|

|

市場調査レポート

商品コード

1611604

産業用オートメーション&制御システムの市場規模、シェア、動向分析レポート:コンポーネント別、制御システム別、最終用途別、地域別、セグメント予測、2025年~2030年Industrial Automation And Control Systems Market Size, Share & Trends Analysis Report By Component (Industrial Robots, Control Valves), By Control System (DCS, PLC, SCADA), By End-use, By Region, And Segment Forecasts, 2025 - 2030 |

||||||

カスタマイズ可能

|

|||||||

| 産業用オートメーション&制御システムの市場規模、シェア、動向分析レポート:コンポーネント別、制御システム別、最終用途別、地域別、セグメント予測、2025年~2030年 |

|

出版日: 2024年11月06日

発行: Grand View Research

ページ情報: 英文 130 Pages

納期: 2~10営業日

|

全表示

- 概要

- 図表

- 目次

産業用オートメーション&制御システム市場の成長と動向

Grand View Research, Inc.の新しい調査によると、世界の産業用オートメーションと制御システム市場規模は2030年までに3,785億7,000万米ドルに達すると予測されています。

2025~2030年にかけてのCAGRは10.8%に達すると予測されています。この成長は、エネルギー公共事業、化学、自動車など、いくつかの産業でプロセス自動化の採用が拡大していることに起因しています。例えば、Kawasaki Heavy Industries, Ltd.は2022年4月、HANEDA INNOVATION CITYに「Future Lab HANEDA」を設立しました。HANEDA INNOVATION CITYは、オープンイノベーションによるロボティクス製品・サービスの開発と、その可能性を実証するためのオフィスや商業施設を備えた複合施設です。このことが、予測期間中の市場成長をさらに促進すると予想されます。

さらに、企業は運用コストや人件費を大幅に削減するとともに、システムの信頼性と効率性により人間に関連するエラーを大幅に削減しており、これが予測期間中の産業用オートメーション&制御システム市場の成長を促進すると予測されます。必要に応じて複数のロボットを使用することは、市場の成長をさらに押し上げると予想されます。例えば、2022年4月、シーメンスAGは、大規模な産業用建物に有用で、エンジニアリングプロセスをスピードアップするPXC7スマートオートメーションコントローラを発表しました。

アジア太平洋は、主要市場参入企業とともに新興企業の存在により、最も急成長している市場になると予想されています。この地域の注目すべき参入企業には、カワサキ・ロボティクス、三菱電機ファクトリーオートメーション、横河電機などがあります。さらに、タイ、ベトナム、インドネシアなどの新興経済諸国は、未開拓の市場が多く潜在力が大きいため、製造工場を開発するために多額の投資が行われています。このため、同地域全体の市場成長に拍車がかかると予想されます。

産業用オートメーション&制御システム市場レポートハイライト

- コンポーネント別では、産業用ロボットコンポーネントセグメントが、インダストリー4.0ブームの到来によるスマート化・自動化工場の動向の高まりから、CAGR12%超の高成長が見込まれます。

- 制御システム別では、分散制御システム(DCS)制御システムセグメントが、産産業におけるIIoT導入の急速なペースにより、34%以上の高い市場シェアを占めています。

- 最終用途別では、医療セグメントは、手術や他の健康アプリケーションにおける自動化の増加傾向に起因する11%以上の最高のCAGRで成長すると予想されます。

- アジア太平洋は、この地域の新興諸国が自動化とスマート製造に多額の投資を行っている結果、2025~2030年までの予測期間中に13%を超える最高のCAGRで成長すると予想されています。

