|

|

市場調査レポート

商品コード

1617516

日本のカードと決済:2028年までの機会とリスクJapan Cards and Payments: Opportunities and Risks to 2028 |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| 日本のカードと決済:2028年までの機会とリスク |

|

出版日: 2024年11月29日

発行: GlobalData

ページ情報: 英文 80 Pages

納期: 即納可能

|

- 全表示

- 概要

- 図表

- 目次

日本の決済会社は、非接触型決済の認知度向上に努めています。Visaはプロモーションキャンペーンを実施し、その一環として、Visaカード保有者は、「かつや」、「からやま」、「すき家」、「なか卯」、「マクドナルド」、「モスバーガー」などの対象加盟店でVisaタッチ決済を利用すると、30%または最大3万円(214.12ドル)のキャッシュバックを受けることができます。キャンペーン期間は6月20日から2024年8月16日まで。このインセンティブは、非接触型決済の利便性と安全性を顧客に受け入れてもらうことを目的としています。

請求書支払いのためのモバイルウォレットの利用が増加していることは、モバイル決済の成長を支えるとみられています。モバイルウォレットは、アプリ経由での請求書支払いオプションも提供しています。例えば、PayPayは請求書による決済ソリューションを使って公共料金の支払いができます。支払いを行うには、各請求書の払込票に記載されているQRコードをスキャンし、PayPayの残高を使って支払う必要があります。同様に、ゆうちょ銀行は請求書払いソリューション「ゆうちょペイ」を提供しており、消費者は請求書のQRコードをスキャンするだけで公共料金を支払うことができます。

デジタル専用銀行の普及は銀行業界の競争を促進し、デビットカードの保有を後押ししています。2023年6月、デジタル専用銀行ハビットが開業しました。モバイル専用の普通預金口座とVisaデビットカードを提供しています。一方、デジタル専用銀行のみんな銀行は、ウェブサイトやモバイル・バンキングアプリから数分で銀行口座を開設できます。また、バーチャルデビットカードも発行されます。2024年3月現在、同行の顧客数は960,000人です。

当レポートは、日本のカードと決済について調査し、業界の市場動向を詳細に分析しています。レビュー期間(2020年~2024年)における現金、カード、信用送金、小切手など、業界の主要業績指標の数値と数量を掲載し、2028年までの機会とリスクについてまとめています。

目次

第1章 エグゼクティブサマリー

第2章 市場概要

第3章 決済手段

第4章 カード決済

第5章 電子商取引の支払い

第6章 店舗内での支払い

第7章 後払い決済

第8章 モバイル決済

第9章 P2P決済

第10章 請求書の支払い

第11章 代替支払い

第12章 決済イノベーション

第13章 職務分析

第14章 決済インフラと規制

第15章 付録

List of Tables

- Key facts, 2024

- Benchmarking of payment cards, 2024

- Payment instrument transaction values (LCU), 2020-28f

- Payment instrument transaction values ($), 2020-28f

- Payment instrument transaction volumes (units), 2020-28f

- Payment cards in circulation by type (units), 2020-28f

- Volume of payment card transactions (units), 2020-28f

- Value of payment card transactions (LCU), 2020-28f

- Value of payment card transactions ($), 2020-28f

- Debit cards in circulation (units), 2020-28f

- Debit card transaction volumes, 2020-28f

- Debit card transaction values (LCU), 2020-28f

- Debit card transaction values ($), 2020-28f

- Debit cards in circulation by scheme (units), 2020-24e

- Debit card transaction values by scheme (LCU), 2020-24e

- Debit card transaction values by scheme ($), 2020-24e

- Debit cards in circulation by issuer (units), 2020-24e

- Debit cards transaction value by issuer (LCU), 2020-24e

- Debit cards transaction value by issuer ($), 2020-24e

- Credit cards in circulation (units), 2020-28f

- Credit card transaction volumes, 2020-28f

- Credit card transaction values (LCU), 2020-28f

- Credit card transaction values ($), 2020-28f

- Credit cards in circulation by scheme (units), 2020-24e

- Credit card transaction values by scheme (LCU), 2020-24e

- Credit card transaction values by scheme ($), 2020-24e

- Credit cards in circulation by issuer (units), 2020-24e

- Credit cards transaction value by issuer (LCU), 2020-24e

- Credit cards transaction value by issuer ($), 2020-24e

List of Figures

- Inflation rate

- GDP growth rate

- Payment instruments transaction value and volume

- Instant payments transaction value and volume

- Card penetration

- Card payments by value

- Debit card frequency of payments and average transaction value

- Debit card schemes transaction value and volume

- Debit card issuers by number of cards and transaction value

- Credit card frequency of payments and average transaction value

- Credit card schemes transaction value and volume

- Credit card issuers by number of cards and transaction value

- Credit card debt

- Prepaid Cards: Market Sizing and Forecasting

- Contactless card holding and usage in detail

- E-commerce transaction value and ecommerce breakdown by mobile vs. desktop/laptop

- Ecommerce market by product and services

- Ecommerce market by paymnet tools

- Factors driving in-store payments and In-store transaction value by payment method

- In-store transaction value by products and services

- BNPL service used in the last six months and Preferred BNPL brand/tool for in-store payments

- BNPL online transaction value and transaction volume

- BNPL share of overall ecommerce transaction value and preferred BNPL brand/tool for online payments

- Mobile wallet holding and use by demographic

- Mobile wallet funding methods, mobile wallet preference by product/service and mobile wallet ownership by brand

- Domestic and international P2P money transfers

- Paymnet tool preference for bill payment and bill paymnet frequency

- Active jobs intensity in the country

- Number of POS terminals and ATMs

GlobalData's 'Japan Cards and Payments: Opportunities and Risks to 2028' report provides detailed analysis of market trends in the Japanese cards and payments industry. It provides values and volumes for a number of key performance indicators in the industry, including cash, card, credit transfer, and cheques during the review-period (2020-24e).

