|

|

市場調査レポート

商品コード

1404675

歯科用機器の市場規模、シェア、動向分析レポート:製品別、地域別、セグメント予測、2024年~2030年Dental Equipment Market Size, Share & Trends Analysis Report By Product (Dental Radiology Equipment, Laboratory Machines, Dental Lasers, Systems & Parts, Hygiene Maintenance Devices, Other Equipment), By Region, And Segment Forecasts, 2024 - 2030 |

||||||

カスタマイズ可能

|

|||||||

| 歯科用機器の市場規模、シェア、動向分析レポート:製品別、地域別、セグメント予測、2024年~2030年 |

|

出版日: 2023年11月16日

発行: Grand View Research

ページ情報: 英文 137 Pages

納期: 2~10営業日

|

- 全表示

- 概要

- 図表

- 目次

歯科用機器市場の成長と動向:

歯科用機器の世界市場規模は2030年に170億6,000万米ドルと推定され、2024年から2030年にかけてCAGR6.3%で成長すると予測されています。

これらのツールは、口腔衛生の診断、ケア、メンテナンスに役立ち、開業医は的確な行動計画を立てることができます。口腔衛生に対する政府の支援策のイントロダクション、歯科手術のための医療ツーリズムの増加、歯科疾患の発生率はすべて、業界の成長に寄与しています。さらに、Planmeca社のようなメーカーは、常に新しいコンピューター支援技術を市場に導入しています。

例えば、同社が2019年3月に発売したPlanmeca Creo C5は、チェアサイドでのCAD/CAM歯科治療と歯科修復治療を1回の来院で提供するために開発された革新的な3Dプリンターであり、業界の需要を牽引しています。2019年に国連が発表した推計によると、世界の65歳以上の高齢者は7億300万人であり、高齢者の数は2050年までに15億人に倍増すると予測されています。老年人口における様々な口腔疾患の有病率の上昇は、将来的に予防、修復、外科的サービスに対する需要を増加させる可能性が高いです。米国歯科医師会によると、米国では85%の人が歯の健康を重視し、総合的なケアに欠かせないものと考えています。

口腔の健康の重要性と維持が認識され、高度な歯科医療サービスへのアクセスが向上すれば、歯科業界の成長につながると思われます。しかし、COVID-19の大流行による「緊急時のみ」の歯科医療提供モードは波紋を広げ、業界は歯科医療の利用コストの差し迫った増加を目の当たりにしました。Journal of Contemporary Dental Practice誌によると、歯科治療は感染リスクの高い治療であるため、パンデミック後の緩和措置の中で歯科治療が再開されたのは最後の一つでした。その結果、歯科市場全体にとって深刻な財務上の問題と収益の損失となった。

歯科用機器市場レポートハイライト

- 歯科用システムおよび部品は、デジタル画像診断や歯科疾患の診断に使用されるため、2022年に最大の製品セグメントとして浮上しました。

- 歯科用レーザー分野は予測期間中に最も高いCAGRが見込まれます。これは、外科手術や歯を白くする処置への応用が増加しているためです。

- 北米は、新技術への高い需要と歯科疾患の蔓延、主要プレーヤーと先進ヘルスケアインフラの大規模なプールの存在により、2022年の世界産業を支配しました。

- 一方、アジア太平洋は、予測期間中に最も高いCAGRを記録すると予想されています。

目次

第1章 調査手法と範囲

第2章 エグゼクティブサマリー

第3章 歯科用機器市場:変数、動向、および範囲

- 市場セグメンテーションと範囲

- 市場促進要因分析

- 市場抑制要因分析

- 普及と成長の見通しマッピング

- ポーターのファイブフォース分析

- PESTEL分析

第4章 歯科用機器市場:製品セグメント分析

- 歯科用機器市場:市場シェア分析、2023年および2030年

- 歯科用放射線装置

- 歯科用レーザー

- システム&パーツ

- 歯科技工機械

- 衛生維持装置

- その他の設備

第5章 歯科用機器市場:地域分析

- 歯科用機器:市場シェア分析、2023年および2030年

- 北米

- 欧州

- アジア太平洋地域

- ラテンアメリカ

- 中東・アフリカ

第6章 企業プロファイル

- 企業プロファイル

- DANAHER

- INSTITUT STRAUMANN AG.

