|

|

市場調査レポート

商品コード

1446823

リチウムイオン電池の世界市場 2024-2031Global Lithium-Ion Battery Market - 2024-2031 |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| リチウムイオン電池の世界市場 2024-2031 |

|

出版日: 2024年02月13日

発行: DataM Intelligence

ページ情報: 英文 207 Pages

納期: 即日から翌営業日

|

- 全表示

- 概要

- 目次

概要

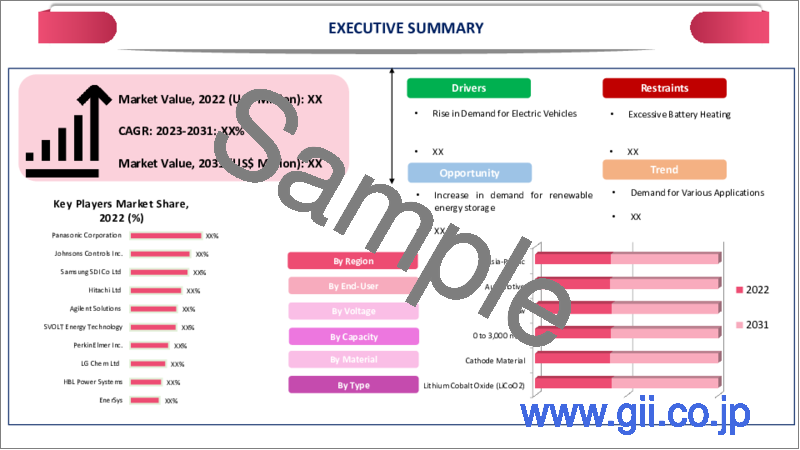

世界のリチウムイオン電池市場は、2023年に435億米ドルに達し、2031年には1,244億米ドルに達すると予測され、予測期間2024-2031年のCAGRは13.5%で成長します。

リチウムイオン電池市場は、新たな進歩と動向によって著しい成長を示しており、採掘からリサイクルまでの活動を包含するチェーンも力強い成長を遂げると予測されています。リチウムイオン電池市場の成長は、電気自動車におけるこれらの電池の使用の増加に起因しています。

例えば、国際エネルギー協会の報告書によると、自動車用リチウムイオン電池の需要は、前年2021年の330GWhから約65%急増し、550GWhに達しました。この成長は主に電気乗用車の販売台数の増加に起因しており、2022年の新規登録台数は2021年比で55%増と顕著な伸びを示しました。

2022年には、アジア太平洋地域が世界のリチウムイオン電池市場の1/3以上を占める急成長地域になると予想されます。中国、日本、インドなどの国々は、リチウムイオン電池の代替品開発競争を支配するために大きく前進しています。中国政府は電気自動車の開発と普及を積極的に推進しており、これが同国の電池産業の成長に拍車をかけています。

ダイナミクス

電気自動車におけるリチウムイオン電池の需要拡大

電気自動車の需要拡大に伴い、リチウムイオン電池の採用が大幅に増加しています。国際エネルギー機関(IEA)によると、電気自動車用リチウムイオン電池の世界需要は2031年までに年間約2~4TWhに達すると予想され、これは約1~200万トンのリチウムと300~500キロトンのコバルトの需要に相当します。

さらにIEAによると、中国では、自動車用電池の需要が約65%増加し、電気自動車の販売台数は2021年比で約78%増加しました。また、米国では、2022年の電気自動車販売台数の伸びが約55%であったのに対し、自動車用電池の需要は約80%伸びており、これは世界中でリチウムイオン電池の消費を増加させる大きな要因となっています。

政府のインセンティブと規制

政府の規制や法令は、電気自動車や電池製造業界を後押しする上で極めて重要な役割を果たしています。そのような重要な規制のひとつが、2022年後半に可決されたインフレ削減法で、特に電気自動車と電池製造に焦点を当てた、気候変動とクリーン・エネルギー・イニシアチブのための多額の資金提供を約束しています。この法律は、生産能力を向上させ、自動車メーカーが米国とその自由貿易パートナー内でバッテリー材料を調達し、バッテリーを生産することを奨励することにより、業界に大きな影響を与えることが期待されています。

さらにIRAは、バッテリー・サプライ・チェーンへの新規投資に約800億米ドルを投じ、少なくとも総額約3,700億米ドルを米国のクリーン・エネルギー経済に割り当てることを発表しました。これは、米国のバッテリー・サプライ・チェーンを強化するためのこれまでで最大の取り組みです。

