|

|

市場調査レポート

商品コード

1268872

DNAポリメラーゼの市場規模、シェア、動向分析レポート、タイプ別(Taqポリメラーゼ、Pfuポリメラーゼ、独自酵素ブレンド)、用途別、最終用途別、地域別、セグメント別予測、2023~2030年DNA Polymerase Market Size, Share & Trends Analysis Report By Type (Taq Polymerase, Pfu Polymerase, Proprietary Enzyme Blends), By Application, By End-use, By Region, And Segment Forecasts, 2023 - 2030 |

||||||

|

● お客様のご希望に応じて、既存データの加工や未掲載情報(例:国別セグメント)の追加などの対応が可能です。 詳細はお問い合わせください。 |

|||||||

| DNAポリメラーゼの市場規模、シェア、動向分析レポート、タイプ別(Taqポリメラーゼ、Pfuポリメラーゼ、独自酵素ブレンド)、用途別、最終用途別、地域別、セグメント別予測、2023~2030年 |

|

出版日: 2023年04月21日

発行: Grand View Research

ページ情報: 英文 180 Pages

納期: 2~10営業日

|

- 全表示

- 概要

- 図表

- 目次

DNAポリメラーゼの市場成長と動向:

Grand View Research, Inc.の新しいレポートによると、世界のDNAポリメラーゼの市場規模は2030年までに1億3,650万米ドルに達すると予想されています。

2023年から2030年までのCAGRは1.30%で拡大すると予想されています。DNAポリメラーゼは、生物におけるDNAの複製と修復に関与する必須酵素です。これらのポリメラーゼ市場は、分子診断、遺伝子工学、医薬品開発などの様々な用途におけるDNAポリメラーゼの需要の増加により、近年著しい成長を遂げています。さらに、医薬品、農業、科学捜査など、さまざまな産業でこうしたポリメラーゼの使用が増加していることが、この市場の拡大にさらに拍車をかけています。

さらに、遺伝性疾患やがんの有病率の上昇も、市場の成長を促進する要因となっています。Genetic and Rare Disease(GARD)Information Centreの報告によると、7,000以上の希少疾病が存在するとされています。米国だけでも、2,500万人から3,000万人が希少疾病と共存していると推定されており、この数は増え続けています。さらに、少なくとも20万人が遺伝性疾患の生存者として知られており、英国では年間3万人以上の赤ちゃんや子供が遺伝性疾患と診断され、その結果、240万人以上が様々な遺伝性疾患の生存者となっています。この動向は予測期間中も続くと予想され、DNAポリメラーゼおよび関連製品の需要拡大につながっています。

COVID-19のパンデミックにより、診断薬や治療薬開発への需要が高まり、市場が急拡大しています。ウイルスの理解を深め、効果的な検査戦略を開発するために、研究者やヘルスケア関係者は、PCRやRT-PCRなどのさまざまな分子診断技術にDNAポリメラーゼを利用しています。このような需要の高まりが、市場の大幅な拡大をもたらしています。COVID-19と闘う緊急性は、新しい診断ツールや治療法を開発するための科学的イノベーションや共同研究の取り組みを後押ししています。例えば、バイオテクノロジー企業のGinkgo Bioworks社は、PCRのようなDNAポリメラーゼに基づく技術に依存する大規模なCOVID-19検査サービスであるConcentric by Ginkgoを開始しました。この取り組みは、革新的な診断ソリューションにおけるDNAポリメラーゼの役割を示しています。

高忠実度、加工性、阻害剤への耐性などの特性を強化した新規DNAポリメラーゼの開発により、その応用範囲は広がっています。これらの進歩により、研究者はより複雑な実験を行い、これまでアクセスできなかったゲノムの領域を探索することができるようになりました。効率的で正確なDNAポリメラーゼの需要が高まる中、この分野のイノベーションが市場をさらに押し上げると予想されます。

さらに、個別化医療研究への投資の増加や、その利点に対する認識の高まりが、今後数年間、市場を牽引すると予想されます。例えば、2020年12月、精密医療技術企業であるTempusは、シリーズG-2の資金調達で2億米ドルを確保し、81億米ドルの実質的な評価額につながっています。同社はこの追加資金をもとに事業を拡大し、感染症、うつ病、心臓病などさまざまな疾患に注力する計画です。個別化医療は、個人の遺伝的体質に基づいてオーダーメイドの治療法を提供することを目的とした新しい分野です。DNAポリメラーゼは、個別化医療に不可欠なシークエンスにおいて重要な役割を担っています。

DNAポリメラーゼ市場レポートハイライト

- タイプ別では、Taqポリメラーゼセグメントが2022年に53.99%のシェアを獲得し、市場を独占しています。Taqポリメラーゼは、PCR技術で一般的に使用されるDNAポリメラーゼの一種です。遺伝学や分子生物学の研究が拡大し続ける中、PCRの需要は増加すると予想され、このセグメントの成長を牽引しています。

- ポリメラーゼ連鎖反応分野は、診断や研究目的でDNA増幅技術が広く使用されていることから、2022年の用途別セグメントで74.85%の最大シェアを占めています。

- 病院および診断センターセグメントは、ポリメラーゼベースの検査オプションの採用急増につながった遺伝性疾患やCOVID-19などの感染症の有病率の増加により、2022年に41.65%の最大市場シェアを占めています。

