|

|

市場調査レポート

商品コード

1660968

ヘルスおよびウェルネス市場レポート:製品タイプ、機能、地域別、2025年~2033年Health and Wellness Market Report by Product Type, Functionality, and Region 2025-2033 |

||||||

カスタマイズ可能

|

|||||||

| ヘルスおよびウェルネス市場レポート:製品タイプ、機能、地域別、2025年~2033年 |

|

出版日: 2025年02月10日

発行: IMARC

ページ情報: 英文 143 Pages

納期: 2~3営業日

|

全表示

- 概要

- 図表

- 目次

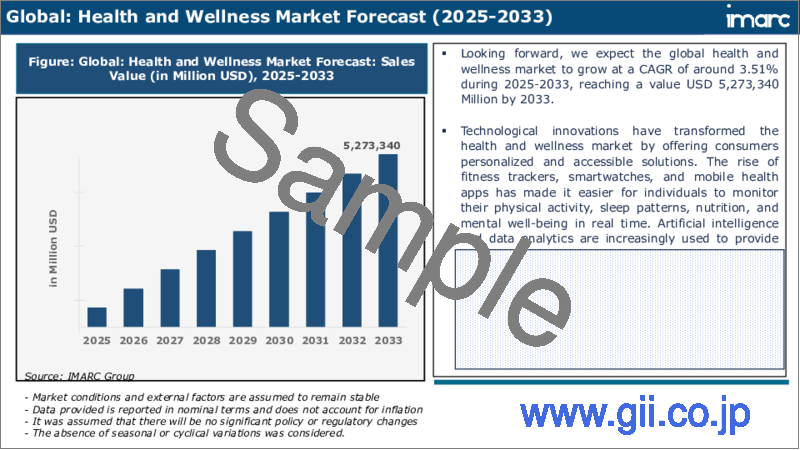

ヘルスおよびウェルネスの世界市場規模は2024年に3兆8,058億米ドルに達しました。今後、IMARC Groupは、市場は2033年までに5兆2,733億米ドルに達し、2025~2033年の成長率(CAGR)は3.51%になると予測しています。モバイルアプリ、健康モニタリング機器、ウェアラブル機器の開発を含む様々な技術的進歩や、健康的なライフスタイルを送ることの重要性に対する消費者の意識の高まりが、主にヘルスおよびウェルネスの世界市場を刺激しています。

ヘルスおよびウェルネスには、活動的で充実した生活を送るための身体的、精神的、感情的、社会的条件を含む個人の幸福のあらゆる側面が含まれます。これには、定期的な運動、禁煙、過度の飲酒、栄養価の高い食事、さまざまな病気に対する適切な医療、セラピーを通じた精神的健康の優先、そして十分な休養の確保などが含まれます。また、ストレスの多い職場環境から距離を置き、健全なワークライフバランスを保てるようなキャリアを追求し、有意義な人間関係を育み、経済的な幸福を重視し、精神的な修行に励むことも含まれます。

この市場の主な原動力となっているのは、若い個人が健康を維持し、人生の目標を達成するために、個人に合わせたライフコーチングや健康増進プログラムへの投資が増加していることです。さらに、仕事に関連したストレスを管理するための健康増進プログラムに対する需要の高まりも、成長を促す大きな要因となっています。このほか、適切な精神衛生状態を維持し、幸福な人生を送るためにより良い選択をすることに関する個人の意識の高まりも市場を後押ししています。さらに、スパの人気の高まりや、パーソナルケアを維持するための機能性食品や飲食品の消費の増加、可処分所得の増加、健康的なライフスタイルやフィットネス習慣、ウェルネス製品を推進するソーシャルメディアプラットフォームやインフルエンサーの影響力の高まりなども、世界中で良好な市場見通しを生み出している要因です。

ヘルスおよびウェルネスの市場動向/促進要因:

