|

|

市場調査レポート

商品コード

1642755

モーター修理およびメンテナンス市場レポート:タイプ、サービス、最終用途産業、地域別、2025年~2033年Motor Repair and Maintenance Market Report by Type (General Repair, Overhaul), Service (On-site Service, Off-site Service), End Use Industry (Utilities, HVAC, Food and Beverage, Mining, and Others), and Region 2025-2033 |

||||||

カスタマイズ可能

|

|||||||

| モーター修理およびメンテナンス市場レポート:タイプ、サービス、最終用途産業、地域別、2025年~2033年 |

|

出版日: 2025年01月18日

発行: IMARC

ページ情報: 英文 142 Pages

納期: 2~3営業日

|

全表示

- 概要

- 図表

- 目次

モーター修理およびメンテナンスの世界市場規模は2024年に333億米ドルに達しました。IMARC Groupは、2025年から2033年にかけての成長率(CAGR)は1.1%で、2033年には366億米ドルに達すると予測しています。電気自動車(EV)の購入が増加していること、持続可能性とエネルギー効率への注目が高まっていること、研修プログラムの増加や企業と教育機関の提携が増加していることなどが、市場を推進している主な要因です。

モーター修理およびメンテナンスとは、様々な用途に使用される電気モーターの適切な機能、信頼性、寿命を確保するための実践とプロセスを指します。モータの診断、トラブルシューティング、修理、最適化を行い、効率的で安全な運転を維持することを目的とした活動が含まれます。目視検査、試験、データ分析を通じてモーターの問題の根本原因を特定します。また、オーバーヒート、振動、異音、性能低下などの特定の問題にも対処します。ベアリング、巻線、コンデンサ、ブラシなどの不良部品を交換し、モーターを最適な状態に回復させます。

現在、定期的なメンテナンスがモータの寿命を延ばし、交換の必要性を遅らせることから、モータの修理・メンテナンスサービスに対する需要が増加しており、市場の成長を後押ししています。これに加え、緊急修理や早期の交換に対処するよりも経済的であることから、モーター修理およびメンテナンスサービスへの投資が増加していることも、市場の成長に寄与しています。さらに、潜在的な危険性を特定し是正することで職場の安全性を高めるため、定期的な検査とメンテナンスが重視されるようになっていることも、市場の見通しを良好なものにしています。これとは別に、熟練技術者の不足に対処するための研修プログラムの開発や企業と教育機関との提携が増加していることが、市場の成長を強化しています。さらに、二酸化炭素排出量を削減するため、エネルギー効率の高いモーターの採用に注目が集まっていることも、市場の成長を後押ししています。

モーター修理およびメンテナンス市場動向/促進要因:

電気自動車(EV)購入の増加

電気自動車(EV)の普及がモーター修理およびメンテナンス市場にプラスの影響を与えています。EVの台頭は、EVの修理とメンテナンスの専門スキルを持つ技術者の需要を生み出しています。そのため、バッテリー、電気ドライブトレイン、充電インフラなど、EV特有のシステムを扱うために必要な専門知識を習得するための、整備士向けのトレーニングプログラムや資格の出現につながっています。EVは、バッテリー管理システムや回生ブレーキシステムなどの先進技術に大きく依存しています。その結果、修理・メンテナンス業者は、これらのハイテク・コンポーネントを効果的に修理するために必要な診断ツールや機器の取得に投資し、その能力を高める必要があります。

