|

市場調査レポート

商品コード

1801901

パワースポーツの市場機会、成長促進要因、産業動向分析、2025年~2034年予測Power Sports Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

カスタマイズ可能

|

|||||||

| パワースポーツの市場機会、成長促進要因、産業動向分析、2025年~2034年予測 |

|

出版日: 2025年08月07日

発行: Global Market Insights Inc.

ページ情報: 英文 310 Pages

納期: 2~3営業日

|

全表示

- 概要

- 目次

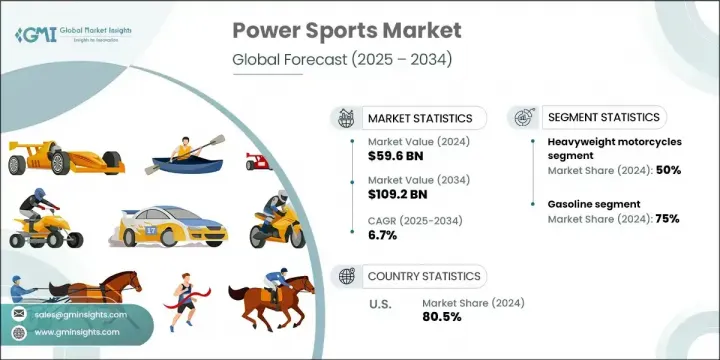

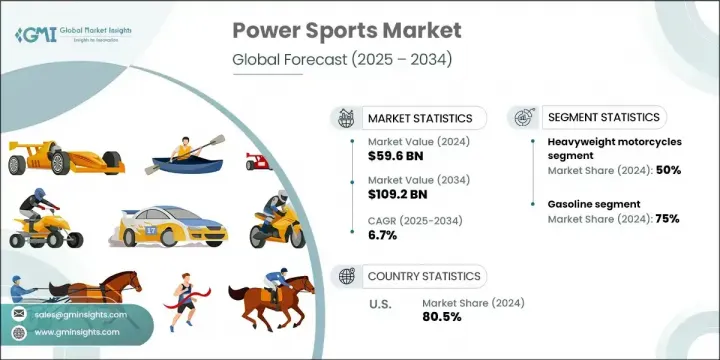

パワースポーツの世界市場規模は2024年に596億米ドルとなり、CAGR6.7%で成長し、2034年までには1,092億米ドルに達すると推定されます。

この市場は、モーターサイクル、パーソナルウォータークラフト、ATV、スノーモービルのようなレクリエーションやパフォーマンス志向の乗り物に対する消費者の熱意が成長を続けているため、持続的な勢いを目の当たりにしています。可処分所得の増加、アウトドアレクリエーション動向の拡大、冒険をベースとした活動への文化的関心の高まりが、こうした乗り物の採用を後押ししています。排出量削減と持続可能なモビリティの実現に向けた世界の取り組みに後押しされ、電気自動車やハイブリッドモデルの普及が成長をさらに後押ししています。

その上、バンドルサービス提供やファイナンスオプションが主要な価値ドライバーになりつつあります。メンテナンス、ロードサイドアシスタンス、柔軟な支払いモデルなどのサポート機能を備えたフルサービスの所有体験を提供する方向へのシフトは、顧客エンゲージメントとブランドロイヤルティを高めています。インド、日本、中国などいくつかのアジア市場では、インフラへの継続的な投資と貿易自由化が、新たな需要と製造の可能性を生み出しています。さらに、国境を越えたロジスティクスの強化、サプライチェーンの現地化、規制上の優遇措置により、新興市場でも既存市場でも新たな成長チャネルが開かれつつあります。

| 市場範囲 | |

|---|---|

| 開始年 | 2024年 |

| 予測年 | 2025年~2034年 |

| 開始金額 | 596億米ドル |

| 予測金額 | 1,092億米ドル |

| CAGR | 6.7% |

重量級モーターサイクル分野は、2034年までCAGR6.9%で成長します。重量級モーターサイクルの魅力は、その高性能、快適な乗り心地、象徴的なデザインにあり、経験豊富なライダーやツーリング愛好家に好まれる選択肢となっています。ライディング・コミュニティの人気とブランド中心の忠誠心は、このセグメントを強化し続けています。このカテゴリーは、北米、欧州、アジア太平洋の特定の国々で特に優位を占めており、プレミアムモデルにおける電動モデルの採用がさらに後押ししています。