慢性疾患の増加

糖尿病、心血管疾患、肥満、ある種のがんなどの慢性疾患が蔓延するにつれて、予防と管理に焦点を当てた製品やサービスに対する需要が高まっています。これには、栄養補助食品、フィットネス・プログラム、ウェルネス・コーチング、疾病管理アプリ、健康モニタリング・デバイスなどが含まれます。さらに、消費者は慢性疾患の発症を予防するために、ライフスタイルの選択、栄養、フィットネスに関する情報や教育を求めています。このため、ヘルス&ウェルネス事業者は、十分な情報に基づいた意思決定を支援するための教育リソース、ワークショップ、プログラムを提供する機会が生まれています。また、世界各国の政府は慢性疾患の負担増に対処するための取り組みや政策を実施しており、これもヘルスおよびウェルネスの市場にとって好ましい環境を生み出しています。

健康モニタリングツールの開発

フィットネストラッカー、スマートウォッチ、ヘルスモニタリングガジェットなどのウェアラブルデバイスは、個人がリアルタイムで様々な健康パラメータを追跡・監視することを可能にします。これらのデバイスは、心拍数、睡眠パターン、歩数、消費カロリーなどの測定基準に関するデータを収集します。これにより、自己認識が促進され、個人が自分のヘルスおよびウェルネス・ルーティンについて十分な情報を得た上で意思決定できるようになります。さらに、モバイルアプリやウェアラブルデバイスには、目標設定、リマインダー、進捗追跡などの機能が含まれていることが多く、行動変容にプラスの影響を与えることができます。これらのツールは、リアルタイムのフィードバックやインセンティブを提供することで、個人の身体活動の増加、睡眠パターンの改善、ストレス解消法の実践など、より健康的な習慣の導入を促し、市場の成長を促進しています。

健康増進サービスを提供する企業の増加

健康増進・ウェルネス・サービスを提供する企業は、従業員に利便性と健康増進を優先する機会を提供するため、健康増進・ウェルネス・プログラムを職場に組み込むことで、より多くの人々にサービスを利用しやすくしています。さらに、多くの企業はヘルスケア・コストの削減と従業員の生産性向上における予防医療の価値を認識しています。その結果、フィットネス・クラス、栄養カウンセリング、ストレス管理ワークショップ、健康診断など、予防に重点を置いた健康増進プログラムに投資しています。さらに、企業はフィットネスセンター、栄養士、メンタルヘルス専門家、その他のウェルネス専門家といった外部のウェルネス・プロバイダーと協力し、従業員により幅広いサービスと専門知識を提供することで、ヘルスおよびウェルネス・プログラムの全体的な質と効果を高め、市場の成長を促進しています。

目次

第1章 序文

第2章 調査範囲と調査手法

- 調査の目的

- ステークホルダー

- データソース

- 一次情報

- 二次情報

- 市場推定

- ボトムアップアプローチ

- トップダウンアプローチ

- 調査手法

第3章 エグゼクティブサマリー

第4章 イントロダクション

- 概要

- 主要業界動向

第5章 世界のヘルスおよびウェルネス市場

- 市場概要

- 市場実績

- COVID-19の影響

- 市場予測

第6章 市場内訳:製品タイプ別

- 機能性食品・飲料

- 市場動向

- 市場予測

- 美容およびパーソナルケア製品

- 市場動向

- 市場予測

- 予防および個別化医薬品

- 市場動向

- 市場予測

- その他

- 市場動向

- 市場予測

第7章 市場内訳:機能別

- 栄養と体重管理

- 市場動向

- 市場予測

- 心臓と腸の健康

- 市場動向

- 市場予測

- 免疫

- 市場動向

- 市場予測

- 骨の健康

- 市場動向

- 市場予測

- 肌の健康

- 市場動向

- 市場予測

- その他

- 市場動向

- 市場予測

第8章 市場内訳:地域別

- 北米

- 米国

- カナダ

- 欧州

- ドイツ

- フランス

- 英国

- イタリア

- スペイン

- ロシア

- その他

- アジア太平洋地域

- 中国

- 日本

- インド

- 韓国

- オーストラリア

- インドネシア

- その他

- ラテンアメリカ

- ブラジル

- メキシコ

- アルゼンチン

- コロンビア

- チリ

- ペルー

- その他

- 中東・アフリカ

- トルコ

- サウジアラビア

- イラン

- アラブ首長国連邦

- その他

第9章 SWOT分析

- 概要

- 強み

- 弱み

- 機会

- 脅威

第10章 バリューチェーン分析

第11章 ポーターのファイブフォース分析

- 概要

- 買い手の交渉力

- 供給企業の交渉力

- 競合の程度

- 新規参入業者の脅威

- 代替品の脅威

第12章 競合情勢

- 市場構造

- 主要企業

- 主要企業のプロファイル

- Amway Corp.

