|

|

市場調査レポート

商品コード

1423450

ゼリーとグミの世界市場-2023年~2030年Global Jellies and Gummies Market - 2023-2030 |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| ゼリーとグミの世界市場-2023年~2030年 |

|

出版日: 2024年02月09日

発行: DataM Intelligence

ページ情報: 英文 189 Pages

納期: 即日から翌営業日

|

- 全表示

- 概要

- 目次

概要

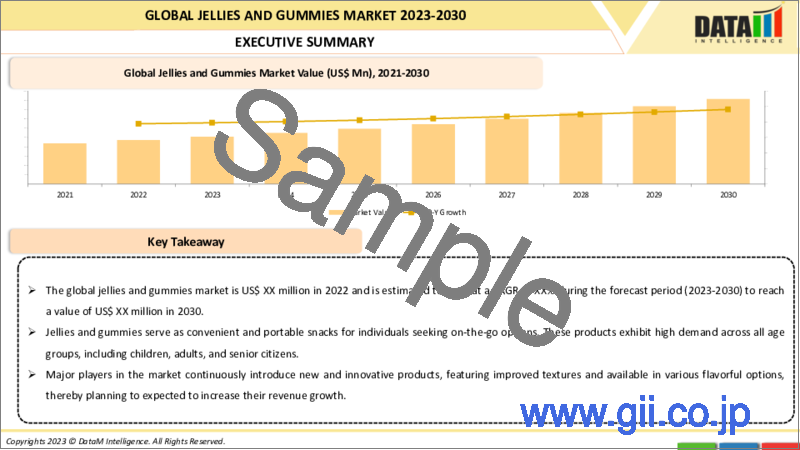

ゼリーとグミの世界市場は、2022年に304億9,000万米ドルに達し、2023~2030年の予測期間中にCAGR 4.1%で成長し、2030年には420億5,000万米ドルに達すると予測されています。

ゼリーとグミは、機能性、伝統的、無糖など様々なタイプのキャンディ製品です。ゼリーやグミは、他の菓子類と同様に味や風味が楽しめるだけでなく、果物やハーブなどの栄養成分を配合しているため、エネルギー、ビタミン、プロバイオティクスを摂取できるという機能的な特典があり、広く普及しています。

ゼリーやグミは、オン・トゥ・スナックを求める人々にとって便利で持ち運びに便利な間食習慣です。これらの製品は、子供、大人、高齢者など、あらゆる年齢層から高い需要があります。テクスチャーが改良され、複数のフレーバーオプションの棚を持つ主要参入企業による新しく革新的な製品が市場規模を拡大しています。

北米は世界のゼリー・グミ市場を独占しています。消費者の間で製品需要が増加しているため、この地域ではさまざまな製造部門が設立されています。2023年7月、ドイツの菓子類会社Hariboは、米国消費者の需要増加に対応するため、ウィスコンシン州プレザントプレーリーに北米初の製造施設を開設しました。この新しい製造施設は、米国市場向けにグミ・ブランドの25種類のお菓子を生産するのに役立ちます。

ダイナミクス

便利な菓子類への高い需要

世界の消費者の生活スケジュールがますます忙しくなるにつれ、外出先での間食製品に対する需要が高まっています。消費者は多忙な生活習慣の中で、毎日の食事に健康的な選択肢を見出すことができないです。低糖質でビタミンやその他の機能性成分を添加した健康的で機能的なタイプの菓子のニーズが、便利でおいしい健康補助食品として市場の需要を押し上げています。

ゼリーやグミは、機能的な利点を備えた菓子類を渇望するあらゆる年齢層に好まれ、新製品のニーズが高まっています。2022年4月、アメリカの大手グミ製品メーカーであるHARIBO社は、子供から大人まで楽しめる最新のグミイノベーション製品「Berry Clouds」を発表しました。新しいベリークラウドは、優しく甘い噛みごたえのあるユニークな3層グミで、ナショナル・キャンディ・デーに特別に発売されます。