2024年には、ガソリン車セグメントは75%のシェアを占め、2034年にはCAGR6.7%で成長すると予測されます。このセグメントは、その優れた出力供給、普及した給油インフラ、性能の信頼性により、引き続きリードしています。ライダーは、モーターサイクル、サイド・バイ・サイド、ATV、スノーモービルなど、すべての車両カテゴリーでガソリンエンジンを選択します。強力な加速力、航続距離の長さ、素早い燃料補給の利点により、特に遠隔地で性能を要求されるレクリエーションやプロの用途に適しています。

米国のパワースポーツ市場は2024年に208億米ドルを生み出し、80.5%のシェアを占めました。同国は、アウトドアとモータースポーツ活動の長年にわたる文化があり、オフロード走行とツーリングのための強固なインフラと相まって、価値の高い市場となっています。米国は、さまざまなタイプの車両における製造と消費の中心的な拠点となっています。米国はまた、カスタマイズ、アフターマーケットの強化、防衛、林業、農業などの産業における実用目的のパワースポーツ車両の使用でもリードしています。

世界のパワースポーツ市場に影響を与える主要企業には、Yamaha、Honda、BMW Motorrad、Suzuki Motor、CFMOTO、Kawasaki、KTM、Harley-Davidson、Polaris、BRPなどがあります。パワースポーツ業界の主要企業は、自動車の電動化における革新、世界な流通の拡大、製品ラインの多様化を通じて競争力を高めています。関連性を維持するため、各ブランドは、環境と消費者の選好の変化に合わせて、電動モデルやコネクテッド機能への取り組みを加速させています。さらに、多くのメーカーは、保険、メンテナンス、ロードサイド・サポートをカバーするサブスクリプション・サービスやバンドル・パッケージを導入し、顧客維持を強化しています。現地生産とディーラー網を通じた新興市場への進出も最優先課題です。研究開発への戦略的投資は、モータースポーツのスポンサーシップやライダー・コミュニティを通じたブランディングとともに、市場の足場をさらに固めています。

目次

第1章 調査手法

- 市場の範囲と定義

- 調査デザイン

- 調査アプローチ

- データ収集方法

- データマイニングソース

- 地域/国

- 基本推定と計算

- 基準年計算

- 市場予測の主な動向

- 1次調査と検証

- 一次情報

- 予測モデル

- 調査の前提と限界

第2章 エグゼクティブサマリー

第3章 業界考察

- 業界エコシステム分析

- サプライヤーの情勢

- 利益率分析

- 付加価値マッピング

- 製造付加価値とブランドプレミアム

- テクノロジーの統合とイノベーションの価値

- サービスとアフターマーケットの価値創造

- バリューチェーンへの影響要因

- 技術革新と電化の影響

- サプライチェーンのレジリエンスと地理的多様化

- 規制遵守と環境基準

- 生態系の混乱

- プラットフォームベースのビジネスモデルとデジタル変革

- 垂直統合の動向とサプライチェーンの再構成

- 新規参入の脅威と市場の進化

- 業界への影響要因

- 成長促進要因

- 人口動態の変化と世代交代

- 屋外レクリエーションへの参加が急増

- 電動化と技術革新

- 経済とインフラの開発

- 戦略的課題と業界の制約

- 経済的圧力と市場の変動

- 規制遵守の負担

- 貿易と関税の圧力

- 市場構造と流通の課題

- 市場機会評価

- 電気自動車市場の拡大

- 軍事・政府部門の拡大

- 国際市場への浸透

- テクノロジーの統合と接続サービス

- 成長促進要因

- 成長可能性分析

- 製品セグメントの成長比較

- 市場成熟度評価とライフサイクルポジショニング

- 成長段階セグメント

- 成熟段階セグメント

- 競争の激しさが成長の可能性に与える影響

- 貿易フロー分析

- 主要生産国(2023年~2024年)

