|

|

市場調査レポート

商品コード

1530599

乗用車の市場規模、シェア、動向分析レポート:推進タイプ別、車両クラス別、タイプ別、地域別、セグメント予測、2024年~2030年Passenger Cars Market Size, Share & Trends Analysis Report By Propulsion Type (ICE, Electric), By Vehicle Class (Luxury, Economy), By Type (Hatchback, MUV, Sedan, SUV), By Region, And Segment Forecasts, 2024 - 2030 |

||||||

カスタマイズ可能

|

|||||||

| 乗用車の市場規模、シェア、動向分析レポート:推進タイプ別、車両クラス別、タイプ別、地域別、セグメント予測、2024年~2030年 |

|

出版日: 2024年07月31日

発行: Grand View Research

ページ情報: 英文 120 Pages

納期: 2~10営業日

|

全表示

- 概要

- 図表

- 目次

乗用車市場の成長と動向:

Grand View Research, Inc.の最新レポートによると、乗用車の世界市場規模は2024年から2030年にかけてCAGR 16.2%で成長し、2030年には9兆6,644億9,000万米ドルに達すると予測されています。

市場成長の背景には、環境に優しく燃費の良い自動車に対する需要の高まりがあります。環境の持続可能性に対する懸念が高まり、二酸化炭素排出量を削減する必要性が高まる中、電気自動車やハイブリッド車へのシフトが顕著になっています。このシフトの背景には、温室効果ガスの排出削減を目的とした政府の厳しい規制や、よりクリーンで持続可能な交通手段を好む消費者の増加があります。

例えば、2022年8月、カリフォルニア州大気資源委員会(CARB)は、ゼロエミッション車(ZEV)の走行台数を急速に増やし、運輸部門からの温室効果ガス排出を削減するための新規則「先進クリーンカーII」を開始しました。この規則では、2035年までにカリフォルニア州で販売される新車の100%をZEVにすることを義務づけています。2026年には、カリフォルニア州で販売されるすべての新車と小型トラックの35%をZEVにしなければならないです。この比率は、2028年には50%、2030年には65%、2035年には100%に増加します。その結果、環境に優しい自動車への需要が高まり、大手自動車メーカーによる電気自動車やハイブリッド車の開発・生産が急増し、世界中の乗用車の需要に拍車をかけています。

世界の自動車産業は、高速鉄道、ハイパーループ技術、自律走行車などの代替輸送手段への投資と開発の増加に伴い、パラダイムシフトを目の当たりにしています。これらの新たな交通手段は、効率的で費用対効果が高く、環境に優しい代替手段を提供することで、従来の乗用車の優位性に課題しています。例えば、高速鉄道は特に長距離移動に便利で迅速な交通手段を提供し、それによって特に都市間通勤における乗用車の需要を減らしています。さらに、ハイパーループ技術は前例のないスピードを提供し、交通に革命をもたらし、従来の道路移動に代わる実行可能な代替手段を提供する可能性があります。その結果、こうした要因が市場の成長をある程度妨げることになります。

電気自動車(EV)技術の急速な開拓と採用は、世界の乗用車市場に大きな影響を与えています。バッテリー技術の進歩などが、EVへのシフトを後押ししています。この移行は、自動車の情勢を再構築し、業界全体にイノベーションの波を巻き起こしました。さらに、バッテリー技術の絶え間ない進化は、エネルギー密度、充電速度、全体的な性能の向上につながり、従来のガソリン車に代わる実用的な選択肢として電気自動車の受容性と実現可能性の向上に寄与しています。例えば、2023年11月、自動車メーカーのStellantis N.V.と電気自動車用電池メーカーのContemporary Amperex Technology Co., Limited(CATL)は、Stellantisの欧州における電気自動車生産向けにLFP電池セルを供給する覚書を締結しました。

さらに2022年11月、電池セルメーカーのアメリカン・バッテリー・ファクトリー社(ABF)は、先端材料技術企業のアノビオン社と提携し、米国製の黒鉛負極部材をLFP電池セルに供給することになった。この提携は、アノビオン社がABFの合成黒鉛負極部材の優先サプライヤーとなり、この重要な電池部材の国内調達を確保することを想定しています。両社は、LFP電池セルの国内サプライヤー基盤の強化にとどまらず、電池効率の向上とサプライチェーンの最適化を目指した長期的な協力関係を検討することを期待しています。

持続可能性と環境に優しい輸送への世界の注目が高まる中、電気自動車技術の進歩は、乗用車市場の再形成を続け、自動車産業における更なる技術革新を促進します。さらに、運転体験の個別化が重視されるようになったことで、個人の好みに合わせたカスタマイズ・オプションを提供する高度なインフォテインメント・システムを搭載した自動車への需要が高まっています。車内のオーディオ設定、空調制御、デジタルアシスタント統合などの機能をカスタマイズできるため、自動車全体の魅力が高まり、消費者の関心が高まり、その結果、このようなデジタル先進乗用車の需要が世界的に増加しています。

乗用車市場のレポートハイライト

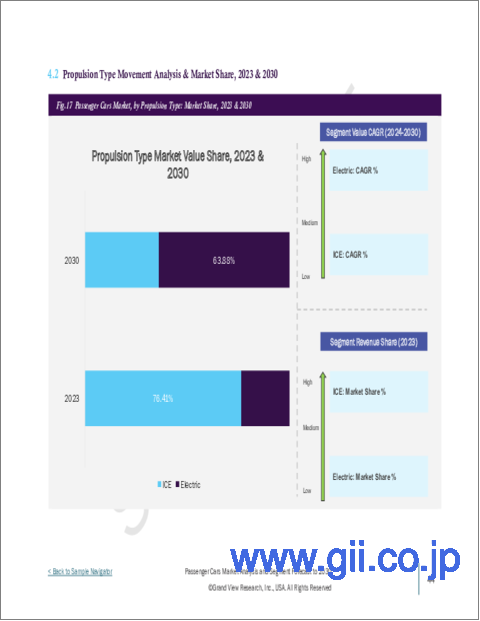

- 推進力タイプ別では、電気セグメントが2024年から2030年にかけて最も速いCAGRを記録する見込み。電動乗用車の世界の成長は、主にバッテリー技術の進歩による航続距離と価格の向上、電気自動車充電ステーションのインフラ整備が進んでいることに起因しています。

