|

|

市場調査レポート

商品コード

1750725

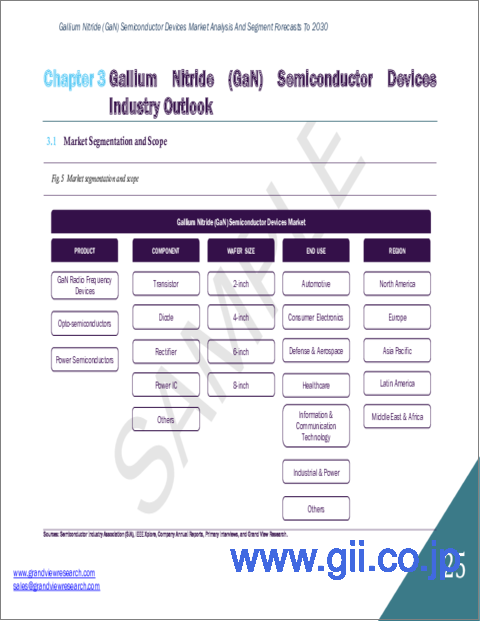

窒化ガリウム半導体デバイスの市場規模、シェア、動向分析レポート:製品別、コンポーネント別、ウエハーサイズ別、最終用途別、地域別、セグメント別予測、2025~2030年Gallium Nitride Semiconductor Devices Market Size, Share & Trends Analysis Report By Product (GaN Radio Frequency Devices, Opto-semiconductors), By Component (Transistor, Diode), By Wafer Size, By End Use, By Region, And Segment Forecasts, 2025 - 2030 |

||||||

カスタマイズ可能

|

|||||||

| 窒化ガリウム半導体デバイスの市場規模、シェア、動向分析レポート:製品別、コンポーネント別、ウエハーサイズ別、最終用途別、地域別、セグメント別予測、2025~2030年 |

|

出版日: 2025年05月02日

発行: Grand View Research

ページ情報: 英文 182 Pages

納期: 2~10営業日

|

全表示

- 概要

- 図表

- 目次

窒化ガリウム半導体デバイス市場の成長と動向:

Grand View Research社の最新レポートによると、世界の窒化ガリウム半導体デバイス市場は2030年までに124億7,000万米ドルに達すると予測され、2025年から2030年までのCAGRは27.4%で成長すると予測されています。

世界的に様々な家電アプリケーションで使用される急速充電器の需要が高まっていることが、市場成長の原動力になると予想されます。アップルやサムスンなど様々なスマートフォン企業が、顧客体験を向上させ競争力を得るために急速充電器の開発に力を入れています。

窒化ガリウム半導体はデータセンター・サーバーにも使用され、潜在的なエネルギー節約を提供し、市場の成長に寄与しています。クラウド技術の普及に伴い、データセンターの拡張が必要となるが、データセンターはエネルギー消費量が大きいです。エネルギー損失を軽減する戦略の1つは、データセンター内で電力を転送する際に、電力変換の全段階を省くことです。

現在、電力はバックプレーン上の48Vから、プロセッシング・ボードに分配するための12V、そして最終的にユースポイントでの約1Vへと、2回の変換を経ています。窒化ガリウムの高いスイッチング速度、コンパクトなサイズ、効率の向上を活用することで、電源設計者は、12Vでの中間ステップをバイパスして、48Vから使用時に必要な1Vに直接変換できるようになりました。このシングル・ステージ・アーキテクチャは、特にコンピューティング・パワーの急速な増大とクラウド・インフラをサポートするデータセンターを考慮すると、大幅なエネルギー削減の可能性があります。

GaNのエンハンスド・モード・バージョンは宇宙アプリケーションの開発に広く使用されており、市場成長をさらに促進しています。商用GaNパワー・デバイスは、従来のシリコン技術ベースのラッドハード・デバイスと比較して高い性能を提供するため、企業の間で高い需要があります。GaNパワー・デバイスは、ドローン、人工衛星、宇宙船、ロボットなどの用途で使用されています。

窒化ガリウム半導体デバイス市場レポートハイライト:

