|

|

市場調査レポート

商品コード

1642555

お茶の市場レポート:製品タイプ、パッケージ、流通チャネル、用途、地域別、2025-2033年Tea Market Report by Product Type, Packaging, Distribution Channel, Application, and Region 2025-2033 |

||||||

カスタマイズ可能

|

|||||||

| お茶の市場レポート:製品タイプ、パッケージ、流通チャネル、用途、地域別、2025-2033年 |

|

出版日: 2025年01月18日

発行: IMARC

ページ情報: 英文 132 Pages

納期: 2~3営業日

|

全表示

- 概要

- 図表

- 目次

世界のお茶の市場の市場規模は2024年に256億米ドルに達しました。今後、市場は2033年までに381億米ドルに達し、2025年から2033年にかけて4.5%の成長率(CAGR)を示すと予測されます。市場は主に、健康志向の高まり、オーガニック茶や高級茶の需要の急増、新興国での消費の増加、フレーバーやパッケージにおける数々のイノベーションによって牽引されています。

お茶の市場分析:

市場の成長と世界のお茶の市場は、健康意識の高まりと自然飲料への嗜好性により、堅調な成長を続けています。さらに、より健康的な飲料へのシフトを反映し、ハーブティーや機能性茶を含む多様な茶の需要が急増し、市場規模は拡大しています。

主な市場促進要因:主な市場促進要因としては、お茶ベースのカクテルに対する需要の高まりとお茶のミクソロジーの革新、免疫力向上としてのお茶を推進するマーケティング戦略、お茶の定期購入サービスやオンラインティーコミュニティの人気の高まり、お茶カフェやお茶専門店の拡大などが挙げられます。

技術の進歩:お茶の生産、品質管理、マーケティングを強化する上で、技術は極めて重要な役割を果たしています。お茶の加工とパッケージ方法の革新は、消費者にとって製品の保存期間と利便性の向上につながりました。

産業への応用:茶葉産業は伝統的な淹れ方にとどまらず、化粧品、医薬品、料理などにも応用され、様々なレシピの材料として使用されています。また、伝統的な飲用にとどまらず、フレーバー・インフュージョンのための飲食品、スキンケアやリラクゼーション効果のための美容・健康分野など、多様な用途が見出されています。

主な市場動向:テロワールや地域の茶葉の特徴への注目の高まり、ティーツーリズムや体験型ティーテイスティングの台頭、特定の健康効果をターゲットにした健康志向のブレンド茶の開発、生分解性ティーバッグや環境に優しいパッケージの採用、コレクターズアイテムとしての希少茶や熟成茶の台頭、都心部でのプレミアムティーラウンジの拡大などが主な市場動向です。

地理的動向:中国はその大規模な茶栽培と輸出活動により、引き続き世界のお茶の市場をリードしています。さらに、その他の地域でも特産品や高級茶の人気が上昇しており、市場全体の拡大に寄与しています。

競合情勢:お茶の市場は競争が激しく、既存ブランドと新規参入企業が市場シェアを争っています。各社は、革新的な製品、ブランディング、持続可能な実践を通じて差別化を図っています。

課題と機会:課題には、気候変動による茶栽培への影響、価格の変動、持続可能性への懸念などがあります。機会は、健康志向の消費者への対応、新興市場への進出、ユニークなお茶製品や体験の革新にあります。

お茶の市場の傾向:

お茶の健康効果に対する消費者の意識の高まり

お茶の健康効果に対する消費者の意識は、世界のお茶の市場の極めて重要な原動力となっています。健康志向の高まりに伴い、消費者はその自然で健康増進に役立つ特性から、ますますお茶に惹かれるようになっています。緑茶やハーブティーに含まれる豊富な抗酸化物質は、飲料に健康効果を求める人々にとって魅力的な選択肢となっています。こうした意識が高まるにつれ、健康志向の選択肢としての茶の需要はさらに拡大すると予想されます。これに伴い、市場プレーヤーはマーケティング・キャンペーンや製品ポートフォリオでこれらの利点を強調することで、この動向を積極的に利用し、世界のお茶の市場全体の成長に貢献しています。

ライフスタイルの変化と利便性

世界のお茶の市場は、進化する消費者のライフスタイルと利便性への嗜好によって大きく形成されています。これに伴い、消費者は手間のかからない迅速な飲料ソリューションを求めるようになっており、多忙なスケジュールに合わせてすぐに飲める(RTD)茶製品の需要が急増しています。移動中にペットボトルや缶入りのお茶を飲める便利さは、現代のライフスタイルにマッチしています。さらに、お茶メーカー各社は、手軽で入手しやすく、便利なお茶の選択肢を求めるこうした需要に応えるため、RTD茶のラインナップを多様化しており、これが世界のお茶の市場の成長を後押ししています。

