|

|

市場調査レポート

商品コード

1400911

軍用GPS受信機の世界市場:市場規模・シェア・動向・予測、競合分析、成長機会 (2023年~2028年)Military GPS Receivers Market Size, Share, Trend, Forecast, Competitive Analysis, and Growth Opportunity: 2023-2028 |

||||||

|

|||||||

| 軍用GPS受信機の世界市場:市場規模・シェア・動向・予測、競合分析、成長機会 (2023年~2028年) |

|

出版日: 2023年10月20日

発行: Stratview Research

ページ情報: 英文 131 Pages

納期: 即日から翌営業日

|

- 全表示

- 概要

- 目次

世界の軍用GPS受信機市場は、予測期間中に7.8%の堅牢なCAGRで成長し、2028年には9億米ドルの規模に達すると推定されています。

軍用GPS受信機の使用は世界中で拡大しており、いくつかの軍事ミッションや軍事作戦はリアルタイムのデータ伝送に大きく依存しているため、業界全体の成長を増大させています。これらのGPS対応デバイスは、正確な標的追跡とルートナビゲーションを提供するだけでなく、正確なデジタルマッピングソリューションを提供しています。武装した部隊やユニットの正確な追跡とターゲティングを可能にし、軍にとって不可欠なコンポーネントとなっています。その結果、これらのGPSデバイスの調達は、軍の能力を倍増させるとして、近年勢いを増しています。

さらに、国境紛争やテロリストの脅威の世界の上昇のために、多くの国が自国の軍事力の能力を向上させることに焦点を当てており、これは近年、軍用GPS受信機の全体的な展開の大幅な増加をもたらしました。

当レポートでは、世界の軍用GPS受信機の市場について分析し、市場の基本構造や主な促進・抑制要因、全体的な市場規模の動向見通し、セグメント別・地域別の詳細動向、競合情勢、主要企業のプロファイルなどを調査しております。

目次

第1章 エグゼクティブサマリー:市場の鳥瞰図

第2章 市場環境分析:市場力学に影響を与える要因の検討

- サプライチェーン分析 (バリューチェーン全体の主要企業/材料の特定)

- PEST分析 (市場需要に直接的・間接的に影響を与える全ての要因の一覧)

- 業界のライフサイクル分析 (市場の現在・将来のライフサイクル段階)

- 市場促進要因 (促進要因とその短期的・長期的な影響の分析)

- 市場の課題 (普及・成長を阻害する要因の調査)

第3章 軍用GPS受信機市場の分析 (単位:100万米ドル、2017年~2028年)

- 軍用GPS受信機:軍用GNSS受信機市場全体における比率

- 軍用GPS受信機市場の動向と予測 (単位:100米ドル)

- 市場シナリオ分析:さまざまな市場環境における成長軌道

- COVID-19の影響評価と予想される回復曲線

第4章 軍用GPS受信機市場:セグメント別分析 (単位:100万米ドル、2017年~2028年)

- 製品種類別の分析

- P (Y) コードGPS受信機:地域別の傾向と予測 (単位:100万米ドル)

- MコードGPS受信機:地域の傾向と予測 (単位:100万米ドル)

- 周波数の種類別の分析

- 単一周波数GPS受信機:地域別の傾向と予測 (単位:100万米ドル)

- 二重周波数GPS受信機:地域別の傾向と予測 (単位:100万米ドル)

- 用途の種類別の分析

- 航空ベースGPS受信機:地域別の傾向と予測 (単位:100万米ドル)

- 地上設置型GPS受信機:地域別の傾向と予測 (単位:100万米ドル)

- PGMベースGPS受信機:地域別の傾向と予測 (単位:100万米ドル)

- ハンドヘルドGPS受信機:地域別の傾向と予測 (単位:100万米ドル)

- 海洋設備ベースGPS受信機:地域別の傾向と予測 (単位:100万米ドル)

- 地域別分析

- 北米の軍用GPS受信機市場:国別分析

- 欧州の軍用GPS受信機市場:国別分析

- アジア太平洋の軍用GPS受信機市場:国別分析

- その他の地域 (ROW) の軍用GPS受信機市場:国別分析

第5章 競合分析

- 競合の程度 (市場再編に基づく競合の現段階)