複数のフレーバーのゼリーとグミが入手可能

ゼリーとグミには、フルーツ、野菜、ハーブのフレーバーがあります。果物は製品に新鮮さと栄養価を加えます。また、味と風味を引き立てて消費者を魅了します。ハーブは、健康に役立つことで製品の機能的価値を高める。メーカーはゼリーやグミの製造に複数のフレーバーを使用し、市場の成長を際立たせています。

2021年12月、Haribo GmbH &Co.KGは、HARIBO Goldbear Filled Caneを含む一連のホリデーグミ製品を発売しました。各キャンディケーンには、ストロベリー、オレンジ、レモン、パイナップル、ラズベリーといったオリジナルのフルーティーなフレーバーのHARIBO定番のゴールドベアがフィリングとして入っています。

2021年2月、Nestle S.A.の子会社であるRowntree社は、マンゴー、ブルーベリー、チェリー、アップルなど様々なフレーバーのゼラチン不使用のグミとデザート・パスティルの新シリーズを市場に投入し、新製品を発売すると発表しました。

ゼリーやグミの過剰摂取による健康への懸念

ゼリーやグミは、世界人口の大多数が間食の選択肢として完全に習慣化しています。ゼリーやグミに含まれる高い糖分は、市場の主要な抑制要因の1つになり得る。シュガーレスやシュガーフリーの新製品がいくつか登場しているとはいえ、市場のゼリーやグミの大半には糖分や人工成分が含まれています。

世界保健機関(WHO)の2022年の統計によると、世界で10億人以上が肥満に苦しんでいます。IDF Diabetes Atlas 2021によると、世界で5億3,700万人の成人が糖尿病を患っており、2030年には6億4,300万人に達すると推定されています。糖分を多く含む製品の消費に関連する健康への懸念が高まるにつれ、市場ではそうした製品の人気と需要が低下し、市場の成長に悪影響を及ぼしています。

目次

第1章 調査手法と調査範囲

第2章 定義と概要

第3章 エグゼクティブサマリー

第4章 市場力学

- 影響要因

- 促進要因

- 簡便な菓子類に対する需要の高さ

- 複数のフレーバーのゼリーとグミの入手可能性

- 抑制要因

- ゼリーやグミの過剰摂取による健康への懸念

- 機会

- 影響分析

- 促進要因

第5章 産業分析

- ポーターのファイブフォース分析

- サプライチェーン分析

- 価格分析

- 規制分析

- DMIの見解

第6章 COVID-19分析

第7章 成分別

- 果物

- 野菜

- リキュール

- 花とハーブ

- その他

第8章 タイプ別

- 機能性ゼリー・グミ

- 伝統的なゼリー・グミ

- 無糖ゼリー・グミ

第9章 機能別

- エネルギー

- ビタミン

- プロバイオティクス

- その他

第10章 パッケージ別

- パウチ

- 瓶

- 箱

第11章 流通チャネル別

- スーパーマーケット&ハイパーマーケット

- コンビニエンスストア

- 専門店

- オンラインストア

- その他

第12章 エンドユーザー別

- 子供

- 大人

- シニア

第13章 地域別

- 北米

- 米国

- カナダ

- メキシコ

- 欧州

- ドイツ

- 英国

- フランス

- イタリア

- スペイン

- その他欧州

- 南米

- ブラジル

- アルゼンチン

- その他南米

- アジア太平洋

- 中国

- インド

- 日本

- オーストラリア

- その他アジア太平洋地域

- 中東・アフリカ

第14章 競合情勢

- 競合シナリオ

- 市況/シェア分析

- M&A分析

第15章 企業プロファイル

- HARIBO GmbH & Co. KG

- 会社概要

- 製品ポートフォリオと説明

- 財務概要

- 主な発展

- Jelly Belly Candy Company

- JuztJelly

- The Hershey Company

- GGB Candies, LLC

- DECORIA Confectionery Co.,Ltd.

- Albanese Candy

- European Food Public Company Limited

- Casa del dolce spa

- The Jelly Bean Factory

第16章 付録

Overview

Global Jellies and Gummies Market reached US$ 30.49 billion in 2022 and is expected to reach US$ 42.05 billion by 2030, growing with a CAGR of 4.1% during the forecast period 2023-2030.