目次

第1章 調査手法と範囲

第2章 エグゼクティブサマリー

第3章 産業用オートメーション&制御システム市場-産業展望

- 市場概要

- 産業バリューチェーン分析

- 市場力学

- 技術の情勢

- 産業分析ツール

第4章 産業用オートメーション&制御システム市場:コンポーネント別、推定・動向分析

- コンポーネントの変動分析と市場シェア、2024年と2030年

- コンポーネント別

- ヒューマンマシンインターフェース

- 産業用ロボット

- コントロールバルブ

- センサー

- その他

第5章 産業用オートメーション&制御システム市場:制御システム別、推定・動向分析

- 制御システムの変動分析と市場シェア、2024年と2030年

- 制御システム別

- DCS

- PLC

- SCADA

- その他

第6章 産業用オートメーション&制御システム市場:最終用途別、推定・動向分析

- 最終用途変動分析と市場シェア、2024年と2030年

- 最終用途別

- 航空宇宙と防衛

- 自動車

- 化学品

- エネルギー・公益事業

- 飲食品

- 医療

- 製造業

- 鉱業・金属

- 石油・ガス

- 輸送

- その他

第7章 地域別、推定・動向分析

- 産業用オートメーション&制御システム市場:地域別、2024年と2030年

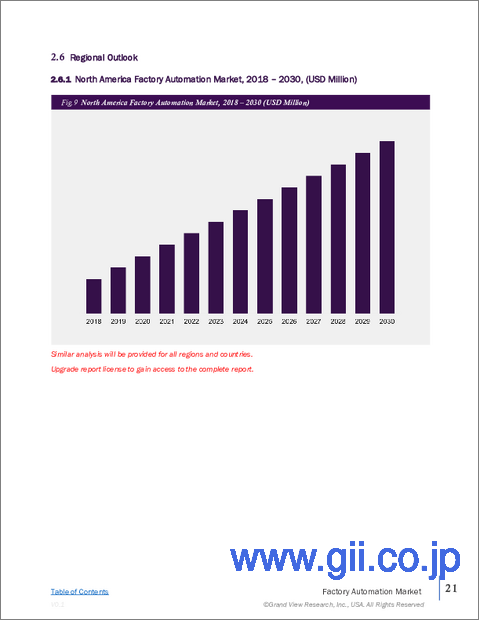

- 北米

- 北米の産業用オートメーション&制御システム市場の推定と予測、2018~2030年

- 米国

- カナダ

- メキシコ

- 欧州

- 欧州の産業用オートメーション&制御システム市場の推定と予測、2018~2030年

- ドイツ

- 英国

- フランス

- その他の欧州

- アジア太平洋

- アジア太平洋の産業用オートメーション&制御システム市場の推定と予測、2018~2030年

- 日本

- 中国

- インド

- 韓国

- オーストラリア

- その他のアジア太平洋

- 南米

- 南米の産業用オートメーション&制御システム市場の推定と予測、2018~2030年

- ブラジル

- その他の南米

- 中東・アフリカ

- 中東・アフリカの産業用オートメーション&制御システム市場の推定と予測、2018~2030年

- サウジアラビア

- アラブ首長国連邦

- 南アフリカ

- その他の中東・アフリカ

第8章 産業用オートメーション&制御システム市場-競合情勢

- 主要市場参入企業による最近の動向と影響分析

- 企業分類

- 参入企業概要

- 企業の市場ポジショニング

- 企業ヒートマップ分析

- 戦略マッピング

- 拡大/売却

- コラボレーション/パートナーシップ

- 新製品の発売

- 研究開発

- 企業プロファイル

- ABB Ltd.

- Emerson Electric Co.

- Honeywell International, Inc.

- Kawasaki Heavy Industries Ltd.

- OMRON Corporation

- Mitsubishi Electric Corporation

- Rockwell Automation, Inc.

