|

|

市場調査レポート

商品コード

1785747

ABL(動産・債権担保融資)の世界市場Asset-based Lending |

||||||

適宜更新あり

|

|||||||

| ABL(動産・債権担保融資)の世界市場 |

|

出版日: 2025年08月07日

発行: Market Glass, Inc. (Formerly Global Industry Analysts, Inc.)

ページ情報: 英文 285 Pages

納期: 即日から翌営業日

|

全表示

- 概要

- 目次

ABL(動産・債権担保融資)の世界市場は2030年までに1兆3,000億米ドルに達する見込み

2024年に7,010億米ドルと推定されるABL(動産・債権担保融資)の世界市場は、2024年から2030年にかけてCAGR 10.3%で成長し、2030年には1兆3,000億米ドルに達すると予測されます。本レポートで分析したセグメントの一つである在庫ファイナンスは、CAGR12.1%を記録し、分析期間終了時には5,603億米ドルに達すると予想されます。債権ファイナンス・セグメントの成長率は、分析期間中CAGR 10.3%と推定されます。

米国市場は推定1,910億米ドル、中国はCAGR14.3%で成長予測

米国のABL(動産・債権担保融資)市場は、2024年には1,910億米ドルと推定されます。世界第2位の経済大国である中国は、分析期間2024-2030年のCAGRを14.3%として、2030年までに2,621億米ドルの市場規模に達すると予測されています。その他の注目すべき地域別市場としては、日本とカナダがあり、分析期間中のCAGRはそれぞれ7.2%と9.2%と予測されています。欧州では、ドイツがCAGR約8.1%で成長すると予測されています。

世界のABL(動産・債権担保融資)市場- 主要動向と促進要因のまとめ

ABL(動産・債権担保融資)はどのようにビジネスを強化するか?

ABL(動産・債権担保融資)(ABL)は、企業の資産を担保にした資金調達ソリューションであり、企業にとって信頼できる資金源として人気を集めています。この融資形態は、中小企業(SME)やキャッシュフローが変動する企業にとって特に有益であり、厳しい与信要件を満たすことなく運転資金へのアクセスを提供します。売掛債権、在庫、設備などの資産を担保として柔軟に利用できるため、借り手は既存のリソースから価値を引き出すことができます。ABLは、経済が不透明な時期に好まれる資金調達オプションとなっており、企業が流動性の課題を効果的に乗り切ることを可能にしています。

どのような動向がABL(動産・債権担保融資)の需要を牽引しているのでしょうか?

いくつかの動向がABL(動産・債権担保融資)市場の成長に拍車をかけています。フィンテック・プラットフォームの台頭により、ローンの組成や引受プロセスが合理化され、ABLがより幅広い借り手にとって利用しやすくなっています。新興企業や中小企業の間でABLの採用が増加しているのは、信用履歴は浅いが貴重な資産を持つ企業にとってABLが適していることを反映しています。さらに、世界の景気変動により、企業はより安全で柔軟な資金調達手段を求めるようになり、ABLは魅力的な選択肢として位置づけられています。また、デジタル・プラットフォームへの移行により、透明性とスピードが向上し、融資プロセスがより効率的になっています。

なぜABL(動産・債権担保融資)がビジネスに不可欠なのか?

ABL(動産・債権担保融資)は、有形資産に基づく流動性を提供することで、困難な時期に企業の資金的なライフラインを提供します。従来のローンとは異なり、ABLはクレジットスコアにあまり依存せず、代わりに担保の価値に焦点を当てます。このため、製造業、小売業、物流業など、多額の在庫や売掛債権を保有することが多い業種にとって理想的な選択肢となります。さらに、ABLは、借り手が資産の成長に応じて資金調達の規模を拡大することを可能にし、事業ニーズに応じて進化するダイナミックなソリューションを提供します。キャッシュフローを安定させるというABLの役割は、弾力的な資金調達手段としての重要性を強調しています。

ABL(動産・債権担保融資)市場の成長の原動力は?

ABL(動産・債権担保融資)市場の成長の原動力は、柔軟な資金調達に対する需要の高まり、デジタル融資プラットフォームの導入拡大、中小企業の参入拡大です。経済の先行き不透明感や与信条件の厳格化により、企業は従来の銀行融資に代わる信頼性の高い選択肢としてABLを検討するようになっています。資産評価とモニタリングの技術的進歩はリスク管理を改善し、ABLを貸し手にとってより魅力的なものにしています。さらに、フィンテック・プラットフォームの普及によりABLへのアクセスが民主化され、あらゆる規模の企業が効率的に資金を確保できるようになりました。これらの要因が総合的に、ABL(動産・債権担保融資)市場の急速な拡大を支えています。

セグメント

タイプ(在庫ファイナンス、売掛債権ファイナンス、設備ファイナンス、その他タイプ)、エンドユーザー(大企業エンドユーザー、中小企業エンドユーザー)

調査対象企業の例

- Bank of America

- Barclays Bank Plc

- Berkshire Bank

- Capital Funding Solutions Inc.

- CIT Group Inc.

- Fifth Third Bank

- HSBC Holdings Plc

- JPMorgan Chase & Co

- KeyCorp

- Lloyds Banking Group

- Porter Capital

- Rabobank Australia

- SLR Credit Solutions

- TD Bank NA

- Wells Fargo

AIインテグレーション

Global Industry Analystsは、有効な専門家コンテンツとAIツールにより、市場情報と競合情報を変革しています。

Global Industry Analystsは、一般的なLLMや業界別SLMのクエリに従う代わりに、ビデオ記録、ブログ、検索エンジン調査、膨大な量の企業、製品/サービス、市場データなど、世界中の専門家から収集したコンテンツのリポジトリを構築しました。

関税影響係数

Global Industry Analystsは、本社の国、製造拠点、輸出入(完成品とOEM)に基づく企業の競争力の変化を予測しています。この複雑で多面的な市場力学は、売上原価(COGS)の増加、収益性の低下、サプライチェーンの再構築など、ミクロおよびマクロの市場力学の中でも特に競合他社に影響を与える見込みです。

目次

第1章 調査手法

第2章 エグゼクティブサマリー

- 市場概要

- 主要企業

- 市場動向と促進要因

- 世界市場の見通し

第3章 市場分析

- 米国

- カナダ

- 日本

- 中国

- 欧州

- フランス

- ドイツ

- イタリア

- 英国

- スペイン

- ロシア

- その他欧州

- アジア太平洋

- オーストラリア

- インド

- 韓国

- その他アジア太平洋地域

- ラテンアメリカ

- アルゼンチン

- ブラジル

- メキシコ

- その他ラテンアメリカ

- 中東

- イラン

- イスラエル

- サウジアラビア

- アラブ首長国連邦

- その他中東

- アフリカ

第4章 競合

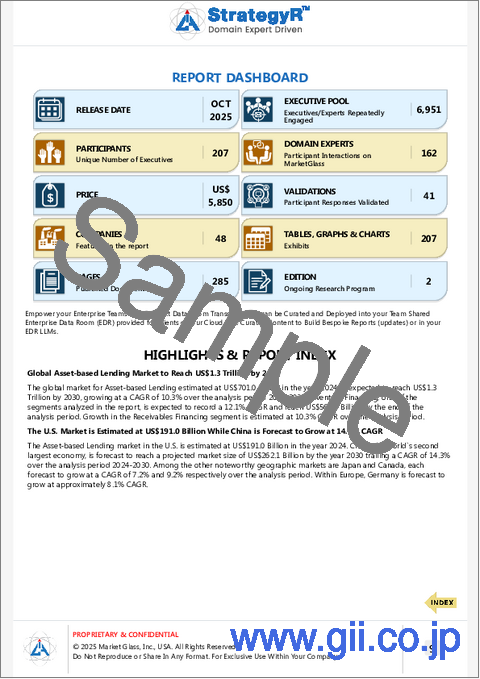

Global Asset-based Lending Market to Reach US$1.3 Trillion by 2030

The global market for Asset-based Lending estimated at US$701.0 Billion in the year 2024, is expected to reach US$1.3 Trillion by 2030, growing at a CAGR of 10.3% over the analysis period 2024-2030. Inventory Financing, one of the segments analyzed in the report, is expected to record a 12.1% CAGR and reach US$560.3 Billion by the end of the analysis period. Growth in the Receivables Financing segment is estimated at 10.3% CAGR over the analysis period.

The U.S. Market is Estimated at US$191.0 Billion While China is Forecast to Grow at 14.3% CAGR

The Asset-based Lending market in the U.S. is estimated at US$191.0 Billion in the year 2024. China, the world's second largest economy, is forecast to reach a projected market size of US$262.1 Billion by the year 2030 trailing a CAGR of 14.3% over the analysis period 2024-2030. Among the other noteworthy geographic markets are Japan and Canada, each forecast to grow at a CAGR of 7.2% and 9.2% respectively over the analysis period. Within Europe, Germany is forecast to grow at approximately 8.1% CAGR.