持続可能性とエネルギー効率への注目の高まり

持続可能性とエネルギー効率の重視の高まりは、モーター修理およびメンテナンス市場にプラスの影響を与えています。産業界や企業は二酸化炭素排出量を削減することの重要性をますます認識するようになっており、モーターシステムを含め、より効率的で環境に優しいソリューションを求めています。さらに、持続可能性の重視は、モーター修理およびメンテナンスの実践における技術革新を促しています。サービスプロバイダーは、モーターの効率を最適化し、寿命を延ばし、廃棄物を最小限に抑える技術を開発しています。これは環境保全に貢献し、企業にとってモーター運用の全体的な費用対効果を高める。さらに市場は、モノのインターネット(IoT)センサーやデータ分析などの先進技術によって可能になった予知保全などの事前保全戦略へのシフトを目の当たりにしています。このアプローチは、問題が拡大する前に潜在的な問題を特定し、ダウンタイムと頻繁な修理の必要性を削減するのに役立ちます。

高度な診断技術とメンテナンス技術の統合が進む

高度な診断技術とメンテナンス技術の統合は、モーター修理およびメンテナンス市場に好影響を及ぼしています。これらの進歩は、モーター修理およびメンテナンスプロセスの効率と効果を高め、企業と消費者の双方に利益をもたらしています。これに加えて、高度な診断ツールを活用することで、技術者はモータ内の問題を迅速に特定して対処することができ、ダウンタイムを短縮して生産中断を最小限に抑えることができます。その結果、モーターに依存している企業にとっては、操業の継続性が向上し、全体的な生産性が向上します。さらに、正確な診断によって的を絞った修理が可能になり、モーター部品全体の交換に伴う不必要なコストを削減することができます。さらに、モノのインターネット(IoT)や機械学習(ML)などの技術の統合により、自身の性能を監視し、パラメーターを自動的に調整し、エネルギー消費を最適化できるスマートモーターシステムの開発が進んでいます。

目次

第1章 序文

第2章 調査範囲と調査手法

- 調査の目的

- ステークホルダー

- データソース

- 一次情報

- 二次情報

- 市場推定

- ボトムアップアプローチ

- トップダウンアプローチ

- 調査手法

第3章 エグゼクティブサマリー

第4章 イントロダクション

- 概要

- 主要業界動向

第5章 世界のモーター修理およびメンテナンス市場

- 市場概要

- 市場実績

- COVID-19の影響

- 市場内訳:タイプ別

- 市場内訳:サービス別

- 市場内訳:最終用途産業別

- 市場内訳:地域別

- 市場予測

- SWOT分析

- 概要

- 強み

- 弱み

- 機会

- 脅威

- バリューチェーン分析

- 研究開発

- 原材料・機器調達

- 修理・メンテナンス会社

- 販売業者および小売業者

- オンサイトサービス

- エンドユーザー

- ポーターのファイブフォース分析

- 概要

- 買い手の交渉力

- 供給企業の交渉力

- 競合の程度

- 新規参入業者の脅威

- 代替品の脅威

- 主要成功要因とリスク要因

第6章 市場内訳:タイプ別

- 一般的な修理

- ベアリング

- 市場動向

- 市場予測

- ステーター

- 市場動向

- 市場予測

- ローター

- 市場動向

- 市場予測

- その他

- 市場動向

- 市場予測

- ベアリング

- オーバーホール

- 市場動向

- 市場予測

第7章 市場内訳:サービス別

- オンサイトサービス

- 市場動向

- 市場予測

- オフサイトサービス

- 市場動向

- 市場予測

第8章 市場内訳:最終用途産業別

- 公共料金(水道、電気、ガス)

- 市場動向

- 市場予測

- HVAC

- 市場動向

- 市場予測

- 食品・飲料

- 市場動向

- 市場予測

- 鉱業

- 市場動向

- 市場予測

- その他

- 市場動向

- 市場予測

第9章 市場内訳:地域別

- 北米

- 市場動向

- 市場予測

- 欧州

- 市場動向

- 市場予測

- アジア太平洋地域

- 市場動向

- 市場予測

- その他地域

- 市場動向

- 市場予測

第10章 競合情勢

- 市場構造

- 主要企業

- 主要企業のプロファイル

- ABB Limited

- Siemens Aktiengesellschaft

- WEG Equipamentos Eletricos SA

- Regal Rexnord Corporation

- TECO E&M/TECO-Westinghouse

List of Figures

- Figure 1: Global: Motor Repair and Maintenance Market: Major Drivers and Challenges

