|

|

市場調査レポート

商品コード

1575198

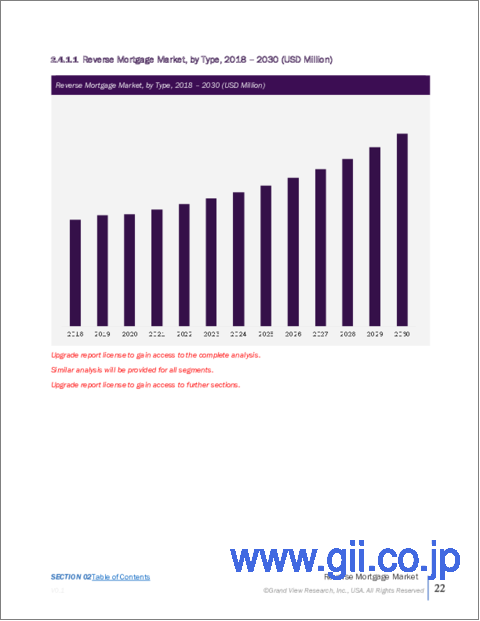

リバースモーゲージの市場規模、シェア、動向分析レポート:タイプ別、用途別、地域別、セグメント予測、2024年~2030年Reverse Mortgage Market Size, Share & Trends Analysis Report By Type, By Application (Debt, Healthcare Related, Renovations, Income Supplement, Living Expenses), By Region, And Segment Forecasts, 2024 - 2030 |

||||||

カスタマイズ可能

|

|||||||

| リバースモーゲージの市場規模、シェア、動向分析レポート:タイプ別、用途別、地域別、セグメント予測、2024年~2030年 |

|

出版日: 2024年09月04日

発行: Grand View Research

ページ情報: 英文 130 Pages

納期: 2~10営業日

|

全表示

- 概要

- 図表

- 目次

リバースモーゲージの市場規模と動向:

リバースモーゲージの世界市場規模は2023年に18億3,000万米ドルと推定され、2024年から2030年までCAGR 5.9%で成長すると予測されています。

リバースモーゲージは、通常62歳以上の高齢者向けに設計された金融商品で、自宅の所有権を保持したまま、自宅持分の一部をローン資金に変換することができます。高齢化の進展、退職後の資金需要、住宅価値とエクイティの増加が、市場成長の主な要因です。加えて、リバースモーゲージに関する認知度や教育水準の向上も、こうした商品がいかに経済的安定性を高めることができるかについて、より多くの退職者が知るようになり、その普及に寄与しています。

世界中で高齢化が急速に進んでおり、65歳以上の人口は2050年までに倍増すると予想されています。この人口動態の変化は、定年退職者が定収入を補い、増加するヘルスケア・コストをカバーしようとするため、リバース・モーゲージ需要の主要な推進力となっています。多くの高齢者にとって自宅資産は依然として最大の資産であるため、リバース・モーゲージは自宅を売却したり引っ越したりすることなく、この富にアクセスする方法を提供します。代替的な老後資金調達ソリューションへのニーズは、今後もこの市場の成長を促進すると思われます。

リバースモーゲージ業者は、借り手の進化するニーズに応えるため、絶えず革新を続け、新しい商品機能を導入しています。変動金利住宅ローンや高額住宅向けジャンボ・リバース・モーゲージなど、より柔軟なローン・オプションのイントロダクションは、潜在的な顧客層を拡大しています。また、申請手続きの合理化や消費者教育の強化により、リバースモーゲージにまつわる偏見が薄れ、より幅広い高齢者にとって魅力的な商品となった。加えて、バーチャル相談、自動引受、デジタル文書管理などの技術革新は、処理時間を短縮し、アクセシビリティを高めています。こうした技術開発は、技術に精通した高齢者をさらに惹きつけ、手続きの透明性と効率性を高め、市場の成長を促進しています。