Global Asset-Based Lending Market - Key Trends & Drivers Summarized

How Is Asset-Based Lending Empowering Businesses?

Asset-based lending (ABL), a financing solution secured by a company’s assets, is gaining traction as a reliable funding source for businesses. This form of lending is particularly beneficial for small- and medium-sized enterprises (SMEs) and companies with fluctuating cash flows, offering access to working capital without stringent credit requirements. The flexibility to use assets such as receivables, inventory, and equipment as collateral allows borrowers to unlock value from their existing resources. ABL has become a preferred financing option during periods of economic uncertainty, enabling businesses to navigate liquidity challenges effectively.

What Trends Are Driving Demand for Asset-Based Lending?

Several trends are fueling the growth of the asset-based lending market. The rise of fintech platforms has streamlined loan origination and underwriting processes, making ABL more accessible to a broader range of borrowers. Increasing adoption of ABL among startups and SMEs reflects its suitability for companies with limited credit histories but valuable assets. Additionally, global economic volatility has driven businesses to seek more secure and flexible financing options, positioning ABL as an attractive alternative. The shift toward digital platforms has also enhanced transparency and speed, making the lending process more efficient.

Why Is Asset-Based Lending Crucial for Business Resilience?

Asset-based lending provides businesses with a financial lifeline during challenging times by offering liquidity based on tangible assets. Unlike traditional loans, ABL is less dependent on credit scores, focusing instead on the value of collateral. This makes it an ideal option for industries such as manufacturing, retail, and logistics, which often possess substantial inventories and receivables. Furthermore, ABL allows borrowers to scale financing based on asset growth, providing a dynamic solution that evolves with business needs. Its role in stabilizing cash flows underscores its importance as a resilient financing tool.

What Drives the Growth in the Asset-Based Lending Market?

The growth in the asset-based lending market is driven by rising demand for flexible financing, the increasing adoption of digital lending platforms, and expanding participation by SMEs. Economic uncertainty and tightening credit conditions have encouraged businesses to explore ABL as a reliable alternative to traditional bank loans. Technological advancements in asset valuation and monitoring have improved risk management, making ABL more attractive to lenders. Additionally, the proliferation of fintech platforms has democratized access to ABL, enabling businesses of all sizes to secure funding efficiently. These factors collectively underpin the rapid expansion of the asset-based lending market.

SCOPE OF STUDY:

The report analyzes the Asset-based Lending market in terms of units by the following Segments, and Geographic Regions/Countries:

Segments:

Type (Inventory Financing, Receivables Financing, Equipment Financing, Other Types); End-User (Large Enterprises End-User, Small and Medium-sized Enterprises (SME) End-User)

Geographic Regions/Countries:

World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Select Competitors (Total 48 Featured) -

- Bank of America

- Barclays Bank Plc

- Berkshire Bank

- Capital Funding Solutions Inc.

- CIT Group Inc.

- Fifth Third Bank

- HSBC Holdings Plc

- JPMorgan Chase & Co

- KeyCorp

- Lloyds Banking Group

- Porter Capital

- Rabobank Australia

- SLR Credit Solutions

- TD Bank NA

- Wells Fargo

AI INTEGRATIONS

We're transforming market and competitive intelligence with validated expert content and AI tools.

Instead of following the general norm of querying LLMs and Industry-specific SLMs, we built repositories of content curated from domain experts worldwide including video transcripts, blogs, search engines research, and massive amounts of enterprise, product/service, and market data.

TARIFF IMPACT FACTOR

Our new release incorporates impact of tariffs on geographical markets as we predict a shift in competitiveness of companies based on HQ country, manufacturing base, exports and imports (finished goods and OEM). This intricate and multifaceted market reality will impact competitors by increasing the Cost of Goods Sold (COGS), reducing profitability, reconfiguring supply chains, amongst other micro and macro market dynamics.

TABLE OF CONTENTS

I. METHODOLOGY

II. EXECUTIVE SUMMARY

- 1. MARKET OVERVIEW

- Influencer Market Insights

- Tariff Impact on Global Supply Chain Patterns

- Asset-based Lending - Global Key Competitors Percentage Market Share in 2025 (E)

- Competitive Market Presence - Strong/Active/Niche/Trivial for Players Worldwide in 2025 (E)

- 2. FOCUS ON SELECT PLAYERS

- 3. MARKET TRENDS & DRIVERS

- Rising Demand for Flexible Financing Among Mid-Market Enterprises Drives Lending Uptake

- Expansion of E-Commerce and Inventory-Based Business Models Supports Asset-Based Credit

- Growth in Private Equity and Leveraged Buyouts Spurs Demand for Working Capital Financing

- Increased Use of Receivables and Inventory as Collateral Enhances Loan Structuring

- Technological Advancements in Asset Valuation and Tracking Improve Lending Efficiency

- Rise of Alternative Lenders and Fintech Platforms Democratizes Access to Asset-Based Loans

- Restructuring of Corporate Debt Amid Economic Cycles Fuels ABL Opportunities

- Businesses Seeking Liquidity During Supply Chain Disruptions Turn to Asset-Based Lending

- Global Expansion of Non-Bank Financial Institutions Supports ABL Market Growth

- Sector-Specific ABL Solutions in Manufacturing, Healthcare, and Logistics Drive Diversification

- Risk Management Technologies and Real-Time Monitoring Tools Reduce Lender Exposure

- High Demand for Short-Term Bridge Financing Enhances Use of Asset-Based Credit

- Customized Loan Structures Attract Capital-Constrained SMEs and Startups

- Increased Acceptance of Intellectual Property and Digital Assets as Collateral Broadens Market

- Rising M&A Activity and Corporate Turnarounds Accelerate Need for Structured ABL Solutions

- 4. GLOBAL MARKET PERSPECTIVE

- TABLE 1: World Asset-based Lending Market Analysis of Annual Sales in US$ Million for Years 2015 through 2030

- TABLE 2: World Recent Past, Current & Future Analysis for Asset-based Lending by Geographic Region - USA, Canada, Japan, China, Europe, Asia-Pacific, Latin America, Middle East and Africa Markets - Independent Analysis of Annual Sales in US$ Million for Years 2024 through 2030 and % CAGR

- TABLE 3: World Historic Review for Asset-based Lending by Geographic Region - USA, Canada, Japan, China, Europe, Asia-Pacific, Latin America, Middle East and Africa Markets - Independent Analysis of Annual Sales in US$ Million for Years 2015 through 2023 and % CAGR

- TABLE 4: World 15-Year Perspective for Asset-based Lending by Geographic Region - Percentage Breakdown of Value Sales for USA, Canada, Japan, China, Europe, Asia-Pacific, Latin America, Middle East and Africa Markets for Years 2015, 2025 & 2030

- TABLE 5: World Recent Past, Current & Future Analysis for Inventory Financing by Geographic Region - USA, Canada, Japan, China, Europe, Asia-Pacific, Latin America, Middle East and Africa Markets - Independent Analysis of Annual Sales in US$ Million for Years 2024 through 2030 and % CAGR

- TABLE 6: World Historic Review for Inventory Financing by Geographic Region - USA, Canada, Japan, China, Europe, Asia-Pacific, Latin America, Middle East and Africa Markets - Independent Analysis of Annual Sales in US$ Million for Years 2015 through 2023 and % CAGR

- TABLE 7: World 15-Year Perspective for Inventory Financing by Geographic Region - Percentage Breakdown of Value Sales for USA, Canada, Japan, China, Europe, Asia-Pacific, Latin America, Middle East and Africa for Years 2015, 2025 & 2030

- TABLE 8: World Recent Past, Current & Future Analysis for Receivables Financing by Geographic Region - USA, Canada, Japan, China, Europe, Asia-Pacific, Latin America, Middle East and Africa Markets - Independent Analysis of Annual Sales in US$ Million for Years 2024 through 2030 and % CAGR

- TABLE 9: World Historic Review for Receivables Financing by Geographic Region - USA, Canada, Japan, China, Europe, Asia-Pacific, Latin America, Middle East and Africa Markets - Independent Analysis of Annual Sales in US$ Million for Years 2015 through 2023 and % CAGR

- TABLE 10: World 15-Year Perspective for Receivables Financing by Geographic Region - Percentage Breakdown of Value Sales for USA, Canada, Japan, China, Europe, Asia-Pacific, Latin America, Middle East and Africa for Years 2015, 2025 & 2030

