|

|

市場調査レポート

商品コード

1808969

低侵襲手術の世界市場:製品別、用途別、エンドユーザー別、地域別 - 2030年までの予測Minimally Invasive Surgery Market by Type (Surgical Device, Imaging System, Electrosurgical Device, Endoscopy Device, Medical Robotics), Application (Urological, Vascular, Oncological), End User (Hospital, Clinic, ASC) Region-Global Forecast to 2030 |

||||||

カスタマイズ可能

|

|||||||

| 低侵襲手術の世界市場:製品別、用途別、エンドユーザー別、地域別 - 2030年までの予測 |

|

出版日: 2025年09月02日

発行: MarketsandMarkets

ページ情報: 英文 390 Pages

納期: 即納可能

|

概要

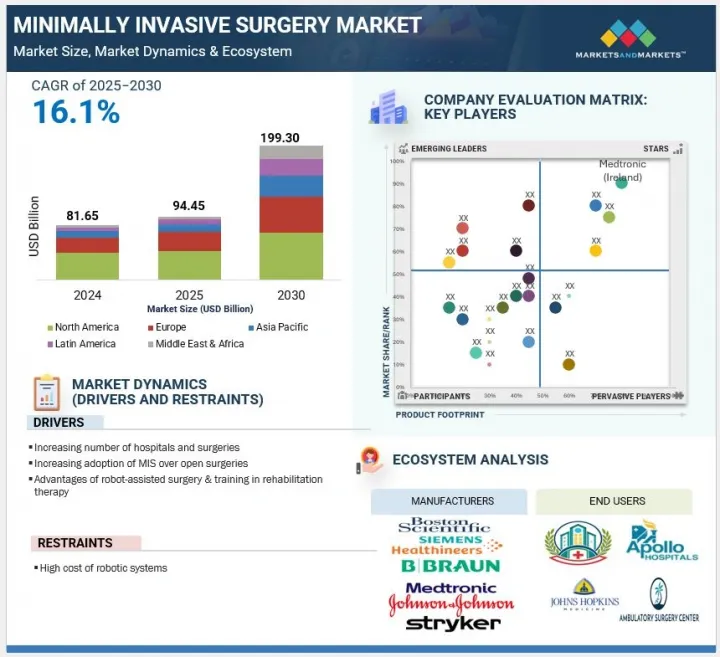

世界の低侵襲手術の市場規模は、予測期間中に16.1%のCAGRで拡大し、2025年の9,445万米ドルから2030年には1億9,930万米ドルに達すると予測されています。

低侵襲手術市場の成長は、頻繁に外科的介入を必要とする消化器疾患、がん、心血管疾患などの慢性疾患の有病率の増加によって促進されています。患者や医療提供者は、回復時間の短縮、合併症の減少、入院期間の短縮など、開腹手術に対する利点から、MISを支持する傾向が強まっています。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2024年~2030年 |

| 基準年 | 2024年 |

| 予測期間 | 2025年~2030年 |

| 検討単位 | 金額(10億米ドル) |

| セグメント | 製品別、用途別、エンドユーザー別、地域別 |

| 対象地域 | 北米、欧州、アジア太平洋、ラテンアメリカ、中東・アフリカ |

さらに、病院数の拡大、ヘルスケアのインフラ整備、入院患者数の増加が、高度な手術オプションの需要を押し上げています。これらの要因は、継続的な技術革新とともに、さまざまな専門分野にわたるMIS手術の世界的な採用を加速させています。

製品別では、世界の低侵襲手術市場は、手術装置、画像&可視化システム、電気手術装置、内視鏡装置、医療用ロボットに区分されます。このうち、2024年には、外科手術用機器部門が最大の市場シェアを占めています。このセグメントはさらに、ハンドヘルド器具、ガイディング器具、インフレーションシステム、腹腔鏡検査機器に分けられます。2024年には、ハンドヘルド器具分野が最も高いシェアを占めましたが、これはその用途の広さ、手頃な価格、さまざまな手術分野での使いやすさによるものです。把持器、リトラクタ、拡張器、鉗子、縫合器などのこれらの機械的器具は、腹腔鏡手術、心臓胸部手術、泌尿器科手術、神経外科手術、心臓血管外科手術に不可欠です。汎用性が高く、標準的なMISシステムとの互換性があるため、先進的な医療環境でも、資源が限られているヘルスケア環境でも不可欠です。これらの手術器具は、人間工学に基づいたデザイン、触覚フィードバック、正確なコントロールが外科医に支持されています。さらに、再利用が可能でメンテナンスコストが低いため、病院での調達効率が向上します。特に一般手術や特殊手術におけるMIS手術の世界的な増加は、引き続き需要を押し上げ、この分野の市場リーダーを維持しています。

用途別では、低侵襲手術市場は、心臓外科、血管外科、神経外科、耳鼻咽喉科・呼吸器外科、美容外科、消化器外科・腹部外科、婦人科外科、泌尿器科外科、整形外科、腫瘍外科、歯科外科、その他の用途に区分されます。2024年現在、心臓・胸部外科分野は、世界的な心血管疾患の高負担に牽引され、2番目に高い市場シェアを占めています。CDCによると、心臓病は依然として米国の主要な死因であり、2023年の死亡者数は91万9,032人で、これは死亡者の3人に1人、34秒に1人の割合に相当します。この憂慮すべき有病率は、効果的で侵襲の少ない外科的選択肢に対する需要を高めています。低侵襲の心臓胸部手術は、外傷の減少、入院期間の短縮、回復の早さといった顕著な利点をもたらし、患者とヘルスケア提供者の両方から支持されています。ロボット支援システムや低侵襲弁置換術のような技術革新がさらに採用を後押しし、MIS市場全体におけるこのセグメントの重要な役割が強化されています。