- オプト半導体セグメントが2024年の売上高シェア36.3%で業界を支配しました。

- トランジスタ・セグメントは、高周波およびハイパワーアプリケーションにおける優れた性能特性により市場を席巻しました。

- 4インチ・セグメントは2024年に38.6%のシェアで市場を独占しました。これは、4インチウエハーが半導体デバイスの大量生産を容易にするためです。

- 情報通信技術(ICT)セグメントは、2024年に23.5%の収益シェアで市場を独占しました。

- 北米の窒化ガリウム半導体デバイス市場は、2024年に34.3%の最大収益シェアで世界を席巻しました。

目次

第1章 調査手法と範囲

第2章 エグゼクティブサマリー

第3章 窒化ガリウム半導体デバイス市場の変数、動向、および範囲

- 市場系統の見通し

- 市場力学

- 市場促進要因分析

- 市場抑制要因分析

- 業界の課題

- 窒化ガリウム半導体デバイス市場分析ツール

- 業界分析- ポーターのファイブフォース分析

- PESTEL分析

第4章 窒化ガリウム半導体デバイス市場:製品別 推定・動向分析

- セグメントダッシュボード

- 窒化ガリウム半導体デバイス市場:製品変動分析、2024年および2030年

- 窒化ガリウム無線周波数デバイス

- 光半導体

- パワー半導体

第5章 窒化ガリウム半導体デバイス市場:コンポーネント別 推定・動向分析

- セグメントダッシュボード

- 窒化ガリウム半導体デバイス市場:コンポーネント変動分析、2024年および2030年

- トランジスタ

- ダイオード

- 整流器

- 電源IC

- その他

第6章 窒化ガリウム半導体デバイス市場:ウエハーサイズ別 推定・動向分析

- セグメントダッシュボード

- 窒化ガリウム半導体デバイス市場:ウエハーサイズ変動分析、2024年および2030年

- 2インチ

- 4インチ

- 6インチ

- 8インチ

第7章 窒化ガリウム半導体デバイス市場:最終用途別 推定・動向分析

- セグメントダッシュボード

- 窒化ガリウム半導体デバイス市場:最終用途変動分析、2024年および2030年

- 自動車

- 家電

- 防衛・航空宇宙

- ヘルスケア

- 産業および電力

- 情報通信技術

- その他

第8章 窒化ガリウム半導体デバイス市場:地域別 推定・動向分析

- 窒化ガリウム半導体デバイス市場シェア(地域別、2024年および2030年)

- 北米

- 米国

- カナダ

- メキシコ

- 欧州

- 英国

- ドイツ

- フランス

- アジア太平洋

- 中国

- 日本

- インド

- 韓国

- オーストラリア

- ラテンアメリカ

- ブラジル

- 中東およびアフリカ

- アラブ首長国連邦

- サウジアラビア

- 南アフリカ

第9章 競合情勢

- 企業分類

- 企業の市場ポジショニング

- 企業ヒートマップ分析

- 企業プロファイル/上場企業

- Fujitsu Ltd.

- Efficient Power Conversion Corporation

- Transphorm, Inc.

- Infineon Technologies AG

- NXP Semiconductors.

- Qorvo, Inc

- Texas Instruments Incorporated.

- Toshiba Corporation

- GaN Systems

- NTT Advanced Technology Corporation.

List of Tables

- Table 1 Global Gallium Nitride (GaN) Semiconductor Devices market size estimates & forecasts, 2018 - 2030 (USD Million)

- Table 2 Global Gallium Nitride (GaN) Semiconductor Devices market, by region, 2018 - 2030 (USD Million)

- Table 3 Global Gallium Nitride (GaN) Semiconductor Devices market, by Product, 2018 - 2030 (USD Million)

- Table 4 Global Gallium Nitride (GaN) Semiconductor Devices market, by Component, 2018 - 2030 (USD Million)

- Table 5 Global Gallium Nitride (GaN) Semiconductor Devices market, by Water Size, 2018 - 2030 (USD Million)

- Table 6 Global Gallium Nitride (GaN) Semiconductor Devices market, by End Use, 2018 - 2030 (USD Million)

- Table 7 GaN Radio Frequency Devices market, by region, 2018 - 2030 (USD Million)

- Table 8 Opto-semiconductors market, by region, 2018 - 2030 (USD Million)

- Table 9 Power-Semiconductors market, by region, 2018 - 2030 (USD Million)

- Table 10 Transistor market, by region, 2018 - 2030 (USD Million)

- Table 11 Diode market, by region, 2018 - 2030 (USD Million)

- Table 12 Rectifier market, by region, 2018 - 2030 (USD Million)

- Table 13 Power IC market, by region, 2018 - 2030 (USD Million)

- Table 14 Others market, by region, 2018 - 2030 (USD Million)

- Table 15 2-inch market, by region, 2018 - 2030 (USD Million)

- Table 16 4-inch market, by region, 2018 - 2030 (USD Million)

- Table 17 6-inch market, by region, 2018 - 2030 (USD Million)

- Table 18 8-inch market, by region, 2018 - 2030 (USD Million)

- Table 19 Automotive market, by region, 2018 - 2030 (USD Million)

- Table 20 Consumer Electronics market, by region, 2018 - 2030 (USD Million)

- Table 21 Defense & Aerospace market, by region, 2018 - 2030 (USD Million)

- Table 22 Healthcare market, by region, 2018 - 2030 (USD Million)

- Table 23 Information & Communication Technology market, by region, 2018 - 2030 (USD Million)

- Table 24 Industrial & Power market, by region, 2018 - 2030 (USD Million)

- Table 25 Others market, by region, 2018 - 2030 (USD Million)

- Table 26 Gallium Nitride (GaN) Semiconductor Devices market, by region, 2018 - 2030 (USD Million)

- Table 27 North America Gallium Nitride (GaN) Semiconductor Devices market, by Product, 2018 - 2030 (USD Million)

- Table 28 North America Gallium Nitride (GaN) Semiconductor Devices market, by Component, 2018 - 2030 (USD Million)

- Table 29 North America Gallium Nitride (GaN) Semiconductor Devices market, by Water Size, 2018 - 2030 (USD Million)