- Bayer AG

- Danone S.A.

- David Lloyd Leisure Ltd.

- Fitness First India Pvt Ltd.

- Herbalife Nutrition Ltd.

- Holland & Barrett Retail Limited

- L'Oreal SA

- Nestle SA

- Procter & Gamble

- Unilever PLC

- Vitabiotics Ltd.

List of Figures

- Figure 1: Global: Health and Wellness Market: Major Drivers and Challenges

- Figure 2: Global: Health and Wellness Market: Sales Value (in Billion USD), 2019-2024

- Figure 3: Global: Health and Wellness Market: Breakup by Product Type (in %), 2024

- Figure 4: Global: Health and Wellness Market: Breakup by Functionality (in %), 2024

- Figure 5: Global: Health and Wellness Market: Breakup by Region (in %), 2024

- Figure 6: Global: Health and Wellness Market Forecast: Sales Value (in Billion USD), 2025-2033

- Figure 7: Global: Health and Wellness (Functional Food and Beverages) Market: Sales Value (in Million USD), 2019 & 2024

- Figure 8: Global: Health and Wellness (Functional Food and Beverages) Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 9: Global: Health and Wellness (Beauty and Personal Care Products) Market: Sales Value (in Million USD), 2019 & 2024

- Figure 10: Global: Health and Wellness (Beauty and Personal Care Products) Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 11: Global: Health and Wellness (Preventive and Personalized Medicinal Products) Market: Sales Value (in Million USD), 2019 & 2024

- Figure 12: Global: Health and Wellness (Preventive and Personalized Medicinal Products) Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 13: Global: Health and Wellness (Others) Market: Sales Value (in Million USD), 2019 & 2024

- Figure 14: Global: Health and Wellness (Others) Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 15: Global: Health and Wellness (Nutrition & Weight Management) Market: Sales Value (in Million USD), 2019 & 2024

- Figure 16: Global: Health and Wellness (Nutrition & Weight Management) Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 17: Global: Health and Wellness (Heart & Gut Health) Market: Sales Value (in Million USD), 2019 & 2024

- Figure 18: Global: Health and Wellness (Heart & Gut Health) Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 19: Global: Health and Wellness (Immunity) Market: Sales Value (in Million USD), 2019 & 2024

- Figure 20: Global: Health and Wellness (Immunity) Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 21: Global: Health and Wellness (Bone Health) Market: Sales Value (in Million USD), 2019 & 2024

- Figure 22: Global: Health and Wellness (Bone Health) Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 23: Global: Health and Wellness (Skin Health) Market: Sales Value (in Million USD), 2019 & 2024

- Figure 24: Global: Health and Wellness (Skin Health) Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 25: Global: Health and Wellness (Others) Market: Sales Value (in Million USD), 2019 & 2024

- Figure 26: Global: Health and Wellness (Others) Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 27: North America: Health and Wellness Market: Sales Value (in Million USD), 2019 & 2024

- Figure 28: North America: Health and Wellness Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 29: United States: Health and Wellness Market: Sales Value (in Million USD), 2019 & 2024

- Figure 30: United States: Health and Wellness Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 31: Canada: Health and Wellness Market: Sales Value (in Million USD), 2019 & 2024

- Figure 32: Canada: Health and Wellness Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 33: Europe: Health and Wellness Market: Sales Value (in Million USD), 2019 & 2024

- Figure 34: Europe: Health and Wellness Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 35: Germany: Health and Wellness Market: Sales Value (in Million USD), 2019 & 2024