- DENTSPLY SIRONA

- 3M COMPANY

- A-DEC, INC.

- BIOLASE, INC.

- PLANMECA OY

- PATTERSON COMPANIES INC

- CARESTREAM HEALTH INC

- GC CORPORATION

List of Tables

- Table 1 List of secondary sources

- Table 2 List of Abbreviations

List of Figures

- Fig. 1 Market research process

- Fig. 2 Information procurement

- Fig. 3 Primary research pattern

- Fig. 4 Market research approaches

- Fig. 5 Value-chain-based sizing & forecasting

- Fig. 6 QFD modeling for market share assessment

- Fig. 7 Market formulation & validation

- Fig. 8 Commodity Flow Analysis

- Fig. 9 Dental equipment market snapshot (2023)

- Fig. 10 Dental equipment market segmentation

- Fig. 11 Market driver relevance analysis (Current & future impact)

- Fig. 12 Market restraint relevance analysis (Current & future impact)

- Fig. 13 Porter's five forces analysis

- Fig. 14 SWOT analysis, by factor (political & legal, economic and technological)

- Fig. 15 Non-invasive fat reduction market: Segment movement analysis

- Fig. 16 Regional marketplace: Key takeaways

- Fig. 17 Regional outlook, 2023 & 2028

- Fig. 18 North America Dental Equipment market, 2018 - 2030 (USD Million)

- Fig. 19 U.S. Dental Equipment market, 2018 - 2030 (USD Million)

- Fig. 20 Canada Dental Equipment market, 2018 - 2030 (USD Million)

- Fig. 21 Europe Dental Equipment market, 2018 - 2030 (USD Million)

- Fig. 22 UK Dental Equipment market, 2018 - 2030 (USD Million)

- Fig. 23 Germany N Dental Equipment market, 2018 - 2030 (USD Million)

- Fig. 24 Italy N Dental Equipment market, 2018 - 2030 (USD Million)

- Fig. 25 Spain Dental Equipment market, 2018 - 2030 (USD Million)

- Fig. 26 France Dental Equipment market, 2018 - 2030 (USD Million)

- Fig. 27 Denmark Dental Equipment market, 2018 - 2030 (USD Million)

- Fig. 28 Sweden Dental Equipment market, 2018 - 2030 (USD Million)

- Fig. 29 Norway Dental Equipment market, 2018 - 2030 (USD Million)

- Fig. 30 Asia Pacific Dental Equipment market, 2018 - 2030 (USD Million)

- Fig. 31 Japan Dental Equipment market, 2018 - 2030 (USD Million)

- Fig. 32 China Dental Equipment market, 2018 - 2030 (USD Million)

- Fig. 33 India Dental Equipment market, 2018 - 2030 (USD Million)

- Fig. 34 South Korea Dental Equipment market, 2018 - 2030 (USD Million)

- Fig. 35 Australia Dental Equipment market, 2018 - 2030 (USD Million)

- Fig. 36 Thailand Dental Equipment market, 2018 - 2030 (USD Million)

- Fig. 37 Latin America Dental Equipment market, 2018 - 2030 (USD Million)

- Fig. 38 Brazil Dental Equipment market, 2018 - 2030 (USD Million)

- Fig. 39 Mexico Dental Equipment market, 2018 - 2030 (USD Million)

- Fig. 40 Argentina Dental Equipment market, 2018 - 2030 (USD Million)

- Fig. 41 MEA Dental Equipment market, 2018 - 2030 (USD Million)

- Fig. 42 South Africa Dental Equipment market, 2018 - 2030 (USD Million)

- Fig. 43 Saudi Arabia Dental Equipment market, 2018 - 2030 (USD Million)

- Fig. 44 UAE Dental Equipment market, 2018 - 2030 (USD Million)

- Fig. 45 Kuwait Dental Equipment market, 2018 - 2030 (USD Million)

- Fig. 46 Strategy framework

Dental Equipment Market Growth & Trends:

The global dental equipment market size was estimated at USD 17.06 billion in 2030 and is projected to grow at a compound annual growth rate (CAGR) of 6.3% from 2024 to 2030. These tools help with an oral health diagnosis, care, and maintenance and allow practitioners to plan a precise course of action. The introduction of supportive government efforts for oral health, an increase in medical tourism for dental operations, and the incidence of dental problems all contribute to the industry's growth. In addition, manufacturers like Planmeca are always introducing fresh computer-aided technology to the market.

