|

|

市場調査レポート

商品コード

1642765

豆類市場レポート:タイプ別、最終用途別、地域別、2025年~2033年Pulses Market Report by Type (Chick Peas, Kaspa Peas, Lentils, Pigeon Peas, Fava Beans, Black Gram, Mung Beans, and Others), End Use (Home Use, Snack Food Industry, Flour Industry), and Region 2025-2033 |

||||||

カスタマイズ可能

|

|||||||

| 豆類市場レポート:タイプ別、最終用途別、地域別、2025年~2033年 |

|

出版日: 2025年01月18日

発行: IMARC

ページ情報: 英文 136 Pages

納期: 2~3営業日

|

全表示

- 概要

- 図表

- 目次

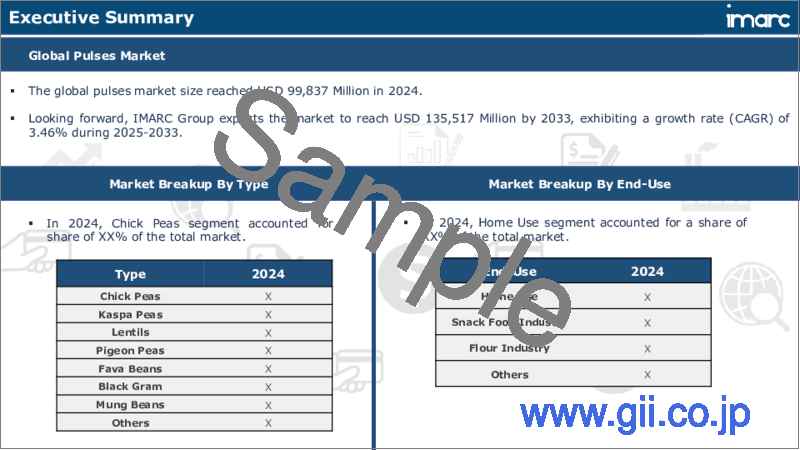

豆類の世界市場規模は2024年に998億米ドルに達しました。今後、IMARC Groupは、市場は2033年までに1,355億米ドルに達し、2025年から2033年にかけて3.46%の成長率(CAGR)を示すと予測しています。豆類の健康と栄養面での利点に対する意識の高まり、世界の人口増加、サプライチェーンの改善、農業活動の進歩、食生活の変化、豆類の料理の多様性などが、市場を推進している主な要因です。

レンズ豆、ひよこ豆、乾燥エンドウ豆を含む豆類は、マメ科植物の食用種子です。植物性タンパク質、食物繊維、鉄、亜鉛、ビタミンB群などの必須栄養素の重要な供給源です。低脂肪でコレステロールを含まない豆類は、心臓の健康にもよく、血糖値の調整にも役立ちます。食物繊維が豊富なので満腹感が得られ、体重管理にも役立ちます。さらに、豆類は他のタンパク源に比べて水や肥料が少なくて済み、環境的に持続可能です。また、豆類は土壌中の窒素を固定することができるため、土壌の健康状態を改善することができます。

健康上の利点と栄養価に関する意識の高まりは、バイオ強化や精密農業のような進歩と相乗して、豆類市場を前進させています。さらに、植物性タンパク質に対する需要の高まりと、持続可能で栄養豊富な食料源の不足は、世界の食生活における高品質の豆類の必要性を強調しています。これに伴い、これらの豆類は食生活の多様性を高め、必須栄養素の要求を満たすのに役立っており、健全な植物性選択肢に対する消費者の期待の高まりと一致しています。さらに、eコマース・プラットフォームの拡大と食品廃棄物削減への取り組みが、市場の成長に寄与しています。食生活パターンの変化、便利ですぐに調理できるオプションへの傾斜、有機・非遺伝子組み換え製品への注目といったその他の要因も、世界中で豆類の成長を後押ししています。

豆類市場動向/促進要因:

健康意識の高まり

健康とウェルネスに対する意識の高まりは、国内における豆類市場の成長を後押しする重要な要因です。タンパク質、食物繊維、必須栄養素を豊富に含む豆類は、食生活の改善を目指す消費者にとって最適な選択肢となりつつあります。生活習慣病の罹患率が上昇を続ける中、健康目標を達成するための栄養価が高く手ごろな手段として、豆類に注目が集まっています。このような健康志向の高まりにより、豆類はヘルスケア負担の軽減と市民の生活の質の向上を目指す国家戦略にとって不可欠な要素となっています。