- Figure 2: Global: Motor Repair and Maintenance Market: Sales Value (in Billion USD), 2019-2024

- Figure 3: Global: Motor Repair and Maintenance Market: Breakup by Type (in %), 2024

- Figure 4: Global: Motor Repair and Maintenance Market: Breakup by Service (in %), 2024

- Figure 5: Global: Motor Repair and Maintenance Market: Breakup by End Use Industry (in %), 2024

- Figure 6: Global: Motor Repair and Maintenance Market: Breakup by Region (in %), 2024

- Figure 7: Global: Motor Repair and Maintenance Market Forecast: Sales Value (in Billion USD), 2025-2033

- Figure 8: Global: Motor Repair and Maintenance Industry: SWOT Analysis

- Figure 9: Global: Motor Repair and Maintenance Industry: Value Chain Analysis

- Figure 10: Global: Motor Repair and Maintenance Industry: Porter's Five Forces Analysis

- Figure 11: Global: Motor Repair and Maintenance Market (General Repair): Sales Value (in Billion USD), 2019 & 2024

- Figure 12: Global: Motor Repair and Maintenance Market Forecast (General Repair): Sales Value (in Billion USD), 2025-2033

- Figure 13: Global: Motor Repair and Maintenance Market (General Repair-Bearing): Sales Value (in Billion USD), 2019 & 2024

- Figure 14: Global: Motor Repair and Maintenance Market Forecast (General Repair-Bearing): Sales Value (in Billion USD), 2025-2033

- Figure 15: Global: Motor Repair and Maintenance Market (General Repair- Stator): Sales Value (in Billion USD), 2019 & 2024

- Figure 16: Global: Motor Repair and Maintenance Market Forecast (General Repair- Stator): Sales Value (in Billion USD), 2025-2033

- Figure 17: Global: Motor Repair and Maintenance Market (General Repair- Rotor): Sales Value (in Billion USD), 2019 & 2024

- Figure 18: Global: Motor Repair and Maintenance Market Forecast (General Repair- Rotor): Sales Value (in Billion USD), 2025-2033

- Figure 19: Global: Motor Repair and Maintenance Market (Others General Repair): Sales Value (in Billion USD), 2019 & 2024

- Figure 20: Global: Motor Repair and Maintenance Market Forecast (Others General Repair): Sales Value (in Billion USD), 2025-2033

- Figure 21: Global: Motor Repair and Maintenance Market (Overhaul): Sales Value (in Billion USD), 2019 & 2024

- Figure 22: Global: Motor Repair and Maintenance Market Forecast (Overhaul): Sales Value (in Billion USD), 2025-2033

- Figure 23: Global: Motor Repair and Maintenance Market (On-site Service): Sales Value (in Billion USD), 2019 & 2024

- Figure 24: Global: Motor Repair and Maintenance Market Forecast (On-site Service): Sales Value (in Billion USD), 2025-2033

- Figure 25: Global: Motor Repair and Maintenance Market (Off-site Service): Sales Value (in Billion USD), 2019 & 2024

- Figure 26: Global: Motor Repair and Maintenance Market Forecast (Off-site Service): Sales Value (in Billion USD), 2025-2033

- Figure 27: Global: Motor Repair and Maintenance Market (in Utilities Sector): Sales Value (in Billion USD), 2019 & 2024

- Figure 28: Global: Motor Repair and Maintenance Market Forecast (in Utilities Sector): Sales Value (in Billion USD), 2025-2033

- Figure 29: Global: Motor Repair and Maintenance Market (in HVAC Industry): Sales Value (in Billion USD), 2019 & 2024

- Figure 30: Global: Motor Repair and Maintenance Market Forecast (in HVAC Industry): Sales Value (in Billion USD), 2025-2033

