|

|

市場調査レポート

商品コード

1554076

自動車用LiDARの市場規模、シェア、動向分析レポート:技術別、用途別、推進タイプ別、車種別、地域別、セグメント別予測、2024年~2030年Automotive LiDAR Market Size, Share & Trends Analysis Report By Technology (Mechanical LiDAR, Solid-state LiDAR), By Application, By Propulsion Type, By Vehicle Type, By Region, And Segment Forecasts, 2024 - 2030 |

||||||

カスタマイズ可能

|

|||||||

| 自動車用LiDARの市場規模、シェア、動向分析レポート:技術別、用途別、推進タイプ別、車種別、地域別、セグメント別予測、2024年~2030年 |

|

出版日: 2024年08月09日

発行: Grand View Research

ページ情報: 英文 150 Pages

納期: 2~10営業日

|

全表示

- 概要

- 図表

- 目次

自動車用LiDAR市場の成長と動向

Grand View Research, Inc.の最新レポートによると、世界の自動車用LiDAR市場規模は、予測期間中にCAGR 9.4%を記録し、2030年までに9億4,210万米ドルに達する見込みです。

自動車安全用途セグメントでの受け入れの急増と、自動車運転自動化における洗練された技術の組み込みが、市場成長を押し上げると予測されています。今後数年間で半自律走行車や自律走行車の受け入れが増加することで、市場成長がさらに促進されると予測されます。

市場は、用途タイプに基づいて、ADAS(先進運転支援システム)と自律走行車に分類することができます。ADAS用途セグメントはさらに、自動緊急ブレーキ(AEB)とアダプティブ・クルーズ・コントロール(ACC)に分別されます。アダプティブ・クルーズ・コントロール(ACC)は、先行車との安全な車間距離を保つために車速をロボット制御で変更する自動車向けの任意クルージングです。様々な自動化レベルの自律走行車や半自律走行車にこれらのシステムが採用されつつあることから、主要参入企業から巨大なベンチャーが参入し、今後数年間の地域市場の需要を牽引すると期待されています。

2016年10月、Infineon Technologies AG(ドイツ)は、ナイメーヘンに本社を置くファブレス半導体企業Innoluce BV(オランダ)を買収しました。インフィニオンは、イノルーチェの特許技術を活用し、高性能LiDARシステム用のチップ部品を開発するとしています。この買収により、Infineonは自動車安全技術ベンダーの1社としての足場を固めることが期待されます。

自動車用LiDAR市場レポートハイライト

- 用途に基づき、世界の自動車用LiDAR市場はADASと自律走行車に区分されます。ADASセグメントはさらに自動緊急ブレーキ(AEB)とアダプティブクルーズコントロール(ACC)に細分化されます。

- 自律走行車セグメントは、予測期間中に健全な成長を記録すると予測されています。この成長は、ADAS(先進運転支援システム)と自動運転車に対する需要の増加に起因しています。

- 北米が市場を独占し、2022年の収益シェアは34.9%で最大となりました。

- アジア太平洋は予測期間中に急成長を記録すると予想されます。固体LiDARの開発やセンサーの小型化など、LiDAR技術の新興国開拓が同地域の市場成長を牽引しています。