For instance, the industry demand is being driven by the company's March 2019 launch of the Planmeca Creo C5, an innovative 3D printer created to deliver chairside CAD/CAM dentistry and restorative dental treatments in a single visit.According to the estimates published by the United Nations in 2019, there were 703 million people aged over 65 years globally, and the number of older individuals is projected to double to 1.5 billion by 2050. The rising prevalence of various oral conditions in the geriatric population is likely to increase the demand for preventive, restorative, and surgical services in the future. According to the American Dental Association, 85% of individuals in the United States, value dental health and consider it an essential aspect of overall care.

The realization of the importance and maintenance of oral health combined with better access to advanced dental services will help in the growth of the industry. However, the "emergency-only" mode of dental care delivery due to the COVID-19 pandemic had a rippling effect and the industry witnessed an imminent increase in availing cost of dental care. According to the Journal of Contemporary Dental Practice, dental services were among the last to relaunch in post-pandemic relaxations since dental procedures are at high risk of transmission. This resulted in serious financial problems and revenue loss for the overall dental market.

Dental Equipment Market Report Highlights:

- Dental systems and parts emerged as the largest product segment in 2022 as these equipment are used for digital imaging and diagnosis of dental ailments

- The dental lasers segment is expected to witness the highest CAGR during the forecast period. This is owing to its increasing application in surgical and teeth-whitening procedures.

- North America dominated the global industry in 2022 owing to the high demand for new technologies & the prevalence of dental disorders and the presence of a large pool of key players & advanced healthcare infrastructure

- Asia Pacific, on the other hand, is expected to register the highest CAGR over the forecast period

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market Segmentation & Scope

- 1.1.1 Product Type

- 1.1.2 Regional Scope

- 1.1.3 Estimates and Forecast Timeline

- 1.2 Research Methodology

- 1.3 Information Procurement

- 1.3.1 Purchased Database

- 1.3.2 Gvr's Internal Database

- 1.3.3 Secondary Sources

- 1.3.4 Primary Research

- 1.3.5 Details of Primary Research

- 1.4 Information or Data Analysis

- 1.4.1 DATA ANALYSIS MODELS

- 1.5 Market Formulation & Validation

- 1.6 Model Details

- 1.6.1 Commodity Flow Analysis (Model 1)

- 1.7 List of Secondary Sources

- 1.8 List of Primary Sources

- 1.9 List of Abbreviations

- 1.10 Objectives

- 1.10.1 Objective - 1:

- 1.10.2 Objective - 2:

- 1.10.3 Objective - 3:

Chapter 2 Executive Summary

- 2.1 Market Outlook

Chapter 3 Dental Equipment Market: Variables, Trends, & Scope

- 3.1 Market Segmentation and Scope

- 3.2 Market Driver Analysis

- 3.2.1 Rising Demand for Dental Procedures

- 3.2.2 Increasing Prevalence of Dental Disorders

- 3.2.3 Introduction of Favorable Government Initiatives Pertaining to the Dental Equipment and Consumables Markets

- 3.2.4 Rising Geriatric Population and Their Demand for Preventive, Restorative, and Surgical Services for Dental Care

- 3.2.5 Rise in medical tourism activities pertaining to dental procedures

- 3.3 Market Restraint Analysis

- 3.3.1.1 Implementation of the Affordable Care Act in the U.S

- 3.3.1.2 Lack of comprehensive reimbursement policies

- 3.4 Penetration & Growth Prospect Mapping

- 3.5 Porter's Five Forces Analysis

- 3.6 PESTEL Analysis

Chapter 4 Dental Equipment Market: Product Segment Analysis

- 4.1 Dental Equipment Market: Market Share Analysis, 2023 & 2030

- 4.2 Dental Radiology Equipment

- 4.2.1 Dental Radiology Equipment, 2018 - 2030 (USD Million)

- 4.2.1.1 Intraoral Radiology Equipment

- 4.2.1.2 Intraoral Radiology Equipment market, 2018 - 2030 (USD Million)

- 4.2.1.2.1 Digital X-ray units

- 4.2.1.2.1.1 Digital X-RAY market, 2018 - 2030 (USD Million)

- 4.2.1.2.2 Digital Sensors

- 4.2.1.2.2.1 Digital Sensors market, 2018 - 2030 (USD Million)