持続可能性と倫理的調達

世界のお茶の市場では、持続可能性への懸念と倫理的な調達慣行が注目を集めています。消費者は、お茶の味や品質だけでなく、環境や倫理への影響についても関心を高めています。その結果、環境に害を与えず、労働力を搾取することなく、持続可能な方法で栽培されたお茶を好む傾向が強まっています。消費者は自らの価値観に合致した製品にプレミアムを支払うことを厭わないため、持続可能性と倫理的調達へのコミットメントを示すことができる企業は、市場で競争優位に立つことが多いです。

プレミアム化とスペシャルティ茶

プレミアム化の動向は世界のお茶の市場を変えつつあります。消費者の目が肥えてきており、より高品質でスペシャルティなお茶を探求し、投資することを厭わなくなってきています。このシフトは、店頭によく並ぶ従来のティーバッグを超えた、ユニークでワンランク上のティー体験を求める需要に後押しされています。これに伴い、茶葉会社はプレミアムなお茶を提供することに力を注いでおり、多くの場合、魅力的なストーリーテリングやブランディングを伴うことで、お茶を飲む体験全体を高めています。

目次

第1章 序文

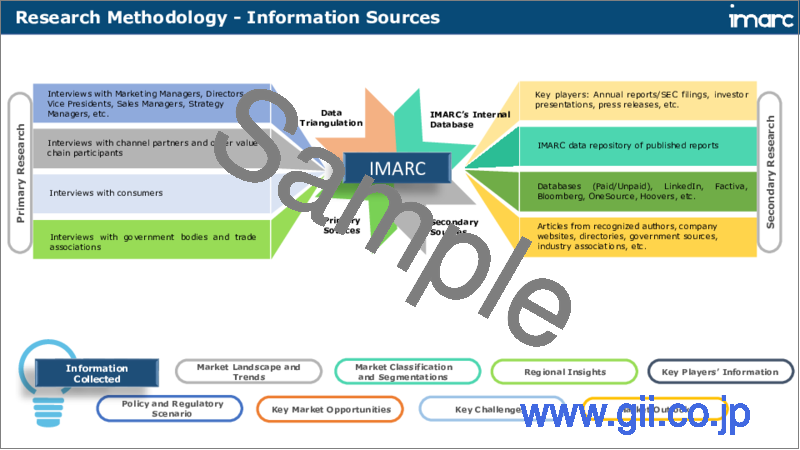

第2章 調査範囲と調査手法

- 調査の目的

- ステークホルダー

- データソース

- 一次情報

- 二次情報

- 市場推定

- ボトムアップアプローチ

- トップダウンアプローチ

- 調査手法

第3章 エグゼクティブサマリー

第4章 イントロダクション

- 概要

- 主要業界動向

第5章 世界のお茶産業

- 市場概要

- 市場実績

- 生産量動向

- 消費量の動向

- 消費価値の動向

- 価格分析

- 主要価格指標

- 価格構造

- 価格動向

- COVID-19の影響

- 市場内訳:製品タイプ別

- 市場内訳:パッケージ別

- 市場内訳:流通チャネル別

- 市場内訳:用途別

- 市場内訳:地域別

- 市場予測

- SWOT分析

- 概要

- 強み

- 弱み

- 機会

- 脅威

- バリューチェーン分析

- 原材料調達

- メーカー

- マーケティングと流通

- 小売業者

- 輸出業者

- エンドユーザー

- ポーターのファイブフォース分析

- 概要

- バイヤーの交渉力

- サプライヤーの交渉力

- 競合の程度

- 新規参入業者の脅威

- 代替品の脅威

- 茶葉製造業者にとっての成功要因とリスク要因

第6章 市場内訳:製品タイプ別

- 緑茶

- 市場動向

- 市場予測

- 紅茶

- 市場動向

- 市場予測

- ウーロン茶

- 市場動向

- 市場予測

- その他

- 市場動向

- 市場予測

第7章 市場内訳:パッケージ別

- プラスチック容器

- 市場動向

- 市場予測

- 茶葉

- 市場動向

- 市場予測

- ペーパーボード

- 市場動向

- 市場予測

- アルミニウム缶

- 市場動向

- 市場予測

- ティーバッグ

- 市場動向

- 市場予測

- その他

- 市場動向

- 市場予測

第8章 市場内訳:流通チャネル別

- スーパーマーケット/ハイパーマーケット

- 市場動向

- 市場予測

- 専門店

- 市場動向

- 市場予測

- コンビニエンスストア

- 市場動向

- 市場予測

- オンライン

- 市場動向

- 市場予測

- その他

- 市場動向

- 市場予測

第9章 市場内訳:用途別

- 家庭用

- 市場動向

- 市場予測

- 商業用

- 市場動向

- 市場予測

第10章 市場内訳:地域別

- 中国

- 市場動向

- 市場予測

- インド

- 市場動向

- 市場予測

- ケニア

- 市場動向

- 市場予測

- スリランカ

- 市場動向

- 市場予測

- トルコ

- 市場動向

- 市場予測

- ベトナム

- 市場動向

- 市場予測

- その他

- 市場動向

- 市場予測

第11章 競合情勢

- 市場構造

- 主要企業

第12章 茶の加工

- 製品概要

- 詳細なプロセスフロー

- 様々な種類の単位操作

- マスバランスと原材料要件

第13章 プロジェクトの詳細・必要条件・費用

- 土地要件と費用

- 建設要件と費用

- 工場レイアウト

- 工場の機械

- 機械写真

- 原材料の要件と支出

- 原材料と最終製品の写真

- パッケージの要件と支出

- 輸送の要件と支出

- ユーティリティの要件と支出

- 人員要件と支出

- その他の設備投資

第14章 融資と資金援助

第15章 プロジェクトの経済性

- プロジェクトの資本コスト

- 技術経済的パラメーター

- サプライチェーンの各段階における製品価格とマージン

- 課税と減価償却

- 収入予測

- 支出予測

- 財務分析

- 利益分析

第16章 主要企業のプロファイル

- Associated British Foods Plc

- Barry's Tea

- Taetea Group

- Tata Consumer Products Limited(Tata Group)

- Unilever

List of Figures

- Figure 1: Global: Tea Market: Major Drivers and Challenges

- Figure 2: Global: Tea and Coffee Drinkers Across Various Regions

- Figure 3: Global: Tea Market: Production Volume Trends (in Million Tons), 2019-2024

- Figure 4: Global: Tea Market: Consumption Volume Trends (in Million Tons), 2019-2024

- Figure 5: Global: Tea Market: Consumption Value Trends (in Billion USD), 2019-2024

