|

|

市場調査レポート

商品コード

1660893

自動車用超音波技術の世界市場:業界分析、規模、シェア、成長、動向、予測(2025年~2032年)Automotive Ultrasonic Technologies Market: Global Industry Analysis, Size, Share, Growth, Trends, and Forecast, 2025 - 2032 |

||||||

カスタマイズ可能

|

|||||||

| 自動車用超音波技術の世界市場:業界分析、規模、シェア、成長、動向、予測(2025年~2032年) |

|

出版日: 2025年02月14日

発行: Persistence Market Research

ページ情報: 英文 182 Pages

納期: 2~5営業日

|

全表示

- 概要

- 目次

世界の自動車用超音波技術の市場規模は、2025年に69億7,000万米ドルになるとみられ、2025年~2032年の予測期間に7.9%のCAGRで拡大し、2032年には118億8,000万米ドルに達すると予測されています。

自動車用超音波技術は、自動車産業における様々な目的のために超音波周波数の音波を使用する様々な用途を包含します。これらの技術は、パーキングセンサー、衝突回避システム、アダプティブクルーズコントロール、インテリアモニタリングシステムなどに広く利用されています。超音波センサーは、自動車の安全性、運転の利便性、性能の向上に不可欠です。これらの技術は、ADAS(先進運転支援システム)や自律走行機能の開発において極めて重要であり、将来の自動車技術革新にとって極めて重要です。

自動車用超音波技術市場は、自動車の安全機能に対する需要の増加、センサー技術の進歩、自律走行車や電気自動車の動向の高まりといった要因によって牽引されています。自動車メーカーが自動車の安全性向上に注力し、よりスマートな自動車に対する消費者の需要が高まる中、超音波技術は自動車システムの変革に重要な役割を果たすと期待されています。

自動車用超音波技術市場の成長を後押ししている主な要因はいくつかあります。駐車支援システム、近接センサー、衝突検知などの先進安全機能の採用が増加していることは、主要な促進要因の1つです。さらに、自律走行車の急速な開発と、自動車の安全基準に関する政府規制の増加が需要をさらに促進しています。自動車業界が運転体験の向上と事故削減のためにより高度な技術を統合し続けているため、超音波技術は不可欠な部品となっています。

さらに、自動駐車、物体検知、航続距離最適化などのために高度なセンシング・システムを必要とする電気自動車(EV)への動向も、車載用超音波技術の需要に寄与しています。

自動車用超音波技術市場には、いくつかの成長機会があります。自律走行とADASの進歩が続くと、高性能超音波センサーの需要が高まる。人工知能(AI)と機械学習(ML)を超音波システムに統合することで、これらの技術の精度が向上し、自動運転車への応用に新たな道が開ける可能性があります。

さらに、電気自動車インフラの拡大とコネクテッドカーやスマートモビリティの動向の高まりが相まって、市場参入企業に革新的で最先端のソリューションを提供する機会を提供しています。自動車メーカーやセンサーメーカーによる研究開発投資の増加は、市場拡大をさらに加速させるとみられています。

当レポートでは、世界の自動車用超音波技術市場について調査し、周波数帯別、車両タイプ別、用途別、地域別動向、および市場に参入する企業のプロファイルなどを提供しています。

