|

|

市場調査レポート

商品コード

1686703

圧力トランスミッターの世界市場:技術別、タイプ別、設計・機能別、流体タイプ別、測定用途別、産業別 - 予測(~2030年)Pressure Transmitter Market by Technology, Type (Absolute, Gauge, Differential, Multivariable), Design & Functionality (Diaphragm, Hygienic, Wireless), Fluid Type (Liquid, Gas, Steam), Measurement Application, Industry - Global Forecast to 2030 |

||||||

カスタマイズ可能

|

|||||||

| 圧力トランスミッターの世界市場:技術別、タイプ別、設計・機能別、流体タイプ別、測定用途別、産業別 - 予測(~2030年) |

|

出版日: 2025年03月18日

発行: MarketsandMarkets

ページ情報: 英文 281 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

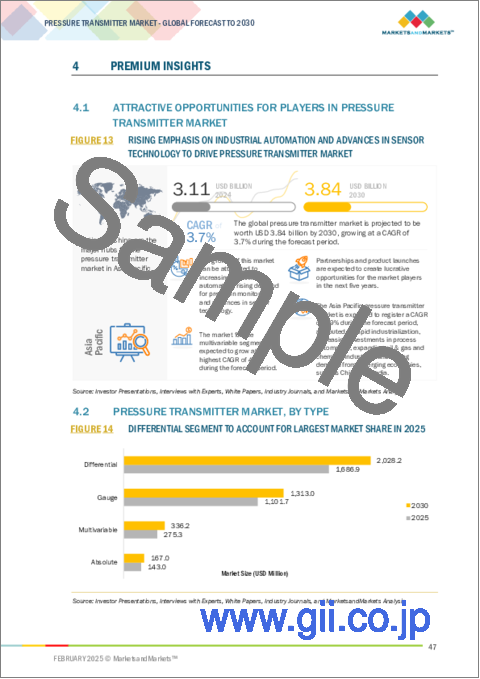

世界の圧力トランスミッターの市場規模は、2025年に32億1,000万米ドル、2030年までに38億4,000万米ドルに達すると予測され、予測期間にCAGRで3.7%の成長が見込まれます。

エネルギー効率の高いシステムに対する需要の高まりが、圧力トランスミッター市場の成長を促進しています。一方、多額の経常費用と運用費用の必要性が圧力トランスミッター市場の成長を抑制しています。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2020年~2030年 |

| 基準年 | 2024年 |

| 予測期間 | 2025年~2030年 |

| 単位 | 10億米ドル |

| セグメント | 技術、タイプ、設計・機能、流体タイプ、測定用途、産業、地域 |

| 対象地域 | 北米、欧州、アジア太平洋、その他の地域 |

「液体流体タイプセグメントが予測期間に圧力トランスミッター市場で最高のCAGRを示す見込みです。」

圧力トランスミッターは、石油・ガス、化学、発電、水処理などのさまざまな産業において、液体・ガス・蒸気の圧力を正確に測定・モニタリングするのに不可欠です。中でも液体用途は、水管理、燃料モニタリング、工業処理における正確な圧力測定に対する広範なニーズにより優位を占めています。先進の圧力トランスミッター技術は、リアルタイムデータの精度を確保し、プロセス制御を最適化し、安全性を向上させることで業務効率を高めます。特に、圧力測定におけるデジタル技術の進歩は、産業システム全体にわたるシームレスなデータ統合を可能にし、よりよい意思決定とプロセスの自動化を促進します。一貫したモニタリングを可能にすることで、圧力トランスミッターは産業が規制遵守を維持し、ダウンタイムを削減し、生産性を高めることを支援します。IoT機能を備えたスマート圧力トランスミッターへの需要の高まりは、液体ベースの用途での役割をさらに強化し、現代の産業経営に不可欠なものとなっています。

「レベル測定用途セグメントが圧力トランスミッター市場で大きなシェアを占める見込みです。」

レベル測定用途セグメントが予測期間に圧力トランスミッター市場で最大のシェアを占める見込みです。この成長は、石油・ガス、化学、上下水道、発電などの産業における、正確で信頼性の高いレベルモニタリングの需要の増加によるものです。圧力トランスミッターは、貯蔵タンク、処理ユニット、産業容器の正確な液面測定を保証する上で重要な役割を果たし、安全性と業務効率の維持に役立っています。プロセスの安全性と環境上のコンプライアンスに関する規制が強化される中、産業はモニタイング精度を高め、オーバーフロー、漏れ、機器の故障を防止するために先進の圧力トランスミッターを採用しています。デジタル通信や遠隔モニタリングの機能を備えた最新の圧力トランスミッターは、問題の早期発見を可能にすることでプロセス制御を向上し、メンテナンスコストを削減します。さらに、自動化とスマートモニタリングシステムの統合が進むことで、高性能レベル測定ソリューションの需要がさらに高まっています。産業が効率性、安全性、規制遵守に重点を置く中、レベル測定用圧力トランスミッターは引き続き市場を独占し、測定用途セグメント全体の成長を促進するとみられます。

「北米が圧力トランスミッター市場で第2位のシェアを占める見込みです。」

複数の要因により、北米市場が圧力トランスミッター市場で第2位のシェアを占めます。この地域には石油・ガス、化学、食品・飲料、医薬品などの主要産業があり、これらの産業はすべて正確なモニタリングとプロセス制御で圧力トランスミッターに依存しています。さらに、北米は発達した発電インフラや先進の製造施設を有しており、運用効率と自動化を確保するために信頼性の高い圧力測定ソリューションが必要とされています。さらに、安全性、環境保護、エネルギー効率に関する厳しい規制が、高精度圧力トランスミッターの採用をさらに後押ししており、産業が業績を高め、排出を削減し、全体的な持続可能性を向上させるのに役立っています。

当レポートでは、世界の圧力トランスミッター市場について調査分析し、主な促進要因と抑制要因、競合情勢、将来の動向などの情報を提供しています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

- 圧力トランスミッター市場の企業にとって魅力的な機会

- 圧力トランスミッター市場:タイプ別

- 圧力トランスミッター市場:流体タイプ別

- 圧力トランスミッター市場:測定用途別

- 圧力トランスミッター市場:産業別

- 圧力トランスミッター市場:地域別

第5章 市場の概要

- イントロダクション

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

- バリューチェーン分析

- エコシステム分析

- 価格分析

- 主要企業が提供する圧力トランスミッターの平均販売価格:タイプ別(2024年)

- 圧力トランスミッターの平均販売価格の動向:タイプ別(2021年~2024年)

- 差圧トランスミッターの平均販売価格の動向:地域別(2021年~2024年)

- 顧客ビジネスに影響を与える動向/混乱

- 投資と資金調達のシナリオ(2019年~2024年)

- 技術分析

- 主要技術

- 隣接技術

- 補完技術

- ポーターのファイブフォース分析

- 主なステークホルダーと購入基準

- ケーススタディ

- SOR、規制要件への準拠を支援するため中西部の公共ガス業者に805PT圧力トランスミッターを供給

- Emerson、信頼性の高い圧力制御を保証するためカナダの石油企業にRosemount 4600石油・ガスパネルトランスミッターを提供

- 貿易分析

- 輸入シナリオ(HSコード902620)

- 輸出シナリオ(HSコード902620)

- 特許分析

- 主な会議とイベント(2025年~2026年)

