|

|

市場調査レポート

商品コード

1372115

リチウム電池用ニッケルめっき鋼板の世界市場-2023年~2030年Global Lithium Battery Nickel Plated Steel Strips Market - 2023-2030 |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| リチウム電池用ニッケルめっき鋼板の世界市場-2023年~2030年 |

|

出版日: 2023年10月18日

発行: DataM Intelligence

ページ情報: 英文 184 Pages

納期: 即日から翌営業日

|

- 全表示

- 概要

- 目次

概要

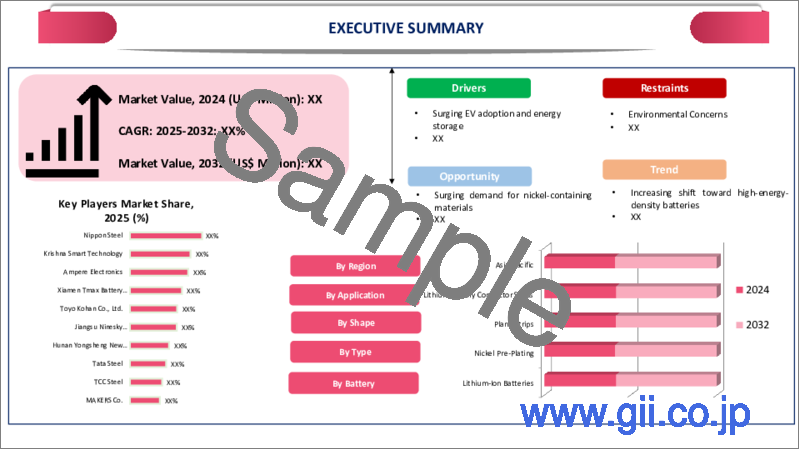

世界のリチウム電池用ニッケルめっき鋼板市場は、2022年に2億2,650万米ドルに達し、2030年には12億5,270万米ドルに達すると予測され、予測期間2023-2030年のCAGRは26.2%で成長する見込みです。

世界のリチウム電池用ニッケルめっき鋼帯市場は、電気自動車需要の増加とそれに伴うニッケル市場の急増により、大きな成長を遂げています。ストックヘッドのレポートによると、電気自動車需要がニッケル市場に与える潜在的な影響は大きく、2025年までにリチウムイオン電池に使用されるニッケル需要が2019年比で最大5.67%増加する可能性が予測されています。

この成長の原動力となるのは、ステンレス鋼業界の要求とは異なる、電池業界における高グレードのニッケル需要です。現在、世界の自動車市場において電気自動車が占める割合は比較的小さいが、その市場シェアは着実に拡大しています。ニッケル・インスティテュートによると、2025年までにEVが自動車の10%以上を占めるようになり、その大部分はニッケルを含むリチウムイオン電池で駆動されるようになるという予測が出ています。

リチウム電池用ニッケルめっき鋼帯市場は、特に中国を中心としたアジア太平洋地域で大幅な成長を遂げています。中国のリチウム電池産業は、電気自動車と再生可能エネルギー分野の需要急増に牽引され、急速な成長を遂げています。クリーンエネルギーと脱炭素化を重視する政府の方針により、電池、特にリチウムイオン電池に対する飽くなき欲求が高まっています。また、中国企業は太陽電池モジュール市場を独占しており、同国の電池需要の伸びにも貢献しています。

ダイナミクス

EVとエネルギー貯蔵が牽引するリチウム電池の成長

世界のリチウム電池用ニッケルめっき鋼帯市場は、特に電気自動車とエネルギー貯蔵システムにおけるリチウム電池の需要増加に牽引され、世界的に大きな成長を遂げています。官民連合Li-Bridgeによると、リチウム電池の世界需要は2030年までに5倍以上に増加すると予測されています。この成長の主な要因は、電気自動車の人気上昇とエネルギー貯蔵ソリューションの採用です。

米国では、リチウム電池の需要は6倍以上に成長し、10年後には年間550億米ドルに達すると予想されています。需要の伸びは、消費者の間で電気自動車とエネルギー貯蔵システムに対する嗜好が高まっていることを反映しています。電気自動車需要の急増は、リチウム電池成長の主要な原動力です。気候変動への懸念や燃料価格の高騰を受け、消費者は電動パワートレインを選ぶ傾向が強まっています。