- Schneider Electric

- Siemens AG

- Yokogawa Electric Corporation

List of Tables

- Table 1 Global Industrial Automation And Control Systems market size estimates & forecasts, 2018 - 2030 (USD Million)

- Table 2 Global Industrial Automation And Control Systems market, by region, 2018 - 2030 (USD Million)

- Table 3 Global Industrial Automation And Control Systems market, by component, 2018 - 2030 (USD Million)

- Table 4 Global Industrial Automation And Control Systems market, by Control Systems, 2018 - 2030 (USD Million)

- Table 5 Global Industrial Automation And Control Systems market, by end use, 2018 - 2030 (USD Million)

- Table 6 HMI Industrial Automation And Control Systems market, by region, 2018 - 2030 (USD Million)

- Table 7 Industrial Robots Industrial Automation And Control Systems market, by region, 2018 - 2030 (USD Million)

- Table 8 Control Valves Industrial Automation And Control Systems market, by region, 2018 - 2030 (USD Million)

- Table 9 Sensors Industrial Automation And Control Systems market, by region, 2018 - 2030 (USD Million)

- Table 10 Others Industrial Automation And Control Systems market, by region, 2018 - 2030 (USD Million)

- Table 11 Aerospace and Defense Studios Industrial Automation And Control Systems market, by region, 2018 - 2030 (USD Million)

- Table 12 Automotive Industrial Automation And Control Systems market, by region, 2018 - 2030 (USD Million)

- Table 13 Chemical Industrial Automation And Control Systems market, by region, 2018 - 2030 (USD Million)

- Table 14 Energy & Utilities Industrial Automation And Control Systems market, by region, 2018 - 2030 (USD Million)

- Table 15 Food & Beverages Industrial Automation And Control Systems market, by region, 2018 - 2030 (USD Million)

- Table 16 Healthcare Industrial Automation And Control Systems market, by region, 2018 - 2030 (USD Million)

- Table 17 Manufacturing Industrial Automation And Control Systems market, by region, 2018 - 2030 (USD Million)

- Table 18 Mining & Metal Automation And Control Systems market, by region, 2018 - 2030 (USD Million)

- Table 19 Oil & Gas Automation And Control Systems market, by region, 2018 - 2030 (USD Million)

- Table 20 Transportation Automation And Control Systems market, by region, 2018 - 2030 (USD Million)

- Table 21 Others Automation And Control Systems market, by region, 2018 - 2030 (USD Million)

- Table 22 Industrial Automation And Control Systems market, by region, 2018 - 2030 (USD Million)

- Table 23 North America Industrial Automation And Control Systems market, by Component,, 2018 - 2030 (USD Million)

- Table 24 North America Industrial Automation And Control Systems market, by Control Systems, 2018 - 2030 (USD Million)

- Table 25 North America Industrial Automation And Control Systems market, by end use, 2018 - 2030 (USD Million)

- Table 26 U.S. Industrial Automation And Control Systems market, by component, 2018 - 2030 (USD Million)

- Table 27 U.S. Industrial Automation And Control Systems market, by Control Systems, 2018 - 2030 (USD Million)

- Table 28 U.S. Industrial Automation And Control Systems market, by end use, 2018 - 2030 (USD Million)

- Table 29 Canada Industrial Automation And Control Systems market, by component, 2018 - 2030 (USD Million)

- Table 30 Canada Industrial Automation And Control Systems market, by Control Systems, 2018 - 2030 (USD Million)

- Table 31 Canada Industrial Automation And Control Systems market, by end use, 2018 - 2030 (USD Million)

- Table 32 Mexico Industrial Automation And Control Systems market, by component, 2018 - 2030 (USD Million)

- Table 33 Mexico Industrial Automation And Control Systems market, by Control Systems, 2018 - 2030 (USD Million)

- Table 34 Mexico Industrial Automation And Control Systems market, by end use, 2018 - 2030 (USD Million)

- Table 35 Europe Industrial Automation And Control Systems market, by component, 2018 - 2030 (USD Million)

- Table 36 Europe Industrial Automation And Control Systems market, by Control Systems, 2018 - 2030 (USD Million)

- Table 37 Europe Industrial Automation And Control Systems market, by end use, 2018 - 2030 (USD Million)

- Table 38 UK Industrial Automation And Control Systems market, by component, 2018 - 2030 (USD Million)

- Table 39 UK Industrial Automation And Control Systems market, by Control Systems, 2018 - 2030 (USD Million)

- Table 40 UK Industrial Automation And Control Systems market, by end use, 2018 - 2030 (USD Million)