- Figure 31: Global: Motor Repair and Maintenance Market (in Food and Beverage Industry): Sales Value (in Billion USD), 2019 & 2024

- Figure 32: Global: Motor Repair and Maintenance Market Forecast (in Food and Beverage Industry): Sales Value (in Billion USD), 2025-2033

- Figure 33: Global: Motor Repair and Maintenance Market (in Mining Industry): Sales Value (in Billion USD), 2019 & 2024

- Figure 34: Global: Motor Repair and Maintenance Market Forecast (in Mining Industry): Sales Value (in Billion USD), 2025-2033

- Figure 35: Global: Motor Repair and Maintenance Market (in Other Industries): Sales Value (in Billion USD), 2019 & 2024

- Figure 36: Global: Motor Repair and Maintenance Market Forecast (in Other Industries): Sales Value (in Billion USD), 2025-2033

- Figure 37: North America: Motor Repair and Maintenance Market: Sales Value (in Billion USD), 2019 & 2024

- Figure 38: North America: Motor Repair and Maintenance Market Forecast: Sales Value (in Billion USD), 2025-2033

- Figure 39: Europe: Motor Repair and Maintenance Market: Sales Value (in Billion USD), 2019 & 2024

- Figure 40: Europe: Motor Repair and Maintenance Market Forecast: Sales Value (in Billion USD), 2025-2033

- Figure 41: Asia Pacific: Motor Repair and Maintenance Market: Sales Value (in Billion USD), 2019 & 2024

- Figure 42: Asia Pacific: Motor Repair and Maintenance Market Forecast: Sales Value (in Billion USD), 2025-2033

- Figure 43: Rest of the World: Motor Repair and Maintenance Market: Sales Value (in Billion USD), 2019 & 2024

- Figure 44: Rest of the World: Motor Repair and Maintenance Market Forecast: Sales Value (in Billion USD), 2025-2033

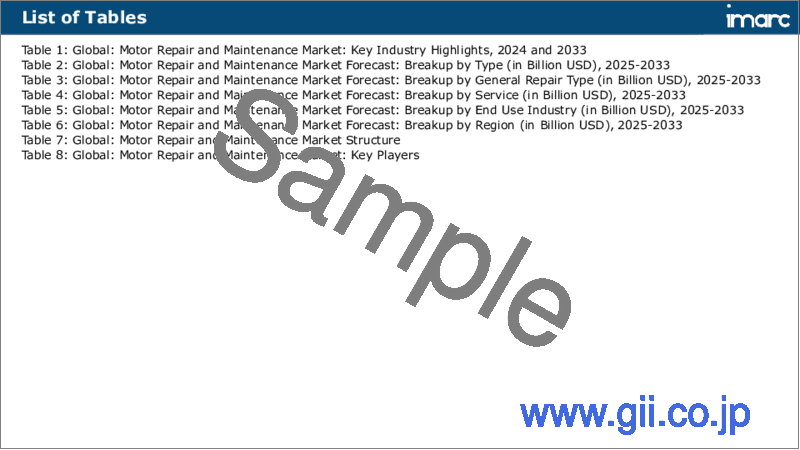

List of Tables

- Table 1: Global: Motor Repair and Maintenance Market: Key Industry Highlights, 2024 and 2033

- Table 2: Global: Motor Repair and Maintenance Market Forecast: Breakup by Type (in Billion USD), 2025-2033

- Table 3: Global: Motor Repair and Maintenance Market Forecast: Breakup by General Repair Type (in Billion USD), 2025-2033

- Table 4: Global: Motor Repair and Maintenance Market Forecast: Breakup by Service (in Billion USD), 2025-2033

- Table 5: Global: Motor Repair and Maintenance Market Forecast: Breakup by End Use Industry (in Billion USD), 2025-2033

- Table 6: Global: Motor Repair and Maintenance Market Forecast: Breakup by Region (in Billion USD), 2025-2033

- Table 7: Global: Motor Repair and Maintenance Market Structure

- Table 8: Global: Motor Repair and Maintenance Market: Key Players

The global motor repair and maintenance market size reached USD 33.3 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 36.6 Billion by 2033, exhibiting a growth rate (CAGR) of 1.1% during 2025-2033. The growing purchase of electric vehicles (EVs), rising focus on sustainability and energy efficiency, and increasing number of training programs and partnerships between companies and educational institutions are some of the major factors propelling the market.