- Figure 6: Tea Market: Price Structure

- Figure 7: Global: Tea Market: Average Prices (in USD/Ton), 2019-2033

- Figure 8: Global: Tea Market: Breakup by Region (in %), 2024

- Figure 9: Global: Tea Market: Breakup by Product Type (in %), 2024

- Figure 10: Global: Tea Market: Breakup by Packaging (in %), 2024

- Figure 11: Global: Tea Market: Breakup by Distribution Channel (in %), 2024

- Figure 12: Global: Tea Market: Breakup by Application (in %), 2024

- Figure 13: Global: Tea Market Forecast: Production Volume Trends (in Million Tons), 2025-2033

- Figure 14: Global: Tea Market Forecast: Consumption Volume Trends (in Million Tons), 2025-2033

- Figure 15: Global: Tea Market Forecast: Consumption Value Trends (in Billion USD), 2025-2033

- Figure 16: Global: Tea Industry: SWOT Analysis

- Figure 17: Global: Tea Industry: Value Chain Analysis

- Figure 18: Global: Tea Industry: Porter's Five Forces Analysis

- Figure 19: China: Tea Market (in Million Tons), 2019 & 2024

- Figure 20: China: Tea Market Forecast (in Million Tons), 2025-2033

- Figure 21: India: Tea Market (in Million Tons), 2019 & 2024

- Figure 22: India: Tea Market Forecast (in Million Tons), 2025-2033

- Figure 23: Kenya: Tea Market (in Million Tons), 2019 & 2024

- Figure 24: Kenya: Tea Market Forecast (in Million Tons), 2025-2033

- Figure 25: Sri Lanka: Tea Market (in Million Tons), 2019 & 2024

- Figure 26: Sri Lanka: Tea Market Forecast (in Million Tons), 2025-2033

- Figure 27: Turkey: Tea Market (in Million Tons), 2019 & 2024

- Figure 28: Turkey: Tea Market Forecast (in Million Tons), 2025-2033

- Figure 29: Vietnam: Tea Market (in Million Tons), 2019 & 2024

- Figure 30: Vietnam: Tea Market Forecast (in Million Tons), 2025-2033

- Figure 31: Others: Tea Market (in Million Tons), 2019 & 2024

- Figure 32: Others: Tea Market Forecast (in Million Tons), 2025-2033

- Figure 33: Global: Green Tea Market: Sales Volume (in Million Tons), 2019 & 2024

- Figure 34: Global: Green Tea Market Forecast: Sales Volume (in Million Tons), 2025-2033

- Figure 35: Global: Black Tea Market: Sales Volume (in Million Tons), 2019 & 2024

- Figure 36: Global: Black Tea Market Forecast: Sales Volume (in Million Tons), 2025-2033

- Figure 37: Global: Oolong Tea Market: Sales Volume (in Million Tons), 2019 & 2024

- Figure 38: Global: Oolong Tea Market Forecast: Sales Volume (in Million Tons), 2025-2033

- Figure 39: Global: Other Tea Market: Sales Volume (in Million Tons), 2019 & 2024

- Figure 40: Global: Other Tea Market Forecast: Sales Volume (in Million Tons), 2025-2033

- Figure 41: Global: Tea Market (Plastic Containers): Sales Volume (in Million Tons), 2019 & 2024