政府の支援とプログラム

持続可能な農業と健康的な食生活を奨励することを目的とした政府の取り組みが、豆類市場の拡大に寄与しています。農家に豆類栽培の奨励金を提供するプログラムや、豆類の栄養的利点に関する一般向けの啓蒙キャンペーンが、豆類作物の普及につながっています。このような政府の取り組みは、農業セクターを近代化するだけでなく、食料安全保障と持続可能な農業を促進することを目的とした国際的な取り組みとも一致しています。

急速な社会経済の変化

同国の急速な経済成長と都市開発により、豆類を原料とする製品に新たな機会が生まれています。都市部の拡大とライフスタイルの変化に伴い、便利で健康的な食品に対する需要が高まっています。豆類は、調理済み食品から栄養強化食品まで、さまざまな食品に利用され、伝統的な消費者の嗜好にも新興の消費者の嗜好にも対応しています。豆類は万能であるため、多様な料理用途に適しており、国の開発目標に合致しています。さらに、豆類は、コミュニティ・ガーデンから大規模農業まで、都市計画における持続可能な選択肢とみなされており、人口増加を支えることのできる強靭で持続可能な都市を建設するという目標に合致しています。

目次

第1章 序文

第2章 調査範囲と調査手法

- 調査の目的

- ステークホルダー

- データソース

- 一次情報

- 二次情報

- 市場推定

- ボトムアップアプローチ

- トップダウンアプローチ

- 調査手法

第3章 エグゼクティブサマリー

第4章 イントロダクション

- 概要

- 主要業界動向

第5章 世界の豆類市場

- 市場概要

- 市場実績

- 数量動向

- 金額動向

- COVID-19の影響

- 価格分析

- 主要価格指標

- 価格構造

- 価格動向

- 市場内訳:地域別

- 市場内訳:タイプ別

- 市場内訳:最終用途別

- 市場予測

- 貿易データ

- 輸入:主要国別

- 輸出:主要国別

- SWOT分析

- 概要

- 強み

- 弱み

- 機会

- 脅威

- バリューチェーン分析

- 入力サプライヤー

- 農民

- コレクター

- プロセッサ

- 販売代理店

- 輸出業者

- 小売業者

- エンドユーザー

- ポーターのファイブフォース分析

- 概要

- 買い手の交渉力

- 供給企業の交渉力

- 競合の程度

- 新規参入業者の脅威

- 代替品の脅威

- 市場促進要因と成功要因

第6章 主要地域の実績

- インド

- 市場動向

- 市場予測

- カナダ

- 市場動向

- 市場予測

- ミャンマー

- 市場動向

- 市場予測

- 中国

- 市場動向

- 市場予測

- ブラジル

- 市場動向

- 市場予測

- その他

- 市場動向

- 市場予測

第7章 タイプ別市場

- ひよこ豆

- 市場動向

- 市場予測

- カスパピーズ

- 市場動向

- 市場予測

- レンズ豆

- 市場動向

- 市場予測

- ピジョンピーズ

- 市場動向

- 市場予測

- ソラマメ

- 市場動向

- 市場予測

- ブラックグラム

- 市場動向

- 市場予測

- 緑豆

- 市場動向

- 市場予測

- その他

- 市場動向

- 市場予測

第8章 最終用途別市場

- 家庭

- 市場動向

- 市場予測

- スナック食品業界

- 市場動向

- 市場予測

- 粉産業

- 市場動向

- 市場予測

- その他

- 市場動向

- 市場予測

第9章 競争構造

- 市場構造

- 主要企業

第10章 パルス処理

- 製品概要

- 詳細なプロセスフロー

- 様々な種類の単位操作

- マスバランスと原材料要件

- レンズ豆

- ひよこ豆

- 緑豆

- ブラックグラム

- ピジョンピーズ

- ソラマメ

- カスパピーズ

第11章 プロジェクトの詳細・必要条件・費用

- 土地要件と費用

- 建設要件と費用

- 工場の機械

- 機械写真

- 原材料の要件と支出

- 原材料と最終製品の写真

- 包装の要件と支出

- 輸送の要件と支出

- ユーティリティの要件と支出

- 人員要件と支出

- その他の設備投資

第12章 融資と資金援助

第13章 プロジェクトの経済性

- プロジェクトの資本コスト

- 技術経済的パラメーター

- サプライチェーンの各段階における製品価格とマージン

- 課税と減価償却

- 収入予測

- 支出予測

- 財務分析

- 利益分析

List of Figures

- Figure 1: Global: Pulses Market: Major Drivers and Challenges

- Figure 2: Global: Pulses Market: Volume Trends (in Million Tons), 2019-2024

- Figure 3: Global: Pulses Market: Value Trends (in Billion USD), 2019-2024

- Figure 4: Global: Pulses Market: Average Prices (in USD/Ton), 2019-2024

- Figure 5: Pulses Market: Price Structure

- Figure 6: Global: Pulses Market: Breakup by Region (in %), 2024

- Figure 7: Global: Pulses Market: Breakup by Type (in %), 2024

- Figure 8: Global: Pulses Market: Breakup by End-Use (in %), 2024

- Figure 9: Global: Pulses Market Forecast: Volume Trends (in Million Tons), 2025-2033