- TABLE 11: World Recent Past, Current & Future Analysis for Equipment Financing by Geographic Region - USA, Canada, Japan, China, Europe, Asia-Pacific, Latin America, Middle East and Africa Markets - Independent Analysis of Annual Sales in US$ Million for Years 2024 through 2030 and % CAGR

- TABLE 12: World Historic Review for Equipment Financing by Geographic Region - USA, Canada, Japan, China, Europe, Asia-Pacific, Latin America, Middle East and Africa Markets - Independent Analysis of Annual Sales in US$ Million for Years 2015 through 2023 and % CAGR

- TABLE 13: World 15-Year Perspective for Equipment Financing by Geographic Region - Percentage Breakdown of Value Sales for USA, Canada, Japan, China, Europe, Asia-Pacific, Latin America, Middle East and Africa for Years 2015, 2025 & 2030

- TABLE 14: World Recent Past, Current & Future Analysis for Other Types by Geographic Region - USA, Canada, Japan, China, Europe, Asia-Pacific, Latin America, Middle East and Africa Markets - Independent Analysis of Annual Sales in US$ Million for Years 2024 through 2030 and % CAGR

- TABLE 15: World Historic Review for Other Types by Geographic Region - USA, Canada, Japan, China, Europe, Asia-Pacific, Latin America, Middle East and Africa Markets - Independent Analysis of Annual Sales in US$ Million for Years 2015 through 2023 and % CAGR

- TABLE 16: World 15-Year Perspective for Other Types by Geographic Region - Percentage Breakdown of Value Sales for USA, Canada, Japan, China, Europe, Asia-Pacific, Latin America, Middle East and Africa for Years 2015, 2025 & 2030

- TABLE 17: World Recent Past, Current & Future Analysis for Large Enterprises End-User by Geographic Region - USA, Canada, Japan, China, Europe, Asia-Pacific, Latin America, Middle East and Africa Markets - Independent Analysis of Annual Sales in US$ Million for Years 2024 through 2030 and % CAGR

- TABLE 18: World Historic Review for Large Enterprises End-User by Geographic Region - USA, Canada, Japan, China, Europe, Asia-Pacific, Latin America, Middle East and Africa Markets - Independent Analysis of Annual Sales in US$ Million for Years 2015 through 2023 and % CAGR

- TABLE 19: World 15-Year Perspective for Large Enterprises End-User by Geographic Region - Percentage Breakdown of Value Sales for USA, Canada, Japan, China, Europe, Asia-Pacific, Latin America, Middle East and Africa for Years 2015, 2025 & 2030

- TABLE 20: World Recent Past, Current & Future Analysis for Small and Medium-sized Enterprises by Geographic Region - USA, Canada, Japan, China, Europe, Asia-Pacific, Latin America, Middle East and Africa Markets - Independent Analysis of Annual Sales in US$ Million for Years 2024 through 2030 and % CAGR

- TABLE 21: World Historic Review for Small and Medium-sized Enterprises by Geographic Region - USA, Canada, Japan, China, Europe, Asia-Pacific, Latin America, Middle East and Africa Markets - Independent Analysis of Annual Sales in US$ Million for Years 2015 through 2023 and % CAGR

- TABLE 22: World 15-Year Perspective for Small and Medium-sized Enterprises by Geographic Region - Percentage Breakdown of Value Sales for USA, Canada, Japan, China, Europe, Asia-Pacific, Latin America, Middle East and Africa for Years 2015, 2025 & 2030

III. MARKET ANALYSIS

- UNITED STATES

- Asset-based Lending Market Presence - Strong/Active/Niche/Trivial - Key Competitors in the United States for 2025 (E)

- TABLE 23: USA Recent Past, Current & Future Analysis for Asset-based Lending by Type - Inventory Financing, Receivables Financing, Equipment Financing and Other Types - Independent Analysis of Annual Sales in US$ Million for the Years 2024 through 2030 and % CAGR

- TABLE 24: USA Historic Review for Asset-based Lending by Type - Inventory Financing, Receivables Financing, Equipment Financing and Other Types Markets - Independent Analysis of Annual Sales in US$ Million for Years 2015 through 2023 and % CAGR

- TABLE 25: USA 15-Year Perspective for Asset-based Lending by Type - Percentage Breakdown of Value Sales for Inventory Financing, Receivables Financing, Equipment Financing and Other Types for the Years 2015, 2025 & 2030

- TABLE 26: USA Recent Past, Current & Future Analysis for Asset-based Lending by End-user - Large Enterprises End-User and Small and Medium-sized Enterprises - Independent Analysis of Annual Sales in US$ Million for the Years 2024 through 2030 and % CAGR

- TABLE 27: USA Historic Review for Asset-based Lending by End-user - Large Enterprises End-User and Small and Medium-sized Enterprises Markets - Independent Analysis of Annual Sales in US$ Million for Years 2015 through 2023 and % CAGR

- TABLE 28: USA 15-Year Perspective for Asset-based Lending by End-user - Percentage Breakdown of Value Sales for Large Enterprises End-User and Small and Medium-sized Enterprises for the Years 2015, 2025 & 2030

- CANADA

- TABLE 29: Canada Recent Past, Current & Future Analysis for Asset-based Lending by Type - Inventory Financing, Receivables Financing, Equipment Financing and Other Types - Independent Analysis of Annual Sales in US$ Million for the Years 2024 through 2030 and % CAGR

- TABLE 30: Canada Historic Review for Asset-based Lending by Type - Inventory Financing, Receivables Financing, Equipment Financing and Other Types Markets - Independent Analysis of Annual Sales in US$ Million for Years 2015 through 2023 and % CAGR

- TABLE 31: Canada 15-Year Perspective for Asset-based Lending by Type - Percentage Breakdown of Value Sales for Inventory Financing, Receivables Financing, Equipment Financing and Other Types for the Years 2015, 2025 & 2030

- TABLE 32: Canada Recent Past, Current & Future Analysis for Asset-based Lending by End-user - Large Enterprises End-User and Small and Medium-sized Enterprises - Independent Analysis of Annual Sales in US$ Million for the Years 2024 through 2030 and % CAGR

- TABLE 33: Canada Historic Review for Asset-based Lending by End-user - Large Enterprises End-User and Small and Medium-sized Enterprises Markets - Independent Analysis of Annual Sales in US$ Million for Years 2015 through 2023 and % CAGR

- TABLE 34: Canada 15-Year Perspective for Asset-based Lending by End-user - Percentage Breakdown of Value Sales for Large Enterprises End-User and Small and Medium-sized Enterprises for the Years 2015, 2025 & 2030

- JAPAN

- Asset-based Lending Market Presence - Strong/Active/Niche/Trivial - Key Competitors in Japan for 2025 (E)

- TABLE 35: Japan Recent Past, Current & Future Analysis for Asset-based Lending by Type - Inventory Financing, Receivables Financing, Equipment Financing and Other Types - Independent Analysis of Annual Sales in US$ Million for the Years 2024 through 2030 and % CAGR

- TABLE 36: Japan Historic Review for Asset-based Lending by Type - Inventory Financing, Receivables Financing, Equipment Financing and Other Types Markets - Independent Analysis of Annual Sales in US$ Million for Years 2015 through 2023 and % CAGR

- TABLE 37: Japan 15-Year Perspective for Asset-based Lending by Type - Percentage Breakdown of Value Sales for Inventory Financing, Receivables Financing, Equipment Financing and Other Types for the Years 2015, 2025 & 2030

- TABLE 38: Japan Recent Past, Current & Future Analysis for Asset-based Lending by End-user - Large Enterprises End-User and Small and Medium-sized Enterprises - Independent Analysis of Annual Sales in US$ Million for the Years 2024 through 2030 and % CAGR

- TABLE 39: Japan Historic Review for Asset-based Lending by End-user - Large Enterprises End-User and Small and Medium-sized Enterprises Markets - Independent Analysis of Annual Sales in US$ Million for Years 2015 through 2023 and % CAGR

- TABLE 40: Japan 15-Year Perspective for Asset-based Lending by End-user - Percentage Breakdown of Value Sales for Large Enterprises End-User and Small and Medium-sized Enterprises for the Years 2015, 2025 & 2030

- CHINA

- Asset-based Lending Market Presence - Strong/Active/Niche/Trivial - Key Competitors in China for 2025 (E)

- TABLE 41: China Recent Past, Current & Future Analysis for Asset-based Lending by Type - Inventory Financing, Receivables Financing, Equipment Financing and Other Types - Independent Analysis of Annual Sales in US$ Million for the Years 2024 through 2030 and % CAGR

- TABLE 42: China Historic Review for Asset-based Lending by Type - Inventory Financing, Receivables Financing, Equipment Financing and Other Types Markets - Independent Analysis of Annual Sales in US$ Million for Years 2015 through 2023 and % CAGR