- UTVとATV

- スノーモービル

- パーソナルウォータークラフト(PWC)

- 重量級バイク(500cc以上)

- 消費上位国(2023年~2024年)

- UTVとATV

- スノーモービル

- パーソナルウォータークラフト(PWC)

- 重量級バイク(500cc以上)

- 貿易フロー分析

- UTVとATVの貿易フロー

- スノーモービルの貿易フロー

- PWC貿易フロー

- 大型バイク(500cc以上)の貿易フロー

- セグメント固有のテーブル

- 主要生産国(2023年~2024年)

- 持続可能性の統合

- ライフサイクルアセスメント(LCA)と比較影響

- ICE vs.電気自動車パワースポーツ

- 製造段階

- 競合ベンチマーキング

- ROIとビジネスケース

- コスト削減

- 規制リスクの軽減

- 障壁と機会

- 障壁

- 機会

- 政策、投資家、市場促進要因

- ポリシー

- 投資家の圧力

- 市場

- ベストプラクティスとケーススタディ

- ライフサイクルアセスメント表(ICEvs.電気自動車)

- 提言

- ライフサイクルアセスメント(LCA)と比較影響

- ベストプラクティス、ケーススタディ、ROI

- ベストプラクティスとケーススタディ

- ポラリス(UTV/ATV、スノーモービル)

- ヤマハ(全セグメント)

- BRP(カンナム、シードゥー、スキードゥー)

- ハーレーダビッドソン(ヘビー級MC)

- ROIとビジネスケース

- 電化

- 廃棄物の削減と循環性

- 規制とコンプライアンス

- 市場と投資家の価値

- 主な障壁と戦略的推奨事項

- ベストプラクティスとケーススタディ

- コスト内訳分析

- UTV

- ATV(全地形対応車)

- スノーモービル

- パーソナルウォータークラフト(PWC)

- 大型バイク(500cc以上)

- 炭素影響評価(2023年~2024年)

- 規制遵守

- セグメント別の成果とギャップ

- 炭素削減戦略

- 実用的な推奨事項

- 規制情勢

- 北米

- 環境保護庁(EPA)排出基準

- 消費者製品安全委員会(CPSC)の安全基準

- 米国道路交通安全局(NHTSA)のオートバイ基準

- 米国沿岸警備隊のパーソナルウォータークラフト規制

- 欧州

- 規則(EU)第168号に基づく型式承認制度/2013

- ユーロ5排出ガス基準

- 安全要件と高度なシステム

- 騒音規制

- レクリエーション用船舶指令

- アジア太平洋

- 地域調和の取り組み

- 市場アクセスとコンプライアンス要件

- ラテンアメリカ

- 規制枠組みの進化

- 中東・アフリカ

- 規制の開発

- コンプライアンスコスト分析と戦略的影響

- 定量的なコンプライアンスコスト評価

- 戦略的市場アクセスへの影響

- 北米

- 価格動向分析

- 地域的な価格動向

- 地域裁定機会

- 地域的な価格変動

- 市場開拓価格設定

- 価格弾力性と感度分析

- セグメント間の需要弾力性

- 所得弾力性と経済要因

- 競争的な価格動向

- 価格決定力の分布

- メーカーの価格統制

- ディーラーの価格設定の柔軟性

- サプライチェーンの価格圧力

- ポーターの分析

- PESTEL分析

- 将来の市場の進化

- シナリオ計画とトレンド外挿

- 基本シナリオ:着実な電動化と市場の成長(2025年~2034年)

- 加速的変革シナリオ:急速な電動化とデジタル統合(2025年~2030年)

- 保守的な進化シナリオ:段階的な変化と市場の統合(2025年~2034年)