- 北米は、2022年に47.25%のシェアを獲得し、同市場において確固たる地位を確立しています。この地域には、新薬や治療法の研究開発に多額の投資を行う著名なバイオテクノロジー企業や製薬企業が数多く存在しています。

目次

第1章 調査手法と範囲

- 情報調達

- 情報またはデータ分析

- 市場範囲とセグメントの定義

- 市場モデル

- 企業市場シェア別の市場調査

- 地域分析

第2章 エグゼクティブサマリー

- 市場スナップショット

- セグメントのスナップショット

- 競合情勢のスナップショット

第3章 市場変数、動向、および範囲

- 市場セグメンテーションと範囲

- 市場系統の見通し

- 親市場の見通し

- 関連/補助的な市場見通し

- 市場動向と展望

- 市場力学

- 市場促進要因

- 診断および調査目的でのシーケンス技術の採用の増加

- ヘルスケアにおける個別化医療の導入の増加

- 慢性疾患および感染症の罹患率の増加

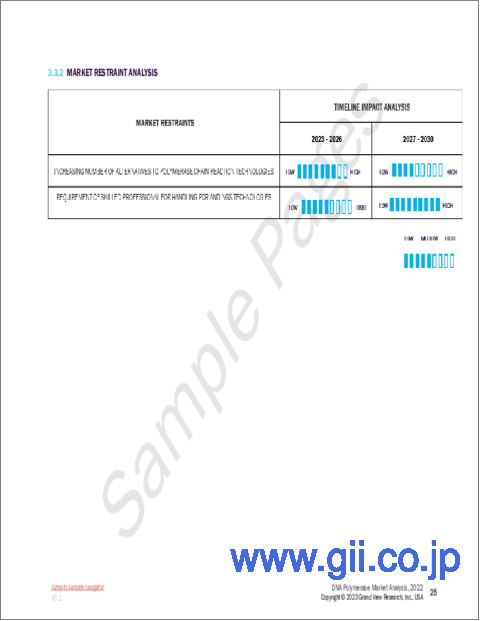

- 市場抑制要因分析

- ポリメラーゼ連鎖反応技術に代わる技術の増加

- PCRおよびNGSテクノロジーを扱うには熟練した専門家の要件

- 市場促進要因

- 事業環境分析

- SWOT分析;要因別(政治・法律、経済・技術)

- ポーターのファイブフォース分析

- COVID-19の影響分析

第4章 タイプビジネス分析

- DNAポリメラーゼ市場:型変動分析

- Taqポリメラーゼ

- Pfuポリメラーゼ

- 独自酵素ブレンド

- その他

第5章 用途ビジネス分析

- DNAポリメラーゼ市場:用途の変動分析

- ポリメラーゼ連鎖反応

- DNA配列決定

- DNAクローニング

- その他

第6章 最終用途ビジネス分析

- DNAポリメラーゼ市場:最終用途の変動分析

- 製薬およびバイオテクノロジー企業

- 学術調査機関

- 病院と診断センター

- その他

第7章 地域ビジネス分析

- 地域別DNAポリメラーゼ市場シェア、2022年および2030年

- 北米

- SWOT分析

- 米国

- カナダ

- 欧州

- SWOT分析

- ドイツ

- 英国

- フランス

- イタリア

- スペイン

- デンマーク

- スウェーデン

- ノルウェー

- アジア太平洋地域

- SWOT分析

- 日本

- 中国

- インド

- 韓国

- オーストラリア

- タイ

- ラテンアメリカ

- SWOT分析

- ブラジル

- メキシコ

- アルゼンチン

- MEA

- SWOT分析

- 南アフリカ

- サウジアラビア

- アラブ首長国連邦

- クウェート

第8章 競合情勢

- 会社の分類

- 戦略マッピング

- 企業の市場シェア分析、2022年

- 企業プロファイル・一覧表

- Thermo Fisher Scientific, Inc.

- 概要

- 財務実績(純収益/売上高/EBITDA/売上総利益)

- 製品のベンチマーク

- 戦略的取り組み

- Agilent Technologies

- 概要

- 財務実績(純収益/売上高/EBITDA/売上総利益)

- 製品のベンチマーク

- 戦略的取り組み

- Merck KGaA

- 概要

- 財務実績(純収益/売上高/EBITDA/売上総利益)

- 製品のベンチマーク

- 戦略的取り組み

- Danaher

- 概要

- 財務実績(純収益/売上高/EBITDA/売上総利益)

- 製品のベンチマーク

- 戦略的取り組み

- QIAGEN

- 概要

- 財務実績(純収益/売上高/EBITDA/売上総利益)

- 製品のベンチマーク

- 戦略的取り組み

- Hoffmann-La Roche Ltd

- 概要

- 財務実績(純収益/売上高/EBITDA/売上総利益)

- 製品のベンチマーク

- 戦略的取り組み

- Bio-Rad Laboratories, Inc.;

- 概要

- 財務実績(純収益/売上高/EBITDA/売上総利益)

- 製品のベンチマーク

- 戦略的取り組み

- Takara Bio, Inc.

- 概要

- 財務実績(純収益/売上高/EBITDA/売上総利益)

- 製品のベンチマーク

- 戦略的取り組み

- Promega Corporation

- 概要

- 財務実績(純収益/売上高/EBITDA/売上総利益)

- 製品のベンチマーク

- 戦略的取り組み

- New England Biolabs

- 概要

- 財務実績(純収益/売上高/EBITDA/売上総利益)

- 製品のベンチマーク

- 戦略的取り組み

- Thermo Fisher Scientific, Inc.