- 競合情勢 (重要指標に基づく主要企業のベンチマーク)

- 市場シェア分析 (主要企業、各社のシェア)

- 製品ポートフォリオのマッピング (各種市場カテゴリにおける製品存在のマッピング)

- 各地への展開状況 (マッピング)

- 製品開発の主要なターゲット領域 (変動中の業界の焦点を理解する)

- 企業合併・買収 (M&A)・合弁事業 (JV)・事業協力・戦略的提携ほか (すべての主要M&A・JVのマッピング)

- ポーターのファイブフォース分析 (競合情勢全体の鳥瞰図)

第6章 戦略的成長機会

- 市場の求心力の分析

- 市場の求心力:製品種類別

- 市場の求心力:周波数別

- 市場の求心力:用途の種類別

- 市場の求心力:地域別

- 市場の求心力:国別

- 新たな動向 (将来の市場力学を形成する可能性のある主要な動向)

- 重要な戦略的影響 (変化する市場力学とその重要な影響)

- 主要成功要因 (KSF) (企業の事業獲得に役立つ可能性のあるいくつかの要因の特定)

第7章 主要企業のプロファイル (アルファベット順)

- BAE Systems

- General Dynamics Corporation

- Hertz Systems

- Israel Aerospace Industries

- Juniper Systems Inc.

- L3Harris Technologies, Inc.

- Mayflower Communications

- Raytheon Technologies

- Thales Group

- Trimble, Inc.

第8章 付録

The Military GPS Receivers Market is estimated to grow at a robust CAGR of 7.8% during the forecast period to reach a value of US$ 0.9 Billion in 2028.

What are Military GPS Receivers?

Military GPS receivers are specialized navigation devices designed for military applications. They are equipped with features and capabilities tailored to meet the unique requirements and challenges of military operations. GPS receivers possess a set of specialized properties that distinguish them from commercial GPS receivers, such as enhanced security, anti-jamming capability, selective availability anti-spoofing module (SAASM), high precision, anti-spoofing, and anti-jamming antennas.

The usage of military GPS receivers is expanding around the world as several military missions and operations rely heavily on the transmission of real-time data, thereby, augmenting the growth of the overall industry. These GPS-enabled devices not only provide accurate target tracking and route navigation but also offer precise digital mapping solutions. They have become an indispensable component of military forces, enabling precise tracking and targeting for armed troops and units. As a result, the procurement of these GPS devices has been gaining momentum in recent years as they multiply the capabilities of military forces.

Furthermore, due to the global rise in border disputes and terrorist threats, many countries are focusing on improving the capabilities of their military forces, which has resulted in a significant increase in the overall deployment of military GPS receivers in recent years.

Segment Analysis

By Product Type

The military GPS receiver market is segmented into P(Y) Code GPS receivers and M-Code GPS receivers. Ever since the commencement of the sales of M-Code GPS receivers, their sales have been increasing exponentially, eroding the market share of the traditionally used P (Y) Code receivers. These advanced devices are designed to enhance the PNT capabilities of armed units and provide improved resistance to existing and emerging threats to GPS such as jamming and spoofing. Therefore, it is estimated that the M-Code GPS receivers will completely replace the P(Y) Code receivers in the coming decade.