各国の政府や規制当局は、リバースモーゲージにとってより有利な環境を作るためのイニシアチブを取っています。例えば米国では、連邦住宅管理局(FHA)が、消費者保護を改善し、貸し手のリスクを軽減するために、ホーム・エクイティ・コンバージョン・モーゲージ(HECM)プログラムにいくつかの変更を加えました。これらの措置には、借り手に対する財務評価の義務化、前払手数料の制限、最初に引き出せるエクイティ額の制限などが含まれます。他の市場参入企業でも同様の規制改革が行われ、リバースモーゲージ業界への消費者の信頼と貸し手の参入が促進され、ひいては市場の成長が期待されます。

こうしたリバースモーゲージ商品に関連する高いコストと手数料は、市場の成長を妨げる可能性があります。リバースモーゲージには、オリジネーション費用、クロージング費用、継続的な保険料など、多額の初期費用がかかることが多く、潜在的な借り手を躊躇させる可能性があります。加えて、リバースモーゲージの契約の複雑さや、相続人の相続財産への潜在的な影響は、こうした選択肢を検討している高齢者に懸念を抱かせる可能性があります。さらに、リバースモーゲージを検討している高齢者は、怪しげな投資を勧める人、財政難に直面している家族、欺瞞に満ちた世話人など、悪徳な人物に搾取される危険性があります。したがって、搾取のリスクは市場の成長をさらに妨げる可能性があります。

目次

第1章 調査手法と範囲

第2章 エグゼクティブサマリー

第3章 市場の変数、動向、範囲

- 市場系統の見通し

- 業界バリューチェーン分析

- 市場力学

- 市場促進要因の影響分析

- 市場抑制要因の影響分析

- 市場機会の影響分析

- 業界分析ツール

- ポーターの分析

- PESTEL分析

第4章 リバースモーゲージ市場:タイプの推定・動向分析

- タイプ変動分析と市場シェア、2023年と2030年

- タイプ別市場推計・予測

第5章 リバースモーゲージ市場:用途の推定・動向分析

- 用途変動分析と市場シェア、2023年と2030年

- 用途別市場推計・予測

- 借金

- ヘルスケア関連

- リノベーション

- 所得補助

- 生活費

第6章 リバースモーゲージ市場:地域の推定・動向分析

- リバースモーゲージ市場:地域別展望

- 北米

- 北米リバースモーゲージ市場の推定と予測、2018年-2030年

- 米国

- カナダ

- メキシコ

- 欧州

- 欧州のリバースモーゲージ市場の推定と予測、2018年-2030年

- ドイツ

- 英国

- フランス

- アジア太平洋

- アジア太平洋地域のリバースモーゲージ市場の推定と予測、2018年-2030年

- 中国

- インド

- 日本

- オーストラリア

- 韓国

- ラテンアメリカ

- ラテンアメリカのリバースモーゲージ市場の推定と予測、2018年-2030年

- ブラジル

- 中東・アフリカ

- 中東・アフリカリバースモーゲージ市場の推定と予測、2018-2030年

- アラブ首長国連邦

- サウジアラビア王国(KSA)

- 南アフリカ

第7章 競合情勢

- 企業分類

- 企業市場シェア分析、2023年

- 企業ヒートマップ分析

- 戦略マッピング

- 拡大

- コラボレーション

- 合併と買収

- 新製品の発売

- パートナーシップ

- その他

- 企業プロファイル

- American Advisors Group

- Mutual of Omaha Mortgage

- Liberty Home Equity Solutions, Inc.

- Home Point Financial

- Mid America Mortgage, Inc.