- Figure 36: Germany: Health and Wellness Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 37: France: Health and Wellness Market: Sales Value (in Million USD), 2019 & 2024

- Figure 38: France: Health and Wellness Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 39: United Kingdom: Health and Wellness Market: Sales Value (in Million USD), 2019 & 2024

- Figure 40: United Kingdom: Health and Wellness Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 41: Italy: Health and Wellness Market: Sales Value (in Million USD), 2019 & 2024

- Figure 42: Italy: Health and Wellness Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 43: Spain: Health and Wellness Market: Sales Value (in Million USD), 2019 & 2024

- Figure 44: Spain: Health and Wellness Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 45: Russia: Health and Wellness Market: Sales Value (in Million USD), 2019 & 2024

- Figure 46: Russia: Health and Wellness Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 47: Others: Health and Wellness Market: Sales Value (in Million USD), 2019 & 2024

- Figure 48: Others: Health and Wellness Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 49: Asia Pacific: Health and Wellness Market: Sales Value (in Million USD), 2019 & 2024

- Figure 50: Asia Pacific: Health and Wellness Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 51: China: Health and Wellness Market: Sales Value (in Million USD), 2019 & 2024

- Figure 52: China: Health and Wellness Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 53: Japan: Health and Wellness Market: Sales Value (in Million USD), 2019 & 2024

- Figure 54: Japan: Health and Wellness Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 55: India: Health and Wellness Market: Sales Value (in Million USD), 2019 & 2024

- Figure 56: India: Health and Wellness Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 57: South Korea: Health and Wellness Market: Sales Value (in Million USD), 2019 & 2024

- Figure 58: South Korea: Health and Wellness Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 59: Australia: Health and Wellness Market: Sales Value (in Million USD), 2019 & 2024

- Figure 60: Australia: Health and Wellness Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 61: Indonesia: Health and Wellness Market: Sales Value (in Million USD), 2019 & 2024

- Figure 62: Indonesia: Health and Wellness Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 63: Others: Health and Wellness Market: Sales Value (in Million USD), 2019 & 2024

- Figure 64: Others: Health and Wellness Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 65: Latin America: Health and Wellness Market: Sales Value (in Million USD), 2019 & 2024

- Figure 66: Latin America: Health and Wellness Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 67: Brazil: Health and Wellness Market: Sales Value (in Million USD), 2019 & 2024

- Figure 68: Brazil: Health and Wellness Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 69: Mexico: Health and Wellness Market: Sales Value (in Million USD), 2019 & 2024

- Figure 70: Mexico: Health and Wellness Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 71: Argentina: Health and Wellness Market: Sales Value (in Million USD), 2019 & 2024

- Figure 72: Argentina: Health and Wellness Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 73: Colombia: Health and Wellness Market: Sales Value (in Million USD), 2019 & 2024

- Figure 74: Colombia: Health and Wellness Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 75: Chile: Health and Wellness Market: Sales Value (in Million USD), 2019 & 2024

- Figure 76: Chile: Health and Wellness Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 77: Peru: Health and Wellness Market: Sales Value (in Million USD), 2019 & 2024

- Figure 78: Peru: Health and Wellness Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 79: Others: Health and Wellness Market: Sales Value (in Million USD), 2019 & 2024

- Figure 80: Others: Health and Wellness Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 81: Middle East and Africa: Health and Wellness Market: Sales Value (in Million USD), 2019 & 2024

- Figure 82: Middle East and Africa: Health and Wellness Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 83: Turkey: Health and Wellness Market: Sales Value (in Million USD), 2019 & 2024

- Figure 84: Turkey: Health and Wellness Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 85: Saudi Arabia: Health and Wellness Market: Sales Value (in Million USD), 2019 & 2024

- Figure 86: Saudi Arabia: Health and Wellness Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 87: Iran: Health and Wellness Market: Sales Value (in Million USD), 2019 & 2024

- Figure 88: Iran: Health and Wellness Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 89: United Arab Emirates: Health and Wellness Market: Sales Value (in Million USD), 2019 & 2024