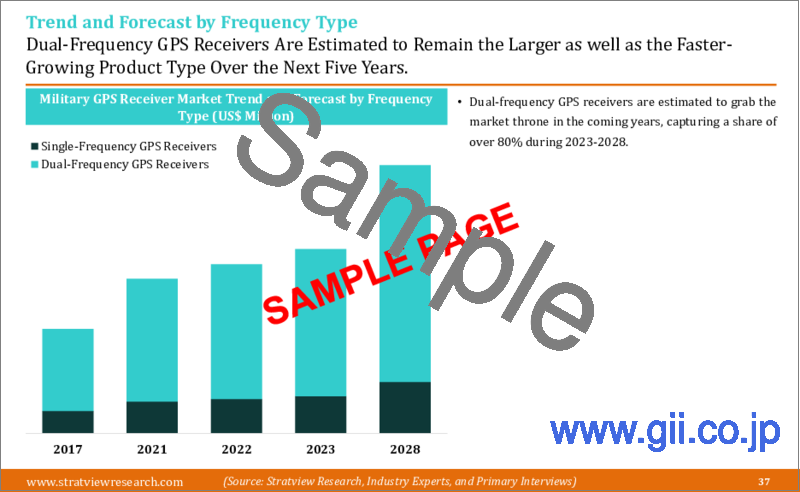

By Frequency Type

The market is segmented into single-frequency GPS receivers and dual-frequency GPS receivers. Dual-frequency GPS receivers are widely used over their single-frequency counterparts due to their greater accuracy and greater resistance to multipath errors, which are fairly common for the latter. Furthermore, if any one of the two frequencies fails, the other one works as a backup, thus ensuring uninterrupted signal transmission.

By Application Type

The military GPS receiver market is segmented into aviation-based GPS receivers, ground-based GPS receivers, PGM-based GPS receivers, handheld GPS receivers, and maritime equipment-based GPS receivers. Among these application types, the PGM-based application is estimated to remain the supreme market leader for military GPS receivers in the coming years, as these GPS systems form an essential component in the PGMs (such as missiles, bombs, and projectiles). Moreover, with the increasing hostilities across the globe, the demand for PGMs has been increasing manifold, thereby, fueling the market growth.

Regional Analysis

In terms of regions, North America is likely to remain the largest market for military GPS receivers over the forecast period, with the USA accounting for the majority of the market. The country has been extensively investing in military GPS receivers to enhance the overall capabilities of its armed forces. Furthermore, market-leading companies, such as BAE Systems, L3Harris Technologies, Inc., and Raytheon Corporation, are present in the region, giving North America an unrivaled advantage over other regions.

Key Players

In recent years, there has been competition in the military GPS receiver market. Moreover, there is a high consolidation in the market with the top companies capturing a mammoth market share. The growth of companies in this market is widely influenced by their financial position, technological expertise, and government support. Most of the players engage in the provision of both P(Y) Code and M-Code GPS receivers. Some of the companies also manufacture ASIC chips for their GPS receiver cards and some of them also supply them to their customers as well. Some major M&A activities within the market space in recent years (such as the purchase of the GPS receiver business unit of Collins Aerospace by BAE Systems, the merger of United Technologies and Raytheon, and the all-stock merger of L3 Technologies and Harris Corporation) have resulted in some significant changes in the competitive landscape. The following are the major players in the military GPS receivers market:

- BAE Systems

- Raytheon Technologies Corporation

- Trimble Inc.

- L3Harris Technologies, Inc.

- General Dynamics Corporation

- Thales Group

- Israel Aerospace Industries

- Mayflower Communications

- Hertz Systems

- Juniper Systems, Inc.

- Recent Product Developments

In recent years, a fair number of new GPS receivers have been launched by manufacturers. Some of them have been mentioned below:

- In June 2023, BAE Systems unveiled NavGuide, a next-generation assured-positioning, navigation, and timing (A-PNT) device featuring M-Code GPS technology.

- In August 2021, BAE Systems unveiled its ultra-small MicroGRAM-M GPS receiver, which is compatible with M-Code signals that are resistant to both jamming and spoofing. These GPS receivers have been developed for the armed troops and for integration in small UAVs.

- In September 2021, Collins Aerospace unveiled the MUNS GPS receiver, a military underwater navigation system that provides the diver with precise position and includes secure anti-jamming capabilities during deep sea missions.

Recent Contracts: There have been several investments in the defense industry directed at GPS receivers in recent years, which would boost the overall market. Some of them have been mentioned below:

- In September 2023, BAE Systems signed a five-year contract worth US$ 319 Million with the Defense Information Systems Agency (DISA), for the development of Miniature PLGR Engine-M-code (MPE-M) receiver cards.