- TABLE 43: China 15-Year Perspective for Asset-based Lending by Type - Percentage Breakdown of Value Sales for Inventory Financing, Receivables Financing, Equipment Financing and Other Types for the Years 2015, 2025 & 2030

- TABLE 44: China Recent Past, Current & Future Analysis for Asset-based Lending by End-user - Large Enterprises End-User and Small and Medium-sized Enterprises - Independent Analysis of Annual Sales in US$ Million for the Years 2024 through 2030 and % CAGR

- TABLE 45: China Historic Review for Asset-based Lending by End-user - Large Enterprises End-User and Small and Medium-sized Enterprises Markets - Independent Analysis of Annual Sales in US$ Million for Years 2015 through 2023 and % CAGR

- TABLE 46: China 15-Year Perspective for Asset-based Lending by End-user - Percentage Breakdown of Value Sales for Large Enterprises End-User and Small and Medium-sized Enterprises for the Years 2015, 2025 & 2030

- EUROPE

- Asset-based Lending Market Presence - Strong/Active/Niche/Trivial - Key Competitors in Europe for 2025 (E)

- TABLE 47: Europe Recent Past, Current & Future Analysis for Asset-based Lending by Geographic Region - France, Germany, Italy, UK, Spain, Russia and Rest of Europe Markets - Independent Analysis of Annual Sales in US$ Million for Years 2024 through 2030 and % CAGR

- TABLE 48: Europe Historic Review for Asset-based Lending by Geographic Region - France, Germany, Italy, UK, Spain, Russia and Rest of Europe Markets - Independent Analysis of Annual Sales in US$ Million for Years 2015 through 2023 and % CAGR

- TABLE 49: Europe 15-Year Perspective for Asset-based Lending by Geographic Region - Percentage Breakdown of Value Sales for France, Germany, Italy, UK, Spain, Russia and Rest of Europe Markets for Years 2015, 2025 & 2030

- TABLE 50: Europe Recent Past, Current & Future Analysis for Asset-based Lending by Type - Inventory Financing, Receivables Financing, Equipment Financing and Other Types - Independent Analysis of Annual Sales in US$ Million for the Years 2024 through 2030 and % CAGR

- TABLE 51: Europe Historic Review for Asset-based Lending by Type - Inventory Financing, Receivables Financing, Equipment Financing and Other Types Markets - Independent Analysis of Annual Sales in US$ Million for Years 2015 through 2023 and % CAGR

- TABLE 52: Europe 15-Year Perspective for Asset-based Lending by Type - Percentage Breakdown of Value Sales for Inventory Financing, Receivables Financing, Equipment Financing and Other Types for the Years 2015, 2025 & 2030

- TABLE 53: Europe Recent Past, Current & Future Analysis for Asset-based Lending by End-user - Large Enterprises End-User and Small and Medium-sized Enterprises - Independent Analysis of Annual Sales in US$ Million for the Years 2024 through 2030 and % CAGR

- TABLE 54: Europe Historic Review for Asset-based Lending by End-user - Large Enterprises End-User and Small and Medium-sized Enterprises Markets - Independent Analysis of Annual Sales in US$ Million for Years 2015 through 2023 and % CAGR

- TABLE 55: Europe 15-Year Perspective for Asset-based Lending by End-user - Percentage Breakdown of Value Sales for Large Enterprises End-User and Small and Medium-sized Enterprises for the Years 2015, 2025 & 2030

- FRANCE

- Asset-based Lending Market Presence - Strong/Active/Niche/Trivial - Key Competitors in France for 2025 (E)

- TABLE 56: France Recent Past, Current & Future Analysis for Asset-based Lending by Type - Inventory Financing, Receivables Financing, Equipment Financing and Other Types - Independent Analysis of Annual Sales in US$ Million for the Years 2024 through 2030 and % CAGR

- TABLE 57: France Historic Review for Asset-based Lending by Type - Inventory Financing, Receivables Financing, Equipment Financing and Other Types Markets - Independent Analysis of Annual Sales in US$ Million for Years 2015 through 2023 and % CAGR

- TABLE 58: France 15-Year Perspective for Asset-based Lending by Type - Percentage Breakdown of Value Sales for Inventory Financing, Receivables Financing, Equipment Financing and Other Types for the Years 2015, 2025 & 2030

- TABLE 59: France Recent Past, Current & Future Analysis for Asset-based Lending by End-user - Large Enterprises End-User and Small and Medium-sized Enterprises - Independent Analysis of Annual Sales in US$ Million for the Years 2024 through 2030 and % CAGR

- TABLE 60: France Historic Review for Asset-based Lending by End-user - Large Enterprises End-User and Small and Medium-sized Enterprises Markets - Independent Analysis of Annual Sales in US$ Million for Years 2015 through 2023 and % CAGR

- TABLE 61: France 15-Year Perspective for Asset-based Lending by End-user - Percentage Breakdown of Value Sales for Large Enterprises End-User and Small and Medium-sized Enterprises for the Years 2015, 2025 & 2030

- GERMANY

- Asset-based Lending Market Presence - Strong/Active/Niche/Trivial - Key Competitors in Germany for 2025 (E)

- TABLE 62: Germany Recent Past, Current & Future Analysis for Asset-based Lending by Type - Inventory Financing, Receivables Financing, Equipment Financing and Other Types - Independent Analysis of Annual Sales in US$ Million for the Years 2024 through 2030 and % CAGR

- TABLE 63: Germany Historic Review for Asset-based Lending by Type - Inventory Financing, Receivables Financing, Equipment Financing and Other Types Markets - Independent Analysis of Annual Sales in US$ Million for Years 2015 through 2023 and % CAGR

- TABLE 64: Germany 15-Year Perspective for Asset-based Lending by Type - Percentage Breakdown of Value Sales for Inventory Financing, Receivables Financing, Equipment Financing and Other Types for the Years 2015, 2025 & 2030

- TABLE 65: Germany Recent Past, Current & Future Analysis for Asset-based Lending by End-user - Large Enterprises End-User and Small and Medium-sized Enterprises - Independent Analysis of Annual Sales in US$ Million for the Years 2024 through 2030 and % CAGR

- TABLE 66: Germany Historic Review for Asset-based Lending by End-user - Large Enterprises End-User and Small and Medium-sized Enterprises Markets - Independent Analysis of Annual Sales in US$ Million for Years 2015 through 2023 and % CAGR

- TABLE 67: Germany 15-Year Perspective for Asset-based Lending by End-user - Percentage Breakdown of Value Sales for Large Enterprises End-User and Small and Medium-sized Enterprises for the Years 2015, 2025 & 2030

- ITALY

- TABLE 68: Italy Recent Past, Current & Future Analysis for Asset-based Lending by Type - Inventory Financing, Receivables Financing, Equipment Financing and Other Types - Independent Analysis of Annual Sales in US$ Million for the Years 2024 through 2030 and % CAGR

- TABLE 69: Italy Historic Review for Asset-based Lending by Type - Inventory Financing, Receivables Financing, Equipment Financing and Other Types Markets - Independent Analysis of Annual Sales in US$ Million for Years 2015 through 2023 and % CAGR

- TABLE 70: Italy 15-Year Perspective for Asset-based Lending by Type - Percentage Breakdown of Value Sales for Inventory Financing, Receivables Financing, Equipment Financing and Other Types for the Years 2015, 2025 & 2030

- TABLE 71: Italy Recent Past, Current & Future Analysis for Asset-based Lending by End-user - Large Enterprises End-User and Small and Medium-sized Enterprises - Independent Analysis of Annual Sales in US$ Million for the Years 2024 through 2030 and % CAGR

- TABLE 72: Italy Historic Review for Asset-based Lending by End-user - Large Enterprises End-User and Small and Medium-sized Enterprises Markets - Independent Analysis of Annual Sales in US$ Million for Years 2015 through 2023 and % CAGR

- TABLE 73: Italy 15-Year Perspective for Asset-based Lending by End-user - Percentage Breakdown of Value Sales for Large Enterprises End-User and Small and Medium-sized Enterprises for the Years 2015, 2025 & 2030

- UNITED KINGDOM

- Asset-based Lending Market Presence - Strong/Active/Niche/Trivial - Key Competitors in the United Kingdom for 2025 (E)

- TABLE 74: UK Recent Past, Current & Future Analysis for Asset-based Lending by Type - Inventory Financing, Receivables Financing, Equipment Financing and Other Types - Independent Analysis of Annual Sales in US$ Million for the Years 2024 through 2030 and % CAGR

- TABLE 75: UK Historic Review for Asset-based Lending by Type - Inventory Financing, Receivables Financing, Equipment Financing and Other Types Markets - Independent Analysis of Annual Sales in US$ Million for Years 2015 through 2023 and % CAGR