- Figure 42: Global: Tea Market Forecast (Plastic Containers): Sales Volume (in Million Tons), 2025-2033

- Figure 43: Global: Tea Market (Loose Tea): Sales Volume (in Million Tons), 2019 & 2024

- Figure 44: Global: Tea Market Forecast (Loose Tea): Sales Volume (in Million Tons), 2025-2033

- Figure 45: Global: Tea Market (Paper Boards): Sales Volume (in Million Tons), 2019 & 2024

- Figure 46: Global: Tea Market Forecast (Paper Boards): Sales Volume (in Million Tons), 2025-2033

- Figure 47: Global: Tea Market (Aluminium Tin): Sales Volume (in Million Tons), 2019 & 2024

- Figure 48: Global: Tea Market Forecast (Aluminium Tin): Sales Volume (in Million Tons), 2025-2033

- Figure 49: Global: Tea Market (Tea Bags): Sales Volume (in Million Tons), 2019 & 2024

- Figure 50: Global: Tea Market Forecast (Tea Bags): Sales Volume (in Million Tons), 2025-2033

- Figure 51: Global: Tea Market (Other Packagings): Sales Volume (in Million Tons), 2019 & 2024

- Figure 52: Global: Tea Market Forecast (Other Packagings): Sales Volume (in Million Tons), 2025-2033

- Figure 53: Global: Tea Market: Sales through Supermarkets/Hypermarkets (in Million Tons), 2019 & 2024

- Figure 54: Global: Tea Market Forecast: Sales through Supermarkets/Hypermarkets (in Million Tons), 2025-2033

- Figure 55: Global: Tea Market: Sales through Specialty Stores (in Million Tons), 2019 & 2024

- Figure 56: Global: Tea Market Forecast: Sales through Specialty Stores (in Million Tons), 2025-2033

- Figure 57: Global: Tea Market: Sales through Convenience Stores (in Million Tons), 2019 & 2024

- Figure 58: Global: Tea Market Forecast: Sales through Convenience Stores (in Million Tons), 2025-2033

- Figure 59: Global: Tea Market: Online Sales (in Million Tons), 2019 & 2024

- Figure 60: Global: Tea Market Forecast: Online Sales (in Million Tons), 2025-2033

- Figure 61: Global: Tea Market: Sales through Other Distribution Channels (in Million Tons), 2019 & 2024

- Figure 62: Global: Tea Market Forecast: Sales through Other Distribution Channels (in Million Tons), 2025-2033

- Figure 63: Global: Tea Market (Residential Applications): Sales Volume (in Million Tons), 2019 & 2024

- Figure 64: Global: Tea Market Forecast (Residential Applications): Sales Volume (in Million Tons), 2025-2033

- Figure 65: Global: Tea Market (Commercial Applications): Sales Volume (in Million Tons), 2019 & 2024

- Figure 66: Global: Tea Market Forecast (Commercial Applications): Sales Volume (in Million Tons), 2025-2033

- Figure 67: Tea Processing Plant: Detailed Process Flow

- Figure 68: Tea Processing Plant: Conversion Rate of Feedstocks

- Figure 69: Tea Processing Plant: Proposed Plant Layout

- Figure 70: Tea Processing Plant: Breakup of Capital Costs (in %)

- Figure 71: Tea Processing Plant: Profit Margins at Various Levels of the Supply Chain

- Figure 72: Tea Processing Plant: Manufacturing Cost Breakup (in %)

List of Tables

- Table 1: Global: Tea Market: Key Industry Highlights, 2024 and 2033

- Table 2: Global: Tea Market Forecast: Breakup by Product Type (in Million Tons), 2025-2033

- Table 3: Global: Tea Market Forecast: Breakup by Packaging (in Million Tons), 2025-2033

- Table 4: Global: Tea Market Forecast: Breakup by Distribution Channel (in Million Tons), 2025-2033

- Table 5: Global: Tea Market Forecast: Breakup by Application (in Million Tons), 2025-2033

- Table 6: Global: Tea Market Forecast: Breakup by Region (in Million Tons), 2025-2033

- Table 7: Global: Tea Market: Competitive Structure

- Table 8: Global: Tea Market: Major Tea Manufacturers

- Table 9: Tea Processing Plant: Costs Related to Land and Site Development (in USD)

- Table 10: Tea Processing Plant: Costs Related to Civil Works (in USD)

- Table 11: Tea Processing Plant: Costs Related to Plant and Machinery (in USD)

- Table 12: Tea Processing Plant: Raw Material Requirements (in Tons/Day) and Expenditures (USD/Ton)

- Table 13: Tea Processing Plant: Costs Related to Salaries and Wages (in USD)

- Table 14: Tea Processing Plant: Costs Related to Other Capital Investments (in USD)

- Table 15: Tea Processing Plant: Capital Costs (in USD)