Motor repair and maintenance refer to the practices and processes involved in ensuring the proper functioning, reliability, and longevity of electric motors used in various applications. They encompass activities that aim to diagnose, troubleshoot, repair, and optimize motors to keep them operating efficiently and safely. They involve identifying the root causes of motor issues through visual inspection, testing, and data analysis. They also address specific problems, such as overheating, vibration, abnormal noise, or reduced performance. They assist in replacing faulty components, such as bearings, windings, capacitors, or brushes, and restoring the motor to its optimal condition.

At present, the increasing demand for motor repair and maintenance services as regular maintenance enhances the operational life of motors, delaying the need for replacements is impelling the growth of the market. Besides this, the rising investment in motor repair and maintenance services, as that is more economical than dealing with emergency repairs or premature replacements, is contributing to the growth of the market. In addition, the growing emphasis on regular inspections and maintenance to enhance workplace safety by identifying and rectifying potential hazards is offering a favorable market outlook. Apart from this, the increasing development of training programs and partnerships between companies and educational institutions, addressing the lack of skilled technicians, is strengthening the growth of the market. Additionally, the rising focus on adopting energy-efficient motors to reduce carbon emissions is bolstering the growth of the market.

Motor Repair and Maintenance Market Trends/Drivers:

Growing purchase of electric vehicles (EVs)

The increasing popularity of electric vehicles (EVs) is positively impacting the motor repair and maintenance market. The rise of EVs is creating a demand for technicians with specialized skills in EV repair and maintenance. This is leading to the emergence of training programs and certifications for mechanics to acquire the necessary expertise in handling EV-specific systems, such as batteries, electric drivetrains, and charging infrastructure. EVs rely heavily on advanced technologies, such as battery management systems and regenerative braking systems. As a result, repair and maintenance providers need to invest in acquiring the necessary diagnostic tools and equipment to effectively service these high-tech components, thereby enhancing their capabilities.

Rising focus on sustainability and energy efficiency

The rising emphasis on sustainability and energy efficiency is positively impacting the motor repair and maintenance market. Besides this, as industries and businesses increasingly recognize the importance of lowering their carbon footprint, they are seeking more efficient and eco-friendly solutions for their operations, including motor systems. Moreover, the emphasis on sustainability is driving innovations in motor repair and maintenance practices. Service providers are developing techniques to optimize motor efficiency, extend their lifespan, and minimize waste. This contributes to environmental preservation and enhances the overall cost-effectiveness of motor operations for businesses. Furthermore, the market is witnessing a shift towards proactive maintenance strategies, such as predictive maintenance, enabled by advanced technologies, including Internet of Things (IoT) sensors and data analytics. This approach helps identify potential issues before they escalate, reducing downtime and the need for frequent repairs.

Increasing integration of advanced diagnostics and maintenance technologies

The integration of advanced diagnostics and maintenance technologies is exerting a positive impact on the motor repair and maintenance market. These advancements are enhancing the efficiency and effectiveness of motor repair and maintenance processes, thereby benefiting both businesses and consumers. Besides this, by leveraging advanced diagnostic tools, technicians can quickly identify and address issues within motors, reducing downtime and minimizing production disruptions. This results in improved operational continuity and higher overall productivity for businesses that rely on motors for their operations. Additionally, accurate diagnostics enable targeted repairs, reducing unnecessary costs associated with replacing entire motor components. Furthermore, the integration of technologies like Internet of Things (IoT) and machine learning (ML) is leading to the development of smart motor systems, which can monitor their own performance, automatically adjust parameters, and optimize energy consumption.

