トップダウンアプローチ

- 調査手法

第3章 エグゼクティブサマリー

第4章 イントロダクション

第5章 世界の水耕栽培市場

- 市場概要

- 市場実績

- COVID-19の影響

- 市場予測

第6章 市場内訳:タイプ別

- 集合体水耕栽培システム

- 主要セグメント

- クローズドシステム

- オープンシステム

- 主要セグメント

- 液体水耕栽培システム

第7章 市場内訳:作物タイプ別

- トマト

- レタスと葉物野菜

- ペッパー

- キュウリ

- マイクログリーン

- その他

第8章 市場内訳:装置別

- 空調設備

- LED栽培ライト

- 灌漑システム

- マテリアルハンドリング

- 制御システム

- その他

第9章 市場内訳:地域別

- 北米

- 米国

- カナダ

- アジア太平洋地域

- 中国

- 日本

- インド

- 韓国

- オーストラリア

- インドネシア

- その他

- 欧州

- ドイツ

- フランス

- 英国

- イタリア

- スペイン

- ロシア

- その他

- ラテンアメリカ

- ブラジル

- メキシコ

- その他

- 中東・アフリカ

第10章 SWOT分析

第11章 バリューチェーン分析

第12章 ポーターのファイブフォース分析

第13章 価格分析

第14章 競合情勢

- 市場構造

- 主要企業

- 主要企業のプロファイル

- AeroFarms

- Argus Control Systems Limited(Controlled Environments Limited)

- BrightFarms

- General Hydroponics Inc.

- GreenTech Agro LLC

- GrowLife Inc.

- Hydrodynamics International

- Hydrofarm LLC

- Logiqs B.V.

- LumiGrow Inc.

- Thanet Earth Limited

- Village Farms International Inc.