目次

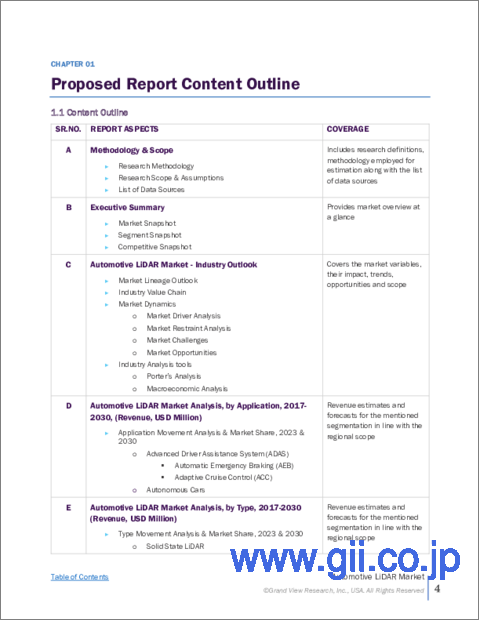

第1章 調査手法と範囲

第2章 エグゼクティブサマリー

第3章 自動車用LiDAR市場の変数、動向、範囲

- 市場イントロダクション/系統展望

- 市場力学

- 市場促進要因分析

- 市場抑制要因分析

- 業界の機会

- 業界の課題

- 自動車用LiDAR市場分析ツール

- ポーターの分析

- PESTEL分析

第4章 自動車用LiDAR市場:技術別、推定・動向分析

- セグメントダッシュボード

- 自動車用LiDAR市場:技術変動分析、100万米ドル、2023年と2030年

- 機械式LiDAR

- ソリッドステートLiDAR

第5章 自動車用LiDAR市場:用途別、推定・動向分析

- セグメントダッシュボード

- 自動車用LiDAR市場:用途変動分析、100万米ドル、2023年と2030年

- ADAS

- 自律走行車

第6章 自動車用LiDAR市場:推進タイプ別、推定・動向分析

- セグメントダッシュボード

- 自動車用LiDAR市場:推進タイプ変動分析、100万米ドル、2023年と2030年

- 内燃機関(ICE)車両

- 電気自動車とハイブリッド車

第7章 自動車用LiDAR市場:車種別、推定・動向分析

- セグメントダッシュボード

- 自動車用LiDAR市場:車種変動分析、100万米ドル、2023年と2030年

- 乗用車

- 商用車

第8章 自動車用LiDAR市場:地域別、推定・動向分析

- 自動車用LiDAR市場シェア、地域別、2023年と2030年、100万米ドル

- 北米

- 米国

- カナダ

- メキシコ

- 欧州

- 英国

- ドイツ

- フランス

- アジア太平洋

- 中国

- 日本

- インド

- 韓国

- オーストラリア

- ラテンアメリカ

- ブラジル

- 中東・アフリカ

- サウジアラビア

- アラブ首長国連邦

- 南アフリカ

第9章 競合情勢

- 主要市場参入企業による最近の動向と影響分析

- 企業分類

- 企業の市場ポジショニング

- 企業の市場シェア分析

- 企業ヒートマップ分析

- 戦略マッピング

- 拡大

- 合併と買収

- パートナーシップとコラボレーション

- 新製品の発売

- 研究開発

- 企業プロファイル

- Continental AG

- Denso Corporation

- LeddarTech Inc.

- KUBOTA Corporation

- Quanergy Solutions, Inc.

- Robert Bosch GmbH

- Teledyne Geospatial

- Valeo

- Velodyne LiDAR, Inc.

- Innoviz Technologies.

List of Tables

- Table 1 Global Automotive LiDAR Market by technology, 2018 - 2030 (USD Million)

- Table 2 Global Automotive LiDAR Market by application, 2018 - 2030 (USD Million)

- Table 3 Global Automotive LiDAR Market by propulsion type, 2018 - 2030 (USD Million)

- Table 4 Global Automotive LiDAR Market by vehicle type, 2018 - 2030 (USD Million)

- Table 5 Global Automotive LiDAR Market by region, 2018 - 2030 (USD Million)

- Table 6 North America Automotive LiDAR Market by country, 2018 - 2030 (USD Million)

- Table 7 Europe Automotive LiDAR Market by country, 2018 - 2030 (USD Million)

- Table 8 Asia Pacific Automotive LiDAR Market by country, 2018 - 2030 (USD Million)

- Table 9 Latin America Automotive LiDAR Market by country, 2018 - 2030 (USD Million)

- Table 10 MEA Automotive LiDAR Market by country, 2018 - 2030 (USD Million)