リチウム電池におけるニッケル含有材料の需要急増

リチウム電池用ニッケルめっき鋼板の世界市場は、ニッケル需要の増加により大きく成長しています。ニッケルは、EVに使用されるリチウムイオン電池の重要な成分です。EV市場の世界の拡大に伴い、ニッケルめっき鋼帯を含むニッケル含有電池材料の需要増加が見込まれています。

INSGは、世界の一次ニッケル生産量の増加を予測しています。2022年には303万トンを超え、2023年にはさらに11.5%増の338万7,000トンに達すると予想されます。生産量の増加は、EVバッテリーを含む様々な産業におけるニッケル需要の増加を反映しています。INSGは、ニッケルの市場収支は2021年には赤字だが、2022年と2023年には黒字になると指摘しています。黒字の主な要因は、クラスⅡのニッケルとニッケル化学品、特に電池の主要成分である硫酸ニッケルです。

ニッケル鉱山からの排出物がもたらす環境問題

リチウム電池用ニッケルめっき鋼帯市場は、ニッケル採掘に関連する環境問題によって大きな影響を受け、電池のサプライチェーンに直接的な影響を与えます。ニッケル採掘は、大気汚染や水質汚染、土壌劣化、生息地の破壊につながります。国によって採掘の規制や慣行が異なるため、地域社会や生態系に有害な影響を及ぼす可能性があります。

鉱山からニッケルを抽出する過程では、二酸化硫黄や発ガン性の粉塵などの有害物質が排出されます。この排出物は、近隣のコミュニティに健康被害をもたらし、大気汚染の原因にもなります。採掘規制が緩い地域では、このような排出物は特に有害です。また、リチウムイオンバッテリーは不適切に廃棄されると、増大する電子廃棄物問題の一因となります。電子廃棄物にはリチウムを含む有害物質が含まれている可能性があり、正しく処理・処分されないと環境中に溶出する恐れがあります。

目次

第1章 調査手法と調査範囲

第2章 定義と概要

第3章 エグゼクティブサマリー

第4章 市場力学

- 影響要因

- 促進要因

- EVとエネルギー貯蔵が牽引するリチウム電池の成長

- リチウム電池におけるニッケル含有材料の需要急増

- 抑制要因

- ニッケル鉱山からの排出物による環境への懸念

- 機会

- 影響分析

- 促進要因

第5章 産業分析

- ポーターのファイブフォース分析

- サプライチェーン分析

- 価格分析

- 規制分析

- ロシア・ウクライナ戦争分析

- DMI意見

第6章 COVID-19分析

第7章 形状別

- Hタイプストリップ

- T型ストリップ

- プレーンストリップ

第8章 電池別

- リチウムイオン電池

- リチウムポリマー電池

- リン酸鉄リチウム電池

- 塩化チオニルリチウム電池

- その他

第9章 地域別

- 北米

- 米国

- カナダ

- メキシコ

- 欧州

- ドイツ

- 英国

- フランス

- イタリア

- ロシア

- その他欧州

- 南米

- ブラジル

- アルゼンチン

- その他南米

- アジア太平洋

- 中国

- インド

- 日本

- オーストラリア

- その他アジア太平洋地域

- 中東・アフリカ

第10章 競合情勢

- 競合シナリオ

- 市況/シェア分析

- M&A分析

第11章 企業プロファイル

- Toyo Kohan Co., Ltd.

- 会社概要

- 製品ポートフォリオと説明

- 財務概要

- 主な発展

- Nippon Steel Corporation

- TCC Steel Corp.

- Datum Alloys LTD.

- Xiamen Tmax Battery Equipment Ltd.

- Targray Technology International Inc

- Explore Synergy Synocare Private Limited

- Yongsheng New Material Co. Ltd

- Baoji Fitow Metals Co., Ltd.

第12章 付録

Overview

Global Lithium Battery Nickel Plated Steel Strips Market reached US$ 226.5 million in 2022 and is expected to reach US$ 1,252.7 million by 2030, growing with a CAGR of 26.2% during the forecast period 2023-2030.

The global lithium battery nickel-plated steel strips market is experiencing significant growth due to the increasing demand for electric vehicles and the subsequent surge in the nickel market. As per the report by Stockhead, the potential impact of electric vehicle demand on the nickel market is substantial, with projections indicating a potential growth of up to 5.67% in nickel demand for use in lithium-ion batteries by 2025 compared to 2019 levels.