- TABLE 76: UK 15-Year Perspective for Asset-based Lending by Type - Percentage Breakdown of Value Sales for Inventory Financing, Receivables Financing, Equipment Financing and Other Types for the Years 2015, 2025 & 2030

- TABLE 77: UK Recent Past, Current & Future Analysis for Asset-based Lending by End-user - Large Enterprises End-User and Small and Medium-sized Enterprises - Independent Analysis of Annual Sales in US$ Million for the Years 2024 through 2030 and % CAGR

- TABLE 78: UK Historic Review for Asset-based Lending by End-user - Large Enterprises End-User and Small and Medium-sized Enterprises Markets - Independent Analysis of Annual Sales in US$ Million for Years 2015 through 2023 and % CAGR

- TABLE 79: UK 15-Year Perspective for Asset-based Lending by End-user - Percentage Breakdown of Value Sales for Large Enterprises End-User and Small and Medium-sized Enterprises for the Years 2015, 2025 & 2030

- SPAIN

- TABLE 80: Spain Recent Past, Current & Future Analysis for Asset-based Lending by Type - Inventory Financing, Receivables Financing, Equipment Financing and Other Types - Independent Analysis of Annual Sales in US$ Million for the Years 2024 through 2030 and % CAGR

- TABLE 81: Spain Historic Review for Asset-based Lending by Type - Inventory Financing, Receivables Financing, Equipment Financing and Other Types Markets - Independent Analysis of Annual Sales in US$ Million for Years 2015 through 2023 and % CAGR

- TABLE 82: Spain 15-Year Perspective for Asset-based Lending by Type - Percentage Breakdown of Value Sales for Inventory Financing, Receivables Financing, Equipment Financing and Other Types for the Years 2015, 2025 & 2030

- TABLE 83: Spain Recent Past, Current & Future Analysis for Asset-based Lending by End-user - Large Enterprises End-User and Small and Medium-sized Enterprises - Independent Analysis of Annual Sales in US$ Million for the Years 2024 through 2030 and % CAGR

- TABLE 84: Spain Historic Review for Asset-based Lending by End-user - Large Enterprises End-User and Small and Medium-sized Enterprises Markets - Independent Analysis of Annual Sales in US$ Million for Years 2015 through 2023 and % CAGR

- TABLE 85: Spain 15-Year Perspective for Asset-based Lending by End-user - Percentage Breakdown of Value Sales for Large Enterprises End-User and Small and Medium-sized Enterprises for the Years 2015, 2025 & 2030

- RUSSIA

- TABLE 86: Russia Recent Past, Current & Future Analysis for Asset-based Lending by Type - Inventory Financing, Receivables Financing, Equipment Financing and Other Types - Independent Analysis of Annual Sales in US$ Million for the Years 2024 through 2030 and % CAGR

- TABLE 87: Russia Historic Review for Asset-based Lending by Type - Inventory Financing, Receivables Financing, Equipment Financing and Other Types Markets - Independent Analysis of Annual Sales in US$ Million for Years 2015 through 2023 and % CAGR

- TABLE 88: Russia 15-Year Perspective for Asset-based Lending by Type - Percentage Breakdown of Value Sales for Inventory Financing, Receivables Financing, Equipment Financing and Other Types for the Years 2015, 2025 & 2030

- TABLE 89: Russia Recent Past, Current & Future Analysis for Asset-based Lending by End-user - Large Enterprises End-User and Small and Medium-sized Enterprises - Independent Analysis of Annual Sales in US$ Million for the Years 2024 through 2030 and % CAGR

- TABLE 90: Russia Historic Review for Asset-based Lending by End-user - Large Enterprises End-User and Small and Medium-sized Enterprises Markets - Independent Analysis of Annual Sales in US$ Million for Years 2015 through 2023 and % CAGR

- TABLE 91: Russia 15-Year Perspective for Asset-based Lending by End-user - Percentage Breakdown of Value Sales for Large Enterprises End-User and Small and Medium-sized Enterprises for the Years 2015, 2025 & 2030

- REST OF EUROPE

- TABLE 92: Rest of Europe Recent Past, Current & Future Analysis for Asset-based Lending by Type - Inventory Financing, Receivables Financing, Equipment Financing and Other Types - Independent Analysis of Annual Sales in US$ Million for the Years 2024 through 2030 and % CAGR

- TABLE 93: Rest of Europe Historic Review for Asset-based Lending by Type - Inventory Financing, Receivables Financing, Equipment Financing and Other Types Markets - Independent Analysis of Annual Sales in US$ Million for Years 2015 through 2023 and % CAGR

- TABLE 94: Rest of Europe 15-Year Perspective for Asset-based Lending by Type - Percentage Breakdown of Value Sales for Inventory Financing, Receivables Financing, Equipment Financing and Other Types for the Years 2015, 2025 & 2030

- TABLE 95: Rest of Europe Recent Past, Current & Future Analysis for Asset-based Lending by End-user - Large Enterprises End-User and Small and Medium-sized Enterprises - Independent Analysis of Annual Sales in US$ Million for the Years 2024 through 2030 and % CAGR

- TABLE 96: Rest of Europe Historic Review for Asset-based Lending by End-user - Large Enterprises End-User and Small and Medium-sized Enterprises Markets - Independent Analysis of Annual Sales in US$ Million for Years 2015 through 2023 and % CAGR

- TABLE 97: Rest of Europe 15-Year Perspective for Asset-based Lending by End-user - Percentage Breakdown of Value Sales for Large Enterprises End-User and Small and Medium-sized Enterprises for the Years 2015, 2025 & 2030

- ASIA-PACIFIC

- Asset-based Lending Market Presence - Strong/Active/Niche/Trivial - Key Competitors in Asia-Pacific for 2025 (E)

- TABLE 98: Asia-Pacific Recent Past, Current & Future Analysis for Asset-based Lending by Geographic Region - Australia, India, South Korea and Rest of Asia-Pacific Markets - Independent Analysis of Annual Sales in US$ Million for Years 2024 through 2030 and % CAGR

- TABLE 99: Asia-Pacific Historic Review for Asset-based Lending by Geographic Region - Australia, India, South Korea and Rest of Asia-Pacific Markets - Independent Analysis of Annual Sales in US$ Million for Years 2015 through 2023 and % CAGR

- TABLE 100: Asia-Pacific 15-Year Perspective for Asset-based Lending by Geographic Region - Percentage Breakdown of Value Sales for Australia, India, South Korea and Rest of Asia-Pacific Markets for Years 2015, 2025 & 2030

- TABLE 101: Asia-Pacific Recent Past, Current & Future Analysis for Asset-based Lending by Type - Inventory Financing, Receivables Financing, Equipment Financing and Other Types - Independent Analysis of Annual Sales in US$ Million for the Years 2024 through 2030 and % CAGR

- TABLE 102: Asia-Pacific Historic Review for Asset-based Lending by Type - Inventory Financing, Receivables Financing, Equipment Financing and Other Types Markets - Independent Analysis of Annual Sales in US$ Million for Years 2015 through 2023 and % CAGR

- TABLE 103: Asia-Pacific 15-Year Perspective for Asset-based Lending by Type - Percentage Breakdown of Value Sales for Inventory Financing, Receivables Financing, Equipment Financing and Other Types for the Years 2015, 2025 & 2030

- TABLE 104: Asia-Pacific Recent Past, Current & Future Analysis for Asset-based Lending by End-user - Large Enterprises End-User and Small and Medium-sized Enterprises - Independent Analysis of Annual Sales in US$ Million for the Years 2024 through 2030 and % CAGR

- TABLE 105: Asia-Pacific Historic Review for Asset-based Lending by End-user - Large Enterprises End-User and Small and Medium-sized Enterprises Markets - Independent Analysis of Annual Sales in US$ Million for Years 2015 through 2023 and % CAGR

- TABLE 106: Asia-Pacific 15-Year Perspective for Asset-based Lending by End-user - Percentage Breakdown of Value Sales for Large Enterprises End-User and Small and Medium-sized Enterprises for the Years 2015, 2025 & 2030

- AUSTRALIA

- Asset-based Lending Market Presence - Strong/Active/Niche/Trivial - Key Competitors in Australia for 2025 (E)

- TABLE 107: Australia Recent Past, Current & Future Analysis for Asset-based Lending by Type - Inventory Financing, Receivables Financing, Equipment Financing and Other Types - Independent Analysis of Annual Sales in US$ Million for the Years 2024 through 2030 and % CAGR

- TABLE 108: Australia Historic Review for Asset-based Lending by Type - Inventory Financing, Receivables Financing, Equipment Financing and Other Types Markets - Independent Analysis of Annual Sales in US$ Million for Years 2015 through 2023 and % CAGR