- 規制情勢

- 圧力トランスミッター市場に関連する規制機関、政府機関、その他の組織

- 標準と指令

- AI/生成AIの影響

- イントロダクション

- 圧力トランスミッター市場に対するAIの影響

- 主なユースケースと市場の将来性

第6章 圧力トランスミッターの設計と機能

- イントロダクション

- ダイヤフラムシール

- 静水

- 衛生

- 無線

第7章 圧力トランスミッター技術

- イントロダクション

- 静電容量

- ピエゾ抵抗

- 薄膜抵抗

- 光ファイバー

第8章 圧力トランスミッター市場:タイプ別

- イントロダクション

- 差圧

- 絶対圧

- ゲージ圧

- マルチバリアブル

第9章 圧力トランスミッター市場:流体タイプ別

- イントロダクション

- 液体

- 蒸気

- ガス

第10章 圧力トランスミッター市場:測定用途別

- イントロダクション

- レベル

- フロー

- 圧力

第11章 圧力トランスミッター市場:産業別

- イントロダクション

- 石油・ガス

- 化学品

- 水・廃水処理

- 食品・飲料

- 電力

- パルプ・紙

- 金属・鉱業

- 医薬品

- その他の産業

第12章 圧力トランスミッター市場:地域別

- イントロダクション

- 北米

- 北米のミクロ経済の見通し

- 米国

- カナダ

- メキシコ

- 欧州

- 欧州のミクロ経済の見通し

- ドイツ

- 英国

- フランス

- イタリア

- スペイン

- ポーランド

- 北欧

- その他の欧州

- アジア太平洋

- アジア太平洋のマクロ経済の見通し

- 中国

- 日本

- インド

- 韓国

- オーストラリア

- インドネシア

- マレーシア

- ベトナム

- その他のアジア太平洋

- その他の地域

- その他の地域のマクロ経済の見通し

- 中東

- アフリカ

- 南米

第13章 競合情勢

- イントロダクション

- 主要参入企業の戦略/強み(2022年~2024年)

- 収益分析(2020年~2024年)

- 市場シェア分析(2024年)

- 企業の評価と財務指標(2025年)

- ブランドの比較

- 企業の評価マトリクス:主要企業(2024年)

- 企業の評価マトリクス:スタートアップ/中小企業(2024年)

- 競合シナリオ

第14章 企業プロファイル

- 主要企業

- EMERSON ELECTRIC CO.

- ABB

- SCHNEIDER ELECTRIC

- YOKOGAWA ELECTRIC CORPORATION

- ENDRESS+HAUSER GROUP SERVICES AG

- SIEMENS

- HONEYWELL INTERNATIONAL INC.

- FUJI ELECTRIC CO., LTD.

- DANFOSS

- AZBIL CORPORATION

- KROHNE GROUP

- ASHCROFT, INC.

- HUBA CONTROL

- その他の主要企業

- WIKA ALEXANDER WIEGAND SE & CO. KG

- DWYER INSTRUMENTS, LLC.

- VEGA

- KELLER DRUCKMESSTECHNIK AG

- HYDAC INTERNATIONAL GMBH

- KLAY INSTRUMENTS

- JUMO GMBH & CO. KG

- BROOKS INSTRUMENT

- BD|SENSORS GMBH

- GEORGIN

- TRAFAG

- APLISENS S.A.

第15章 付録

List of Tables

- TABLE 1 LIMITATIONS AND ASSOCIATED RISKS

- TABLE 2 ROLE OF COMPANIES IN PRESSURE TRANSMITTER ECOSYSTEM

- TABLE 3 AVERAGE SELLING PRICE OF PRESSURE TRANSMITTERS OFFERED BY KEY PLAYERS BASED ON TYPES, 2024 (USD)

- TABLE 4 AVERAGE SELLING PRICE TREND OF PRESSURE TRANSMITTERS, BY TYPE, 2021-2024 (USD)

- TABLE 5 AVERAGE SELLING PRICE TREND OF DIFFERENTIAL PRESSURE TRANSMITTERS, BY REGION, 2021-2024 (USD)

- TABLE 6 PRESSURE TRANSMITTER MARKET: PORTER'S FIVE FORCES ANALYSIS

- TABLE 7 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS FOR TOP THREE INDUSTRIES (%)

- TABLE 8 KEY BUYING CRITERIA FOR TOP THREE INDUSTRIES

- TABLE 9 IMPORT DATA FOR HS CODE 902620-COMPLIANT PRODUCTS, BY COUNTRY, 2019-2023 (USD MILLION)

- TABLE 10 EXPORT DATA FOR HS CODE 902620-COMPLIANT PRODUCTS, BY COUNTRY, 2019-2023 (USD MILLION)

- TABLE 11 LIST OF APPLIED/GRANTED PATENTS RELATED TO PRESSURE TRANSMITTER MARKET, 2023-2024

- TABLE 12 PRESSURE TRANSMITTER MARKET: LIST OF MAJOR CONFERENCES AND EVENTS, 2025-2026

- TABLE 13 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 14 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 15 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 16 ROW: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 17 PRESSURE TRANSMITTER MARKET: MAJOR STANDARDS/DIRECTIVES

- TABLE 18 PRESSURE TRANSMITTER MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 19 PRESSURE TRANSMITTER MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 20 PRESSURE TRANSMITTER MARKET, BY TYPE, 2021-2024 (THOUSAND UNITS)

- TABLE 21 PRESSURE TRANSMITTER MARKET, BY TYPE, 2025-2030 (THOUSAND UNITS)

- TABLE 22 DIFFERENTIAL: PRESSURE TRANSMITTER MARKET, BY INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 23 DIFFERENTIAL: PRESSURE TRANSMITTER MARKET, BY INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 24 DIFFERENTIAL: PRESSURE TRANSMITTER MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 25 DIFFERENTIAL: PRESSURE TRANSMITTER MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 26 ABSOLUTE: PRESSURE TRANSMITTER MARKET, BY INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 27 ABSOLUTE: PRESSURE TRANSMITTER MARKET, BY INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 28 ABSOLUTE: PRESSURE TRANSMITTER MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 29 ABSOLUTE: PRESSURE TRANSMITTER MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 30 GAUGE: PRESSURE TRANSMITTER MARKET, BY INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 31 GAUGE: PRESSURE TRANSMITTER MARKET, BY INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 32 GAUGE: PRESSURE TRANSMITTER MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 33 GAUGE: PRESSURE TRANSMITTER MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 34 MULTIVARIABLE: PRESSURE TRANSMITTER MARKET, BY INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 35 MULTIVARIABLE: PRESSURE TRANSMITTER MARKET, BY INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 36 MULTIVARIABLE: PRESSURE TRANSMITTER MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 37 MULTIVARIABLE: PRESSURE TRANSMITTER MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 38 PRESSURE TRANSMITTER MARKET, BY FLUID TYPE, 2021-2024 (USD MILLION)

- TABLE 39 PRESSURE TRANSMITTER MARKET, BY FLUID TYPE, 2025-2030 (USD MILLION)

- TABLE 40 LIQUID: PRESSURE TRANSMITTER MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 41 LIQUID: PRESSURE TRANSMITTER MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 42 STEAM: PRESSURE TRANSMITTER MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 43 STEAM: PRESSURE TRANSMITTER MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 44 GAS: PRESSURE TRANSMITTER MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 45 GAS: PRESSURE TRANSMITTER MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 46 PRESSURE TRANSMITTER MARKET, BY MEASUREMENT APPLICATION, 2021-2024 (USD MILLION)

- TABLE 47 PRESSURE TRANSMITTER MARKET, BY MEASUREMENT APPLICATION, 2025-2030 (USD MILLION)

- TABLE 48 LEVEL: PRESSURE TRANSMITTER MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 49 LEVEL: PRESSURE TRANSMITTER MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 50 FLOW: PRESSURE TRANSMITTER MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 51 FLOW: PRESSURE TRANSMITTER MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 52 PRESSURE: PRESSURE TRANSMITTER MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 53 PRESSURE: PRESSURE TRANSMITTER MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 54 PRESSURE TRANSMITTER MARKET, BY INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 55 PRESSURE TRANSMITTER MARKET, BY INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 56 OIL & GAS: PRESSURE TRANSMITTER MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 57 OIL & GAS: PRESSURE TRANSMITTER MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 58 CHEMICALS: PRESSURE TRANSMITTER MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 59 CHEMICALS: PRESSURE TRANSMITTER MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 60 WATER & WASTEWATER TREATMENT: PRESSURE TRANSMITTER MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 61 WATER & WASTEWATER TREATMENT: PRESSURE TRANSMITTER MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 62 FOOD & BEVERAGES: PRESSURE TRANSMITTER MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 63 FOOD & BEVERAGES: PRESSURE TRANSMITTER MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 64 POWER: PRESSURE TRANSMITTER MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 65 POWER: PRESSURE TRANSMITTER MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 66 PULP & PAPER: PRESSURE TRANSMITTER MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 67 PULP & PAPER: PRESSURE TRANSMITTER MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 68 METALS & MINING: PRESSURE TRANSMITTER MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 69 METALS & MINING: PRESSURE TRANSMITTER MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 70 PHARMACEUTICALS: PRESSURE TRANSMITTER MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 71 PHARMACEUTICALS: PRESSURE TRANSMITTER MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 72 OTHER INDUSTRIES: PRESSURE TRANSMITTER MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 73 OTHER INDUSTRIES: PRESSURE TRANSMITTER MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 74 PRESSURE TRANSMITTER MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 75 PRESSURE TRANSMITTER MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 76 NORTH AMERICA: PRESSURE TRANSMITTER MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 77 NORTH AMERICA: PRESSURE TRANSMITTER MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 78 NORTH AMERICA: PRESSURE TRANSMITTER MARKET, BY FLUID TYPE, 2021-2024 (USD MILLION)