- Table 30 North America Gallium Nitride (GaN) Semiconductor Devices market, by End Use, 2018 - 2030 (USD Million)

- Table 31 U.S. Gallium Nitride (GaN) Semiconductor Devices market, by Product, 2018 - 2030 (USD Million)

- Table 32 U.S. Gallium Nitride (GaN) Semiconductor Devices market, by Component, 2018 - 2030 (USD Million)

- Table 33 U.S. Gallium Nitride (GaN) Semiconductor Devices market, by Water Size, 2018 - 2030 (USD Million)

- Table 34 U.S. Gallium Nitride (GaN) Semiconductor Devices market, by End Use, 2018 - 2030 (USD Million)

- Table 35 Canada Gallium Nitride (GaN) Semiconductor Devices market, by Product, 2018 - 2030 (USD Million)

- Table 36 Canada Gallium Nitride (GaN) Semiconductor Devices market, by Component, 2018 - 2030 (USD Million)

- Table 37 Canada Gallium Nitride (GaN) Semiconductor Devices market, by Water Size, 2018 - 2030 (USD Million)

- Table 38 Canada Gallium Nitride (GaN) Semiconductor Devices market, by End Use, 2018 - 2030 (USD Million)

- Table 39 Mexico Gallium Nitride (GaN) Semiconductor Devices market, by Product, 2018 - 2030 (USD Million)

- Table 40 Mexico Gallium Nitride (GaN) Semiconductor Devices market, by Component, 2018 - 2030 (USD Million)

- Table 41 Mexico Gallium Nitride (GaN) Semiconductor Devices market, by Water Size, 2018 - 2030 (USD Million)

- Table 42 Mexico Gallium Nitride (GaN) Semiconductor Devices market, by End Use, 2018 - 2030 (USD Million)

- Table 43 Europe Gallium Nitride (GaN) Semiconductor Devices market, by Product, 2018 - 2030 (USD Million)

- Table 44 Europe Gallium Nitride (GaN) Semiconductor Devices market, by Component, 2018 - 2030 (USD Million)

- Table 45 Europe Gallium Nitride (GaN) Semiconductor Devices market, by Water Size, 2018 - 2030 (USD Million)

- Table 46 Europe Gallium Nitride (GaN) Semiconductor Devices market, by End Use, 2018 - 2030 (USD Million)

- Table 47 U.K. Gallium Nitride (GaN) Semiconductor Devices market, by Product, 2018 - 2030 (USD Million)

- Table 48 U.K. Gallium Nitride (GaN) Semiconductor Devices market, by Component, 2018 - 2030 (USD Million)

- Table 49 U.K. Gallium Nitride (GaN) Semiconductor Devices market, by Water Size, 2018 - 2030 (USD Million)

- Table 50 U.K. Gallium Nitride (GaN) Semiconductor Devices market, by End Use, 2018 - 2030 (USD Million)

- Table 51 Germany Gallium Nitride (GaN) Semiconductor Devices market, by Product, 2018 - 2030 (USD Million)

- Table 52 Germany Gallium Nitride (GaN) Semiconductor Devices market, by Component, 2018 - 2030 (USD Million)

- Table 53 Germany Gallium Nitride (GaN) Semiconductor Devices market, by Water Size, 2018 - 2030 (USD Million)

- Table 54 Germany Gallium Nitride (GaN) Semiconductor Devices market, by End Use, 2018 - 2030 (USD Million)

- Table 55 France Gallium Nitride (GaN) Semiconductor Devices market, by Product, 2018 - 2030 (USD Million)

- Table 56 France Gallium Nitride (GaN) Semiconductor Devices market, by Component, 2018 - 2030 (USD Million)

- Table 57 France Gallium Nitride (GaN) Semiconductor Devices market, by Water Size, 2018 - 2030 (USD Million)

- Table 58 France Gallium Nitride (GaN) Semiconductor Devices market, by End Use, 2018 - 2030 (USD Million)

- Table 59 Asia Pacific Gallium Nitride (GaN) Semiconductor Devices market, by Product, 2018 - 2030 (USD Million)

- Table 60 Asia Pacific Gallium Nitride (GaN) Semiconductor Devices market, by Component, 2018 - 2030 (USD Million)

- Table 61 Asia Pacific Gallium Nitride (GaN) Semiconductor Devices market, by Water Size, 2018 - 2030 (USD Million)

- Table 62 Asia Pacific Gallium Nitride (GaN) Semiconductor Devices market, by End Use, 2018 - 2030 (USD Million)

- Table 63 China Gallium Nitride (GaN) Semiconductor Devices market, by Product, 2018 - 2030 (USD Million)

- Table 64 China Gallium Nitride (GaN) Semiconductor Devices market, by Component, 2018 - 2030 (USD Million)

- Table 65 China Gallium Nitride (GaN) Semiconductor Devices market, by Water Size, 2018 - 2030 (USD Million)

- Table 66 China Gallium Nitride (GaN) Semiconductor Devices market, by End Use, 2018 - 2030 (USD Million)