- In May 2021, BAE Systems signed a contract worth US$ 325.5 million, with the US Defense Logistics Agency, for the supply of the advanced M-Code GPS receiver devices to the US Army and its allies.

- In November 2020, the US Space and Missile Systems Center awarded a contract worth US$ 552 Million to BAE Systems, L3Harris Technologies, Inc., and Raytheon Technologies Corporation, for the development of the next-generation M-Code GPS receivers.

Recent Market JVs and Acquisitions: Over the past few years, there have been a fair number of strategic alliances, including M&As, JVs, etc., across the globe. Some of them have been mentioned below:

- In July 2020, BAE Systems acquired the GPS business unit from Collins Aerospace, to become the undisputed market leader.

- In July 2020, Raytheon Corporation merged with United Technologies Corporation, to form Raytheon Technologies Corporation. This merger of equals is the defense sector's largest-ever merger, in terms of value.

- In June 2019, L3 Technologies had an all-stock merger with Harris Corporation, which led to the formation of L3Harris Technologies, Inc.

- Research Methodology

- This strategic assessment report from Stratview Research provides a comprehensive analysis that reflects today's military GPS receivers market realities and future market possibilities for the forecast period. The report segments and analyzes the market in the most detailed manner to provide a panoramic view of the market. The vital data/information provided in the report can play a crucial role for market participants as well as investors in the identification of the low-hanging fruits available in the market as well as to formulate the growth strategies to expedite their growth process.

- This report offers high-quality insights and is the outcome of a detailed research methodology comprising extensive secondary research, rigorous primary interviews with industry stakeholders, and validation and triangulation with Stratview Research's internal database and statistical tools. More than 1,000 authenticated secondary sources, such as company annual reports, fact books, press releases, journals, investor presentations, white papers, patents, and articles, have been leveraged to gather the data. We conducted more than 15 detailed primary interviews with market players across the value chain in all four regions and industry experts to obtain both qualitative and quantitative insights.

Table of Contents

- Report Scope

- Report Objectives

- Research Methodology

- Market Segmentation

- Secondary Research

- Key Information Gathered from Secondary Research

- Primary Research

- Key Information Gathered from Primary Research

- Breakdown of Primary Interviews by Region, Designation, and Value Chain Node

- Data Analysis and Triangulation

1. Executive Summary: A Bird's Eye View of the Market

2. Market Environment Analysis: Study of Factors Affecting the Market Dynamics

- 2.1. Supply Chain Analysis (Identification of Key Players/Materials across the Value Chain)

- 2.2. PEST Analysis (List of All Factors Directly or Indirectly Affecting the Market Demand)

- 2.3. Industry Life Cycle Analysis (Current and Future Lifecycle Stage of the Market)

- 2.4. Market Drivers (Study of Drivers and their Short- and Long-Term Impacts)

- 2.5. Market Challenges (Study of Factors Hindrance the Adoption/Growth)

3. Military GPS Receiver Market Assessment (2017-2028) (US$ Million)

- 3.1. Contribution of Military GPS Receivers in the Total Military GNSS Receivers Market

- 3.2. Military GPS Receiver Market Trend and Forecast (US$ Million)

- 3.3. Market Scenario Analysis: Growth Trajectories in Different Market Conditions

- 3.4. COVID-19 Impact Assessment and Expected Recovery Curve

4. Military GPS Receiver Market Segments' Analysis (2017-2028) (US$ Million)

- 4.1. Product-Type Analysis

- 4.1.1. P(Y) Code GPS Receivers: Regional Trend and Forecast (US$ Million)

- 4.1.2. M-Code GPS Receivers: Regional Trend and Forecast (US$ Million)

- 4.2. Frequency-Type Analysis

- 4.2.1. Single-Frequency GPS Receivers: Regional Trend and Forecast (US$ Million)

- 4.2.2. Dual-Frequency GPS Receivers: Regional Trend and Forecast (US$ Million)

- 4.3. Application-Type Analysis

- 4.3.1. Aviation-based GPS Receivers: Regional Trend and Forecast (US$ Million)