- Figure 10: Global: Pulses Market Forecast: Value Trends (in Billion USD), 2025-2033

- Figure 11: Global: Pulses Market: Export Volume Trends (in Tons)

- Figure 12: Global: Pulses Market: Breakup by Export Volume (in %)

- Figure 13: Global: Pulses Market: Import Volume Trends (in Tons)

- Figure 14: Global: Pulses Market: Breakup by Import Volume (in %)

- Figure 15: Global: Pulses Industry: SWOT Analysis

- Figure 16: Global: Pulses Industry: Value Chain Analysis

- Figure 17: Global: Pulses Industry: Porter's Five Forces Analysis

- Figure 18: India: Pulses Market (in Million Tons), 2019 & 2024

- Figure 19: India: Pulses Market Forecast (in Million Tons), 2025-2033

- Figure 20: Canada: Pulses Market (in Million Tons), 2019 & 2024

- Figure 21: Canada: Pulses Market Forecast (in Million Tons), 2025-2033

- Figure 22: Myanmar: Pulses Market (in Million Tons), 2019 & 2024

- Figure 23: Myanmar: Pulses Market Forecast (in Million Tons), 2025-2033

- Figure 24: China: Pulses Market (in Million Tons), 2019 & 2024

- Figure 25: China: Pulses Market Forecast (in Million Tons), 2025-2033

- Figure 26: Brazil: Pulses Market (in Million Tons), 2019 & 2024

- Figure 27: Brazil: Pulses Market Forecast (in Million Tons), 2025-2033

- Figure 28: Others: Pulses Market (in Million Tons), 2019 & 2024

- Figure 29: Others: Pulses Market Forecast (in Million Tons), 2025-2033

- Figure 30: Global: Pulses Market: Chick Peas (in Million Tons), 2019 & 2024

- Figure 31: Global: Pulses Market Forecast: Chick Peas (in Million Tons), 2025-2033

- Figure 32: Global: Pulses Market: Kaspa Peas (in Million Tons), 2019 & 2024

- Figure 33: Global: Pulses Market Forecast: Kaspa Peas (in Million Tons), 2025-2033

- Figure 34: Global: Pulses Market: Lentils (in Million Tons), 2019 & 2024

- Figure 35: Global: Pulses Market Forecast: Lentils (in Million Tons), 2025-2033

- Figure 36: Global: Pulses Market: Pigeon Peas (in Million Tons), 2019 & 2024

- Figure 37: Global: Pulses Market Forecast: Pigeon Peas (in Million Tons), 2025-2033

- Figure 38: Global: Pulses Market: Fava Beans (in Million Tons), 2019 & 2024

- Figure 39: Global: Pulses Market Forecast: Fava Beans (in Million Tons), 2025-2033

- Figure 40: Global: Pulses Market: Black Gram (in Million Tons), 2019 & 2024

- Figure 41: Global: Pulses Market Forecast: Black Gram (in Million Tons), 2025-2033

- Figure 42: Global: Pulses Market: Mung Beans (in Million Tons), 2019 & 2024

- Figure 43: Global: Pulses Market Forecast: Mung Beans (in Million Tons), 2025-2033

- Figure 44: Global: Pulses Market: Other Types (in Million Tons), 2019 & 2024

- Figure 45: Global: Pulses Market Forecast: Other Types (in Million Tons), 2025-2033