- TABLE 79 NORTH AMERICA: PRESSURE TRANSMITTER MARKET, BY FLUID TYPE, 2025-2030 (USD MILLION)

- TABLE 80 NORTH AMERICA: PRESSURE TRANSMITTER MARKET, BY MEASUREMENT APPLICATION, 2021-2024 (USD MILLION)

- TABLE 81 NORTH AMERICA: PRESSURE TRANSMITTER MARKET, BY MEASUREMENT APPLICATION, 2025-2030 (USD MILLION)

- TABLE 82 NORTH AMERICA: PRESSURE TRANSMITTER MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 83 NORTH AMERICA: PRESSURE TRANSMITTER MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 84 US: PRESSURE TRANSMITTER MARKET, BY INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 85 US: PRESSURE TRANSMITTER MARKET, BY INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 86 CANADA: PRESSURE TRANSMITTER MARKET, BY INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 87 CANADA: PRESSURE TRANSMITTER MARKET, BY INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 88 MEXICO: PRESSURE TRANSMITTER MARKET, BY INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 89 MEXICO: PRESSURE TRANSMITTER MARKET, BY INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 90 EUROPE: PRESSURE TRANSMITTER MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 91 EUROPE: PRESSURE TRANSMITTER MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 92 EUROPE: PRESSURE TRANSMITTER MARKET, BY FLUID TYPE, 2021-2024 (USD MILLION)

- TABLE 93 EUROPE: PRESSURE TRANSMITTER MARKET, BY FLUID TYPE, 2025-2030 (USD MILLION)

- TABLE 94 EUROPE: PRESSURE TRANSMITTER MARKET, BY MEASUREMENT APPLICATION, 2021-2024 (USD MILLION)

- TABLE 95 EUROPE: PRESSURE TRANSMITTER MARKET, BY MEASUREMENT APPLICATION, 2025-2030 (USD MILLION)

- TABLE 96 EUROPE: PRESSURE TRANSMITTER MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 97 EUROPE: PRESSURE TRANSMITTER MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 98 GERMANY: PRESSURE TRANSMITTER MARKET, BY INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 99 GERMANY: PRESSURE TRANSMITTER MARKET, BY INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 100 UK: PRESSURE TRANSMITTER MARKET, BY INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 101 UK: PRESSURE TRANSMITTER MARKET, BY INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 102 FRANCE: PRESSURE TRANSMITTER MARKET, BY INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 103 FRANCE: PRESSURE TRANSMITTER MARKET, BY INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 104 ITALY: PRESSURE TRANSMITTER MARKET, BY INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 105 ITALY: PRESSURE TRANSMITTER MARKET, BY INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 106 SPAIN: PRESSURE TRANSMITTER MARKET, BY INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 107 SPAIN: PRESSURE TRANSMITTER MARKET, BY INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 108 POLAND: PRESSURE TRANSMITTER MARKET, BY INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 109 POLAND: PRESSURE TRANSMITTER MARKET, BY INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 110 NORDIC: PRESSURE TRANSMITTER MARKET, BY INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 111 NORDIC: PRESSURE TRANSMITTER MARKET, BY INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 112 REST OF EUROPE: PRESSURE TRANSMITTER MARKET, BY INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 113 REST OF EUROPE: PRESSURE TRANSMITTER MARKET, BY INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 114 ASIA PACIFIC: PRESSURE TRANSMITTER MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 115 ASIA PACIFIC: PRESSURE TRANSMITTER MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 116 ASIA PACIFIC: PRESSURE TRANSMITTER MARKET, BY FLUID TYPE, 2021-2024 (USD MILLION)

- TABLE 117 ASIA PACIFIC: PRESSURE TRANSMITTER MARKET, BY FLUID TYPE, 2025-2030 (USD MILLION)

- TABLE 118 ASIA PACIFIC: PRESSURE TRANSMITTER MARKET, BY MEASUREMENT APPLICATION, 2021-2024 (USD MILLION)

- TABLE 119 ASIA PACIFIC: PRESSURE TRANSMITTER MARKET, BY MEASUREMENT APPLICATION, 2025-2030 (USD MILLION)

- TABLE 120 ASIA PACIFIC: PRESSURE TRANSMITTER MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 121 ASIA PACIFIC: PRESSURE TRANSMITTER MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 122 CHINA: PRESSURE TRANSMITTER MARKET, BY INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 123 CHINA: PRESSURE TRANSMITTER MARKET, BY INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 124 JAPAN: PRESSURE TRANSMITTER MARKET, BY INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 125 JAPAN: PRESSURE TRANSMITTER MARKET, BY INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 126 INDIA: PRESSURE TRANSMITTER MARKET, BY INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 127 INDIA: PRESSURE TRANSMITTER MARKET, BY INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 128 SOUTH KOREA: PRESSURE TRANSMITTER MARKET, BY INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 129 SOUTH KOREA: PRESSURE TRANSMITTER MARKET, BY INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 130 AUSTRALIA: PRESSURE TRANSMITTER MARKET, BY INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 131 AUSTRALIA: PRESSURE TRANSMITTER MARKET, BY INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 132 INDONESIA: PRESSURE TRANSMITTER MARKET, BY INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 133 INDONESIA: PRESSURE TRANSMITTER MARKET, BY INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 134 MALAYSIA: PRESSURE TRANSMITTER MARKET, BY INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 135 MALAYSIA: PRESSURE TRANSMITTER MARKET, BY INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 136 VIETNAM: PRESSURE TRANSMITTER MARKET, BY INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 137 VIETNAM: PRESSURE TRANSMITTER MARKET, BY INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 138 REST OF ASIA PACIFIC: PRESSURE TRANSMITTER MARKET, BY INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 139 REST OF ASIA PACIFIC: PRESSURE TRANSMITTER MARKET, BY INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 140 ROW: PRESSURE TRANSMITTER MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 141 ROW: PRESSURE TRANSMITTER MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 142 ROW: PRESSURE TRANSMITTER MARKET, BY FLUID TYPE, 2021-2024 (USD MILLION)

- TABLE 143 ROW: PRESSURE TRANSMITTER MARKET, BY FLUID TYPE, 2025-2030 (USD MILLION)

- TABLE 144 ROW: PRESSURE TRANSMITTER MARKET, BY MEASUREMENT APPLICATION, 2021-2024 (USD MILLION)

- TABLE 145 ROW: PRESSURE TRANSMITTER MARKET, BY MEASUREMENT APPLICATION, 2025-2030 (USD MILLION)