- Figure 90: United Arab Emirates: Health and Wellness Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 91: Others: Health and Wellness Market: Sales Value (in Million USD), 2019 & 2024

- Figure 92: Others: Health and Wellness Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 93: Global: Health and Wellness Industry: SWOT Analysis

- Figure 94: Global: Health and Wellness Industry: Value Chain Analysis

- Figure 95: Global: Health and Wellness Industry: Porter's Five Forces Analysis

List of Tables

- Table 1: Global: Health and Wellness Market: Key Industry Highlights, 2024 and 2033

- Table 2: Global: Health and Wellness Market Forecast: Breakup by Product Type (in Million USD), 2025-2033

- Table 3: Global: Health and Wellness Market Forecast: Breakup by Functionality (in Million USD), 2025-2033

- Table 4: Global: Health and Wellness Market Forecast: Breakup by Region (in Million USD), 2025-2033

- Table 5: Global: Health and Wellness Market: Competitive Structure

- Table 6: Global: Health and Wellness Market: Key Players

The global health and wellness market size reached USD 3,805.8 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 5,273.3 Billion by 2033, exhibiting a growth rate (CAGR) of 3.51% during 2025-2033. Various technological advancements, including the development of mobile apps, health monitoring devices, wearable instruments, and the rising consumer awareness towards the importance of leading a healthy lifestyle are primarily stimulating the global market for health and wellness.

Health and wellness include all aspects of an individual's well-being, including physical, mental, emotional, and social conditions to lead an active and fulfilling life. This entails engaging in regular exercise, abstaining from smoking and excessive drinking, adopting a nutritious diet, seeking appropriate medical care for various ailments, prioritizing mental health through therapies, and ensuring adequate rest for the body. It also involves distancing from stressful work environments, pursuing a career that allows for a healthy work-life balance, nurturing meaningful relationships, focusing on financial well-being, and engaging in spiritual practices.

The market is primarily driven by increasing investments in personalized life coaching and health and wellness programs for young individuals to stay fit and achieve their life goals. In addition, the escalating demand for health and wellness programs to manage work-related stress represents another major growth-inducing factor. Besides this, the market is also propelled by the increasing awareness among individuals regarding the maintenance of proper mental health conditions and making better choices for leading a happy life. Moreover, the growing popularity of spas and increasing consumption of functional foods and beverages to maintain personal care, the rising disposable incomes, and the rising influence of social media platforms and influencers promoting healthy lifestyles, fitness routines, and wellness products are other factors creating a favorable market outlook across the globe.

Health and Wellness Market Trends/Drivers:

Rising occurrence of various chronic diseases

As chronic diseases, such as diabetes, cardiovascular diseases, obesity, and certain types of cancer, become more prevalent, there is a heightened demand for products and services that focus on prevention and management. This includes dietary supplements, fitness programs, wellness coaching, disease management apps, and health monitoring devices. Moreover, consumers are seeking information and education about lifestyle choices, nutrition, and fitness to prevent the onset of chronic conditions. This has created opportunities for health and wellness businesses to offer educational resources, workshops, and programs to support informed decision-making. Besides, governments worldwide are implementing initiatives and policies to address the growing burden of chronic diseases, which is also creating a favorable environment for the health and wellness market.

Development of health monitoring tools

Wearable devices, such as fitness trackers, smartwatches, and health monitoring gadgets, enable individuals to track and monitor various health parameters in real time. These devices collect data on metrics like heart rate, sleep patterns, steps taken, calories burned, and more. This promotes self-awareness and empowers individuals to make informed decisions about their health and wellness routines. Moreover, mobile apps and wearable devices often include features like goal setting, reminders, and progress tracking, which can positively impact behavior change. By providing real-time feedback and incentives, these tools encourage individuals to adopt healthier habits, such as increasing physical activity, improving sleep patterns, or practicing stress reduction techniques, thus propelling the market growth.