Jellies and Gummies are candy products available in various types such as functional, traditional and sugar-free forms. In addition to the taste and flavor provided just like any other confectionery products, jellies and gummies are widely popular due to their functional benefits of providing energy, vitamins and probiotics due to the incorporation of nutritive ingredients such as fruits and herbs.

The jellies and gummies are convenient and portable snacking habits for people who demand the on-to-snacks. These products have high demand from all age groups including children, adults and senior citizens. The new and innovative products laucnhes by the major palyers with improved texture and shelves in multiple flavoured options expand the size of the market.

North America dominated the global jellies and gummies market. With the increasing product demand among consumers, various manufacturing units are being established in the region. In July 2023, Haribo, a German confectionery company opened its first-ever North American manufacturing facility in Pleasant Prairie, WI to help meet increasing demand from U.S. consumers. The new manufacturing facility will help produce the gummy brand's 25 varieties of treats for the U.S. market.

Dynamics

High Demand for Convenient Confectionery Products

With the increasingly busy life schedules of global consumers, there is a greater demand for on-the-go snacking products. Consumers are not able to figure out the healthy options for their daily diet with hectic lifestyle habits. The need for healthy and functional types of confections with low sugar added vitamins and other functional ingredients boosts the market demand due to its convenient and tasty way of health supplementation.

Jellies and Gummies are enjoyed by any age group that craves confectionery products with functional benefits and a growing need for new products. In April 2022, HARIBO, an American leading manufacturer of gummi products announced its newest gummi innovation, Berry Clouds a product that can be enjoyed by children and adults. The new Berry Clouds are unique triple-layered gummies with a gentle and sweet chew functionality and are specially launched on National Candy Day.

Availability of Jellies and Gummies in Multiple Flavors

Jellies and gummies are available in fruit, vegetable, and herbal flavors. Fruits add fresh and nutritive value to the product. It also enhances the taste and flavor attracting consumers. Herbs enhance the functional value of the product by providing health benefits. The manufacturers use multiple flavors in the production of jellies and gummies highlighting the market growth.

In December 2021, Haribo GmbH & Co. KG released a range of holiday gummy products, including the HARIBO Goldbear Filled Cane. Each of the candy cane contains Haribo's classic Goldbears, which come in their original fruity flavors such as strawberry, orange, lemon, pineapple, and raspberry, as the filling.

In February 2021, Rowntree, a subsidiary of Nestle S.A., announced the launch of new products into the market by introducing a new range of gelatin-free gummies and dessert Pastilles in different flavors such as mango, blueberry, cherry, and apple. the products are gelatin-free and are suitable for vegetarian people.

Health Concerns Related to Over-Consumption of Jellies and Gummies

Jellies and gummies are perfectly habituated as an on-to-snacking option by the majority of the global population. The high sugar content in the jellies and gummies can be one of the major restraining factors for the market. Even though there are some of the new products that are emerging with sugar-less or sugar-free range, the majority of the jellies and gummies in the market are loaded with sugars and artificial ingredients.

According to the World Health Organization 2022 statistics, more than 1 billion people globally are suffering from obesity. According to IDF Diabetes Atlas 2021, 537 million adults are living with diabetes in the world, and estimated to reach 643 million by 2030. With the increasing health concerns related to high sugar-based product consumption, there is reduced popularity and demand for such products in the market negatively affecting the market growth.

Segment Analysis

The global jellies and gummies market is segmented based on ingredient, type, function, packaging, distribution channel, end-user and region.

Increasing Prevalence of Health Concerns Related to Consumption of Sugar-Based is Rising Demand for Sugar-Free Products

The global jellies and gummies market is segmented based on type into functional, traditional and sugar-free. The sugar-free jellies and gummies segment accounted for the largest share. The increasing prevalence of health concerns related to high sugar-based product consumption is driving the need for the sugar-free or low-sugar range in every food and beverage category, including the jellies and gummies market and positively influencing the segment growth.

In September 2023, SIRIO Pharma, a China-based company released new formulations to help its partners accelerate into the fast-growing nutraceutical gummy industry, specifically targeting pharma and OTC brands in the active health space to deal with regular health issues of cough, cold and UTLs. The newly developed gummies are of vegan origin have low or no sugar content and have value added with an herbal blend of hibiscus and cranberry addition.