- Wells Fargo Home Mortgage

- Bank of America

- Apex Mortgage

- Pinnacle Financial Group

- Equity Release Council

List of Tables

- Table 1. Reverse mortgage market, 2018 - 2030 (USD Million)

- Table 2. Global market estimates and forecasts, by region, 2018 - 2030 (USD Million)

- Table 3. Global market estimates and forecasts, by type, 2018 - 2030 (USD Million)

- Table 4. Global market estimates and forecasts, by application, 2018 - 2030 (USD Million)

- Table 5. Home equity conversion mortgages (HECMs) market, by region, 2018 - 2030 (USD Million)

- Table 6. Single-purpose reverse mortgages market, by region, 2018 - 2030 (USD Million)

- Table 7. Proprietary reverse mortgages market, by region, 2018 - 2030 (USD Million)

- Table 8. Debt reverse mortgage market, by region, 2018 - 2030 (USD Million)

- Table 9. Healthcare related reverse mortgage market, by region, 2018 - 2030 (USD Million)

- Table 10. Renovations reverse mortgage market, by region, 2018 - 2030 (USD Million)

- Table 11. Income supplement reverse mortgage market, by region, 2018 - 2030 (USD Million)

- Table 12. Living expenses reverse mortgage market, by region, 2018 - 2030 (USD Million)

- Table 13. North America reverse mortgage market, by type, 2018 - 2030 (USD Million)

- Table 14. North America reverse mortgage market, by application, 2018 - 2030 (USD Million)

- Table 15. U.S. reverse mortgage market, by type, 2018 - 2030 (USD Million)

- Table 16. U.S. reverse mortgage market, by application, 2018 - 2030 (USD Million)

- Table 17. Canada reverse mortgage market, by type, 2018 - 2030 (USD Million)

- Table 18. Canada reverse mortgage market, by application, 2018 - 2030 (USD Million)

- Table 19. Mexico reverse mortgage market, by type, 2018 - 2030 (USD Million)

- Table 20. Mexico reverse mortgage market, by application, 2018 - 2030 (USD Million)

- Table 21. Europe reverse mortgage market, by type, 2018 - 2030 (USD Million)

- Table 22. Europe reverse mortgage market, by application, 2018 - 2030 (USD Million)

- Table 23. U.K. reverse mortgage market, by type, 2018 - 2030 (USD Million)

- Table 24. U.K. reverse mortgage market, by application, 2018 - 2030 (USD Million)

- Table 25. Germany reverse mortgage market, by type, 2018 - 2030 (USD Million)

- Table 26. Germany reverse mortgage market, by application, 2018 - 2030 (USD Million)

- Table 27. France reverse mortgage market, by type, 2018 - 2030 (USD Million)

- Table 28. France reverse mortgage market, by application, 2018 - 2030 (USD Million)

- Table 29. Asia Pacific reverse mortgage market, by type, 2018 - 2030 (USD Million)

- Table 30. Asia Pacific reverse mortgage market, by application, 2018 - 2030 (USD Million)

- Table 31. China reverse mortgage market, by type, 2018 - 2030 (USD Million)

- Table 32. China reverse mortgage market, by application, 2018 - 2030 (USD Million)

- Table 33. India reverse mortgage market, by type, 2018 - 2030 (USD Million)

- Table 34. India reverse mortgage market, by application, 2018 - 2030 (USD Million)

- Table 35. Japan reverse mortgage market, by type, 2018 - 2030 (USD Million)

- Table 36. Japan reverse mortgage market, by application, 2018 - 2030 (USD Million)

- Table 37. South Korea reverse mortgage market, by type, 2018 - 2030 (USD Million)

- Table 38. South Korea reverse mortgage market, by application, 2018 - 2030 (USD Million)

- Table 39. Australia reverse mortgage market, by type, 2018 - 2030 (USD Million)

- Table 40. Australia reverse mortgage market, by application, 2018 - 2030 (USD Million)

- Table 41. Latin America reverse mortgage market, by type, 2018 - 2030 (USD Million)

- Table 42. Latin America reverse mortgage market, by application, 2018 - 2030 (USD Million)

- Table 43. Brazil reverse mortgage market, by type, 2018 - 2030 (USD Million)

- Table 44. Brazil reverse mortgage market, by application, 2018 - 2030 (USD Million)

- Table 45. MEA reverse mortgage market, by type, 2018 - 2030 (USD Million)

- Table 46. MEA reverse mortgage market, by application, 2018 - 2030 (USD Million)

- Table 47. Kingdom of Saudi Arabia (KSA) reverse mortgage market, by type, 2018 - 2030 (USD Million)