Increasing number of companies providing health and wellness services

Corporate companies offering health and wellness services often make these services more accessible to a larger population by integrating health and wellness programs within the workplace to provide employees with the convenience and opportunity to prioritize their well-being. In addition, many corporate companies recognize the value of preventive care in reducing healthcare costs and improving employee productivity. As a result, they invest in health and wellness programs that emphasize prevention, such as fitness classes, nutrition counseling, stress management workshops, and health screenings. Moreover, corporate companies often collaborate with external wellness providers such as fitness centers, nutritionists, mental health professionals, and other wellness experts to offer a wider range of services and expertise to their employees, enhancing the overall quality and effectiveness of their health and wellness programs, thus augmenting the market growth.

Health and Wellness Industry Segmentation:

Breakup by Product Type:

- Functional Foods and Beverages

- Beauty and Personal Care Products

- Preventive and Personalized Medicinal Products

- Others

Beauty and personal care products dominate the market

Beauty and personal care routines involves engaging in beauty rituals, such as skincare routines that provide individuals with a sense of comfort, relaxation, and stress relief. As people increasingly prioritize self-care practices, the demand for beauty and personal care products continues to grow. Moreover, the rise of influencer culture and the influence of social media have significantly impacted the beauty and personal care market. Influencers and beauty bloggers on platforms like Instagram, YouTube, and TikTok showcase new products, share tutorials, and provide reviews, shaping consumer preferences and trends. Social media platforms have also made it easier for brands to reach and engage with their target audience, creating a powerful marketing and sales channel.

At present, there is an escalating demand for functional foods and beverages that provide additional health benefits beyond basic nutrition. By incorporating these functional products into their diet, consumers can proactively improve their well-being and reduce the risk of chronic diseases, thus influencing growth of this segment.

Breakup by Functionality:

- Nutrition & Weight Management

- Heart & Gut Health

- Immunity

- Bone Health

- Skin Health

- Others

Nutrition and weight management holds the largest share in the market

There is a growing awareness among individuals about the impact of diet and weight on their health as they are becoming conscious of the importance of consuming nutritious foods and managing their weight to maintain good health and prevent disease. This heightened awareness has led to an increased demand for products and services related to nutrition and weight management. Moreover, lifestyle-related diseases such as obesity, diabetes, and cardiovascular conditions are often closely tied to poor dietary habits and weight management issues. As a result, individuals are actively seeking solutions to address these health concerns, driving the demand for products and services that focus on nutrition and weight management.

Skin care has become an integral part of self-care and wellness routines. As a result, individuals are incorporating skincare rituals into their daily routines to relax, de-stress, and promote a sense of self-care and self-love. This focus on skin health contributes to the growth of this segment.

Breakup by Region:

- North America

- United States

- Canada

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Chile

- Peru

- Others

- Middle East and Africa

- Turkey

- Saudi Arabia

- Iran

- United Arab Emirates

- Others

North America exhibits a clear dominance, accounting for the largest health and wellness market share

The report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Europe (Germany, France, the United Kingdom, Italy, Spain, Russia, and others); Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Latin America (Brazil, Mexico, Argentina, Colombia, Chile, Peru, and others); and the Middle East and Africa (Turkey, Saudi Arabia, Iran, United Arab Emirates, and others). According to the report, North America holds the leading position in the market.

North America, particularly the United States and Canada, has a relatively high level of disposable income among its population. This higher purchasing power enables individuals to invest more in their health and wellness. As a result, people in the region actively seek out products, services, and experiences that support their health goals and lifestyle choices. Moreover, North America boasts a well-established and robust fitness and wellness industry. The region is home to numerous gyms, fitness centers, spas, wellness resorts, and health clubs. These establishments offer a wide range of services, including fitness classes, personal training, wellness programs, and specialized treatments. Besides, the region is home to many cutting-edge technology companies, start-ups, and research institutions focused on developing innovative products, digital health solutions, wearable devices, and mobile applications that cater to consumers' health and wellness needs. The availability of advanced technologies and digital platforms contributes to the market dominance in North America.