- TABLE 109: Australia 15-Year Perspective for Asset-based Lending by Type - Percentage Breakdown of Value Sales for Inventory Financing, Receivables Financing, Equipment Financing and Other Types for the Years 2015, 2025 & 2030

- TABLE 110: Australia Recent Past, Current & Future Analysis for Asset-based Lending by End-user - Large Enterprises End-User and Small and Medium-sized Enterprises - Independent Analysis of Annual Sales in US$ Million for the Years 2024 through 2030 and % CAGR

- TABLE 111: Australia Historic Review for Asset-based Lending by End-user - Large Enterprises End-User and Small and Medium-sized Enterprises Markets - Independent Analysis of Annual Sales in US$ Million for Years 2015 through 2023 and % CAGR

- TABLE 112: Australia 15-Year Perspective for Asset-based Lending by End-user - Percentage Breakdown of Value Sales for Large Enterprises End-User and Small and Medium-sized Enterprises for the Years 2015, 2025 & 2030

- INDIA

- Asset-based Lending Market Presence - Strong/Active/Niche/Trivial - Key Competitors in India for 2025 (E)

- TABLE 113: India Recent Past, Current & Future Analysis for Asset-based Lending by Type - Inventory Financing, Receivables Financing, Equipment Financing and Other Types - Independent Analysis of Annual Sales in US$ Million for the Years 2024 through 2030 and % CAGR

- TABLE 114: India Historic Review for Asset-based Lending by Type - Inventory Financing, Receivables Financing, Equipment Financing and Other Types Markets - Independent Analysis of Annual Sales in US$ Million for Years 2015 through 2023 and % CAGR

- TABLE 115: India 15-Year Perspective for Asset-based Lending by Type - Percentage Breakdown of Value Sales for Inventory Financing, Receivables Financing, Equipment Financing and Other Types for the Years 2015, 2025 & 2030

- TABLE 116: India Recent Past, Current & Future Analysis for Asset-based Lending by End-user - Large Enterprises End-User and Small and Medium-sized Enterprises - Independent Analysis of Annual Sales in US$ Million for the Years 2024 through 2030 and % CAGR

- TABLE 117: India Historic Review for Asset-based Lending by End-user - Large Enterprises End-User and Small and Medium-sized Enterprises Markets - Independent Analysis of Annual Sales in US$ Million for Years 2015 through 2023 and % CAGR

- TABLE 118: India 15-Year Perspective for Asset-based Lending by End-user - Percentage Breakdown of Value Sales for Large Enterprises End-User and Small and Medium-sized Enterprises for the Years 2015, 2025 & 2030

- SOUTH KOREA

- TABLE 119: South Korea Recent Past, Current & Future Analysis for Asset-based Lending by Type - Inventory Financing, Receivables Financing, Equipment Financing and Other Types - Independent Analysis of Annual Sales in US$ Million for the Years 2024 through 2030 and % CAGR

- TABLE 120: South Korea Historic Review for Asset-based Lending by Type - Inventory Financing, Receivables Financing, Equipment Financing and Other Types Markets - Independent Analysis of Annual Sales in US$ Million for Years 2015 through 2023 and % CAGR

- TABLE 121: South Korea 15-Year Perspective for Asset-based Lending by Type - Percentage Breakdown of Value Sales for Inventory Financing, Receivables Financing, Equipment Financing and Other Types for the Years 2015, 2025 & 2030

- TABLE 122: South Korea Recent Past, Current & Future Analysis for Asset-based Lending by End-user - Large Enterprises End-User and Small and Medium-sized Enterprises - Independent Analysis of Annual Sales in US$ Million for the Years 2024 through 2030 and % CAGR

- TABLE 123: South Korea Historic Review for Asset-based Lending by End-user - Large Enterprises End-User and Small and Medium-sized Enterprises Markets - Independent Analysis of Annual Sales in US$ Million for Years 2015 through 2023 and % CAGR

- TABLE 124: South Korea 15-Year Perspective for Asset-based Lending by End-user - Percentage Breakdown of Value Sales for Large Enterprises End-User and Small and Medium-sized Enterprises for the Years 2015, 2025 & 2030

- REST OF ASIA-PACIFIC

- TABLE 125: Rest of Asia-Pacific Recent Past, Current & Future Analysis for Asset-based Lending by Type - Inventory Financing, Receivables Financing, Equipment Financing and Other Types - Independent Analysis of Annual Sales in US$ Million for the Years 2024 through 2030 and % CAGR

- TABLE 126: Rest of Asia-Pacific Historic Review for Asset-based Lending by Type - Inventory Financing, Receivables Financing, Equipment Financing and Other Types Markets - Independent Analysis of Annual Sales in US$ Million for Years 2015 through 2023 and % CAGR

- TABLE 127: Rest of Asia-Pacific 15-Year Perspective for Asset-based Lending by Type - Percentage Breakdown of Value Sales for Inventory Financing, Receivables Financing, Equipment Financing and Other Types for the Years 2015, 2025 & 2030

- TABLE 128: Rest of Asia-Pacific Recent Past, Current & Future Analysis for Asset-based Lending by End-user - Large Enterprises End-User and Small and Medium-sized Enterprises - Independent Analysis of Annual Sales in US$ Million for the Years 2024 through 2030 and % CAGR

- TABLE 129: Rest of Asia-Pacific Historic Review for Asset-based Lending by End-user - Large Enterprises End-User and Small and Medium-sized Enterprises Markets - Independent Analysis of Annual Sales in US$ Million for Years 2015 through 2023 and % CAGR

- TABLE 130: Rest of Asia-Pacific 15-Year Perspective for Asset-based Lending by End-user - Percentage Breakdown of Value Sales for Large Enterprises End-User and Small and Medium-sized Enterprises for the Years 2015, 2025 & 2030

- LATIN AMERICA

- Asset-based Lending Market Presence - Strong/Active/Niche/Trivial - Key Competitors in Latin America for 2025 (E)

- TABLE 131: Latin America Recent Past, Current & Future Analysis for Asset-based Lending by Geographic Region - Argentina, Brazil, Mexico and Rest of Latin America Markets - Independent Analysis of Annual Sales in US$ Million for Years 2024 through 2030 and % CAGR

- TABLE 132: Latin America Historic Review for Asset-based Lending by Geographic Region - Argentina, Brazil, Mexico and Rest of Latin America Markets - Independent Analysis of Annual Sales in US$ Million for Years 2015 through 2023 and % CAGR

- TABLE 133: Latin America 15-Year Perspective for Asset-based Lending by Geographic Region - Percentage Breakdown of Value Sales for Argentina, Brazil, Mexico and Rest of Latin America Markets for Years 2015, 2025 & 2030

- TABLE 134: Latin America Recent Past, Current & Future Analysis for Asset-based Lending by Type - Inventory Financing, Receivables Financing, Equipment Financing and Other Types - Independent Analysis of Annual Sales in US$ Million for the Years 2024 through 2030 and % CAGR

- TABLE 135: Latin America Historic Review for Asset-based Lending by Type - Inventory Financing, Receivables Financing, Equipment Financing and Other Types Markets - Independent Analysis of Annual Sales in US$ Million for Years 2015 through 2023 and % CAGR

- TABLE 136: Latin America 15-Year Perspective for Asset-based Lending by Type - Percentage Breakdown of Value Sales for Inventory Financing, Receivables Financing, Equipment Financing and Other Types for the Years 2015, 2025 & 2030

- TABLE 137: Latin America Recent Past, Current & Future Analysis for Asset-based Lending by End-user - Large Enterprises End-User and Small and Medium-sized Enterprises - Independent Analysis of Annual Sales in US$ Million for the Years 2024 through 2030 and % CAGR

- TABLE 138: Latin America Historic Review for Asset-based Lending by End-user - Large Enterprises End-User and Small and Medium-sized Enterprises Markets - Independent Analysis of Annual Sales in US$ Million for Years 2015 through 2023 and % CAGR

- TABLE 139: Latin America 15-Year Perspective for Asset-based Lending by End-user - Percentage Breakdown of Value Sales for Large Enterprises End-User and Small and Medium-sized Enterprises for the Years 2015, 2025 & 2030

- ARGENTINA

- TABLE 140: Argentina Recent Past, Current & Future Analysis for Asset-based Lending by Type - Inventory Financing, Receivables Financing, Equipment Financing and Other Types - Independent Analysis of Annual Sales in US$ Million for the Years 2024 through 2030 and % CAGR

- TABLE 141: Argentina Historic Review for Asset-based Lending by Type - Inventory Financing, Receivables Financing, Equipment Financing and Other Types Markets - Independent Analysis of Annual Sales in US$ Million for Years 2015 through 2023 and % CAGR