リチウムイオン電池の輸送におけるリスク

リチウムイオン電池の輸出入の伸びを妨げているのは、その輸送に関する問題です。リチウムイオン電池の輸送には、電池の故障や熱暴走などの潜在的なリスクがあります。リチウムイオン電池が故障すると、急速に高熱が発生し、有毒ガスや可燃性ガスが発生し、爆発的状況を引き起こす可能性があります。

また、このような故障の速度と重大性は過小評価されがちで、海事コミュニティや物流サプライチェーンにおける認識と備えの欠如につながっています。世界には数十億個のリチウムイオン電池が流通しているため、このような火災の影響は、特に輸送や港湾において重大なものとなり、リチウムイオン電池市場の成長にさらに影響を与えています。

目次

第1章 調査手法と調査範囲

第2章 定義と概要

第3章 エグゼクティブサマリー

第4章 市場力学

- 影響要因

- 促進要因

- 電気自動車におけるリチウムイオン電池の需要拡大

- 政府のインセンティブと規制

- 抑制要因

- リチウムイオン電池の輸送におけるリスク

- 機会

- 影響分析

- 促進要因

第5章 産業分析

- ポーターのファイブフォース分析

- サプライチェーン分析

- 価格分析

- 規制分析

- ロシア・ウクライナ戦争の影響分析

- DMIの見解

第6章 COVID-19分析

第7章 タイプ別

- コバルト酸リチウム(LiCoO2)

- リン酸鉄リチウム(LiFePO4)

- リチウムニッケルコバルト負極酸化物(LiNiCoAlO2またはNCA)

- リチウムニッケルマンガンコバルト酸化物(LiNiMnCoO2またはNMC)

- チタン酸リチウム(Li4Ti5O12またはLTO)

- マンガン酸リチウム

第8章 材料別

- 正極

- 負極

- 電解液

- セパレーター

- 集電体

- その他

第9章 容量別

- 0~3,000 mAh

- 3,000~10,000mAh

- 10,000~60,000mAh

- 60,000mAh以上

- 電圧別

- 低(12V以下)

- 中(12~36V)

- 高(36V以上)

第10章 エンドユーザー別

- 自動車

- コンシューマー・エレクトロニクス

- 航空宇宙・防衛

- 海洋

- 産業用

- ヘルスケア

- 産業・製造

- その他

第11章 地域別

- 北米

- 米国

- カナダ

- メキシコ

- 欧州

- ドイツ

- 英国

- フランス

- イタリア

- ロシア

- その他欧州

- 南米

- ブラジル

- アルゼンチン

- その他南米

- アジア太平洋

- 中国

- インド

- 日本

- オーストラリア

- その他アジア太平洋地域

- 中東・アフリカ

第12章 競合情勢

- 競合シナリオ

- 市況/シェア分析

- M&A分析

第13章 企業プロファイル

- LG Chem Ltd

- 会社概要

- 製品ポートフォリオと説明

- 財務概要

- 主な発展

- Panasonic Corporation

- Samsung SDI Co Ltd

- BYD Co Ltd

- BAK Group

- A123 Systems

- GS Yuasa Corporation

- Hitachi Ltd

- Johnsons Controls Inc.

- Saft Groupe S.A.

第14章 付録

- 米国とリン酸鉄リチウム(LiFePO4)について

Overview

Global Lithium-Ion Battery Market reached US$ 43.5 billion in 2023 and is expected to reach US$ 124.4 billion by 2031, growing with a CAGR of 13.5% during the forecast period 2024-2031.

The lithium-ion battery market is showing significant growth with new advancements and trends, also chain encompassing activities from mining to recycling is projected to experience robust growth. The growth of the lithium-ion battery market can be attributed to the increased use of these batteries in electric vehicles.

For instance, according to the report given by International Energy Association, the demand for automotive lithium-ion batteries surged by approximately 65% to reach 550 GWh compared to 330 GWh in the previous year 2021. The growth can be attributed primarily to the rising sales of electric passenger cars, with new registrations experiencing a notable 55% increase in 2022 compared to 2021.

In 2022, Asia-Pacific is expected to be the fastest growing region holding more than 1/3rd of the global lithium-ion battery market. Countries such as China, Japan, India are taking significant strides to dominate the race for developing alternatives to lithium-ion batteries. Chinese government has been actively promoting the development and adoption of electric vehicles, which has further fueled the growth of the battery industry in the country.