- Table 16: Tea Processing Plant: Techno-Economic Parameters

- Table 17: Tea Processing Plant: Income Projections (in USD)

- Table 18: Tea Processing Plant: Expenditure Projections (in USD)

- Table 19: Tea processing Plant: Cash Flow Analysis Without Considering the Income Tax Liability (in USD)

- Table 20: Tea processing Plant: Cash Flow Analysis on Considering the Income Tax Liability (in USD)

The global tea market size reached USD 25.6 Billion in 2024. Looking forward, the market is expected to reach USD 38.1 Billion by 2033, exhibiting a growth rate (CAGR) of 4.5% during 2025-2033. The market is primarily driven by the rising health consciousness, a surge in demand for organic and premium teas, and increased consumption in emerging economies, along with numerous innovations in flavors and packaging.

Tea Market Analysis:

Market Growth and Size: The global tea market continues to witness robust growth, due to increasing health awareness and a preference for natural beverages. Moreover, the market size is expanding with a surge in demand for diverse tea varieties, including herbal and functional teas, reflecting a shift towards healthier beverage choices.

Major Market Drivers: The major market drivers include the rising demand for tea-based cocktails and innovations in tea mixology, marketing strategies promoting tea as an immunity booster, growing popularity of tea subscription services and online tea communities, and expansion of tea cafes and specialized tea shops.

Technological Advancements: Technology plays a pivotal role in enhancing tea production, quality control, and marketing. Innovations in tea processing and packaging methods have led to increased product shelf life and convenience for consumers.

Industry Applications: The tea industry extends beyond traditional brewing, with applications in cosmetics, pharmaceuticals, and the culinary arts, where tea is used as an ingredient in various recipes. It also finds diverse applications beyond traditional beverage consumption, including in the food industry for flavor infusion, and in the beauty and wellness sectors for its skincare and relaxation properties.

Key Market Trends: Increased focus on terroir and regional tea characteristics, rise of tea tourism and experiential tea tastings, development of health-focused tea blends targeting specific health benefits, incorporation of biodegradable tea bags and eco-friendly packaging, emergence of rare and aged teas as collector's items, and expansion of premium tea lounges in urban centers are some of the key market trends.

Geographical Trends: China continues to lead the global tea market due to its extensive tea cultivation and export activities. Furthermore, the popularity of specialty and premium teas is on the rise in other regions which is contributing to the overall expansion of the market.

Competitive Landscape: The tea market is highly competitive, with both established brands and newer entrants vying for market share. Companies are differentiating through innovative products, branding, and sustainable practices.

Challenges and Opportunities: Challenges include climate change impacts on tea cultivation, fluctuating prices, and sustainability concerns. Opportunities lie in catering to health-conscious consumers, expanding into emerging markets, and innovating with unique tea products and experiences.

Tea Market Trends:

Surging consumer awareness regarding tea's health benefits

Consumer awareness regarding the health benefits of tea is a pivotal driver in the global tea market. With a growing emphasis on health-conscious choices, consumers are increasingly drawn to tea due to its perceived natural and wellness-promoting attributes. The rich antioxidants found in tea varieties, such as green tea and herbal infusions, make it an appealing choice for those seeking health benefits in their beverages. As this awareness continues to rise, the demand for tea as a health-conscious option is expected to expand further. In line with this, market players are actively capitalizing on this trend by highlighting these advantages in their marketing campaigns and product portfolios, thereby contributing to the overall growth of the global tea market.

Changing lifestyles and convenience

The global tea market is significantly shaped by evolving consumer lifestyles and a pronounced preference for convenience. In line with this, consumers are increasingly seeking hassle-free and rapid beverage solutions, which has led to a surge in demand for ready-to-drink (RTD) tea products that align with their busy schedules. The convenience of being able to grab bottled or canned tea while on the move resonates with the modern lifestyle. Additionally, tea companies are diversifying their RTD tea offerings to cater to this demand for quick, accessible, and convenient tea options, which, in turn, is propelling the growth of the global tea market.

Sustainability and ethical sourcing

Sustainability concerns and ethical sourcing practices are gaining prominence within the global tea market. Consumers are increasingly concerned about the taste and quality of tea, as well as its impact on the environment and ethics. As a result, there is a growing preference for teas that are cultivated sustainably, without causing harm to the environment or exploiting labor. Companies that can demonstrate their commitment to sustainability and ethical sourcing often gain a competitive advantage in the market, as consumers are willing to pay a premium for products that align with their values.

Premiumization and specialty teas

The trend towards premiumization is reshaping the global tea market landscape. Consumers are becoming more discerning, willing to explore, and invest in higher-quality and specialty teas. This shift is fueled by the demand for unique and elevated tea experiences, transcending the conventional tea bags commonly found on store shelves. In line with this, tea companies are focusing their efforts on creating premium tea offerings, often accompanied by compelling storytelling and branding to enhance the overall tea-drinking experience.