The growth is driven by the need for higher-grade nickel in the battery industry, which differs from the requirements of the stainless-steel industry. Although electric vehicles currently represent a relatively small portion of the global automobile market, their market share is steadily increasing. According to Nickel Institute, projections suggest that EVs could account for more than 10% of vehicles by 2025, with the majority powered by nickel-containing Li-ion batteries.

The lithium battery nickel-plated steel strips market is witnessing substantial growth, particularly in the Asia-Pacific, with a significant focus on China. China's lithium battery industry is experiencing rapid growth, driven by soaring demand from the electric vehicle and renewable energy sectors. The government's emphasis on clean energy and decarbonization has led to an insatiable appetite for batteries, especially lithium-ion batteries. Chinese companies also dominate the solar battery module market, contributing to the country's growth in battery demand.

Dynamics

Lithium Battery Growth Driven by EVs and Energy Storage

The global lithium battery nickel-plated steel strips market is experiencing significant growth globally, driven by the increasing demand for lithium batteries, particularly in electric vehicles and energy storage systems. According to the public-private alliance Li-Bridge, global demand for lithium batteries is projected to increase more than five-fold by 2030. It growth is primarily fueled by the rising popularity of electric vehicles and the adoption of energy storage solutions.

In U.S., demand for lithium batteries is expected to grow more than six times, reaching an annual value of US$55 billion by the end of the decade. The growth in demand reflects the increasing preference for electric vehicles and energy storage systems among consumers. The surge in demand for electric vehicles is a key driver of lithium battery growth. Consumers are increasingly opting for electric powertrains in response to climate concerns and rising fuel prices.

Surging Demand for Nickel-Containing Materials in Lithium Batteries

Global Lithium Battery Nickel Plated Steel Strips Market is experiencing significant growth driven by growing demand for nickel. Nickel is a crucial component in lithium-ion batteries used in EVs. As the EV market expands globally, the demand for nickel-containing battery materials, including nickel-plated steel strips, is expected to rise.

INSG forecasts an increase in world primary nickel production. It growth is expected to surpass 3.03 million metric tons in 2022 and rise by another 11.5% to reach 3.387 million metric tons in 2023. It increase in production reflects the growing demand for nickel across various industries, including EV batteries. INSG notes that the market balances for nickel indicate a deficit in 2021 but surpluses in 2022 and 2023. The surpluses are primarily attributed to Class II nickel and nickel chemicals, particularly nickel sulphate, which is a key component in batteries.

Environmental Concerns Posed by Nickel Mining Emissions

The lithium battery nickel-plated steel strips market is significantly impacted by environmental concerns associated with nickel mining can directly impact the supply chain of these batteries. Nickel mining contributes to air and water pollution, soil degradation and habitat destruction. Depending on the country, mining regulations and practices can vary, potentially leading to harmful effects on local communities and ecosystems.

The process of extracting nickel from mines releases harmful substances like sulfur dioxide and cancer-causing dust. The emissions can pose health risks to nearby communities and contribute to air pollution. In regions with lax mining regulations, these emissions can be especially detrimental. Also, lithium-ion batteries, when disposed of improperly, contribute to the growing problem of electronic waste. E-waste can contain hazardous materials, including lithium, which can leach into the environment when not handled and disposed of correctly.

Segment Analysis

The global lithium battery nickel plated steel strips market is segmented based on shape, battery and region.

EV Boom Powers Lithium-Ion Battery Nickel-Plated Steel Strips Market

The lithium-ion battery holds the largest share in lithium battery nickel plated steel strips market and the global demand is growing rapidly due to the increasing demand for electric vehicles and renewable energy storage. Electric vehicles are becoming increasingly popular, as they offer a more environmentally friendly alternative to gasoline-powered vehicles. Lithium battery nickel-plated steel strips are used in the batteries of electric vehicles.

The demand for lithium-ion batteries, which use nickel-plated steel strips in their construction, has seen significant growth. According to IEA, in 2022, automotive lithium-ion battery demand increased by approximately 65% to reach 550 GWh, up from about 330 GWh in 2021. It surge in demand is primarily due to the rising popularity of electric passenger cars.

Geographical Penetration

Asia-Pacific Dominates Lithium Battery Nickel-Plated Steel Strips Market Amid NEV Boom and Solar Drive

Asia-Pacific is the largest market in lithium battery nickel-plated steel strips driven by booming new energy vehicle (NEV) industry and the push for decarbonization through solar energy are driving China's increasing need for batteries. Lithium-ion batteries are central to these technologies due to their superior energy density and storage capabilities. Chinese government policies have incentivized consumer adoption of EVs and supported domestic battery makers, giving them a competitive edge over foreign-owned rivals operating in China.