目次

第1章 エグゼクティブサマリー

第2章 市場概要

- 市場の範囲と定義

- バリューチェーン分析

- マクロ経済要因

- 予測要因- 関連性と影響

- COVID-19の影響評価

- PESTLE分析

- ポーターのファイブフォース分析

- 地政学的緊張:市場への影響

- 規制と技術の情勢

第3章 市場力学

- 促進要因

- 抑制要因

- 機会

- 動向

第4章 価格動向分析、2019年~2032年

第5章 世界の自動車用超音波技術市場の見通し

- 主なハイライト

- 世界の自動車用超音波技術市場の見通し:周波数帯別

- 世界の自動車用超音波技術市場の見通し:車両タイプ別

- 世界の自動車用超音波技術市場の見通し:用途別

第6章 世界の自動車用超音波技術市場の見通し:地域別

- 主なハイライト

- 過去の市場規模(10億米ドル)の分析、地域別、2019年~2024年

- 現在の市場規模(10億米ドル)の分析と予測、地域別、2025年~2032年

- 市場の魅力分析:地域別

第7章 北米の自動車用超音波技術市場の見通し

第8章 欧州の自動車用超音波技術市場の見通し

第9章 東アジアの自動車用超音波技術市場の見通し

第10章 南アジアおよびオセアニアの自動車用超音波技術市場の見通し

第11章 ラテンアメリカの自動車用超音波技術市場の見通し

第12章 中東・アフリカの自動車用超音波技術市場の見通し

第13章 競合情勢

- 市場シェア分析、2025年

- 市場構造

- 企業プロファイル

- Aisin Corporation

- Continental Ag

- Denso Corporation

- Elmos Semiconductor SE

- Hyundai Motors

- Magna International Inc

- Murata Manufacturing Co. Ltd

- Robert Bosch Gmbh

- Tdk Corporation

- Valeo

第14章 付録

Persistence Market Research has recently released a comprehensive report on the global market for automotive ultrasonic technologies. The report provides an in-depth analysis of key market dynamics, including drivers, trends, opportunities, and challenges, delivering valuable insights into the market structure. This research publication offers exclusive data and forecasts the anticipated growth trajectory of the automotive ultrasonic technologies market from 2025 to 2032.

Key Insights:

- Automotive Ultrasonic Technologies Market Size (2025E): USD 6.97 Billion

- Projected Market Value (2032F): USD 11.88 Billion

- Global Market Growth Rate (CAGR 2025 to 2032): 7.9%

Automotive Ultrasonic Technologies Market - Report Scope:

Automotive ultrasonic technologies encompass a range of applications using sound waves at ultrasonic frequencies for various purposes within the automotive industry. These technologies are widely used in parking sensors, collision avoidance systems, adaptive cruise control, and interior monitoring systems. Ultrasonic sensors are integral in enhancing vehicle safety, driving convenience, and performance. These technologies have been pivotal in the development of advanced driver assistance systems (ADAS) and autonomous driving features, which are crucial for the future of automotive innovation.

The automotive ultrasonic technologies market is driven by factors such as the increasing demand for vehicle safety features, advancements in sensor technology, and the growing trend of autonomous and electric vehicles. As automakers focus on improving vehicle safety and the consumer demand for smarter vehicles increases, ultrasonic technologies are expected to play a significant role in transforming automotive systems.

Market Growth Drivers:

Several key factors are driving the growth of the automotive ultrasonic technologies market. The rising adoption of advanced safety features, such as parking assist systems, proximity sensors, and collision detection, is one of the primary drivers. Additionally, the rapid development of autonomous vehicles and increasing government regulations concerning vehicle safety standards are further fueling demand. As the automotive industry continues to integrate more sophisticated technologies to improve driving experience and reduce accidents, ultrasonic technologies have become essential components.

Moreover, the trend toward electric vehicles (EVs), which require enhanced sensing systems for automated parking, object detection, and range optimization, is contributing to the demand for automotive ultrasonic technologies.

Market Restraints:

Despite its promising growth prospects, the automotive ultrasonic technologies market faces some challenges. High production costs and the complexity of integrating these technologies into existing vehicle platforms can create barriers, particularly for smaller manufacturers. Additionally, the need for precision in sensor calibration and environmental factors, such as weather conditions, can affect the performance of ultrasonic systems. These factors may lead to challenges in cost optimization and market adoption, particularly in budget-friendly vehicle segments.

Market Opportunities:

The automotive ultrasonic technologies market presents several opportunities for growth. As advancements in autonomous driving and ADAS continue, the demand for high-performance ultrasonic sensors will rise. The integration of artificial intelligence (AI) and machine learning (ML) with ultrasonic systems could enhance the accuracy of these technologies, opening new avenues for application in self-driving cars.

Additionally, the expansion of electric vehicle infrastructure, combined with the growing trend of connected cars and smart mobility, provides opportunities for market players to innovate and offer cutting-edge solutions. Increased investments in research and development by automakers and sensor manufacturers will further accelerate market expansion.

Key Questions Answered in the Report:

- What are the primary factors driving the growth of the automotive ultrasonic technologies market globally?