Motor Repair and Maintenance Industry Segmentation:

Breakup by Type:

General Repair

Bearing

Stator

Rotor

Others

Overhaul

General repair (bearing, stator, rotor, and others) dominates the market

General repair pertains to the comprehensive restoration of vital components such as bearings, stators, rotors, and other integral parts of electric motors. It can significantly extend the operational lifespan of electric motors. By addressing wear and tear, these repairs prevent premature motor failure and the need for costly replacements. Besides this, repaired components ensure that electric motors operate at peak efficiency levels. This efficiency enhancement leads to energy savings and reduced operational costs over time. Moreover, skilled technicians performing repairs are adept at identifying underlying issues that could impact motor performance. This diagnostic expertise helps in addressing potential problems proactively, preventing further damage.

Breakup by Service:

On-site Service

Off-site Service

On-site service holds the largest share in the market

On-site motor repair services offer the convenience of addressing issues directly at the location of the client, minimizing downtime and operational disruptions. Skilled technicians with expertise in motor systems can diagnose problems, perform necessary repairs, and conduct routine maintenance tasks to keep motors running smoothly. On-site motor repair services often offer emergency response capabilities to address critical issues promptly. This minimizes downtime and helps clients resume their operations quickly. On-site technicians can better understand the specific requirements of your equipment and operations, enabling them to provide customized solutions that align with your business needs. Furthermore, on-site services eliminate the need for shipping or transporting motors to repair facilities. This translates to lower transportation costs, reduced equipment handling risks, and potentially faster turnaround times.

Breakup by End Use Industry:

Utilities (water, electricity, and gas)

HVAC

Food and Beverage

Mining

Others

Utilities (water, electricity, and gas) hold the biggest share of the market

Motor repair and maintenance play a crucial role in ensuring the smooth and reliable operation of utility services, such as water, electricity, and gas. These utilities are essential for modern life, and any disruptions can lead to significant inconvenience and economic losses. In the realm of water utilities, motors are employed in pumping stations to transport water from treatment plants to distribution networks. Routine maintenance of these motors ensures a consistent water supply to communities, reducing the risk of shortages or service interruptions. In electricity distribution, motors are utilized in various components of the power grid, including generators, transformers, and distribution networks. Regular maintenance safeguards against power outages help maintain voltage stability and promote the overall reliability of the electrical supply.

Breakup by Region:

North America

Europe

Asia Pacific

Rest of the World

Asia Pacific exhibits a clear dominance, accounting for the largest motor repair and maintenance market share

The market research report has also provided a comprehensive analysis of all the major regional markets, which include North America, Europe, Asia Pacific, and the rest of the world. According to the report, Asia Pacific accounted for the largest market share.

Asia Pacific held the biggest market share due to the increasing installation of heavy and efficient machinery in industries to improve efficiency and productivity. Besides this, the rising integration of advanced technologies, such as predictive maintenance, Internet of Things (IoT), and artificial intelligence (AI)-based diagnostics, is contributing to the growth of the market. Apart from this, the increasing focus on energy efficiency and emphasis on sustainable practices is supporting the growth of the market. Additionally, the rising shift from reactive maintenance to preventive maintenance strategies among businesses is strengthening the growth of the market.

North America is estimated to expand further in this domain due to the increasing emphasis on sustainability to lower the harmful effects of global warming. Besides this, the rising popularity of EVs is bolstering the growth of the market.