Dynamics

Growing Demand for Li-ion Batteries in Electric Vehicle

The growing demand for electric vehicles has been accompanied by a significant rise in the adoption of Lithium-ion batteries. As per the International Energy Agency, the anticipated globally demand for Li-ion batteries for electric vehicles is projected to reach approximately 2-4 TWh per year by 2031, corresponding to a demand of around 1-2 million tons of lithium and 300-500 kilotons of cobalt.

Moreover, according to IEA, in China, the demand for batteries in vehicles grew by around 65%, while electric car sales increased by around 78% compared to 2021. Also, in U.S. The battery demand in vehicles grew by around 80% outpacing the growth in electric car sales which was around 55% in 2022, which is a major factor for increased consumption of lithium-ion batteries all around the globe.

Government Incentives and Regulations

Government regulations and acts are playing a pivotal role in boosting the electric vehicle and battery manufacturing industries. One such significant regulation is the Inflation Reduction Act passed in late 2022, which promises substantial funding for climate and cleans energy initiatives, with a particular focus on EV and battery manufacturing. The legislation is expected to have a profound impact on the industry by increasing production capacity and encouraging automakers to procure battery materials and produce batteries within U.S. and its free-trade partners.

Furthermore, the IRA has announced to invest approximately US$ 80 billion in new investments into the battery supply chain with a total of at least around US$ 370 billion allocated to the country's clean energy economy. It represents the largest effort to date to strengthen the battery supply chain in U.S.

Risks in the Transport of Lithium-Ion Batteries

The Lithium-ion batteries export and import growth is hindered due to its transportation related problems. The transport of lithium-ion batteries presents potential risks including battery failure and thermal runaway. When a lithium-ion battery fails it can rapidly generate intense heat, produce toxic and flammable gases and create explosive situations.

Also, the speed and severity of these failures are often underestimated, leading to a lack of awareness and preparedness within the maritime community and logistics supply chain. With billions of lithium-ion batteries in circulation globally, the impact of such fires can be significant, particularly in transportation and ports, which furthermore impacting the lithium-ion batteries market growth.

Segment Analysis

The global lithium-ion battery market is segmented based on type, material, capacity, voltage, end-user and region.

Rising EVs Adoption Drives Automotive Segment

Automotive is expected to be the dominant segment with more than 30% of the market during the forecast period 2024-2031. The electric vehicle manufacturers have become the biggest consumers of lithium-ion batteries, owing to the growing sales of EVs. EVs do not emit CO2, NOX and have a lower environmental impact compared to conventional internal combustion engine vehicles.

Owing to this, many countries are encouraging the use of EVs by introducing subsidies and government programs. Major countries have announced plans to ban the sales of ICE vehicles in the future. Norway announced plans to ban the sales of ICE vehicles by 2025, France by 2040 and UK by 2050. India also planned to phase out ICE engines by 2031, while China's similar plan is currently under the relevant research phase.

Geographical Penetration

Growing Electrification in Asia-Pacific

Asia-Pacific is the dominant region in the global lithium-ion battery market covering over 1/3rd of the market. As per IEA, in 2022, there was a significant increase of over 70% in the demand for batteries used in vehicles in China. During the same period, electric car sales experienced remarkable growth, rising by 80% compared to the previous year. Also, As per Invest India, the Indian government has established an ambitious goal of electrifying 30% of the nation's vehicle fleet by 2031.

To facilitate the growth of the electric vehicle industry, the government has implemented various incentives and policies. India has also made advancements in lithium resources, with the announcement of establishing lithium inferred resources of around 6 million Tons in the Reasi district of Jammu and Kashmir in 2023. In line with this growth there is a need for indigenous lithium-ion battery manufacturing in India.

Competitive Landscape

The major global players in the market include LG Chem Ltd, Panasonic Corporation, Samsung SDI Co Ltd, BYD Co Ltd, BAK Group, A123 Systems, GS Yuasa Corporation, Hitachi Ltd, Johnsons Controls Inc. and Saft Groupe S.A.

COVID-19 Impact Analysis

The COVID-19 pandemic had affected the energy storage sector. Although there was a temporary slowdown in energy storage investments, it is expected to regain momentum in the future. The energy storage sector is projected to grow by around 30% in 2031, reaching 740 GWh. LIBs are expected to play a significant role in energy storage, particularly in the context of electric vehicles and related technologies.