- 4.2.1.3 Extraoral Radiology Equipment

- 4.2.1.4 Extraoral Radiology Equipment market, 2018 - 2030 (USD Million)

- 4.2.1.4.1 Digital Units

- 4.2.1.4.1.1 Digital Units market, 2018 - 2030 (USD Million)

- 4.2.1.4.2 Analog units

- 4.2.1.4.2.1 Analog Units market, 2018 - 2030 (USD Million)

- 4.2.1 Dental Radiology Equipment, 2018 - 2030 (USD Million)

- 4.3 Dental Lasers

- 4.3.1 Dental Laser Equipment Market, 2018 - 2030 (USD MILLION)

- 4.3.1.1 Diode Laser

- 4.3.1.2 Diode Laser Equipment market, 2018 - 2030 (USD Million)

- 4.3.1.2.1 Quantum Well Lasers

- 4.3.1.2.1.1 Quantum Well Laser Equipment market, 2018 - 2030 (USD Million)

- 4.3.1.2.2 Distributed Feedback Lasers

- 4.3.1.2.2.1 Distributed Feedback Laser Equipment market, 2018 - 2030 (USD Million)

- 4.3.1.2.3 Vertical Cavity Surface Emitting Lasers

- 4.3.1.2.3.1 Vertical Cavity Surface Emitting Laser Equipment market, 2018 - 2030 (USD Million)

- 4.3.1.2.5 Heterostructure Lasers

- 4.3.1.2.5.1 Heterostructure Laser Equipment market, 2018 - 2030 (USD Million)

- 4.3.1.2.6 Quantum Cascade Lasers

- 4.3.1.2.6.1 Quantum Cascade Laser Equipment, 2018 - 2030 (USD Million)

- 4.3.1.2.7 Separate Confinement Heterostructure Lasers

- 4.3.1.2.7.1 Separate Confinement Heterostructure Laser Equipment, 2018 - 2030 (USD Million)

- 4.3.1.2.8 Vertical External Cavity Surface Emitting Lasers

- 4.3.1.2.8.1 Vertical External Cavity Surface Emitting Laser Equipment, 2018 - 2030 (USD Million)

- 4.3.1.3 Carbon Dioxide Lasers

- 4.3.1.4 Carbon Dioxide Laser Equipment, 2018 - 2030 (USD Million)

- 4.3.1.5 Yttrium Aluminum Garnet Lasers

- 4.3.1.6 Yttrium Aluminum Garnet Laser Equipment, 2018 - 2030 (USD Million)

- 4.3.1 Dental Laser Equipment Market, 2018 - 2030 (USD MILLION)

- 4.4 System & Parts

- 4.4.1 System and Parts Equipment, 2018 - 2030 (USD MILLION)

- 4.5.1.1 Instrument Delivery systems

- 4.5.1.1.1 Instrument Delivery system, 2018 - 2030 (USD Million)

- 4.5.1.2 Vacuums & Compressors

- 4.5.1.2.1 Vacuums & Compressors 2018 - 2030 (USD Million)

- 4.5.1.3 Cone Beam CT Systems

- 4.5.1.3.1 Cone beam CT systems market 2018 - 2030 (USD Million)

- 4.5.1.4 Cast Machine

- 4.5.1.4.1 Cast machine market 2018 - 2030 (USD Million)

- 4.5.1.5 Furnace and Ovens

- 4.5.1.5.1 Furnace and ovens market 2018 - 2030 (USD Million)

- 4.5.1.6 Electrosurgical Equipment

- 4.5.1.6.1 Electrosurgical Equipment market 2018 - 2030 (USD Million)

- 4.5.1.7 Other system and parts

- 4.5.1.7.1 Other system and parts market 2018 - 2030 (USD Million)

- 4.5.1.8 CAD/CAM

- 4.5.1.8.1 CAD/CAM market 2018 - 2030 (USD Million)

- 4.4.1 System and Parts Equipment, 2018 - 2030 (USD MILLION)

- 4.6 Dental Laboratory Machines

- 4.6.1 Dental Laboratory Machines Market 2018 - 2030 (USD MILLION)

- 4.6.1.1 Ceramic Furnaces

- 4.6.1.1.1 Ceramic Furnaces market 2018 - 2030 (USD Million)