Geographical Penetration

Increasing Demand for Better Confectionery Products in North America

North America dominated the global jellies and gummies market. The region has a high demand for vegan & and sugar-free confections with consumers preferring better-for-use candy options to maintain good health. According to the Centers for Disease Control and Prevention 2023, obesity affects over 41.9 % of adults and 19.7 % of children in the United States. Similarly, according to the CDC, about 37.3 million Americans are suffering from diabetes, covering about 11.3 % of the United States population.

With the increasing prevalence of obesity and diabetes in this region, there is high demand for sugar-free products. To meet consumer, demand the major players are focusing on the development of jellies and gummies that have a positive impact on consumer health. For instance, in June 2022, the Gummy Project Inc. announced the launch of low-sugar, plant-based, gluten-free gummy products in Canada and U.S. markets.

Competitive Landscape

The major global players in the market include HARIBO GmbH & Co. KG, Jelly Belly Candy Company, JuztJelly, The Hershey Company, GGB Candies, LLC, DECORIA Confectionery Co., Ltd., Albanese Candy, European Food Public Company Limited, Casa del dolce spa and The Jelly Bean Factory.

COVID-19 Impact Analysis

The COVID-19 pandemic has had a moderate impact on the jellies and gummies market. The jellies and gummies market also faced challenges during the pandemic situation due to sudden lockdown retractions that resulted in witnessing a lot of drawbacks with interrupted processing and industrial activities from raw material procurement to final product distribution.

The pandemic increased consumer focus on overall health resulting in the high demand for a product that helps to support the overall health of a person. The jellies and gummies are fortified with vitamins, minerals, antioxidants, and probiotics that help in building immunity and dealing with unhealthy conditions. With the change in the consumers' preference towards health-promoting products, the market has increased sales during COVID-19, with the high demand for convenient confection.

By Ingredient

- Fruits

- Vegetables

- Liqueur

- Flowers and Herbs

- Others

By Type

- Functional Jellies and Gummies

- Traditional Jellies and Gummies

- Sugar-Free Jellies and Gummies

By Nature

- Organic

- Conventional

By Function

- Energy

- Vitamins

- Probiotics

- Other

By Packaging

- Pouches

- Jars

- Boxes

By Distribution Channel

- Supermarkets & Hypermarket

- Convenience Stores

- Speciality Stores

- Online Stores

- Others

By End-User

- Children

- Adults

- Seniors

By Region

- North America

- U.S.

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Rest of Europe

- South America

- Brazil

- Argentina

- Rest of South America

- Asia-Pacific

- China

- India

- Japan

- Australia

- Rest of Asia-Pacific

- Middle East and Africa

Key Developments

- In May 2022, Jelly Drops, a U.K.-based company that manufactures candy flavor Jelly drops that help people stay hydrated appeared in the United States. Jelly Drops are an innovative sugar-free treat, made of 95% water with added electrolytes & vitamins, designed to increase fluid intake. The product helps the aged population, especially people suffering from dementia.

- In December 2021, Haribo GmbH & Co. KG released a range of holiday gummy products, including the HARIBO Goldbear Filled Cane. Each of the candy cane contains Haribo's classic Goldbears, which come in their original fruity flavors such as strawberry, orange, lemon, pineapple, and raspberry, as the filling.

- In February 2021, Rowntree, a subsidiary of Nestle S.A., announced the launch of new products into the market by introducing a new range of gelatin-free gummies, Dessert Pastilles in different flavours such as mango, blueberry, cherry, and apple. the products are gelatin-free and are suitable for vegetarian people.

Why Purchase the Report?

- To visualize the global jellies and gummies market segmentation based on ingredient, type, function, packaging, distribution channel, end-user and region, as well as understand key commercial assets and players.

- Identify commercial opportunities by analyzing trends and co-development.

- Excel data sheet with numerous data points of jellies and gummies market-level with all segments.

- PDF report consists of a comprehensive analysis after exhaustive qualitative interviews and an in-depth study.

- Product mapping available as excel consisting of key products of all the major players.

The global jellies and gummies market report would provide approximately 86 tables, 86 figures and 189 pages.