- 高級車クラスは、2024年から2030年にかけて最も速いCAGRを記録すると予想されます。高級感と技術革新の融合により、これらの自動車は現代性と洗練の象徴として位置付けられ、世界の高級車市場で見られる持続的な需要を牽引しています。

- 車種別では、セダン・セグメントが2024年から2030年にかけて最も速いCAGRを記録すると予測されます。安全性と高度な技術機能が重視されるようになったことで、多くの消費者がセダンを選ぶようになった。セダンには最新の安全技術や最先端のインフォテインメント・システムが組み込まれていることが多いからです。

- アジア太平洋地域は、2024年から2030年にかけて最も速いCAGRを記録すると予想されます。アジア太平洋地域における乗用車の成長は、都市化の進展、可処分所得の増加、中間層の増加、個人的な移動と利便性に対する消費者の嗜好の変化などが主な要因となっています。さらに、道路網の改善や有利な政策など、インフラ整備を促進する政府の取り組みが、この地域の市場拡大にさらに拍車をかけています。

- 世界の乗用車市場は、Tesla, Inc.、トヨタ自動車、フォルクスワーゲン、ゼネラルモーターズ、フォード・モーターなどの主要プレーヤーが優位を占めており、競争が続いています。これらの業界大手は、テスラやNIOなどの新興電気自動車メーカーとの競争激化に直面しており、進化する消費者の嗜好と厳しい環境規制を満たすために、持続可能で技術的に高度な製品へのシフトを促しています。

- 2023年7月、BYD Co.Ltd.のDenzaブランドは、N7電動SUVを発表しました。Denza N7は5人乗りのミッドサイズSUVで、中国の電気自動車市場におけるプレミアムモデルに位置付けられます。N7には、航続距離540kmのシングルモーター後輪駆動モデルと、航続距離630kmのデュアルモーター全輪駆動モデルの2種類があります。両モデルとも、安全性と長寿命で知られるBYDのBladeバッテリーを採用しています。

目次

第1章 調査手法と範囲

第2章 エグゼクティブサマリー

第3章 乗用車市場の変数、動向、範囲

- 市場系統の見通し

- 乗用車市場-バリューチェーン分析

- 乗用車市場-市場力学

- 市場 促進要因分析

- 市場抑制要因分析

- 市場機会分析

- 業界分析ツール

- 乗用車市場- ポーターの分析

- 乗用車市場-PESTEL分析

第4章 乗用車市場の推進タイプ別展望

- 乗用車市場シェア(推進タイプ別)、2023年および2030年

- ICE

- 電気

第5章 乗用車市場の車両クラス別展望

- 乗用車市場シェア(車両クラス別)、2023年と2030年

- ラグジュアリー

- エコノミー

第6章 乗用車市場のタイプ別展望

- 乗用車市場シェア(タイプ別)、2023年と2030年

- ハッチバック

- マルチ

- セダン

- SUV

- その他

第7章 乗用車市場:地域別展望

- 地域別乗用車市場シェア、2023年と2030年

- 北米

- 市場推計・予測、2018年-2030年

- 推進タイプ別、2018年-2030年

- 車両クラス別、2018年-2030年

- タイプ別、2018年-2030年

- 米国

- カナダ

- メキシコ

- 欧州

- 市場推計・予測、2018年-2030年

- 推進タイプ別、2018年-2030年

- 車両クラス別、2018年-2030年

- タイプ別、2018年-2030年

- 英国

- ドイツ

- フランス

- アジア太平洋

- 市場推計・予測、2018年-2030年

- 推進タイプ別、2018年-2030年

- 車両クラス別、2018年-2030年

- タイプ別、2018年-2030年

- 中国

- インド

- 日本

- オーストラリア

- 韓国

- ラテンアメリカ

- 市場推計・予測、2018年-2030年

- 推進タイプ別、2018年-2030年

- 車両クラス別、2018年-2030年

- タイプ別、2018年-2030年

- ブラジル

- 中東・アフリカ

- 市場推計・予測、2018年-2030年

- 推進タイプ別、2018年-2030年

- 車両クラス別、2018年-2030年

- タイプ別、2018年-2030年

- アラブ首長国連邦

- サウジアラビア

- 南アフリカ

第8章 競合情勢

- 企業分類

- 企業市場シェア分析、2023年

- 企業ヒートマップ分析

- 戦略マッピング

- 企業プロファイル(概要、財務実績、推進タイプ概要、戦略的取り組み)

- AUDI AG.

- BMW AG

- Ford Motor Company

- General Motors

- Honda Cars India Limited

- Suzuki

- Hyundai Motor India

- Kia India Pvt. Limited.

- Mercedes-Benz

- Nissan Motor Co., Ltd.