- How is the adoption of advanced driver assistance systems (ADAS) influencing the demand for ultrasonic technologies?

- Which applications and segments are expected to experience the highest growth during the forecast period?

- What are the major challenges faced by manufacturers in implementing ultrasonic technologies in vehicles?

- Who are the key players influencing the automotive ultrasonic technologies market, and what strategies are they adopting to expand their market share?

Competitive Intelligence and Business Strategy:

Leading players in the automotive ultrasonic technologies market, including companies such as Continental AG, Bosch, Denso Corporation, and Delphi Technologies, are focusing on technological innovation, product development, and strategic partnerships to strengthen their market position. These companies are investing in the development of next-generation sensors, improving their integration with ADAS, and enhancing sensor accuracy in challenging environments.

Collaborations with automotive manufacturers, as well as investments in the development of cost-effective solutions, are key strategies for market penetration. Furthermore, companies are exploring opportunities in the rapidly growing electric vehicle segment, where ultrasonic technologies can play a significant role in optimizing vehicle functionality.

The automotive ultrasonic technologies market is poised for significant growth in the coming years, driven by the increasing demand for vehicle safety and the rise of autonomous and electric vehicles. Key players will continue to innovate and collaborate to meet the evolving needs of the automotive industry.

Key Companies Profiled:

- Aisin Corporation

- Continental Ag

- Denso Corporation

- Elmos Semiconductor SE

- Hyundai Motors

- Magna International Inc

- Murata Manufacturing Co. Ltd

- Robert Bosch Gmbh

- Tdk Corporation

- Valeo

Automotive Ultrasonic Technologies Market Segmentation

By Frequency Range

- 20kHz to 50kHz

- 50kHz to 150kHz

- 150kHz to 250kHz

- Above 250kHz

By Vehicle Type

- ICE

- Passenger Vehicles

- Commercial Vehicles

- Electric Vehicles

By Distribution Channel

- Park Assist

- Blind Spot Detection

- Collision Avoidance System

- Adaptive Cruise Control

By Region

- North America

- Europe

- East Asia

- South Asia and Oceania

- Middle East and Africa

- Latin America

Table of Contents

1. Executive Summary

- 1.1. Global Automotive Ultrasonic Technologies Market Snapshot 2025 - 2032

- 1.2. Market Opportunity Assessment, 2025 - 2032, US$ Bn

- 1.3. Key Market Trends

- 1.4. Industry Developments and Key Market Events

- 1.5. Demand Side and Supply Side Analysis

- 1.6. PMR Analysis and Recommendations

2. Market Overview

- 2.1. Market Scope and Definitions

- 2.2. Value Chain Analysis

- 2.3. Macro-Economic Factors

- 2.3.1. Global GDP Outlook

- 2.3.2. Global Automotive Sales by Region

- 2.3.3. Global Automotive Sales by Vehicle Type

- 2.3.4. Global EV Sales Overview

- 2.4. Forecast Factors - Relevance and Impact

- 2.5. COVID-19 Impact Assessment

- 2.6. PESTLE Analysis

- 2.7. Porter's Five Forces Analysis

- 2.8. Geopolitical Tensions: Market Impact

- 2.9. Regulatory and Technology Landscape

3. Market Dynamics

- 3.1. Drivers

- 3.2. Restraints

- 3.3. Opportunities

- 3.4. Trends

4. Price Trend Analysis, 2019 - 2032

- 4.1. Region-wise Price Analysis

- 4.2. Price by Segments

- 4.3. Price Impact Factors

5. Global Automotive Ultrasonic Technologies Market Outlook:

- 5.1. Key Highlights

- 5.2. Global Automotive Ultrasonic Technologies Market Outlook: Frequency Range

- 5.2.1. Introduction/Key Findings

- 5.2.2. Historical Market Size (US$ Bn) Analysis by Frequency Range, 2019 - 2024

- 5.2.3. Current Market Size (US$ Bn) Analysis and Forecast, by Frequency Range, 2025 - 2032