Target Audience 2023

- Manufacturers/ Buyers

- Industry Investors/Investment Bankers

- Research Professionals

- Emerging Companies

Table of Contents

1. Methodology and Scope

- 1.1. Research Methodology

- 1.2. Research Objective and Scope of the Report

2. Definition and Overview

3. Executive Summary

- 3.1. Snippet by Ingredient

- 3.2. Snippet by Type

- 3.3. Snippet by Function

- 3.4. Snippet by Packaging

- 3.5. Snippet by Distribution Channel

- 3.6. Snippet by End-User

- 3.7. Snippet by Region

4. Dynamics

- 4.1. Impacting Factors

- 4.1.1. Drivers

- 4.1.1.1. High Demand for Convenient Confectionery Products

- 4.1.1.2. Availability of Jellies and Gummies in Multiple Flavors

- 4.1.2. Restraints

- 4.1.2.1. Health Concerns Related to Over-Consumption of Jellies and Gummies

- 4.1.3. Opportunity

- 4.1.4. Impact Analysis

- 4.1.1. Drivers

5. Industry Analysis

- 5.1. Porter's Five Force Analysis

- 5.2. Supply Chain Analysis

- 5.3. Pricing Analysis

- 5.4. Regulatory Analysis

- 5.5. DMI Opinion

6. COVID-19 Analysis

- 6.1. Analysis of COVID-19

- 6.1.1. Scenario Before COVID

- 6.1.2. Scenario During COVID

- 6.1.3. Scenario Post COVID

- 6.2. Pricing Dynamics Amid COVID-19

- 6.3. Demand-Supply Spectrum

- 6.4. Government Initiatives Related to the Market During Pandemic

- 6.5. Manufacturers Strategic Initiatives

- 6.6. Conclusion

7. By Ingredient

- 7.1. Introduction

- 7.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By Ingredient

- 7.1.2. Market Attractiveness Index, By Ingredient

- 7.2. Fruits

- 7.2.1. Introduction

- 7.2.2. Market Size Analysis and Y-o-Y Growth Analysis (%)

- 7.3. Vegetables

- 7.4. Liqueur

- 7.5. Flowers and Herbs

- 7.6. Others

8. By Type

- 8.1. Introduction

- 8.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By Type

- 8.1.2. Market Attractiveness Index, By Type

- 8.2. Functional Jellies and Gummies

- 8.2.1. Introduction

- 8.2.2. Market Size Analysis and Y-o-Y Growth Analysis (%)

- 8.3. Traditional Jellies and Gummies

- 8.4. Sugar-Free Jellies and Gummies

9. By Function

- 9.1. Introduction

- 9.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By Function

- 9.1.2. Market Attractiveness Index, By Function

- 9.2. Energy

- 9.2.1. Introduction

- 9.2.2. Market Size Analysis and Y-o-Y Growth Analysis (%)

- 9.3. Vitamins

- 9.4. Probiotics

- 9.5. Other

10. By Packaging

- 10.1. Introduction

- 10.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By Packaging

- 10.1.2. Market Attractiveness Index, By Packaging

- 10.2. Pouches

- 10.2.1. Introduction

- 10.2.2. Market Size Analysis and Y-o-Y Growth Analysis (%)

- 10.3. Jars

- 10.4. Boxes

11. By Distribution Channel

- 11.1. Introduction

- 11.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By Distribution Channel

- 11.1.2. Market Attractiveness Index, By Distribution Channel

- 11.2. Supermarkets & Hypermarket

- 11.2.1. Introduction

- 11.2.2. Market Size Analysis and Y-o-Y Growth Analysis (%)

- 11.3. Convenience Stores

- 11.4. Speciality Stores

- 11.5. Online Stores

- 11.6. Others

12. By End-User

- 12.1. Introduction

- 12.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By End-User

- 12.1.2. Market Attractiveness Index, By End-User

- 12.2. Children

- 12.2.1. Introduction

- 12.2.2. Market Size Analysis and Y-o-Y Growth Analysis (%)

- 12.3. Adults

- 12.4. Seniors

13. By Region

- 13.1. Introduction

- 13.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By Region

- 13.1.2. Market Attractiveness Index, By Region

- 13.2. North America

- 13.2.1. Introduction

- 13.2.2. Key Region-Specific Dynamics

- 13.2.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Ingredient

- 13.2.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Type

- 13.2.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By Function

- 13.2.6. Market Size Analysis and Y-o-Y Growth Analysis (%), By Packaging

- 13.2.7. Market Size Analysis and Y-o-Y Growth Analysis (%), By Distribution Channel

- 13.2.8. Market Size Analysis and Y-o-Y Growth Analysis (%), By End-User

- 13.2.9. Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

- 13.2.9.1. U.S.