- Table 11 Key companies launching new products/services

- Table 12 Key companies engaged in mergers & acquisition

- Table 13 Key companies engaged in Research & development

- Table 14 Key Companies engaged in expansion

List of Figures

- Fig. 1 Automotive LiDAR Market segmentation

- Fig. 2 Market research process

- Fig. 3 Information procurement

- Fig. 4 Primary research pattern

- Fig. 5 Market research approaches

- Fig. 6 Market formulation & validation

- Fig. 7 Automotive LiDAR Market snapshot

- Fig. 8 Automotive LiDAR Market segment snapshot

- Fig. 9 Automotive LiDAR Market competitive landscape snapshot

- Fig. 10 Market driver impact analysis

- Fig. 11 Market restraint impact analysis

- Fig. 12 Automotive LiDAR Market, technology outlook key takeaways (USD Million)

- Fig. 13 Automotive LiDAR Market: technology movement analysis (USD Million), 2023 & 2030

- Fig. 14 Mechanical LiDAR market revenue estimates and forecasts, 2018 - 2030 (USD Million)

- Fig. 15 Solid-state LiDAR market revenue estimates and forecasts, 2018 - 2030 (USD Million)

- Fig. 16 Automotive LiDAR Market: application outlook key takeaways (USD Million)

- Fig. 17 Automotive LiDAR Market: application movement analysis (USD Million), 2023 & 2030

- Fig. 18 ADAS market revenue estimates and forecasts, 2018 - 2030 (USD Million)

- Fig. 19 Autonomous Cars market revenue estimates and forecasts, 2018 - 2030 (USD Million)

- Fig. 20 Automotive LiDAR Market: Propulsion Type outlook key takeaways (USD Million)

- Fig. 21 Automotive LiDAR Market: Propulsion Type movement analysis (USD Million), 2023 & 2030

- Fig. 22 Internal Combustion Engine (ICE) Vehicle market revenue estimates and forecasts, 2018 - 2030 (USD Million)

- Fig. 23 Electric & Hybrid Vehicles market revenue estimates and forecasts, 2018 - 2030 (USD Million)

- Fig. 24 Automotive LiDAR Market: vehicle type outlook key takeaways (USD Million)

- Fig. 25 Automotive LiDAR Market: vehicle type movement analysis (USD Million), 2023 & 2030

- Fig. 26 Passenger Cars market revenue estimates and forecasts, 2018 - 2030 (USD Million)

- Fig. 27 Commercial Vehicles market revenue estimates and forecasts, 2018 - 2030 (USD Million)

- Fig. 28 Regional marketplace: Key takeaways

- Fig. 29 Automotive LiDAR Market: Regional outlook, 2023 & 2030, USD Million

- Fig. 30 North America Automotive LiDAR Market estimates and forecasts, 2018 - 2030 (USD Million)

- Fig. 31 U.S. Automotive LiDAR Market estimates and forecasts, 2018 - 2030 (USD Million)

- Fig. 32 Canada Automotive LiDAR Market estimates and forecasts, 2018 - 2030 (USD Million)

- Fig. 33 Mexico Automotive LiDAR Market estimates and forecasts, 2018 - 2030 (USD Million)

- Fig. 34 Europe Automotive LiDAR Market estimates and forecasts, 2018 - 2030 (USD Million)

- Fig. 35 U.K. Automotive LiDAR Market estimates and forecasts, 2018 - 2030 (USD Million)

- Fig. 36 Germany Automotive LiDAR Market estimates and forecasts, 2018 - 2030 (USD Million)

- Fig. 37 France Automotive LiDAR Market estimates and forecasts, 2018 - 2030 (USD Million)

- Fig. 38 Asia Pacific Automotive LiDAR Market estimates and forecasts, 2018 - 2030 (USD Million)

- Fig. 39 China Automotive LiDAR Market estimates and forecasts, 2018 - 2030 (USD Million)

- Fig. 40 Japan Automotive LiDAR Market estimates and forecasts, 2018 - 2030 (USD Million)

- Fig. 41 India Automotive LiDAR Market estimates and forecasts, 2018 - 2030 (USD Million)

- Fig. 42 South Korea Automotive LiDAR Market estimates and forecasts, 2018 - 2030 (USD Million)