- Renault Group

- TATA Motors

- Tesla

- Volkswagen Group

List of Tables

- Table 1 Passenger cars market - Industry snapshot & key buying criteria, 2018 - 2030

- Table 2 Global passenger cars market, 2018 - 2030 (USD Million, Units)

- Table 3 Global passenger cars market, by region, 2018 - 2030 (USD Million, Units)

- Table 4 Global passenger cars market, by propulsion type, 2018 - 2030 (USD Million, Units)

- Table 5 Global passenger cars market, by vehicle class, 2018 - 2030 (USD Million, Units)

- Table 6 Global passenger cars market, by type, 2018 - 2030 (USD Million, Units)

- Table 7 Vendor landscape

- Table 8 ICE passenger cars market, 2018 - 2030 (USD Million, Units)

- Table 9 ICE passenger cars market, by region, 2018 - 2030 (USD Million, Units)

- Table 10 Electric passenger cars market, 2018 - 2030 (USD Million, Units)

- Table 11 Electric passenger cars market, by region, 2018 - 2030 (USD Million, Units)

- Table 12 Luxury passenger cars market, 2018 - 2030 (USD Million, Units)

- Table 13 Luxury passenger cars market, by region, 2018 - 2030 (USD Million, Units)

- Table 14 Economy passenger cars market, 2018 - 2030 (USD Million, Units)

- Table 15 Economy passenger cars market, by region, 2018 - 2030 (USD Million, Units)

- Table 16 Hatchback passenger cars market, 2018 - 2030 (USD Million, Units)

- Table 17 Hatchback passenger cars market, by region, 2018 - 2030 (USD Million, Units)

- Table 18 MUV passenger cars market, 2018 - 2030 (USD Million, Units)

- Table 19 MUV passenger cars market, by region, 2018 - 2030 (USD Million, Units)

- Table 20 Sedan passenger cars market, 2018 - 2030 (USD Million, Units)

- Table 21 Sedan passenger cars market, by region, 2018 - 2030 (USD Million, Units)

- Table 22 SUV passenger cars market, 2018 - 2030 (USD Million, Units)

- Table 23 SUV passenger cars market, by region, 2018 - 2030 (USD Million, Units)

- Table 24 Others passenger cars market, 2018 - 2030 (USD Million, Units)

- Table 25 Others passenger cars market, by region, 2018 - 2030 (USD Million, Units)

- Table 26 North America passenger cars market, 2018 - 2030 (USD Million, Units)

- Table 27 North America passenger cars market, by propulsion type, 2018 - 2030 (USD Million, Units)

- Table 28 North America passenger cars market, by vehicle class, 2018 - 2030 (USD Million, Units)

- Table 29 North America passenger cars market, by type, 2018 - 2030 (USD Million, Units)

- Table 30 The U.S. passenger cars market, 2018 - 2030 (USD Million)

- Table 31 The U.S. passenger cars market, by propulsion type, 2018 - 2030 (USD Million, Units)

- Table 32 The U.S. passenger cars market, by vehicle class, 2018 - 2030 (USD Million, Units)

- Table 33 The U.S. passenger cars market, by type, 2018 - 2030 (USD Million, Units)

- Table 34 Canada passenger cars market, 2018 - 2030 (USD Million)

- Table 35 Canada passenger cars market, by propulsion type, 2018 - 2030 (USD Million, Units)

- Table 36 Canada passenger cars market, by vehicle class, 2018 - 2030 (USD Million, Units)

- Table 37 Canada passenger cars market, by type, 2018 - 2030 (USD Million, Units)

- Table 38 Mexico passenger cars market, 2018 - 2030 (USD Million)

- Table 39 Mexico passenger cars market, by propulsion type, 2018 - 2030 (USD Million, Units)

- Table 40 Mexico passenger cars market, by vehicle class, 2018 - 2030 (USD Million, Units)

- Table 41 Mexico passenger cars market, by type, 2018 - 2030 (USD Million, Units)

- Table 42 Europe passenger cars market, 2018 - 2030 (USD Million)

- Table 43 Europe passenger cars market, by propulsion type, 2018 - 2030 (USD Million, Units)

- Table 44 Europe passenger cars market, by vehicle class, 2018 - 2030 (USD Million, Units)

- Table 45 Europe passenger cars market, by type, 2018 - 2030 (USD Million, Units)

- Table 46 Germany passenger cars market, 2018 - 2030 (USD Million)

- Table 47 Germany passenger cars market, by propulsion type, 2018 - 2030 (USD Million, Units)

- Table 48 Germany passenger cars market, by type, 2018 - 2030 (USD Million, Units)

- Table 49 UK passenger cars market, 2018 - 2030 (USD Million)

- Table 50 UK passenger cars market, by propulsion type, 2018 - 2030 (USD Million, Units)

- Table 51 UK passenger cars market, by vehicle class, 2018 - 2030 (USD Million, Units)

- Table 52 UK passenger cars market, by type, 2018 - 2030 (USD Million, Units)

- Table 53 France passenger cars market, 2018 - 2030 (USD Million)

- Table 54 France passenger cars market, by propulsion type, 2018 - 2030 (USD Million, Units)

- Table 55 France passenger cars market, by vehicle class, 2018 - 2030 (USD Million, Units)

- Table 56 France passenger cars market, by type, 2018 - 2030 (USD Million, Units)

- Table 57 Asia Pacific passenger cars market, 2018 - 2030 (USD Million, Units)

- Table 58 Asia Pacific passenger cars market, by propulsion type, 2018 - 2030 (USD Million, Units)

- Table 59 Asia Pacific passenger cars market, by vehicle class, 2018 - 2030 (USD Million, Units)

- Table 60 Asia Pacific passenger cars market, by type, 2018 - 2030 (USD Million, Units)

- Table 61 China passenger cars market, 2018 - 2030 (USD Million, Units)

- Table 62 China passenger cars market, by propulsion type, 2018 - 2030 (USD Million, Units)