List of Tables

- TABLE 1 List of Abbreviations

- TABLE 2 Global DNA polymerases market, by type, 2018 - 2030 (USD Million)

- TABLE 3 Global DNA polymerases market, by application, 2018 - 2030 (USD Million)

- TABLE 4 Global DNA polymerases market, by end-use, 2018 - 2030 (USD Million)

- TABLE 5 Global DNA polymerases market, by region, 2018 - 2030 (USD Million)

- TABLE 6 North America DNA polymerases market, by country, 2018 - 2030 (USD Million)

- TABLE 7 North America DNA polymerases market, by type, 2018 - 2030 (USD Million)

- TABLE 8 North America DNA polymerases market, by application, 2018 - 2030 (USD Million)

- TABLE 9 North America DNA polymerases market, by end-use, 2018 - 2030 (USD Million)

- TABLE 10 U.S. DNA polymerases market, by type, 2018 - 2030 (USD Million)

- TABLE 11 U.S. DNA polymerases market, by application, 2018 - 2030 (USD Million)

- TABLE 12 U.S. DNA polymerases market, by end-use, 2018 - 2030 (USD Million)

- TABLE 13 Canada DNA polymerases market, by type, 2018 - 2030 (USD Million)

- TABLE 14 Canada DNA polymerases market, by application, 2018 - 2030 (USD Million)

- TABLE 15 Canada DNA polymerases market, by end-use, 2018 - 2030 (USD Million)

- TABLE 16 Europe DNA polymerases market, by country, 2018 - 2030 (USD Million)

- TABLE 17 Europe DNA polymerases market, by type, 2018 - 2030 (USD Million)

- TABLE 18 Europe DNA polymerases market, by application, 2018 - 2030 (USD Million)

- TABLE 19 Europe DNA polymerases market, by end-use, 2018 - 2030 (USD Million)

- TABLE 20 Germany DNA polymerases market, by type, 2018 - 2030 (USD Million)

- TABLE 21 Germany DNA polymerases market, by application, 2018 - 2030 (USD Million)

- TABLE 22 Germany DNA polymerases market, by end-use, 2018 - 2030 (USD Million)

- TABLE 23 UK DNA polymerases market, by type, 2018 - 2030 (USD Million)

- TABLE 24 UK DNA polymerases market, by application, 2018 - 2030 (USD Million)

- TABLE 25 UK DNA polymerases market, by end-use, 2018 - 2030 (USD Million)

- TABLE 26 France DNA polymerases market, by type, 2018 - 2030 (USD Million)

- TABLE 27 France DNA polymerases market, by application, 2018 - 2030 (USD Million)

- TABLE 28 France DNA polymerases market, by end-use, 2018 - 2030 (USD Million)

- TABLE 29 Italy DNA polymerases market, by type, 2018 - 2030 (USD Million)

- TABLE 30 Italy DNA polymerases market, by application, 2018 - 2030 (USD Million)

- TABLE 31 Italy DNA polymerases market, by end-use, 2018 - 2030 (USD Million)

- TABLE 32 Spain DNA polymerases market, by type, 2018 - 2030 (USD Million)

- TABLE 33 Spain DNA polymerases market, by application, 2018 - 2030 (USD Million)

- TABLE 34 Spain DNA polymerases market, by end-use, 2018 - 2030 (USD Million)

- TABLE 35 Denmark DNA polymerases market, by type, 2018 - 2030 (USD Million)

- TABLE 36 Denmark DNA polymerases market, by application, 2018 - 2030 (USD Million)

- TABLE 37 Denmark DNA polymerases market, by end-use, 2018 - 2030 (USD Million)

- TABLE 38 Sweden DNA polymerases market, by type, 2018 - 2030 (USD Million)

- TABLE 39 Sweden DNA polymerases market, by application, 2018 - 2030 (USD Million)

- TABLE 40 Sweden DNA polymerases market, by end-use, 2018 - 2030 (USD Million)

- TABLE 41 Norway DNA polymerases market, by type, 2018 - 2030 (USD Million)

- TABLE 42 Norway DNA polymerases market, by application, 2018 - 2030 (USD Million)

- TABLE 43 Norway DNA polymerases market, by end-use, 2018 - 2030 (USD Million)

- TABLE 44 Asia Pacific DNA polymerases market, by country, 2018 - 2030 (USD Million)

- TABLE 45 Asia Pacific DNA polymerases market, by type, 2018 - 2030 (USD Million)

- TABLE 46 Asia Pacific DNA polymerases market, by application, 2018 - 2030 (USD Million)

- TABLE 47 Asia Pacific DNA polymerases market, by end-use, 2018 - 2030 (USD Million)

- TABLE 48 China DNA polymerases market, by type, 2018 - 2030 (USD Million)

- TABLE 49 China DNA polymerases market, by application, 2018 - 2030 (USD Million)

- TABLE 50 China DNA polymerases market, by end-use, 2018 - 2030 (USD Million)

- TABLE 51 Japan DNA polymerases market, by type, 2018 - 2030 (USD Million)

- TABLE 52 Japan DNA polymerases market, by application, 2018 - 2030 (USD Million)

- TABLE 53 Japan DNA polymerases market, by end-use, 2018 - 2030 (USD Million)