世界の低侵襲手術市場は、北米、欧州、アジア太平洋、ラテンアメリカ、中東・アフリカの5つの主要地域に区分されます。このうち、北米地域は、慢性疾患の有病率の高さ、美容整形手術の需要の増加、大手医療機器メーカーの存在などを背景に、2024年の低侵襲手術市場で最大のシェアを占めています。CDCによると、2024年時点で1億2,900万人の米国人が少なくとも1つの慢性疾患を抱えており、10人に6人が少なくとも1つ、10人に4人が2つ以上の慢性疾患を抱えています。このような疾病負担の増大は、より侵襲の少ない、より効果的な外科的選択肢に対する需要を高めます。さらに、美容目的の低侵襲手術は力強い成長を遂げており、2024年には980万件以上の神経調節剤注射(4%増)と370万件以上の皮膚表面置換術(6%増)が実施され、患者の嗜好が高まっていることを示しています。この地域はまた、高度なヘルスケア・インフラ、有利な償還政策、革新的技術の広範な採用からも恩恵を受けています。さらに、Johnson & Johnson、Stryker、Boston Scientific、Abbott、Intuitive Surgicalといった業界大手企業が存在するため、製品の革新と供給が継続的に行われ、世界のMIS市場における北米のリーダーシップは揺るぎないものとなっています。

当レポートでは、世界の低侵襲手術市場について調査し、製品別、用途別、エンドユーザー別、地域別動向、および市場に参入する企業のプロファイルなどをまとめています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- 市場力学

- 技術分析

- 業界動向

- バリューチェーン分析

- エコシステム分析

- サプライチェーン分析

- 貿易分析

- ポーターのファイブフォース分析

- 主要な利害関係者と購入基準

- 規制分析

- 特許分析

- 価格分析

- 2025年~2026年の主な会議とイベント

- 隣接市場分析

- アンメットニーズ/エンドユーザーの期待

- 顧客のビジネスに影響を与える動向/混乱

- 投資と資金調達のシナリオ

- AI/生成AIが低侵襲手術市場に与える影響

- 2025年の米国関税が低侵襲手術市場に与える影響

第6章 低侵襲手術市場(製品別)

- イントロダクション

- 外科用機器

- イメージングおよび可視化システム

- 電気外科装置

- 内視鏡装置

- 医療ロボット

第7章 低侵襲手術市場(用途別)

- イントロダクション

- 消化器・腹部外科

- 心臓胸部外科

- 整形外科

- 血管外科

- 婦人科手術

- 腫瘍外科

- 神経外科

- 泌尿器科手術

- 耳鼻咽喉科・呼吸器外科

- 美容整形

- 歯科手術

- その他

第8章 低侵襲手術市場(エンドユーザー別)

- イントロダクション

- 病院

- 外来手術センター

- クリニック

- 救急・外傷センター

- その他

第9章 低侵襲手術市場(地域別)

- イントロダクション

- 北米

- 北米のマクロ経済見通し

- 米国

- カナダ

- 欧州

- 欧州のマクロ経済見通し

- ドイツ

- 英国

- フランス

- イタリア

- スペイン

- その他

- アジア太平洋

- アジア太平洋のマクロ経済見通し

- 中国

- インド

- 日本

- 韓国

- オーストラリア

- その他

- ラテンアメリカ

- ラテンアメリカのマクロ経済見通し

- ブラジル

- メキシコ

- その他

- 中東・アフリカ

- 中東・アフリカのマクロ経済見通し

- GCC諸国

- その他

第10章 競合情勢

- イントロダクション

- 主要参入企業の戦略/強み

- 収益分析、2020年~2024年

- 市場シェア分析、2024年

- 企業評価マトリックス:主要参入企業、2024年

- 企業評価マトリックス:スタートアップ/中小企業、2024年

- 企業評価と財務指標

- ブランド/製品比較

- 競合シナリオ

第11章 企業プロファイル

- 主要参入企業

- MEDTRONIC

- JOHNSON & JOHNSON

- STRYKER

- BOSTON SCIENTIFIC CORPORATION

- ABBOTT

- ZIMMER BIOMET

- B. BRAUN SE

- GLOBUS MEDICAL

- INTEGRA LIFESCIENCES CORPORATION

- SIEMENS HEALTHINEERS AG

- FUJIFILM CORPORATION

- KONINKLIJKE PHILIPS N.V.

- INTUITIVE SURGICAL OPERATIONS, INC.

- KARL STORZ SE & CO. KG

- GE HEALTHCARE

- その他の企業

- NIPRO

- SMITH+NEPHEW

- GETINGE

- CONMED CORPORATION

- TELEFLEX INCORPORATED

- OLYMPUS CORPORATION

- COOPERSURGICAL, INC.

- APPLIED MEDICAL RESOURCES CORPORATION

- OTU MEDICAL

- ATMOS MEDIZINTECHNIK GMBH & CO. KG