- Table 63 China passenger cars market, by vehicle class, 2018 - 2030 (USD Million, Units)

- Table 64 China passenger cars market, by type, 2018 - 2030 (USD Million, Units)

- Table 65 India passenger cars market, 2018 - 2030 (USD Million, Units)

- Table 66 India passenger cars market, by propulsion type, 2018 - 2030 (USD Million, Units)

- Table 67 India passenger cars market, by vehicle class, 2018 - 2030 (USD Million, Units)

- Table 68 India passenger cars market, by type, 2018 - 2030 (USD Million, Units)

- Table 69 Japan passenger cars market, 2018 - 2030 (USD Million, Units)

- Table 70 Japan passenger cars market, by propulsion type, 2018 - 2030 (USD Million, Units)

- Table 71 Japan passenger cars market, by vehicle class, 2018 - 2030 (USD Million, Units)

- Table 72 Japan passenger cars market, by type, 2018 - 2030 (USD Million, Units)

- Table 73 Australia passenger cars market, 2018 - 2030 (USD Million, Units)

- Table 74 Australia passenger cars market, by propulsion type, 2018 - 2030 (USD Million, Units)

- Table 75 Australia passenger cars market, by vehicle class, 2018 - 2030 (USD Million, Units)

- Table 76 Australia passenger cars market, by type, 2018 - 2030 (USD Million, Units)

- Table 77 South Korea passenger cars market, 2018 - 2030 (USD Million, Units)

- Table 78 South Korea passenger cars market, by propulsion type, 2018 - 2030 (USD Million, Units)

- Table 79 South Korea passenger cars market, by vehicle class, 2018 - 2030 (USD Million, Units)

- Table 80 South Korea passenger cars market, by type, 2018 - 2030 (USD Million, Units)

- Table 81 Latin America passenger cars market, 2018 - 2030 (USD Million, Units)

- Table 82 Latin America passenger cars market, by propulsion type, 2018 - 2030 (USD Million, Units)

- Table 83 Latin America passenger cars market, by vehicle class, 2018 - 2030 (USD Million, Units)

- Table 84 Latin America passenger cars market, by type, 2018 - 2030 (USD Million, Units)

- Table 85 Brazil passenger cars market, 2018 - 2030 (USD Million, Units)

- Table 86 Brazil passenger cars market, by propulsion type, 2018 - 2030 (USD Million, Units)

- Table 87 Brazil passenger cars market, by vehicle class, 2018 - 2030 (USD Million, Units)

- Table 88 Brazil passenger cars market, by type, 2018 - 2030 (USD Million, Units)

- Table 89 Middle East & Africa passenger cars market, 2018 - 2030 (USD Million, Units)

- Table 90 Middle East & Africa passenger cars market, by propulsion type, 2018 - 2030 (USD Million, Units)

- Table 91 Middle East & Africa passenger cars market, by vehicle class, 2018 - 2030 (USD Million, Units)

- Table 92 Middle East & Africa passenger cars market, by type, 2018 - 2030 (USD Million, Units)

- Table 93 UAE passenger cars market, 2018 - 2030 (USD Million, Units)

- Table 94 UAE passenger cars market, by propulsion type, 2018 - 2030 (USD Million, Units)

- Table 95 UAE passenger cars market, by vehicle class, 2018 - 2030 (USD Million, Units)

- Table 96 UAE passenger cars market, by type, 2018 - 2030 (USD Million, Units)

- Table 97 Saudi Arabia passenger cars market, 2018 - 2030 (USD Million, Units)

- Table 98 Saudi Arabia passenger cars market, by propulsion type, 2018 - 2030 (USD Million, Units)

- Table 99 Saudi Arabia passenger cars market, by vehicle class, 2018 - 2030 (USD Million, Units)

- Table 100 Saudi Arabia passenger cars market, by type, 2018 - 2030 (USD Million, Units)

- Table 101 South Africa passenger cars market, 2018 - 2030 (USD Million, Units)

- Table 102 South Africa passenger cars market, by propulsion type, 2018 - 2030 (USD Million, Units)

- Table 103 South Africa passenger cars market, by vehicle class, 2018 - 2030 (USD Million, Units)

- Table 104 South Africa passenger cars market, by type, 2018 - 2030 (USD Million, Units)

List of Figures

- Fig. 1 Market segmentation and scope

- Fig. 2 Passenger cars market, 2018 - 2030 (USD Million)

- Fig. 3 Passenger cars market - Value chain analysis

- Fig. 4 Passenger cars market - Market dynamics

- Fig. 5 Passenger cars market - Key market driver impact

- Fig. 6 Passenger cars market - Key market restraint impact

- Fig. 7 Passenger cars market - Key opportunities prioritized

- Fig. 8 Passenger cars market - Porter's five forces analysis

- Fig. 9 Passenger cars market - PESTEL analysis

- Fig. 10 Passenger cars market, by propulsion type, 2023

- Fig. 11 ICE passenger cars market size estimates and forecasts, 2018 - 2030

- Fig. 12 Electric passenger cars market size estimates and forecasts, 2018 - 2030

- Fig. 13 Passenger cars market, by vehicle class, 2023

- Fig. 14 Luxury passenger cars market size estimates and forecasts, 2018 - 2030

- Fig. 15 Economy passenger cars market size estimates and forecasts, 2018 - 2030

- Fig. 16 Passenger cars market, by type, 2023

- Fig. 17 Hatchback passenger cars market size estimates and forecasts, 2018 - 2030