Tea Industry Segmentation:

Breakup by Product Type:

Green Tea

Black Tea

Oolong Tea

Others

Black tea holds the largest share in the industry

The black tea segment leads the market on account of the increasing preference for bold and robust flavors, making it a popular choice among consumers who enjoy a stronger tea taste. Additionally, the growing awareness of black tea's potential health benefits, such as antioxidants and improved heart health, contributes to its steady demand in the market. Moreover, the versatility of black tea in being a base for various flavored and specialty teas adds to its appeal, appealing to a wide range of consumers with different taste preferences.

On the other hand, the green tea segment is driven by the increasing emphasis on health and wellness, as consumers seek natural and antioxidant-rich beverages. Green tea is well-known for its potential health benefits, including weight management and improved metabolism, making it a preferred choice among health-conscious individuals. Furthermore, the rise of green tea in various culinary applications, including desserts and savory dishes, also fuels the segment growth.

The oolong tea segment is driven by its unique flavor profile, falling between black and green teas in terms of oxidation. Oolong tea's distinct taste, ranging from floral and fruity to woody and roasted, appeals to consumers seeking a diverse tea experience. Oolong tea is often considered a connoisseur's choice, attracting those interested in exploring the nuances of tea flavor.

In the others segment, factors driving growth include surging demand for herbal and fruit infusions due to consumers seeking caffeine-free and naturally flavored options, often for their perceived health benefits.

Breakup by Packaging:

Plastic Containers

Loose Tea

Paper Boards

Aluminium Tin

Tea Bags

Others

Paper boards represents the leading market segment

The paper boards segment is influenced by escalating environmental concerns and the preference for eco-friendly packaging solutions. Paperboard materials are biodegradable and recyclable, aligning with consumers' growing sustainability consciousness.

The plastic containers segment is driven by the increasing demand for convenience and durability in tea packaging. Plastic containers offer airtight sealing and easy storage, ensuring the tea's freshness is preserved for an extended period.

In contrast, the loose tea segment is fueled by consumers' desire for customization and sustainability. Loose tea allows tea enthusiasts to select and measure their preferred quantity, reducing packaging waste and offering a more authentic tea experience.

In the case of the aluminum tin segment, its popularity is attributed to its ability to protect tea leaves from light, moisture, and air, maintaining tea freshness and flavor. Tea bags continue to thrive due to their convenience, especially in terms of portion control and ease of brewing.

The other segments in the tea packaging industry are influenced by innovation, offering unique and specialized packaging solutions to cater to different consumer preferences, such as compostable packaging, decorative collectible tins, or innovative pouch designs.

Breakup by Distribution Channel:

Supermarkets/Hypermarkets

Specialty Stores

Convenience Stores

Online

Others

Supermarkets/hypermarkets holds the largest share in the industry

The supermarkets and hypermarkets segment is driven by the increasing consumer preference for one-stop shopping destinations that offer a wide variety of products under a single roof. They leverage their massive store spaces to provide a diverse range of goods, including groceries, household items, and electronics, all in a convenient and accessible manner. Moreover, they often employ bulk-purchasing strategies, enabling cost-effective pricing for consumers, and invest in extensive marketing campaigns to draw in customers.

The specialty stores segment thrives due to the growing demand for niche and unique products. These outlets cater to consumers seeking specialized items that may not be readily available in larger retail formats. Whether it's gourmet foods, artisanal crafts, or high-end fashion, specialty stores excel in offering curated selections that appeal to distinct tastes and preferences.

The convenience stores segment is driven by the premise of providing accessibility and convenience to consumers, often 24/7. They are driven by the need for quick and easy purchases, typically focusing on essential items such as snacks, beverages, and basic groceries.

The online retail segment, representing the e-commerce segment, is experiencing rapid growth, primarily fueled by the digital age and technological advancements. Consumers are increasingly drawn to the convenience of shopping from the comfort of their homes or on-the-go via smartphones. The online segment leverages data-driven recommendations, extensive product catalogs, and efficient logistics to provide a seamless shopping experience.

Moreover, the others segment encompasses a diverse array of retail formats, including discount stores, warehouse clubs, and direct-to-consumer brands. Each of these segments has its unique value proposition and caters to specific consumer needs.

Breakup by Application:

Residential

Commercial

Residential represents the leading market segment

The residential segment is driven by the increasing consumer awareness of the health benefits associated with tea consumption. As more individuals seek natural and wellness-promoting beverages, tea's rich antioxidants and potential health advantages have made it a popular choice for households. Additionally, the convenience of preparing tea at home aligns with busy lifestyles, further boosting its demand in residential settings.

In contrast, the commercial segment is primarily driven by the growing trend of tea as a versatile beverage in various foodservice establishments. The proliferation of cafes, restaurants, and tea shops has created a substantial demand for tea as both a traditional and innovative menu option. The commercial segment is also influenced by the rising popularity of tea-based cocktails and specialty beverages, offering a broader range of tea experiences to consumers when dining out.