- TABLE 54 India DNA polymerases market, by type, 2018 - 2030 (USD Million)

- TABLE 55 India DNA polymerases market, by application, 2018 - 2030 (USD Million)

- TABLE 56 India DNA polymerases market, by end-use, 2018 - 2030 (USD Million)

- TABLE 57 South Korea DNA polymerases market, by type, 2018 - 2030 (USD Million)

- TABLE 58 South Korea DNA polymerases market, by application, 2018 - 2030 (USD Million)

- TABLE 59 South Korea DNA polymerases market, by end-use, 2018 - 2030 (USD Million)

- TABLE 60 Australia DNA polymerases market, by type, 2018 - 2030 (USD Million)

- TABLE 61 Australia DNA polymerases market, by application, 2018 - 2030 (USD Million)

- TABLE 62 Australia DNA polymerases market, by end-use, 2018 - 2030 (USD Million)

- TABLE 63 Thailand DNA polymerases market, by type, 2018 - 2030 (USD Million)

- TABLE 64 Thailand DNA polymerases market, by application, 2018 - 2030 (USD Million)

- TABLE 65 Thailand DNA polymerases market, by end-use, 2018 - 2030 (USD Million)

- TABLE 66 Latin America DNA polymerases market, by country, 2018 - 2030 (USD Million)

- TABLE 67 Latin America DNA polymerases market, by type, 2018 - 2030 (USD Million)

- TABLE 68 Latin America DNA polymerases market, by application, 2018 - 2030 (USD Million)

- TABLE 69 Latin America DNA polymerases market, by end-use, 2018 - 2030 (USD Million)

- TABLE 70 Brazil DNA polymerases market, by type, 2018 - 2030 (USD Million)

- TABLE 71 Brazil DNA polymerases market, by application, 2018 - 2030 (USD Million)

- TABLE 72 Brazil DNA polymerases market, by end-use, 2018 - 2030 (USD Million)

- TABLE 73 Mexico DNA polymerases market, by type, 2018 - 2030 (USD Million)

- TABLE 74 Mexico DNA polymerases market, by application, 2018 - 2030 (USD Million)

- TABLE 75 Mexico DNA polymerases market, by end-use, 2018 - 2030 (USD Million)

- TABLE 76 Argentina DNA polymerases market, by type, 2018 - 2030 (USD Million)

- TABLE 77 Argentina DNA polymerases market, by application, 2018 - 2030 (USD Million)

- TABLE 78 Argentina DNA polymerases market, by end-use, 2018 - 2030 (USD Million)

- TABLE 79 Middle East & Africa DNA polymerases market, by type, 2018 - 2030 (USD Million)

- TABLE 80 Middle East & Africa DNA polymerases market, by application, 2018 - 2030 (USD Million)

- TABLE 81 Middle East & Africa DNA polymerases market, by end-use, 2018 - 2030 (USD Million)

- TABLE 82 South Africa DNA polymerases market, by type, 2018 - 2030 (USD Million)

- TABLE 83 South Africa DNA polymerases market, by application, 2018 - 2030 (USD Million)

- TABLE 84 South Africa DNA polymerases market, by end-use, 2018 - 2030 (USD Million)

- TABLE 85 Saudi Arabia DNA polymerases market, by type, 2018 - 2030 (USD Million)

- TABLE 86 Saudi Arabia DNA polymerases market, by application, 2018 - 2030 (USD Million)

- TABLE 87 Saudi Arabia DNA polymerases market, by end-use, 2018 - 2030 (USD Million)

- TABLE 88 UAE DNA polymerases market, by type, 2018 - 2030 (USD Million)

- TABLE 89 UAE DNA polymerases market, by application, 2018 - 2030 (USD Million)

- TABLE 90 UAE DNA polymerases market, by end-use, 2018 - 2030 (USD Million)

- TABLE 91 Kuwait DNA polymerases market, by type, 2018 - 2030 (USD Million)

- TABLE 92 Kuwait DNA polymerases market, by application, 2018 - 2030 (USD Million)

- TABLE 93 Kuwait DNA polymerases market, by end-use, 2018 - 2030 (USD Million)

List of Figures

- FIG. 1 Market research process

- FIG. 2 Information procurement

- FIG. 3 Primary research pattern

- FIG. 4 Market research approaches

- FIG. 5 Value chain-based sizing & forecasting

- FIG. 6 Market formulation & validation

- FIG. 7 DNA polymerases market segmentation

- FIG. 8 Market snapshot, 2022

- FIG. 9 Market trends & outlook

- FIG. 10 Market driver relevance analysis (current & future impact)

- FIG. 11 Market restraint relevance analysis (current & future impact)

- FIG. 12 SWOT analysis, by factor (political & legal, economic and technological)

- FIG. 13 Porter's five forces analysis

- FIG. 14 Market penetration & growth prospect mapping, 2022

- FIG. 15 Global DNA polymerases market: type movement analysis

- FIG. 16 Global DNA polymerases market, for Taq polymerase, 2018 - 2030 (USD Million)

- FIG. 17 Global DNA polymerases market, for Pfu polymerase, 2018 - 2030 (USD Million)

- FIG. 18 Global DNA polymerases market, for proprietary enzyme blends, 2018 - 2030 (USD Million)

- FIG. 19 Global DNA polymerases market, for other types, 2018 - 2030 (USD Million)

- FIG. 20 Global DNA polymerases market: application movement analysis

- FIG. 21 Global DNA polymerases market, for polymerase chain reaction, 2018 - 2030 (USD Million)