Competitive Landscape:

The competitive landscape of the health and wellness market is diverse and dynamic, with various companies operating across various sectors. The market encompasses a wide range of products, services, and industries, making competition intense and constantly evolving. Presently, the leading market players are expanding their portfolio of consumer health products, including skincare, baby care, oral care, and over-the-counter medications. They are also making strategic acquisitions and partnerships to enhance their presence in areas such as digital health and wellness. Moreover, various food and beverage companies have been focusing on the health and wellness market by introducing healthier product options and promoting balanced nutrition. They are reformulating their products to reduce salt, sugar, and artificial ingredients while increasing the inclusion of natural and functional ingredients. In addition, key players are investing in research and development activities to strengthen their market foothold.

The report has provided a comprehensive analysis of the competitive landscape in the global health and wellness market. Detailed profiles of all major companies have also been provided. Some of the key players in the market include:

- Amway Corporation

- Bayer AG

- Danone S.A

- David Lloyd Leisure Ltd.

- Fitness First India Pvt Ltd.

- Herbalife International of America, Inc.

- Holland and Barrett Retail Limited

- L'Oreal SA

- Nestle SA

- Procter & Gamble

- Unilever PLC

- Vitabiotics Ltd

Key Questions Answered in This Report

- 1.What was the global health and wellness market size in 2024?

- 2.What will be the global health and wellness market outlook during the forecast period 2025-2033?

- 3.What are the global health and wellness market drivers?

- 4.What are the major trends in the global health and wellness market?

- 5.What is the impact of COVID-19 on the global health and wellness market?

- 6.What is the global health and wellness market breakup by product type?

- 7.What is the global health and wellness market breakup by functionality?

- 8.What are the major regions in the global health and wellness market?