- Figure 46: Global: Pulses Market (Home Use): Volume Trends (in Million Tons), 2019 & 2024

- Figure 47: Global: Pulses Market Forecast (Home Use): Volume Trends (in Million Tons), 2025-2033

- Figure 48: Global: Pulses Market (End-Use in Snack Food Industry): Volume Trends (in Million Tons), 2019 & 2024

- Figure 49: Global: Pulses Market Forecast (End-Use in Snack Food Industry): Volume Trends (in Million Tons), 2025-2033

- Figure 50: Global: Pulses Market (End-Use in Flour Industry): Volume Trends (in Million Tons), 2019 & 2024

- Figure 51: Global: Pulses Market Forecast (End-Use in Flour Industry): Volume Trends (in Million Tons), 2025-2033

- Figure 52: Global: Pulses Market (Other End-Uses): Volume Trends (in Million Tons), 2019 & 2024

- Figure 53: Global: Pulses Market Forecast (Other End-Uses): Volume Trends (in Million Tons), 2025-2033

- Figure 54: Pulses Processing Plant: Detailed Process Flow

- Figure 55: Lentils Processing Plant: Conversion Rate of Feedstocks

- Figure 56: Chick Peas Processing Plant: Conversion Rate of Feedstocks

- Figure 57: Mung Beans Processing Plant: Conversion Rate of Feedstocks

- Figure 58: Black Gram Processing Plant: Conversion Rate of Feedstocks

- Figure 59: Pigeon Peas Processing Plant: Conversion Rate of Feedstocks

- Figure 60: Fava Beans Processing Plant: Conversion Rate of Feedstocks

- Figure 61: Kaspa Peas Processing Plant: Conversion Rate of Feedstocks

- Figure 62: Pulses Processing Plant: Breakup of Capital Costs (in %)

- Figure 63: Pulses Industry: Profit Margins at Various Levels of the Supply Chain

- Figure 64: Pulses Processing Plant: Manufacturing Cost Breakup (in %)

List of Tables

- Table 1: Global: Pulses Market: Key Industry Highlights, 2024 and 2033

- Table 2: Global: Pulses Market Forecast: Breakup by Region (in Million Tons), 2025-2033

- Table 3: Global: Pulses Market Forecast: Breakup by Type (in Million Tons), 2025-2033

- Table 4: Global: Pulses Market Forecast: Breakup by End-Use (in Million Tons), 2025-2033

- Table 5: Global: Pulses Market: Export Data of Major Countries

- Table 6: Global: Pulses Market: Import Data of Major Countries

- Table 7: Global: Pulses Market: Competitive Structure

- Table 8: Global: Pulses Market: Major Players

- Table 9: Pulses Processing Plant: Costs Related to Land and Site Development (in USD)

- Table 10: Pulses Processing Plant: Costs Related to Civil Works (in USD)

- Table 11: Pulses Processing Plant: Costs Related to Machinery (in USD)

- Table 12: Pulses Processing Plant: Raw Material Requirements (in Tons/Day) and Expenditures (in USD/Ton)

- Table 13: Pulses Processing Plant: Costs Related to Salaries and Wages (in USD)

- Table 14: Pulses Processing Plant: Costs Related to Other Capital Investments (in USD)

- Table 15: Details of Financial Assistance Offered by Financial Institutions

- Table 16: Pulses Processing Plant: Capital Costs (in USD)

- Table 17: Pulses Processing Plant: Techno-Economic Parameters

- Table 18: Pulses Processing Plant: Taxation and Depreciation

- Table 19: Pulses Processing Plant: Income Projections (in USD)

- Table 20: Pulses Processing Plant: Expenditure Projections (in USD)

- Table 21: Pulses Processing Plant: Cash Flow Analysis Without Considering the Income Tax Liability (in USD)

- Table 22: Pulses Processing Plant: Cash Flow Analysis on Considering the Income Tax Liability (in USD)

- Table 23: Pulses Processing Plant: Profit and Loss Account (in USD)

The global pulses market size reached USD 99.8 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 135.5 Billion by 2033, exhibiting a growth rate (CAGR) of 3.46% during 2025-2033. The increasing awareness of the health and nutritional benefits of pulses, global population growth, supply chain improvements, advancements in agricultural activities, dietary shifts and the culinary versatility of pulses are some of the major factors propelling the market.