- FIG. 22 Global DNA polymerases market, for DNA sequencing, 2018 - 2030 (USD Million)

- FIG. 23 Global DNA polymerases market, for DNA cloning, 2018-030, (USD Million)

- FIG. 24 Global DNA polymerases market, for other applications, 2018 - 2030 (USD Million)

- FIG. 25 Global DNA polymerases market: end-use movement analysis

- FIG. 26 Global DNA polymerases market, for pharmaceutical and biotechnology companies , 2018 - 2030 (USD Million)

- FIG. 27 Global DNA polymerases market, for academic and research institute, 2018 - 2030 (USD Million)

- FIG. 28 Global DNA polymerases market, for hospital and diagnostic centers, 2018 - 2030 (USD Million)

- FIG. 29 Global DNA polymerases market, for other end-uses, 2018 - 2030 (USD Million)

- FIG. 30 Regional marketplace: key takeaways

- FIG. 31 Regional outlook, 2022 & 2030

- FIG. 32 Global DNA polymerases market: region movement analysis

- FIG. 33 North America DNA polymerases market, 2018 - 2030 (USD Million)

- FIG. 34 U.S. DNA polymerases market, 2018 - 2030 (USD Million)

- FIG. 35 Canada DNA polymerases market, 2018 - 2030 (USD Million)

- FIG. 36 Europe DNA polymerases market, 2018 - 2030 (USD Million)

- FIG. 37 Germany DNA polymerases market, 2018 - 2030 (USD Million)

- FIG. 38 UK DNA polymerases market, 2018 - 2030 (USD Million)

- FIG. 39 France DNA polymerases market, 2018 - 2030 (USD Million)

- FIG. 40 Italy DNA polymerases market, 2018 - 2030 (USD Million)

- FIG. 41 Spain DNA polymerases market, 2018 - 2030 (USD Million)

- FIG. 42 Denmark DNA polymerases market, 2018 - 2030 (USD Million)

- FIG. 43 Sweden DNA polymerases market, 2018 - 2030 (USD Million)

- FIG. 44 Norway DNA polymerases market, 2018 - 2030 (USD Million)

- FIG. 45 Asia Pacific DNA polymerases market, 2018 - 2030 (USD Million)

- FIG. 46 Japan DNA polymerases market, 2018 - 2030 (USD Million)

- FIG. 47 China DNA polymerases market, 2018 - 2030 (USD Million)

- FIG. 48 India DNA polymerases market, 2018 - 2030 (USD Million)

- FIG. 49 Australia DNA polymerases market, 2018 - 2030 (USD Million)

- FIG. 50 South Korea DNA polymerases market, 2018 - 2030 (USD Million)

- FIG. 51 Thailand DNA polymerases market, 2018 - 2030 (USD Million)

- FIG. 52 Latin America DNA polymerases market, 2018 - 2030 (USD Million)

- FIG. 53 Brazil DNA polymerases market, 2018 - 2030 (USD Million)

- FIG. 54 Mexico DNA polymerases market, 2018 - 2030 (USD Million)

- FIG. 55 Argentina DNA polymerases market, 2018 - 2030 (USD Million)

- FIG. 56 Middle East and Africa DNA polymerases market, 2018 - 2030 (USD Million)

- FIG. 57 South Africa DNA polymerases market, 2018 - 2030 (USD Million)

- FIG. 58 Saudi Arabia DNA polymerases market, 2018 - 2030 (USD Million)

- FIG. 59 UAE DNA polymerases market, 2018 - 2030 (USD Million)

- FIG. 60 Kuwait DNA polymerases market, 2018 - 2030 (USD Million)

DNA Polymerase Market Growth & Trends:

The global DNA polymerase market size is expected to reach USD 136.5 million by 2030, according to a new report by Grand View Research, Inc. The market is expected to expand at a CAGR of 1.30% from 2023 to 2030. DNA polymerase are essential enzymes involved in the replication and repair of DNA in living organisms. These polymerases market has experienced significant growth in recent years due to the increasing demand for DNA polymerases in various applications, such as molecular diagnostics, genetic engineering, and drug development. Moreover, the increasing use of such polymerases in various industries, such as pharmaceuticals, agriculture, and forensics, has further fueled the expansion of this market.

In addition, rising prevalence of genetic disorders and cancers is another factor is driving the growth of the market. According to the Genetic and Rare Disease (GARD) Information Centre reports there are more than 7,000 rare diseases. In the U.S. alone, it is estimated that between 25 million and 30 million people are living with a rare disease, and this number continues to rise. Additionally, at least 200,000 people are known survivors of genetic disorders, while over 30,000 babies and children are diagnosed annually with genetic disorders in the UK, resulting in more than 2.4 million survivors of various genetic conditions. This trend is expected to continue over the forecast period, leading to a growing demand for DNA polymerase and related products.

The COVID-19 pandemic has led to an increased demand for diagnostics and therapeutic development, resulting in a surge in the market. To better understand the virus and develop effective testing strategies, researchers and healthcare professionals have relied on DNA polymerases for various molecular diagnostic techniques, such as PCR and RT-PCR. This increased demand has resulted in a significant expansion of the market. The urgency to combat COVID-19 has propelled scientific innovation and collaboration efforts to develop new diagnostic tools and therapies. For instance, Ginkgo Bioworks, a biotechnology company, has launched Concentric by Ginkgo, a large-scale COVID-19 testing service that depends on DNA polymerase-based techniques like PCR. This initiative showcases the role of DNA polymerases in innovative diagnostic solutions.