- Table 67 India Gallium Nitride (GaN) Semiconductor Devices market, by Product, 2018 - 2030 (USD Million)

- Table 68 India Gallium Nitride (GaN) Semiconductor Devices market, by Component, 2018 - 2030 (USD Million)

- Table 69 India Gallium Nitride (GaN) Semiconductor Devices market, by Water Size, 2018 - 2030 (USD Million)

- Table 70 India Gallium Nitride (GaN) Semiconductor Devices market, by End Use, 2018 - 2030 (USD Million)

- Table 71 Japan Gallium Nitride (GaN) Semiconductor Devices market, by Product, 2018 - 2030 (USD Million)

- Table 72 Japan Gallium Nitride (GaN) Semiconductor Devices market, by Component, 2018 - 2030 (USD Million)

- Table 73 Japan Gallium Nitride (GaN) Semiconductor Devices market, by Water Size, 2018 - 2030 (USD Million)

- Table 74 Japan Gallium Nitride (GaN) Semiconductor Devices market, by End Use, 2018 - 2030 (USD Million)

- Table 75 Australia Gallium Nitride (GaN) Semiconductor Devices market, by Product, 2018 - 2030 (USD Million)

- Table 76 Australia Gallium Nitride (GaN) Semiconductor Devices market, by Component, 2018 - 2030 (USD Million)

- Table 77 Australia Gallium Nitride (GaN) Semiconductor Devices market, by Water Size, 2018 - 2030 (USD Million)

- Table 78 Australia Gallium Nitride (GaN) Semiconductor Devices market, by End Use, 2018 - 2030 (USD Million)

- Table 79 South Korea Gallium Nitride (GaN) Semiconductor Devices market, by Product, 2018 - 2030 (USD Million)

- Table 80 South Korea Gallium Nitride (GaN) Semiconductor Devices market, by Component, 2018 - 2030 (USD Million)

- Table 81 South Korea Gallium Nitride (GaN) Semiconductor Devices market, by Water Size, 2018 - 2030 (USD Million)

- Table 82 South Korea Gallium Nitride (GaN) Semiconductor Devices market, by End Use, 2018 - 2030 (USD Million)

- Table 83 Latin America Gallium Nitride (GaN) Semiconductor Devices market, by Product, 2018 - 2030 (USD Million)

- Table 84 Latin America Gallium Nitride (GaN) Semiconductor Devices market, by Component, 2018 - 2030 (USD Million)

- Table 85 Latin America Gallium Nitride (GaN) Semiconductor Devices market, by Water Size, 2018 - 2030 (USD Million)

- Table 86 Latin America Gallium Nitride (GaN) Semiconductor Devices market, by End Use, 2018 - 2030 (USD Million)

- Table 87 Brazil Gallium Nitride (GaN) Semiconductor Devices market, by Product, 2018 - 2030 (USD Million)

- Table 88 Brazil Gallium Nitride (GaN) Semiconductor Devices market, by Component, 2018 - 2030 (USD Million)

- Table 89 Brazil Gallium Nitride (GaN) Semiconductor Devices market, by Water Size, 2018 - 2030 (USD Million)

- Table 90 Brazil Gallium Nitride (GaN) Semiconductor Devices market, by End Use, 2018 - 2030 (USD Million)

- Table 91 MEA Gallium Nitride (GaN) Semiconductor Devices market, by Product, 2018 - 2030 (USD Million)

- Table 92 MEA Gallium Nitride (GaN) Semiconductor Devices market, by Component, 2018 - 2030 (USD Million)

- Table 93 MEA Gallium Nitride (GaN) Semiconductor Devices market, by Water Size, 2018 - 2030 (USD Million)

- Table 94 MEA Gallium Nitride (GaN) Semiconductor Devices market, by End Use, 2018 - 2030 (USD Million)

- Table 95 UAE Gallium Nitride (GaN) Semiconductor Devices market, by Product, 2018 - 2030 (USD Million)

- Table 96 UAE Gallium Nitride (GaN) Semiconductor Devices market, by Component, 2018 - 2030 (USD Million)

- Table 97 UAE Gallium Nitride (GaN) Semiconductor Devices market, by Water Size, 2018 - 2030 (USD Million)

- Table 98 UAE Gallium Nitride (GaN) Semiconductor Devices market, by End Use, 2018 - 2030 (USD Million)

- Table 99 KSA Gallium Nitride (GaN) Semiconductor Devices market, by Product, 2018 - 2030 (USD Million)

- Table 100 KSA Gallium Nitride (GaN) Semiconductor Devices market, by Component, 2018 - 2030 (USD Million)

- Table 101 KSA Gallium Nitride (GaN) Semiconductor Devices market, by Water Size, 2018 - 2030 (USD Million)

- Table 102 KSA Gallium Nitride (GaN) Semiconductor Devices market, by End Use, 2018 - 2030 (USD Million)

- Table 103 South Africa Gallium Nitride (GaN) Semiconductor Devices market, by Product, 2018 - 2030 (USD Million)

- Table 104 South Africa Gallium Nitride (GaN) Semiconductor Devices market, by Component, 2018 - 2030 (USD Million)