- TABLE 142: Argentina 15-Year Perspective for Asset-based Lending by Type - Percentage Breakdown of Value Sales for Inventory Financing, Receivables Financing, Equipment Financing and Other Types for the Years 2015, 2025 & 2030

- TABLE 143: Argentina Recent Past, Current & Future Analysis for Asset-based Lending by End-user - Large Enterprises End-User and Small and Medium-sized Enterprises - Independent Analysis of Annual Sales in US$ Million for the Years 2024 through 2030 and % CAGR

- TABLE 144: Argentina Historic Review for Asset-based Lending by End-user - Large Enterprises End-User and Small and Medium-sized Enterprises Markets - Independent Analysis of Annual Sales in US$ Million for Years 2015 through 2023 and % CAGR

- TABLE 145: Argentina 15-Year Perspective for Asset-based Lending by End-user - Percentage Breakdown of Value Sales for Large Enterprises End-User and Small and Medium-sized Enterprises for the Years 2015, 2025 & 2030

- BRAZIL

- TABLE 146: Brazil Recent Past, Current & Future Analysis for Asset-based Lending by Type - Inventory Financing, Receivables Financing, Equipment Financing and Other Types - Independent Analysis of Annual Sales in US$ Million for the Years 2024 through 2030 and % CAGR

- TABLE 147: Brazil Historic Review for Asset-based Lending by Type - Inventory Financing, Receivables Financing, Equipment Financing and Other Types Markets - Independent Analysis of Annual Sales in US$ Million for Years 2015 through 2023 and % CAGR

- TABLE 148: Brazil 15-Year Perspective for Asset-based Lending by Type - Percentage Breakdown of Value Sales for Inventory Financing, Receivables Financing, Equipment Financing and Other Types for the Years 2015, 2025 & 2030

- TABLE 149: Brazil Recent Past, Current & Future Analysis for Asset-based Lending by End-user - Large Enterprises End-User and Small and Medium-sized Enterprises - Independent Analysis of Annual Sales in US$ Million for the Years 2024 through 2030 and % CAGR

- TABLE 150: Brazil Historic Review for Asset-based Lending by End-user - Large Enterprises End-User and Small and Medium-sized Enterprises Markets - Independent Analysis of Annual Sales in US$ Million for Years 2015 through 2023 and % CAGR

- TABLE 151: Brazil 15-Year Perspective for Asset-based Lending by End-user - Percentage Breakdown of Value Sales for Large Enterprises End-User and Small and Medium-sized Enterprises for the Years 2015, 2025 & 2030

- MEXICO

- TABLE 152: Mexico Recent Past, Current & Future Analysis for Asset-based Lending by Type - Inventory Financing, Receivables Financing, Equipment Financing and Other Types - Independent Analysis of Annual Sales in US$ Million for the Years 2024 through 2030 and % CAGR

- TABLE 153: Mexico Historic Review for Asset-based Lending by Type - Inventory Financing, Receivables Financing, Equipment Financing and Other Types Markets - Independent Analysis of Annual Sales in US$ Million for Years 2015 through 2023 and % CAGR

- TABLE 154: Mexico 15-Year Perspective for Asset-based Lending by Type - Percentage Breakdown of Value Sales for Inventory Financing, Receivables Financing, Equipment Financing and Other Types for the Years 2015, 2025 & 2030

- TABLE 155: Mexico Recent Past, Current & Future Analysis for Asset-based Lending by End-user - Large Enterprises End-User and Small and Medium-sized Enterprises - Independent Analysis of Annual Sales in US$ Million for the Years 2024 through 2030 and % CAGR

- TABLE 156: Mexico Historic Review for Asset-based Lending by End-user - Large Enterprises End-User and Small and Medium-sized Enterprises Markets - Independent Analysis of Annual Sales in US$ Million for Years 2015 through 2023 and % CAGR

- TABLE 157: Mexico 15-Year Perspective for Asset-based Lending by End-user - Percentage Breakdown of Value Sales for Large Enterprises End-User and Small and Medium-sized Enterprises for the Years 2015, 2025 & 2030

- REST OF LATIN AMERICA

- TABLE 158: Rest of Latin America Recent Past, Current & Future Analysis for Asset-based Lending by Type - Inventory Financing, Receivables Financing, Equipment Financing and Other Types - Independent Analysis of Annual Sales in US$ Million for the Years 2024 through 2030 and % CAGR

- TABLE 159: Rest of Latin America Historic Review for Asset-based Lending by Type - Inventory Financing, Receivables Financing, Equipment Financing and Other Types Markets - Independent Analysis of Annual Sales in US$ Million for Years 2015 through 2023 and % CAGR

- TABLE 160: Rest of Latin America 15-Year Perspective for Asset-based Lending by Type - Percentage Breakdown of Value Sales for Inventory Financing, Receivables Financing, Equipment Financing and Other Types for the Years 2015, 2025 & 2030

- TABLE 161: Rest of Latin America Recent Past, Current & Future Analysis for Asset-based Lending by End-user - Large Enterprises End-User and Small and Medium-sized Enterprises - Independent Analysis of Annual Sales in US$ Million for the Years 2024 through 2030 and % CAGR

- TABLE 162: Rest of Latin America Historic Review for Asset-based Lending by End-user - Large Enterprises End-User and Small and Medium-sized Enterprises Markets - Independent Analysis of Annual Sales in US$ Million for Years 2015 through 2023 and % CAGR

- TABLE 163: Rest of Latin America 15-Year Perspective for Asset-based Lending by End-user - Percentage Breakdown of Value Sales for Large Enterprises End-User and Small and Medium-sized Enterprises for the Years 2015, 2025 & 2030

- MIDDLE EAST

- Asset-based Lending Market Presence - Strong/Active/Niche/Trivial - Key Competitors in Middle East for 2025 (E)

- TABLE 164: Middle East Recent Past, Current & Future Analysis for Asset-based Lending by Geographic Region - Iran, Israel, Saudi Arabia, UAE and Rest of Middle East Markets - Independent Analysis of Annual Sales in US$ Million for Years 2024 through 2030 and % CAGR

- TABLE 165: Middle East Historic Review for Asset-based Lending by Geographic Region - Iran, Israel, Saudi Arabia, UAE and Rest of Middle East Markets - Independent Analysis of Annual Sales in US$ Million for Years 2015 through 2023 and % CAGR

- TABLE 166: Middle East 15-Year Perspective for Asset-based Lending by Geographic Region - Percentage Breakdown of Value Sales for Iran, Israel, Saudi Arabia, UAE and Rest of Middle East Markets for Years 2015, 2025 & 2030

- TABLE 167: Middle East Recent Past, Current & Future Analysis for Asset-based Lending by Type - Inventory Financing, Receivables Financing, Equipment Financing and Other Types - Independent Analysis of Annual Sales in US$ Million for the Years 2024 through 2030 and % CAGR

- TABLE 168: Middle East Historic Review for Asset-based Lending by Type - Inventory Financing, Receivables Financing, Equipment Financing and Other Types Markets - Independent Analysis of Annual Sales in US$ Million for Years 2015 through 2023 and % CAGR

- TABLE 169: Middle East 15-Year Perspective for Asset-based Lending by Type - Percentage Breakdown of Value Sales for Inventory Financing, Receivables Financing, Equipment Financing and Other Types for the Years 2015, 2025 & 2030

- TABLE 170: Middle East Recent Past, Current & Future Analysis for Asset-based Lending by End-user - Large Enterprises End-User and Small and Medium-sized Enterprises - Independent Analysis of Annual Sales in US$ Million for the Years 2024 through 2030 and % CAGR

- TABLE 171: Middle East Historic Review for Asset-based Lending by End-user - Large Enterprises End-User and Small and Medium-sized Enterprises Markets - Independent Analysis of Annual Sales in US$ Million for Years 2015 through 2023 and % CAGR

- TABLE 172: Middle East 15-Year Perspective for Asset-based Lending by End-user - Percentage Breakdown of Value Sales for Large Enterprises End-User and Small and Medium-sized Enterprises for the Years 2015, 2025 & 2030

- IRAN

- TABLE 173: Iran Recent Past, Current & Future Analysis for Asset-based Lending by Type - Inventory Financing, Receivables Financing, Equipment Financing and Other Types - Independent Analysis of Annual Sales in US$ Million for the Years 2024 through 2030 and % CAGR

- TABLE 174: Iran Historic Review for Asset-based Lending by Type - Inventory Financing, Receivables Financing, Equipment Financing and Other Types Markets - Independent Analysis of Annual Sales in US$ Million for Years 2015 through 2023 and % CAGR