- 5.2.3.1. 20kHz to 50kHz

- 5.2.3.2. 50kHz to 150kHz

- 5.2.3.3. 150kHz to 250kHz

- 5.2.3.4. Above 250kHz

- 5.2.4. Market Attractiveness Analysis: Frequency Range

- 5.3. Global Automotive Ultrasonic Technologies Market Outlook: Vehicle Type

- 5.3.1. Introduction/Key Findings

- 5.3.2. Historical Market Size (US$ Bn) Analysis by Vehicle Type, 2019 - 2024

- 5.3.3. Current Market Size (US$ Bn) Analysis and Forecast, by Vehicle Type, 2025 - 2032

- 5.3.3.1. ICE

- 5.3.3.1.1. Passenger Vehicles

- 5.3.3.1.2. Commercial Vehicles

- 5.3.3.2. Electric Vehicles

- 5.3.3.1. ICE

- 5.3.4. Market Attractiveness Analysis: Vehicle Type

- 5.4. Global Automotive Ultrasonic Technologies Market Outlook: Application

- 5.4.1. Introduction/Key Findings

- 5.4.2. Historical Market Size (US$ Bn) Analysis by Application, 2019 - 2024

- 5.4.3. Current Market Size (US$ Bn) Analysis and Forecast, by Application, 2025 - 2032

- 5.4.3.1. Park Assist

- 5.4.3.2. Blind Spot Detection

- 5.4.3.3. Collision Avoidance System

- 5.4.3.4. Adaptive Cruise Control

- 5.4.3.5. Others

- 5.4.4. Market Attractiveness Analysis: Application

6. Global Automotive Ultrasonic Technologies Market Outlook: Region

- 6.1. Key Highlights

- 6.2. Historical Market Size (US$ Bn) Analysis by Region, 2019 - 2024

- 6.3. Current Market Size (US$ Bn) Analysis and Forecast, by Region, 2025 - 2032

- 6.3.1. North America

- 6.3.2. Europe

- 6.3.3. East Asia

- 6.3.4. South Asia & Oceania

- 6.3.5. Latin America

- 6.3.6. Middle East & Africa

- 6.4. Market Attractiveness Analysis: Region

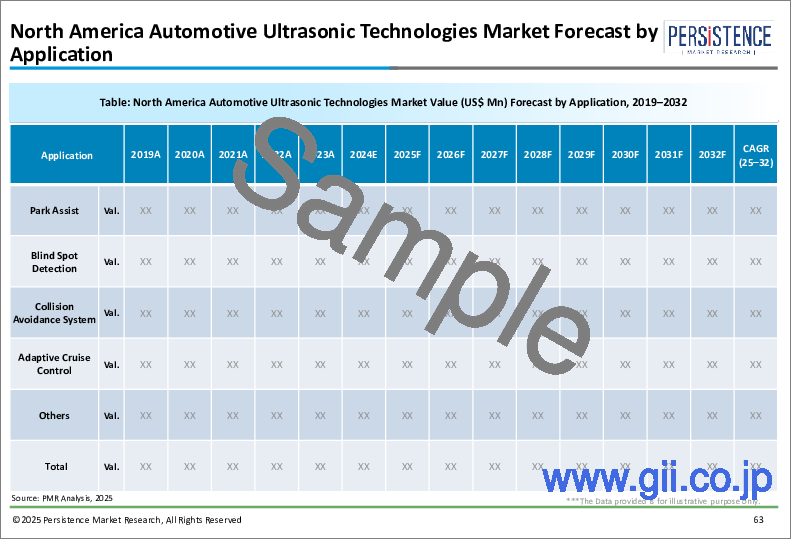

7. North America Automotive Ultrasonic Technologies Market Outlook:

- 7.1. Key Highlights

- 7.2. Pricing Analysis

- 7.3. North America Market Size (US$ Bn) Analysis and Forecast, by Country, 2025 - 2032

- 7.3.1. U.S.