- Fig. 18 MUV passenger cars market size estimates and forecasts, 2018 - 2030

- Fig. 19 Sedan passenger cars market size estimates and forecasts, 2018 - 2030

- Fig. 20 SUV passenger cars market size estimates and forecasts, 2018 - 2030

- Fig. 21 Others passenger cars market size estimates and forecasts, 2018 - 2030

- Fig. 22 Passenger cars market, by region, 2023

- Fig. 23 Passenger cars market - Regional takeaways

- Fig. 24 North America passenger cars market - Key takeaways

- Fig. 25 US passenger cars market size estimates and forecasts, 2018 - 2030

- Fig. 26 Canada passenger cars market size estimates and forecasts, 2018 - 2030

- Fig. 27 Mexico passenger cars market size estimates and forecasts, 2018 - 2030

- Fig. 28 Europe passenger cars market - Key takeaways

- Fig. 29 UK passenger cars market size estimates and forecasts, 2018 - 2030

- Fig. 30 Germany passenger cars market size estimates and forecasts, 2018 - 2030

- Fig. 31 France passenger cars market size estimates and forecasts, 2018 - 2030

- Fig. 32 Asia Pacific passenger cars market - Key takeaways

- Fig. 33 China passenger cars market size estimates and forecasts, 2018 - 2030

- Fig. 34 India passenger cars market size estimates and forecasts, 2018 - 2030

- Fig. 35 Japan passenger cars market size estimates and forecasts, 2018 - 2030

- Fig. 36 Australia passenger cars market size estimates and forecasts, 2018 - 2030

- Fig. 37 South Korea passenger cars market size estimates and forecasts, 2018 - 2030

- Fig. 38 Latin America passenger cars market - Key takeaways

- Fig. 39 Brazil passenger cars market size estimates and forecasts, 2018 - 2030

- Fig. 40 Middle East & Africa passenger cars market - Key takeaways

- Fig. 41 UAE passenger cars market size estimates and forecasts, 2018 - 2030

- Fig. 42 Saudi Arabia passenger cars market size estimates and forecasts, 2018 - 2030

- Fig. 43 South Africa passenger cars market size estimates and forecasts, 2018 - 2030

Passenger Cars Market Growth & Trends:

The global passenger cars market size is anticipated to reach USD 9,664.49 billion by 2030, growing at a CAGR of 16.2% from 2024 to 2030, according to a new report by Grand View Research, Inc. The market growth is attributed to the growing demand for eco-friendly and fuel-efficient vehicles. With increasing concerns about environmental sustainability and the need to reduce carbon emissions, there has been a significant shift towards electric and hybrid vehicles. This shift is driven by stringent government regulations aimed at reducing greenhouse gas emissions, as well as by consumers' increasing preference for cleaner and more sustainable transportation options.

For instance, in August 2022, the California Air Resources Board (CARB) initiated a new rule, The Advanced Clean Cars II, to rapidly increase the number Of Zero-Emission Vehicles (ZEVs) on the road and reduce greenhouse gas emissions from the transportation sector. The rule requires that by 2035, 100% of all new cars sold in California must be ZEVs. In 2026, 35% of all new cars and light trucks sold in California must be ZEVs. This percentage will increase to 50% in 2028, 65% in 2030, and 100% in 2035. As a result, this demand for eco-friendly cars has led to a surge in the development and production of electric and hybrid vehicles by major automotive manufacturers, thereby fueling the demand for passenger cars across the globe.

The global automotive industry has been witnessing a paradigm shift with the increasing investment and development in alternative transportation modes such as high-speed trains, hyperloop technology, and autonomous vehicles. These emerging modes challenge the traditional dominance of passenger cars by offering efficient, cost-effective, and environmentally friendly alternatives. For instance, high-speed trains provide a convenient and rapid transportation, particularly for long-distance travel, thereby reducing the demand for passenger cars, especially for intercity commuting. Additionally, hyperloop technology provides unprecedented speeds, potentially revolutionizing transportation and providing a viable alternative to conventional road travel, which could further dampen the demand for passenger cars. As a result, such factors hamper the market growth to a certain extent.

The rapid development and adoption of Electric Vehicle (EV) technology have significantly influenced the global passenger car market. Factors such as advancements in battery technology have driven the shift toward EVs. This transition has reshaped the automotive landscape and also sparked a wave of innovation across the industry. Additionally, the continuous evolution of battery technology has led to advancements in energy density, charging speed, and overall performance, contributing to the increased acceptance and viability of electric vehicles as a practical alternative to traditional gasoline-powered cars. For instance, in November 2023, Stellantis N.V., an automotive manufacturer and Contemporary Amperex Technology Co., Limited (CATL), a battery manufacturer for electric vehicles signed a Memorandum of Understanding (MoU) for LFP battery cell supply for Stellantis' electric vehicle production in Europe.

Furthermore, in November 2022, American Battery Factory Inc. (ABF), a battery cell manufacturer, collaborated with Anovion, an advanced material technology company, to supply LFP battery cells with graphite anode components made in the U.S. The collaboration envisaged Anovion being the preferred supplier for ABF's synthetic graphite anode materials and ensuring that this essential battery component is sourced domestically. The two organizations were looking forward to considering long-term collaborations to increase battery efficiency and optimize the supply chain, extending beyond bolstering the domestic supplier base for LFP battery cells.

As the global focus on sustainability and eco-friendly transportation intensifies, the ongoing advancements in electric vehicle technology are poised to continue reshaping the passenger car market and driving further innovation in the automotive industry. Additionally, the increasing emphasis on personalized driving experiences has propelled the demand for vehicles equipped with advanced infotainment systems that offer customization options tailored to individual preferences. The ability to customize features such as audio settings, climate control, and digital assistant integrations within the vehicle enhances the overall appeal of the car, leading to a rise in consumer interest and, subsequently, an increase in demand for such digitally advanced passenger cars globally.