Competitive Landscape:

Key market players are leveraging advanced technologies, such as predictive maintenance, IoT, and AI-powered analytics to monitor equipment health in real-time, carry out preventive repairs, minimize downtime, and improve overall operational efficiency. They are also investing in training and upskilling their technicians to have updated knowledge about the latest repair and maintenance techniques. Top companies are expanding their service portfolios by offering specialized repair services for different types of motors, customized maintenance plans, and remote monitoring solutions. They are also gaining valuable insights into equipment performance, failure patterns, and maintenance trends by utilizing data analytics. Leading companies are delivering exceptional customer experiences by streamlining communication, providing transparent pricing, and offering convenient scheduling options.

The report has provided a comprehensive analysis of the competitive landscape in the market. Detailed profiles of all major companies have also been provided. Some of the key players in the market include:

ABB Limited

Siemens Aktiengesellschaft

WEG Equipamentos Eletricos SA

Regal Rexnord Corporation

TECO E&M/TECO-Westinghouse

Key Questions Answered in This Report

- 1. What was the size of the global motor repair and maintenance market in 2024?

- 2. What is the expected growth rate of the global motor repair and maintenance market during 2025-2033?

- 3. What are the key factors driving the global motor repair and maintenance market?

- 4. What has been the impact of COVID-19 on the global motor repair and maintenance market?

- 5. What is the breakup of the global motor repair and maintenance market based on the type?

- 6. What is the breakup of the global motor repair and maintenance market based on the service?

- 7. What is the breakup of the global motor repair and maintenance market based on the end-use industry?

- 8. What are the key regions in the global motor repair and maintenance market?

- 9. Who are the key players/companies in the global motor repair and maintenance market?