COVID-19 pandemic has brought about changes in energy demand, transportation habits and energy storage. The adoption of electric micro-mobility devices, powered by lithium-ion batteries has increased due to their safety and affordability. The shift towards renewable energy sources and the growing importance of sustainability is driving the demand for energy storage technologies, including lithium-ion batteries in both stationary and non-stationary applications.

Russia-Ukraine War Impact

Preliminary estimates suggest that Ukraine holds a significant lithium reserve of around 500,000 tons, a crucial mineral for renewable energy and electric vehicle batteries. With skyrocketing global demand for lithium, which is estimated to grow by around 450% to 4,000%, there are concerns that supply won't meet the demand.

Russia and Ukraine ongoing war have a major impact on the global lithium-ion battery market. One of the main factors is the dependence on Russia and Ukraine as major suppliers of metals used in battery production like lithium, cobalt, nickel and copper. With geopolitical tensions and potential disruptions in the supply chain there are concerns about the availability and prices of these critical metals.

The war in Ukraine has highlighted the need for global energy security and the urgency of clean energy development. Europe's heavy reliance on Russian energy which includes oil and natural gas has prompted countries like Germany to seek alternative suppliers and invest in renewable energy to reduce dependence.

By Type

- Lithium Cobalt Oxide (LiCoO2)

- Lithium Iron Phosphate (LiFePO4)

- Lithium Nickel Cobalt Anode Oxide (LiNiCoAlO2 or NCA)

- Lithium Nickel Manganese Cobalt Oxide (LiNiMnCoO2 or NMC)

- Lithium Titanate (Li4Ti5O12 or LTO)

- Lithium Manganese Oxide

By Material

- Cathode

- Anode

- Electrolyte

- Separator

- Current Collector

- Others

By Capacity

- 0 to 3,000 mAh

- 3,000 t0 10,000 mAh

- 10,000 to 60,000 mAh

- 60,000 mAh and Above

By Voltage

- Low (Below 12 V)

- Medium (12-36V)

- High (Above 36V)

By End-User

- Automotive

- Consumer Electronics

- Aerospace and Defense

- Marine

- Industrial

- Healthcare

- Industrial and Manufacturing

- Others

By Region

- North America

- U.S.

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Rest of Europe

- South America

- Brazil

- Argentina

- Rest of South America

- Asia-Pacific

- China

- India

- Japan

- Australia

- Rest of Asia-Pacific

- Middle East and Africa

Key Developments

- In June 2023, Toyota Motor revealed plans to produce a new EV vehicle with a lithium-ion battery capable of providing an outstanding range of 1,000 kilometers.

- In January 2022, Nexeon Limited, a supplier of innovative silicon anode materials for next-generation lithium-ion batteries, has licensed its NSP-1 technology to SKC Co. Ltd., a leading advanced materials company. The transfer assures that clients globally have quick and dependable access to these key resources.

- In February 2022, Panasonic Corporation has announced that its Energy Company will create a manufacturing plant at its Wakayama Factory in western Japan to manufacture new, huge 4680 (46 millimeters wide and 80 millimeters tall) cylindrical lithium-ion batteries for electric vehicles.

Why Purchase the Report?

- To visualize the global lithium-ion battery market segmentation based on type, material, capacity, voltage, end-user and region, as well as understand key commercial assets and players.

- Identify commercial opportunities by analyzing trends and co-development.

- Excel data sheet with numerous data points of lithium-ion battery market-level with all segments.

- PDF report consists of a comprehensive analysis after exhaustive qualitative interviews and an in-depth study.

- Product mapping available as excel consisting of key products of all the major players.

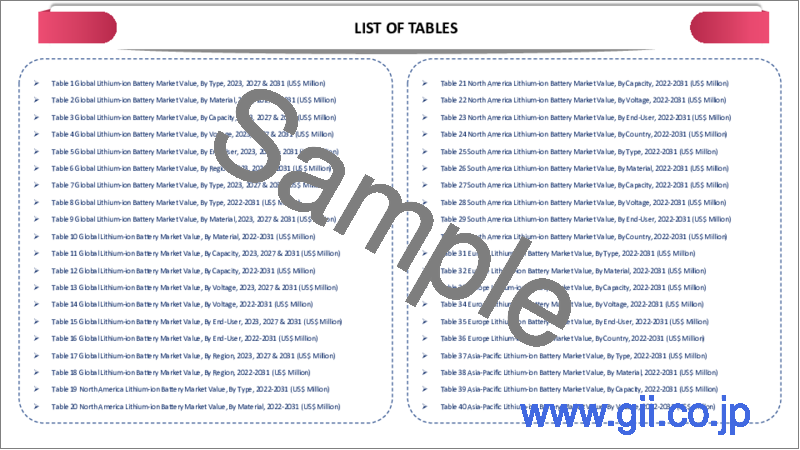

The global lithium-ion battery market report would provide approximately 78 tables, 83 figures and 207 pages.