Breakup by Region:

China

India

Kenya

Sri Lanka

Turkey

Vietnam

Others

China leads the market, accounting for the largest tea market share

The market research report has also provided a comprehensive analysis of all the major regional markets, which include China, India, Kenya, Sri Lanka, Turkey, Vietnam, and others. According to the report, China accounted for the largest market share.

The Chinese tea market is primarily driven by a resurgence in traditional tea culture and a burgeoning demand for premium tea varieties, notably green and white teas. China's reputation as one of the world's leading tea producers further fuels the market growth. The country's commitment to tea exports and its diverse range of tea offerings, including renowned options like Longjing and Tie Guan Yin, cater to both domestic and international tastes.

In India, the tea market experiences strong growth driven by its status as one of the globe's largest tea producers and the growing consumption of tea as a staple beverage. The country offers an array of distinctive teas, such as Assam, Darjeeling, and Nilgiri, satisfying a wide spectrum of preferences. With tea deeply ingrained in Indian culture, its market continues to thrive as consumers embrace both traditional blends and modern innovations.

Kenya's tea market is propelled by its expanding production of black tea and its pivotal role as a significant agricultural export. The country's focus on producing high-quality black teas has positioned it as a key player in the global tea industry.

Sri Lanka's tea market is characterized by its rich history of tea cultivation, especially Ceylon tea. The country's emphasis on quality and the unique flavor profiles of its teas drives its market.

Turkey's tea market is deeply influenced by the popularity of traditional Turkish tea. It is an integral part of Turkish culture and social life. The unique brewing method and strong, black tea flavor are cherished by the Turkish population, making Turkey a unique market in the global tea industry.

The tea market in Vietnam is on the rise, driven by the increasing production of green tea. Vietnam is emerging as a notable green tea producer, capitalizing on its agricultural capabilities. As consumers seek healthier beverage options, the demand for green tea continues to grow, positioning Vietnam as a key player in the global green tea market.

Leading Key Players in the Tea Industry:

The key players in the global tea market are actively engaged in various strategies to maintain and expand their market presence. They are focusing on product diversification and innovation, introducing new tea blends, flavors, and packaging formats to cater to evolving consumer preferences. Sustainability is a significant priority for these players, with initiatives aimed at reducing their environmental footprint, implementing ethical sourcing practices, and obtaining certifications that reflect their commitment to sustainability. Moreover, marketing efforts are increasingly geared towards promoting the health benefits of tea consumption, leveraging the growing health-conscious consumer base. Collaborations and partnerships are common, allowing tea companies to access new markets and distribution channels. E-commerce and digital marketing have become crucial tools for reaching a wider audience and enhancing customer engagement.

The market research report has provided a comprehensive analysis of the competitive landscape. Detailed profiles of all major companies have also been provided. Some of the key players in the market include:

Associated British Foods Plc

Barry's Tea

Taetea Group

Tata Consumer Products Limited (Tata Group)

Unilever

Key Questions Answered in This Report

- 1. What was the size of the global tea market in 2024?

- 2. What is the expected growth rate of the global tea market during 2025-2033?

- 3. What are the key factors driving the global tea market?

- 4. What has been the impact of COVID-19 on the global tea market?

- 5. What is the breakup of the global tea market based on the product type?

- 6. What is the breakup of the global tea market based on the packaging?

- 7. What is the breakup of the global tea market based on the distribution channel?

- 8. What is the breakup of the global tea market based on the application?

- 9. What are the key regions in the global tea market?

- 10. Who are the key players/companies in the global tea market?