Table of Contents

1 Preface

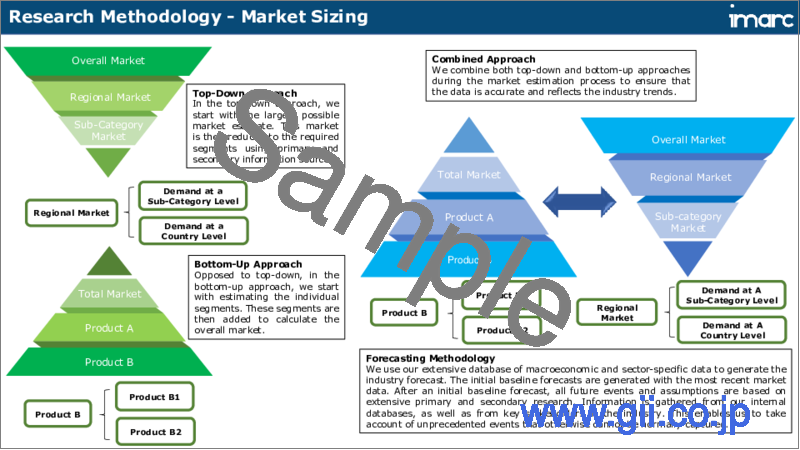

2 Scope and Methodology

- 2.1 Objectives of the Study

- 2.2 Stakeholders

- 2.3 Data Sources

- 2.3.1 Primary Sources

- 2.3.2 Secondary Sources

- 2.4 Market Estimation

- 2.4.1 Bottom-Up Approach

- 2.4.2 Top-Down Approach

- 2.5 Forecasting Methodology

3 Executive Summary

4 Introduction

- 4.1 Overview

- 4.2 Key Industry Trends

5 Global Motor Repair and Maintenance Market

- 5.1 Market Overview

- 5.2 Market Performance

- 5.3 Impact of COVID-19

- 5.4 Market Breakup by Type

- 5.5 Market Breakup by Service

- 5.6 Market Breakup by End Use Industry

- 5.7 Market Breakup by Region

- 5.8 Market Forecast

- 5.9 SWOT Analysis

- 5.9.1 Overview

- 5.9.2 Strengths

- 5.9.3 Weaknesses

- 5.9.4 Opportunities

- 5.9.5 Threats

- 5.10 Value Chain Analysis

- 5.10.1 Research and Development

- 5.10.2 Raw Parts/Equipment Procurement

- 5.10.3 Repair and Maintenance Companies

- 5.10.4 Distributors and Retailers

- 5.10.5 On Site Service

- 5.10.6 End-Users

- 5.11 Porters Five Forces Analysis

- 5.11.1 Overview

- 5.11.2 Bargaining Power of Buyers

- 5.11.3 Bargaining Power of Suppliers

- 5.11.4 Degree of Competition

- 5.11.5 Threat of New Entrants

- 5.11.6 Threat of Substitutes

- 5.12 Key Success and Risk Factors

6 Market Breakup by Type

- 6.1 General Repair

- 6.1.1 Bearing

- 6.1.1.1 Market Trends

- 6.1.1.2 Market Forecast

- 6.1.2 Stator

- 6.1.2.1 Market Trends

- 6.1.2.2 Market Forecast

- 6.1.3 Rotor

- 6.1.3.1 Market Trends

- 6.1.3.2 Market Forecast

- 6.1.4 Others

- 6.1.4.1 Market Trends

- 6.1.4.2 Market Forecast

- 6.1.1 Bearing

- 6.2 Overhaul

- 6.2.1 Market Trends

- 6.2.2 Market Forecast

7 Market Breakup by Service

- 7.1 On-site Service

- 7.1.1 Market Trends

- 7.1.2 Market Forecast

- 7.2 Off-site Service

- 7.2.1 Market Trends

- 7.2.2 Market Forecast

8 Market Breakup by End Use Industry

- 8.1 Utilities (water, electricity and gas)

- 8.1.1 Market Trends

- 8.1.2 Market Forecast

- 8.2 HVAC

- 8.2.1 Market Trends

- 8.2.2 Market Forecast

- 8.3 Food and Beverage

- 8.3.1 Market Trends

- 8.3.2 Market Forecast

- 8.4 Mining

- 8.4.1 Market Trends

- 8.4.2 Market Forecast

- 8.5 Others

- 8.5.1 Market Trends

- 8.5.2 Market Forecast

9 Market Breakup by Region

- 9.1 North America

- 9.1.1 Market Trends

- 9.1.2 Market Forecast

- 9.2 Europe

- 9.2.1 Market Trends

- 9.2.2 Market Forecast

- 9.3 Asia Pacific

- 9.3.1 Market Trends

- 9.3.2 Market Forecast

- 9.4 Rest of the World

- 9.4.1 Market Trends

- 9.4.2 Market Forecast

10 Competitive Landscape

- 10.1 Market Structure

- 10.2 Key Players

- 10.3 Profiles of Key Players

- 10.3.1 ABB Limited

- 10.3.1.1 Company Overview

- 10.3.1.2 Company Description

- 10.3.1.3 Product Portfolio

- 10.3.1.4 Financials

- 10.3.1.5 Key Contacts

- 10.3.2 Siemens Aktiengesellschaft

- 10.3.2.1 Company Overview

- 10.3.2.2 Company Description

- 10.3.2.3 Product Portfolio

- 10.3.2.4 Financials

- 10.3.2.5 Key Contacts

- 10.3.3 WEG Equipamentos Eletricos SA

- 10.3.3.1 Company Overview

- 10.3.3.2 Company Description

- 10.3.3.3 Product Portfolio

- 10.3.3.4 Financials

- 10.3.3.5 Key Contacts

- 10.3.4 Regal Rexnord Corporation

- 10.3.4.1 Company Overview

- 10.3.4.2 Company Description

- 10.3.4.3 Product Portfolio

- 10.3.4.4 Financials

- 10.3.4.5 Key Contacts

- 10.3.5 TECO E&M/TECO-Westinghouse

- 10.3.5.1 Company Overview

- 10.3.5.2 Company Description

- 10.3.5.3 Product Portfolio

- 10.3.5.4 Financials

- 10.3.5.5 Key Contacts

- 10.3.1 ABB Limited