- 技術の軌道への影響

- 電動化技術の進化

- 自動運転・コネクテッドカー技術

- 先端材料と製造技術

- 市場構造の変革

- ビジネスモデルの進化

- 競合情勢の再構築

- 地理的市場開拓

- 消費者行動と人口動態の進化

- 世代交代の影響

- 体験重視の消費

- 持続可能性と環境統合

- カーボンニュートラルへの道筋

- 循環型経済の統合

- 戦略的意味合いと将来のポジショニング

- テクノロジー投資の優先順位

- 市場ポジショニング戦略

- シナリオ計画とトレンド外挿

- テクノロジーとイノベーションの情勢

- 現在の技術パラダイム

- 新興技術による混乱

- イノベーションサイクル分析

- 研究開発投資のパターンと強度

- テクノロジー導入の障壁と促進要因

- イノベーションエコシステムの開発

- 技術の軌道への影響

- 電動化技術の進化

- 接続性とデジタルサービスの進化

- 戦略的イノベーションへの影響

- テクノロジー投資の優先順位

- 競争力のある技術ポジショニング

- 特許分析

- イノベーションのホットスポットと知的財産の集中

- パテントクリフ分析とその影響

- R&D投資パターンと特許の相関関係

- 技術分野の特許分析

- 戦略的特許情報の意味

第4章 競合情勢

- イントロダクション

- 企業の市場シェア分析

- 主要市場企業の競合分析

- 競合ポジショニングマトリックス

- 戦略的展望マトリックス

- 主な発展

- 合併と買収

- パートナーシップとコラボレーション

- 新製品の発売

- 拡張計画と資金調達

第5章 市場推計・予測:車両別、2021年~2034年

- 主要動向

- サイドバイサイド車両

- 全地形対応車

- 重量級バイク

- パーソナルウォータークラフト

- スノーモービル

第6章 市場推計・予測:推進力別、2021年~2034年

- 主要動向

- ガソリン

- ディーゼル

- 電気

第7章 市場推計・予測:用途別、2021年~2034年

- 主要動向

- レクリエーション

- サイドバイサイド車両

- 全地形対応車

- 重量級バイク

- パーソナルウォータークラフト

- スノーモービル

- ユーティリティ

- サイドバイサイド車両

- 全地形対応車

- 重量級バイク

- パーソナルウォータークラフト

- スノーモービル

- 商業用

- サイドバイサイド車両

- 全地形対応車

- 重量級バイク

- パーソナルウォータークラフト

- スノーモービル

- スポーツ

- サイドバイサイド車両

- 全地形対応車

- 重量級バイク

- パーソナルウォータークラフト

- スノーモービル

- サイドバイサイド車両

- 全地形対応車

- 重量級バイク

- パーソナルウォータークラフト

- スノーモービル

- 建設

- サイドバイサイド車両

- 全地形対応車

- 重量級バイク

- パーソナルウォータークラフト

- スノーモービル

- 防衛

- サイドバイサイド車両

- 全地形対応車

- 重量級バイク

- パーソナルウォータークラフト

- スノーモービル

第8章 市場推計・予測:地域別、2021年~2034年

- 主要動向

- 北米

- 米国

- カナダ

- 欧州

- 英国

- ドイツ

- フランス

- イタリア

- スペイン

- ロシア

- 北欧諸国

- アジア太平洋

- 中国

- インド

- 日本

- オーストラリア

- 韓国

- 東南アジア

- ラテンアメリカ

- ブラジル

- メキシコ

- アルゼンチン

- 中東・アフリカ

- 南アフリカ

- サウジアラビア

- アラブ首長国連邦

第9章 企業プロファイル

- グローバルプレーヤー

- Honda Motor Company

- Yamaha Motor Company

- Polaris Industries

- BRP(Bombardier Recreational Products)

- Harley-Davidson

- Kawasaki Heavy Industries

- Suzuki Motor Corporation

- BMW Motorrad

- KTM AG

- 地域プレーヤー

- Arctic Cat

- CFMOTO

- Ducati Motor Holding

- Hisun Motors

- John Deere

- Kubota Corporation

- KYMCO

- Mahindra &Mahindra

- Piaggio Group

- Toro Company

- Triumph Motorcycles

The Global Power Sports Market was valued at USD 59.6 billion in 2024 and is estimated to grow at a CAGR of 6.7% to reach USD 109.2 billion by 2034. This market is witnessing sustained momentum as consumer enthusiasm for recreational and performance-oriented vehicles like motorcycles, personal watercraft, ATVs, and snowmobiles continues to grow. Rising disposable income, expanding outdoor recreational trends, and a broader cultural interest in adventure-based activities are encouraging the adoption of these vehicles. Increasing traction of electric and hybrid power sports models is further supporting growth, driven by global efforts to cut emissions and implement sustainable mobility.