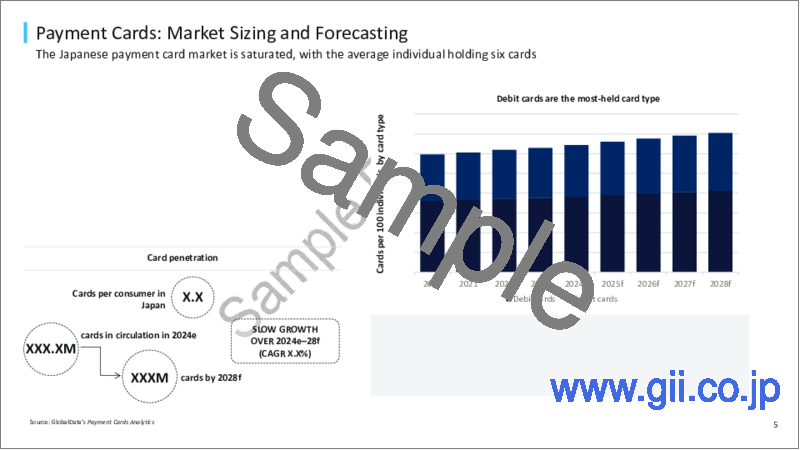

The report also analyzes various payment card markets operating in the industry and provides detailed information on the number of cards in circulation, transaction values and volumes during the review-period and over the forecast-period (2024e-28f). It also offers information on the country's competitive landscape, including market shares of issuers and schemes.

The report brings together GlobalData's research, modeling, and analysis expertise to allow banks and card issuers to identify segment dynamics and competitive advantages. The report also covers detailed regulatory policies and recent changes in regulatory structure.

GlobalData's 'Japan Cards and Payments: Opportunities and Risks to 2028' report provides top-level market analysis, information and insights into the Japanese cards and payments industry, including -

- Current and forecast values for each market in the Japanese cards and payments industry, including debit, credit and charge cards.

- Detailed insights into payment instruments including cash, card, credit transfer, and cheques. It also, includes an overview of the country's key alternative payment instruments.

- Ecommerce market analysis.

- Analysis of various market drivers and regulations governing the Japanese cards and payments industry.

- Detailed analysis of strategies adopted by banks and other institutions to market debit, and credit cards.

- Comprehensive analysis of consumer attitudes and buying preferences for cards.

- The competitive landscape of the Japanese cards and payments industry.

Key Highlights

- Payment companies in Japan are making efforts to increase awareness of contactless payments. Visa ran a promotional campaign and as part of it, Visa card holders receive a 30% or a maximum of JPY30,000 ($214.12) cashback when making payments using Visa touch payment at participating merchants, such as Katsuya, Karayama, Sukiya, Nakau, McDonald's, and Mos Burger. The campaign ran from June 20 to August 16, 2024. This incentive aims to incentivize customers to embrace the convenience and security of contactless payments.

- The increasing use of mobile wallets for bill payment will support mobile payment growth. Mobile wallets also offer a bill payment option via its app. For example, PayPay allow its users to make a utility bill payment using its pay by invoice solution. To make a payment, users need to scan the QR code on the payment slip for each bill and pay using PayPay balance. Similarly, Japan Post Bank offers the bill payment solution Yucho Pay; allowing consumers to pay their utility bill by simply scanning the QR code on the invoice.

- The proliferation of digital-only banks has helped drive competition in banking; boosting debit card holding. In June 2023, the digital-only bank Habitto went live. It offers a mobile-only savings account, along with Visa debit cards. Meanwhile, the digital-only bank Minna Bank is enabling its customers to open a bank account via its website or mobile banking app within a few minutes. They also receive a virtual debit card. As of March 2024, the bank had a customer base of 960,000.

Scope

- Card market size in terms of number of cards, value and volume of transactions in Japan along with detailed card segmentation of debit, and credit cards available in the country.

- Market sizing and analysis of major payment instruments including cash, card, credit transfer, and cheques .

- Payment market trends and growth for both historical and forecast period

- Competitor analysis with detailed insights into leading card issuers and schemes.

- Comprehensive analysis of consumer attitudes and buying preferences for cards.

- A detailed snapshot of country's key alternative payment brands.

Reasons to Buy

- Make strategic business decisions, using top-level historic and forecast market data, related to the Japanese cards and payments industry and each market within it.

- Understand the key market trends and growth opportunities in the Japanese cards and payments industry.

- Assess the competitive dynamics in the Japanese cards and payments industry.

- Gain insights into marketing strategies used for various card types in Japan.

- Gain insights into key regulations governing the Japanese cards and payments industry.