The development of novel DNA polymerase with enhanced properties, such as high fidelity, processivity, and resistance to inhibitors, has expanded their range of applications. These advancements have allowed researchers to conduct more complex experiments and explore previously inaccessible areas of the genome. As the demand for efficient and accurate DNA polymerases increases, innovations in this area are expected to boost the market further.

Furthermore, the growing investment in personalized medicine research and the rising awareness of its benefits are expected to drive the market in the coming years. For instance, in December 2020, Tempus, a precision medicine technology company, secured USD 200 million in Series G-2 funding, leading to a substantial valuation of USD 8.1 billion. The company plans to use the additional funding to expand its operations and focus on a range of diseases, including infectious diseases, depression, and cardiology. Personalized medicine is an emerging field that aims to provide tailored treatment options based on an individual's genetic makeup. DNA polymerase play a crucial role in sequencing, which is an essential component of personalized medicine.

DNA Polymerase Market Report Highlights:

- By type, the Taq polymerase segment dominated the market with a share of 53.99% in 2022. Taq polymerases are a type of DNA polymerases that is commonly used in the PCR technique. As research in genetics and molecular biology continues to expand, the demand for PCR is expected to increase, driving the growth of this segment

- The polymerase chain reaction segment accounted for the largest share of 74.85% in the application segment in 2022, due to the widespread use of the DNA amplification technique for diagnostic and research purposes

- The hospitals and diagnostic centers segment accounted for the largest market share of 41.65% in 2022 due to the increasing prevalence of genetic disorders and infectious diseases like COVID-19 which led to a surge in the adoption of polymerase-based testing options

- North America has established a strong regional position in the market with 47.25% share in 2022, which can be attributed to the high demand for biotechnology techniques. The region is home to numerous prominent biotech and pharmaceutical companies that invest heavily in research and development of new drugs and therapies.

Table of Contents

Chapter 1. Methodology and Scope

- 1.1. Information Procurement

- 1.2. Information or Data Analysis

- 1.3. Market Scope & Segment Definition

- 1.4. Market Model

- 1.4.1. Market Study, by Company Market Share

- 1.4.2. Regional Analysis

Chapter 2. Executive Summary

- 2.1. Market Snapshot

- 2.2. Segment Snapshot

- 2.3. Competitive Landscape Snapshot

Chapter 3. Market Variables, Trends, & Scope

- 3.1. Market Segmentation And Scope

- 3.2. Market Lineage Outlook

- 3.2.1. Parent Market Outlook

- 3.2.2. Related/Ancillary Market Outlook

- 3.3. Market Trends And Outlook

- 3.4. Market Dynamics

- 3.4.1. Market Drivers

- 3.4.1.1. Increasing Adoption Of Sequencing Technologies For Diagnostic And Research Purposes

- 3.4.1.2. Rising Adoption Of Personalized Medicine In Healthcare

- 3.4.1.3. Increasing Prevalence Of Chronic And Infectious Diseases

- 3.4.2. Market Restraint Analysis

- 3.4.2.1. Increasing Number Of Alternatives To Polymerase Chain Reaction Technologies

- 3.4.2.2. Requirement Of Skilled Professional For Handling PCR and NGS Technologies

- 3.4.1. Market Drivers

- 3.5. Business Environment Analysis

- 3.5.1. SWOT Analysis; By Factor (Political & Legal, Economic And Technological)

- 3.5.2. Porter's Five Forces Analysis

- 3.6. COVID-19 Impact Analysis

Chapter 4. Type Business Analysis

- 4.1. DNA Polymerases Market: Type Movement Analysis

- 4.2. Taq Polymerase

- 4.2.1. Taq Polymerase Market, 2018 - 2030 (USD Million)

- 4.3. Pfu Polymerase

- 4.3.1. Pfu Polymerase Market, 2018 - 2030 (USD Million)

- 4.4. Proprietary Enzyme Blends

- 4.4.1. Proprietary Enzyme Blends Polymerase Market, 2018 - 2030 (USD Million)

- 4.5. Others

- 4.5.1. Other Types Market, 2018 - 2030 (USD Million)

Chapter 5. Application Business Analysis

- 5.1. DNA Polymerases Market: Application Movement Analysis

- 5.2. Polymerase Chain Reaction

- 5.2.1. Polymerase Chain Reaction Market, 2018 - 2030 (USD Million)

- 5.3. DNA Sequencing

- 5.3.1. DNA Sequencing Market, 2018 - 2030 (USD Million)

- 5.4. DNA Cloning

- 5.4.1. DNA Cloning Market, 2018 - 2030 (USD Million)

- 5.5. Others

- 5.5.1. Other Applications Market, 2018 - 2030 (USD Million)

Chapter 6. End-Use Business Analysis

- 6.1. DNA Polymerases Market: End-Use Movement Analysis

- 6.2. Pharmaceutical & Biotechnology Companies

- 6.2.1. Pharmaceutical & Biotechnology Companies Market, 2018 - 2030 (USD Million)

- 6.3. Academic & Research Institutes

- 6.3.1. Academic & Research Institutes Market, 2018 - 2030 (USD Million)

- 6.4. Hospitals & Diagnostic Centers

- 6.4.1. Hospitals & Diagnostic Centers Market, 2018 - 2030 (USD Million)

- 6.5. Others

- 6.5.1. Other End-uses Market, 2018 - 2030 (USD Million)

Chapter 7. Regional Business Analysis

- 7.1. DNA Polymerases Market Share By Region, 2022 & 2030

- 7.2. North America

- 7.2.1. SWOT Analysis

- 7.2.2. North America DNA Polymerases Market, 2018 - 2030 (USD Million)

- 7.2.3. U.S.