- Table 48. Kingdom of Saudi Arabia (KSA) reverse mortgage market, by application, 2018 - 2030 (USD Million)

- Table 49. UAE reverse mortgage market, by type, 2018 - 2030 (USD Million)

- Table 50. UAE reverse mortgage market, by application, 2018 - 2030 (USD Million)

- Table 51. South Africa reverse mortgage market, by type, 2018 - 2030 (USD Million)

- Table 52. South Africa reverse mortgage market, by application, 2018 - 2030 (USD Million)

- Table 53. Company Market Share, 2023

- Table 54. Company Heat Map Analysis

- Table 55. Key companies undergoing expansion

- Table 56. Key companies undergoing collaborations

- Table 57. Key companies undergoing new product launch

- Table 58. Key companies undergoing mergers & acquisitions

- Table 59. Key companies undergoing other strategies

List of Figures

- Fig. 1 Reverse Mortgage Market Segmentation

- Fig. 2 Information Procurement

- Fig. 3 Information Analysis

- Fig. 4 Market Formulation & Data Visualization

- Fig. 5 Data Validation & Publishing

- Fig. 6 Reverse Mortgage Market Snapshot

- Fig. 7 Segment Snapshot

- Fig. 8 Competitive Landscape Snapshot

- Fig. 9 Reverse Mortgage Market Value, 2023 & 2030 (USD Million)

- Fig. 10 Reverse Mortgage - Industry Value Chain Analysis

- Fig. 11 Reverse Mortgage Market - Market Dynamics

- Fig. 12 Reverse Mortgage Market: PORTER's Analysis

- Fig. 13 Reverse Mortgage Market: PESTEL Analysis

- Fig. 14 Reverse Mortgage Market, by Type: Key Takeaways

- Fig. 15 Reverse Mortgage Market, by Type: Market Share, 2023 & 2030

- Fig. 16 Reverse Mortgage Market, by Application: Key Takeaways

- Fig. 17 Reverse Mortgage Market, by Application: Market Share, 2023 & 2030

- Fig. 18 Reverse Mortgage Market, by Region, 2023 & 2030 (USD Million)

- Fig. 19 Regional Marketplace: Key Takeaways

- Fig. 20 North America Reverse Mortgage Market Estimates & Forecast, 2018 - 2030 (USD Million)

- Fig. 21 U.S. Reverse Mortgage Market Estimates & Forecast, 2018 - 2030 (USD Million)

- Fig. 22 Canada Reverse Mortgage Market Estimates & Forecast, 2018 - 2030 (USD Million)

- Fig. 23 Mexico Reverse Mortgage Market Estimates & Forecast, 2018 - 2030 (USD Million)

- Fig. 24 Europe Reverse Mortgage Market Estimates & Forecast, 2018 - 2030 (USD Million)

- Fig. 25 Germany Reverse Mortgage Market Estimates & Forecast, 2018 - 2030 (USD Million)

- Fig. 26 U.K. Reverse Mortgage Market Estimates & Forecast, 2018 - 2030 (USD Million)

- Fig. 27 France Reverse Mortgage Market Estimates & Forecast, 2018 - 2030 (USD Million)

- Fig. 28 Asia Pacific Reverse Mortgage Market Estimates & Forecast, 2018 - 2030 (USD Million)

- Fig. 29 China Reverse Mortgage Market Estimates & Forecast, 2018 - 2030 (USD Million)

- Fig. 30 India Reverse Mortgage Market Estimates & Forecast, 2018 - 2030 (USD Million)

- Fig. 31 Japan Reverse Mortgage Market Estimates & Forecast, 2018 - 2030 (USD Million)

- Fig. 32 Australia Reverse Mortgage Market Estimates & Forecast, 2018 - 2030 (USD Million)

- Fig. 33 South Korea Reverse Mortgage Market Estimates & Forecast, 2018 - 2030 (USD Million)

- Fig. 34 Latin America Reverse Mortgage Market Estimates & Forecast, 2018 - 2030 (USD Million)