- Table 41 Germany Industrial Automation And Control Systems market, by component, 2018 - 2030 (USD Million)

- Table 42 Germany Industrial Automation And Control Systems market, by Control Systems, 2018 - 2030 (USD Million)

- Table 43 Germany Industrial Automation And Control Systems market, by end use, 2018 - 2030 (USD Million)

- Table 44 France Industrial Automation And Control Systems market, by component, 2018 - 2030 (USD Million)

- Table 45 France Industrial Automation And Control Systems market, by Control Systems, 2018 - 2030 (USD Million)

- Table 46 France Industrial Automation And Control Systems market, by end use, 2018 - 2030 (USD Million)

- Table 47 Asia Pacific Industrial Automation And Control Systems market, by component, 2018 - 2030 (USD Million)

- Table 48 Asia Pacific Industrial Automation And Control Systems market, by Control Systems, 2018 - 2030 (USD Million)

- Table 49 Asia Pacific Industrial Automation And Control Systems market, by end use, 2018 - 2030 (USD Million)

- Table 50 China Industrial Automation And Control Systems market, by component, 2018 - 2030 (USD Million)

- Table 51 China Industrial Automation And Control Systems market, by Control Systems, 2018 - 2030 (USD Million)

- Table 52 China Industrial Automation And Control Systems market, by end use, 2018 - 2030 (USD Million)

- Table 53 India Industrial Automation And Control Systems market, by component, 2018 - 2030 (USD Million)

- Table 54 India Industrial Automation And Control Systems market, by Control Systems, 2018 - 2030 (USD Million)

- Table 55 India Industrial Automation And Control Systems market, by end use, 2018 - 2030 (USD Million)

- Table 56 South Korea Industrial Automation And Control Systems market, by component, 2018 - 2030 (USD Million)

- Table 57 South Korea Industrial Automation And Control Systems market, by Control Systems, 2018 - 2030 (USD Million)

- Table 58 South Korea Industrial Automation And Control Systems market, by end use, 2018 - 2030 (USD Million)

- Table 59 Australia Industrial Automation And Control Systems market, by component, 2018 - 2030 (USD Million)

- Table 60 Australia Industrial Automation And Control Systems market, by Control Systems, 2018 - 2030 (USD Million)

- Table 61 Australia Industrial Automation And Control Systems market, by end use, 2018 - 2030 (USD Million)

- Table 62 Japan Industrial Automation And Control Systems market, by component, 2018 - 2030 (USD Million)

- Table 63 Japan Industrial Automation And Control Systems market, by Control Systems, 2018 - 2030 (USD Million)

- Table 64 Japan Industrial Automation And Control Systems market, by end use, 2018 - 2030 (USD Million)

- Table 65 Latin America Industrial Automation And Control Systems market, by component, 2018 - 2030 (USD Million)

- Table 66 Latin America Industrial Automation And Control Systems market, by Control Systems, 2018 - 2030 (USD Million)

- Table 67 Latin America Industrial Automation And Control Systems market, by end use, 2018 - 2030 (USD Million)

- Table 68 Brazil Industrial Automation And Control Systems market, by component, 2018 - 2030 (USD Million)

- Table 69 Brazil Industrial Automation And Control Systems market, by Control Systems, 2018 - 2030 (USD Million)

- Table 70 Brazil Industrial Automation And Control Systems market, by end use, 2018 - 2030 (USD Million)

- Table 71 MEA Industrial Automation And Control Systems market, by component, 2018 - 2030 (USD Million)

- Table 72 MEA Industrial Automation And Control Systems market, by Control Systems, 2018 - 2030 (USD Million)

- Table 73 MEA Industrial Automation And Control Systems market, by end use, 2018 - 2030 (USD Million)

- Table 74 UAE Industrial Automation And Control Systems market, by component, 2018 - 2030 (USD Million)

- Table 75 UAE Industrial Automation And Control Systems market, by Control Systems, 2018 - 2030 (USD Million)