Passenger Cars Market Report Highlights:

- Based on propulsion type, the electric segment is expected to register the fastest CAGR from 2024 to 2030. The growth of electric passenger cars globally can be primarily attributed to advancements in battery technology, driving improved range and affordability, and a growing infrastructure for electric vehicle charging stations.

- The luxury vehicle class segment is anticipated to register the fastest CAGR from 2024 to 2030. The convergence of luxury and technological innovation has positioned these vehicles as symbols of modernity and sophistication, driving the sustained demand observed across the global luxury car market.

- Based on car type, the sedan segment is anticipated to register the fastest CAGR from 2024 to 2030. The growing emphasis on safety and advanced technological features has prompted many consumers to opt for sedans, as these vehicles often incorporate the latest safety innovations and cutting-edge infotainment systems.

- Asia Pacific is expected to register the fastest CAGR from 2024 to 2030. The growth of passenger cars in Asia Pacific can be primarily attributed to rising urbanization, increasing disposable incomes, and a growing middle class, coupled with a shift in consumer preferences for personal mobility and convenience. Additionally, government initiatives promoting the development of infrastructure, such as improved road networks and favorable policies, have further fueled the expansion of the regional market.

- The global passenger car market remains competitive, characterized by the dominance of key players such as Tesla, Inc.; Toyota; Volkswagen; General Motors; and Ford Motor Company. These industry leaders face intensifying competition from emerging electric vehicle manufacturers such as Tesla and NIO, prompting a shift towards sustainable and technologically advanced offerings to meet evolving consumer preferences and stringent environmental regulations.

- In July 2023, BYD Co. Ltd's Denza brand revealed a N7 electric SUV. The Denza N7 is a mid-size, five-seater SUV that is positioned as a premium offering in the Chinese electric car market. The N7 is available in two versions namely a single-motor rear-wheel drive model with a range of 540 km (336 miles) and a dual-motor all-wheel drive model with a range of 630 km (391 miles). Both versions use BYD's Blade Battery, which is known for its safety and long lifespan.

Table of Contents

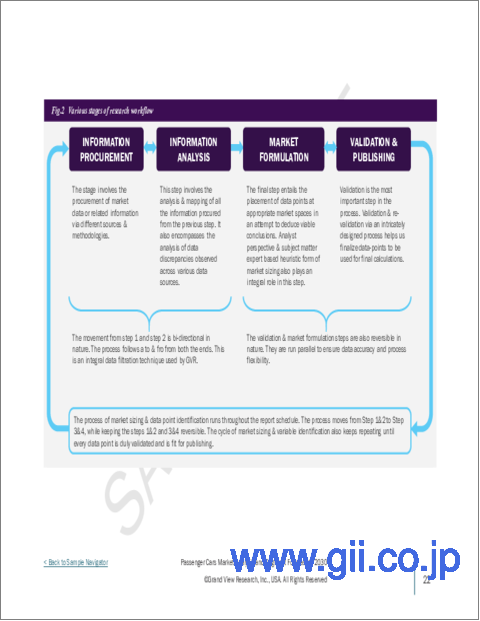

Chapter 1. Methodology and Scope

- 1.1. Research Methodology

- 1.2. Information Procurement

- 1.2.1. Purchased database.

- 1.2.2. GVR's internal database

- 1.2.3. Secondary sources & third - party perspectives

- 1.2.4. Primary research

- 1.3. Information Analysis

- 1.3.1. Data Analysis Models

- 1.4. Market Formulation & Data Visualization

- 1.5. Data Validation & Publishing

Chapter 2. Executive Summary

- 2.1. Passenger Cars Market Snapshot, 2023 & 2030

- 2.2. Segment Snapshot, 2023 & 2030

- 2.3. Competitive Landscape Snapshot, 2023 & 2030

Chapter 3. Passenger Cars Market Variables, Trends & Scope

- 3.1. Market Lineage Outlook

- 3.2. Passenger Cars Market - Value Chain Analysis

- 3.3. Passenger Cars Market - Market Dynamics

- 3.3.1. Market Driver Analysis

- 3.3.2. Market Restraint Analysis

- 3.3.3. Market Opportunity Analysis

- 3.4. Industry Analysis Tools

- 3.4.1. Passenger Cars Market - Porter's Analysis

- 3.4.2. Passenger Cars Market - PESTEL Analysis

Chapter 4. Passenger Cars Market Propulsion Type Outlook

- 4.1. Passenger Cars Market Share by Propulsion Type, 2023 & 2030 (USD Million, Units)

- 4.2. ICE

- 4.2.1. ICE Passenger Cars Market Estimates and Forecast, 2018 - 2030 (USD Million, Units)

- 4.3. Electric

- 4.3.1. Electric Passenger Cars Market Estimates and Forecast, 2018 - 2030 (USD Million, Units)

Chapter 5. Passenger Cars Market Vehicle Class Outlook

- 5.1. Passenger Cars Market Share by Vehicle Class, 2023 & 2030 (USD Million, Units)

- 5.2. Luxury

- 5.2.1. Luxury Passenger Cars Market Estimates and Forecast, 2018 - 2030 (USD Million, Units)

- 5.3. Economy

- 5.3.1. Economy Passenger Cars Market Estimates and Forecast, 2018 - 2030 (USD Million, Units)

Chapter 6. Passenger Cars Market Type Outlook

- 6.1. Passenger Cars Market Share by Type, 2023 & 2030 (USD Million, Units)

- 6.2. Hatchback

- 6.2.1. Hatchback Passenger Cars Market Estimates and Forecast, 2018 - 2030 (USD Million, Units)