- TABLE 146 ROW: PRESSURE TRANSMITTER MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 147 ROW: PRESSURE TRANSMITTER MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 148 MIDDLE EAST: PRESSURE TRANSMITTER MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 149 MIDDLE EAST: PRESSURE TRANSMITTER MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 150 GCC: PRESSURE TRANSMITTER MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 151 GCC: PRESSURE TRANSMITTER MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 152 BAHRAIN: PRESSURE TRANSMITTER MARKET, BY INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 153 BAHRAIN: PRESSURE TRANSMITTER MARKET, BY INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 154 KUWAIT: PRESSURE TRANSMITTER MARKET, BY INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 155 KUWAIT: PRESSURE TRANSMITTER MARKET, BY INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 156 OMAN: PRESSURE TRANSMITTER MARKET, BY INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 157 OMAN: PRESSURE TRANSMITTER MARKET, BY INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 158 QATAR: PRESSURE TRANSMITTER MARKET, BY INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 159 QATAR: PRESSURE TRANSMITTER MARKET, BY INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 160 SAUDI ARABIA: PRESSURE TRANSMITTER MARKET, BY INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 161 SAUDI ARABIA: PRESSURE TRANSMITTER MARKET, BY INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 162 UAE: PRESSURE TRANSMITTER MARKET, BY INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 163 UAE: PRESSURE TRANSMITTER MARKET, BY INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 164 REST OF MIDDLE EAST: PRESSURE TRANSMITTER MARKET, BY INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 165 REST OF MIDDLE EAST: PRESSURE TRANSMITTER MARKET, BY INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 166 AFRICA: PRESSURE TRANSMITTER MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 167 AFRICA: PRESSURE TRANSMITTER MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 168 SOUTH AFRICA: PRESSURE TRANSMITTER MARKET, BY INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 169 SOUTH AFRICA: PRESSURE TRANSMITTER MARKET, BY INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 170 OTHER AFRICAN COUNTRIES: PRESSURE TRANSMITTER MARKET, BY INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 171 OTHER AFRICAN COUNTRIES: PRESSURE TRANSMITTER MARKET, BY INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 172 SOUTH AMERICA: PRESSURE TRANSMITTER MARKET, BY INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 173 SOUTH AMERICA: PRESSURE TRANSMITTER MARKET, BY INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 174 PRESSURE TRANSMITTER MARKET: OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS, MARCH 2022-NOVEMBER 2024

- TABLE 175 PRESSURE TRANSMITTER MARKET: DEGREE OF COMPETITION, 2024

- TABLE 176 REGION FOOTPRINT

- TABLE 177 INDUSTRY FOOTPRINT

- TABLE 178 FLUID TYPE FOOTPRINT

- TABLE 179 TYPE FOOTPRINT

- TABLE 180 MEASUREMENT APPLICATION FOOTPRINT

- TABLE 181 PRESSURE TRANSMITTER MARKET: DETAILED LIST OF KEY STARTUPS/SMES

- TABLE 182 PRESSURE TRANSMITTER MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- TABLE 183 PRESSURE TRANSMITTER MARKET: PRODUCT LAUNCHES, MARCH 2022-NOVEMBER 2024

- TABLE 184 PRESSURE TRANSMITTER MARKET: DEALS, MARCH 2022-NOVEMBER 2024

- TABLE 185 PRESSURE TRANSMITTER MARKET: EXPANSIONS, MARCH 2022-NOVEMBER 2024

- TABLE 186 EMERSON ELECTRIC CO.: COMPANY OVERVIEW

- TABLE 187 EMERSON ELECTRIC CO.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 188 ABB: COMPANY OVERVIEW

- TABLE 189 ABB: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 190 ABB: PRODUCT LAUNCHES

- TABLE 191 SCHNEIDER ELECTRIC: COMPANY OVERVIEW

- TABLE 192 SCHNEIDER ELECTRIC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 193 YOKOGAWA ELECTRIC CORPORATION: COMPANY OVERVIEW

- TABLE 194 YOKOGAWA ELECTRIC CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 195 ENDRESS+HAUSER GROUP SERVICES AG: COMPANY OVERVIEW

- TABLE 196 ENDRESS+HAUSER GROUP SERVICES AG: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 197 SIEMENS: COMPANY OVERVIEW

- TABLE 198 SIEMENS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 199 HONEYWELL INTERNATIONAL INC.: COMPANY OVERVIEW

- TABLE 200 HONEYWELL INTERNATIONAL INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 201 FUJI ELECTRIC CO., LTD.: COMPANY OVERVIEW

- TABLE 202 FUJI ELECTRIC CO., LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 203 DANFOSS: COMPANY OVERVIEW

- TABLE 204 DANFOSS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 205 DANFOSS: PRODUCT LAUNCHES

- TABLE 206 AZBIL CORPORATION: COMPANY OVERVIEW

- TABLE 207 AZBIL CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 208 AZBIL CORPORATION: EXPANSIONS

- TABLE 209 KROHNE GROUP: COMPANY OVERVIEW

- TABLE 210 KROHNE GROUP: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 211 ASHCROFT, INC.: COMPANY OVERVIEW

- TABLE 212 ASHCROFT, INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 213 HUBA CONTROL: COMPANY OVERVIEW

- TABLE 214 HUBA CONTROL: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 215 HUBA CONTROL: PRODUCT LAUNCHES

- TABLE 216 HUBA CONTROL: EXPANSIONS

- TABLE 217 WIKA ALEXANDER WIEGAND SE & CO. KG: COMPANY OVERVIEW

- TABLE 218 DWYER INSTRUMENTS, LLC.: COMPANY OVERVIEW

- TABLE 219 VEGA: COMPANY OVERVIEW

- TABLE 220 KELLER DRUCKMESSTECHNIK AG: COMPANY OVERVIEW

- TABLE 221 HYDAC INTERNATIONAL GMBH: COMPANY OVERVIEW

- TABLE 222 KLAY INSTRUMENTS: COMPANY OVERVIEW

- TABLE 223 JUMO GMBH & CO. KG: COMPANY OVERVIEW

- TABLE 224 BROOKS INSTRUMENT: COMPANY OVERVIEW

- TABLE 225 BD|SENSORS GMBH: COMPANY OVERVIEW

- TABLE 226 GEORGIN: COMPANY OVERVIEW

- TABLE 227 TRAFAG: COMPANY OVERVIEW

- TABLE 228 APLISENS S.A.: COMPANY OVERVIEW

List of Figures

- FIGURE 1 PRESSURE TRANSMITTER MARKET SEGMENTATION AND REGIONAL SCOPE

- FIGURE 2 PRESSURE TRANSMITTER MARKET: RESEARCH DESIGN

- FIGURE 3 MARKET SIZE ESTIMATION METHODOLOGY (SUPPLY SIDE): REVENUE GENERATED BY COMPANIES THROUGH SALES OF PRESSURE TRANSMITTERS

- FIGURE 4 BOTTOM-UP APPROACH TO ARRIVE AT MARKET SIZE

- FIGURE 5 TOP-DOWN APPROACH TO ARRIVE AT MARKET SIZE

- FIGURE 6 DATA TRIANGULATION

- FIGURE 7 ASSUMPTIONS FOR RESEARCH STUDY

- FIGURE 8 DIFFERENTIAL SEGMENT TO DOMINATE PRESSURE TRANSMITTER MARKET BETWEEN 2025 AND 2030

- FIGURE 9 LIQUID SEGMENT TO CAPTURE LARGEST SHARE OF PRESSURE TRANSMITTER MARKET IN 2030

- FIGURE 10 LEVEL SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE IN 2030

- FIGURE 11 OIL & GAS SEGMENT TO HOLD LARGEST MARKET SHARE IN 2025

- FIGURE 12 ASIA PACIFIC TO EXHIBIT HIGHEST CAGR IN PRESSURE TRANSMITTER MARKET DURING FORECAST PERIOD

- FIGURE 13 RISING EMPHASIS ON INDUSTRIAL AUTOMATION AND ADVANCES IN SENSOR TECHNOLOGY TO DRIVE PRESSURE TRANSMITTER MARKET

- FIGURE 14 DIFFERENTIAL SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE IN 2025