According to one charge report, China's share of the battery market, covering the entire spectrum of the supply chain, has increased remarkably. In just two years, from 2018 to 2020, China's market share surged from 60% to 72%. In comparison, United States holds a relatively small share of approximately 8.5% in this pipeline. China's share of the battery market, covering the entire spectrum of the supply chain, has increased remarkably. In just two years, from 2018 to 2020, China's market share surged from 60% to 72%. In comparison, United States holds a relatively small share of approximately 8.5% in this pipeline.

Competitive Landscape

The major global players in the market include: Toyo Kohan Co., Ltd., Nippon Steel Corporation, TCC Steel Corp., Datum Alloys LTD., Xiamen Tmax Battery Equipment Ltd., Targray Technology International Inc, Explore Synergy Synocare Private Limited, Yongsheng New Material Co. Ltd and Baoji Fitow Metals Co., Ltd

COVID-19 Impact Analysis:

COVID-19 pandemic had a significant effect on the lithium battery nickel-plated steel strips market, As the pandemic led to business shutdowns, quarantines and economic uncertainty, the demand for electric automobiles, which rely on lithium batteries with nickel-plated steel strips, plunged. Consumers were less inclined to make large purchases like electric vehicles during this period.

The post-COVID battery world faces challenges in government funding, supply chain resilience and improving battery management systems. Lithium-ion batteries have limitations in energy density and charging speed, hindering widespread use in electric vehicles and renewable energy storage. Innovations in battery technology are crucial for a low-carbon economy. Monitoring and managing batteries are essential for preventing degradation and failure, with real-time diagnostics and active balancing playing key roles. Addressing these issues will be vital for the future of battery-powered products and renewable energy adoption.

Russia-Ukraine War Impact

The Russia-Ukraine war significantly impacted the lithium battery nickel plated steel strips market, Russia and Ukraine are both major producers of nickel, a key component of lithium battery nickel plated steel strips. The war has disrupted the supply chain for nickel, driving up prices and making it more difficult to obtain. The war could lead to investments in new production capacity for lithium battery nickel plated steel strips.

The U.S. and other countries have imposed sanctions on Russia, which have made it more difficult for Russian companies to export nickel. It has further disrupted the supply chain and driven up prices. Also, the war is disrupting the global economy and could lead to a slowdown in demand for electric vehicles and other products that use lithium batteries.

By Shape

- H-Type Strips

- T-Type Strips

- Plane Strips

By Battery

- Lithium-Ion Batteries

- Lithium Polymer Batteries

- Lithium Iron Phosphate Batteries

- Lithium Thionyl Chloride Batteries

- Others

By Region

- North America

- U.S.

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Rest of Europe

- South America

- Brazil

- Argentina

- Rest of South America

- Asia-Pacific

- China

- India

- Japan

- Australia

- Rest of Asia-Pacific

- Middle East and Africa

Key Developments

Why Purchase the Report?

- To visualize the global lithium battery nickel plated steel strips market segmentation based on shape, battery and region, as well as understand key commercial assets and players.

- Identify commercial opportunities by analyzing trends and co-development.

- Excel data sheet with numerous data points of lithium battery nickel plated steel strips market-level with all segments.

- PDF report consists of a comprehensive analysis after exhaustive qualitative interviews and an in-depth study.

- Product mapping available as excel consisting of key products of all the major players.

The global lithium battery nickel plated steel strips market report would provide approximately 51 tables, 48 figures and 184 Pages.