On top of that, bundled service offerings and financing options are becoming a major value driver. The shift toward delivering full-service ownership experiences with support features like maintenance, roadside assistance, and flexible payment models is adding to customer engagement and brand loyalty. In several Asian markets such as India, Japan, and China, continued investment in infrastructure and trade liberalization is creating fresh demand and manufacturing potential. Additionally, enhanced cross-border logistics, supply chain localization, and regulatory incentives are opening new growth channels across emerging and established markets alike.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $59.6 Billion |

| Forecast Value | $109.2 Billion |

| CAGR | 6.7% |

The heavyweight motorcycles segment will grow at a CAGR of 6.9% through 2034. Their appeal stems from their high-performance capabilities, extended ride comfort, and iconic design, making them a preferred option for experienced riders and touring enthusiasts. The popularity of riding communities and brand-centric loyalty continues to strengthen this segment. This category is particularly dominant across North America, Europe, and selected Asia-Pacific countries, further propelled by the adoption of electric variants among premium models.

In 2024, the gasoline-powered vehicles segment held 75% share and is projected to grow at a CAGR of 6.7% during 2034. The segment continues to lead due to its superior power delivery, widespread fueling infrastructure, and performance reliability. Riders opt for gasoline engines across all vehicle categories-including motorcycles, side-by-sides, ATVs, and snowmobiles-especially in regions where access to charging networks remains limited. Their strong acceleration, greater range, and quick refueling advantage make them especially viable for remote, performance-demanding recreational and professional applications.

United States Power Sports Market generated USD 20.8 billion and held 80.5% share in 2024. The country's long-standing culture of outdoor and motorsport activity, coupled with a robust infrastructure for off-road riding and touring, makes it a high-value market. It serves as a central hub for both manufacturing and consumption across a variety of vehicle types. The U.S. also leads in customization, aftermarket enhancements, and usage of power sports vehicles for utility purposes in industries such as defense, forestry, and agriculture.

Key players influencing the Global Power Sports Market include Yamaha, Honda, BMW Motorrad, Suzuki Motor, CFMOTO, Kawasaki, KTM, Harley-Davidson, Polaris, and BRP. Leading companies in the power sports industry are enhancing their competitive edge through innovation in vehicle electrification, expanded global distribution, and diversified product lines. To maintain relevance, brands are accelerating their push into electric models and connected features to align with shifting environmental and consumer preferences. Additionally, many manufacturers are introducing subscription services and bundled packages covering insurance, maintenance, and roadside support to boost customer retention. Expansion into emerging markets through localized production and dealer networks is also a top priority. Strategic investments in R&D, along with branding through motorsports sponsorships and rider communities, are further solidifying their market foothold.

Table of Contents

Chapter 1 Methodology

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Vehicle

- 2.2.3 Propulsion

- 2.2.4 Application

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin analysis

- 3.1.3 Value addition mapping

- 3.1.3.1 Manufacturing value addition and brand premium

- 3.1.3.2 Technology integration and innovation value

- 3.1.3.3 Service and aftermarket value creation

- 3.1.4 Value chain impact factors

- 3.1.4.1 Technology disruption and electrification impact

- 3.1.4.2 Supply chain resilience and geographic diversification

- 3.1.4.3 Regulatory compliance and environmental standards

- 3.1.5 Ecosystem disruptions

- 3.1.5.1 Platform-based business models and digital transformation

- 3.1.5.2 Vertical integration trends and supply chain reconfiguration

- 3.1.5.3 New entrant threats and market evolution

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Demographic transformation and generational shift