- FIGURE 15 LIQUID SEGMENT TO HOLD LARGEST MARKET SHARE IN 2030

- FIGURE 16 LEVEL SEGMENT TO CAPTURE LARGEST SHARE OF PRESSURE TRANSMITTER MARKET IN 2030

- FIGURE 17 OIL & GAS SEGMENT TO DOMINATE PRESSURE TRANSMITTER MARKET FROM 2025 TO 2030

- FIGURE 18 INDIA TO RECORD HIGHEST CAGR IN GLOBAL PRESSURE TRANSMITTER MARKET DURING FORECAST PERIOD

- FIGURE 19 PRESSURE TRANSMITTER MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 20 IMPACT ANALYSIS: DRIVERS

- FIGURE 21 IMPACT ANALYSIS: RESTRAINTS

- FIGURE 22 IMPACT ANALYSIS: OPPORTUNITIES

- FIGURE 23 IMPACT ANALYSIS: CHALLENGES

- FIGURE 24 PRESSURE TRANSMITTER VALUE CHAIN ANALYSIS

- FIGURE 25 GLOBAL PRESSURE TRANSMITTER ECOSYSTEM

- FIGURE 26 AVERAGE SELLING PRICE OF PRESSURE TRANSMITTERS OFFERED BY MAJOR PLAYERS, BY TYPE, 2024

- FIGURE 27 AVERAGE SELLING PRICE TREND OF DIFFERENT TYPES OF PRESSURE TRANSMITTERS, 2021-2024

- FIGURE 28 AVERAGE SELLING PRICE TREND OF DIFFERENTIAL PRESSURE TRANSMITTERS, BY REGION, 2021-2024

- FIGURE 29 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- FIGURE 30 INVESTMENT AND FUNDING SCENARIO, 2019-2024

- FIGURE 31 PRESSURE TRANSMITTER MARKET: PORTER'S FIVE FORCES ANALYSIS

- FIGURE 32 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE INDUSTRIES

- FIGURE 33 KEY BUYING CRITERIA FOR TOP THREE INDUSTRIES

- FIGURE 34 IMPORT SCENARIO FOR HS CODE 902620-COMPLIANT PRODUCTS IN TOP FIVE COUNTRIES, 2019-2023

- FIGURE 35 EXPORT SCENARIO FOR HS CODE 902620-COMPLIANT PRODUCTS IN TOP FIVE COUNTRIES, 2019-2023

- FIGURE 36 ANALYSIS OF PATENTS GRANTED, APPLIED, AND OWNED IN PRESSURE TRANSMITTER MARKET, 2015-2024

- FIGURE 37 KEY AI USE CASES IN PRESSURE TRANSMITTER MARKET

- FIGURE 38 DESIGNS AND FUNCTIONALITIES OF PRESSURE TRANSMITTERS

- FIGURE 39 PRESSURE TRANSMITTER TECHNOLOGIES

- FIGURE 40 PRESSURE TRANSMITTER MARKET, BY TYPE

- FIGURE 41 MULTIVARIABLE SEGMENT TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 42 PRESSURE TRANSMITTER MARKET, BY FLUID TYPE

- FIGURE 43 LIQUID SEGMENT TO DOMINATE PRESSURE TRANSMITTER MARKET BETWEEN 2025 AND 2030

- FIGURE 44 PRESSURE TRANSMITTER MARKET, BY MEASUREMENT APPLICATION

- FIGURE 45 LEVEL SEGMENT TO HOLD LARGEST SHARE OF PRESSURE TRANSMITTER MARKET IN 2025

- FIGURE 46 PRESSURE TRANSMITTER MARKET, BY INDUSTRY

- FIGURE 47 OIL & GAS SEGMENT TO HOLD LARGEST SHARE OF PRESSURE TRANSMITTER MARKET IN 2030

- FIGURE 48 COUNTRY-LEVEL SPLIT OF PRESSURE TRANSMITTER MARKET

- FIGURE 49 INDIA TO BE MOST LUCRATIVE MARKET GLOBALLY FOR PRESSURE TRANSMITTERS FROM 2025 TO 2030

- FIGURE 50 ASIA PACIFIC TO RECORD HIGHEST CAGR IN PRESSURE TRANSMITTER MARKET BETWEEN 2025 AND 2030

- FIGURE 51 SNAPSHOT OF PRESSURE TRANSMITTER MARKET IN NORTH AMERICA

- FIGURE 52 US TO HOLD MAJORITY OF NORTH AMERICAN PRESSURE TRANSMITTER MARKET IN 2030

- FIGURE 53 SNAPSHOT OF PRESSURE TRANSMITTER MARKET IN EUROPE

- FIGURE 54 GERMANY TO HOLD MAJORITY OF EUROPEAN PRESSURE TRANSMITTER MARKET IN 2030

- FIGURE 55 SNAPSHOT OF PRESSURE TRANSMITTER MARKET IN ASIA PACIFIC

- FIGURE 56 CHINA TO CAPTURE LARGEST SHARE OF ASIA PACIFIC MARKET IN 2030

- FIGURE 57 MIDDLE EAST TO DOMINATE PRESSURE TRANSMITTER MARKET IN ROW DURING FORECAST PERIOD

- FIGURE 58 PRESSURE TRANSMITTER MARKET: REVENUE ANALYSIS OF FIVE KEY PLAYERS, 2020-2024

- FIGURE 59 MARKET SHARE ANALYSIS OF COMPANIES OFFERING PRESSURE TRANSMITTERS, 2024

- FIGURE 60 COMPANY VALUATION, 2025

- FIGURE 61 FINANCIAL METRICS (EV/EBITDA), 2025

- FIGURE 62 BRAND COMPARISON

- FIGURE 63 PRESSURE TRANSMITTER MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2024

- FIGURE 64 PRESSURE TRANSMITTER MARKET: COMPANY FOOTPRINT

- FIGURE 65 PRESSURE TRANSMITTER MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2024

- FIGURE 66 EMERSON ELECTRIC CO.: COMPANY SNAPSHOT

- FIGURE 67 ABB: COMPANY SNAPSHOT

- FIGURE 68 SCHNEIDER ELECTRIC: COMPANY SNAPSHOT

- FIGURE 69 YOKOGAWA ELECTRIC CORPORATION: COMPANY SNAPSHOT

- FIGURE 70 ENDRESS+HAUSER GROUP SERVICES AG: COMPANY SNAPSHOT

- FIGURE 71 SIEMENS: COMPANY SNAPSHOT

- FIGURE 72 HONEYWELL INTERNATIONAL INC.: COMPANY SNAPSHOT

- FIGURE 73 FUJI ELECTRIC CO., LTD.: COMPANY SNAPSHOT

- FIGURE 74 DANFOSS: COMPANY SNAPSHOT

- FIGURE 75 AZBIL CORPORATION: COMPANY SNAPSHOT

The global pressure transmitter market was valued at USD 3.21 billion in 2025 and is projected to reach USD 3.84 billion by 2030; it is expected to register a CAGR of 3.7% during the forecast period. Rising demand for energy-efficient systems is driving the growth of the pressure transmitter market. Whereas need for substantial recurring and operational expenses is restraining the growth of the pressure transmitter market.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2020-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Billion) |

| Segments | By Technology, Type, Design & Functionality, Fluid Type, Measurement Application, Industry and Region |

| Regions covered | North America, Europe, APAC, RoW |

"The liquid fluid type segment is expected to exhibit highest CAGR in the pressure transmitter market during the forecast period."

The liquid fluid type segment is expected to exhibit highest CAGR in the pressure transmitter market during the forecast period. Pressure transmitters are essential for accurately measuring and monitoring liquid, gas, and steam pressure across various industries, including oil & gas, chemicals, power generation, and water treatment. Among these, liquid applications dominate due to the widespread need for precise pressure measurement in water management, fuel monitoring, and industrial processing. Advanced pressure transmitter technology enhances operational efficiency by ensuring real-time data accuracy, optimizing process control, and improving safety. In particular, digital advancements in pressure measurement enable seamless data integration across industrial systems, facilitating better decision-making and process automation. By enabling consistent monitoring, pressure transmitters help industries maintain regulatory compliance, reduce downtime, and enhance productivity. The growing demand for smart pressure transmitters with IoT capabilities further strengthens their role in liquid-based applications, making them an indispensable part of modern industrial operations.

"The level measurement application segment is expected to hold major share in the pressure transmitter market."

The level measurement application segment is expected to hold the largest share in the pressure transmitter market during the forecast period. This growth is driven by the increasing demand for accurate and reliable level monitoring across industries such as oil & gas, chemicals, water & wastewater, and power generation. Pressure transmitters play a vital role in ensuring precise liquid level measurements in storage tanks, processing units, and industrial vessels, helping maintain safety and operational efficiency.With stricter regulations on process safety and environmental compliance, industries are adopting advanced pressure transmitters to enhance monitoring accuracy and prevent overflows, leaks, and equipment failures. Modern pressure transmitters, equipped with digital communication and remote monitoring capabilities, improve process control and reduce maintenance costs by enabling early issue detection.Additionally, the growing integration of automation and smart monitoring systems further boosts the demand for high-performance level measurement solutions. As industries focus on efficiency, safety, and regulatory compliance, pressure transmitters for level measurement will continue to dominate the market, driving overall growth in the measurement application segment.

"North America is expected to hold the second largest share of the pressure transmitter market."