- Table 76 UAE Industrial Automation And Control Systems market, by end use, 2018 - 2030 (USD Million)

- Table 77 KSA Industrial Automation And Control Systems market, by component, 2018 - 2030 (USD Million)

- Table 78 KSA Industrial Automation And Control Systems market, by Control Systems, 2018 - 2030 (USD Million)

- Table 79 KSA Industrial Automation And Control Systems market, by end use, 2018 - 2030 (USD Million)

- Table 80 South Africa Industrial Automation And Control Systems market, by component, 2018 - 2030 (USD Million)

- Table 81 South Africa Industrial Automation And Control Systems market, by Control Systems, 2018 - 2030 (USD Million)

- Table 82 South Africa Industrial Automation And Control Systems market, by end use, 2018 - 2030 (USD Million)

List of Figures

- Fig. 1 Industrial Automation And Control Systems market segmentation

- Fig. 2 Market research process

- Fig. 3 Information procurement

- Fig. 4 Primary research pattern

- Fig. 5 Market research approaches

- Fig. 6 Value chain-based sizing & forecasting

- Fig. 7 Market formulation & validation

- Fig. 8 Industrial Automation And Control Systems market snapshot

- Fig. 9 Industrial Automation And Control Systems market segment snapshot

- Fig. 10 Industrial Automation And Control Systems market, Component outlook key takeaways (USD Million)

- Fig. 11 Industrial Automation And Control Systems market Component movement analysis, 2024 & 2030 (USD Million)

- Fig. 12 HMI market revenue estimates and forecasts, 2018 - 2030 (USD Million)

- Fig. 13 Industrial Robots market revenue estimates and forecasts, 2018 - 2030 (USD Million)

- Fig. 14 Sensors market revenue estimates and forecasts, 2018 - 2030 (USD Million)

- Fig. 15 Other Robots market revenue estimates and forecasts, 2018 - 2030 (USD Million)

- Fig. 16 Industrial Automation And Control Systems market: End Use outlook key takeaways (USD Million)

- Fig. 17 Industrial Automation And Control Systems market: End Use movement analysis, 2024 & 2030 (USD Million)

- Fig. 18 Automotive market revenue estimates and forecasts, 2018 - 2030 (USD Million)

- Fig. 19 Chemical market revenue estimates and forecasts, 2018 - 2030 (USD Million)

- Fig. 20 Energy & Utilities market revenue estimates and forecasts, 2018 - 2030 (USD Million)

- Fig. 21 Food & Beverage market revenue estimates and forecasts, 2018 - 2030 (USD Million)

- Fig. 22 Healthcare market revenue estimates and forecasts, 2018 - 2030 (USD Million)

- Fig. 23 Manufacturing market revenue estimates and forecasts, 2018 - 2030 (USD Million)

- Fig. 24 Mining & Metal market revenue estimates and forecasts, 2018 - 2030 (USD Million)

- Fig. 25 Oil & Gas market revenue estimates and forecasts, 2018 - 2030 (USD Million)

- Fig. 26 Transportation market revenue estimates and forecasts, 2018 - 2030 (USD Million)

- Fig. 27 Others market revenue estimates and forecasts, 2018 - 2030 (USD Million),

- Fig. 28 Industrial Automation And Control Systems market: Product outlook key takeaways (USD Million)

- Fig. 29 Industrial Automation And Control Systems market: Product outlook key takeaways (USD Million)

- Fig. 30 DCS market revenue estimates and forecasts, 2018 - 2030 (USD Million)

- Fig. 31 PLC market revenue estimates and forecasts, 2018 - 2030 (USD Million)

- Fig. 32 SCADA market revenue estimates and forecasts, 2018 - 2030 (USD Million)

- Fig. 33 Others market revenue estimates and forecasts, 2018 - 2030 (USD Million)

- Fig. 34 Regional marketplace: Key takeaways

- Fig. 35 Industrial Automation And Control Systems market: Regional outlook, 2024 & 2030 (USD Million)

- Fig. 36 North America Industrial Automation And Control Systems market estimates and forecasts, 2018 - 2030 (USD Million)