- Fig. 35 Brazil Reverse Mortgage Market Estimates & Forecast, 2018 - 2030 (USD Million)

- Fig. 36 MEA Reverse Mortgage Market Estimates & Forecast, 2018 - 2030 (USD Million)

- Fig. 37 U.A.E. Reverse Mortgage Market Estimates & Forecast, 2018 - 2030 (USD Million)

- Fig. 38 Kingdom of Saudi Arabia Reverse Mortgage Market Estimates & Forecast, 2018 - 2030 (USD Million)

- Fig. 39 South Africa Reverse Mortgage Market Estimates & Forecast, 2018 - 2030 (USD Million)

- Fig. 40 Company Market Share Analysis, 2023

- Fig. 41 Strategic Framework

Reverse Mortgage Market Size & Trends:

The global reverse mortgage market size was estimated USD 1.83 billion in 2023 and is projected to grow at a CAGR of 5.9% from 2024 to 2030. A reverse mortgage is a financial product designed for seniors, typically aged 62 and older that allows them to convert part of their home equity into loan proceeds while retaining ownership of their home. The aging population retirement funding needs, and increasing home values and equity are major factors behind the growth of the market. In addition, increased awareness and education about reverse mortgages are contributing to their popularity, as more retirees become informed about how these products can enhance their financial stability.

The population across the globe is rapidly aging, with the number of people aged 65 and above expected to double by 2050. This demographic shift is a major driver of reverse mortgage demand, as retirees seek to supplement fixed incomes and cover rising healthcare costs. As home equity remains the largest asset for many seniors, reverse mortgages provide a way to access this wealth without selling or moving out of their homes. The need for alternative retirement funding solutions will continue to fuel growth in this market.

Reverse mortgage providers are continuously innovating and introducing new product features to meet the evolving needs of borrowers. The introduction of more flexible loan options, such as adjustable-rate mortgages and jumbo reverse mortgages for high-value homes, has expanded the potential customer base. Streamlined application processes and enhanced consumer education efforts have also helped to reduce the stigma associated with reverse mortgages and make them more appealing to a broader range of seniors. In addition, innovations such as virtual consultations, automated underwriting, and digital document management are reducing processing times and increasing accessibility. These technological developments are further attracting tech-savvy seniors and making the process more transparent and efficient, thereby driving the market's growth.

Governments and regulators in many countries are taking initiatives to create a more favorable environment for reverse mortgages. In the U.S., for instance, the Federal Housing Administration (FHA) has made several changes to the Home Equity Conversion Mortgage (HECM) program to improve consumer protections and reduce risk for lenders. These measures include mandatory financial assessments for borrowers, limits on upfront fees, and restrictions on the amount of equity that can be withdrawn initially. Similar regulatory reforms in other markets are expected to boost consumer confidence and lender participation in the reverse mortgage industry, which in turn, expected to boost market growth.

The high costs and fees associated with these reverse mortgage products could hamper the growth of the market. Reverse mortgages often come with substantial upfront costs, including origination fees, closing costs, and ongoing insurance premiums, which can deter potential borrowers. In addition, the complexity of reverse mortgage agreements and the potential impact on heirs' inheritance can create concern among seniors considering these options. Furthermore, seniors exploring reverse mortgages are at risk of exploitation by unscrupulous individuals, such as those promoting dubious investments, family members facing financial difficulties, or deceitful caretakers. Thus, the risk of exploitation could further hinder the market's growth.

Global Reverse Mortgage Market Report Segmentation

The report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global reverse mortgage market based on type, application, and region.

- Type Outlook (Revenue, USD Million, 2018 - 2030)

- Home Equity Conversion Mortgages (HECMs)

- Single-purpose Reverse Mortgages

- Proprietary Reverse Mortgages

- Application Outlook (Revenue, USD Million, 2018 - 2030)

- Debt

- Healthcare Related

- Renovations

- Income Supplement

- Living Expenses

- Regional Outlook (Revenue, USD Million, 2018 - 2030)

- North America

- U.S.