- 7.3.2. Canada

- 7.4. North America Market Size (US$ Bn) Analysis and Forecast, by Frequency Range, 2025 - 2032

- 7.4.1. 20kHz to 50kHz

- 7.4.2. 50kHz to 150kHz

- 7.4.3. 150kHz to 250kHz

- 7.4.4. Above 250kHz

- 7.5. North America Market Size (US$ Bn) Analysis and Forecast, by Vehicle Type, 2025 - 2032

- 7.5.1. ICE

- 7.5.1.1. Passenger Vehicles

- 7.5.1.2. Commercial Vehicles

- 7.5.2. Electric Vehicles

- 7.5.1. ICE

- 7.6. North America Market Size (US$ Bn) Analysis and Forecast, by Application, 2025 - 2032

- 7.6.1. Park Assist

- 7.6.2. Blind Spot Detection

- 7.6.3. Collision Avoidance System

- 7.6.4. Adaptive Cruise Control

- 7.6.5. Others

8. Europe Automotive Ultrasonic Technologies Market Outlook:

- 8.1. Key Highlights

- 8.2. Pricing Analysis

- 8.3. Europe Market Size (US$ Bn) Analysis and Forecast, by Country, 2025 - 2032

- 8.3.1. Germany

- 8.3.2. Italy

- 8.3.3. France

- 8.3.4. U.K.

- 8.3.5. Spain

- 8.3.6. Russia

- 8.3.7. Rest of Europe

- 8.4. Europe Market Size (US$ Bn) Analysis and Forecast, by Frequency Range, 2025 - 2032

- 8.4.1. 20kHz to 50kHz

- 8.4.2. 50kHz to 150kHz

- 8.4.3. 150kHz to 250kHz

- 8.4.4. Above 250kHz

- 8.5. Europe Market Size (US$ Bn) Analysis and Forecast, by Vehicle Type, 2025 - 2032

- 8.5.1. ICE

- 8.5.1.1. Passenger Vehicles

- 8.5.1.2. Commercial Vehicles

- 8.5.2. Electric Vehicles

- 8.5.1. ICE

- 8.6. Europe Market Size (US$ Bn) Analysis and Forecast, by Application, 2025 - 2032

- 8.6.1. Park Assist

- 8.6.2. Blind Spot Detection

- 8.6.3. Collision Avoidance System

- 8.6.4. Adaptive Cruise Control

- 8.6.5. Others

9. East Asia Automotive Ultrasonic Technologies Market Outlook:

- 9.1. Key Highlights

- 9.2. Pricing Analysis

- 9.3. East Asia Market Size (US$ Bn) Analysis and Forecast, by Country, 2025 - 2032

- 9.3.1. China

- 9.3.2. Japan

- 9.3.3. South Korea

- 9.4. East Asia Market Size (US$ Bn) Analysis and Forecast, by Frequency Range, 2025 - 2032

- 9.4.1. 20kHz to 50kHz

- 9.4.2. 50kHz to 150kHz

- 9.4.3. 150kHz to 250kHz

- 9.4.4. Above 250kHz

- 9.5. East Asia Market Size (US$ Bn) Analysis and Forecast, by Vehicle Type, 2025 - 2032

- 9.5.1. ICE

- 9.5.1.1. Passenger Vehicles

- 9.5.1.2. Commercial Vehicles

- 9.5.2. Electric Vehicles

- 9.5.1. ICE

- 9.6. East Asia Market Size (US$ Bn) Analysis and Forecast, by Application, 2025 - 2032

- 9.6.1. Park Assist

- 9.6.2. Blind Spot Detection

- 9.6.3. Collision Avoidance System

- 9.6.4. Adaptive Cruise Control

- 9.6.5. Others

10. South Asia & Oceania Automotive Ultrasonic Technologies Market Outlook:

- 10.1. Key Highlights

- 10.2. Pricing Analysis

- 10.3. South Asia & Oceania Market Size (US$ Bn) Analysis and Forecast, by Country, 2025 - 2032

- 10.3.1. India

- 10.3.2. Southeast Asia

- 10.3.3. ANZ

- 10.3.4. Rest of SAO

- 10.4. South Asia & Oceania Market Size (US$ Bn) Analysis and Forecast, by Frequency Range, 2025 - 2032

- 10.4.1. 20kHz to 50kHz

- 10.4.2. 50kHz to 150kHz

- 10.4.3. 150kHz to 250kHz

- 10.4.4. Above 250kHz

- 10.5. South Asia & Oceania Market Size (US$ Bn) Analysis and Forecast, by Vehicle Type, 2025 - 2032

- 10.5.1. ICE

- 10.5.1.1. Passenger Vehicles

- 10.5.1.2. Commercial Vehicles

- 10.5.2. Electric Vehicles

- 10.5.1. ICE

- 10.6. South Asia & Oceania Market Size (US$ Bn) Analysis and Forecast, by Application, 2025 - 2032