- 13.2.9.2. Canada

- 13.2.9.3. Mexico

- 13.3. Europe

- 13.3.1. Introduction

- 13.3.2. Key Region-Specific Dynamics

- 13.3.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Ingredient

- 13.3.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Type

- 13.3.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By Function

- 13.3.6. Market Size Analysis and Y-o-Y Growth Analysis (%), By Packaging

- 13.3.7. Market Size Analysis and Y-o-Y Growth Analysis (%), By Distribution Channel

- 13.3.8. Market Size Analysis and Y-o-Y Growth Analysis (%), By End-User

- 13.3.9. Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

- 13.3.9.1. Germany

- 13.3.9.2. U.K.

- 13.3.9.3. France

- 13.3.9.4. Italy

- 13.3.9.5. Spain

- 13.3.9.6. Rest of Europe

- 13.4. South America

- 13.4.1. Introduction

- 13.4.2. Key Region-Specific Dynamics

- 13.4.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Ingredient

- 13.4.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Type

- 13.4.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By Function

- 13.4.6. Market Size Analysis and Y-o-Y Growth Analysis (%), By Packaging

- 13.4.7. Market Size Analysis and Y-o-Y Growth Analysis (%), By Distribution Channel

- 13.4.8. Market Size Analysis and Y-o-Y Growth Analysis (%), By End-User

- 13.4.9. Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

- 13.4.9.1. Brazil

- 13.4.9.2. Argentina

- 13.4.9.3. Rest of South America

- 13.5. Asia-Pacific

- 13.5.1. Introduction

- 13.5.2. Key Region-Specific Dynamics

- 13.5.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Ingredient

- 13.5.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Type

- 13.5.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By Function

- 13.5.6. Market Size Analysis and Y-o-Y Growth Analysis (%), By Packaging

- 13.5.7. Market Size Analysis and Y-o-Y Growth Analysis (%), By Distribution Channel

- 13.5.8. Market Size Analysis and Y-o-Y Growth Analysis (%), By End-User

- 13.5.9. Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

- 13.5.9.1. China

- 13.5.9.2. India

- 13.5.9.3. Japan

- 13.5.9.4. Australia

- 13.5.9.5. Rest of Asia-Pacific

- 13.6. Middle East and Africa

- 13.6.1. Introduction

- 13.6.2. Key Region-Specific Dynamics

- 13.6.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Ingredient

- 13.6.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Type

- 13.6.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By Function

- 13.6.6. Market Size Analysis and Y-o-Y Growth Analysis (%), By Packaging

- 13.6.7. Market Size Analysis and Y-o-Y Growth Analysis (%), By Distribution Channel

- 13.6.8. Market Size Analysis and Y-o-Y Growth Analysis (%), By End-User

14. Competitive Landscape

- 14.1. Competitive Scenario

- 14.2. Market Positioning/Share Analysis

- 14.3. Mergers and Acquisitions Analysis

15. Company Profiles

- 15.1. HARIBO GmbH & Co. KG

- 15.1.1. Company Overview

- 15.1.2. Product Portfolio and Description

- 15.1.3. Financial Overview

- 15.1.4. Key Developments

- 15.2. Jelly Belly Candy Company

- 15.3. JuztJelly

- 15.4. The Hershey Company

- 15.5. GGB Candies, LLC

- 15.6. DECORIA Confectionery Co.,Ltd.

- 15.7. Albanese Candy

- 15.8. European Food Public Company Limited

- 15.9. Casa del dolce spa

- 15.10. The Jelly Bean Factory

LIST NOT EXHAUSTIVE

16. Appendix

- 16.1. About Us and Services

- 16.2. Contact Us