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Asia Pacific

- China

- India

- Japan

- Australia

- South Korea

- Latin America

- Brazil

- Middle East & Africa

- UAE

- Kingdom of Saudi Arabia

- South Africa

Table of Contents

Chapter 1. Methodology and Scope

- 1.1. Market Segmentation & Scope

- 1.2. Market Definitions

- 1.3. Information Procurement

- 1.4. Information Analysis

- 1.4.1. Market Formulation & Data Visualization

- 1.4.2. Data Validation & Publishing

- 1.5. Research Scope and Assumptions

- 1.6. List of Data Sources

Chapter 2. Executive Summary

- 2.1. Market Outlook

- 2.2. Segmental Outlook

- 2.3. Competitive Landscape Snapshot

Chapter 3. Market Variables, Trends, and Scope

- 3.1. Market Lineage Outlook

- 3.2. Industry Value Chain Analysis

- 3.3. Market Dynamics

- 3.3.1. Market Driver Impact Analysis

- 3.3.2. Market Restraint Impact Analysis

- 3.3.3. Market Opportunity Impact Analysis

- 3.4. Industry Analysis Tools

- 3.4.1. Porter's Analysis

- 3.4.2. PESTEL Analysis

Chapter 4. Reverse Mortgage Market: Type Estimates & Trend Analysis

- 4.1. Type Movement Analysis & Market Share, 2023 & 2030

- 4.2. Reverse Mortgage Market Estimates & Forecast, By Type

- 4.2.1. Home Equity Conversion Mortgages (HECMs)

- 4.2.2. Single-purpose Reverse Mortgages

- 4.2.3. Proprietary Reverse Mortgages

Chapter 5. Reverse Mortgage Market: Application Estimates & Trend Analysis

- 5.1. Application Movement Analysis & Market Share, 2023 & 2030

- 5.2. Reverse Mortgage Market Estimates & Forecast, By Application

- 5.2.1. Debt

- 5.2.2. Healthcare Related

- 5.2.3. Renovations

- 5.2.4. Income Supplement

- 5.2.5. Living Expenses

Chapter 6. Reverse Mortgage Market: Regional Estimates & Trend Analysis

- 6.1. Reverse Mortgage Market: Regional Outlook

- 6.2. North America

- 6.2.1. North America reverse mortgage market estimates & forecasts, 2018 - 2030 (USD Million)

- 6.2.2. U.S.

- 6.2.2.1. U.S. reverse mortgage market estimates & forecasts, 2018 - 2030 (USD Million)

- 6.2.3. Canada

- 6.2.3.1. Canada Reverse Mortgage market estimates & forecasts, 2018 - 2030 (USD Million)

- 6.2.4. Mexico

- 6.2.4.1. Mexico reverse mortgage market estimates & forecasts, 2018 - 2030 (USD Million)

- 6.3. Europe

- 6.3.1. Europe reverse mortgage market estimates & forecasts, 2018 - 2030 (USD Million)

- 6.3.2. Germany

- 6.3.2.1. Germany reverse mortgage market estimates & forecasts, 2018 - 2030 (USD Million)

- 6.3.3. U.K.

- 6.3.3.1. U.K. reverse mortgage market estimates & forecasts, 2018 - 2030 (USD Million)

- 6.3.4. France

- 6.3.4.1. France reverse mortgage ge market estimates & forecasts, 2018 - 2030 (USD Million)

- 6.4. Asia Pacific

- 6.4.1. Asia Pacific reverse mortgage market estimates & forecasts, 2018 - 2030 (USD Million)

- 6.4.2. China

- 6.4.2.1. China reverse mortgage market estimates & forecasts, 2018 - 2030 (USD Million)

- 6.4.3. India

- 6.4.3.1. India reverse mortgage market estimates & forecasts, 2018 - 2030 (USD Million)

- 6.4.4. Japan

- 6.4.4.1. Japan reverse mortgage market estimates & forecasts, 2018 - 2030 (USD Million)