- Table 105 South Africa Gallium Nitride (GaN) Semiconductor Devices market, by Water Size, 2018 - 2030 (USD Million)

- Table 106 South Africa Gallium Nitride (GaN) Semiconductor Devices market, by End Use, 2018 - 2030 (USD Million)

List of Figures

- Fig. 1 Gallium nitride (GaN) semiconductor devices market segmentation

- Fig. 2 Market research service

- Fig. 3 Information procurement

- Fig. 4 Primary research pattern

- Fig. 5 Market research approaches

- Fig. 6 Value chain-based sizing & forecasting

- Fig. 7 Parent market analysis

- Fig. 8 Market formulation & validation

- Fig. 9 Gallium nitride (GaN) semiconductor devices market snapshot

- Fig. 10 Gallium nitride (GaN) semiconductor devices market segment snapshot

- Fig. 11 Gallium nitride (GaN) semiconductor devices market competitive landscape snapshot

- Fig. 12 Market driver relevance analysis (Current & future impact)

- Fig. 13 Market restraint relevance analysis (Current & future impact)

- Fig. 14 Gallium nitride (GaN) semiconductor devices market, Product outlook key takeaways (USD Million)

- Fig. 15 Gallium nitride (GaN) semiconductor devices market Product movement analysis (USD Million) 2024 & 2030

- Fig. 16 GaN Radio Frequency Devices market revenue estimates and forecasts, 2018 - 2030 (USD Million)

- Fig. 17 Opto-semiconductors market revenue estimates and forecasts, 2018 - 2030 (USD Million)

- Fig. 18 Power Semiconductors market revenue estimates and forecasts, 2018 - 2030 (USD Million)

- Fig. 19 Gallium nitride (GaN) semiconductor devices market, Component outlook key takeaways (USD Million)

- Fig. 20 Gallium nitride (GaN) semiconductor devices market: Component movement analysis (USD Million) 2024 & 2030

- Fig. 21 Transistor market revenue estimates and forecasts, 2018 - 2030 (USD Million)

- Fig. 22 Diode market revenue estimates and forecasts, 2018 - 2030 (USD Million)

- Fig. 23 Rectifier market revenue estimates and forecasts, 2018 - 2030 (USD Million)

- Fig. 24 Power IC market revenue estimates and forecasts, 2018 - 2030 (USD Million)

- Fig. 25 Others market revenue estimates and forecasts, 2018 - 2030 (USD Million)

- Fig. 26 Gallium nitride (GaN) semiconductor devices market: Water Size outlook key takeaways (USD Million)

- Fig. 27 Gallium nitride (GaN) semiconductor devices market: Water Size movement analysis (USD Million) 2024 & 2030

- Fig. 28 2-inch market revenue estimates and forecasts, 2018 - 2030 (USD Million)

- Fig. 29 4-inch market revenue estimates and forecasts, 2018 - 2030 (USD Million)

- Fig. 30 6-inch market revenue estimates and forecasts, 2018 - 2030 (USD Million)

- Fig. 31 8-inch market revenue estimates and forecasts, 2018 - 2030 (USD Million)

- Fig. 32 Gallium nitride (GaN) semiconductor devices market revenue estimates and forecasts, 2018 - 2030 (USD Million)

- Fig. 33 Gallium nitride (GaN) semiconductor devices market: End Use outlook key takeaways (USD Million)

- Fig. 34 Gallium nitride (GaN) semiconductor devices market: End Use movement analysis (USD Million) 2024 & 2030

- Fig. 35 Automotive market revenue estimates and forecasts, 2018 - 2030 (USD Million)

- Fig. 36 Consumer Electronics market revenue estimates and forecasts, 2018 - 2030 (USD Million)

- Fig. 37 Defense & Aerospace market revenue estimates and forecasts, 2018 - 2030 (USD Million)

- Fig. 38 Healthcare market revenue estimates and forecasts, 2018 - 2030 (USD Million)

- Fig. 39 Information & communication technology market revenue estimates and forecasts, 2018 - 2030 (USD Million)

- Fig. 40 Industrial & Power market revenue estimates and forecasts, 2018 - 2030 (USD Million)

- Fig. 41 Others market revenue estimates and forecasts, 2018 - 2030 (USD Million)

- Fig. 42 Regional marketplace: Key takeaways

- Fig. 43 Gallium nitride (GaN) semiconductor devices market: Regional outlook, 2024 & 2030 (USD Million)

- Fig. 44 North America Gallium nitride (GaN) semiconductor devices market estimates and forecasts, 2018 - 2030 (USD Million)

- Fig. 45 U.S. Gallium nitride (GaN) semiconductor devices market estimates and forecasts, 2018 - 2030 (USD Million)

- Fig. 46 Canada Gallium nitride (GaN) semiconductor devices market estimates and forecasts, 2018 - 2030 (USD Million)

- Fig. 47 Mexico Gallium nitride (GaN) semiconductor devices market estimates and forecasts, 2018 - 2030 (USD Million)

- Fig. 48 Europe Gallium nitride (GaN) semiconductor devices market estimates and forecasts, 2018 - 2030 (USD Million)