- 3.2.1.2 Outdoor recreation participation surge

- 3.2.1.3 Electrification and technology innovation

- 3.2.1.4 Economic and infrastructure development

- 3.2.2 Strategic challenges & industry restraints

- 3.2.2.1 Economic pressures and market volatility

- 3.2.2.2 Regulatory compliance burden

- 3.2.2.3 Trade and tariff pressures

- 3.2.2.4 Market structure and distribution challenges

- 3.2.3 Market opportunity assessment

- 3.2.3.1 Electric vehicle market expansion

- 3.2.3.2 Military and government sector expansion

- 3.2.3.3 International market penetration

- 3.2.3.4 Technology integration and connected services

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.3.1 Application growth potential ranking

- 3.3.1.1 Top-ranked growth applications

- 3.3.2 Product segment growth comparison

- 3.3.3 Market maturity assessment and lifecycle positioning

- 3.3.3.1 Growth stage segments

- 3.3.3.2 Mature stage segments

- 3.3.4 Competitive intensity impact on growth potential

- 3.3.1 Application growth potential ranking

- 3.4 Trade Flow Analysis

- 3.4.1 Top production countries (2023-2024)

- 3.4.1.1 UTVs & ATVs

- 3.4.1.2 Snowmobiles

- 3.4.1.3 Personal Watercraft (PWC)

- 3.4.1.4 Heavyweight motorcycles (>500cc)

- 3.4.2 Top consumption countries (2023-2024)

- 3.4.2.1 UTVs & ATVs

- 3.4.2.2 Snowmobiles

- 3.4.2.3 Personal Watercraft (PWC)

- 3.4.2.4 Heavyweight motorcycles (>500cc)

- 3.4.3 Trade flow analysis

- 3.4.3.1 UTV & ATV trade flows

- 3.4.3.2 Snowmobile trade flows

- 3.4.3.3 PWC trade flows

- 3.4.3.4 Heavyweight motorcycle (>500cc) trade flows

- 3.4.4 Segment-specific tables

- 3.4.1 Top production countries (2023-2024)

- 3.5 Sustainability integration

- 3.5.1 Lifecycle Assessment (LCA) and comparative impacts

- 3.5.1.1 ICE vs. electric power sports

- 3.5.1.2 Manufacturing phase

- 3.5.2 Competitive benchmarking

- 3.5.3 ROI and business case

- 3.5.3.1 Cost savings

- 3.5.3.2 Regulatory risk reduction

- 3.5.4 Barriers and opportunities

- 3.5.4.1 Barriers

- 3.5.4.2 Opportunities

- 3.5.5 Policy, investor, and market drivers

- 3.5.5.1 Policy

- 3.5.5.2 Investor pressure

- 3.5.5.3 Market

- 3.5.6 Best practices and case studies

- 3.5.7 Lifecycle assessment table (ICE vs. Electric)

- 3.5.8 Recommendations

- 3.5.1 Lifecycle Assessment (LCA) and comparative impacts

- 3.6 Best practices, case studies, and ROI

- 3.6.1 Best practices & case studies

- 3.6.1.1 Polaris (UTV/ATV, Snowmobile)

- 3.6.1.2 Yamaha (All segments)

- 3.6.1.3 BRP (Can-Am, Sea-Doo, Ski-Doo)

- 3.6.1.4 Harley-Davidson (Heavyweight MC)

- 3.6.2 ROI & business case

- 3.6.2.1 Electrification

- 3.6.2.2 Waste reduction & circularity

- 3.6.2.3 Regulatory & compliance

- 3.6.2.4 Market & investor value

- 3.6.3 Key barriers & strategic recommendations

- 3.6.1 Best practices & case studies

- 3.7 Cost breakdown analysis

- 3.7.1 UTV

- 3.7.2 ATV (All-Terrain Vehicle)

- 3.7.3 Snowmobile

- 3.7.4 Personal Watercraft (PWC)

- 3.7.5 Heavyweight Motorcycle (>500cc)

- 3.8 Carbon impact assessment (2023-2024)