- 4.6.1.2 Electronic Waxer

- 4.6.1.2.1 Electronic Waxer market 2018 - 2030 (USD Million)

- 4.6.1.3 Suction Unit

- 4.6.1.3.1 Suction unit market 2018 - 2030 (USD Million)

- 4.6.1.4 Micro Motor

- 4.6.1.4.1 Micro Motor market 2018 - 2030 (USD Million)

- 4.6.1 Dental Laboratory Machines Market 2018 - 2030 (USD MILLION)

- 4.7 Hygiene Maintenance Devices

- 4.7.1 Hygiene Maintenance Devices MARKET 2018 - 2030 (USD MILLION)

- 4.7.1.1 Sterilizers

- 4.7.1.1.1 Sterilizers market 2018 - 2030 (USD Million)

- 4.7.1.2 Air Purification & Filters

- 4.7.1.2.1 Air purification market 2018 - 2030 (USD Million)

- 4.7.1.3 Hypodermic Needle Incinerator

- 4.7.1.3.1 Hypodermic Needle incinerator market 2018 - 2030 (USD Million)

- 4.7.1 Hygiene Maintenance Devices MARKET 2018 - 2030 (USD MILLION)

- 4.8 Other Equipment

- 4.8.1 Other Equipment Market, 2018 - 2030 (USD MILLION)

- 4.8.1.1 Chairs

- 4.8.1.1.1 Chairs market 2018 - 2030 (USD Million)

- 4.8.1.2 HAND PIECE

- 4.8.1.2.1 Hand Piece market 2018 - 2030 (USD Million)

- 4.8.1.3 Light Cure

- 4.8.1.3.1 Light cure market 2018 - 2030 (USD Million)

- 4.8.1.4 Scaling Unit

- 4.8.1.4.1 Scaling Unit market 2018 - 2030 (USD Million)

- 4.8.1 Other Equipment Market, 2018 - 2030 (USD MILLION)

Chapter 5 Dental Equipment Market: Regional Analysis

- 5.1 Dental equipment: Market Share Analysis, 2023 & 2030

- 5.2 North America

- 5.2.1 North America Dental Equipment Market, 2018 - 2030 (USD MILLION)

- 5.2.2 U.S.

- 5.2.2.1 U.S. dental equipment market, 2018 - 2030 (USD Million)

- 5.2.3 CANADA

- 5.2.3.1 Canada Dental Equipment Market, 2018 - 2030 (USD Million)

- 5.3 Europe

- 5.3.1 Europe Dental Equipment market, 2018 - 2030 (USD MILLION)

- 5.3.2 GERMANY

- 5.3.2.1 Germany Dental Equipment market, 2018 - 2030 (USD Million)

- 5.3.3 UK

- 5.3.3.1 UK Dental Equipment market, 2018 - 2030 (USD Million)

- 5.3.4 FRANCE

- 5.3.4.1 France Dental Equipment market, 2018 - 2030 (USD Million)

- 5.3.5 ITALY

- 5.3.5.1 Italy Dental Equipment market, 2018 - 2030 (USD Million)

- 5.3.6 SPAIN

- 5.3.6.1 Spain Dental Equipment market, 2018 - 2030 (USD Million)

- 5.3.7 DENMARK

- 5.3.7.1 Denmark Dental Equipment market, 2018 - 2030 (USD Million)

- 5.3.8 SWEDEN

- 5.3.8.1 Sweden Dental Equipment market, 2018 - 2030 (USD Million)

- 5.3.9 NORWAY

- 5.3.9.1 Norway Dental Equipment market, 2018 - 2030 (USD Million)

- 5.4 Asia Pacific

- 5.4.1 Asia Pacific Dental Equipment Market, 2018 - 2030 (USD MILLION)

- 5.4.2 CHINA

- 5.4.2.1 China Dental Equipment market, 2018 - 2030 (USD Million)

- 5.4.3 INDIA

- 5.4.3.1 India Dental Equipment, 2018 - 2030 (USD Million)

- 5.4.4 JAPAN

- 5.4.4.1 Japan Dental Equipment market, 2018 - 2030 (USD Million)

- 5.4.5 AUSTRALIA

- 5.4.5.1 Australia Dental Equipment market, 2018 - 2030 (USD Million)

- 5.4.6 SOUTH KOREA

- 5.4.6.1 South Korea Dental Equipment market, 2018 - 2030 (USD Million)