Target Audience 2024

- Manufacturers/ Buyers

- Industry Investors/Investment Bankers

- Research Professionals

- Emerging Companies

Table of Contents

1. Methodology and Scope

- 1.1. Research Methodology

- 1.2. Research Objective and Scope of the Report

2. Definition and Overview

3. Executive Summary

- 3.1. Snippet by Type

- 3.2. Snippet by Material

- 3.3. Snippet by Capacity

- 3.4. Snippet by Voltage

- 3.5. Snippet by End-User

- 3.6. Snippet by Region

4. Dynamics

- 4.1. Impacting Factors

- 4.1.1. Drivers

- 4.1.1.1. Growing Demand for Li-ion Batteries in Electric Vehicle

- 4.1.1.2. Government Incentives and Regulations

- 4.1.2. Restraints

- 4.1.2.1. Risks in the Transport of Lithium-Ion Batteries

- 4.1.3. Opportunity

- 4.1.4. Impact Analysis

- 4.1.1. Drivers

5. Industry Analysis

- 5.1. Porter's Five Force Analysis

- 5.2. Supply Chain Analysis

- 5.3. Pricing Analysis

- 5.4. Regulatory Analysis

- 5.5. Russia-Ukraine War Impact Analysis

- 5.6. DMI Opinion

6. COVID-19 Analysis

- 6.1. Analysis of COVID-19

- 6.1.1. Scenario Before COVID

- 6.1.2. Scenario During COVID

- 6.1.3. Scenario Post COVID

- 6.2. Pricing Dynamics Amid COVID-19

- 6.3. Demand-Supply Spectrum

- 6.4. Consumer Electronics Initiatives Related to the Market During Pandemic

- 6.5. Manufacturers Strategic Initiatives

- 6.6. Conclusion

7. By Type

- 7.1. Introduction

- 7.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By Type

- 7.1.2. Market Attractiveness Index, By Type

- 7.2. Lithium Cobalt Oxide (LiCoO2)*

- 7.2.1. Introduction

- 7.2.2. Market Size Analysis and Y-o-Y Growth Analysis (%)

- 7.3. Lithium Iron Phosphate (LiFePO4)

- 7.4. Lithium Nickel Cobalt Anode Oxide (LiNiCoAlO2 or NCA)

- 7.5. Lithium Nickel Manganese Cobalt Oxide (LiNiMnCoO2 or NMC)

- 7.6. Lithium Titanate (Li4Ti5O12 or LTO)

- 7.7. Lithium Manganese Oxide

8. By Material

- 8.1. Introduction

- 8.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By Material

- 8.1.2. Market Attractiveness Index, By Material

- 8.2. Cathode*

- 8.2.1. Introduction

- 8.2.2. Market Size Analysis and Y-o-Y Growth Analysis (%)

- 8.3. Anode

- 8.4. Electrolyte

- 8.5. Separator

- 8.6. Current Collector

- 8.7. Others

9. By Capacity

- 9.1. Introduction

- 9.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By Capacity

- 9.1.2. Market Attractiveness Index, By Capacity

- 9.2. 0 to 3,000 mAh*

- 9.2.1. Introduction

- 9.2.2. Market Size Analysis and Y-o-Y Growth Analysis (%)

- 9.3. 3,000 t0 10,000 mAh

- 9.4. 10,000 to 60,000 mAh

- 9.5. 60,000 mAh and Above

- 9.6. By Voltage

- 9.6.1. Introduction

- 9.6.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By Voltage

- 9.6.1.2. Market Attractiveness Index, By Voltage

- 9.6.2. Low (Below 12 V)*

- 9.6.2.1. Introduction

- 9.6.2.2. Market Size Analysis and Y-o-Y Growth Analysis (%)

- 9.6.3. Medium (12-36V)