- 4.3.2. Ground-based GPS Receivers: Regional Trend and Forecast (US$ Million)

- 4.3.3. PGM-based GPS Receivers: Regional Trend and Forecast (US$ Million)

- 4.3.4. Handheld GPS Receivers: Regional Trend and Forecast (US$ Million)

- 4.3.5. Maritime Equipment-based GPS Receivers: Regional Trend and Forecast (US$ Million)

- 4.3.5.1. Surface Water-based GPS Receivers: Trend and Forecast (US$ Million)

- 4.3.5.2. Underwater-based GPS Receivers: Trend and Forecast (US$ Million)

- 4.4. Regional Analysis

- 4.4.1. North American Military GPS Receiver Market: Country Analysis

- 4.4.1.1. The USA's Military GPS Receiver Market T&F (US$ Million)

- 4.4.1.2. Rest of the North American Military GPS Receiver Market T&F (US$ Million)

- 4.4.2. European Military GPS Receiver Market: Country Analysis

- 4.4.2.1. German Military GPS Receiver Market T&F (US$ Million)

- 4.4.2.2. The UK's Military GPS Receiver Market T&F (US$ Million)

- 4.4.2.3. French Military GPS Receiver Market T&F (US$ Million)

- 4.4.2.4. Russian Military GPS Receiver Market T&F (US$ Million)

- 4.4.2.5. Rest of the European Military GPS Receiver Market T&F (US$ Million)

- 4.4.3. Asia-Pacific's Military GPS Receiver Market: Country Analysis

- 4.4.3.1. Chinese Military GPS Receiver Market T&F (US$ Million)

- 4.4.3.2. Japanese Military GPS Receiver Market T&F (US$ Million)

- 4.4.3.3. Indian Military GPS Receiver Market T&F (US$ Million)

- 4.4.3.4. Rest of the Asia-Pacific's Military GPS Receiver Market T&F (US$ Million)

- 4.4.4. Rest of the World's (RoW) Military GPS Receiver Market: Country Analysis

- 4.4.1. North American Military GPS Receiver Market: Country Analysis

5. Competitive Analysis

- 5.1. Degree of Competition (Current Stage of Competition based on Market Consolidation)

- 5.2. Competitive Landscape (Benchmarking of Key Players in Crucial Parameters)

- 5.3. Market Share Analysis (Key Players and their Respective Shares)

- 5.4. Product Portfolio Mapping (Map their Presence in Different Market Categories)

- 5.5. Geographical Presence (Map their Geographical Presence)

- 5.6. Key Target Areas for Product Development (Understand the Industry Focus while Development)

- 5.7. M&As, JVs, Collaborations, Strategic Alliances, etc. (Map All the Major M&As and JVs)

- 5.8. Porter's Five Forces Analysis (A Bird's Eye View of the Overall Competitive Landscape)

6. Strategic Growth Opportunities

- 6.1. Market Attractiveness Analysis

- 6.1.1. Market Attractiveness by Product Type

- 6.1.2. Market Attractiveness by Frequency Type

- 6.1.3. Market Attractiveness by Application Type

- 6.1.4. Market Attractiveness by Region

- 6.1.5. Market Attractiveness by Country

- 6.2. Emerging Trends (Key Trends that May Shape the Market Dynamics in the Future)

- 6.3. Key Strategic Implications (Changing Market Dynamics and their Key Implications)

- 6.4. Key Success Factors (KSFs) (Identifying Some Factors that May Help Companies to Gain Business)

7. Company Profile of Key Players (Alphabetically Arranged)

- 7.1. BAE Systems

- 7.2. General Dynamics Corporation

- 7.3. Hertz Systems

- 7.4. Israel Aerospace Industries

- 7.5. Juniper Systems Inc.

- 7.6. L3Harris Technologies, Inc.

- 7.7. Mayflower Communications

- 7.8. Raytheon Technologies

- 7.9. Thales Group

- 7.10. Trimble, Inc.

8. Appendix

- 8.1. Disclaimer

- 8.2. Copyright

- 8.3. Abbreviation

- 8.4. Currency Exchange

- 8.5. Market Numbers