- Fig. 37 U.S. Industrial Automation And Control Systems market estimates and forecasts, 2018 - 2030 (USD Million)

- Fig. 38 Canada Industrial Automation And Control Systems market estimates and forecasts, 2018 - 2030 (USD Million)

- Fig. 39 Mexico Industrial Automation And Control Systems market estimates and forecasts, 2018 - 2030 (USD Million)

- Fig. 40 Europe Industrial Automation And Control Systems market estimates and forecasts, 2018 - 2030 (USD Million)

- Fig. 41 UK Industrial Automation And Control Systems market estimates and forecasts, 2018 - 2030 (USD Million)

- Fig. 42 Germany Industrial Automation And Control Systems market estimates and forecasts, 2018 - 2030 (USD Million)

- Fig. 43 France Industrial Automation And Control Systems market estimates and forecasts, 2018 - 2030 (USD Million)

- Fig. 44 Asia Pacific Industrial Automation And Control Systems market estimates and forecasts, 2018 - 2030 (USD Million)

- Fig. 45 Japan Industrial Automation And Control Systems market estimates and forecasts, 2018 - 2030 (USD Million)

- Fig. 46 China Industrial Automation And Control Systems market estimates and forecasts, 2018 - 2030 (USD Million)

- Fig. 47 India Industrial Automation And Control Systems market estimates and forecasts, 2018 - 2030 (USD Million)

- Fig. 48 Australia Industrial Automation And Control Systems market estimates and forecasts, 2018 - 2030 (USD Million)

- Fig. 49 South Korea Industrial Automation And Control Systems market estimates and forecasts, 2018 - 2030 (USD Million)

- Fig. 50 Latin America Industrial Automation And Control Systems market estimates and forecasts, 2018 - 2030 (USD Million)

- Fig. 51 Brazil Industrial Automation And Control Systems market estimates and forecasts, 2018 - 2030 (USD Million)

- Fig. 52 MEA Industrial Automation And Control Systems market estimates and forecasts, 2018 - 2030 (USD Million)

- Fig. 53 KSA Industrial Automation And Control Systems market estimates and forecasts, 2018 - 2030 (USD Million)

- Fig. 54 UAE Industrial Automation And Control Systems market estimates and forecasts, 2018 - 2030 (USD Million)

- Fig. 55 South Africa Industrial Automation And Control Systems market estimates and forecasts, 2018 - 2030 (USD Million)

- Fig. 56 Strategy framework

- Fig. 57 Company Categorization

Industrial Automation And Control Systems Market Growth & Trends:

The global industrial automation and control systems market size is anticipated to reach USD 378.57 billion by 2030, according to a new study by Grand View Research, Inc. The market is expected to reach at a CAGR of 10.8% from 2025 to 2030. The growth is attributed to the growing adoption of process automation in several industries, such as energy utilities, chemicals, and automotive. For instance, in April 2022, Kawasaki Heavy Industries, Ltd. established "Future Lab HANEDA" at HANEDA INNOVATION CITY, a substantial, multi-purpose complex with offices and retail facilities for the development of robotics products and services based on open innovation along with real-life implementation and demonstrations for their potential. This, in turn, is expected to drive market growth further during the forecast period.

Moreover, the companies are considerably reducing operational and labor costs, as well as significantly reducing errors associated with humans due to the system's reliability and efficiency, which is projected to fuel the industrial automation and control systems market growth over the forecast period. The use of multiple robots as per need is expected to push the market growth further. For instance, in April 2022, Siemens AG unveiled the PXC7 smart automation controller, which is useful for large industrial buildings and speeds up engineering processes.

Asia Pacific is anticipated to emerge as the fastest-growing market owing to the presence of emerging companies along with key market players. Some notable regional players are Kawasaki Robotics, Mitsubishi Electric Factory Automation, and Yokogawa Electric Corporation. Furthermore, emerging economies such as Thailand, Vietnam, and Indonesia have huge potential with a largely untapped market that drives substantial investments to develop manufacturing plants. This, in turn, is expected to fuel the market growth across the region.