- 7.2.3.1. Key Country Dynamics

- 7.2.3.2. Target Disease Prevalence

- 7.2.3.3. Competitive Scenario

- 7.2.3.4. U.S. DNA Polymerases Market, 2018 - 2030 (USD Million)

- 7.2.4. Canada

- 7.2.4.1. Key Country Dynamics

- 7.2.4.2. Target Disease Prevalence

- 7.2.4.3. Competitive Scenario

- 7.2.4.4. Canada DNA Polymerases Market, 2018 - 2030 (USD Million)

- 7.3. Europe

- 7.3.1. SWOT Analysis

- 7.3.2. Europe DNA Polymerases Market, 2018 - 2030 (USD Million)

- 7.3.3. Germany

- 7.3.3.1. Key Country Dynamics

- 7.3.3.2. Target Disease Prevalence

- 7.3.3.3. Competitive Scenario

- 7.3.3.4. Germany DNA Polymerases Market, 2018 - 2030 (USD Million)

- 7.3.4. UK

- 7.3.4.1. Key Country Dynamics

- 7.3.4.2. Target Disease Prevalence

- 7.3.4.3. Competitive Scenario

- 7.3.4.4. UK DNA Polymerases Market, 2018 - 2030 (USD Million)

- 7.3.5. France

- 7.3.5.1. Key Country Dynamics

- 7.3.5.2. Target Disease Prevalence

- 7.3.5.3. Competitive Scenario

- 7.3.5.4. France DNA Polymerases Market, 2018 - 2030 (USD Million)

- 7.3.6. Italy

- 7.3.6.1. Key Country Dynamics

- 7.3.6.2. Target Disease Prevalence

- 7.3.6.3. Competitive Scenario

- 7.3.6.4. Italy DNA Polymerases Market, 2018 - 2030 (USD Million)

- 7.3.7. Spain

- 7.3.7.1. Key Country Dynamics

- 7.3.7.2. Target Disease Prevalence

- 7.3.7.3. Competitive Scenario

- 7.3.7.4. Spain DNA Polymerases Market, 2018 - 2030 (USD Million)

- 7.3.8. Denmark

- 7.3.8.1. Key Country Dynamics

- 7.3.8.2. Target Disease Prevalence

- 7.3.8.3. Competitive Scenario

- 7.3.8.4. Denmark DNA Polymerases Market, 2018 - 2030 (USD Million)

- 7.3.9. Sweden

- 7.3.9.1. Key Country Dynamics

- 7.3.9.2. Target Disease Prevalence

- 7.3.9.3. Competitive Scenario

- 7.3.9.4. Sweden DNA Polymerases Market, 2018 - 2030 (USD Million)

- 7.3.10. Norway

- 7.3.10.1. Key Country Dynamics

- 7.3.10.2. Target Disease Prevalence

- 7.3.10.3. Competitive Scenario

- 7.3.10.4. Norway DNA Polymerases Market, 2018 - 2030 (USD Million)

- 7.4. Asia Pacific

- 7.4.1. SWOT Analysis

- 7.4.2. Asia Pacific DNA Polymerases Market, 2018 - 2030 (USD Million)

- 7.4.3. Japan

- 7.4.3.1. Key Country Dynamics

- 7.4.3.2. Target Disease Prevalence

- 7.4.3.3. Competitive Scenario

- 7.4.3.4. Japan DNA Polymerases Market, 2018 - 2030 (USD Million)

- 7.4.4. China

- 7.4.4.1. Key Country Dynamics

- 7.4.4.2. Target Disease Prevalence

- 7.4.4.3. Competitive Scenario

- 7.4.4.4. China DNA Polymerases Market, 2018 - 2030 (USD Million)

- 7.4.5. India

- 7.4.5.1. Key Country Dynamics

- 7.4.5.2. Target Disease Prevalence

- 7.4.5.3. Competitive Scenario

- 7.4.5.4. India DNA Polymerases Market, 2018 - 2030 (USD Million)

- 7.4.6. South Korea

- 7.4.6.1. Key Country Dynamics

- 7.4.6.2. Target Disease Prevalence

- 7.4.6.3. Competitive Scenario

- 7.4.6.4. South Korea DNA Polymerases Market, 2018 - 2030 (USD Million)

- 7.4.7. Australia

- 7.4.7.1. Key Country Dynamics

- 7.4.7.2. Target Disease Prevalence

- 7.4.7.3. Competitive Scenario

- 7.4.7.4. Australia DNA Polymerases Market, 2018 - 2030 (USD Million)

- 7.4.8. Thailand

- 7.4.8.1. Key Country Dynamics

- 7.4.8.2. Target Disease Prevalence

- 7.4.8.3. Competitive Scenario

- 7.4.8.4. Thailand DNA Polymerases Market, 2018 - 2030 (USD Million)

- 7.5. Latin America

- 7.5.1. SWOT Analysis

- 7.5.2. Latin America DNA Polymerases Market, 2018 - 2030 (USD Million)