Table of Contents

1 Preface

2 Scope and Methodology

- 2.1 Objectives of the Study

- 2.2 Stakeholders

- 2.3 Data Sources

- 2.3.1 Primary Sources

- 2.3.2 Secondary Sources

- 2.4 Market Estimation

- 2.4.1 Bottom-Up Approach

- 2.4.2 Top-Down Approach

- 2.5 Forecasting Methodology

3 Executive Summary

4 Introduction

- 4.1 Overview

- 4.2 Key Industry Trends

5 Global Health and Wellness Market

- 5.1 Market Overview

- 5.2 Market Performance

- 5.3 Impact of COVID-19

- 5.4 Market Forecast

6 Market Breakup by Product Type

- 6.1 Functional Foods and Beverages

- 6.1.1 Market Trends

- 6.1.2 Market Forecast

- 6.2 Beauty and Personal Care Products

- 6.2.1 Market Trends

- 6.2.2 Market Forecast

- 6.3 Preventive and Personalized Medicinal Products

- 6.3.1 Market Trends

- 6.3.2 Market Forecast

- 6.4 Others

- 6.4.1 Market Trends

- 6.4.2 Market Forecast

7 Market Breakup by Functionality

- 7.1 Nutrition & Weight Management

- 7.1.1 Market Trends

- 7.1.2 Market Forecast

- 7.2 Heart & Gut Health

- 7.2.1 Market Trends

- 7.2.2 Market Forecast

- 7.3 Immunity

- 7.3.1 Market Trends

- 7.3.2 Market Forecast

- 7.4 Bone Health

- 7.4.1 Market Trends

- 7.4.2 Market Forecast

- 7.5 Skin Health

- 7.5.1 Market Trends

- 7.5.2 Market Forecast

- 7.6 Others

- 7.6.1 Market Trends

- 7.6.2 Market Forecast

8 Market Breakup by Region

- 8.1 North America

- 8.1.1 United States

- 8.1.1.1 Market Trends

- 8.1.1.2 Market Forecast

- 8.1.2 Canada

- 8.1.2.1 Market Trends

- 8.1.2.2 Market Forecast

- 8.1.1 United States

- 8.2 Europe

- 8.2.1 Germany

- 8.2.1.1 Market Trends

- 8.2.1.2 Market Forecast

- 8.2.2 France

- 8.2.2.1 Market Trends

- 8.2.2.2 Market Forecast

- 8.2.3 United Kingdom

- 8.2.3.1 Market Trends

- 8.2.3.2 Market Forecast

- 8.2.4 Italy

- 8.2.4.1 Market Trends

- 8.2.4.2 Market Forecast

- 8.2.5 Spain

- 8.2.5.1 Market Trends

- 8.2.5.2 Market Forecast

- 8.2.6 Russia

- 8.2.6.1 Market Trends

- 8.2.6.2 Market Forecast

- 8.2.7 Others

- 8.2.7.1 Market Trends

- 8.2.7.2 Market Forecast

- 8.2.1 Germany

- 8.3 Asia Pacific

- 8.3.1 China

- 8.3.1.1 Market Trends

- 8.3.1.2 Market Forecast

- 8.3.2 Japan

- 8.3.2.1 Market Trends

- 8.3.2.2 Market Forecast

- 8.3.3 India

- 8.3.3.1 Market Trends

- 8.3.3.2 Market Forecast

- 8.3.4 South Korea

- 8.3.4.1 Market Trends

- 8.3.4.2 Market Forecast

- 8.3.5 Australia

- 8.3.5.1 Market Trends

- 8.3.5.2 Market Forecast

- 8.3.6 Indonesia

- 8.3.6.1 Market Trends

- 8.3.6.2 Market Forecast

- 8.3.7 Others

- 8.3.7.1 Market Trends

- 8.3.7.2 Market Forecast

- 8.3.1 China

- 8.4 Latin America

- 8.4.1 Brazil

- 8.4.1.1 Market Trends

- 8.4.1.2 Market Forecast

- 8.4.2 Mexico

- 8.4.2.1 Market Trends

- 8.4.2.2 Market Forecast

- 8.4.3 Argentina

- 8.4.3.1 Market Trends

- 8.4.3.2 Market Forecast

- 8.4.4 Colombia

- 8.4.4.1 Market Trends

- 8.4.4.2 Market Forecast

- 8.4.5 Chile

- 8.4.5.1 Market Trends

- 8.4.5.2 Market Forecast

- 8.4.6 Peru

- 8.4.6.1 Market Trends

- 8.4.6.2 Market Forecast

- 8.4.7 Others

- 8.4.7.1 Market Trends

- 8.4.7.2 Market Forecast

- 8.4.1 Brazil

- 8.5 Middle East and Africa

- 8.5.1 Turkey

- 8.5.1.1 Market Trends

- 8.5.1.2 Market Forecast

- 8.5.2 Saudi Arabia

- 8.5.2.1 Market Trends

- 8.5.2.2 Market Forecast

- 8.5.3 Iran

- 8.5.3.1 Market Trends

- 8.5.3.2 Market Forecast

- 8.5.4 United Arab Emirates

- 8.5.4.1 Market Trends

- 8.5.4.2 Market Forecast

- 8.5.5 Others

- 8.5.5.1 Market Trends

- 8.5.5.2 Market Forecast

- 8.5.1 Turkey

9 SWOT Analysis

- 9.1 Overview

- 9.2 Strengths

- 9.3 Weaknesses

- 9.4 Opportunities

- 9.5 Threats

10 Value Chain Analysis

11 Porters Five Forces Analysis

- 11.1 Overview

- 11.2 Bargaining Power of Buyers

- 11.3 Bargaining Power of Suppliers

- 11.4 Degree of Competition

- 11.5 Threat of New Entrants

- 11.6 Threat of Substitutes

12 Competitive Landscape

- 12.1 Market Structure

- 12.2 Key Players

- 12.3 Profiles of Key Players

- 12.3.1 Amway Corp.

- 12.3.2 Bayer AG

- 12.3.3 Danone S.A.

- 12.3.4 David Lloyd Leisure Ltd.

- 12.3.5 Fitness First India Pvt Ltd.

- 12.3.6 Herbalife Nutrition Ltd.

- 12.3.7 Holland & Barrett Retail Limited

- 12.3.8 L'Oreal SA

- 12.3.9 Nestle SA

- 12.3.10 Procter & Gamble

- 12.3.11 Unilever PLC

- 12.3.12 Vitabiotics Ltd.