Industrial Automation And Control Systems Market Report Highlights:

- Based on component type segment, the industrial robots' component segment is expected to grow at the highest CAGR of over 12% owing to rising trend of smart and automated factories during the advent of industry 4.0 boom.

- Based on control system segment, the distributed control system (DCS) control system segment accounted the highest market share of over 34% owing to fast pace of adoption of IIoT by industrialists.

- Based on vertical segment, the healthcare segment is expected to grow at the highest CAGR of over 11% owing to the growing trend of automation in surgeries and other health applications.

- Asia Pacific is expected to grow at the highest CAGR of over 13% during the forecast period from 2025 to 2030 as a result of developing countries in the region investing significantly in automation and smart manufacturing.

Table of Contents

Chapter 1. Methodology and Scope

- 1.1. Market Segmentation & Scope

- 1.2. Market Definitions

- 1.3. Information Procurement

- 1.3.1. Information analysis

- 1.3.2. Market formulation & data visualization

- 1.3.3. Data validation & publishing

- 1.4. 4 Research Scope and Assumptions

- 1.4.1. List of Data Sources

Chapter 2. Executive Summary

- 2.1. Industrial Automation And Control Systems Market Snapshot

- 2.2. Industrial Automation And Control Systems Market - Competitive Landscape Snapshot

Chapter 3. Industrial Automation And Control Systems Market - Industry Outlook

- 3.1. Market Overview

- 3.2. Industry Value Chain Analysis

- 3.3. Market Dynamics

- 3.3.1. Market Driver Analysis

- 3.3.2. Market Restraint Analysis

- 3.3.3. Market Opportunity

- 3.4. Technology Landscape

- 3.5. Industry Analysis Tools

- 3.5.1. Porter's analysis

- 3.5.2. Macroeconomic analysis

Chapter 4. Industrial Automation And Control Systems Market: Component Estimates & Trend Analysis

- 4.1. Component Movement Analysis & Market Share, 2024 & 2030

- 4.2. Industrial Automation And Control Systems Market Estimates & Forecast, By Component (USD Million)

- 4.2.1. HMI

- 4.2.2. Industrial Robots

- 4.2.3. Control Valves

- 4.2.4. Sensors

- 4.2.5. Others

Chapter 5. Industrial Automation And Control Systems Market: Control System Estimates & Trend Analysis

- 5.1. Control System Movement Analysis & Market Share, 2024 & 2030

- 5.2. Industrial Automation And Control Systems Market Estimates & Forecast, By Technology (USD Million)

- 5.2.1. DCS

- 5.2.2. PLC

- 5.2.3. SCADA

- 5.2.4. Others

Chapter 6. Industrial Automation And Control Systems Market: End Use Estimates & Trend Analysis

- 6.1. End Use Movement Analysis & Market Share, 2024 & 2030

- 6.2. Industrial Automation And Control Systems Market Estimates & Forecast, By End Use (USD Million)

- 6.2.1. Aerospace and Defense

- 6.2.2. Automotive

- 6.2.3. Chemical

- 6.2.4. Energy & Utilities

- 6.2.5. Food & Beverage

- 6.2.6. Healthcare

- 6.2.7. Manufacturing

- 6.2.8. Mining & Metal

- 6.2.9. Oil & Gas

- 6.2.10. Transportation

- 6.2.11. Others

Chapter 7. Regional Estimates & Trend Analysis

- 7.1. Industrial Automation And Control Systems Market by Region, 2024 & 2030

- 7.2. North America

- 7.2.1. North America Industrial Automation And Control Systems Market Estimates & Forecasts, 2018 - 2030 (USD Million)

- 7.2.2. U.S.