- Fig. 49 U.K. Gallium nitride (GaN) semiconductor devices market estimates and forecasts, 2018 - 2030 (USD Million)

- Fig. 50 Germany Gallium nitride (GaN) semiconductor devices market estimates and forecasts, 2018 - 2030 (USD Million)

- Fig. 51 France Gallium nitride (GaN) semiconductor devices market estimates and forecasts, 2018 - 2030 (USD Million)

- Fig. 52 Asia Pacific Gallium nitride (GaN) semiconductor devices market estimates and forecasts, 2018 - 2030 (USD Million)

- Fig. 53 Japan Gallium nitride (GaN) semiconductor devices market estimates and forecasts, 2018 - 2030 (USD Million)

- Fig. 54 China Gallium nitride (GaN) semiconductor devices market estimates and forecasts, 2018 - 2030 (USD Million)

- Fig. 55 India Gallium nitride (GaN) semiconductor devices market estimates and forecasts, 2018 - 2030 (USD Million)

- Fig. 56 Australia Gallium nitride (GaN) semiconductor devices market estimates and forecasts, 2018 - 2030 (USD Million)

- Fig. 57 South Korea Gallium nitride (GaN) semiconductor devices market estimates and forecasts, 2018 - 2030 (USD Million)

- Fig. 58 Latin America Gallium nitride (GaN) semiconductor devices market estimates and forecasts, 2018 - 2030 (USD Million)

- Fig. 59 Brazil Gallium nitride (GaN) semiconductor devices market estimates and forecasts, 2018 - 2030 (USD Million)

- Fig. 60 MEA Gallium nitride (GaN) semiconductor devices market estimates and forecasts, 2018 - 2030 (USD Million)

- Fig. 61 KSA Gallium nitride (GaN) semiconductor devices market estimates and forecasts, 2018 - 2030 (USD Million)

- Fig. 62 UAE Gallium nitride (GaN) semiconductor devices market estimates and forecasts, 2018 - 2030 (USD Million)

- Fig. 63 South Africa Gallium nitride (GaN) semiconductor devices market estimates and forecasts, 2018 - 2030 (USD Million)

- Fig. 64 Strategy framework

- Fig. 65 Company Categorization

Gallium Nitride Semiconductor Devices Market Growth & Trends:

The global gallium nitride semiconductor devices market is anticipated to reach USD 12.47 billion by 2030 and is projected to grow at a CAGR of 27.4% from 2025 to 2030, according to a new report by Grand View Research. The growing demand for fast chargers used in various consumer electronics applications worldwide is expected to drive market growth. Various smartphone companies such as Apple and Samsung are making efforts to develop fast chargers to enhance their customer experience and gain a competitive edge.

Gallium nitride semiconductors are also used in data center servers to offer potential energy savings, thereby contributing to the growth of the market. The proliferation of cloud technology necessitates the expansion of data centers, which are significant energy consumers. One strategy to mitigate energy loss involves eliminating an entire stage of power conversion when transferring power within the data center.

Currently, power undergoes two conversions: from 48 V on the backplane to 12 V for distribution on processing boards and finally to around 1 V at the point of use. Leveraging the high switching speed, compact size, and improved efficiency of gallium nitride, power supply designers can now convert directly from 48 V to the required 1 V at the point of use, bypassing the intermediate step at 12 V. This single-stage architecture presents substantial potential energy savings, especially considering the rapid growth of computing power and data centers supporting cloud infrastructure.

The enhanced-mode version of GaN is widely used in the development of space applications, and it is further driving market growth. The demand for commercial GaN power devices is high among businesses as these devices offer high performance compared to traditional silicon technology-based Rad Hard devices. GaN power devices are used in applications such as drones, satellites, spacecraft, and robotics.

Gallium Nitride Semiconductor Devices Market Report Highlights:

- The opto-semiconductors segment dominated the industry with a revenue share of 36.3% in 2024.

- The transistor segment dominated the market due to its superior performance characteristics in high-frequency and high-power applications.

- The 4-inch segment dominated the market in 2024 with a share of 38.6%. This is because 4-inch wafers facilitate the large-scale production of semiconductor devices.

- The information & communication technology (ICT) segment dominated the market with a revenue share of 23.5% in 2024.

- North America gallium nitride (GaN) semiconductor devices market dominated globally in 2024, with the largest revenue share of 34.3%.