- 7.5.3. Brazil

- 7.5.3.1. Key Country Dynamics

- 7.5.3.2. Target Disease Prevalence

- 7.5.3.3. Competitive Scenario

- 7.5.3.4. Brazil DNA Polymerases Market, 2018 - 2030 (USD Million)

- 7.5.4. Mexico

- 7.5.4.1. Key Country Dynamics

- 7.5.4.2. Target Disease Prevalence

- 7.5.4.3. Competitive Scenario

- 7.5.4.4. Mexico DNA Polymerases Market, 2018 - 2030 (USD Million)

- 7.5.5. Argentina

- 7.5.5.1. Key Country Dynamics

- 7.5.5.2. Target Disease Prevalence

- 7.5.5.3. Competitive Scenario

- 7.5.5.4. Argentina DNA Polymerases Market, 2018 - 2030 (USD Million)

- 7.6. MEA

- 7.6.1. SWOT Analysis

- 7.6.2. MEA DNA Polymerases Market, 2018 - 2030 (USD Million)

- 7.6.3. South Africa

- 7.6.3.1. Key Country Dynamics

- 7.6.3.2. Target Disease Prevalence

- 7.6.3.3. Competitive Scenario

- 7.6.3.4. South Africa DNA Polymerases Market, 2018 - 2030 (USD Million)

- 7.6.4. Saudi Arabia

- 7.6.4.1. Key Country Dynamics

- 7.6.4.2. Target Disease Prevalence

- 7.6.4.3. Competitive Scenario

- 7.6.4.4. Saudi Arabia DNA Polymerases Market, 2018 - 2030 (USD Million)

- 7.6.5. UAE

- 7.6.5.1. Key Country Dynamics

- 7.6.5.2. Target Disease Prevalence

- 7.6.5.3. Competitive Scenario

- 7.6.5.4. UAE DNA Polymerases Market, 2018 - 2030 (USD Million)

- 7.6.6. Kuwait

- 7.6.6.1. Key Country Dynamics

- 7.6.6.2. Target Disease Prevalence

- 7.6.6.3. Competitive Scenario

- 7.6.6.4. Kuwait DNA Polymerases Market, 2018 - 2030 (USD Million)

Chapter 8. Competitive Landscape

- 8.1. Company Categorization

- 8.2. Strategy Mapping

- 8.3. Company Market Share Analysis, 2022

- 8.4. Company Profiles/Listing

- 8.4.1. Thermo Fisher Scientific, Inc.

- 8.4.1.1. Overview

- 8.4.1.2. Financial Performance (Net Revenue/Sales/EBITDA/Gross Profit)

- 8.4.1.3. Product Benchmarking

- 8.4.1.4. Strategic Initiatives

- 8.4.2. Agilent Technologies

- 8.4.2.1. Overview

- 8.4.2.2. Financial Performance (Net Revenue/Sales/EBITDA/Gross Profit)

- 8.4.2.3. Product Benchmarking

- 8.4.2.4. Strategic Initiatives

- 8.4.3. Merck KGaA

- 8.4.3.1. Overview

- 8.4.3.2. Financial Performance (Net Revenue/Sales/EBITDA/Gross Profit)

- 8.4.3.3. Product Benchmarking

- 8.4.3.4. Strategic Initiatives

- 8.4.4. Danaher

- 8.4.4.1. Overview

- 8.4.4.2. Financial Performance (Net Revenue/Sales/EBITDA/Gross Profit)

- 8.4.4.3. Product Benchmarking

- 8.4.4.4. Strategic Initiatives

- 8.4.5. QIAGEN

- 8.4.5.1. Overview

- 8.4.5.2. Financial Performance (Net Revenue/Sales/EBITDA/Gross Profit)

- 8.4.5.3. Product Benchmarking

- 8.4.5.4. Strategic Initiatives

- 8.4.6. Hoffmann-La Roche Ltd

- 8.4.6.1. Overview

- 8.4.6.2. Financial Performance (Net Revenue/Sales/EBITDA/Gross Profit)

- 8.4.6.3. Product Benchmarking

- 8.4.6.4. Strategic Initiatives

- 8.4.7. Bio-Rad Laboratories, Inc.;

- 8.4.7.1. Overview

- 8.4.7.2. Financial Performance (Net Revenue/Sales/EBITDA/Gross Profit)

- 8.4.7.3. Product Benchmarking

- 8.4.7.4. Strategic Initiatives

- 8.4.8. Takara Bio, Inc.

- 8.4.8.1. Overview

- 8.4.8.2. Financial Performance (Net Revenue/Sales/EBITDA/Gross Profit)

- 8.4.8.3. Product Benchmarking

- 8.4.8.4. Strategic Initiatives

- 8.4.9. Promega Corporation

- 8.4.9.1. Overview

- 8.4.9.2. Financial Performance (Net Revenue/Sales/EBITDA/Gross Profit)

- 8.4.9.3. Product Benchmarking

- 8.4.9.4. Strategic Initiatives

- 8.4.10. New England Biolabs

- 8.4.10.1. Overview

- 8.4.10.2. Financial Performance (Net Revenue/Sales/EBITDA/Gross Profit)

- 8.4.10.3. Product Benchmarking

- 8.4.10.4. Strategic Initiatives

- 8.4.1. Thermo Fisher Scientific, Inc.