- Fig. 43 Australia Automotive LiDAR Market estimates and forecasts, 2018 - 2030 (USD Million)

- Fig. 44 Latin America Automotive LiDAR Market estimates and forecasts, 2018 - 2030 (USD Million)

- Fig. 45 Brazil Automotive LiDAR Market estimates and forecasts, 2018 - 2030 (USD Million)

- Fig. 46 MEA Automotive LiDAR Market estimates and forecasts, 2018 - 2030 (USD Million)

- Fig. 47 KSA Automotive LiDAR Market estimates and forecasts, 2018 - 2030 (USD Million)

- Fig. 48 UAE Automotive LiDAR Market estimates and forecasts, 2018 - 2030 (USD Million)

- Fig. 49 South Africa Automotive LiDAR Market estimates and forecasts, 2018 - 2030 (USD Million)

- Fig. 50 Company Categorization

- Fig. 51 Company Market Positioning

- Fig. 52 Strategy framework

Automotive LiDAR Market Growth & Trends:

The global automotive LiDAR market size is expected to reach USD 942.1 million by 2030, registering a CAGR of 9.4% during the forecast period, according to a new report by Grand View Research, Inc. The surging acceptance of automobile safety application arenas and sophisticated technology incorporations in automobile driving automation are expected to boost the market growth. The increasing acceptance for semi-autonomous and autonomous cars in the years to come is further anticipated to bolster the market growth.

The market can be categorized, based on application types, into Advanced Driver Assistance Systems (ADAS) & autonomous cars. The ADAS application segment is further segregated into Automatic Emergency Braking (AEB) and Adaptive Cruise Control (ACC). The ADAS application segment is expected witness a significant growth, owing to the surging incorporation of forward-collision avoidance systems.Adaptive cruise control (ACC) is adiscretionary cruising choice for automobiles that robotically modifies the vehicle speed to retain a safe distance from vehicles ahead.The rising adoption of these systems in autonomous and semi-autonomous cars at various levels of automation is expected to draw huge ventures from the key participants, thus driving the regional market demand in the years to come.

In October 2016, Infineon Technologies AG (Germany) acquired Innoluce BV (The Netherlands), a fabless semiconductor company headquartered in Nijmegen. Infineon says it would develop chip components for high-performance LiDAR systems by utilizing Innoluce's patented technology. This acquisition is expected to establish Infineon's strong foothold as one of the automotive safety technologies vendors.

Automotive LiDAR Market Report Highlights:

- Based on the application, the global automotive LiDAR market is segmented into ADAS and autonomous cars. The ADAS segment is further sub-segmented into automatic emergency braking (AEB) and adaptive cruise control (ACC).

- The autonomous cars segment is estimated to register the healthy growth over the forecast period. This growth is attributed to increasing demand for advanced driver assistance systems (ADAS) and self-driving vehicles.

- North America dominated the market and accounted for the largest revenue share of 34.9% in 2022.

- Asia Pacific is expected to register rapid growth over the forecast period. Advancements in LiDAR technology, such as the development of solid-state LiDAR and the miniaturization of sensors, are driving market growth in the region.

Table of Contents

Chapter 1. Methodology and Scope

- 1.1. Market Segmentation and Scope

- 1.2. Market Definitions

- 1.3. Research Methodology

- 1.3.1. Information Procurement

- 1.3.2. Information or Data Analysis

- 1.3.3. Market Formulation & Data Visualization

- 1.3.4. Data Validation & Publishing

- 1.4. Research Scope and Assumptions

- 1.4.1. List of Data Sources

Chapter 2. Executive Summary

- 2.1. Market Outlook

- 2.2. Segment Outlook

- 2.3. Competitive Insights

Chapter 3. Automotive LiDAR Market Variables, Trends, & Scope

- 3.1. Market Introduction/Lineage Outlook

- 3.2. Market Dynamics

- 3.2.1. Market Drivers Analysis

- 3.2.2. Market Restraints Analysis

- 3.2.3. Industry Opportunities

- 3.2.4. Industry Challenges

- 3.3. Automotive LiDAR Market Analysis Tools

- 3.3.1. Porter's Analysis

- 3.3.2. PESTEL Analysis

Chapter 4. Automotive LiDAR Market: Technology Estimates & Trend Analysis

- 4.1. Segment Dashboard

- 4.2. Automotive LiDAR Market: Technology Movement Analysis, USD Million, 2023 & 2030