Table of Contents

Chapter 1. Methodology and Scope

- 1.1. Market Segmentation and Scope

- 1.2. Research Methodology

- 1.2.1. Information Procurement

- 1.3. Information or Data Analysis

- 1.4. Methodology

- 1.5. Research Scope and Assumptions

- 1.6. Market Formulation & Validation

- 1.7. Country Based Segment Share Calculation

- 1.8. List of Data Sources

Chapter 2. Executive Summary

- 2.1. Market Outlook

- 2.2. Segment Outlook

- 2.3. Competitive Insights

Chapter 3. Gallium Nitride (GaN) Semiconductor Devices Market Variables, Trends, & Scope

- 3.1. Market Lineage Outlook

- 3.2. Market Dynamics

- 3.2.1. Market Driver Analysis

- 3.2.2. Market Restraint Analysis

- 3.2.3. Industry Challenge

- 3.3. Gallium Nitride (GaN) Semiconductor Devices Market Analysis Tools

- 3.3.1. Industry Analysis - Porter's

- 3.3.1.1. Bargaining power of the suppliers

- 3.3.1.2. Bargaining power of the buyers

- 3.3.1.3. Threats of substitution

- 3.3.1.4. Threats from new entrants

- 3.3.1.5. Competitive rivalry

- 3.3.2. PESTEL Analysis

- 3.3.2.1. Political landscape

- 3.3.2.2. Economic landscape

- 3.3.2.3. Social landscape

- 3.3.2.4. Technological landscape

- 3.3.2.5. Environmental landscape

- 3.3.2.6. Legal landscape

- 3.3.1. Industry Analysis - Porter's

Chapter 4. Gallium Nitride (GaN) Semiconductor Devices Market: Product Estimates & Trend Analysis

- 4.1. Segment Dashboard

- 4.2. Gallium Nitride (GaN) Semiconductor Devices Market: Product Movement Analysis, 2024 & 2030 (USD Million)

- 4.3. GaN Radio Frequency Devices

- 4.3.1. GaN Radio Frequency Devices Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

- 4.4. Opto-semiconductors

- 4.4.1. Opto-semiconductors Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

- 4.5. Power Semiconductors

- 4.5.1. Power Semiconductors Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

Chapter 5. Gallium Nitride (GaN) Semiconductor Devices Market: Component Estimates & Trend Analysis

- 5.1. Segment Dashboard

- 5.2. Gallium Nitride (GaN) Semiconductor Devices Market: Component Movement Analysis, 2024 & 2030 (USD Million)

- 5.3. Transistor

- 5.3.1. Transistor Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

- 5.4. Diode

- 5.4.1. Diode Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

- 5.5. Rectifier

- 5.5.1. Diode Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

- 5.6. Power IC

- 5.6.1. Diode Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

- 5.7. Others

- 5.7.1. Diode Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

Chapter 6. Gallium Nitride (GaN) Semiconductor Devices Market: Wafer Size Estimates & Trend Analysis

- 6.1. Segment Dashboard

- 6.2. Gallium Nitride (GaN) Semiconductor Devices Market: Wafer Size Movement Analysis, 2024 & 2030 (USD Million)

- 6.3. 2-inch

- 6.3.1. 2-inch Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

- 6.4. 4-inch

- 6.4.1. 4-inch Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

- 6.5. 6-inch

- 6.5.1. 6-inch Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

- 6.6. 8-inch

- 6.6.1. 8-inch Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

Chapter 7. Gallium Nitride (GaN) Semiconductor Devices Market: End Use Estimates & Trend Analysis

- 7.1. Segment Dashboard

- 7.2. Gallium Nitride (GaN) Semiconductor Devices Market: End Use Movement Analysis, 2024 & 2030 (USD Million)

- 7.3. Automotive

- 7.3.1. Automotive Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

- 7.4. Consumer Electronics

- 7.4.1. Consumer Electronics Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

- 7.5. Defense & Aerospace

- 7.5.1. Defense & Aerospace Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

- 7.6. Healthcare

- 7.6.1. Healthcare Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

- 7.7. Industrial & Power

- 7.7.1. Industrial & Power Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

- 7.8. Information & Communication Technology

- 7.8.1. Information & Communication Technology Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

- 7.9. Others

- 7.9.1. Others Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

Chapter 8. Gallium Nitride (GaN) Semiconductor Devices Market: Regional Estimates & Trend Analysis

- 8.1. Gallium Nitride (GaN) Semiconductor Devices Market Share, By Region, 2024 & 2030 (USD Million)

- 8.2. North America

- 8.2.1. North America Gallium Nitride (GaN) Semiconductor Devices Market Estimates and Forecasts, 2018 - 2030 (USD Million)

- 8.2.2. U.S.

- 8.2.2.1. U.S. Gallium Nitride (GaN) Semiconductor Devices Market Estimates and Forecasts, 2018 - 2030 (USD Million)

- 8.2.3. Canada

- 8.2.3.1. Canada Gallium Nitride (GaN) Semiconductor Devices Market Estimates and Forecasts, 2018 - 2030 (USD Million)

- 8.2.4. Mexico

- 8.2.4.1. Mexico Gallium Nitride (GaN) Semiconductor Devices Market Estimates and Forecasts, 2018 - 2030 (USD Million)

- 8.3. Europe

- 8.3.1. Europe Gallium Nitride (GaN) Semiconductor Devices Market Estimates and Forecasts, 2018 - 2030 (USD Million)

- 8.3.2. U.K.