- 10.6.1. Park Assist

- 10.6.2. Blind Spot Detection

- 10.6.3. Collision Avoidance System

- 10.6.4. Adaptive Cruise Control

- 10.6.5. Others

11. Latin America Automotive Ultrasonic Technologies Market Outlook:

- 11.1. Key Highlights

- 11.2. Pricing Analysis

- 11.3. Latin America Market Size (US$ Bn) Analysis and Forecast, by Country, 2025 - 2032

- 11.3.1. Brazil

- 11.3.2. Mexico

- 11.3.3. Rest of LATAM

- 11.4. Latin America Market Size (US$ Bn) Analysis and Forecast, by Frequency Range, 2025 - 2032

- 11.4.1. 20kHz to 50kHz

- 11.4.2. 50kHz to 150kHz

- 11.4.3. 150kHz to 250kHz

- 11.4.4. Above 250kHz

- 11.5. Latin America Market Size (US$ Bn) Analysis and Forecast, by Vehicle Type, 2025 - 2032

- 11.5.1. ICE

- 11.5.1.1. Passenger Vehicles

- 11.5.1.2. Commercial Vehicles

- 11.5.2. Electric Vehicles

- 11.5.1. ICE

- 11.6. Latin America Market Size (US$ Bn) Analysis and Forecast, by Application, 2025 - 2032

- 11.6.1. Park Assist

- 11.6.2. Blind Spot Detection

- 11.6.3. Collision Avoidance System

- 11.6.4. Adaptive Cruise Control

- 11.6.5. Others

12. Middle East & Africa Automotive Ultrasonic Technologies Market Outlook:

- 12.1. Key Highlights

- 12.2. Pricing Analysis

- 12.3. Middle East & Africa Market Size (US$ Bn) Analysis and Forecast, by Country, 2025 - 2032

- 12.3.1. GCC Countries

- 12.3.2. South Africa

- 12.3.3. Northern Africa

- 12.3.4. Rest of MEA

- 12.4. Middle East & Africa Market Size (US$ Bn) Analysis and Forecast, by Frequency Range, 2025 - 2032

- 12.4.1. 20kHz to 50kHz

- 12.4.2. 50kHz to 150kHz

- 12.4.3. 150kHz to 250kHz

- 12.4.4. Above 250kHz

- 12.5. Middle East & Africa Market Size (US$ Bn) Analysis and Forecast, by Vehicle Type, 2025 - 2032

- 12.5.1. ICE

- 12.5.1.1. Passenger Vehicles

- 12.5.1.2. Commercial Vehicles

- 12.5.2. Electric Vehicles

- 12.5.1. ICE

- 12.6. Middle East & Africa Market Size (US$ Bn) Analysis and Forecast, by Application, 2025 - 2032

- 12.6.1. Park Assist

- 12.6.2. Blind Spot Detection

- 12.6.3. Collision Avoidance System

- 12.6.4. Adaptive Cruise Control

- 12.6.5. Others

13. Competition Landscape

- 13.1. Market Share Analysis, 2025

- 13.2. Market Structure

- 13.2.1. Competition Intensity Mapping

- 13.2.2. Competition Dashboard

- 13.3. Company Profiles

- 13.3.1. Aisin Corporation

- 13.3.1.1. Company Overview

- 13.3.1.2. Product Portfolio/Offerings

- 13.3.1.3. Key Financials

- 13.3.1.4. SWOT Analysis

- 13.3.1.5. Company Strategy and Key Developments

- 13.3.2. Continental Ag

- 13.3.3. Denso Corporation

- 13.3.4. Elmos Semiconductor SE

- 13.3.5. Hyundai Motors

- 13.3.6. Magna International Inc

- 13.3.7. Murata Manufacturing Co. Ltd

- 13.3.8. Robert Bosch Gmbh

- 13.3.9. Tdk Corporation

- 13.3.10. Valeo

- 13.3.1. Aisin Corporation

14. Appendix

- 14.1. Research Methodology

- 14.2. Research Assumptions

- 14.3. Acronyms and Abbreviations