Target Audience 2023

- Manufacturers/ Buyers

- Industry Investors/Investment Bankers

- Research Professionals

- Emerging Companies

Table of Contents

1. Methodology and Scope

- 1.1. Research Methodology

- 1.2. Research Objective and Scope of the Report

2. Definition and Overview

3. Executive Summary

- 3.1. Snippet By Shape

- 3.2. Snippet By Battery

- 3.3. Snippet by Region

4. Dynamics

- 4.1. Impacting Factors

- 4.1.1. Drivers

- 4.1.1.1. Lithium Battery Growth Driven by EVs and Energy Storage

- 4.1.1.2. Surging Demand for Nickel-containing Materials in Lithium Batteries

- 4.1.2. Restraints

- 4.1.2.1. Environmental Concerns Posed by Nickel Mining Emissions

- 4.1.3. Opportunity

- 4.1.4. Impact Analysis

- 4.1.1. Drivers

5. Industry Analysis

- 5.1. Porter's Five Force Analysis

- 5.2. Supply Chain Analysis

- 5.3. Pricing Analysis

- 5.4. Regulatory Analysis

- 5.5. Russia - Ukraine War Analysis

- 5.6. DMI Opinion

6. COVID-19 Analysis

- 6.1. Analysis of COVID-19

- 6.1.1. Scenario Before COVID

- 6.1.2. Scenario During COVID

- 6.1.3. Scenario Post COVID

- 6.2. Pricing Dynamics Amid COVID-19

- 6.3. Demand-Supply Spectrum

- 6.4. Government Initiatives Related to the Market During Pandemic

- 6.5. Manufacturers Strategic Initiatives

- 6.6. Conclusion

7. By Shape

- 7.1. Introduction

- 7.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By Shape

- 7.1.2. Market Attractiveness Index, By Shape

- 7.2. H-Type Strips*

- 7.2.1. Introduction

- 7.2.2. Market Size Analysis and Y-o-Y Growth Analysis (%)

- 7.3. T-Type Strips

- 7.4. Plane Strips

8. By Battery

- 8.1. Introduction

- 8.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By Battery

- 8.1.2. Market Attractiveness Index, By Battery

- 8.2. Lithium-Ion Batteries*

- 8.2.1. Introduction

- 8.2.2. Market Size Analysis and Y-o-Y Growth Analysis (%)

- 8.3. Lithium Polymer Batteries

- 8.4. Lithium Iron Phosphate Batteries

- 8.5. Lithium Thionyl Chloride Batteries

- 8.6. Others

9. By Region

- 9.1. Introduction

- 9.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By Region

- 9.1.2. Market Attractiveness Index, By Region

- 9.2. North America

- 9.2.1. Introduction

- 9.2.2. Key Region-Specific Dynamics

- 9.2.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Shape

- 9.2.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Battery

- 9.2.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

- 9.2.5.1. U.S.

- 9.2.5.2. Canada

- 9.2.5.3. Mexico

- 9.3. Europe

- 9.3.1. Introduction

- 9.3.2. Key Region-Specific Dynamics

- 9.3.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Shape

- 9.3.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Battery

- 9.3.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

- 9.3.5.1. Germany

- 9.3.5.2. UK

- 9.3.5.3. France

- 9.3.5.4. Italy

- 9.3.5.5. Russia

- 9.3.5.6. Rest of Europe

- 9.4. South America

- 9.4.1. Introduction

- 9.4.2. Key Region-Specific Dynamics

- 9.4.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Shape

- 9.4.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Battery

- 9.4.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

- 9.4.5.1. Brazil

- 9.4.5.2. Argentina

- 9.4.5.3. Rest of South America

- 9.5. Asia-Pacific

- 9.5.1. Introduction

- 9.5.2. Key Region-Specific Dynamics

- 9.5.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Shape

- 9.5.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Battery

- 9.5.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

- 9.5.5.1. China

- 9.5.5.2. India

- 9.5.5.3. Japan

- 9.5.5.4. Australia

- 9.5.5.5. Rest of Asia-Pacific

- 9.6. Middle East and Africa

- 9.6.1. Introduction

- 9.6.2. Key Region-Specific Dynamics

- 9.6.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Shape

- 9.6.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Battery

10. Competitive Landscape

- 10.1. Competitive Scenario

- 10.2. Market Positioning/Share Analysis

- 10.3. Mergers and Acquisitions Analysis

11. Company Profiles

- 11.1. Toyo Kohan Co., Ltd.*

- 11.1.1. Company Overview

- 11.1.2. Product Portfolio and Description

- 11.1.3. Financial Overview

- 11.1.4. Key Developments

- 11.2. Nippon Steel Corporation

- 11.3. TCC Steel Corp.

- 11.4. Datum Alloys LTD.

- 11.5. Xiamen Tmax Battery Equipment Ltd.

- 11.6. Targray Technology International Inc

- 11.7. Explore Synergy Synocare Private Limited

- 11.8. Yongsheng New Material Co. Ltd

- 11.9. Baoji Fitow Metals Co., Ltd.

LIST NOT EXHAUSTIVE

12. Appendix

- 12.1. About Us and Services

- 12.2. Contact Us