Pulses, including lentils, chickpeas, and dry peas, are the edible seeds of legume plants. They are a significant source of plant-based protein, fiber, and essential nutrients like iron, zinc, and B-vitamins. Characterized by their low-fat content and lack of cholesterol, pulses are beneficial for heart health and can aid in regulating blood sugar levels. Their high fiber content contributes to a feeling of fullness, which can be advantageous in weight management. Additionally, pulses are environmentally sustainable, requiring less water and fertilizer compared to other protein sources. They are also capable of fixing nitrogen in the soil, thereby improving soil health.

The increasing awareness about health benefits and nutritional value is synergizing with advancements like bio-fortification and precision agriculture to propel the pulses market forward. Moreover, the growing demand for plant-based proteins and the scarcity of sustainable, nutrient-rich food sources have emphasized the need for quality pulses in the global diet. In line with this, these pulses are instrumental in enhancing dietary diversity and fulfilling essential nutrient requirements, aligning with rising consumer expectations for wholesome plant-based options. Furthermore, the expansion of e-commerce platforms and initiatives to reduce food waste are contributing to market growth. Other factors such as changing dietary patterns, the inclination towards convenient, ready-to-cook options, and an acute focus on organic and non-GMO products are bolstering the growth of the pulses across the globe.

Pulses Market Trends/Drivers:

Increasing Health Consciousness

The growing awareness of health and wellness is a key factor propelling the market growth for pulses in the country. Rich in protein, fiber, and essential nutrients, pulses are becoming the go-to choice for consumers seeking to improve their dietary habits. As rates of lifestyle diseases continue to rise, individuals are turning to pulses as a nutritious and affordable means to achieve their health goals. This growing focus on wellness makes pulses an essential element of national strategies aimed at reducing healthcare burdens and enhancing citizens' quality of life.

Governmental Support and Programs

Government initiatives aimed at encouraging sustainable agriculture and healthy eating are contributing to the pulse market's expansion. Programs that offer farmers incentives for pulse cultivation, alongside public awareness campaigns on the nutritional benefits of pulses, are leading to increased adoption of these crops. Such governmental actions not only modernize the agricultural sector but also align with international efforts aimed at promoting food security and sustainable farming practices.

Rapid Socioeconomic Changes

The country's swift economic growth and urban development are creating new opportunities for pulse-based products. As urban areas expand and lifestyles change, there is increasing demand for convenient and healthy food options. Pulses are finding their way into a range of food products, from ready-to-eat meals to fortified foods, serving both traditional and emerging consumer preferences. Their versatile nature makes them apt for diverse culinary applications, thereby matching the nation's development objectives. In addition, pulses are seen as a sustainable choice in urban planning, from community gardens to large-scale farming, aligning with the goal of building resilient and sustainable cities capable of supporting a growing population.

Pulses Industry Segmentation:

Breakup by Type:

Chick Peas

Kaspa Peas

Lentils

Pigeon Peas

Fava Beans

Black Gram

Mung Beans

Others

Kaspa peas dominate the market

Kaspa peas, also known as Kaspa beans or Lablab beans, are indeed a type of pulses that holds significance in the market. Pulses are a subgroup of legumes, and Kaspa peas are no exception. They are popular in various cuisines and are valued for their nutritional content, which includes protein, fiber, vitamins, and minerals. These yellow peas are commonly used for their creamy texture in a range of dishes, from classic pea soup to innovative plant-based protein products. They are also gaining popularity in specialized applications like gluten-free baking, where their flour form serves as an excellent alternative to traditional wheat flour. Kaspa peas offer a rich source of nutrients for specific dietary needs, such as in high-protein, low-fat meals and snacks. Innovative food tech solutions, including the development of pea-based protein powders and meat alternatives, are allowing consumers to incorporate Kaspa peas into their diets more conveniently. These trends not only provide diverse and nutritious options for consumption but also align with broader goals of sustainable and healthy living. These multiple roles solidify Kaspa peas as an essential component in modern culinary practices, reflecting market research companies' insights into evolving food trends and applications.