- 4.3. Mechanical LiDAR

- 4.3.1. Mechanical LiDAR Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

- 4.4. Solid-state LiDAR

- 4.4.1. Solid-state LiDAR Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

Chapter 5. Automotive LiDAR Market: Application Estimates & Trend Analysis

- 5.1. Segment Dashboard

- 5.2. Automotive LiDAR Market: Application Movement Analysis, USD Million, 2023 & 2030

- 5.3. ADAS

- 5.3.1. ADAS Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

- 5.4. Autonomous Cars

- 5.4.1. Autonomous Cars Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

Chapter 6. Automotive LiDAR Market: Propulsion Type Estimates & Trend Analysis

- 6.1. Segment Dashboard

- 6.2. Automotive LiDAR Market: Propulsion Type Movement Analysis, USD Million, 2023 & 2030

- 6.3. Internal Combustion Engine (ICE) Vehicle

- 6.3.1. Internal Combustion Engine (ICE) Vehicle Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

- 6.4. Electric & Hybrid Vehicles

- 6.4.1. Electric & Hybrid Vehicles Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

Chapter 7. Automotive LiDAR Market: Vehicle Type Estimates & Trend Analysis

- 7.1. Segment Dashboard

- 7.2. Automotive LiDAR Market: Vehicle Type Movement Analysis, USD Million, 2023 & 2030

- 7.3. Passenger Cars

- 7.3.1. Passenger Cars Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

- 7.4. Commercial Vehicles

- 7.4.1. Commercial Vehicles Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

Chapter 8. Automotive LiDAR Market: Regional Estimates & Trend Analysis

- 8.1. Automotive LiDAR Market Share, By Region, 2023 & 2030, USD Million

- 8.2. North America

- 8.2.1. North America Automotive LiDAR Market Estimates and Forecasts, 2018 - 2030 (USD Million)

- 8.2.2. U.S.

- 8.2.2.1. U.S. Automotive LiDAR Market Estimates and Forecasts, 2018 - 2030 (USD Million)

- 8.2.3. Canada

- 8.2.3.1. Canada Automotive LiDAR Market Estimates and Forecasts, 2018 - 2030 (USD Million)

- 8.2.4. Mexico

- 8.2.4.1. Mexico Automotive LiDAR Market Estimates and Forecasts, 2018 - 2030 (USD Million)

- 8.3. Europe

- 8.3.1. Europe Automotive LiDAR Market Estimates and Forecasts, 2018 - 2030 (USD Million)

- 8.3.2. U.K.

- 8.3.2.1. U.K. Automotive LiDAR Market Estimates and Forecasts, 2018 - 2030 (USD Million)

- 8.3.3. Germany

- 8.3.3.1. Germany Automotive LiDAR Market Estimates and Forecasts, 2018 - 2030 (USD Million)

- 8.3.4. France

- 8.3.4.1. France Automotive LiDAR Market Estimates and Forecasts, 2018 - 2030 (USD Million)

- 8.4. Asia Pacific

- 8.4.1. Asia Pacific Automotive LiDAR Market Estimates and Forecasts, 2018 - 2030 (USD Million)

- 8.4.2. China

- 8.4.2.1. China Automotive LiDAR Market Estimates and Forecasts, 2018 - 2030 (USD Million)

- 8.4.3. Japan

- 8.4.3.1. Japan Automotive LiDAR Market Estimates and Forecasts, 2018 - 2030 (USD Million)

- 8.4.4. India

- 8.4.4.1. India Automotive LiDAR Market Estimates and Forecasts, 2018 - 2030 (USD Million)

- 8.4.5. South Korea

- 8.4.5.1. South Korea Automotive LiDAR Market Estimates and Forecasts, 2018 - 2030 (USD Million)