- 3.8.1 Regulatory compliance

- 3.8.2 Segment-specific achievements & gaps

- 3.8.3 Carbon reduction strategies

- 3.8.4 Actionable recommendations

- 3.9 Regulatory landscape

- 3.9.1 North America

- 3.9.1.1 Environmental protection agency (EPA) emissions standards

- 3.9.1.2 Consumer product safety commission (CPSC) safety standards

- 3.9.1.3 National highway traffic safety administration (NHTSA) motorcycle standards

- 3.9.1.4 U.S. coast guard personal watercraft regulations

- 3.9.2 Europe

- 3.9.2.1 Type approval system under regulation (EU) no 168/2013

- 3.9.2.2 Euro 5 emissions standards

- 3.9.2.3 Safety requirements and advanced systems

- 3.9.2.4 Noise regulations

- 3.9.2.5 Recreational craft directive

- 3.9.3 Asia Pacific

- 3.9.3.1 Regional harmonization efforts

- 3.9.3.2 Market access and compliance requirements

- 3.9.4 Latin America

- 3.9.4.1 Regulatory framework evolution

- 3.9.5 Middle East & Africa

- 3.9.5.1 Regulatory development trends

- 3.9.6 Compliance cost analysis and strategic implications

- 3.9.6.1 Quantitative compliance cost assessment

- 3.9.6.2 Strategic market access implications

- 3.9.1 North America

- 3.10 Price trend analysis

- 3.10.1 Regional price dynamics

- 3.10.2 Regional arbitrage opportunities

- 3.10.2.1 Geographic price variations

- 3.10.2.2 Market development pricing

- 3.10.3 Price elasticity and sensitivity analysis

- 3.10.3.1 Demand elasticity across segments

- 3.10.3.2 Income elasticity and economic factors

- 3.10.3.3 Competitive price dynamics

- 3.10.4 Pricing power distribution

- 3.10.4.1 Manufacturer pricing control

- 3.10.4.2 Dealer pricing flexibility

- 3.10.4.3 Supply chain pricing pressures

- 3.11 Porter's analysis

- 3.12 PESTEL analysis

- 3.13 Future market evolution

- 3.13.1 Scenario planning and trend extrapolation

- 3.13.1.1 Base case scenario: Steady electrification and market growth (2025-2034)

- 3.13.1.2 Accelerated transformation scenario: Rapid electrification and digital integration (2025-2030)

- 3.13.1.3 Conservative evolution scenario: Gradual change and market consolidation (2025-2034)

- 3.13.2 Technology trajectory implications

- 3.13.2.1 Electrification technology evolution

- 3.13.2.2 Autonomous and connected vehicle technologies

- 3.13.2.3 Advanced materials and manufacturing technologies

- 3.13.3 Market structure transformation

- 3.13.3.1 Business model evolution

- 3.13.3.2 Competitive landscape restructuring

- 3.13.3.3 Geographic market development

- 3.13.4 Consumer behavior and demographic evolution

- 3.13.4.1 Generational transition impact

- 3.13.4.2 Experience-oriented consumption

- 3.13.5 Sustainability and environmental integration

- 3.13.5.1 Carbon neutrality pathways

- 3.13.5.2 Circular economy integration

- 3.13.6 Strategic implications and future positioning

- 3.13.6.1 Technology investment priorities

- 3.13.6.2 Market positioning strategies

- 3.13.1 Scenario planning and trend extrapolation

- 3.14 Technology & innovation landscape

- 3.14.1 Current technology paradigms

- 3.14.2 Emerging technology disruptions

- 3.14.3 Innovation cycle analysis

- 3.14.3.1 R&D investment patterns and intensity

- 3.14.3.2 Technology adoption barriers and accelerators

- 3.14.3.3 Innovation ecosystem development

- 3.14.4 Technology trajectory implications

- 3.14.4.1 Electrification technology evolution

- 3.14.4.2 Connectivity and digital service evolution

- 3.14.5 Strategic innovation implications

- 3.14.5.1 Technology investment priorities

- 3.14.5.2 Competitive technology positioning

- 3.15 Patent analysis

- 3.15.1 Innovation hotspots and IP concentration

- 3.15.2 Patent cliff analysis and implications

- 3.15.3 R&D investment patterns and patent correlation

- 3.15.4 Technology area patent analysis

- 3.15.5 Strategic patent intelligence implications

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 Latin America

- 4.2.5 MEA

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategic outlook matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans and funding