- 6.4.5. Australia

- 6.4.5.1. Australia reverse mortgage market estimates & forecasts, 2018 - 2030 (USD Million)

- 6.4.6. South Korea

- 6.4.6.1. South Korea reverse mortgage market estimates & forecasts, 2018 - 2030 (USD Million)

- 6.5. Latin America

- 6.5.1. Latin America reverse mortgage market estimates & forecasts, 2018 - 2030 (USD Million)

- 6.5.2. Brazil

- 6.5.2.1. Brazil reverse mortgage market estimates & forecasts, 2018 - 2030 (USD Million)

- 6.6. MEA

- 6.6.1. MEA reverse mortgage market estimates & forecasts, 2018 - 2030 (USD Million)

- 6.6.2. UAE

- 6.6.2.1. UAE reverse mortgage market estimates & forecasts, 2018 - 2030 (USD Million)

- 6.6.3. Kingdom of Saudi Arabia (KSA)

- 6.6.3.1. Kingdom of Saudi Arabia (KSA) reverse mortgage market estimates & forecasts, 2018 - 2030 (USD Million)

- 6.6.4. South Africa

- 6.6.4.1. South Africa reverse mortgage market estimates & forecasts, 2018 - 2030 (USD Million)

Chapter 7. Competitive Landscape

- 7.1. Company Categorization

- 7.2. Company Market Share Analysis, 2023

- 7.3. Company Heat Map Analysis

- 7.4. Strategy Mapping

- 7.4.1. Expansion

- 7.4.2. Collaborations

- 7.4.3. Mergers & Acquisitions

- 7.4.4. New Product Launches

- 7.4.5. Partnerships

- 7.4.6. Others

- 7.5. Company Profiles

- 7.5.1. American Advisors Group

- 7.5.1.1. Company Overview

- 7.5.1.2. Financial Performance

- 7.5.1.3. Product Benchmarking

- 7.5.1.4. Strategic Initiatives

- 7.5.2. Mutual of Omaha Mortgage

- 7.5.2.1. Company Overview

- 7.5.2.2. Financial Performance

- 7.5.2.3. Product Benchmarking

- 7.5.2.4. Strategic Initiatives

- 7.5.3. Liberty Home Equity Solutions, Inc.

- 7.5.3.1. Company Overview

- 7.5.3.2. Financial Performance

- 7.5.3.3. Product Benchmarking

- 7.5.3.4. Strategic Initiatives

- 7.5.4. Home Point Financial

- 7.5.4.1. Company Overview

- 7.5.4.2. Financial Performance

- 7.5.4.3. Product Benchmarking

- 7.5.4.4. Strategic Initiatives

- 7.5.5. Mid America Mortgage, Inc.

- 7.5.5.1. Company Overview

- 7.5.5.2. Financial Performance

- 7.5.5.3. Product Benchmarking

- 7.5.5.4. Strategic Initiatives

- 7.5.6. Wells Fargo Home Mortgage

- 7.5.6.1. Company Overview

- 7.5.6.2. Financial Performance

- 7.5.6.3. Product Benchmarking

- 7.5.6.4. Strategic Initiatives

- 7.5.7. Bank of America

- 7.5.7.1. Company Overview

- 7.5.7.2. Financial Performance

- 7.5.7.3. Product Benchmarking

- 7.5.7.4. Strategic Initiatives

- 7.5.8. Apex Mortgage

- 7.5.8.1. Company Overview

- 7.5.8.2. Financial Performance

- 7.5.8.3. Product Benchmarking

- 7.5.8.4. Strategic Initiatives

- 7.5.9. Pinnacle Financial Group

- 7.5.9.1. Company Overview

- 7.5.9.2. Financial Performance

- 7.5.9.3. Product Benchmarking

- 7.5.9.4. Strategic Initiatives

- 7.5.10. Equity Release Council

- 7.5.10.1. Company Overview

- 7.5.10.2. Financial Performance

- 7.5.10.3. Product Benchmarking

- 7.5.10.4. Strategic Initiatives

- 7.5.1. American Advisors Group