The North American market holds the second-largest share in the pressure transmitter market, driven by several key factors. The region is home to major industries such as oil & gas, chemicals, food & beverages, and pharmaceuticals, all of which rely on pressure transmitters for accurate monitoring and process control. Additionally, North America has a well-developed infrastructure for power generation and advanced manufacturing facilities that require reliable pressure measurement solutions to ensure operational efficiency and automation. Moreover, stringent regulations on safety, environmental protection, and energy efficiency further drive the adoption of high-precision pressure transmitters, helping industries enhance performance, reduce emissions, and improve overall sustainability.

Breakdown of primaries

The study contains insights from various industry experts, ranging from component suppliers to Tier 1 companies and OEMs. The break-up of the primaries is as follows:

- By Company Type - Tier 1 - 30%, Tier 2 - 30%, Tier 3 - 40%

- By Designation- C-level Executives - 35%, Directors - 40%, Others - 25%

- By Region-North America - 32%, Europe - 20%, Asia Pacific - 40%, RoW - 8%

The pressure transmitter market is dominated by a few globally established players The key companies in the pressure transmitter market include Emerson Electric Co. (US), Yokogawa Electric Corporation (Japan), Honeywell International Inc. (US), ABB (Switzerland), Schneider Electric (France), Endress+Hauser Group Services AG (Switzerland), Fuji Electric Co., Ltd.(Japan), Azbil Corporation (Japan), Ashcroft, Inc(US), Danfoss (Denmark), Huba Control (Switzerland), Siemens (Germany).The study includes an in-depth competitive analysis of these key players in the pressure transmitter market, with their company profiles, recent developments, and key market strategies.

Research Coverage:

The report segments the pressure transmitter market and forecasts its size by type, by fluid type, by measurement application, by industry. The report also discusses the drivers, restraints, opportunities, and challenges pertaining to the market. It gives a detailed view of the market across four main regions-North America, Europe, Asia Pacific, and RoW. Supply chain analysis has been included in the report, along with the key players and their competitive analysis in the pressure transmitter ecosystem.

Key Benefits to Buy the Report:

- Analysis of key drivers (Rising use of automation by industry players to optimize resources and boost efficiency). Restraint (Need for period calibration of pressure transmitters to ensure precision), Opportunity (Development of pressure transmitters with smart calibration and self-diagnostics features), Challenges (Balancing efficiency, compatibility, and sustainability in pressure transmitters in rapid digital transformation).

- Product Development/Innovation: Detailed insights on upcoming technologies, research and development activities, and new product launches in the pressure transmitter market.

- Market Development: Comprehensive information about lucrative markets - the report analyses the pressure transmitter market across varied regions

- Market Diversification: Exhaustive information about new products and services, untapped geographies, recent developments, and investments in the pressure transmitter market.

- Competitive Assessment: In depth assessment of market shares, growth strategies, and service offerings of leading players Emerson Electric Co. (US), Yokogawa Electric Corporation (Japan), Honeywell International Inc. (US), ABB (Switzerland), Schneider Electric (France), Endress+Hauser Group Services AG (Switzerland) among others in the pressure transmitter market.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED AND REGIONAL SCOPE

- 1.3.2 INCLUSIONS AND EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 UNIT CONSIDERED

- 1.6 LIMITATIONS

- 1.7 STAKEHOLDERS

- 1.8 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY AND PRIMARY RESEARCH

- 2.1.2 SECONDARY DATA

- 2.1.2.1 List of major secondary sources

- 2.1.2.2 Key data from secondary sources

- 2.1.3 PRIMARY DATA

- 2.1.3.1 List of key participants in primary interviews

- 2.1.3.2 Key data from primary sources

- 2.1.3.3 Key industry insights

- 2.1.3.4 Breakdown of primaries

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 BOTTOM-UP APPROACH

- 2.2.1.1 Arriving at market size using bottom-up approach (demand side)

- 2.2.2 TOP-DOWN APPROACH

- 2.2.2.1 Arriving at market size using top-down approach (supply side)

- 2.2.1 BOTTOM-UP APPROACH

- 2.3 MARKET BREAKDOWN AND DATA TRIANGULATION

- 2.4 RESEARCH ASSUMPTIONS

- 2.5 RESEARCH LIMITATIONS

- 2.6 RISK ANALYSIS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN PRESSURE TRANSMITTER MARKET

- 4.2 PRESSURE TRANSMITTER MARKET, BY TYPE

- 4.3 PRESSURE TRANSMITTER MARKET, BY FLUID TYPE

- 4.4 PRESSURE TRANSMITTER MARKET, BY MEASUREMENT APPLICATION

- 4.5 PRESSURE TRANSMITTER MARKET, BY INDUSTRY

- 4.6 PRESSURE TRANSMITTER MARKET, BY GEOGRAPHY

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Rising use of automation by industry players to optimize resources and boost efficiency

- 5.2.1.2 Increasing implementation of IIoT and Industry 4.0 technologies

- 5.2.1.3 Growing inclination of manufacturing firms toward real-time analytics and predictive maintenance

- 5.2.2 RESTRAINTS

- 5.2.2.1 Requirement for significant investment and technical expertise

- 5.2.2.2 Need for periodic calibration of pressure transmitters to ensure precision

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Development of pressure transmitters with smart calibration and self-diagnostics features

- 5.2.4 CHALLENGES

- 5.2.4.1 Balancing efficiency, compatibility, and sustainability in pressure transmitters in rapid digital transformation

- 5.2.4.2 Providing quick and efficient services or easy replacement solutions to clients

- 5.2.4.3 Addressing cybersecurity risks associated with IIoT integration

- 5.2.1 DRIVERS

- 5.3 VALUE CHAIN ANALYSIS

- 5.4 ECOSYSTEM ANALYSIS

- 5.5 PRICING ANALYSIS

- 5.5.1 AVERAGE SELLING PRICE OF PRESSURE TRANSMITTERS OFFERED BY KEY PLAYERS, BY TYPE, 2024

- 5.5.2 AVERAGE SELLING PRICE TREND OF PRESSURE TRANSMITTERS, BY TYPE, 2021-2024

- 5.5.3 AVERAGE SELLING PRICE TREND OF DIFFERENTIAL PRESSURE TRANSMITTERS, BY REGION, 2021-2024

- 5.6 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.7 INVESTMENT AND FUNDING SCENARIO, 2019-2024

- 5.8 TECHNOLOGY ANALYSIS

- 5.8.1 KEY TECHNOLOGIES

- 5.8.1.1 Pressure sensing elements

- 5.8.1.2 Smart calibration

- 5.8.1.3 Real-time diagnostics

- 5.8.2 ADJACENT TECHNOLOGIES

- 5.8.2.1 Industrial Internet of Things (IIoT)

- 5.8.2.2 AI-powered analytics

- 5.8.2.3 Wireless communication protocols

- 5.8.3 COMPLEMENTARY TECHNOLOGIES

- 5.8.3.1 Cloud computing

- 5.8.3.2 Cybersecurity solutions

- 5.8.1 KEY TECHNOLOGIES

- 5.9 PORTER'S FIVE FORCES ANALYSIS

- 5.9.1 THREAT OF NEW ENTRANTS

- 5.9.2 THREAT OF SUBSTITUTES

- 5.9.3 BARGAINING POWER OF SUPPLIERS

- 5.9.4 BARGAINING POWER OF BUYERS

- 5.9.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.10 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.10.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.10.2 BUYING CRITERIA

- 5.11 CASE STUDIES

- 5.11.1 SOR PROVIDES 805PT PRESSURE TRANSMITTER TO MIDWEST PUBLIC GAS UTILITY TO HELP COMPLY WITH REGULATORY REQUIREMENTS

- 5.11.2 EMERSON OFFERS ROSEMOUNT 4600 OIL & GAS PANEL TRANSMITTER TO CANADIAN OIL COMPANY TO ENSURE RELIABLE PRESSURE CONTROL

- 5.12 TRADE ANALYSIS

- 5.12.1 IMPORT SCENARIO (HS CODE 902620)

- 5.12.2 EXPORT SCENARIO (HS CODE 902620)

- 5.13 PATENTS ANALYSIS

- 5.14 KEY CONFERENCES AND EVENTS, 2025-2026

- 5.15 REGULATORY LANDSCAPE

- 5.15.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS RELATED TO PRESSURE TRANSMITTER MARKET