Breakup by End Use:

Home use

Snack Food Industry

Flour Industry

Home use holds the largest share in the market

Home use as an end-use segment for the pulses market is a significant and vital component of the overall pulse consumption landscape. Pulses, which include various legumes like lentils, chickpeas, and beans, have been a staple in diets across the globe for centuries. Home consumption of pulses serves as a fundamental source of nutrition and sustenance for countless households. Pulses are renowned for their high protein content, making them an essential dietary component, especially for vegetarians and vegans. They are also rich in fiber, vitamins, and minerals, contributing to a balanced and nutritious diet. Many cultures have deep-rooted traditions of incorporating pulses into their culinary heritage. This tradition has been passed down through generations, highlighting the cultural significance of pulses in home cooking.

Breakup by Country:

India

Canada

Myanmar

China

Brazil

Others

India holds the largest share in the market

The increasing emphasis on nutritious and plant-based diets in India is acting as a significant driver for the pulses market. Concurrently, advancements in agricultural techniques are leading to higher yield varieties of pulses, thereby boosting their market availability. Additionally, the expanding middle class in the country is showing a growing preference for diverse, protein-rich foods like pulses. Online grocery platforms are also playing a role, making a wide variety of pulses more accessible to the general populace, thus positively impacting market dynamics. The rising focus on sustainable farming practices is drawing attention to pulses as they are known to enrich soil with essential nutrients, aligning with the government's sustainability objectives and enhancing the market landscape. Events such as food and agriculture expos, as well as online webinars on nutrition and sustainability, are cumulatively contributing to a vibrant growth outlook for the pulses market in India.

Competitive Landscape:

In the global pulses market, leading firms are actively employing a range of strategies to assert their market dominance and address the changing needs of consumers. These companies are heavily investing in research and development to cultivate new pulse varieties that offer enhanced nutritional profiles, shorter growing cycles, and better resistance to diseases. Collaborations with local farmers and agricultural bodies are being forged to guarantee a wide-reaching supply chain that spans multiple geographies. Additionally, comprehensive marketing efforts are underway to enlighten both consumers and industries about the health advantages and sustainability of incorporating pulses into diets and products. Some of these market leaders are even committing resources to establish or upgrade processing facilities, thus boosting local economies and providing employment opportunities. Partnerships with governmental agencies and endorsements from health organizations are solidifying their stand on adhering to quality standards and sustainable farming practices. These key players are also embracing technological advancements like blockchain for transparent sourcing and artificial intelligence for predictive yield analysis. Through a judicious mix of innovation, consumer education, strategic alliances, and sustainability initiatives, these firms are fortifying their standing in the global pulses market.

The report has provided a comprehensive analysis of the competitive landscape in the market. Detailed profiles of all major companies have also been provided. Some of the key players in the market include:

Adani Wilmar Limited.

Globeways Canada, Inc.

BroadGrain Commodities Inc.

NHC Adani Foods Limited

AGT Food and Ingredients

Louis Dreyfus

Goya Food Inc.

Key Questions Answered in This Report

- 1. What was the size of the global pulses market in 2024?

- 2. What is the expected growth rate of the global pulses market during 2025-2033?

- 3. What are the key factors driving the global pulses market?

- 4. What has been the impact of COVID-19 on the global pulses market?

- 5. What is the breakup of the global pulses market based on the type?

- 6. What is the breakup of the global pulses market based on the end-use?

- 7. What are the key regions in the global pulses market?