- 8.3.2.1. U.K. Gallium Nitride (GaN) Semiconductor Devices Market Estimates and Forecasts, 2018 - 2030 (USD Million)

- 8.3.3. Germany

- 8.3.3.1. Germany Gallium Nitride (GaN) Semiconductor Devices Market Estimates and Forecasts, 2018 - 2030 (USD Million)

- 8.3.4. France

- 8.3.4.1. France Gallium Nitride (GaN) Semiconductor Devices Market Estimates and Forecasts, 2018 - 2030 (USD Million)

- 8.4. Asia Pacific

- 8.4.1. Asia Pacific Gallium Nitride (GaN) Semiconductor Devices Market Estimates and Forecasts, 2018 - 2030 (USD Million)

- 8.4.2. China

- 8.4.2.1. China Gallium Nitride (GaN) Semiconductor Devices Market Estimates and Forecasts, 2018 - 2030 (USD Million)

- 8.4.3. Japan

- 8.4.3.1. Japan Gallium Nitride (GaN) Semiconductor Devices Market Estimates and Forecasts, 2018 - 2030 (USD Million)

- 8.4.4. India

- 8.4.4.1. India Gallium Nitride (GaN) Semiconductor Devices Market Estimates and Forecasts, 2018 - 2030 (USD Million)

- 8.4.5. South Korea

- 8.4.5.1. South Korea Gallium Nitride (GaN) Semiconductor Devices Market Estimates and Forecasts, 2018 - 2030 (USD Million)

- 8.4.6. Australia

- 8.4.6.1. Australia Gallium Nitride (GaN) Semiconductor Devices Market Estimates and Forecasts, 2018 - 2030 (USD Million)

- 8.5. Latin America

- 8.5.1. Latin America Gallium Nitride (GaN) Semiconductor Devices Market Estimates and Forecasts, 2018 - 2030 (USD Million)

- 8.5.2. Brazil

- 8.5.2.1. Brazil Gallium Nitride (GaN) Semiconductor Devices Market Estimates and Forecasts, 2018 - 2030 (USD Million)

- 8.6. Middle East and Africa

- 8.6.1. Middle East and Africa Gallium Nitride (GaN) Semiconductor Devices Market Estimates and Forecasts, 2018 - 2030 (USD Million)

- 8.6.2. UAE

- 8.6.2.1. UAE Gallium Nitride (GaN) Semiconductor Devices Market Estimates and Forecasts, 2018 - 2030 (USD Million)

- 8.6.3. KSA

- 8.6.3.1. KSA Gallium Nitride (GaN) Semiconductor Devices Market Estimates and Forecasts, 2018 - 2030 (USD Million)

- 8.6.4. South Africa

- 8.6.4.1. South Africa Gallium Nitride (GaN) Semiconductor Devices Market Estimates and Forecasts, 2018 - 2030 (USD Million)

Chapter 9. Competitive Landscape

- 9.1. Company Categorization

- 9.2. Company Market Positioning

- 9.3. Company Heat Map Analysis

- 9.4. Company Profiles/Listing

- 9.4.1. Fujitsu Ltd.

- 9.4.1.1. Participant's Overview

- 9.4.1.2. Financial Performance

- 9.4.1.3. Product Benchmarking

- 9.4.1.4. Strategic Initiatives

- 9.4.2. Efficient Power Conversion Corporation

- 9.4.2.1. Participant's Overview

- 9.4.2.2. Financial Performance

- 9.4.2.3. Product Benchmarking

- 9.4.2.4. Strategic Initiatives

- 9.4.3. Transphorm, Inc.

- 9.4.3.1. Participant's Overview

- 9.4.3.2. Financial Performance

- 9.4.3.3. Product Benchmarking

- 9.4.3.4. Strategic Initiatives

- 9.4.4. Infineon Technologies AG

- 9.4.4.1. Participant's Overview

- 9.4.4.2. Financial Performance

- 9.4.4.3. Product Benchmarking

- 9.4.4.4. Strategic Initiatives

- 9.4.5. NXP Semiconductors.

- 9.4.5.1. Participant's Overview

- 9.4.5.2. Financial Performance

- 9.4.5.3. Product Benchmarking

- 9.4.5.4. Strategic Initiatives

- 9.4.6. Qorvo, Inc

- 9.4.6.1. Participant's Overview

- 9.4.6.2. Financial Performance

- 9.4.6.3. Product Benchmarking

- 9.4.6.4. Strategic Initiatives

- 9.4.7. Texas Instruments Incorporated.

- 9.4.7.1. Participant's Overview

- 9.4.7.2. Financial Performance

- 9.4.7.3. Product Benchmarking

- 9.4.7.4. Strategic Initiatives

- 9.4.8. Toshiba Corporation

- 9.4.8.1. Participant's Overview

- 9.4.8.2. Financial Performance

- 9.4.8.3. Product Benchmarking

- 9.4.8.4. Strategic Initiatives

- 9.4.9. GaN Systems

- 9.4.9.1. Participant's Overview

- 9.4.9.2. Financial Performance

- 9.4.9.3. Product Benchmarking

- 9.4.9.4. Strategic Initiatives

- 9.4.10. NTT Advanced Technology Corporation.

- 9.4.10.1. Participant's Overview

- 9.4.10.2. Financial Performance

- 9.4.10.3. Product Benchmarking

- 9.4.10.4. Strategic Initiatives

- 9.4.1. Fujitsu Ltd.