- 8.4.6. Australia

- 8.4.6.1. Australia Automotive LiDAR Market Estimates and Forecasts, 2018 - 2030 (USD Million)

- 8.5. Latin America

- 8.5.1. Latin America Automotive LiDAR Market Estimates and Forecasts, 2018 - 2030 (USD Million)

- 8.5.2. Brazil

- 8.5.2.1. Brazil Automotive LiDAR Market Estimates and Forecasts, 2018 - 2030 (USD Million)

- 8.6. Middle East and Africa

- 8.6.1. Middle East and Africa Automotive LiDAR Market Estimates and Forecasts, 2018 - 2030 (USD Million)

- 8.6.2. KSA

- 8.6.2.1. KSA Automotive LiDAR Market Estimates and Forecasts, 2018 - 2030 (USD Million)

- 8.6.3. UAE

- 8.6.3.1. UAE Automotive LiDAR Market Estimates and Forecasts, 2018 - 2030 (USD Million)

- 8.6.4. South Africa

- 8.6.4.1. South Africa Automotive LiDAR Market Estimates and Forecasts, 2018 - 2030 (USD Million)

Chapter 9. Competitive Landscape

- 9.1. Recent Developments & Impact Analysis by Key Market Participants

- 9.2. Company Categorization

- 9.3. Company Market Positioning

- 9.4. Company Market Share Analysis

- 9.5. Company Heat Map Analysis

- 9.6. Strategy Mapping

- 9.6.1. Expansion

- 9.6.2. Mergers & Acquisition

- 9.6.3. Partnerships & Collaborations

- 9.6.4. New Product Launches

- 9.6.5. Research And Development

- 9.7. Company Profiles

- 9.7.1. Continental AG

- 9.7.1.1. Participant's Overview

- 9.7.1.2. Financial Performance

- 9.7.1.3. Product Benchmarking

- 9.7.1.4. Recent Developments

- 9.7.2. Denso Corporation

- 9.7.2.1. Participant's Overview

- 9.7.2.2. Financial Performance

- 9.7.2.3. Product Benchmarking

- 9.7.2.4. Recent Developments

- 9.7.3. LeddarTech Inc.

- 9.7.3.1. Participant's Overview

- 9.7.3.2. Financial Performance

- 9.7.3.3. Product Benchmarking

- 9.7.3.4. Recent Developments

- 9.7.4. KUBOTA Corporation

- 9.7.4.1. Participant's Overview

- 9.7.4.2. Financial Performance

- 9.7.4.3. Product Benchmarking

- 9.7.4.4. Recent Developments

- 9.7.5. Quanergy Solutions, Inc.

- 9.7.5.1. Participant's Overview

- 9.7.5.2. Financial Performance

- 9.7.5.3. Product Benchmarking

- 9.7.5.4. Recent Developments

- 9.7.6. Robert Bosch GmbH

- 9.7.6.1. Participant's Overview

- 9.7.6.2. Financial Performance

- 9.7.6.3. Product Benchmarking

- 9.7.6.4. Recent Developments

- 9.7.7. Teledyne Geospatial

- 9.7.7.1. Participant's Overview

- 9.7.7.2. Financial Performance

- 9.7.7.3. Product Benchmarking

- 9.7.7.4. Recent Developments

- 9.7.8. Valeo

- 9.7.8.1. Participant's Overview

- 9.7.8.2. Financial Performance

- 9.7.8.3. Product Benchmarking

- 9.7.8.4. Recent Developments

- 9.7.9. Velodyne LiDAR, Inc.

- 9.7.9.1. Participant's Overview

- 9.7.9.2. Financial Performance

- 9.7.9.3. Product Benchmarking

- 9.7.9.4. Recent Developments

- 9.7.10. Innoviz Technologies.

- 9.7.10.1. Participant's Overview

- 9.7.10.2. Financial Performance

- 9.7.10.3. Product Benchmarking

- 9.7.10.4. Recent Developments

- 9.7.1. Continental AG