- 6.3. MUV

- 6.3.1. MUV Passenger Cars Market Estimates and Forecast, 2018 - 2030 (USD Million, Units)

- 6.4. Sedan

- 6.4.1. Sedan Passenger Cars Market Estimates and Forecast, 2018 - 2030 (USD Million, Units)

- 6.5. SUV

- 6.5.1. SUV Passenger Cars Market Estimates and Forecast, 2018 - 2030 (USD Million, Units)

- 6.6. Others

- 6.6.1. Others Passenger Cars Market Estimates and Forecast, 2018 - 2030 (USD Million, Units)

Chapter 7. Passenger Cars Market: Regional Outlook

- 7.1. Passenger Cars Market Share by Region, 2023 & 2030 (USD Million, Units)

- 7.2. North America

- 7.2.1. Market Estimates and Forecast, 2018 - 2030 (USD Million, Units)

- 7.2.2. Market Estimates and Forecast by Propulsion Type, 2018 - 2030 (USD Million, Units)

- 7.2.3. Market Estimates and Forecast by Vehicle Class, 2018 - 2030 (USD Million, Units)

- 7.2.4. Market Estimates and Forecast by Type, 2018 - 2030 (USD Million, Units)

- 7.2.5. U.S.

- 7.2.5.1. Market Estimates and Forecast, 2018 - 2030 (USD Million, Units)

- 7.2.5.2. Market Estimates and Forecast by Propulsion Type, 2018 - 2030 (USD Million, Units)

- 7.2.5.3. Market Estimates and Forecast by Vehicle Class, 2018 - 2030 (USD Million, Units)

- 7.2.5.4. Market Estimates and Forecast by Type, 2018 - 2030 (USD Million, Units)

- 7.2.6. Canada

- 7.2.6.1. Market Estimates and Forecast, 2018 - 2030 (USD Million, Units)

- 7.2.6.2. Market Estimates and Forecast by Propulsion Type, 2018 - 2030 (USD Million, Units)

- 7.2.6.3. Market Estimates and Forecast by Vehicle Class, 2018 - 2030 (USD Million, Units)

- 7.2.6.4. Market Estimates and Forecast by Type, 2018 - 2030 (USD Million, Units)

- 7.2.7. Mexico

- 7.2.7.1. Market Estimates and Forecast, 2018 - 2030 (USD Million, Units)

- 7.2.7.2. Market Estimates and Forecast by Propulsion Type, 2018 - 2030 (USD Million, Units)

- 7.2.7.3. Market Estimates and Forecast by Vehicle Class, 2018 - 2030 (USD Million, Units)

- 7.2.7.4. Market Estimates and Forecast by Type, 2018 - 2030 (USD Million, Units)

- 7.3. Europe

- 7.3.1. Market Estimates and Forecast, 2018 - 2030 (USD Million, Units)

- 7.3.2. Market Estimates and Forecast by Propulsion Type, 2018 - 2030 (USD Million, Units)

- 7.3.3. Market Estimates and Forecast by Vehicle Class, 2018 - 2030 (USD Million, Units)

- 7.3.4. Market Estimates and Forecast by Type, 2018 - 2030 (USD Million, Units)

- 7.3.5. UK

- 7.3.5.1. Market Estimates and Forecast, 2018 - 2030 (USD Million, Units)

- 7.3.5.2. Market Estimates and Forecast by Propulsion Type, 2018 - 2030 (USD Million, Units)

- 7.3.5.3. Market Estimates and Forecast by Vehicle Class, 2018 - 2030 (USD Million, Units)

- 7.3.5.4. Market Estimates and Forecast by Type, 2018 - 2030 (USD Million, Units)

- 7.3.6. Germany

- 7.3.6.1. Market Estimates and Forecast, 2018 - 2030 (USD Million, Units)

- 7.3.6.2. Market Estimates and Forecast by Propulsion Type, 2018 - 2030 (USD Million, Units)

- 7.3.6.3. Market Estimates and Forecast by Vehicle Class, 2018 - 2030 (USD Million, Units)

- 7.3.6.4. Market Estimates and Forecast by Type, 2018 - 2030 (USD Million, Units)

- 7.3.7. France

- 7.3.7.1. Market Estimates and Forecast, 2018 - 2030 (USD Million, Units)

- 7.3.7.2. Market Estimates and Forecast by Propulsion Type, 2018 - 2030 (USD Million, Units)

- 7.3.7.3. Market Estimates and Forecast by Vehicle Class, 2018 - 2030 (USD Million, Units)

- 7.3.7.4. Market Estimates and Forecast by Type, 2018 - 2030 (USD Million, Units)

- 7.4. Asia Pacific

- 7.4.1. Market Estimates and Forecast, 2018 - 2030 (USD Million, Units)

- 7.4.2. Market Estimates and Forecast by Propulsion Type, 2018 - 2030 (USD Million, Units)

- 7.4.3. Market Estimates and Forecast by Vehicle Class, 2018 - 2030 (USD Million, Units)

- 7.4.4. Market Estimates and Forecast by Type, 2018 - 2030 (USD Million, Units)

- 7.4.5. China

- 7.4.5.1. Market Estimates and Forecast, 2018 - 2030 (USD Million, Units)

- 7.4.5.2. Market Estimates and Forecast by Propulsion Type, 2018 - 2030 (USD Million, Units)

- 7.4.5.3. Market Estimates and Forecast by Vehicle Class, 2018 - 2030 (USD Million, Units)

- 7.4.5.4. Market Estimates and Forecast by Type, 2018 - 2030 (USD Million, Units)

- 7.4.6. India

- 7.4.6.1. Market Estimates and Forecast, 2018 - 2030 (USD Million, Units)