- 5.15.2 STANDARDS AND DIRECTIVES

- 5.16 IMPACT OF AI/GEN AI

- 5.16.1 INTRODUCTION

- 5.16.2 IMPACT OF AI ON PRESSURE TRANSMITTER MARKET

- 5.16.3 TOP USE CASES AND MARKET POTENTIAL

6 DESIGNS AND FUNCTIONALITIES OF PRESSURE TRANSMITTERS

- 6.1 INTRODUCTION

- 6.2 DIAPHRAGM SEAL

- 6.3 HYDROSTATIC

- 6.4 HYGIENIC

- 6.5 WIRELESS

7 PRESSURE TRANSMITTER TECHNOLOGIES

- 7.1 INTRODUCTION

- 7.2 CAPACITIVE

- 7.3 PIEZORESISTIVE

- 7.4 THIN-FILM RESISTIVE

- 7.5 FIBER-OPTIC

8 PRESSURE TRANSMITTER MARKET, BY TYPE

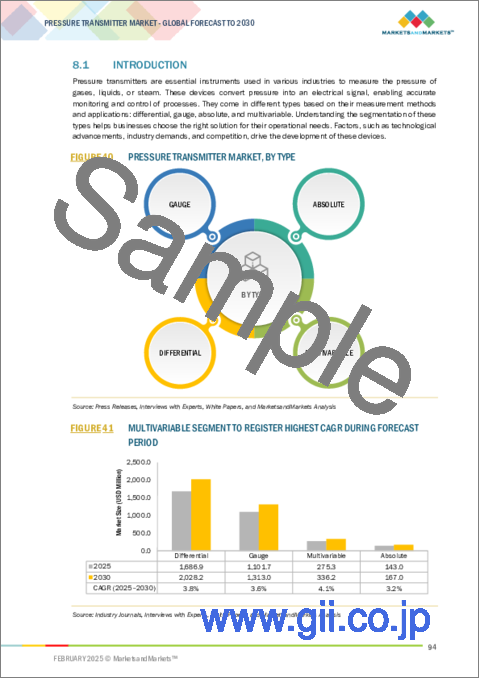

- 8.1 INTRODUCTION

- 8.2 DIFFERENTIAL

- 8.2.1 DURABILITY, EFFICIENCY, AND USER-FRIENDLY ATTRIBUTES TO BOOST SEGMENTAL GROWTH

- 8.3 ABSOLUTE

- 8.3.1 HIGH ACCURACY AND WIRELESS CONNECTIVITY FEATURES TO CONTRIBUTE TO SEGMENTAL GROWTH

- 8.4 GAUGE

- 8.4.1 RAPID TECHNOLOGICAL INNOVATIONS AND DIGITALIZATION TO FOSTER SEGMENTAL GROWTH

- 8.5 MULTIVARIABLE

- 8.5.1 ABILITY TO MEASURE MULTIPLE PARAMETERS WITH FEWER INSTRUMENTS TO SPUR DEMAND

9 PRESSURE TRANSMITTER MARKET, BY FLUID TYPE

- 9.1 INTRODUCTION

- 9.2 LIQUID

- 9.2.1 INCREASING NEED FOR SAFE AND CERTIFIED MEASURING DEVICES IN OIL & GAS SECTOR TO BOOST SEGMENTAL GROWTH

- 9.3 STEAM

- 9.3.1 RISING DEVELOPMENT OF MEASUREMENT SYSTEMS FOR HIGH-TEMPERATURE ENVIRONMENTS TO BOLSTER SEGMENTAL GROWTH

- 9.4 GAS

- 9.4.1 INCREASING IMPLEMENTATION OF STRINGENT SAFETY STANDARDS FOR HAZARDOUS ENVIRONMENTS TO DRIVE MARKET

10 PRESSURE TRANSMITTER MARKET, BY MEASUREMENT APPLICATION

- 10.1 INTRODUCTION

- 10.2 LEVEL

- 10.2.1 RISING TECHNOLOGICAL INNOVATION AND OPERATIONAL EFFICIENCY TO FUEL SEGMENTAL GROWTH

- 10.3 FLOW

- 10.3.1 GROWING PRODUCTION OF PLASTICS, FERTILIZERS, AND PHARMACEUTICALS TO ACCELERATE SEGMENTAL GROWTH

- 10.4 PRESSURE

- 10.4.1 INCREASING FOCUS ON INDUSTRIAL AUTOMATION AND SAFETY DEMAND TO AUGMENT SEGMENTAL GROWTH

11 PRESSURE TRANSMITTER MARKET, BY INDUSTRY

- 11.1 INTRODUCTION

- 11.2 OIL & GAS

- 11.2.1 INCREASING OFFSHORE DRILLING AND EMPHASIS ON AUTOMATION TO FOSTER SEGMENTAL GROWTH

- 11.3 CHEMICALS

- 11.3.1 RISING IMPLEMENTATION OF STRICT SAFETY AND ENVIRONMENTAL REGULATIONS TO CONTRIBUTE TO SEGMENTAL GROWTH

- 11.4 WATER & WASTEWATER TREATMENT

- 11.4.1 GROWING EMPHASIS ON EFFECTIVE CONTROL AND MONITORING OF WATER CYCLE PROCESSES TO FUEL SEGMENTAL GROWTH

- 11.5 FOOD & BEVERAGES

- 11.5.1 INCREASING FOCUS ON COMPLYING WITH STRICT SAFETY REGULATIONS TO AUGMENT SEGMENTAL GROWTH

- 11.6 POWER

- 11.6.1 MOUNTING INVESTMENT IN CLEAN ENERGY TO CONTRIBUTE TO SEGMENTAL GROWTH

- 11.7 PULP & PAPER

- 11.7.1 RISING NEED TO TACKLE CLOGGING AND MONITOR PRESSURE DIFFERENCES IN DIGESTERS AND DRYING CYLINDERS TO DRIVE MARKET

- 11.8 METALS & MINING

- 11.8.1 BURGEONING DEMAND FOR CRITICAL MINERALS TO TRANSITION TO GREEN ENERGY TO FOSTER SEGMENTAL GROWTH

- 11.9 PHARMACEUTICALS

- 11.9.1 INCREASING FOCUS ON MAINTAINING CONTROL OVER FACILITY CONDITIONS TO PREVENT CONTAMINATION TO FUEL SEGMENTAL GROWTH

- 11.10 OTHER INDUSTRIES

12 PRESSURE TRANSMITTER MARKET, BY REGION

- 12.1 INTRODUCTION

- 12.2 NORTH AMERICA

- 12.2.1 MICROECONOMIC OUTLOOK FOR NORTH AMERICA

- 12.2.2 US

- 12.2.2.1 Substantial demand from oil & gas, chemicals, and power sectors to accelerate market growth

- 12.2.3 CANADA

- 12.2.3.1 Supportive government initiatives focused on energy efficiency and sustainability goals to support market growth

- 12.2.4 MEXICO

- 12.2.4.1 Strategic investments in natural gas and oil exploration and production projects to boost demand

- 12.3 EUROPE

- 12.3.1 MICROECONOMIC OUTLOOK FOR EUROPE

- 12.3.2 GERMANY

- 12.3.2.1 Growing adoption of smart manufacturing practices in energy & power and chemicals industries to fuel demand

- 12.3.3 UK

- 12.3.3.1 Rapid transition toward cleaner energy sources to contribute to market growth

- 12.3.4 FRANCE

- 12.3.4.1 Government initiatives and investments in green energy projects to foster market growth

- 12.3.5 ITALY

- 12.3.5.1 Exponential growth of food & beverages industry to spike demand

- 12.3.6 SPAIN

- 12.3.6.1 Surging demand for processed and packaged foods to offer lucrative opportunities

- 12.3.7 POLAND

- 12.3.7.1 Elevating implementation in natural gas and power plants and oil refineries to drive market

- 12.3.8 NORDICS

- 12.3.8.1 Significant focus on increasing oil and gas exploration and production capacity to contribute to market growth

- 12.3.9 REST OF EUROPE

- 12.4 ASIA PACIFIC

- 12.4.1 MACROECONOMIC OUTLOOK FOR ASIA PACIFIC

- 12.4.2 CHINA

- 12.4.2.1 Prominence in chemical production to spur demand

- 12.4.3 JAPAN

- 12.4.3.1 Adoption of Green Growth Strategy to elevate demand

- 12.4.4 INDIA

- 12.4.4.1 Government measures to strengthen textiles industry to boost demand

- 12.4.5 SOUTH KOREA

- 12.4.5.1 Industrial digitalization, supported by 5G and IoT-based manufacturing, to drive market