- 5.4.7 THAILAND

- 5.4.7.1 Thailand Dental Equipment market, 2018 - 2030 (USD Million)

- 5.5 Latin America

- 5.5.1 Latin America Dental Equipment Market, 2018 - 2030 (USD MILLION)

- 5.5.2 BRAZIL

- 5.5.2.1 Brazil Dental Equipment market, 2018 - 2030 (USD Million)

- 5.5.3 MEXICO

- 5.5.3.1 Mexico Dental Equipment market, 2018 - 2030 (USD Million)

- 5.5.4 ARGENTINA

- 5.5.4.1 Argentina Dental Equipment market, 2018 - 2030 (USD Million)

- 5.6 MEA

- 5.6.1 MEA Dental Equipment Market, 2018 - 2030 (USD MILLION)

- 5.6.2 SOUTH AFRICA

- 5.6.2.1 South Africa Dental Equipment market, 2018 - 2030 (USD Million)

- 5.6.3 SAUDI ARABIA

- 5.6.3.1 Saudi Arabia Dental Equipment market, 2018 - 2030 (USD Million)

- 5.6.4 UAE

- 5.6.4.1 UAE Dental Equipment market, 2018 - 2030 (USD Million)

- 5.6.5 KUWAIT

- 5.6.5.1 Kuwait Dental Equipment market, 2018 - 2030 (USD Million)

Chapter 6 Company Profiles

- 6.1 Company Profiles

- 6.2.1 DANAHER

- 6.2.1.1 Company Overview

- 6.2.1.2 Financial Performance

- 6.2.1.3 Product Benchmarking

- 6.2.2 INSTITUT STRAUMANN AG.

- 6.2.2.1 Company Overview

- 6.2.2.2 Financial Performance

- 6.2.2.3 Product Benchmarking

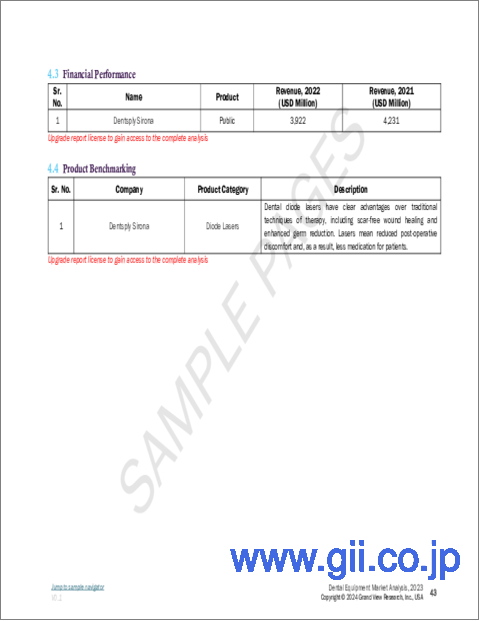

- 6.2.3 DENTSPLY SIRONA

- 6.2.3.1 Company overview

- 6.2.3.2 Financial performance

- 6.2.3.3 Product benchmarking

- 6.2.3.4 Strategic initiatives

- 6.2.4 3M COMPANY

- 6.2.4.1 Company overview

- 6.2.4.2 Financial performance

- 6.2.4.3 Product benchmarking

- 6.2.4.4 Strategic initiatives

- 6.2.5 A-DEC, INC.

- 6.2.5.1 Company overview

- 6.2.5.2 Financial performance

- 6.2.5.3 Product benchmarking

- 6.2.6 BIOLASE, INC.

- 6.2.6.1 Company overview

- 6.2.6.2 Financial performance

- 6.2.6.3 Product benchmarking

- 6.2.7 PLANMECA OY

- 6.2.7.1 Company overview

- 6.2.7.2 Financial performance

- 6.2.7.3 Product benchmarking

- 6.2.8 PATTERSON COMPANIES INC

- 6.2.8.1 Financial performance

- 6.2.8.2 Product benchmarking

- 6.2.9 CARESTREAM HEALTH INC

- 6.2.9.1 Company overview

- 6.2.9.2 Product benchmarking

- 6.2.9.3 Strategic initiatives

- 6.2.10 GC CORPORATION

- 6.2.10.1 Company overview

- 6.2.10.2 Product benchmarking

- 6.2.1 DANAHER