Table of Contents

1 Preface

2 Scope and Methodology

- 2.1 Objectives of the Study

- 2.2 Stakeholders

- 2.3 Data Sources

- 2.3.1 Primary Sources

- 2.3.2 Secondary Sources

- 2.4 Market Estimation

- 2.4.1 Bottom-Up Approach

- 2.4.2 Top-Down Approach

- 2.5 Forecasting Methodology

3 Executive Summary

4 Introduction

- 4.1 Overview

- 4.2 Key Industry Trends

5 Global Tea Industry

- 5.1 Market Overview

- 5.2 Market Performance

- 5.2.1 Production Volume Trends

- 5.2.2 Consumption Volume Trends

- 5.2.3 Consumption Value Trends

- 5.3 Price Analysis

- 5.3.1 Key Price Indicators

- 5.3.2 Price Structure

- 5.3.3 Price Trends

- 5.4 Impact of COVID-19

- 5.5 Market Breakup by Product Type

- 5.6 Market Breakup by Packaging

- 5.7 Market Breakup by Distribution Channel

- 5.8 Market Breakup by Application

- 5.9 Market Breakup by Region

- 5.10 Market Forecast

- 5.11 SWOT Analysis

- 5.11.1 Overview

- 5.11.2 Strengths

- 5.11.3 Weaknesses

- 5.11.4 Opportunities

- 5.11.5 Threats

- 5.12 Value Chain Analysis

- 5.12.1 Raw Material Procurement

- 5.12.2 Manufacturer

- 5.12.3 Marketing and Distribution

- 5.12.4 Retailer

- 5.12.5 Exporter

- 5.12.6 End-User

- 5.13 Porter's Five Forces Analysis

- 5.13.1 Overview

- 5.13.2 Bargaining Power of Buyers

- 5.13.3 Bargaining Power of Suppliers

- 5.13.4 Degree of Competition

- 5.13.5 Threat of New Entrants

- 5.13.6 Threat of Substitutes

- 5.14 Key Success and Risk Factors for Tea Manufacturers

6 Market Breakup by Product Type

- 6.1 Green Tea

- 6.1.1 Market Trends

- 6.1.2 Market Forecast

- 6.2 Black Tea

- 6.2.1 Market Trends

- 6.2.2 Market Forecast

- 6.3 Oolong Tea

- 6.3.1 Market Trends

- 6.3.2 Market Forecast

- 6.4 Others

- 6.4.1 Market Trends

- 6.4.2 Market Forecast

7 Market Breakup by Packaging

- 7.1 Plastic Containers

- 7.1.1 Market Trends

- 7.1.2 Market Forecast

- 7.2 Loose Tea

- 7.2.1 Market Trends

- 7.2.2 Market Forecast

- 7.3 Paper Boards

- 7.3.1 Market Trends

- 7.3.2 Market Forecast

- 7.4 Aluminium Tin

- 7.4.1 Market Trends

- 7.4.2 Market Forecast

- 7.5 Tea Bags

- 7.5.1 Market Trends

- 7.5.2 Market Forecast

- 7.6 Others

- 7.6.1 Market Trends

- 7.6.2 Market Forecast

8 Market Breakup by Distribution Channel

- 8.1 Supermarkets/Hypermarkets

- 8.1.1 Market Trends

- 8.1.2 Market Forecast

- 8.2 Specialty Stores

- 8.2.1 Market Trends

- 8.2.2 Market Forecast

- 8.3 Convenience Stores

- 8.3.1 Market Trends

- 8.3.2 Market Forecast

- 8.4 Online

- 8.4.1 Market Trends

- 8.4.2 Market Forecast

- 8.5 Others

- 8.5.1 Market Trends

- 8.5.2 Market Forecast

9 Market Breakup by Application

- 9.1 Residential

- 9.1.1 Market Trends

- 9.1.2 Market Forecast

- 9.2 Commercial

- 9.2.1 Market Trends

- 9.2.2 Market Forecast

10 Market Breakup by Region

- 10.1 China

- 10.1.1 Market Trends

- 10.1.2 Market Forecast

- 10.2 India

- 10.2.1 Market Trends

- 10.2.2 Market Forecast

- 10.3 Kenya

- 10.3.1 Market Trends

- 10.3.2 Market Forecast

- 10.4 Sri Lanka

- 10.4.1 Market Trends

- 10.4.2 Market Forecast

- 10.5 Turkey

- 10.5.1 Market Trends

- 10.5.2 Market Forecast

- 10.6 Vietnam

- 10.6.1 Market Trends

- 10.6.2 Market Forecast

- 10.7 Others

- 10.7.1 Market Trends

- 10.7.2 Market Forecast

11 Competitive Landscape

- 11.1 Market Structure

- 11.2 Key Players

12 Tea Processing

- 12.1 Product Overview

- 12.2 Detailed Process Flow

- 12.3 Various Types of Unit Operations Involved

- 12.4 Mass Balance and Raw Material Requirements

13 Project Details, Requirements and Costs Involved

- 13.1 Land Requirements and Expenditures

- 13.2 Construction Requirements and Expenditures

- 13.3 Plant Layout

- 13.4 Plant Machinery

- 13.5 Machinery Pictures

- 13.6 Raw Material Requirements and Expenditures

- 13.7 Raw Material and Final Product Pictures

- 13.8 Packaging Requirements and Expenditures

- 13.9 Transportation Requirements and Expenditures

- 13.10 Utility Requirements and Expenditures

- 13.11 Manpower Requirements and Expenditures

- 13.12 Other Capital Investments

14 Loans and Financial Assistance

15 Project Economics

- 15.1 Capital Cost of the Project

- 15.2 Techno-Economic Parameters

- 15.3 Product Pricing and Margins Across Various Levels of the Supply Chain

- 15.4 Taxation and Depreciation

- 15.5 Income Projections

- 15.6 Expenditure Projections

- 15.7 Financial Analysis

- 15.8 Profit Analysis

16 Key Player Profiles

- 16.1 Associated British Foods Plc

- 16.2 Barry's Tea

- 16.3 Taetea Group

- 16.4 Tata Consumer Products Limited (Tata Group)

- 16.5 Unilever