- 12.4.6 AUSTRALIA

- 12.4.6.1 Adoption of automation and IoT to transform mining operations to support market growth

- 12.4.7 INDONESIA

- 12.4.7.1 Rising emphasis on domestic pharmaceutical manufacturing to drive market

- 12.4.8 MALAYSIA

- 12.4.8.1 Launch of Industry4WRD policy promoting use of advanced technologies to propel market

- 12.4.9 VIETNAM

- 12.4.9.1 Increasing investments in LNG infrastructure and thermal power plants to create opportunities

- 12.4.10 REST OF ASIA PACIFIC

- 12.5 ROW

- 12.5.1 MACROECONOMIC OUTLOOK FOR ROW

- 12.5.2 MIDDLE EAST

- 12.5.2.1 GCC

- 12.5.2.1.1 Bahrain

- 12.5.2.1.1.1 Growing emphasis on industrial automation to contribute to market growth

- 12.5.2.1.2 Kuwait

- 12.5.2.1.2.1 Increasing projects on refinery upgrades and petrochemical plant expansions to drive market

- 12.5.2.1.3 Oman

- 12.5.2.1.3.1 Rising investment in enhanced oil recovery techniques to accelerate market growth

- 12.5.2.1.4 Qatar

- 12.5.2.1.4.1 Rapid expansion of LNG production capacity to bolster market growth

- 12.5.2.1.5 Saudi Arabia

- 12.5.2.1.5.1 Increasing smart city initiatives and digitalization to contribute to market growth

- 12.5.2.1.6 UAE

- 12.5.2.1.6.1 Large-scale infrastructure projects and commitment to sustainable development to drive market

- 12.5.2.1.1 Bahrain

- 12.5.2.2 Rest of Middle East

- 12.5.2.1 GCC

- 12.5.3 AFRICA

- 12.5.3.1 South Africa

- 12.5.3.1.1 Strong focus on energy efficiency and automation fuel market growth

- 12.5.3.2 0ther African countries

- 12.5.3.1 South Africa

- 12.5.4 SOUTH AMERICA

- 12.5.4.1 Rapid industrial expansion and sustainability targets to fuel market growth

13 COMPETITIVE LANDSCAPE

- 13.1 INTRODUCTION

- 13.2 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2022-2024

- 13.3 REVENUE ANALYSIS, 2020-2024

- 13.4 MARKET SHARE ANALYSIS, 2024

- 13.5 COMPANY VALUATION AND FINANCIAL METRICS, 2025

- 13.6 BRAND COMPARISON

- 13.7 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 13.7.1 STARS

- 13.7.2 EMERGING LEADERS

- 13.7.3 PERVASIVE PLAYERS

- 13.7.4 PARTICIPANTS

- 13.7.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 13.7.5.1 Company footprint

- 13.7.5.2 Region footprint

- 13.7.5.3 Industry footprint

- 13.7.5.4 Fluid type footprint

- 13.7.5.5 Type footprint

- 13.7.5.6 Measurement application footprint

- 13.8 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 13.8.1 PROGRESSIVE COMPANIES

- 13.8.2 RESPONSIVE COMPANIES

- 13.8.3 DYNAMIC COMPANIES

- 13.8.4 STARTING BLOCKS

- 13.8.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024

- 13.8.5.1 Detailed list of key startups/SMEs

- 13.8.5.2 Competitive benchmarking of key startups/SMEs

- 13.9 COMPETITIVE SCENARIO

- 13.9.1 PRODUCT LAUNCHES

- 13.9.2 DEALS

- 13.9.3 EXPANSIONS

14 COMPANY PROFILES

- 14.1 KEY PLAYERS

- 14.1.1 EMERSON ELECTRIC CO.

- 14.1.1.1 Business overview

- 14.1.1.2 Products/Solutions/Services offered

- 14.1.1.3 MnM view

- 14.1.1.3.1 Key strengths/Right to win

- 14.1.1.3.2 Strategic choices

- 14.1.1.3.3 Weaknesses/Competitive threats

- 14.1.2 ABB

- 14.1.2.1 Business overview

- 14.1.2.2 Products/Solutions/Services offered

- 14.1.2.3 Recent developments

- 14.1.2.3.1 Product launches

- 14.1.2.4 MnM view

- 14.1.2.4.1 Key strengths/Right to win

- 14.1.2.4.2 Strategic choices

- 14.1.2.4.3 Weaknesses/Competitive threats

- 14.1.3 SCHNEIDER ELECTRIC

- 14.1.3.1 Business overview

- 14.1.3.2 Products/Solutions/Services offered

- 14.1.3.3 MnM view

- 14.1.3.3.1 Key strengths/Right to win

- 14.1.3.3.2 Strategic choices

- 14.1.3.3.3 Weaknesses/Competitive threats

- 14.1.4 YOKOGAWA ELECTRIC CORPORATION

- 14.1.4.1 Business overview

- 14.1.4.2 Products/Solutions/Services offered

- 14.1.4.3 MnM view

- 14.1.4.3.1 Key strengths/Right to win

- 14.1.4.3.2 Strategic choices

- 14.1.4.3.3 Weaknesses/Competitive threats

- 14.1.5 ENDRESS+HAUSER GROUP SERVICES AG

- 14.1.5.1 Business overview

- 14.1.5.2 Products/Solutions/Services offered

- 14.1.5.3 MnM view

- 14.1.5.3.1 Key strengths/Right to win

- 14.1.5.3.2 Strategic choices

- 14.1.5.3.3 Weaknesses/Competitive threats

- 14.1.6 SIEMENS

- 14.1.6.1 Business overview

- 14.1.6.2 Products/Solutions/Services offered

- 14.1.7 HONEYWELL INTERNATIONAL INC.

- 14.1.7.1 Business overview

- 14.1.7.2 Products/Solutions/Services offered

- 14.1.8 FUJI ELECTRIC CO., LTD.

- 14.1.8.1 Business overview

- 14.1.8.2 Products/Solutions/Services offered

- 14.1.9 DANFOSS

- 14.1.9.1 Business overview

- 14.1.9.2 Products/Solutions/Services offered

- 14.1.9.3 Recent developments

- 14.1.9.3.1 Product launches

- 14.1.10 AZBIL CORPORATION

- 14.1.10.1 Business overview

- 14.1.10.2 Products/Solutions/Services offered

- 14.1.10.3 Recent developments

- 14.1.10.3.1 Expansions

- 14.1.11 KROHNE GROUP

- 14.1.11.1 Business overview

- 14.1.11.2 Products/Solutions/Services offered

- 14.1.12 ASHCROFT, INC.

- 14.1.12.1 Business overview

- 14.1.12.2 Products/Solutions/Services offered

- 14.1.13 HUBA CONTROL

- 14.1.13.1 Business overview

- 14.1.13.2 Products/Solutions/Services offered

- 14.1.13.3 Recent developments

- 14.1.13.3.1 Product launches

- 14.1.13.3.2 Expansions

- 14.1.1 EMERSON ELECTRIC CO.

- 14.2 OTHER KEY PLAYERS

- 14.2.1 WIKA ALEXANDER WIEGAND SE & CO. KG

- 14.2.2 DWYER INSTRUMENTS, LLC.

- 14.2.3 VEGA

- 14.2.4 KELLER DRUCKMESSTECHNIK AG

- 14.2.5 HYDAC INTERNATIONAL GMBH

- 14.2.6 KLAY INSTRUMENTS

- 14.2.7 JUMO GMBH & CO. KG

- 14.2.8 BROOKS INSTRUMENT

- 14.2.9 BD|SENSORS GMBH

- 14.2.10 GEORGIN

- 14.2.11 TRAFAG

- 14.2.12 APLISENS S.A.

15 APPENDIX

- 15.1 INSIGHTS FROM INDUSTRY EXPERTS

- 15.2 DISCUSSION GUIDE

- 15.3 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 15.4 CUSTOMIZATION OPTIONS

- 15.5 RELATED REPORTS

- 15.6 AUTHOR DETAILS