- TABLE 175: Iran 15-Year Perspective for Asset-based Lending by Type - Percentage Breakdown of Value Sales for Inventory Financing, Receivables Financing, Equipment Financing and Other Types for the Years 2015, 2025 & 2030

- TABLE 176: Iran Recent Past, Current & Future Analysis for Asset-based Lending by End-user - Large Enterprises End-User and Small and Medium-sized Enterprises - Independent Analysis of Annual Sales in US$ Million for the Years 2024 through 2030 and % CAGR

- TABLE 177: Iran Historic Review for Asset-based Lending by End-user - Large Enterprises End-User and Small and Medium-sized Enterprises Markets - Independent Analysis of Annual Sales in US$ Million for Years 2015 through 2023 and % CAGR

- TABLE 178: Iran 15-Year Perspective for Asset-based Lending by End-user - Percentage Breakdown of Value Sales for Large Enterprises End-User and Small and Medium-sized Enterprises for the Years 2015, 2025 & 2030

- ISRAEL

- TABLE 179: Israel Recent Past, Current & Future Analysis for Asset-based Lending by Type - Inventory Financing, Receivables Financing, Equipment Financing and Other Types - Independent Analysis of Annual Sales in US$ Million for the Years 2024 through 2030 and % CAGR

- TABLE 180: Israel Historic Review for Asset-based Lending by Type - Inventory Financing, Receivables Financing, Equipment Financing and Other Types Markets - Independent Analysis of Annual Sales in US$ Million for Years 2015 through 2023 and % CAGR

- TABLE 181: Israel 15-Year Perspective for Asset-based Lending by Type - Percentage Breakdown of Value Sales for Inventory Financing, Receivables Financing, Equipment Financing and Other Types for the Years 2015, 2025 & 2030

- TABLE 182: Israel Recent Past, Current & Future Analysis for Asset-based Lending by End-user - Large Enterprises End-User and Small and Medium-sized Enterprises - Independent Analysis of Annual Sales in US$ Million for the Years 2024 through 2030 and % CAGR

- TABLE 183: Israel Historic Review for Asset-based Lending by End-user - Large Enterprises End-User and Small and Medium-sized Enterprises Markets - Independent Analysis of Annual Sales in US$ Million for Years 2015 through 2023 and % CAGR

- TABLE 184: Israel 15-Year Perspective for Asset-based Lending by End-user - Percentage Breakdown of Value Sales for Large Enterprises End-User and Small and Medium-sized Enterprises for the Years 2015, 2025 & 2030

- SAUDI ARABIA

- TABLE 185: Saudi Arabia Recent Past, Current & Future Analysis for Asset-based Lending by Type - Inventory Financing, Receivables Financing, Equipment Financing and Other Types - Independent Analysis of Annual Sales in US$ Million for the Years 2024 through 2030 and % CAGR

- TABLE 186: Saudi Arabia Historic Review for Asset-based Lending by Type - Inventory Financing, Receivables Financing, Equipment Financing and Other Types Markets - Independent Analysis of Annual Sales in US$ Million for Years 2015 through 2023 and % CAGR

- TABLE 187: Saudi Arabia 15-Year Perspective for Asset-based Lending by Type - Percentage Breakdown of Value Sales for Inventory Financing, Receivables Financing, Equipment Financing and Other Types for the Years 2015, 2025 & 2030

- TABLE 188: Saudi Arabia Recent Past, Current & Future Analysis for Asset-based Lending by End-user - Large Enterprises End-User and Small and Medium-sized Enterprises - Independent Analysis of Annual Sales in US$ Million for the Years 2024 through 2030 and % CAGR

- TABLE 189: Saudi Arabia Historic Review for Asset-based Lending by End-user - Large Enterprises End-User and Small and Medium-sized Enterprises Markets - Independent Analysis of Annual Sales in US$ Million for Years 2015 through 2023 and % CAGR

- TABLE 190: Saudi Arabia 15-Year Perspective for Asset-based Lending by End-user - Percentage Breakdown of Value Sales for Large Enterprises End-User and Small and Medium-sized Enterprises for the Years 2015, 2025 & 2030

- UNITED ARAB EMIRATES

- TABLE 191: UAE Recent Past, Current & Future Analysis for Asset-based Lending by Type - Inventory Financing, Receivables Financing, Equipment Financing and Other Types - Independent Analysis of Annual Sales in US$ Million for the Years 2024 through 2030 and % CAGR

- TABLE 192: UAE Historic Review for Asset-based Lending by Type - Inventory Financing, Receivables Financing, Equipment Financing and Other Types Markets - Independent Analysis of Annual Sales in US$ Million for Years 2015 through 2023 and % CAGR

- TABLE 193: UAE 15-Year Perspective for Asset-based Lending by Type - Percentage Breakdown of Value Sales for Inventory Financing, Receivables Financing, Equipment Financing and Other Types for the Years 2015, 2025 & 2030

- TABLE 194: UAE Recent Past, Current & Future Analysis for Asset-based Lending by End-user - Large Enterprises End-User and Small and Medium-sized Enterprises - Independent Analysis of Annual Sales in US$ Million for the Years 2024 through 2030 and % CAGR

- TABLE 195: UAE Historic Review for Asset-based Lending by End-user - Large Enterprises End-User and Small and Medium-sized Enterprises Markets - Independent Analysis of Annual Sales in US$ Million for Years 2015 through 2023 and % CAGR

- TABLE 196: UAE 15-Year Perspective for Asset-based Lending by End-user - Percentage Breakdown of Value Sales for Large Enterprises End-User and Small and Medium-sized Enterprises for the Years 2015, 2025 & 2030

- REST OF MIDDLE EAST

- TABLE 197: Rest of Middle East Recent Past, Current & Future Analysis for Asset-based Lending by Type - Inventory Financing, Receivables Financing, Equipment Financing and Other Types - Independent Analysis of Annual Sales in US$ Million for the Years 2024 through 2030 and % CAGR

- TABLE 198: Rest of Middle East Historic Review for Asset-based Lending by Type - Inventory Financing, Receivables Financing, Equipment Financing and Other Types Markets - Independent Analysis of Annual Sales in US$ Million for Years 2015 through 2023 and % CAGR

- TABLE 199: Rest of Middle East 15-Year Perspective for Asset-based Lending by Type - Percentage Breakdown of Value Sales for Inventory Financing, Receivables Financing, Equipment Financing and Other Types for the Years 2015, 2025 & 2030

- TABLE 200: Rest of Middle East Recent Past, Current & Future Analysis for Asset-based Lending by End-user - Large Enterprises End-User and Small and Medium-sized Enterprises - Independent Analysis of Annual Sales in US$ Million for the Years 2024 through 2030 and % CAGR

- TABLE 201: Rest of Middle East Historic Review for Asset-based Lending by End-user - Large Enterprises End-User and Small and Medium-sized Enterprises Markets - Independent Analysis of Annual Sales in US$ Million for Years 2015 through 2023 and % CAGR

- TABLE 202: Rest of Middle East 15-Year Perspective for Asset-based Lending by End-user - Percentage Breakdown of Value Sales for Large Enterprises End-User and Small and Medium-sized Enterprises for the Years 2015, 2025 & 2030

- AFRICA

- Asset-based Lending Market Presence - Strong/Active/Niche/Trivial - Key Competitors in Africa for 2025 (E)

- TABLE 203: Africa Recent Past, Current & Future Analysis for Asset-based Lending by Type - Inventory Financing, Receivables Financing, Equipment Financing and Other Types - Independent Analysis of Annual Sales in US$ Million for the Years 2024 through 2030 and % CAGR

- TABLE 204: Africa Historic Review for Asset-based Lending by Type - Inventory Financing, Receivables Financing, Equipment Financing and Other Types Markets - Independent Analysis of Annual Sales in US$ Million for Years 2015 through 2023 and % CAGR

- TABLE 205: Africa 15-Year Perspective for Asset-based Lending by Type - Percentage Breakdown of Value Sales for Inventory Financing, Receivables Financing, Equipment Financing and Other Types for the Years 2015, 2025 & 2030

- TABLE 206: Africa Recent Past, Current & Future Analysis for Asset-based Lending by End-user - Large Enterprises End-User and Small and Medium-sized Enterprises - Independent Analysis of Annual Sales in US$ Million for the Years 2024 through 2030 and % CAGR

- TABLE 207: Africa Historic Review for Asset-based Lending by End-user - Large Enterprises End-User and Small and Medium-sized Enterprises Markets - Independent Analysis of Annual Sales in US$ Million for Years 2015 through 2023 and % CAGR

- TABLE 208: Africa 15-Year Perspective for Asset-based Lending by End-user - Percentage Breakdown of Value Sales for Large Enterprises End-User and Small and Medium-sized Enterprises for the Years 2015, 2025 & 2030