- 7.4.6.2. Market Estimates and Forecast by Propulsion Type, 2018 - 2030 (USD Million, Units)

- 7.4.6.3. Market Estimates and Forecast by Vehicle Class, 2018 - 2030 (USD Million, Units)

- 7.4.6.4. Market Estimates and Forecast by Type, 2018 - 2030 (USD Million, Units)

- 7.4.7. Japan

- 7.4.7.1. Market Estimates and Forecast, 2018 - 2030 (USD Million, Units)

- 7.4.7.2. Market Estimates and Forecast by Propulsion Type, 2018 - 2030 (USD Million, Units)

- 7.4.7.3. Market Estimates and Forecast by Vehicle Class, 2018 - 2030 (USD Million, Units)

- 7.4.7.4. Market Estimates and Forecast by Type, 2018 - 2030 (USD Million, Units)

- 7.4.8. Australia

- 7.4.8.1. Market Estimates and Forecast, 2018 - 2030 (USD Million, Units)

- 7.4.8.2. Market Estimates and Forecast by Propulsion Type, 2018 - 2030 (USD Million, Units)

- 7.4.8.3. Market Estimates and Forecast by Vehicle Class, 2018 - 2030 (USD Million, Units)

- 7.4.8.4. Market Estimates and Forecast by Type, 2018 - 2030 (USD Million, Units)

- 7.4.9. South Korea

- 7.4.9.1. Market Estimates and Forecast, 2018 - 2030 (USD Million, Units)

- 7.4.9.2. Market Estimates and Forecast by Propulsion Type, 2018 - 2030 (USD Million, Units)

- 7.4.9.3. Market Estimates and Forecast by Vehicle Class, 2018 - 2030 (USD Million, Units)

- 7.4.9.4. Market Estimates and Forecast by Type, 2018 - 2030 (USD Million, Units)

- 7.5. Latin America

- 7.5.1. Market Estimates and Forecast, 2018 - 2030 (USD Million, Units)

- 7.5.2. Market Estimates and Forecast by Propulsion Type, 2018 - 2030 (USD Million, Units)

- 7.5.3. Market Estimates and Forecast by Vehicle Class, 2018 - 2030 (USD Million, Units)

- 7.5.4. Market Estimates and Forecast by Type, 2018 - 2030 (USD Million, Units)

- 7.5.5. Brazil

- 7.5.5.1. Market Estimates and Forecast, 2018 - 2030 (USD Million, Units)

- 7.5.5.2. Market Estimates and Forecast by Propulsion Type, 2018 - 2030 (USD Million, Units)

- 7.5.5.3. Market Estimates and Forecast by Vehicle Class, 2018 - 2030 (USD Million, Units)

- 7.5.5.4. Market Estimates and Forecast by Type, 2018 - 2030 (USD Million, Units)

- 7.6. Middle East & Africa

- 7.6.1. Market Estimates and Forecast, 2018 - 2030 (USD Million, Units)

- 7.6.2. Market Estimates and Forecast by Propulsion Type, 2018 - 2030 (USD Million, Units)

- 7.6.3. Market Estimates and Forecast by Vehicle Class, 2018 - 2030 (USD Million, Units)

- 7.6.4. Market Estimates and Forecast by Type, 2018 - 2030 (USD Million, Units)

- 7.6.5. UAE

- 7.6.5.1. Market Estimates and Forecast, 2018 - 2030 (USD Million, Units)

- 7.6.5.2. Market Estimates and Forecast by Propulsion Type, 2018 - 2030 (USD Million, Units)

- 7.6.5.3. Market Estimates and Forecast by Vehicle Class, 2018 - 2030 (USD Million, Units)

- 7.6.5.4. Market Estimates and Forecast by Type, 2018 - 2030 (USD Million, Units)

- 7.6.6. Saudi Arabia

- 7.6.6.1. Market Estimates and Forecast, 2018 - 2030 (USD Million, Units)

- 7.6.6.2. Market Estimates and Forecast by Propulsion Type, 2018 - 2030 (USD Million, Units)

- 7.6.6.3. Market Estimates and Forecast by Vehicle Class, 2018 - 2030 (USD Million, Units)

- 7.6.6.4. Market Estimates and Forecast by Type, 2018 - 2030 (USD Million, Units)

- 7.6.7. South Africa

- 7.6.7.1. Market Estimates and Forecast, 2018 - 2030 (USD Million, Units)

- 7.6.7.2. Market Estimates and Forecast by Propulsion Type, 2018 - 2030 (USD Million, Units)

- 7.6.7.3. Market Estimates and Forecast by Vehicle Class, 2018 - 2030 (USD Million, Units)

- 7.6.7.4. Market Estimates and Forecast by Type, 2018 - 2030 (USD Million, Units)

Chapter 8. Competitive Landscape

- 8.1. Company Categorization

- 8.2. Company Market Share Analysis, 2023

- 8.3. Company Heat Map Analysis

- 8.4. Strategy Mapping

- 8.5. Company Profiles (Overview, Financial Performance, Propulsion Type Overview, Strategic Initiatives)

- 8.5.1. AUDI AG.

- 8.5.2. BMW AG

- 8.5.3. Ford Motor Company

- 8.5.4. General Motors

- 8.5.5. Honda Cars India Limited

- 8.5.6. Suzuki

- 8.5.7. Hyundai Motor India

- 8.5.8. Kia India Pvt. Limited.

- 8.5.9. Mercedes-Benz

- 8.5.10. Nissan Motor Co., Ltd.

- 8.5.11. Renault Group

- 8.5.12. TATA Motors

- 8.5.13. Tesla

- 8.5.14. Volkswagen Group