Chapter 5 Market Estimates & Forecast, By Vehicle, 2021 - 2034 ($Bn, Units)

- 5.1 Key trends

- 5.2 Side By Side Vehicle

- 5.3 All-Terrain Vehicle

- 5.4 Heavyweight Motorcycle

- 5.5 Personal Watercrafts

- 5.6 Snowmobile

Chapter 6 Market Estimates & Forecast, By Propulsion, 2021 - 2034 ($Bn, Units)

- 6.1 Key trends

- 6.2 Gasoline

- 6.3 Diesel

- 6.4 Electric

Chapter 7 Market Estimates & Forecast, By Application, 2021 - 2034 ($Bn, Units)

- 7.1 Key trends

- 7.2 Recreational

- 7.2.1 Side By Side Vehicle

- 7.2.2 All-Terrain Vehicle

- 7.2.3 Heavyweight Motorcycle

- 7.2.4 Personal Watercrafts

- 7.2.5 Snowmobile

- 7.3 Utility

- 7.3.1 Side By Side Vehicle

- 7.3.2 All-Terrain Vehicle

- 7.3.3 Heavyweight Motorcycle

- 7.3.4 Personal Watercrafts

- 7.3.5 Snowmobile

- 7.4 Commercial

- 7.4.1 Side By Side Vehicle

- 7.4.2 All-Terrain Vehicle

- 7.4.3 Heavyweight Motorcycle

- 7.4.4 Personal Watercrafts

- 7.4.5 Snowmobile

- 7.5 Sports

- 7.5.1 Side By Side Vehicle

- 7.5.2 All-Terrain Vehicle

- 7.5.3 Heavyweight Motorcycle

- 7.5.4 Personal Watercrafts

- 7.6 Snowmobile

- 7.6.1 Side By Side Vehicle

- 7.6.2 All-Terrain Vehicle

- 7.6.3 Heavyweight Motorcycle

- 7.6.4 Personal Watercrafts

- 7.6.5 Snowmobile

- 7.7 Construction

- 7.7.1 Side By Side Vehicle

- 7.7.2 All-Terrain Vehicle

- 7.7.3 Heavyweight Motorcycle

- 7.7.4 Personal Watercrafts

- 7.7.5 Snowmobile

- 7.8 Defense

- 7.8.1 Side By Side Vehicle

- 7.8.2 All-Terrain Vehicle

- 7.8.3 Heavyweight Motorcycle

- 7.8.4 Personal Watercrafts

- 7.8.5 Snowmobile

Chapter 8 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn, Units)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 UK

- 8.3.2 Germany

- 8.3.3 France

- 8.3.4 Italy

- 8.3.5 Spain

- 8.3.6 Russia

- 8.3.7 Nordics

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.4.6 Southeast Asia

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 MEA

- 8.6.1 South Africa

- 8.6.2 Saudi Arabia

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 Global Players

- 9.1.1 Honda Motor Company

- 9.1.2 Yamaha Motor Company

- 9.1.3 Polaris Industries

- 9.1.4 BRP (Bombardier Recreational Products)

- 9.1.5 Harley-Davidson

- 9.1.6 Kawasaki Heavy Industries

- 9.1.7 Suzuki Motor Corporation

- 9.1.8 BMW Motorrad

- 9.1.9 KTM AG

- 9.2 Regional Players

- 9.2.1 Arctic Cat

- 9.2.2 CFMOTO

- 9.2.3 Ducati Motor Holding

- 9.2.4 Hisun Motors

- 9.2.5 John Deere

- 9.2.6 Kubota Corporation

- 9.2.7 KYMCO

- 9.2.8 Mahindra & Mahindra

- 9.2.9 Piaggio Group

- 9.2.10 Toro Company

- 9.2.11 Triumph Motorcycles