- 9.6.4. High (Above 36V)

- 9.6.1. Introduction

10. By End-User

- 10.1. Introduction

- 10.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By End-User

- 10.1.2. Market Attractiveness Index, By End-User

- 10.2. Automotive*

- 10.2.1. Introduction

- 10.2.2. Market Size Analysis and Y-o-Y Growth Analysis (%)

- 10.3. Consumer Electronics

- 10.4. Aerospace and Defense

- 10.5. Marine

- 10.6. Industrial

- 10.7. Healthcare

- 10.8. Industrial and Manufacturing

- 10.9. Others

11. By Region

- 11.1. Introduction

- 11.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By Region

- 11.1.2. Market Attractiveness Index, By Region

- 11.2. North America

- 11.2.1. Introduction

- 11.2.2. Key Region-Specific Dynamics

- 11.2.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Type

- 11.2.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Material

- 11.2.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By Capacity

- 11.2.6. Market Size Analysis and Y-o-Y Growth Analysis (%), By Voltage

- 11.2.7. Market Size Analysis and Y-o-Y Growth Analysis (%), By End-User

- 11.2.8. Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

- 11.2.8.1. U.S.

- 11.2.8.2. Canada

- 11.2.8.3. Mexico

- 11.3. Europe

- 11.3.1. Introduction

- 11.3.2. Key Region-Specific Dynamics

- 11.3.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Type

- 11.3.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Material

- 11.3.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By Capacity

- 11.3.6. Market Size Analysis and Y-o-Y Growth Analysis (%), By Voltage

- 11.3.7. Market Size Analysis and Y-o-Y Growth Analysis (%), By End-User

- 11.3.8. Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

- 11.3.8.1. Germany

- 11.3.8.2. UK

- 11.3.8.3. France

- 11.3.8.4. Italy

- 11.3.8.5. Russia

- 11.3.8.6. Rest of Europe

- 11.4. South America

- 11.4.1. Introduction

- 11.4.2. Key Region-Specific Dynamics

- 11.4.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Type

- 11.4.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Material

- 11.4.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By Capacity

- 11.4.6. Market Size Analysis and Y-o-Y Growth Analysis (%), By Voltage

- 11.4.7. Market Size Analysis and Y-o-Y Growth Analysis (%), By End-User

- 11.4.8. Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

- 11.4.8.1. Brazil

- 11.4.8.2. Argentina

- 11.4.8.3. Rest of South America

- 11.5. Asia-Pacific

- 11.5.1. Introduction

- 11.5.2. Key Region-Specific Dynamics

- 11.5.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Type

- 11.5.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Material

- 11.5.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By Capacity

- 11.5.6. Market Size Analysis and Y-o-Y Growth Analysis (%), By Voltage

- 11.5.7. Market Size Analysis and Y-o-Y Growth Analysis (%), By End-User

- 11.5.8. Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

- 11.5.8.1. China

- 11.5.8.2. India

- 11.5.8.3. Japan

- 11.5.8.4. Australia

- 11.5.8.5. Rest of Asia-Pacific

- 11.6. Middle East and Africa

- 11.6.1. Introduction

- 11.6.2. Key Region-Specific Dynamics

- 11.6.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Type

- 11.6.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Material

- 11.6.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By Capacity

- 11.6.6. Market Size Analysis and Y-o-Y Growth Analysis (%), By Voltage

- 11.6.7. Market Size Analysis and Y-o-Y Growth Analysis (%), By End-User

12. Competitive Landscape

- 12.1. Competitive Scenario

- 12.2. Market Positioning/Share Analysis

- 12.3. Mergers and Acquisitions Analysis

13. Company Profiles

- 13.1. LG Chem Ltd*

- 13.1.1. Company Overview

- 13.1.2. Product Portfolio and Description

- 13.1.3. Financial Overview

- 13.1.4. Key Developments

- 13.2. Panasonic Corporation

- 13.3. Samsung SDI Co Ltd

- 13.4. BYD Co Ltd

- 13.5. BAK Group

- 13.6. A123 Systems

- 13.7. GS Yuasa Corporation

- 13.8. Hitachi Ltd

- 13.9. Johnsons Controls Inc.

- 13.10. Saft Groupe S.A.

LIST NOT EXHAUSTIVE

14. Appendix

- 14.1. About Us and Lithium Iron Phosphate (LiFePO4)

- 14.2. Contact Us