Table of Contents

1 Preface

2 Scope and Methodology

- 2.1 Objectives of the Study

- 2.2 Stakeholders

- 2.3 Data Sources

- 2.3.1 Primary Sources

- 2.3.2 Secondary Sources

- 2.4 Market Estimation

- 2.4.1 Bottom-Up Approach

- 2.4.2 Top-Down Approach

- 2.5 Forecasting Methodology

3 Executive Summary

4 Introduction

- 4.1 Overview

- 4.2 Key Industry Trends

5 Global Pulses Market

- 5.1 Market Overview

- 5.2 Market Performance

- 5.2.1 Volume Trends

- 5.2.2 Value Trends

- 5.3 Impact of COVID-19

- 5.4 Price Analysis

- 5.4.1 Key Price Indicators

- 5.4.2 Price Structure

- 5.4.3 Price Trends

- 5.5 Market Breakup by Region

- 5.6 Market Breakup by Type

- 5.7 Market Breakup by End-Use

- 5.8 Market Forecast

- 5.9 Trade Data

- 5.9.1 Imports by Major Countries

- 5.9.2 Exports by Major Countries

- 5.10 SWOT Analysis

- 5.10.1 Overview

- 5.10.2 Strengths

- 5.10.3 Weaknesses

- 5.10.4 Opportunities

- 5.10.5 Threats

- 5.11 Value Chain Analysis

- 5.11.1 Input Suppliers

- 5.11.2 Farmers

- 5.11.3 Collectors

- 5.11.4 Processors

- 5.11.5 Distributors

- 5.11.6 Exporters

- 5.11.7 Retailers

- 5.11.8 End-Users

- 5.12 Porter's Five Forces Analysis

- 5.12.1 Overview

- 5.12.2 Bargaining Power of Buyers

- 5.12.3 Bargaining Power of Suppliers

- 5.12.4 Degree of Competition

- 5.12.5 Threat of New Entrants

- 5.12.6 Threat of Substitutes

- 5.13 Key Market Drivers and Success Factors

6 Performance of Key Regions

- 6.1 India

- 6.1.1 Market Trends

- 6.1.2 Market Forecast

- 6.2 Canada

- 6.2.1 Market Trends

- 6.2.2 Market Forecast

- 6.3 Myanmar

- 6.3.1 Market Trends

- 6.3.2 Market Forecast

- 6.4 China

- 6.4.1 Market Trends

- 6.4.2 Market Forecast

- 6.5 Brazil

- 6.5.1 Market Trends

- 6.5.2 Market Forecast

- 6.6 Others

- 6.6.1 Market Trends

- 6.6.2 Market Forecast

7 Market by Type

- 7.1 Chick Peas

- 7.1.1 Market Trends

- 7.1.2 Market Forecast

- 7.2 Kaspa Peas

- 7.2.1 Market Trends

- 7.2.2 Market Forecast

- 7.3 Lentils

- 7.3.1 Market Trends

- 7.3.2 Market Forecast

- 7.4 Pigeon Peas

- 7.4.1 Market Trends

- 7.4.2 Market Forecast

- 7.5 Fava Beans

- 7.5.1 Market Trends

- 7.5.2 Market Forecast

- 7.6 Black Gram

- 7.6.1 Market Trends

- 7.6.2 Market Forecast

- 7.7 Mung Beans

- 7.7.1 Market Trends

- 7.7.2 Market Forecast

- 7.8 Others

- 7.8.1 Market Trends

- 7.8.2 Market Forecast

8 Market by End-Use

- 8.1 Home Use

- 8.1.1 Market Trends

- 8.1.2 Market Forecast

- 8.2 Snack Food Industry

- 8.2.1 Market Trends

- 8.2.2 Market Forecast

- 8.3 Flour Industry

- 8.3.1 Market Trends

- 8.3.2 Market Forecast

- 8.4 Others

- 8.4.1 Market Trends

- 8.4.2 Market Forecast

9 Competitive Structure

- 9.1 Market Structure

- 9.2 Key Players

10 Pulses Processing

- 10.1 Product Overview

- 10.2 Detailed Process Flow

- 10.3 Various Types of Unit Operations Involved

- 10.4 Mass Balance and Raw Material Requirements

- 10.4.1 Lentils

- 10.4.2 Chick Peas

- 10.4.3 Mung Beans

- 10.4.4 Black Gram

- 10.4.5 Pigeon Peas

- 10.4.6 Fava Beans

- 10.4.7 Kaspa Peas

11 Project Details, Requirements and Costs Involved

- 11.1 Land Requirements and Expenditures

- 11.2 Construction Requirements and Expenditures

- 11.3 Plant Machinery

- 11.4 Machinery Pictures

- 11.5 Raw Material Requirements and Expenditures

- 11.6 Raw Material and Final Product Pictures

- 11.7 Packaging Requirements and Expenditures

- 11.8 Transportation Requirements and Expenditures

- 11.9 Utility Requirements and Expenditures

- 11.10 Manpower Requirements and Expenditures

- 11.11 Other Capital Investments

12 Loans and Financial Assistance

13 Project Economics

- 13.1 Capital Cost of the Project

- 13.2 Techno-Economic Parameters

- 13.3 Product Pricing and Margins Across Various Levels of the Supply Chain

- 13.4 Taxation and Depreciation

- 13.5 Income Projections

- 13.6 Expenditure Projections

- 13.7 Financial Analysis

- 13.8 Profit Analysis