- 7.2.3. Canada

- 7.2.4. Mexico

- 7.3. Europe

- 7.3.1. Europe Industrial Automation And Control Systems Market Estimates & Forecasts, 2018 - 2030 (USD Million)

- 7.3.2. Germany

- 7.3.3. UK

- 7.3.4. France

- 7.3.5. Rest of Europe

- 7.4. Asia Pacific

- 7.4.1. Asia Pacific Industrial Automation And Control Systems Market Estimates & Forecasts, 2018 - 2030 (USD Million)

- 7.4.2. Japan

- 7.4.3. China

- 7.4.4. India

- 7.4.5. South Korea

- 7.4.6. Australia

- 7.4.7. Rest of Asia Pacific

- 7.5. South America

- 7.5.1. South America Industrial Automation And Control Systems Market Estimates & Forecasts, 2018 - 2030 (USD Million)

- 7.5.2. Brazil

- 7.5.3. Rest of South America

- 7.6. Middle East & Africa (MEA)

- 7.6.1. MEA Industrial Automation And Control Systems Market Estimates & Forecasts, 2018 - 2030 (USD Million)

- 7.6.2. Saudi Arabia

- 7.6.3. UAE

- 7.6.4. South Africa

- 7.6.5. Rest of MEA

Chapter 8. Industrial Automation And Control Systems Market - Competitive Landscape

- 8.1. Recent Developments & Impact Analysis, By Key Market Participants

- 8.2. Company Categorization

- 8.3. Participant's Overview

- 8.4. Financial Performance

- 8.5. Product Benchmarking

- 8.6. Company Market Positioning

- 8.7. Company Heat Map Analysis

- 8.8. Strategy Mapping

- 8.8.1. Expansion/Divestiture

- 8.8.2. Collaborations/Partnerships

- 8.8.3. New Product Launches

- 8.8.4. Research & Development

- 8.9. Company Profiles

- 8.9.1. ABB Ltd.

- 8.9.1.1. Participant's Overview

- 8.9.1.2. Financial Performance

- 8.9.1.3. Product Benchmarking

- 8.9.1.4. Recent Developments

- 8.9.2. Emerson Electric Co.

- 8.9.2.1. Participant's Overview

- 8.9.2.2. Financial Performance

- 8.9.2.3. Product Benchmarking

- 8.9.2.4. Recent Developments

- 8.9.3. Honeywell International, Inc.

- 8.9.3.1. Participant's Overview

- 8.9.3.2. Financial Performance

- 8.9.3.3. Product Benchmarking

- 8.9.3.4. Recent Developments

- 8.9.4. Kawasaki Heavy Industries Ltd.

- 8.9.4.1. Participant's Overview

- 8.9.4.2. Financial Performance

- 8.9.4.3. Product Benchmarking

- 8.9.4.4. Recent Developments

- 8.9.5. OMRON Corporation

- 8.9.5.1. Participant's Overview

- 8.9.5.2. Financial Performance

- 8.9.5.3. Product Benchmarking

- 8.9.5.4. Recent Developments

- 8.9.6. Mitsubishi Electric Corporation

- 8.9.6.1. Participant's Overview

- 8.9.6.2. Financial Performance

- 8.9.6.3. Product Benchmarking

- 8.9.6.4. Recent Developments

- 8.9.7. Rockwell Automation, Inc.

- 8.9.7.1. Participant's Overview

- 8.9.7.2. Financial Performance

- 8.9.7.3. Product Benchmarking

- 8.9.7.4. Recent Developments

- 8.9.8. Schneider Electric

- 8.9.8.1. Participant's Overview

- 8.9.8.2. Financial Performance

- 8.9.8.3. Product Benchmarking

- 8.9.8.4. Recent Developments

- 8.9.9. Siemens AG

- 8.9.9.1. Participant's Overview

- 8.9.9.2. Financial Performance

- 8.9.9.3. Product Benchmarking

- 8.9.9.4. Recent Developments

- 8.9.10. Yokogawa Electric Corporation

- 8.9.10.1. Participant's Overview

- 8.9.10.2. Financial Performance

- 8.9.10.3. Product Benchmarking

- 8.9.10.4. Recent Developments

- 8.9.1. ABB Ltd.